Don't wanna be here? Send us removal request.

Text

Form GST DRC-03 Now Available On GST Portal For Making Voluntary Payments By A Taxpayer

Form DRC-03 enables a taxpayer to make voluntary payments, before issue of notice u/s 73 or 74 of the CGST Act, 2017 or within 30 days of issue of show cause notice (SCN). Facility to intimate payment made voluntarily or made against SCN has now been enabled on GST Portal (refer Rule 142(2) S. Rule 142(3) of the CGST Rules, 2017).

FORM GST DRC- 03 is for Intimation of payment made voluntarily or made against the show cause notice (SCN) or statement notified under rule 142(2) & 142 (3) of Central Goods and Services Tax Rules, 2017. Article explains Procedure for intimation of voluntary payment- FORM GST DRC 03.

Filing an intimation of payment (GST FORM DRC-03) made voluntarily or made against the show cause notice (SCN) or statement

FAQs

for more information, stay tuned with http://arpitguptaclasses.com/blog/2018/06/19/form-gst-drc-03-now-available-gst-portal-making-voluntary-payments-taxpayer/

0 notes

Text

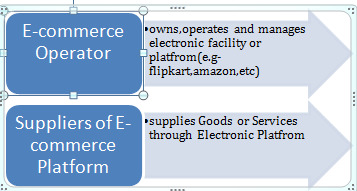

Taxation Of E-Commerce Operator Under Income Tax

http://arpitguptaclasses.com/blog/2018/03/13/taxation-e-commerce-operator-income-tax/

E-Commerce or Electronic Commerce- what it is ?

In Simple terms :

Buying or selling goods & services through electronic mode

Transmission of Funds or DataE-commerce operation i.e. online shopping or transactions by the consumers are becoming popular day by day and easy due to various reasons. Key factors are:

Major portion of the population of the entire world are using broadband Internet services,3G internet, and a recent introduction of 4G across the country.

Increasing growth of Smartphone users not only in urban or developed areas as well as in rural areas.

Rising standards of living due to which people are adapting to easy going way of living,instead of going to the market and buy things they prefer shopping online as easy and standard way to shop.

Availability of much wider range of product since it help consumer to compare things easily and choose the most compatible items.

Due to competition in the market worldwide, traders offer exciting offers which helps people to get the standard items at cheaper costs.

Also there is increased development of user friendly sites, where people can buy and sell second hand product, eg. OLX, QUICKER, etc.

Evolution of major online shopping startups like Flipkart, Amazon, Jabong, etc.

Since all Business Activities involves transactions to generate income, therefore in case of E-commerce business, to implement tax on business income generated is a major challenge as these operations involve many transactions which is difficult to identify as to where, when and at which rate to be charged so that their would not be any difficulties pertaining to double taxation, excessive tax burden, etc. Therefore this could be understood by having a detailed study of taxation structure for E-commerce operator under Direct Taxation System(i.e Income tax) and Indirect Taxation System(i.e. GST).

Taxation under Income Tax

Tax regime for e-commerce and the key challenges

In case of Indian E-commerce Operator who are carryout their business operations within the boundaries of the country the tax provisions are very simple and easy and as applicable to normal business houses. However, in case of non-residents carrying out e-commerce business in India, there is lot of confusion and dispute. Under Indian Tax system the basis for taxation is resident based while in other countries the basis of taxation is sources. As a result, in order to tax the assessee the countries enrich upon each others territory. However under e-commerce operations the availability of physical existence virtually ceases, which results as hindrance in the enforcement of tax laws. Accordingly, in 2001, Central Board of Direct Taxes constituted a High Powered Committee (HPC) to toughly observe the need of a separate tax regime for e-commerce operations.

The report submitted by the HPC took into consideration the principles laid down by the Organization for Economic Co-operation and Development (OECD) for taxation of e-commerce transactions. According to the press note issued by the department of industrial policy and promotion (DIPP), a marketplace model is an information technology platform run by an e-commerce entity on a digital and electronic network to act as a facilitator between buyer and seller.

While non-residents practice under multiple business models and mechanisms to carry out their e-commerce business in the country, issues relating to the taxability of income and the subsequent litigations are primarily on account of the following reasons:

In the finance Act, 2016 the government has levied an equalization levy of 6% on payments exceeding INR 1 lakh a year made to foreign e-commerce companies as consideration for online advertisement. Through this move, the Government aims to tap the income accruing to foreign e-commerce companies in India.

For more information please visit at http://arpitguptaclasses.com/

0 notes

Text

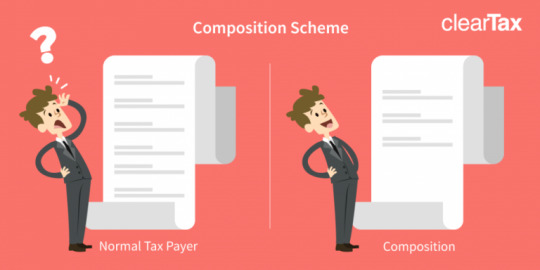

ALL ABOUT COMPOSITION SCHEME IN GST

http://arpitguptaclasses.com/blog/2018/04/05/composition-scheme-gst/

Composition scheme is a convenient way for the small taxpayers in order to escape from too many GST formalities and pay the tax at a fixed rate based on their business turnover.

Under this scheme, a taxpayer will pay tax as a percentage of his/her turnover during the financial year without the benefit of Input Tax Credit. A taxpayer opting for composition scheme will not collect any tax from his/her customers.

When the eligible taxpayer is opting for the Composition Scheme under GST, a taxpayer has to file a summarized returns on a quarterly basis, instead of three monthly returns (as is applicable for normal businesses).

Key Features

Eligibility: Turnover must be below Rs. 1.50 Crore (Rs. 75 Lakhs for North-Eastern States)

Tax rate: Fixed tax rate on the total sales turnover

Input Tax Credit: Not eligible for Input Tax Credit

Place of supply: Applies only to the Intra-State supplies

Return: No monthly filing, only Quarterly returns

Billing: Issues Bill of Supply & not tax invoice

Who can avail composition scheme? (Eligibility)

Only those persons who fulfill all the following are eligible to apply for composition scheme:

Deals only in the intra-state supply of goods (or service of only restaurant sector).

Does not supply goods not leviable to tax.

have an annual turnover below Rs. 1.50 Crore (Rs. 75 Lakhs for north-eastern states) in preceding financial year.

He shall pay tax at normal rates in case he is liable under reverse charge mechanism.

Not supplying through e-commerce operator.

Not a manufacturer of

ice cream,

pan masala or

tobacco (and its substitutes).

Why should you opt for composition scheme under GST?

No requirement to maintain records

Hassle free payments of tax at single rate

Filing monthly returns is a costly and cumbersome process that may just be asking too much from a small dealer trying to grow a business

Tax Rate under Composition Effective from 1st January 2018 (01.01.18)

Rate

CGST (%)

SGST (%)

Total (%)

Manufacturer

0.5%0.5%1%

Traders

0.25%0.25%0.5%

Restaurants

2.50%2.50%5%

Process to get registered as Composite Taxpayer

There can be two cases under the process of getting registered as composite taxpayer:

CASE 1- Registration process under composition scheme for a person who is already registered under current tax regime

A person who is registered under the current regime and applying for the Registration under GST will be given Provisional Certificate first.

If that person wants to get registered as composite taxpayer under GST, he shall file intimation in FORM GST CMP-01, duly signed or verified through electronic verification code. It may be noted that that it has to be filed prior or within 30 days after the appointed day(July 1, 2017) :

directly on the common portal

through a Facilitation Centre

Further, he has to give the details of stock, whether purchased from registered or non-registered person, held by him before he has opted to get registered under the composition scheme in FORM GST CMP-03 within 60 days in the electronic form.

The registered person shall not collect any tax from the appointed day but shall issue bill of supply for supplies made after the said day.

CASE 2- Registration process under composition scheme for a person who is applying for fresh registration.

A person who is applying for the fresh Registration under GST has to file FORM REG-01 and under Part B of the form he has to select the option of Section 10 (Registration as composite taxpayer).

Return Filing Process under Composition Scheme

It is only a simplified quarterly return in FORM GSTR 4 for which the taxpayer only requires indicating:

Total consolidated value of the supplies. Invoice-wise detail is not to be disclosed.

Tax paid at the composition rate.

Invoice level purchase information for the purchases made from normal taxpayers, which will be auto-populated in GSTR 4A from supply invoices uploaded by the counter party normal registered taxpayers.

Invoicing Rules under GST

The person who is registered as a composition taxpayer shall at the top of the bill of supply issued by him, mention the words- “not eligible to collect tax on supplies” because person registered as the composite taxpayer is not eligible to collect tax on the supplies from his buyer rather tax is paid by the composite taxpayer himself at the special rates decided for the composition dealers.

For more information please visit at http://arpitguptaclasses.com/

0 notes

Text

Highlights Of The Finance Bill, 2018

http://arpitguptaclasses.com/blog/2018/04/17/highlights-finance-bill-2018/

Tax Rates

No Change in Tax Rates for Individuals/Partnership firms and LLPs.

Tax Rates for domestic companies will be 25% of the total income if the total turnover or gross receipts of the previous year 2016-17 does not exceed Rs.250 crores (earlier it was 50 crores) and in all other cases the rate of Income-tax shall be 30 % of the total income. In the case of company other than domestic company, the rates of tax are the same as those specified for the financial year 2017-18.

No change in surcharge.

The health & education cess shall now be computed @ 4% on aggregate of Income-Tax & Surcharge.

Capital Gains

No more exemption for the capital gains arising from listed equity shares

[Section 10(38), 112A – Applicable from Assessment Year 2019-20]

Currently, long term capital gains arising from transfer of listed equity shares or units of equity oriented fund or units of business trusts, are exempt from income-tax under Section 10(38) of the Act. In order to minimize the economic distortions and curb erosion of tax base, it is proposed to withdraw this exemption and to introduce a new section 112A in the Act.

As per new proposed Section 112A, long term capital gains arising from transfer of an equity share, or a unit of an equity oriented fund or a unit of a business trust shall be taxed at 10% of such capital gains. The tax on capital gains shall be levied in excess of Rs. 1 lakh. This concessional rate of 10% will be applicable if STT has been paid on both acquisition and transfer of such capital asset, in case of equity shares, and paid at the time of transfer in case of unit of equity oriented fund or a unit of a business trust.

Though the tax rate has been kept at 10% but it shall be charged on the capital gains as computed without giving the benefit of indexation to the investor. Let us understand the meaning of indexation. It is a process to increase the cost of acquisition so as to nullify the impact of inflation. The indexation process takes into account the inflation from the time taxpayer bought the asset to the time he sells it. The indexation process increases the cost of acquisition of the asset and consequently, lowers the capital gains. The indexation benefit is generally allowed in case of transfer of a long-term capital asset, however, such benefit shall not be allowed in case of transfer of listed equity shares.

This new provision to tax the long-term capital gains arising from transfer of listed equity shares shall be applicable for all those share trades which are done on or after April 1, 2018. To provide an interim relief and to provide an opportunity to the investors to plan their affairs, the investors are given an option to assume the cost of acquisitions of the shares forming part of their portfolio different from the one they have actually paid to acquire them.

The cost of acquisitions of a listed equity share acquired by the taxpayer before the February 1, 2018, shall be deemed to be the higher of following:

a) The actual cost of acquisition of such asset; or

b) Fair market value of such shares or actual sales consideration accruing on its transfer, whichever is lower.

The Fair market value of listed equity share shall mean its highest price quoted on the stock exchange on January 31, 2018.

However, if there is no trading in such shares on such exchange on January 31, 2018, the highest price of such asset on such exchange on a date immediately proceeding January 31, 2018.

While in case of units which are not listed on recognized stock exchange, the net asset value of such units as on January 31, 2018 shall be deemed to be its FMV.

Taxability of LTCG on trading in listed equity shares may be understood with the help of following example:

ParticularsScenario 1Scenario 2Scenario 3Scenario 4Scenario 5

Sales Consideration (A)10,00,00010,00,00010,00,00010,00,00010,00,000

Date Of Sale31-03-1801-04-1801-04-1801-04-1801-04-19

Actual Cost Of Acquisition (B) 800,000 800,000 800,000 800,000 800,000

Date Of Purchase01-01-1701-01-1701-01-1701-01-1701-03-18

Quoted Price On Stock Exchange As On 31/01/2018 (C) 850,000 750,000 900,000 1,100,000 1,100,000

Deemed Cost Of Acquisition (D)* 800,000 800,000 900,000 1,000,000 800,000

Long-Term Capital Gains (E = D-A) 200,000 200,000 100,000 – 200,000

Exemption For Capital Gains (F = E – 1,00,000) 200,000 100,000 100,000 – 100,000

Tax On Capital Gains (F * 10%) – 10,000 – – 10,000

* D shall be higher of following:

a) Actual Cost of acquisition

b) Lower of Sales Consideration and Quoted Price on Stock Exchange as on 31/01/2018

This capital gain has been kept out of preview of Chapter VIA deductions and relief under Section 87A. It means a taxpayer cannot claim any deduction under Sections 80C to 80U or relief under Section 87A from the gross total income to the extent of such capital gains. If an investors has earned the long-term capital gains of Rs. 2,00,000 from sale of listed equity shares, he shall be liable to pay tax of Rs. 10,400 (Rs. 10,000 tax on capital gains + Rs. 400 health and education cess ).

Slight variation of sales consideration from stamp value is acceptable

[Section 43CA, 50C and 56 – Applicable from Assessment Year 2019-20]

As per the current provisions, when a taxpayers claims that the sales consideration received by him from transfer of an immovable property is less than the value adopted by the Stamp authorities, then the stamp value is deemed as the actual sales consideration. Deeming the stamp value as the sales consideration, result in higher amount of capital gains even if the seller has not gained anything due to such higher stamp valuation. Further, such difference in the stamp value and the actual consideration disclosed by the parties is also taxed in the hands of the buyer.

It is generally pointed out that this variation can occur in respect of similar properties in the same area because of a variety of factors, including shape of the plot or location. In order to minimize hardship in case of genuine transactions in the real estate sector, it is proposed to provide that no adjustments shall be made in a case where the variation between stamp duty value and the sale consideration is not more than five percent of the sale consideration. These amendments will be applicable for all transactions occurred entered into on or after April 1, 2018.

Sec. 54EC exemption only for immovable properties

[Section 54EC – Applicable from Assessment Year 2019-20]

Section 54EC of the Act provides exemptions up to Rs. 50 lakhs if any long-term capital gain is invested in the specified bonds of NHAI and RECL within a period of six months after the date of such transfer. Such investments in these bonds have a lock-in period of 3 years.

The Finance Bill has significantly curtailed the scope of this exemption. As per proposed amendment, exemption under Section 54EC shall be allowed only if long-term capital gains arising from transfer of an immovable property (land or building or both) is invested in the specified bonds. The lock-in period of such bonds has also been increased to 5 years.

Corporate Tax

‘Accumulated Profits’ redefined for purpose of Deemed Dividend

[Section 2(22)(d) – Applicable from Assessment Year 2019-20]

Currently, any distribution of accumulated profits (whether capitalized or not) to the shareholders by a company is subject to Dividend Distribution Tax. Companies with large accumulated profits used to adopt the amalgamation route to reduce accumulated profits so as to bypass the provisions of deemed dividend under Section 2(22)(d).

With a view to prevent such abusive arrangements, a new Explanation 2A is proposed to be inserted in section 2(22) to widen the scope of the term ‘accumulated profits’.

As per the new Explanation, the accumulated profits/losses of an amalgamated company shall be increased by the accumulated profits of the amalgamating company (whether capitalized or not) on the date of amalgamation.

Dividend payouts of equity oriented mutual fund subject to DDT

[Section 115R, 115T – Applicable from Assessment Year 2018-19]]

Specified company or Mutual Fund shall be liable to pay tax on income distributed to its unit holders. However, in respect of any income distributed to a unit holder of equity oriented funds is currently not chargeable to Dividend Distribution Tax.

It is proposed to amend the section 115R to provide that where any income is distributed by a Mutual Fund, being an equity oriented fund, the fund shall be liable to pay additional income tax at the rate of 10% on income so distributed.

Relaxation in provisions of carry forward and set off of losses for companies applied for Insolvency [Section 79 – Applicable from Assessment Year 2018-19]

Losses of a closely held company are allowed to be carried forward and set off only if there is a continuity in the beneficial ownership of not less than 51% of the voting power on the last day of the year in which losses were incurred.

This provision is a big hurdle for restructuring and rehabilitating the companies who have applied for insolvency and who have witnessed change in the beneficial ownership.

In order to address this problem, it is proposed that the rigors of section 79 shall be relaxed in case of those companies whose resolution plan has been approved under the Insolvency and Bankruptcy Code, 2016.

Relief from MAT for companies who have applied for Insolvency

[Section 115JB – Applicable from Assessment Year 2018-19]

While calculating book profit for payment of MAT under Section 115JB, lower of brought forward loss and unabsorbed depreciation, is allowed as deduction. The amount of deduction becomes nil if either brought forward loss or unabsorbed depreciation is also nil.

Not allowing deduction for losses or depreciation does not provide any tax relief to the rehabilitating companies that are seeking insolvency resolution.

To end the hardship for the companies under insolvency resolution, Section 115JB is proposed to be amended. Such companies are allowed to claim deduction of both unabsorbed depreciation and brought forward losses while calculating book profits for the purpose of MAT.

Non-Individual entity to obtain PAN

[Section 139A – Applicable from Assessment Year 2018-19]

Section 139A is proposed to be amended that every non-individual entity should have to obtain a PAN as its Unique Entity Number (UEN) if they enter into a financial transaction of an amount aggregating to Rs. 2.50 lakhs or more in a financial year.

There is always a natural person who enters into the transaction on behalf of the non-individual entity. Therefore, the amendment shall be of no use if the related natural person behind such entities doesn’t obtain the PAN.

Thus, in order to make the amendment useful, it is also proposed that the managing director, director, partner, trustee, author, founder, karta, CEO, principal officer or office bearer or any person competent to act on behalf of such entities will also have to apply for allotment of PAN.

Compensation covered within the tax ambit

[Section 2(24), 28, 56 – Applicable from Assessment Year 2019-20]

In various rulings, the Courts have held that compensation amount received in connection with business and employment contracts are out of the purview of income-tax.

It is now proposed that any compensation received in connection with the termination or modification of a contract is taxable. The taxability of the compensation would depend upon nature of contract and relationship of the recipient with the payer. If the compensation is related to a business contract, the receipts shall be taxable as business income under Section 28. If it is relating to the employment and the compensation is received after termination of the employment, the receipts shall be taxable as residuary income under Section 56.

These amendments will take effect from 1st April, 2019 and will, accordingly, apply in relation to assessment year 2019-20 and onwards.

Disallowance of expenditure paid in cash by Trusts

[Section 10(23C), Section 11 – Applicable from Assessment Year 2019-20]

Currently, there are no restrictions on mode of payments by charitable or religious trusts or institutions. There are also no checks on whether such trusts or institutions follow TDS provisions or not. This has led to lack of an audit trail for verification of application of income.

In order to encourage a cash-less economy and to reduce the generation and circulation of black money, it is proposed that trusts or institutions will also be required to follow the provisions of TDS and will make all expenses in excess of Rs. 10,000 through banking channels.

Consequently, the provisions of TDS disallowance under section 40(a)(ia) and expenses disallowance under section 40A(3) and 40A(3A) shall be applicable while computing the application of income in case of trusts or institutions.

Personal Taxation

Standard deduction from salary income reintroduced

[Section 16, 17 – Applicable from Assessment Year 2019-20]

The Finance Bill, 2018 proposed standard deduction of up to Rs. 40,000 to the salaried taxpayers. Such deduction is allowed in lieu of transport allowance and reimbursement of medical expenses. Currently, a deduction of Rs. 19,200 is allowed from salary income in respect to transport allowance and Rs. 15,000 for the medical reimbursement.

Hence, the net benefit for the employees already claiming deduction for transport allowance and medical reimbursement will be just Rs. 5,800 (Rs. 40,000 – Rs. 19,200 – Rs. 15,000).

PGBP

Rationalization of presumptive taxation scheme in case of goods carriage

[Section 44AE – Applicable from Assessment Year 2019-20]

A taxpayers who is engaged in the business of plying, hiring or leasing of Goods Carriage and having not more than 10 good carriage, has an option to avail presumptive taxation scheme under section 44AE. In this case, income of taxpayer is deemed to be Rs. 7,500 per goods carriage per month.

The only condition which needs to be fulfilled is that the taxpayer should not have owned more than 10 goods carriages at any time during the previous year. Accordingly, the big transporters who owns large capacity/ size goods carriages, even if number is less than 10, are also availing the benefit of section 44AE.

The legislative intent of introducing this provision was to give benefit to small transporters in order to reduce their compliance burden.

Therefore, it is proposed to amend the section 44AE to provide that, in the case of heavy goods vehicle (more than 12MT gross vehicle weight), the income would deemed to be an amount equal to Rs. 1,000 per ton of gross vehicle weight or unladen weight per month for each goods vehicle The vehicles other than heavy goods vehicle will continue to be taxed as per the existing scheme.

No adjustment under section 143(1) on account of mismatch with Form 26AS

[Section 143 – Applicable from Assessment Year 2018-19]

Section 143(1)(a)(vi) provides that while processing the return of income, the total income or loss shall be computed after making addition for the difference in income appearing in Form 26AS or Form 16A or Form 16 and income shown in the ITR. Generally, salaried taxpayers are mostly aggrieved by this adjustments.

It is now proposed that no adjustments shall be made in respect of Income-tax return furnished on or after Assessment Year 2018-19 just to account for the difference in the income reported in ITR and displayed in tax passbook or tax certificates.

NPS withdrawal exemption extended to non-employees

[Section 10(12A) – Applicable from Assessment Year 2019-20]

Any amount received by employee from National Pension Scheme (NPS) either on closure or opting out from scheme is exempt upto 40% of the total amount payable to employee. This exemption is not available to non-employee subscriber. It is proposed to extend the said benefit to all NPS subscribers.

Deemed dividend isn’t taxable in hands of receivers

[Section 115-O, 115Q – Applicable from Assessment Year 2019-20]

Deemed dividend as specified in section 2(22)(e) were kept out of the ambit of Dividend Distribution Tax (DDT). Therefore, the deemed dividend as arising from payment of loan by closely held companies are taxable in the hands of the shareholders.

The taxability of deemed dividend in the hands of recipient has posed serious problem of collection of the tax liability and has also been the subject matter of extensive litigation.

Now it is proposed to bring deemed dividends also under the scope of dividend distribution tax. Therefore, companies are now liable to pay DDT on the deemed dividend.

The tax at the rate of 30% is proposed on such deemed dividend in order to prevent camouflaging of dividend in various ways such as loans or advances.

No deduction of exp. even if unexplained income is determined by Assessing Officer

[Section 115BBE – Applicable retrospectively from Assessment Year 2017-18]

Any sum found credited in the books of the taxpayer, for which he offers no explanation about the nature and source thereof or the Assessing Officer (AO) are not satisfied by the explanation offered by the taxpayer, is termed as unexplained income. Such incomes are taxed at the flat rate of 60% under section 115BBE. It also provides that no deduction in respect of any expenditure shall be allowed to taxpayers from such unexplained income. However, the provision was silent whether taxpayer would get any deduction if tax officer has made additions in the total income of taxpayers which is deemed as unexplained income.

The Finance Bill, 2018 proposed that taxpayer would not be eligible to deduction even in this case where additions are made by the Assessing Officer for the unexplained income.

Deductions under Chapter VI-A

Limit of Deduction under Section 80D is enhanced for senior citizens

[Section 80D – Applicable from Assessment Year 2019-20]

Currently, an individual taxpayer can claim deduction of up to Rs. 30,000 in respect of payment made by him for the medical insurance for himself, his spouse or children. He is allowed to claim additional deduction of Rs. 30,000 for the payment made for the medical insurance policy for his parents. The deduction of Rs. 30,000 is reduced to Rs. 25,000 each if the insured persons are less than 60 years of age. In other words, if none of the family member is a senior citizen (i.e. less than 60 years of age), the deduction is limited to Rs. 50,000. If either parents or any of his family member is a senior citizen (i.e. above 60 years of age), the deduction shall be up to Rs. 55,000. If parents and any of family member is a senior citizen, the deduction up to Rs. 60,000 can be claimed under Section 80D.

The limit of Rs. 30,000 is proposed to be increased to Rs. 50,000. In nutshell, an individual taxpayer can claim deduction of up to Rs. 1 lakh under Section 80D if he or his family members and his parents are 60 years or above.

A summary of deduction allowable under Section 80D is explained in below table:

Nature Of Amount SpentFamily MemberParents

Age Below 60 YearsAge 60 Years Or MoreAge Below 60 YearsAge 60 Years Or More

A. Medical Insurance25,00050,00025,00050,000

B. CGHS25,00050,000––

C. Health Check-Up5,0005,0005,0005,000

D. Medical Expenditure–50,000–50,000

Maximum Deduction25,00050,00025,00050,000

Further, the Finance Bill also proposes that in case of single premium health insurance policies which covers more than one year, deduction shall be allowed on proportionate basis for all those years for which health insurance cover is provided, subject to the specified monetary limit.

Deduction limit under section 80DDB is enhanced

[Section 80DDB – Applicable from Assessment Year 2019-20]

This deduction is allowed when an individual or HUF taxpayer pays for the medical treatment of critical illness for himself or family members. Currently, this deduction is allowed upto Rs. 60,000 for senior citizen, up to Rs. 80000 for very senior citizen and Rs. 40,000 in any other case.

The differentiation between senior and super senior citizen is removed and the deduction limit in both the case is proposed to be increased to Rs. 1,00,000. There is no change in amount of deduction for expenditure incurred in any other case i.e., for person who is below 60 years of age.

Deductions under Section 80JJAA is extended to footwear and leather industry

[Section 80JJAA – Applicable from Assessment Year 2019-20]

Section 80JJAA allows deductions to the manufacturers who employ new employees for a minimum period of 240 days during the year. This deduction is calculated at the rate of 30% of the additional employee cost incurred by the assessee during the year.

The eligibility of a manufacturer to claim this deduction is determined only if he gives employment for a minimum period of 240 days during the year. However, for apparel industry the minimum period of employment is relaxed to 150 days. The concession of minimum employment period for 150 days has been extended to footwear and leather industry.

Manufacturers are often denied the deduction if an employee is employed in year 1 for a period of less than 240 days or 150 days, but continues to remain employed for more than 240 days or 150 days in year 2. To overcome this difficulty, the requirement of period of employment has been proposed to be relaxed. Now as per the proposed provision the deductions shall be allowed to the manufacturer in respect of an employee hired in last year, if he continues to remain in employment in current year for more than 240 or 150 days, as the case may be.

New deduction introduced for Farm Producer Companies

[Section 80PA – Applicable from Assessment Year 2019-20]

To promote agricultural activities a new section 80PA is proposed to be inserted. This new provision proposes 100% deductions of profits for a period of 5 years to farm producer companies.

This deduction is allowed to farm producer companies who have total turnover of up to Rs. 100 crores during the financial year. For claiming this deduction, companies’ gross total income should include income from:

a) Marketing of agricultural produce grown by its members

b) Purchase of agricultural implements, seeds, livestock or other articles intended for agriculture for the purpose of supplying them to its members

c) Processing of agricultural produce of its members.

New deduction for senior citizens in respect of bank interest

[Section 80TTA, 80TTB, 194A – Applicable from Assessment Year 2019-20]

Keeping in view the fixed and restricted sources of income for senior citizens, a new section 80TTB is proposed to be inserted. This provision allows deduction of up to Rs. 50,000 to the senior citizen who has earned interest income from deposits with banks or post office or co-operative banks. Interest earned on saving deposits and fixed deposits both shall be eligible for deduction under this provision.

Deduction under Section 80TTA shall not be available to senior citizens in respect of interest on saving deposits.

Further, corresponding amendment has been proposed in Section 194A to provide that no tax shall be deducted at source from payment of interest to a senior citizen up to Rs. 50,000.

Certain Deductions not to be allowed if return is not filed on time

[Section 80AC – Applicable from Assessment Year 2018-19]

As per existing provisions of Section 80AC of the Act, no deduction would be admissible under section 80-IA or section 80-IAB or section 80-IB or section 80-IC or section 80-ID or section 80-IE, unless the return of income by the assessee is furnished on or before the due date specified under Section 139(1). This burden of filing of return on time is not casted on other assesses who are claiming deductions under other similar provisions.

Therefore, to bring uniformity in all income-based deduction, it is now proposed that the scope of section 80AC shall be extended to all similar deductions which are covered in heading “C.—Deductions in respect of certain incomes” in Chapter VIA (sections 80 H to 80RRB). The impact of such amendment shall be that no deduction would be allowed to a taxpayer under these provisions if income-tax return is not filled on or before the due date.

Others

E-Proceedings of all scrutiny assessments

[Section 143(3A), 143(3B), 143(3C) – Applicable from Assessment Year 2018-19]

The Finance Bill, 2018 has proposed to launch a new scheme for scrutiny assessments to eliminate the interface between the Assessing Officer and the taxpayers. Under the new system, taxpayer will not be required to appear in person before the Assessing Officer as assessment proceedings in all cases selected under scrutiny will now be conducted through e-mail based communications.The directions in this regard need to be issued on or before March 31, 2020.

Higher penalty for default in furnishing AIR (Section 271FA)

[Section 271FA – Applicable from Assessment Year 2018-19]

DefaultExisting PenaltyProposed Penalty

Penalty For Not Filing Statement Within Due DateRs. 100 Per Day During Which The Default ContinuesRs. 500 Per Day During Which The Default Continues

Penalty For Not Filing Statement Within Time Limit Given In NoticeRs. 500 Per Day During Which The Default ContinuesRs. 1,000 Per Day During Which The Default Continues

Stringent prosecution for not filing the ITR

[Section 276CC – Applicable from Assessment Year 2018-19]

Section 276CC provides for imprisonment of up to 2 years in case a person doesn’t file the return of income.

However exemption is provided from prosecution under section 276CC, if the return is furnished till end of assessment year or if the tax payable is up to Rs. 3,000.

The Finance Bill targets to prevent abuse of the exemption provided on the basis of amount of tax payable by shell companies or by companies holding Benami properties.

As per the proposed amendment the immunity from prosecution under section 276CC is not available to a company even if the amount of tax payable is Rs. 3,000 or less.

TDS from payment of interest on specified bonds

[Section 193 – Applicable from Assessment Year 2018-19]

Section 193 is proposed to be amended to provide that the person responsible for paying to a resident any interest on 7.75% Savings (Taxable) Bonds, 2018 shall deduct tax therefrom, if the interest payable on such bonds exceeds Rs. 10,000 during the financial year.

Cessation of Authority for Advance Ruling for the purposes of Custom Duty

[Section 245-O, 245Q]

The Finance Act, 2017 has merged the Authority for Advance Ruling (AAR) for income-tax, central excise, customs duty and service tax. Therefore, the Authority for Advance Rulings constituted under Income-tax Act shall be the Authority for giving advance rulings for the purposes of the Customs Act as well.

It is now proposed that the Income-tax Authority shall cease to act as an Authority for Advance Rulings for the purposes of the Customs Act, 1962 on and from the date of appointment of the Customs Authority for Advance Rulings.

For more information please visit at http://arpitguptaclasses.com/

0 notes

Text

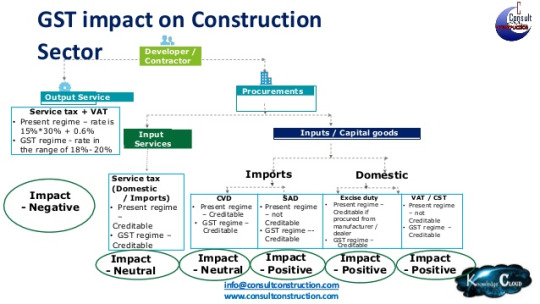

IMPACT OF GST ON CONSTRUCTION INDUSTRY AND REAL ESTATE

http://arpitguptaclasses.com/blog/2018/05/29/impact-gst-construction-industry-real-estate-2/

Introduction

A single tax structure is definitely a welcome move and the introduction of Goods and Services Tax (GST) seeks to do just that by way of amalgamating a large number of Central and State taxes into a single tax. GST will not only address the concerns of double taxation but will also help in reducing the overall tax burden on goods and services. Furthermore, it will also help in making Indian goods competitive internationally thus providing a much-needed boost to the economy.

The Real estate industry is one of the most pivotal sectors in India and has seen a phenomenal growth, not just in cities, but even small towns. GST is another development that will have a significant impact on this sector. Let’s take a look at the impact of GST on the construction industry and the real sector.

Transparency and Accountability :- GST will lend a whole lot of transparency in the real estate sector while also playing a major role in minimizing unscrupulous (black money) transactions. Currently, there is a huge percentage in every projects where expenditure goes unrecorded on the books. GST by curbing the practice of fake billing on purchase-side will help cut down cash component in construction, which in turn, will help in boosting stakeholders’ confidence.

Input Tax Credit :- Although the GST rate of 18% on the supply of works contract in the construction sector may be higher than the previous rates, the regime of local composition schemes is over, though now they are eligible for full input tax credit. However, many of the listed construction services such as constructions of dams, roads etc. which were previously exempted are now under the GST purview. This basically means the average construction contract in the previous regime which used to hover around the 11-18% range is now chargeable at a flat rate of 18%. As a matter of fact, if you take exempted services into consideration, this marked difference is more pronounced, like certain infrastructure services are no more exempt in current regime. Having said that, thanks to the availability of input tax credit, the construction sector is expected to benefit in the long run. This is because, under the GST regime, the input tax credit on the raw materials would result in an overall neutral tax incidence for construction services. Additionally, with GST, real estate developers will have access to free input tax credits on GST paid for services and goods purchased by them while the rate of GST on outward supply is 12% including the value of land. As the inward supply consist of many a items with more than 12% rate, it is expected not a very significant cash flow will involve in paying GST on outward supply. This will not only help in reducing the cost for the developers but owing to this, they can even pass on the benefit of these credits as a reduction to potential buyers. The significant point is it takes away the ambiguities of pre-GST regime, and resultant litigation, so far as the indirect taxation on real estate is concerned.

Compliance and Efficiency :- Thanks to the abolition of various central, state and local taxes, GST will permit quicker and easier transfer of goods between states.By implementing a uniform tax structure,the entire real estate sector will stand to benefit thus improving the tax compliance. GST will also inadvertently replace most indirect taxes, with a single tax, thereby ensuring an overall efficient taxation system.

Double Taxation :- The Real estate sector was plagued with several issues regarding multiple taxation which amounted to over 25 percent in indirect taxes. GST will break the shackles of double taxation by freeing home buyers and investors from the hassle of paying several state taxes at different levels.

Stamp Duty and Registration :- The remaining hurdle is that Stamp duty is not to be subsumed under GST and hence will continue as it is today. There is no provision for input tax set off available for the stamp duty paid for the land which basically goes against the entire premise of GST. Moreover, there would be no change in registration charges as well on real estate sale transactions. The silver lining as such is that GST will subsume the service tax and value added tax (VAT) charges which were payable on sale of under-construction properties.

TAXABILITY OF WORKS CONTRACT UNDER PREVIOUS TAX REGIME

Various provisions were in place to separately determine the value of taxable goods and taxable services in the total consideration of a works contract.

VAT was charged on the value of sale of goods component and Service Tax was charged on the value of service component

Cascading effect of different taxes. For Example:- Software

Confusions and legal disputes

WORKS CONTRACT UNDER GST

WORKS CONTRACT HAS BEEN DEFINED IN SECTION 2(119)OF CGST ACT,

contracts involving constructions of immovable propertiesare only kept within the purview of works contract under GST Law

A contract in relation to movable property, however, would be treated as a ‘composite supply’ of goods or services depending on the principal supply.

( WORKS CONTRACT IS NOT A WORKS CONTRACT IN GST IF IT RESULTING IN MOVABLE PROPERTY)

IMMOVABLE PROPERTY

GST Law recognizes only two classes of Immovable property.

Sch III Entry 5-

a)Land &

b)Building (other than under construction sale of flats/unit)

SCHEDULE II OF THE CGST ACT, 2017

Schedule II of the CGST Act, 2017, deals with the classification of Activities into Supply of Goods and Services.

Entry number 5(b) of Schedule II mentions clearly that the “construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly…” will be treated as a Supply of Service.

Rate of construction services where value of land is included:

ChSecHeadingDescription Of ServiceRate

9959954(I) Sale Of Under Construction Flats Involving Transfer Of Property In Land Or Undivided Share In Land18% After Deduction Of 1/3rd Of Total Amount Charged As The Value Of Land Or Undivided Share In Land

Further, Entry number 6(a) of Schedule II reads as follows: “The following composite supplies shall be treated as a supply of services, namely:—(a) works contractas defined in clause (119) of section 2;”

Rate of Works Contract Service-

ChSecHeadingDescription Of ServiceRate

9959954Ii) Composite Supply Of Works Contract As Defined In Clause 119 Of Section 2 Of CGST, 2017.18%

(Iii) Specified Composite Supply Of Works Contract12%

(Iv) Construction Services Other Than (I) And (Ii) Above18%

TIME OF SUPPLY OF SERVICE

PLACE OF SUPPLY IN GST

The place of supply of the service is the location of the immovable property.

Example-If site is at New Delhi and office is at Gujrat. Immovable property is build up in New Delhi, hence It will be the place of supply of services.

INPUT TAX CREDIT ON WORKS CONTRACT UNDER GST

Input Tax Credit of GST paid on Works contract will be allowed if

the output supply is also Works Contract, and;

When the Contract is for construction of Plant and Machinery.

Apart from the above two, no Input Tax Credit will be available for works contracts for construction of immovable property. For Example- Hotel.

Input Tax Credits – Implications

ProcurementPre-GST PositionPost-GST Position

Materials•No Cenvat Of Excise Duty, CVD, Etc Paid On Materials

• No VAT Credit On Materials

Full ITC Available

Input ServicesCenvat Credit Of Service Tax Was AvailableFull ITC Available

Capital GoodsCenvat Credit Of Excise Was Available In Two TrenchesFull ITC Available In The Year Of Receipt

ABATEMENT AND COMPOSITION SCHEME

No abatement is till now available for works contracts under GST.

Works Contractor cannot opt for composition scheme as a works contract is treated as a supply of services.

For supply of services, only restaurant business are allowed to be registered under Composition Scheme.

PRE & POST GST

ParticularsService TaxVATTOTALGST

Sale Of Flats And Units- Under Construction4.50%1%5.50%18% (1/3 Reduction Of Land)

Joints Development- Owner Area4.50% To 6%NIL4.50% To 6%18% (1/3 Reduction Of Land)

Rehabilitation Of Flats6%NIL6%18%

ISSUES

Pre GST- Joint Development (Area Sharing)

Land Owner transfers certain percentage of development potential to Developer

In return Developer gives owners flat to Land Owner, also developer sales his developed flats to customers.

Present regime:

Service tax:

* Flats allotted to Land owner – service tax payable under works contract category or construction service on the value of development potentials received

* Saleable flats – service tax payable on sale of under construction units

VAT:

* Not payable on flats allotted to land owner as it amounts to barter

* Payable on saleable flats under construction

CONTINUOUS SUPPLY OF SERVICE

It means a supply of services which is provided or will be provided continuously or on recurrent basis under a contract for a period exceeding three months with periodic payment obligations

Where the due date of payment is ascertainable from the contract Time of supply shall be the due date of payment..

Where the due date of payment is not ascertainable from the contract Time of supply it will be earliest of

1) date of receipt of payment or

2) the date of issue of invoice

Where payment is linked to the completion of an event Time of supply it will be earliest of

1)date of receipt of payment Or

2) completion of event where payment is linked to completion of event.

Time of supply:

* Receipt of development rights amounts to advance receipt of consideration in kind

* Hence, date when irrevocable rights are received will be time of supply

* Receipt voucher has to be issued by developer to owner on receipt of development right

Valuation to be done as per GST Valuation Rules

Taxable @ 18% or 18% (after deducting land value) depending on facts of the case

Area Sharing Agreement- Section 7(1) a, “ Supply Means” Supply made and Agreed to be made

Taxability of saleable flats:

Taxable on transaction value under construction service category @ 18% (after deducting land value)

Taxability of development rights in the hands of owner

Transfer of development rights by landlord can be said in course or furtherance of business

As per Sch II Entry (2) License to occupy land to builder is supply

Refund to customer on cancellation

Present regime:

Rule 6(3) of Service tax Rules, 1994 permits Builder to adjust service tax refunded to customer on cancellation of flats/ units against his tax liability of the month in which refund is made

No time limit for such adjustment

GST regime:

Whether builder is entitled to issue credit note u/s 34 and claim the tax adjustment? Provision speaks of deficiency of service and not “non-provision of service”

Does this mean that adjustment of GST refunded on advance against GST liability is not permissible?

Section 54(8)(c) permits refund of tax paid on supply which is not provided either wholly or partially

Debit note and Credit note in Works Contract- DN and CN should be issued by supplier only U/s 34 of GST Act

Sale of Completed flats – Reversal of ITC

Section 17(2) provides that where goods or services are used partly for effecting taxable supplies and partly for exempt supplies, ITC credit attributable to taxable supplies can only be taken

Exempt Supply is defined u/s 2(47)] to include non-taxable supply

Non-taxable supply is defined u/s 2(78) of the Act to mean:

Supply of goods or services or both

Which is not liable to tax under CGST or IGST Act

Section 17(3) specifically includes sale of building and sale of land as exempt supply

Sale of completed flat will be exempt supply for the purpose of reversal of ITC u/s 17(2) of the Act from start of the project.

Also builder may liable to pay interest on such reversal of credit for the period starting from the date of completion certificate till date of actual reversal.

Free Supplies by the Builder to the contractor

A supply without consideration to non-related persons is not “supply” as defined u/s 7 of CGST Act

As such activity is not a supply, same will not be liable to GST

It is not an exempted supply as defined u/s 2(47) of CGST Act

It is not wholly exempt u/s 11 of CGST Act

It is not a Nil rated supply

It is not a non-taxable supply as defined u/s 2(78) of CGST Act

ITC reversal may not be required

ITC Overflow- Refund

Not allowed in capacity of builder. Builder can use overflow credit,

In other project as set off or

Get Income tax deduction as write off to Profit and Loss account.

Subcontract of construction

Subcontractor are not works contractor but composite supplier. Hence ITC overflow is not applicable to subcontractor he will get refund.

Impact on ongoing projects

The provisions relating to treatment of ongoing contracts on appointed day are contained in Section 142 (10) and 142 (11) of the CGST Act 2017

1) If the goods or services are being supplied on or after the appointed date in pursuance of the contract entered prior to the appointed date, then tax would be levied under GST.

2)If the goods or services are supplied before the appointed date and VAT was leviable on such transaction on account of Sale of goods or Service Tax was leviable on account of provision of services, no tax will be required to be paid under GST.

3)If the consideration has been received prior to appointed date in respect of such supply and tax has already been paid under current regime, no tax would be required to discharged /paid under GST.

4) If any VAT and Service Tax has been paid on any supply under the existing laws, but the supply of goods and/or services is to be received under GST scheme, then the tax already paid shall be allowed as credit under GST and the supplies when made shall be taxed under GST as well. This clause covers specifically works contract transactions. For example: If an invoice is raised on 30th June 2017 and the supply is for the month of June 2017 and July 2017 and VAT and Service Tax have been paid, then such VAT and Service Tax paid shall be allowed as credit in GST proportionate to the month of July 2017; and when supplies are made in July 2017, they shall be put to tax under GST.

IMPACT ON CONSTRUCTION AND REAL ESTATE SECTOR

Positive Impact

Easy Compliance

Availability of Input Tax Credit

Possible reduction in prices

Excise Duty, VAT, Service tax get replaced by GST

Final Thoughts

Overall, GST is expected to help bring a lot of required transparency and accountability. Moreover, owing to the expected free flow of credit, developers should be able to enjoy an increase in overall margin. Whether these benefits trickle down to the consumers is yet to be seen as the pricing in this sector tends to be dictated by market forces rather than costing policies. Looking from the consumer point of view, the one primary advantage would be in terms of decrease in the overall tax burden on goods and increased transparency in tax system. GST will also help in eliminating unnecessary paperwork while eliminating time wastage spent by good suppliers at various state borders. One thing for sure is, the impact of GST will be felt albeit after a while.

Summary

Article NameIMPACT OF GST ON CONSTRUCTION INDUSTRY AND REAL ESTATEDescriptionGST Impact explained on construction industry and real estate by arpitguptaclasses.com which is the best online classes for GST.AuthorArpit GuptaPublisher Namearpitguptaclasses.comPublisher Logo

0 notes

Text

Table 6A Of GSTR-1: Refund On Export

http://arpitguptaclasses.com/blog/2018/06/09/table-6a-gstr-1-refund-export/

This article talks about the latest developments in the refund procedure for exporters under GST regime who were suffering due to huge working capital blockages either due to payment of IGST for making exports or by way of un- utilized ITC on inputs in case the exports were effected via LUT/Bond and non-availability of the refund module (RFD-01) on the GSTN common portal. In India, Exports are treated as zero-rated supplies.

Taxpayers who export goods or services can choose any of the following options:

Export under bond/ Letter of Undertaking without payment of tax and claim refund of Input Tax Credit or

Pay *IGST after setting-off ITC and claim the refund of tax paid.

*Note: All Exports are deemed as inter-state. Only IGST is applicable on Exports.

As per Section 54(8) of the CGST Act, Refunds may arise under the following situations:

Exports of goods with payment of IGST (Rule 96 applicable)

Exports of goods without payment of IGST.( accumulated ITC) (Rule 89 applicable)

Exports of services with or without payment of IGST( both situations) (Rule 89 applicable)

On account of supply of goods or services made to SEZ Unit / SEZ Developer.

In case of deemed Exports,

On account of assessment/ provisional assessment/ appeal/any other order

ITC accumulated due to inverted tax structure

Tax paid on advances and subsequently refunded due to non -supply or partial supply.

Tax deposited under wrong head

As per the provisions of GST Law, Refunds to be granted to the dealer electronically on the basis of application in RFD-01 in all the above cases except Exports of Goods with payment of IGST for which Exports details are required to be filled in Table 6A of GSTR-1 and the same would be deemed to be an application for Refund.

But due to the non-availability of the refund module (RFD-01) on the common portal, the refund could not be claimed by the dealer and GSTR-1 provided initially only for July-2017 and later on Window closed on 04/10/2017 even for GSTR-1 and now extended the due date for filing GSTR-1 up to 31/12/2017 for the month of July-2017, August-2017, September-2017 & October-2017. Under the situation, none is in a position to claim Refund from the department.

Vide Notification No.39/2017-Central Tax, dt. 13-10-2017 Officers are given powers to sanction, process and grants Refunds manually to the dealers.

Vide Notification No.45/2017-Central Tax, dt. 13-10-2017, an additional Table 6A of GSTR-1 is provided on the portal to facilitate early refunds as the due dates for GSTR-1 has been extended to 31.12.2017 for the m/o July, August, September & October 2017 and this Table 6A will be auto-populated in the GSTR-1 of the respective tax periods as and when final GSTR-1 would be finally filed by the dealer.

This additional Table 6A is given on the portal so that the exporters can file the details of zero rated supply and proceed for refund without having to wait to file GSTR-1.

Several representations were received by CBEC seeking further clarifications on issues relating to refund. In order to clarify such issues and with a view to ensure uniformity in the implementation of the provisions of the law across field formations, the CBEC has again issued clarification on a list of issues through Circular No. 37/11/2018-GST, dated 15.03.2018 . The matters covered in the clarifications are:

Non-availment of drawback – A supplier availing of drawback only with respect to basic customs duty shall be eligible for refund of unutilized ITC of CGST /SGST /UGST / IGST / compensation cess.

It is further clarified that refund of eligible credit on account of SGST shall be available even if the supplier of goods or services or both has availed of drawback in respect of central tax.

Amendment through Table 9 of GSTR-1 – Refund claims processing not to be withheld on account of mis-matches between data contained in FORM GSTR-1, FORM GSTR-3B and shipping bills/bills of export.

If a taxpayer has committed an error while entering the details of an invoice / shipping bill / bill of export in Table 6A or Table 6B of FORM GSTR-1, he can rectify the same in Table 9 of FORM GSTR-1.

While processing refund claims on account of zero rated supplies, information contained in Table 9 of FORM GSTR-1 of the subsequent tax periods should be taken into cognizance, wherever applicable.

In case of discrepancies between the data furnished by the taxpayer in FORM GSTR-3B and FORM GSTR-1, the officer shall refer to the said Circular and process the refund application accordingly.

Exports without LUT – The substantive benefits of zero rating may not be denied where it has been established that exports in terms of the relevant provisions have been made. The delay in furnishing of LUT in such cases may be condoned and the facility for export under LUT may be allowed on ex post facto basis taking into account the facts and circumstances of each case.

Exports after specified period – Exports have been zero rated under the IGST Act, 2017and as long as goods have actually been exported even after a period of three months, payment of IGST first and claiming refund at a subsequent date should not be insisted upon. In such cases, the jurisdictional Commissioner may consider granting extension of time limit for export as provided in the said sub-rule on post facto basis keeping in view the facts and circumstances of each case. The same principle should be followed in case of export of services.

Deficiency memo –That once an applicant has been communicated the deficiencies in respect of a particular application, the applicant shall furnish a fresh refund application after rectification of such deficiencies (rule 90 of the CGST Rules). Therefore, there can be only one deficiency memo for one refund application and once such a memo has been issued, the applicant is required to file a fresh refund application, manually in FORM GST RFD-01A.

Self-declaration for non-prosecution – Self–declaration for non-prosecution is not required with every refund claim (under LUT).

Refund of transitional credit –The transitional credit pertains to duties and taxes paid under the existing laws viz., under Central Excise Act, 1944 and Chapter V of the Finance Act, 1994. The same cannot be said to have been availed during the relevant period and thus, cannot be treated as part of ‘Net ITC’ under Rule 89(4) and (5) of CGST Rules.

Discrepancy between values of GST invoice and shipping bill/bill of export – During the processing of the refund claim, the value of the goods declared in the GST invoice and the value in the corresponding shipping bill / bill of export should be examined and the lower of the two values should be sanctioned as refund.

There are some conditions laid down for successful claiming of refund of IGST paid on exports:

GSTR-3B for the month is filed

Table 6A of GSTR-1 has been filed

Details of Shipping Bill and Invoice provided in Table 6A of GSTR-1 should match

The IGST amount mentioned in GSTR-3B is equal or more than the IGST mentioned in Table 6A of GSTR-1.

As per Act, 90% of refund is processed on a provisional basis within 7 days of application for refund

Summary

Article NameTable 6A of GSTR-1: Refund on ExportDescriptionThis article talks about the latest developments in the refund procedure for exporters under GST regime who were suffering due to huge working capital blockages either due to payment of IGST for making exports or by way of un- utilized ITC on inputs in case the exports were effected via LUT/Bond and non-availability of the refund module (RFD-01) on the GSTN common portal.AuthorArpit GuptaPublisher Namearpitguptaclasses.comPublisher Logo

For more information please visit at http://arpitguptaclasses.com/

0 notes

Text

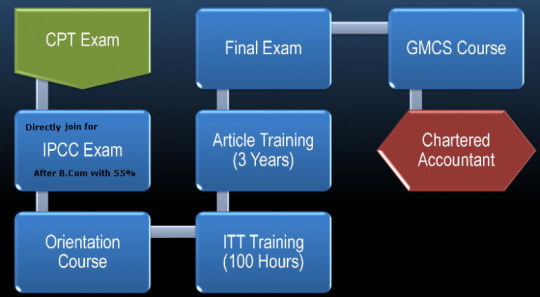

CA New Syllabus 2018, CA IPCC Or CA Intermediate Syllabus

http://arpitguptaclasses.com/blog/2018/02/07/ca-new-syllabus-2018-ca-ipcc-or-ca-intermediate-syllabus/

There are 8 papers in CA IPCC or CA Intermediate new scheme from 2016. In the previous notification, ICAI said that they are going to remove Information Technology and Strategic Management Paper from CA IPCC Group – 2 completely. But in the new notification, Information Technology & Strategic Management paper also included. In new syllabus Direct tax laws for 60 marks and Indirect tax laws for 40 Marks. Read the changes made in IPCC new syllabus from 2018 below:

Number of Papers – 8

Group I

PAPER

SUBJECT

MARKS

1

ACCOUNTING

100

2

CORPORATE LAWS & OTHER LAW

S

Section A: CORPORATE LAWS

60

Section B: OTHER LAWS

40

3

COST & MANAGEMENT ACCOUNTING

100

4

TAXATION

Section A: INCOME TAX

60

Section B: INDIRECT TAX

40

Group II

PAPER

SUBJECT

MARKS

5

ADVANCE ACCOUNTING

100

6

AUDITING & ASSURANCE

100

7

ENTERPRISE INFORMATION SYSTEM & STRATEGIC MANAGEMENT

ENTERPRISE INFORMATION SYSTEM

50

STRATEGIC MANAGEMENT

50

8

Financial Management & Economics For Finance

Section A: Financial Management

60

Section B: Economics For Finance

40

CA FINAL NEW vs OLD SYLLABUS

CA FINAL OLD SCHEME1 (8 SUBJECTS 800 MARKS) CA FINAL NEW SCHEME1 (8 SUBJECTS 800 MARKS)

GROUP 1

Financial Reporting (100 Marks)

Financial Reporting (100 Marks)

Strategic Financial Management (100 Marks)

Strategic Financial Management (100 Marks)

Advanced Auditing And Professional Ethics (100 Marks)

Advanced Auditing And Professional Ethics (100 Marks)

Corporate (70 Marks) And Other Economic Laws (30 Marks)

Corporate (70

Marks )

And Other Economic Laws (30 Marks)

GROUP 2

Advanced Management Accounting (100 Marks)

Strategic Cost Management & Performance Evaluation (100 Marks)

Information Systems Control And Audit

Elective Paper (100Marks)

Risk Management

International Taxation

Economics Laws

Financial Services & Capital Markets

Global Financial Reporting Standards

Multidisciplinary Case Study

Direct Tax Laws (100 Marks)

Direct Tax Laws (70 Marks) And International Taxation (30 Marks)

Indirect Tax Laws (100 Marks)

Advance Indirect Tax Laws (100 Marks)

For more information please visit at http://arpitguptaclasses.com/

0 notes

Text

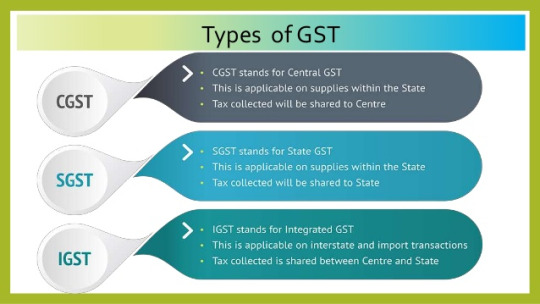

GST In Reality Is ‘Good & Simple’ Tax-:

http://arpitguptaclasses.com/blog/2018/03/20/gst-reality-good-simple-tax/

Goods & Services Tax Law in India is a comprehensive, multi-stage that is levied on every value addition.

Goods and Service Tax is an indirect tax levied on the supply of goods and services. GST Law has replaced many indirect tax laws that previously existed in India.

GST is one indirect tax for the whole country.

Advantages Of GST-:

The main purpose of GST is remove the Cascading effect on the sale of goods and services. Removal of cascading effect will directly impact the cost of goods and services.The cost of goods should decrease since tax on tax is eliminated in the GST regime.

GST is also technologically driven. All activities like registration, application for refund and response to notice needs to be done online on the GST Portal. This will speed up the processes and procedures.

What are the components of GST?

There are 3 types of taxes under GST: CGST, SGST & IGST.

CGST: Collected by the Central Government on an intra-state sale…

SGST: Collected by the State Government on an intra-state sale…

IGST: Collected by the Central Government for inter-state sale …

GST Tax Rate: What are Rate of Taxes under GST?Items under 5% Frozen Vegetables and fruits, branded wheat and rice, branded flour, hand-made safety matches, cotton, cotton fabrics, Footwear below Rs.500.items under 12% Butter, Cheese, Dry fruits, mobile phones, ayurvedic productsItems under 18% Biddi wrapper leaves, biscuits, footwear exceeding Rs. 500, man-made fibre, hair oil, soap, toothpasteItems under 28%Biris, LED TV, AC, Cars, tobacco products, cement…Benefits of GST Bill-:For the center & the states– By implementing the GST, india will gain $15 billion a year. This is because, it will promote more exports, create more employment & opportunities. It will divide the burden of tax b/w manufacturing & services.For individuals & companies– Under GST system, taxes for both center & state will be collected at the point of sale. Both will charged at the manufacturing cost. Individual will be benefited by this as prices are likely to come down and lower prices with more consumption.items not under GST- Alcohol, Tobacco, Petroleum Products. For more information about GST, stay tuned with- http://www.arpitguptaclasses.com/

0 notes

Text

Online Classes For CA –

http://arpitguptaclasses.com/blog/2018/04/17/online-classes-ca/

Chartered accountancy is a professional degree course which offers much scope as well.. After becoming a CA, a person can choose to either be employed with a firm as an employee or they can choose to open their own private practice.

Scope of a chartered accountant career-

By the course of charted accountancy, you can choose their own practice and develop.

CA’s can also apply for the job of any company.

They work in a field of capital marketing.

CA can also work in the field of government services, public sector,or even in a private sector.

Institute of CA of India is also well recognized abroad like in England, Wales and Australia so one can even practice in these countries as well.

It is not necessary that a CA has to work only on number crunching and excel sheets. A CA employed with a firm can also contribute towards decision making and enhancement of profits for the firm.

A CA employed with a firm can also contribute towards decision making and enhancement of profits for the firm.

As per a report by the Economic Times, there is a huge demand for CA’s in the manufacturing and financial services sectors

CA is emerging as a good career option for women as it allows work to be done at one’s own pace and time, and, also allows one to control the money flow. Besides, a CA is free to take break in his / her profession.

Why to select online classes for CA course-It’s not necessary to join the coaching classes for CA preparation. Online study is the new trend today. You can join any YouTube or any type of online CA classes’ tutorial. You will get many video classes for CA available on the internet.

We also have our online video tutorial for CA available on youtube. If you want you can have a look here,

For more information please visit at http://arpitguptaclasses.com/

0 notes

Text

Online Classes For Ca Final

http://arpitguptaclasses.com/blog/2018/05/17/online-classes-ca-final/

Arpit gupta classes is India’s one of the best platform for Online Classes for ca final After a long time, it’s a good news for all night owls and early birds, there is no more hassle to hurry to reach classroom or exert yourself extraordinarily more to join classes. You can now study at your ease and according to your pace by our website for Online Classes for ca final.

The best features of our website are given below. 1. Online classes- You can view classes online similar to youtube with the option of changing the video quality according to your internet speed. 2. Offline download classes- It requires very low internet connectivity of just 3. Live classes will soon be starting from onward. 4. Regular notifications to all students are provided so that all students remain updated. 5. The discussion forum in the courses provides the facility of discussion with other subscribers.

If facing any issue, you can first go to our blog section Visit Our Website

If not resolved, feel free to contact us via email and pls visit

0 notes

Text

Exclusion Of Chartered Accountants From Valuation Of Unquoted Shares: ICAI Submits Representation To Fin Min

http://arpitguptaclasses.com/blog/2018/06/05/exclusion-chartered-accountants-valuation-unquoted-shares-icai-submits-representation-fin-min/

The Central Board of Direct Taxes (CBDT) has today notified the Income Tax (6th Amendment Rules) wherein it is provided that only Merchant Bankers are entitled to do Valuation of Unquoted Shares and the Chartered Accountants are no more eligible to do so. Presently, the fair market value of the unlisted equity share is calculated at the option of the company either on the book value on the valuation date or as per discounted free cash flow method calculated by a Merchant Banker or a Chartered Accountant

The Institute of Chartered Accountants of India (ICAI), the regulatory body of Chartered Accountants has made a representation to the Finance Ministry expressing dissatisfaction against Notification amending Rule 11UA omitting reference to term “accountant” and thereby excluding its members from valuing unquoted shares. As per the Notification issued last week, the Income Tax (6th Amendment Rules) provided that only Merchant Bankers are entitled to do Valuation of Unquoted Shares and the Chartered Accountants are no more eligible to do so. for more information, visit our website- http://arpitguptaclasses.com/

Summary

Article NameExclusion of Chartered Accountants from Valuation of Unquoted SharesDescriptionThe Central Board of Direct Taxes (CBDT) has today notified the Income Tax (6th Amendment Rules) wherein it is provided that only Merchant Bankers are entitled to do Valuation of Unquoted Shares and the Chartered Accountants are no more eligible to do so.AuthorArpit GuptaPublisher Namearpitguptaclasses.comPublisher Logo

For more information please visit at http://arpitguptaclasses.com/

0 notes

Text

Understanding Place Of Supply In GST

http://arpitguptaclasses.com/blog/2018/02/01/online-classes-for-gst/

To determine the actual nature of the movement of goods and services, it is imperative to understand the “place of supply” of such goods or services. It plays a pivotal role in identifying whether CGST & SGST or IGST will be levied on any transaction.

Place of supply of goods and services have been given separate provisions. The location of the supplier and the place of supply together define the nature of the transaction. The registered place of business of the supplier is the location of the supplier, and the registered place of the recipient is the place of supply.

Place of supply rules for Goods

1) Where the supply involves a movement of goods, the place of supply shall be determined by the location of the goods at the time of final delivery.

Example: –A manufacturer in Kolkata, West Bengal has an order from a customer in Surat, Gujarat. The manufacturer directs his branch in Mumbai, Maharashtra to ship the goods to Surat. In this case, place of supply shall be Surat, Gujarat and thus entails an inter-state movement of goods and will attract levy of IGST.

2) Where the supply involves a movement of goods, on the direction of a third party, whether as an agent or otherwise, the place of supply shall be the principle place of business of such third party, irrespective of the place of delivery of goods.

Example: –A dealer in Mumbai, Maharashtra sells products to a customer in Delhi. Delhi-based customer directs the Mumbai seller to send the materials to Kolkata-based customer. Although the place of delivery is Kolkata, since Delhi-based seller had directed such movement, then the place of supply shall be the principle place of business, i.e. Delhi and thus, charge IGST on such movement.

3) Where the supply does not involve any movement of goods, then place of supply shall be the location of such goods at the time of final delivery.

Example: –An Ltd has its registered office in Hyderabad, Telangana, opens a branch in Bengaluru, Karnataka, and purchases workstations from B Ltd. Whose office is in Bengaluru, Karnataka. Even though the same is, a supply of goods but there is no movement of goods. Since the movement is intra-state, it will attract CGST and SGST.

4) Where the supply includes installation of goods at the site, then place of supply shall be the place of such installation.

Example: –Installation of telephone towers or lift in an office building.

5) Where the goods are being supplied on board a vehicle, vessel, aircraft, or a train, i.e. on board a conveyance, then place of supply shall be the first location at which the goods are boarded.

Example: – Howrah to New Delhi Rajdhani starts its journey from Howrah, West Bengal and passes through many states before ending its journey in New Delhi. The food served on board the train shall be considered as supply of goods. Thus, place of supply shall be Howrah since it is the first location of the goods.

NOTE: –Any other cases not covered above will be determined further as per recommendations from the GST council (yet to be finalised)

For more information please visit at http://arpitguptaclasses.com/

0 notes

Text

Non Resident Taxable Person Under GST Law

http://arpitguptaclasses.com/blog/2018/03/08/video-classes-for-ca-non-resident-taxable-person-gst-law/

A non-resident taxable person is defined as one residing outside India and making a taxable supply in India. Read more to understand the taxability.

If you are a business importing goods or services from outside India or managing a business on behalf of a person resident outside India, or if you are a non-resident and reading our article from a place outside India and intend to do business here, then this article is relevant to you.

The Goods and Services Tax Law has defined a ‘non-resident taxable person’ as any person who occasionally undertakes transactions involving the supply of goods or services, or both, whether as principal or agent or in any other capacity, but who has no fixed place of business or residence in India.

Section 24 of the GST law further specifies the requirement for registration for a non-resident taxable person. It mentions certain businesses and entities which are mandatorily required to register under Goods and Services Tax and are not governed by the minimum threshold limit of Rs. 20 lakh/ 10 lakh. Thus, irrespective of whether the business is involved in a one-time transaction or frequent taxable transactions, every non-resident individual or company will have to obtain a registration under the Goods and Services Tax.

Registration Procedure for a Non-Resident Taxable Person

Every person or business who falls under the definition covered above needs to apply for registration at least five days prior to the commencement of business. Further clarification has been provided in case of a high-sea sale; the law says that every person who makes a supply from the territorial waters of India shall obtain registration in the coastal state or Union territory where the nearest point of the appropriate baseline is located.

High Sea Sale (HSS) is a sale carried out by the carrier document consignee to another buyer while the goods are still being transported, or after their dispatch from the port/airport of origin and before their arrival at the port/airport of destination.

Thus if any high-sea sale is carried out near the shore of Mumbai, the GST registration has to be obtained in the state of Maharashtra.

A non-resident taxable person needs to electronically submit a duly signed application, along with a self-attested copy of his valid passport, for registration, using the form GST REG- 09, at least five days prior to the commencement of business on the Common Portal. An application must be duly signed or verified through EVC, a new mode of electronic verification based on Aadhar.

The non-resident (if it is a company) must submit its tax identification number of its original country (whatever is the equivalent of our PAN in that country).

A person applying for registration as a non-resident taxable person will be given a temporary reference number electronically by the Common Portal for making an advance deposit of tax in his electronic cash ledger and an acknowledgment will be issued thereafter.

Advance Payment of Tax by Non-Resident Taxable Person

A non-resident taxable person is required to make an advance deposit of tax in an amount equivalent to the estimated tax liability of such person for the period for which registration is sought.