Don't wanna be here? Send us removal request.

Text

Attention: Wealth Management & Brokerage Firms. PEGA’s CLIENT SERVICE has tailored solutions for you

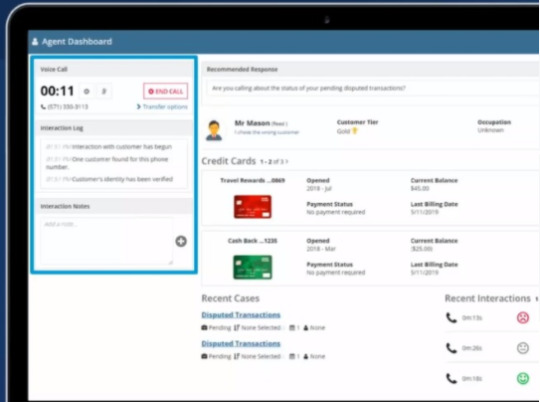

The value of client relationships cannot be overstated. Every client wants a frictionless experience that can meet their specific requirements in an automated manner. Hence, it becomes essential for businesses to deliver client-focused services while managing multiple accounts and processes. Brokers, advisors, and service representatives must offer high-touch service while growing their productivity and managing other processes professionally.

Pega client service for Wealth Management & Brokerage address the challenges financial firms face and streamline their client experience. It professionally manages all types of clients services, allowing them to develop client loyalty with optimal performance. They can easily manage multiple accounts without harming their performance and other processes.

What Does Pega Client Service For Wealth Management Do?

With Pega Client Service, Wealth Management and Brokerage, financial firms can manage

End-to-end client lifecycle management with personalised interaction & segmentation

A single view of the client to help your representatives know each individual

Streamline inquiry and service request management with intelligent process automation

Improve the performance of advisors with a role-based advisor desktop

Customize client experience and deliver proactive services

Remarkable Benefits Businesses Can Utilize With Pega Wealth Management:

Increase Business Agility

Pre-defined, easily configured processes, rules, object and data models, interfaces, and other application assets accelerate implementation time.

Simplify Operations to Maximize Productivity

End-to-end work automation boosts productivity by automatically reducing duplicate requests, delivering relevant documents, and intelligently routing, prioritizing, and tracking cases.

Engage Clients with Personal and Proactive Service

Omni-channel user experience transparently transitions activities across any channel and device, including phone, mobile, web, e-mail, chat, and social media.

Customize the client experience

Make every interaction an efficient, client-centric experience using context-driven processes to dynamically guide representatives through each step.

PEGA & Crochet Technologies

Pega is the leader in cloud software for customer engagement and operational excellence. The world’s most recognized and successful brands rely on Pega’s AI-powered software to optimize client experiences on any channel. Crochet Technologies (www.crochetech.com) is a silver partner of Pega and assists its customers across the globe achieving ROI on their Pega investments. Crochet has major clients in the Banking, Financial Services, Insurance & Government Sectors in India, Middle East, Europe, UK, Israel, Australia. Reach us today: [email protected]

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Looking for Automation In your Billing Inquiries Here is a Quick Solution !

Billing and payment issues act as a top driver of inquiries to customer service centers. Some issues repeat repetitively and are easier to resolve like customer profile changes or subscription cancellations. However, some inquiries are much harder to understand and handle such as an unexpected charge or first bill. Often, the greatest challenge is resolving the customer’s billing inquiries in an automated manner.

Undeniably, poor billing practices can drive away customers. According to a research, billing issues are so widespread that as many as 77% of customers have experienced some form of a billing problem, with two-thirds stating they would consider, or definitely switch providers, when one arises. It clearly indicates poor billing practice isn’t an issue businesses can just sweep under the carpet.

Billing Inquiry Microjourney:

A Microjourney is a single process that promptly allows business outcomes for multiple stakeholders across channels.

World leading low code automation software Pega’s Customer Service plays a vital role in understanding the Billing inquiry Microjourney to resolve customers’ inquiries. It helps customer service representatives (CSRs) answer the most common issues customers have when calling in about their bill. CSRs can use billing inquiries to efficiently compare changes line by line for any two billing periods.

Billing inquiry Microjournery gives important features such as previews of the next bill, explanation of taxes, summaries of billing changes, contextual information on hover, and indicators for one-time charges. All these features help you to resolve billing questions in an automated and quick way.

How Billing inquiry Microjourney in Pega Customer Service Helps Business?

The Billing inquiry case helps CSRs save time by bringing together all key customer billing details on a single screen.

Billing inquiry is a popular call type for communication companies and approximately represents about 50% of total call volume.

Companies can reduce call center AHT by using billing inquiries to overcome the friction CSRs encounter in supporting customers on billing inquiry calls.

Billing Inquiry Microjourney is available in web self-service channels

With Billing Inquiry Microjourney web self-service, customers can open a payment inquiry when they get a notification of a particular payment transaction. That notification holds the complete details of payment received by the bank. They can review the notification and identify missing data if any. When the customer uses the bank’s self-service channel to request a payment inquiry, the probable inquiry reason is prefilled.

Crochet Technologies

If you want to resolve billing inquiries quickly in your business, you must consider the Pega Customer Service to resolve Billing Inquiry Microjourney. To implement this service successfully we at Crochet Technologies can help you. We are a Global Information Technology (IT) Services and Solutions company and offer end-to-end services from business consulting, development, design, and managed support in Pega space.

Crochet has worked with many leading banks and financial firms. Our hands on tech teams are experts to understand the specific requirements of a business and serve them in the most relevant solutions.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Appian Cloud Native RPA – Now Automate Your Business, Anywhere

Today, more and more businesses are embracing Robotic Process Automation (RPA). It is considered the fastest-growing enterprise software, with revenue. According to Gartner, in the last few years it increased businesses revenue by 63.1% to $846 million.

Despite these notable figures, due to certain limitations, we have not yet reached the peak of where this emerging technology can take the businesses, though it has potential to transform global enterprises.

To enhance RPA adoption, technology should be more widely accessible and easily scalable. It should capitalize on built AI, enabling an intelligent RPA platform that’s more intuitive to use and more powerful in capability.

Appians cloud-native intelligent RPA is a platform that is simple to use, access and works with all applications, whether on-premises or in the Cloud.

Appian Cloud Native RPA

Cloud-native RPA is more than just virtualizing your on-premises application and delivering it via the cloud. It involves extensive reengineering to the design, implementation, deployment, and operation of your applications from scratch that enhance the significance of RPA.

Appian Cloud-native RPA delivers secure, highly governed automation to the entire enterprise. It helps companies to streamline and automate their business process and drive the best outcomes in business.

Salient Features Of Appian Cloud Native RPA

Effective Governance Policies – Appian helps you to build strong project governance policies. With these policies, you can centrally manage, monitor, and deploy bots across the organizations.

Powerful Exception Handling – You can easily manage the exceptions and ad-hoc activities with Appian cloud-native RPA services.

Optimize digital workforce operation cost: You can build unlimited bots and easily deploy in any environment; Linux or Window. This will reduce the cost of operating a digital workforce.

Detailed Audit Trails: It provides you leverage to get complete visibility into every RPA process. Additionally, you can take action and optimize your digital workforce seamlessly.

If you are planning for a Long Term Business Impact by Reducing Cost, Increasing Customer Satisfaction & Delivering Customer Success, you must consider APPIAN RPA.

To help you evaluate this product you can reach Crochet Technologies. Crochet is partners with worlds leading low code automation platform APPIAN which offers this cloud native intelligent RPA.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Are You Finding it Difficult Managing your Bank’s Lending Process? We may have a Solution!

Still there are many banks, financial lenders and insurance companies who track their outstanding dues and their sales activities in spreadsheets, calendars, and notebooks without a centralized system. It’s quite difficult for management to measure progress or develop predictable forecasts. They need a unified loan management platform that can enable them to assimilate information and launch loan applications across a variety of channels and categories.

By acknowledging these facts, Appian offers reliable solutions that efficiently automate lender processes and integrates multiple system interactions. These solutions are developed to simplify loan processes, improving user experience, and automate reporting and compliance.

Appian Loan Origination:

Appian Loan Management solutions help businesses in the entire origination process, from application to funding. These solutions come up with many benefits for organizations that efficiently drive more revenue such as:

Reduce complexity and enable faster funding to speed loan origination

Assimilate data from disparate sources and stakeholders

Serve customers in a better way

Appian Loan Management:

The dynamic regulatory environment and complex loan process make it challenging for the financing sector to manage loan activities accurately. Due to the mismanagement of loans, they have to face loss in lending volume. Appian loan management solution can efficiently address these challenges and serve them with the following capabilities:

More visibility to third-party collection providers for the overall management of at-risk programs

Integrate legacy systems and different data sources for more agile reporting and decision-making

Adhere to local, product and customer-specific regulatory guidelines

Trusted By Leading Banks & Financial Industries:

Bank of Tennessee competes with large national banks through superior speed and customer responsiveness by involving Appian loan origination solutions. They have experienced an enhancement in the efficiency of straight-through processing using the platform’s integrated business rules, alerts, escalations while building a mobile and social strategy.

Similarly, Appian is trusted by many leading lenders, i.e. Addiko bank, Bendigo bank, Commerce bank, City National bank and many others.

Crochet Technologies

Crochet Technologies is a Global IT Solution & Service company that streamline and automate different business processes with the partnership of Appian. Crochetech provides end-to-end business services to the Banks,Insurance, Financial services & Government sector. With Crochet’s deep business acumen, world-class project delivery and leadership capabilities and most importantly Appian partnership, you can adopt the advanced features of Records technology in your organization and abolish data silos.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Turn Your Business Risks Into Opportunities With Pega AI

Today, Artificial Intelligence has become the key driver for transforming the banking industry, saving time, increasing revenue, recognizing risks and frauds. It can simplify complex decision-making processes, which is why it is a catalyst for transformation in the financial and banking industry. It allows onerous and time-consuming tasks to be performed more accurately and can give management teams depth of insight that was never available before. This is why the most leading banks are investing in Pega Artificial Intelligence.

How Does Pega Artificial Intelligence Help Financial Firms?

Today most banks and financial firms rely on Pega Artificial Intelligence and the reasons are very clear. They can smoothly operate their business and utilize the following capabilities of Pega AI:

Streamline and automate complex business processes

Create a quick and efficient decision-making process

Manage complex investigation cases

Smoothly handle the unstructured data

Improve fraud identification and eradication process

Automate & accelerate the sales process

Simplify customer dispute process

Deliver Customer satisfaction services

Pega AI – A Risk Management Tool For Financial Firms:

Artificial Intelligence is a game-changer for risk management in finance as it provides effective solutions to identify potential risks and fraud.

The financial crisis of the past decade created financial services industries with a lot of obstacles with credit-challenged consumers. Before the digital revolution in the financial services industry customer intelligence was based on some comparatively simple heuristics, the customer value data was obtained through focus groups and surveys of consumer behavior the consequences of which didn’t always resemble reality.

Pega AI gives businesses access to really large amounts of data about consumers’ behavior and requirements. For risk management, banks can use cognitive technologies to gain competitive advantage and use risk to power their organization with the help of Pega AI solutions.

These solutions are able to fuel financial institutions with trusted and timely data for building competence around their customer intelligence and successful implementation of their strategies.

From the above-mentioned factors, it is clear that Pega Artificial Intelligence (AI) can transform the way financial firms and banks interact with money. They can streamline and optimize processes ranging from credit decisions to quantitative trading and financial risk management with the help of this advanced technology. Thus, investing in Pega AI will help them to add value in business and generate good revenue outcomes seamlessly.

Crochet Technologies

If you want to implement this advanced technology, Crochet Technologies can help you.

We are a Global Information Technology (IT) Services & Solutions company and a silver partner of Pega. We have worked with many leading banks and help them to streamline their complex business processes. We offer end-to-end services from business consulting, development, design, and managed support in Pega space. With Crochet’s deep business acumen, world-class project delivery and leadership capabilities, we assist companies in obtaining best cloud results for keeping business data safely

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Launching A New Product? We Can Streamline Your Launching Process!

Frequent changes in the banking and financial industries make it challenging to match the pace of the current market. New technology, improved regulation, and the development of digital channels have come together to make an interesting time for banks & financial industries.

Introducing new products is now hyper-paced for every financial business and more essential to success than ever. Remaining relevant, maintaining growth and introducing new markets can expand profit potential. If the financial firms want to drive great revenue in the business, they should introduce advanced technologies and feature-enriched products in the market. The process of launching new products is full of challenges.

But now you can implement this process quite smoothly and error free with Appian low code platform for new business and product launch.

How Does Appian Help In New Product Launch?

The financial institutions can manage the full lifecycle of introducing new banking products and services from concept to post-launch monitoring and optimization. They can improve the product launch process by real-time monitoring of product launch processes, tasks, and statuses.

Also Appian’s enterprise low-code application platform helps them to accelerate time to value through streamlined processes and orchestrated launch tasks. They can successfully launch a new product by just considering country-specific launch sequences and regulations

What Benefits Industries Can Utilize With Appian?

Appian low code platform helps financial industries in various ways:

Automate product launch process

Efficiently manage the campaign

Deliver intelligent process automation

Give actionable information views

Real-time collaboration

Coordinate activities and approvals

Provide secure access to vital information

Crochet Technologies: www.crochetech.com

In a nutshell with the right implementation of Appian low code Platform, Crochet Technologies can help you create Long Term Business Impact by Reducing Cost, Increasing Customer Satisfaction & Delivering Customer Success.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Why KYC & Onboarding Is Essential To Financial Service Providers & Their Customers?

Do you know what are the parameters that a customer usually uses to decide the experience with a new bank and insurance service provider? The answer is the onboarding process. To put it utterly, this process plays a vital role in setting the tone for the client’s overall experience with the bank or insurance service provider. Furthermore, in today’s time of important Know Your Customer or KYC norms, it is equally valuable to collect KYC data that will help for the ongoing maintenance and management of the account. Today, digital data banks like Aadhaar, NSDL, CKYC repositories, etc, and regulatory bodies make it compulsory for performing e-KYC via biometric authentication.

Significance of CRM For KYC and Onboarding For Financial Service Providers:

Different financial services providers, whether be it banking or be it insurance mandated responsibility to understand their customers and negotiate the risks they pose before offering services. When the prospective customers lack any kind of testimony, or when their identification is challenging to authenticate, it becomes tough for service providers to deliver the necessary Customer Due Diligence (CDD) on them. Then, this can appear in two restrictions on financial inclusion:

On the demand side: Lengthy or embarrassing onboarding systems can discourage potential customers from signing up for financial services, and

On the supply side: Expensive customer identification and due diligence systems can give low-income customers profitless, compelling the size of the viable market.

Effective and powerful CDD systems fix both these concerns. Here is where KYC and onboarding become the best solution to banks and insurance providers. Although more complicated to perform than conventional KYC, it encourages plenty of benefits in the long term like lesser man hours, cost reduction, developing the record-keeping system, and as a macro view, also advance financial inclusion.

Significance of CRM For KYC and Onboarding For Customer

KYC and onboarding of the customers come up with different aspects:

Require no paperwork or waiting time for accounts to be opened

No more queuing up at bank branches to submit paperwork

No wasting time and effort in multiple follow-ups and innumerable other processes that the customer had to undergo until some years ago.

Due to CRM for KYC and on-boarding, opening a bank account or applying for an insurance policy has become completely hassle. All it requires is just a few minutes and some basic details and you are all set to go.

Crochet Technologies:

If you are finding the CRM solutions for KYC and onboarding, Crochtech Technologies is what you need. Crochtech Technologies is the silver partner of Pega and can help your business with the KYC or onboarding requirements. Crochet Technologies is a Global Information Technology (IT) Services and Solutions company that puts its hard efforts to streamline and automate your business processes

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Achieve Your Business Success with Pega Cloud Computing

The organizations that seek to enable applications to scale with consistent performance and meet a quickly evolving security landscape rely only on cloud computing. For businesses, migrating customer engagement and digital process automation applications to the cloud need an architecture developed for the task. And here comes the significance of Pega Cloud services.

What are Pega Cloud Services?

Pega Cloud Services is a managed cloud that offers the tools, environments, and operational support established for the organizations. The purpose of these services is to enable businesses to provide applications and value to their organizations quicker. With the help of Pega Cloud services, clients can deploy their cloud globally on secured infrastructure to meet severe security and compliance requirements.

What You Can Find In Pega Cloud Services?

Cloud-based microservices in Pega Platform:

Pega Platform uses container technology to provide Elasticsearch as a microservice. This change shows how the Pega Platform is developing into a cloud-native application.

Development of global footprint with support for the AWS Stockholm region

Improved reliability & Streamlined Upgraded Processes

Now with the latest Pega Infinity™ release features, clients can optimize their business goals and processes. In addition to that, Pega Cloud Services infrastructure improvements drive the following advantages:

Automatically upgrades the database to Amazon RDS PostgreSQL 11.4

Clients’ global footprint expansion with support for the AWS Mumbai region

Support Cassandra 3.11.3 to enhance the system’s reliability & reduce memory footprint

Salient features Of Pega Cloud Services:

Comprehensive, global client support

Predictive Diagnostic cloud – Focus more on action not on management

Improved connectivity and networking solutions

Integrate with scalability, security and stability

Deliver apps more quickly without compromising the quality

Pega’s Happy Client Stories

Xchanging is a business process and technology services provider and integrator, owned by DXC Technology. It provides technology-enabled business services to the commercial insurance industry. They have observed the drastic changes in their business with the adoption of Pega Cloud services, such as:

Improved regulatory control

Enhanced application security

Decreased transaction settlement time from months to seconds

Enhanced client operations by 50%

The Royal Bank of Scotland (RBS) is a major retail and commercial bank in Scotland. With the implementation of Pega, RBS has experienced important performance improvements including:

5X Increase in digital lending

20% Improvement in balance retention

35% Fewer impressions (waste)

21 Channels integrated in 4 years

Crochet Technologies

Crochet Technologies is a Global Information Technology (IT) Services and Solutions company.

Crochet’s Pega competency helps streamline and automate business processes across industries. We offer end-to-end services from business consulting, development, design, and managed support in Pega space. With Crochet’s deep business acumen, world-class project delivery and leadership capabilities, we assist companies in obtaining best cloud results for keeping business data safely.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Pega Workforce Intelligence – Smart Approach To Track Employee Activities

If you are operating a business, there is a list of questions that essential to consider to achieve successful results in terms of productivity and revenue, like:

Where are your employees using their time?

How are the different processes implemented in your company?

How much duration are your employees spending on ‘Off-Time’?

Remember self-reporting will never tell you the reality!

Time and motion studies are expensive and slow, yet incomplete as it’s tough to determine things like manual workarounds that may hide broken processes, applications that cause wait time, and digital disturbances that can take employees’ eyes off the ball.

What Can Be The Solution?

The most effective and reliable solution to manage such things is adopting Pega’s workforce intelligence feature. Start by deploying Pega’s workforce intelligence bots on the desktop and these AI-powered discovery bots will work around the clock, collecting information. This way, you can get a full view of employees’ day.

Desktop information shows application usage, processes performed, and more. All this information helps managers to understand the hindrances and distractions that weaken productivity.

More About Pega Workforce Intelligence

Pega Workforce Intelligence takes the actionable insights that you have to quantify and evaluate productivity and performance across your organization. With these insights into employee workdays and their use of the technology & processes on their desktops, you can easily evaluate the employee productivity. You can understand how and when work is performed and identify opportunities to optimize productive work and overall productivity.

Workforce Intelligence with the unique ability to collect a “day in the life” view of your workforce transforms this data into operational insights into the productivity, efficiency, and technology hurdles that are challenging your workforce.

Features Of Workforce Intelligence

The list of salient features of Pega Workforce Intelligence that makes it best to choose:

Analyze employee workflow

Effective opportunity finder in business

Unleash people insights

Focus on improving productivity

Identify digital distractions

Workforce intelligence for CRM

Uplift customer experience and agent performance

Benefits Of Workforce Intelligence

With Pega’s Workforce Intelligence, you can explore the following benefits in organization:

Quick and Easy installation

No instrumentation is required. Immediate data collection.

Insights within a month

Get opportunities for coaching, automation, and or technology improvements.

Accelerate impact

5-15% productivity growth by starting with coaching or add RPA and RDA automation to increase value

Guaranteed! ROI begins in 30 Days

Workforce Intelligence delivers value within 30 days of implementation. You can drive great ROI in your business.

Success Stories Of Pega Workforce Intelligence

A multinational e-commerce company Radial, Inc. uses Pega Workforce Intelligence to understand its workforce productivity. After involving this feature in business, they observed many exciting results. Workforce Intelligence makes the job of agents and customers quite easy. They find a noticeable improvement in productivity.

A multinational professional services Ernst & Young Global Limited, commonly known as Ernst & Young or simply EY has observed the improvement in employees’ performance by adopting Pega Workforce Intelligence. You may watch their video for more detail on Pega Workforce Intelligence official page.

Crochet Technologies:

Crochet Technologies is a global partner of Pega and successfully delivers the best solutions to Banking & Financing services, Manufacturing, E-Commerce, Government & Logistic industries. Crochet provides its core specialized business process management (BPM) consulting and advisory services to worlds leading Fortune 500 & UK FTSE 100 companies. With focus on driving digital transformation through lean & technology-driven approach, Crochet has gained popularity with its Cloud Services offering.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Accelerate your Client Onboarding Process with Automation

Often Banking & Financial service organizations face multiple challenges during client onboarding due to isolated systems and unproductive systems. This not only affects their productivity and morale of the employees but also adds to the frustration of the customers who go through these mundane manual tasks. These fragmented processes leave the customers disappointed and end up with huge operational expenses and missed opportunities to cross-sell/up-sell.We as partners of Pega enable such organizations to automate and optimize their new business and account maintenance processes through PEGA’s Know Your Customer (KYC) and Onboarding Solutions.

What Does Pega KYC and Onboarding Do?

Pega KYC and Onboarding solutions bring the power of robotic automation to speed client onboarding processes that help in delivering:

Best client onboarding experience

Reduce the processing time

Reduce operational expenses

Accelerate time to market

Improve revenue for the business

Quick response to change

Global Banks & Financial Institutes Add Value To Their Business With Pega KYC & Onboarding

By joining Pega Robotic Automation with in Pega KYC, global banks and financial institutions can automate manual tasks in onboarding and KYC remediation processes to enhance the customer experience.

Global bank and financial executives reconsider their onboarding, and KYC processes, which are identified as the most expensive and time consuming steps banks have to manage. Pega KYC & Onboarding can streamline and coordinate these end-to-end processes from client adoption, new product, and right onboarding, and KYC, to legal, fulfillment, and offboarding on a single solution.

The good news is that now Pega KYC provides more productivity improvements with Pega Robotic Automation by offloading high-volume, low-complexity onboarding, and KYC tasks that affect banks and financial industries. For the very first time, banks can perform these tasks more efficiently and quickly to ensure speedy delivery and minimum time to transact with unified robotic automation capabilities.

Pega KYC & Onboarding – Ease The Workload Of Global Banks & Financial Service Providers:

Here are the top reasons how Pega KYC & Onboarding helping global banks and financial service institutes in easing their workload:

Minimize time to market and eliminate manual data entry failures in large-scale KYC remediation projects

Streamline user tasks from front to back office

Cut costs by an additional 20 to 50% by combining robotic automation with Pega Client Lifecycle Management optimized target operating model

Final Words

Pega onboarding, KYC, and CRM are built on the Pega 7 platform, which gives business-friendly tools to make application development 8x quicker than traditional coding. Pega operates in the cloud or your centers to keep your system updated. It is the only solution that offers the scalability required for full client lifecycle management.

Crochet Technologies

Crochet Technologies is a Global IT Solution & Service company that automates complex business processes and helps in building a strong relationship with customers with the silver partnership of Pega. Crochtech provides end-to-end businesses from Insurance, Financial services providers to Government. With Crochet’s deep business acumen, world-class project delivery, and leadership capabilities and our Pega partnership, you can advance with KYC & onboarding services.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Does Your Sale Need A Lift? Try Pega Sales Automation

Mobile devices are emerging as a powerful tool providing phenomenal opportunities to the sales team. These devices offer fantastic opportunities for sales representatives and managers to automate different processes and perform an array of work like checking email and schedules tasks, sharing files, accessing documents and collaborating with their co-workers effortlessly.

That’s why every well-developed organization considered mobile applications the most reliable and efficient platform to achieve success in lifting sales.

The purpose of providing mobile devices to the sales team is usually getting the deft and diligent performance. Improvement in sales performance depicts that you’re saving the time it takes to get things completed that ultimately ends in financial savings for the business.

But, the substantial fact is that you don’t have to settle for just boosting productivity. You have to look for solutions that can aggressively drive more sales and energize your sales teams. And, for this purpose, Pega Sales Automation which works equally seamlessly on mobile can be a game-changer.

The Pega Sale Automation application is specially designed for the mobile sales rep or manager and gives an intuitive user experience to automate and streamline common sales activities. In addition to that many other features of this application make it a perfect tool to choose.

Salient Features Of Pega Sales Automation:

Automate & accelerate the sales process

Less time on updating system or hunting content

Instant access to important sale info

More time with potential customers

Keep progressing sale efforts 24×7

Online & offline access to sale reminders

Informed actions in real-time

Seamless customer experience

Improve sales management performance

As responsive as on the desktop version

Easy to use application

Crochet Technologies is a trusted silver partner with PEGA and has successfully delivered on Sales Automation requirements in Banking, Financial Services, Insurance, Government & Telecom clients. While building the application, their primary focus is always gathering information about clients’ current objectives and then applying the best practices to action.

More About Crochet Technologies

Crochet Technologies is a Global Information Technology (IT) Services and Solutions company.

Crochet’s Pega competency helps streamline and automate business processes across industries. Crochet offers end-to-end services from business consulting, development, design, and managed support in Pega space. With Crochet’s deep business acumen, world-class project delivery and leadership capabilities, we assist companies in making the most of BPM investments for driving their business value.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Don’t Waste Time! 3 Facts Until You Reach Your Case Management Needs

Whether it’s a small business or an enterprise, everyone faces the common challenge of maintaining lengthy, time-consuming documentation track of records.

For instance,

In the finance industry, customer needs are addressed, cash flow is managed, inventories are conducted, among other things.

In the field of medical industries, patients must be partnered with the correct physician, provided reliable services, supplied medication, and given accurate documentation of their medical history.

In law firms, they have to answer client questions, refer clients to a suitable lawyer, handle simple to complex cases, schedule court cases, and perform required documentation of all cases.

Well, all these are quite complicated processes that are extremely collaborative and information comprehensive. For smooth and correct implementation of these tasks, you have to choose a system that can complete them in an automated and efficient manner. Case management is the perfect solution to this.

1. What Is Case Management Software?

“Case management” is a subjective term that indicates various things to different people. It can be as easy as a contact management and organization application. Or, it can be as complex as an end-to-end legal platform which allows you to investigate every action on a case. Basically, case management software is driven by data the information you collect from multiple sources. This comprises:

Case documents

Clients

Third parties, or more

Or in technical words, case management software is a data-driven solution that lets you efficiently implement your legal processes by managing each step on a data level.

What actually case management performs for the companies?

Case management comes up with a dynamic structure for implementing non-routine unpredictable business processes that lack coordination of multiple tasks and difficult decision-making.

2. Remarkable Benefits Of Case Management Software:

Effective resolution of cases

Case management software gives one solution to manage multiple cases. This improves productivity and efficiency.

Enhanced transparency

Its workflow elements contribute to enhanced transparency in all processes.

Customized customer care

Customers are given a more customized experience through various means like analytics, live chat software, or messaging apps. Customer profiles can be pulled out so customer service reps can accurately fix the queries of the customer.

Prompt access to information

An integrated system advances up searching for information required to solve a case.

Self Service Portal

Some case management systems can be utilized to give customers self-service portals that allow them to fix issues on their own.

3. What To Look For In The Case Management System?

As there are many case management systems available in the market, but it’s essential to choose the one that exactly meets your business’s tracking, communication, and reporting requirements. And while features are valuable to look at when selecting which system to choose, there are vital questions to analyze:

Does the provider give quality, ongoing support?

Can the system be configured to match your industry’s unique demands?

Can the software grow and adapt to your industry?

Is it accessible to recover and report on the data you gather?

Can you make minor system modifications without having to go through the provider?

The Best Case Management System Provider:

We compared many softwares and basis the above-mentioned factors, we found Pega is the best award-winning case management solution that has multi industry niche experience handling complex processes quite smoothly. The solutions are specially designed to address the challenges companies are facing nowadays with a simple low code approach.

In a nutshell, if you want to run your business smartly through a reliable case management software, you can consider Pega! We are silver partners for Pega and can help you assist your business with your Case Management needs.

Crochet Technologies is a Global Information Technology (IT) Services and Solutions company. Crochet’s Pega competency helps streamline and automate business processes across industries. Crochet offers end-to-end services from business consulting, development, design, and managed support in Pega space. With Crochet’s deep business acumen, world-class project delivery and leadership capabilities, we assist companies in making the most of BPM investments for driving their business value.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Unlock The Secret To Everlasting Customer Relationship through CRM Solutions

Well-said by a great businessman, “There is only one boss, The Customer.” Any company can find unpredictable obstacles in their path, but those who place their customers’ on top priority can handle them successfully. One of the lessons 2020 has taught businesses is the importance of developing sound relationships with customers. With the strength of strong customer relationships, businesses can stand in the market even in the COVID-19 like situation. This simply depicts to drive successful outcomes in your business, you need to be focused on improving customer services. When it comes to improving customer services, the CRM system is considered the most effective tool to keep the businesses organized and customers satisfied. The system helps the business to engage their potential customers from anywhere, anytime, or on any device rather than just making them wait over the phone.

How CRM helps in improving customer services:

CRM tools are specially designed with a number of advanced features and functionality that help the business to improve productivity and build a sound relationship with the targeted audience. In addition to this the most business CRM systems have case management functionality that enables agents to track & manage professionally:

Customer Contact Information

Correspondence

Documents

Conversations

Billing Information

CRM system offers many leverages like LIVE chat or more to the service agents that help them in making a good relationship:

Engagement Through Different Social Media Platforms:

One of the best benefits agents can utilize with CRM software is social engagement with customers. Agents can distinguish the key social media influencers within their customer community, and get vital marketing insights applying the built-in analytics that are usually given by CRM systems.

Knowledge Management Portals

Another remarkable feature of CRM systems is knowledge management portals for customer self-service. These portals allow customers to reach FAQ or troubleshooting items(usually articles) without the help of an agent. Some CRM solutions also allow organizations to provide customers with their online communities where they can invite each other for help, provide feedback, and even voice their plans for new services or products.

Crochet Bespoke CRM Solutions

Crochet Technologies is a Global Information Technology (IT) Services and Solutions company. Crochet’s helps streamline and automate business processes across industries. Crochet offers end-to-end services from business consulting, development, design and bespoke CRM & enterprise solutions. With Crochet’s deep business acumen, world-class project delivery and leadership capabilities, we assist companies in making the most of digital transformation CRM investments for driving their business value. We have clients across Banking and Financial Services, Manufacturing, Telecom and Public affairs. We create AI-powered CRM applications that helps small and large enterprises to revolutionize their customer engagement with end-to-end automation.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

American Bank FINED by Regulator for Lapses in Digital Transformation

Digital Transformation is the use of new, fast and frequently changing digital technology utilizing process, people and automation to solve business problems. It is about transforming processes that were non digital or manual to digital processes to enhance business performance through DATA. However, often digital transformation when not implemented correctly could lead to potential disruption in business and result in playing puppets in the claws of the Regulator.

This is exactly what happened on August 6, 2020 when the Regulator Office of the Comptroller of the Currency (OCC) fined an American Bank with multi-million dollars as penalty for failure to implement cyber security and digital transformation efficiently before migrating their IT to the cloud environment.Data in excess of 100 MN individuals in the US & almost 6 MN individuals in Canada was exposed to a security breach by an unauthorised access as admitted by the Bank. Millions of American Dollars & the ugly encounter with the regulator for violating strict data privacy laws led to the organisations reputation at stake, all which could have been avoided.

There are innumerous automation product softwares available just a click away at the disposal of the organisational leaders. These software not only mitigate the risks by identifying, assessing, monitoring and generating threats alerts but also provides suggestions to further tighten and improvise policies, processes, and controls.

Crochet Technologies is a reputed partner with PEGA & APPIAN BPM Softwares who believes in creating “Cloud First” mentalities. They have unmatched capabilities and claim more than 50 years of combined BPM experience. With their thorough understanding of the regulatory process, it’s not a surprise to see most of their clients in the Banking & Financial Services Industry trusting them with their BPM needs. Having historical heritage partnerships with Pegasystems who has great engineering expertise, Crochet has immense consulting experience helping oransationsations evaluate their cloud needs and then recommend best practises to migrate in a Cloud based environment to meet their digital transformation goals. Carefully managing the process risk capabilities, mitigating regulatory operational risks & implementing best practices timely makes them different from the crowd in the Cloud.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Appian Intelligent Contact Center – A Revolutionary Platform For Smart Enterprises

Customers come with expectations and businesses have to innovate newer ways of handling customer queries with more personalised and seamless experience.

Customized experiences, quick response and absolute engagement are the factors that customers expect in return for their loyalty. But contact centers are saddles with manual processes that consume lots of time, disconnected channels, and siloed data.

All these end up with poor customer experience!

Business leaders are expected to drive the daunting tasks of meeting these customers demands with speed, empathy & success. How do you achieve that?

The answer is pretty simple: Automation

If you want to deliver a fantastic customer experience, you must transform your contact center with an innovative platform that lets you swiftly deliver an integrated customer experience across channels and customer touchpoints. This is where Appian Intelligent Contact Center can help you.

Who is APPIAN?

Appian is a recognized global leader in multiple enterprise technology markets. Markets called intelligent business process management systems (iBPMS), dynamic case management (DCM), digital process automation (DPA), and low-code development.

Who is Crochet Technologies?

Crochet Technologies is a Global Information Technology (IT) Services provider and a trusted partner of Appian that offers strategic technology partnerships to support the clients with Intelligent Contact Center needs for a better future. With years of BPM experience, Crochet leverages its technical skill sets in driving digital transformation goals through delivery & implementing BPM consulting, advisory & tech solutions shaping the organisations to achieving their ROI on existing investments efficiently & effectively.

Regardless of what you call it, we work for the same goal

We’re here to simplify what it takes to turn great ideas into powerful business applications that deliver significant value.

What APPIAN Offers:

Low-Code Cloud Platform

Design brilliant applications that match advanced security features, confidentiality, and compliance controls by embracing a cloud strategy with a low-code application development platform.

Intelligent Automation

Automate work, integrate systems, orchestrate processes and apply business rules with key technologies – Artificial Intelligence (AI), Business Process Management (BPM) and Robotic Process Automation (RPA)

Omni-Channel Engagement

Turn multi-channel support into an omnichannel environment by integrating email, chat, voice, SMS into a single interface

Enable agents to handle multiple digital channels at a time.

Provide agents a broad view of the customer journey, create rewarding experiences, and promote lasting customer loyalty.

Dynamic Case Management

Use case management to unify the interactions between people, processes, data, and content.

Get a consistent view of the customer and support problem solving for complex interactions.

Salient Features of Appian ICC:

Unified Customer View for personalized customer interaction

Universal Agents for Fast First Call Resolution

Omni-channel communication for seamless customer engagement

Managers Dashboard View:

Unified Agent Information

KPI Monitoring

Sentiment Analysis

Agent’s Dashboard View:

Unified Customer View

Universal Agents

Omni-channel Communication

Appian ICC Technology : Success Cases

British multinational investment bank and financial services company Barclays plc has observed a 64% increase in customer satisfaction services by adopting Appian ICC technology.

Similarly, Target , a reputed American retail corporation experienced 80% improved customer service levels with Appian ICC platform.

Aviva Insurance UK claimed 40% of cost-saving results with Appian advanced Intelligent Contact Center feature.

In a nutshell with the right implementation of your Appian ICC Platform, Crochet Technologies can help you create Long Term Business Impact by Reducing Cost, Increasing Customer Satisfaction & Delivering Customer Success.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

“ITS A YES” To Pega Low Code Development Platform

Until now, enterprises had to code from scratch or purchase a packaged app and then customize it as per unique business requirements. This in turn ends up with a greater cost and time-consuming development process.

With Pega Low Code Development platform you can create a standard in your business application and drastically cut down the cost of traditional app development and other related operational expenses.

What is Pega Low-Code App Development Platform:

This platform is a low-code factory approach that enables developers to develop enterprise apps with low or zero coding stress. Business users, developers, and IT can collaborate, build, and deliver brilliant applications from one comprehensive environment. It provides leverage to organizations to build apps quicker and smarter. It additionally speeds up the customization process of app development and support to the most complex enterprise use cases.

Key Features Of Pega Low Code Platform:

Enhance productivity in one agile environment

Cosmos design system

Higher quality application

Quick and powerful integration

Earlier business value realization

Greater Transparency & visibility

Greater Agility

Case management & BPM for regular flawless operations

Critical Challenges Fixed By Pega Low Code Platform:

In most general cases, the low-code application development software supports two types of users

Business/power users who remain in search of the software that makes it simple to design & build simple applications.

This group of users faces the following challenges:

Not fluent in a programming language

An accurate translation of business requirements into functional capabilities

Ability to respond faster to changing product, market, or campaign requirements

Limited knowledge of governance, control, and policy management

IT departments who need software that assists develop more complex processes and integrations while support to automate the app development process.

This group of users faces the challenges:

Modification of legacy systems

Collaboration with stakeholders timely

Enterprise-wide governance

Software toolkits that limit collaboration

Project overload/restrictions on IT staff availability

Pega low-code app development platform provides a simplified, graphical UI commonly supported from limited functions and basic apps to complex enterprise app development. On the other hand, Pega low-code app factory strategy leverages visual tools that let business experts build the applications faster and without writing code. It offers governance frameworks to leverage, reuse, and collaborate with IT in order to assure quality, security, and sustainability.

Benefits Of Using Pega Low Code Platform:

Helps organizations to build agile applications quickly

Reduce 1/10 app development cost

Speed up x10 times the app development process

Enhance productivity to build more apps in less time

Better customer experience

Efficient risk management & governance

Faster digital transformation

Give end-to-end developer experience

Success Stories:

An American leading scientific research organization Air Force Research Laboratory has built a powerful platform with the help of Pega Low Code capabilities that help them to improve data quality for empowered decision-making.

Siemens AG is a German multinational conglomerate company that has created a new Global Master Data Management solution with the support of the Pega Low Code. This solution helps them in reducing 65% of customer onboarding time and automating data validated at initial data entry points.

With Pega’s low-code platform, Optum, a part of UnitedHealth Group, was able to move the lead business architect to the business side. It drastically enhances the delivery due to subject matter expertise. By connecting data across the enterprise, Optum also designed a chargeback model to track spending down to a clinician-level with Pega assistance.

Crochet Technologies

Crochet Technologies is a Global Information Technology (IT) Services and Solutions company. With the silver partnership of Pega, Crochet helps organizations in streamlining and automating business processes. Crochet offers end-to-end services from business consulting, development, design, and managed support in Pega space. With Crochet’s deep business acumen, world-class project delivery and leadership capabilities, we are supporting companies in building the most powerful application quicker and with low code capabilities. These applications help them to drive powerful outcomes in business.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes

Text

Appian Robotic Process Automation (RPA)- The Choice Of Intelligent Enterprises

In this fast-paced time, automation becomes the first priority for organizations to enhance revenue and reduce complexities in business processes. Almost every process within a company can boost productivity, though, every business is unique.

How many times have you thought, “I wish this task could be automated, but it is too explicit to our company”? Take a deep breath and brace yourself, because Appian Robotic Process Automation (RPA) can give you the opportunity to customize your automation.

What is Appian Robotic Process Automation?

Robotic Process Automation (RPA), is the technology that provides the ability to configure the software by building rules, rather than codes. RPA can respond to particular triggers and simulate many, if not most, human actions. It can automate any repetitive, time-consuming task without replacing the legacy system that an employee might do manually. This enables employees to use their time on more important tasks.,

Why is Appian RPA becoming popular among organizations?

Here are the reasons why intelligent enterprises want to connect with Appian RPA technology:

Automate high volume, rules-based, ordinary tasks usually done by people, or for connecting systems that don’t have modern APIs.

Appian RPA software robots work with systems and data exactly as people do, but with more efficiency and much quicker.

Effectively improve productivity

Appian bots can work 24x7x365

Provide much time to employees to work on high-value activities

Drive more value from legacy systems

Break down data silos

Unique Features Of Appian RPA:

Appian RPA features include:

Intelligent image recognition of objects on a screen, eliminating errors in bot actions

“Human in the loop” optimization

Bots can be deployed on a scheduled basis for common back-end processes

Detailed RPA audit trails present screenshots of robotic actions for total visibility, management, and reporting.

Success Story of Appian RPA clients:

British multinational insurance company Aviva plc has observed many impressive outcomes in the business by involving Appian RPA technology, for example as per a report:

They deliver 9 time faster services

They get 40% cost-saving results

Integrate approx 22 system into a single interface

Get a 360 degree customer view

A leading American full-service Union Bank has also provided the report of successful results driven by involving Appian RPA. They have seen an increase of 5% to 97% digitization within 2 years. They successfully reduced the time of loan organization and approval from 2 weeks to 5 minutes. Their 80% business processes are still running on Appian RPA.

An American publicly traded corporation S&P Global Inc. has noticed the following enhancements with Appian RPA:

150k news stories auto published in few weeks

Appian+RPA+NLG automates the process of creating news stories

Quick outcomes end-to-end automation built in 6weeks

Crochet Technologies

Crochet Technologies is a Global Information Technology (IT) Services & Solutions company. We are the partner of Appian to help companies to automate their business processes through Robotic Process Automation. We offer automation solutions from manufacturing and government industries to financial service and insurance. With Crochet’s deep business acumen, world-class project delivery, and leadership capabilities, we help companies in making the most of BPM investments for driving their business value.

To keep in touch, follow us on our LinkedIn Page. For any business requirements reach us directly on [email protected]

0 notes