Don't wanna be here? Send us removal request.

Text

Streamline Recruitment and Upskilling with Advanced Online Assessment Systems

Recruitment and employee development are no longer manual, time-consuming processes. Advanced online assessment systems have transformed how companies evaluate talent—both during hiring and in ongoing upskilling. These tools not only speed up decision-making but also improve accuracy, reduce bias, and deliver measurable ROI across HR functions.

Why Assessment Systems Matter in Modern Hiring

Finding the right candidate isn’t about resumes alone. Today’s hiring decisions must be based on skills, problem-solving ability, and job readiness. Online assessment platforms provide structured, data-driven evaluations that help organizations filter the best talent efficiently.

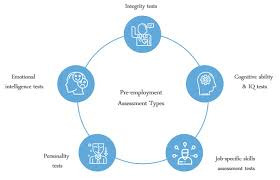

From cognitive ability and personality tests to technical and domain-specific quizzes, these systems cover a wide range of hiring needs. Recruiters no longer have to rely solely on interviews or gut feelings. Instead, they gain a clear, standardized view of a candidate’s capability—even before the first call.

Key Benefits for Recruitment

Faster Shortlisting Pre-employment assessments automate the early screening process, narrowing down the applicant pool with minimal manual effort.

Objective Evaluation Standardized tests eliminate subjective bias, allowing for fair comparisons between candidates based on real skill sets.

Customizable Test Formats Online platforms offer multiple formats—MCQs, coding simulators, situational judgment tests—ensuring assessments align with role requirements.

Better Candidate Experience Modern interfaces and remote testing options make assessments more accessible, encouraging higher participation from top talent.

Data-Backed Decisions Analytics dashboards provide detailed reports on candidate performance, helping HR teams make informed decisions quickly.

Upskilling Made Easier with Assessment Tools

The role of online assessments doesn’t end at recruitment. As industries evolve, continuous learning becomes essential. Online assessment platforms help HR and L&D teams identify skill gaps and track employee development in real time.

For instance, if a team needs to improve its data analytics capability, a pre-assessment can identify knowledge gaps. Tailored training programs can then be introduced, followed by post-assessments to measure progress. This data-driven approach leads to more effective upskilling and improved workforce performance.

Features to Look for in a Good Assessment Platform

To get the most value, it’s essential to choose an online assessment system with the right features:

Custom Test Creation: Build assessments tailored to your business and job roles.

Anti-Cheating Mechanisms: Ensure integrity with webcam monitoring, question randomization, and time limits.

Real-Time Reporting: Access instant analytics on individual and group performance.

Integration Capabilities: Sync results with your ATS or LMS for seamless workflow.

Scalability: Handle high-volume assessments across departments or global offices.

Platforms like SkillRobo, Mettl, Codility, and TestGorilla are widely recognized for offering robust assessment tools suited for both recruitment and training.

Streamlining the Full Talent Lifecycle

When integrated into your talent strategy, online assessments reduce hiring cycles, improve quality of hire, and drive a culture of continuous learning. The same system that screens applicants can later be used to benchmark employees for promotions, team placements, or reskilling initiatives.

Moreover, by using these tools, HR teams shift from reactive operations to proactive workforce development. They can identify top performers early, tailor growth paths, and align employee skills with business goals—ensuring long-term organizational success.

youtube

Final Thoughts

Online assessment systems are more than a hiring aid—they’re a strategic investment in workforce efficiency and future-readiness. Whether you're looking to hire the best talent or strengthen your existing team’s capabilities, leveraging these tools simplifies the process and adds measurable value. By streamlining both recruitment and upskilling, businesses gain a competitive edge in attracting, retaining, and growing high-performing teams.

SITES WE SUPPORT

Assess Flow Manager - Blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

1 note

·

View note

Text

Choosing the Best Online Tools to Assess Employee Skills Effectively

Evaluating employee skills is a critical part of hiring, training, and development. With the growing demand for data-driven hiring and continuous upskilling, businesses are turning to online tools to assess employee competencies more accurately and efficiently. Selecting the right assessment platform is key to building a productive, future-ready workforce.

Why Skill Assessment Tools Matter

Effective skills assessments provide more than just a score—they offer insights into an individual’s aptitude, learning style, and real-world capabilities. Whether it’s for recruitment, performance evaluation, or learning and development, these tools help:

Identify the right candidates during hiring

Understand skill gaps among existing employees

Support targeted upskilling and reskilling

Improve workforce planning and retention strategies

Unlike resumes or interviews, skill tests deliver objective data, reducing hiring bias and helping managers make informed decisions.

Features to Look for in a Skills Assessment Tool

Not all assessment platforms offer the same value. The best tools combine ease of use with comprehensive features. Here’s what to prioritize:

Customizable Test Library: Choose tools that offer pre-built tests and allow you to create role-specific assessments.

Real-Time Analytics: Instant results, benchmarking, and insights into candidate performance help drive faster decisions.

Remote Proctoring: Ensures test integrity, especially for remote hiring or virtual teams.

Soft and Hard Skill Coverage: Evaluate everything from technical proficiency to communication, leadership, and problem-solving.

Integration Capabilities: Platforms that integrate with your ATS or LMS streamline hiring and onboarding.

Top Online Tools for Skill Assessment

Below are some leading platforms that help organizations assess employee skills effectively:

1. SkillRobo SkillRobo provides customizable pre-employment tests that cover a wide range of roles and industries. It supports cognitive, behavioral, and technical assessments, making it ideal for both recruitment and internal evaluations.

2. TestGorilla Known for its user-friendly interface and wide test library, TestGorilla allows businesses to assess soft skills, personality traits, and job-specific knowledge, all with anti-cheating features built-in.

3. iMocha iMocha excels in IT and coding assessments and is widely used for tech hiring. It also offers AI-powered analytics and benchmarking features for smarter hiring.

4. Codility and HackerRank For companies focused on hiring developers, these tools provide live coding tests, algorithm challenges, and customizable coding environments to evaluate real-world programming skills.

5. Mettl by Mercer Mettl offers end-to-end assessment solutions for hiring, skill benchmarking, and L&D. It supports remote proctoring and has one of the most extensive test libraries available.

Tailoring Assessments to Business Goals

The effectiveness of any tool depends on how well it aligns with your hiring or development strategy. Before implementation, ask:

What specific skills do we need to measure?

Do we need industry-standard tests or internal benchmarks?

How will the results feed into our broader talent strategy?

The right platform should not only test skills but also support informed action—whether that’s making the right hire, designing training programs, or preparing succession plans.

Making the Final Choice

Choose a tool that is scalable, secure, and adaptable to your evolving business needs. Check for support services, reporting accuracy, and the ability to deliver a smooth candidate experience. A trial period or demo can also help you evaluate usability and feature depth before full adoption.

youtube

Conclusion

Online skills assessment tools are powerful assets for organizations aiming to build a strong, capable workforce. By selecting the right platform, companies can streamline hiring, eliminate guesswork, and focus on nurturing talent that drives results. As workforce needs evolve, having reliable data on employee capabilities will remain a key competitive advantage.

SITES WE SUPPORT

Assess Flow Manager - Blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Top Pre-Employment Assessment Tools to Hire Smarter and Faster

Finding the right candidate is one of the most critical—and time-consuming—tasks in recruitment. Traditional hiring methods like resumes and interviews often don’t provide enough insight into a candidate’s skills, behavior, or cultural fit. That’s where pre-employment assessment tools come in. These platforms help employers evaluate applicants more effectively, leading to faster, smarter hiring decisions.

'

Why Pre-Employment Assessment Tools Matter

Pre-employment assessments are designed to test a candidate's aptitude, personality, soft skills, and job-specific knowledge. They provide objective data to support hiring decisions, minimize bias, and reduce the risk of costly mis-hires. With data-driven insights, recruiters can compare candidates fairly and select individuals who are more likely to perform well and stay longer in the role.

Whether you’re hiring for technical roles, customer service, or leadership positions, assessment tools can streamline the entire recruitment funnel—from initial screening to final selection.

Key Features to Look For

When evaluating assessment platforms, here are some essential features to consider:

Customizable Tests tailored to different job roles

Automated scoring and reporting for faster decision-making

Behavioral and cognitive testing for a deeper understanding of candidates

Integration with your Applicant Tracking System (ATS)

Compliance with data privacy and equal opportunity regulations

Now, let’s look at some of the top pre-employment assessment tools available today.

1. SkillRobo

SkillRobo offers customizable pre-employment assessments covering a wide range of roles, from finance and HR to software development and sales. It supports both technical and non-technical tests, making it suitable for businesses of all sizes.

Key features:

Real-time test monitoring

Role-based test templates

Behavioral and cognitive assessment modules

Detailed analytics and reports

SkillRobo stands out for its user-friendly interface and quick setup, helping recruiters reduce time-to-hire while maintaining quality standards.

2. TestGorilla

TestGorilla provides a large library of professionally created tests, including language skills, programming, personality, and situational judgment.

Key features:

Anti-cheating mechanisms

One-way video interviews

ATS integration

Custom branding options

TestGorilla helps employers build a strong hiring funnel by eliminating guesswork and focusing on candidate capabilities from the start.

3. HackerRank

Ideal for tech hiring, HackerRank offers coding assessments for developers, data scientists, and IT roles. The platform supports real-time coding interviews and technical skill challenges.

Key features:

Code playback and performance metrics

Support for 40+ programming languages

AI-based plagiarism detection

Detailed scorecards

For companies hiring software engineers, HackerRank provides the technical depth needed to filter top talent efficiently.

4. Criteria Corp

Criteria’s assessment suite includes cognitive aptitude, personality, emotional intelligence, and skills testing. Its scientifically validated tests help predict job performance across a wide range of industries.

Key features:

Mobile-friendly testing

EEOC-compliant assessments

Fast implementation

Insightful candidate analytics

This tool is ideal for organizations that want to ensure hiring consistency and fairness while improving retention.

5. eSkill

eSkill enables businesses to build job-specific tests from a vast question bank or create their own. It’s particularly useful for administrative, sales, customer support, and healthcare roles.

Key features:

Job simulation tests

Video response questions

Custom branding and workflows

Multilingual support

eSkill’s flexibility makes it a strong choice for businesses that need highly tailored evaluations.

youtube

Final Thoughts

Pre-employment assessment tools give employers the power to make data-informed decisions, reduce hiring bias, and improve the overall quality of hires. With features like customizable tests, real-time analytics, and seamless integrations, these platforms help companies save time and hire with confidence.

Whether you’re a startup scaling your team or an enterprise seeking precision in your hiring process, using the right assessment tool is a smart step toward building a high-performing workforce.

SITES WE SUPPORT

Assess Flow Manager - Blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Why Online Examination Software Is Essential for Modern Hiring and Training

Digital transformation has reshaped how organizations hire and train employees. One tool that stands out in this shift is online examination software a powerful solution designed to streamline evaluations, improve objectivity, and enhance overall workforce quality. As remote work and hybrid models become more common, organizations need scalable, secure, and efficient assessment tools that go beyond traditional testing methods.

What Is Online Examination Software?

Online examination software is a digital platform that allows businesses to create, administer, and evaluate tests remotely. These assessments can cover a wide range of topics, from technical knowledge and soft skills to job-specific scenarios and compliance training. With customizable question banks, automated scoring, and advanced analytics, this software provides a comprehensive solution for both hiring and employee development.

The Role of Online Exams in Recruitment

Modern recruitment demands more than a resume and a short interview. With competition for talent increasing, employers need reliable ways to evaluate candidates’ skills before making hiring decisions.

Key benefits of using online examination tools in hiring include:

Skill-Based Filtering: Assess candidates for role-specific competencies like programming, communication, or problem-solving.

Reduced Bias: Automated scoring and standardized assessments ensure objectivity.

Faster Screening: Online exams can filter out unqualified applicants early in the process, saving time for hiring teams.

Remote Accessibility: Candidates can take exams from anywhere, allowing businesses to hire from a global talent pool.

Data-Driven Decisions: Detailed reports and analytics support better hiring choices.

By integrating exams early in the hiring process, companies can avoid poor hires and ensure only top-performing candidates proceed to interviews.

Online Exams as a Training and Upskilling Tool

The role of online examination software extends far beyond recruitment. It’s an equally effective tool for training and upskilling current employees. As industries evolve, continuous learning is essential—and online testing ensures that training programs are actually effective.

Here’s how online exams enhance employee training:

Knowledge Validation: Measure understanding after training modules to identify learning gaps.

Compliance Assurance: Use tests to certify completion of mandatory training, especially in regulated industries.

Personalized Learning Paths: Assessment results can guide customized training programs based on each employee’s needs.

Progress Tracking: Monitor learning outcomes over time to evaluate ROI and make improvements.

For HR and L&D teams, this means less paperwork, quicker assessments, and more actionable insights into workforce performance.

Key Features to Look for in Online Examination Software

To get the most out of your investment, choose a platform that offers:

Customizable Test Formats: MCQs, coding tasks, case studies, and more

Security Measures: Anti-cheating tools like webcam monitoring, time limits, and question randomization

Analytics and Reporting: Real-time dashboards for tracking performance

Integration Capabilities: Compatibility with your HRMS or LMS

User-Friendly Interface: Easy setup for admins and seamless experience for candidates

These features ensure that your testing process is not only robust but also scalable across departments and geographies.

Why Businesses Are Making the Shift

Traditional hiring and training methods are time-consuming, inconsistent, and often lack measurable outcomes. Online examination software addresses these issues by:

Automating routine tasks

Improving accuracy in evaluations

Enhancing scalability across large teams or remote locations

Providing compliance documentation and audit trails

In industries like IT, healthcare, finance, and education, where skills and compliance are critical, these platforms are quickly becoming a standard part of operations.

youtube

Final Thoughts

Online examination software is no longer optional for modern businesses—it’s essential. Whether you're looking to hire faster, train smarter, or ensure compliance, a well-implemented online assessment tool delivers measurable benefits. As digital workplaces continue to evolve, investing in the right exam platform is a step toward building a more efficient, skilled, and future-ready workforce.

SITES WE SUPPORT

Assess Flow Manager - Blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Boost Efficiency with Smart Rules, Smarter Spending, and Streamlined Processes

efficiency is key to staying competitive. Companies must continually adapt to rapidly changing market conditions while optimizing their internal processes. One of the most effective ways to enhance business efficiency is by implementing smart rules, making smarter spending decisions, and streamlining processes. By focusing on these three key areas, organizations can significantly improve productivity, reduce operational costs, and boost overall performance.

1. Smart Rules: Automating Decisions and Improving Accuracy

A key aspect of business efficiency is the ability to automate decision-making. Smart rules, embedded in workflow automation tools, can significantly streamline complex processes by defining conditions that trigger specific actions. For instance, you can create rules that automatically route documents to the appropriate department based on predefined criteria or approve budget requests above a certain amount without manual intervention.

By leveraging a rules engine, businesses can eliminate unnecessary human involvement in routine decision-making tasks, freeing up time for employees to focus on more strategic activities. This helps avoid bottlenecks and accelerates decision-making, ensuring tasks are completed faster and with higher accuracy.

Moreover, these rules can be designed to adapt to changing business needs. Whether it’s adjusting workflows based on new regulations or optimizing resource allocation in real-time, smart rules ensure that the organization’s operations remain flexible and responsive to change.

2. Smarter Spending: Balancing CapEx and OpEx for Financial Efficiency

An often-overlooked component of efficiency is the management of finances, specifically how businesses handle Capital Expenditures (CapEx) and Operational Expenditures (OpEx). Both types of spending have a significant impact on cash flow, business growth, and long-term financial health.

CapEx involves long-term investments in physical assets such as buildings, machinery, or IT infrastructure. While these investments may require substantial upfront costs, they provide long-term value and are typically depreciated over several years.

OpEx, on the other hand, refers to daily operational costs like salaries, utilities, software subscriptions, and other recurring expenses. These costs are typically easier to manage on an ongoing basis but can add up over time.

In today’s business climate, many companies are moving away from CapEx-heavy models to more OpEx-focused strategies. Cloud-based tools and software-as-a-service (SaaS) products allow businesses to pay for services on a subscription basis, reducing the need for large upfront investments. By making smarter spending decisions and finding a balance between CapEx and OpEx, businesses can maintain flexibility, scale more efficiently, and reduce financial risks.

3. Streamlining Processes: Removing Redundancies and Improving Collaboration

Even the most powerful rules and financial strategies are ineffective if your processes are cumbersome and inefficient. Streamlining business processes is critical to improving operational efficiency. The first step in this is mapping out your workflows to identify areas where time and resources are being wasted.

One effective strategy is to automate repetitive tasks such as data entry, scheduling, and approvals. Tools like project management software and HR platforms can automate these processes, reducing the need for manual input and minimizing the risk of human error. Automation not only speeds up task completion but also enhances consistency and accuracy across the organization.

In addition to automation, collaboration tools can streamline communication and foster cross-functional teamwork. By consolidating all communication, project tracking, and document sharing in one platform, teams can work more cohesively and efficiently. Tools like Slack, Microsoft Teams, and Asana allow employees to collaborate on projects in real-time, making it easier to meet deadlines and ensure the successful completion of tasks.

4. Measuring Success: Track Efficiency Gains with Metrics

It’s important to track the success of your efficiency initiatives. Key performance indicators (KPIs) such as time saved, cost reduction, employee productivity, and customer satisfaction provide valuable insights into the effectiveness of your smart rules, spending strategies, and streamlined processes.

By continuously monitoring these metrics, businesses can make data-driven decisions to fine-tune their operations. For example, if automating an HR onboarding process leads to a decrease in time-to-hire, you can apply the same approach to other areas like procurement or finance.

youtube

Conclusion

Boosting efficiency with smart rules, smarter spending, and streamlined processes is not just about implementing technology—it’s about fostering a culture of continuous improvement. By embracing automation, optimizing financial strategies, and eliminating redundancies, businesses can work smarter, not harder. Ultimately, organizations that prioritize efficiency will be well-positioned to thrive in an increasingly competitive marketplace.

SITES WE SUPPORT

Assess Flow Manager - Blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Simple Yet Effective Ways to Improve Any Business Process at Work

Improving business processes doesn’t always require massive restructuring or expensive software. Often, small, targeted changes can drive big gains in efficiency, accuracy, and team productivity. Whether you're in operations, HR, finance, or customer service, refining internal processes is key to reducing costs and improving outcomes.

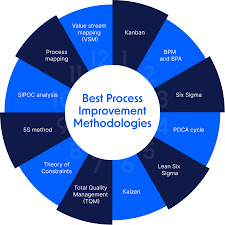

This guide outlines practical and effective ways to improve business processes matter any department or industry.

1. Map the Current Process

Before you can improve a process, you need to fully understand it. Start by mapping out each step in the current workflow. Use a simple flowchart to visualize actions, decisions, handoffs, and outcomes.

Include:

Who is involved at each stage

What tools or documents are used

Where delays or bottlenecks typically occur

Tools like Cflow offer visual workflow builders that help in documenting and analyzing workflows quickly and clearly.

2. Identify Bottlenecks and Redundancies

Once your process is mapped, look closely for inefficiencies. Are there approvals that take too long? Are manual data entries slowing things down? Are tasks duplicated across departments?

Common bottlenecks include:

Over-reliance on email or spreadsheets

Unclear roles or task ownership

Manual approvals that could be automated

Inconsistent data formats

Recognizing these problem areas helps you focus on the changes that will make the biggest impact.

3. Gather Feedback from Your Team

Employees who use the process daily are your best source of improvement ideas. Organize a quick survey or informal discussion to learn:

Which steps they find frustrating

What slows them down

What changes they believe would help

This input not only uncovers hidden pain points but also ensures buy-in when changes are implemented.

4. Set Clear, Measurable Goals

Don’t improve processes just for the sake of change. Define what success looks like. Examples of measurable goals include:

Reducing turnaround time by 25%

Cutting approval delays from 3 days to 1

Automating 80% of manual entries

These goals help guide your strategy and measure progress post-implementation.

5. Leverage Workflow Automation Tools

Automating repetitive tasks can significantly reduce errors and save time. Platforms like Cflow allow you to build customized workflows with logic-based rules, role-based access, and automated notifications.

Examples of automation:

Auto-assigning tasks when a form is submitted

Sending reminders for pending approvals

Generating reports based on real-time data

By eliminating manual steps, teams can focus on higher-value work.

6. Pilot, Test, and Iterate

Before rolling out changes organization-wide, test your new process in a controlled environment. Monitor performance and gather feedback. Does the change deliver on your goals? Are there unintended side effects?

Use this testing phase to make adjustments before scaling. Continuous iteration ensures your improvements remain relevant as business needs evolve.

7. Train and Communicate Clearly

Even the best-designed processes can fail if users don’t understand them. Develop short training materials, quick-start guides, or screen recordings to explain what’s new and why it matters.

Ensure teams know:

What changed

How it benefits them

Where to get help if needed

Clear communication speeds up adoption and minimizes resistance.

8. Track Metrics and Optimize Regularly

Process improvement is not a one-time project. Once changes are implemented, track performance using key metrics. Schedule regular reviews to assess whether the process still meets business needs, especially as teams grow or technologies evolve.

Some useful KPIs include:

Process completion time

Error rate

Approval turnaround

User satisfaction scores

Final Thoughts

Improving business processes doesn’t have to be complex or expensive. By mapping workflows, listening to users, automating where possible, and monitoring results, you can unlock greater productivity and build a more agile organization. Small changes, applied consistently, can lead to transformative results over time.

SITES WE SUPPORT

Assess Flow Manager - Blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

CapEx vs OpEx: Which Spending Strategy Is Right for Your Business?

Managing business expenses effectively is essential for long-term growth and profitability. A key part of financial strategy is understanding how different types of expenditures impact your operations, tax liabilities, and budgeting. Two fundamental categories in business finance are (CapEx) and (OpEx). While both involve spending, they serve very different purposes and have distinct financial implications.

So, how do you decide which approach suits your business needs? This blog breaks down the differences between CapEx and OpEx and helps you evaluate the best strategy for your organization.

What Is CapEx?

Capital Expenditure (CapEx) refers to long-term investments made by a business to acquire or upgrade physical assets. These include purchases such as:

Equipment and machinery

Office buildings

Vehicles

Infrastructure improvements

Hardware and servers

CapEx is recorded on the balance sheet and depreciated over the useful life of the asset. These investments often require significant upfront capital and involve long-term commitment.

Key Characteristics of CapEx:

Long-term asset creation

Depreciated over time

Large upfront costs

Typically approved through lengthy budgeting processes

What Is OpEx?

Operating Expenditure (OpEx) covers the day-to-day costs of running a business. These are recurring expenses required to maintain operations, such as:

Rent and utilities

Salaries and wages

Software subscriptions (SaaS)

Office supplies

Marketing and advertising costs

OpEx is recorded on the income statement and is fully tax-deductible in the year it's incurred.

Key Characteristics of OpEx:

Short-term operating costs

Fully expensed in the current period

Flexible and scalable

Easier to approve and manage

CapEx vs OpEx: Key Differences

FeatureCapExOpExPurposeLong-term investmentsDay-to-day operationsAccounting TreatmentCapitalized and depreciatedExpensed immediatelyApproval ProcessOften complex and time-consumingTypically faster and more flexibleTax ImpactTax benefit spread over timeTax-deductible in the year incurredCash Flow ImpactSignificant upfront costDistributed over time

The Rise of OpEx in Modern Business Models

With the growth of cloud computing, software-as-a-service (SaaS), and outsourcing, more companies are shifting towards OpEx models. For example, instead of purchasing servers (CapEx), businesses now prefer cloud-based infrastructure where they pay monthly for usage (OpEx).

This shift provides multiple benefits:

Lower upfront investment

Greater flexibility and scalability

Easier upgrades and maintenance

Faster deployment of solutions

OpEx models are particularly beneficial for startups and SMBs that want to maintain healthy cash flow and avoid long-term asset commitments.

When to Choose CapEx

CapEx is still the right choice in several scenarios, particularly when:

Ownership of an asset is critical

Long-term ROI is expected

The asset contributes directly to business value

Custom infrastructure is required

Industries like manufacturing, construction, and transportation still rely heavily on CapEx for equipment and facility investments.

When to Choose OpEx

OpEx is ideal when:

You need operational flexibility

Rapid scalability is required

You want predictable monthly expenses

Technology changes frequently (e.g., software)

OpEx also aligns with lean operations and agile budgeting, making it easier to adapt to market changes without committing large sums of capital.

Finding the Right Balance

Many businesses benefit from a hybrid approach, using CapEx for foundational investments and OpEx for scalable solutions. For example, a company may invest in custom hardware (CapEx) but use cloud-based project management software (OpEx) for team collaboration.

The key is aligning your spending strategy with your business goals, cash flow requirements, and long-term vision.

youtube

Conclusion

Choosing between CapEx and OpEx isn't just a financial decision—it's a strategic one. Understanding the differences helps you allocate resources wisely, reduce risks, and support sustainable growth. Evaluate your company’s needs, growth stage, and financial structure to decide which spending approach—or combination—delivers the most value.

Whether you're upgrading infrastructure or subscribing to new software, the right strategy can position your business for long-term success.

SITES WE SUPPORT

Assess Flow Manager - Blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

How a Sophisticated Rules Engine Transforms Workflow Automation

Workflow automation has become a cornerstone of modern business operations. While basic automation improves efficiency, it’s the rules engine behind the system that brings true transformation. A sophisticated rules engine empowers organizations to build flexible, intelligent workflows that adapt to dynamic business requirements, eliminating repetitive tasks, reducing human error, and accelerating decision-making.

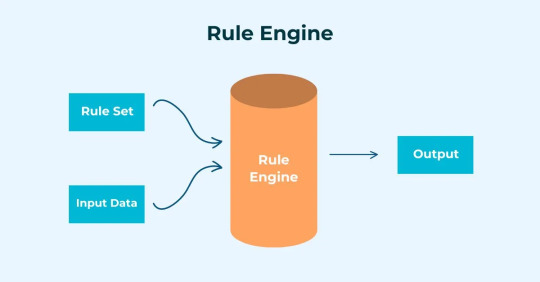

What Is a Rules Engine?

A rules engine is a software component that applies pre-defined conditions (rules) to incoming data and determines actions based on those conditions. In workflow automation, it serves as the “brain” of the system—automatically routing tasks, triggering notifications, approving requests, or escalating issues based on set criteria.

Rather than relying on hard-coded logic or manual interventions, businesses can use a rules engine to create workflows that evolve with operational needs. For example, you might configure a rule that automatically sends purchase requests above $10,000 to the finance head for approval, or routes an HR onboarding checklist only if a certain department is selected.

Key Benefits of Using a Sophisticated Rules Engine

1. Greater Process Flexibility Rules engines allow workflows to adjust dynamically. You can define complex conditions using “if/then,” “and/or,” or nested logic structures. This means your workflow isn’t just a static sequence of tasks—it responds intelligently to context and data.

2. No-Code Customization Advanced platforms offer visual or no-code rules builders, enabling non-technical users to set up and manage rules easily. This democratizes process control and reduces reliance on IT teams for changes or updates.

3. Improved Decision-Making Speed By automating decisions based on real-time inputs, the rules engine cuts down on delays caused by manual reviews or unclear responsibilities. For example, vacation requests, expense approvals, or document verifications can be processed instantly if they meet certain conditions.

4. Enhanced Accuracy and Compliance When rules are clearly defined and consistently enforced, it becomes easier to comply with organizational policies or regulatory standards. Automated rules minimize errors and maintain audit trails, which are essential for industries with strict compliance requirements.

5. Scalable Business Processes As companies grow, so do the complexities of their operations. A rules engine provides the scalability needed to handle an increasing number of conditions, users, and exceptions—without overhauling the entire system.

Practical Use Cases Across Departments

Finance: Automatically approve budget requests under a specific threshold or escalate based on department.

HR: Trigger different onboarding workflows based on role type or location.

IT: Route helpdesk tickets based on issue type and priority level.

Sales & Marketing: Assign leads to sales reps based on territory or deal size.

By leveraging a sophisticated rules engine, these departments reduce manual handoffs, shorten process cycles, and maintain clarity at every stage.

Choosing the Right Workflow Automation Tool

When selecting a workflow automation platform, ensure that it offers:

A visual rules builder for ease of use

Support for nested logic and conditional routing

Integration with third-party tools and databases

Role-based access control

Real-time tracking and rule-based analytics

Cflow is an example of a powerful workflow automation solution that features an intuitive rules engine. It allows businesses to build logic-driven workflows with minimal effort while ensuring transparency, consistency, and compliance.

youtube

Final Thoughts

A sophisticated rules engine is no longer a luxury—it’s a necessity for businesses that want to automate intelligently. By defining how tasks flow, when they’re triggered, and who handles them, organizations gain control, speed, and reliability in their operations. If you're aiming to scale and streamline without sacrificing flexibility, investing in a robust workflow automation platform with a built-in rules engine is a strategic move.

SITES WE SUPPORT

Assess Flow Manager - Blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Choosing the Right Tools: HR and Finance Software to Power Business Growth

When it comes to scaling a business efficiently, the right tools can make all the difference. Among the most critical areas that demand streamlined processes are human resources (HR) and financial management. Choosing the right HR and finance software not only enhances productivity but also directly contributes to long-term growth, improved compliance, and smarter decision-making.

Why the Right Software Matters

In growing businesses, manual processes for HR and finance can quickly become bottlenecks. Tasks such as payroll processing, expense tracking, performance reviews, and recruitment become time-consuming and error-prone without automation. Investing in the right tools helps businesses:

Reduce administrative burden

Ensure regulatory compliance

Gain real-time insights into workforce and financial performance

Improve accuracy and data integrity

Enable strategic planning

Key Features to Look for in HR Software

When evaluating HR software, focus on solutions that simplify core HR functions while supporting scalability. Essential features include:

Automated Onboarding: Streamlines new hire processes and reduces paperwork

Performance Management: Tools to track employee goals, feedback, and evaluations

Leave and Attendance Tracking: Accurate logging and reporting for better planning

Payroll Integration: Seamless synchronization with financial systems

Compliance Management: Helps stay aligned with labor laws and policies

Top tools to consider: BambooHR, Zoho People, Gusto, and Freshteam

These platforms offer cloud-based solutions that are easy to deploy, integrate well with other business tools, and provide data-driven insights into employee engagement and performance.

Key Features to Look for in Financial Management Software

Finance software should do more than just bookkeeping. Look for systems that support your business goals with features such as:

Real-Time Reporting: Access to live dashboards for cash flow and budgeting

Expense Management: Automated tools for tracking business expenses and reimbursements

Invoicing and Billing: Easy-to-use templates and recurring billing options

Tax Compliance: Integrated features to help with accurate tax reporting

Multi-Currency Support: Essential for businesses operating globally

Top tools to consider: QuickBooks, Xero, FreshBooks, and Oracle NetSuite

These tools are known for reliability, ease of use, and robust financial analytics that empower leaders to make informed decisions.

Benefits of Integrating HR and Finance Tools

One of the most impactful ways to leverage technology is to integrate your HR and finance systems. Unified platforms enable better collaboration between departments, reduce data silos, and improve strategic alignment. For example, connecting payroll data with financial forecasting allows for more accurate budgeting and resource planning.

Additionally, automation across HR and finance functions minimizes human error, improves employee satisfaction (with timely payroll, reimbursements, and performance reviews), and supports compliance through consistent reporting and audit trails.

Choosing the Right Solution for Your Business

Here are a few tips for choosing the right HR and finance tools:

Identify Your Needs: Understand which processes are most time-consuming or error-prone

Prioritize Usability: Choose tools your team can adopt quickly

Ensure Scalability: Opt for software that can grow with your business

Check for Integration Capabilities: Ensure the tools can connect with your existing systems

Consider Vendor Support: Reliable customer service is critical, especially during onboarding

youtube

Final Thoughts

Investing in the right HR and finance software is not just a tech upgrade—it’s a strategic decision that supports productivity, compliance, and sustainable growth. By selecting tools that align with your business goals, you set the foundation for a more efficient and competitive organization.

SITES WE SUPPORT

Assess Flow Manager - Blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Essential Financial Management Tools Every Business Should Use

Managing finances efficiently is one of the most critical aspects of running a successful business. Whether you're a startup, small business, or growing enterprise, having the right financial management tools in place can make all the difference. These tools help streamline processes, reduce manual errors, and provide valuable insights for better decision-making.

In this blog, we’ll explore the top financial management tools that every business should consider using to stay on track and drive growth.

1. Cflow – Automate Financial Workflows

Cflow is a no-code workflow automation tool that plays a pivotal role in streamlining financial processes like invoice approvals, purchase requests, and vendor payments. With its intuitive interface and customizable workflows, finance teams can reduce manual tasks, enforce compliance, and ensure timely processing of financial transactions.

Key Features:

Automates approvals for expense claims and payments

Tracks financial workflows in real-time

Integrates easily with accounting platforms

Cflow is ideal for businesses looking to minimize bottlenecks and bring transparency to their financial operations.

2. QuickBooks – Cloud Accounting Made Simple

QuickBooks is one of the most widely used accounting tools, especially among small and medium-sized businesses. It helps manage income and expenses, track sales and tax, and generate reports that give a clear overview of financial health.

Key Benefits:

Simplifies payroll and tax calculations

Allows invoice generation and payment tracking

Offers integration with various financial apps

With its user-friendly interface, QuickBooks helps business owners keep their books in order without needing deep accounting knowledge.

3. Xero – Real-Time Financial Insights

Xero is a powerful cloud-based accounting solution designed for growing businesses. It offers real-time financial reporting, bank reconciliation, and budgeting tools, making it a great option for businesses that want better visibility over their cash flow.

Top Features:

Real-time bank feeds

Easy invoice and bill management

Collaborate with financial advisors securely

Xero’s mobile accessibility and intuitive design make it a strong contender in the financial management space.

4. FreshBooks – Best for Service-Based Businesses

FreshBooks is tailored for service-based businesses like consultants, freelancers, and agencies. It combines time tracking, invoicing, and expense management in one platform.

Why FreshBooks?

Automatically tracks time and billable hours

Sends professional invoices with payment reminders

Tracks project costs and profitability

This tool ensures your financial data is organized, helping you spend more time focusing on clients and less on paperwork.

5. Zoho Books – Scalable Accounting for Growing Teams

Zoho Books is part of the larger Zoho suite and offers a full range of accounting features. It’s perfect for companies that need more customization and want to scale their operations.

Highlights:

Inventory and order management

Multi-currency support

Workflow automation and API access

It’s a great fit for businesses operating globally or looking to grow their operations without switching platforms.

youtube

Final Thoughts

Choosing the right financial management tools can make or break your business's operational efficiency. From automating workflows with Cflow to simplifying accounting with QuickBooks and FreshBooks, there’s a solution to fit every business model.

By investing in the right tools, businesses can reduce errors, save time, ensure compliance, and make smarter financial decisions. Evaluate your needs, test out a few options, and build a financial system that supports your growth now and into the future.

SITES WE SUPPORT

Assess Flow Manager - blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Top HR Management Tools to Streamline Employee Operations in 2025

Managing human resources has evolved far beyond spreadsheets and manual paperwork. As we move deeper into 2025, businesses are relying more on smart, integrated HR management tools to streamline employee operations, improve engagement, and drive performance. Choosing the right HR software not only reduces administrative burden but also enhances productivity across all levels of the organization.

In this blog, we explore the top HR management tools that are leading the way in 2025 — each helping HR teams automate core functions, simplify workflows, and create a better employee experience.

1. Cflow – Automate HR Workflows with Ease

Cflow is a no-code workflow automation tool that’s transforming HR operations. With its visual process builder, HR departments can automate onboarding, leave requests, performance reviews, payroll processing, and more — all without writing a single line of code.

The platform allows full customization of workflows, real-time tracking, automated notifications, and seamless integration with existing systems. Cflow is particularly useful for HR teams that want to improve compliance, maintain consistency, and reduce manual tasks.

Key Features:

Visual workflow builder

Integration with payroll and HRMS tools

Automated routing and approval tracking

Real-time process monitoring

2. BambooHR – Best for Small to Mid-Sized Businesses

BambooHR continues to be a favorite among small and medium-sized companies for its user-friendly interface and powerful core HR features. From applicant tracking and employee records to time-off management and e-signatures, BambooHR centralizes all HR tasks in one place.

Its intuitive dashboard helps HR teams track employee performance, manage documents securely, and generate insightful reports that assist in data-driven decision-making.

Top Benefits:

Easy-to-use dashboard

Applicant Tracking System (ATS)

Employee self-service portal

Customizable reports

3. Gusto – Best for HR and Payroll Integration

Gusto is more than just a payroll service. It offers a comprehensive HR platform with tools for onboarding, benefits management, and compliance. Gusto is ideal for businesses looking for an all-in-one solution that combines payroll with HR functions.

It offers automation for onboarding workflows, document signing, and benefits enrollment. Gusto also simplifies tax filing and benefits compliance, which is crucial for HR professionals managing complex labor regulations.

Why Choose Gusto:

Seamless HR and payroll integration

Benefits and tax compliance support

Automated onboarding workflows

Employee financial wellness tools

4. Zoho People – Great for Customizable HR Workflows

Zoho People offers a robust cloud-based HR solution tailored for businesses that need customization and scalability. It supports employee lifecycle management, from hiring to retirement, and features self-service portals, attendance tracking, and custom workflows.

Zoho People is best for companies that are growing fast and need scalable tools that adjust to evolving HR needs.

Highlights:

Highly customizable modules

Mobile app for employee access

Integration with Zoho suite and third-party tools

Time tracking and performance management

Why Investing in HR Tools Matters in 2025

HR management tools are not just software — they are strategic assets. In 2025, organizations that adopt smart HR solutions will have a competitive edge in attracting and retaining top talent, optimizing workforce productivity, and ensuring regulatory compliance.

Automation reduces human error, speeds up repetitive tasks, and frees HR teams to focus on strategic functions like talent development and employee engagement. Whether you're a startup or an enterprise, adopting the right HR tools can significantly streamline operations and enhance employee satisfaction.

youtube

Conclusion

From automation platforms like Cflow to comprehensive solutions like BambooHR, Gusto, and Zoho People, these top HR management tools in 2025 are redefining how organizations manage their most valuable asset — their people. Evaluate your company’s unique HR needs and choose a tool that not only simplifies operations but also aligns with your long-term business goals.

SITES WE SUPPORT

Assess Flow Manager - blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

0 notes

Text

Boost Team Collaboration with Smart Workflow Solutions for Google Docs

Collaboration lies at the heart of successful teams, and in the modern workplace, digital tools play a vital role in shaping how teams communicate, share, and complete tasks. One of the most widely used tools—Google Docs—has revolutionized the way teams collaborate on documents in real time. But to unlock its full potential, integrating smart workflow solutions can take collaboration to the next level.

In this blog, we’ll explore how using workflow automation with Google Docs can streamline processes, reduce errors, and improve productivity across your organization.

Why Google Docs Is Ideal for Team Collaboration

Google Docs offers real-time editing, automatic version control, easy sharing, and cloud-based access, making it a go-to tool for remote and hybrid teams. Its built-in commenting and suggestion features allow for seamless feedback and collaborative editing, eliminating the confusion of multiple email threads and outdated file versions.

However, as your team grows and tasks become more complex, simply using Google Docs isn't enough. That's where workflow automation steps in.

What Are Workflow Solutions for Google Docs?

Workflow solutions for Google Docs involve integrating tools or platforms that automate document-related processes. These include approvals, notifications, version tracking, and deadline reminders. Instead of manually routing documents for review or approvals, a workflow system ensures everything happens automatically and consistently.

Key Benefits of Google Docs Workflow Automation

1. Faster Approvals and Reviews

Workflow tools can automatically send documents to the right stakeholders for review, track changes, and notify users when their input is needed. This speeds up the approval process and eliminates bottlenecks.

2. Clear Accountability

With automated workflows, every step is tracked. You know exactly who’s responsible for what, and when it's due—helping your team stay on track without the need for constant follow-ups.

3. Reduced Manual Errors

Automated workflows eliminate the risk of forgetting to send a document for approval or missing a deadline. This leads to more consistent document quality and fewer errors.

4. Improved Transparency

With a central dashboard or tracking system, everyone can see the document’s status. This visibility reduces confusion and improves communication among team members.

Tools That Integrate Workflow Automation with Google Docs

Several tools help automate workflows while integrating seamlessly with Google Docs. One such tool is Cflow, a powerful workflow automation platform that allows you to build custom workflows tailored to your document processes. With drag-and-drop ease, Cflow can automate document approvals, HR forms, purchase requests, and more—streamlined directly from your Google Docs environment.

Other tools worth exploring include:

Zapier – to trigger actions between Google Docs and other apps

Form Publisher – to turn Google Forms into Docs with automation

DocuSign – for automated document signing and approval

Best Practices for Implementing Google Docs Workflows

Map Your Processes: Understand your current document process and identify points of delay or inefficiency.

Set Clear Permissions: Ensure that only authorized users can edit, approve, or view certain documents.

Use Templates: Standardized templates ensure consistency and save time.

Train Your Team: Ensure everyone knows how to use the new workflow system to maximize its benefits.

Final Thoughts

Integrating smart workflow solutions with Google Docs can significantly enhance collaboration, improve efficiency, and reduce time spent on manual tasks. Whether you’re managing HR documentation, financial reports, or project proposals, automating your document workflows allows your team to focus on what matters most—getting results.

youtube

By adopting tools like Cflow, your organization can create structured, scalable, and intelligent workflows that align with today’s agile work culture.

SITES WE SUPPORT

Assess Flow Manager - Blogspot

SOCIAL LINKS Facebook Twitter LinkedIn

1 note

·

View note