Text

Bitcoin Legality and Taxation in India

Lot of questions have been asked on the legality of the cryptocurrency. And like any other country, India too is not different as this Financial Instrument does not have any existence in the eyes of regulator.

Abrupt statements by senior officials of RBI during their conferences visits or Media FAQs have further led to speculations on the future of this technology in India. It’s the responsibility of these Financial Gatekeepers to responsibly assess and give their sermons on the usage of the same without creating further issues.

The proactive Indian audience has started to decipher its legality and taxation as per their own understanding. It’s ridiculous how every person is treating the taxation of the same thing differently. Some are so cautious that they would prefer to pay highest bracket taxes showing their intentions of no wrong doing. So why can’t we be progressive-proactive like US or Japan or Australia issuing licenses and guidelines or depressive-proactive like China where they have chosen to ban its exchanges. Interesting take is that they have not banned users holding these currencies. Why are we so slow?

The regulators’ jobs are done by top law firms or exchanges shooting its guideline.

In a recent instance, the cautiously brave ZebPay has issued generic guideline on its treatment of taxation from the gains or losses which looks to be quite fair with disclaimers.

They have already quoted Bitcoin is not illegal in India, but is it legal in India? It is, until it’s not.

Zebpay’s Guidelines

A. In the case of trading business If the person is in the regular buying and selling of bitcoins (say weekly 5 transactions or more), then in that eventuality, the gain from sale of bitcoins will be a business income and the loss would be a business loss. The accounting entries for such transaction is as under: 1. In the case of purchase of bitcoins - Purchase of bitcoins A/c Dr. To Party (Zebpay) A/c - Party A/c Dr. To Bank A/c 2. In the case of sales of bitcoins - Party (Zebpay) A/c Dr. To Sale of bitcoins A/c - Bank A/c Dr. To Party A/c Here, if the turnover (sales) of the person exceeds Rs. 1 crore, then it may be subject to tax audit as per the provisions of Section 44AB of the Income Tax Act, 1961. B. In the case of investments In this case, the person is buying or selling bitcoins occasionally, then it would be considered as purchase/sale of investments which would be subject to long term or short term capital gain or long term or short term capital loss. The accounting entries for such transaction is as under: 1. In the case of purchase of bitcoins - Investments A/c Dr. To Party (Zebpay) A/c - Party A/c Dr. To Bank A/c 2. In the case of sales of bitcoins - Party (Zebpay) A/c Dr. To Investments A/c - Bank A/c Dr. To Party A/c In this case, the short term gain shall be subject to 15% income tax and long term gain shall be subject to 20% income tax.

Disclaimer: This is an opinion based on our discussions with our CAs. This should not be considered as legal advice. We suggest that you take the final opinion of your CA.

0 notes

Text

BITCOIN – The Future of Money

Warren Buffet – arguably the most successful investor of all time says “Never depend upon single income. We must make INVESTMENT to create second source.”

This second source of income is important to reach many financial goals.

Today Indians are investing in different assets classes such as Gold, Real Estate, Stocks, MFs, Bonds, etc. These investments are either goal based or simple disciplinary savings in nature. Each of these assets class is a winner in phases. And winners rotate. Every asset class has its upward and downward phase and the best strategy to take advantage of each one without actually timing is to diversify. Diversification minimizes the risks and optimizes the returns.

Diversification has also led people to invest in arbitrary asset classes such as investing in paintings and art. Another next big thing where people are looking to increasing value is cryptocurrencies, most popular of them being Bitcoin.

What is Bitcoin?

A software developer or a group of people under the name of Satoshi Nakamoto proposed Bitcoin, which was a data transfer system based on mathematical proof. The idea was to produce a currency independent of any central authority, transferable electronically more or less instantly and with very low transaction fees.

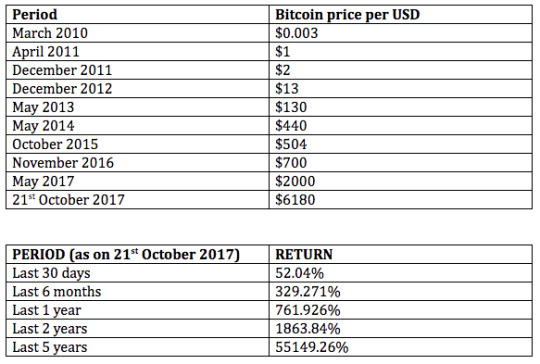

Bitcoin Price Growth

There have been numerous events in the last 8 years since 2010 when bitcoin came into existence that tried to disrupt the financial market, but Bitcoin remained unfazed and kept rising to newer heights.

Can you think of any other asset class with such a mammoth return continuously over the years?

Why will Bitcoin price keep rising?

1. Solid Blockchain Technology behind Bitcoin:

- A transparent, single source of truth: If any member of the network tries to make a change to a block, everyone else in the chain can see where the change happened and can decide whether this is an authorized change.

- Tamper proof information: In practice, say the distributed ledger is shared across 5,000 computers and a hacker wants to change some information recorded in one of the blocks, they would have to hack all 5,000 computers simultaneously. This is an arduous task.

- Instantaneous transfer: Reconciliation and payment of transaction happens in less than 10 minutes versus an average of a few days for third-party systems.

2. Limited supply of Bitcoins:

- Only 21 million bitcoins will be mined. This means there is a limited supply against increasing demand of Bitcoins. More and more people are adopting Bitcoins in their daily life use. High demand and low supply will take bitcoin to newer heights.

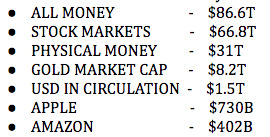

3. Market size:

- Bitcoin just touched $100B market cap which is nothing as compared to the other asset classes and total money in circulation.

- Bitcoin has till now acquired just 1% market cap as that of gold. And it is already being called Gold 2.0. Numbers are only going to increase.

4. Low transaction fees:

- It is really very easy to transfer bitcoins from one person to another with very low transaction cost unlike banks.

It is just a beginning. Be smart and make a smart choice.

0 notes

Text

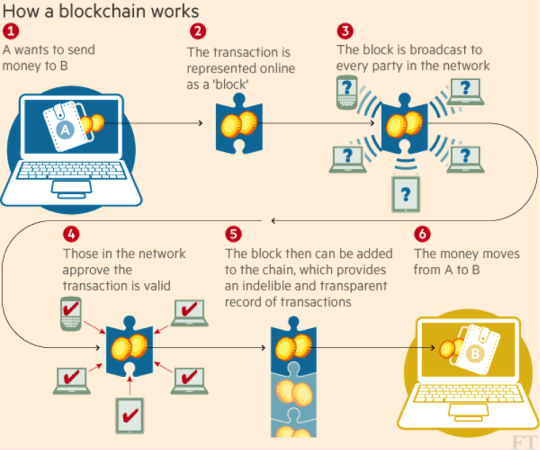

How Blockchain Technology Works?

The blockchain is just a public ledger log of all transactions that were ever verified on the network.

Each and every transaction is collected in blocks, which are found approximately every ten minutes in a random process called mining. As transactions transfer ownership happens, each of these blocks represents an update of the user's balances on the network.

By following the blockchain from the Genesis Block and applying all transactions that were validated in each block in the correct order, you arrive at the current status quo.

Generally, transactions can only spend "coins" that have already been created. This is why each block has a fixed position: Each block references its direct predecessor. E.g. Block 90 says that Block 89 preceded it, in turn, Block 89 names Block 88 as its predecessor, and so forth, until Block 2 points at the first block, the Genesis Block.

Genesis Block ← 2 ← … ← 88 ← 89 ← 90

Blockchain technology may provide several important features that could be leveraged for use in the creative economy:

Deterministic results: Everyone can start from the Genesis Block and apply each block consecutively to arrive at the same result.

Synchronization & Consensus: When you have applied the latest block, the balances in your ledger have the exact same state as in all the other participants' ledgers.

Unchangeable History: As each block builds upon its predecessor, each new block buries the history under more work. It can’t be changed.

Transactions are verified and approved by consensus among participants in the network, making fraud more difficult.

The full chronology of events (for example, transactions) that take place are tracked, allowing anyone to trace or audit prior transactions.

The technology operates on a distributed, rather than centralized, platform, with each participant having access to exactly the same ledger records, allowing participants to enter or leave at will and providing resilience against attacks.

0 notes