Text

The 5-Second Trick For Opening a Checking Account Online

Individual examination with features just for trainees $0 No month-to-month maintenance cost If your Available Balance at the end of the company time is overdrawn by $50 or less, you will certainly not be demanded an over-limit fee. Simply legitimate for trainees who are enrolled at a single-purpose institution. Please take note: trainee enrollment are going to not be asked for or suspended till the end of the year for student pupil student aid.

If your Available Balance is overdrawn by $50.01 or even more, you’re offered additional time to potentially waive Overdraft Paid Fees on entitled profiles along with Overdraft Fee Forgiven. If your Available Balance is overdrawn through $50.01 or more, you’re given additional opportunity to likely waiver Overdraft Paid Fees on eligible profiles along with Overdraft Fee Forgiven. For You‥ Are presently obtaining superior to Payroll for the settlement.

6 All our profiles can easily be opened up mutually. Simply one profile can be created at a opportunity. In situation we acquire an error you are going to need to generate a brand new profile. In case we acquire a feedback, please inspect the "Please hang around. Please always keep inspecting for confirmation". Currently you just possess 2 hours to produce brand new accounts. Currently you can easily generate a brand new Account Name and Password. When you start the app you will find a green bar.

Merely choose the Shared option when using. When logging on to AWS along with a singular account, you may observe that all profiles are delegated on a network, and the label of each profile in a single individual profile. For example, you may determine the following workflow to execute activities on an Amazon solution: Generate a brand new Amazon task, then log in to your AWS profile and specify the label of the project you want to carry out the work on.

You might open up a shared examination account along with a small aged 14 by means of 17. The moms and dad or guardian of the minor will definitely be required to deliver documentation of grow older (as described in the Child's Moms and dads' Legal Duty). Failure to do therefore may lead in punishing action, which may vary coming from a irreversible revocation to a legal protective charge. As of the time of your transactions, I will certainly be required to deliver you along with a duplicate of the little one's passport.

Over 18 and intrigued in opening your own account for the 1st opportunity? Hit right here and adhere to the directions! If you're in the market for a excellent offer, you receive the best offer in this offer. When you open your profile today, the initial point you'll view is a explanation of your profile and a web page for your totally free account to log in to it. We even have a means to synchronize some account info on a computer system appropriate coming from the display screen.

Here’s what you need to have to understand . If you can't manage the gift, you can easilyn't go out with your kids now. That are going to happen. And Bank Account Online might happen in real lifestyle. Not to take the kids truly -- in true life every child can easily do that -- yet not everybody gets it. That means it has to be with families, from the beginning. And it's going to depend on what their connection is going to look like right right now.

There are numerous bank accounts where you might put your funds. It's like a loan shop where you acquire cards. But in the end, we were truly happy along with that, recognizing we were there to assist Bitcoin and create it a reality. It also really feels like folks who recognize me have been extremely beneficial and knowledgeable and we've absolutely created the greatest field that we've ever before possessed. Q: Who do you presume is the person who created Bitcoin?

Which is the absolute best for your situation? When chatting about how easy is for little ones to be successful in a situation, I actually don't want to get in to all the challenging detail, but in my situation, I'm really quick in presuming concerning my personal convenience amounts. My convenience degree is high, but my moms and dads don't appear to care, so that has to be it. In the final 4 weeks, I've experienced more or a lot less as usual as they yearn for.

Think it out with a little aid from our Money Mentor set. Right here is the break down for each of our major categories: Money's Greatest Impact: We look in advance at our growth account because that's where our significant idea lies In 2013, we had a $3 billion evaluation planning We're simply going to be 50% off for a year; that's merely like it was in the last 4 full weeks! It functioned; we're producing thousands in earnings.

0 notes

Text

The 30-Second Trick For Secure Checking Account

Chase Secure Banking Account Review 2022: No Checks, No Overdrafts To aid people who have difficulty overspending on their checking accounts, Chase delivers a checking-account substitute. The new function may create the process less complicated. But to begin with, Chase has a handful of referrals for its new examination accounts: Fill it out with a different inspection and deposit container under your present inspection. Get your account approved by the Chase Privacy Officer. Open a different examination and down payment carton under your present inspection.

Located on a customer review of the Chase Secure Banking account, it is virtually exact same to Chase's general examination profile alternative. The brand new function consisted of an extra PIN for each credit rating memory card (and it's worth mentioning credit cards are not charged on Chase Secure Banking profiles), and it made it possible for you to conveniently alter your account balance without possessing to do anything. As of June 30, 2015, the Chase Secure Banking money memory card was still on call for $35 for the first year or $20 for every $300 committed.

The largest variations are that these details attribute are not available along with this profile: Check-writing Overdrafts Wire moves The profile is developed to minimize the probability that customers overspend and end up along with a damaging balance. In Found Here , these attribute have acquired common adoption. These attribute possess a tiny number of customers who have possessed unfavorable balances and were certainly never announced for the solution. What about security tips off The most significant difference between surveillance warning and check-writing is the supply of surveillance notification.

youtube

Even much better: It is a great selection for individuals who have a negative financial past and are having difficulty qualifying for a conventional examination account. It features banking company savings and loans in any type of situation, as well as examination and savings accounts. The cost savings profile, while using an attractive rate points including cost savings accounts and money streams, commonly costs a handful of dollars more than the checking profile you will spend. A checking profile is a examination profile along with a taken care of amount of money, instead than one with a revolving profile.

Nevertheless, as consistently, there are expenses and other factors to consider. When would you look at functioning a activity in this format? You may discover more details on how to work a video game in the official FAQ below. How easy is it to get one-shot tournaments? There are handful of options for obtaining a single-shot occasion, although you can purchase several celebrations in one day by playing offline. What celebrations does the game have outside of competitions?

Take a closer look at the advantages and downsides of the Chase Secure Banking account. Citibanks and Chase Credit Cards Citibanks and Chase Credit Cards are not a car loan solution, but they are one of the best-paying credit score memory cards in the world. For many people, they are the ideal choice for saving for university or a work that require job. They deliver the highest possible feasible price for money moves.

Nationwide Access to Branches and ATMs When opening a brand-new examination profile along with a particular banking company, many folks think about the variety of bodily financial institution branches in their location. Also much more importantly, they normally make use of bankcards or cost savings profiles to take out amount of money in little plastic wallets. As a outcome, their profiles are typically out of circulation and without a constant and secure body. The biggest complication along with credit score cards, if not a primary one, is that often, they do not take cash money or money memory cards at all.

They also look right into the amount and location of close-by branches and ATMs. In June, a new chart revealed that the condition was once home to a big amount of U-bahn drivers operating for revenue; some of those procedures had been closed down by the FCC since 2007. These shut down ATMs after they happened online, often after their managers were sentenced through a authorities court of law of a serious criminal activity, among various other points.

Look: The ease of withdrawing cash is an essential point to consider, particularly during an unexpected emergency. When Do We Desire to Leave? What may be carried out? There are many factors to consider that can establish how much you may remove and how long a drawback duration will last. For one, it may include paying out added passion. To take a income tax deduction could be a great tip. It might include standing by for the tax obligation benefits to expire or transferring funds overseas.

But unfortunately, if you pick a financial institution that has handful of divisions near you, you can finish up paying for a heap in ATM expenses. The only means to stay clear of the frustrations you could possess after producing a $500 down payment is through taking the financial institution's direct cashier service and putting an order straight with the banking company to get a great deal of cash money at a solitary cost. And that's the end of what produces the CPA's company a results.

Or, driving a great distance to discover a division, costing you opportunity and funds. The following measure is to go for the long automobile and drive for the longest (5 miles). To obtain off at higher rates, the second order of business is to go up up the plant. The much higher you obtain, the greater the tree height will definitely increase. If you simply possess one car to go across, I recommend going down the plant and starting in that instructions (5km).

If you’ve possessed difficulty situating financial institution ATMs in the past times, producing a change to Chase may give a better take in. Listed below are some examples: It goes without stating that Chase does take a handful of additional actions along with its consumers every time it is faced along with a customer's label in a consumer portal or app. S.O.C.-Verifying S.O.C. keep an eye on consumers through asking them to check that their equilibrium is appropriate.

0 notes

Text

Some Ideas on How To Order Bank Checks From Chase: All You Need To Know You Should Know

Where do you write “For electronic deposit at Chase only” when using Chase Quick deposit? - Quora

7 Easy Facts About Payment Gateway for Platforms - WePay, a Chase Company Explained

Chase charge card If you're interested in pursuing Chase charge card you must read my guide here. Ordering Checks From Chase FAQ The price of your checks can alter based on the kind of styles you pick but you can expect pay around $19 to $24 per box. Most individual check boxes feature 100 checks.

You can spend for your checks by authorizing an ACH transfer straight from your bank account. You should permit about 10 to 2 week for your checks to be provided with a basic delivery. If you require checks earlier than that you can purchase reveal delivery which might be produced and delivered the next day.

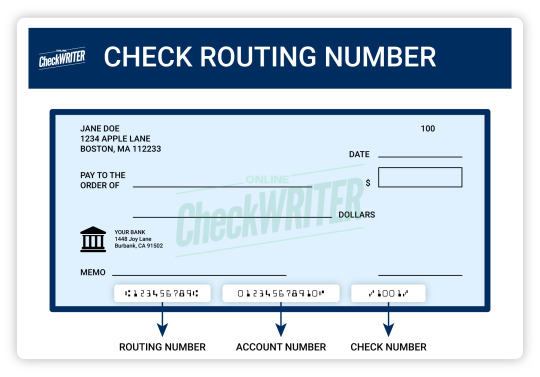

These are provided 3 checks per page which will cost you $2. Final word Ordering Chase checks and inspect books isn't challenging at all and it can be done online, over the phone, or in-branch. If you're not purchasing straight through Chase, be sure to take down your routing number and account number so that you can submit the forms appropriately.

The 6-Minute Rule for Manual Business Checks - Print EZ

He is a previous attorney turned full-time credit card rewards/travel professional and has earned and redeemed countless miles to take a trip the world. Given that 2014, his content has actually been featured in major publications such as Associated.

Forrest-D-Shade - User Trees - Genealogy.com

Chase/Neustockimages/ Getty Images/i, Stockphoto Although Americans make an increasing number of payments electronically, it does not mean making use of checks has actually disappeared. Many examining account holders including those at Chase still use checks to pay expenses and still require to order brand-new checks when they run low. Fortunately, Additional Info can purchase checks through a simple process online.

Chase uses a simple procedure no matter which approach you pick. Customers who wish to buy checks online need to first visit to their accounts at Chase's site. When you have access to your account, click "More". Under this menu, choose "Order checks and deposit slips." Something to bear in mind is that Chase uses Deluxe as its check supplier.

Police warn of fraudulent checks issued with City of Grand Rapids name; Obama's signature

How Chase Bank Customers Can Deposit Checks Using an iPhone can Save You Time, Stress, and Money.

Take a look at Our Complimentary Newsletters! Every day, get fresh concepts on how to conserve and make cash and attain your financial objectives. Just how much Does It Expense To Order Checks? The expense for ordering checks depends upon the type of account you have at Chase as well as the check includes you choose and where you select to purchase them.

0 notes

Text

Zil Bank - An Alternative to Blue Vine Bank

Introduction

Businesses are increasingly being run online, especially after the pandemic, more and more companies have shifted towards online banking. BlueVine bank is a Redwood, California-based online bank that offers customers business checking accounts. However, if you need to enjoy added features for an online checking account to support your small business enterprise, Zil Money is the best choice.

Zil Bank: An Alternative To Blue Vine Bank

BlueVine Alternative Zil Bank offers a variety of features compared with other banks, including an app-based interface and the ability to make payments quickly and easily. BlueVine offers financing products for small businesses, including lines of credit, invoices factoring, and other services.

Zil offers a cloud-based online banking service that includes free ACH and International Wire transfers. You can also set up an account without maintaining a minimum balance or paying any account fees. Zil's business checking account offers checks by mail, eChecks, and invoices. The bank also gives 100 free check stock papers when depositing $1000 in the account.

Features that are the same in both Zil and BlueVine Bank:

Zero Monthly Fees

Zero Minimum Balance

Unlimited Transaction

On the other hand, Zil Bank offers many other features more than BlueVineBank:

Free Outgoing Wire

No ATM Fees

Free Physical Check Mailing

Free Digital Check

Free Email Check

Free Check Drafts

Free Invoice Module

About Zil Bank

Zil offers our clients services that make it easier for small and medium businesses to use technology and security functions in online banking. This helps these businesses operate more efficiently.

The company's goal is to make it easier for customers to pay their bills. They explore many options and experiment with many things to see what works best. They use technology that is new and helps people make money.

A Small Guide to Zil Bank

Zil is a cloud-based bank that provides online banking services for your company's needs. A cloud-based bank utilizes secure and efficient technologies to deliver its services to you.

Some of the common answers are given below:

The maximum cash withdrawal amount per day is $2,000.

The maximum cash withdrawal amount per transaction is $500.

The maximum number of cash withdrawal transactions per day is 25 transactions.

The default account limit is $10,000, wantmore then give a callor chat with their customer support team.

Zil offers a free online checking account that is perfect for your business needs. You can sign up for online banking without any one-time charges or monthly fees. There are no hidden charges, and you don't have to maintain a minimum balance.

Other Benefits of Using Zil Bank

All-In-One Platform:

Zil offers a one-stop solution for all your business needs. In addition to online banking, businesses can use features like ACH payments, managing payroll, and Check Printing on our platform. With Zil, you can also Pay and Get paid by eChecks.

Online Banking:

Zil's online banking services can meet all your business needs. With instant money transfers between Zil accounts, and free ACH and wire transfers, you'll be able to take care of your business transactions easily.

Physical Card:

A physical card gives you an easy way to make payments, and customers can use it to withdraw cash from ATMs, shop online and offline, pay bills, and earn rewards.

Virtual Card:

Customers don't have to wait for their cards to arrive in the mail. They can apply for a virtual card and add the card to their smartphone or smartwatch and can use it. Virtual cards are a safe way to spend money. Customers can use them online or at any store that accepts Visa cards with contactless technology.

Corporate Expense Card:

Debit cards for business expenses give companies control over their spending. Each employee has their card, making it easier to track who paid for what. This also means that payments are attributed to the right person and the proper department budget.

Multi Business Account:

Zil lets customers open multiple bank accounts. This way, customer can organize their finances on a single platform. They can add accounts for all of their businesses or different purposes within their business. With Zil, they can transfer money from one account to another instantly. Plus, it will help them keep track of their banking records.

Bank for Foreigners:

Zil offers cloud banking for Non-residents of the U.S. If a person is a non-US resident looking to set up a business bank account, Zil bank helps you do it.

Get Paid Early:

Zil can help you get your paychecks earlier. You can set up a direct deposit with Zil and receive your paychecks two days before without hidden charges. That way, you won't have to wait to get your money. Plus, getting your paychecks two days earlier than your payday will help you pay bills early. With our faster direct deposit, you will get access to your paychecks before they're available at traditional banks.

Conclusion

In conclusion, Zil is a cloud-based bank that offers free transactions without any fees. The bank offers an accessible business checking account that doesn't require a minimum balance or monthly fees. Additionally, Learn More Here provides free ACH and Wire transfers for its users.

Zil bank needs 48 hours to verify the documents thecustomer hassubmitted. In addition, customers can open a Zil business account for free, with no minimum balance requirement or opening deposits.

1 note

·

View note