Don't wanna be here? Send us removal request.

Text

Decentralized Marketing: Why Traditional Approaches Fall Short in Web3

Decentralized Marketing: Why Traditional Approaches Fall Short in Web3

Traditional marketing methods don’t work well in Web3. At first glance, strategies like digital ads, email campaigns, and influencer partnerships may seem universal. However, when applied to decentralized projects, they often fall flat.

Web3 relies on principles like user ownership, transparency, and participation. These principles demand a different marketing approach that aligns with the ecosystem’s decentralized nature.

This blog will explore why traditional marketing fails in Web3 and how decentralized marketing can better serve your project.

The Problem with Traditional Marketing in Web3

Web2 marketing strategies were built for centralized platforms. They focus on broadcasting messages to large audiences, driving conversions, and analyzing user data to refine campaigns.

Web3 operates differently. Here’s why traditional approaches fail:

Advertising Isn’t Trusted: Web3 users are skeptical. Paid ads on platforms like Google or Meta are often ignored or perceived as inauthentic. Many users assume these campaigns prioritize profits over meaningful engagement.

Data Collection Conflicts with Privacy Expectations: In Web2, tracking cookies and personalized ads are the norm. Web3 prioritizes privacy. Collecting data without user consent can alienate the audience.

One-Way Messaging Fails: Traditional marketing treats users as passive recipients of information. Web3 communities expect two-way interactions where they have a voice.

Fragmented Ecosystem: Web3’s decentralized infrastructure means users are spread across various platforms—Discord, Telegram, Twitter, and decentralized forums. Centralized campaigns struggle to reach them effectively.

Short-Term Tactics Backfire: Campaigns like giveaways or influencer promotions can attract speculators. These users often disengage after claiming rewards.

What Is Decentralized Marketing?

Decentralized marketing adapts to the Web3 ecosystem by embracing its core values. Instead of broadcasting messages, it focuses on building relationships and empowering communities.

Fundamental principles of decentralized marketing:

Community-Centric: Engage communities as participants, not consumers.

Transparent: Share information openly to build trust.

Participatory: Encourage users to contribute to marketing efforts, whether through content creation, referrals, or governance.

Privacy-Respecting: Avoid invasive data practices.

On-Chain Enabled: Use blockchain-based tools for transparency and automation.

How to Build a Decentralized Marketing Strategy

A decentralized marketing strategy starts with understanding your users and aligning with their values. Here are actionable steps to get started:

1. Focus on Community-Led Growth

Communities drive growth in Web3. Instead of targeting users with ads, invest in creating a vibrant, engaged community.

Tips for community-led marketing:

Choose the Right Platforms: Focus on platforms where your audience is active. Twitter and Discord are popular in Web3.

Create Value: Share content that educates and empowers your community, such as tutorials, AMAs, or explainer videos.

Encourage User-Generated Content (UGC): Reward community members for creating memes, guides, or reviews.

Recognize Contributors: Highlight and reward active community members.

2. Tokenize Your Marketing Efforts

Tokens are a natural fit for decentralized marketing. They let you reward users for promoting your project, creating content, or referring friends.

How to use tokens effectively:

Incentivize Word-of-Mouth: Use referral programs where users earn tokens to bring in new participants.

Governance Incentives: Reward users for voting on project decisions or participating in DAOs.

Staking for Access: Offer exclusive access to events, content, or features in exchange for staking tokens.

Tokens create alignment between your project’s success and user incentives.

3. Embrace Transparency

In Web3, trust is currency. Being transparent about your marketing efforts builds credibility.

How to implement transparency:

Publish Roadmaps: Share your project’s milestones and timelines openly.

Open Campaign Budgets: Use on-chain tracking to show how funds are spent on marketing initiatives.

Host Public Discussions: Use Discord or Twitter Spaces to answer questions and gather feedback.

Avoid overhyping. Instead, share realistic updates that align with your project’s actual progress.

4. Leverage Decentralized Tools

Web3 offers tools that traditional marketers don’t use. These tools enhance transparency, automate processes, and build trust.

Examples of decentralized marketing tools:ToolUse CaseSnapshotCommunity voting on marketing campaigns.Mirror.xyzBlogging and content distribution with Web3.GalxeRewarding users for participating in campaigns.Gnosis SafeTransparent multisig wallets for budgets.

These tools replace centralized solutions and align with Web3 values.

5. Build Long-Term Relationships

Web3 marketing isn’t about quick wins. Focus on building relationships with users who believe in your project’s vision.

How to foster long-term engagement:

Engage Early Adopters: Work closely with power users who can champion your project.

Offer Real Value: Design products or services that users want organically share.

Iterate Based on Feedback: Incorporate user suggestions into your roadmap.

Metrics That Matter in Decentralized Marketing

Traditional metrics like impressions or clicks aren’t as valuable for Web3. Focus on metrics that measure real engagement and community growth.

Critical metrics for decentralized marketing:

Active Community Members: Track participation on Discord, Telegram, or other platforms.

Token Holder Activity: Measure token holders’ engagement with staking, governance, or on-chain activities.

Referral Rates: Count how many users join through word-of-mouth or tokenized referral programs.

On-Chain Interactions: Monitor wallet activity, such as transactions or staking.

Metrics should reflect how well you build trust and engagement, not how much you spend.

Common Pitfalls to Avoid

Decentralized marketing isn’t foolproof. Many projects make avoidable mistakes:

Overhyping Tokens: Projects that rely on token price speculation lose credibility. Focus on utility.

Ignoring Feedback: Web3 users are vocal. Ignoring criticism damages trust.

Spamming Channels: Posting irrelevant updates on Discord or Twitter alienates users.

Copying Web2 Strategies: Applying traditional marketing methods without adapting them to Web3 leads to wasted effort.

Stay focused on creating value and empowering your users.

Why Decentralized Marketing Matters

Decentralized marketing aligns with Web3’s core values. Traditional approaches focus on transactions, but decentralized strategies prioritize relationships.

Focusing on community, transparency, and participation can build trust and attract users who are invested in your project for the long term. Decentralized marketing isn’t about spending more—it’s about working smarter.

0 notes

Text

NFT Analytics 2.0: The Tools, Metrics, and Techniques Shaping Tomorrow’s Market

In the ever-evolving world of Non-Fungible Tokens (NFTs), a new chapter of analytics, often called “NFT Analytics 2.0,” is emerging. From simple dashboards that track sales volume to sophisticated platforms leveraging artificial intelligence (AI) and machine learning (ML), the analytics surrounding NFTs are becoming more advanced and critical for both seasoned investors and curious newcomers. Whether your goal is to discover undervalued digital art, gauge community sentiment, or identify the next big NFT trend, understanding how data and analytics fit into this rapidly changing landscape is crucial.

In this in-depth blog, we’ll explore the latest news, research, and trends in NFT analytics, providing an educational, informational perspective on how these tools, metrics, and techniques are shaping tomorrow’s market. We’ll delve into key NFT metrics, advanced analytic tools, on-chain and off-chain data, AI-driven insights, and best practices for navigating the next generation of NFT analytics.

1. The Rise of NFT Analytics 2.0

From Simple Dashboards to Advanced Analytics

When NFTs first made waves around 2020–2021, analytics platforms were relatively simple. They provided basic metrics—sales volumes, floor prices, and recent transactions—that helped early collectors and traders gauge market sentiment. However, over the past few years, NFT analytics have transformed into multi-dimensional ecosystems, leveraging large datasets, real-time wallet tracking, and advanced computational models to forecast trends.

Latest News and Trends

Growing Institutional Interest: According to a late 2024 report by DappRadar, institutional investors and major brands (such as Nike, Disney, and Starbucks) have begun integrating NFTs into loyalty programs and collectibles. This has spurred the need for deeper data insights—NFT Analytics 2.0—to track consumer behavior and forecast project viability.

Evolution of Utility NFTs: As more projects emphasize utility—such as staking, revenue sharing, or metaverse integrations—the complexity of analyzing such NFTs has grown. Metrics now must incorporate game mechanics, governance participation, and usage statistics.

Layer-2 and Multi-Chain Expansion: NFTs are no longer confined to Ethereum; they now thrive on chains like Polygon, Solana, Tezos, and BNB Chain. This multi-chain expansion has necessitated cross-chain analytics solutions capable of aggregating and interpreting data from multiple sources.

Why It Matters

NFT Analytics 2.0 is more than just a buzzword; it represents a paradigm shift in how data is gathered, interpreted, and acted upon in the NFT space. With the rise of multi-chain ecosystems, complex utility tokens, and sophisticated AI-driven analysis, the next generation of NFT analytics will dictate how quickly and effectively market participants can identify the “next big thing.”

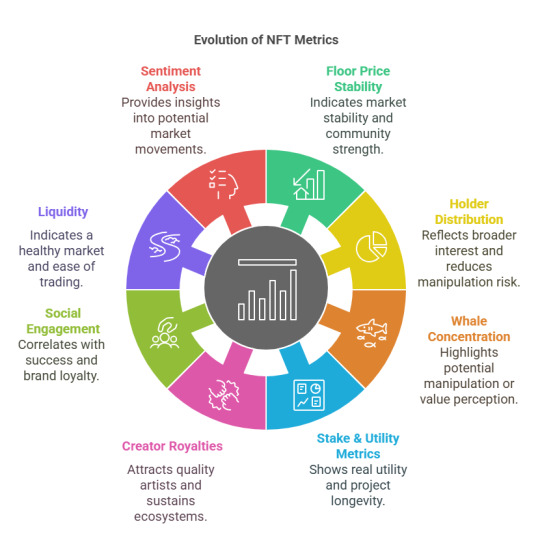

2. Key Metrics Defining the Future of NFT Analysis

The metrics that once dominated NFT data—floor price, volume, market capitalization—still matter. However, NFT Analytics 2.0 goes deeper. Below is a table outlining key metrics that define the new generation of NFT analysis and why they matter.

The Shift to Utility and Engagement

Modern NFTs are more than static collectibles. They can be gamified, integrated into DeFi protocols, or serve governance roles in decentralized autonomous organizations (DAOs). Thus, metrics such as staking rates, in-game utility, and community-driven governance participation are increasingly vital.

3. On-Chain vs. Off-Chain Data: Why Both Matter

On-Chain Data

On-chain data refers to all the information on the blockchain—transaction histories, wallet addresses, mint dates, contract interactions, etc. On-chain data is immutable, transparent, and often available in real-time. Analysts can leverage on-chain data to track who buys or sells, the timing of transactions, and overall liquidity.

Advantages: Transparency, immutability, real-time updates

Limitations: Requires specialized tools to parse blockchain records; raw data can be overwhelming

Off-Chain Data

Off-chain data includes social media chatter (Twitter, Reddit, Telegram, Discord), Google search trends, news articles, and any external factor influencing the NFT’s perceived value.

Advantages: Captures user sentiment, community engagement, market hype, and brand collaborations

Limitations: Data can be manipulated by bot activity or paid promotions; requires robust sentiment analysis to glean meaningful insights

Bridging the Gap

In NFT Analytics 2.0, the best tools seamlessly integrate on-chain and off-chain data for a holistic market view. For instance, a spike in on-chain trading volume combined with a surge in positive social media sentiment can be an early indicator of an NFT collection about to trend upwards. Conversely, if trading volume is stagnating but social engagement is skyrocketing, it might mean hype is primarily speculative and not necessarily backed by genuine investor interest.

4. AI and Machine Learning in NFT Analysis

Why AI Matters in NFT Analytics 2.0

Manual data analysis becomes increasingly unsustainable as the complex NFT market grows—spanning multiple chains, social platforms, and cultural niches. This is where AI and ML come in, automating the sifting, sorting, and interpreting of vast data sets. AI tools can detect emerging trends and flag suspicious activity by identifying patterns, correlations, and outliers more quickly than humans.

Use Cases

Price Prediction Models: AI can forecast short-term price fluctuations and longer-term valuation trends by leveraging historical data.

Sentiment Analysis: Natural Language Processing (NLP) algorithms can rapidly process tweets, Discord messages, and Reddit posts to gauge public sentiment at scale.

Fraud Detection: Machine-learning anomaly detection makes spotting wash trading, bot activity, and other manipulative behaviors much more manageable.

Personalized Recommendations: Like streaming services suggest shows based on your history, some NFT analytics platforms can recommend collections that align with your trading or collecting style.

Ongoing Research

Recent academic papers and industry reports (including some from the Crypto Valley Association in early 2025) highlight how machine learning can dramatically reduce the time between identifying and capitalizing on new NFT trends. Neural network models—trained on past bull and bear markets—promise to predict which newly minted NFTs will likely experience sustained growth.

5. Integrating Social Media and Community Insights

The Power of Community in NFTs

Unlike traditional stocks or commodities, NFTs thrive on community engagement. Whether it’s a PFP (Profile Picture) collection or a metaverse gaming asset, the project’s success often hinges on the enthusiasm of its holders and fans. Therefore, measuring social metrics is a crucial aspect of NFT Analytics 2.0.

Advanced Methods of Community Analysis

Discord and Telegram Bot Analysis: Advanced bots now scrape thousands of channels to identify real conversation depth versus automated spam, helping to filter out synthetic hype.

Twitter Topic Clustering: Using AI to group tweets by topic, sentiment, or influencer. This helps identify micro-communities and sub-trends within the larger NFT ecosystem.

Influencer Mapping: Platforms that can show you the key influencers in a particular project and how their endorsement affects price and volume.

Incorporating Human Touch

While AI-driven sentiment analysis is robust, combining it with human interpretation remains vital. A sudden spike in negative sentiment might be triggered by legitimate issues (e.g., a hack, rug pull, or leadership scandal) or a competitor’s smear campaign. Human analysts, or at least well-designed double-check protocols, are crucial for validating machine-generated insights.

6. Practical Use Cases: Real-World Scenarios

Use Case 1: Identifying an Early Gem

On-Chain Indicators: A small but steadily increasing number of unique holders and stable floor price growth.

Social Sentiment: Positive Twitter chatter from niche communities; no evidence of bots amplifying.

Development Roadmap: Clear timeline for game integration, staking, or other added utility.

By combining these factors, an investor might spot a still-undervalued collection before a price surge.

Use Case 2: Avoiding a Rug Pull

On-Chain Red Flags: Disproportionate token holdings by a small number of wallets.

Off-Chain Red Flags: Discord growth is suspiciously significant quickly, with repeated spam messages or automated tweets lacking genuine engagement.

Team Transparency: Lack of clear documentation about the founding team or roadmap.

A robust NFT Analytics 2.0 platform with whale monitoring and advanced sentiment analysis could warn users of potential risks.

Use Case 3: Monitoring a High-Profile Brand Entry

Cross-Chain Volume: Tracking adoption on multiple blockchains if the brand launches on various networks (e.g., Ethereum, Polygon).

Social Media Impact: Analyzing how brand collaborations or celebrity endorsements correlate with immediate and long-term price fluctuations.

Utility and Merch: Many brands tie NFTs to physical merchandise or real-world events. Analytics must track redemption rates, community satisfaction, and secondary market prices.

7. Challenges and Considerations for NFT Analytics 2.0

Data Overload

As analytics become more complex, information overload is a genuine concern. Not all metrics are created equal, and too much data can lead to analysis paralysis.

Quality Control

Wash Trading: Some marketplaces have seen “wash trading,” in which participants trade NFTs among themselves to artificially inflate prices or volume.

Bots: Automated bots can generate misleading social media engagement, complicating sentiment analysis.

Regulatory Uncertainty

The regulatory landscape for NFTs continues to evolve, whether in the U.S., Europe, or Asia. Platforms must adapt to ensure compliance and secure user data. For example, royalty enforcement controversies in late 2024 forced specific marketplaces to overhaul their fee structures, impacting data on creator earnings.

Technological Complexities

Multi-Chain Interoperability: Tools must integrate with multiple blockchains, each with unique standards, leading to inconsistent data formats.

Security Vulnerabilities: Smart contract exploits can compromise data integrity and trust in analytics platforms, especially if the exploit leads to false transaction reporting or manipulative data logs.

8. Future Outlook: From Data to DAO Governance

Data-Driven DAOs

DAOs are expected to become more data-driven in the coming years. Some communities already use voting mechanisms tied to NFT holdings. The next generation might tie voting power not just to ownership but to active contributions and analytics-driven insights—for instance, awarding greater governance weight to those who stake their NFTs or participate in project development.

Metaverse Integration

The rise of the metaverse, where NFT assets such as virtual land, avatars, and wearables play significant roles, will demand real-time analytics on usage, foot traffic, and user engagement. Property value in a virtual world will hinge on metrics like daily visitors, event frequency, and brand sponsorships.

AI-Enhanced Marketplaces

Future NFT marketplaces could become intelligent platforms that provide recommended purchases, real-time risk assessments, and even automated negotiation or auctioning based on user-defined parameters. As the marketplace and analytics platforms converge to more comprehensively serve user needs, the line between them may blur.

Education and Accessibility

As more mainstream users enter the NFT space—through collaborations with major sports leagues, fashion brands, and entertainment companies—user-friendly analytics will be paramount. Expect simplified dashboards, in-app analytics tutorials, and natural language queries (e.g., “Show me NFTs with rising floor prices in the last 24 hours, with at least 1,000 holders”) to become commonplace.

9. Conclusion

NFT Analytics 2.0 represents a significant leap forward in understanding and navigating the digital collectible and asset space. Gone are the days when a simple view of floor prices and trading volumes sufficed. Today’s—and tomorrow’s—NFT enthusiasts, investors, and creators need a multidimensional approach that seamlessly weaves on-chain and off-chain data, employs AI-driven insights, measures community engagement, and keeps pace with multi-chain ecosystems.

Key Takeaways:

Holistic View: Metrics such as whale concentration, social sentiment, staking utility, and cross-chain volume provide a more holistic view than traditional volume and floor price metrics alone.

AI Integration: Machine learning algorithms can sift through vast data sets, offering predictive analytics, fraud detection, and personalized recommendations.

Community-Driven Success: The success of any NFT project hinges on its community. Tools that accurately gauge sentiment and engagement are vital for spotting sustainable opportunities.

Complex Regulation & Data Integrity: Wash trading, bots, and uncertain regulations pose significant challenges. Constantly scrutinize the quality and sources of your data.

Looking Ahead: The evolution of data-driven governance in DAOs, metaverse integration, and AI-powered marketplaces suggests that NFT Analytics 2.0 is only the beginning.

As the industry matures, analytics will play a central role in bridging the gap between speculation and value creation, between short-lived hype and enduring utility. Whether you’re an artist, investor, developer, or simply a curious observer, staying informed about the tools, metrics, and techniques driving NFT analytics forward will be indispensable. In a rapidly transforming ecosystem, knowledge is power—and in the NFT world, data-driven knowledge might be the ultimate superpower.

Disclaimer: This blog is for informational purposes only and does not constitute financial or investment advice. Always do your own research and consult professionals before making any significant financial decisions.

1 note

·

View note