DataVision’s suite of products and solutions offer full-scope support to back-office and front-end processes of banking and financial services organisations, enabling them to provide services for unmatched customer experience on any device.

Don't wanna be here? Send us removal request.

Text

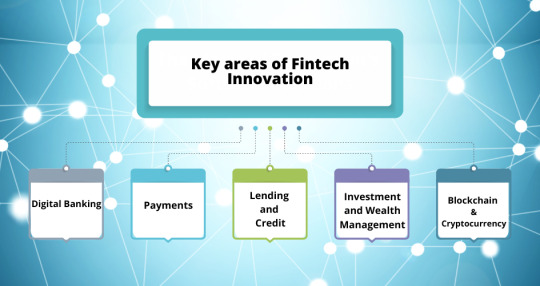

Fintech and the Future of Finance

Introduction The world of finance is undergoing a tremendous transformation driven by rapid technological advancements. Fintech, short for financial technology, has emerged as a disruptive force reshaping how we manage, invest, and transact with our money. In this comprehensive blog article, we will explore the fascinating world of fintech and its impact on the future of finance.

What is Fintech? Before we dive deeper into the future of finance, it is essential to understand what fintech is and how it has evolved over the years.Fintech refers to integrating technology into financial services to make them more efficient, accessible, and customer centric. It encompasses many applications, from mobile payment solutions and peer-to-peer lending platforms to robo-advisors and blockchain-based cryptocurrencies.

The evolution of fintech can be divided into three distinct waves:

The Early Wave (1950s-2000s): This phase saw the introduction of electronic trading, ATMs, and credit cards, which were significant advancements at the time. However, these innovations were focused on automating existing financial processes.

The Internet Wave (Late 1990s-2000s): With the advent of the Internet, online banking and brokerage services became more prominent. Companies like PayPal and E*TRADE emerged, paving the way for greater convenience and accessibility in financial services.

The Modern Wave (2010s-Present): This phase is characterized by the proliferation of smartphones, cloud computing, and big data analytics. It has given rise to various fintech startups and innovations fundamentally changing how we interact with money.

0 notes

Text

Online Lending: Emerging as the Leading Asset Class in the Digital Era

Introduction

In the rapidly evolving finance and investment landscape, online lending has emerged as a leading asset class, attracting individual and institutional investors. With the expansion of technology and the internet, lending has transitioned from traditional banks to online platforms, offering investors an array of opportunities and benefits. This article is all-encompassing and covers various aspects of the subject matter. We will explore why online lending has gained prominence and is considered a leading asset class.

Understanding Online Lending

Online or peer-to-peer (P2P) lending or marketplace lending is a financial practice that connects borrowers with individual or institutional lenders through online platforms. These platforms use advanced algorithms and data analytics to assess the creditworthiness of borrowers and match them with lenders willing to fund their loans. This model bypasses traditional banks and financial intermediaries, directly linking borrowers and lenders.

Why Online Lending is Becoming the Leading Asset Class

Diversification and Portfolio Enhancement

Online lending provides investors with an opportunity to diversify their portfolios. Traditionally, portfolios consisted of stocks, bonds, and real estate. However, online lending offers an additional asset class that can reduce a portfolio’s overall risk. Diversification is a fundamental principle of investment, and including loans in a portfolio can help mitigate risks associated with market volatility.

Attractive Returns

One of the primary reasons online lending has gained popularity among investors is the potential for attractive returns. Online lending platforms often offer higher interest rates than traditional savings accounts and other fixed-income investments. Depending on the type of loans and the platform, investors can earn substantial returns, which can be particularly appealing in a low-yield environment.

Accessibility

Investing in online lending is accessible to a wide range of investors. Unlike traditional investments that require substantial capital or accreditation, many online lending platforms allow individuals to start with relatively small amounts of money. This democratization of finance means that a broader spectrum of investors can participate and potentially benefit from this asset class.

Risk Mitigation

Online lending platforms utilize sophisticated underwriting models and risk assessment tools to evaluate borrowers. While there are risks associated with lending, these platforms aim to minimize them by assigning risk grades to borrowers and providing investors with information to make informed decisions. Additionally, investors can diversify their investments across multiple loans to mitigate individual loan default risks.

Liquidity

Online lending offers varying levels of liquidity, depending on the platform and the type of loans chosen. Investors can sell their loan notes to others on some platforms that offer secondary markets. It allows investors to exit their investments before the loan term expires, offering a degree of liquidity that traditional fixed-income investments may lack.

Technological Advancements

Advancements in technology have greatly facilitated online lending. Machine learning, AI (Artificial Intelligence), and big data analytics accurately assess borrower risk. These technologies also enhance the user experience for borrowers and lenders, making online lending an attractive option in the digital age.

Diverse Loan Types

Online lending platforms offer various loan types, from personal and small business loans to real estate and consumer credit. This diversity allows investors to customize their portfolios based on risk tolerance and objectives, making online lending more appealing.

Regulatory Evolution

The regulatory environment for online lending has evolved to provide more oversight and consumer protection. As the industry matures, regulatory bodies increasingly recognize and regulate online lending platforms, enhancing transparency and security for borrowers and investors.

Challenges and Risks in Online Lending: A Detailed Analysis

While online lending presents lucrative opportunities for investors, it is vital to acknowledge the challenges and risks of this asset class. Understanding these risks is crucial for making informed investment decisions. Below, we delve into the challenges and risks of online lending in detail:

Default Risk:

a. Borrower Default: Borrowers may fail to repay their loans, leading to potential investor losses. Default risk is inherent in lending, and it is particularly relevant in online lending, where borrowers may have varying creditworthiness.

b. Credit Risk: Investors in online lending are exposed to significant credit risk, which means that borrowers may default on their loans. While platforms employ advanced underwriting algorithms to assess creditworthiness, there is no guarantee against defaults.

c. Economic Downturns: Economic recessions or downturns can significantly impact default rates. When economic conditions deteriorate, borrowers may experience financial hardships, making it more challenging to meet their repayment obligations.

Platform Risk:

a. Platform Viability: The stability and credibility of the online lending platform can significantly affect investor returns. Some platforms may struggle to attract borrowers or experience financial difficulties, potentially leading to losses for investors.

b. Operational Risk: Technical issues, cybersecurity threats, or operational failures on the platform can disrupt loan servicing and pose risks to investor returns. These risks underscore the importance of choosing a reputable and well-established platform.

c. Regulatory Changes: Changes in regulations can impact the operations of online lending platforms. Regulatory uncertainty or shifts can lead to compliance challenges for platforms and may affect the availability of specific loan types.

Market Risk:

a. Interest Rate Risk: Online lending platforms often offer fixed-interest rate loans. Changes in broader interest rates can affect the attractiveness of these loans. For example, if interest rates rise significantly, the returns on fixed-rate loans may become less competitive than other investments.

b. Economic Factors: Economic conditions and market trends can influence borrower behaviour and loan performance. In a strong economy, default rates may be lower, but during economic downturns, defaults can increase, affecting investor returns.

Lack of Diversification:

a. Concentration Risk: If investors allocate a substantial portion of their portfolio to online lending, they may face concentration risk. Concentrating investments in a single asset class can increase exposure to its specific risks, potentially leading to more significant losses if problems arise.

b. Lack of Asset Variety: While online lending platforms offer various loan types, investors may still need more asset variety compared to traditional financial markets. This lack of diversity can make portfolios more vulnerable to specific market conditions.

Liquidity Risk:

a. Lock-In Periods: Many online lending platforms have lock-in periods where investors can only access their funds once loans mature. This lack of immediate liquidity can be problematic for investors, who may need to access their capital on short notice.

b. Secondary Markets: While some platforms offer secondary markets where investors can sell their loan notes, liquidity may still be limited, and investors may need to accept discounts to sell their investments before the loan term expires.

Regulatory and Compliance Risks:

a. Regulatory Variability: The regulatory environment for online lending varies by jurisdiction and can change over time. It can create uncertainty for investors regarding the legal and regulatory framework governing their investments.

b. Compliance Challenges: Online lending platforms must adhere to evolving, complex regulations. Non-compliance or regulatory changes can disrupt platform operations and impact investor returns.

Information Asymmetry:

a. Limited Information: Investors rely on the information provided by the lending platforms to assess loan opportunities. There may be limited transparency, and investors may need access to all relevant borrower information, increasing the risk of investing in loans with hidden weaknesses.

Conclusion

Online lending has emerged as a leading asset class in the financial landscape due to its potential for attractive returns, diversification benefits, accessibility, and technological advancements. While it offers numerous advantages, investors should also be aware of the associated risks. As the industry continues to evolve and mature, online lending will play an increasingly significant role in individual and institutional investors’ portfolios, solidifying its status as a leading asset class in the digital era.

FAQs (Frequently Asked Questions)

Are online lending platforms safe for investors?

While online lending platforms can be safe, they are not without risk. It is essential to research and choose reputable platforms, diversify your investment portfolio, and be aware of the potential for defaults.

How much interest can I earn from online lending?

Earnings from online lending can vary widely depending on the loans you choose, interest rates, and the platform’s performance. It is crucial to establish achievable expectations that are grounded in past performance.

Can I withdraw my funds from online lending platforms?

Many platforms offer liquidity options, such as secondary markets, but the ability to withdraw funds may be subject to certain restrictions and terms. Read the platform’s terms and conditions carefully.

Is online lending a suitable investment for retirees?

Online lending can be a suitable investment for retirees looking for passive income, but assessing risk tolerance and investment goals is crucial to ensure they align with their financial plan.

How do I get started with online lending?

To get started, research online lending platforms, create an account, fund it, and begin selecting loans to invest in. Some platforms offer automated investment options for convenience.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision stands proudly as a prominent banking software solutions provider, recognized for our unwavering commitment to excellence in the industry. We have earned our esteemed reputation by consistently delivering cutting-edge core banking software, catering to the needs of both retail and corporate banking software sectors. At Datavision, our mission is clear: to provide our clients with the best banking software products, ensuring that they stay ahead in an ever-evolving financial landscape. We take pride in serving our prestigious clients and look forward to continuing our journey of innovation and excellence.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Payments: | FinPay |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.

0 notes

Text

Boosting Efficiency and Empowering Banks: Workforce Automation Revolutionizes the Banking Industry

In the fast-paced world of finance, where precision and speed are paramount, banks have always been at the forefront of technological innovation. From the advent of ATMs to the rise of online banking, financial institutions have consistently sought. Here are some suggestions on how to enhance customer service and simplify operations. Now, a new wave of transformation is sweeping the banking industry – workforce automation. This technological revolution promises to boost efficiency and empower banks like never before.

The Banking Industry in the Digital Age

The banking industry has undergone a profound transformation in recent decades. Gone are the days of long queues at brick-and-mortar branches, replaced by the convenience of mobile banking apps and online transactions. While these technological advancements have improved customer experience, they have intensified competition among banks.

Banks increasingly turn to workforce automation to stay ahead in this fiercely competitive landscape. This strategy involves using technologies such as artificial intelligence (AI), robotic process automation (RPA), and data analytics to optimize their operations.

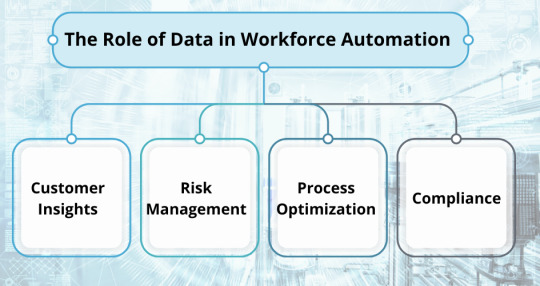

The Role of Data in Workforce Automation

Data is the lifeblood of the modern banking industry. Banks deal with vast data daily, from customer profiles and transaction histories to risk assessments and compliance records. Leveraging this data is crucial for operational efficiency and providing better customer service.

0 notes

Text

Pioneering Environmental Responsibility with Innovative Banking Solutions

In an era where environmental consciousness is rapidly becoming a primary concern for individuals, businesses, and governments alike, sustainable banking has emerged as a groundbreaking paradigm shift within the financial services sector. Green and sustainable banking integrates environmental, social, and governance (ESG) factors into banking operations, products, and services. This transformative approach reflects the industry’s commitment to environmental responsibility and underscores the potential of innovative banking solutions to drive positive change.

The Essence of Sustainable Banking

The essence of sustainable banking lies in its ability to align financial practices with the principles of environmental responsibility. This shift transcends mere corporate social responsibility; it redefines the banking sector’s role as a catalyst for sustainability. Sustainable banking involves proactive measures to minimize the carbon footprint of banking operations, facilitate eco-friendly lending practices, and support environmentally conscious investments.

Traditional banking models often prioritize short-term gains and profit margins, sometimes at the expense of environmental considerations. Sustainable banking, however, introduces a long-term perspective that balances economic growth with ecological well-being. The digital revolution within banking can be harnessed to amplify the impact of sustainable practices, leading to a mutually beneficial relationship between digital innovation and environmental stewardship.

The Nexus of Digital Banking and Environmental Sustainability

Digital banking has emerged as a potent driver of both convenience and sustainability. Digital banking solutions enable customers to adopt environmentally friendly practices effortlessly. Reduced paper usage through electronic statements, online bill payments, and mobile banking applications reduces the industry’s carbon footprint. Additionally, digital channels allow banks to educate customers about sustainable financial decisions and incentivize eco-conscious behaviours.Furthermore, the digital transformation of banking operations optimizes resource utilization and energy consumption within the banking infrastructure. Automated processes, data-driven insights, and cloud-based platforms minimize waste and enhance operational efficiency. It contributes to cost savings and positions banks as champions of environmental conservation.

Nurturing Sustainability through Innovative Products

Sustainable banking goes beyond operational changes and extends to the core of banking products and services. “What is Sustainable Banking? Underscores the significance of offering innovative financial products that fund environmentally sustainable projects. Green bonds, for instance, raise capital for initiatives aimed at renewable energy, climate adaptation, and sustainable infrastructure. These financial instruments allow investors to participate in projects that yield both financial returns and ecological benefits.

Moreover, sustainable banking involves integrating ESG considerations into credit assessments. This approach ensures that loans are extended to projects and businesses aligned with sustainable practices. Banks play a pivotal role in shaping a more sustainable future by evaluating borrowers’ commitment to environmental and social responsibility.

Collaborative Partnerships for Lasting Impact

The transition towards green and sustainable banking necessitates collaboration among banks, governments, regulators, and non-governmental organizations (NGOs). Regulatory frameworks that incentivize sustainable lending practices can catalyze industry-wide change. Additionally, partnerships with NGOs and environmental experts offer banks access to specialized knowledge, fostering the development of innovative solutions that address pressing ecological challenges.

Collaborative platforms enable the exchange of best practices, exploring innovative ideas, and pooling resources to drive meaningful change. This collaborative approach amplifies the impact of sustainable banking beyond individual institutions, leading to a more resilient and environmentally conscious financial sector.

Overcoming Challenges and Seizing Opportunities

While the path to green and sustainable banking is marked by immense promise, it has challenges. Navigating the complexities of sustainable finance requires banks to integrate ESG considerations seamlessly into their decision-making processes. It demands robust data analytics, innovative technology, and skilled personnel who can evaluate the environmental impact of financial activities.

Moreover, the adoption of sustainable practices necessitates cultural shifts within banking organizations. A commitment to sustainability must be embedded in the institution’s values and operational policies. Training and awareness programs can foster a culture of environmental consciousness, empowering employees to champion sustainable practices within and outside the workplace.

Advantages of Green and Sustainable Banking

Positive Environmental Impact: One of the most significant advantages of green and sustainable banking is its contribution to environmental preservation. Banks can significantly reduce their carbon footprint by adopting eco-friendly practices, such as paperless transactions and renewable energy initiatives.

Risk Mitigation: Integrating ESG considerations into banking practices helps mitigate risks associated with environmental and social issues. Banks that lend to environmentally responsible projects will avoid disruptions caused by regulatory changes or public sentiment shifts.

Enhanced Reputation: Embracing sustainable practices enhances a bank’s reputation and brand image. Customers are increasingly drawn to institutions that share their values and actively contribute to environmental causes.

Innovation Opportunities: Sustainable banking encourages innovation in product offerings. Green financial products like green bonds and sustainable investment funds provide customers with opportunities to support environmentally conscious initiatives.

Financial Performance: While some might assume that sustainability comes at the cost of financial performance, studies have shown that sustainable investments can yield competitive returns and long-term stability.

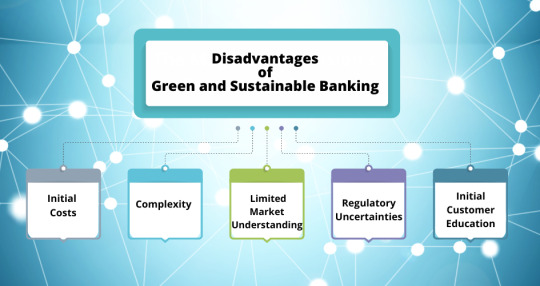

Disadvantages of Green and Sustainable Banking

Initial Costs: Transitioning to sustainable banking practices might involve initial costs for technology upgrades, employee training, and implementing new policies.

Complexity: Integrating ESG considerations can be complex due to the multifaceted nature of environmental and social issues. Banks must develop sophisticated assessment methods to evaluate the impact of financial decisions accurately.

Limited Market Understanding: Some customers might need help understanding the value of green banking products, potentially limiting the adoption of such offerings.

Regulatory Uncertainties: Rapid changes in environmental regulations and standards can pose challenges for banks aiming to align with evolving sustainability criteria.

Initial Customer Education: Shifting towards green and sustainable banking requires educating customers about the benefits and importance of these practices. Banks must invest in educational campaigns to raise awareness and help customers understand the value of sustainable banking initiatives, which can initially slow down the adoption process.

Banks need to be more active in embracing sustainability measures than other industries. However, the campaign for sustainable banking is gaining traction and will intensify over the next ten years.

At this critical point in the transition to sustainability, there are a few major areas where banks may accelerate their efforts to become more ecologically responsible:

Developing a Long-Term Banking Strategy: Create a clear sustainability plan and take actionable efforts to achieve it. Conduct a thorough investigation to help guide your transition to a socially responsible bank. Determine the business strategy and technologies required to capitalize on this potential and how you will give value to your clients.

Managing Risk and Regulatory Compliance: The landscape of ESG (Environmental, Social, and Governance) legislation is fast growing, encompassing social and governance concerns and climate change. While some requirements, such as climate stress testing and sustainability disclosures, are already in place, greater filtration of lending practices based on established taxonomies will follow. Banks should plan ahead of time for potential regulatory changes. Handling ESG-related risk entails more than just reporting; it needs a fundamental shift in risk management throughout the organization.

Providing Sustainable Products: Banks are already attempting to gain a competitive advantage in sustainable finance by developing new products such as green bonds, sustainable mortgages, and eco-conscious loans. This push for green solutions will have a knock-on effect across other industries, driving more adoption of sustainable practices. While banks are under pressure right now, ESG-linked products can be beneficial in both lending and investing. Banks must build streamlined solutions with efficient process frameworks and technical architecture to support these activities.

Implementing a Strategic Operating Model: The impact of ESG may be seen in many elements of bank operating models, including front and back offices. Sustainable financial decision-making, ESG due diligence for clients, investment guidance, and supply chain finance are all becoming more important. As ESG standards and taxonomies evolve, ESG analysts’ efforts will increase. It is critical to incorporate ESG data into client lifecycle management, expanding on existing KYC (Know Your Customer) and AML (Anti-Money Laundering) processes.

Green IT Initiatives: Improve operational efficiency by transferring apps, data, and infrastructure to the cloud, which provides the added benefit of lowering carbon emissions and operational expenses. Approaching cloud migration from a sustainability standpoint can dramatically reduce global carbon emissions, contributing significantly to climate change pledges.

However, it is a task that necessitates the proper approach. Banks that quickly develop and implement their sustainability agendas will gain an advantage as pioneers aiming to meet, if not exceed, their sustainability objectives. The time has come to act.

Conclusion

Green and sustainable banking represents a monumental shift in the financial services industry, signalling a departure from profit-focused moves towards ecological responsibility.

By integrating ESG factors into banking operations, harnessing the power of digital innovation, offering innovative products, and forging collaborative partnerships, banks are contributing to environmental sustainability and positioning themselves as pioneers of positive change.

As the world grapples with environmental challenges, the banking sector’s transformation towards sustainability serves as a beacon of hope. By embracing this shift, banks can drive lasting impact, foster economic growth, and become catalysts for a greener, more sustainable future.

FAQs (Frequently Asked Questions) about Green and Sustainable Banking

Q1: What is the difference between sustainable banking and traditional banking? Ans. Sustainable banking integrates environmental, social, and governance factors into decision-making, while traditional banking often focuses solely on financial profitability.

Q2: How can digital banking support green initiatives? Ans. Digital banking reduces paper usage, streamlines operations, and facilitates customer educational campaigns, promoting eco-conscious behaviours.

Q3: What are green bonds? Ans. Green bonds are financial instruments that raise capital for environmentally friendly projects, offering investors the chance to support sustainability while earning returns.

Q4: How do banks ensure the authenticity of their sustainable practices? Ans. Many banks obtain third-party certifications to validate their sustainable initiatives, enhancing transparency and trust.

Call to Action: Nurturing a Greener Banking Future

The path to a more sustainable banking sector requires collective effort. To drive meaningful change, banks, regulators, and customers must collaborate:

Banks: Commit to integrating ESG considerations into all operations, from lending practices to internal policies.

Regulators: Develop supportive regulatory frameworks that incentivize and reward sustainable banking practices.

Customers: Demand transparency from banks about their sustainability efforts and actively choose green financial products.

Partnerships: Collaborate with NGOs, environmental experts, and other stakeholders to amplify the impact of sustainable initiatives.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision is a leading Banking software solutions provider having operations in India. We at Datavision are the top retail and Corporate Banking Software provider as we serve our prestigious clients with cutting-edge core application software in Maharashtra and Karnataka, Delhi and Uttar Pradesh.

We provide the best banking software products to our clients in Rajasthan and Gujarat. Get in touch with us for customizable, scalable, and affordable banking software products and solutions.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Payments: | FinPay |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.

0 notes

Text

Fortifying Cyber security and Data Privacy

Safeguarding Financial Institutions: Fortifying Cybersecurity and Data Privacy with Cutting-Edge Banking Software Solutions

In the fast-paced world of financial technology, the influence of Artificial Intelligence (AI) in shaping and driving the future of banking is undeniable. With its ability to analyze, learn from, and act on data, AI is transforming banking from a transaction-driven to an experience-driven sector.

Table of Contents Introduction Understanding Cyber Threats to Financial Institutions The Significance of Data Privacy in Banking Exploring Cutting-Edge Banking Software Solutions Strengthening Cybersecurity with Banking Software Solutions Benefits of Fortifying Cybersecurity and Data Privacy with Cutting-Edge Banking Software Solutions Disadvantages of Relying Heavily on Cutting-Edge Banking Software Solutions for Cybersecurity and Data Privacy Enhancing Data Privacy with Banking Software Solutions Ensuring Regulatory Compliance with Banking Software Solutions Fostering a Culture of Cybersecurity Awareness Building Customer Trust through Robust Security Measures Conclusion FAQs (Frequently Asked Questions) How Can Datavision help?

Introduction Data Privacy and Cybersecurity have become critical concerns for financial institutions in the digital age. As cyber threats evolve, banks and other financial organizations must fortify their defenses with cutting-edge banking software solutions. In this blog, we will learn about the importance of cybersecurity and data privacy in financial institutions and the role of advanced software solutions in ensuring their protection.

Understanding Cyber Threats to Financial Institutions Financial institutions face many cyber threats, including data breaches, ransomware attacks, and phishing attempts. Organizations must recognize and comprehend the risks associated with cybersecurity threats, as they can lead to severe financial losses, harm to reputation, and legal implications. By doing so, adequate measures are taken to secure against these threats.

The Significance of Data Privacy in Banking Regulatory frameworks, such as GDPR and CCPA, place stringent requirements on financial institutions to protect customer data and privacy. Adhering to these regulations prevents legal consequences and establishes trust with customers. Maintaining data privacy is essential to nurturing a strong client relationship and promoting lasting loyalty.

Exploring Cutting-Edge Banking Software Solutions Innovative banking software solutions leverage technologies like Our system and use AI and machine learning to identify and stop cyber threats in real-time. We also utilize advanced encryption methods to keep confidential data safe and inaccessible to unauthorized individuals. These technologies play a pivotal role in enhancing the overall security posture of financial institutions.

Strengthening Cybersecurity with Banking Software Solutions Implementing multi-factor authentication (MFA) adds more protection against unauthorized access. Securing endpoints and networks through firewalls, intrusion detection systems, and regular security audits minimizes vulnerabilities.

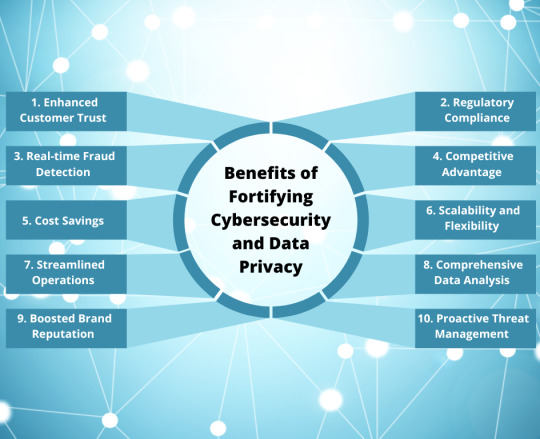

Enhanced Customer Trust: Customers want assurance that their funds and personal data are safe. Robust security measures in banking software enhance trust and brand loyalty.

Compliance with Regulatory StandardsAdvanced software solutions ensure that financial institutions remain compliant with evolving data protection regulations, avoiding hefty fines and legal repercussions.

Real-time Fraud DetectionModern banking software, especially those with AI capabilities, can detect and respond to fraudulent activities in real-time, mitigating potential losses.

Competitive AdvantageBanks and financial institutions that invest in top-tier security solutions can differentiate themselves in the market, attracting more customers.

Cost SavingsBy preventing cyber-attacks and data breaches, banks can avoid the associated financial repercussions, including compensating affected customers and restoring damaged systems.

Scalability and FlexibilityInnovative solutions are designed to adapt and grow with the institution, ensuring security is not compromised during periods of expansion or change.

Streamlined OperationsModern banking software not only offers security but also comes with tools for automation and streamlined operations, reducing manual errors and inefficiencies.

Comprehensive Data AnalysisWith integrated analytics tools, banks can gain insights from their data, improving decision-making processes and understanding customer behaviors.

Boosted Brand ReputationIn a world where data breaches often make headlines, having a strong cybersecurity posture can significantly enhance an institution’s reputation.

Proactive Threat ManagementRather than responding to threats after they have occurred, advanced software solutions allow institutions to proactively manage and mitigate potential risks.

Embracing cutting-edge banking software solutions is not just about staying ahead technologically; it is about protecting stakeholders, optimizing operations, and securing the future of financial institutions.

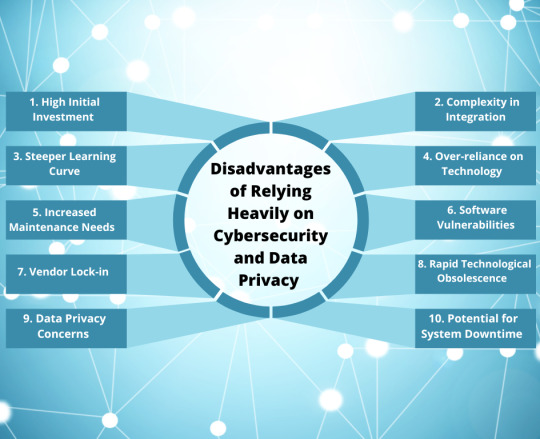

Disadvantages of Relying Heavily on Banking Software Solutions for Cybersecurity and Data Privacy

High Initial InvestmentImplementing advanced software solutions can be costly, particularly for smaller institutions or those with limited IT budgets.

Complexity in IntegrationIntegrating new software with existing systems can be complex, potentially leading to disruptions or conflicts in operations.

Steeper Learning CurveStaff and stakeholders might face challenges adapting to new systems requiring intensive training and potentially causing errors in the interim.

Over-reliance on TechnologyTrusting technology implicitly can sometimes overshadow the human judgment necessary for nuanced decision-making, especially in unprecedented situations.

Increased Maintenance NeedsInnovative software solutions may require regular updates, patches, and maintenance, which can strain IT departments and resources.

Potential for Software VulnerabilitiesNo software is entirely immune from vulnerabilities. Over time, as attackers learn more about a system, they might find ways to exploit it.

Vendor Lock-inOnce an institution heavily invests in a particular software solution, they might find it challenging and costly to switch providers or solutions later.

Rapid Technological ObsolescenceIn the fast-paced world of tech, today’s innovative solution might become outdated tomorrow, necessitating further investment.

Data Privacy ConcernsRelying on third-party solutions might raise concerns about where and how customer data is stored, processed, and potentially accessed.

Potential for System DowntimeImplementing or updating advanced software can sometimes lead to unplanned downtimes, affecting both customers and internal operations.

While innovative banking software solutions offer numerous advantages in fortifying cybersecurity and data privacy, it is essential for financial institutions to weigh these against potential drawbacks. A balanced, well-informed approach is crucial for maximizing benefits and minimizing risks.

Enhancing Data Privacy with Banking Software Solutions Role-Based Access Controls (RBAC) ensure that employees can only access information relevant to their roles, reducing the risk of internal data breaches. Data encryption and tokenization techniques render data unreadable, even if it falls into the wrong hands.

Ensuring Regulatory Compliance with Banking Software Solutions Financial institutions rely on Know Your Customer (KYC) and Anti-Money Laundering (AML) solutions to meet regulatory requirements. In addition, using robust banking software solutions can ensure that companies comply with data protection regulations like GDPR and CCPA.

Fostering a Culture of Cybersecurity Awareness It is vital to educate employees on cybersecurity risks and best practices to prevent security breaches caused by human errors. Creating a security-conscious culture ensures that every staff member takes responsibility for maintaining a secure environment.

Building Customer Trust through Robust Security Measures Transparent communication regarding security practices and measures helps build customer trust. Showing dedication to safeguarding data reinforces the idea that customer information is handled with the highest level of care.

Conclusion Safeguarding Financial Institutions with Advanced Banking Software Solutions

The quest for airtight cybersecurity and impeccable data privacy in financial institutions is not just a luxury; it is a necessity. As cyber threats continue to evolve, so should our defense mechanisms. By integrating innovative banking software solutions and fostering a culture of awareness, financial institutions can safeguard their reputation and, more importantly, their customers’ trust. In the digital age, it is not just about keeping money safe but ensuring that every byte of data is treated with the respect and security it deserves.

FAQs (Frequently Asked Questions)

Q. How do innovative banking software solutions protect against cyber threats? Advanced banking software solutions utilize Artificial Intelligence to instantly identify and prevent cyber threats. Advanced encryption techniques ensure that sensitive data remains secure and inaccessible to unauthorized parties.

Q. What is the significance of data privacy in banking? Ensuring data privacy is of utmost importance for financial institutions. It helps establish customer trust and ensures compliance with regulatory frameworks such as CCPA and GDPR. Protecting customer data strengthens the relationship between the institution and its clients.

Q. How do banking software solutions strengthen cybersecurity? Banking software solutions strengthen cybersecurity through multi-factor authentication (MFA) and securing endpoints and networks with firewalls and intrusion detection systems. These measures minimize vulnerabilities to unauthorized access and attacks.

Q. How can financial institutions ensure regulatory compliance with software solutions? Financial institutions can ensure regulatory compliance with banking software solutions by implementing Anti-Money Laundering (AML) and Know Your Customer (KYC) solutions. This helps us to adhere to regulatory requirements and data protection regulations.

Q. Why is fostering a culture of cybersecurity awareness influential? Fostering a culture of cybersecurity awareness is crucial as it educates employees about cybersecurity risks and best practices, reducing the likelihood of human error-based security breaches and ensuring a secure environment.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision is a leading Banking software solutions provider having operations in India. We at Datavision are the top retail and Corporate Banking Software provider as we serve our prestigious clients with cutting-edge core application software in Maharashtra and Karnataka, Delhi and Uttar Pradesh.

We provide the best banking software products to our clients in Rajasthan and Gujarat. Get in touch with us for customizable, scalable, and affordable banking software products and solutions.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Payments: | FinPay |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.

0 notes

Text

AI-Driven Personalization

AI-Driven Personalization: Redefining the Banking Landscape with Datavision’s Banking Software Solutions

In the fast-paced world of financial technology, the influence of Artificial Intelligence (AI) in shaping and driving the future of banking is undeniable. With its ability to analyze, learn from, and act on data, AI is transforming banking from a transaction-driven to an experience-driven sector.

Table of Contents Introduction to AI in Banking Transforming Customer Experience with AI AI in Risk Assessment and Fraud Detection Intelligent Automation with AI in Banking Data Analysis and Predictive Analytics with AI The Challenges of Implementing AI in Banking The Future of AI in Banking Conclusion FAQs How Can Datavision Help?

Introduction to AI in Banking In the fast-paced world of financial technology, the influence of Artificial Intelligence (AI) in shaping and driving the future of banking is undeniable. With its ability to analyze, learn from, and act on data, AI is transforming banking from a transaction-driven to an experience-driven sector.

Datavision, a leading banking software company, is spearheading the banking industry’s evolution with its world – class software solutions. Their AI-driven personalization platform is empowering banks to redefine the way they interact with customers, ensuring enhanced engagement, loyalty, and ultimately, a stronger bottom line.

Welcome to the world of advanced banking, where AI-driven personalization is reshaping the financial services landscape! Today, let’s delve into the transformative power of Datavision’s software solutions and their contributions to the banking industry.

Transforming Customer Experience with AI Enhanced User Experience

Thanks to AI, banks can now provide a more personalized and seamless user experience. Imagine, instead of going through multiple menus, you can ask your banking app to transfer money to a friend. It’s like having a personal assistant tucked away in your pocket!

Personalized Services

From personalized product recommendations to custom-made financial advice, AI enables banks to tailor services to the unique needs of every individual. It’s no longer a one-size-fits-all approach but a bespoke service designed just for you!

Financial Management Tools

AI has also allowed banks to provide customers with tools to manage their finances effectively. These tools can analyze your spending habits, provide insights, and even offer suggestions on how to save more. Isn’t that like having your own financial advisor at your fingertips?

AI in Risk Assessment and Fraud Detection Accurate Risk Profiling

AI algorithms can sift through vast amounts of data to accurately assess a customer’s risk profile. It’s like an eagle-eyed detective spotting potential red flags that human analysts might miss.

Detecting Fraudulent Activities

Fraud detection has also seen a revolutionary shift with AI. The technology can identify patterns, anomalies, and trends in data that can help predict and prevent fraudulent activities. Think of it as your banking bodyguard, protecting your hard-earned money.

Intelligent Automation with AI in Banking

Process Automation

In banking, AI has resulted in more intelligent and faster automation of routine processes. This has improved efficiency and eliminated the chances of human error. Imagine a factory line where each piece of the process works in perfect harmony – that’s what AI brings to banking operations!

Improved Decision Making

AI’s data-driven insights aid in better decision-making in loan approval, investment strategies, or customer service. It’s like having a crystal ball that helps banks make informed choices and avoid pitfalls.

Data Analysis and Predictive Analytics with AI

Data-Driven Decisions

AI allows banks to tap into the gold mine of data they possess. These data insights allow precise decision-making, improving banking operations and customer experience. You can think of it as your GPS, guiding you to your destination with pinpoint accuracy!

Predicting Future Trends

AI’s ability to predict future trends based on past and present data is a game-changer. This can help banks strategize for the future and stay ahead of the curve. It’s like having a time machine giving you a peek into the future!

Despite the numerous advantages, AI implementation in banking comes with its own challenges. Ensuring data privacy and security is a paramount concern. After all, who wants their personal information to fall into the wrong hands?

Regulatory Compliance

Adherence to regulations is another major hurdle. How can banks ensure their AI systems comply with the ever-changing legal landscape? It’s like playing a never-ending game of catch-up!

Technological Infrastructure

Lastly, the need for robust technological infrastructure must be addressed. Implementing AI requires significant investment in technology and skilled personnel. So, how can banks strike a balance between innovation and cost-effectiveness?

The Future of AI in Banking Evolving Customer Expectations

As AI continues to evolve, so do customer expectations. Consumers demand instant, personalized, and seamless banking experiences. Will banks be able to keep up with these changing demands?

The Rise of Neobanks and Fintechs

The growth of neo banks and fintech with their AI-first approach poses a serious challenge to traditional banks. Will traditional banks be able to compete, or will they be left behind in the race?

Conclusion AI-driven personalization is redefining the banking landscape. AI’s potential in banking is vast, from transforming customer experience to detecting fraud. However, the journey to fully AI-powered banking is fraught with challenges. Nevertheless, the promise that AI holds is too vast to ignore. After all, who wants banking to be more complex than asking a question to your phone?

The future of banking is here, and it is exciting to witness the positive impact that AI-driven personalization is making on the financial industry. With Datavision’s software solutions leading the way, the possibilities for innovation are boundless, and the banking landscape is set to evolve like never before! So, let’s embrace this revolution and redefine the way we bank with AI-driven personalization. The future is bright, and the time to act is now!

FAQs

Q. What is AI-driven personalization in banking? AI-driven personalization in banking refers to using artificial intelligence to provide personalized banking services based on individual customer needs and preferences.

Q. How does AI improve customer experience in banking? AI improves customer experience in banking by providing personalized services, enhancing user experience with conversational interfaces, and offering intelligent financial management tools.

Q. AI improves customer experience in banking by providing personalized services, enhancing user experience with conversational interfaces, and offering intelligent financial management tools. AI helps in risk assessment by accurately profiling the risk associated with a customer. It aids in fraud detection by identifying patterns, anomalies, and trends that may signify fraudulent activities.

Q. AI helps in risk assessment by accurately profiling the risk associated with a customer. It aids in fraud detection by identifying patterns, anomalies, and trends that may signify fraudulent activities. The challenges of implementing AI in banking include ensuring data privacy and security, adhering to regulatory compliance, and investing in the necessary technological infrastructure and skilled personnel.

Q. How is AI shaping the future of banking? AI is shaping the future of banking by transforming customer experience, enabling accurate risk assessment, automating processes, aiding in data-driven decisions, and predicting future trends.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

Datavision is a leading Banking software solutions provider having operations in India. We at Datavision are the top retail and Corporate Banking Software provider as we serve our prestigious clients with cutting-edge core application software in Maharashtra and Karnataka, Delhi and Uttar Pradesh.

We provide the best banking software products to our clients in Rajasthan and Gujarat. Get in touch with us for customizable, scalable, and affordable banking software products and solutions.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Payments: | FinPay |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.

#Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |#Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |#Payments: | FinPay |#Risk & Compliance: |FinTrust |

0 notes

Text

The Rise of Fintech and Its Impact on Traditional Banking

The Rise of Fintech and Its Impact on Traditional Banking

In recent years, the financial industry has seen a significant shift towards digitalization, with the emergence of financial technology (Fintech) companies challenging the traditional banking sector.

Table of Contents

Introduction What is Fintech? The Rise of Fintech How is Fintech Disrupting Traditional Banking? Advantages of Fintech companies Impact of Fintech on Traditional Banking Challenges for Fintech Companies Conclusion

FAQs 1. What is Fintech? 2. How is Fintech affecting traditional banking? 3. Are Fintech companies safe to use? 4. Will Fintech replace traditional banks? 5. What are some examples of Fintech companies?

How Can Datavision help?

Introduction The financial technology industry, or “Fintech,” has snowballed in recent years. It is a term that describes any technological innovation in financial services, from mobile payments and online banking to blockchain and cryptocurrency. Fintech has disrupted traditional banking, which has needed to be faster to adopt new technologies.

Fintech has disrupted the banking industry, forcing traditional banks to adapt to new technologies and improve their services to stay relevant in the digital age. In this article, we will discuss the growth of Fintech and its impact on traditional banking.

What is Fintech? Fintech is an umbrella term for any technological innovation in financial services. It includes various financial services like mobile payments, online banking, and peer-to-peer lending. Fintech companies are often startups that use technology to provide financial services more efficiently and cost-effectively.

The term Fintech refers to the use of technology to provide financial services to customers.

It can range from online banking services to mobile payment platforms and digital currencies. Fintech companies use cutting-edge technology to provide customers with innovative financial services that are often faster, cheaper, and more convenient than traditional banking services.

The Rise of Fintech The rise of Fintech has been fueled by several factors, which include the increasing use of mobile devices, the rise of e-commerce, and the rising demand for faster and more convenient financial services. Fintech companies have been able to leverage these trends to develop innovative financial products and services that are disrupting the traditional banking industry.

Fintech has been on the rise for several years, and its growth shows no sign of slowing down.

In 2019, global Fintech investments reached $135.7 billion, up from $111.8 billion in 2018. The demand for more innovative financial services and the growing adoption of digital technology drive this growth.

How is Fintech Disrupting Traditional Banking? Fintech is disrupting traditional banking in several ways:

First, Fintech companies provide consumers with alternative ways to access financial services. It includes mobile banking, online banking, and peer-to-peer lending.

Second, Fintech companies use technology to provide financial services at a lower cost. It is because Fintech companies have lower overhead costs than traditional banks.

Third, Fintech companies are providing consumers with more personalized financial services. They use data analytics and artificial intelligence to analyze consumer behavior and offer customized financial products and services.

Advantages of Fintech companies Here are three key advantages of Fintech companies:

Convenience and accessibility:Fintech companies often use digital channels to offer financial services, making it easier and more convenient for customers to access and manage their finances. Customers can perform transactions, such as making payments, transferring funds, and checking account balances, from the convenience of their own residences using computers or mobile devices.This level of accessibility is especially beneficial for people who live in remote locations.

Lower operating costs:Fintech companies have lower operating costs than traditional financial institutions because they don’t have to maintain physical branches or large staff teams. It allows them to offer lower fees and interest rates to their customers. In addition, fintech companies often use algorithms and automation to streamline their operations, minimizing the need for manual labor and the possibility of human error.

Innovation and customization:Fintech companies are often founded by entrepreneurs with technology backgrounds, allowing them to approach financial services in new and innovative ways.

To enhance their products and services, they continually experiment with new technologies such as artificial intelligence and machine learning. can benefit from personalized financial solutions tailored to their specific needs and preferences.

Impact of Fintech on Traditional Banking The rise of Fintech has had a substantial impact on traditional banking. Fintech companies have challenged the dominance of traditional banks, offering innovative financial products and services that are often more convenient, faster, and cheaper. As a result, traditional banks have been forced to adapt to new technologies and improve their services to remain competitive.

One of the ways that traditional banks have responded to the rise of Fintech is by investing in new technologies and developing their digital banking services. It has enabled traditional banks to offer customers various digital banking services, including online banking, mobile banking, and digital wallets. Traditional banks have also embraced data and analytics to provide more personalized financial services to customers.

Another way that traditional banks have responded to the rise of Fintech is by partnering with Fintech companies.

By partnering with Fintech companies, traditional banks can offer their customers access to innovative financial products and services without developing them in-house. It has enabled traditional banks to remain competitive while providing customers with a broader range of financial services.

Challenges for Fintech Companies While Fintech companies are disrupting traditional banking, they also face several challenges. One of the main challenges is regulation. Fintech companies are often subject to less regulation than traditional banks, which can lead to a lack of consumer trust.

Fintech companies also need help with funding. While the amount of investment in Fintech is growing, it is still concentrated in a few large companies. It means that smaller Fintech companies may need help securing funding.

Conclusion Fintech companies are disrupting the traditional banking system by offering alternative ways for consumers to access financial services. For example, mobile banking apps allow consumers to manage their finances on the go without visiting a physical bank branch.

Fintech companies also often use technology to offer financial services at a lower cost than traditional banks. It is because Fintech companies typically have lower overhead costs, such as rent and staff salaries.

In addition, Fintech companies can offer more personalized financial services by using data analytics and artificial intelligence to analyze consumer behavior. It allows Fintech companies to tailor financial products and services to individual consumers’ needs and preferences.

Fintech companies also face challenges, such as regulation and funding.

However, the future looks bright for Fintech and will likely continue to disrupt the financial industry for years.

FAQs 1. What is Fintech? Fintech is an umbrella term for any technological innovation in financial services.

It includes various financial services like mobile payments, online banking, and peer-to-peer lending. Fintech companies are often startups that use technology to provide financial services in a more efficient and cost-effective way.

2. How is Fintech affecting traditional banking?

Fintech is disrupting the traditional banking industry by offering alternative ways for consumers to access financial services. It pressures traditional banks to innovate and adapt to the changing landscape.

3. Are Fintech companies safe to use? Fintech companies are regulated by the same authorities that regulate traditional banks,

so they are generally safe to use. However, doing your research and due diligence before using any financial service, whether a Fintech company or a traditional bank, is necessary.

4. Will Fintech replace traditional banks? While Fintech is undoubtedly changing how we access and use financial services,

it’s unlikely that traditional banks will be replaced entirely by Fintech companies. However, traditional banks must innovate and adapt to stay relevant in the changing landscape.

5. What are some examples of Fintech companies? Many Fintech companies are operating in different areas of financial services. Some examples include PayPal, GPay, Venmo etc.

How Can Datavision help? We support a range of financial institutions and global banks on their digital transformation journey. Our unique strategy, which blends people, process, and technology, expedites the delivery of outstanding solutions to our clients and promotes excellence. Several reputable firms utilize our exclusive portfolio of business excellence tools and services to unlock new growth levers and achieve a ROI that is unmatched.

Datavision is a leading Banking software solutions provider having operations in Central American and Latin America like Mexico, Columbia, Guatemala and Honduras. We at Datavision are the top retail and Corporate Banking Software provider as we serve our prestigious clients with cutting-edge core application software in Peru, Nicaragua as well as High-performance ETF solution in Costa Rica and El Salvador. Also, we provide the best banking software products in Panama, Brazil and Belize.

Get in touch with us for customizable, scalable, and affordable banking software products and solutions. Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Payments: | FinPay |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.

0 notes

Text

The Role of Banks in the Transition to a Cashless Society

The Role of Banks in the Transition to a Cashless Society

The development of technology has resulted in numerous changes to how people conduct business. Digital payments are steadily displacing cash as the preferred payment method, and this tendency has been growing for a while. The financial sector relies on banks, which is critical to transitioning to a cashless society. With a focus on the banking industry’s viewpoint, we will analyze the role of banks in the shift to a cashless society in this article.

As technology develops, more people are adopting digital payments to conduct business. Banks play a significant role in aiding the shift to a cashless society and are essential stakeholders.

Possibilities for Digital Payments

Banks can offer their consumers Internet payment systems and mobile banking apps as digital payment choices. Customers will find it simple to switch to digital payments, increasing productivity and lowering the possibility of fraud. Customers can also use digital payment solutions to make purchases without using cash, which is often safer.

Investing in Technology

Banks must invest in technology to enhance their digital payment systems to remain competitive. To ensure the efficiency and security of digital payments means spending money on infrastructure like servers and software. Banks can raise customer satisfaction and attract new clients by investing in technology.

Creating New Products

To meet the shifting demands of its consumers, banks might create new products. For instance, banks can provide tools that facilitate consumer mobile payment processing. Examples include mobile payment apps, contactless payment methods, and other electronic payment options. Banks may boost client loyalty and remain ahead of the market by creating innovative products.

Customer Education

Banks can explain to customers the advantages of digital payments and how to use digital payment options. It may entail offering clients educational materials, workshops, and other tools to aid in their understanding of the advantages of electronic payments. Banks may promote digital payment usage and raise customer satisfaction by educating their customers.

Assistance to Small Businesses

By offering digital payment solutions to small enterprises, banks may assist them. Banks can aid small companies in enhancing their cash flow and lowering the likelihood of fraud by doing this. Thanks to digital payment methods, small businesses may find it simpler to take payments from clients, which can increase client loyalty and satisfaction.

The Need for a Cashless Society

A society is called “cashless” if its financial transactions are carried out digitally rather than physically. This transition has various advantages, such as:

Reduced Fraud Risk: The danger of fraud and theft is lower with digital transactions than with cash transactions. Digital payments are a safer alternative because they do away with the need for currency, eliminating the possibility of theft.

Efficiency Gains: Digital transactions are quicker and more effective than cash ones. Counting cash is unnecessary with digital transactions, which can be completed immediately. Due to time savings and productivity gains, digital payments are becoming more popular.

Enhanced Financial Inclusion: A world without currency can increase financial inclusion by enabling more people to engage with the financial system. Mobile devices, more accessible than bank accounts, can be used to conduct digital transactions. Financial inclusion may be improved by making it more straightforward for those without bank accounts to engage in the financial system.

Fraud Prevention Measures

The shift to a cashless society can dramatically lower the risk of fraud since cash transactions are more susceptible to criminal activity. Banks and other financial institutions have used several fraud protection mechanisms, such as multi-factor authentication, biometric identification, and real-time transaction monitoring, to ensure the security of digital transactions. Customers may feel more confident performing transactions since they won’t worry about being taken advantage of or losing their money.

Financial Integration

The shift to a cashless society might encourage financial inclusion by giving more individuals, especially the unbanked or underbanked, access to banking services. Digital payments have the potential to become more convenient, inexpensive, and accessible than traditional banking services, as they can be beneficial for those who live in remote demographic locations or are unable to visit bank facilities. To reach more clients and increase accessibility for everyone, banks have been growing their digital services.

Greater Effectiveness and Cost Savings

Cash transactions can be processed more slowly than digital transactions, saving both banks and customers money. Manual processing, which can be time-consuming and expensive, is no longer necessary with digital payments. Because digital banking services don’t require as much physical presence, banks can also save on the expense of maintaining physical infrastructure like bank offices and ATMs. Customers may get cost savings in the form of lower fees and levies, making banking more accessible to all.

Customer Insights and Data Analytics

Digital transactions produce significant amounts of data, which can be analyzed to learn more about client behavior and preferences. With this information, banks may enhance their offerings and tailor them to the demands of specific clients. Data analytics can also assist banks in identifying possible dangers and fraud, allowing them to take preventative action to stop illegal activity.

Banking in the Future

Moving away from a cash-based society is essential to the current financial system change. Banks must adapt to this development to remain competitive in the market. Digital payments are the way of the future for banking; thus, to stay competitive, banks must make technology investments and provide customers with digital payment options.

The shift to a cashless society can be beneficial for banks and customers. Banks can increase productivity, cut expenses, and provide consumers with specialized services. Greater customer ease, security, and financial inclusion are all possible benefits. For a successful transition to a cashless society, it is crucial for banks to maintain their investments in digital infrastructure and fraud protection techniques.

Conclusion

Banks play a vital role in this transition as the world moves towards a cashless society. By investing in technology, creating new products, educating customers, and assisting small businesses, banks can help make this shift smoother and more accessible for all.

Finally, shifting to a cashless society offers a reduced risk of fraud, increased efficiency, and enhanced financial inclusion. Banks must remain proactive and innovative to stay competitive and support this ongoing transformation.

Datavision’s FinPay financial switch is a payment solution designed on open platforms and offers efficient debit card processing services. It provides reliable acquisition of devices, authentications, card management, settlements, switching to multiple networks and authorizations to card-based transactions from multiple channels. High availability and centralized monitoring and control enhance operations and customer experience. FinPay, with its open platform architecture, helps lower the total ownership cost without affecting performance, reliability and scalability. For more details watch the video below:

FAQs

What is a “cashless society”? A society where all financial transactions are carried out digitally rather than with physical currency is called a cashless society.

How do banks contribute to the shift toward a cashless society? Banks contribute by investing in technology, creating new digital payment products, educating customers, and assisting small businesses in adopting digital payment methods.

What are the actual advantages of a cashless society? Reduced fraud risk, increased efficiency, and increased financial inclusion for persons who may not have access to regular banking services are some of the advantages.

What measures can banks take to prevent fraud in a cashless society? To ensure the security of digital transactions, banks can employ fraud prevention methods such as multi-factor authentication, biometric identification, and real-time transaction monitoring.

How does a cashless society impact financial inclusion? A cashless society can improve financial inclusion by making digital transactions more convenient, affordable, and accessible than traditional banking services. It is especially beneficial for those living in remote areas or unable to access banking facilities.

How Can Datavision help?

We assist various financial institutions and global banks on their digital transformation journey. Our one-of-a-kind approach, which combines people, process, and technology, expedites the delivery of superior results to our clients and drives excellence. Several reputed companies leverage our proprietary suite of business excellence tools and services to unlock new growth levers and unparalleled ROI.

We support a range of financial institutions and global banks on their digital transformation journey. Our unique strategy, which blends people, process, and technology, expedites the delivery of outstanding solutions to our clients and promotes excellence. Several reputable firms utilize our exclusive portfolio of business excellence tools and services to unlock new growth levers and achieve a ROI that is unmatched.

Datavision is a leading Banking software solutions provider having operations in Central American and Latin America like Mexico, Columbia, Guatemala and Honduras. We at Datavision are the top retail and Corporate Banking Software provider as we serve our prestigious clients with cutting-edge core application software in Peru, Nicaragua as well as High-performance ETF solution in Costa Rica and El Salvador. Also, we provide the best banking software products in Panama, Brazil and Belize.

Our portfolio of banking software product and services include:

Core Banking Solutions: | FinNext Core | Banking: | FinTrade | EasyLoan | MicroFin |

Digital Banking Solutions: | IBanc | MobiBanc | MBranch | FinTab | FinSight |

Payments: | FinPay |

Risk & Compliance: |FinTrust |

Want to know how our team of experts at Datavision provides customizable, scalable, and cost-effective banking software products and solutions to our esteemed clients? Visit us for more information.

0 notes

Text

The increasing popularity of mobile banking and the role of banks in developing mobile banking apps in India

The increasing popularity of mobile banking and the role of banks in developing mobile banking apps in India

The rising use of smartphones and the Internet in India has contributed to the development of mobile banking’s popularity there. As the number of individuals with smartphones and other mobile devices continues to increase tremendously, the demand for mobile banking services has risen. In response to this transition, many Indian financial institutions have devoted significant resources to developing user-friendly mobile banking applications.

Many individuals in India primarily rely on mobile banking apps because they allow immediate and uncomplicated access to various financial services. These apps allow customers to check their account balances, make transfers, pay bills, and even apply for loans without leaving their homes. The proactive measures taken by the Indian government to promote digital transactions and cashless economies have also facilitated the usage of mobile banking applications. Accessing one’s banking information anytime is a prominent selling feature for mobile banking applications. It is advantageous for those who reside in rural areas and require simple access to traditional banking services.

Using mobile banking apps, customers may complete banking transactions on the go, expediting the banking process. As the demand for mobile banking services continues to increase, Indian banks have devoted substantial resources to app development. Numerous of India’s top financial institutions now offer mobile banking applications for Android and iOS. Customers can utilize these applications for multiple financial services, including account management, bill payment, and money transfers.

Regarding mobile banking in India, the Reserve Bank of India (RBI) has also played an important role. The Reserve Bank of India (RBI) has issued mobile banking services restrictions to secure users’ private data and financial activities. Banks must also provide a two-factor authentication system better to protect the security of their customers’ financial transactions.

The principal advantages of Mobile banking apps are as follows:

Convenience:Customers can check their accounts, pay invoices, transfer funds quickly, and use mobile banking applications. This enables consumers to do financial transactions from the convenience of their own homes at any time of day.

Accessibility:Mobile banking applications are advantageous since they can be used from anywhere, which is particularly significant for rural residents who may require easy access to other financial options. They can conduct banking whenever and wherever they choose.

Time-saving:Users can save time by not having to physically visit a bank branch to conduct transactions using a mobile banking application.

Increased Security:According to RBI regulations, banks must provide consumers with a two-factor authentication system to safeguard their financial transactions.

Simple Transaction Tracking: Using mobile banking apps, customers can conveniently check their account balances, see what has been deposited and withdrawn, and view any other activity on their accounts.

Cost-Effective: Mobile banking saves clients money because they do not have to pay for gas or parking to get to the bank.

Cashless Economy:The government’s backing for digital transactions and cashless economies has led to the growth of mobile banking in India.

Personalized Experience:Mobile banking apps can provide a personalized banking experience by allowing users to customize various settings according to their preferences.

Paperless Banking:Transactions conducted using mobile banking apps are conducted without paper, hence reducing the environmental effect of banking.

Here are some key statistics about the rise of mobile banking in India and the role of banks in developing mobile banking applications:

India’s rapidly rising middle class and the increased availability of high-speed internet connectivity due to the proliferation of smartphones help explain the stratospheric development of mobile banking’s appeal in the country. As the number of individuals with smartphones and other mobile devices continues to increase, the demand for mobile banking services has risen.

Access to banking services via mobile applications: Using mobile banking apps, customers can monitor their accounts, pay their bills, and transfer funds quickly and easily. These apps allow customers to check their account balances, make transfers, pay bills, and even apply for loans without leaving their homes.

To accommodate the growing demand for mobile banking services, Indian banks have made substantial investments in developing mobile banking applications. A large number of India’s top financial institutions now offer mobile banking applications for Android and iOS. These apps provide users access to many features, boosting the user experience and eliminating banking-related friction.