Text

Why choose a Gold Loan over a Credit Card loan?

Gold and silver are money, everything else is credit.” J. P. Morgan

The iconic statement by the American financier and investment banker who dominated corporate finance on Wall Street, J.P. Morgan, encapsulates his belief in the concrete value of precious metals compared to the more abstract nature of other financial assets. By emphasizing the role of gold and silver as genuine money, he implies their stability and time-tested reliability.

Anyone can face a situation where the available funds or income is not sufficient to cover certain expenses. Such a situation can be a medical emergency for oneself, or a family member, or it could be an expense related to a family wedding or for higher studies. Today, there are many credit options available to overcome such short mid-term crises, including personal loans, credit card loans, and gold loans. Many lenders are offering online applications for processing that can be completed in minutes if one has relevant KYC documents handy. However, it is very important to have a clear understanding of the available credit options. Here are a few points that one must consider before making the decision:

Immediate Fund Availability: When there’s an urgency, i.e., immediate fund requirement, the quickest and hassle-free form of credit is a gold loan. Unlike a credit card loan, which comes with a lengthy application, KYC documentation followed by assessment, a gold loan needs only the valuation of the asset, and the fund is disbursed seamlessly. The borrower has to pledge the gold and obtain the funds required. No documentation and credit checks.

Lower Rate of Interest: The rate of interest on gold loans is generally lower than the interest on credit card loans. Gold (Jewellery) as collateral gives security to the lenders to offer a lesser rate of interest.

Higher Loan Amount: It is the KYC documentation that decides the loan eligibility in the case of a credit card or personal loan, whereas, for a gold loan, the value of the asset decides the loan eligibility. So, the larger the value of gold, the higher the loan amount too, and there’s no limit.

Low Processing Charges: Gold loans incur the least processing fees and, hence are always cheaper than other loans. Gold loans do not have pre-payment charges too, and thus are more cost-effective.

Hassle-free Process: Since a gold loan does not require KYC and other documentation, the process is much easier, quick, and convenient. Unlike credit card loans or personal loans where KYC and other documentation is much lengthier comparatively.

Credit Score Not Applicable: Since the borrower is submitting gold as collateral, no other documentation is needed. A gold loan is the best option for borrowers with a lower credit score.

Open Purpose Loan: The gold loan has no purpose restriction. Suppose the borrower has taken a loan for children’s education and the career plan is changed, the loan fund can be used for any other purpose. This may not be feasible in a personal loan.

A gold loan is based on tangible wealth, whereas other loans are derived from the trust and credibility bestowed based on financial systems — and that is the key distinction between a gold loan versus a credit card loan. And that is why a gold loan is a better credit form than any other type of loan. visit our gold loan FAQs page if you have any question related gold loan.

Augmont is a new-age, AI/ML-powered, customer-centric finance company that makes digital lending quick, efficient, and easy. We see worth in lending wings to people’s aspirations, hopes, and dreams. We believe purpose-driven credit can be a true-life enabler. Augmont is here to lend a helping hand, with affordable Gold loans designed specifically for those who need them the most.

Augmont empowers NBFCs and fintechs with the tools and solutions they need to get fast access to credit, thus building more resilient and confident communities.

visit our LinkedIn article given below for a detailed comparison…..

gold loan vs credit card loan

0 notes

Text

Digital Gold vs Physical Gold

In today’s ever-evolving financial landscape, investors are constantly seeking avenues to diversify their portfolios and safeguard their wealth. Gold, often hailed as a timeless asset, has been a preferred choice for investors seeking stability and value retention. With the advent of technology, the concept of gold ownership has evolved, giving rise to digital gold. This article delves into the comparison between digital gold and physical gold, evaluating their respective advantages and disadvantages to determine which might be a better investment option.

What is digital gold investment?

Digital gold investment refers to the process of buying and owning gold in digital form rather than physically possessing the precious metal. It involves purchasing fractions of real gold through digital platforms or apps that are backed by physical gold reserves. Investors can participate in digital gold investment by buying, selling, or trading these digital representations of gold, which are often offered by trusted financial institutions or online platforms. Digital gold provides investors with the flexibility of accessing and managing their gold holdings conveniently through online channels, eliminating the need for physical storage and handling. This form of investment allows individuals to diversify their portfolios and hedge against inflation or economic uncertainties without the logistical challenges associated with owning physical gold. Overall, digital gold investment offers a modern and accessible approach to gaining exposure to the precious metal within the digital realm.

Benefits of investing in digital gold

Investing in digital gold offers several benefits to investors. Firstly, it provides accessibility, allowing individuals to buy, sell, or trade gold conveniently through online platforms or mobile applications from anywhere at any time. This accessibility also enables fractional ownership, enabling investors to purchase small fractions of gold, making it affordable and accessible to a wider range of individuals. Secondly, digital gold offers transparency, with many platforms providing real-time updates on gold prices and the status of gold reserves, enhancing investor confidence. Additionally, digital gold eliminates the need for physical storage and associated costs, as investors hold electronic records of their gold holdings. Furthermore, digital gold investment provides liquidity, enabling investors to quickly convert their holdings into cash or other assets when needed. Overall, investing in digital gold presents a modern and efficient way for investors to diversify their portfolios and gain exposure to the precious metal.

What is physical gold investment?

Physical gold investment refers to the acquisition and ownership of tangible gold assets in the form of bullion, coins, or jewelry. Unlike digital gold, which exists in electronic form, physical gold investment involves purchasing actual physical gold items for possession and ownership. Investors typically buy physical gold as a means of preserving wealth, diversifying their investment portfolios, or hedging against inflation and economic uncertainties. Physical gold investment offers several advantages, including the tangible nature of the asset, providing a sense of security and stability. It is considered a reliable store of value throughout history, often maintaining its worth during periods of economic turmoil. However, physical gold investment also comes with considerations such as storage and insurance costs, as well as the need to ensure the authenticity and purity of the gold items. Overall, physical gold investment remains a popular choice among investors seeking a tangible and time-tested asset for wealth preservation.

Benefits of investing in physical gold investment

Investing in physical gold offers numerous benefits for investors. Firstly, physical gold serves as a tangible and universally recognized store of value, providing a hedge against inflation and economic uncertainties. Unlike paper currency or digital assets, physical gold maintains its intrinsic value over time, making it a reliable long-term investment. Additionally, physical gold investment provides diversification within investment portfolios, reducing overall risk exposure. Owning physical gold also offers a sense of security, as investors have direct possession and control over their assets, mitigating counterparty risks associated with digital or paper-based investments. Furthermore, physical gold is highly liquid, allowing investors to easily buy, sell, or trade gold in various forms such as bullion or coins globally. Lastly, physical gold investment offers potential capital appreciation, as the demand for gold often increases during times of geopolitical instability or economic downturns, leading to price appreciation. Overall, investing in physical gold provides investors with a tangible and valuable asset that can preserve wealth and enhance portfolio stability.

Digital Gold vs Physical Gold. Which is better?

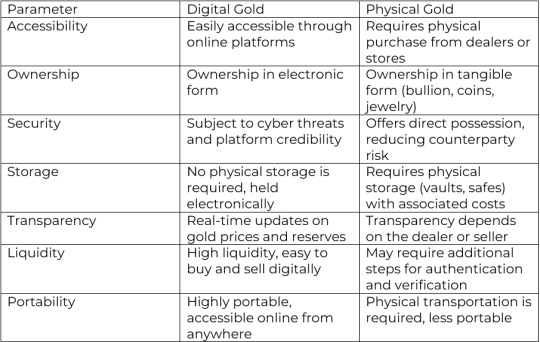

Below is a comparison table highlighting the differences between digital gold and physical gold across various parameters:

ConclusionIn conclusion, both digital gold and physical gold offer unique advantages and disadvantages for investors. Digital gold provides accessibility, fractional ownership, and convenience, while physical gold offers tangibility, security, and lack of counterparty risk. The choice between digital gold and physical gold ultimately depends on individual preferences, investment goals, and risk tolerance.

For those interested in exploring digital gold further, Augmont Gold For All offers comprehensive services in this regard. Augmont Gold For All aims to provide accessible and reliable digital gold investment options, catering to diverse investor needs. Whether you prefer the convenience of digital transactions or the tangibility of physical gold, Augmont Gold For All ensures a seamless and secure investment experience. Explore our website for more information on digital gold investment opportunities.

#digital gold#physical gold#gold#digital gold investment#gold investment guide#digital gold vs physical gold

1 note

·

View note

Text

Exploring 8 Ways to Invest in Gold Online: A Comprehensive Guide

Gold has long been seen as an appealing investment option, prized for its resilience and timeless allure. Now more than ever before, investing in gold online offers convenience and accessibility like never before — no matter if you are an experienced investor or new to finance; investing online gives access to various avenues. In this comprehensive guide, we explore 8 methods you can invest in gold from home!

Buy Physical Gold Online: One of the oldest methods of investing in gold involves purchasing physical bars or coins online dealers, offering tangible assets with which they can securely store. Although investing in physical gold online provides peace of mind for investors, it’s still wise to research reputable dealers as well as consider factors like shipping costs and storage solutions before purchasing physical assets online.

How to Invest in Gold Exchange-Traded Funds (ETFs): Gold ETFs provide investors with exposure to price movements of gold without physically owning it, making online investing in these ETFs convenient and cost effective, providing liquidity and diversification benefits while offering liquidity management fees may provide liquidity benefits but should remain aware of performance of underlying assets when selecting an ETF investment strategy.

Consider Gold Futures and Options: Trading gold futures and options contracts online offers investors an exciting way to speculate on future price movements of the precious metal, but also involves high risks due to market dynamics. Investors should prepare themselves for potential losses and implement risk management strategies as an added precautionary measure.

Investment Opportunities in Gold Mining Stocks: Gold mining company stocks offer investors exposure to the industry’s potential growth and profits, making online trading easy for investors looking for diversification across companies and portfolio diversification. Investors should conduct thorough research on individual companies as well as monitoring industry trends carefully for maximum returns on their investments.

Online Marketplaces as an Investment Platform: Online marketplaces provide an ideal venue for buying and selling gold bullion or coins at competitive rates, providing users with easy management of their investments through accessibility. When investing online it is also key that investors choose reputable sellers as well as consider factors like shipping/insurance options as this allows investors to easily manage their holdings.

Digital Gold From Augmont facilitates the purchase of physical bullion (i.e. bars of Gold/Silver) for as low as Re. 1 with the ease of online access. The customer can request for the delivery of Gold/Silver purchased from Augmont anytime they want in the form of coins/ bars and jewellery and it will be delivered at your doorstep. Customers can also sell the bullion (bought from us) in a secured and convenient manner back to Augmont.

Utilize Gold Saving Schemes: Gold saving schemes offered on online platforms enable investors to slowly accumulate gold through regular investments at relatively small amounts over time. They offer flexibility and convenience; investors can start small amounts and build upon it over time — though investors should carefully examine each scheme’s terms and conditions, such as fees and redemption options before signing on with one.

Consider Gold-backed Cryptocurrencies: Gold-backed cryptocurrencies are digital tokens backed by physical gold reserves that combine the advantages of blockchain technology with physical gold’s stability to offer investors an all-around investment experience that may offer superior returns compared to conventional investments, though investors should remain wary of potential volatility issues or regulatory concerns related to investing.

Conclusion: Gold investments online provide investors with a multitude of options to tailor their experience and risk profiles, ranging from owning physical gold to trading derivatives or investing in gold-related securities. With Augmont Gold for All, investors can explore various investment schemes, from purchasing digital gold and investing in Gold SIP to acquiring gold and silver bars online. Through thorough research on these available avenues, investors can make informed decisions to expand their portfolio and achieve their financial goals more efficiently. Visit Augmont Gold for All to explore our investment options and begin your journey toward financial success.

0 notes

Text

Guaranteed Gifts & a Bike Up for Grabs Augmont inaam mela✨

it's Live! Don’t walk to your nearest Augmont branch run🏃

Guaranteed gifts, a chance to win a bike – your gold loan just got a golden upgrade! Augmont's "Inaam Mela" makes loan against gold a celebration. Get instant cash at low interest rates, choose your guaranteed gift. Every loan comes with exciting gifts like TVs, refrigerators, and much more, and enter the lucky draw for a brand-new bike. As part of the campaign. Augmont Gold For All is extending the Sell Old Gold (SOG) offer, providing customers with the chance to win Digi Gold up to 10k through a scratch and win offer. It's a win-win for your finances and your dreams! Head to your nearest Augmont Gold For All in Karnataka, Andhra Pradesh, and Telangana and unlock the golden opportunity of "Inaam Mela".

#goldloan #Augmont #GoldForAll #InaamMela #GiftForAll #LoanAgainstGold

0 notes

Text

Digital Gold: The Revolution of Buying Digital Gold Online in India

Modern investing of gold has undergone dramatic change over time. Traditional methods for purchasing physical gold have given way to digital gold investment platforms like Augmont Gold. We facilitate individuals seeking digital investments via our secure and seamless platform, offering seamless solutions.

Introduction to Digital Gold

Digital gold is an innovative new method for investing in precious metals that allows individuals to own the precious metal electronically and is quickly growing popular in India, where gold holds significant cultural and economic significance. Digital gold offers all of its value while being more convenient and accessible compared to real physical gold investments.

Understanding Augmont Gold

Augmont Gold is an industry-leading platform designed to facilitate the purchase of digital gold online. Thanks to its user-friendly interface and transparent processes, Augmont has quickly earned itself a name synonymous with trust and reliability in this competitive digital gold space. Plus, Augmont offers modern investors plenty of features designed specifically to cater to them!

Advantages of Buying Digital Gold Online

Augmont Gold's platform ensures an effortless buying experience for digital gold online in India, giving users access to invest gold without leaving home. Furthermore, security and transparency in every transaction foster trust between users of Augmont Gold.How to Buy Digital Gold Online with Augmont

Augmont makes investing in digi gold an easy process: users simply create an account, browse available options and make purchases - the intuitive design makes the entire transaction accessible even to first-time investors.Why Choose Augmont Gold

Augmont Gold is distinguished by its commitment to providing an honest platform and competitive pricing. Investors who are interested in digital gold choose the platform because of its reliability and commitment to customer satisfaction.Digital transactions are a high-risk business. Augmont uses robust security measures in order to protect users' investment, providing a worry-free and secure experience.

Future of Digital Gold in India

Digital gold has a huge potential for growth in India. Augmont sees digital gold as a key component of financial inclusion in the future, allowing a broader demographic to invest. A balanced portfolio of investments relies on diversification. Augmont Gold offers investors the chance to effectively diversify their investment portfolios, while capitalizing on gold's long-term potential.

Comparing Augmont Gold with Other Platforms

Augmont's unique features and focus on customer service set it apart from its competitors. The platform is distinguished by its strengths in the gold digital market. Augmont puts customer satisfaction first and offers responsive support channels. Platform's dedication to helping users makes for a seamless investment experience. Augmont promotes transparency through authentic and traceable transactions. Platform maintains detailed records that foster a feeling of trust in investors. Augmont’s intuitive interface improves your overall experience. The platform is backed up by positive user feedback and testimonials.

ConclusionAugmont Gold, in conclusion, has revolutionized how individuals invest their money. Augmont Gold's easy-to-use interface, its security protocols and transparency make it a market leader on the Indian digital gold markets.

Augmont provides educational resources to investors, so they can make educated decisions. Augmont's goal is to share knowledge. Beyond facilitating investment, Augmont also contributes back to the community. Platform aims to create a network of investors who share the same values while also making an impact on society.

FAQs

Is digital gold as valuable as physical gold?

Digital gold holds the same value as physical gold, providing the convenience of electronic ownership.

2. What sets Augmont Gold apart from other platforms?

Augmont distinguishes itself through competitive pricing, robust security, and a user-centric approach.

3. Can I trust the security measures employed by Augmont?

Yes, Augmont ensures stringent security measures to safeguard users' investments.

4. How does Augmont contribute to the community?

Augmont not only facilitates investments but also focuses on social impact initiatives.

5. Is digital gold a viable long-term investment option?

Yes, digital gold offers diversification benefits and long-term investment potential.

0 notes

Text

Cash in a Flash: Unlock Instant Gold Loans & Get Back on Track

Need cash, fast? Don't settle for hefty fees. Get instant gold loans online – pledge your gold, get approved in minutes, and receive cash directly to your account. Quick, convenient, and flexible, it's the smart way to bridge financial gaps.

#gold loan#gold loan in india#instant gold loan#gold loan online#augmont#gold loans#online gold loan

0 notes

Text

Introduction to Gold Loans: Unlocking Financial Possibilities with Augmont loan against gold

Gold is not just a precious asset but also a possible financial asset in a nation like India, where it has great cultural meaning and value. Gold loans are a financial tool that is becoming more and more popular because of its accessibility and simplicity. This makes them one of the creative methods to exploit this asset.

Understanding Gold Loans

What are Gold Loans?

Secured loans covered by gold coins or ornaments are known as gold loans. A lender will grant a loan amount determined by the appraised value of the gold that a borrower pledges. These loans offer various repayment choices and generally have cheaper interest rates than unsecured loans

The Rise of Gold Loans in India

The idea of obtaining loans using gold has a long history in India. Nonetheless, the market for gold loans has expanded significantly in recent years as a result of the numerous suppliers' swift disbursement procedures and ease of access.

Augmont Gold For All: A Leading Gold Loan Provider in India.

Augmont Gold For All has emerged as a reliable and customer-centric gold loan provider in the country, offering seamless services and competitive rates. Their commitment to transparency and customer satisfaction sets them apart as one of the best gold loan providers in India.

Benefits of Opting for Gold Loans

Quick Disbursal and Minimal Documentation

The quick disbursement process of gold loans is one of their main benefits. Augmont Gold For All guarantees less paperwork, allowing users to get money quickly. This makes it a great option for those who need money right now.

Lower Interest Rates

Gold loans typically have cheaper interest rates than unsecured loans. Because Augmont Gold For All has affordable rates, borrowers can obtain funds without having to pay excessive interest.

Flexible Repayment Options

The repayment arrangements offered to borrowers are flexible with Augmont Gold For All. This lessens stress and guarantees a more seamless loan payback process by enabling borrowers to customize the repayment plan in accordance with their financial situation.

Understanding the Gold Loan Process with Augmont Gold For All

Loan Assessment

Augmont Gold For All uses qualified experts to determine the purity and worth of the gold. The evaluation establishes the maximum loan amount that the applicant is eligible for.

Loan Disbursal

Augmont Gold For All rapidly disburses the loan amount after the gold is appraised, guaranteeing that consumers receive the necessary amounts on time.

Secure Storage of Gold

Augmont Gold For All ensures the safety of the pledged gold during the loan term by keeping it under secure storage until the loan is returned.

Loan Repayment and Gold Retrieval

Augmont Gold For All ensures the safety of the pledged gold during the loan term by keeping it under secure storage until the loan is returned.

Conclusion: Augmont Gold For All - Empowering Financial Freedom

For those in need of financial support, Augmont Gold For All loan against gold offer a sound and safe alternative without sacrificing their priceless possessions. Their affordable prices, hassle-free processes, and customer-centric attitude make them an exemplary choice for individuals seeking to maximize the value of their gold assets.

In summary, gold loans offer a way to leverage an enduring asset to safeguard one's financial future in addition to serving as a source of financial assistance. Augmont Gold For All is a top option for gold loans in India because of their dedication to offering reliable and easily accessible services.

Think of Augmont Gold For All as your financial growth partner, utilizing your gold holdings to create the foundation for a safe and prosperous future.

0 notes

Text

Buy Digital Gold Online

Choosing to buy digital gold online allows you to enter a world of efficiency and accessibility. Online platforms offer an intuitive user interface that enables investors to keep an eye on market trends, keep track of their investments in real time, and make well-informed decisions. A further degree of attractiveness is added by the ease of quick transactions and safe storage. Buying digital gold online appears to be a progressive method for individuals looking for a flexible and contemporary approach to wealth management in the digital age, when speed and accessibility are critical.

0 notes

Text

Unlocking the Potential of Digital Gold: Your Guide to Investing in the Future

Digital gold is a term that has gained prominence in the world of finance and investment. In the fast-paced digital age, traditional forms of investment, such as physical gold, are evolving to keep up with the changing landscape. Enter the concept of digital gold - a representation of value and a store of wealth in the digital realm.

0 notes

Text

Gold SIP

Gold SIP or Gold Systematic Investment Plan, is a methodical and systematic way for people who want to invest in gold. Within the realm of financial planning, Gold SIP is a distinctive investment option that lets investors gradually and methodically amass gold. Like conventional mutual fund SIPs, the Gold SIP entails frequent investments, usually made on a monthly basis, which enables investors to take advantage of rupee cost averaging and lessen the impact of market swings.

0 notes

Text

Gold Loans Made Simple: Your Gateway to Quick Funds and Financial Stability

Our gold loan services are designed to provide you with flexible repayment options and competitive interest rates. At Augmont, we prioritize your convenience, ensuring that you get the financial assistance you need, backed by the reliability and stability of your gold assets. Experience financial empowerment with our gold loan solutions – turning your valuable possessions into a gateway to a more secure future.

Visit the link given below to know more:

0 notes

Text

Buying gold online on EMI has become an accessible and flexible way to invest in this precious metal. This method allows you to spread the cost of acquiring gold over a period of time, making it more affordable and manageable for a wider range of investors.

Choose Augmont to buy gold online on EMI, Augmont Gold For All makes it possible for everyone to easily buy gold jewellery or gold articles, regardless of their financial situation. Buying gold on EMI not only allows you to invest in a valuable

0 notes

Text

Augmont's Digi Gold is transforming gold investing, By introducing a classic asset into the digital era. Digi Gold provides a convenient and safe online gold buying and management experience at the best price available in the market where time is of the essence. Augmont is a desirable choice for investors to invest in Digi Gold since it guarantees affordability, security, and transparency. Digi Gold offers peace of mind with real-time monitoring and a 24K 999 purity guarantee. visit the Augmont website, choose the desired amount of gold to buy (24K 999 Pure Digital Gold starts at ₹1), pay for it, and keep it safe in your digital gold wallet. Digi Gold is the future of gold investment, combining technology and tradition.

1 note

·

View note