We’ve been providing credit repair services for many years now. Our credit repair experts have years of experience when it comes to dealing with credit bureaus, collectors and creditors. This encounter can often be a nuisance, stressful and lead to anxiety dealing with these parties. LET DECS WE KILL DEBT intercede utilizing our expertise and professionalism.

Don't wanna be here? Send us removal request.

Text

In today’s economy, your credit score is more than just a number—it’s your financial passport. Whether you’re applying for a mortgage, financing a car, or trying to qualify for a personal loan, your creditworthiness can shape your options and your future. Unfortunately, many people find themselves trapped in cycles of bad credit due to errors, outdated information, or previous financial hardship.

#credit score#bad credit#credit repair services#top credit score companies#bad credit loans los angeles#fix bad credit los angeles

0 notes

Text

Bad credit can feel like a financial prison — high-interest rates, loan denials, limited housing options, and even job rejections. But here’s the truth: you can fix bad credit, and you can do it faster than you think with the right plan, tools, and mindset. At Decs – We Kill Debt, we’ve helped countless clients take control of their credit lives using practical strategies that deliver real, lasting results.

0 notes

Text

You're not alone—and you don’t have to fix it alone either. At DECS WE KILL DEBT, we help you take control of your credit with expert support, fast solutions, and a game plan that gets real results. Whether it’s late payments, collections, or high balances—we fight back and help clean it up.

#credit score#bad credit loans los angeles#bad credit#credit repair services#fix bad credit los angeles#top credit score companies#bad credit home loans#credit repair services los angeles#boost your credit score#personal loans

0 notes

Text

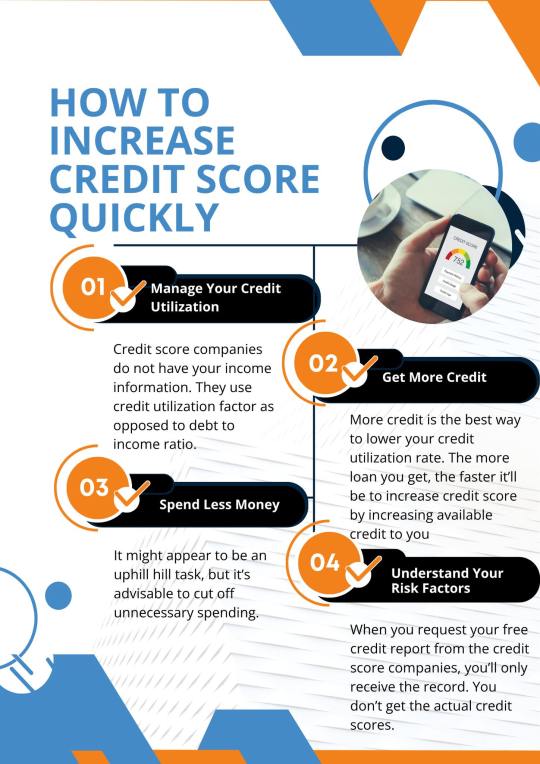

At some point in your financial life, situations may compel you to find ways to increase credit score. Developing a peachy credit score, also known as a credit rating, is imperative since it can affect your money borrowing ability. The definite number of your credit rating can vary between lenders, depending on the criterion used in appraising you as a probable client.

#credit score#bad credit#bad credit loans los angeles#credit repair services#fix bad credit los angeles

0 notes

Text

Fix Bad Credit Faster: Proven Tips That Really Work

Bad credit can feel like a financial prison — high-interest rates, loan denials, limited housing options, and even job rejections. But here’s the truth: you can fix bad credit, and you can do it faster than you think with the right plan, tools, and mindset. At Decs – We Kill Debt, we’ve helped countless clients take control of their credit lives using practical strategies that deliver real, lasting results.

This comprehensive guide isn’t just another list of generic tips. We’ll walk you through proven, actionable steps to improve your credit score — fast. Whether you’re aiming to qualify for a mortgage, secure a car loan, or simply stop getting denied for credit cards, this is your roadmap.

Let’s dive into the six key steps to fix bad credit and take control of your financial future.

1. Understand What’s Damaging Your Credit

Before you can fix bad credit, you need to understand what’s hurting your score. Start by reviewing your credit reports from the three major bureaus: Equifax, Experian, and TransUnion.

Key Actions:

Get Your Free Credit Reports at com. You’re entitled to one free report from each bureau every 12 months.

Look for common negative items such as:

Late or missed payments

Charge-offs

Collections

High credit utilization

Bankruptcies or foreclosures

Dispute inaccuracies: If there are errors on your report — like debts that aren’t yours or accounts marked late when they weren’t — dispute them immediately.

Why It Matters:

Many people don’t realize how often credit reports contain mistakes. Identifying and fixing these issues can give your score a quick boost.

At Decs – We Kill Debt, we specialize in professionally disputing incorrect or unverifiable items that are unfairly holding you back.

2. Make Timely Payments — Always

Your payment history makes up 35% of your credit score, so making payments on time is non-negotiable. Even one missed payment can knock down your score significantly.

Strategies to Stay On Track:

Automate your bills through your bank or creditor

Set calendar reminders a few days before due dates

Negotiate with creditors if you’re falling behind – some may allow for hardship payment plans

Use a secured credit card responsibly to rebuild your history if traditional cards are closed

Why It Works:

Every on-time payment helps your score. Consistency over a few months can lead to a noticeable improvement, especially if late payments are currently dragging you down.

If you’ve had late payments in the past, we can help you challenge and remove them where possible or negotiate with creditors for goodwill adjustments.

3. Reduce Your Credit Utilization Ratio

Your credit utilization is how much of your credit limit you’re using. Ideally, you should keep it below 30% — and below 10% if you want to see faster results.

Example:

If you have a credit card with a $1,000 limit, try to keep the balance under $300, and pay it off in full monthly.

Quick Fixes:

Pay down credit card balances aggressively

Request a credit limit increase (but don’t increase your spending)

Spread balances across multiple cards to keep individual utilizations lower

Make multiple payments each month to keep balances consistently low

Why It Works:

Utilization is 30% of your score, and unlike payment history, you can influence this rapidly. Paying off just a portion of your revolving debt can have an almost instant positive effect.

Our team at Decs – We Kill Debt helps clients restructure their balances in ways that minimize utilization damage and maximize score gains.

4. Dispute Negative Items You Don’t Recognize or Can’t Verify

You have a legal right under the Fair Credit Reporting Act (FCRA) to dispute any credit item that is inaccurate, outdated, or unverified.

Types of Items to Dispute:

Collections past the 7-year reporting limit

Debts that don’t belong to you

Duplicate accounts

Incorrect balances or dates

Repossessions or bankruptcies with incorrect filing information

How to Do It:

Submit disputes directly to each credit bureau

Provide supporting documentation (bank statements, letters, etc.)

Follow up — bureaus typically have 30 days to investigate and respond

Why It Works:

Credit bureaus and data furnishers must be able to verify any account they report. If they can’t, it must be removed. Many clients see major improvements just from eliminating inaccurate or unverifiable data.

Our dispute experts handle this process professionally, using legal language and persistent follow-up to hold credit bureaus accountable.

5. Use Credit-Building Tools Wisely

To fix bad credit, you often need to rebuild positive credit — not just remove negatives.

Best Tools:

Secured Credit Cards: You put down a deposit (usually $200-$500), and your payments get reported to the bureaus.

Credit Builder Loans: Offered by credit unions or fintechs; you pay into a savings account and build credit over time.

Authorized User Status: Get added to a trusted family member’s credit card to benefit from their positive history (make sure they have great payment habits).

Experian Boost: A free service that adds your on-time utility, streaming, or phone payments to your Experian credit report.

Why It Works:

Adding positive, low-risk activity to your credit profile helps outweigh any remaining negatives. Over time, these small wins build momentum and credibility with lenders.

Decs – We Kill Debt can help you select and apply for the right tools for your situation — we’ve seen clients go from 500s to 700s within months using a customized rebuilding strategy.

6. Negotiate With Creditors and Collection Agencies

If you have past-due accounts or collections, don’t ignore them — negotiate.

Options to Consider:

Pay-for-delete agreements (get the item removed once paid)

Debt settlements for less than what you owe

Payment plans to avoid charge-offs

Goodwill letters requesting deletion after on-time history

Why It Works:

Creditors and collectors want to get paid. If you approach them with a reasonable offer — especially in writing — many are open to settling or deleting the account from your report.

However, never pay a collection without getting an agreement in writing first. A paid collection still hurts your score unless it’s removed.

At Decs – We Kill Debt, we help our clients professionally negotiate with creditors to ensure the best possible result and avoid further credit damage.

Conclusion

Fixing bad credit is possible — and you can do it faster when you approach the problem with the right plan and the right help.

Let’s recap the game plan:

Get clarity on your credit report

Start making on-time payments consistently

Slash your credit utilization

Dispute inaccurate negative marks

Rebuild with smart credit tools

Negotiate with creditors strategically

Whether your score is in the 400s or the low 600s, these strategies are proven to help fix bad credit and build a stronger, more secure financial future.

At Decs – We Kill Debt, we do more than offer advice — we roll up our sleeves and fight for you. Our team is trained to handle credit disputes, design rebuilding plans, and negotiate with creditors — so you don’t have to go it alone.

Contact us:

Address - 18930 HWY 18STE 101 Apple valley CA 92307

Email - [email protected]

Website - DECS-WE KILL DEBT

Blog - Fix Bad Credit Faster: Proven Tips That Really Work

#credit score#bad credit#bad credit loans los angeles#credit repair services#fix bad credit los angeles#top credit score companies#bad credit home loans#credit repair services los angeles#personal loans#boost your credit score

0 notes

Text

Credit Repair Demystified: 10 Facts Every Consumer Should Know Before Getting Started

In today’s economy, your credit score isn’t just a number—it’s your financial reputation. It affects everything from getting approved for a home loan to landing a job. Yet, despite its importance, many Americans remain confused or misinformed about what credit repair truly is and how it works.

At Decs – We Kill Debt, we’ve seen firsthand how credit myths can hurt consumers. Whether you’re struggling with late payments, charge-offs, or identity theft, understanding the facts about credit repair is the first step toward financial recovery. This blog is designed to cut through the noise, clarify misconceptions, and equip you with 10 essential truths every consumer should know before beginning the credit repair journey.

1. Credit Repair Is Legal—and You Can Do It Yourself

Let’s clear the air: Credit repair is 100% legal. The Fair Credit Reporting Act (FCRA) grants every consumer the right to dispute inaccurate or outdated information on their credit reports.

Yes, you can repair your credit on your own—but that doesn’t mean you should. Just like you can fix your own car or file your own taxes, many people prefer to work with experts for better, faster results. At Decs – We Kill Debt, we understand the laws, dispute strategies, and credit bureau behaviors to optimize the process for our clients.

2. Not All Negative Items Can Be Removed

Contrary to what shady operators may promise, accurate and verifiable negative items cannot be removed from your credit reports. If you genuinely missed payments, defaulted on loans, or declared bankruptcy, those records will remain for a set period (usually 7 to 10 years).

However, many credit reports contain errors. According to a 2021 report by the Consumer Financial Protection Bureau (CFPB), more than 1 in 5 consumers had at least one mistake on their credit report. These are the kinds of items that credit repair can target and successfully remove.

We help clients identify inaccurate or outdated records—and challenge them with supporting documentation.

3. Each Credit Bureau Operates Differently

There are three major credit bureaus: Equifax, Experian, and TransUnion. Each bureau collects and reports data independently, which means your score can vary across reports.

A common misconception is that fixing your credit with one bureau automatically updates the others. It doesn’t. You must address disputes separately with each agency. At Decs – We Kill Debt, we handle disputes across all three to ensure complete and consistent results.

Pro Tip: Always review reports from all three bureaus—not just one.

4. Disputes Aren’t Just Letters Anymore

Gone are the days when sending a generic dispute letter worked. Today, credit bureaus use advanced algorithms and even AI to filter out “frivolous” disputes.

To be effective, disputes must be specific, well-documented, and legally sound. That’s where professional credit repair services come in. At Decs – We Kill Debt, we craft customized dispute letters backed by legal statutes, evidence, and data that demand real results—not automated denials.

Reminder: Vague claims like “This is not mine” won’t get you far. Specificity wins.

5. Credit Repair Is Not a Quick Fix

Let’s be honest: If it sounds too good to be true, it probably is. Credit repair is a process, not a miracle. Depending on the complexity of your situation, real progress can take 30 to 90 days—or even longer.

The FCRA allows 30 days for bureaus to respond to disputes. Some require follow-ups, escalations, or re-disputes. That’s why consistent effort over time yields the best results.

At Decs – We Kill Debt, we don’t just submit one round of disputes—we work with you until we get results.

Timeline Reality: Be wary of anyone promising overnight fixes.

6. There Are No “Secret Loopholes”—Just Proven Methods

Some companies claim to know “insider secrets” or “credit hacks.” The truth? There are no secret shortcuts in credit repair. What works is a combination of legal knowledge, documentation, and persistence.

We utilize tried-and-true strategies, based on consumer rights laws such as:

FCRA (Fair Credit Reporting Act)

FDCPA (Fair Debt Collection Practices Act)

FCBA (Fair Credit Billing Act)

These laws protect consumers from unfair or inaccurate reporting—and we use them to your advantage.

Insight: Success in credit repair comes from knowledge, not magic tricks.

7. Paying Off Collections Doesn’t Always Improve Your Score

This surprises many consumers. While paying off old debts is morally and financially responsible, it doesn’t always help your credit score—especially if the account is already closed or charged off.

Worse, paying an old collection can reset the “date of last activity,” which may lower your score or extend the item’s lifespan on your report.

This is why strategy matters. At Decs – We Kill Debt, we help clients negotiate “pay-for-delete” agreements or validate debts before paying.

Smart Strategy: Always consult before paying collections.

8. Credit Utilization Matters—A Lot

One of the fastest ways to improve your credit is by lowering your credit utilization ratio—the amount of credit you use versus your total limit.

Keep it below 30%, ideally under 10%. Even if you pay on time, maxing out cards can tank your score.

We advise our clients on balance management, strategic payments, and even authorized user accounts to improve utilization metrics.

Quick Win: Reduce balances before the statement closing date—not just the due date.

9. Inquiries Can Hurt—But Only a Little

Hard inquiries (from credit card applications, loans, etc.) can impact your score—but usually only by a few points. And they only last 12 months on your score and 24 months on your report.

What matters more is the pattern. Multiple inquiries in a short time may signal risk to lenders.

Best Practice: Limit credit applications and plan them strategically.

10. New Accounts Can Help or Hurt

Adding new credit can help your “credit mix” and overall utilization—but it can also temporarily drop your score due to the hard inquiry and new account age.

At Decs – We Kill Debt, we evaluate whether it makes sense to apply for secured cards, credit-builder loans, or become an authorized user. Timing and type are key.

Expert Tip: Don’t apply for new credit during active disputes or right before a major purchase (like a home).

Conclusion

Credit repair isn’t a mystery—it’s a strategic, legal process that empowers you to take control of your financial destiny. But success begins with knowledge. Now that you understand the 12 essential facts about credit repair, you’re better equipped to make smart, informed decisions. Whether you choose the DIY path or partner with professionals like Decs – We Kill Debt, remember: you are not stuck with bad credit.

Contact us:

Address - 18930 HWY 18STE 101 Apple valley CA 92307

Email - [email protected]

Website - DECS-WE KILL DEBT

Blog - Credit Repair Demystified: 10 Facts Every Consumer Should Know Before Getting Started

#credit score#bad credit#bad credit loans los angeles#credit repair services#fix bad credit los angeles

0 notes

Text

Top Tips to Secure Bad Credit Loans and Rebuild Your Financial Future

At Decs – We Kill Debt, we believe that your financial past doesn’t have to dictate your future. Many Americans face financial hardship due to unexpected life events—medical bills, job loss, or missed payments. These challenges often result in damaged credit, making it seem nearly impossible to qualify for a loan when you need one most.

But here’s the truth: Bad credit loans are not a dead end—they can be a new beginning.

With the right knowledge, preparation, and strategy, you can secure a loan even with bad credit and use it as a stepping stone to rebuild your financial health. In this blog, we’ll walk you through top expert tips to not only get approved for a bad credit loan, but also to turn your finances around for the long term.

1. Understand What “Bad Credit Loans” Really Mean

Before you start applying, it’s crucial to understand what bad credit loans are and how they work.

What Are Bad Credit Loans?

Bad credit loans are loans designed for borrowers with credit scores typically below 580. These loans come with higher interest rates, shorter terms, and sometimes stricter repayment schedules to offset the lender’s risk.

They can come in several forms:

Personal loans from online lenders

Credit unions and community banks

Payday or cash advance loans (often not recommended)

Secured loans using collateral

Why Are They Offered?

Lenders understand that life happens. While credit scores are used to assess risk, many companies still offer loans to people with less-than-stellar credit by factoring in:

Your income

Job stability

Loan amount

Other debt obligations

Knowing how bad credit loans work is the first step toward using them wisely.

2. Know Your Credit Score and What’s Dragging It Down

You can’t fix what you don’t understand. Start by getting a free credit report from Experian, Equifax, or TransUnion (or all three).

What You Should Look For:

Credit score range: Under 580 is typically considered poor.

Payment history: Are there any missed or late payments?

Credit utilization: Are you using more than 30% of your credit limit?

Negative marks: Charge-offs, collections, bankruptcies.

Errors: Incorrect information that can be disputed.

Pro Tip: At Decs – We Kill Debt, we offer a free credit assessment to help you pinpoint the issues damaging your score and guide you toward quick fixes.

3. Consider Different Types of Lenders—and Be Cautious

Not all lenders are created equal, especially in the bad credit loan space. There are three major types of lenders you can explore:

A. Online Lenders

These are among the most accessible, often catering specifically to borrowers with low credit. They offer:

Fast approvals

Minimal paperwork

Flexible terms

Watch Out For: Extremely high APRs and predatory practices.

B. Credit Unions and Community Banks

Credit unions tend to offer lower interest rates and more personalized service. They may overlook poor credit if you have steady income or are a long-time member.

C. Peer-to-Peer Lending Platforms

Sites like LendingClub or Upstart connect borrowers directly with investors. Approval depends on a combination of credit, income, and purpose of the loan.

D. Avoid Payday Loans

Though tempting, payday loans often charge triple-digit APRs and can lead to a cycle of debt. At Decs – We Kill Debt, we never recommend payday loans unless it’s an absolute last resort—and even then, with caution.

4. Improve Your Chances of Approval Before Applying

Every loan application triggers a hard inquiry on your credit report, which can lower your score even further. That’s why it’s important to prep before applying.

Steps to Take:

A. Prequalify Without a Hard Pull

Many lenders offer a prequalification tool that uses a soft inquiry to estimate your approval odds.

B. Lower Your Existing Debt

Paying off even small balances can improve your credit utilization ratio, which accounts for 30% of your credit score.

C. Add a Co-signer

If you have a trusted friend or family member with good credit, a co-signer can significantly increase your chances of approval and reduce your interest rate.

D. Offer Collateral for a Secured Loan

If you own a vehicle, savings account, or other asset, offering collateral can reduce lender risk and improve your loan terms.

5. Use the Loan Strategically to Rebuild Credit

Getting a loan is only half the journey—using it wisely is what sets you apart.

How to Use a Bad Credit Loan for Financial Growth:

A. Pay Off High-Interest Debt

Use your bad credit loan to consolidate multiple debts (like credit cards) into one manageable monthly payment.

B. Make On-Time Payments Without Fail

Payment history is the biggest factor in your credit score (35%). Automate your payments and set reminders.

C. Don’t Max Out the Loan

Only borrow what you absolutely need. The more manageable the payment, the easier it is to stay current.

D. Track Your Progress

Monitor your credit score monthly. As your payment history builds, you’ll see steady improvements.

At Decs – We Kill Debt, we provide monthly credit progress reviews to help you stay on track.

6. Explore Alternatives That May Work Even Better

Sometimes, you may not need a traditional loan. Consider these alternative strategies before signing on the dotted line:

A. Credit Builder Loans

These loans help build your credit by holding the money in a savings account until you’ve made all your payments. Ideal for those who want to build credit without needing immediate cash.

B. Secured Credit Cards

With a small refundable deposit, you can start using a secured credit card to rebuild your credit through small, regular purchases and on-time payments.

C. Debt Management Plans (DMPs)

If your goal is to repay debt—not borrow more—consider a DMP through a nonprofit credit counseling agency. They negotiate with creditors to lower interest rates and consolidate payments.

D. Personal Grants or Community Programs

In some cases, local nonprofits offer small grants or no-interest loans to those in need. These are harder to find, but worth looking into.

Conclusion

Bad credit loans aren’t a trap when used correctly—they can be a powerful tool to rebuild your finances and reclaim control over your future. But success doesn’t just come from borrowing money—it comes from smart decisions, consistent effort, and guided support.

At Decs – We Kill Debt, we don’t just help you secure loans—we help you eliminate debt, restore your credit, and unlock new opportunities. Whether you’re looking for a bad credit loan, guidance on rebuilding your score, or a full financial recovery plan, we’re here to help every step of the way.

Contact us:

Address - 18930 HWY 18STE 101 Apple valley CA 92307

Email - [email protected]

Website - DECS-WE KILL DEBT

Blog - Top Tips to Secure Bad Credit Loans and Rebuild Your Financial Future

#credit score#bad credit#bad credit loans los angeles#credit repair services#fix bad credit los angeles#credit repair services los angeles#boost your credit score#top credit score companies

0 notes

Text

Bankruptcy is a challenging experience that can leave you feeling financially drained and uncertain about the future. One of the most significant consequences of bankruptcy is the impact it has on your credit score and history. After going through bankruptcy, rebuilding your credit may seem overwhelming, but it’s not impossible. The process requires patience, consistency, and strategic financial decisions.

#credit score#bad credit#bad credit loans los angeles#credit repair services#fix bad credit los angeles

0 notes

Text

In today’s digital world, protecting your credit score is more critical than ever. It can take years to build strong credit—but only a matter of days for identity thieves to destroy it. From fraudulent credit card applications to unauthorized loans, identity theft can severely damage your financial standing.

At Decs – We Kill Debt, we’ve helped countless clients recover their credit after identity theft. In this blog, we’ll explain how identity theft can impact your credit score, how to spot it early, and what steps you must take to repair and protect your credit.

#credit score#bad credit#bad credit loans los angeles#credit repair services#fix bad credit los angeles#top credit score companies#bad credit home loans#credit repair services los angeles#boost your credit score#personal loans

0 notes

Text

Decs - We Kill Debt specializes in repairing and rebuilding your credit so you can get approved for the things that matter. Real strategies Personalized support Better financial future

0 notes

Text

At Decs - We Kill Debt, we specialize in powerful credit repair solutions that help you take control of your financial future. Remove negative items Boost your credit score Restore your confidence It’s time to win the battle against bad debt.

#credit score#bad credit#bad credit loans los angeles#credit repair services#fix bad credit los angeles#top credit score companies#bad credit home loans

0 notes

Text

6 Key Points to Consider Before Applying for a Bad Credit Loan

At Decs – We Kill Debt, we understand that life doesn’t always go according to plan. Whether it’s unexpected medical bills, job loss, or just tough times, many Americans find themselves facing a low credit score and limited financial options. That’s where bad credit loans can appear as a lifeline — but they come with important considerations. Before jumping into a loan application, it’s crucial to fully understand the risks and rewards. Here are six key points to keep in mind before applying for a bad credit loan:

1. Understand What a Bad Credit Loan Is

A bad credit loan is a financial product designed specifically for individuals with a low credit score or limited credit history. These loans typically come with higher interest rates than traditional loans because lenders see borrowers with bad credit as higher risk.

There are several types of bad credit loans:

Secured loans, which require collateral like a car or savings account

Unsecured loans, which don’t require collateral but often have stricter repayment terms

Payday loans, which are short-term loans with extremely high interest rates

Personal installment loans, which allow borrowers to repay in fixed monthly amounts

At Decs – We Kill Debt, we encourage clients to thoroughly evaluate which type of loan suits their situation and to understand the terms in full before signing any contract.

2. Know Your Credit Score and Report

Before applying for any type of credit, it’s essential to know where your credit stands. Many people don’t realize they can get free copies of their credit reports from AnnualCreditReport.com, and many credit card companies now offer free credit score tracking.

Key things to check:

Are there any errors or outdated information?

Are all your payments and balances being reported accurately?

Do you have any open collections or charge-offs?

Understanding your credit report not only helps you know what kind of loan terms you might qualify for but also helps identify opportunities for credit repair before applying. Decs – We Kill Debt can assist with disputing inaccuracies and boosting your score before taking on new debt.

3. Watch Out for Predatory Lenders

Unfortunately, many lenders take advantage of individuals with bad credit by offering unreasonably high interest rates, fees, and unfair terms. These are known as predatory loans.

Red flags to watch out for:

No credit check or income verification

Interest rates above 36% APR

Prepayment penalties or fees just to apply

Pressure to sign quickly without reading the contract

Before you commit, compare offers from multiple lenders and always read the fine print. Reputable lenders are transparent and upfront about fees and repayment expectations.

At Decs – We Kill Debt, we help you navigate safe lending options and warn you about common traps that can lead to deeper debt.

4. Calculate the True Cost of Borrowing

Many borrowers focus only on the monthly payment and forget to calculate the total cost of the loan. A loan with a “low” monthly payment stretched over several years could cost you thousands in interest.

Let’s break it down with a quick example:

Say you borrow $5,000 with a 29.99% APR over 36 months. You’ll pay around $2,700 in interest, making your total repayment over $7,700.

Ask yourself:

Can I afford this monthly payment consistently?

Will this loan improve my financial situation or make it worse?

Are there better alternatives available?

Use online calculators or talk to a debt expert at Decs – We Kill Debt to make sure you understand the full financial impact before you borrow.

5. Explore Alternatives First

Sometimes a bad credit loan feels like the only choice — but it may not be. Consider these alternatives that could reduce your reliance on high-cost borrowing:

Credit union loans – Many credit unions offer small-dollar loans with more favorable terms.

Family or friends – A personal loan from someone you trust may come with less interest and more flexibility.

Debt relief programs – You may be eligible for debt consolidation or negotiation, which could lower your payments or interest rates.

Side hustles or temporary gigs – Increasing your income can help you avoid taking on more debt.

At Decs – We Kill Debt, we specialize in debt elimination strategies. If you’re struggling financially, we may be able to help you restructure your current debts instead of taking on new ones.

6. Have a Plan for Repayment

Before applying, ask yourself: What’s my plan to repay this loan on time? A loan is only helpful if it brings you closer to financial stability — not deeper into debt.

Consider:

Will your income cover the loan plus your other monthly expenses?

Can you automate payments to avoid late fees?

Will this loan help you pay off high-interest credit cards or consolidate debts effectively?

If the loan isn’t part of a bigger financial plan, it may not be the best move. Our credit experts at Decs – We Kill Debt can help you build a repayment plan that works for you — and help you rebuild your credit at the same time.

Final Thoughts

A bad credit loan can be a stepping stone or a stumbling block — the outcome depends on how well-informed and prepared you are. At Decs – We Kill Debt, we’ve helped hundreds of clients make smart financial decisions, break the cycle of debt, and start fresh.

Before signing on the dotted line, take time to:

Educate yourself

Review your credit report

Compare lenders

Understand the total cost

Explore alternatives

Build a repayment strategy

Debt doesn’t have to define your future. With the right guidance, you can take control of your financial journey — and we’re here to help.

Contact us:

Address - 18930 HWY 18STE 101 Apple valley CA 92307

Email - [email protected]

Website - DECS-WE KILL DEBT

Blog - 6 Key Points to Consider Before Applying for a Bad Credit Loan

#credit score#bad credit#bad credit loans los angeles#credit repair services#fix bad credit los angeles#credit repair services los angeles#boost your credit score#top credit score companies

0 notes

Text

5 Proven Strategies to Rebuild Your Credit History After Bankruptcy

Bankruptcy is a challenging experience that can leave you feeling financially drained and uncertain about the future. One of the most significant consequences of bankruptcy is the impact it has on your credit score and history. After going through bankruptcy, rebuilding your credit may seem overwhelming, but it’s not impossible. The process requires patience, consistency, and strategic financial decisions.

At Decs – We Kill Debt, we specialize in helping individuals recover from financial setbacks, including bankruptcy. In this blog, we’ll guide you through five proven strategies to rebuild your credit history after bankruptcy, providing actionable steps to get you back on track and secure your financial future.

Strategy #1: Check Your Credit Report for Errors

The first step in rebuilding credit after bankruptcy is to check your credit report for any errors. Even after bankruptcy, mistakes can appear on your credit report, such as incorrect balances, outdated personal information, or accounts that should have been discharged but still appear as open.

To begin, request a free copy of your credit report from the three major credit bureaus: Experian, Equifax, and TransUnion. You are entitled to one free report from each bureau every year, which you can access through AnnualCreditReport.com.

Once you have your reports, carefully review them for any inaccuracies. Common errors include:

Accounts that were discharged in bankruptcy but are still marked as open

Incorrect account balances or payment histories

Accounts that do not belong to you

Outdated information or personal data

If you find any errors, dispute them with the credit bureaus. The bureaus are required to investigate and correct any inaccuracies within a reasonable timeframe. By addressing these errors, you can ensure that your credit report accurately reflects your financial situation, which can have a positive impact on your credit score.

Strategy #2: Establish a Secured Credit Card

A secured credit card is an excellent tool for rebuilding your credit after bankruptcy. Unlike traditional credit cards, a secured card requires you to deposit a sum of money as collateral, which acts as your credit limit. For example, if you deposit $500, your secured card will have a $500 limit.

Using a secured credit card responsibly can help rebuild your credit in the following ways:

Reports to Credit Bureaus: Most secured credit cards report to the three major credit bureaus, meaning your responsible use will show up on your credit report and contribute to your credit score.

Improving Your Payment History: On-time payments are crucial for rebuilding your credit. A secured card allows you to demonstrate that you can manage credit responsibly by making regular payments.

Gradual Credit Limit Increases: As you build your credit history, many credit card issuers may offer you an increase in your credit limit, which can further improve your score.

Be mindful to keep your balance low (ideally under 30% of your credit limit) and always make payments on time. Responsible use of a secured credit card can significantly improve your credit score over time.

Strategy #3: Make Timely Payments on All Bills

One of the most critical factors in rebuilding your credit history after bankruptcy is making timely payments on all your bills. This includes not only your credit card payments but also utility bills, rent, and any other recurring expenses.

Your payment history accounts for a significant portion of your credit score, so staying on top of all your bills can have a major impact on your financial recovery. Here are a few tips to help you manage timely payments:

Set Up Automatic Payments: To avoid missing due dates, set up automatic payments for bills that allow it. This ensures that you never miss a payment, even during busy periods.

Create a Budget: Having a clear budget can help you manage your finances and prioritize bill payments. This is especially important after bankruptcy, as you want to avoid falling behind on payments.

Use Payment Reminders: Set up reminders on your phone or calendar for upcoming bills to ensure you don’t forget.

By making timely payments, you demonstrate your commitment to improving your credit, which will positively impact your credit score over time.

Strategy #4: Consider a Credit Builder Loan

A credit builder loan is a unique financial product designed to help individuals rebuild their credit history. These loans are typically offered by smaller financial institutions, such as credit unions or community banks. With a credit builder loan, the loan amount is deposited into a savings account, and you make monthly payments to pay off the loan.

While this may sound similar to a regular loan, the difference is that the funds are not available to you until the loan is fully paid off. The purpose of this loan is to demonstrate your ability to make timely payments, which can improve your credit score.

Here’s how a credit builder loan can help:

Positive Payment History: As you make payments on the loan, the lender reports your payment activity to the credit bureaus. This helps build your payment history, which is one of the most important factors in your credit score.

Boost Your Credit Score: By making timely payments, you’ll see your credit score rise over time. Once the loan is paid off, the money in your savings account is released to you, which can serve as a financial boost.

Before taking out a credit builder loan, ensure that the financial institution reports to all three major credit bureaus to ensure that your payment history will be reflected on your credit report.

Strategy #5: Avoid Opening Too Many New Accounts

While it may be tempting to open multiple new credit accounts after bankruptcy, doing so can hurt your credit score in the long run. Each time you apply for a new credit card or loan, a hard inquiry is made on your credit report, which can lower your score by a few points.

Additionally, opening too many new accounts can reduce the average age of your credit, which can negatively affect your credit score. Instead of opening several accounts, focus on gradually rebuilding your credit by using the tools mentioned above, such as secured cards or credit builder loans.

When you are ready to apply for new credit, be selective. Look for cards with low fees and interest rates and avoid applying for too many at once. A strategic approach to opening new credit accounts will help protect your credit score during the rebuilding process.

Conclusion:

Rebuilding credit after bankruptcy is not an overnight process, but with the right strategies, you can regain your financial footing and improve your credit score over time. By checking your credit report for errors, establishing a secured credit card, making timely payments, considering a credit builder loan, and avoiding opening too many new accounts, you can steadily rebuild your credit history.

At Decs – We Kill Debt, we understand the challenges that come with recovering from bankruptcy. If you need help creating a personalized plan to rebuild your credit, don’t hesitate to reach out to us. Our team is here to support you as you take control of your financial future and work toward a stronger credit history.

Contact us:

Address - 18930 HWY 18STE 101 Apple valley CA 92307

Email - [email protected]

Website - DECS-WE KILL DEBT

Blog - 5 Proven Strategies to Rebuild Your Credit History After Bankruptcy

#credit score#bad credit#bad credit loans los angeles#credit repair services#fix bad credit los angeles

0 notes

Text

How to Spot a Credit Repair Scam: Essential Tips

Credit repair is an essential part of achieving financial freedom. If your credit report has mistakes or negative items affecting your credit score, it can impact everything from loan approvals to interest rates. However, with the increasing demand for credit repair services, the rise of scams targeting consumers has also grown. In this blog post, we’ll guide you through some essential tips on how to spot a credit repair scam, so you can avoid falling victim to fraudulent schemes and ensure you get the legitimate help you need.

Understand What Legitimate Credit Repair Entails

Before you can identify a credit repair scam, it’s important to know what legitimate credit repair services actually involve. Legitimate credit repair companies, like Decs – We Kill Debt, work to:

Review your credit reports: A credit repair company will analyze your credit report to identify errors or areas that could be improved.

Dispute inaccuracies: Legitimate credit repair services will help you challenge errors with the credit bureaus, such as incorrect personal information, outdated accounts, or accounts that don’t belong to you.

Offer guidance: They will offer advice on how to improve your credit in the long term, including strategies for paying down debt, managing credit cards, and building a stronger financial future.

However, any company promising to “fix” your credit score without proper legal actions or tangible steps may be operating under fraudulent pretenses.

Beware of "Guaranteed" Results

One of the biggest red flags when it comes to credit repair scams is the promise of guaranteed results. While reputable credit repair services can often help you improve your credit score over time, no one can guarantee specific results or a particular score increase.

The law prohibits companies from guaranteeing specific outcomes, as credit repair companies cannot control how quickly the credit bureaus will act on disputes or if the negative items will be removed. If a company offers guarantees or promises to “remove bad credit” quickly, it’s likely a scam.

Avoid Companies that Charge Before Providing Services

The Credit Repair Organizations Act (CROA) prohibits credit repair companies from charging upfront fees before services are provided. If a credit repair company asks for payment before doing any work, it’s a clear violation of the law. Legitimate credit repair companies will only charge after they have provided their services and made an effort to help you. Be wary of companies asking for large upfront payments without giving you a clear, detailed breakdown of services. Any reputable company will explain how their pricing works and ensure you understand what you’re paying for.

Watch Out for "Quick Fix" Promises

Credit repair takes time and careful effort, and there’s no such thing as an overnight solution. If you come across a company that promises a quick fix or an unusually fast credit repair process, that should immediately raise a red flag. Scammers may claim that they can quickly erase negative marks from your credit report, but this is either misleading or impossible. Even if mistakes are found on your credit report, it can take weeks or even months for these changes to reflect in your credit score. Any company that claims they can make drastic changes overnight is not being truthful.

Look for Negative Reviews and Feedback

Another useful tool to spot a potential credit repair scam is researching the company online. A simple Google search can often uncover whether a company has a history of complaints, negative reviews, or even legal action taken against them.

Check the Better Business Bureau (BBB): The BBB is a great resource for reviewing the reputation of a business. Companies with a lot of complaints or unresolved issues may not be trustworthy.

Online Reviews: Platforms like Trustpilot, Yelp, or Facebook can offer insight into the experiences of other clients. If there are a lot of negative reviews or complaints, it’s best to move on to another company.

In addition, try to find real customer testimonials on the company’s website. Be wary of overly glowing reviews that seem too good to be true, as they could be fabricated.

Check for Unclear or Vague Contracts

A legitimate credit repair company will always provide you with a clear, detailed contract outlining the terms and services. Be cautious if the contract is vague, filled with legal jargon, or lacks transparency about fees and services.

Key details to look for in a contract include:

Clear service description: The contract should list the specific services being provided and any guarantees.

Payment structure: It should detail when and how you will be charged, including any upfront fees (which, remember, should be avoided).

Cancellation policy: Reputable companies will allow you to cancel your contract without facing steep penalties.

If a credit repair company does not provide a clear, understandable contract or is unwilling to share important details, this is a significant red flag.

Be Cautious of "New" or "Unregistered" Companies

Most reputable credit repair companies are registered with the appropriate state and federal agencies, including the Consumer Financial Protection Bureau (CFPB). Before working with any company, verify that they are compliant with the law and are properly licensed to operate in your state.

Additionally, if you find a company that is newly formed or lacks a strong track record, be cautious. A long-established reputation can often be a sign of trustworthiness, and you may want to think twice about working with a company that’s not been in business for a reasonable amount of time.

They Suggest "Dirty Tricks"

Some companies will recommend illegal methods to repair your credit, such as creating a new identity or instructing you to dispute accurate information. These are illegal practices and can lead to severe legal consequences. A legitimate credit repair company will never suggest actions that involve fraud or breaking the law. If a company suggests things like using a different name, creating a false credit report, or using a “new credit file,” immediately walk away.

No Contact with Credit Bureaus

A legitimate credit repair company will work directly with the three major credit bureaus (Experian, Equifax, and TransUnion) on your behalf. They will help you dispute inaccurate or outdated information and follow up to ensure the dispute is processed. If a company is promising results without ever contacting the credit bureaus, this is another major red flag. No legitimate company can improve your credit score without engaging in these formal processes.

Conclusion

At Decs – We Kill Debt, we believe in transparency, honesty, and providing effective, reliable credit repair services. Our approach focuses on reviewing your credit report for inaccuracies, guiding you through the process, and helping you create a path toward long-term financial health. By following these tips and staying vigilant, you can avoid the pitfalls of credit repair scams and work with a trustworthy company to improve your credit score the right way. If you have any questions or would like to get started with professional, reliable credit repair, feel free to contact us. We’re here to help you kill debt and get back on the road to financial success!

Contact us:

Address - 18930 HWY 18STE 101 Apple valley CA 92307

Email - [email protected]

Website - DECS-WE KILL DEBT

Blog - How to Spot a Credit Repair Scam: Essential Tips

0 notes

Text

At Decs – We Kill Debt, we understand that life doesn’t always go according to plan. Whether it’s unexpected medical bills, job loss, or just tough times, many Americans find themselves facing a low credit score and limited financial options.

#bad credit#credit score#bad credit loans los angeles#credit repair services los angeles#bad credit home loans#fix bad credit los angeles

0 notes

Text

Credit repair is an essential part of achieving financial freedom. If your credit report has mistakes or negative items affecting your credit score, it can impact everything from loan approvals to interest rates. However, with the increasing demand for credit repair services, the rise of scams targeting consumers has also grown.

0 notes

Text

A low credit score can cost you higher interest rates, loan denials, and missed financial opportunities—but you don’t have to stay stuck! At Decs – We Kill Debt, we help you: Remove negative items from your credit report Boost your credit score fast Secure better financial opportunities

#credit score#bad credit#credit repair services#bad credit loans los angeles#fix bad credit los angeles

0 notes