As a legal advisor with over 10 years of experience. I lead a legal advisory company that provides solutions for all types of businesses with expertise lies in understanding the legal needs of businesses and crafting solutions to address them.

Don't wanna be here? Send us removal request.

Text

Payment Aggregator License in India | Eligibility, Process & Documents

In this video, we explain the complete process for Payment Aggregator Registration in India, covering the eligibility criteria, required documents, and key steps to secure a Payment Aggregator license. Learn how to navigate the regulatory requirements and successfully register your business to offer secure payment solutions in India.

0 notes

Text

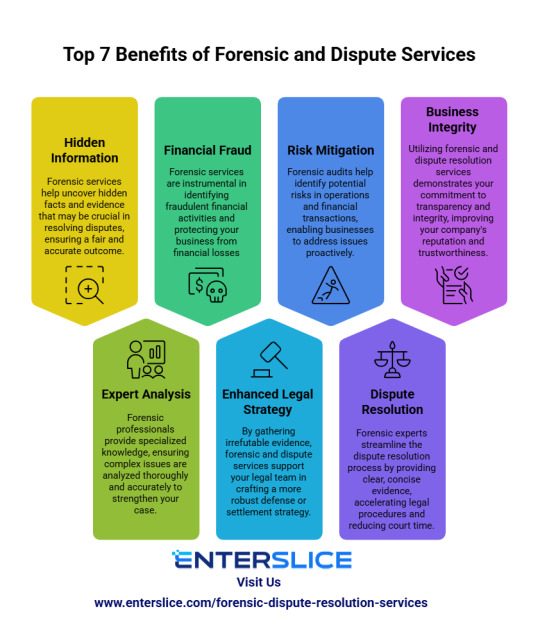

Top 7 Benefits of Forensic and Dispute Services in India

Dealing with legal disputes can be tough, but Forensic and Dispute Services can help businesses find hidden facts, reduce risks, and resolve issues faster. These services provide important insights, spot fraud, and support your legal strategy. With expert help, businesses can protect their assets and reputation while staying transparent and trustworthy.

Learn how forensic and dispute services can protect your business. Contact Enterslice today!

0 notes

Text

To register as an NBFC in India, a company must fulfill certain criteria. It should be incorporated under the Companies Act, 2013, with at least Rs. 2 crore in Net Owned Funds (NOF). The company must maintain a good credit history and have a qualified management team with relevant financial expertise. The business should primarily focus on financial services, such as lending or investing, rather than manufacturing or trading. Compliance with RBI regulations regarding capital adequacy and asset classification is essential. Additionally, promoters and directors must meet the 'fit and proper' criteria, and there should be no ongoing legal issues.

0 notes

Text

Essential Documents Required for Limited Liability Partnership Registration

Starting a business? The process of Limited Liability Partnership (LLP) registration can be smooth if you have the right documents in hand! Check out our latest infographic highlighting all the essential paperwork required for Limited Liability Partnership registration in India. 📑

👉 Make sure you have these key documents ready to avoid delays and get your business up and running!

0 notes

Text

Outsourcing your accounting and bookkeeping service needs can significantly streamline your business operations, reduce overhead costs, and improve overall financial management. By entrusting financial tasks to experienced professionals, you can ensure accuracy and compliance while freeing up time and resources to focus on what you do best growing your business and driving success!

0 notes

Text

A well-crafted NBFC marketing strategy boosts brand visibility, attracts quality leads, and enhances customer engagement. It ensures regulatory compliance, builds trust, and drives business growth. By leveraging targeted campaigns, NBFC marketing benefits include expanded reach, increased profitability, and improved returns. With data-driven insights, marketing efforts are optimized for maximum impact, paving the way for long-term success in the financial industry.

2 notes

·

View notes

Text

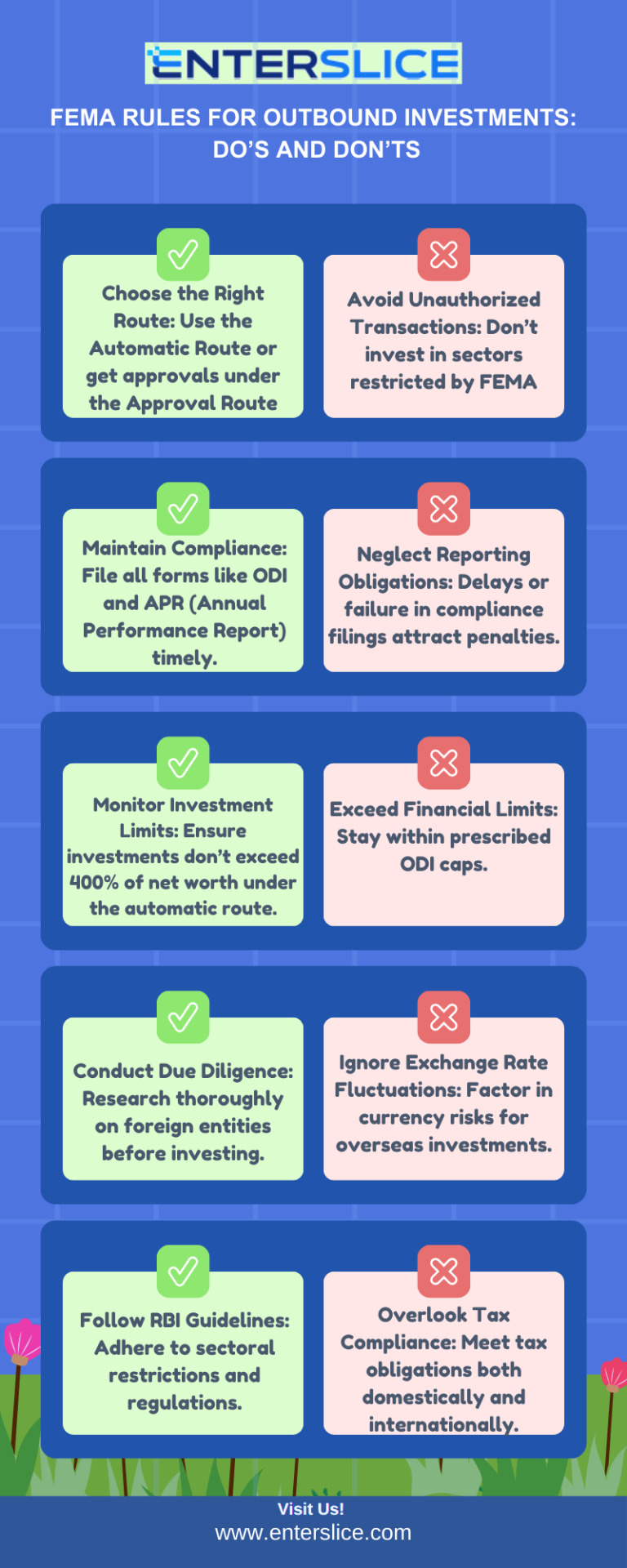

Navigating Outbound Investment under FEMA requires adherence to specific rules. Key do’s include selecting the correct investment route—Automatic or Approval, complying with RBI guidelines, and submitting necessary forms like ODI and APR on time. Avoid exceeding prescribed financial limits, investing in restricted sectors, or overlooking reporting obligations. Following these do’s and don’ts ensures smooth outbound investments, minimizes compliance risks, and enables businesses to expand internationally while staying aligned with FEMA regulations.

1 note

·

View note

Text

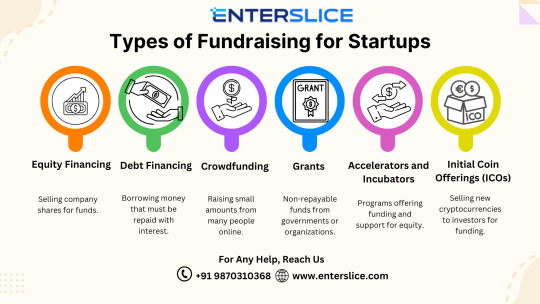

Fundraising for startups can involve equity financing, debt financing, crowdfunding, or grants. Each option offers unique benefits depending on the startup's needs and growth stage. Choosing the right approach is crucial for success. Enterslice provides expert fundraising services for startups to help navigate these options and secure the capital needed to fuel growth.

1 note

·

View note

Text

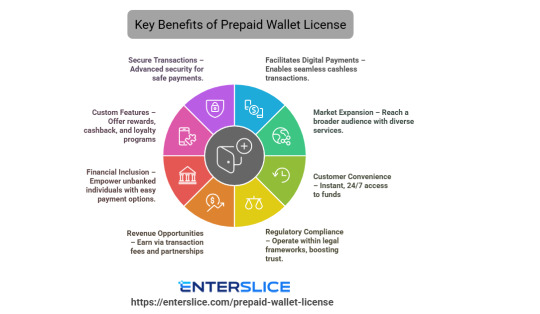

A Prepaid Wallet License offers several benefits, making it a valuable asset for businesses in the fintech and digital payment space.

0 notes

Text

Top Benefits of Media Audit for Businesses

A media audit helps businesses maximize ROI by revealing inefficiencies in ad spend and optimizing advertising strategies. It provides transparency, actionable insights, and ensures smart budget allocation. By ensuring compliance, benchmarking success, and reducing risk, media audits empower businesses to negotiate better deals and create more effective campaigns, ultimately boosting performance and growth.

1 note

·

View note

Text

The Role of the PMLA Appellate Tribunal in Fighting Money Laundering

Money laundering poses a significant threat to the global economy, and India is no exception. To combat this menace, the Indian government enacted the Prevention of Money Laundering Act (PMLA) in 2002. One of the critical components of this act is the establishment of the PMLA Appellate Tribunal, which serves as a specialized forum for resolving disputes and appeals related to money laundering cases. In this blog, we’ll explore the role of the PMLA Appellate Tribunal in combating money laundering, its functions, and its impact on individuals and businesses.

Understanding the PMLA Appellate Tribunal

The PMLA Appellate Tribunal is an independent judicial authority set up under the PMLA to handle appeals against the orders of the Adjudicating Authority or other authorities specified in the act. Its primary objective is to provide a fair and efficient resolution mechanism for disputes related to money laundering offenses.

The tribunal acts as a bridge between enforcement agencies like the Enforcement Directorate (ED) and the judiciary. It ensures that cases of alleged money laundering are reviewed impartially and in accordance with the law. The tribunal also provides individuals and businesses an opportunity to contest penalties, confiscations, or other actions taken under the PMLA.

Functions of the PMLA Appellate Tribunal

The tribunal plays a pivotal role in India’s anti-money laundering framework. Below are its key functions:

Hearing Appeals The tribunal hears appeals against orders passed by the Adjudicating Authority under the PMLA. This includes disputes over attachment or confiscation of property suspected to be involved in money laundering.

Review of Penalties It reviews penalties imposed on individuals or entities for non-compliance with PMLA provisions. The tribunal ensures that these penalties are fair and proportionate.

Ensuring Fair Representation The tribunal ensures that individuals and businesses accused of money laundering have a platform to present their case and defend themselves against allegations.

Resolving Disputes It resolves disputes related to the ownership of property, compliance with PMLA guidelines, and the legitimacy of financial transactions.

Providing Legal Clarity The tribunal sets legal precedents through its decisions, offering clarity on the interpretation of PMLA provisions and guiding future cases.

The Tribunal’s Role in Fighting Money Laundering

The PMLA Appellate Tribunal plays a crucial role in India’s fight against money laundering by ensuring that justice is served in a fair and transparent manner. Below are some key ways in which the tribunal contributes to combating this financial crime:

1. Promoting Accountability

The tribunal ensures that enforcement agencies like the ED adhere to due process while investigating and prosecuting money laundering cases. By reviewing their actions, it holds these agencies accountable and prevents misuse of power.

2. Protecting Innocent Parties

Not every financial transaction flagged as suspicious is illegal. The tribunal provides individuals and businesses an opportunity to prove their innocence and avoid unwarranted penalties or property confiscation.

3. Deterring Money Laundering

By upholding the law and imposing penalties on guilty parties, the tribunal acts as a deterrent to money laundering activities. Its decisions send a strong message about the consequences of violating PMLA provisions.

4. Encouraging Compliance

The tribunal’s role in resolving disputes and clarifying legal ambiguities encourages businesses to comply with PMLA regulations. It motivates companies to adopt robust anti-money laundering measures to avoid legal complications.

5. Strengthening India’s Financial System

By addressing money laundering cases effectively, the tribunal contributes to the overall stability and integrity of India’s financial system. It ensures that illicit funds do not undermine legitimate economic activities.

Key Challenges Faced by the Tribunal

While the PMLA Appellate Tribunal plays a vital role, it faces several challenges:

Backlog of Cases Like many judicial bodies in India, the tribunal often deals with a significant backlog of cases, leading to delays in justice.

Complex Nature of Cases Money laundering cases often involve intricate financial transactions and cross-border elements, making them challenging to resolve.

Limited Awareness Many individuals and businesses are unaware of their rights under the PMLA or the role of the tribunal, leading to underutilization of this legal forum.

Coordination with Other Authorities Effective coordination between the tribunal, enforcement agencies, and the judiciary is crucial but can sometimes be a bottleneck.

Read: Key Components of AML Compliance Testing and Monitoring

How Individuals and Businesses Can Benefit from the Tribunal

If you or your business is facing action under the PMLA, understanding the role of the tribunal can be immensely helpful. Here’s how you can leverage the tribunal’s services:

Seek Professional Guidance Hire legal experts or compliance consultants to help you navigate the tribunal’s procedures and present a strong case.

Maintain Proper Records Ensure that all your financial transactions and compliance reports are well-documented. This can serve as crucial evidence in your favor.

File Appeals Promptly If you believe you’ve been wrongly penalized, file an appeal with the tribunal within the stipulated timeframe. Delays can weaken your case.

Stay Informed Keep yourself updated on the latest PMLA provisions and tribunal rulings to ensure compliance and avoid future complications.

Conclusion

The PMLA Appellate Tribunal is a cornerstone of India’s anti-money laundering efforts. By providing a platform for fair dispute resolution, it not only protects the rights of individuals and businesses but also strengthens the enforcement of PMLA regulations. Whether you’re an individual or a corporate entity, understanding the tribunal’s role and functions can help you address money laundering issues effectively and ensure compliance with the law.

FAQs

1. What is the jurisdiction of the PMLA Appellate Tribunal? The tribunal has jurisdiction over appeals against orders passed by the Adjudicating Authority under the PMLA, including disputes related to property attachment and penalties.

2. How can I file an appeal with the PMLA Appellate Tribunal? You can file an appeal by submitting the required documents and fees to the tribunal within the prescribed time frame. It’s advisable to consult a legal expert for guidance.

3. Can businesses challenge penalties imposed under the PMLA? Yes, businesses can challenge penalties by filing an appeal with the PMLA Appellate Tribunal. The tribunal provides a fair platform for resolving such disputes.

Also, read: Checklist for your AML Compliance for cross-border transactions

1 note

·

View note

Text

Business Valuation Services offer critical insights into the true worth of your business. They support strategic decision-making, help attract investors, and facilitate smooth mergers, acquisitions, or sales. Valuations are essential for compliance, tax planning, and succession planning, ensuring transparency and fairness. By identifying financial strengths and risks, these services enhance credibility with stakeholders, enabling businesses to make informed choices and achieve sustainable growth.

1 note

·

View note

Text

An NOC Pollution Control Board is mandatory for industries and businesses that impact the environment. Manufacturing units, infrastructure projects, healthcare facilities, waste management plants, mining operations, and power plants are required to obtain this certification. Sectors like food processing, hospitality, and recycling units also need an NOC to comply with environmental laws. This ensures businesses adopt sustainable practices, control pollution, and avoid legal penalties, making the NOC Pollution Control Board a vital step for environmentally responsible operations.

0 notes

Text

youtube

A financial statement audit ensures accuracy and transparency in financial reporting, enhancing credibility with stakeholders. It identifies discrepancies, ensures compliance with regulations, and supports informed decision-making. By verifying the integrity of financial data, audits build trust with investors, lenders, and regulatory authorities, making them a cornerstone of responsible financial management.

1 note

·

View note

Text

Best Practices for a Sustainable and Ethical Supply Chain

Building a sustainable and ethical supply chain is vital for businesses aiming to minimize environmental impact and uphold social responsibility. By adopting green supply chain management strategies, companies can align with global sustainability goals while maintaining operational excellence. Here are key steps to achieve this:

1. Collaborate with Ethical Suppliers

Work with suppliers who prioritize fair labor practices, waste reduction, and sustainable resource usage. Regular audits and strong partnerships ensure alignment with your environmental and ethical standards.

2. Emphasize Sustainable Sourcing

Choose materials that are renewable, recycled, or ethically produced. Avoid resources linked to deforestation or unethical labor practices to build a responsible supply chain.

3. Streamline Logistics for Efficiency

Use eco-friendly transportation, optimize shipping routes, and adopt energy-efficient vehicles to reduce the supply chain’s carbon footprint.

4. Implement Waste Management Systems

Reduce waste through recycling initiatives, closed-loop systems, and proper disposal of hazardous materials. This limits environmental damage while promoting resource efficiency.

5. Adopt Renewable Energy and Energy-Efficient Technology

Upgrade production processes with energy-saving equipment and rely on renewable sources like solar or wind power to decrease your energy footprint.

6. Ensure Transparency with Digital Tools

Leverage blockchain and real-time monitoring systems to track and verify supply chain activities, ensuring adherence to ethical and sustainable standards.

7. Engage in Carbon Offset Programs

Compensate for unavoidable emissions by investing in projects like reforestation or renewable energy, contributing to a healthier planet.

8. Champion Fair Labor Practices

Protect workers' rights by ensuring safe work environments, fair wages, and adherence to labor laws. Conduct regular evaluations to maintain compliance.

9. Educate and Engage Stakeholders

Foster sustainability by educating suppliers, employees, and customers. Collaborative efforts enhance accountability and promote a culture of ethical practices.

10. Track Performance and Adapt

Measure your sustainability efforts and publish transparent reports. Continuous improvement is key to achieving long-term success in ethical supply chain management.

Conclusion

By integrating these strategies into your supply chain, businesses can simultaneously protect the planet and enhance their market reputation. A commitment to ethical practices is not just a competitive advantage but a responsibility in today’s world. Sustainable supply chains build trust, drive loyalty, and contribute to a thriving, eco-conscious future.

0 notes

Text

Common Questions About SEBI Research Analyst Registration

Curious about SEBI Research Analyst Registration? Here’s a quick FAQ guide to answer some of the most common questions!

Q1: Who needs to be SEBI registered to provide research services?

Answer: Any individual or firm offering research analysis, investment recommendations, or financial advice in India must be registered with SEBI. This includes independent analysts, brokerage firms, and investment advisory companies.

Q2: What qualifications are required to register as a SEBI research analyst?

Answer: You’ll need a postgraduate degree in finance or related fields, plus at least five years of experience in finance or securities. Alternatively, certain certifications, like the SEBI Research Analyst Certification, can fulfill these requirements.

Q3: How long does the SEBI registration process take?

Answer: Once you’ve submitted all required documents, the process usually takes around 4-6 weeks. SEBI will review your qualifications, experience, and documentation before approving your registration.

Q4: What is the SEBI Research Analyst Exam?

Answer: SEBI requires analysts to pass an exam that tests knowledge on various financial and investment topics. This ensures all registered analysts meet a standardized level of competency and knowledge.

Q5: Why is SEBI registration important for research analysts?

Answer: SEBI registration not only adds credibility but also ensures that analysts follow ethical standards and guidelines, protecting investor interests and promoting transparency in financial markets.

Have more questions? Drop them below! 👇

1 note

·

View note

Text

📜 A Step-by-Step Guide to 12A & 80G Registration for NGOs 📜

If you’re running an NGO or charitable organization, obtaining 12A and 80G registration can make a big difference! These registrations allow your organization to be tax-exempt and give donors the benefit of tax deductions, encouraging more contributions. Here’s a quick guide to help you through the process:

youtube

Steps to Get 12A & 80G Registration:

Gather Key Documents: Make sure you have your PAN card, registration certificate, financial statements, and a report on activities.

Log in to the Income Tax Portal: Use your organization’s PAN to access the Income Tax e-filing portal.

Complete Form 10A: Select Form 10A for both 12A and 80G and enter the required details about your organization.

Attach Essential Documents: Upload all supporting documents, like your NPO’s PAN, registration proof, and activity details.

Submit and Confirm: Double-check everything before submitting your form online.

Follow Up on the Status: Track the application status; the Income Tax Department may review and request additional information before giving the final approval.

Why 12A & 80G Registration Matters:

✔️ Tax exemption for your NGO ✔️ Tax benefits for donors (a great motivation for more donations!) ✔️ Compliance and transparency with government regulations

Getting registered doesn’t have to be overwhelming—just take it step by step. Best of luck on your journey to making a greater impact! 🌍💙

2 notes

·

View notes