Don't wanna be here? Send us removal request.

Text

RESTRICTED STOCK AND 83 (B) ELECTION

RESTRICTED STOCK

Grant date

Startup / Company gives employee equity of company at a discounted price.

Vesting Schedule

Shares are vested at 1, 2, 3 yrs to retain the employee. So, employee gets some of shares vested. There are two types of RS : RSU and RSA.

Sale

Employee exercise sale to cover taxes and sometimes you wait till end of the vesting to make sale and pay CGT

DIFFERENCE BETWEEN RSU AND RSA

RSU(Restricted Stock Unit)

Shares are not issued until vesting completion

Underlying shares considered issued/outstanding after vesting complete.

Subject to tax after vesting complete.

Not section 83(b) eligible.

Normally taxed as ordinary income

RSA (Restricted Stock Award)

Shares issued at grant date and held until vested

Underlying shares considered issued/outstanding before vesting complete.

Subject to tax from grant day.

Section 83(b) eligible

Maximize capital gains.

HOW RSU IS TAXED ?

Grant Date

1000 Shares granted @$1 per share

2 yr. vesting period begins

No taxes due

Vesting 1st year

5000 shares vested @$100 per share

Taxed on $5,00,000 of ordinary income included in W2.

Vesting 2nd year

5000 shares vested @$110 per share

Taxed on $5,50,000 of ordinary income included in W2.

Total Income: $105k over 2-year period of vesting.

Capital Gains: If shares are held beyond 2 years, $105k become cost basis and gains beyond that are taxed as capital gains.

HOW IS RSA TAXED? ASSUMING NO 83 (B) - ELECTION TAKEN.

Grant Date

1000 Shares granted @$1 per share

2 yr. vesting period begins

No taxes due

Vesting 1st year

5000 shares vested @$100 per share

Taxed on $5,00,000 as federal tax slabs (i.e.,35%).

Vesting 2nd year

5000 shares vested @$110 per share

Taxed on $5,50,000 as federal tax slabs(i.e.,35%).

Total Income: $105k over 2-year period of vesting.

Capital Gains: If shares are sold after 2 years. Any gain is subject to capital gains tax.

HOW IS RSA TAXED? ASSUMING 83 (B) - ELECTION TAKEN.

Grant Date

10,000 Shares granted @$10 per share

2 yr. vesting period begins

You pay taxes on $1,00,000 as ordinary income rates (i.e., 35%)

Vesting 1st year

5000 shares vested @$100 per share

No taxes due

Vesting 2nd year

5000 shares vested @$110 per share

No taxes due.

Total Income: $105k over 2-year period of vesting.

Capital Gains: If shares are sold after 2 years. Any LT gain is subject to capital gains tax @25%.

PROS AND CONS OF 83 (B) ELECTION

Pros

Taxes paid at the time of grant of equity at a nominal rate.

83 b election needs to taken within 30 days of grant.

Grant date is taken which is on paper not the time you received the documents.

No taxes due on incremental value of shares at the time of vesting.

Capital gains subject to LTCG tax.

83 (b) election form

Cons

If the company performance declines, you overpaid the taxes at the time of grant of equity. (which happens rarely)

If 83 b election is not taken within 30 days of grant of equity, then there is no way you can rectify.

Do you still have questions about restricted stock and 83 (B) Election? Email us at [email protected] or fill up the below form. We will get back to you asap.

0 notes

Text

Understanding How FICA Tips Credit Worked

As now the time comes Restaurant owners are looking to finalize their previous year books and filing federal tax return. But wait are you a restaurant owner whose employee get tipped by customers. Employee payslip can include standard hourly wages, meal value, tips, service charges, special event compensation, and more. Each type of compensation may require a different tax treatment. As a result of keeping track of so many details, many restaurant owners are not taking advantage of an important tax credit potentially available to them.

Do you want to know how much you saved in taxes by taking employee tips credit in your federal tax return 1120?

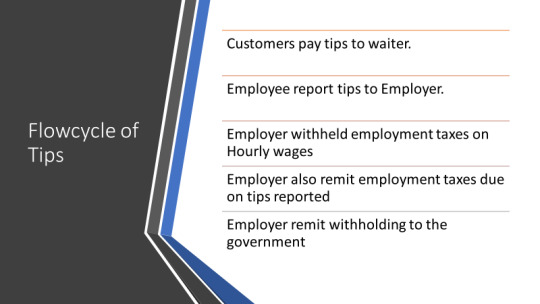

First lets understand the topic in depth

What is the FICA tip credit?

The FICA tip tax credit, generally Known to as the “Credit for Portion of Employer Social Security Taxes Paid with Respect to Employee Cash Tips,”

This is a tax relief to restaurant owners who pays an employer’s share of employment taxes on tip income paid to their employees by someone else.

Purpose of FICA tips Credit

Incentive to Employer so they report employee full income including all tips.

Eliminates employer intention to hide underreported Tips Income

More revenue is likely to be collected

More transparency in working.

Who is Required to Report Cash Tips?

Employees who get more than $20 in tips in a month are required to report the sum of tips they receive to their employer at least once a month.

The difference between the standard minimum wages and cash you pay your employee is called a tip credit.

So for a tipped employee, Minimum wages end up looking like this:

(Tipped minimum wage) + (Tip credit) = (Standard minimum wage)

What is the maximum Tip Credit allowed?

Each state has its own minimum wages, tipped minimum wages and maximum tips credit:

(Source: US Dept. of Labor, Minimum Wages for Tipped Employees) – Updated as on July 1, 2021

Table of Minimum Hourly Wages for Tipped Employees, by State.

Please click here to know about Table of Minimum Hourly Wages for Tipped Employees, by State.

FICA Tip Credit Savings Calculator

Tipped employee are generally paid hourly rate and well below the federal minimum wages.

Step 1: To Calculate the credit, employer first have to calculate creditable tips.

Creditable Tips = Total Tips – (Difference of federal minimum wages – cash wages paid by employer).

Step 2: Multiply the creditable tip amount by Combined FICA (6.2%) and Medicare taxes (1.45%) I.e., total 7.65% to determine the amount of credit available.

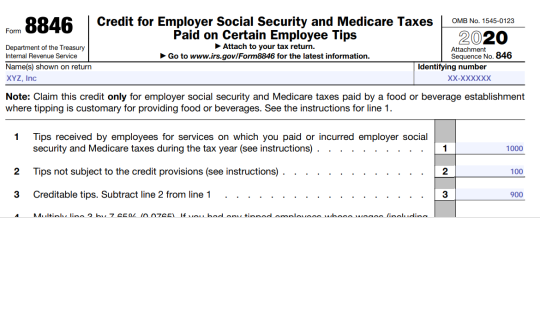

This calculation is also illustrated by the following example which help you to simple understand the topic:

Example 1.

XYZ Inc operates a restaurant and employed Individual Mr A. During July, Individual A worked 80 hours, was paid $480 in wages, and received $1000 in tips.

Federal minimum wage amount: $580 (80 hours x $7.25)

Net tips ineligible for the credit: $100 ($580 minimum - $480 wages paid)

Creditable tips: $900 ($1000 total tips, less $100 ineligible amount)

Total credit: $68.85 ($900 x 7.65%)

So Net amount eligible for credit against taxes = $68.85

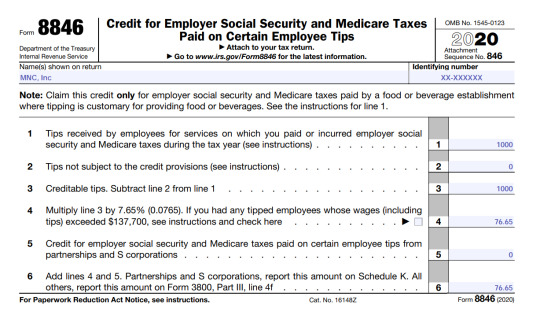

Example 2.

MNC Inc operates a restaurant and employed Individual Mr N. During July, Individual N worked 80 hours, was paid $600 in wages, and received $1000 in tips.

Federal minimum wage amount: $580 (80 hours x $7.25)

Net tips ineligible for the credit: $0 ($580 minimum - $600 wages paid)

Creditable tips: $100

Total credit: $76.50 ($1000 x 7.65%)

So Net amount eligible for credit against taxes = $76.5

How do I report the FICA Tip Tax Credit?

You can claim the credit of employer social security and Medicare taxes paid on certain employee Tips on IRS form 8846.

This form is filled with Federal Income tax Return

Form 8846 for Example 1

Form 8846 For Example 2

This article is for informational purposes and is not meant to provide legal, regulatory, accounting services or tax advice.

Still Questions about How FICA Tips Credit Worked ? Don't hesitate to call the office and speak to a tax professional. Email us at [email protected] or fill up the below form. We will get back to you asap.

0 notes

Text

IRS Hits the Brakes on Collections in Response to the Corona Virus

As part of government attempts to alleviate economic pressures due to the coronavirus, the IRS has begun to pause collection activities for many taxpayers.

In a memorandum to collection executives from Frederick Schindler, director, Headquarters Collection, in the Small Business/Self-Employed Division, collection executives were told: “We are implementing a temporary deviation that provides guidance as to the collection activities that should be suspended as well as others that will continue to take place during the suspension period [March 30, 2020, through July 15, 2020].”

To provide relief to taxpayers, employees were advised to suspend most collection activities unless:

There is a risk of permanent loss to the government due to the expiration of a statute or other exigent circumstance; or,

The taxpayer has agreed to an action.

Taxpayers on installment agreements may suspend making any payments normally due between April 1 and July 15, 2020, according to E. Martin Davidoff and Robbin Caruso, partners at Top 100 Firm Prager Metis and partner-in-charge and co-managing partner of the National Tax Controversy Practice, respectively.

“This may be three or four payments depending upon when your payment would normally be due,” said Davidoff. “Although the IRS will allow such suspension without terminating the agreement, interest will continue to accrue at a rate of 5 percent per year. And, in many cases, an additional charge for late payment of 0.25 to 0.5 percent per month will also be added to the balance.”

For clients in a direct debit installment agreement, Davidoff and Caruso recommend that they contact their bank and ask them to stop the direct debits payments. “Some banks may take this information over the phone, while others will require written instructions,” advised Caruso. “Since some banks may require at least two weeks' notice, this should be done as soon as possible.”

Once DDIA payments have been stopped, there are several possibilities after July 15, 2020. Davidoff and Caruso explained a number of options.

If a taxpayer’s financial situation has changed permanently, it may take a bit of renegotiating the installment agreement. If the taxpayer has recovered fully, or merely wishes to begin the payments again, one option is to simply ask the bank to resume the direct debit. This may not be an option at all banks. Other options are to make post-July 15 payments via Direct Pay on the IRS website, through the Electronic Federal Tax Payment System.

For those who have been targets of IRS collection but are not yet in an installment agreement, the IRS is suspending garnishment, seizures of property, civil suit proceedings and lien filings through July 15, 2020. Davidoff notes that this is a good opportunity to assemble documentation and prepare a financial disclosure package to secure a collection alternative (installment agreement, offer in compromise, or currently not collectible status).

“Revenue officers in the field will be able to establish new installment agreements for those who wish to enter into such agreements,” Davidoff added.

Not necessarily a permanent situation

“Practitioners and taxpayers should not be lulled into complacency,” cautioned Daniel Gibson, a tax partner at Top 100 Firm EisnerAmper. “Once this suspension period ends, the IRS could very well start to file liens and levies with a vengeance. Therefore, practitioners and taxpayers should take advantage of this breathing space to prepare collection forms and organize supporting documentation in order to be ready when the suspension period ends.”

“Although revenue officers will continue to the extent they can operate remotely, no enforcement action will occur except for exigent circumstances,” he said.

“Officers must make taxpayer contacts with caution and extreme sensitivity to the taxpayer’s personal circumstances,” Gibson said. “Stress and fatigue are factors requiring consideration, even in instances where taxpayers have not experienced any personal illness or monetary loss from the pandemic. In most cases, revenue officers may request that taxpayers provide documentation, but will not warn taxpayers of enforcement action, except in exigent circumstances.”

“The memo notes that, while SB/SE cannot anticipate and provide guidelines for every possible situation, it remains vitally important for all front-line SB/SE employees to be sensitive to the individual circumstances of taxpayers and provide them with appropriate relief,” Gibson said.

0 notes

Text

Stimulus Check Frequently Asked Questions

The $2 trillion relief bill will send money directly to Americans, greatly expand unemployment coverage and make a number of other changes.

We have been reviewing the stimulus bill and have compiled a list of answers to frequently asked questions about the economic stimulus checks.

When will I receive my stimulus check?

The Treasury Department and the Internal Revenue Service announced today (March 30th) that the distribution of economic impact payments will begin in the next three weeks.

How much will I receive?

$1,200 per adult or $2,400 for married couples filing jointly

$500 per child

Are there income limits on checks?

Yes. The amount of the checks would start to phase out for those earning more than $75,000 ($150,000 for joint returns and $112,500 for heads of household). This is adjusted gross income (AGI), not taxable income. You can find your AGI online 8(b) of your 2019 if filed or 2018 form 1040.

Is the check being mailed or sent direct deposit?

The check will be sent in the same method you received your IRS refund. If you are not set up for direct deposit, your check will be mailed using the address on your most recent tax return.

In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.

What if I don’t have the same bank account or the information is incorrect?

If the bank account information on your return is invalid, the deposit will not go through. If this happens, the IRS will mail your check to the address on your most recent tax return.

Will I need a Social Security Number to get a check?

Yes. You will need an SSN or a taxpayer identification number.

Do I need to file anything to get my check?

No. If you have filed a tax return for 2019 or 2018, you don’t need to do anything else. If you haven’t filed taxes for either year, the IRS recommends that you file back taxes for 2018.

Will the IRS take my check if I owe back taxes?

No, you will receive your check even if you owe back taxes.

Are the payments taxable income?

No. The checks won’t be considered as income on your 2020 tax return.

How many payments will I receive?

Just one. Future bills could order up additional payments.

Can I get a stimulus check if I’m self-employed?

Yes, as long as you meet the requirements listed above.

Do college students get a check?

Not if anyone claims them as a dependent on a tax return. Usually, students under age 24 are dependents in the eyes of the taxing authorities if a parent pays for at least half of their expenses. If the student files their own return and claims themselves then they should receive their own check.

Will I receive this check if I’m still working?

Yes.

Will I receive this check if I’m on unemployment?

Yes.

Will I receive a check if I’m retired?

Retired seniors are eligible so long as they meet the other criteria listed above. If you depend on Social Security but normally don’t file a tax return, you do not need to file a tax return to get the check.

What if my check doesn’t arrive?

Within 15 days of mailing your check (or directly depositing it into your bank account), you will receive a notice in the mail indicating the method of payment, the amount of payment, and an IRS phone number to call if you didn’t receive your payment.

Both the payment (paper check) and notice will be mailed to your last known address the IRS has on file. If you have recently moved, you should file a Form 8822 with the IRS and a change of address notice with the U.S. Postal Service. This will ensure correspondence and payments from the IRS will be sent to your new address.

0 notes

Text

Worker Classification: Employee vs. Contractor

If you hire someone for a long-term, full-time project or a series of projects that are likely to last for an extended period, you must pay special attention to the difference between independent contractors and employees.

Why It Matters

The Internal Revenue Service and state regulators scrutinize the distinction between employees and independent contractors because many business owners try to categorize as many of their workers as possible as independent contractors rather than as employees. They do this because independent contractors are not covered by unemployment and workers' compensation, or by federal and state wage, hour, anti-discrimination, and labor laws. In addition, businesses do not have to pay federal payroll taxes on amounts paid to independent contractors.

If you incorrectly classify an employee as an independent contractor, you can be held liable for employment taxes for that worker, plus a penalty.

The Difference Between Employees and Independent Contractors

Independent Contractors are individuals who contract with a business to perform a specific project or set of projects. You, the payer, have the right to control or direct only the result of the work done by an independent contractor, and not the means and methods of accomplishing the result.

Sam Smith, an electrician, submitted a bid of $6,400 to a housing complex for electrical work. Per the terms of his contract, every two weeks for the next 10 weeks, he is to receive a payment of $1,280. This is not considered payment by the hour. Even if he works more or less than 400 hours to complete the work, Sam will still receive $6,400. He also performs additional electrical installations under contracts with other companies that he obtained through advertisements. Sam Smith is an independent contractor.

Labor laws vary by state. Please call if you have specific questions.

Employees provide work in an ongoing, structured basis. In general, anyone who performs services for you is your employee if you can control what will be done and how it will be done. A worker is still considered an employee even when you give them freedom of action. What matters is that you have the right to control the details of how the services are performed.

Sarah Smith is a salesperson employed on a full-time basis by Rob Robinson, an auto dealer. She works 6 days a week and is on duty in Rob's showroom on certain assigned days and times. She appraises trade-ins, but her appraisals are subject to the sales manager's approval. Lists of prospective customers belong to the dealer. She has to develop leads and report results to the sales manager. Because of her experience, she requires only minimal assistance in closing and financing sales and in other phases of her work. She is paid a commission and is eligible for prizes and bonuses offered by Rob. Rob also pays the cost of health insurance and group term life insurance for Sally. Sally Smith is an employee of Rob Robinson.

The IRS, workers' compensation boards, unemployment compensation boards, federal agencies, and even courts all have slightly different definitions of what an independent contractor is though their means of categorizing workers as independent contractors are similar.

One of the most prevalent approaches used to categorize a worker as either an employee or independent contractor is the analysis created by the IRS, which considers the following:

What instructions the employer gives the worker about when, where, and how to work. The more specific the instructions and the more control exercised, the more likely the worker will be considered an employee.

What training the employer gives the worker. Independent contractors generally do not receive training from an employer.

The extent to which the worker has business expenses that are not reimbursed. Independent contractors are more likely to have unreimbursed expenses.

The extent of the worker's investment in the worker's own business. Inde

The extent to which the worker makes services available to other employers. Independent contractors are more likely to make their services available to other employers.

How the business pays the worker. An employee is generally paid by the hour, week, or month. An independent contractor is usually paid by the job.

The extent to which the worker can make a profit or incur a loss. An independent contractor can make a profit or loss, but an employee does not.

Whether there are written contracts describing the relationship the parties intended to create. Independent contractors generally sign written contracts stating that they are independent contractors and setting forth the terms of their employment.

Whether the business provides the worker with employee benefits, such as insurance, a pension plan, vacation pay, or sick pay. Independent contractors generally do not get benefits.

The terms of the working relationship. An employee generally is employed at will (meaning the relationship can be terminated by either party at any time). An independent contractor is usually hired for a set period.

Whether the worker's services are a key aspect of the company's regular business. If the services are necessary for regular business activity, it is more likely that the employer has the right to direct and control the worker's activities. The more control an employer exerts over a worker, the more likely it is that the worker will be considered an employee.

Minimize the Risk of Misclassification

If you misclassify an employee as an independent contractor, you may end up before a state taxing authority or the IRS.

Sometimes the issue comes up when a terminated worker files for unemployment benefits and it's unclear whether the worker was an independent contractor or employee. The filing can trigger state or federal investigations that can cost many thousands of dollars to defend, even if you successfully fight the challenge.

There are ways to reduce the risk of an investigation or challenge by a state or federal authority. At a minimum, you should:

Familiarize yourself with the rules. Ignorance of the rules is not a legitimate defense. Knowledge of the rules will allow you to structure and carefully manage your relationships with your workers to minimize risk.

Document relationships with your workers and vendors. Although it won't always save you, it helps to have a written contract stating the terms of employment.

Questions about how to classify workers? Don't hesitate to call the office and speak to a tax professional who can assist you.

0 notes

Link

1 note

·

View note