Don't wanna be here? Send us removal request.

Text

What Will Happen In The 2020s

It’s 2020. Time to look forward to the decade that is upon us.

One of my favorite quotes, attributed to Bill Gates, is that people overestimate what will happen in a year and underestimate what will happen in a decade.

This is an important decade for mankind. It is a decade in which we will need to find answers to questions that hang over us like last night’s celebrations.

I am an optimist and believe in society’s ability to find the will to face our challenges and the intelligence to find solutions to them.

So, I am starting out 2020 in an optimistic mood and here are some predictions for the decade that we are now in.

1/ The looming climate crisis will be to this century what the two world wars were to the previous one. It will require countries and institutions to re-allocate capital from other endeavors to fight against a warming planet. This is the decade we will begin to see this re-allocation of capital. We will see carbon taxed like the vice that it is in most countries around the world this decade, including in the US. We will see real estate values collapse in some of the most affected regions and we will see real estate values increase in regions that benefit from the warming climate. We will see massive capital investments made in protecting critical regions and infrastructure. We will see nuclear power make a resurgence around the world, particularly smaller reactors that are easier to build and safer to operate. We will see installed solar power worldwide go from ~650GW currently to over 20,000GW by the end of this decade. All of these things and many more will cause the capital markets to focus on and fund the climate issue to the detriment of many other sectors.

2/ Automation will continue to take costs out of operating many of the services and systems that we rely on to live and be productive. The fight for who should have access to this massive consumer surplus will define the politics of the 2020s. We will see capitalism come under increasing scrutiny and experiments to reallocate wealth and income more equitably will produce a new generation of world leaders who ride this wave to popularity.

3/ China will emerge as the world’s dominant global superpower leveraging its technical prowess and ability to adapt quickly to changing priorities (see #1). Conversely the US becomes increasingly internally focused and isolationist in its world view.

4/ Countries will create and promote digital/crypto versions of their fiat currencies, led by China who moves first and benefits the most from this move. The US will be hamstrung by regulatory restraints and will be slow to move, allowing other countries and regions to lead the crypto sector. Asian crypto exchanges, unchecked by cumbersome regulatory restraints in Europe and the US and leveraging decentralized finance technologies, will become the dominant capital markets for all types of financial instruments.

5/ A decentralized internet will emerge, led initially by decentralized infrastructure services like storage, bandwidth, compute, etc. The emergence of decentralized consumer applications will be slow to take hold and a killer decentralized consumer app will not emerge until the latter part of the decade.

6/ Plant based diets will dominate the world by the end of the decade. Eating meat will become a delicacy, much like eating caviar is today. Much of the world’s food production will move from farms to laboratories.

7/ The exploration and commercialization of space will be dominated by private companies as governments increasingly step back from these investments. The early years of this decade will produce a wave of hype and investment in the space business but returns will be slow to come and we will be in a trough of disillusionment on the space business as the decade comes to an end.

8/ Mass surveillance by governments and corporations will become normal and expected this decade and people will increasingly turn to new products and services to protect themselves from surveillance. The biggest consumer technology successes of this decade will be in the area of privacy.

9/ We will finally move on from the Baby Boomers dominating the conversation in the US and around the world and Millennials and Gen-Z will be running many institutions by the end of the decade. Age and experience will be less valued by shareholders, voters, and other stakeholders and vision and courage will be valued more.

10/ Continued advancements in genetics will produce massive wins this decade as cancer and other terminal illnesses become well understood and treatable. Fertility and reproduction will be profoundly changed. Genetics will also create new diseases and moral/ethical issues that will confound and confuse society. Balancing the gains and losses that come from genetics will be our greatest challenge in this decade.

That’s ten predictions, enough for now and enough for me. I hope I made you think as much as I made myself think writing this. That’s the goal. It is impossible to be right about all of this. But it is important to be thinking about it.

I know that comments here at AVC are broken at the moment and so I look forward to the conversation on email and Twitter and elsewhere.

via A VC https://ift.tt/2QdoI1k

0 notes

Text

Nuclear Energy Saves Lives

Germany’s closing of nuclear power stations after Fukishima cost billions of dollars and killed thousands of people due to more air pollution. Here’s Stephen Jarvis, Olivier Deschenes and Akshaya Jha on The Private and External Costs of Germany’s Nuclear Phase-Out:

Following the Fukashima disaster in 2011, German authorities made the unprecedented decision to: (1) immediately shut down almost half of the country’s nuclear power plants and (2) shut down all of the remaining nuclear power plants by 2022. We quantify the full extent of the economic and environmental costs of this decision. Our analysis indicates that the phase-out of nuclear power comes with an annual cost to Germany of roughly$12 billion per year. Over 70% of this cost is due to the 1,100 excess deaths per year resulting from the local air pollution emitted by the coal-fired power plants operating in place of the shutdown nuclear plants. Our estimated costs of the nuclear phase-out far exceed the right-tail estimates of the benefits from the phase-out due to reductions in nuclear accident risk and waste disposal costs.

Moreover, we find that the phase-out resulted in substantial increases in the electricity prices paid by consumers. One might thus expect German citizens to strongly oppose the phase-out policy both because of the air pollution costs and increases in electricity prices imposed upon them as a result of the policy. On the contrary, the nuclear phase-out still has widespread support, with more than 81% in favor of it in a 2015 survey.

If even the Germans are against nuclear and are also turning against wind power the options for dealing with climate change are shrinking.

Hat tip: Erik Brynjolfsson.

The post Nuclear Energy Saves Lives appeared first on Marginal REVOLUTION.

via Marginal Revolution https://ift.tt/37ySbZf

1 note

·

View note

Text

Having Kids

Paul Graham wrote a blog post this week about having kids. I read it with interest because I have long noticed that having kids has had a profound and positive effect on Paul. So I was interested in what he had to say on the topic. I am not going to summarize what he said, you can read it here, but suffice it to say that he has found it to be an very positive experience.

The Gotham Gal and I had children fairly early in our marriage and we had three children before I started Flatiron Partners in 1996. That was mostly driven by Joanne as she pushed for having kids early and I went along with that plan.

When founders and other executives ask the Gotham Gal when is the right time to have kids, she always says “now” and explains that there will never be a good time to have kids so you might as well get on with it.

In my experience, that is good advice for a lot of reasons. Having young children is demanding and the younger you are, the easier it is to manage all of those demands.

I also believe that having children teaches you things you can’t learn any other way and that those lessons are incredibly valuable in other parts of your life, including your work life.

In my line of work, I have to work with hard charging willful entrepreneurs who won’t take orders from anyone (nor should they). Having children and learning how to work with them when we are not on the same page has helped me a lot with entrepreneurs.

Children have taught me to be patient, to care, and be present (something that has been a challenge for me over the years). Those are things that are extremely valuable in all walks of life.

But certainly the best thing of all about having kids is the children themselves. I have a lot of relationships in my life, but the relationships I have with my wife and children are the very best ones. Just getting a text from one of my kids is often the highlight of my day.

So if you are struggling with the question of when to have kids, I side with the Gotham Gal on this. Do it now. It will be the greatest thing you do and it will change your life. Like it did for Paul.

via A VC https://ift.tt/2ssh4qs

0 notes

Text

China fact of the day

China is set to add new coal-fired power plants equivalent to the EU’s entire capacity, as the world’s biggest energy consumer ignores global pressure to rein in carbon emissions in its bid to boost a slowing economy.

Across the country, 148GW of coal-fired plants are either being built or are about to begin construction, according to a report from Global Energy Monitor, a non-profit group that monitors coal stations. The current capacity of the entire EU coal fleet is 149GW.

While the rest of the world has been largely reducing coal-powered capacity over the past two years, China is building so much coal power that it more than offsets the decline elsewhere.

Here is more from Leslie Hook at the FT.

The post China fact of the day appeared first on Marginal REVOLUTION.

via Marginal Revolution https://ift.tt/35jC2WA

0 notes

Text

A countercultural take on China

That is what I serve up in my Bloomberg column, note it is a reminder more than a modal prediction. Here is one excerpt:

Is the rest of the world getting China wrong yet again? Maybe the country is not doomed to live out unending top-down rule. What is history, after all, but the realization of the wills of countless unpredictable human beings.

Past mistakes about China are too numerous to mention.

A list then follows. And:

But has China suddenly become so predictable? Are events there now no longer contingent on the exercise of human will? Modern China is one of the most unusual and surprising societies humankind has created. There are no good models for it, nor are there data from comparable historical situations.

There is, unfortunately, a tendency for Westerners to impose superficial narratives on China and the Chinese, often based on scant observation.

To close:

For myself, I don’t have a coherent story about how the Chinese might move to greater liberty in the next 10 to 15 years. But I do think the actions of the current regime can be read as signs of vulnerability rather than entrenchment. Taiwan and Hong Kong, despite its current crisis, remain strong examples of the benefits of liberalization. Meanwhile, the notion of the internet — even with censorship — as a liberalizing force has been too quickly dismissed, especially in an America that has fallen out of love with Big Tech.

Which leads to a reality even deeper than China’s unpredictability: people’s continuing capacity to respond to current events and shape their futures for the better. As you listen, watch and read about China, keep in mind this essential human quality.

There is much more at the link.

The post A countercultural take on China appeared first on Marginal REVOLUTION.

via Marginal Revolution https://ift.tt/30maJc6

0 notes

Text

Warsaw notes

I recommend a trip here. Imagine a European country with (roughly) a four percent growth rate and the streets full of young people. Dining out here is much better than it was in Milan, and cheaper too (eat in the serious Polish place on the left side of the food hall, Hala Kozyski, and get gelato afterwards). What seems to be the city’s second best hotel is less than half the price it would be in Western Europe. For better or worse, e-scooters and bike lanes are everywhere. The city has a lively concert life, even in August.

There aren’t many traditional tourist sites. Construction workers will look at you funny if you visit the remnants of the Warsaw Ghetto, and the memorial plaque isn’t exactly prominent. The city’s much-heralded Jewish Museum is as much a critique of the Jews during medieval times as anything else. I don’t consider those sites as focal for the Warsaw population as a whole, but the official side of life here has not exactly taken the German tack of ongoing apologies. It is now against the law to suggest that Poles were complicit in the Holocaust (now only a fine, the threat of imprisonment was removed).

These days the 1953 Stalin building downtown looks quite beautiful. Cross the river to see more of Warsaw’s residential districts, such as the Praga district, and stop by to see the architecture — both new and old — near the Neon Museum.

“Poland issued more first-time residence permits to non-EU citizens than any other EU nation in 2017, with 86% of them going to Ukrainians, in the latest available European migration statistics. Those Ukrainians accounted for 18.7% of all newcomers to the entire EU.” (WSJ link here).

Poland is a country where nationalism doesn’t seem to be going away. In fact, there seems to be a kind of intertemporal substitution into a new nationalism, a secure nationalism, finally safe from the bullying of larger neighbors. Polish flags are everywhere. So many Poles, even secular ones, view the Catholic Church as the central institution of Western civilization, and indeed they have a concept of Western civilization as having a central institution (though a minus for gay rights).

The country is not on the verge of becoming a “Western liberal’s dream,” at least not in terms of mood or rhetoric. Yet actual life here is fairly liberal, and is more prosperous every day. 2019 has been the best year in Polish history, ever, and you feel it palpably.

Do not be surprised if more and more of Western Europe sees Polish nationalism as a model to be copied.

The post Warsaw notes appeared first on Marginal REVOLUTION.

via Marginal Revolution https://ift.tt/2P6B5NZ

0 notes

Text

How much of education is signaling? — yet again

The social and the private returns to education differ when education can increase productivity and also be used to signal productivity. We show how instrumental variables can be used to separately identify and estimate the social and private returns to education within the employer learning framework of Farber and Gibbons (1996) and Altonji and Pierret (2001). What an instrumental variable identifies depends crucially on whether the instrument is hidden from or observed by the employers. If the instrument is hidden, it identifies the private returns to education, but if the instrument is observed by employers, it identifies the social returns to education. Interestingly, however, among experienced workers the instrument identifies the social returns to education, regardless of whether or not it is hidden. We operationalize this approach using local variation in compulsory schooling laws across multiple cohorts in Norway. Our preferred estimates indicate that the social return to an additional year of education is 5%, and the private internal rate of return, aggregating the returns over the life-cycle, is 7.2%. Thus, 70% of the private returns to education can be attributed to education raising productivity and 30% to education signaling workers’ ability.

That is from a new NBER Working Paper by Gaurab Aryal, Manudeep Bhuller, and Fabian Lange. You can enter “education signaling” into the MR search function for much more on this ongoing debate.

The post How much of education is signaling? — yet again appeared first on Marginal REVOLUTION.

via Marginal Revolution http://bit.ly/2Wwqbnr

0 notes

Text

UK Tory fact of the day

In the UK, Conservative party membership has been dwindling for decades. At its peak, in the early 50s, it was 2.8 million. Last year, it was 124,000 and the party received twice as much money from dead members, through wills, as from the living.

That is from a longer Andy Bennett piece on the deepening crisis in conservatism.

The post UK Tory fact of the day appeared first on Marginal REVOLUTION.

via Marginal Revolution http://bit.ly/2Xh32T6

0 notes

Text

M87 Black Hole Size Comparison

via xkcd.com https://xkcd.com/2135/

0 notes

Text

The Spotify Apple Issue

Many people who follow tech know that Spotify has filed a complaint with the European Commission regarding the challenges that Spotify has doing business in the iOS app store.

I am very sympathetic to Spotify’s complaint. In my post last week on The Warren Breakup Plan, I wrote:

The mobile app stores, in particular, have always seemed to me to be a constraint on innovation vs a contributor to it.

Spotify has a huge user base and brings in billions of dollars of revenues every year but it has a challenging business model. Let’s say that 70cents of every dollar they bring in goes to labels and artists. That seems fair given that the artists are the ones producing the content we listen to on Spotify. But if they also have to share 30cents of every dollar with Apple, that really does not leave them much money to build and maintain their software, market to new users, pay for servers and bandwidth, and more.

You might say “well that’s what they signed up for” and you would be right except that their number one competitor is Apple. So their number one competitor does not pay the 30% app store fee, meaning that they have a competitive advantage.

But this is about more than money. If you look at the web page Spotify put up to explain how challenging it has been to do business with Apple, you will see numerous instances of Apple not approving app upgrades.

We see this with our portfolio companies a fair bit too. Apple has complete control over what gets into their app stores and what does not. And the process can be arbitrary and frustrating. But that is how it works and our portfolio companies are reluctant to make any noises publicly for fear of making their situation with Apple even worse.

I am not a fan of Warren’s idea of breaking up companies like Apple.

I like my partner Albert’s ideas better which he expressed in a tweet last week:

A better set of policies to restore competition in the digital age would be (1) consumer right to API access (2) consumer right to side load apps (3) restored ability for small companies to go public / sensible regulation of crypto currencies. https://t.co/4bOFTnZ5NK

— Albert Wenger (@albertwenger) March 12, 2019

If it was the law of the land that any company could side load any application onto the iPhone or any iOS device, including third party app stores, we would have a much more competitive market with a lot more innovation, and Spotify would not have to go to the European Commission to deal with this nonsense.

via A VC https://ift.tt/2udJli2

0 notes

Text

The effect of banning payday loans

n November 2008, Ohio enacted the Short-Term Loan Law which imposed a 28% APR on payday loans, effectively banning the industry. Using licensing records from 2006 to 2010, I examine if there are changes in the supply side of the pawnbroker, precious-metals, small-loan, and second-mortgage lending industries during periods when the ban is effective. Seemingly unrelated regression results show the ban increases the average county-level operating small-loan, second-mortgage, and pawnbroker licensees per million by 156, 43, and 97%, respectively.

That is from Stefanie R. Ramirez, via the excellent Kevin Lewis.

The post The effect of banning payday loans appeared first on Marginal REVOLUTION.

via Marginal Revolution https://ift.tt/2Ejlnqq

0 notes

Text

Library of Congress to archive Marginal Revolution

From my email:

The United States Library of Congress has selected your website for inclusion in the historic collection of Internet materials related to the Economics Blogs Web Archive. We consider your website to be an important part of this collection and the historical record.

The Library of Congress preserves important cultural artifacts and provides enduring access to them. The Library’s traditional functions, acquiring, cataloging, preserving and serving collection materials of historical importance to foster education and scholarship, extend to digital materials, including websites. Our web archives are important because they contribute to the historical record, capturing information that could otherwise be lost. With the growing role of the web as an influential medium, records of historic events could be considered incomplete without materials that were “born digital” and never printed on paper.

The following URL has been selected for archiving:

https://marginalrevolution.com/

We request your permission to collect your website and add it to the Library’s research collections. In order to properly archive this URL, and potentially other URLs of interest on your site, we would appreciate your permission to archive both this URL and other portions of your site, including public content that your page links to on third party sites such as Facebook, YouTube, etc. With your permission, the Library of Congress or its agent will engage in the collection of content from your website at regular intervals over time and may include it in future collections.

The Library will make this collection available to researchers at Library facilities and by special arrangement. The Library may also make the collection available more broadly by hosting the collection on the Library’s public access website no earlier than one year after our archiving has been completed. The Library hopes that you share its vision of preserving Internet materials and permitting researchers from across the world to access them.

The post Library of Congress to archive Marginal Revolution appeared first on Marginal REVOLUTION.

via Marginal Revolution http://bit.ly/2UnKA9x

0 notes

Text

The Economy Won’t Rescue Trump

President Trump delivering remarks on tax reform last May.CreditTom Brenner/The New York Times

By Paul Krugman

Opinion Columnist

Jan. 21, 2019

Although there have been approximately 100,000 media profiles of enthusiastic blue-collar Trump supporters in diners, the reality is that Donald Trump is extraordinarily unpopular. A recent Pew analysis found only one other modern president with such a low approval rating two years into his administration.

On the other hand, that president was Ronald Reagan, who went on to win re-election in a landslide. So some Trump boosters are suggesting their champion can repeat that performance. Can he?

No, he can’t. And it’s worth understanding why, both to assess current political prospects and to debunk the Reagan mythology still infesting U.S. conservatism.

Let’s talk first about the Reagan story.

Reagan was indeed unpopular in January 1983, mainly because of the economic situation. Despite a huge tax cut in 1981 and a sharp rise in military spending, more than 10 percent of the labor force was unemployed.

Although many voters blamed Reagan for this economic distress, the truth was that it had little to do with his policies; it was, instead, the consequence of the Federal Reserve’s attempts to bring down inflation, which had driven interest rates as high as 19 percent.

By mid-1982, however, the Fed had reversed course, sharply reducing rates. And these rate cuts eventually produced a huge housing boom, which in turn drove a rapid economic recovery.

Like the earlier slump, this boom had little to do with Reagan’s policies, but voters gave him credit anyway. Unemployment was still fairly high — more than 7 percent — in November 1984, but what matters for elections is whether things are getting better or worse, not how good they are in absolute terms. And in 1983-84, unemployment fell fast, so Reagan won big.

Image

A group awaiting Ronald Reagan's arrival in 1983.CreditGeorge Widman/Associated Press

How does this story compare with Trump’s prospects now?

First of all, where Reagan was unpopular because of a weak economy, Trump is unpopular despite a strong economy. That is, he starts from a much lower baseline.

And there is no chance of a “morning in America”-type boom over the next two years.

For one thing, in 1983-84 America was able to grow very fast by taking up the huge amount of economic slack that had accumulated over the course of the double-dip recession from 1979 to 1982. Right now, with unemployment below 4 percent, it’s not clear whether there’s any economic slack at all. There’s certainly not enough to allow the 7-plus percent growth rates in real personal income that prevailed in the run-up to the 1984 election.

Also, a housing boom driven by dramatic interest rate reductions was central to the rapid growth of Reagan’s third and fourth year in office. (No, it wasn’t all about the miraculous effects of tax cuts.)

But today’s Fed can’t — literally can’t — deliver the kind of boost it did back then by bringing double-digit interest rates down to single-digit levels, because rates are already quite low. And with housing prices looking rather high, it’s hard to imagine a huge surge looking forward.

Are there other ways that the economy might rescue Trump? What about the 2017 tax cut, which Trump said would be “rocket fuel” for the economy?

Well, by increasing the budget deficit, that cut probably gave the economy some stimulus, temporarily raising growth. But that effect is already fading out, and the economy would have been slowing down even without the extra drag created by the Trump shutdown. This doesn’t necessarily mean that we’ll have a recession soon, but we’re almost surely looking at unimpressive growth at best.

But wasn’t the tax cut supposed to increase long-run growth, by increasing business investment? Yes, it was — but it isn’t delivering on that promise. Corporations received huge tax breaks, but they mostly used the money to pay higher dividends and buy back stocks, not for investment. And even the modest rise in business investment that did take place in 2018 seems to have been driven by higher oil prices, not tax cuts.

So Donald Trump is no Ronald Reagan.

Actually, even Ronald Reagan was no Ronald Reagan. Although right-wing legend portrays his experience as proof of the magical power of tax cuts, the economy actually performed somewhat better under Bill Clinton, who raised taxes. (Although, to be fair, almost all Republicans seem to have managed to expunge that fact from their memories.)

Most of Reagan’s political success reflected not fundamental economic achievement but good luck with the timing of the business cycle. And Trump almost certainly won’t experience comparable luck.

Combine this lack of a strong economic upside over the next two years with Trump’s extreme current unpopularity, and his chances for re-election — if he even makes it to the end of his first term — don’t look too good. Which raises the question of what he and his party will do if defeat is staring them in the face.

I don’t know the answer to that question, and if you aren’t scared about how a cornered Trump might lash out, you haven’t been paying attention.

What’s clear, however, is that Trump and his allies are in a deep hole right now — and the economy isn’t going to dig them out of it.

Follow The New York Times Opinion section on Facebook, Twitter (@NYTopinion) and Instagram.

0 notes

Text

Update: "Scariest jobs chart ever"

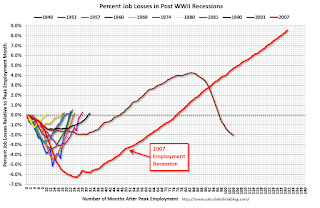

During and following the 2007 recession, every month I posted a graph showing the percent jobs lost during the recession compared to previous post-WWII recessions. Some people started calling this the "scariest jobs chart ever". In 2009 it was pretty scary! I retired the graph in May 2014 when employment finally exceeded the pre-recession peak. I keep getting asked if I could post an update to the graph, and here it is through the December 2018 report.

This graph shows the job losses from the start of the employment recession, in percentage terms, compared to previous post WWII recessions. Since exceeding the pre-recession peak in May 2014, employment is now 8.6% above the previous peak. Note: I ended the lines for most previous recessions when employment reached a new peak, although I continued the 2001 recession too on this graph. The downturn at the end of the 2001 recession is the beginning of the 2007 recession. I don't expect a downturn for employment any time soon (unlike in 2007 when I was forecasting a recession). via Calculated Risk http://bit.ly/2TOAL45

0 notes

Photo

Lindo día de familia (at Wharf DC) https://www.instagram.com/p/Br_aaluA0BN/?utm_source=ig_tumblr_share&igshid=madeqqc0a0h3

0 notes