Capital Sands was founded in 2016 and quickly grew to become one of the largest forex brokers in the world. Our mission? To create a world of tech-enabled trading where ambitious traders can embrace the challenge and opportunity of global markets.

Don't wanna be here? Send us removal request.

Link

0 notes

Text

Rising Three Methods

Rising Three Methods

Bullish Rising Three Methods is a trend continuation pattern that alerts traders to a weakening in the current trend. The long white candle of the first day is followed by three shorter descending candles. The smaller candles reflect trend resistance, which may include a trend reversal. These 3 candlesticks are usually black and part of their body remains within the price action range of the first day. The formation ends on the fifth day with another white candle. The opening price of this candle is higher than the closing price of the first day. The uptrend should continue. The three-way pattern is a trend continuation pattern that can occur in an uptrend or downtrend. In an uptrend it is called a three-way ascending pattern and in a downtrend it is called a three-way descending pattern. The three-way pattern consists of at least five candlesticks, but can contain more. It is similar to flag or pennant formations and also represents a period of congestion or consolidation.

Rising Three Methods Definition & Meaning

In order for a candlestick pattern to become a three-way ascending method, it must meet the following criteria:

1 The first pattern must be bullish.

2 The second, third and fourth candles are small and bearish. They are limited to the area of the first bullish candle.

3The last and fifth bar is bullish and closes above the top of the pattern.

A rise of three indicates that the market has seen a slight pullback, but is still strong enough to go higher.

How to spot a rising three methods candlestick pattern?

The ascending three candlestick pattern has five candlesticks. The first and fifth are clear, usually indicated by the color green. These are long bullish candles. The second, third and fifth candles are dark, usually indicated in red. These are short bearish candles. In the figure below, the five candlesticks are assumed to represent five consecutive business days. However, as explained above, the ascending three candlestick pattern can occur in any trading period, i.e. it applies to both intraday trading and position trading.

Trading the Rising Three Methods Pattern

Entry – Traders can enter the market when the last bar of the pattern closes. Alternatively, a trade could be taken if the price breaks above the high of the last candlestick. Aggressive traders can look for entry before the last bar closes, but should be prepared to exit if the fifth bar does not complete the pattern.

Traders need to make sure that the ascending three-way pattern does not break below key resistance to ensure that the uptrend has enough room to continue. For example, a trend line or broad moving average slightly above the pattern could limit further gains. Resistance levels should be checked on longer term charts to increase the probability of a successful trade. The "three amount method" can be most effective when the wicks of the initial bullish candle, indicating the highest and lowest traded price for that period, are flat and form a whole number Read More...

Contact us

0 notes

Text

Bearish Counter-Attack Candlestick Pattern

What are bearish counterattack lines?

The Counterattack Lines Pattern is a two-candle reversal pattern that appears on candlestick charts. This can happen during an uptrend or downtrend. In a bullish reversal during a downtrend, the first candle is a long black candle (low) and the second candle pulls away but then closes higher near the close of the first candle. This shows that sellers were in control, but could lose control as buyers could fill the void.

In a bear reversal during an uptrend, the first candle is a long white (rising) candle and the second candle goes up but then closes lower near the close of the first candle.

Counterattack candlestick pattern: an example

Understanding the model and what it means becomes much easier when you see it in action. So let's take a look. This is what the bullish counterattack pattern looks like.

Take a moment to look at this figure. The bearish candlestick is black while the bullish candlestick is white. Here you can see that prices are in a downtrend. The bears have a firm grip on the market and regularly push prices lower. The first black candle testifies to this. In line with the strong selling pressure in the trend, the white candle pulls away and continues to fall until it hits the session low. At this point, however, the bears lose momentum and the bulls flood the market, driving the price up significantly. Thanks to this strong demand from the bulls, the session ends higher towards the end of the previous day.

On this candlestick chart, you can see that prices are trending up. Bulls have a strong presence in the market and regularly push prices up. The chain of white candles testifies to this. In line with the high demand, the first black candle opens with a "gap up" expecting the price to continue rising. At this point, however, the bulls lose steam and give way to the entry of the bears. Sellers then flood the market and significantly reduce prices. Due to this intense selling pressure from the bears, the session ends in the negative near the end of the previous day.

What does the bearish pattern tell traders?

The bearish counterattack pattern predicts the reversal of the current trend. The appearance of the first bullish candle indicates that the uptrend will continue. The close of the second candle well above the open further confirms the uptrend. Bullish control is also indicated by the second candle, which creates a bullish gap from the close of the first candle. However, the opening of the first candle causes demand to drop, allowing the bears to continue pushing prices lower. Thus, it becomes clear that after the formation of the bearish counterattack candlestick, the uptrend will reverse in favor of the downtrend.

Bearish Counter Lines Traders Psychology

Suppose the market is in an active uptrend. The first candle is still going up, with the close well above the open, creating a really long body. This increases the confidence of the bulls and puts the bears on the defensive. Your caution is warranted at the open of the second candle, which differs from the close of the previous session. However, the opening reduces buying demand and allows the bears to lower the stock in a reversal session that ends near the end of the first candle. This price action indicates a possible bearish reversal that will be confirmed by the third or fourth candlestick Read More...

Contact us

0 notes

Text

Bearish Counter-Attack Candlestick Pattern

Bearish Counter-Attack Candlestick Pattern

The bearish counterattack candlestick pattern is a bearish reversal candlestick pattern. A bearish counterattack candlestick pattern can lead to a quick price reversal to the downside.

An uptrend has been underway for some time, and bullish investors are comfortable with the momentum in the stock price. A bearish counterattack candlestick pattern starts with too much of the same, maybe even too much of an anniversary, as price opens with a gap from the close of the previous candlestick pattern. Bullish investors feel good about the gap this morning.

But somewhere in the middle of the trading period, things change. Investors sell shares, and at the end of the trading period, the closing price of the candle is equal to or even slightly lower than the closing price of the previous candle. Hence the naming convention "counterattack".

How to Use the Counterattack Candlestick Pattern?

Recognizing the pattern is one thing. Entering a trade using the identified pattern is a completely different ball game. So, here are some important points to consider before entering a trade based on the Counter Line candlestick pattern.

– Watch out for a hard trend first. It can be an uptrend or downtrend.

– Once you have identified the trend, look for a candle that opens with a gap up or down. The openings must be consistent with the current trend.

– Observe the movement of this candle. The movement of the candle must be in a direction opposite to the prevailing trend.

– Once this condition is met, make sure that the candle moving in the opposite direction closes close to the previous day's close.

– A pattern can only be called a counter lines candle if it meets all the above conditions.

– Once the pattern has been accurately identified, it is advisable to wait for a confirmation candlestick before entering a position. For example, in the case of a bullish counterattack pattern, you should only consider taking a trade if the candle that appears after the pattern is bullish. Otherwise, the bullish reversal is said to have failed.

See how the candlestick that appears after the bearish counterattack candlestick pattern is also bearish? This candle essentially confirms the trend reversal and should ideally be the entry point.

What does the Bullish Pattern tell Traders?

The bullish counterattack candle predicts that the reversal of the current downtrend in the market is imminent. The appearance of the first black candlestick with a long real body indicates that the downward trend of the market will continue. The close of the first candle well below the open lifts the morale of the bears at the expense of the confidence of the bulls. The second candle opens and creates a gap below the close of the previous session. However, the opening of the second candlestick also indicates that the selling pressures and the overall downtrend are easing and the bullish reversal is near. The third or fourth day candles confirm the change in trend.

Difference Between Counterattack Lines and an Engulfing Pattern

Both patterns are created by candlesticks of the opposite color/direction. The engulfing pattern differs in that the candles are side by side with the true body of the second candle fully engulfing the true body of the first. It is also a reversal pattern.

Limitations of Using Counterattack Lines

Contour lines may not be reliable. They generally require confirmation candlesticks and are best used in conjunction with other confirmation technical analysis.

Candlestick patterns also do not offer profit targets, so there is no indication of the magnitude of the reversal. The pattern may initiate a long-term reversal, or the reversal may be very short-lived.

Although the pattern does occur, it is not common. The ways to use this candlestick pattern are limited Read More...

Contact us

0 notes

Text

What is in The Neck Candlestick Pattern

What is in The Neck Candlestick Pattern?

The pattern at the neckline occurs when a long real-body bearish candle is followed by a smaller real-body rising candle that widens at the open but then closes near the close of the previous candle. The pattern is called a cleavage because the two closes are the same (or nearly the same) on both candles, forming a horizontal cleavage.

In theory, the pattern is considered a continuation pattern, which indicates that the price will continue to fall following the pattern. In reality, this only happens half the time. As such, the pattern often suggests at least a short-term bullish reversal.

What Does the Neckline Candlestick Pattern tell Traders?

The candlestick pattern at the neckline informs traders of the possibility of the current trend in the market continuing. If the study is exhaustive, it also sheds light on the general behavior of the market in which it occurs. The appearance of the first bearish candle indicates the strength of the bears in the market. The second candlestick is bullish and shows that the bulls are trying to rally to turn the tide. However, the second candle does not close above the close of the bearish candle.

Theoretically, the appearance of the pattern at the neckline predicts the continuation of the current downtrend in the market, as the bulls simply cannot outperform the bears. What is unique about the neckline pattern is that it can predict the continuation despite the bull's best efforts to push the market higher through significant buying pressure. The market goes its own way after being sold off by the once-long bulls hoping for a brief pullback. This continues the current downward trend in the market.

How is a Neck Candlestick Pattern different from a hump pattern?

– A push pattern is considered both a bearish continuation pattern and a reversal indicating an uptrend. It is similar to the neckline candlestick pattern or the neckline pattern as it is two candlesticks where the first candlestick is high and bearish while the second candlestick is bullish and short.

– The difference between the stock pattern and the neck and neck pattern is in the closing point. In the push pattern, the second candlestick closes above the close of the first candlestick, but closes at or near the middle of the body of the first candlestick.

– However, a push pattern does not produce any clear results and sometimes shows a reversal and sometimes resumes the downtrend.

- A trader should be careful when following this pattern as it is not a strong pattern to confirm the trend. It is ideal to be on the lookout for other signals that may indicate a downtrend before trading. A trader should look carefully and take the time to identify a neckline pattern to trade as there are close similarities to the other two candlestick patterns.

On the Psychology of the Neck Trader

To increase their chances of success, traders can use this neck-in approach in combination with other types of technical analysis, including technical factors and chart structures. The Psychology Behind the Neck The traded value is either in a major downtrend or a significant pullback that is within a major uptrend. There is a small daily high on the first candle that reverses into an extended blackbody and creates a whole new low. Such weak or low price activity increases the value of the declining market and forces weak bulls to retreat altogether. The second candle deviates a few ticks and sells the stock to a new low. However, it lowers both the buyers and the other bulls to take control before the closing bell, causing the price to rise from the bottom in a quick uptrend that outweighs the opening pressure. This strong pricing strategy builds confidence among bullish investors, causing complacent bears to scrutinize positions and worry about a trend reversal. A limited amount of bullish power sizzles before the close when the long tick fails to penetrate the true body of the first candle. The bears analyze the waning power of the bulls and push lower in the continuation of the current downtrend. This low price approach drops the value to a new low on the third or fourth candle Read More...

Contact us

0 notes

Text

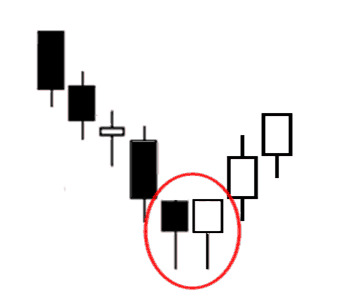

Tweezer Bottom and Top Candlestick Patterns

How to Trade the Tweezer Bottom and Top Candlestick Patterns.

The depth of the lower shadows of this signal indicates a support zone. The bears were unwilling to sell below that low price, so the bulls came back with great force, driving the price higher. The fact that two or more shadow candles have formed at the same level confirms the strength of the support and shows that the downtrend is likely to continue or turn into an uptrend.

Like the high tweezers, this signal is considered a short-term minor reversal pattern. To better understand its meaning, pay attention to these characteristics:

1When this model appears at the bottom of the market, it is more reliable.

2If the first candle has a high body and the second one has a short body, then the reversal will be more reliable.

3If the bottom of the tweezer is followed by another reversal pattern, such as B. an engulfing or bullish piercing pattern, with identical lows, this is even more reliable.

The Tweezers Top and Tweezers Bottom Patterns.

Tweezers Top

The Tweezers Top pattern appears in an uptrend. The first candle of this pattern should be a bullish candle with a large real body, followed by a bearish candle with a short real body. Both candlesticks must have the same high or their real bodies must be at the same high. The pattern is most reliable when viewed in the context of the larger price chart, with the pattern appearing at market highs or near resistance or trend lines.

tweezers Bottom

The Tweezers Bottom pattern appears in a downtrend, with the first candle being a dark bearish candle with a large real body, followed by a bullish candle with a short real body. Both candlesticks must have the same low or their actual body lows must be at the same level. The pattern is most reliable when it appears at market lows or near support levels or lower trend lines.

Advantages and Disadvantages: Using Tweezer Patterns at the Top and Bottom

Let's see the advantages of the upper and lower gripper models:

1Tweezer patterns are reliable price reversal patterns that put traders at the forefront of a new trend.

2The tweezers pattern can reliably indicate the mood of the buyer and seller.

3Tweezers of a necessary support and resistance level increase the trading accuracy of other indicators and methods.

4This trading strategy integrates well with other indicators.

5 There are also some drawbacks to using the top and bottom clamp models:

1It can be difficult to count on a trend reversal just by looking at two candles. The addition of high volatility suggests a very likely price reversal.

2When the tweezers pattern forms against a major trend, it may not work as well.

3Tweezer patterns occur regardless of market volatility and uncertainty.

4Investors should use indicators other than the tweezer pattern to increase accuracy.

conclusion

The candlestick patterns at the top and bottom of the caliper generally take on different appearances, but they do share some common characteristics that typically occur in market turns Read More...

Contact us

0 notes

Text

What is a Marubozu candlestick pattern?

What is a Marubozu candlestick pattern?

A Marubozu candlestick pattern is a stock chart pattern that can help investors gain insight into market sentiment at any time. Although Marubozu's model performs quite well when spotted, it remains relatively unpopular with investors. We take a look at the basics and key features of the model so you can start harnessing the power of this little-known stock market predictor. Marubozus are full-bodied bullish or bearish candlesticks with no upper wicks or lower shadows. Marubozus are usually green or white when they are bullish and red or black when they are bearish on stock charts.

What are the pros and cons of using the Marubozu candlestick pattern?

An important point to keep in mind when researching Marubozu candles is that while you should never trade in the same direction as the candles, you should definitely trade against them. Given the trading activity that is driving this pattern, if the market continues to move in this direction, you may feel crushed. History has shown that price rarely reverses immediately, consuming the movement of the candle. In this sense, the Marubozu model is excellent for demonstrating the market sentiment behind a currency pair. As these patterns develop, they can help traders gauge how forex traders view this pair overall, which plays a critical role in determining the price action of this pair in the near future.

However, sentiment is only one of the factors that influence exchange rates. For this reason, the Marubozu can be a frustrating source of false signals that incur costs for forex traders, deflecting potential price moves and setting up their trades for huge losses. For this reason, Marubozu models should be combined with indicators and models that assess trading opportunities based on other key metrics such as trading volume and/or resistance levels.

Why use charts to track stocks

Stock market charting activity is not a new idea. Analysts were charting long before the New York Stock Exchange (NYSE) was created, albeit in a more rudimentary form than it is today. Charts are used to create an easy-to-understand visual representation of stock market activity. Regardless of the reasons for decline or growth, graphs track changes and show activity over time. Even a casual investor can read charts once he understands the basics of what he is tracking. This gives the investor the information that he may need to make decisions based on what is happening in the market. Using charts, they can see what is overbought or oversold and decide whether to follow those trends or try to take advantage of less popular assets or dump high-demand assets.

Keep in mind, however, that the charts can track many different features. So be very careful with the information you see broken down. Some charts cover daily activity, while others may track weeks or months. To get a bigger, more complete picture, a trader may want to look at many different charts to see short-term and long-term changes before making decisions.

What does a Marubozu pattern tell you?

The Marubozu sends a strong message: the market is moving in one direction. If you break out the candle, you can see that the price of the asset is trading in one direction throughout the session.

This feature applies to both open and closed Marubozu candles, despite the small wicks on both sides, as the buying or selling interest was so strong that it overwhelmed the other side of the market. For bearish Marubozu candles, the pattern indicates that sellers are in full control as they dominate the session in the desired direction, and vice versa for bullish Marubozu candles. Marubozu is especially important when the candlestick is near resistance or support levels, as it can open on one side and close on the other, further amplifying the current trend Read More...

Contact us

0 notes

Text

Three White Soldiers Definition

Three White Soldiers Definition

The Three White Soldiers candlestick pattern is unusual in that its meaning depends on its context. However, the pattern itself is easy to spot. This training is simply three days in a row with a white candle, each higher than the last. The apparition is of three white soldiers standing in a row, hence the name. The bullish significance of this formation is easy to guess. But how reliable is this indicator?

This indicator is quite strong and very reliable in most situations, indicating an accumulation of bullish strength. For example, when a market is flat or moving mostly sideways, the three white soldiers indicate that the bulls are gaining ground. When the market has entered a downtrend, this candlestick pattern indicates a reversal. However, when the market is constantly progressing, the three white soldiers are considered less important. That's because they fit the current blueprint and aren't even really considered a sequel.

How to identify the Three White Soldiers Candlestick Pattern?

A three-soldier white candlestick consists of three long white royal bodies separated by two black royal bodies. The third long white body should be wider than the first two.

It is formed when three consecutive long candles are formed:

1The first candle must be black, which means that it opens above the opening price of its previous candle but closes below it.

2A second white candlestick should open above the close of the previous one and also close above your open position.

3A third white candle should form with a long body that should stay within or slightly above the range of your previous two candles for the day.

A three white soldier’s candlestick pattern indicates that prices have reached a temporary low after a prolonged decline. A break above the resistance level will confirm the uptrend reversal and suggest that prices will continue to rise. Therefore, the Three White Soldiers candlestick is most effective when used with other technical indicators. This is significant as it suggests a continuation of the uptrend despite several small pullbacks. Therefore, traders can use Three White Soldiers as a signal to enter long positions.

What does the pattern tell traders?

The Three White Soldiers candlestick pattern is a bullish reversal pattern. This indicates that the bears are losing control and a market reversal is very likely. In this pattern, each candle must be above the close of the previous candle, creating a ladder where each step is higher than the previous one. This upward movement of the pattern is actually an indication of the start of an uptrend.

As we have already mentioned, the model of the three white soldiers is a very solid and reliable model. This is especially true when used in conjunction with other indicators like the relative strength index. Therefore, it is also an excellent tool for trading strategies. However, traders must also consider other factors such as volume.

The Three White Soldiers pattern helps start or exit existing operations. For example, a trader may enter a long position when the Three White Soldiers candlestick appears on the chart and the next candlestick shows an open gap (the opening price is higher than the previous day's closing price). It is also useful for day trading where traders can also look for the three white soldiers on 5 minute, 15 minute or hourly charts. After initiating a long position, it is always advisable to set a stop loss at the last low and take profit whenever there are more signs of a trend reversal. Although it is quite rare to spot the Three White Soldiers candlestick pattern, it is a very useful pattern that traders should never ignore.

Difference between three white soldiers and three black crows:

The opposite of the three white soldiers is the candlestick pattern with the three black crows. Three Black Crows consists of three consecutive long-bodied candles that open at the real body of the previous candle and close lower than the previous candle. As three white soldiers capture the bears passing the bulls, three black crows show the bears taking control of the bulls. The same caveats regarding volume and additional confirmation apply to both samples.

The three black crows candlestick pattern is the opposite of the three white soldiers.

Three black crows consist of three consecutive bearish candlesticks.

On the other hand, three white soldiers indicate a change from bearish to bullish and consist of three consecutive bullish candlesticks Read More...

Contact us

0 notes

Text

Morning Star

The Morning Star

For the sake of simplicity, a bearish candlestick is one in which the stock's closing price is lower than its opening price, meaning that the price has fallen during the day. In contrast, a bullish candlestick is one where the closing price is higher than the opening price because the price has risen throughout the day. With that in mind, let us know as we take a closer look at the construction and key features of this popular candlestick pattern.

What is the difference between Morning Star and Evening Star candlestick patterns?

The main difference between the Morning Star and Evening Star candlestick patterns is that the Morning Star is considered a bullish indicator, while the Evening Star is considered a bearish indicator. The Evening Star has the center candle at a higher high than the two side candles with a gap up followed by a gap down, while the Morning Star has the center candle at its highest low with a gap down followed by a gap up.

An example of a morning star trade

Morning star patterns can be used as a visual signal of the beginning of a bearish to bullish trend change, but they become more important when they are supported by other technical indicators, as mentioned above. Another important factor is volume, which contributes to pattern formation. Typically, a trader wants volume to increase during the three sessions that make up the pattern, with the highest volume occurring on the third day. The high volume on the third day is often seen as a confirmation of the trend (and the subsequent uptrend) regardless of other indicators. A trader takes a bullish position on stocks/commodities/pairs/etc. a. while the morning star forms in the third session and doubles the uptrend until there are signs of another reversal.

Trading Morning Star Candlestick Pattern.

As mentioned above, the appearance of a morning star pattern is not as common as the appearance of a single candlestick pattern. They are more difficult to detect apart from the fact that you have to meet almost all four conditions before you can check them. In this case, we have the daily chart AUD USD. The price traded lower to the point of reaching a new short-term low. Before this candle, there is a long bearish candle that indicates a strong downtrend. However, the sellers fail to force a close near the session low and the price rises to create a doji candle, indicating indecision on the part of buyers and sellers. The next candlestick is a long bullish candlestick that forms the morning star pattern. We can now be almost certain that the bullish reversal will start soon.

The Difference Between a Morning Star and an Evening Star.

The Morning Star is a bullish reversal pattern found at the end of a downtrend. The first candle is bearish. The second candle has a small body. It doesn't matter if the second body is bullish or bearish (although a bullish body with little or no upper wick indicates more bullish power). The small body serves as an indicator that the bears are losing their ability to drop the market. It is also possible that the second candle has no body (a doji). The third body is bullish and closes within the first candle, preferably above the midpoint of the first candle. This shows that the bulls are taking control.

The Formation of the Evening Star Candlestick.

The Evening Star is the retrograde counterpart to the Morning Star pattern. The Evening Star is a reversal pattern and appears after an uptrend.

The first candle has a strong bullish body.

The second candle has a small body. It can be bullish or bearish. It is also possible that the second candle has no body (a doji).

The third candle has a strong bearish body and closes within the body of the first candle, preferably beyond the middle of the first candle in the pattern

Read More...

Contact us

0 notes

Text

Bullish Engulfing Pattern.

What is a Bullish Engulfing Pattern?

A bullish engulfing pattern is a white candlestick that closes above the previous day's open after opening below the previous day's close. It can be recognized when a small black candlestick indicating a downtrend is followed the next day by a large white candlestick indicating an uptrend, the body of which completely covers or engulfs the body of the previous day's candlestick. A bullish engulfing pattern can be contrasted with a bearish engulfing pattern. With a single candlestick pattern, the trader only needed one candlestick to spot a trading opportunity. However, when analyzing multiple candlestick patterns, the trader needs 2 or sometimes 3 candlesticks to identify a trading opportunity. This means that the trading opportunity develops for at least 2 trading sessions.

What Is a Bullish Engulfing Pattern?

To find bullish engulfing patterns, look for these two candlesticks side by side:

A small red candlestick, usually at the end of a downtrend.

A much larger green candle completely flooded the previous one.

There should be a gap between the close of the first candle and the open of the second candle. If not, then it's not a devour. What's happening? Essentially, the bearish run continues until the beginning of the second period of the pattern. The gap between the time frames shows that the selling sentiment is still quite strong. But then, mid-session, the buyers take over. They send the market sky high well past the red candle opening and hopefully start a new bull run. The longer the green body, the stronger the signal. Although they usually occur after downtrends, you can also see a bullish engulfment when a market is rising. This bullish continuation pattern is taken as a sign that the move still has strong momentum.

Understanding Bullish Engulfing Candlesticks

When a security closes at a higher price than the opening price, the body of the candle is colored green or left hollow and is referred to as a green or hollow candle. On the other hand, if the closing price is lower than the opening price, the candle is colored red or black and is called a red or black candle. A red candle indicates a downtrend and represents a bearish market phase. Sometimes a red candle is followed by a green candle, so the second day's open price is lower than the first day's close and the second day's close is higher than the first day's close.

Graphically we see that the green candlestick is engulfing the red one. This is a bullish engulfing candlestick pattern.

Example of a bearish engulfing pattern

If we look at the USD/JPY chart below, we can see an example of a bearish reversal. The green candle indicates the last bullish day of a slow market rally, while the red candle indicates the start of a significant decline.

The second candle opens at a similar level, but falls as the day progresses to close significantly lower.

Trading Scenario for Bullish Engulfing

Here are the general considerations and scenarios for trading the bullish engulfing candle.

Trade Entry – The formation of a bullish swallow during a downtrend is considered a reversal signal, meaning the market is expected to go higher in the near future. Traders therefore look to enter a long position at or around the price low of the bullish engulfing candlestick. However, since many traders like to wait for the confirmation candle to form, the buy price may be higher as the trend has already started to drive prices higher. This is the compensation you have to make.

Stop Loss Limit – The stop loss limit varies from trader to trader depending on their individual trading preferences, but they generally set the stop loss on long positions at 2-3 units below the lower price of the bullish engulfing candle. Others entering at a higher price may wish to adjust the stop loss accordingly.

Profit Levels – While actively trading short ranges, traders should follow a risk/reward ratio to determine the potential profit level of their bullish engulfing trading pattern. For example, if the stop-loss limit is set at $1 (the maximum loss one is willing to take on a trade) and the risk-reward ratio one is following is 1/2, then take profit when it reaches $2. If the risk/reward ratio being tracked is 1/3, aim to take profit when the price reaches a level that generates $3 for every $1 stop loss set.

Market Conditions – More volatile stocks with high beta values often tend to exhibit frequent bullish engulfing patterns. Therefore, the proper selection of stocks/ETFs/Indices is important when making bullish engulfing trades. In addition to the requirement of a bullish engulfing pattern mentioned above, traders should ensure that the chosen price range, band or trendline boundary is breached on significant moves of the second (and following) bullish candle. This guarantees a higher success rate of profitability. Although it should be noted that trading using technical analysis such as candlestick patterns has a limited success rate, it is advisable to adhere to strict stop-loss rules, disciplined trading and efficient capital management read more.

Contact us.

0 notes

Text

PIERCING PATTERN

WHAT IS A PIERCING PATTERN?

The piercing line pattern is considered a bullish reversal candlestick pattern at the bottom of a downtrend. This often results in a trend reversal when bulls enter the market and push prices higher. The piercing pattern features two candles, with the second bullish candle opening lower than the previous bearish candle. This is followed by buyers pushing prices past the 50% bearish candlestick body.

How a Piercing Pattern Works

A piercing pattern has two days where the first day is decidedly influenced by sellers and the second day is answered by enthusiastic buyers. This may indicate that the supply of shares that market participants are looking to sell has dried up a bit and the price has fallen to a level where the demand to buy shares has increased and increased. This momentum appears to be a reasonably reliable indicator of a short-term bullish outlook.

How to identify Piercing Patterns?

First of all, it should be considered that the pattern formulation should consist of 2 candlesticks. The second candle must be such that it starts below the low of the day 1 candle (which is inherently bearish). At the same time, it should close at the top of the middle part of the bearish candlestick. When the bullish candle of day 2 closes above the middle of the bearish candle of day 1, it forms a triangle. Also, it only appears during a downtrend, and price gaps at the beginning of day 2 are necessary. The formation of this pattern is unique in that it shows the reverse trend of the market when its appearance has not been accepted.

It also includes a lower spread after the first trading day, with the second trading day starting around the low and ending near the high. The close must also be a candle that covers at least half the length of the previous day's red candle.

Advantages of using piercing pattern

This method is easy to use and implement. Any investor or trader can implement this technique. This method generally offers its investors a better risk/return ratio. By paying attention and understanding this technique, investors can easily find entry points into the stock or index.

Disadvantages of using piercing pattern

The main disadvantage of this method is that it can only be used for a bullish reversal pattern. And to confirm the reversal pattern, this technique should be combined with oscillators and other technical indicators. One cannot fully rely on this model when making trading decisions. This involves analyzing the entire market movement and not just the candlestick pattern itself read more.

Contact us.

0 notes

Text

Hammer Candlestick pattern

What is the hammer candlestick pattern?

When the opening and closing prices are almost the same, it shows that the bulls have taken control of the prices. Since Hammer is a bullish reversal chandelier model, it should form at the end of a downtrend. The long shadow below shows that the bears initially pushed prices too low near the support. But then the bulls came along and eventually pushed the price higher and closed above the opening price. There is a difference between the hammer and the inverted hammer in terms of training. The inverted hammer candlestick is the inverted version of the hammer.

What does the hammer candlestick pattern tell you?

As seen above, Hammer forms after the stock price falls, indicating that prices are trying to bottom out. The hammers indicate that the bears have lost control of the prices, which suggests a possible reversal of the uptrend. It should be noted that this candle should form after 3 or more bearish candles as it gives more confirmation. Confirmation occurs when the post-hammer candlestick closes above the hammer close. This confirmation shows that the bullish return has occurred. Traders should only enter long positions after the confirmation candle. A stop loss can be placed at the bottom of the hammer shadow.

The Difference Between a Hammer Candlestick and a Doji.

A doji is another type of candlestick with a small real body. A doji means indication because it has both an upper shadow and a lower shadow. Dojis can signal a reversal in price or a continuation of the trend depending on the confirmation that follows. This differs from the hammer, which occurs after a price drop, indicating that a possible bullish reversal (if the confirmation path) has only a long lower shadow.

Limitations of Using Hammer Candlesticks

There is no guarantee that the price will continue to rise after the confirmation candle. A long gloomy hammer and a strong confirmation candle can push the price quite high in two periods. This may not be an ideal place to buy as the stop loss may be far from the entry point, exposing the trader to risk that the potential reward does not justify. Hammers also do not offer a target price, so it can be difficult to determine the profit potential of a hammer trade. The results should be based on other types of Japanese candlestick models or analysis read more.

Contact us.

0 notes

Text

Candlestick Chart

The 3 Most Powerful Candlestick Chart Patterns

Candlestick charts are a technical tool that groups data from multiple timeframes into individual price bars. This makes them more useful than traditional open-high, low-close bars or simple lines connecting closing price points. Candlesticks form patterns that predict the direction of prices when they end. Proper color coding adds depth to this colorful technical tool, which dates back to 18th-century Japanese rice traders. Steve Nison introduced Japanese candlestick patterns to the Western world in his popular 1991 book, Candlestick Charting Techniques.1 Many traders today can identify dozens of these patterns, which have colorful names like bearish cloud cover, evening star, and bearish cloud cover. three black ravens. Additionally, single bar patterns including Doji and Hammer have been incorporated into dozens of long and short trading strategies.

1. Spinning Top

When trading stock markets or other liquid and risky asset classes, profits can be maximized by spotting a change in trend and then moving it in the right direction. This is exactly what a gyro candlestick pattern does: it helps spot trend changes for the underlying asset. Highs are simple candlestick lines that have small real bodies with upper and lower bodies that are longer than the real bodies. In general, this is a small candlestick pattern (single candlesticks) where stock prices open and close together. The pattern forms at the top of an uptrend or at the end of a downtrend.

Unlike many other candles, a gyro can be a bearish or a bullish candle, which means that the color of the candle doesn't matter and therefore shouldn't be too important. It is important for the trader to wait once the gyro pattern has formed and see the next price move to bet on the direction of the market. Assuming an uptrend prevails and a trader sees a bearish candlestick shape following the gyro pattern at a resistance level, the exit point would be there. The interpretation, structure and logic of spins and doji are more or less the same. However, a gyroscope shows a larger candle body, highlighting the fact that there has been significant price movement during the candle's time frame. As shown in the photo to the side, shares of Tasty Bite Eatables Ltd. formed a gyroscope pattern and then saw a nearly 41% correction over 19 trading sessions.

2. The Piercing Pattern

A piercing pattern is a candlestick pattern that gives us potential bullish reversal signals and forms near support levels at the end of a downtrend. This pattern consists of two candlesticks, the first one is a bearish candlestick and the second one is a bullish candlestick.

The bearish candlestick should have a large real body and the second bullish candlestick should move below the low of the previous candlestick and close above the midpoint of the real body of the first candlestick. Investors should be aware of a few features when trading this bullish candlestick pattern – the ubiquitous pattern:

First of all, the trend should be down, as the penetrating pattern is a bullish reversal pattern.

Second, the length of the candlestick plays an important role in determining the strength of the reversal.

The gap between the bearish and bullish candles indicates the strength of the trend reversal.

Fourth, the bullish candlestick should close higher than the midpoint of the previous bearish candlestick.

Finally, the bearish and bullish candle should have larger bodies.

3 The Doji Candlestick Pattern

There are times when the forex candlestick is neither bullish nor bearish. Instead, it is a candlestick with short wicks and an insignificant body. It is shaped like a "plus" sign. The candlestick formed is called a Doji.

The best Japanese candlestick patterns for intraday trading

The doji appears on the charts when the market is temporarily undecided on which direction to go, up or down. In other words, it is neutral and cannot be used to trade a reversal or continuation.

So what makes this unbiased candle so powerful?

Its power lies in the positioning of the doji. You can find a doji almost anywhere on the charts, and each position says something important about the currency pair read more.

Contact us.

0 notes

Text

What is the relationship between PPO and MACD?

What is the relationship between PPO and MACD?

The PPO is almost identical to the moving average convergence divergence (MACD) technical indicator. Both are momentum oscillators, which measure the difference between the two moving averages. However, there are differences between the two listed below:

Difference between the two, PPO and MACD

Here, the PPO measures the percentage difference between the two EMAs, while the MACD measures the absolute difference (in dollars).

MACD(12,26,9) calculated the absolute difference between the 12-day and 26-day EMA. On the other hand, PPO(12,26,9) MACD goes a step further by showing the percentage difference between these two MAs.

Percentage Price Oscillator (PPO) Formula and Calculation

Use the following formula to calculate the relationship between two moving averages for a holding.

PPO=

26-period EMA

12-period EMA−26-period EMA

×100

Signal Line=9-period EMA of PPO

PPO Histogram=PPO−Signal Line

where:

EMA=Exponential moving average

Use with Sharp Charts

The PPO can be placed as an indicator above, below, or behind a stock's price chart. Once the indicator is selected from the dropdown list, the default parameter settings (12,26,9) appear. These settings can be adjusted to increase or decrease sensitivity. A slower long moving average combined with a faster short moving average increases sensitivity. The histogram can be suppressed by setting the signal line parameter to 1. This is useful when viewing the PPO behind a stock's price chart. Users can even add the signal line back by applying a 9-day EMA to the PPO. Click "Advanced Options" to add the moving average overlay for an indicator read more.

Contact us.

0 notes

Text

Balance of Power

Balance of Power (BOP)

It is an oscillator that measures the strength of the buying and selling pressure. The Balance of Power indicator is a technical analysis tool. It constantly measures the balance between the market power of buyers and sellers. This helps traders determine the prevailing mood at the moment. Traders can use this indicator to: When the indicator is positive, the bulls are in control; and sellers dominate when the indicator is negative. A reading near the zero line indicates a balance between the two and may indicate a trend reversal.

History

The Balance of Power (BOP) indicator was developed by Igor Livshin and later presented to the public through Stocks and Commodities magazine in 2001. The BOP measures price trends by measuring the strength of buyers and sellers in the market and determining what prices reach extreme ups and downs.

Calculations

To calculate the force ratio, use the following formula:

Balance of Power = (Close Price - Open Price) / (High Price - Low Price)

Takeaway

The balance of power (BOP) is known to oscillate around the zero centerlines, which ranges from -1 to +1. A positive BOP indicates dominance in the buyer's market, while a negative BOP indicates dominance in the seller's market. When the BOP is zero, it shows that the buyer and seller are the same in today's market.

Identifying Trends

An uptrend is indicated by an ascending BOP line and a descending trend by a descending BOP line. The transition from the zero line confirms the change in trend.

Price Differences

This is a negative spread if new price levels are reached, but not BOPs; if the price rises but the BoP does not, the price difference is positive. These differences can predict a change in trend.

Terms and conditions Overbought / Oversold

Chartists must look at historical levels of security that challenge them to determine what should be considered oversold/bought for that security. Once these stocks have been overbought/overbought for that security, look for declines beyond that read more.

Contact us.

0 notes

Text

Elliott Wave Theory

Introduction to Elliott Wave Theory

Ralph Nelson Elliott developed Elliott Wave Theory in the 1930s.1 Elliott believed that stock markets, which are generally considered more random and chaotic, were in fact traded in repeating patterns. In this article, we take a look at the history of Elliott's wave theory and its application to trading.

WAVES

Elliott has suggested that financial price trends system on the psychology of the dominant investor. He found that fluctuations in mass psychology always manifested in the same recurring or "vague" fractal patterns in financial markets. Elliott's theory is similar to Dow's theory in that they both recognize that stock prices move in waves. But because Elliott also recognized the "fractal" nature of markets, he was able to break them down and analyze them in much more detail. Fractals are mathematical structures that repeat themselves over and over on a smaller and smaller scale. Elliott found that stock index pricing models were structured in the same way. He then began to examine how these repeating patterns could be used as predictors of future market movements.

1st impulse:

Momentum is the most common motivational wave and it is also the easiest to recognize in a market.

Like all motion waves, the pulse wave has five sub-waves: three motion waves and two corrective waves called the 5-3-5-3-5 structure.

However, the creation of the wave is based on a set of rules.

If any of these rules are violated, the pulse wave will not form and we will have to rename the suspect pulse wave.

The three rules of pulse wave formation are as follows:

Wave 2 cannot go back more than 100% of wave 1.

Wave 3 can never be the shortest of waves 1, 3, and 5.

Wave 4 can never overlap with Wave 1.

2nd diagonal:

Another type of driving wave is the diagonal wave, which like all driving waves is made up of five sub-waves and moves in the direction of the trend. The diagonal looks like a wedge that can expand or contract. Also, the partial waves of the diagonal may not count to five, depending on the type of diagonal observed. Like other moving waves, each partial wave of the diagonal wave does not completely traverse the previous partial wave. Also, sub-wave 3 on the diagonal is not the shortest wave.

Diagonals can be subdivided into start and end diagonals.

The final diagonal usually occurs on wave 5 of a pulse wave or the last wave of corrective waves, while the main diagonal can be found on wave 1 of a pulse wave or wave A of a zigzag correction.

3. Zigzag:

The zigzag is a corrective wave made up of 3 waves called A, B, and C that moves sharply up or down.

Waves A and C are moving waves, while wave B is corrective (often with 3 sub-waves).

Zigzag patterns are sharp declines in a bullish rally or advances in a bearish rally that essentially correct the price levels of previous momentum patterns.

Zigzags can also be formed in a combination known as double or triple zigzags, with two or three zigzags connected by another correction axis between them.

Triangle:

The triangle is a pattern made up of five sub-waves in the form of a 3-3-3-3-3 structure called A-B-C-D-E.

This corrective diagram shows a balance of forces and extends laterally.

The triangle can expand, each of the following partial waves is enlarged or contracted, that is, wedge-shaped.

Triangles can also be classified as symmetric, descending, or ascending, depending on whether they point to the side, up with a flat top, or down with a flat bottom.

Partial waves can be formed in complex combinations. In theory, it may seem easy to spot a triangle, but it may take a little practice to identify it in the market.

Elliott Wave Trading Benefits

As a diagnostic tool for identifying potential business opportunities, Elliott Wave Theory offers value by providing a structure for organizing price action information into easy-to-understand graphical representations. With a broad understanding of the rules of this theory, even beginners can begin to use the theory to support their strategies.

At the same time, the popularity of Elliott Wave Trading is an advantage in itself: since it is rooted in consumer psychology, its relevance to forex trading is greatest when a large group of traders observe these patterns and act on them. they. information.

Disadvantages of Elliott Wave Trading

Despite its advantages, Elliott's wave theory also has limitations that can create complications and lead to inaccurate conclusions during business analysis. While Fibonacci models and similar tools provide clear indices and thresholds for traders to observe, Elliott Wave Theory is more subjective when it comes to identifying patterns. Traders must identify these patterns for themselves, and the price movements that mark the start and end of a wave can vary in interpretation from one trader to another. For this reason, some critics argue that this theory is too arbitrary to provide consistent advice for trading read more.

Contact us

0 notes

Text

What are Fibonacci Retracements?

What are Fibonacci Retracements?

Fibonacci retracements identify key levels of support and resistance. Fibonacci levels are generally calculated after a market has made a big move up or down and appears to have stabilized at a certain price point. Traders plot the key Fibonacci retracement levels of 38.2%, 50%, and 61.8% by drawing horizontal lines on a chart at those price levels to identify areas that the market could retreat to before recovering. initial price movement.

How does Fibonacci work in trading?

Before examining the mechanics of Fibonacci trading and how it translates into a Fibonacci Forex trading strategy, it is important to first understand the Fibonacci sequence and the unique mathematical properties it offers.

The Fibonacci sequence is a sequence of numbers in which after 0 and 1 each number is the sum of the two previous numbers. Lasts indefinitely.

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, 144, 233, 377, 610, 987, 1597, 2584, 4181, 6765 ...

There are some interesting relationships between these numbers that form the basis of Fibonacci number trading. While we can't cover all of these relationships in this article, here are the main ones to be aware of when looking at a Fibonacci forex trading strategy later on:

If you divide a number by the number above, you get approximately 1,618. This is used as a key level in Fibonacci extensions, as you will learn later in this article.

If you divide a number by the next highest number, it is approximately 0.618. This number forms the base of the 61.8% Fibonacci retracement level.

If you divide a number by two more digits, it gives approximately 0.382. This number forms the base of the Fibonacci retracement level of 38.2%.

1.618 is known as the golden ratio, golden ratio, or phi. The reverse is 0.618, and both numbers can be found in nature, biology, and the cosmos. In fact, William Hoffner of the Smithsonian Magazine said in December 1975: “The ratio of 0.618034 to 1 is the mathematical basis for the shape of playing cards and the Parthenon, sunflowers and snail shells, Greek vases and the spiral galaxies of the outer Greeks formed. much of his art and architecture on that relationship.

Trade Fibonacci Retracements

Every trader, especially a beginner, dreams of mastering the Fibonacci theory. Many traders use it to identify potential support and resistance levels on a price chart, suggesting that a reversal is likely to occur. Many are entering the market simply because the price has reached one of the Fibonacci ratios on the chart. Is not sufficient! It is best to research other signals before entering the market, such as reversing the candlestick patterns or oscillators that cross the baseline or even a moving average to confirm your decision.

Best Fibonacci Trading Strategies

Fibonacci retracement lines are often used as part of trend trading strategies. When a reversal occurs in a trend, you can use Fibonacci levels to place a trade in the direction of the underlying trend. The idea is that the price of a security is more likely to jump from the Fibonacci level to the original trend. Fibonacci levels can be useful when a trader is looking to buy particular security but has not seen a recent uptrend. In this situation, you may be waiting for a withdrawal. By displaying Fibonacci indices as 61.8%, 38.2%, and 23.6% on a chart, traders can identify potential retracement levels and enter potential trade positions.

The Fibonacci levels are used for different strategic trading names, the following:

1 Combination of Fibonacci retracement lines with the MACD indicator. This strategic research has crony of the MACD indicator that the price of a title touches an important level of Fibonacci. In this case, a position can be opened in the direction of the trend.

2 Combine the Fibonacci levels with the stochastic indicator. This two-line indicator is intended to help identify levels of overbought and oversold. The strategy looks for the key signals of the stochastic indicator when the price reaches an important level of Fibonacci. The two signals taken together indicating an opportunity to open a position.

3 The levels of Fibonacci retracement can be used over several periods, but are considered as the most precise over longer periods. For example, a retracement of 38% on a graph that has been completed is a more technical level that a retracement of 38% on a graph of five minutes. Learn more about choosing the right chart period.

Like for all the analysis techniques, the Fibonacci retracement levels are most effective, but they are used as a larger strategy. The combination of several indicators offers the possibility of recognition plus precisely the tendencies of the march and of adding the potential for profit. As a general rule, the more confirming factors there are, the stronger the trading signal read more.

Contact us

0 notes