Don't wanna be here? Send us removal request.

Text

ビットメックス(BitMEX) マニュアル(Manual)_ビットコイン

『BitMEX(ビットメックス)』は香港とサンフランシスコにオフィスを構える仮想通貨のデリバティブ取引所です。

最大100倍のハイレバレッジ、追証なしのゼロカットシステム、世界1位の圧倒的な取引量など、ビットコインFXをするなら外せない鉄板の取引所です。

今回はBitMEXの登録方法をはじめ、魅力や登録できない時の対処法などについてご紹介します。

この記事を読めば、どんな人でもスムーズにBitMEXの登録ができますよ!

→ BitMEX(ビットメックス)公式サイトはこちら

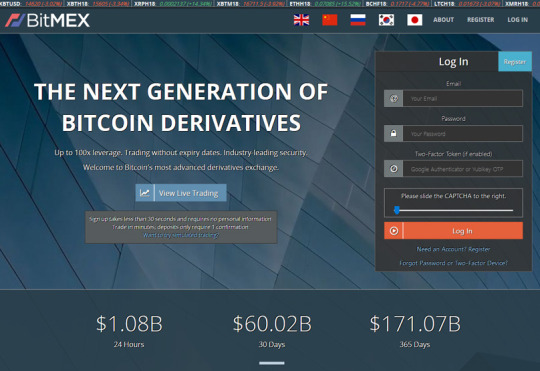

まずは、BitMEXの登録方法についてご紹介します。

実際の画面付きで解説していくので、ぜひ参考にしてみてくださいね!

· STEP.1

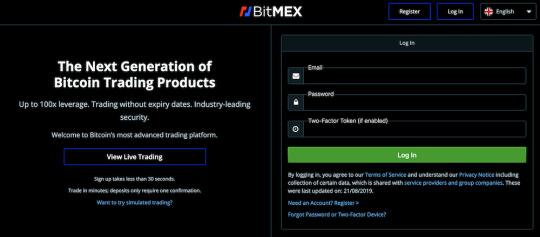

公式サイトにアクセス

BitMEXの公式サイトへアクセスします。

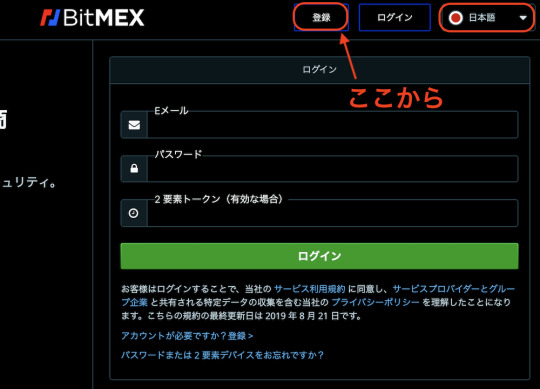

画面右上で日本の国旗を選ぶと日本語表示に切り替わるので、そこから「登録」をクリックしましょう。

上図のような登録画面が開きます。

日本語になっていない場合は右上の日の丸マークをクリックすれば日本語になります。

· STEP.2

メールアドレスの入力

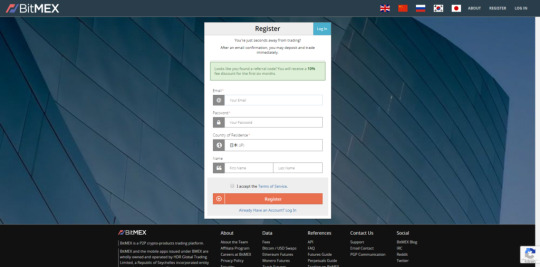

するとこのような画面が表示されるので、メールアドレス・パスワード・住んでいる国・氏名を入力し、最後に「登録」をクリックします。

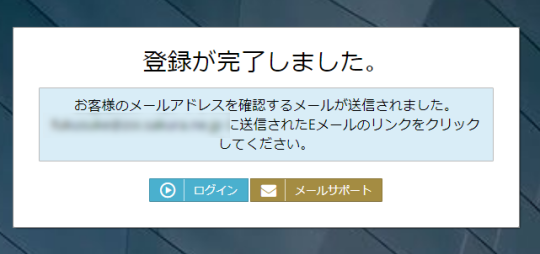

·STEP.3

メールの確認

すると、登録したメールアドレス宛に登録メールが届きますので、本文にある「メールを検証」をクリックすれば登録は完了です。

* 2段階認証の設定

BitMEXの登録が完了したら、そのまま2段階認証の設定もしておきましょう。

·STEP.1

アカウント画面の表示

BitMEXにログイン後、画面上部にある「アカウント」をクリックします。

次に、画面左側のメニューから「マイアカウント」を選択。

·STEP.2

Google Authenticatorの選択

2要素認証を有効化の欄で「Google Authenticator」を選択します。

「お客様のGoogle認証コード」は忘れないようにメモしておきます。

万が一スマホを紛失したり故障したりして、Google Authenticatorアプリを使えなくなった際のアカウント復旧に必要です。

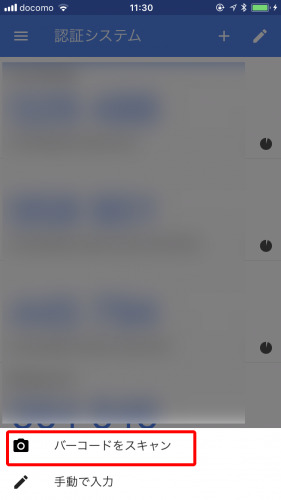

·STEP.3

QRコードの読み取り

スマホのGoogle Authenticatorを起動し、右上の「+」マークをタップします。

「バーコードをスキャン」をタップ。

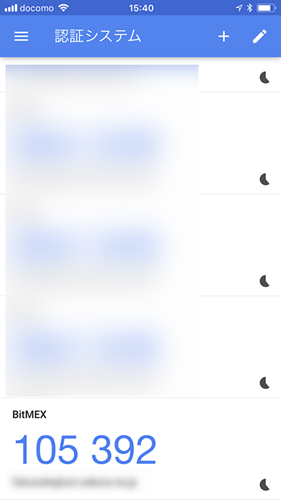

スキャンが完了すると2段階認証のコードが表示されます。

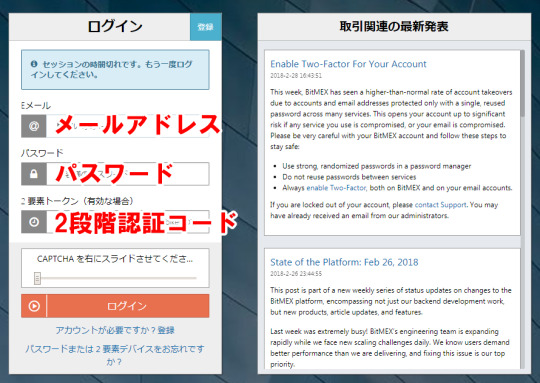

STEP.4

承認コードの入力

するとログイン画面が表示されますので、「メールアドレス」「ログインパスワード」とアプリに表示されている「2段階認証コード」を入力してログインします。

その後、アカウント画面に「2要素認証が有効となっています。」と表示されていれば完了です。

→ BitMEX(ビットメックス)公式サイトはこちら

BitMEXは、高レバレッジで多くの種類の仮想通貨の取引ができる取引所として、投資家から注目され取引量もとても多い海外取引所です。

なぜ、こんなに人気で注目されている仮想通貨取引所なのか、ここではビットメックスの特徴について見ていきましょう。

* 魅力1:最大100倍のハイレバレッジ

BTC FXの一番の魅力はやはり少ない資金でも大きく儲かる可能性があるハイレバレッジでしょう。

『BitMEX(ビットメックス)』は最大100倍というハイレバレッジを実現しています。

2019年10月現在、国内取引所の最大レバレッジは4倍となりますから、BitMEXはどれだけハイレバレッジなのかがわかりますよね!

* 魅力2:追証なしで借金リスクゼロ

ハイレバレッジのFXというと「失敗したら借金背負って人生終了…」と思っている方も多いかもしれません。

以前、ビットフライヤーのFXで追証450万円になってしまった人のツイートが話題になっていました。

* 魅力3:動作が軽く安定した取引環境

BitMEXを少し使ってみれば分かりますが、ウェブブラウザ上での取引システムにもかかわらずめちゃくくちゃ軽くサクサク動きます。

相場急変時などでもサーバーが重くなり「取引したいときに取引できない!」なんてこともないのでいつでも安心して使うことができます。

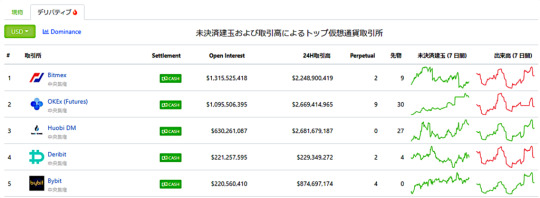

* 魅力4:取引量が多く、板が厚い

BitMEXの取引量は、バイナンスやOKEx、Upbit、Huobi、Bitfinexなど名だたる取引所を抑えて第1位となっています。(2019年11月現在)

非常に流動性が高く板が厚いので「なかなか約定しない!」なんてことはめったにありません。 * 魅力5:完璧な日本語対応 BitMEXは日本語に対応しているので英語が苦手な方でも安心です。また海外取引所にありがちな自動翻訳の不自然な日本語ではなく、きちんと人の手が入っているであろう完璧な日本語表示となっています。 詳細なヘルプページも翻訳されているので、BitMEXの使い方や仕組み・ルールなどもちゃんと理解できるようになっています。 * 魅力6:コールドウォレットによる高いセキュリティ BitMEXでは証拠金としてビットコインのみ入金を受け付けています。 顧客から預かったビットコインはすべてインターネットにつながっていないコールドマルチサインウォレットに保管され、出金するための秘密鍵は銀行の貸金庫に紙で保管されています。 出金処理は1日1回のみに限定され、3人の共同創業者のうち2人の手作業での承認があってはじめて出金されます。 そのため、すぐにビットコインを引き出せないという不便さはあるものの、ハッキングなどによる盗難の可能性はないので安心です。

実際に取引を始めるには、レバレッジや取引手数料など基本的なルールを把握しておくことが重要です。

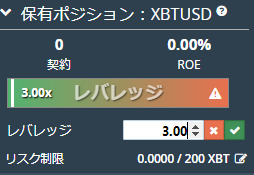

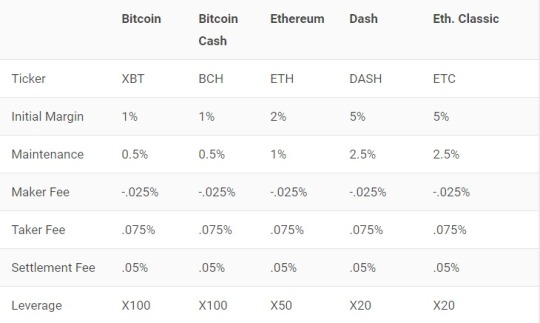

* レバレッジ 設定できる最大レバレッジは通貨により異なり、最大100倍のレバレッジを設定できるのはビットコインのみです。

* 取引手数料

手数料はビットコインとその他で異なります。 どの通貨もメイカーはマイナスとなっており、手数料を支払うのではなく受け取ることができます。 テイカーの場合は手数料を支払う必要があるので、よっぽど急いで約定させたい場合以外は極力メイカーになるようにしましょう。 決済料はビットコインのみに必要なもので、決済時にポジションが残っている場合に発生します。 * 限月(満期日) BitMEXのレバレッジ取引は先物取引となっています。 先物取引とは「決まった期日」に「決まった価格」で購入するとあらかじめ契約する取引のこと。 たとえば、「3ヶ月後にビットコインを1XBT100万円で購入する」と契約したとします。 3ヶ月後にビットコインの価格が値上がりして120万円になっていれば、そのときの相場よりも20万円安く購入できることになり利益が出ます。 反対に値下がりしてしまえば損失となりますね。 この期日のことを限月といい、BitMEXでは満期日と表記されています。

上図はETHの契約詳細ですが、「満期日:2ヶ月後」となっているのが期日です。 この期日までは自由にポジションを売買できますが、期日が来てもポジションを保有していた場合は強制的に決済されます。

* Funding(資金調達) ビットコインのみ満期日なしの「無期限」を選ぶことができますが、無期限の場合は「Funding(ファンディング:資金調達)」と呼ばれるスワップ手数料が発生するので注意が必要です。

上図の赤枠で囲った「資金調達率:0.0100% 7時間後」と表示されているのが「Funding(資金調達)」です。 Fundingは8時間ごとに日本時間で5:00、13:00、21:00の1日3回発生し、レートは-0.375%���0.375%の間で変動します。 また、ロング(買いポジション)とショート(売りポジション)のどちらのポジションを持っているか、資金調達率がプラスかマイナスかによって、手数料を支払うか・受け取るかが変わります。

ビットメックスは海外取引所ですが、国内取引所とそこまで異なることもなく使いやすい取引所です。 ここでは、簡単にビットメックスの使い方について解説していきます。

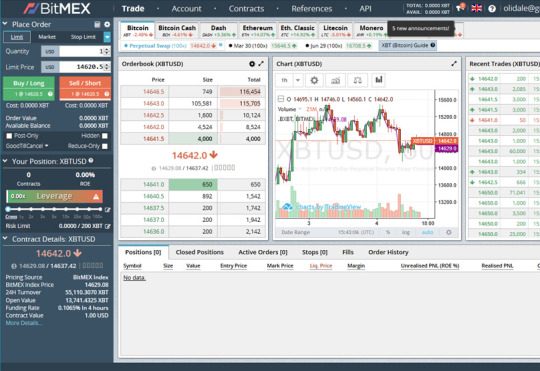

* 取引画面の解説

取引画面はシンプルに情報がまとまっており使いやすく、コントラストが強めで見やすいです。 ①注文画面 買い(ロング)や売り(ショート)の注文はこちらで出します。 ②レバレッジ設定 デフォルトで最大レバレッジになっていますが、手動で1倍~設定できます。 ③契約の詳細 24時間出来高や満期日、ビットコイン無期限の場合は次の資金調達までの時間や資金調達率など重要な情報が載っているパネルです。 ④通貨ペアの切替 通貨ペアはこちらのタブで切り替えできます。 ⑤売り板/買い板 オーダーブックです。 ⑥価格チャート チャートは多くの取引所で使われているTradingViewです。 ⑦デプスチャート 売りと買いの数量を視覚的にわかりやすく表示したチャートです。 全体の傾向をビジュアル的につかみやすくなっています。 ⑧約定履歴 全体の約定履歴です。 ⑨自分のポジション、アクティブな注文、約定・注文履歴など 自分が現在持っているポジションや注文中で約定待ちの注文、過去の注文履歴などが表示されます。 * 注文方法の種類 BitMEXでは下記7種類の注文方法が可能です。

注文画面には「指値」「成行」「ストップ指値」のみ表示されていますが、右側の▽マークをクリックすると残りの注文方法も出てきます。

成行

現在の取引価格ですぐに約定させる注文です。 すぐに買いたい・売りたいという時に即座に約定させることができますが、テイカー手数料がかかります。

指値

この価格になったら買う(売る)と価格を指定する注文方法です。 自分の買いたい(売りたい)価格で注文できますが、相場が指定した価格にならなければいつまでたっても約定しないこともあります。 ストップ成行・ストップ指値 ストップ注文とは相場が指定したストップ価格にならないとオーダーブックに記録されない注文です。 ストップ成行は相場がストップ価格に達すると成行注文が出されます。 ストップ指値は相場がストップ価格に達すると指値注文が出されます。 主に既に持っているポジションの損切りに使ったり、「この価格まで上がったら上昇トレンドに乗るだろうから買いだ!」という風に、自身が希望するポイントで自動でポジションを持つための注文方法として使われます。 トレイリングストップ トレイリングストップはストップ注文の一種で、「200ドル上がったら注文する」というように上がり幅(下がり幅)を指定する注文方法です。 たとえば現在の価格が1XBT:9322.5ドルの時にトレイル値200��ルで買い注文を出したとします。 その後、価格が1XBT:9522.5ドルに値上がりすれば200ドル上昇したので成行注文が出されます。 またトレイリングストップはあくまで上がり幅(下がり幅)のみを指定する注文なので、逆に1XBT:9000ドルまで下がったとします。 その後、反転して1XBT:9200ドルまで上がると200ドル上昇したので、その時点で成行注文が出されます。 トレイル値をプラスにすれば買い注文、マイナスにすれば売りから入れます。 利食い指値・利食い成行 利食い注文はストップ注文とほぼ同じです。 ストップ注文が主に自分の意図した価格と逆に動いたときの損切りに使われることに対して、利食い注文は自分に有利な値動きをしたときの利益確定に使います。 * 注文のオプション設定 ビットメックスでは、さらに注文時にオプションを設定することができます。

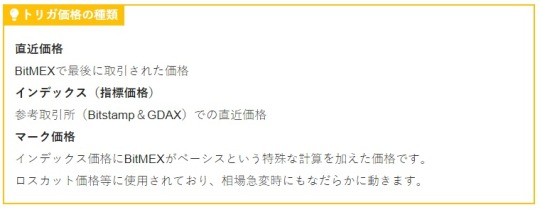

トリガ

ストップ注文など基準とする価格が必要な注文方法の際に有効になるオプションです。 BitMEXでは「直近価格」「指標価格」「マーク価格」の3種類の価格から選択できます。

トリガ時に決済

デフォルトでONになっており、注文時にポジションを持っている場合、既存ポジションを決済・減少させる注文となります。 チェックを外すと既にポジションを持っていたとしても新規でポジションを建てます。

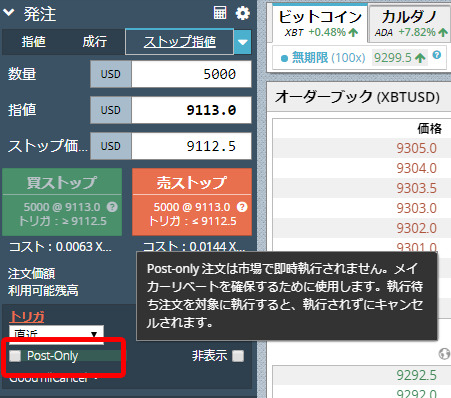

Post-Only

Post-Onlyにチェックを入れると必ず板に注文を載せるので、メイカー手数料を受け取ることができます。

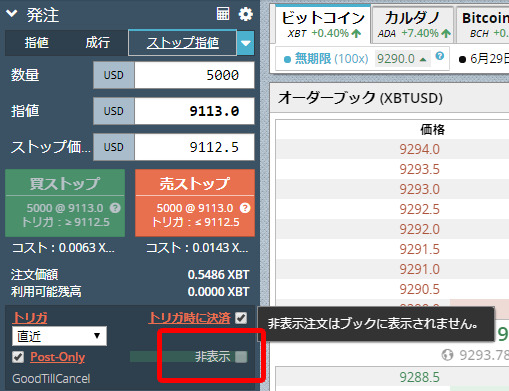

非表示

Post-Onlyと反対にオーダーブックに自分の注文を載せなくする設定です。

減少限定

新規でポジションを増やさず、すでに保有しているポジションを減らしたいときに使います。

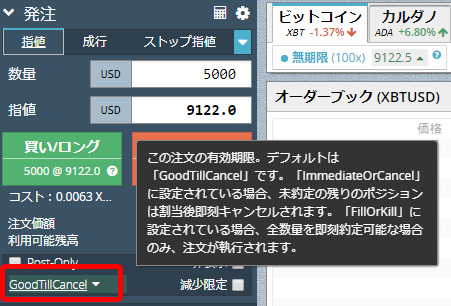

注文の有効期限

「GoodTillCancel(通称:GTC)」「ImmediateorCancel(通称:IOC)」「FillOrKill(通称:FOK)」の3種類の有効期限を設定できます。 デフォルトはGoodTillCancelになっており、よく分からなければこのままで問題ありません。

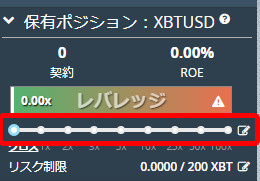

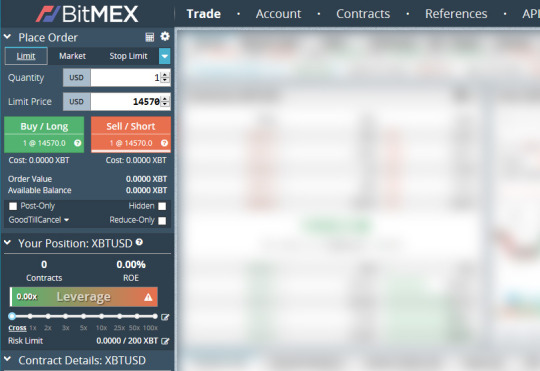

* レバレッジ設定

BitMEXのレバレッジ設定は上図の赤枠で囲ったスライダーを動かすことで自在に設定できます。

スライダーの右端の鉛筆みたいなマークをクリックすれば、数字を手動で入力することもできます。

初期設定では左端の「クロスマージン(Cross Margin)」になっています。 そこから右にスライドして1倍、2倍、3倍、100倍など数字でレバレッジを設定すると分離マージン(Isolated Margin)となります。 クロスマージンと分離マージンとは クロスマージンとは口座に入金しているビットコイン全額を証拠金として使う設定です。 レバレッジは常に最大値となります。(ビットコインなら100倍) 一方、分離マージンは口座のビットコイン全額ではなく、必要な証拠金のみを一部使う設定になります。

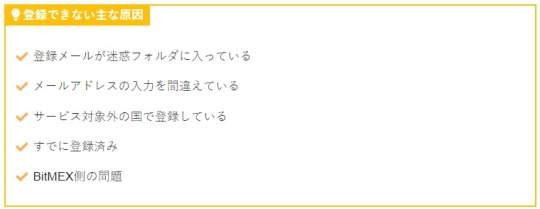

BitMEXの登録方法はとてもシンプルなので、大抵の人は迷わず登録することができます。 しかし、登録メールが届かなかったり、登録しようとするとエラー画面が出たりして、うまく登録できない人も少なくありません。 ここでは、そんな時の原因と対処方法についてご紹介します。

* 原因1:登録メールが迷惑フォルダに入っている 登録メールが届かないときは、まず迷惑フォルダを確認してみましょう。 登録メールの本文にはURLや英文が含まれていることから、まれに迷惑メールに振り分けられていることがあります。 * 原因2:メールアドレスの入力を間違えている 登録メールが届かないもう1つの原因は、入力したメールアドレスが間違っているというもの。 登録メールは、最初に入力したメールアドレス宛に送られますので、入力を間違えれば一向に届きません。 迷惑フォルダにも振り分けされていなければ、再度登録をしてみましょう。 * 原因3:サービス対象外の国で登録している BitMEXは、一部地域からのアクセスを拒否していますので、該当エリアでは登録ができません。 * 原因4:すでに登録済み BitMEXのアカウントは、1つのメールアドレスに対して1つのみです。 そのため、以前登録したメールアドレスで再登録することはできません。 もし新規で登録したいのであれば、別のメールアドレスを使って登録を行いましょう。 * 原因5:BitMEX側の問題 他に考えられる原因としては、BitMEX側のサーバーが落ちているということ。 特に、仮想通貨の価格が急変している際などは出来高も急増するため、BitMEXのサーバー側でアクセス制限されることもあります。 その場合は、しばらく時間を置いてから登録するようにしましょう。

BitMEXは日本語に対応した取引所となるため、国内取引所と同じような感覚で登録することができます。 万が一うまく登録ができない場合も、今回紹介した5パターンのうちいずれかに当てはまるはずなので、ぜひ参考にしながら対処してみてくださいね。 また、追証なしのゼロカットシステムで借金のリスクもありませんから、まずは実際に使ってみましょう!

→ BitMEX(ビットメックス)公式サイトはこちら

28 notes

·

View notes

Text

Beginner’s Guide to BitMEX

Founded by HDR Global Trading Limited (which in turn was founded by former bankers Arthur Hayes, Samuel Reed and Ben Delo) in 2014, BitMEX is a trading platform operating around the world and registered in the Seychelles.

Meaning Bitcoin Mercantile Exchange, BitMEX is one of the largest Bitcoin trading platforms currently operating, with a daily trading volume of over 35,000 BTC and over 540,000 accesses monthly and a trading history of over $34 billion worth of Bitcoin since its inception.

Unlike many other trading exchanges, BitMEX only accepts deposits through Bitcoin, which can then be used to purchase a variety of other cryptocurrencies. BitMEX specialises in sophisticated financial operations such as margin trading, which is trading with leverage. Like many of the exchanges that operate through cryptocurrencies, BitMEX is currently unregulated in any jurisdiction.

Visit BitMEX

How to Sign Up to BitMEX

In order to create an account on BitMEX, users first have to register with the website. Registration only requires an email address, the email address must be a genuine address as users will receive an email to confirm registration in order to verify the account. Once users are registered, there are no trading limits. Traders must be at least 18 years of age to sign up.

However, it should be noted that BitMEX does not accept any US-based traders and will use IP checks to verify that users are not in the US. While some US users have bypassed this with the use of a VPN, it is not recommended that US individuals sign up to the BitMEX service, especially given the fact that alternative exchanges are available to service US customers that function within the US legal framework. How to Use BitMEX

BitMEX allows users to trade cryptocurrencies against a number of fiat currencies, namely the US Dollar, the Japanese Yen and the Chinese Yuan. BitMEX allows users to trade a number of different cryptocurrencies, namely Bitcoin, Bitcoin Cash, Dash, Ethereum, Ethereum Classic, Litecoin, Monero, Ripple, Tezos and Zcash.

The trading platform on BitMEX is very intuitive and easy to use for those familiar with similar markets. However, it is not for the beginner. The interface does look a little dated when compared to newer exchanges like Binance and Kucoin’s.

Once users have signed up to the platform, they should click on Trade, and all the trading instruments will be displayed beneath.

Clicking on the particular instrument opens the orderbook, recent trades, and the order slip on the left. The order book shows three columns – the bid value for the underlying asset, the quantity of the order, and the total USD value of all orders, both short and long.

The widgets on the trading platform can be changed according to the user’s viewing preferences, allowing users to have full control on what is displayed. It also has a built in feature that provides for TradingView charting. This offers a wide range of charting tool and is considered to be an improvement on many of the offering available from many of its competitors.

Once trades are made, all orders can be easily viewed in the trading platform interface. There are tabs where users can select their Active Orders, see the Stops that are in place, check the Orders Filled (total or partially) and the trade history. On the Active Orders and Stops tabs, traders can cancel any order, by clicking the “Cancel” button. Users also see all currently open positions, with an analysis if it is in the black or red.

BitMEX uses a method called auto-deleveraging which BitMEX uses to ensure that liquidated positions are able to be closed even in a volatile market. Auto-deleveraging means that if a position bankrupts without available liquidity, the positive side of the position deleverages, in order of profitability and leverage, the highest leveraged position first in queue. Traders are always shown where they sit in the auto-deleveraging queue, if such is needed.

Although the BitMEX platform is optimized for mobile, it only has an Android app (which is not official). There is no iOS app available at present. However, it is recommended that users use it on the desktop if possible.

BitMEX offers a variety of order types for users:

Limit Order (the order is fulfilled if the given price is achieved);

Market Order (the order is executed at current market price);

Stop Limit Order (like a stop order, but allows users to set the price of the Order once the Stop Price is triggered);

Stop Market Order (this is a stop order that does not enter the order book, remain unseen until the market reaches the trigger);

Trailing Stop Order (it is similar to a Stop Market order, but here users set a trailing value that is used to place the market order);

Take Profit Limit Order (this can be used, similarly to a Stop Order, to set a target price on a position. In this case, it is in respect of making gains, rather than cutting losses);

Take Profit Market Order (same as the previous type, but in this case, the order triggered will be a market order, and not a limit one)

The exchange offers margin trading in all of the cryptocurrencies displayed on the website. It also offers to trade with futures and derivatives – swaps.

Futures and Swaps

A futures contract is an agreement to buy or sell a given asset in the future at a predetermined price. On BitMEX, users can leverage up to 100x on certain contracts.

Perpetual swaps are similar to futures, except that there is no expiry date for them and no settlement. Additionally, they trade close to the underlying reference Index Price, unlike futures, which may diverge substantially from the Index Price.

BitMEX also offers Binary series contracts, which are prediction-based contracts which can only settle at either 0 or 100. In essence, the Binary series contracts are a more complicated way of making a bet on a given event.

The only Binary series betting instrument currently available is related to the next 1mb block on the Bitcoin blockchain. Binary series contracts are traded with no leverage, a 0% maker fee, a 0.25% taker fee and 0.25% settlement fee.

Bitmex Leverage

BitMEX allows its traders to leverage their position on the platform. Leverage is the ability to place orders that are bigger than the users’ existing balance. This could lead to a higher profit in comparison when placing an order with only the wallet balance. Trading in such conditions is called “Margin Trading.”

There are two types of Margin Trading: Isolated and Cross-Margin. The former allows the user to select the amount of money in their wallet that should be used to hold their position after an order is placed. However, the latter provides that all of the money in the users’ wallet can be used to hold their position, and therefore should be treated with extreme caution.

The BitMEX platform allows users to set their leverage level by using the leverage slider. A maximum leverage of 1:100 is available (on Bitcoin and Bitcoin Cash). This is quite a high level of leverage for cryptocurrencies, with the average offered by other exchanges rarely exceeding 1:20.

BitMEX Fees

For traditional futures trading, BitMEX has a straightforward fee schedule. As noted, in terms of leverage offered, BitMEX offers up to 100% leverage, with the amount off leverage varying from product to product.

However, it should be noted that trading at the highest leverages is sophisticated and is intended for professional investors that are familiar with speculative trading. The fees and leverage are as follows:

However, there are additional fees for hidden / iceberg orders. A hidden order pays the taker fee until the entire hidden quantity is completely executed. Then, the order will become normal, and the user will receive the maker rebate for the non-hidden amount.

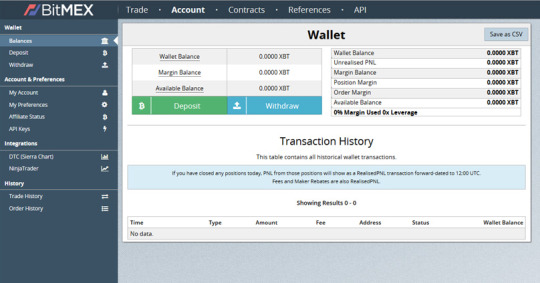

Deposits and Withdrawals

BitMEX does not charge fees on deposits or withdrawals. However, when withdrawing Bitcoin, the minimum Network fee is based on blockchain load. The only costs therefore are those of the banks or the cryptocurrency networks.

As noted previously, BitMEX only accepts deposits in Bitcoin and therefore Bitcoin serves as collateral on trading contracts, regardless of whether or not the trade involves Bitcoin.

The minimum deposit is 0.001 BTC. There are no limits on withdrawals, but withdrawals can also be in Bitcoin only. To make a withdrawal, all that users need to do is insert the amount to withdraw and the wallet address to complete the transfer.

Deposits can be made 24/7 but withdrawals are processed by hand at a recurring time once per day. The hand processed withdrawals are intended to increase the security levels of users’ funds by providing extra time (and email notice) to cancel any fraudulent withdrawal requests, as well as bypassing the use of automated systems & hot wallets which may be more prone to compromise.

Supported Currencies

BitMEX operates as a crypto to crypto exchange and makes use of a Bitcoin-in/Bitcoin-out structure. Therefore, platform users are currently unable to use fiat currencies for any payments or transfers, however, a plus side of this is that there are no limits for trading and the exchange incorporates trading pairs linked to the US Dollar (XBT), Japanese Yen (XBJ), and Chinese Yuan (XBC).

BitMEX supports the following cryptocurrencies:

Bitcoin (XBT)

Bitcoin Cash (BCH)

Ethereum (ETH)

Ethereum Classic (ETC)

Litecoin (LTC)

Ripple Token (XRP)

Monero (XMR)

Dash (DASH)

Zcash (ZEC)

Cardano (ADA)

Tron (TRX)

EOS Token (EOS)

BitMEX also offers leverage options on the following coins:

5x: Zcash (ZEC)

20x : Ripple (XRP),Bitcoin Cash (BCH), Cardano (ADA), EOS Token (EOS), Tron (TRX)

25x: Monero (XMR)

33x: Litecoin (LTC)

50x: Ethereum (ETH)

100x: Bitcoin (XBT), Bitcoin / Yen (XBJ), Bitcoin / Yuan (XBC)

Trading Technologies International Partnership

HDR Global Trading, the company which owns BitMEX, has recently announced a partnership with Trading Technologies International, Inc. (TT), a leading international high-performance trading software provider.

The TT platform is designed specifically for professional traders, brokers, and market-access providers, and incorporates a wide variety of trading tools and analytical indicators that allow even the most advanced traders to customize the software to suit their unique trading styles. The TT platform also provides traders with global market access and trade execution through its privately managed infrastructure and the partnership will see BitMEX users gaining access to the trading tools on all BitMEX products, including the popular XBT/USD Perpetual Swap pairing.

The BitMEX Insurance Fund

The ability to trade on leverage is one of the exchange’s main selling points and offering leverage and providing the opportunity for traders to trade against each other may result in a situation where the winners do not receive all of their expected profits. As a result of the amounts of leverage involved, it’s possible that the losers may not have enough margin in their positions to pay the winners.

Traditional exchanges like the Chicago Mercantile Exchange (CME) offset this problem by utilizing multiple layers of protection and cryptocurrency trading platforms offering leverage cannot currently match the levels of protection provided to winning traders.

In addition, cryptocurrency exchanges offering leveraged trades propose a capped downside and unlimited upside on a highly volatile asset with the caveat being that on occasion, there may not be enough funds in the system to pay out the winners.

To help solve this problem, BitMEX has developed an insurance fund system, and when a trader has an open leveraged position, their position is forcefully closed or liquidated when their maintenance margin is too low.

Here, a trader’s profit and loss does not reflect the actual price their position was closed on the market, and with BitMEX when a trader is liquidated, their equity associated with the position drops down to zero.

In the following example, the trader has taken a 100x long position. In the event that the mark price of Bitcoin falls to $3,980 (by 0.5%), then the position gets liquidated with the 100 Bitcoin position needing to be sold on the market.

This means that it does not matter what price this trade executes at, namely if it’s $3,995 or $3,000, as from the view of the liquidated trader, regardless of the price, they lose all the equity they had in their position, and lose the entire one Bitcoin.

Assuming there is a fully liquid market, the bid/ask spread should be tighter than the maintenance margin. Here, liquidations manifest as contributions to the insurance fund (e.g. if the maintenance margin is 50bps, but the market is 1bp wide), and the insurance fund should rise by close to the same amount as the maintenance margin when a position is liquidated. In this scenario, as long as healthy liquid markets persist, the insurance fund should continue its steady growth.

The following graphs further illustrate the example, and in the first chart, market conditions are healthy with a narrow bid/ask spread (just $2) at the time of liquidation. Here, the closing trade occurs at a higher price than the bankruptcy price (the price where the margin balance is zero) and the insurance fund benefits.

Illustrative example of an insurance contribution – Long 100x with 1 BTC collateral

(Note: The above illustration is based on opening a 100x long position at $4,000 per BTC and 1 Bitcoin of collateral. The illustration is an oversimplification and ignores factors such as fees and other adjustments.

The bid and offer prices represent the state of the order book at the time of liquidation. The closing trade price is $3,978, representing $1 of slippage compared to the $3,979 bid price at the time of liquidation.)

The second chart shows a wide bid/ask spread at the time of liquidation, here, the closing trade takes place at a lower price than the bankruptcy price, and the insurance fund is used to make sure that winning traders receive their expected profits.

This works to stabilize the potential for returns as there is no guarantee that healthy market conditions can continue, especially during periods of heightened price volatility. During these periods, it’s actually possible that the insurance fund can be used up than it is built up.

Illustrative example of an insurance depletion – Long 100x with 1 BTC collateral

(Notes: The above illustration is based on opening a 100x long position at $4,000 per BTC and 1 Bitcoin of collateral. The illustration is an oversimplification and ignores factors such as fees and other adjustments.

The bid and offer prices represent the state of the order book at the time of liquidation. The closing trade price is $3,800, representing $20 of slippage compared to the $3,820 bid price at the time of liquidation.)

The exchange declared in February 2019, that the BitMEX insurance fund retained close to 21,000 Bitcoin (around $70 million based on Bitcoin spot prices at the time).

This figure represents just 0.007% of BitMEX’s notional annual trading volume, which has been quoted as being approximately $1 trillion. This is higher than the insurance funds as a proportion of trading volume of the CME, and therefore, winning traders on BitMEX are exposed to much larger risks than CME traders as:

BitMEX does not have clearing members with large balance sheets and traders are directly exposed to each other.

BitMEX does not demand payments from traders with negative account balances.

The underlying instruments on BitMEX are more volatile than the more traditional instruments available on CME.

Therefore, with the insurance fund remaining capitalized, the system effectively with participants who get liquidated paying for liquidations, or a losers pay for losers mechanism.

This system may appear controversial as first, though some may argue that there is a degree of uniformity to it. It’s also worth noting that the exchange also makes use of Auto Deleveraging which means that on occasion, leveraged positions in profit can still be reduced during certain time periods if a liquidated order cannot be executed in the market.

More adventurous traders should note that while the insurance fund holds 21,000 Bitcoin, worth approximately 0.1% of the total Bitcoin supply, BitMEX still doesn’t offer the same level of guarantees to winning traders that are provided by more traditional leveraged trading platforms.

Given the inherent volatility of the cryptocurrency market, there remains some possibility that the fund gets drained down to zero despite its current size. This may result in more successful traders lacking confidence in the platform and choosing to limit their exposure in the event of BitMEX being unable to compensate winning traders.

How suitable is BitMEX for Beginners?

BitMEX generates high Bitcoin trading levels, and also attracts good levels of volume across other crypto-to-crypto transfers. This helps to maintain a buzz around the exchange, and BitMEX also employs relatively low trading fees, and is available round the world (except to US inhabitants).

This helps to attract the attention of people new to the process of trading on leverage and when getting started on the platform there are 5 main navigation Tabs to get used to:

Trade:The trading dashboard of BitMEX. This tab allows you to select your preferred trading instrument, and choose leverage, as well as place and cancel orders. You can also see your position information and view key information in the contract details.

Account:Here, all your account information is displayed including available Bitcoin margin balances, deposits and withdrawals, and trade history.

Contracts:This tab covers further instrument information including funding history, contract sizes; leverage offered expiry, underlying reference Price Index data, and other key features.

References:This resource centre allows you to learn about futures, perpetual contracts, position marking, and liquidation.

API:From here you can set up an API connection with BitMEX, and utilize the REST API and WebSocket API.

BitMEX also employs 24/7 customer support and the team can also be contacted on their Twitter and Reddit accounts.

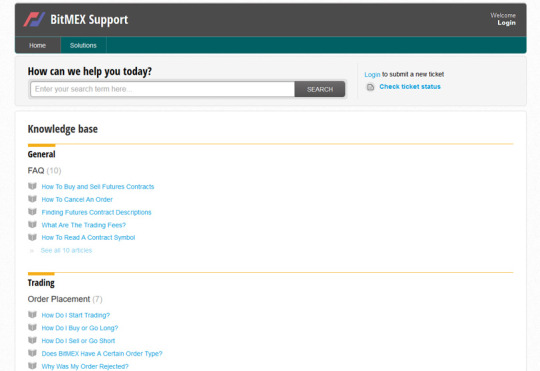

In addition, BitMEX provides a variety of educational resources including an FAQ section, Futures guides, Perpetual Contracts guides, and further resources in the “References” account tab.

For users looking for more in depth analysis, the BitMEX blog produces high level descriptions of a number of subjects and has garnered a good reputation among the cryptocurrency community.

Most importantly, the exchange also maintains a testnet platform, built on top of testnet Bitcoin, which allows anyone to try out programs and strategies before moving on to the live exchange.

This is crucial as despite the wealth of resources available, BitMEX is not really suitable for beginners, and margin trading, futures contracts and swaps are best left to experienced, professional or institutional traders.

Margin trading and choosing to engage in leveraged activity are risky processes and even more advanced traders can describe the process as a high risk and high reward “game”. New entrants to the sector should spend a considerable amount of time learning about margin trading and testing out strategies before considering whether to open a live account.

Is BitMEX Safe?

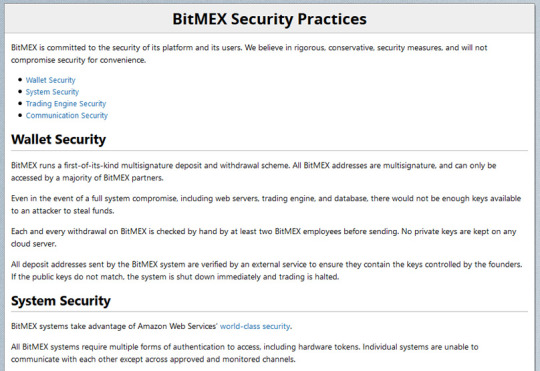

BitMEX is widely considered to have strong levels of security. The platform uses multi-signature deposits and withdrawal schemes which can only be used by BitMEX partners. BitMEX also utilises Amazon Web Services to protect the servers with text messages and two-factor authentication, as well as hardware tokens.

BitMEX also has a system for risk checks, which requires that the sum of all account holdings on the website must be zero. If it’s not, all trading is immediately halted. As noted previously, withdrawals are all individually hand-checked by employees, and private keys are never stored in the cloud. Deposit addresses are externally verified to make sure that they contain matching keys. If they do not, there is an immediate system shutdown.

In addition, the BitMEX trading platform is written in kdb+, a database and toolset popular amongst major banks in high frequency trading applications. The BitMEX engine appears to be faster and more reliable than some of its competitors, such as Poloniex and Bittrex.

They have email notifications, and PGP encryption is used for all communication.

The exchange hasn’t been hacked in the past.

How Secure is the platform?

As previously mentioned, BitMEX is considered to be a safe exchange and incorporates a number of security protocols that are becoming standard among the sector’s leading exchanges. In addition to making use of Amazon Web Services’ cloud security, all the exchange’s systems can only be accessed after passing through multiple forms of authentication, and individual systems are only able to communicate with each other across approved and monitored channels.

Communication is also further secured as the exchange provides optional PGP encryption for all automated emails, and users can insert their PGP public key into the form inside their accounts.

Once set up, BitMEX will encrypt and sign all the automated emails sent by you or to your account by the [email protected] email address. Users can also initiate secure conversations with the support team by using the email address and public key on the Technical Contact, and the team have made their automated system’s PGP key available for verification in their Security Section.

The platform’s trading engine is written in kdb+, a database and toolset used by leading financial institutions in high-frequency trading applications, and the speed and reliability of the engine is also used to perform a full risk check after every order placement, trade, settlement, deposit, and withdrawal.

All accounts in the system must consistently sum to zero, and if this does not happen then trading on the platform is immediately halted for all users.

With regards to wallet security, BitMEX makes use of a multisignature deposit and withdrawal scheme, and all exchange addresses are multisignature by default with all storage being kept offline. Private keys are not stored on any cloud servers and deep cold storage is used for the majority of funds.

Furthermore, all deposit addresses sent by the BitMEX system are verified by an external service that works to ensure that they contain the keys controlled by the founders, and in the event that the public keys differ, the system is immediately shut down and trading halted. The exchange’s security practices also see that every withdrawal is audited by hand by a minimum of two employees before being sent out.

BitMEX Customer Support

The trading platform has a 24/7 support on multiple channels, including email, ticket systems and social media. The typical response time from the customer support team is about one hour, and feedback on the customer support generally suggest that the customer service responses are helpful and are not restricted to automated responses.

The BitMEX also offers a knowledge base and FAQs which, although they are not necessarily always helpful, may assist and direct users towards the necessary channels to obtain assistance.

BitMEX also offers trading guides which can be accessed here

.

Conclusion

There would appear to be few complaints online about BitMEX, with most issues relating to technical matters or about the complexities of using the website. Older complaints also appeared to include issues relating to low liquidity, but this no longer appears to be an issue.

BitMEX is clearly not a platform that is not intended for the amateur investor. The interface is complex and therefore it can be very difficult for users to get used to the platform and to even navigate the website.

However, the platform does provide a wide range of tools and once users have experience of the platform they will appreciate the wide range of information that the platform provides.

Visit BitMEX

42 notes

·

View notes

Text

Beginners guide to Bitmex trading

As we all know, Bitmex is a cryptocurrency-based CFD trading platform. Their trading pairs include various cryptos that users can trade via a contract for difference. Bitmex offers high levels of leverage (up to 100x) and uses a Fair Price Marking system to fairly price both their perpetual and futures contracts.

Many crypto traders turn to Bitmex because of their high leverage trading options, but it can be a bit daunting at first for beginners to the platform, or trading in general. So here’s a complete guide to Bitmex trading, to help newbies get to speed on the do’s and dont’s of Bitmex.

32 notes

·

View notes