Don't wanna be here? Send us removal request.

Text

CryptoPunks: The Blueprint of NFTs

Long before Bored Apes, Pudgy Penguins, and Azukis, there were CryptoPunks—the first-ever Ethereum NFTs, launched in 2017 by Larva Labs. These pixelated avatars became the foundation of today’s NFT culture.

www.cifdaq.com #CIFDAQ #CIFD #NFT #CryptoPunk #BlockchainEcosystem #CryptoTrading

0 notes

Text

Stay tuned and follow us for more exciting insights and facts!

www.cifdaq.com #CIFDAQ #Crypto #Blockchain #CIFD

0 notes

Text

Curious about how staking can boost your crypto earnings? 🤔💸 Have you considered locking your tokens for rewards yet?

www.cifdaq.com #CIFDAQ #CIFD #BlockchainEcosystem #CryptoTrading #Web3Community #Staking #CryptoEarnings

0 notes

Text

Why Is Bitcoin Rising? BTC Price Surpasses $100K

BTC is the world’s largest cryptocurrency, with a market capitalization of $2.03 trillion. It skyrocketed immediately after Donald Trump won the U.S. presidential election on Nov. 5, 2024, and has continued rising since then, surpassing its previous highs multiple times. As of Dec. 5, 2024, Bitcoin has surpassed its prior highs and hit an all-time high of $103,900.

After nearly touching $100K, BTC stabilized at $95,000, with the market optimistic that it will continue to rise; as of Dec. 05, 2024, it peaked at an all-time high of $103,900.

The hope that the U.S. and the rest of the world will embrace pro-crypto policies appears to be the most appealing factor fuelling BTC’s rise. China’s efforts to lift restrictions on personal cryptocurrency ownership are also spurring hopes. Reports of Brazil and Russia considering BTC as a reserve too signal promise for cryptocurrency.

Bitcoin Trading At $100K In December 2024

Bitcoin peaked at its all-time high at $103,900, with a market capitalization of $2.03 trillion and a global market capitalization of $3.69 trillion as of Dec. 5, 2024, after the U.S. presidential election, Donald Trump’s victory, and anticipation of more favorable policies for the crypto industry.

Bitcoin is stable at around $102,473, with an increase of approximately 7.85% from the last week. The crypto market sentiment is “extreme greed.”

Last week, the U.S. Federal Reserve lowered its interest rate by 25 basis points from 4.50% to 4.75%, making borrowing money through credit cards, loans, and auto financing cheaper. This contributed to the surge. In the past, BTC rose due to the U.S. Federal Reserve’s announcement of a rate cut of 0.5% on Sept. 19, 2024, the start of an easing cycle.

The currency has struggled to maintain above $65,000 since hitting an all-time high in March. Still, it has neared $98,000, surpassing the all-time high multiple times in November 2024 after Trump, who has a pro-crypto stance, clocked victory in the U.S. presidential election.

Why is Bitcoin Rising?

Among the key reasons why Bitcoin has surged to reach its highest since 2021 include:

Donald Trump won the U.S. presidential election in 2024.

The U.S. Federal Reserve cut interest rates by another 25 bps after its once-in-four-years cut of 50 bps.

The Swiss National Bank followed suit by reducing the interest rate by 25 bps.

The Bank of Japan maintained a steady interest rate.

U.S. SEC approval of Spot Ethereum ETFs.

Strong inflows into Spot Bitcoin ETFs.

The U.S. banking sector’s woes in 2024 led digital currency supporters to reiterate the significance of decentralized finance and the need to have complete control of one’s own money without the regulation of banks that themselves find it difficult to stay afloat in a challenging global economic environment.

What Lies Ahead for Bitcoin?

Institutional adoption is accelerating, exemplified by Bitcoin ETFs like BlackRock’s, which have attracted billions in investments, signaling growing confidence from traditional financial markets. On the regulatory front, President-elect Donald Trump’s nomination of Paul Atkins, a known cryptocurrency advocate, to head the SEC highlights a potentially favorable shift in the regulatory landscape. This could pave the way for more precise guidelines, encouraging widespread adoption.

The market momentum is another bullish signal. Let us see what industry experts have to say about what lies ahead for Bitcoin:

Vikram Subburaj, chief executive officer of Giottus, said that Bitcoin is currently in price discovery with experts predicting the price of BTC to reach $150,000 or even more. Volatility is expected as early entrants will indulge in booking profits. The overall sentiment for BTC will remain bullish till 2025.

Saravanan Pandian, chief executive officer of KoinB, said that market sentiment and adoption and increased confidence: Hitting $100K could fuel further confidence among retail and institutional investors, driving more capital into the market. Businesses and governments may increase Bitcoin adoption as a store of value.

He further said that the price milestone may speed up regulatory approvals for spot Bitcoin ETFs in major economies. More companies could follow Tesla and MicroStrategy’s lead in holding Bitcoin on their balance sheets.

Bottom Line

According to CoinMarketCap data, as of Dec. 5, 2024, Bitcoin had exceptionally surged to an all-time high at $103,900, indicating 79% bullish and 21% bearish community sentiment, voted by 845.9K votes.

As per the BTC holdings, 78.35% are in $0-$1k, 20.12% are in $1k-$100k, and 1.52% are in $100k+. The whale holdings are 1.25%, and others are 98.75%. Despite the surge in BTC, it is essential to approach cryptocurrencies with caution and diligence. Remember to stay informed, patient, and vigilant in protecting your investments.

www.cifdaq.com #CIFDAQ #Crypto #Blockchain #CIFD

0 notes

Text

Bitcoin at $100,000? Trump rally sends crypto past $80,000 mark

Bitcoin Price today: The largest and oldest crypto asset scaled new highs since the announcement of the US elections and the bullish momentum has pushed it above $81,000 mark.

Bitcoin has been surging higher ever since the outcome of US election, where the Republican Party's Donald Trump will be swearing in as the 47th president of the United States. The largest and oldest crypto asset scaled new highs since the announcement of the US elections and the bullish momentum has pushed it above $81,000 mark.

According to the data from Coinmarketcap, Bitcoin rose nearly 6.25 per cent in the last 24 hours to $81,858.29 in the early Asian trading hours. The largest crypto assets total market capitalization has neared $1.7 trillion mark, thanks to the 20 per cent rise in the digital asset in the last one week.

In the past week, Bitcoin surged from $67,000 to $79,900, breaking multiple all-time highs following Trump’s US presidential victory. Ethereum followed the same trend, said Edul Patel, co-founder and CEO at Mudrex. He sees steady ETF inflows, rising global liquidity, a positive economic outlook, recent rate cuts, and regulatory support as the key factors in the latest crypto rally.

Bitcoin has surged to $80,000, marking a major milestone that highlights its resilience and growing acceptance in global finance, said Balaji Srihari, Business Head, CoinSwitch.

"We have large institutional investors accumulating Bitcoin and offering it as an asset to customers in the form of ETFs, a positive regulatory environment and several innovative projects ready for take off. It's the perfect set up for a bull cycle," he said.

The recently elected US president Donald Trump has presented himself as a staunch crypto supporter on multiple occasions. His win is seen as a big positive by the crypto industry in terms of validation and regulation. On the other hand, institutional inflows have been moving from gold to Bitcoin, said the industry participants.

Bitcoin’s rally towards $80k indicates a resurgence of confidence in the crypto market, fueled by solid fundamentals, said Sumit Gupta, co-founder at CoinDCX. "With growing institutional interest, reflected in increased investments through Bitcoin ETFs and clearer regulatory guidelines, Bitcoin is solidifying its 'digital gold moniker," he said.

If regulatory frameworks become more crypto-friendly, we may witness broader institutional adoption and a positive impact on the entire digital asset ecosystem, potentially marking the end of the crypto winter, Gupta said.

The global crypto market capitalization was up by about 5 per cent in the last 24 hours to $2.79 trillion level, the Coinmarketcap data suggests. The total crypto market volume over the last 24 hours has seen a rise of as much as 106 per cent at $230.05 billion, while Bitcoin's dominance in the total marketcap of crypto assets is up marginally, inching toward the 58 per cent mark.

Not just Bitcoin, Elon Musk-backed Dogecoin has zoomed nearly 30 per cent in the 24 hours. The meme-token, which is the sixth most valued cryptocurrency globally, has nearly doubled its value in the last one week. The total market capitalization of Dogecoin has soared above $43.25 billion.

Known for his favorable stance on cryptocurrency and financial innovation, Trump’s win has raised expectations for a more supportive regulatory environment for digital assets, said Himanshu Maradiya, Founder and Chairman at CIFDAQ. "This peak underscores Bitcoin's expanding role within global finance, capturing interest across sectors and signaling future prospects."

Srihari from CoinSwitch said that the trading volumes on their platform have risen by 350 per cent since the election results on a weekly basis. "As the market gains momentum, it's important for investors to stay vigilant and informed about factors that could influence price stability," he said.

Among other crypto assets Cronos, Floki Inu, Shiba Inu rallied 18-28 per cent in the last 24-hours. Top tokens like Solana, XRP, Cardano, Tron and Avalanche rallied 4-10 per cent in the last 24 hours. To recall, 14-year old Bitcoin has rallied nearly 16,80,04,056 per cent or 16.80 lakh times from its all time low hit on July 15, 2010.

Patel from Mudrex expects Bitcoin to hit $100,000 market in the coming weeks due to increasing retail participation since the last few sessions signals a strong bull run going forward. "Strong momentum in the top two coins could also trigger a rally in the altcoins setting stage for further rally in the crypto market," he said.

The $100,000 mark is indeed the next significant psychological target for Bitcoin said Gupta from CoinDCX. The homegrown exchange recently appointed former Indian Cricketer and current head coach Gautam Gambhir as their brand ambassador.

"As the market matures and regulatory support grows, we may see a surge in interest across both Bitcoin and altcoins. Such tailwinds, paired with Bitcoin’s fundamentals, point to a strong possibility of Bitcoin achieving this milestone, reinforcing its status as a key asset in diversified portfolios," he said.

www.cifdaq.com #CIFDAQ #Crypto #Blockchain #CIFD

0 notes

Text

Bitcoin rallies past $81,000. What's driving the surge?

Bitcoin surged past $81,000 for the first time, hitting a record high on Monday with its market cap reaching $1.6 trillion. Bitcoin soared to a new record high, crossing the $81,000 mark on Monday. This rally is fuelled by the potential of a favourable regulatory environment following Donald Trump’s recent election victory in the US. With this sharp rise, Bitcoin was trading at $81,119.61 as of 11 AM, giving it a market cap of $1.6 trillion.

Trump’s pro-crypto stance during his campaign has been a major driver of this surge. He promised to make the US the “crypto capital of the planet” and proposed policies such as building a national Bitcoin reserve and appointing regulators to support the industry. These promises have sparked optimism among investors, with expectations that his administration could introduce crypto-friendly regulations.

BITCOIN HITS NEW RECORD HIGH

Many in the market believe Trump’s plans for Bitcoin and other digital assets have set the stage for the recent surge. His win has increased hopes for a friendly environment for digital assets, which many investors see as a shield against inflation and traditional market swings.

Sumit Gupta, co-founder of CoinDCX, sees Bitcoin’s $81,000 milestone and $1.5 trillion market cap as a sign of renewed optimism.

"Bitcoin’s record-breaking surge is backed by strong fundamentals and signals from the recent US election that suggest pro-crypto policies may be on the horizon. This shows Bitcoin’s strength as a hedge against regular market ups and downs," he said.

Gupta also highlighted how growing interest from large institutions and the introduction of Bitcoin ETFs (exchange-traded funds) have played a key role in Bitcoin’s rise.

“With favourable regulatory support, we could see even more adoption from institutions, which may mark the end of the ‘crypto winter’ and strengthen the digital asset market further,” he added.

Gupta explained that the $100,000 mark is now the next big target for Bitcoin, which could be reached with continued institutional backing, expanding ETF markets, and supportive regulations.

"Bitcoin’s unique qualities like its scarcity, decentralisation, and increasing acceptance make it an appealing choice in a diversified portfolio," he noted.

WHAT'S DRIVING THE RALLY?

"This rally was catalysed by the Federal Reserve’s recent 25 basis points rate cut in November, which has prompted a shift in investor sentiment toward alternative assets. This monetary policy adjustment signals a more accommodative approach, driving increased interest in assets like Bitcoin as inflationary concerns ease," said Himanshu Maradiya, Founder and Chairman, CIFDAQ.

One of the significant factors behind Bitcoin’s rising value is the growing interest from institutional investors. The approval of Bitcoin ETFs in the US earlier this year has made it easier for these institutions to invest in Bitcoin legally, which has increased demand. ETFs provide a regulated way for both individual and institutional investors to gain exposure to Bitcoin without needing to directly buy or manage the cryptocurrency.

Edul Patel, CEO of Mudrex, believes Bitcoin’s all-time high is a result of several factors.

"Firstly, the approval of Bitcoin spot ETFs by the US SEC has been a game-changer, making it simpler for institutions to enter the market. Secondly, rate cuts in major regions, including the US, EU, and China, have led to higher cash flow, with more people willing to invest in alternatives like cryptocurrencies,” he explained.

Patel also said that Trump’s pro-Bitcoin stance has led more institutions to purchase Bitcoin in anticipation of friendlier regulations. He pointed out that nearly 30-40% of Americans already hold crypto, and a supportive stance from the government could lead to a significant boost in demand. “With this, the general mood among investors has improved greatly,” he added.

The current investor sentiment around Bitcoin remains high, with the BTC fear-greed index, which tracks market sentiment, now indicating “Extreme Greed.” This positive sentiment has also resulted in an increase in long positions in Bitcoin futures, with an estimated $2.8 billion in contracts betting on Bitcoin reaching $90,000.

According to Patel, Bitcoin’s support level is at $75,600, while it faces resistance around $82,500. If the rally continues, it may drive other cryptocurrencies upwards as well, with Ethereum already showing gains, rising to $3,200 on Monday due to the positive sentiment surrounding Bitcoin’s latest peak.

Bitcoin’s recent surge has also positively impacted other digital assets, particularly Ethereum, which hit $3,200. Often, Bitcoin’s movements influence the broader cryptocurrency market, and Ethereum’s price increase shows the impact of Bitcoin’s record-breaking climb.

www.cifdaq.com #CIFDAQ #Crypto #Blockchain #CIFD

0 notes

Text

Dogecoin has seen incredible price swings over the years. Check out its price history and see how this meme coin became a serious player in the digital asset space!

www.cifdaq.com #Dogecoin #DOGE #CryptoHistory #MemeToMarket #CIFDAQ

0 notes

Text

The cryptocurrency market saw remarkable growth in 2024

"🌍 The cryptocurrency market saw remarkable growth in 2024, driven by Bitcoin’s 120% surge, Ethereum’s 55% rise, and the approval of BTC & ETH ETFs. 📈 Institutional adoption expanded through derivatives trading, liquid staking, and restaking protocols, while several nations embraced Bitcoin as reserves, boosting global confidence. 💰 As crypto matures and integrates further into mainstream finance, 2025 is set to be another pivotal year. – Himanshu Maradiya, Chairman & Founder, CIFDAQ"

https://lnkd.in/dANwCpWM

www.cifdaq.com #Crypto2025#Bitcoin#DeFi#BlockchainRevolution#CIFDAQ#CIFD

0 notes

Text

Stay tuned and follow us for more exciting insights and facts!

www.cifdaq.com #CIFDAQ #CIFD #BlockchainEcosystem #CryptoExchange #Web3Community

0 notes

Text

Bitcoin Price Rebounds to $97K: CIFDAQ Founder Predicts Continued Volatility in the Crypto Market

Bitcoin recently crossed the $100,000 mark for the first time, having skyrocketed nearly 140% this year. This surge has generated excitement, especially with the anticipation that President-elect Donald Trump will support cryptocurrencies. Trump has expressed his goal to make America the “crypto capital of the planet” and even proposed creating a national stockpile of Bitcoin.

Bitcoin Reaches $100,000: A Historic Milestone

But alongside this milestone, the altcoin market is also showing movement, with Ethereum breaking its retracement levels and XRP surging past its 2021 high to $2.90. While Bitcoin’s rise is grabbing headlines, the question ‘what’s next’ is also haunting investors. At the time of writing, Bitcoin has retraced back to the $97k levels and is down by more than five percent.

This moment feels eerily similar to the crypto boom of 2017 when Bitcoin broke $10,000 and the media machine kicked into high gear. That was when the altcoin market truly took off, creating a frenzy of gains. Now, with Bitcoin reaching $100,000, we might be witnessing the beginning of a similar surge in altcoins, where volatility and quick gains are the name of the game. However, the question remains: is Bitcoin’s rise a sign of continued growth, or is it entering a consolidation phase?

Altcoins Surge: Ethereum and XRP Lead the Charge

Himanshu Maradiya, Chairman and Founder, CIFDAQ, told Coinpedia, “Bitcoin’s leap past the $100,000 mark isn’t just a financial milestone—it’s a historic moment that cements the growing clout of decentralized assets in the mainstream. For investors, the spotlight now shifts to long-term planning: keeping an eye on market cycles, diversifying portfolios, and staying updated on regulatory shifts.”

He added,

“While this breakthrough fuels optimism, it’s important to tread carefully—volatility remains part of the game. Seasoned investors see this as a chance to reassess risk strategies, while newcomers are urged to prioritize learning the ropes before diving in. The road ahead will demand both patience and conviction.”

www.cifdaq.com #CIFDAQ #CRYPTO #TRADING #BLOCKCHAIN

0 notes

Text

XRP Price Prediction: Will Ripple Make Waves In 2025?

Love it or loathe it, XRP has cemented itself as a prominent player in the crypto market. Ranked sixth by market capitalization, XRP has held a spot among the top-ranking cryptocurrencies for more than 10 years.

Created by Ripple Labs, XRP is more than just a cryptocurrency—it’s an ambitious project aimed at transforming how money is moved worldwide. Ripple’s vision is to provide an efficient and cost-effective alternative to the existing SWIFT banking system. Using XRP, Ripple aims to enable faster, low-cost international transactions, making money transfers as easy as sending an email.

As cryptocurrency was created to move away from financial middlemen—such as banks—XRP has been a divisive project over the years. The project is known for its cult-like following, with members keen to silence naysayers and defend their belief in XRP, with some boosters making wildly unrealistic predictions about its growth potential.

To provide a balanced opinion on the project, we’ve sought the expertise of Grzegorz Drozdz, a market analyst at Conotoxia.

What Is Going On With XRP?

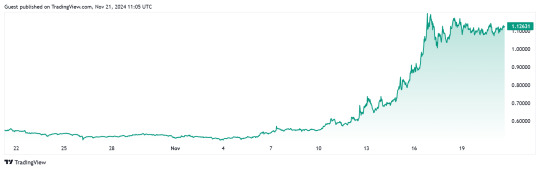

The XRP price is rising due to technological advancements and a market structure that implies a rally toward $2 shortly. The cryptocurrency market is doing exceptionally well for major cryptocurrencies, including BTC, significantly due to Donald Trump’s victory in the 2024 U.S. election. As of Nov. 21, 2024, XRP is trading at $1.12 with a market capitalization of $63.92 billion. The price was up by approximately 7% over the last week, outperforming the rest of the crypto market.

According to the data from Trading View, XRP rose from a low of $0.6833 on Nov. 14, 2024, to a whopping 24% high to a 16-month high of $0.8479 before retracing to the current level of $1.12.

XRP’s Price History

Incredible highs, steep falls, and long periods of steady decline mark XRP’s journey.

The project launched its token in 2013 but saw little significant price action until the bull run of 2017. However, after this period, listings on popular exchanges became pivotal to the coin’s considerable price rises.

“The history of XRP cryptocurrency listings begins in 2018, a pivotal year for Ripple (the company behind XRP),” Drozdz tells Forbes Advisor. Ripple’s launch of the xRapid product was a defining moment, ushering in a new era where XRP cryptocurrency aimed to revolutionize money transfer, including within the banking system. The response from the market was phenomenal.

“Within a very short time, the price of XRP skyrocketed by as much as 1820%,” Drozdz says. From a humble $0.2, XRP soared to $3.84, an all-time high that naturally thrilled investors. However, as Drozdz notes, this jubilation was short-lived. “The cryptocurrency then fell by 93% in a matter of months, leaving a stark reminder of the volatile nature of the crypto world.”

But XRP wasn’t finished. In 2021, as the entire cryptocurrency market was caught in a bull market frenzy, XRP again provided significant returns to investors who got in at the right time. “Within six months, the cryptocurrency had increased by an impressive 710% to $US1.96,” Drozdz recounts. Yet the following period was a steady downward trend, as XRP’s value gradually declined to $US0.3.

Ripple has been engaged in a multi-year legal battle with the US Securities and Exchange Commission (SEC), which has impacted the price of XRP for the past few years, although the company has been on a winning streak lately. The first win, despite only being a partial victory, occurred when a judge ruled last year that Ripple had not violated existing securities laws by selling XRP to exchanges for retail investors. However, it did break the law by selling directly to institutional investors. This first victory caused XRP to soar over 80% in price overnight.

The second win came when a judge blocked the SEC’s attempt to appeal the ruling, again causing positive price action for XRP. The third win came in October last year when the SEC dismissed its own case against the company’s CEO and executive chairman. As of Nov. 21, 2024, XRP sits at $1.12 with a market capitalization of $63.77 billion.

As Drozdz points out, the past may not necessarily predict the future, but it can offer valuable insights to help guide investment decisions.

How Will XRP Perform?

Many investors are wondering about the future after Ripple’s recent winning streak against the SEC last year. The most significant victory, despite being only a partial win, involved the court ruling that the sale of Ripple’s XRP tokens on exchanges and through algorithms did not constitute investment contracts, while the institutional sale of the tokens violated federal securities laws.

“The partial resolution of the dispute with the US Securities and Exchange Commission (SEC) could potentially spur growth for XRP in the near future,” explains Drozdz. This legal battle has been a significant factor in XRP’s performance, with developments closely watched by investors and the wider crypto community.

Yet, Drozdz offers a note of caution. “The dispute has not yet been fully resolved. While the recent developments are certainly encouraging, we cannot be completely certain about XRP’s future trajectory.”

In March, the SEC requested around $US2 billion in remedies against Ripple for the institutional sale of XRP. Ripple responded to the request in late April, arguing that a penalty of more than $US10 million was unjustified in this situation. The SEC has since responded and the final ruling will be handed down by the judge.

Understanding the correlation between legal resolutions and market performance is crucial. If the dispute with the SEC reaches a favorable final conclusion, it’s reasonable to anticipate that investor interest in XRP could spike. This would likely fuel new growth and potentially lead to an uptick in its price.

However, it’s important to remember, as Drozdz points out, that these projections are just that—projections. They offer a potential path for XRP’s performance in 2024, and beyond, but do not provide a definitive guarantee. Much hinges on the outcome of the SEC dispute and how the crypto market fares in the coming months.

XRP Price Prediction

According to Coincodex, the price prediction for XRP for the year 2024, based on the data of Nov. 21, 2024, the sentiment is bullish, with 27 technical analyses indicating bullish signals and 5 indicating bearish signals.

XRP is predicted to close between $0.699874 and $1.15328 for 2024. This would mean that the price would be decreased by -24.16% compared to today’s prices (assuming last month’s average price of $ 0.845628). In other words, short sellers would generate a potential profit of 37.23% if XRP follows the prediction.

Himanshu Maradiya, founder and chairman of CIFDAQ, believes that XRP’s long-term price outlook for 2025 presents a range of possibilities, heavily influenced by adoption, regulatory dynamics, and market sentiment.

“A bull case suggests widespread ODL adoption and solid global partnerships, combined with favorable regulations, could propel XRP to $10-$15. Conversely, a moderate scenario reflects steady but competitive growth, potentially placing XRP in the $5-$10 range. In a bear case, challenges such as slow adoption, unfavorable regulations, or intense competition could restrict XRP to $1-$4. Ultimately, XRP’s trajectory will hinge on its ability to navigate and capitalize on this crypto wave,” said Maradiya.

Utkarsh Tiwari, KoinBX’s chief strategy officer, said that the price prediction for XRP in 2025 will be shaped by a combination of critical factors, including regulatory clarity, advancements in Ripple’s technology, and its adoption across the traditional spectrum.

He also says that if Ripple successfully navigates ongoing regulatory challenges, such as its ongoing case with the SEC, and continues to expand partnerships with financial institutions, XRP could emerge as a strong contender for cross-border payment solutions.

He added that XRP’s demand could position it for significant price growth as blockchain becomes more mainstream. While market volatility and external economic factors remain unknown, the long-term outlook for XRP appears promising if these current conditions remain constant.

According to the Binance price prediction for XRP, its value may increase by 5% and reach $1.504836 by 2030. The current sentiment is very bullish; based on 408 crypto users’ ratings, 54.17% of users are very bullish.

What Does the Future Hold for XRP?

Forecasting the future of any cryptocurrency can be like trying to predict the weather: many variables are at play, some predictable, others less so.

Over the years, many price predictions have been made regarding XRP.

Crypto hedge fund manager, Thomas Kralow, previously predicted that XRP would hit $US30 a coin in 2023. This prediction fails to consider the mathematical improbability of XRP reaching this price, as the total supply of 100 billion coins means the project’s market cap would be $US3 trillion dollars. That is more than double the current market cap of all cryptocurrencies combined.

To avoid the sensationalist views often provided by XRP fanatics, Drozdz provides a balanced insight into two scenarios: a bullish outlook, driven by increased popularity and positive legal outcomes, and a bearish view, potentially impacted by declining interest, token design and broader market sell-offs.

The Bull Case

“Cryptocurrencies, in general, are driven largely by news, popularity, and in the case of XRP, court decisions,” says Drozdz. These currencies lack intrinsic value, like physical assets or cash flows. Therefore, their value largely depends on the sentiment of investors.

The recent winning streak against the SEC has already created a ripple effect, pardon the pun, on its price. However, the trend back to the baseline price before the ruling indicates that the market thinks the project might not be out of the woods just yet.

The end of the SEC case in the coming months, especially if the penalties for the institutional sales of XRP are light, could boost XRP’s price, but whether the price will stay high or fall afterwards is yet to be seen.

Beyond the legal realm, the general state of the cryptocurrency market can significantly impact XRP. Drozdz notes: “A large-scale upswing in the crypto world could be a boon for XRP. If other cryptocurrencies rise, XRP could well ride the wave.”

The Bear Case

However, not all potential scenarios are rosy. The resolution of the ongoing litigation could, paradoxically, lead to a decline in XRP’s price.

“Once the excitement around the lawsuit fades, we could see a drop in interest for XRP. That could, in the medium term, negatively impact its price,” Drozdz explains.

While the price currently remains above the level the token was at prior to the ruling, if XRP continues on the trend, it won’t be long before it drops to a new low.

The broader market also presents possible challenges. If a significant sell-off in the cryptocurrency market occurs, this could also depress the value of XRP. “Just as XRP can benefit from a bull market, it’s susceptible to bearish trends in the wider cryptocurrency space,” Drozdz says.

There are also concerns about using XRP in Ripple’s cross-border payment system. The currency is largely redundant and potentially isn’t necessary for the payments system to function. Even if XRP is used to settle payments, the value of XRP does not affect the system’s functionality, as the payments are settled in fiat value. This means that the payment can still be sent as usual whether XRP is $1 or 1 cent, providing little incentive for positive price action.

For this reason, it is easier to perceive long-term value if the token’s design and utility in the system is improved.

Is XRP a Good Investment?

Investing in cryptocurrencies, including XRP, isn’t a decision to be taken lightly. As Drozdz notes, while current events suggest a positive outlook for XRP, particularly with the new bull market in cryptocurrencies, inherent risks are involved.

However, the world of cryptocurrencies is known for its wild swings and unpredictability.

“Investing in XRP is risky and may not be suitable for most investors due to the high price volatility and the difficulty in predicting future trends in the cryptocurrency market,” Drozdz says.

This advice highlights the need for prospective investors to consider their own risk tolerance and financial goals carefully.

“Investment decisions should be made with a clear understanding of the risks involved,” Drozdz says. “For some, XRP could present an exciting opportunity. For others, it may not align with their risk appetite or investment strategy.”

However, erring on the side of caution is always recommended.

“In the world of cryptocurrency, a dash of caution is always wise. Keep a keen eye on the developments surrounding XRP and make informed decisions based on the evolving landscape,” he says.

Whether XRP is a good investment depends mainly on an individual’s financial situation, risk tolerance, and investment goals. As always, it’s imperative to do thorough research and consider seeking advice from a financial advisor before diving into cryptocurrency of any kind. www.cifdaq.com #CIFDAQ #CRYPTO #TRADING #BLOCKCHAIN

0 notes

Text

Google’s Willow chip to challenge cryptography, but Bitcoin will hold steady, players believe

Google unveils Willow quantum chip, posing potential threat to Bitcoin security, but experts believe decryption remains distant with 105 qubits.

Google has unveiled its Willow quantum computing chip, which some speculate could “crack” Bitcoin. However, cryptocurrency experts argue that decrypting a Bitcoin typically requires around 13 million qubits, far exceeding Willow’s 105 qubits.

On Monday,Alphabet and Google CEO Sundar Pichai announced the development of Willow on social media platform X. He stated that the quantum computing chip can reduce errors exponentially as Google scales up using more qubits, cracking a 30-year challenge in the field. In benchmark tests, Willow solved a standard computation in less than five minutes, unlike a supercomputer that would require indefinite time.

A qubit, or a quantum bit, is the basic unit of quantum information in quantum computing. Unlike a classical bit or a binary of 0 or 1, a qubit can represent both 0 and 1, allowing quantum computers to process many combinations simultaneously.

Existential risk?

Twitter user Monetary Commentary pointed out that this development is potentially alarming for Bitcoin and other cryptos that rely on public-key cryptography.

The user explained that Bitcoin’s security is supported by elliptic curve cryptography (ECC), a system designed to be computationally impossible for traditional computers to break within a reasonable timeframe. However, quantum computers like Willow, with exponentially reduced error rates and vast computational power, pose a direct threat to ECC.

Quantum algorithms can factorise large integers and compute discrete logarithms — either of which can break ECC. A machine like Willow that can perform computations in minutes that would take other supercomputers infinitely longer, represents an existential risk to Bitcoin’s security model.

“The idea of quantum computers cracking Bitcoin is still far off. Google’s Willow chip, with 105 qubits, is impressive, but lightyears away from the millions needed to challenge Bitcoin’s security. Think of qubits as the ‘power cores’ — the more you have, the more powerful the computer. Even if Willow’s qubits are ground-breaking and hold promise for addressing challenges like climate modelling and drug discovery, it’s not enough to break Bitcoin’s encryption,” observed Himanshu Maradiya, Chairman and Founder of CIFDAQ.

Obstacles like scaling and error correction remain. However, while the crypto world is building quantum-resistant solutions with the evolution of quantum technology, industries from finance to cybersecurity will need to adapt, ensuring that they are future-ready, he said.

Utkarsh Tiwari, the chief strategy office of KoinBX, resounded this, saying that while some discussions link quantum advancements to the potential for “cracking” it, Bitcoin is based on cryptographic algorithms like SHA-256, which would require more than a million qubits to pose a genuine threat.

“Willow’s capabilities, while impressive, do not yet pose an immediate risk to the cryptographic foundations. The estimated computational power required to compromise Bitcoin’s encryption methods is still far beyond what Willow can achieve,” said Balaji Srihari, Vice-President, CoinSwitch.

A call to action

Quantum computing could theoretically solve cryptographic puzzles faster than classical systems. However, the timeline to achieve such capabilities remains uncertain, says Sathvik Vishwanath, the co-founder and CEO of Unocoin. Willow’s demonstration focuses on specific benchmarks rather than direct cryptographic attacks.

However, Mohammed Roshan Aslam, the co-founder & CEO of GoSats, feels that new cryptography practices and encryption methodology will have to be developed to address any potential challenge posed by Google’s Willow.

Nearly 105 qubits fall short of the necessary 13 million qubits to complete Bitcoin’s decryption, he pointed out. “If subsequent R&D in Google Willow manages to integrate such computational power in the future, cryptography and encryption developments may align with addressing this challenge. Additional software upgrades like hard fork in blockchain may be implemented to address this issue, but that may not be the ideal solution. For now, we have only limited understanding of Google Willow, and crypto and tech stakeholders will have to work in tandem to find an amicable solution for this.”

The Willow development serves as both a breakthrough and a call to action, with quantum computing potentially reshaping financial systems, including Bitcoin, in the future. However, Unocoin’s Vishwanath added, the Bitcoin community remains resilient, focusing on maintaining long-term security and technological advancements to counter potential quantum threats.

www.cifdaq.com #CIFDAQ #CRYPTO #TRADING #BLOCKCHAIN

0 notes

Text

Defining moments in Web3 history—where innovation meets decentralisation! Every step is shaping the future of the internet.

www.cifdaq.com #Web3 #BlockchainRevolution #DefiningMoments #CIFDAQ

1 note

·

View note

Text

Bitcoin isn’t just a currency, it’s the market leader!

www.cifdaq.com #CIFDAQ #CIFD #Web3 #Blockchain #Crypto #bitcoin

0 notes

Text

Arweave: Revolutionizing data permanence

With its immutable storage model, innovative Permaweb, and partnerships like Meta archiving digital collectibles, Arweave is shaping the future of decentralized data storage. 🚀💾 AR token stands strong at $18.72, with analysts eyeing $19.69 by Nov 2024. 📈 A game-changer for developers, creators, and blockchain ecosystems alike.

www.cifdaq.com #Web3 #DecentralizedStorage #Crypto

0 notes

Text

DOGE Price Predictions: What’s in Store for Dogecoin Through 2030?

Dogecoin (DOGE), originally created as a lighthearted joke in the cryptocurrency world, has evolved into a prominent player among the top 10 cryptocurrencies by market capitalization. Named after the popular Shiba Inu meme, DOGE utilizes blockchain technology to ensure security and transparency. Despite its whimsical origins, Dogecoin has garnered serious attention and investment.

DOGE Price Prediction for 2024

As we head into 2024, Dogecoin’s price dynamics are attracting considerable interest. Recent market movements show DOGE experiencing fluctuations around the $0.10 mark, reflecting a weak bullish sentiment amidst a broader market correction. According to Coinpedia, the coin saw substantial bullish activity early in the year. However, by July, the weekly trend shifted to bearish, with the price finding support at the dynamic 200-day EMA.

The lower price rejections suggest robust demand for Dogecoin at these lower levels, which could potentially fuel a bull run. A conservative estimate sees DOGE potentially reaching $0.3751. Conversely, if selling pressure prevails, the price might test the $0.10 support level. CoinDCX offers a slightly more optimistic forecast, predicting a minimum price of $0.4 and a maximum of $0.5 for DOGE in 2024.

Looking Ahead to 2025 and 2026

For 2025, the trajectory of Dogecoin’s price will likely be influenced by both market conditions and broader adoption trends. If DOGE maintains its momentum and continues to attract major investors, the price could rise significantly. Historical data and recent whale activity hint at a positive outlook, with large holders showing increased bullish sentiment.

By 2026, if Dogecoin sustains its growth and remains relevant in the cryptocurrency space, it could see further gains. The key factors will include continued market interest, technological developments, and broader acceptance of meme coins as viable assets.

The Long-Term View: 2030

Looking further ahead to 2030, predicting Dogecoin’s price becomes more speculative. The cryptocurrency landscape is evolving rapidly, and DOGE’s future will depend on its ability to adapt and maintain investor interest. If Dogecoin continues to capture the public’s imagination and integrates new features or partnerships, its price could potentially see substantial increases.

Expert Insights

Himanshu Maradiya, Founder and Chairman of CIFDAQ Blockchain Ecosystem India Ltd., highlights the recent shift in Dogecoin whale activity as a positive sign. The Large Holders Netflow indicator recently transitioned from a bearish to an extremely bullish stance, reflecting growing optimism among major investors. This shift in sentiment suggests a favorable outlook for Dogecoin, driven by increased accumulation from large holders.

While Dogecoin’s journey from a meme to a major cryptocurrency has been remarkable, its future price trajectory will be shaped by market conditions, investor sentiment, and technological advancements.

www.cifdaq.com #CIFDAQ #CRYPTO #TRADING #BLOCKCHAIN

0 notes

Text

Donald Trump's crypto push: Not just Bitcoin, even these tokens are soaring

Bitcoin, the world’s biggest cryptocurrency, has become one of the most eye-catching movers in the week since the US presidential election, crossing the $90,000 mark.

On November 14, Bitcoin recorded a surge of 21.05% over the last seven days. It was trading at $90,617.33 and had a market cap of $1.79 trillion at the time the article was being written.

The surge is not only crucial in terms of Bitcoin’s valuation but also in its wider impact on the altcoin market.

The catalyst for this dramatic uptrend is President-elect Donald Trump’s positive stance on digital currencies. Trump has expressed his desire for the US to become the ‘crypto capital of the planet’. This has shifted investor sentiment across the digital asset landscape.

ALTCOIN MARKET BENEFITS FROM BITCOIN’S MOMENTUM

The Bitcoin rally has acted as a rising tide lifting many altcoins. Ethereum, which has long played second fiddle to Bitcoin, and the second largest cryptocurrency, is currently trading at $3,234.44, experiencing a growth of 14.40%, at the time the article was being written.

Other major altcoins, such as XRP, Avalanche, and Cardano, posted robust gains, climbing by 25.85%, 27.01%, and 57.72%, respectively, over the past week.

Meanwhile, the optimism surrounding Trump’s endorsement has extended even to smaller-cap coins such as Polkadot and Chainlink which posted impressive surges of 26.13% and 11.31% in the last seven days, thereby reflecting a broad-based boost in investor confidence, as both institutional and retail traders are looking to diversify their portfolios in anticipation of sustained market momentum.

MEMECOINS WITNESS A TRUMP-FUELLED RALLY

Dogecoin, the canine-based memecoin, presently priced at $0.3965, has witnessed an enormous growth of 108.76% over the past week. This surge can be attributed to positive market sentiment and the strong backing of Tesla CEO Elon Musk.

While Musk hasn't made any recent statements about Dogecoin, his past endorsements have firmly established the coin's position in the market.

As per analysts, Musk’s public endorsements backing Dogecoin and Trump’s pro-crypto stance have been pivotal in boosting investor interest and demand. Another memecoin, Shiba Inu, recorded an upward tick of 43.79% in its price over the past week.

Himanshu Maradiya, Founder and Chairman, CIFDAQ, said, “Bitcoin hitting $100,000 is within reach, given its supply cap of 21 million and the recent break of its all-time high near $73,500 and hitting almost $90,000.”

“Rising institutional interest, adoption growth, ongoing accumulation trends, and post-halving cycles point to a higher long-term valuation. While market conditions and regulatory clarity will play a crucial role, Bitcoin’s fundamentals and demand trends make six-figure prices plausible,” he added.

"It was also a strong day for meme coins, as Pepe and Bonk were both listed on Coinbase, fueling substantial demand and pushing their prices up by 30-50%. Additionally, Pnut, a new memecoin listed on Binance, saw an impressive 250%+ price jump in just one day," said the CoinSwitch Markets Desk.

EXPERTS ADVISE CAUTION

The catalyst for a dramatic uptrend in crypto prices is Donald Trump's newly vocal pro-crypto stance, which has unexpectedly shifted investor sentiment across the digital asset landscape.

His influence, as the President-elect, has provided a new form of legitimacy to digital currencies, reshaping the narrative within financial markets.

"While this market surge presents enticing opportunities, investors must remain vigilant. The rapid price movements in this niche highlight the inherent risks, as these tokens can experience steep declines just as quickly as they rise. Ultimately, this environment calls for a balanced approach—leveraging the potential of meme coins while exercising caution and conducting thorough research.," said Avinash Shekhar, Co-Founder & CEO, Pi42.

www.cifdaq.com #CIFDAQ #CRYPTO #TRADING #BLOCKCHAIN

0 notes