Don't wanna be here? Send us removal request.

Text

Google Cloud ramps up blockchain efforts by launching a digital asset team

Blockchain, cryptocurrency, and decentralized technology are all cool topics that have been popular for nearly a decade. Nowadays, everyone wants to be part of the latest innovations. An announcement Thursday from Yolande Piazza, Vice President of Financial Services at Google Cloud, states that the company has created a Google Cloud digital assets team that will help clients create, trade, store value and launch new products on blockchain-based platforms. The blog post reads: “This new team will enable our clients to accelerate their efforts in this emerging field and help strengthen blockchain ecosystems in the future.” We're launching a new, dedicated Digital Asset Team to help underpin the #blockchain ecosystems of tomorrow. Whether you're implementing blockchain strategies or blockchain-native, you can rely on our scalable, secure and sustainable infrastructure ↓ https://t.co/YirBzA0sPe— Google Cloud (@googlecloud) January 27, 2022 The blog cites blockchain and distributed ledger-based solutions such as Hydera, Theta Labs, and Dabur Labs as examples of companies that have already implemented Google Cloud, adding that the digital assets team will conduct a variety of activities in the near and long term. With dedicated nodes to host the nodes / remote procedure call (RPC) for developers; node validation and on-chain governance with some partners; helping users and developers to host their nodes on the “industry’s cleanest cloud”; As some of the activities that the team will carry out. The announcement also reveals that, as the new team expands, it will study ways to allow Google Cloud customers to make and receive payments using cryptocurrencies. Source link Read the full article

0 notes

Text

YouTube CEO hints that non-destructible tokens can be added to the platform for creators

YouTube CEO Susan Wojcicki addressed YouTube's priorities for 2022 in a letter published Tuesday on the company's blog. Among these priorities is the ability to add non-destructible tokens, or NFTs, for video creators on the platform. there's *so much* to in 2022: @SusanWojcicki shares the future of YouTube → https://t.co/uL2WIbLwXK pic.twitter.com/JEW8yzqh7e— YouTube (@YouTube) January 25, 2022 However, what this might look like has yet to be determined. No additional details were provided in Wojcicki's statement apart from claiming that the YouTube team would use developments in Web3 as "inspiration". “The past year in the world of cryptocurrencies, non-destructible tokens (NFTs) and even decentralized autonomous organizations has highlighted a previously unimaginable opportunity to grow the relationship between creators and their fans.” As YouTube looks to increase the number of ways creators can make money, one option is to "take advantage of emerging technologies." Currently, there are 10 ways for creators to monetize their business according to Lujcicki, including ads and short videos similar to the newly launched TikTok. Could non-destructible tokens be next? YouTube boasts one of the largest communities of creators and is the second most visited site in the world, according to Similar Web. In light of the rise of metaviruses and other Web3 initiatives by social media platforms such as Meta and Twitter, which recently allowed iOS users to use non-destructible tokens as their profile pictures, YouTube is looking to the competition to retain and attract talent. In her letter, Wojcicki also mentioned her intention to improve the live experience for game creators as a priority. As the incorporation of non-destructible tokens into video games has become the primary use case for the adoption of non-destructible tokens, this may indicate that game creators may be more open to benefiting from YouTube's new initiative. Source link Read the full article

0 notes

Text

'Less Sophisticated' Malware Is Stealing Millions, Chainalysis Report Reveals

Cryptojacking accounted for 73% of the total value received by malware-related addresses between 2017 and 2021, according to a new malware report from blockchain analytics firm Chainalysis. The malware is used to carry out nefarious activity on the victim's device, such as a smartphone or PC, after being downloaded without the victim's knowledge. Malware-driven crime can be anything from information theft to denial-of-service (DDoS) attacks to large-scale ad fraud. Report excludes ransomware, which involves initial use of hacks and malware to extract ransom payments from victims in order to stop attacks, Chainalysis declared: “While most tend to focus on high-profile ransomware attacks against large corporations and government agencies, cybercriminals are using less sophisticated types of malware to steal millions in cryptocurrency from individual holders.” Chainalysis's January 19 report focuses on the various types of cryptomalware, excluding ransomware, used in the last decade, such as information theft, clippers, cryptojackers and Trojans, noting that they are generally cheap to acquire and can even be used by "low-skilled cybercriminals" to siphon funds from their victims. Cryptojacking tops the list of value received through malware at 73%, Trojans come in second at 19%, "Others" account for 5% while information thieves and clippers represent just 1% each. According to Chainalysis, malware addresses send the "majority of funds to centralized exchange addresses," but keep in mind that number is declining. As of 2021, exchanges only received 54% of funds from those addresses, compared to 75% in 2020 and around 90% in 2019. “DeFi protocols make up much of the difference, at 20% in 2021, after receiving a negligible share of malware funding in 2020.” The report looked at the prolific clipper Hackboss who has stolen around $560,000 since 2012 by infecting users' clipboards to steal and replace information. He discovered that the info-hijacker "Cryptobot" was a significant source of ill-gotten gains in 2021, generating $500,000 worth of bitcoin (BTC) from some 2,000 transactions. Cryptojacking Cryptojacking malware uses the victim's computing power to mine various cryptocurrencies; the target asset is usually Monero, but sometimes Zcash (ZEC) and Ethereum (ETH) are also mined. Chainalysis points out that it is difficult to pin down the specific amount generated by this method, as funds are transferred from mempools to unknown mining addresses, rather than "from the victim's wallet to a new wallet". Despite not being able to provide an estimated monetary figure on the damage caused by cryptojackers, Chainalysis projects that this type of malware accounts for nearly three-quarters of the total value generated by cryptomalware. The report noted a 2020 report from Cisco's cloud security division stating that cryptojacking affected 69% of its customers, translating to an "incredible amount of stolen computing power" used to mine large amounts of cryptocurrencies. It also highlighted a 2018 report from Palo Alto Networks that estimated that 5% of the circulating supply of Monero was mined by cryptojackers, which is estimated to be around $100 million in ill-gotten gains. Information thieves and clippers Data stealers are used to steal the victim's cryptocurrency wallet information and account credentials, while clippers can be used to insert specific text into the victim's clipboard. El malware Clipper is often used to hijack a victim's outgoing transactions by inserting the cybercriminal's wallet address when victims attempt to paste a sending address. The report notes that these two types of malware received a total of 5,974 transfers from victims in 2021, up from 5,449 the previous year. Keep reading: Source link Read the full article

0 notes

Text

Bitcoin sits at the last level of crucial price support

Trading activity on Wednesday indicates that Bitcoin bulls are fighting hard to keep the market price of bitcoin (BTC) above the crucial support level at around $42,000. According to data from IntoTheBlock, the IOMAP (In/Out of the Money Around Price) reveals that bitcoin currently sits at the last level of crucial support.Many Bitcoin addresses are still in the green between $41,180 and $42,470, meaning they bought at this level and are probably reluctant to sell at a lower price. In this range, more than 1.22 million addresses previously acquired 615,000 BTC. As evidenced by the level of trading activity, bulls are fighting to hold here.

Whales are accumulating

Bitcoin has rebounded and has regained around $1,000 in the past day or so. This comes after whales have accumulated 40,000 more BTC in the past three days alone. Whales are now back to owning the same amount of BTC as from before their dump began at $49,000.If the price of bitcoin rebounds from around $42,500, it will bump into stiff resistance on its path above $48,000. At the level around $43,700, almost one million addresses are holding 316,000 BTC. These are addresses that might want to break even on their positions if the price of the premier cryptocurrency reaches that level.

BTC faces strong resistance at $48k

After and above the mid $43,000 level, and to surpass $48,000, BTC must go through 5.7 million addresses holding 1.54 million BTC. Upside appears to be limited toward the $43,000 to $45,000 resistance level, and $48,000 could present another resistance for bulls given the series of lower price highs since November.Zooming out, the top cryptocurrency by market cap is down around 4.1 percent the past seven days, and down 38.9 percent since all-time-high at $69,044 on the 10th of November last year. At the time of writing on Thursday, bitcoin is changing hands at $42,141.

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge. On-chain analysis Price snapshots More context Join now for $19/month Explore all benefits Source link Read the full article

0 notes

Text

Google Pay hires former PayPal executive to expand crypto services

According to Bloomberg, Google Pay, one of the leading digital wallets for payments, has hired former Paypal executive Arnold Goldberg, in a bid to expand and accelerate its crypto operations. Goldberg will be responsible for heading Google’s payment division to expand the firm’s financial service domain which also includes cryptocurrency-related services.

Google hires ex PayPal executive to bolster crypto services

According to Bloomberg, the recruitment of Goldberg is a part of the company’s “broader strategy” to include a wider range of financial services including cryptocurrencies. Commenting on the growing demand for cryptocurrency, Google’s president of commerce Bill Ready stated:“Crypto is something we pay a lot of attention to. As user demand and merchant demand evolves, we’ll evolve with it.” Ready told Bloomberg. As part of the process, Google will be paying more attention to making its payment services robust by being “a comprehensive digital wallet” that includes digital tickets, airline passes, and vaccine passports. Google is also working on integrating more payment features in its wallet within search and its shopping service, to help users see “the entire array of financial services out there.”Arnold Goldberg, who will be heading Google’s payment division previously worked with PayPal as a chief architect and general manager of the firm. Google has lately been engaging itself with various crypto companies such as Bitpay and crypto exchange Coinbase. Bill Ready further stated that the company is looking forward to more associations like these in the future. In April 2021, Google partnered with crypto exchange Gemini to assist users in purchasing Bitcoin through google pay using fiat currency via debit or credit cards. The company had also partnered with crypto exchange Baked allowing customers to purchase goods and services using select cryptocurrencies through their google pay wallet. Launched in 2015, Google Pay is a digital wallet for consumers to track expenses and make online digital payments with an active user base of nearly 150 million. Posted In: Adoption, Payments

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge. On-chain analysis Price snapshots More context Join now for $19/month Explore all benefits Source link Read the full article

0 notes

Text

Pakistani Bank warns customers against trading cryptos

TL;DR Breakdown- A major bank in Pakistan has warned its clients against trading cryptocurrencies. - Bank Alfalah has warned its clients following the reveal that the State Bank of Pakistan (SBP) asked the Sindh High Court (SHC) to install a blanket ban on these assets.Bank Alfalah has asked its clients in Pakistan to distance themselves from trading cryptocurrencies through its systems. After the SBP submitted paperwork to the Sindh High Court to ban cryptocurrencies, Alfalah had to comply.Earlier this month, a significant crypto scam was unearthed in Pakistan, explaining the measures their Central Bank is trying to take.

Pakistani’s Bank Alfalah asks clients to distance themselves from cryptos

Pakistani’s Bank Alfalah has been sending notifications to its clients warning them not to engage in crypto trading through its remittance channels. The bank began operations in 1992 and is one of Pakistan’s most significant financial institutions. It has over 800 operating ATMs in over 200 cities in the country. The Abu Dhabi Group owns and manages this bank.Per local media outlets, the message by the bank read that every customer should know that digital assets are not legal. These assets are neither backed by the SBP nor authorized by any organization with equal power. Therefore, all customers should distance themselves from trading these assets through any remittance system of the bank.The news from the bank follows the recent filing for a ban with the high court by the SBP. The SBP is seeking a blanket ban on cryptocurrencies in the country. The SHC has directed law and finance ministries to look into the paperwork from SBP and come up with a report on the legal structure of the assets.

The world continues figuring out how to adopt and regulate cryptos

The regulatory developments in Pakistan came after the FIA uncovered a mega scam that cost Pakistanis over $100 million. The FIA issued a notice to Binance seeking cooperation in the investigations since the applications used were wired through the exchange. The authorities have also frozen 1064 suspicious accounts regarding the scam.Additionally, Propaksitani reported that several banks in the country had ceased offering crypto services by blocking bank cards used to pay for the assets. Some banks also froze accounts of citizens who use the Binance P2P systems to trade cryptocurrency. These developments are happening since the country does not have any crypto regulation framework, and it recently tasted the bitter side of the assets.Scams and targeted cyber-attacks have risen in recent months. Immunefi announced that investors might have lost funds amounting to over $10.2B through such means in the crypto world. Such losses push governments to find the best ways to protect their clients from such risks while still offering them the freedom to trade them.Some countries are against the assets, while others are out to regulate them in the best way possible. China was among the first countries that look into the assets. It announced a complete ban, and India almost followed in its steps. Now the Prime minister of India wants the world to have a standard regulatory structure for uniformity.The US has also confirmed that it won’t ban cryptocurrency and has already allowed trading of good crypto ETFs by the books. However, it is still among the long list of countries that are yet to regulate these assets. Therefore, all crypto enthusiasts and investors should follow these developments to trade these assets. Source link Read the full article

0 notes

Text

Australia's Financial Watchdog Warns Against Investing Retirement Savings into Crypto

Alex DovbnyaAustralians with self-managed super funds should be wary of cryptocurrency ads, says the country’s financial watchdogThe Australian Securities and Investments Commission, the country’s top financial watchdog, has cautioned Australians who manage their superannuation funds against dabbling in cryptocurrencies.The agency describes crypto as a “speculative investment” after recently publishing a warning about the rise of cryptocurrency-related scams.The ASIC has registered an uptick in marketing campaigns that specifically target SMSF trustees on social media, urging investors to exercise caution:Do not rely on social media ads or online contact from someone promoting an ‘investment opportunity.’An SMSF gives people complete control over their retirement savings, which allows them to make unorthodox investing decisions by putting money into stamps, art and crypto.Moreover, managing your superannuation fund comes with additional risks given that fraud victims will not be compensated.The regulator recommends consulting with a licensed financial adviser before making a decision to transfer funds to an SMSF.SMSF trustees are fully responsible for following taxation requirements, and cryptocurrency investing could make compliance even more complicated. In December, Australian federal police estimated that Aussies were scammed out of A$109 million last year.In November, South Australia police seized A$700,000 worth of crypto following a dark web drug bust.As per a survey conducted by the Independent Reserve’s Cryptocurrency Index (IRCI), nearly a third of Australians own cryptocurrencies, which represents an 18% increase from a year ago.Source: https://u.today/australias-financial-watchdog-warns-against-investing-retirement-savings-into-crypto

Source link Read the full article

0 notes

Text

Tesla Reportedly Tests Dogecoin Payment Option, DOGE Climbs 12%

Electric car maker, Tesla is reportedly testing the payment option of cryptocurrency Dogecoin (DOGE). According to a report published by The Block, most of the non-technical people cannot see the DOGE payment option as of now due to its ‘hidden feature’.However, the backend of Tesla’s website for Dogecoin payments is now active. A software engineer who goes by the name of ‘Tree of Alpha’ on Twitter told The Block that most of the code is already present in the latest Javascript files Tesla uses for processing payments.In December 2021, Elon Musk, CEO of Tesla, announced that the company is planning to accept DOGE as a mode of payment. After the recent testing, the DOGE community is hoping for an official announcement from Musk in the coming days.On its website, Tesla has a dedicated section for Dogecoin to explain the process of buying the products of the company through DOGE.Related content“To purchase using Dogecoin on the Tesla Shop, you will need a “Dogecoin wallet.” A DOGE wallet is a device, platform, app, and software that supports DOGE transfers. When checking out with DOGE, the payment page will display the Tesla Dogecoin wallet “address” in both an alphanumeric code and a QR code form for you to connect to your DOGE wallet to transfer the DOGE,” the company noted.

Dogecoin’s Price Action

Following the testing rumors, the price of Dogecoin spiked by nearly 12% within two hours. In the last 7 days, the crypto asset jumped by almost 25%. After hitting an all-time high of over $0.70 in May 2021, DOGE has been in a downtrend. The most valuable meme coin also faced challenges from Shiba Inu (SHIB). With a market cap of more than $25 billion, DOGE currently holds 11th position in the list of most valuable digital currencies.Electric car maker, Tesla is reportedly testing the payment option of cryptocurrency Dogecoin (DOGE). According to a report published by The Block, most of the non-technical people cannot see the DOGE payment option as of now due to its ‘hidden feature’.However, the backend of Tesla’s website for Dogecoin payments is now active. A software engineer who goes by the name of ‘Tree of Alpha’ on Twitter told The Block that most of the code is already present in the latest Javascript files Tesla uses for processing payments.In December 2021, Elon Musk, CEO of Tesla, announced that the company is planning to accept DOGE as a mode of payment. After the recent testing, the DOGE community is hoping for an official announcement from Musk in the coming days.On its website, Tesla has a dedicated section for Dogecoin to explain the process of buying the products of the company through DOGE.Related content“To purchase using Dogecoin on the Tesla Shop, you will need a “Dogecoin wallet.” A DOGE wallet is a device, platform, app, and software that supports DOGE transfers. When checking out with DOGE, the payment page will display the Tesla Dogecoin wallet “address” in both an alphanumeric code and a QR code form for you to connect to your DOGE wallet to transfer the DOGE,” the company noted.

Dogecoin’s Price Action

Following the testing rumors, the price of Dogecoin spiked by nearly 12% within two hours. In the last 7 days, the crypto asset jumped by almost 25%. After hitting an all-time high of over $0.70 in May 2021, DOGE has been in a downtrend. The most valuable meme coin also faced challenges from Shiba Inu (SHIB). With a market cap of more than $25 billion, DOGE currently holds 11th position in the list of most valuable digital currencies.Source: https://www.financemagnates.com/cryptocurrency/news/tesla-reportedly-tests-dogecoin-payment-option-doge-climbs-12/ Source link Read the full article

0 notes

Text

Cardano founder says delays are just the nature of the game

Input Output (IO) CEO Charles Hoskinson is pleased with Cardano’s progress to date.Speaking with Dan Gambardello from the Crypto Capital Venture YouTube channel, Hoskinson said people are too focused on the micro picture.He added that this perspective doesn’t take into account achievements made to date, nor does it give leeway for bumps in the road. Especially considering the scale of the task at hand, which can be summed up as utilizing blockchain technology to make positive change at the global level.Hoskinson’s words were in direct reference to community pressure over Cardano’s meager dApp offerings so far. Many assumed four months since Alonzo smart contracts went live, that the ecosystem would be a bustling hive of activity by now.However, to the frustration of many, just one Cardano dApp, in MuesliSwap, is listed on DeFi Lama.

Hoskinson is pleased with Cardano’s progress

Framing the situation, Hoskinson summarized Cardano’s progress saying we went from nothing to becoming a top 10 project, and a significant force in setting the research standard for Proof-of-Stake.“with over 100 exchanges, 2 million people, 130 dApps being built, 2 million assets issued on it.”However, despite the achievements made since late 2017, the Cardano founder said people “get caught on the narrow.”In justifying the delays, Hoskinson said there had been significant changes throughout the four-year journey. All of which forced IO to take new approaches, leading to the delays people are complaining about.“We had to rewrite the software three times, there were major changes in architecture and vendors. There were approaches taken that didn’t work out, there were of course delays.”

Delays don’t invalidate what has happened before

Taking the opportunity to equate circumstances with Ethereum, Hoskinson points out that Vitalik Buterin initially gave ETH 2.0 a 2018 rollout date. But now, Buterin’s estimate comes in at some time in 2025.“Vitalik said that in 2015, he said Ethereum 2 would come out in 2018, worst-case scenario. It’s 2022, he’s saying maybe 2025.”Last week, Buterin said that ETH 2.0 is approximately 50% of the way to completion. However, major tasks, in merging the ETH 1.0 and ETH 2.0 chains and in implementing sharding, are still to be tackled.Hoskinson asks whether this means Ethereum’s achievements to date are “bad.” Answering himself, he says no, “it’s just the nature of the game” when building blockchains.“Does that mean everything Ethereum has done and achieved is bad? No, it’s just the nature of the game and there’s things you learn along the way.”Posted In: People, Technology

CryptoSlate Newsletter

Featuring a summary of the most important daily stories in the world of crypto, DeFi, NFTs and more.

Get an edge on the cryptoasset market

Access more crypto insights and context in every article as a paid member of CryptoSlate Edge. On-chain analysis Price snapshots More context Join now for $19/month Explore all benefitsSource: https://cryptoslate.com/cardano-founder-says-delays-are-just-the-nature-of-the-game/ Source link Read the full article

0 notes

Text

Meta recruits staff from Microsoft and Apple to continue advancing its Metaverse plans

Microsoft and Apple Employees Are Leaving Ship to Join Meta Platforms, a company that has set out to create the Metaverse. According to former Microsoft employees cited by the Wall Street Journal, Around 100 people have left the tech giant's augmented reality team in the last year to join Meta Platforms. They claim that Meta has especially focused on recruiting people who have worked on Microsoft's HoloLens augmented reality (AR) headsets. According to the WSJ, Linkedin profiles show that More than 70 people who were part of Microsoft's HoloLens team have left the project in the last year, and more than 40 of them have taken new positions at Meta. Microsoft's edge in the AR space makes its employees valuable assets to Meta. Microsoft announced its HoloLens project more than five years ago, in 2016, and the technology became one of the most advanced helmets in the world. Apple is trying to counter an exodus of employees to Meta by offering lucrative stock and bond options worth between $ 50,000 and $ 180,000, according to a Bloomberg report. In late December 2021, the company offered the bonuses to a group of silicon design engineers, hardware, and some software operations workers. Facebook's wish Meta Platforms was previously known as Facebook until a major rebrand in October 2021, indicating the company's growing ambitions beyond social media. Your virtual reality hardware business "Reality Labs" has worked hard in the months since, successfully prototyping their virtual reality "haptic gloves" in mid-November 2021. Announcing @Meta — the Facebook company’s new name. Meta is helping to build the metaverse, a place where we’ll play and connect in 3D. Welcome to the next chapter of social connection. pic.twitter.com/ywSJPLsCoD- Meta (@Meta) October 28, 2021 @Meta Ad - The new Facebook company name. Meta is helping to build the metaverse, a place where we will play and connect in 3D. Welcome to the next chapter of social connection. Despite these early successes, The centralized Meta's attempts to dominate the Metaverse have drawn not a little criticism from the broader community, which includes leaders from the cryptocurrency, NFT, blockchain, and GameFi spaces. Some cryptocurrency leaders, like Hodl Asset's Jenny Ta, have suggested that Mark Zuckerberg shouldn't be the one to lead Facebook in the Metaverse, given his track record on data mining, privacy and content policies. "For there to be a clean slate for Meta, Mark must resign and there must be a new CEO to lead it," he said in a November interview with Cointelegraph. Both Microsoft and Apple have long had their sights set on the metaverse.. In early November 2021, Microsoft announced a series of updates to Teams and its Xbox game console, along with a new product called "Dynamics 365 Connected Spaces." The metaverse is here, and it’s not only transforming how we see the world but how we participate in it – from the factory floor to the meeting room. Take a look. pic.twitter.com/h5tsdYMXRD- Satya Nadella (@satyanadella) November 2, 2021 The metaverse is here, and it is transforming not only the way we view the world, but also how we participate in it, from the shop floor to the boardroom. Check out. "The Metaverse allows us to embed computing in the real world and embed the real world in computing"Microsoft CEO Satya Nadella said at the time. "The most important thing is that we are able to take our humanity with us, and choose how we want to experience this world." Keep reading: Source link Read the full article

0 notes

Text

Ethereum Rallies Above $3,200 But This Resistance Is The Key

Ethereum started an upside correction above the $3,180 zone against the US Dollar. ETH price must clear the $3,250 to continue higher in the near term.- Ethereum started a decent increase above the $3,200 resistance zone. - The price is trading above $3,200 and the 100 hourly simple moving average. - There is a key bullish trend line forming with support near $3,190 on the hourly chart of ETH/USD (data feed via Kraken). - The pair could continue to rise if there is a clear break above the $3,250 resistance zone.

Ethereum Price Aims Upside Break

Ethereum started a decent increase above the $3,150 resistance zone. ETH even broke the $3,200 resistance zone and the 100 hourly simple moving average to move into a positive zone.The upward move gained pace, but the bears appeared near the $3,250 level. A high was formed near $3,264 and the price is now consolidating gains. It is trading well above the 23.6% Fib retracement level of the recent increase from the $2,931 swing low to $3,264 high.Besides, there is a key bullish trend line forming with support near $3,190 on the hourly chart of ETH/USD. Bitcoin price is trading above $3,200 and the 100 hourly simple moving average.Source: ETHUSD on TradingView.comOn the upside, an immediate resistance is near the $3,250 level. A clear move above the $3,250 level might start a major increase in the near term. The next major resistance is near the $3,330 level, above which ether price could test $3,400. Any more gains could send the price towards the $3,550 level in the near term.

Fresh Decline in ETH?

If ethereum fails to start a fresh increase above the $3,250 level, it could start another decline. An initial support on the downside is near the $3,200 level.The first key support is now forming near the $3,190 level and the trend line. A downside break below the $3,190 level might spark a fresh decline. In the stated case, the price could test the $3,100 support zone. It is near the 50% Fib retracement level of the recent increase from the $2,931 swing low to $3,264 high.Technical IndicatorsHourly MACD – The MACD for ETH/USD is slowly losing pace in the bullish zone.Hourly RSI – The RSI for ETH/USD is above the 50 level.Major Support Level – $3,190Major Resistance Level – $3,250 Source link Read the full article

0 notes

Text

Coinbase and PayPal Join Purple TaxBit to Get Free Tax Forms for Cryptocurrencies

The cryptocurrency tax compliance company TaxBit is working to unite leading industry companies such as Coinbase and Binance.US within a crimson to allow free 2021 tax forms for users. The crypto tax software provider announced Tuesday the launch of the TaxBit Network, a certified crimson that aims to democratize crypto tax calculations and tax forms by providing the necessary data for tax return to all users of the network for free. The Purple TaxBit at its launch includes some 20 major cryptocurrency-related companies in the United States, including firms such as PayPal, Binance.US, Coinbase, FTX.US, Gemini, Celsius Community, Blockchain.com, Venmo, Paxos, OkCoin, and BlockFi. As part of the initiative, All users of a certified company of the pink TaxBit will be able to receive free and accurate tax forms for 2021. In addition, several participating platforms will incorporate a quick TaxBit registration within their applications to simplify access to tax information tools. "If a user has taxable transactions on platforms that are not part of the Pink TaxBit, a cost will be applied to retrieve the tax forms from off-network platforms", pointed out TaxBit. The new development aims to remove barriers to the adoption of cryptocurrencies in basic, ensuring that cryptocurrency users in the US can comply with taxes without spending tons of money. "Historically, the process of generating cryptocurrency tax forms cost individuals hundreds to thousands of dollars per year, depending on whether they used DIY computer software or hired an accountant," TaxBit said. Binance.US typical director Brian Shroder noted that the company's participation in the crimson TaxBit is a critical step in its engagement. with security and compliance, especially after President Joe Biden signed the infrastructure bill in November. TaxBit is a leading cryptocurrency-focused tax compliance company that brings together tax attorneys and application developers to build an application that simplifies and automates the cryptocurrency tax filing process. Backed by the acquainted office of the Winklevoss twins, TaxBit has seen noteworthy growth recently, securing a rise of $ 130 million to a valuation of $ 1.3 billion in August 2021. Keep reading: Source link Read the full article

0 notes

Text

Jack Dorsey's Company Hiring for Bitcoin Mining Experts

Former Twitter CEO and co-founder of Block Jack Dorsey continues to pursue bitcoin (BTC) mining plans as his company moves to hire a Custom Digital Design Lead.

Block Advertises Bitcoin Mining-related Job

San Francisco-based financial services group Block (formerly known as Square) is hiring a Custom Digital Design Lead, according to a recent job listing on LinkedIn. The role description looks to recruit an experienced designer to join a team of developers working on an application-specific integrated circuit (ASIC) for bitcoin mining.The job posting aligns with previous statements from company CEO Jack Dorsey regarding the plans to build and develop a BTC mining system based on custom silicon designs and open-source collaboration.Dorsey, a well-known bitcoin enthusiast, has explained in the past why his company’s bitcoin ASIC project is necessary and what it could mean for the future of the BTC network. In a thread back in October 2021, the CEO outlined the need for bitcoin mining to be more decentralized and energy-efficient.Block’s project seeks to address the long-standing energy concerns associated with mining cryptocurrency. The company says it is working towards developing more efficient computer chips and power architectures to drive sole dependence on renewable energy sources for all miners.Dorsey’s plans to drive quicker adoption of green energy might provide a viable solution to growing energy concerns surrounding mining activities. Earlier in January 2022, the Kosovo government reportedly implemented a policy banning all cryptocurrency mining in a bid to manage the country’s energy crisis during the winter months.

Dorsey Going Full Steam Ahead with BTC

Jack Dorsey’s companies have been closely related to mainstream crypto adoption and developments in recent times. Before stepping down as CEO of Twitter, the social media platform announced a tipping feature with bitcoin as a supported payment.CashApp, a mobile transaction service developed by Block, also announced its availability to customers 13 years and older, giving users the option to purchase bitcoin.Dorsey also continues to show his support and appreciation for the world of digital assets by targeting environmental concerns surrounding cryptocurrency.Back in Dember 2020, his company reportedly invested $10 million into a Bitcoin Clean Energy Investment Initiative.SPECIAL OFFER (Sponsored) Binance Free $100 (Exclusive): Use this link to register and receive $100 free and 10% off fees on Binance Futures first month (terms).PrimeXBT Special Offer: Use this link to register & enter POTATO50 code to get 25% off trading fees.Source: https://cryptopotato.com/jack-dorseys-company-to-hire-bitcoin-mining-experts/ Source link Read the full article

0 notes

Text

Bitcoin returns to $ 42,000 as expectations of a 'short squeeze' rise to the upside

Bitcoin (BTC) price surpassed $ 42,000 on January 11, at the same time that the expectations of a new brief squeeze increased. BTC / USD (Bitstamp) 1-hour candlestick chart. Source: TradingView

A short-term queeze brief is "reasonably likely"

Cointelegraph Markets Pro and TradingView data followed on the BTC / USD pair as it recovered from Monday's slide to $ 39,600, its first breakout of the $ 40,000 mark since September. While short-term bullish forecasts were conspicuously absent on the day, The focus was on the possibility of derivatives markets triggering another brief squeeze. With open interest near its all-time highs despite the slide and clearly favorable sentiment to the downside, a surprise rally could have the impact of "squeezing" short positions and providing some relief to the bulls. As the on-chain analytics company Glassnode points out in the latest issue of its weekly newsletter, "The Week On-Chain," such an event is pending. Longs have suffered almost constantly since November's all-time highs of $ 69,000, and squeezes also come when the market least expects a certain result. "Short traders, who have not been punished for taking increasing risk, may be candidates for a short-term squeeze."«, Predict the researchers. Such an event could well be amplified by the 'tepid' demand for spot BTC and leveraging the open interest of futures, which is approaching 2% of Bitcoin's market capitalization, Glassnode continued. "Together with the oversold indicators in on-chain spending activity, this suggests that a small squeeze is actually a reasonably possible short-term resolution for the market.", concluded the newsletter. Graph with comments of the leverage ratio of the open interest of Bitcoin futures. Source: Glassnode

For every short, there is a long

For its part, Analysts considered alternatives to the elimination of the high open interest through another leg to the low towards USD 30,000. Although there has not yet been an 'erasure' of open interest, a surprise upward movement could be the event that restores the composition of the market, as argued by the common Twitter account Credible Crypto. "What if the big open interest erasure that everyone is looking for ends up with a squeeze to the upside rather than a move further down?" questioned in response to data from fellow analyst William Clemente. “It happened on August 21 when we came out of the bottom of 30,000. I think we'll probably see that again. The bearish momentum is about to fade. "

Open interest chart of Bitcoin (Binance) futures. Source: Coinglass As Cointelegraph reported, The $ 40,000 mark has been forming a significant price zone from multiple points in the last 12 months. Keep reading: Source link Read the full article

0 notes

Text

UAE Regulators Pave Way for Crypto and Blockchain Adoption, Says Legal Expert

While many countries are inclined to simply ban the use of Bitcoin (BTC) and virtual assets, UAE regulators are taking a different approach. The country has been constantly enacting its vision of becoming a blockchain capital by providing frameworks to guide cryptocurrency companies on how to operate in accordance with the laws.. The jurisdictions in the country are divided between the continent, where the regulator is the Securities and Commodities Authority (SCA), and the free zones, that is, geographically specified areas within the UAE with relaxed tax and regulatory regimes. These free zones include the Dubai International Financial Center (DIFC), regulated by the Dubai Financial Services Authority (DFSA), the Abu Dhabi Global Markets (ADGM), regulated by the Financial Services Regulatory Authority (FSRA). ), and the Dubai Commodities Center (DMCC), whose regulation corresponds to the SCA. In an interview with Cointelegraph, Kokila Alagh, founder and CEO of Karm Legal Consultants, shared a brief overview of the regulatory situation in the country. According to Alagh, the SCA, the continental regulator, provides certainty and opportunities for cryptocurrency and blockchain businesses: “The regulations provided certainty and have opened up new opportunities in the UAE, making the SCA a progressive regulator on the global stage as they have not ignored this vital growing sector and are continually working on developing frameworks for adjust according to these emerging sectors like DLT and blockchain. " The FSRA, ADGM's financial services regulator, was the first to introduce digital asset regulations in the country back in 2018. Alagh said that ADGM was also one of the first regulators globally to introduce digital securities regulations and guidance on virtual assets, adding that ADGM is "one of the most important jurisdictions for established blockchain companies.". Alagh also spoke about the regulations in the DIFC. According to Alagh, DFSA, the DIFC regulator, "is one of the first regulators of a major financial free zone to bring regulations regarding security tokens.". Current DFSA regulations cover the tokenization of securities through blockchain and distributed ledger technology, including the tokenization of stocks, derivatives, bonds, debentures, certificates or units of a fund.. However, consultation documents for stablecoins, fungible cryptocurrencies, and non-fungible tokens are still in the process of being drafted. Lastly, Alagh pointed out the DMCC. The free zone issued special licenses, such as the DLT technology service provider license and the cryptocurrency proprietary trading license.. It also has a dedicated cryptocurrency center called Crypto Oasis, where more than 130 blockchain companies have registered. Alagh said that "the DMCC is one of the most advanced regulators in this space and has spearheaded the development of the crypto ecosystem in the UAE.. The DMCC is a crypto-friendly regulator and provides companies with a friendly framework to establish a business. " Meanwhile, the cryptocurrency exchange Binance has set out to collaborate with the UAE government to help crypto exchanges and companies obtain their licenses in Dubai.. The firm signed a memorandum of understanding with the Dubai World Trade Center Authority when launching a cryptocurrency hub. Keep reading: Source link Read the full article

0 notes

Text

Why Solana may be the Apple iOS in the crypto world?

Perhaps, in the not-too-distant future, Solana and Ethereum may become the iOS and Android of the crypto world, respectively. By Shigeru, Researcher at CryptogramVenture FoF Compilation: Russell Editor's note: 2021 is the "Warring States Era" for public chains. Solana, Avalanche, Terra and other public chains have successively become market stars, and Solana is particularly dazzling. Data shows that Solana is the main gathering place for developers other than Ethereum. Why do developers particularly favor Solana? The author of this article, CryptogramVenture FoF researcher Shigeru, believes that Solana has the ultimate user experience, strong ecological support, etc. similar to Apple's iOS. Will Solana Really Be the Apple iOS of the Crypto World? We hope that by compiling this article, readers will know Solana from another perspective. The text is as follows: If you own an iPhone and happen to be a fan or active participant in the Solana system and applications, you may feel a sense of deja vu when using them separately at many moments. Are Solana and Apple iOS similar in many ways? It just seems like an intuition. However, when I try to analyze the two from the history and the current situation, and compare them carefully, the results may surprise you even more: the previous intuition may be very close to a certain truth, and even a bold one came to my mind. Prediction: One day in the future, Solana may truly become the Apple iOS in the crypto world. In my opinion, although Apple iOS and Solana belong to two different tracks of the Internet and the encryption world, the logic behind the first principles behind the development is very similar (the following materials and conclusions are jointly completed by the CGV FOF research team .) First, the ultimate user experience User experience, as the core competitiveness of a product, has been mentioned again and again by us. The iOS system seems to always be smoother than the Android system, which is behind Apple's unremitting efforts for the ultimate user experience. The virtual keyboard is not the first of Apple's mobile phones. Smartphone manufacturers such as Microsoft and Palm have tried to promote smartphones with full touch screens, but the iPhone has broken through the technical difficulties of capacitive touch screens and multi-touch technology, and improved the ultimate touch experience to an unattainable height. For example, iOS has the highest priority of responding to the screen, and its response sequence is Touch--Media--Service--Core architecture. Simply put, when the user touches the screen, the system will process it first. The screen display (Touch) level; the priority response level of the Android system is the Application--Framework--Library--Kernel architecture, and the display-related graphics and image processing (Library) is only ranked third. There are many similar factors, which directly cause huge differences in user experience. Similarly, although Solana is not the first underlying public chain to come out, relying on ultra-high TPS and low transaction fees, it broke through the biggest development constraints of most public chains in the same period and conquered more and more encryption developers. and users.

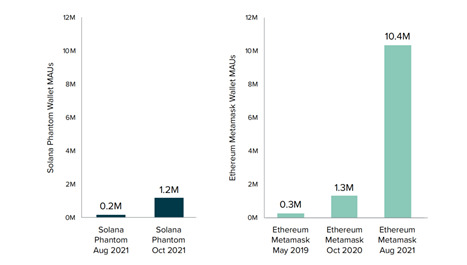

Performance comparison between Solana public chain and other mainstream public chains Data source: RareLiquid For example, Solana can support more than 50,000 transactions per second while maintaining a block time of 400 milliseconds, while tying TPS improvements to Moore’s Law, thereby providing a “predictability” of TPS scaling. In addition, Solana’s low execution fees are even more impressive: the network transaction cost for 1 million transactions is only about $10. Among them, Solana's core consensus mechanism is "Proof of History (PoH)", which aims to solve the time problem in a distributed network that lacks a single reliable time source. With a verifiable delay function, PoH allows each node to generate timestamps locally using the SHA256 algorithm. The benefit of this is that it removes the need to broadcast timestamps across the network, thereby increasing the efficiency of the entire network. The quality of the public chain use experience can be reflected by one indicator - the number of encrypted wallets and the frequency of use. Take Phantom, one of the most popular wallets on Solana, for example, it integrates basically all the functions of the Solana ecosystem, including: token swapping, collecting NFTs and collectibles, connecting hardware wallets, anti-surveillance, Web3.0 support, and Stake SOL to earn income.

Monthly Active Users Comparison of Solana and Ethereum Mainstream Wallets Data source: Grayscale Building Blocks With a one-stop excellent user experience, Phantom has become the wallet of choice for users to participate in Solana, with monthly active users exceeding 1.2 million, and this number will increase 5 times in the two-month period from August to October 2021. Second, excellent UI design UI (User Interface), as a variety of human-computer interaction windows that realize the functions required by users, determines whether a software or product can be intuitively operated by users. Apple's iOS system has a strict system in terms of platform UI design specifications. From buttons to icon styles, from image size to resolution, special customization is required. This not only makes the styles of various programs and software tend to be unified, but also subtly allows users to gradually get used to the way of using iOS software. Today, the rounded rectangular design with only one button on the front and the rest completely covered by a glass panel has become the iconic design of the iPhone. Whether in the Internet, or in the field of blockchain and encryption, UI design is what the project party needs to pay attention to. Even the "user-oriented" UI design will attract traffic to the product and make it more popular. Dr. Nielsen, an expert in the field of human-computer interaction, once pointed out that in the field of the Internet, usability is a necessary condition for survival. If the site is difficult to use, users will immediately turn around and leave. Some people say that when they buy tokens, they only look at the logo of the project. This is a joke, but it also shows the importance of the visual design of the project. Solana's logo at least tells me that it's a team that pays attention to detail and has a good aesthetic. The color of Solana Logo is a gradient from green to purple. Similar colors can also be seen in nature, such as aurora, which is mysterious and noble. In addition, many sci-fi movies with cyberpunk theme often use purple, green and blue in the picture. It reflects the future prospects of Solana's innovative blockchain technology development.

List of Solana Ecological DeFi Projects Data source: Solanians Many projects based on Solana seem to be from the same designer at first glance, and they have a very consistent experience in color matching, interface design, interaction design, etc. The interface is intuitive and concise, and the operation is convenient and fast. After contacting the software, users can understand the corresponding functions on the interface at a glance, and they can easily use the Solana system without much training. According to CGV FOF, on a well-known Solana IDO platform, when reviewing a project, the UI performance of the project will be given a higher evaluation priority. It seems that Solana is increasing the acceptance of Solana use by incubating and supporting more projects with excellent UI from top to bottom. Third, strong ecological support According to the second law of thermodynamics, the isolated system has no energy exchange with the environment, and always spontaneously changes in the direction of increasing chaos (entropy), that is, the principle of entropy increase. In response to this phenomenon, Nobel Laureate Prigogine proposed that the system must be open to transition from a disordered state to an ordered structure, that is, the system must exchange matter and energy with the outside world. The opening of the business ecosystem requires core companies to open up their resources and capabilities to partners, attracting them to join the ecosystem, and realizing value co-creation through mutual empowerment. Since its inception, Apple has attached great importance to external empowerment, providing external developers with a powerful development kit and allowing them to connect users through the App Store, resulting in the birth of a large number of star apps such as Instagram, Snapchat, Uber, and WhatsApp. Compared with other platforms, Apple's release mechanism for developers' works is more fair and reasonable. The download ranking data on the software store is true and reliable, which creates a good competition system and environment for developers, and developers can understand users more accurately. real needs. In terms of ecological construction, Solana has also put a lot of effort into it. For outstanding projects, Solana has a long-term funding plan, providing them with a full range of resource support including targeted funding, VC referrals, technical support, recruitment support, marketing, and legal resources.

The development of active developers of Solana and other mainstream public chains Data source: Santiment Take the hackathon as an example. In 2021, Solana officially held three global hackathons within a year. In the recent hackathon, the prize money was as high as one million US dollars, the number of applicants exceeded 15,000, and developers from all over the world submitted more than 300 projects, which made Solana gain the attention and support of a large number of developers, and even more Collection of premium Solana native apps. Another statistic worth paying attention to is that 90-95% of hackathon developers expressed their willingness to continue long-term development on the Solana blockchain. These excellent developers will continue to provide energy for the Solana ecosystem. Fourth, the charismatic soul It may be a bit radical to say that Apple founder Steve Jobs changed the whole world, but it can definitely be said that Steve Jobs is synonymous with the "spirit of innovation" pursued by the United States and all mankind. Jobs is a giant standing at the intersection of technology and humanities. His combination of idealism and perfectionism makes Apple walk out of a completely different route from traditional industries. Taking simplicity as an example, Steve Jobs likes minimalism, as well as the Indian Dharma that he came into contact with in India, "no words, direct to the heart", all of which have a great influence on the design of Apple's "no button". In addition to pursuing simplification in product design, Jobs took the initiative to cut off many product lines; he may only launch 1-2 products every year, but they are guaranteed to be the best. In my personal opinion, Jobs was to Apple what Sam Bankman-Fried (SBF) was to Solana. Of course, I don't mean to deny Solana's excellent team, which is as respected as the tens of thousands of excellent engineers and development teams behind Apple.

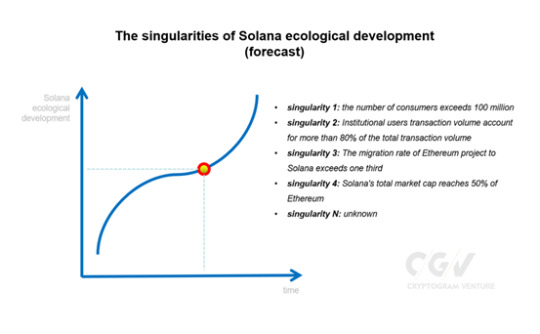

SBF on Forbes' 2021 list of the world's richest people Data source: Forbes SBF's earliest professional background was as a trader, and he spent his early days at quantitative giant Jane Street. The Alameda Research (quantitative trading company) and FTX (centralized cryptocurrency exchange) teams he founded were full of financial people—quants, engineers, high-frequency traders. They care less about the centralization/decentralization debate and more about "Can this blockchain scale massively?" After leaving Jane Street in 2017, SBF took the time to think about potential opportunities and found: “Cryptocurrencies have a lot of characteristics, can be a very inefficient system, and have a huge demand for liquidity, which is basically a huge demand suddenly There will be very rapid growth.” So SBF set out to find the ultimate solution to these problems until he discovered Solana. Solana co-founder Anatoly Yakovenko once described the scene of Solana’s first contact with SBF before the mainnet launch (2019): During the test, 80 transactions were processed in an average of 4.02 seconds. This result impressed SBF. After communicating and discussing with the team, after realizing the huge development potential of Solana, it immediately decided to build Serum (decentralized derivatives exchange) on it. In this way, Solana has not only acquired a new application project, but also acquired an excellent encryption spokesperson (whose importance now seems to be undoubtedly like James in the NBA). That is, from that day on, Solana officially entered the SBF moment. In January 2021, SBF tweeted that everyone would sell SOL to him, and that he would buy as much SOL as possible for $3. Although this is obviously a joke, it shows that SBF has high hopes for SOL. Fifth, a passionate fan base Remember when iPhone fans lined up in front of stores all night to buy a new iPhone, hoping to be the first owners of the new iPhone, just like they hoped to get tickets to a superstar concert. The iPhone launched by Apple every year is not only a new product, but also a brand-new cultural phenomenon. This is an unlikely market effect from any other company's new product launch. Taking Twitter fans as an example, according to CGV FOF statistics, as of now, Solana has as many as 1.1 million fans, although not as many as Ethereum (1.97 million), ranking first among other mainstream public chain teams, Polkadot (1.01 million). ), Avalanche (450,000), Fantom (270,000), Near (230,000). Let’s take a look at the fan token, Solana’s meme coin: Samoyedcoin ($SAMO). It was inspired by Dogecoin, Sam Bankman-Fried (with the letters S, A, M) and Solana co-founder Anatoly Yakovenko (whose hometown is the birthplace of the Samoyed dog). Today, SAMO has become the mascot and image ambassador of the Solana ecosystem, and the peak value of SAMO's token circulating market value has exceeded 700 million US dollars. In the Solana community, you can often feel a completely different atmosphere from all other public chain communities. We can often see the "mutual spray" between ETH diehards and Solana diehards, which is completely different from the peaceful and happy feeling of Near, Avalanche, Fantom communities and the Ethereum community. ) the "willful" price paid. Of course, from the above dimensions, it may be a bit far-fetched to compare Solana with Apple iOS, and some people are still criticizing the recent instability of the Solana network, but in the long run, through network upgrades, service node expansion and incentive mechanisms adjustment, these similar problems will become a little episode in the historical development of Solana. In fact, Apple's development was not achieved overnight, but accompanied by the arrival of several important turning points, which established the status of Apple's king in the future. For example, the iPhone 4 is an epoch-making product that has made breakthroughs in hardware, software and design of the iPhone: the first commercial retina screen on mobile phones, the dual evolution of mobile phone camera hardware and algorithms, the most classic mobile phone model, and the first use of self-developed chips... In cosmology, the Big Bang, created by the singularity, constitutes the universe we are familiar with. The singularity is an important turning point in history. The birth of iPhone4 is a singularity in Apple's development history, allowing Apple to enter the rapid development channel. As I try to list the realization of Solana's vision of becoming the Apple iOS in the crypto world, there are a few singularities to look forward to: ——The number of C-end users exceeds 100 million. On November 7, 2021, Solana wallet Phantom has exceeded 1 million active users. 1 million to 100 million seems to be a big leap, but the exponential effect of network development in the encrypted world will greatly speed up this process. On a more positive note, Solana co-founder Anatoly Yakovenko has said several times that Solana's next phase is "attracting a billion users" as the technology is up and running. You know, the number of global users of VISA exceeded 3 billion as early as 2018. ——The transaction volume of institutional users accounted for over 80%. More institutional users joining the crypto market will drive more capital inflows. The bull market in 2021 is also known as the institutional bull, and many institutions have entered the market one after another, such as Tesla, Microstrategy, Grayscale Company Trust, and the ARK Fund of the "female stock god" Mutoujie. SBF believes that the crypto space is likely to grow over the next five years, mainly driven by potential institutional investment. In my personal judgment, according to the Pareto law (80/20 rule), if institutional users become the main force in the Solana market, and if their transaction volume accounts for more than 80%, Solana will surely usher in a new round of development. - The migration rate of Ethereum projects to Solana is more than one-third. In June of this year, Neon Labs, a cross-chain bridge between Ethereum and Solana, was released. Neon allows anyone to run Ethereum smart contracts on the Solana blockchain, making it easier for developers to build programs that work on both blockchains. It must be an exciting time if more than a third of projects already deployed on Ethereum are building on Solana at the same time. ——The total market value of Solana reaches 50% of Ethereum. SBF believes that Solana's unique underlying technology for developing DeFi protocols will also drive the price of its SOL token soaring, and he even believes that Solana may surpass Ethereum to become the largest decentralized financial platform. Although the current market value of Solana (about 55 billion US dollars) is nearly 8 times that of Ethereum (about 470 billion US dollars), if it reaches 50% of the market value of Ethereum, it will definitely be an important milestone in the development of Solana.

The singularity (prediction) of the ecological development of Solana Will Solana Really Be the Apple iOS of the Crypto World? I very much agree with Kyle Samani, managing partner at Multicoin Capital, "We're going to see both Solana and Ethereum coexist. Read the full article

0 notes

Text

Billionaire Bill Miller Invests 50% of His Assets in Bitcoin

Investor Bill Miller is bullish on Bitcoin (BTC) despite the cryptocurrency hitting multi-month lows below $ 40,000 in early January 2022. Miller no longer considers himself just a "Bitcoin watcher," but a true Bitcoin bull, as he said in a WealthTrack interview last Friday. The billionaire investor now has 50% of his net worth allocated to Bitcoin and related investments in important companies in the sector such as MicroStrategy, by Michael Saylor, and BTC's mining company, Stronghold Digital Mining. Miller, who was one of the first investors in Amazon, owns almost 100% of the rest of his portfolio in this company. Miller bought his first Bitcoin back in 2014 when BTC was trading around $ 200 and then bought "a little more" when it hit $ 500. The investor didn't buy for years until the cryptocurrency plummeted to $ 30,000 after that. reach a price of $ 66,000 in April 2021, he said. "This time I started to buy it again at USD 30,000, down from USD 66,000, and the reasoning was that there are many more people using it, there is much more money coming from the world of venture capital", Miller stated, adding that he bought a "good amount in the $ 30,000 range." The billionaire investor noted that regards Bitcoin as an "insurance policy against a financial catastrophe", as well as a powerful investment tool that has outperformed gold. He also pointed out the scarcity of Bitcoin, which means that only 21 million bitcoins can be created. While you invest up to 50% of your wealth in BTC and related markets, Miller recommended individual investors to put at least 1% of their assets in Bitcoin, declaring: "I think the average investor should ask themselves what they have in their portfolio that has that kind of track record - number one; they have very, very little penetration; they can provide a financial catastrophe insurance service that nothing else can provide; and they can go up ten. times or fifty times. The answer is: nothing. " Today, Miller is celebrating his 40th anniversary in the investment business and is the chief investment officer of Miller Value Partners, a company he founded in 1999 while working at investment giant Legg Mason. The legendary investor is known to have beaten the S&P 500 for 15 years in a row with Legg Mason, where he reportedly controlled up to $ 70 billion. Miller's flagship fund, Legg Mason Capital Management Value Trust, lost two-thirds of its value due to the financial crisis in late 2008. Keep reading: Source link Read the full article

0 notes