Don't wanna be here? Send us removal request.

Text

Economics of Technological Stocks and Coronavirus

You may have seen before news of stock markets rising or decreasing, meaning that the stocks of companies have either gained or lost value. Anyone can buy or sell shares within these companies, and once they hold shares, they become investors for that company. Through these shares, companies raise money in hopes to grow their business, and investors own a certain percent (a very small percent) of that company. So if the company and its products start losing value, you, as a shareholder, lose the value you have in your shares. Likewise, if the company is profiting, the investor will also profit.

Within the stock market, there are many types of companies that can be invested in. In recent years, tech companies have been rising in the market. In particular, computer microchips have been a headline in the news. Intel, short for Integrated Electronics, has been the dominant company within the industry for microchips, both in terms of their products and in their market share, as seen below. This is mainly due to the fact that the performance and efficiency of computer microchips are heavily based on their microarchitecture and the manufacturing process on which they are built.

For instance, a 14nm process would offer a better and faster product as opposed to a 22nm process because 14nm refers to the size of the transistors on the microchip. Thus, more transistors would fit on the same allocated CPU for 14nm compared to 22nm and is then able to offer more computations, leading to a faster and more efficient CPU. Ever since the introduction of their Core series lineup, Intel had been continually innovating on their microchip design, with incremental but significant improvements from year to year. Meanwhile, AMD had been in a dry spell due to the inadequacies of their microchip architecture. Due to their strong hold on the CPU market for both everyday consumers and enterprises, Intel have been notorious for setting high prices for their product offerings. And with AMD unable to compete with their products, this remained a norm.

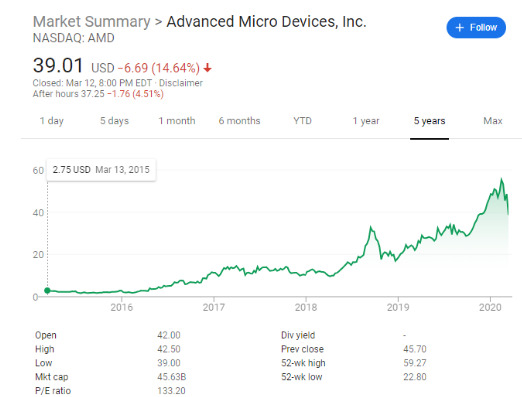

However, AMD has recently been on the rise while Intel began to hit a wall. With a revamp to their computer microchip architecture, they were able to catch up to Intel in 2017. Since then, AMD has been offering the same incremental improvements Intel had provided in previous years, but at a lower price. At the same time, Intel was unable and is still unable to transition from a 14nm process to a 10nm process they had hoped to reach by 2018. Meanwhile, AMD successfully went from 14 nm to 12 nm in 2018 and in 2019 transitioned to 7nm. This new sense of competition began to force Intel to lower the price of its products in order to compete with AMD. But even with the lower prices of Intel’s products, AMD products are currently superior and cheaper for the price. Naturally, AMD began to win back market share as shown below. If we set up two supply and demand curves, one of Intel and one of AMD we see major shifts. For Intel, due to their monopoly-like dominance in the CPU market, we see that their equilibrium price and quantity sold remain consistent from 2011 to 2017.

However as soon as AMD became competitive again, the demand of Intel products decrease, shifting to the left. At the same time, their manufacturing inabilities to transition to a 10nm process caused product shortages, also shifting the supply curve to the left. This caused products supplied to be lowered causing shortages and unknown equilibrium prices as well.

On the other hand, AMD has garnered more interest in their products, increasing their demand. And with the efficiency of the 7nm process, they are able to supply more computer microchips. In summary, AMD is able to produce more goods at a cheaper price as compared to Intel, which is seen by both the supply and demand curves shifting right but with supply shifting further.

Considering that AMD was considered a penny stock in 2015, it is astonishing that it has now become a company in the talk with the likes of Intel. Just recently in February 2020, AMD had hit an all-time high of $59.27.

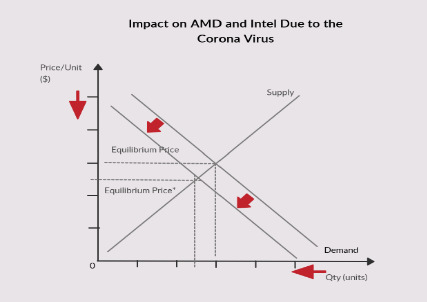

Fast forward to the present day, the entire stock market has been crashing; this has not occurred with just AMD or Intel, but with other big name companies like Apple, Disney, and Google. Why? The coronavirus. This virus, now announced as a pandemic, has stirred up great fear to everyone. When we set up a supply and demand curve, we visualize how companies are affected by the coronavirus. It can be stated using general microeconomic analysis that workers will produce less supply of products. This stems from workers’ fears for their health, and many companies understanding these concerns of not wanting the spread of disease. Therefore, companies have mandated social distancing practices to decrease the spreading of the disease; often the solution for social distancing practices is for remote working or simply not working at all. This causes the production of products to decrease heavily, and so the supply curve will decrease and shift to the left. Yet, we can say that the demand remains the same as the onset of the coronavirus has not affected consumers from wanting to either build PCs or datacenters with the computer microchips provided by Intel and AMD.

American stocks have dived due to coronavirus’s appearance, pushing the US market to its biggest drop since 1987. According to the statistics from the index of the Dow Jones industrial, Standard & Poor and the Nasdaq, all of these three indexes have down substantially more than 20% from the record highs they set since last month, which is called the “highly unusual disruptions” in trading of Treasury securities.

After Trump advocated the travel ban, which suspends most travel to the US from Europe, the American economic situation has gotten even worse. The reasons contributing to the significant decrease of the American stock market are various and can be analyzed using basic microeconomic skills. Firstly, trading in the Treasury market doesn’t work well since traders have seen large gaps on prices being offered by buyers and sellers, which causes the market to seize up. In addition, workers in the market all stopped going to work because of fear of getting sick with the coronavirus. As a result, less outputs were produced but the customers’ demand for products remain the same. Based on the graph of supply-demand curve, the supply curve shifts left and intersects with the demand curve at a higher equilibrium point. Looking at the new point, people will see the market price rises. Since fewer consumers want to buy the products at a higher price, most of the company don’t get enough revenue to maintain their daily transaction. Therefore, the strike of workers (the factor of production) causes the US stock market to dive seriously.

by Bryan Lee, Wenyu Wu, Jeremy Kim, Nathan Han

2 notes

·

View notes