Don't wanna be here? Send us removal request.

Text

Plan Your Child’s Future With SIP Calculator

The greatest gift that the parents can give to their children is a secured future. Every parent wishes to provide the best education, best health facilities, and in general the BEST of everything. With the education and health costs touching the sky and rising above the inflation rate, it becomes necessary that Indian parents should plan at an early stage. How to plan wisely for a child’s future?, may be your next question. Well, you don’t need Aladdin and his magic lamp for your child planning but an online tool known as SIP Calculator that can ease the task for you. This write-up sheds light on this tool.

How Can SIP Calculator Help You in Planning Your Child’s Future? Online SIP Calculator is a tool that helps to determine the amount that you should start investing in mutual funds regularly through SIP mode of investment for achieving your future target. An individual is required to fill the investment amount, time horizon, and expected growth rate. The calculator will display the wealth creation build over the period of time. According to the suitability, an investor can fill-in the values in the calculator. Let us understand this with the help of an example- Let’s say a person A decides to start the best SIP plan in mutual funds with an investment of Rs. 5000 monthly. Person A is willing to invest for a period of 20 years and he is expecting the growth return of 12%.

After filling the details, when Mr. A will click on ‘Calculate’, the SIP calculator will display the investment amount, expected amount, and wealth gain on the screen. In this case, the online calculator will display the following details: Investment Amount: Rs. 1,200,000. Expected Amount: Rs. 4,995,740. Wealth Creation: Rs. 3,795,740.

The results depicts that if Mr. A start investing from today with a monthly SIP of Rs. 5000, then after 20 years he will receive Rs. 3,795,740. Knowing this information before 20 years, will surely help Mr. A in planning effectively for his child’s future.

How to Get Benefited by SIP Calculator the Most?

Suitable Investment Amount: You don’t want to get bankrupt in search of good returns, right? Thus, choose the investment amount that you can afford in the SIP Calculator. The minimum SIP investment starts with a minimum of Rs. 500. Thus, choose a suitable investment amount and stick to the disciplined approach of investment for securing your child’s future.

Long Term Investment Perspective: Money in mutual funds grow by the power of compounding which generates more return in the long term. Therefore, select a suitable time horizon for accomplishing your dreams in the online SIP calculator. According to the financial experts, a minimum of 5 year is required if you want your money to grow in numbers.

Affordable Expected Returns: Know your risk appetite before picking the returns. With high return percentages, comes great risk. Thus, if you are not willing to take much risk in the mutual fund market then stick to the normalized range and enjoy the stable returns in the long run.

Diversify the Portfolio: Don’t stick to just one category of mutual fund. Instead, try to maintain a balanced portfolio with a combination of equity, debt, hybrid funds etc.

Reading so far, you must have known that by using the SIP Calculator you can easily plan your child’s future effectively. For using the online calculator click sip calculator. If in case of any query, you can reach out to us at- 9660032889.

#sip return calculator#sip calculator#sip planner#sip calculator online#sip investment calculator#mutual funds calculator#mutual fund sip calculator

0 notes

Text

Factors to Consider Before Investing in Reliance Low Duration Fund

The recent disturbance in the debt instruments has made investors very conscious and jittery. The recent uncertainty has been created by the bonds of IL&FS and DHFL as they were downgraded, due to which many debt funds, including low duration and liquid funds have observed drop by around one percent in their NAV. Therefore, the financial analysts of MySIPonline have bought a few factors to consider before investing in Reliance Low Duration Fund, which is considered low risk in nature but are not completely risk-free. So, let’s see which factors you should look at before investing in the fund.

1. Interest Rate Risk The movement in the interest rate prices in the economy affects the bond prices. If the interest rates increase, the returns of bonds fall and vice-a-verse. It is because investors move towards newer bonds that offer higher rates, and therefore, the attractiveness of older papers with lower rates goes down as well as their prices decline. So, the investors investing in Reliance Low Duration fund should know the duration strategy of it. As per the financial experts of MySIPonline, the fund manager, Ms Anju Chhajer reduce the duration of the fund to cap losses and sell longer maturity papers to accumulate shorter maturity papers. Currently, the modified duration of the portfolio of the fund is 0.57 years.

2. Default Risk Default and credit risk depends on the financial stability of the company which is issuing the bonds. The company needs to pay interest and principal amount to the funds, but when it fails, the NAV of the fund gets affected. Many times, the rating agencies such as CRISIL also reduce the ratings of the bonds, which will downgrade the papers and the NAV of the funds fall. Therefore, before investing in the Reliance Low Duration Fund, investors should look after the portfolio and check in which instruments the fund is invested majorly.

Currently, Reliance Low Duration is investing its major corpus in AAA rated papers, keeping the interest high, and credit risk low. While many of its peers are investing their assets in AA and below-rated debt papers to earn a higher interest. This makes the fund much safer than other schemes in the category.

3. Average Portfolio Rating The average allocation of the fund is in AAA-rated instruments which makes its portfolio insulated as compared to its peers. This fund manager avoids investing in the AA- rated papers and those whose short-term ratings are less than A1+. She also maintains the liquidity in the portfolio by investing 40-50% of assets in Public sector undertakings and certificate of deposits. This helps the fund to provide stable and magnificent returns beating its benchmark as well as peers.

4. Low Concentration in Single Security Reliance Low Duration Fund is not investing more than 5% in a single security, because the concentration in a single security increases the risk in the portfolio. Therefore, it keeps the risk low by mitigating them in various instruments. Currently, the fund is investing in 153 securities having the highest concentration in the debentures of ONGC with AAA credit ratings.

All these factors prove that the fund is better than its peers. Investing in Reliance Low Duration Fund Growth plan is typically beneficial for people who are looking to park their money for a shorter duration with an investment horizon of 6 to 12 months. You can experience the growth in your wealth by investing in the fund via SIP or lumpsum mode. If you feel any difficulty in the investment, you can connect with our experts through a call or email. You can also post your questions to invest in the regular plan of the fund at https://goo.gl/WofRJm, and our financial experts will get back to you ASAP.

#Reliance Money Manager Fund - Regular Plan#Reliance Money Manager Fund#Reliance Low Duration Fund G#Reliance Low Duration Fund Growth

0 notes

Text

Is HDFC Top 100 Fund Safe for Long Term SIP?

HDFC Top 100 Fund is a large-cap fund which has been chosen by a large number of investors for long-term wealth creation. Large-cap mutual funds are considered safe investment in the equity mutual fund category. To find out if the fund is safe for long-term SIP, the experts at MySIPonline have taken many aspects of mutual funds into consideration.

Fund Overview

HDFC Top 100 Fund was previously known as HDFC Top 200 Fund, but the fund selection is now limited to the top 100 stocks ranked on the basis of the market capitalisation. 80% of the corpus is invested in the top 100 stocks of the equity market. The fund has maintained consistent returns well above the benchmark and peers for long-term investments, but is it worth the risk it possesses?

Risk Factor of HDFC Top 100 Fund

As we can see in the above table, the fund has shown higher standard deviation and beta than the category average and benchmark in the last 3 years. The fund is ranked among the riskiest schemes in the category. But if we look at the risk to reward ratios like Sharpe and Sortino, it has delivered better returns than the majority of the stocks. The risk to reward factor is better than the category average even though the risk is high. It means that the fund has delivered high returns with frequent fluctuations.

Who Should Invest? Large-cap funds are considered as low-risk mutual funds, but HDFC Top 100 Fund possesses high risk due to the selection of sensitive stocks and higher allocation in the mid-cap section. The fund can face massive drawdown in the negative market and is not suitable for conservative investors. The recent trends in the market have brought down the NAV of the fund, and it is the right time for the potential investors to invest.

Conclusion For long-term SIP of more than 5 years, the volatility and the risk factor should not affect the investment, but for a short-term SIP, the fund is not safe. High returns can be grabbed if SIP is continued for a longer duration and additional purchases are made along with it. To know if the fund is safe for you or not, connect with the experts at MySIPonline and get the best investment-related suggestions. Any query regarding regular plans of mutual funds can be raised through the link https://goo.gl/WofRJm.

#hdfc top 200#hdfc top 200 nav#HDFC Top 200 Fund#hdfc top 200 fund growth#hdfc top 200 growth nav#hdfc top 200 mutual fund#hdfc top 100 mutual fund#hdfc top 100

0 notes

Text

Will You Get the Long Term Growth in L&T Equity Fund?

Multi-cap funds are very efficient in providing a diversified portfolio to investors. From such funds, investors risk will get adjusted from various sectors and market caps. One such fund under this category offered by L&T Mutual Fund is L&T Equity Fund. The fund has been managed by one of the most efficient and knowledgeable fund managers of the fund house Mr Soumendra Nath Lahiri, under whose guidance, the fund has been performing well. The financial analysts of MySIPonline have researched the details of fund, its performance, and strategy. These details have been provided in the article below:

A Quick Overview of L&T Equity Fund:

Launched in the year 2005, the fund has an AUM of Rs 2,798 Cr as on Jul 31, 2018, with an expense ratio of 2.28%. It is a multi-cap category scheme, which is currently holding 69 stocks in its portfolio.

L&T Equity Fund is investing in the equity and debt instruments, and it has an average market capitalisation of Rs 72,494.78 Cr as on Sept 03, 2018. This capital is invested 52% in giant companies, 18% in large-cap companies, 23.04% in mid-cap, and 7% in small-cap companies. On the basis of sectors, the fund has been investing in various sectors, which are displayed in the pie chart provided below:

The portfolio of L&t equity fund growth shows that it has the highest asset allocation in the finance and banking sector. The remaining sector allocation of the fund shows that the fund is not highly aggressive as it is investing in defensive and cyclical sectors both. As per the financial analysts of MySIPonline, a very few amounts of investment have been made in sensitive sectors.

Past Performance Analysis of L&T Equity Fund (G)

Predominantly investing in the equity and equity-related securities across the market cap, the fund has generated the returns of 17.54% since launch. As per the fund manager, Mr S N Lahiri and Mr Karan Desai, the fund house has its own goals line in, which helps in the growth of investors. Therefore, the whole fund management team works fairly to offer the best to investors.

L&T Equity Fund growth has generated the compounded returns of 12.42% in the past three years, 20.29% in five years, and 14.70% in seven years. The returns have outperformed the returns of its benchmark, S&P BSE 500 TRI Index. They pick the high-conviction stocks which are selected on the basis of a bottom-up approach.

Keeping the portfolio turnover ratio between 40-50% at any time of the market, the fund management team of L&T Equity has generated the returns of 34.19% in 2017. They keep the sector allocation portfolio-agnostic, while changing the underweight and overweight positions of the sector, as per the market fluctuations. They try to mitigate the risk of the fund to offer the good long-term returns to investors.

As per the financial experts of MySIPonline, the fund has generated good returns in the long run. Thus, if you are looking for investment in it, you must have an appetite of tolerating a moderately high-risk. With this, you also need to have an investment horizon of 3 years or more.

#l&t equity fund#l&t equity fund growth#l&t equity growth fund#L&t equity fund g performance#l&t equity fund nav#l&t equity g fund

0 notes

Text

Why Should I Select Mirae Asset Mutual Fund?

With the growing popularity of mutual fund investments in India, don’t be surprised if you suddenly start hearing about them at your home. Investment has become all the more convenient with online platforms like MySIPonline. Coming down to selecting the right asset management company, it is impossible to ignore Mirae Asset Mutual Fund.

Mirae Asset Mutual Fund (G) - Introduction Launched in Asia, this fund house has spread its wings globally with 12 offices since 1997. The team here believes in working together towards achieving the goal whether locally or across regions. It has around 177 professionals around the world with a platter of diversified products across different asset classes. To solve problems faced by clients, it focuses on innovation to seek investment solutions of high quality. As on June 30th, 2018, the assets under management as on June 30th, 2018 was $123.5 billion. Experts at MySIPonline believe that this fund house is a dedicated one when it comes to work and client services.

Principles That it Follows An investor can make out how a fund house is by looking at its principles. Below are the ones that are followed by Mirae Asset MF.

Long-Term Perspective - Mirae Asset Mutual Fund believes in investing for a long-term as it understands that with time the short-term volatility will be overcome and the investors will be able to get fair returns. It focuses on selecting those companies which have stable cash flow and are competitive in nature.

Decision-Making - Decisions are taken keeping an eye on the principles and after conducting extensive discussion. The success of this fund house is because of the decisions that are taken collectively as a team after conducting a thorough market research.

Risk Management - There is a continuous monitoring which is done when it comes to risk on the investment made. It is seen that the risk is managed well so that the long-term benefits do not get hampered. Though risk cannot be avoided fully but steps are taken to minimize it as much as possible.

Competitiveness of Companies - At Mirae Asset, it is seen that the companies selected for investment have a competitive edge in the market. The factors such as their market share, business model, corporate governance, and transparency are considered while making the selection. It is believed that if companies have a strong base, they will do well in long-term even if they fluctuate a little from time to time.

Core Values of Mirae Asset MF

It keeps its clients first as it understands that they are the soul of the business. If clients are satisfied, only then a business can bloom. Therefore, they focus on building long-term relationships with them. The objectives that they select are based on the requirements of the investors and they see that it is reached. It believes in team work and giving back to the society that it has been offered by them, in a better way.

This fund house has launched a number of schemes under different categories such as Equity, Hybrid, Thematic, etc. You may invest in Mirae Asset Mutual Funds online via MySIPonline, a one-stop digital platform providing all investment-related solutions.

0 notes

Text

HDFC Mid Cap Opportunities Fund and its Asset Allocation

Among twenty AMCs on MySIPonline, one is HDFC Mutual Fund which comes under the top asset management companies of India. There are a number of its schemes in which you may invest through this platform. Among them one is HDFC Mid Cap Opportunities Fund which was launched on June 25th, 2007. This scheme aims to generate long-term capital appreciation through investment predominantly in mid cap companies. Let’s see how the assets of this scheme are allocated.

Asset Allocation of HDFC Mid Cap Opportunities Fund (G) As on July 31st, 2018, the assets under management were Rs. 21,149 crores. The investment made in equity and equity related instruments is 94.79%, in debt is 1.3%, and in cash and cash equivalents is 3.91%. The investment in equity is further divided in to large-cap, mid-cap, and small-cap equities. Investment in large-cap and small-cap is 3.30% and 9.59%, respectively. As this scheme predominantly invests in mid-cap fund, therefore, the asset allocation percentage in mid cap equity is 87.11%.

Sector Allocation Its benchmark is NIFTY Midcap 100 TRI, in comparison to which it has invested more in sectors such as Engineering, Automobile, Chemicals, Technology, etc., and less in sectors such as Financial, Healthcare, Services, and Energy. Overall, the fund of this scheme has been invested maximum in financial sector with 23.53%.

Company Allocation The top ten companies in which it has invested majorly are Sundram Fasteners (Engineering), Balkrishna Industries (Automobile), Cholamandalam Invest. & Fin. (Financial), Hexaware Technologies (Technology), Voltas (Cons Durable), RBL Bank (Financial), City Union Bank (Financial), Exide Industries (Engineering), Torrent Pharmaceuticals (Healthcare), and Edelweiss Financial Services (Financial).

Key Points About HDFC Mid Cap Opportunities Fund Growth HDFC Mid Cap Opportunities Fund NAV as on August 14th, 2018 was Rs. 57.879. The units are allotted to the investors by dividing the application amount with the applicable net asset value.

1. The minimum investment amount with which an investor may start investing in this scheme is Rs. 5000 for the first time investors and for existing investors this amount is Rs. 1000.

2. No entry load will be charged from investors investing in this scheme. As the switch out may affect the overall functioning of the investment, therefore 1% will charged as exit load, in case an investor redeems within one year of investment. After completion of one year, no exit load will be charged.

3. As this scheme is an open-ended scheme, so investors will be free to switch in or switch out of the scheme by buying or selling the units directly to the fund house itself.

To invest in HDFC Mid Cap Opportunities Fund Growth, simply log on to MySIPonline, a leading online investment platform that helps you invest from the comfort of your place. As you have gone through the assets allocation of this scheme, so now knowledge about one of the important factors that should be considered while investing in this scheme. To know more or clarify any doubt, don’t forget to consult the financial experts anytime without incurring any additional charges.

#HDFC Mid Cap Opportunities Fund#HDFC Mid Cap Opportunities Fund G#HDFC Mid Cap Opportunities Fund Growth#HDFC Mid Cap Opportunities Fund NAV

0 notes

Link

0 notes

Video

youtube

SBI Small Cap Fund The Perfect Solution For All Financial Problems:

If you are looking for a perfect mutual fund scheme then SBI Small Cap Fund is the best option for you. It offers great returns and growth options. SBI Small Cap Fund is top performing in small cap category in mutual funds. For more information watch the video.

0 notes

Text

A Complete Analysis of SBI Credit Risk Fund

A common misconception among mutual fund investors in India is that SBI Mutual Fund has top schemes only in the equity category, which is totally incorrect. This fund house has launched several remarkable schemes in the debt category as well, and one of them is SBI Credit Risk Fund. Today, in this post, we are going to see a detailed analysis of this scheme.

SBI Credit Risk Fund Growth Plan: Introduction

The scheme was launched on Jul 14, 2018, and was previously known as SBI Corporate Bond Fund. The aim of the scheme is to provide moderate returns to investors by investing predominantly in corporate bonds and debentures, with a credit rating of AA and less. It currently has 63.51% of total investment in AA rated instruments, 23.02% in A and below-rated instruments, 8.91% in AAA rated instruments, and 1.87% in A1+ rated instruments. Currently, SBI Credit Risk Fund NAV is Rs 28.38 (as on Aug 10, 2018), and the assets under management as recorded on Jul 31, 2018, are worth Rs 5,347 crores. One important thing to remember about this fund is the exit load that it charges. If you redeem your investments before 365 days, then you are liable to pay an exit load of 3%, if you redeem it between 366-760 days, then you will have to pay an exit load of 1.5%, and if you redeem it between 731-1095 days, then you will be charged an exit load of 0.75%. For more details regarding this scheme, you can visit MySIPonline. Now, let's have a look at how this scheme has performed in the past few years.

SBI Credit Risk Fund (G): Performance Analysis

Before starting the analysis, let’s have a look at the returns provided by this scheme and benchmark in the past 3, 5, and 10 years.

From the above table, you can see that this scheme has beaten the benchmark on all occasions and that too with a great margin. The consistency in returns shows the fund managers’ efficiency in managing the scheme and selecting the investment instruments. Keep in mind that this cannot be used to predict the future performance of the scheme.

SBI Credit Risk Fund (G): Risk Analysis

We discussed above that SBI Credit Risk Fund Invests mainly in low-rated bonds and debentures, which greatly increases the risk associated with it. The fund has a beta of 3.83 which show that the effect of market volatility faced by it is very high. But, the risk to return ratio (Sharpe) is 0.80, which means by taking a high risk an investor can enjoy high returns, and an alpha of 9.59 is the proof of that. By taking in account all the above measures, we can say that the risk associated with the fund is moderately high, but the returns provided are even higher.

With help of the above data, you can now see that how good this scheme is. SBI credit Risk Fund Growth Plan is one of the top performers in its respective category and has proven the same from time to time. Despite that, don’t invest in this scheme blindly, and do consult your financial adviser before making the final decision. If you have any query related to this or any other mutual fund scheme, feel free to contact our experts at MySIPonline.

#SBI Credit Risk Fund SBI Credit Risk Fund G SBI Credit Risk Fund Growth#sbi corporate bond fund#sbi bond fund

0 notes

Text

How will Your Patience Pay When You Invest in L&T Infrastructure Fund?

In the past 2-3 years in the rule of NDA government, more than 1 Lakh villages have been connected to the other parts of the country under Pradhan Mantri Gram Sadak Yojana. And recently in a press conference, the Union Minister Nitin Gadkari has asked the banking sector to take part in the infrastructure growth. This all leads to an increase in the growth of the sector which helps in the infrastructure development of India. In this sector, a fund that has been reaching to heights quietly, providing superlative returns from past many years is L&T Infrastructure Fund. The article further, has been providing you all the details related to the fund, its recent performances etc., which has been discussed as under:

Overview of L&T Infrastructure Fund:

Launched in the year 2007, the fund is an open-ended scheme, investing in the infrastructure sector. It is predominantly investing in equity, equity-linked derivatives and approximately 4% in debt instruments to keep the required liquidity in the fund.

The AUM of the fund is 2,082 Cr as on Jul 31, 2018, with an expense ratio of 2.04%. The average market capitalisation of the fund is Rs 22,026.23 Cr, as on Aug 4, 2018. This capital is invested 17% in giant companies, 22% in large-cap companies, 45% in mid-cap, 17% in small-cap, and a small ratio in micro-cap companies. This allocation made the fund multi-cap, which has been diversified in sub-sectors of infrastructure which are construction, engineering, metals, energy, communication, services sector, etc.

L&T Infrastructure Fund (G) is currently investing in 52 companies, where top five companies hold 27.88% of the total corpus. These companies are Larsen & Toubro, Graphite India, Shree Cement, The Ramco Cement and Grasim Industries. As of now, the construction sector of India is on the boom, which has been disclosed in the BMI Research report, and the fund is investing 40% capital in this sector. This all shows that the fund will grow in the future at a fast pace, as the real growth will be average 6.2% between 2018 and 2027 in the sector, as per BMI Research.

What the Past Performance of L&T Infrastructure Fund Depicts?

L&T Infrastructure has been delivered 5.09% returns since its launch. Following Nifty Infrastructure TRI Index as its benchmark, the fund has generated alpha of 12.91% in the past three years, as provided on July 31, 2018.

The compounded returns of the fund for the past three, five and seven years were 13.79%, 28.42%, and 14.59%, respectively. All these returns have outperformed its benchmark as well as its category average. All these returns have made it best fund in the category, beating all other funds.

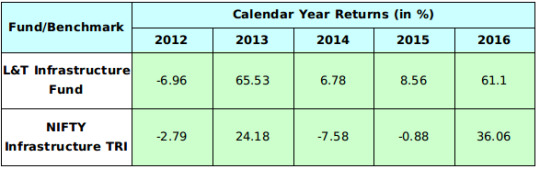

The annualised returns of the fund for the past four years are discussed in the table provided below:

Source: Value Research

The trends of returns show that fund has backed up even after providing negative returns in 2012 and beat the benchmark every year except for 2012. In 2014, when the benchmark returns are negative, the fund has delivered excellent returns to investors.

What Strategies Are Followed by the Fund Manager of L&T Infrastructure?

The fund has been managed by very efficient Chief Investment Officer of L&T Mutual Fund, Mr Soumendra Nath Lahiri. He follows the combination of growth and value investing approach for selecting any stock or company. As compared to the industry benchmark NIFTY infrastructure, the fund is less volatile.

Therefore, the investors who wants to bet in the fund with a little lower risk than that of market risk, this fund good for them. At the same time, when the world is moving towards high growth in infrastructure, Mr Lahiri maintains good risk spread across various sectors.

Investing in the fund will provide you with high growth, but you have to be patient as the fund grow according to the fluctuation of macro and micro factors. It ensures the growth of capital in the long run, and we can also predict the growth of capital with its past returns. L&T Infrastructure Fund growth indirectly contributing towards the growth of country. For more details about this fund or to seek guidance on investment, connect with the experts at MySIPonline. We offer an easy investment platform where you can invest and manage your funds effortlessly.

0 notes

Text

How to Make the Best Use of Your Money with Reliance Small Cap Fund?

It’s an ancient myth that only those who have big bucks can make a fortune in mutual fund investing. This is completely untrue. Making a successful investment depends on a lot of things, and not just the amount that you spend. The chassis of your portfolio ought to be strong enough to withhold the weight of the market adversities, and shall let the fund perform well in the market. And for this, you ought to involve those funds in your plan that have the requisite energy to achieve this.

Adding Reliance Small Cap Fund is the most essential component of a strong, robust portfolio that has the required balance of toughness and energy to earn superior returns. This fund has been constantly rated as the most successful fund in the realm of mutual fund investing in India. The past scores are phenomenal that have broken several records and have set new milestones that are very difficult to achieve. In order to address the readers with clear knowledge of best mutual funds, MySIPonline keeps adding information on top funds on its website. One such fund is Reliance Small Cap, a detailed account of which has been given below.

Why all the Hype?

Reliance Small Cap Fund (Growth) is one of the most authentic schemes ever designed by any fund house across the globe. The fund parks its assets in budding companies that have an exceptional future and glorious chances of success. It combines the stocks of companies established in different market sectors, thus infusing the portfolio with high energy and value that prepares it to run longer in the market.

What was the Best Performance of the Fund?

Reliance Small Cap Fund Regular Plan G is currently rated as the best small cap fund to invest in India. The reason for its undisputed ranking lies in its past performance, which has always been surprising the investors and spectators. In the last 3-5 years, the fund has achieved a milestone by flooding the market with high returns that went up to 37.56%. Returns of this magnitude are very rare, and stand almost 7-10% higher than what the benchmark and the peers have achieved.

Which Class will it Suit the Best?

Technically speaking, Reliance Small Cap Fund should find a place in every portfolio, regardless of the profile of the owner. However, the condition should be that the investor has selected other funds that have the power to neutralise the risk factors drawn in by Reliance Small Cap Fund (Growth). If done correctly, an investment with this fund in combination with other top-performing funds will create a bomb. Take the help of the assistant team at MySIPonline, as they possess vast experience in handling different types of profiles, and thus will be able to narrate the best possible planning attuned to your needs.

How Much Should be Invested?

It’s an old saying that says more the merrier. However, this is not the case with Reliance Small Cap. You should first analyse, according to your profile and risk prospects, how much you should invest in this fund. Since the minimum investment is set at just Rs. 100 via an SIP plan, you can start with a small amount and then can gradually increase the amount, if necessary.

So, if you are desirous of high returns and good growth, then you must consider investing in Reliance Small Cap Fund (Growth). Use the services of MySIPonline for a quick, effortless and free online investment to make sure that you earn the best.

#reliance small cap fund#reliance small cap#reliance small cap fund growth#reliance small cap fund g#reliance smallcap fund#reliance small cap fund sip

0 notes

Text

3 Top Performers from UTI Mutual Fund in 2018

UTI is one of the oldest and leading fund houses of India. This was the only AMC till 1992 that was running the capital market in India. It has provided several multi-baggers over the years and has helped investors in attaining their financial goals. In this post, we are going to discuss some top performing schemes from UTI Mutual Fund that have shown really good performance in 2018.

UTI Equity Fund

This is one of the best schemes provided by UTI MF in the equity category. The scheme has shown exceptional performance over the years and has beaten its benchmark at most occasions since its launch. The returns provided by the scheme in the last 1, 3, 5, and 10 years are 16.93%, 10.42%, 17.85%, and 15.84% respectively (as on Jul 17, 2018). Being a hybrid scheme, it invests in a mix of large, mid, and small-cap companies and can change the allocation in these market caps according to the behavior of the equity market. Right now it has a NAV of Rs 142.40 (as on Jul 17, 2018) and the assets under management as recorded on Jun 30, 2018, are worth Rs 7,986 crores. The minimum investment you can make in this scheme is Rs 5000.

UTI Hybrid Equity Fund

This scheme was launched on Mar 20, 1995, under the hybrid aggressive category and was previously known as UTI Balanced Fund. The scheme invests in a blend of equity and debt instruments and has 73.03% investments in equities and the rest 26.97% in debt and money market instruments. The returns given by the scheme in 3, 5, and 10 years of time are 8.48%, 14.43%, and 12.17%, respectively (as on Jul 17, 2018). It has failed to beat the benchmark in 3-year returns but has successfully beaten the benchmark in 5 and 10-year trailing returns. It has a current NAV of Rs 165.64 (as on Jul 17, 2018) and the assets under management as on Jun 30, 2018, are worth Rs 6,272 crores. The minimum investment you can make in this scheme is Rs 1000. Some of the top holdings of this scheme are ITC, ICICI Bank, HDFC Bank, Infosys, and Larsen & Toubro.

UTI Infrastructure Fund

This is an infrastructure sector fund provided by UTI Mutual Fund and was launched on Apr 07, 2004 as an open-ended scheme. The scheme invests in a blend of different market caps with 52.19% investment in large-caps, 36.34% in mid-caps, and 11.46% in small-cap companies. The returns this scheme has provided in 3, 5 and 10 years are 3.15%, 14.36%, and 5.81%, respectively (as on Jul 17, 2018). It has beaten its benchmark on all occasions. As on Jul 17, 2018, it has a NAV of Rs 50.18 and the assets under management as recorded on Jun 30, 2018, are worth Rs 1,403 crores. The top holdings of the scheme include top-notch companies like Larsen & Toubro, Shree Cement, Yes Bank, ICICI Bank, and Axis Bank.

So, these are the 3 schemes from UTI Mutual Fund that have shown great growth in 2018. But keep in mind that you can't determine the future performance of a scheme by looking at its past performance, as market conditions regularly keep changing. To make an investment in these or any other mutual fund schemes, you can visit MySIPonline.

#uti mutual fund#uti mutual funds#uti mf#uti mf online#uti mutual fund online#uti mutual fund schemes#best uti mutual fund#online uti mf

0 notes

Text

What You Need to Know about the Schemes of Canara Robeco Mutual Fund?

India was once known as ‘The Golden Bird’, a metaphor that aptly described the financial condition of the country before it was looted by the invaders. History speaks that in the early eighteenth century, before the British Raj had deepened its roots in the country, India contributed a massive 23% to the world’s GDP. But gradually as the torment and torture from the British rose, the contribution plummeted down to 3% by the time India won its independence in 1947.

That was history. But what about today? Well, the surprising news is that India has recovered from a great depression, and stands today as one of the largest economies in the world, ironically enough, equal to that of the Great Britain. One of the major reasons for the strengthening of India’s economy is the rising interest of the Indian citizens in making investments in mutual funds, for which we shall thank fund houses such as Canara Robeco Mutual Fund.

In order to teach the readers about how the fund house came to prominence and made a major contribution to India’s growing economy, MySIPonline has come up with a detailed account on the funds that this AMC offers. Give it a patient read, and find out which fund can help strengthen your economy.

The Top Performing Funds of Canara Mutual Fund

Canara Robeco Bluechip Equity Fund (G) : This fund belongs to the safe and reliable large cap category. It is a good pick for all those who do not bear a very aggressive nature towards their investments, and would rather like to settle with something steady and promising. The fund has shared a fair amount of wealth with its investors since inception, which amounts to an average 14.51%. Further, it enjoys a four-star rating from CRISIL, and has been voted as one of the top five large cap funds to invest in India.

Canara Robeco Liquid Fund (G) : About a decade ago, investment meant either opening a savings bank account or buying a fixed deposit, and preserving your money in them for years to earn decent returns. But this method has withered away with time and have become archaic. Now, liquid funds are the new methods of earning heavy returns. Canara Robeco Liquid Fund stands amongst the top liquid funds offered in India, with an annual average yield glinting at 7.97%. So, if you have some spar cash loitering around, then do consider investing in this fund for earning far better returns than what the bank accounts could ever pay.

Canara Robeco Tax Saver Fund (G) : India is the largest democracy in the world in terms of population. However, only 3% of the gigantic figure of 1.35 billion honestly pays taxes. And the reason is the heavy taxes imposed on the citizens. Hence, ELSS plans were introduced to mitigate the rising tax problems in the country. Canara Robeco Tax Saver Fund is a fantastic tax-saving scheme which besides giving you returns as high as 16.28%, can trim your tax bill by a hefty amount of Rs. 46, 800 by the virtue of being enlisted under section 80C of the Income Tax Act, 1961. Start with an SIP plan via MySIPonline to make an efficient tax-saving plan for a better future.

Canara Robeco Infrastructure Fund (G) : If there’s any fund which has been making marvellous progress lately, then it is Canara Robeco Infrastructure Fund. With a tightly woven investment strategy that mainly involves companies engaged in infrastructure and real estate, it attempts to garner huge wealth by leveraging on the thriving infrastructure sector in India. In the last 10 months, the fund has shown remarkable upward movement, beating the benchmark and setting new milestones in the market. The fund has emerged from a depressing state of negative returns to an applaudable figure of 16.40% in just five years.

To make a solid investment plan that can help you conquer your future endeavours, the above schemes of Canara Robeco MF will fit in the best. Take advantage of the free online services of MySIPonline for a smooth investment experience.

0 notes

Text

A Must-Read Before Investing in Balanced Funds

Balanced funds are becoming the first choice of investors and the main reason behind that is the diversity in portfolio these schemes provide. These funds are safer than equity schemes and the returns they provide are also good. Today, we are going to learn what balanced funds are and how they are beneficial for an investor.

What Is a Balanced Fund?

A balanced fund is a hybrid equity scheme which invests in a mix of equity and debt instruments. These funds can be easily identified by their portfolio distribution. The schemes from this category generally invest 70% fund in the equity instruments and 30% in debt instruments with a 5% leeway. Some of the examples of top performing balanced fund schemes are L&T Equity Hybrid Fund, Reliance Equity Hybrid Fund, Aditya Birla Sun Life Equity Hybrid 95 Fund, etc.

Benefits of Investing in Balanced Schemes

There are various advantages of investing in a balanced fund. Let's have a look at some of the top benefits that you can enjoy by investing in these schemes.

Diversity - This is the main reason behind the increasing popularity of balanced mutual fund schemes. While investing in equity instruments grants it with the endless opportunities for growth, the investment in debt instruments provides it with the stability when the stock market is not performing well.

Good Long-term Returns - Balanced Mutual Funds have proved again and again that they are one of the best mutual fund schemes in terms of providing high long-term capital appreciation. On one hand, the equity instruments keep on providing with high returns, the interest from debt instruments also keeps piling up.

Stability - These schemes are comparatively more stable than the pure equity schemes. The reason behind that is the diversification in the portfolio. Let's say equity market is not performing well and are at a standstill position, making no profit for investors. In equity schemes, this means that there will be no profit booking at that time, but in the balanced fund, the debt instruments will keep giving the returns, thus providing stability to the scheme.

Risk Involved

As stated above, the risk involved in these type of schemes are comparatively lower than equity schemes, but still, it is pretty considerable. As we have seen that more than half the investment is in equity related instruments, so if the stock market is not performing well for a long time, then these schemes will also suffer.

Who Can Invest?

Balanced Funds are a great option for investors who do not want to invest completely in equities and are looking for an option that can provide them with good long-term capital gain with moderate risk. These are also a great choice for investors who are new to the mutual fund market, as they can experience the performance of equity as well as debt category.

So, this covers most of the information that you are going to need about balanced mutual funds if you are planning on investing in them. One thing you should keep in mind before investing in any scheme is you should do a thorough research about it. For investing in balanced fund schemes, you can visit MySIPonline.

#balanced fund#balanced funds#balanced mutual funds#best balanced funds#best balanced mutual fund#what is balanced fund#best balanced fund#best balanced mutual funds

1 note

·

View note

Text

Know Reliance Liquid Fund Like You Never Did Before!

Reliance Mutual Fund, a part of Reliance ADA (Anil Dhirubhai Ambani Group) is one of the fastest growing companies that has provided a number of schemes under various categories to its investors. On December 9th, 2003, it launched a scheme named Reliance Liquid Fund which is an open-ended scheme. Its investment objective is to generate returns that are optimal by investing in debt and money market instruments with high liquidity to investors. You may invest in this scheme through an online platform MySIPonline for quicker transactions and time saving.

Wondering If You Can Invest In This Scheme or Not?

Well, if you are an investor who is looking for an opportunity to invest in a scheme that can help in generating income with short-term investment in fixed income securities, then you may invest in Reliance Liquid Fund. This scheme is for conservative investors who do not want to indulge in high risk and those who need liquidity.

Who Is The Mastermind Behind Its Functioning?

This fund is managed by Ms. Anju Chhajer since October 2013. She has done B.Com(Hons.) and is a Chartered Accountant. Before joining Reliance Mutual Fund, she was working with companies such as National Insurance Company and D.C. Dharewa & Co. Apart from this scheme, she has been managing a number of schemes simultaneously such as Reliance Low Duration Fund, Reliance Prime Debt Fund, Reliance Ultra Short Duration Fund, Reliance Equity Savings Fund, etc.

Did You Know?

Reliance Liquid Fund Growth was earlier known as Reliance Liquid Fund - Treasury Plan. Its net asset value as on July 06th, 2018 was Rs. 4302.0893 and the assets under management were Rs. 36110 crores as on May 31st, 2018. The minimum investment amount with which you may start investing in this scheme is Rs. 100 only. Its competitors are Aditya Birla Sun Life Liquid Fund, HSBC Cash Fund, Principal Cash Management Fund, and UTI Liquid Cash Fund. The top five companies in which it has invested majorly are Reliance Industries

83-D 25/06/2018 (Commercial Paper), Bank of Baroda (Fixed Deposits), Axis Bank 2018 (Certificate of Deposit), National Bank Agr. Rur. Devp 91-D 16/07/2018 (Commercial Paper), and Andhra Bank (Fixed Deposits) with the investment percentage being 5.42, 4.43, 4.28, 3.53, and 2.77, respectively as on May 31st, 2018. There is no entry or exit load that an investor has to incur. This scheme by Reliance Mutual Fund has been rated four stars by Value Research.

How Is Reliance Liquid Fund Doing?

As on July 06th, 2018, the trailing returns of this fund were 0.63% for one month, 1.77% for three months, 3.57% for six months, 6.94% for one year. This shows that the returns are gradually increasing with time, so if you wish to earn better returns on your principal amount, invest for a bit more months. Its best monthly performance was in August 08th, 2013 to September 09th, 2013.

To know more about Reliance Liquid Fund, log on to MySIPonline which is a user-friendly platform that helps you take the right decision with helpful tools like SIP calculator, etc.

0 notes

Text

Know All About L&T Mutual Fund's Hybrid Schemes

L&T Mutual Fund is one of the most common names that almost every mutual fund investor knows about as it has brought for the investors a bunch of schemes to invest in. It aims to be the most admired and sustainable institution which is also inspirational at the same time. It follows Gem process which is Generation of idea, Evaluation of companies, and Manufacturing and Monitoring of portfolios for investment purpose.

Among various categories under which it has launched schemes, one is hybrid category. Here, in this article we are going to talk about such schemes. They are as follows.

L&T Hybrid Equity Fund - Formerly, it was known as L&T India Prudence Fund which was launched on February 07th, 2011. It is an open-ended scheme that invests predominantly in equity and equity related instruments. Its net asset value as on July 04th, 2018 was Rs. 25.9680. It is managed jointly by three fund managers who are Mr. S.N. Lahiri, Mr. Shrinath Ramanathan and Mr. Karan Desai.

L&T Conservative Hybrid Fund - Formerly, it was known as L&T Monthly Income Plan. This fund is managed by Mr. Venugopal Manghat and Mr. Jalpan Shah. Its net asset value as on July 04th, 2018, was Rs. 32.8079. It was launched on July 31st, 2003 and its benchmark is CRISIL MIP Blended Fund Index. The minimum initial application amount for this scheme is Rs. 10000.

L&T Dynamic Equity Fund - The investment objective of this scheme is to generate capital growth through investment in equity and equity related instruments and to help its investors earn consistent income by investing in debt securities, money market instruments and also gaining through investing in arbitrage opportunities. It was launched on February 11th, 2007 and its benchmark is 50% S&P BSE 200 TRI and 50% CRISIL Short Term Bond Fund Index.

L&T Arbitrage Opportunities Fund - This scheme by L&T MF was launched on June 30th, 2014. The fund is jointly managed by Mr. Karan Desai, Mr. Venugopal Manghat and Mr. Praveen Ayathan. Its investment objective is to generate returns that are reasonable through investment in the arbitrage opportunities of cash and derivatives segment of equity market and investing the rest of the amount in debt securities and money market instruments.

L&T Equity Savings Fund - This fund was launched on October 18th, 2011. It is manged jointly by Mr. Praveen Ayathan, Mr. Venugopal Manghat and Mr. Jalpan Shah. The net asset value as on July 04th, 2018 of this scheme was Rs. 17.2840 and the minimum initial application amount is Rs. 5000.

These are the hybrid schemes provided by L&T Mutual Fund which are apt for those investors who wish to invest in a portfolio that consists of an investment in equity as well as an investment in debt and money market instruments. To invest in L&T Mutual Fund online, simply log on to MySIPonline, a user-friendly platform that helps an investor invest in a hassle-free and environmental-friendly way. In order to clarify any doubts, you may also avail the help of the financial experts at MySIPonline absolutely free!

0 notes

Text

How Can Large Cap Funds Provide Better Returns Without Greater Risk?

Whenever investment in mutual funds are considered the equity funds creates insecurity in the back of the mind of the investors, which have a low-risk appetite. Much to their surprise, equity schemes have a category of schemes for the investors who cannot bear the substantial market risk of the equity market. The group is called large-cap mutual funds which allow the investor to grow the wealth with a stable return without exposing the corpus to the high-risk portfolio.

What Are Large Cap Funds?

Large-cap funds are the mutual funds which invest the majority of the corpus in the equity instruments of large-cap companies. According to the recent categorisation and rationalisation by SEBI, a large-cap fund has to invest at least 80% of the corpus in the equity and equity derivative instruments of large-cap companies. SEBI has also given more straightforward criteria to define the large-cap companies which say the top 100 companies ranking 1st to 100th regarding full market capitalisation are called large-cap companies. Investors can start investing in a variety of goal-oriented large-cap fund today, by connecting with the official website of MySIPonline.

Benefits of Large Cap Funds

Since the large-cap companies are much experienced and have faced various uncertainty and volatility, they can withstand any kind of heavy loss which can be incurred due to any reason in the equity market. These companies have strong roots and background in whichever sector they are concerned. Hence they have lesser chance to suffer a heavy loss. Which makes the large-cap funds least risky out of all the equity schemes available.

Large-cap companies often provide dividends which in turn reflects on the NAV of the fund, and hence it adds a cherry on the cake of mutual fund investment. The small and mid-cap companies are not prone to such benefits as they are financially unstable and are at their emerging stage. The large cap mutual funds investment have multiple benefits. The only limitation is an amount of growth which is limited. As large-cap companies are already at their zenith, they have a slight margin of growth and hence are limited to offer the returns. The returns of small and mid-cap funds are higher as compared to large-cap funds as small-cap companies have a wider margin of growth.

Who Should Invest?

Investors who seek for the long-term growth without exposing their capital to a high-risk portfolio can go for the large-cap funds without a doubt. It also a good destination for the investors who are new to the mutual fund industry and are uncertain of the risk factor they can bear. Though the endeavours and ambitions of every investor are different hence it is considered beneficial to take the assistance of a financial adviser regarding mutual fund investments.

At MySIPonline, every goal and investment related details of the investor are well studied and analysed thoroughly. The schemes are advised with an honest opinion with the aim to make every investor financially stable and independent. Connect through email, chat, call and make the most out of your mutual fund investment.

#large cap mutual funds#best large cap mutual funds#large cap funds#top large cap mutual funds#best large cap funds

0 notes