Text

Crypto Exchanges 101

Now that you have learned a little bit about crypto, you are wondering how you can buy it on an exchange.

A crypto exchange is essentially a marketplace where you can buy and sell cryptocurrency. Think of it as a stock brokerage, but for crypto.

You can exchange fiat (i.e. dollars/yen/euro/etc.) for crypto (i.e. BTC, DOGE, etc.) or you can exchange one crypto asset for another (i.e. BTC -> DOGE).

Some exchanges allow you to margin trade, which is when you essentially trade with borrowed money from the exchange, using leverage.

Most exchanges charge fees based on volume traded over a 30-day rolling period. The more you trade, the lower the fees get.

Generally speaking, exchanges that are geared more for intermediate and advanced users have lower fees than exchanges that are user friendly and marketed to beginners.

BUYING/SELLING The very first thing that you must understand is that there must always be a buyer to buy when someone wants to sells crypto, and a seller to sell, when someone wants to buy crypto. When you place an order to either buy or sell, the order goes into the exchange’s order book. This is essentially a list of orders that shows all pending buy or sell orders that are running through the exchange. These orders are then matched by the exchange, which finds a buyer that is willing to buy the asset at a specific price set by the seller. For example, let’s say Joe wants to sell BTC for USD at a price of $45,000. He sets a limit sell with an execution price of $45,000. At the same exact time, Jane wants to buy BTC with USD. She sets a limit buy with an execution price of $45,000. The exchange sees Joe’s sell order and Jane’s buy order in the order book and then matches the two orders together. At that point in time, Joe receives the USD Jane traded to buy the BTC, and Jane receives the BTC in exchange for USD.

If Joe sets a market sell, then price of his sell order will execute at the current price of BTC in the exchange. If Jane sets a market buy, her buy order will execute at the current price of BTC in the exchange. If their orders happen to match - or if they match another order that is already “on the books” (i.e. waiting to be processed, such as in the case of a limit sell that was set ahead of time), then the exchange matches the orders and they execute.

EXCHANGE FEES

All exchanges charge fees whenever you buy or sell crypto. The fees change from exchange to exchange, but what you need to understand is the difference between taker and maker fees.

A taker fee is a fee that the exchange charges when you execute an order that executes instantly. When these types of order execute, they actually decrease/remove liquidity from the marker.

A maker fee is a fee that does not immediately execute. It is usually an order that “sits on the books” and waits to be executed. Because the order waits for price to reach it and does not immediately execute when it is created, it creates liquidity for the market.

Not all exchanges charge initial maker fees for trading - some actually provide rebates. But, all exchanges charge initial taker fees. (As mentioned before, these fees get lower the more you trade, until they eventually become zero at the highest volumes of trading.)

In order to understand what the exchanges charge, you need to Google the exchange + fees to pull up the fee schedule. So, if I want to determine what FTX.us charges, I would Google “FTX.us fees,” which turns up this page.

I see that at $0 per 30 day volume, I would be charged either 0.10% taker fees / 0.40% maker fees.

So, let’s say that I want to trade $1000 worth of USD for BTC.

If I make a market order and the order instantly executes, then I will be charged a taker fee of $1000 * 0.4% = $4.

If I make a limit order for $51,000 and the order sits on the books for some time before executing, then I am charged a maker fee when it executes of $1000 * 0.1% = $1.

To research different fees for exchanges, you have to Google each exchange to look up their fee structures.

(Note: There might be some exchanges that claim they charge no fees, but they have to make money some way, so be careful if you come across an exchange like that.)

OK, NOW WHAT? So, now that you know some basics about fees and what limit/market orders are, you are probably wondering how you can buy some crypto. Here are the steps.

1. Register at the exchange. Some exchanges will require you to provide your ID and verification. This is known as “KYC” (Know Your Customer) and it is normal. It is how exchanges stay compliant with regulators. (Note: not all exchanges require KYC, but many exchanges - especially in the US - do.)

2. Now that you have registered, you have to connect a bank account. Deposit funds from your bank account into the exchange via ACH or wire (if you are in the US.) If you’re outside of the US, you may have other methods available to you for funding your account. Generally speaking, only trade what you are willing to lose, so do not deposit your life savings in here. (Disclaimer: I am not a financial advisor. This is not financial advice.)

3. Now that you have funds in your account, go and find the “pair” you want to trade. (Sometimes this is also known as the “market.”) If you want to buy BTC with USD, it will look like BTC/USD. If you want to buy DOGE with USD, then it will be DOGE/USD.

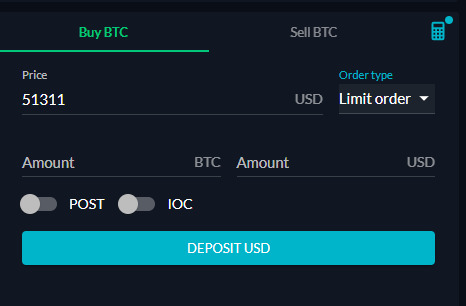

You would see something like this if you clicked on the BTC/USD market on FTX.us:

As you can see the above is a limit order. You set the price at which you want the order to execute and the amount of either USD or BTC you want to purchase.

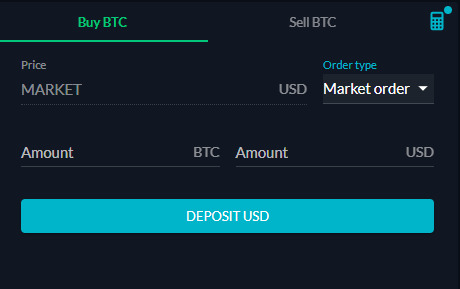

A market order looks like this:

Every exchange will look different but most tend to look pretty similar!

In any case, I hope this 101 post helps explain most of the basics. There’s a lot more that goes into exchanges, but hopefully, this post breaks down what you need to know to register and execute your first crypto order!

Good luck!

For a list of exchanges and other crypto resources, click here.

3 notes

·

View notes

Text

Crypto Trading Resources

Here are some of my favorite resources for crypto trading.

Last Updated: Feb 16, 2021 7:50PM EST

EDUCATION

CrackingCryptocurrency.com If you want to learn how to trade cryptocurrency responsibly using system-based algorithmic trading, there is no better resource than Cracking Cryptocurrency. They are a great educational group that hosts a daily Youtube show Mon-Fri at 1:00PM EST, where they perform live trading and teach people how to trade.

BabyPips.com If you are super new to trading and don’t even know how to read a chart, you can start by trying out BabyPips’ free forex trading course. Here, you will learn basic chart patterns, candlestick formations, and trading fundamentals that will help you on your trading journey.

EXCHANGES (US) Coinbase Coinbase Pro - The cheaper pro version of Coinbase Binance.us FTX.us Gemini OK Coin

EXCHANGES (INTERNATIONAL) Binance FTX Deribit - Derivatives and options Bybit - Margin trading (Intermediate/Advanced users only!) Uniswap - DeFi Exchange | Tutorial

WALLETS Ledger Nano X (Hard) Trezor (Hard) Trust Wallet (Hot) | Setup Video Exodus Wallet (Hot) | Setup Video Metamask (Hot) | Setup Video

TRADING TOOLS

Trading View - Chart crypto, stocks, and more. Use indicators! Coin Trader Pro - Chart coin projects that haven’t yet been listed on exchanges

Chartex - Chart more coin projects that might not be on exchanges!

CoinGecko.com - Your best search engine for tokens! Great for research.

CryptoParrot.com - Paper trading platform - digitally simulate trading for free with “paper” money! 3commas.io - Set multiple take profit points and simultaneous stop loss, trailing take profit, and stop loss timeouts. Sync all of your exchanges in one place to keep track of your trades!

BITCOIN INFO btc101.io bitcoin-only.com bitcoin.page bitcoin-resources.com

CLUBHOUSE CLUBS Crypto Church Black Bitcoin Billionaires BITCOIN LIGHTNING GAMING - EARN SATS! Sarutobi - Android | iPhone (Requires Test Flight) Bitcoin Bounce - Android | iPhone (Requires Test Flight) Bitcoin Bounty Hunt - Windows PC Bitcoin Rally - Windows PC Bitrealm Lightnite - Available for Linux, MAC, and Windows Turbo ‘84 - Android | iPhone CS:Go Infuse Mint Gox Discord Bitcoin Lightning Gaming Discord

EARN MORE SATS Fold App Lolli App NON-CUSTODIAL LIGHTNING WALLETS FOR LIGHTNING BTC Breez Zap Muun

3 notes

·

View notes

Text

Crypto Trading 101

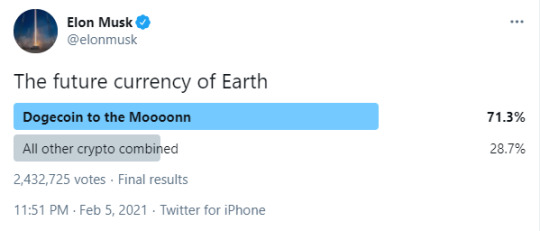

So, you’re new to crypto and may have bought some DOGE or BTC on Robinhood after reading Elon’s tweet and now have no idea what to do or where to begin.

Welcome to Crypto Trading 101!

Here, you will find posts on cryptocurrency, how to trade responsibly, and other trading resources that will help you on your trading journey. Feel free to send asks if you have any questions!

1 note

·

View note