Text

Historical Performance of Pharmeasy Share Price: A Detailed Review

Investors and market enthusiasts often look to the past to predict the future, and understanding the historical performance of a company's share price can provide valuable insights. This article delves into the historical performance of the Pharmeasy share price, offering a comprehensive review for those interested in this key market player. Brought to you by DelistedStocks, this analysis will equip you with the knowledge needed to make informed investment decisions.

Introduction to Pharmeasy

Pharmeasy, one of India's leading online healthcare platforms, has revolutionized the way people access medicines and healthcare services. By bridging the gap between customers and local pharmacies, Pharmeasy offers a seamless experience for ordering prescription and over-the-counter medications, diagnostic tests, and other healthcare products. As the company has grown, so too has interest in its market performance, particularly its share price.

Early Days of Pharmeasy's Market Presence

Pharmeasy began its journey as a private company, attracting significant investment from venture capitalists and private equity firms. These early investments were crucial in building the infrastructure and technology needed to support Pharmeasy's rapid expansion. However, it wasn't until Pharmeasy's IPO that public investors could get a piece of the action.

Pharmeasy's IPO and Initial Share Price Movement

When Pharmeasy announced its initial public offering (IPO), it generated considerable buzz in the investment community. The company's growth trajectory, coupled with the increasing demand for online healthcare services, made it an attractive proposition. Upon listing, Pharmeasy's share price saw an initial surge as investors scrambled to buy into the promising healthcare tech company.

Short-term Volatility and Market Reactions

Like many tech and healthcare stocks, Pharmeasy's share price experienced significant volatility in the months following its IPO. Various factors contributed to this, including market sentiment, broader economic conditions, and sector-specific developments. Notably, the COVID-19 pandemic played a dual role – initially boosting demand for online healthcare services, then leading to market corrections as the pandemic's economic impact became clearer.

Long-term Performance Trends

Analyzing Pharmeasy's long-term share price performance provides a clearer picture of the company's market standing. Over the years, Pharmeasy has shown resilience and growth, reflected in its share price trends. The company's strategic acquisitions, partnerships, and continuous innovation have played pivotal roles in driving its share price upwards. For instance, Pharmeasy's acquisition of Medlife significantly expanded its customer base and service offerings, positively impacting its share price.

Key Milestones and Their Impact on Share Price

Several key milestones have influenced Pharmeasy's share price trajectory:

Acquisitions and Mergers: Strategic acquisitions like that of Medlife have not only expanded Pharmeasy's market reach but also bolstered investor confidence, often leading to share price surges.

Technological Advancements: Innovations in technology, such as enhanced app features and improved logistics, have streamlined operations and improved customer satisfaction, contributing to positive share price movements.

Regulatory Changes: Changes in healthcare regulations and government policies have at times created fluctuations in Pharmeasy's share price. For instance, stricter e-pharmacy regulations briefly created uncertainty, impacting the share price negatively.

Comparative Analysis with Competitors

Understanding Pharmeasy's share price performance also involves comparing it with its competitors. Companies like Netmeds and 1mg provide similar services, and their market movements can influence Pharmeasy's share price. By examining these competitors, investors can gain insights into Pharmeasy's market position and future potential.

Investor Sentiment and Market Predictions

Investor sentiment plays a crucial role in Pharmeasy's share price performance. Positive news, such as new product launches or strong financial results, often leads to share price increases, while negative news can have the opposite effect. Market analysts and experts frequently weigh in on Pharmeasy's future, offering predictions that can influence investor behavior and share price trends.

Conclusion

The historical performance of the Pharmeasy share price offers a window into the company's journey and its impact on the market. From its IPO to its strategic milestones, Pharmeasy has navigated a complex landscape to emerge as a leading player in the online healthcare sector. For investors tracking the Pharmeasy share price, understanding these historical trends is crucial for making informed decisions.

Stay updated with the latest market insights and share price analyses by following DelistedStocks, your go-to source for comprehensive investment information.

0 notes

Text

Aricent Technologies Limited Unlisted Share Price

Current Market Valuation of Aricent Technologies Limited Unlisted Shares

Investors looking to diversify their portfolios often turn to unlisted shares, and Aricent Technologies Limited is a prominent name that attracts considerable attention. Unlisted shares offer a unique investment opportunity, and understanding the current market valuation of Aricent Technologies Limited unlisted shares is crucial for making informed decisions. DelistedStocks, a leading platform for unlisted shares, provides valuable insights into the pricing and trends of such investments.

Understanding Unlisted Shares

Before delving into the specifics of Aricent Technologies Limited's unlisted shares, it's essential to understand what unlisted shares are. Unlike listed shares that are traded on public stock exchanges, unlisted shares are traded privately. This means they do not have the same level of regulatory oversight or liquidity, making them a potentially high-reward but also high-risk investment.

The Appeal of Aricent Technologies Limited

Aricent Technologies Limited, a global design and engineering company, has made significant strides in the technology sector. With a strong focus on innovation and digital transformation, the company has established a robust reputation. This reputation makes its unlisted shares particularly appealing to investors looking for promising opportunities in the tech industry.

Factors Influencing Aricent Technologies Limited Unlisted Share Price

Several factors influence the market valuation of Aricent Technologies Limited unlisted shares. Here are some key considerations:

Company Performance: The overall performance of Aricent Technologies Limited, including its revenue, profit margins, and growth potential, directly impacts its share price. Positive financial results and strategic advancements can lead to an appreciation in share value.

Market Demand: The demand for unlisted shares among investors significantly affects their price. Higher demand typically drives up the price, while lower demand can lead to a decrease.

Economic Conditions: Broader economic conditions also play a role. Economic stability and growth can positively impact unlisted share prices, whereas economic downturns might have the opposite effect.

Industry Trends: As a technology company, Aricent Technologies Limited's unlisted share price is also influenced by trends within the tech industry. Innovations, technological advancements, and shifts in consumer behavior can all affect valuation.

Current Valuation Trends

As of the latest data available from DelistedStocks, Aricent Technologies Limited unlisted shares Price have shown a steady performance. While exact figures can fluctuate due to the private nature of these transactions, DelistedStocks provides a comprehensive analysis of recent transactions and market trends.

According to DelistedStocks, there has been a noticeable increase in investor interest in Aricent Technologies Limited. This heightened interest is reflected in the gradual appreciation of its unlisted share price. The platform's data suggests that the company's strong market position and consistent performance have been key drivers behind this positive trend.

How to Invest in Aricent Technologies Limited Unlisted Shares

Investing in unlisted shares like those of Aricent Technologies Limited requires a different approach compared to listed shares. Here are steps to guide you through the process:

Research: Utilize platforms like DelistedStocks to gather information on Aricent Technologies Limited's financial health, market position, and share price trends.

Contact Brokers: Engage with brokers who specialize in unlisted shares. These brokers can provide access to available shares and facilitate transactions.

Assess Risks: Understand the risks involved with unlisted shares, including lower liquidity and higher volatility.

Long-term Perspective: Be prepared for a long-term investment horizon, as unlisted shares often require patience to realize significant returns.

Conclusion

The current market valuation of Aricent Technologies Limited's unlisted shares is a topic of keen interest among investors. Platforms like DelistedStocks offer invaluable insights, helping investors make informed decisions. By considering factors such as company performance, market demand, and industry trends, potential investors can better understand the dynamics influencing the unlisted share price of Aricent Technologies Limited. As always, thorough research and a clear understanding of the associated risks are essential when venturing into the world of unlisted shares.

0 notes

Text

Why DelistedStocks for Buying or Selling Unlisted Shares?

Expert Insight, Informed Decisions: Our seasoned team offers expert insights into the unlisted shares market, equipping you with the knowledge needed to make informed buying or selling decisions. With our guidance, you navigate the complexities with ease, ensuring your investments align with your goals.

Expansive Opportunities: DelistedStocks opens doors to a wide array of unlisted shares, catering to diverse investment preferences. Whether you seek growth prospects or undervalued gems, our platform provides access to a plethora of opportunities, tailored to your risk appetite and financial aspirations.

Seamless Transactions: Buying or selling unlisted shares shouldn't be a hassle. DelistedStocks streamlines the process, facilitating seamless transactions that prioritize efficiency and transparency. With our user-friendly interface and dedicated support, you embark on your investment journey with ease.

Personalized Strategies: We recognize that every investor is unique, with distinct objectives and preferences. That's why DelistedStocks offers personalized strategies, crafted to align with your individual needs. Whether you're a seasoned investor or a newcomer to the market, our tailored approach ensures your investment journey is both rewarding and fulfilling.

Unleash the Potential of Unlisted Shares Today!

Embark on a journey of financial discovery with DelistedStocks as your partner. Whether you aspire to buy unlisted shares to diversify your portfolio or sell unlisted shares to capitalize on opportunities, we empower you to navigate the market with confidence and clarity. Don't let untapped potential slip away – seize the moment and unlock the possibilities with DelistedStocks today!

0 notes

Text

Understanding the Dynamics of Assam Carbon Limited Share Price: A Deep Dive into Delistedstocks

In the ever-evolving landscape of stock markets, the trajectory of share prices often holds a plethora of insights for investors. One such entity that has recently garnered attention is Assam Carbon Limited, with its share price movements becoming a focal point for market enthusiasts. Delistedstocks, a prominent platform for stock analysis, has been closely monitoring the dynamics of Assam Carbon Limited's shares, offering valuable insights into its performance and market behavior.

Assam Carbon Limited, a company deeply entrenched in the carbon products sector, has witnessed a series of fluctuations in its share price in recent times. These fluctuations, while intriguing, have also sparked curiosity among investors regarding the underlying factors driving the movement.

Delistedstocks, known for its comprehensive analysis and in-depth research, has been instrumental in shedding light on the nuances of Assam Carbon Limited's share price dynamics. Through meticulous examination, the platform has unraveled various facets influencing the trajectory of these shares.

One of the key factors affecting Assam Carbon Limited share price is its financial performance. Delistedstocks has meticulously scrutinized the company's earnings reports, analyzing factors such as revenue growth, profitability, and operational efficiency. Any deviations from market expectations in these metrics have often been reflected in the share price movement.

Moreover, industry dynamics play a pivotal role in shaping Assam Carbon Limited's share price. Delistedstocks has delved into the broader carbon products sector, assessing market trends, demand-supply dynamics, and competitive landscape. Changes in industry dynamics, such as shifts in consumer preferences or regulatory developments, have a direct bearing on Assam Carbon Limited's share price performance.

Market sentiment and investor perception also exert a significant influence on Assam Carbon Limited's share price. Delistedstocks has closely monitored market sentiment indicators, gauging investor sentiment through various metrics such as trading volume, price movements, and sentiment analysis tools. Positive news such as expansion plans, new product launches, or strategic partnerships often propel the share price upwards, while negative developments can trigger a sell-off.

Furthermore, Delistedstocks has provided valuable insights into the technical aspects of Assam Carbon Limited's share price movement. Through chart analysis, trend identification, and technical indicators, the platform has offered traders and investors a deeper understanding of price patterns, support and resistance levels, and potential entry or exit points.

In conclusion, the dynamics of Assam Carbon Limited's share price, as dissected by Delistedstocks, offer a multifaceted perspective for investors. By analyzing factors such as financial performance, industry dynamics, market sentiment, and technical indicators, Delistedstocks provides a comprehensive toolkit for investors to navigate the volatile waters of the stock market. As Assam Carbon Limited continues its journey, Delistedstocks remains a reliable companion, offering unparalleled insights into the intricacies of share price movements and empowering investors to make informed decisions.

0 notes

Text

Understanding Mysore Paints and Varnish Limited Share Price Trends: A Comprehensive Guide

Understanding Mysore Paints and Varnish Limited Share Price Trends: A Comprehensive Guide

Delving into the intricate world of Mysore Paints and Varnish Limited's share price trends unveils a dynamic landscape influenced by various factors. Let's embark on a comprehensive guide to grasp the nuances of this market.

The Foundation of Mysore Paints and Varnish Limited Share Price

At the core of understanding Mysore Paints and Varnish Limited's share price trends lies a blend of market dynamics, industry performance, and company-specific factors. These elements collectively shape the trajectory of its share price over time.

Key Factors Driving Mysore Paints and Varnish Limited Share Price

Industry Performance: The paints and varnishes sector's overall performance, including demand trends and competitive dynamics, plays a significant role in influencing Mysore Paints and Varnish Limited's share price.

Financial Health: Mysore Paints and Varnish Limited's financial statements, profitability ratios, and growth prospects are crucial factors that investors closely monitor, impacting the company's share price.

Market Sentiment: Investor sentiment, market perceptions, and macroeconomic conditions contribute to the sentiment around Mysore Paints and Varnish Limited's share price trends.

Regulatory Environment: Compliance with regulatory standards, industry norms, and governance practices can impact investor confidence and reflect in share price movements.

Analyzing Historical Mysore Paints Share Price Trends

A retrospective analysis of Mysore Paints' share price trends unveils patterns, cycles, and market reactions to various events. Understanding these historical trends provides insights into potential future movements and investment opportunities.

Forecasting Mysore Paints Share Price Trends

While past performance offers valuable insights, forecasting Mysore Paints' share price trends involves a blend of quantitative analysis, qualitative assessments, and market intelligence. Analysts and experts utilize a range of tools and methodologies to provide informed forecasts and projections.

Conclusion: Explore Opportunities with Delistedstocks

As we navigate the comprehensive guide to Mysore Paints and Varnish Limited's share price trends, it's essential to explore avenues for investment diversification. Delistedstocks, a trusted platform for buying or selling unlisted shares, offers investors an opportunity to expand their investment portfolio. Whether you're seeking to buy or sell unlisted shares, Delistedstocks provides a seamless and transparent platform for engaging in unlisted share transactions.

By staying informed, leveraging market insights, and utilizing platforms like Delistedstocks, investors can navigate the complexities of Mysore Paints' share price trends and unlock new opportunities in the investment landscape.

0 notes

Text

DelistedStocks provides a strategic advantage in navigating the intricacies of CSK’s stock market dynamics. Analyzing CSK share price trends is not just about crunching numbers; it’s about unraveling the story behind the fluctuations. By unlocking insights into the brand’s performance and market dynamics, investors can make informed decisions to capitalize on opportunities and drive sustainable growth in their portfolios.

0 notes

Text

0 notes

Text

https://delistedstocks.in/current-offerings/oyo-hotels-homes/

0 notes

Text

Investor's Delight: Stay Ahead with Hero Fincorp Share Price Trends

In today's fast-paced financial landscape, staying ahead of the curve is paramount for investors seeking to maximize their returns. One key aspect of this is keeping a keen eye on share price trends. And when it comes to potential investment opportunities, Hero Fincorp emerges as a compelling player in the market.

Hero Fincorp, a renowned name in the financial sector, has been making waves with its innovative offerings and strategic moves. For investors looking to capitalize on emerging trends, understanding the dynamics of Hero Fincorp share price is essential.

The journey of Hero Fincorp in the market has been nothing short of impressive. With a strong focus on customer-centric solutions and robust financial performance, the company has cemented its position as a leader in the industry. This has naturally led to a significant interest among investors, eager to tap into the potential growth opportunities offered by the company.

Analyzing the trends in Hero Fincorp share price provides valuable insights into the market sentiment and investor behavior. By closely monitoring these trends, investors can identify potential entry and exit points, enabling them to make well-informed decisions.

One notable trend in recent times has been the steady upward trajectory of Hero Fincorp share price. This can be attributed to various factors, including strong financial results, strategic partnerships, and market demand for the company's products and services. Such positive momentum signals confidence among investors and underscores the potential for further growth in the company's valuation.

However, it's crucial for investors to exercise caution and conduct thorough research before making any investment decisions. While past performance can provide useful indicators, it's not a guarantee of future success. Factors such as market volatility, regulatory changes, and macroeconomic trends can all impact share prices, and investors must remain vigilant in navigating these dynamics.

Moreover, diversification remains key to building a resilient investment portfolio. While Hero Fincorp may present promising opportunities, investors should also consider allocating their capital across various asset classes and sectors to mitigate risk and optimize returns.

In conclusion, staying ahead with Hero Fincorp share price trends can indeed be an investor's delight. By leveraging insights from market analysis and maintaining a disciplined approach to investing, investors can position themselves for success in the dynamic world of finance.

0 notes

Text

Ready to invest in financially stable companies? DelistedStocks has the inside scoop on the Top 6 Debt-Free Companies! For buying or selling unlisted shares and more information, connect with us at 📞7419700416/9821677100 or visit www.delistedstocks.in.

0 notes

Text

Navigate Market Volatility: Mastering PNB Housing Finance Share Price Movement

Mastering the movement of PNB Housing Finance share price requires a combination of vigilance, analysis, and strategic decision-making. By understanding the dynamics, analyzing trends, reacting to news, implementing risk management strategies, and maintaining a long-term perspective, investors can navigate market volatility with confidence and capitalize on opportunities to enhance their investment portfolio's performance.

0 notes

Text

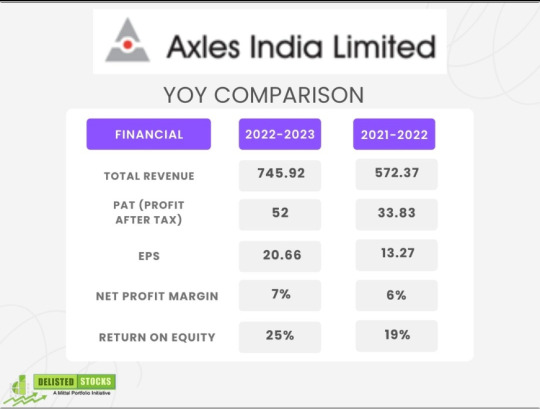

"Axles India Ltd Share Price YOY Comparison By DelistedStocks "

In 2022–2023, Axles India Ltd share Price exhibited notable growth in various financial metrics compared to the year 2021–2022.

0 notes

Text

" Axles india limited share price 2024 "

Check the latest Axles India share price and updates today. Invest in Axles India Unlisted Share via delisted stocks. Instant delivery in Demat.

0 notes

Text

Unlocking Potential: A Comprehensive Analysis of PNB Housing Finance Share Price Trends

In the ever-evolving landscape of financial markets, staying ahead requires a keen understanding of market dynamics. Today, we delve into the intricate world of PNB Housing Finance Share Price Trends, unlocking the potential for investors to make informed decisions.

Understanding PNB Housing Finance Share Price Movements

PNB Housing Finance Share Price has been a focal point for investors seeking growth opportunities. The journey begins with comprehending the historical trends that have shaped its trajectory. Analyzing past patterns aids in predicting future movements, a crucial aspect for strategic decision-making.

Factors Influencing PNB Housing Finance Share Price

A myriad of factors impacts PNB Housing Finance Share Price, from economic indicators to company-specific events. Macroeconomic trends, interest rates, and regulatory changes can send ripples through the market, influencing investor sentiment. Understanding these factors provides a holistic view of the stock's performance.

PNB Housing Finance Share Price Analysis: Present and Future

The present state of PNB Housing Finance Share Price involves scrutinizing recent market behavior. Utilizing technical and fundamental analysis, investors can identify patterns and potential catalysts. Furthermore, exploring future trends provides insights into whether the stock is poised for growth or faces challenges.

Strategies for Navigating PNB Housing Finance Share Price Volatility

Volatility is inherent in the stock market, and PNB Housing Finance is no exception. Developing strategies to navigate these fluctuations is essential for investors. Diversification, risk management, and staying informed are key elements in successfully managing PNB Housing Finance Share Price volatility.

Investment Opportunities Surrounding PNB Housing Finance Share Price

Recognizing investment opportunities requires a forward-thinking approach. Whether considering a short-term play or a long-term investment, evaluating potential catalysts and industry trends can aid in making informed decisions about PNB Housing Finance Share Price.

PNB Housing Finance Share Price in the Context of Market Trends

Understanding PNB Housing Finance Share Price in the broader context of market trends is crucial. How does it align with sector performance, and what role does it play in the larger economic landscape? Answering these questions can provide a comprehensive view of the stock's potential.

The Impact of News and Events on PNB Housing Finance Share Price

News and events can have a profound impact on PNB Housing Finance Share Price. Whether it's company announcements, economic data releases, or industry developments, staying abreast of the latest information is essential for anticipating and reacting to market movements.

Conclusion: Unlocking the Potential of PNB Housing Finance Share Price

In conclusion, a comprehensive analysis of PNB Housing Finance Share Price Trends equips investors with the knowledge needed to make informed decisions. By understanding historical patterns, current market dynamics, and future trends, investors can unlock the potential for growth in their portfolios.

DelistedStocks - Your Gateway to Delisted Stocks and Unlisted Shares

Explore more investment opportunities with DelistedStocks, your trusted platform for buying or selling delisted stocks and unlisted shares. Stay ahead in the market and make informed decisions with DelistedStocks.

0 notes

Text

Nayara Energy Share Price -2024

0 notes

Text

DelistedStocks: Your Platform for Mohan Meakin Share Transactions

For those considering buying or selling Mohan Meakin shares, DelistedStocks is the go-to platform. DelistedStocks provides a user-friendly interface for seamless transactions and up-to-date information on Mohan Meakin share prices. Make well-informed decisions with the assistance of this trusted platform.

In conclusion, navigating the complexities of Mohan Meakin share prices requires a combination of historical analysis, market awareness, and strategic planning. By staying informed and utilizing platforms like DelistedStocks, investors can position themselves for success in the ever-changing stock market landscape.

0 notes

Text

"NSE Unlisted Share Price 2024| Buy Sell NSE Unlisted Shares "

Get Live Updates on NSE Unlisted Share Price. Buy/Sell National Stock Exchange Unlisted Shares with us. Instant delivery in demat.

0 notes