Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/censorship-free-social-network-akasha-aims-to-tackle-internet-censorship-with-blockchain-technology/

Censorship-Free Social Network AKASHA Aims to Tackle Internet Censorship With Blockchain Technology

A few weeks ago Bitcoin Magazine published a report on the launch of AKASHA, a blockchain-based social network built on top of Ethereum and IPFS (the InterPlanetary File System).

As a followup to the previous report, AKASHA CEO Mihai Alisie spoke to Bitcoin Magazine and said that the idea behind creating a blockchain-based social network came to him and his team as they were looking for ways to use existing technologies such as Ethereum and IPFS to solve bigger problems.

The team eventually decided to select the issue of internet censorship as the problem to tackle, and the best way to address the issue, according to Alisie, was to build a better channel of expression in the form of a decentralized publishing platform.

“It started with the search for a really big problem that could be solved now that we have technologies like Ethereum and IPFS. This is how I ended up picking internet censorship as the problem to tackle and I figured that the best way to do it is by building a better channel of expression in the form of a decentralized publishing platform,” Alisie said.

Talking about censorship and how popular social media networks fail to uphold the idea of freedom of expression, Alisie said that the centralized architecture of popular social networks puts them in a situation where complying with censorship laws and regulations becomes necessary for them to stay in business.

“I am not implying that there’s necessarily some sort of evil agenda at play here, but we have seen numerous times how established companies have to comply with certain requests if they want to stay in business,” Alisie wrote in a blog post.

“It just so happens that some of those requests involve censorship, and the root problem here is the information architecture used. This centralized architecture enables the companies to honor such obnoxious requests in the first place.”

According to Alisie, the team initially worked on developing AKASHA into something like a decentralized WordPress, but the project gradually evolved into something more interconnected and social that could be compared to a decentralized Medium or Reddit.

The team started developing a prototype of their platform last year using Ethereum, IPFS and the Meteor app development platform. But according to Alisie, Meteor was replaced by Electron, React and Node.js as it was not suitable for building what they had in mind.

How It Works

According to Alisie, when a user publishes an entry on AKASHA, an IPFS hash gets broadcasted to his or her network of followers. The IPFS hash then declares where interested people can access the content. No files get uploaded into the network until users start accessing the content.

Addressing concerns raised about abusive content being shared on a censorship-free social network, Alisie said that AKASHA has a quadratic upvote/downvote mechanism similar to Reddit.

So content that receives upvotes gets featured on the tags/keywords used, while also receiving ETH since it comes bundled with ETH microtransactions. The content that receives downvotes gets buried at the bottom of the keyword or tag used. But now that BTC Relay is live, Alise said that BTC could be used alongside ETH as a default token inside the AKASHA ecosystem as well.

When it comes to communities or groups where a number of people have publishing rights, Alisie said that users will be able to access a “moderated view” and unmoderated view of the content. He said his team will probably come up with a better solution in the beta release while they test current solutions in the alpha stage.

In terms of access speed, Alisie said that unlike centralized publishing platforms, the more people access something on AKASHA the faster it gets.

“If the people who follow you (or the tags you used) read and appreciate the posted content, they ‘pin’ the IPFS content on their local machine and become similar to a BitTorrent seed.

That, in turn, increases the access speed and redundancy of the content. Thanks to the peer-to-peer architecture and technologies used, the more people access something the better and faster it gets ‒ quite opposite to how centralized publishing platforms work.”

Comparing AKASHA to similar blockchain-based social networks like Synero and Datt, Alisie said that having multiple experiments in the areas is important as it will help drive innovation.

“I think it’s important to have multiple experiments in the area of social media, and I root for each and every one of them, because the issue we’re tackling is too important for humanity as a whole to get caught in the ‘competitor’ game,” Alisie said.

The company said it will be doing an alpha release of AKASHA in a few weeks, but has not mentioned any specific dates yet. Interested parties can sign up for the alpha release on the AKASHA website.

Editor’s note: AKASHA CEO Mihai Alise was one of the original founders of Bitcoin Magazine.

The post Censorship-Free Social Network AKASHA Aims to Tackle Internet Censorship With Blockchain Technology appeared first on Bitcoin Magazine.

0 notes

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/santander-becomes-first-u-k-bank-to-introduce-blockchain-technology-for-international-payments/

Santander Becomes First U.K. Bank to Introduce Blockchain Technology for International Payments

Santander U.K. has announced its introduction of blockchain technology for international payments through a new app that is currently being rolled out as a staff pilot. The bank plans to make the application, which is only available on Apple’s iOS, available to consumers after it completes the pilot program. The announcement makes Santander the first bank in the U.K. to use blockchain for international payments.

The new Santander app connects to Apple Pay, where users can confirm payments securely using Touch ID. It lets users transfer between £10 and £10,000, and payments can be made from British pounds to euros and U.S. dollars. Currently, payments made in euros can be sent to 21 countries and U.S. dollar payments to the United States only.

“The need for finance has evolved from providing a physical pound in your pocket or card in your purse, where you pay at a till, to being seamlessly integrated into a new, always on, connected lifestyle,” said Sigga Sigurdardottir, head of customer and innovation at Santander. “At Santander we work hard to ensure our banking is simple, personal and fair and believe new blockchain technology will play a transformational role in the way we achieve our goals and better serve our customers, adding value by creating more choice and convenience.”

The Santander app is powered by the blockchain technology implementation developed by Ripple, a company in which Santander Innoventures, the $100 million fintech venture capital fund of Santander Group, has invested. Working with Ripple builds on Santander’s philosophy of collaborating with the most innovative companies to consistently provide better services to customers. In June 2015, Bitcoin Magazine reported that, in a paper titled “The Fintech 2.0 Paper: Rebooting financial services,” Santander Innoventures issued “a call to action to banks, financial institutions and financial technology (fintech) businesses to work together to undertake a fundamental ‘reboot’ of the core processes, systems and infrastructure of the banking industry.”

According to Ripple, its technology offers a real-time cross-currency settlement solution that is flexible enough to comply with the risk policy, privacy and compliance needs of banks. “It is architected to fit within your bank’s existing infrastructure, resulting in minimal integration overhead and business disruption,” notes the Ripple website.

“Ripple is redefining the way that value moves around the world, and today we’re already enabling real-time, affordable international settlement between banks who have adopted our solutions,” said Ripple cofounder and CEO Chris Larsen. “As an early adopter and pioneer in the banking industry, Santander is the first bank in the world to transfer real funds externally. In doing so, they are creating a new, exemplary standard of service.” The Ripple announcement notes that security and regulatory compliance is central to all activity undertaken at Santander and their Ripple-powered app has already undergone the same rigorous testing all new technology goes through ahead of roll out.

The move is a much-needed response to the upcoming wave of digital payment providers that threatens to lure customers away from the banks.

“Clearly, it’s an area where, as an industry, we don’t have as good a customer experience as we could do . . . there are a lot of pain points,” said Ed Metzger, head of innovation, technology and operations at Santander U.K., as reported by The Financial Times. “There’s lots of activity in international payments.” Metzger added that the reason why new digital players have been able to make progress is because “customer experiences through normal channels aren’t great.”

“It’s the first time a U.K. bank has sent payments of this type via Ripple and launched it as a commercial service,” Metzger told Bloomberg News. “Many people are doing lab style experiments, the key difference here is about getting real people to send real money for real purposes. I just paid my wife, who is Spanish, some money to a Spanish bank account this morning.”

Bloomberg News notes that Santander is one of several major banks, including Citigroup, UBS and Barclays, striving to find ways to exploit the distributed ledger technology behind Bitcoin to cut costs and stay at the leading edge of modern fintech.

In April, Bitcoin Magazine reported that Barclays formed a partnership with “Bitcoin bank” Circle in a move that received welcoming support from U.K. authorities. Barclays Corporate Banking is providing the account that Circle needs to store sterling for consumers and the infrastructure to allow transfers from any U.K. bank account in and out of Circle. An interesting feature of the Barclays/Circle initiative is that it uses the standard, public Bitcoin blockchain, instead of an alternative implementation.

The post Santander Becomes First U.K. Bank to Introduce Blockchain Technology for International Payments appeared first on Bitcoin Magazine.

0 notes

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/ibm-government-and-blockchain-sector-should-work-together-to-enhance-national-security-2/

IBM: Government and Blockchain Sector Should Work Together to Enhance National Security

IBM Vice President for Blockchain Technologies Jerry Cuomo recently testified before the Commission on Enhancing National Cybersecurity on how the blockchain can benefit transactions, eWeek reports.

Cuomo is persuaded that the technology could potentially cause a tectonic shift in the way financial systems are secured and that government, technology companies and industries should work together to advance blockchain technology to enhance national security.

The Commission on Enhancing National Cybersecurity, announced in April, is tasked with making detailed recommendations on actions that can be taken over the next decade to enhance cybersecurity awareness and protections throughout the private sector and at all levels of government, to protect privacy, to ensure public safety and economic and national security, and to empower Americans to take better control of their digital security. Sam Palmisano, former CEO of IBM, is the commission’s vice-chair.

President Barack Obama issued Executive Order 13718 to establish the commission in February. The executive order tasked the National Institute of Standards and Technology (NIST) to provide the commission with such expertise, services, funds, facilities, staff, equipment and other support services necessary to carry out its mission.

“The Commission will make detailed short-term and long-term recommendations to strengthen cybersecurity in both the public and private sectors, while protecting privacy, ensuring public safety and economic and national security, fostering discovery and development of new technical solutions, and bolstering partnerships between federal, state and local government and the private sector in the development, promotion and use of cybersecurity technologies, policies and best practices,” notes the official commission websiteat NIST.

The commission held an open meeting on May 16 in New York City. Cuomo’s statement, which appears in the Panelist Statements document issued by the commission, is republished in the IBM Think blog with the title “Blockchain: Securing the Financial Systems of the Future.”

Cuomo noted that 80 years ago a public-private partnership between the U.S. government and IBM created the Social Security system, which was the most advanced financial system of the time. “Today, as financial transactions become increasingly digital and networked, government and industry must once again combine forces to make the financial systems of the future more efficient, effective and secure than those of the past,” he said.

A similar partnership between government and industry, centered on innovative applications of distributed ledger technology, could enhance national security. Cuomo is persuaded that the government has a key role to play in funding blockchain research and providing official identity certification services for the emergent blockchain economy. In particular, according to the IBM executive, the NIST should define standards for interoperability, privacy and security, and government agencies should become early adopters of blockchain applications.

Cuomo identifies four key priority areas for government-supported developments in distributed ledger technology for national security: a new identity management system able to provide robust proof of identity; automatic systems able to track changes made to data and verify data provenance with time stamps and annotations; secure transaction processing; and a blockchain-based system to securely and confidentially share intelligence on cyber-threats and cyber-terrorism.

“We need to create a new social compact, where business, with input from government, architects the future of financial services,” concluded Cuomo. “We at IBM look forward to working with our partners in government, industry and academia to get this done.”

Of course, Cuomo defended IBM’s positions on current distributed ledger issues and development prospects. After bashing the “public enemy” Bitcoin for its openness, anarchy and potential for anonymity, Cuomo defended the “permissioned blockchain” approach favored by IBM and other major industry players.

“Blockchain came to prominence because it’s the core technology underlying the infamous Bitcoin cryptocurrency, but, while Bitcoin is an anonymous network, industries and government agencies are exploring the use of blockchain in networks where the participants are known,” said Cuomo. “We call this a ‘permissioned blockchain.’”

IBM is a premier member of Linux Foundation’s Hyperledger Project, a collaborative effort started in December to establish, build and sustain an open ‒ but “permissioned” ‒ non-Bitcoin blockchain. In February, Bitcoin Magazine reported that IBM is making tens of thousands of lines of code available to the Hyperledger Project. In April, IBM announced new cloud services based on the company’s Hyperledger code and Bluemix, IBM’s cloud Platform as a Service (PaaS).

“IBM is playing a central role in the development of a permissioned blockchain,” said Cuomo. “We’re a founding member of the Linux Foundation’s open-source Hyperledger Project, where we’re helping to build the foundational elements of business-ready blockchain architecture with a focus on privacy, confidentiality and auditability. We have joined consortia that are developing industry-specific blockchain implementations. And we’re pioneering the use of blockchain in our own operations.”

The post IBM: Government and Blockchain Sector Should Work Together to Enhance National Security appeared first on Bitcoin Magazine.

2 notes

·

View notes

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/ibm-government-and-blockchain-sector-should-work-together-to-enhance-national-security/

IBM: Government and Blockchain Sector Should Work Together to Enhance National Security

IBM Vice President for Blockchain Technologies Jerry Cuomo recently testified before the Commission on Enhancing National Cybersecurity on how the blockchain can benefit transactions, eWeek reports.

Cuomo is persuaded that the technology could potentially cause a tectonic shift in the way financial systems are secured and that government, technology companies and industries should work together to advance blockchain technology to enhance national security.

The Commission on Enhancing National Cybersecurity, announced in April, is tasked with making detailed recommendations on actions that can be taken over the next decade to enhance cybersecurity awareness and protections throughout the private sector and at all levels of government, to protect privacy, to ensure public safety and economic and national security, and to empower Americans to take better control of their digital security. Sam Palmisano, former CEO of IBM, is the commission’s vice-chair.

President Barack Obama issued Executive Order 13718 to establish the commission in February. The executive order tasked the National Institute of Standards and Technology (NIST) to provide the commission with such expertise, services, funds, facilities, staff, equipment and other support services necessary to carry out its mission.

“The Commission will make detailed short-term and long-term recommendations to strengthen cybersecurity in both the public and private sectors, while protecting privacy, ensuring public safety and economic and national security, fostering discovery and development of new technical solutions, and bolstering partnerships between federal, state and local government and the private sector in the development, promotion and use of cybersecurity technologies, policies and best practices,” notes the official commission websiteat NIST.

The commission held an open meeting on May 16 in New York City. Cuomo’s statement, which appears in the Panelist Statements document issued by the commission, is republished in the IBM Think blog with the title “Blockchain: Securing the Financial Systems of the Future.”

Cuomo noted that 80 years ago a public-private partnership between the U.S. government and IBM created the Social Security system, which was the most advanced financial system of the time. “Today, as financial transactions become increasingly digital and networked, government and industry must once again combine forces to make the financial systems of the future more efficient, effective and secure than those of the past,” he said.

A similar partnership between government and industry, centered on innovative applications of distributed ledger technology, could enhance national security. Cuomo is persuaded that the government has a key role to play in funding blockchain research and providing official identity certification services for the emergent blockchain economy. In particular, according to the IBM executive, the NIST should define standards for interoperability, privacy and security, and government agencies should become early adopters of blockchain applications.

Cuomo identifies four key priority areas for government-supported developments in distributed ledger technology for national security: a new identity management system able to provide robust proof of identity; automatic systems able to track changes made to data and verify data provenance with time stamps and annotations; secure transaction processing; and a blockchain-based system to securely and confidentially share intelligence on cyber-threats and cyber-terrorism.

“We need to create a new social compact, where business, with input from government, architects the future of financial services,” concluded Cuomo. “We at IBM look forward to working with our partners in government, industry and academia to get this done.”

Of course, Cuomo defended IBM’s positions on current distributed ledger issues and development prospects. After bashing the “public enemy” Bitcoin for its openness, anarchy and potential for anonymity, Cuomo defended the “permissioned blockchain” approach favored by IBM and other major industry players.

“Blockchain came to prominence because it’s the core technology underlying the infamous Bitcoin cryptocurrency, but, while Bitcoin is an anonymous network, industries and government agencies are exploring the use of blockchain in networks where the participants are known,” said Cuomo. “We call this a ‘permissioned blockchain.’”

IBM is a premier member of Linux Foundation’s Hyperledger Project, a collaborative effort started in December to establish, build and sustain an open ‒ but “permissioned” ‒ non-Bitcoin blockchain. In February, Bitcoin Magazine reported that IBM is making tens of thousands of lines of code available to the Hyperledger Project. In April, IBM announced new cloud services based on the company’s Hyperledger code and Bluemix, IBM’s cloud Platform as a Service (PaaS).

“IBM is playing a central role in the development of a permissioned blockchain,” said Cuomo. “We’re a founding member of the Linux Foundation’s open-source Hyperledger Project, where we’re helping to build the foundational elements of business-ready blockchain architecture with a focus on privacy, confidentiality and auditability. We have joined consortia that are developing industry-specific blockchain implementations. And we’re pioneering the use of blockchain in our own operations.”

The post IBM: Government and Blockchain Sector Should Work Together to Enhance National Security appeared first on Bitcoin Magazine.

2 notes

·

View notes

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/why-the-global-economy-needs-open-blockchain-assets-to-fight-negative-interest-rates-2/

Why the Global Economy Needs Open Blockchain Assets to Fight Negative Interest Rates

The world economy is in a fascinating period. It is an encouraging time for those hopeful about Bitcoin and other open blockchain-based systems, but many high-level decision-makers still must be persuaded of this technology’s global impact.

The United States seems to be doing fine in the aftermath of 2008’s Great Recession. Despite technological change causing some workforce pain, the U.S. economy is doing well.

But other parts of the world are still feeling some nasty economic aftereffects. Some might say this is due to colorful central banking policies. One of these policies is negative interest rates imposed by various central banks around the world.

The idea of negative interest rate policy becoming normal is concerning, as this could set a dangerous precedent for the global economy. At the same time, it provides an opportunity for alternatives to thrive. Negative interest rates could actually influence enormous growth for cryptographically backed open blockchain assets.

Negative Interest Rate Problems

Sweden, Switzerland and Japan are among countries currently enforcing negative interest rate policies. Negative interest rates, which essentially charge savers a fee to put their money in a bank, are set to induce borrowing to stimulate a sagging economy. They are also a reason for central banks to print more cash, popularly known as quantitative easing.

Over time, negative interest rate policy results in bank holdings being worth less. Therefore, it is arguable that this is not really a solution, but a stopgap until something else comes along. Some have described this policy as medicine for a “weak patient.” This refers to the concept that negative interest rates can’t heal what has already been broken for too long.

Europe has become a popular place for negative interest rates.

Negative interest rate policy forces people to look for alternatives and creates a need for services that can reflect growth rather than contraction. Retail banking relies on everyone storing cash in bank accounts, but in a negative interest rate world, people are better off borrowing money than they are saving.

In the standard fractional reserve environment, banks rely on savings to lend. Yet holding cash, for most people, is actually more lucrative in a negative interest rate environment. Even when factoring in inflation, there is long-term value in holding cash rather than putting it in a bank imposing a negative interest rate. But physical cash can be tough to hold because of security and storage issues.

Many countries believe negative interest rates are a benefit to their economies. The common mindset is that these policies are staving off even more economic problems. Distributed blockchain-based assets are clearly an attractive option in this scenario.

Choices Over Traditional Assets

As an early stage technology, Bitcoin and open blockchain are in growth mode. This is especially true since it’s not clear what long-term impact negative interest rates will have on banking. People seeking financial alternatives should be aware that there are options over traditional assets.

Bitcoin is no longer the only viable open digital currency option, with platforms such as Ethereum also offering a promising choice. With impressive performance metrics and many developers working on Ethereum projects, that choice benefits everyone. The back-end of open blockchain tech is looking more promising than ever.

Ethereum, with 14-second block times, is an attractive alternative to BTC.

The price of Bitcoin has been performing well as a store of value. Ethereum’s price performance in 2016 has been remarkable, and the fiat-to-open-blockchain exchange infrastructure around the world continues to improve.

Because of these factors, there has never been a better time to invest in and use cryptographically backed open assets. Companies such as Circle, Abra and Lawnmower are making it easier to use borderless forms of money. These startups offer a solid premise: open banking, done entirely on a digital device.

Open digital assets could provide a salvo from economic problems like negative interest rates. They can be an alternative to less transparent cash-based systems. However, there is still work to be done. This growing ecosystem still requires understanding by influential leaders to achieve widespread success.

Championing Bitcoin and Blockchain

Given the growth of Bitcoin and blockchain, new application platforms will emerge from these technologies. Global economic conditions resulting in negative interest rates certainly provide some motivation for this. But there are still obstacles to overcome for open blockchain platforms to succeed.

In Steve Case’s new book, The Third Wave, the AOL cofounder discusses today’s era of technology. In the “third wave,” current technological entrepreneurs must work to champion Bitcoin and blockchain to global leaders. This is similar to the work Case had to do at AOL in the 1990s, where he fought hard to convince regulators that the Internet would become an enormous economic opportunity.

Today, entrepreneurs must educate about the importance of Bitcoin and open blockchain. This means promoting it as an engine of economic growth and financial inclusion.

The challenge today is convincing others that this open technology is needed in economic systems. That will take dedication to developing inventive applications to solve global economic problems.

Transparency, combined with tools such as programmable agreements, ranks among the most exciting characteristics of open blockchain assets. As such, these assets should be considered highly impactful to the future of the global economy. In the case of negative interest rate policies, it is obvious that new solutions to economic problems are necessary.

Bitcoin, Ethereum and other open blockchain systems now exist to help make that happen.

Editor’s note: This is a guest post by Daniel Cawrey and the opinions offered are those of the author.

The post Why the Global Economy Needs Open Blockchain Assets to Fight Negative Interest Rates appeared first on Bitcoin Magazine.

2 notes

·

View notes

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/why-the-global-economy-needs-open-blockchain-assets-to-fight-negative-interest-rates/

Why the Global Economy Needs Open Blockchain Assets to Fight Negative Interest Rates

The world economy is in a fascinating period. It is an encouraging time for those hopeful about Bitcoin and other open blockchain-based systems, but many high-level decision-makers still must be persuaded of this technology’s global impact.

The United States seems to be doing fine in the aftermath of 2008’s Great Recession. Despite technological change causing some workforce pain, the U.S. economy is doing well.

But other parts of the world are still feeling some nasty economic aftereffects. Some might say this is due to colorful central banking policies. One of these policies is negative interest rates imposed by various central banks around the world.

The idea of negative interest rate policy becoming normal is concerning, as this could set a dangerous precedent for the global economy. At the same time, it provides an opportunity for alternatives to thrive. Negative interest rates could actually influence enormous growth for cryptographically backed open blockchain assets.

Negative Interest Rate Problems

Sweden, Switzerland and Japan are among countries currently enforcing negative interest rate policies. Negative interest rates, which essentially charge savers a fee to put their money in a bank, are set to induce borrowing to stimulate a sagging economy. They are also a reason for central banks to print more cash, popularly known as quantitative easing.

Over time, negative interest rate policy results in bank holdings being worth less. Therefore, it is arguable that this is not really a solution, but a stopgap until something else comes along. Some have described this policy as medicine for a “weak patient.” This refers to the concept that negative interest rates can’t heal what has already been broken for too long.

Europe has become a popular place for negative interest rates.

Negative interest rate policy forces people to look for alternatives and creates a need for services that can reflect growth rather than contraction. Retail banking relies on everyone storing cash in bank accounts, but in a negative interest rate world, people are better off borrowing money than they are saving.

In the standard fractional reserve environment, banks rely on savings to lend. Yet holding cash, for most people, is actually more lucrative in a negative interest rate environment. Even when factoring in inflation, there is long-term value in holding cash rather than putting it in a bank imposing a negative interest rate. But physical cash can be tough to hold because of security and storage issues.

Many countries believe negative interest rates are a benefit to their economies. The common mindset is that these policies are staving off even more economic problems. Distributed blockchain-based assets are clearly an attractive option in this scenario.

Choices Over Traditional Assets

As an early stage technology, Bitcoin and open blockchain are in growth mode. This is especially true since it’s not clear what long-term impact negative interest rates will have on banking. People seeking financial alternatives should be aware that there are options over traditional assets.

Bitcoin is no longer the only viable open digital currency option, with platforms such as Ethereum also offering a promising choice. With impressive performance metrics and many developers working on Ethereum projects, that choice benefits everyone. The back-end of open blockchain tech is looking more promising than ever.

Ethereum, with 14-second block times, is an attractive alternative to BTC.

The price of Bitcoin has been performing well as a store of value. Ethereum’s price performance in 2016 has been remarkable, and the fiat-to-open-blockchain exchange infrastructure around the world continues to improve.

Because of these factors, there has never been a better time to invest in and use cryptographically backed open assets. Companies such as Circle, Abra and Lawnmower are making it easier to use borderless forms of money. These startups offer a solid premise: open banking, done entirely on a digital device.

Open digital assets could provide a salvo from economic problems like negative interest rates. They can be an alternative to less transparent cash-based systems. However, there is still work to be done. This growing ecosystem still requires understanding by influential leaders to achieve widespread success.

Championing Bitcoin and Blockchain

Given the growth of Bitcoin and blockchain, new application platforms will emerge from these technologies. Global economic conditions resulting in negative interest rates certainly provide some motivation for this. But there are still obstacles to overcome for open blockchain platforms to succeed.

In Steve Case’s new book, The Third Wave, the AOL cofounder discusses today’s era of technology. In the “third wave,” current technological entrepreneurs must work to champion Bitcoin and blockchain to global leaders. This is similar to the work Case had to do at AOL in the 1990s, where he fought hard to convince regulators that the Internet would become an enormous economic opportunity.

Today, entrepreneurs must educate about the importance of Bitcoin and open blockchain. This means promoting it as an engine of economic growth and financial inclusion.

The challenge today is convincing others that this open technology is needed in economic systems. That will take dedication to developing inventive applications to solve global economic problems.

Transparency, combined with tools such as programmable agreements, ranks among the most exciting characteristics of open blockchain assets. As such, these assets should be considered highly impactful to the future of the global economy. In the case of negative interest rate policies, it is obvious that new solutions to economic problems are necessary.

Bitcoin, Ethereum and other open blockchain systems now exist to help make that happen.

Editor’s note: This is a guest post by Daniel Cawrey and the opinions offered are those of the author.

The post Why the Global Economy Needs Open Blockchain Assets to Fight Negative Interest Rates appeared first on Bitcoin Magazine.

0 notes

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/blockchain-technology-will-profoundly-change-the-derivatives-industry-2/

Blockchain Technology Will Profoundly Change the Derivatives Industry

Editor’s note: This is a guest post by Matt O’Brien and the opinions represented are those of the author.

As the hype and pessimism around blockchain technology converge toward reality over the next several years, one certainty emerging among Wall Street and Main Street traders is that advancements in platform technology will profoundly change how commonly used securities known as derivative contracts will be traded. The distributed ledgers inconceivable just a couple of years ago are on the precipice of ushering in a new era of innovative financial engineering and precision in risk management.

Wall Street firms are beginning to tinker with blockchain and smart contract technology that will allow buyers, sellers and central clearing houses of derivative trades to share information, such as KYC (Know Your Customer), in real time across various distributed ledger platforms unleashing incredible efficiencies.

Last month it was reported that Barclays tested a blockchain platform called Corda, developed by the bank consortium R3. Electronic documents that served as derivative contracts were pre-populated with standardized values, which, one day, will allow the contracts to be hashed out between counterparties, traded on an exchange across multiple banks and then cleared and settled instantaneously.

Derivative contracts are financial instruments that derive their value from some underlying asset, such as stocks, bonds, commodities or even interest rates. Derivative contracts have become increasingly fundamental in effectively managing financial risk and creating synthetic exposures to asset classes. For example, airlines use future contracts, a form of derivative, to hedge against fluctuating oil prices. Hedge funds use options, another form of derivatives, to speculate in questionable company stock without baring the cost of purchasing a large number of shares. Derivative contracts typically have shelf lives of 30-day increments.

Industry leaders expect distributed ledger infrastructure to foster new approaches to financial engineering, enabling financiers to customize derivatives consisting of individual cash flows to meet precise needs in terms of timing and credit risk. According to a report produced by Oliver Wyman, a management consulting firm, blockchain-enabled derivative contracts could be financed by issuers selling their own instruments that match the cash flows they expect to achieve, “in essence creating swaps without the need for balance sheet intermediation.” Traditional swap agreements are traded over the counter.

Smart derivative contracts will spell out each party’s obligation such as margin agreements and swap conditions. Traditionally, financial exchanges have required clearing houses to provide a guarantee to the winning party of the derivative contract in case the loser does not pay. The clearing house is able to provide this guarantee by requiring both parties to make cash deposits during the pre-trade phase.

While one of the original goals of blockchain technology is to remove the need for central governing bodies, industry analysts reason traders will continue to novate derivative trades via a Counterparty Clearing House (CCP) in order for dealers to net their exposures and monitor the financial well-being of counterparties (ensuring problems like double-spending are eliminated). Blockchain vendors, such as kompany.com, can supply banks with customer and company information for due diligence. On May 12, at an industry conference, kompany.com announced its development of electronic ledgers with original and authoritative company information and that it is moving information on 100 million firms onto a blockchain for KYC and Know Your Bank documentation.

In the age of blockchain, dealers will post collateral to the clearing house in the form of initial and variation margin by escrowing cash on a distributed cash ledger or by allocating assets held on other asset ledgers to a distributed collateral ledger. Smart derivative contracts that bind both seller and buyer will be stored on a distributed derivative ledger along with information from the cash and asset ledgers. This will lead to efficiencies for calculating derivative positions and obligations.

“The smart contract can automatically compute exposures by referencing agreed external data sources (e.g. S&P 500, NASDAQ) that recalculate variation margin. Interoperable derivative and collateral ledgers would automatically allow the contract to call additional collateral units on asset ledgers to support these needs. At maturity, a final net obligation is computed by the smart contract, and a payment instruction automatically generated in the cash ledger, closing out the deal,” the authors of the report state. With regard to the settlement of funds, presently the interbank transfer system entails a three to five day process that includes the Automated Clearing House and Federal Reserve as clearing agent. This represents a significant opportunity cost that parties can recapture with a real-time system.

Proponents of blockchain technology see the improvement in funds settlement and counterparty risk assessment as shortening the liquidity cycle for various derivative positions, allowing financiers to inject liquidity into the system for other transactions much more quickly. “In order to maintain liquidity levels firms have to overcompensate where the money has to be tied up for some time before the next transaction,” said Derick Smith, Cofounder and CEO of Chainreactor. “Transaction time will improve and risk assessment will improve. Most other players will get to see who they are providing liquidity for.”

Industry executives figure cost savings can come from eliminating redundant IT systems and trading and risk management overhead. The finance industry currently spends roughly $150 billion annually on IT and operations expenditures in addition to $100 billion on post-trade and securities servicing fees.

Some media outlets have reported that many Wall Street firms have increased capital budget allocations to blockchain technology initiatives. JPMorgan plans to increase its overall technology spending to approximately $9.4 billion this year while allocating about 40 percent of that budget to new investments and technologies, up from 30 percent.

While private blockchain systems continue to develop they remain closed to the trading public. A public blockchain currently available on the web is Ether Opt, which is a decentralized options exchange built on Ethereum. The website claims that options traded on its platform are vanilla call and put options priced in an Ether/USD exchange rate. Cryptocurrency exchanges Poloniex and Coindesk provide pricing information. The open-source platform is produced by Etherboost, which is a producer of decentralized autonomous organizations governed by smart contracts on the Ethereum blockchain. According to Etherboost’s website developers also created Ethvertise, an ad market, SzaboDice, a dice game, and Pokereth, a poker game.

In early April, Etherboost programmers blogged that “the first Etheropt expiration was successful. The transaction. … represents the first decentralized options expiration in the history of mankind.”

Phone calls seeking comment for Bitcoin Magazine were not returned before publication.

Despite all the fervor around blockchain and smart contract technology, many challenges still exist. Some experts estimate the new systems will be fully implemented within a decade. The well documented challenge of scalability continues to hamper progress. “Looking at Bitcoin from an architectural perspective it can at this point handle only seven transactions per second,” said Mr. Smith. “The issue is verifiability of each transaction where people have to wait for the global network to verify it.”

CME Group literature states exchange-listed derivative contracts volume averaged 15.6 million per day in 2015. The CME is the largest exchange of derivative contracts in the world. Mr. Smith added that the public blockchain platform Ethereum with its programmable transaction functionality will, in time, overcome scalability issues.

Officials with CME Group did not respond when reached for comment, however, they referred Bitcoin Magazine to a May 2 press release about the exchange’s latest initiative in collaboration with Crypto Facilities, a digital assets trading platform, for launching the Bitcoin Reference Rate and Real-Time Index.

Regarding digital currencies, the token unit of the Ethereum platform is ether, which is used to pay for computational services on the Ethereum network. Financial firms see the digital currency as a challenge because it is perceived as lacking stability. Fiat currency would prove problematic because blockchain technology treats it as another asset class on a distributed ledger. The authors of the Oliver Wyman report suggest banks create specific digital currencies for interbank use or use existing accounts at banks where participants deposit liquidity for trading in segregated accounts.

Photo Liz Bustamante / Flickr(CC)

The post Blockchain Technology Will Profoundly Change the Derivatives Industry appeared first on Bitcoin Magazine.

0 notes

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/bitcoin-price-soars-as-chinese-investors-look-for-safe-haven-from-devaluation-and-capital-controls/

Bitcoin Price Soars as Chinese Investors Look for Safe Haven From Devaluation and Capital Controls

Many have speculated that the recent increase in the price of bitcoin ($542 USD on Bitfinex at time of publication) can be traced to China, where Bitcoin trading has doubled on some exchanges in the last four days as Chinese investors respond to a recent currency devaluation, and look for ways to avoid the government’s stringent capital controls.

China’s economy has been flatlining for some time now. That and the strengthening U.S. dollar prompted the People’s Bank of China to devalue the yuan by 0.45 percent last Friday to its lowest level since February 2011.

New Interest in Bitcoin

Huobi and OKCoin, the two largest Chinese exchanges that now account for some 92 percent of Bitcoin global trading by (self-reported) volume, both reported almost double the usual trading volume over the past weekend. BTCC, China’s third largest exchange, also reported a surge in bitcoin trading volume, setting a new record on its Pro Exchange.

OKCoin’s Jack Liu, Chief Strategy Officer, confirmed the surge in trading volume and told Bitcoin Magazine:

“After two long years, Bitcoin’s price crossed back across the USD $500 mark led by OKCoin’s CNY exchange – the largest digital asset trading platform in the world. The price first reached $500 on May 28, and was followed later on by OKCoin’s USD exchange and other global platforms such as Coinbase.”

Huobi’s CEO Leon Li said that trading volume on their exchange has doubled in the last few days as investors look for a safe haven:

“We do think that China’s economic situation has certain influence to the price. Totally, RMB has been on the trend of depreciation for a long time, and the domestic stock market has been weak since last September. More and more Chinese investors and their hot money need a new investment market, and a convenient alternative investment like Bitcoin is easy to be accepted by the traders.”

Bobby Lee, CEO of BTCC exchange told Bitcoin Magazine:

“BTCC has seen very high trading volumes this past weekend. In fact, on our Pro Exchange, we saw record volumes on Friday, the highest ever since our launch last October. This recent rally was indeed led by the China market, which gives credit to the theory that people were predicting today’s yuan devaluation.”

Jack Liu believes that China’s economic situation is in for a long period of flat or stagnant growth.

“We believe with the Chinese economy is entering into a “L-shaped” recovery rather than a “U-shaped” one; the dearth of mainstream, prudent investment choices has made Bitcoin a relatively attractive choice.”

However Huobi’s Leon Li told us that he sees more than just these short-term economic factors in explaining the growing popularity of Bitcoin:

“The policy environment has been more and more tolerant worldwide, and blockchain technology has been acknowledged by academic and traditional financial institutions. Even People’s Bank of China (China’s central bank) is discussing blockchain. In the long term, when the price returns to rationality, it would vibrate by those fundamentals.”

Bitcoin Halving in July Seen as a Possible Cause of Price Increase

Both Jack Liu and Leon Li see the upcoming halving as a significant factor in the increase in the price of Bitcoin. Liu told us:

“This is especially in light of the fact that the Bitcoin supply will be halved in just over a month, adding to deflationary supply pressures and increasing the digital asset’s investment value in the short, and long term.”

Bitcoin Continuing a Steady Increase in Price and Market Capitalization

As noted in this recent Bitcoin Magazine article about the price of Bitcoin, the digital currency is showing a steady and almost methodical ascent, with moderate increases in both price and market capitalization.

It appears that China’s bad fortune is good for Bitcoin, although Jack Liu notes that economic uncertainty is not just limited to China. He told us:

“It was not a surprise to see the upturn. After all, the whole world is facing slower growth and low to negative interest rates, not just China.”

The post Bitcoin Price Soars as Chinese Investors Look for Safe Haven From Devaluation and Capital Controls appeared first on Bitcoin Magazine.

0 notes

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/understanding-the-lightning-network-part-1-building-a-bidirectional-bitcoin-payment-channel/

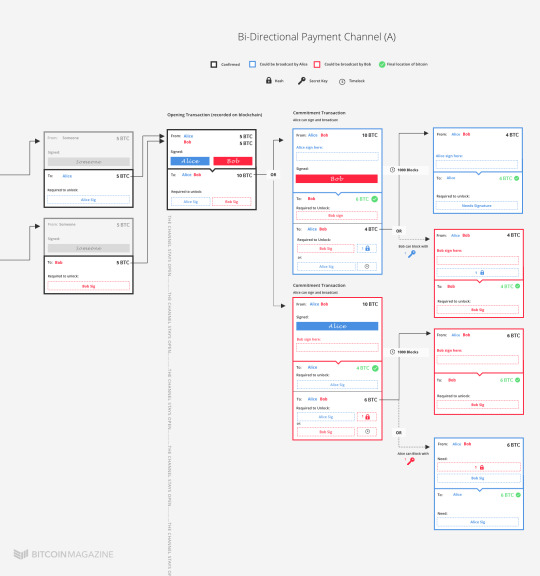

Understanding the Lightning Network, Part 1: Building a Bidirectional Bitcoin Payment Channel

The Lightning Network is probably the most highly anticipated technological innovation to be deployed on top of Bitcoin. The payment layer, first proposed by Joseph Poon and Tadge Dryja about a year ago, promises to support a virtually unlimited number of off-chain transactions among users, at nearly no cost – while leveraging the security offered by Bitcoin.

At least three companies – Poon and Dryja’s Lightning, Blockstream and Blockchain – are currently working on implementations of the technology. But few outside this small technological frontline fully grasp how the “future of micropayments” is set to boost Bitcoin’s capabilities.

In this three-part series, Bitcoin Magazine lays out the basic building blocks of the Lightning Network, and shows how they fit together to realize this upcoming protocol layer.

This first part of the series establishes the necessary building blocks, and shows how these can be combined to create “smart contracts,” which can be applied to realize the first requirement of the Lightning Network: a bidirectional payment channel.

(Note: Anyone with a solid understanding of Bitcoin can skip the building blocks.)

Building Block #1: Unconfirmed Transactions

At its heart, the Bitcoin protocol consists of transactions, that are typically linked to previous transactions, and potentially to future transactions. Each transaction contains inputs, which refer to addresses bitcoins are sent from, and outputs, which refer to addresses bitcoins are sent to. Additionally, inputs must include the requirements to send the bitcoins, like signatures that prove “ownership” of the input-addresses. Outputs, meanwhile, establish the new requirements, that must be included in the input of a subsequent transaction.

As one of its key features, the Lightning Network is built up from more or less regular Bitcoin transactions. It’s just that these transactions are typically not actually broadcast over the Bitcoin network. Instead, they are stored locally, on the nodes of users – but they can be broadcast over the network at any time.

Building Block #2: Double-Spend Protection

The second building block for the Lightning Network probably doesn’t require much explaining, as it’s arguably the raison d’être for Bitcoin itself: double-spend protection. If two transactions (or: inputs) rely on the same output, only one can confirm.

The important thing to keep in mind here is that even unconfirmed transactions can be conflicting, meaning only one can ever confirm.

Building Block #3: Multisig

The third building block of the Lightning Network is also a straightforward one: multisignature (multisig) addresses. (Or more generally: P2SH-addresses.)

Multisig addresses are Bitcoin addresses that – as the name suggests – require multiple private keys to “unlock” and spend bitcoins from. Multisig addresses can be set up under all sorts of conditions. For instance to require two out of three possible keys, or fifteen out of fifteen, or just about any other combination.

The Lightning Network often uses two out of two (2-of-2) multisig set-ups. Unlocking bitcoins from 2-of-2 multisig addresses requires two signatures, from two dedicated keys.

Building Block #4: Time-Locks

The fourth building block is the time-lock. Time-locks can “lock bitcoins up” in an output, to make them spendable (to be included in a subsequent input) only at some point in the future.

There are two different types of time-locks: the absolute type, called CheckLockTimeVerify (CLTV), and the relative type, CheckSequenceVerify (CSV). CLTV locks bitcoins up until a (more or less) concrete time in the future: an actual time and date, or a specific block height. CSV, instead, uses relative time. Once a CVS-output is recorded on the blockchain, it takes a specific amount of blocks from that point on before the bitcoins can be spent again.

Building Block #5: Hash Values and Secrets

The fifth and final building block – cryptography – is the most fundamental building block of Bitcoin itself. But in the Lightning Network, it’s applied in a new way.

In short, a “value” or “secret” is a long and unique string of numbers that is practically impossible to guess, even for a computer with infinite tries. With a special calculation, this value (or secret) can be “hashed” into a different string of numbers, a “hash.” And here’s the trick: anyone who knows the value can easily reproduce the hash. But this doesn’t work the other way around; it’s a one way street.

This trick can be utilized in Bitcoin itself, again to “lock bitcoins up.” (In fact, it’s really how Bitcoin works.) For example, a hash can be included in an output, and require the subsequent input to include the corresponding value in order to be spendable.

The First Challenge: Bidirectional Payment Channels

Even before the Lightning Network was presented, the concept of payment channels had been around for some time. Typical payment channels are useful for certain purposes, but also limited: they are one-directional. Alice can pay Bob several off-chain transactions, but Bob cannot pay Alice through the same channel at all.

As a key feature of the Lightning Network, Poon and Dryja proposed trustless bidirectional payment channels.

Opening the Channel

To set up a bidirectional payment channel, both parties involved must first agree on an opening transaction. This opening transaction determines how many bitcoins each deposits into the channel.

Let’s say Alice wants to send one bitcoin to Bob. Since Alice and Bob expect to transact more frequently, they decide to open up a bidirectional payment channel, and use this to send the bitcoin. (Sending a whole bitcoin is probably a lot for a payment channel, as these might be more useful for micropayments – but it’s perfectly possible.)

To open the channel, Alice and Bob each send five bitcoins to a 2-of-2 multisig address. This is the “opening transaction.” Bitcoins can only be spent from this address if both Alice and Bob sign a subsequent transaction.

Additionally, Alice and Bob both create a secret (a string of numbers), and exchange the hash.

Alice now immediately creates a subsequent transaction from the opening transaction. This is a “commitment transaction.” With the commitment transaction, Alice sends four bitcoins to herself, and six bitcoins to a second multisig address. This second multisig address is a bit funky. It can be unlocked by Bob on his own, but only after 1000 extra blocks have been mined after it’s included on the blockchain; it includes a CSV-lock. Or, it can be opened by Alice on her own, but only if she also includes the secret for which Bob has just now given her the hash. (Of course, Alice has no idea what this secret is – she only knows hash – so there’s no way she can make use of this option right now.)

Alice signs her end of this commitment transaction. But she doesn’t broadcast it! Instead, she gives it to Bob.

Meanwhile, Bob does the same, but mirrored. He creates a commitment transaction as well, from which he sends six bitcoins to himself, and four to a funky new multisig-address. Alice can unlock this address if she waits an additional 1000 blocks, or Bob can unlock it with Alice using her secret.

Bob signs this half, and gives it to Alice.

After all this exchanging of “half-valid” commitment transactions and hashes of secrets, they both sign and broadcast the opening transaction, to make sure it’s recorded on the blockchain. The channel is now officially open.

At this point, both Alice and Bob could sign and broadcast the half-valid commitment transaction they got from the other. If Alice does, Bob gets six bitcoins immediately. If Bob does, Alice gets four bitcoins immediately. But whomever signs and broadcasts the transaction will have to wait 1000 blocks to unlock the subsequent multisig-address, and claim the remaining bitcoins.

However, and this is the key trick of a payment channel: neither sign and broadcast their half of the transaction at all.

Updating the Channel

A little later, Bob wants to send Alice one bitcoin back. They want to update the channel state, to make the balance five-five again. To accomplish this, Alice and Bob do two things.

First, both repeat the process as described above (except that the opening transaction is already recorded on the blockchain; that part is skipped). This time, both Alice and Bob attribute themselves five bitcoins, and both attribute five bitcoins to funky multisig-addresses. The conditions for these multisig-addresses are similar, except that they require new secrets: both Alice and Bob provide each other withnew hashes. They both sign their new half valid commitment transaction, and give it to each other.

Second, Alice and Bob hand each other their first secrets, as used in the first set-up.

At this point, again, both Alice and Bob could sign and broadcast the new “half valid” commitment transaction they just got. Their counterparty would get five bitcoins immediately, while the broadcaster would have to wait 1000 blocks. As such, the channel is updated.

But what’s stopping Bob from broadcasting the older commitment transaction instead? That commitment transaction led to a path that paid him six bitcoins, instead of five….

What’s stopping Bob, of course, is his first secret, which he has now given to Alice.

Bob cannot safely sign and broadcast the older commitment transaction any more, because Alice now knows Bob’s first secret. If Bob were to sign and broadcast that commitment transaction, he would immediately send four bitcoins to Alice… and he would have to wait 1000 blocks to claim his own six bitcoins. That’s a problem, because now that Alice knows his secret, she could use this time to beat Bob to the punch, and claim the other six bitcoins as well!

And since Bob has Alice’s secret too, this is just as true for the other way around. If Alice tries to sign and broadcast an old commitment transaction, Bob can steal all the bitcoins in the channel.

This of course means that both Alice and Bob are strongly incentivized to play fair, and only ever sign and broadcast the most recent state of the channel.

Next, this bidirectional payment channel set-up needs to expand to allow payments over a network. This is covered in the second article of this series.

Thanks to Rusty Russell and Joseph Poon for added feedback.

The post Understanding the Lightning Network, Part 1: Building a Bidirectional Bitcoin Payment Channel appeared first on Bitcoin Magazine.

0 notes

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/finance-and-beyond-an-infographic-map-of-bitcoin-and-the-emerging-blockchain-ecosystem/

Finance and Beyond: An Infographic Map of Bitcoin and the Emerging Blockchain Ecosystem

This popular article and its infographic, originally published on November 15, 2015, have been updated by Michael Gord to reflect the major developments since then in the world of Bitcoin and blockchain. In the fall of 2015, BitPay and BTC Media (parent company of Bitcoin Magazine) commissioned Josh Dykgraaf, an artist based in Amsterdam who specializes in 3D and photo illustrations, to design an infograph as a guide to navigating the emerging Bitcoin and blockchain ecosystem. The infographic has been so popular, and the growth in the ecosystem so dynamic, that BTC Media commissioned Dykgraaf to create an updated poster which made its debut in March at SXSW®, and is available as a digital download (JPEG, PDF) or printed copy.

On January 3, 2009, the Genesis block, or the first block in the Bitcoin blockchain, was created. In the coinbase parameter, there was a simple message: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” From that one block, Bitcoin was born.

Bitcoin has come a long way from that initial statement by Bitcoin’s pseudonymous founder, Satoshi Nakamoto. The technology is growing up and changing, from its early days as a project adopted by impassioned technologists and libertarians to a technology widely researched and used by financial institutions worldwide.

Bitcoin had a rough road ahead of it, as did many early technologies, including the Internet. It dealt with newspaper headlines lambasting Bitcoin because of its connection to Silk Road and drugs. Early adopters suffered millions of dollars in losses when early exchange Mt. Gox imploded. “Bitcoin is Dead,” many prophesied.

And yet, as Bitcoin approaches its eighth birthday, we see things changing. It is turning into that curious, wide-eyed technology with ideas as widespread as any normal eight-year-old. Cross-border payments, machine-to-machine transactions, smart contracts, microtransactions and stock settlements all have been discussed and developed. Nothing is off limits; no question goes unasked.

From the early days of mining using a laptop computer, now Bitcoin miners have industrial-sized data centers with hundreds of thousands of high-powered, specialized machines. In January 2014, the Bitcoin network hashrate was only 10 million GH/s. Today, it is more than 1 billion GH/s and growing quickly as new mining machines are built and sold. Around January 2014, there were around 50,000 Bitcoin transactions daily. That measure of network utility has increased to more than 200,000 Bitcoin transactions daily.

A big part of this growth in transactions is linked to the growth in Bitcoin-accepting merchants. In mid-2014, there were approximately 65,000 merchants who accepted Bitcoin. Now, there are more than 100,000, which represents a 50 percent increase. TigerDirect, a publicly traded online electronics retailer, has seen incredible results. Of all the buyers that used Bitcoin, 46 percent of them were brand new to TigerDirect. Further, orders placed with Bitcoin were 30 percent larger.

BitPay, a Bitcoin payment processor, also has seen a significant increase in volume. It announced in a blog post written at the beginning of 2016 that it has experienced a transactional increase of 50 percent in the last two months and an increase of 110 percent in the past 12 months. BitPay also saw record-breaking months for Bitcoin transactions in November and December of 2015, with more than 100,000 BitPay invoices processed each month. BitPay explains in the post, “At these rates, every 25 seconds a shopper somewhere in the world was spending Bitcoin at a BitPay merchant.” In Latin America, total transactions were up 1,747 percent in 2015. Bitcoin as a tool of transaction is growing.

Bitcoin as an asset class is also maturing. For the majority of 2015, the price stayed relatively nonvolatile and constant, fluctuating between $200 and $300. It was only toward the end of 2015 that the price experienced a significant increase, reminiscent of the early years, to finish the year as the world’s top performing currency (down from -67 percent in 2014 to +35 percent in 2015). From January 1, 2013 to January 1, 2014, the price went from $13.41 to $808.05, going as high as $1,147.25 on December 4. Just one month earlier, on November 4, 2013, the price was $225.20. Even the “bubbles” in Bitcoin are maturing. On the other hand, the market cap of Bitcoin is down from an all-time high of nearly $14 billion to around $6.5 billion at the time of writing.

Venture capital funding continues to pour into the space. In 2013, Bitcoin companies raised only $93.8 million. In 2014, firms raised $314.7 million. In 2015, Bitcoin and blockchain companies raised more than $1 billion.

Regulations are also changing. Before, there were politicians decrying Bitcoin because of its use on the underground marketplace Silk Road. Now, organizations such as Coin Center and the Chamber of Digital Commerce work to help these politicians and regulators draft rules that will ensure Bitcoin can continue to grow worldwide. New York has led the regulatory charge with its recent BitLicense initiative. The European Union also recently ruled that Bitcoin was not subject to VAT, providing significant clarity for those participating in the ecosystem.

Finally, the development of blockchain companies and enterprise solutions continues to grow. In 2015, Bitcoin and blockchain enterprise development generated over $1 billion in capital investments, with the first quarter of the year surpassing the total amount of funding for the entire previous 12 months. To date, more than 65 banks and financial institutions have made investments in the industry, and businesses in diverse fields ranging from health care to insurance to global supply chain trade networks have entered the arena.

The year 2016 has seen Augur, a decentralized prediction market, announce that it had raised $5.1 million in a crowdsale. Ethereum, the smart contract and publishing platform, raised $18.4 million in its own crowdsale. It is expected that OpenBazaar, the completely decentralized peer-to-peer ecommerce site, will launch in the coming months. Blockchain technology is rapidly ushering in a new world of data integrity that will impact industry and commerce on a magnitude comparable to the dawning of the Internet.

Bitcoin is not just on the fringes anymore; it is becoming mainstream. Whether it’s miners, payment processors, wallets, developer tools, large-enterprise blockchain solutions or innovative new fintech accelerators, the reality is simple. Bitcoin and its blockchain are growing up. And the future they are opening to the world is as vast as that unlocked by any of the greatest technologies in history.

The post Finance and Beyond: An Infographic Map of Bitcoin and the Emerging Blockchain Ecosystem appeared first on Bitcoin Magazine.

1 note

·

View note

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/syscoin-is-like-ebay-interview-with-developer-of-decentralized-marketplace-cryptocurrency/

“Syscoin is like eBay”: Interview with Developer of Decentralized Marketplace Cryptocurrency

How can you explain Syscoin to someone who has, for example, only ever used eBay, and is not familiar with cryptocurrencies? CoinTelegraph spoke to Dan Wasyluk, Developer at Syscoin, about their innovation.

“Syscoin is like eBay stores or “Buy it Now” listings, except with a payment and escrow system built-in”, explains Dan Wasyluk.

Syscoin do not have an auction system in place yet. They connect buyers and sellers directly, and the fees are substantially lower than any competing platform because there is no-one in the middle party taking a percentage of the sale.

Syscoin is both a currency and a platform. The fees only exist to keep the network running autonomously. Syscoin can easily be exchanged for USD or other currencies, Bitcoin can also be directly used on the platform.

Syscoin has integrated messaging features that offer a higher level of privacy compared to eBay’s messaging system.

Getting started

CoinTelegraph: What’s the first step in getting started with Syscoin as a buyer or a seller?

Dan Wasyluk: Downloading the wallet and getting an alias is the first step in getting started as a buyer or seller. An alias costs a small amount- 1 SYS is plenty (at the moment 1 SYS costs approx $0.007 USD). Aliases are like usernames on the Syscoin network and can be used in place of a long and complicated address. Once you have an alias you can use any of the Syscoin platform services- buying and selling on the decentralized marketplace, storing and selling information using digital certificates or secure communications using encrypted messaging.

OpenBazaar competition

CT: Do you consider OpenBazaar a competitor, or do you think you have fundamentally different uses?

DW: We only consider OpenBazaar a competitor insofar as they also provide a decentralized marketplace offering. Syscoin and OpenBazaar provide similar but different services using very different technologies. Syscoin builds on Bitcoin’s blockchain technology while OpenBazaar relies on p2p technology using Bitcoin only for payment. Because OpenBazaar, a privately funded company, doesn’t have this foundation in blockchain tech the possibilities and potential for Syscoin are quite different than those of OpenBazaar – ranging from sidechains to new BIP operations and more. We feel that competition in this space is healthy and will only result in better products for end users.

Future development

CT: How is Syscoin planning to develop the cryptocurrency/platform in the future?

DW: Syscoin 2.0 only launched a few weeks ago, so at the moment we’re really listening to the community – both buyers and sellers – and trying to make sure we address their key pieces of feedback before attracting more users to the platform. Many of these pieces of feedback are being addressed in the upcoming Syscoin 2.1 release which brings many new features, some suggested by the community. We don’t plan on stopping there – we’re exploring other potential features ranging from assets to voting on the Syscoin chain.

In parallel with blockchain development we’re also developing products on top of the Syscoin platform – the first of which is Blockmarket, a hosted blockchain commerce platform. Blockmarket’s release will be followed by plugin integrations for major centralized e-commerce platforms such as Magento, Shopify, Prestashop, OpenCart, etc which will allow merchants on those platforms to easily sync their inventory to and from the Syscoin marketplace/blockchain. We also have plans to develop integrations for eBay and Etsy which will provide sellers on those platforms similarly simple methods of listing their items on Syscoin’s marketplace.

Decentralized marketplaces

CT: Do you think decentralized marketplaces will be able to penetrate the mainstream? If so, how?

DW: Yes, we think decentralized marketplaces have major potential for penetrating and disrupting mainstream commerce channels. We think the key to this will be ease of use, while still being able to realize all the benefits of decentralization. Products will need to mask the implementation complexity from the users interacting with the technology. There is a lot of power in the borderless and secure technology offered by the blockchain. In our opinion there are two major keys to this tech and moreover decentralized markets penetrating the mainstream – packaging up the technology in a user-friendly manner (ie: can your grandma use it?) and enabling users by providing them with easy methods of moving in and out of their native currency.

CoinTelegraph spoke to Brian Hoffman, Project Lead at OpenBazaar.

He says about Syscoin’s emergence in the decentralized marketplace industry:

“We built OpenBazaar in order to give people the ability engage in decentralized trade, and we’re glad to see others doing the same thing. We chose not to build our marketplace directly on top of a blockchain for numerous reasons, but it’s good to have different projects take different approaches and see what works best.”

1 note

·

View note

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/lost-in-interpretation-landmark-case-in-florida-may-decide-future-of-bitcoin/

Lost in Interpretation: Landmark Case in Florida May Decide Future of Bitcoin

A money-laundering case in Miami is expected to determine what the future of Bitcoin in the U.S. will be.

A 32-year-old Florida man is charged with attempted money-laundering after illegally selling $1,500 in Bitcoins. The essential question is: was it really money he was laundering?

The verdict of Miami-Dade Circuit Judge Teresa Mary Pooler may serve as a landmark of what Bitcoin actually is from the US law’s viewpoint. It’s the fact that this is the first case of its kind which makes it so special.

What are you Bitcoin?

The actual history of Bitcoin use and officials’ attempts to regulate it, is, to express it mildly, a mess. Some see Bitcoin as property, others as money, and even more as something in-between. Thus, the Internal Revenue Service in March 2014 issued the statement that “virtual currency is treated as property for U.S. federal tax purposes”.

In line with that, the Commodities and Futures Trading Commission found in September 2015 that “Bitcoin and other virtual currencies are properly defined as commodities.” However, in December 2015, the Securities and Exchange Commission, in its charges against two Bitcoin mining firms, described Bitcoin in the same way as U.S. dollars.

Between money and property

On the other hand, as long ago as March 2013, FinCEN suggested that an exchanger or administrator of some mysterious “virtual currency” which wasn’t referred to by name is an MSB (Money Service Business) under FinCEN’s regulations. That means these exchangers and administrators are subject to MSB registration and reporting regulations etc., while just “users” of MSBs are free of those. Only the line between the exchangers and users appears to be drawn in the sand.

On June 20th, the first Bitcoin auction in Australia is taking place in Sydney. Around 24,500 Bitcoins seized in late 2013 from a Melbourne drug dealer are going to be on sale. Auctioning Bitcoin off suggests that local authorities in Australia view Bitcoins as property, not money. While on the other hand, for instance, Japan does officially recognize Bitcoin and other virtual currencies as money.

Comic books for Professor Evans

This time around, the fate of a Florida man and the destiny of Bitcoin seem to be on a different set of scales. The defense and the prosecution have differing arguments over the cryptocurrency. Last Friday, Barry University economics Professor, Charles Evans, appeared in court as a defense witness testifying that Bitcoin isn’t really money, but rather something equivalent to poker chips or comic books.

However, as the prosecution points out, one can pay with Bitcoins in some restaurants as you can do with money, but this is obviously not possible with comic books or poker chips. This would seem to suggest that Bitcoin is more equal to money. Professor Evans himself was even paid for attending court in Bitcoins.

Whether Bitcoin will be defined as money in Florida or not – the verdict will play a noticeable role in future definitions and usage of Bitcoin. It seems as if something so big is going on that it is hard to predict what kind of movement the decision will cause around the world. Either way, it is going to add its own spice to the realm of uncertainty that envelops Bitcoin.

Read more here.

0 notes

Text

New Post has been published on Cryptonewz.com

New Post has been published on http://cryptonewz.com/the-crack-of-thunder-blockchain-com-announces-alpha-release-of-lightning-network/

The Crack of Thunder: Blockchain.com Announces Alpha Release of Lightning Network

Blockchain, the world’s leading provider of Blockchain tools and software, has announced that the first usable implementation of the Lightning network, Thunder, has been released as an alpha.

Lightning networks

Lightning networks, as explained on the Lightning Network webpage, are dependent upon the underlying technology of the blockchain.

By using real Bitcoin/Blockchain transactions and using its native smart-contract scripting language, it is possible to create a secure network of participants which are able to transact at high volume and high speed.

Essentially, they are designed to reduce the volume on the Bitcoin blockchain by transferring transactions, and microtransactions in particular to a sidechain that syncs with the main blockchain at regular intervals.

Thunder alpha release

In this alpha release, Blockchain’s implementation of the Lightning network, Thunder has both a node and a wallet present. Blockchain also claims that the network can achieve “better-than-Visa scale (100,000 TPS) with only a few thousand nodes.”

According to Blockchain.com, Lightning networks have been purely conceptual until now. With the release of the alpha version of Thunder Network, the company makes it the first usable implementation of the Lightning network for off chain bitcoin payments that settles back to the main Bitcoin blockchain.

Thus, Thunder has the potential to “facilitate secure, trustless and nearly instant payments, unleash the power of microtransactions, allow the network to handle heavy loads, and increase user privacy.”

Blockchain also says that, due to the free market in an open and permissionless network, fees will be significantly lower than with on-chain payments. In addition, for those interested in security, Blockchain encrypts all communications between nodes and wallets using AES-CTR and only allows them to take place after completing authentication.