Don't wanna be here? Send us removal request.

Text

How to Trade Forex

The Forex market offers a wide range of ways to trade currencies, designed to meet the needs of different participants—from large institutional investors to individual retail traders. Whether you’re just starting out or already have trading experience, it’s important to understand the various trading methods and tools available. Let’s break down the main ways to trade Forex, their features, and the pros and cons of each. https://www.youtube.com/shorts/wS4aE-SBovo Common Methods for Trading Forex Here’s an overview of the most popular ways to trade Forex and how they work: 1. Spot Forex (Spot FX Market) What Is It? Spot Forex is the simplest and most straightforward way to trade currencies. It involves buying or selling currency pairs at the current exchange rate (called the “spot rate”). These trades are executed over-the-counter (OTC)—meaning there’s no centralized exchange. How It Works: - Traders agree to exchange one currency for another at the spot rate. - Settlement usually happens T+2 (two business days after the trade), but some pairs, like USD/CAD, settle in T+1. - Retail traders access the spot market through brokers, but instead of physical delivery of currencies, their positions are rolled over daily until closed. Advantages: - 24-hour trading: The market is open continuously during the week. - High liquidity: Major pairs like EUR/USD or USD/JPY have tight spreads and low transaction costs. Drawbacks: - Rollover fees: Interest may be charged or earned on overnight positions. 2. Forex CFDs (Contracts for Difference) What Is It? CFDs allow you to speculate on the price movements of currency pairs without actually owning the underlying currencies. How It Works: - You can go long (buy) if you expect a currency pair to rise, or short (sell) if you think it will fall. - CFDs use leverage, meaning you can control larger positions with a smaller initial investment. Example: If you predict EUR/USD will rise, you open a long position. If the price moves in your favor, you earn a profit. If it moves against you, you incur a loss. Advantages: - Flexible trading: Profit from both rising and falling markets. - No ownership: Avoid the complexity of physically settling currencies. Drawbacks: - CFDs are illegal in some regions, such as the U.S. - High leverage: While it amplifies profits, it also increases the risk of significant losses. 3. Currency Futures What Is It? Currency futures are standardized contracts traded on regulated exchanges like the Chicago Mercantile Exchange (CME). These contracts specify a future date and price for the exchange of a currency pair. How It Works: - Futures contracts have set expiration dates and fixed lot sizes. - Pricing is transparent because they’re traded on regulated exchanges. Advantages: - Great for hedging: Protect yourself against future currency risks. - Regulated markets: Offers security and transparency for traders. Drawbacks: - Limited flexibility: You must stick to the contract’s specifications. - Futures aren’t as liquid as the spot Forex market. 4. Currency Options What Is It? A currency option gives you the right (but not the obligation) to buy or sell a currency pair at a specific price before the contract expires. How It Works: - Call option: The right to buy a currency pair. - Put option: The right to sell a currency pair. - Options can be traded on exchanges (like CME) or over-the-counter (OTC). Advantages: - Limited risk: Losses are capped at the premium (cost of the option). - Useful for both hedging and speculative trading strategies. Drawbacks: - Options are less liquid than spot or futures markets. - Pricing can be complex due to factors like volatility and time decay. 5. Currency ETFs (Exchange-Traded Funds) What Is It? Currency ETFs provide exposure to one or more currencies by investing in a fund that tracks currency performance. These funds trade on stock exchanges like regular shares. How It Works: - ETFs are passively managed and designed to mirror the performance of specific currencies or baskets of currencies. - Examples include the Invesco CurrencyShares ETFs. Advantages: - Diversification: Gain exposure to multiple currencies in one fund. - Ease of trading: Buy and sell ETFs just like stocks. Drawbacks: - ETFs are not available 24/5 like the Forex market. - Management fees: Some ETFs come with additional costs. 6. Forex Spread Betting What Is It? Spread betting allows you to speculate on the price movements of a currency pair. Your profit or loss depends on how much the price moves in your chosen direction. How It Works: - Spread betting is particularly popular in the U.K. and Ireland, where profits are tax-free. - Regulated by authorities like the FCA in the U.K. Advantages: - No ownership: You don’t actually buy or sell currencies. - Tax-free profits: In some jurisdictions, you don’t pay taxes on your earnings. Drawbacks: - Spread betting is illegal in the U.S. due to gambling restrictions. 7. Retail Forex Trading (Leveraged Trading) What Is It? Retail Forex trading involves trading currency pairs using leverage through online brokers. Instead of physically exchanging currencies, you speculate on price movements. How It Works: - Positions are rolled over daily to avoid delivery obligations. - Leverage allows traders to control larger positions with smaller capital. Example: With $2,000 and leverage of 1:50, you can control a $100,000 position in EUR/USD. Advantages: - Accessible: Low starting capital required. - Wide variety of tools: Brokers offer platforms with analysis tools and charts. Drawbacks: - High leverage increases risk: Losses can exceed your initial investment. - Swap fees apply for overnight positions. Comparing Forex Trading Methods MethodOwnership of AssetLiquidityMarket HoursRisk LevelSpot ForexNoVery High24/5Moderate (fees, leverage)Forex CFDsNoHigh24/5High (due to leverage)Currency FuturesYesModerateLimitedModerateCurrency OptionsNoLow to ModerateLimitedLow (premium capped)Currency ETFsNoModerateLimitedLowSpread BettingNoModerate24/5High (due to leverage) Final Thoughts on Forex Trading The Forex market offers unmatched opportunities due to its size, liquidity, and flexibility. From spot Forex and CFDs to options and ETFs, there’s a method for every type of trader—whether you’re looking to hedge risks, diversify your portfolio, or profit from currency fluctuations. However, success in Forex trading requires a solid understanding of the tools you use, proper risk management, and ongoing education. Choose the trading method that aligns with your goals and risk tolerance, and always trade responsibly.

Read more

What is Forex? What Is Traded in Forex? Trading Currency Pairs in Forex: The Basics Forex Market Size and Liquidity Read the full article

0 notes

Text

Forex Market Size and Liquidity: Exploring the World's Largest Financial Market

The Forex market—also called the foreign exchange market—is the biggest and most liquid financial market in the world. Its size, global accessibility, and decentralized structure make it unlike any other market, such as the New York Stock Exchange (NYSE) or London Stock Exchange (LSE). Let’s dive into what makes the Forex market so unique, the role of liquidity, and why it has become a global powerhouse. https://www.youtube.com/shorts/wS4aE-SBovo What Is the Forex Market? The Forex market operates differently from traditional markets. It doesn’t have a central exchange or a physical location. Instead, it functions as an over-the-counter (OTC) market, where trades are conducted electronically through a global network. Key features of the Forex market include: - Global Accessibility: Open 24 hours a day, 5 days a week, making it convenient for traders worldwide. - Decentralized Structure: No central exchange; trading follows the sun across financial hubs like Tokyo, London, and New York. - Ease of Entry: All you need is an internet connection to start trading. This decentralized setup ensures the market is always active, no matter where you are in the world. The Interbank Market: The Core of Forex Trading The majority of Forex trading happens in the interbank market, where large financial institutions trade currencies directly. Key participants include: - Central Banks: Manage national currency policies and stabilize exchange rates. - Commercial Banks: Facilitate large-scale currency transactions for clients. - Investment Firms and Multinational Corporations: Hedge against currency risks and finance international trade. In this market, participants can choose their trading partners based on price, conditions, and reputation, creating flexibility and depth that drive the massive scale of the Forex market. Currency Distribution: The U.S. Dollar Reigns Supreme Currencies in Forex are always traded in pairs, and the U.S. Dollar (USD) is by far the most influential and widely traded currency in the market. CurrencyMarket ShareUSD84.9%EUR39.1%JPY19.0%GBP13.6%AUD6.8D5.0%CHF5.0% Why Is the U.S. Dollar the King of Forex? - Reserve Currency of the World: The USD makes up 62% of global foreign exchange reserves, according to the IMF. Central banks and businesses worldwide hold USD for trade and investment. - Global Economic Influence: The U.S. has the largest economy and the most liquid financial markets, making the USD the default currency for international loans, bonds, and commodities (e.g., oil is often traded in "petrodollars"). - Stability: The U.S. is politically stable and a military superpower, boosting global confidence in the dollar. - Cross-Border Transactions: Many countries trade in USD even when the U.S. isn’t directly involved. Speculation: The Driving Force Behind Forex Volume Although Forex serves practical purposes like financing trade and hedging, the majority of its daily trading volume—around 90%—comes from speculative trading. - Speculators aim to profit from short-term price movements in currency pairs. - This speculative activity makes Forex one of the most dynamic and liquid markets in the world. Market Liquidity: The Lifeblood of Forex Liquidity refers to how easily an asset can be bought or sold without significantly affecting its price. The Forex market’s size and depth give it unparalleled liquidity. Key Benefits of High Liquidity: - Tight Spreads: Lower transaction costs for traders. - Efficient Execution: Trades happen quickly, even for large positions. - Reduced Slippage: Minimal price changes between order placement and execution. Factors That Affect Liquidity - Currency Pair: - Majors like EUR/USD and USD/JPY are highly liquid due to their trading volume. - Exotics like USD/ZAR (U.S. Dollar / South African Rand) have lower liquidity and wider spreads. - Time of Day: - Liquidity peaks during overlapping trading sessions, such as the London-New York overlap. - Off-hours can see reduced liquidity and increased volatility. The Scale of the Forex Market The Forex market’s daily trading volume is staggering, dwarfing other financial markets. MarketDaily VolumeForex Market$7.5 trillionNew York Stock Exchange$20 billionCryptocurrency Market~$50 billion - The spot market, which is most relevant for retail traders, accounts for approximately $2 trillion of daily trading volume. - This means the Forex market is over 200 times larger than the NYSE! Key Takeaways About the Forex Market - Global and Decentralized: Operates 24/5 through a global network of institutions, making it accessible at all times. - USD Dominance: The U.S. Dollar is involved in almost 85% of transactions, solidifying its status as the backbone of Forex trading. - Speculation Drives Volume: Over 90% of trades are speculative, focused on short-term price movements. - Unparalleled Liquidity: High liquidity ensures efficient trading, especially in major currency pairs. Ready to Explore the Forex Market? The Forex market’s size, liquidity, and accessibility make it one of the most exciting and dynamic financial markets to trade. Whether you’re a retail trader, an institutional investor, or a central bank, Forex offers endless opportunities to profit from global economic movements. Next, dive deeper into Forex trading sessions and learn how the time of day impacts liquidity and price action. The more you explore, the closer you’ll get to mastering the world’s largest financial market!

Read more

What is Forex? What Is Traded in Forex? Trading Currency Pairs in Forex: The Basics How to Trade Forex Read the full article

0 notes

Text

Trading Currency Pairs in Forex: The Basics

In the Forex market, trading revolves around currency pairs—the act of buying one currency while selling another. This simple concept is the foundation of Forex trading, allowing traders to speculate on the relative strength of different economies. Let’s explore how currency pairs work, their classifications, and the factors that drive their movement. https://www.youtube.com/shorts/wS4aE-SBovo What Are Currency Pairs? A currency pair represents the exchange rate between two currencies, showing how much of one currency is needed to buy one unit of the other. Each pair is made up of: - Base Currency: The first currency in the pair (e.g., EUR in EUR/USD). - Quote Currency: The second currency in the pair (e.g., USD in EUR/USD). Example: - If EUR/USD = 1.10, it means 1 Euro equals 1.10 US Dollars. - If you buy EUR/USD, you’re essentially buying Euros and selling US Dollars. - Later, if the rate rises to 1.20, you can sell Euros at a higher price, making a profit. Types of Currency Pairs Currency pairs are grouped into three main categories based on their composition and trading activity: Majors, Crosses, and Exotics. 1. Major Currency Pairs Major pairs always include the US Dollar (USD) and are the most traded in the Forex market. These pairs represent the world’s largest economies and account for the highest trading volumes, making them the most liquid. Currency PairCountriesNicknameEUR/USDEurozone / United StatesEuro DollarUSD/JPYUnited States / JapanDollar YenGBP/USDUnited Kingdom / USPound DollarUSD/CHFUnited States / SwitzerlandDollar SwissyUSD/CADUnited States / CanadaDollar LoonieAUD/USDAustralia / United StatesAussie DollarNZD/USDNew Zealand / United StatesKiwi Dollar Why Trade Major Pairs? - High Liquidity: You can easily buy or sell with minimal price changes. - Frequent Price Movements: They offer plenty of opportunities to trade. - Tight Spreads: Lower transaction costs make them attractive for traders. 2. Cross-Currency Pairs (Crosses or Minors) Crosses exclude the US Dollar and are made up of two other major currencies. They provide a wide range of trading opportunities, though they tend to have slightly less liquidity than major pairs. Popular Crosses: A. Euro Crosses Currency PairCountriesNicknameEUR/GBPEurozone / United KingdomEuro PoundEUR/JPYEurozone / JapanEuro YenEUR/CHFEurozone / SwitzerlandEuro Swissy B. Yen Crosses Currency PairCountriesNicknameGBP/JPYUK / JapanPound Yen or GuppyAUD/JPYAustralia / JapanAussie Yen 3. Exotic Currency Pairs Exotic pairs consist of one major currency paired with a currency from an emerging or developing economy. Examples include USD/TRY (US Dollar / Turkish Lira) and USD/ZAR (US Dollar / South African Rand). Why Trade Exotics? - Higher Volatility: These pairs tend to have bigger price swings, creating opportunities for larger profits. - Risk Considerations: Exotics are more sensitive to economic and political events, which can create higher risks. Understanding Liquidity in Currency Pairs Liquidity refers to how easily you can buy or sell a currency pair without affecting its price. - High Liquidity: Found in major pairs like EUR/USD and USD/JPY, which are heavily traded. - Lower Liquidity: Common in exotic pairs like USD/BRL (US Dollar / Brazilian Real), which have wider spreads and higher costs. Example: - EUR/USD is the most liquid pair due to its massive trading volume. - AUD/USD, while still a major pair, is less liquid than EUR/USD because it has lower overall trading activity. Exchange Rates: A Constant Tug of War Think of every currency pair as being in a constant “tug of war.” - If one currency strengthens, the other weakens, causing the exchange rate to shift. - These fluctuations are driven by factors like market sentiment, economic reports, and geopolitical events. Example: If the US economy outperforms the Eurozone, EUR/USD might fall as the US Dollar gains strength against the Euro. Tips for Trading Currency Pairs - Start with Majors: Their high liquidity and predictable behavior make them ideal for beginners. - Understand Correlations: - Positive Correlation: EUR/USD and GBP/USD often move in the same direction. - Negative Correlation: USD/JPY and EUR/USD often move in opposite directions. - Follow Economic Indicators: Pay attention to GDP reports, employment data, and central bank announcements, as they impact exchange rates. - Be Cautious with Exotics: Wider spreads mean higher transaction costs, so trade them carefully. Final Thoughts: The Heart of Forex Trading Currency pair trading is the core of Forex, offering countless opportunities to profit from global market movements. By understanding how pairs work, the role of liquidity, and the factors that drive price changes, you can approach the market with confidence and strategy. So, are you ready to navigate the exciting world of Forex trading? Start with the majors, learn the basics, and keep refining your skills—there’s always more to discover!

Read more

What is Forex? What Is Traded in Forex? Forex Market Size and Liquidity How to Trade Forex Read the full article

0 notes

Text

What Is Traded in Forex?

The short answer? Money—specifically, currencies. Forex trading is all about buying one currency while selling another at the same time. This allows traders to speculate on the relative value of currencies and make profits from their movements. Since Forex trading doesn’t involve physical goods, it can feel a bit abstract. Think of it this way: when you buy a currency, it’s like buying a “share” in that country’s economy. Essentially, you’re betting on that country’s current and future economic health compared to others. Let’s break it down further to make it easier to understand. https://www.youtube.com/shorts/wS4aE-SBovo Currency Trading Explained In Forex trading, exchange rates show how much one currency is worth in comparison to another. Here’s an example: - If you buy the Japanese Yen (JPY), you’re essentially betting on Japan’s economy to perform better than the country whose currency you’re selling (e.g., the US Dollar). - If the exchange rate shifts in your favor, you can sell the currency back at a higher rate and pocket the profit. Example: - You buy Japanese Yen (JPY) when 1 USD = 100 JPY. - Later, the exchange rate changes to 1 USD = 95 JPY. - You sell the JPY for USD at the new rate, making a profit because your Yen has gained value against the Dollar. The Major Currencies in Forex There are over 180 currencies around the world, but Forex traders focus on just a handful called “the majors.” What Are Major Currencies? Major currencies are the most traded in the Forex market, representing the world’s largest and most stable economies. These currencies are heavily used in international trade, finance, and investment. Here’s a list of the major currencies, along with their symbols and popular nicknames: CodeCountryCurrencyNicknameUSDUnited StatesDollarBuck, GreenbackEUREurozoneEuroFiberJPYJapanYenYenGBPGreat BritainPoundCableCHFSwitzerlandFrancSwissyCADCanadaDollarLoonieAUDAustraliaDollarAussieNZDNew ZealandDollarKiwi Why Are They Called “Majors”? - They make up the bulk of Forex market transactions. - These currencies are tied to stable economies, making them more predictable and highly liquid. - Their tight spreads and frequent price movements create plenty of trading opportunities. Understanding Currency Codes Currency codes are standardized by the ISO 4217 system. Each code has three letters: - The first two letters represent the country. - The third letter represents the currency. Examples: - NZD: New Zealand Dollar - GBP: Great Britain Pound Fun Facts About Currencies Here are some interesting tidbits about the world’s currencies: - The British Pound (GBP) is the oldest currency still in use today, dating back to the 8th century. - The Zimbabwe Gold (ZiG), introduced in 2024, is the newest currency, replacing the Zimbabwean dollar. - The US Dollar (USD) has a long list of nicknames, including: - Greenback, Benjamins, Cheddar, Bread, Loot, and Dead Presidents. - In Peru, it’s even nicknamed “Coco,” a reference to George Washington’s face on the $1 bill (since “Jorge” is Spanish for George). Why Currencies Are Traded Currencies are traded for more than just practical reasons like international travel or trade. In fact, most Forex trading is driven by speculation. - Speculators: These traders aim to profit by buying currencies they expect to increase in value and selling them at a higher price. - Hedgers: Businesses and financial institutions use Forex to protect themselves from unfavorable exchange rate changes (for example, when importing or exporting goods). Summing It Up: What’s Traded in Forex? In Forex, money itself is the commodity. When traders buy and sell currencies, they’re essentially trading on the strength and potential future performance of entire economies. So the next time you hear someone talk about trading currencies, remember—it’s not just about money. It’s about betting on the economic health of nations around the world. Ready to jump into this exciting market? Start with the major currencies, keep an eye on global events, and always stay curious—there’s always something new to learn!

Read more

What is Forex? Trading Currency Pairs in Forex: The Basics Forex Market Size and Liquidity How to Trade Forex Read the full article

0 notes

Text

What is Forex?

Forex, short for foreign exchange or FX, is the global marketplace where currencies are traded. It’s the largest and most liquid financial market on the planet, with a staggering daily trading volume of over $7.5 trillion—yes, that’s trillion with a “T”! But what does this really mean, and why is Forex trading so popular? Let’s break it down step by step and dive into the fascinating world of Forex. We’ll uncover how it works, who participates, and what makes it so unique. https://www.youtube.com/shorts/wS4aE-SBovo The Basics of Forex At its core, Forex trading involves buying one currency while simultaneously selling another. These transactions are done in currency pairs, like EUR/USD or GBP/JPY, where one currency is exchanged for the other. The exchange rate represents the value of one currency compared to another. For example: - If EUR/USD = 1.10, it means 1 Euro equals 1.10 US Dollars. Forex traders speculate on how these exchange rates will change. If you think one currency will strengthen against another, you can “go long” (buy) or “go short” (sell) a currency pair to potentially profit from the price movement. Real-Life Example: Traveling and Currency Exchange To simplify, imagine you’re traveling: - You’re an American visiting Japan. At the airport, you exchange USD for JPY. - The exchange rate is 1 USD = 100 JPY, so you trade $10 and receive ¥1,000. - While you’re in Japan, the exchange rate shifts to 1 USD = 95 JPY. When you exchange your leftover Yen back to USD, you’ll get more dollars for the same amount of Yen. This fluctuation in exchange rates is the same principle Forex traders use to make profits. The Size and Scale of Forex The Forex market dwarfs all other financial markets in size: - Every day, more than $7.5 trillion is traded globally. - For comparison, the New York Stock Exchange (NYSE) trades about $20 billion daily. Not all of this volume is accessible to individual (retail) traders, though: - The spot market, where most retail traders operate, accounts for roughly $2 trillion daily. - Retail trading represents just 3-5% of the market, around $200-300 billion per day. The market’s sheer size ensures high liquidity, meaning trades can happen quickly—even in volatile conditions. Forex Operates 24 Hours a Day One unique feature of Forex is that it operates continuously, 24 hours a day, 5 days a week. Unlike stock markets that have set trading hours, Forex trading moves through different global time zones. Here’s how the trading day flows: - Auckland/Wellington: The day kicks off here. - Sydney: Trading activity picks up. - Tokyo and Singapore: The Asian trading session begins. - London: Europe’s financial powerhouse joins the action. - New York: The day wraps up here, before the cycle restarts in New Zealand. This global cycle means traders can participate at virtually any time, no matter where they are in the world. Who Trades in the Forex Market? The Forex market attracts a variety of participants, such as: - Central Banks: They influence exchange rates through monetary policy and interventions. - Banks and Financial Institutions: Conduct large-scale trades on behalf of clients or their own accounts. - Corporations: Use Forex to manage international trade and hedge currency risks. - Hedge Funds: Speculate on currency movements for profit. - Retail Traders: Individuals like you and me, trading for personal profit through online platforms. Speculation vs. Real Transactions Interestingly, only a small portion of Forex trading involves real-world activities like international trade or tourism. Most trades are speculative, where traders analyze economic events, political news, and market sentiment to predict currency price movements. Forex vs. Stock Market: Key Differences Here’s how Forex stacks up against the stock market: FeatureForex MarketStock Market (NYSE)Daily Volume$7.5 trillion$20 billionTrading Hours24 hours, 5 daysLimited (e.g., 9:30 AM–4:00 PM EST)LiquidityExtremely highModerate to highAccessibilityLow entry barriersHigher capital requiredMarket StructureDecentralizedCentralized Forex’s size, round-the-clock trading, and low barriers to entry make it an attractive option for traders seeking flexibility and opportunity. Key Features of Forex - Leverage: Forex brokers offer leverage, letting you control large positions with relatively small investments. However, while leverage can amplify profits, it also increases risks. - Volatility: Currency prices move frequently due to economic data, geopolitical events, and market sentiment, creating plenty of trading opportunities. - Liquidity: High liquidity ensures you can enter or exit trades quickly, even for large transactions. - Diverse Instruments: You can trade major currency pairs (e.g., EUR/USD), minor pairs (e.g., EUR/GBP), or exotic pairs (e.g., USD/ZAR). Fun Facts About Forex - The British pound is the world’s oldest currency still in use, dating back to the 8th century. - The Zimbabwe Gold (ZiG), introduced in 2024, is the newest currency, replacing the Zimbabwean dollar. - In Peru, the US Dollar is nicknamed “Coco” because of George Washington’s portrait on the $1 bill. Final Thoughts: Why Trade Forex? Forex is the largest, most accessible, and most liquid market in the world. Its flexibility, low barriers to entry, and diverse opportunities make it appealing to traders of all skill levels. That said, success in Forex requires knowledge, discipline, and solid risk management. While the potential for profit is high, so are the risks. By understanding how the market works and staying informed, you can make smarter trading decisions. Ready to dive into Forex? The journey starts here—trade responsibly and keep learning!

Read more

What Is Traded in Forex? Trading Currency Pairs in Forex: The Basics Forex Market Size and Liquidity How to Trade Forex Read the full article

0 notes

Text

MAM vs PAMM Accounts: A Comprehensive Guide to Forex Money Management Solutions

The forex market has seen significant innovations aimed at bridging the gap between professional traders and retail investors. Among the most popular solutions are Multi-Account Manager (MAM) and Percentage Allocation Management Module (PAMM) accounts. These tools provide opportunities for investors to access professional expertise and allow traders to manage multiple accounts efficiently. While both systems share similarities, they cater to distinct needs and operate differently. This article delves into the nuances of MAM and PAMM accounts, helping you determine which is best suited to your trading or investment goals.

What is a MAM Account?

A Multi-Account Manager (MAM) account is designed for professional traders who manage multiple client accounts simultaneously from a single master account. Here’s how it works: - Centralized Control: The trader manages trades through a master account linked to individual sub-accounts, owned by investors. - Fund Pooling: Funds from all sub-accounts are pooled for trading purposes, but each sub-account retains proportional ownership of the capital. - Trade Execution: Trades executed on the master account are mirrored across sub-accounts according to predefined allocation percentages. - Flexibility: The trader can adjust allocation percentages, assign varying trade volumes, and group sub-accounts for specific strategies. Advantages of MAM Accounts - Efficiency for Traders: Traders can execute trades on all sub-accounts with a single action, saving time and effort. - Flexibility for Investors: Investors can deposit or withdraw funds at any time without disrupting the overall trading process. - Real-Time Monitoring: Investors can view trades as they happen, providing transparency and confidence in the trader’s actions. Disadvantages of MAM Accounts - Investors cannot intervene in trading decisions, meaning their success entirely depends on the trader’s performance. - Management complexity increases with more sub-accounts and strategies.

What is a PAMM Account?

A Percentage Allocation Management Module (PAMM) account offers retail investors a way to pool their funds with other investors under the management of an experienced trader. Here’s how it works: - Fund Pooling: Investors allocate funds to a common pool managed by a trader. - Profit Sharing: Profits or losses are distributed proportionally to each investor’s share of the pool. - Pre-Screened Traders: Forex brokers often vet traders managing PAMM accounts, giving investors insight into their performance history and strategies. Advantages of PAMM Accounts - Hands-Off Investing: Ideal for investors who lack the time or expertise to trade actively. - Shared Risk and Returns: Both traders and investors allocate capital, ensuring shared stakes in the outcome. - Transparent Selection: Investors can evaluate a trader’s track record and strategy before committing funds. Disadvantages of PAMM Accounts - Investors cannot modify allocations or withdraw funds mid-investment cycle. - The pool’s performance depends entirely on the trader’s decisions, posing risks if the trader underperforms.

Key Differences Between MAM and PAMM Accounts

FeatureMAM (Multi-Account Manager)PAMM (Percentage Allocation Management Module)PurposeEnables traders to manage multiple client accounts efficientlyEnables investors to pool funds with a professional traderFunds ManagementFunds are pooled but managed per sub-account allocationsFunds are pooled collectively for a single trading strategyInvestor ControlInvestors can deposit/withdraw funds anytime but can’t tradeInvestors decide initial allocation but can’t intervene mid-cycleProfit DistributionProfits/losses are allocated based on sub-account percentagesProfits/losses are distributed proportionally to pool sharesTransparencyInvestors can view trades in real-timeInvestors rely on periodic updates or results summaries

Choosing Between MAM and PAMM Accounts

Who Should Choose MAM Accounts? - Professional Traders: - Ideal for traders seeking to expand their client base without compromising efficiency. - Enables scaling operations by managing multiple sub-accounts from a single master account. - Advanced Investors: - Suitable for investors who value real-time transparency. - Provides flexibility to deposit or withdraw funds without waiting for investment cycles to close. Who Should Choose PAMM Accounts? - Hands-Off Investors: - Best for those who want passive exposure to the forex market. - Leverages the expertise of pre-screened traders with minimal active involvement. - Traders Seeking Capital: - Attracts capital from multiple investors, enabling trading with larger volumes. - Offers opportunities to earn management fees and a share of profits.

Factors to Consider When Choosing MAM or PAMM

- Investor Goals: - MAM: For active monitoring and flexibility. - PAMM: For hands-off investing with vetted traders. - Risk Appetite: - Evaluate the trader’s track record, strategy, and risk management practices. - Transparency: - MAM accounts provide real-time trade visibility, while PAMM accounts rely on periodic performance updates. - Costs: - Consider management fees, performance fees, and any additional broker charges. - Broker Reputation: - Ensure the broker offering MAM or PAMM accounts is regulated and trustworthy.

Conclusion

Both MAM and PAMM accounts offer unique advantages for investors and traders. MAM accounts are ideal for professional traders managing multiple clients and advanced investors seeking flexibility. On the other hand, PAMM accounts cater to hands-off investors looking to pool funds with professional traders for shared profits. When choosing between MAM and PAMM, consider your trading or investment goals, risk tolerance, and desired level of involvement. With the right choice, these forex money management solutions can significantly enhance trading efficiency and investment returns. Read the full article

0 notes

Text

Understanding Round-Turn and Half-Turn Commission in Trading: A Comprehensive Guide

When engaging in trading activities, one of the critical aspects to consider is the cost structure associated with executing trades. Among the various costs traders face, commission charges play a significant role. Two commonly used commission structures are round-turn commission and half-turn commission. Understanding these models is essential for traders, whether they are retail investors or institutional players. Let’s explore both concepts in detail, along with their implications for trading strategies and profitability.

What is Round-Turn Commission?

Definition Round-turn commission is the fee charged for completing a full trade cycle, which includes both the buying and selling of an asset. This means that a single round-turn commission covers the entire transaction, making it straightforward to calculate the total cost of trading a specific instrument. Example Suppose a broker charges a round-turn commission of $5 per contract. This means you pay $5 in total for entering and exiting a trade, regardless of how much time passes between the two actions. - Buy 1 contract of an asset → No immediate commission deduction. - Sell the same contract later → The $5 commission is applied upon completion of the trade.

What is Half-Turn Commission?

Definition Half-turn commission, also known as per-side commission, is charged separately for each leg of a trade: once when you open the position and again when you close it. This model allows traders to see the cost of each individual action, offering greater granularity in cost calculation. Example If the broker charges $2.50 as a half-turn commission: - Buy 1 contract of an asset → $2.50 commission is deducted immediately. - Sell the same contract later → An additional $2.50 commission is charged. - Total commission for the round-turn trade → $5.

Key Differences Between Round-Turn and Half-Turn Commission

FeatureRound-Turn CommissionHalf-Turn CommissionCharge FrequencyApplied once per full tradeCharged separately for each sideVisibilityCosts consolidated in one feeCosts visible at each actionCalculationSimpler, as it covers both legsMore detailed and granularApplicationCommon in futures tradingPopular in forex and CFD trading

Advantages and Disadvantages

Round-Turn Commission Advantages - Simplified Cost Management: Since the fee covers both buying and selling, traders can easily calculate their total expenses for a trade. - Ideal for Futures Trading: Widely used in futures markets, where the clarity of a single charge for the complete trade cycle is preferred. - Incentives for Completion: Encourages traders to complete trades rather than leave positions open indefinitely. Disadvantages - Less Granularity: Traders cannot see the cost of each side of the trade individually, which may hinder detailed cost analysis. - Fixed Structure: May not offer flexibility for strategies that involve holding trades over long periods. Half-Turn Commission Advantages - Detailed Cost Visibility: Traders know exactly how much they are paying for each action—entering or exiting a trade. - Customizable Strategies: Offers greater flexibility for traders who frequently adjust positions or hedge. - Common in Retail Trading: Often used in forex and CFD platforms, making it familiar to a broader audience. Disadvantages - Complex Cost Tracking: Requires traders to calculate total costs by summing charges for each leg of the trade. - Potential for Higher Costs: In some cases, half-turn commissions can add up to more than equivalent round-turn fees, especially for short-term strategies.

Which Commission Structure is Better?

For Futures Traders Futures markets predominantly use round-turn commission structures because they align with the contract-based nature of these markets. The simplicity of a single fee for the full trade makes it easier to manage costs. For Forex and CFD Traders Half-turn commission is more common in forex and CFD trading. These markets often involve high trading volumes and frequent position adjustments, making the granular cost visibility of half-turn commissions advantageous.

Impact on Trading Strategies

Scalping and High-Frequency Trading - Key Concern: Cost efficiency. - Preference: Half-turn commission is often preferred as scalpers need to monitor the impact of costs on individual trades closely. Swing and Position Trading - Key Concern: Simplified cost calculation for longer-term trades. - Preference: Round-turn commission is better suited as traders focus on overall profitability rather than granular cost breakdowns. Hedging - Key Concern: Flexibility to adjust positions. - Preference: Half-turn commission allows better cost tracking for complex strategies involving multiple legs.

Tips for Choosing the Right Broker

- Understand Your Strategy: Choose a commission structure that aligns with your trading style and frequency. - Compare Total Costs: Look beyond commission rates and account for spreads, rollover fees, and platform charges. - Check Transparency: Ensure the broker provides clear details about how commissions are charged, especially for half-turn models. - Use Demo Accounts: Test the broker's fee structure in a demo environment to understand its impact on profitability.

Conclusion

Round-turn and half-turn commissions are fundamental aspects of trading costs that can significantly affect your bottom line. Understanding their differences and implications allows traders to optimize their strategies and select brokers that align with their trading goals. Whether you prefer the simplicity of round-turn commissions or the detailed visibility of half-turn charges, the key lies in aligning the cost structure with your trading style and objectives. Always evaluate commission models alongside other costs and features to ensure a holistic understanding of your trading expenses. Read the full article

0 notes

Text

State Street Global Market Outlook 2025 – Finding the Right Path

State Street Global Advisors' Market Outlook 2025 anticipates a year shaped by geopolitical tensions, monetary policy shifts, and evolving investment opportunities. The report emphasizes the importance of active portfolio diversification, leveraging thematic investments, and exploring alternative assets to navigate an environment characterized by slow-moving fragmentation and rising macroeconomic volatility. Key Themes and Strategic Insights 1. Global Economic and Market Outlook - Soft Landing Scenario: - Global central banks, including the Federal Reserve and ECB, are expected to continue rate cuts, supporting a soft economic landing. - Inflationary pressures have moderated, opening opportunities for equity and fixed-income markets. - Growth Drivers: - U.S. economic outperformance fueled by fiscal expansion and deregulation under a Trump administration. - Moderate growth in Europe, hindered by weak domestic demand and geopolitical uncertainties. - Resilience in emerging markets (EM), with stronger performances in Asia ex-China, led by India and Indonesia. - Risks: - Geopolitical tensions (e.g., U.S.-China trade conflicts, conflicts in Europe and the Middle East). - Volatility from policy changes, including tariffs and fiscal adjustments. 2. Equities - U.S. Equities: - Large-cap equities remain strong due to earnings growth and profitability in technology, utilities, and industrial sectors. - Small- and mid-cap stocks offer upside potential from cyclical recovery and regulatory tailwinds. - European Equities: - Opportunities in sectors like healthcare, industrials (renewables), and energy due to relative undervaluation. - Challenges from sluggish consumer demand and weak fixed investment. - Emerging Markets: - Asia ex-China equities benefit from regional trade integration and domestic consumption trends. - Latin America offers opportunities in commodity-linked sectors, while China faces structural growth headwinds. 3. Fixed Income - Favorable Environment for Sovereign Debt: - Rate cuts and easing inflation create attractive opportunities in U.S. Treasuries and other advanced economy sovereign bonds. - Bull steepening of yield curves anticipated, with duration management being critical. - Investment-Grade Credit: - Limited potential for spread compression; returns driven by carry rather than capital appreciation. - Select opportunities in securitized credit and short-dated high-yield debt. - Emerging Market Debt: - Local currency bonds in Asia and Latin America favored due to policy easing and attractive yield differentials. - Risks include geopolitical tensions and potential U.S. dollar strength. 4. Thematic and Alternative Investments - Thematic Investing: - AI and Blockchain technologies continue to gain traction, with applications expanding across industries. - Infrastructure investments, particularly in renewable energy and digital transformation, align with global sustainability trends. - Alternative Assets: - Real assets like commodities, real estate, and infrastructure provide diversification and inflation hedges. - Private equity and private credit opportunities offer enhanced returns and reduced volatility compared to traditional assets. 5. Regional Spotlight: GCC Region - Economic Transformation: - Gulf Cooperation Council (GCC) countries, including Saudi Arabia and UAE, are diversifying away from oil through investments in renewable energy, healthcare, and smart infrastructure. - GCC equity markets have outperformed broader EM indices, offering lower volatility and attractive valuations. - Fixed Income Growth: - Rapid expansion in GCC bond markets, with increased issuance of sukuk and green bonds supporting sustainable growth objectives. Portfolio Recommendations - Equity Focus: - Overweight U.S. large caps and mid-caps; selectively allocate to undervalued European sectors and resilient EM regions like India and Indonesia. - Fixed Income Strategies: - Prioritize duration exposure in sovereign debt; selectively allocate to high-yield and EM bonds for yield enhancement. - Thematic and Real Assets: - Invest in transformative technologies (AI, blockchain) and real assets (commodities, infrastructure) for diversification and growth. - Diversification Beyond 60/40: - Incorporate alternative strategies, such as hedge fund replication, private credit, and real estate, to enhance portfolio durability and reduce correlation risks. Conclusion State Street Global Advisors underscores the importance of adaptability and diversification in navigating a fragmented and volatile global landscape. By balancing traditional and alternative investments, focusing on thematic opportunities, and managing risks through active strategies, investors can optimize their portfolios for 2025 and beyond. State_Street_Global_Market_Outlook_2025_Finding_the_Right_PathDownload Read the full article

0 notes

Text

Crédit Agricole CIB Emerging Markets 2025 Outlook – Navigating Headwinds

The Emerging Markets 2025 Outlook by Crédit Agricole CIB emphasizes resilience amidst external pressures, including geopolitical shifts, monetary policy divergence, and global trade realignment. The report forecasts a tempered slowdown in EM growth while highlighting opportunities in selective asset classes and regions. Key Macro Themes 1. Growth Dynamics - Overall EM Growth: - Projected to slow modestly from 4.1% in 2024 to 3.8% in 2025. - EM-DM growth differential remains positive but narrows slightly from 2.6 percentage points (2024) to 2.3 points (2025). - Domestic demand continues to support growth, though external headwinds, including U.S. tariffs, could intensify. - China: - Growth slows to 4.2%, driven by a decline in exports and cautious recovery in domestic demand amid property sector challenges. - Aggressive U.S. tariffs are anticipated to reduce GDP growth by 0.4 percentage points in 2025. - Other EM Regions: - Asia: Moderated growth due to weaker electronics demand and increasing trade protectionism. - Latin America: Resilience in Brazil and commodity exporters but vulnerabilities in Mexico and Colombia due to U.S. policy risks. - EMEA: Geopolitical uncertainty and rising inflation risks weigh on Central and Eastern Europe. 2. Monetary Policy - Easing Bias: - EM central banks expected to cautiously lower rates amid progress in disinflation, but risks of renewed inflation persist in parts of Latin America and EMEA. - Asia maintains a dovish tilt, with less urgency for rate cuts due to lower inflation concerns. - Fed Influence: - U.S. monetary policy pivots will dictate the pace and extent of EM rate cuts, with a focus on preserving interest rate differentials to stabilize currencies. 3. Geopolitical Risks - US-China Tensions: - Escalation in tariffs and restrictions on technology and critical minerals could destabilize EM supply chains. - China’s economic buffer includes stimulus measures, but sustained pressures may weaken investor sentiment. - Tariff Impacts: - U.S. protectionist policies expected to negatively impact trade-dependent EMs, particularly in Asia and Mexico. - Global South vs. West: - The widening divide amplifies political risks and challenges global collaboration on trade and climate issues. Market Views and Investment Opportunities 1. Currencies (EM FX) - Performance Expectations: - EM FX to face pressure in H1 2025 due to stronger USD and tariff-induced risks but could stabilize in H2 as U.S. rates decline. - Top Picks: - Asia: Favor high-yielders (INR, IDR, PHP) over open economies (KRW, SGD, MYR). - EMEA: ZAR benefits from reforms; TRY shows resilience in H1. - LatAm: BRL remains resilient, but bearish on MXN and COP. 2. Fixed Income - Carry Opportunities: - EM-DM interest rate differential supports high-yield debt. - Short-duration instruments in Asia and EMEA remain attractive. - Regional Preferences: - Asia: Receive CNY repo rates and long 5Y CGBs as China’s easing accelerates. - Latin America: Focus on local currency debt in Brazil and Peru. - EMEA: Selective exposure to South African and Turkish bonds. 3. Equities - Regional Insights: - Asia: Weaker growth momentum in North Asia; India and Indonesia lead on domestic resilience. - LatAm: Brazil favored for structural reforms and commodity exposure. - EMEA: Cautious on CE4 equities due to geopolitical risks but opportunities in South Africa. 4. Commodities - Oil and Metals: - Softer oil prices benefit commodity importers in Asia, while metal exporters in LatAm stand to gain from China’s stimulus measures. - Gold: - Retains appeal as a hedge against inflation and geopolitical instability. Strategic Recommendations - Geographic Diversification: - Prioritize resilient economies like India, Indonesia, and Brazil. - Reduce exposure to trade-sensitive markets like Mexico and Korea. - Focus on High-Yielders: - Leverage carry opportunities in Asia (INR, IDR) and LatAm (BRL). - Hedge Against Geopolitical Risks: - Use gold and U.S. Treasuries as stabilizers within portfolios. - Sectoral Allocation: - Emphasize structural themes like sustainability and regional infrastructure development. Conclusion The Emerging Markets 2025 Outlook highlights a year of cautious optimism. While headwinds from tariffs, geopolitical tensions, and inflation risks persist, selective opportunities exist across high-yield currencies, local debt, and resilient equity markets. Strategic diversification and active management remain crucial to navigate this evolving landscape. Read the full article

0 notes

Text

ING Global Outlook for 2025 – Economic Evolution Amid Geopolitical Shifts

The ING Global Outlook December 2024 provides a comprehensive analysis of the global economic and market landscape for 2025. With a new U.S. administration under Donald Trump, evolving trade policies, and a reorientation of central bank strategies, the report identifies key macroeconomic trends, opportunities, and risks. Global Economic Themes 1. Diverging Growth Patterns - United States: - GDP growth projected at 2.0%, supported by fiscal measures but constrained by tariff-related disruptions. - Inflation to average 2.4%-2.5%, with the Federal Reserve adopting a cautious rate-cutting path. - Fiscal stimulus includes tax cuts, infrastructure investments, and targeted government efficiency savings. - Eurozone: - Sluggish growth forecast at 0.7%, hindered by weak consumer confidence and industrial stagnation. - ECB expected to lower rates to 1.75% to support growth. - China: - Growth to decelerate to 4.6%, as escalating tariffs impact exports, despite fiscal measures to stabilize the economy. - Property prices to bottom out, providing some relief to households and businesses. - Emerging Markets (EM): - Resilience in India (GDP growth 6.8%) due to structural reforms and robust domestic demand. - Risks in Korea and other trade-reliant Asian economies due to tariff pressures and currency volatility. 2. Inflation Dynamics - Inflation is expected to oscillate in shorter, more frequent cycles, requiring central banks to adopt flexible and adaptive monetary policies. - Factors driving inflation include tariffs, supply chain realignment, and investment-led constraints. 3. Geopolitical and Policy Risks - U.S.-China Relations: - Tariffs as high as 25% on imports from China, with potential spillovers into Europe and other trade partners. - Strategic isolation of China through trade and investment restrictions. - European Political Uncertainty: - Political instability in France and Germany affects eurozone-wide fiscal and economic policies. - Protectionist measures within the EU could exacerbate inflationary pressures. Key Investment Themes 1. Equities - U.S. Markets: - Defensive sectors such as healthcare and utilities favored amid macroeconomic uncertainty. - AI and automation continue to drive tech sector growth. - Europe: - Opportunities in Southern Europe (e.g., Spain, Italy) due to fiscal stimulus from EU recovery funds. - Risks from trade conflicts and sluggish manufacturing persist. - Emerging Markets: - Favor domestic-driven economies like India and Indonesia, while avoiding heavily export-reliant markets like Korea. 2. Fixed Income - Developed Markets: - U.S. Treasuries and European government bonds to benefit from rate cuts and safe-haven demand. - Emerging Market Debt: - Opportunities in local currency bonds in Brazil, Indonesia, and India, offering attractive yields. 3. Currencies - Strong USD dominance expected, driven by rate differentials and geopolitical uncertainty. - Weakness in euro and Asian trade-oriented currencies (e.g., KRW, SGD) as they face trade tensions and economic headwinds. 4. Commodities - Gold remains a key hedge against inflation and geopolitical risks. - Oil prices forecast to remain range-bound ($70-$75/bbl), with downside risks from global supply increases. Strategic Recommendations - Diversify Across Asset Classes: - Include equities, fixed income, and commodities to balance risk and return. - Leverage Safe-Haven Assets: - Focus on U.S. Treasuries, gold, and high-quality equities. - Target Emerging Market Opportunities: - Prioritize domestic-oriented economies over trade-sensitive regions. - Monitor Policy Risks: - Stay vigilant on tariff developments and their market implications. Conclusion The ING Global Outlook 2025 underscores the importance of navigating an increasingly complex global economic environment. While challenges from tariffs, inflation, and geopolitical tensions persist, selective investments in resilient sectors and geographies offer substantial opportunities. Active management and diversification are essential to optimize portfolios in this evolving landscape. Macro_Outlook_Dec_24_finalDownload Read the full article

0 notes

Text

Goldman Sachs Global Markets Outlook 2025 – Trading Tails and Tailwinds

Goldman Sachs' Global Markets Outlook 2025 identifies a year of transition, with U.S. policy shifts, geopolitical tensions, and inflation risks dominating the global narrative. The report highlights ten key investment themes to guide portfolio strategies, emphasizing the balance between tail risks and tailwinds as markets adjust to a post-election environment and evolving economic landscapes. Key Investment Themes for 2025 1. Wider Distributions After the Soft Landing - Base Case: Solid U.S. growth, cooling inflation, and favorable monetary policies support higher equities, stronger USD, and moderate rate cuts. - Tail Risks: - Upside: Tariff limitations and stronger-than-expected productivity gains. - Downside: Inflation resurgence or broader trade conflicts. 2. Tariff Risks - China Tariffs: New 20% tariffs expected in early 2025 with moderate impacts due to reduced U.S.-China trade dependence. - Global Spillovers: - Broader tariffs on Europe or Mexico could significantly disrupt global trading arrangements, pushing inflation up by 1% in the U.S. and tightening financial conditions globally. 3. Fiscal Risks and Terminal Rates - U.S. Fiscal Expansion: Tax cuts and increased defense spending push U.S. rates higher, while easing immigration adds to inflationary pressures. - Global Divergences: Higher terminal rates anticipated in Japan and EMs due to fiscal stimulus and policy realignments. 4. Dollar Strength - Divergence Theme: The U.S. outpaces DM peers in growth, supported by fiscal policies and tariffs. - Risks to USD Dominance: Broad-based trade conflicts or synchronized global fiscal responses could challenge USD strength. 5. China's Resilience Amid Challenges - Policy Response: Fiscal measures (raising deficit to 3.6% of GDP) and local government debt resolution aim to stabilize growth. - Geopolitical Risks: Tariffs and domestic restructuring remain key hurdles, though domestic demand transitions provide longer-term support. 6. Europe and Emerging Markets (EMs) - Europe: Sluggish growth exacerbated by trade tensions, with ECB deepening rate cuts. - EMs: - Focus on resilient markets (e.g., India, select CEE economies). - Risks from a stronger USD and U.S. tariffs linger. 7. Energy and Commodities - Oil: Brent crude expected to remain range-bound ($70–$85/bbl) with upside from geopolitical disruptions and downside from increased supply. - Gold: Positioned as a hedge against inflation and geopolitical risks. 8. Inflation and Growth Shocks - Inflation Normalization: - Baseline: Inflation eases, allowing central banks to focus on growth. - Risks: Trade wars could increase U.S. core inflation to 3%, while a favorable oil supply backdrop aids disinflation. 9. Valuation Challenges - U.S. Equities: Historically high valuations suggest potential downside if growth slows. - Credit Markets: Tight spreads offer limited upside, but high yields provide resilience. 10. Diversification and Hedges - Portfolio Strategies: - Emphasize U.S. equities with hedges against downside risks using options. - Long positions in USD and commodities like gold and oil enhance portfolio resilience. - Non-U.S. Opportunities: Select EM equities and bonds may benefit if U.S. policies are less aggressive than anticipated. Strategic Recommendations - Equities: - Maintain overweight positions in U.S. equities, especially mid-cap and value stocks. - Diversify globally, focusing on non-U.S. opportunities with hedges for geopolitical risks. - Fixed Income: - Allocate to U.S. Treasuries, TIPS, and Bunds for diversification. - Favor short-duration bonds and select EM debt for yield opportunities. - Commodities: - Maintain exposure to oil and gold as hedges against inflation and geopolitical uncertainties. - Currency Positions: - Long USD against EUR, CAD, and EM currencies to capture strength from divergent growth trends. Conclusion Goldman Sachs' 2025 outlook underscores a pivotal year for global markets, balancing opportunities in U.S. equities and commodities with risks from inflation, geopolitical tensions, and tariff shocks. Active portfolio management, diversification, and strategic hedging will be crucial in navigating the complexities of the year ahead. Goldman Sachs - Global Markets Outlook 2025Download Read the full article

0 notes

Text

BNP Paribas AM: Investment Outlook for 2025

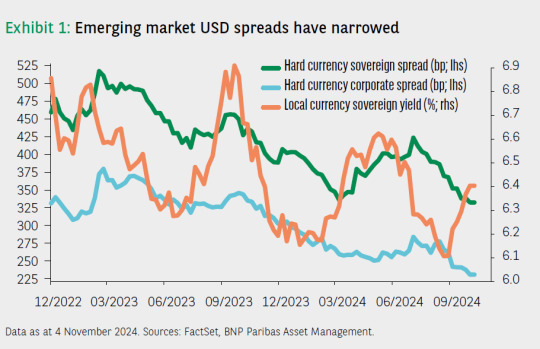

The Investment Outlook for 2025 highlights a year of significant economic and market transitions. With inflation under control, central banks are poised for easing cycles, offering new opportunities for investors. At the same time, geopolitical and environmental challenges underscore the importance of resilience, diversification, and thematic investing. Key Themes and Strategic Insights 1. Navigating Macroeconomic Shifts - Soft Landing or Recession Risks: - Markets anticipate a soft landing, but scenarios such as renewed inflationary pressures or a hard landing remain possible. - Global central banks, including the Federal Reserve and European Central Bank, are expected to cut rates to support growth. - Regional disparities persist, with the U.S. outperforming Europe, while China focuses on stabilizing its property market and stimulating emerging industries.

- Geopolitical Dynamics: - The re-election of Donald Trump introduces uncertainty, with potential shifts in U.S. tax policies, trade agreements, and global economic ties. - Geopolitical hotspots (e.g., Ukraine, Taiwan, Israel) create additional risks for markets. 2. Sustainability and Thematic Investments - Transition Finance: - Investments targeting decarbonization and sustainable operations in high-emission sectors (e.g., energy, heavy industry) are gaining momentum. - EU regulations like ESMA’s fund naming guidelines in 2025 will enhance transparency and accountability in transition investments. - Climate Adaptation: - Climate resilience strategies, including infrastructure upgrades and disaster response, are becoming central to investment portfolios. - Water scarcity solutions (e.g., smart irrigation, water treatment) present a diverse and resilient investment opportunity. - Natural Capital: - Regenerative agriculture, forestry, and water resource preservation are key areas for achieving both economic stability and sustainability goals. - Governments and institutions increasingly prioritize biodiversity and ecosystem restoration. 3. Equity Markets: Favoring Resilience - U.S. Market Leadership: - U.S. equities remain attractive due to fiscal stimulus and advancements in technology, particularly artificial intelligence (AI). - Small caps and value stocks are positioned for recovery as interest rates decline. - European Equities: - Europe lags due to structural challenges in Germany and geopolitical headwinds, but exporters benefit from robust U.S. growth. - Consumer-driven sectors depend on stronger demand recovery. - Emerging Markets: - Markets like India and Southeast Asia offer growth potential, driven by demographics and policy reforms. - China’s success in revitalizing its economy remains a critical swing factor. 4. Fixed Income: Life Beyond Cash - Opportunities in Bonds: - Investment-grade credit offers stable returns amid easing monetary policies. - U.S. mortgages and emerging market local currency bonds provide attractive yields. - Active Management: - A steep yield curve and higher real yields favor active strategies to capitalize on dispersion and timing. - Quantitative Tightening: - Central banks unwinding quantitative easing introduce volatility, creating arbitrage opportunities in fixed income markets.

5. Private Credit and Alternatives - Private Credit Expansion: - Private credit markets are democratizing, with innovations like ELTIF 2.0 making them accessible to retail investors in Europe. - Partnerships between asset managers, banks, and insurers streamline the credit chain. - Sustainability in Private Credit: - Investors increasingly demand ESG-compliant frameworks, pushing managers to develop robust methodologies for evaluating borrowers’ sustainability practices. - Infrastructure and Real Assets: - Renewable energy projects, energy-efficient buildings, and digital infrastructure investments align with long-term structural trends. Strategic Asset Allocation - Equities: - Overweight U.S. equities, particularly AI and technology sectors. - Focus on value opportunities in Europe and growth-oriented emerging markets. - Fixed Income: - Emphasize high-yield credit, local currency emerging market bonds, and inflation-linked securities. - Active duration management to navigate rate volatility. - Private Markets: - Leverage private credit for stable yields and diversification. - Real assets, including infrastructure and water solutions, provide inflation hedging and long-term growth. - Sustainability: - Prioritize transition finance, climate adaptation strategies, and natural capital investments. 2025 presents a landscape of opportunities driven by sustainability, technological innovation, and economic recovery. Investors should adopt a balanced and flexible approach, leveraging thematic investments, private markets, and active management to navigate risks and capture growth. Resilience, diversification, and long-term sustainability remain key to optimizing portfolios in an evolving global environment. Read the full article

0 notes

Text

T. Rowe Price 2025 Global Market Outlook: Investing During Transitions

The 2025 investment landscape is marked by a series of transformative shifts, with global economies transitioning toward new growth paradigms. Major drivers include the rise of artificial intelligence (AI), health care innovations, evolving geopolitical landscapes, and the recalibration of monetary policies. The report underscores the necessity of diversification, active management, and the exploration of undervalued opportunities to navigate the challenges and capitalize on emerging trends. Key Themes and Insights 1. Global Economic Transition - Growth Slowdown and Recovery: - Initial slowdowns in early 2025, largely due to China’s economic uncertainties, will give way to a manufacturing-led recovery in the second half of the year. - Pent-up demand for interest rate-sensitive goods and infrastructure investments will fuel this rebound. - Regional Dynamics: - U.S.: Fiscal policies, productivity improvements, and easing monetary conditions ensure continued economic leadership. - Europe: Heavily impacted by China’s slowdown but poised for recovery through monetary easing and infrastructure spending. - Emerging Markets: Benefit from lower global rates and ongoing supply chain realignments.

2. Artificial Intelligence (AI): Growth Beyond the Hype - AI as a Productivity Driver: - AI's first phase of infrastructure buildout is nearing maturity, but widespread adoption across industries promises continued productivity enhancements. - The global AI chip market is projected to grow from $45 billion in 2023 to $500 billion by 2028. - Investment Opportunities: - Focus on companies innovating in semiconductors, cloud services, and data infrastructure. - Growth prospects remain robust for software vendors, cybersecurity, and fintech applications leveraging AI. 3. Health Care: Innovations Redefining Growth - Golden Age of Health Care: - Radical innovations in treatments such as GLP-1 drugs for diabetes and obesity, robotic surgeries, and AI-driven diagnostics are reshaping the sector. - Biopharma and managed care are adapting to new cost structures and technological advancements. - Investment Focus: - Early-stage companies developing breakthrough therapies. - Managed health organizations leveraging AI for value-based care delivery. 4. Fixed Income Opportunities - Divergent Monetary Policies: - Major central banks, including the Federal Reserve and ECB, are transitioning to rate cuts, while regions like Japan maintain tighter policies. - High-Yield and Emerging Market Debt: - High-Yield Bonds: Attractive yields with moderate spread widening. - Emerging Markets: Local currency bonds benefit from easing policies and stronger currencies. - Inflation-Linked Bonds: - Allocations to Treasury Inflation-Protected Securities (TIPS) hedge against potential inflation resurgence.

5. Private Markets and Alternatives - Private Credit: - Increasing demand for bespoke credit solutions amid challenging macroeconomic conditions. - Opportunities in M&A-driven private credit and capital restructuring. - Private Equity: - Focus on late-stage private companies with IPO prospects as equity markets stabilize. - Real Assets: - Real estate and infrastructure remain resilient, supported by the global push for energy transition and digitalization. 6. Equity Market Outlook - U.S. Equities: - Small caps and value stocks are poised for strong performance due to attractive valuations and anticipated rate cuts. - Sectors like financials and energy are well-positioned for growth. - International Markets: - Japan and South Korea offer attractive valuations supported by corporate governance reforms and innovation. - European equities, particularly industrials and energy, benefit from undervaluation and cyclical recovery. Tactical Asset Allocation Equities - Overweight small caps, value stocks, and industrials in developed markets. - Selectively overweight emerging markets, with a focus on India and Southeast Asia. Fixed Income - Favor high-yield bonds, floating rate loans, and emerging market debt for income generation. - Allocate to inflation-linked bonds and longer-duration investment-grade credit for diversification. Alternatives - Prioritize infrastructure, private equity, and real estate in sectors like renewable energy and digital infrastructure. The 2025 outlook presents a dynamic investment environment shaped by technological advancements, economic recovery, and evolving market opportunities. By diversifying across asset classes, actively managing portfolios, and leveraging growth sectors like AI, health care, and infrastructure, investors can position themselves for long-term success in an era of profound transitions. Active monitoring of geopolitical and economic shifts will be critical for adapting to the uncertainties and seizing emerging opportunities. Investing-During-Transitions-GMO-2025Download Read the full article

0 notes

Text

Amundi 2025 Investment Outlook – Bright Spots in a World of Anomalies

Amundi’s 2025 Investment Outlook identifies a world reconfigured by anomalies such as geopolitical tensions, economic fragmentation, and evolving market dynamics. Despite these challenges, the report emphasizes “bright spots” for investors to capitalize on, supported by resilient economic growth, monetary easing, and targeted opportunities in risk assets, private markets, and sustainability themes. Key Themes and Investment Convictions 1. A Benign Global Economic Outlook - United States: - Economic moderation as inflation subsides and the Federal Reserve gradually cuts rates. GDP growth expected at ~1.7%. - Transition from fiscal stimulus to structural adjustments under Trump’s administration. - Europe: - Modest recovery driven by disinflation, rate cuts by the ECB, and green transition investments. Expected GDP growth ~1.0%. - Growth challenges persist due to geopolitical risks and productivity gaps. - Emerging Markets (EMs): - Asia, led by India and Indonesia, continues to grow robustly, supported by regional trade ties and technological leadership. - China’s economy stabilizes with strategic fiscal and monetary policy adjustments.

2. Investment Opportunities in a Fragmented World - Risk Assets: - Pro-risk stance favors equities, investment-grade credit, and EM bonds. - High-yield bonds and leveraged loans offer attractive yields, particularly in a low-volatility environment. - Private Markets: - Infrastructure investments, driven by global energy transition needs, provide long-term growth and stability. - Private debt offers appealing income opportunities amid a low-interest-rate landscape. - Sectoral Focus: - Growth in artificial intelligence (AI), clean energy, healthcare, and manufacturing re-shoring. - Financials, communication services, and utilities stand out for their resilience and valuation attractiveness. 3. Geopolitical Risks and Diversification - Geopolitical Tensions: - U.S.-China trade wars and strategic rivalries reshape global supply chains. - Potential peace talks in Ukraine and evolving alliances (e.g., BRICS) create uncertainties and opportunities. - Risk Mitigation: - Inflation-linked bonds, gold, and other safe-haven assets provide hedges against geopolitical and inflation risks. - Diversification across geographies and asset classes remains critical. 4. The Role of Central Banks - Monetary Policy: - Global central banks, led by the Fed and ECB, are easing policy rates to support economic recovery. - Rates unlikely to return to pre-pandemic lows, requiring investors to adjust income expectations. - Fixed Income: - U.S. Treasuries and investment-grade credit offer attractive yields. - EM bonds benefit from dovish local central banks, with select opportunities in high-yield debt. 5. Emerging Market Resilience - Asia’s Growth Drivers: - Intra-regional trade networks, such as RCEP, strengthen resilience across sectors like ICT, semiconductors, and agriculture. - India and Indonesia remain top picks, offering strong growth, favorable demographics, and policy support. - China’s Recovery: - Stabilization efforts focus on domestic demand and re-routing trade impacted by U.S. tariffs. Key Investment Strategies - Dynamic Asset Allocation: - Balance pro-risk positions in equities and credit with inflation-resilient assets like infrastructure and cyclical metals. - Sectoral Rotation: - Favor sectors aligned with structural trends, including AI, clean energy, and industrials. - Private Markets: - Emphasize private debt and infrastructure for income and growth in a low-yield environment. - Geopolitical Hedging: - Integrate gold, inflation-linked bonds, and defensive equities to mitigate geopolitical risks.

Amundi’s 2025 Outlook underscores the importance of strategic flexibility in navigating a fragmented world. By balancing pro-risk exposures with inflation-resilient strategies and focusing on thematic opportunities, investors can harness growth while safeguarding against economic and geopolitical disruptions. 2024.11 - Investment_Outlook_2025 - ENDownload Read the full article

0 notes

Text

Robeco 2025 Outlook – This is Not a Landing

The Robeco 2025 Outlook paints a nuanced picture of the global economy and markets, challenging traditional narratives about the current cycle. Echoing René Magritte’s “The Treachery of Images,” the report highlights that while surface-level indicators suggest an economic landing, the reality is far more complex. The central thesis is that the global economy is not experiencing a true landing, but rather navigating a turbulent transition shaped by geopolitical shifts, policy realignments, and structural transformations. Key Themes and Scenarios 1. Three Scenarios for 2025 - Base Case: "This is Not a Landing" - Economic resilience despite surface-level weakness; inflation risks rise due to procyclical fiscal and monetary policy. - Key risks: Excessive easing could bring forward inflationary pressures, especially in the U.S. due to tight labor markets and elevated growth rates. - U.S. GDP growth forecast: 1.7%, slightly below consensus, with inflation at 2.75%. - Bull Case: "A Surreal Ascent" - Synchronization of global monetary easing and further disinflation fuels a "golden age." - U.S. consumption remains strong, driven by productivity gains and well-supplied energy markets. - Key catalysts: AI infrastructure, chips industry growth, and geopolitical detente. - Bear Case: "Waking up from a Pipe Dream" - Trade wars and geopolitical tensions trigger stagflation, escalating inflation and unemployment. - Eurozone faces deteriorating consumption due to tariff threats; China struggles with youth unemployment and domestic unrest.

2. Financial Markets Outlook - Equities: - U.S. markets remain resilient, but elevated valuations limit upside; forecasted mid-single-digit returns for the S&P 500. - Opportunities in small-cap and value stocks, benefiting from tariffs and domestic consumption. - Europe sees potential for multiple expansion due to lower discount rates and positive earnings surprises. - Fixed Income: - Investment-grade credit attractive due to tight spreads and supportive monetary policy. - High-yield bonds offer limited upside as spreads remain compressed, increasing risk of spread widening. - U.S. 10-year yields forecasted to peak between 4.5%-5%, reflecting nominal growth above 4%. - Currencies: - USD remains overvalued but strong amid geopolitical tensions; expected to peak if Fed cuts rates further. - JPY undervalued, with potential to strengthen on both domestic (rate hikes) and global (safe haven demand) fronts.

3. Sustainable Investing: Transitioning to Long-Term Opportunities - Transition Investing: - Rapid growth in funds focused on transitioning to low-carbon economies and broader sustainability themes. - EU leads in implementing robust ESG reporting and transitioning to climate-resilient economies. - Climate and Nature Action: - COP 30 to address new climate commitments and financial mobilization for adaptation and resilience. - Increased focus on biodiversity and nature-related investments through initiatives like Nature Action 100. - Green Bonds: - Record issuance of USD 942 billion in 2024; diversification into emerging markets and hard-to-abate sectors expected in 2025. - Pricing remains attractive as the greenium (green bond premium) declines. Key Risks and Opportunities - Geopolitical Risks: - Trade wars, particularly between the U.S. and China, could disrupt global supply chains and amplify inflationary pressures. - Tensions over Taiwan and hybrid conflicts exacerbate uncertainties. - U.S. Policy Shifts: - Procyclical fiscal and monetary expansion under the Trump administration may spur short-term growth but risk stagflation in the medium term. - Global Transition Themes: - Continued investment in AI, renewable energy, and decarbonization presents compelling long-term opportunities. Robeco’s 2025 Outlook underscores a world in transition, where short-term uncertainties obscure long-term growth potential. Active management, flexible investment strategies, and a focus on structural themes like sustainability, digital transformation, and economic resilience are critical for navigating the year ahead. By aligning portfolios with transformative trends and carefully managing risks, investors can uncover value in an increasingly complex landscape. Read the full article

0 notes

Text

Barclays Outlook 2025 – Time to Deliver

Barclays' Outlook 2025 focuses on a year of transition, as global economies navigate the complexities of post-pandemic recovery, geopolitical uncertainties, and accelerating technological disruptions. Key themes include adapting to economic realignment, harnessing opportunities in AI and sustainable investing, and managing risks from geopolitical tensions and inflation. Key Themes and Economic Insights 1. Global Macro Overview - United States: - GDP growth is projected at 2.1% for 2025, supported by fiscal stimulus and rate cuts, but headwinds include waning consumer strength and tariff uncertainties. - Inflation is forecast at 2.3%, with the Federal Reserve likely cutting rates further. - Eurozone: - Growth remains subdued at 0.7%, with recovery led by Spain, while Germany and France face challenges due to sluggish manufacturing and political instability. - The ECB is expected to continue rate cuts, with inflation dropping below 2%. - China: - Growth slows to 4% amid demographic headwinds and a troubled property market. Stimulus measures focus on recapitalizing banks and supporting local governments. - Trade tensions with the U.S. and demographic pressures further complicate the outlook. - United Kingdom: - GDP growth estimated at 1.2%, as inflation recedes. Fiscal pressures and higher unemployment remain concerns, though gilt markets and export-driven equities offer investment opportunities.

2. Equities - Broad Market Trends: - Equity markets have been buoyed by strong performance in AI and mega-cap tech stocks but face valuation challenges. - Sectors such as utilities, consumer staples, and healthcare present defensive opportunities. - Regional Insights: - U.S. equities expected to deliver moderate returns as earnings growth replaces multiple expansion. - European equities offer select opportunities despite overall weaker growth. - Thematic Investing: - AI and automation drive investment narratives, though concerns about sustainability, energy use, and broader economic impact persist.

3. Fixed Income - Yield Dynamics: - Global yields are likely past their peak, with divergence expected as U.S. growth remains robust while Europe and the UK face weaker growth. - Tight credit spreads suggest limited upside, making securitized credit and BB-rated bonds attractive for carry opportunities. - Emerging Market Debt: - Emerging markets present opportunities for diversification, though China’s property market issues pose default risks in Asia. 4. Artificial Intelligence - Productivity vs. Constraints: - While AI adoption accelerates, challenges such as energy demands, training costs, and societal integration slow progress. - Estimates for AI-driven GDP growth range from modest (1.1%) to transformative (100%) over the next decade, depending on scalability and adoption. - Sectoral Impact: - AI’s implementation is uneven across industries, with healthcare and finance requiring stringent oversight due to data sensitivity and accuracy concerns.