Don't wanna be here? Send us removal request.

Text

Professionals can comprehend and use IFRS in financial reporting thanks to the International Financial Reporting Standards (IFRS) course, which offers thorough knowledge of worldwide accounting concepts. It addresses important principles such lease accounting, financial statement format, and revenue recognition. For accountants and other financial professionals who want to become more knowledgeable about worldwide financial reporting standards, this course is crucial.

#IFRS#IFRS COURSE#IFRS EXAM#IFRS FEES#IFRS ELIGIBILITY#IFRS EXEMPTIONS#diploma in ifrs#IFRS CERTIFICATION

0 notes

Text

A globally recognized qualification, the Chartered Financial Analyst (CFA) program gives professionals knowledge of ethical standards, portfolio management, and investment analysis. Three tiers of demanding examinations covering subjects including corporate finance, asset management, and economics make up this program. Individuals' employment chances are improved with the highly regarded CFA designation in the finance sector.

#CFA#CFA COURSE#CFA EXAM#CFA FEES#CFA ELIGIBILITY#CFA EXEMPTIONS#CFA CERTIFICATION#CFA STUDENT#CFA JOB#CFA SALARY#CFA GLOBAL#CFA INDIA#CFA LEVEL 1#CFA LEVEL 2#CFA LEVEL 3

0 notes

Text

CFA Certification

The CFA Institute bestows the esteemed Chartered Financial Analyst (CFA) qualification on professionals working in the finance and investment management industries. Advanced knowledge and proficiency in subjects including quantitative methodologies, ethics, portfolio management, and financial analysis are demonstrated by the certification. Candidates must successfully complete three levels of demanding tests, gain appropriate work experience, and uphold the ethical standards of the CFA Institute in order to obtain the CFA certification. This internationally recognized qualification greatly improves career prospects by giving individuals the abilities and reputation required for top positions in financial advising, asset management, and investment analysis.

#cfa#cfa course#cfa exam#cfa fees#cfa eligibility#cfa exemptions#cfa certification#cfa global#cfa india

0 notes

Text

CFA Eligibility

The Chartered Financial Analyst (CFA) program requires applicants to fulfill specific professional and academic requirements. A bachelor's degree or be in their final year of undergraduate studies are prerequisites for admission. On the other hand, applicants who have four years of professional job experience or who have completed at least four years of schooling and work experience qualify as well. Anybody interested in a profession in finance, asset management, or investment analysis can enroll in the CFA program. Since English is used for all tests and materials, fluency in the language is necessary. The program's eligibility conditions guarantee that applicants have a strong basis for success.

#CFA#CFA COURSE#CFA EXAM#CFA FEES#CFA ELIGIBILITY#CFA EXEMPTIONS#CFA CERTIFICATION#CFA STUDENT#CFA JOB#CFA SALARY#cfa global#CFA INDIA

0 notes

Text

CFA Fees

The cost of the Chartered Financial Analyst (CFA) program varies according on the exam level and the enrollment period. In addition to individual exam fees for each level, the CFA Institute levies an enrollment fee for new applicants. Compared to usual registration fees, early registration offers a lower rate. In addition to the exam fees, candidates might have to pay for workshops, study materials, and other resources. With costs that reflect the program's comprehensive scope and the widely acknowledged value of the CFA designation in the finance industry, the CFA program is an investment in professional development.

#CFA#CFA COURSE#CFA FEES#CFA EXAM#CFA ELIGIBILITY#CFA Exemptions#CFA CERTIFICATION#CFA STUDENT#CFA JOB#CFA SALARY

0 notes

Text

CFA Exam

The CFA Institute administers the demanding, internationally recognized Chartered Financial Analyst (CFA) test, which is a prerequisite for investment professionals. The three levels of the test are intended to evaluate increasingly in-depth knowledge and comprehension of mathematical methodologies, economics, ethics, portfolio management, and financial analysis. Candidates who successfully complete all three levels are prepared for advanced positions in asset management, investment analysis, and financial advising and exhibit their proficiency in the finance sector. Due to its demanding character, the CFA exam is highly regarded for offering individuals a prestigious certificate that provides access to international employment prospects in finance and investing.

0 notes

Text

CFA Course

Professionals in the field of investment management can enroll in the extensive, internationally recognized Chartered Financial Analyst (CFA) program. The course, which is offered by the CFA Institute, focuses on important topics like economics, quantitative methodologies, portfolio management, ethical and professional standards, and financial analysis. Its three increasingly difficult levels are designed to give candidates the advanced knowledge and abilities needed for positions in financial advising, asset management, and investment analysis. Completing the CFA course opens doors to significant employment prospects by demonstrating knowledge and dedication to the highest standards in the finance industry.

#cfa#cfa course#cfa exam#cfa fees#cfa eligibility#cfa exemptions#cfa certification#cfa job#cfa student#cfa salary

0 notes

Text

For investment professionals, the Chartered Financial Analyst (CFA) designation is a worldwide recognized degree. It denotes proficiency in investment analysis, portfolio management, and moral financial conduct and is given by the CFA Institute. By covering subjects including equity, fixed income, and derivatives, the CFA curriculum equips students for advanced positions in asset management, investment research, and finance.

#CFA#CFA COURSE#CFA EXAM#CFA FEES#CFA ELIGIBILITY#CFA EXEMPTIONS#CFA CERTIFICATION#CFA STUDENT#CFA JOB#CFA SALARY

0 notes

Text

Accounting professionals can earn the famous ACCA (Association of Chartered Certified Accountants) accreditation worldwide. It gives them thorough knowledge of taxation, auditing, corporate law, and financial management. The internationally recognized ACCA accreditation is a great tool for prospective finance professionals as it improves career opportunities by showcasing proficiency in accounting procedures and compliance.

#acca#acca course#acca certification#acca jobs#acca exam#acca fees#acca global#acca eligibility#acca india#acca exemptions#acca salary

0 notes

Text

One internationally recognized accreditation for risk management professionals is the Financial Risk Manager (FRM) certification. It is provided by the Global Association of Risk Professionals (GARP) and shows proficiency in recognizing, evaluating, and reducing financial risks. The curriculum prepares students for advanced positions in risk management and finance by covering subjects like market risk, credit risk, operational risk, and risk modeling.

#FRM#FRM COURSE#FRM CERTIFICATION#FRM SALARY#FRM JOB#FRM STUDENT#FRM ELIGIBILITY#FRM EXEMPTIONS#FRM EXAM#FRM FEES#FRM INDIA

0 notes

Text

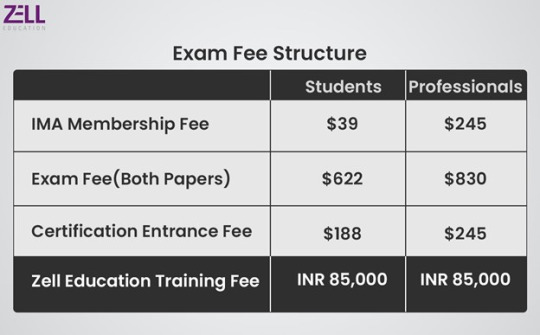

CMA Fees

Those seeking the esteemed CMA certification must pay the CMA (Certified Management Accountant) fees. Exam registration, membership, and study materials are all included in the pricing structure, which offers a variety of payment alternatives. In order to join the IMA, candidates must first pay an admission fee. Then, they must pay separate costs for each section of the CMA exam. Study materials, review courses, and, if necessary, reexamination fees are examples of additional expenses. The candidate's location and membership status affect the CMA fees. The CMA designation provides access to more lucrative job options and increased earning potential in management accounting and finance, despite the fees being an investment.

#cma#cma course#cma exam#cma fees#cma eligibility#cma student#cma india#cma certification#cma syllabus

0 notes

Text

US CMA Exam

Candidates are put to the test on key management accounting and financial management skills in the demanding two-part US CMA (Certified Management Accountant) exam. The test is given by the Institute of Management Accountants (IMA) and assesses knowledge in areas like professional ethics, financial planning, analysis, control, and decision support. Part 2 discusses financial decision-making, including risk management and strategic planning, whereas Part 1 concentrates on financial reporting, planning, performance, and control. A high degree of skill is demonstrated by passing the US CMA exam, which also equips people for leadership positions in accounting and finance. For individuals hoping to obtain the esteemed CMA certification and progress in the international banking sector, passing the exam is a crucial first step.

#cma#us cma#cma course#us cma exam#cma fees#cma eligibility#cma exemptions#cma student#cma job#cma syllabus#us cma certification

0 notes

Text

CMA Course

A specialized professional curriculum for those seeking proficiency in financial management and management accounting is the Certified Management Accountant (CMA) course. The course, which is provided by the Institute of Management Accountants (IMA), addresses important topics such ethical standards, financial planning, analysis, control, and decision-making. By supporting corporate decision-making and guaranteeing efficient financial control, the CMA certification gives professionals the ability to manage strategic financial obligations. The CMA designation provides access to advanced professional options in management, accounting, and finance due to its widespread recognition. The course offers a thorough foundation for success in the fast-paced sector of management accounting, making it perfect for anyone hoping to hold leadership positions in business and finance.

#cma#cma course#cma exam#cma fees#cma eligibility#cma exemptions#cma certification#cma job#cma salary#cma student#cma india#us cma

0 notes

Text

US CMA

The American Institute of Management Accountants (IMA) offers the internationally recognized professional certification known as the US CMA (Certified Management Accountant). Those who want to become experts in financial management and management accounting are the target audience for this certification. Key competencies like risk management, financial planning, analysis, control, and decision-making are prioritized in the US CMA curriculum. Professionals having the US Certified Public Accountant (CPA) qualification possess the expertise needed for leadership positions in accounting and finance. With its emphasis on ethical behavior and strategic business decision-making, the US CMA expands career options and is a great tool for individuals seeking positions in corporate leadership, finance, and management accounting globally.

#US CMA#US CMA COURSE#CMA#US CMA EXAM#US CMA FEES#US CMA ELIGIBILITY#US CMA EXEMPTION#US CMA CERTIFICATION

0 notes

Text

CMA

A professional qualification that attests to proficiency in financial management and management accounting is the CMA (Certified Management Accountant) title. The Institute of Management Accountants (IMA) bestows it, and it is widely accepted. Financial planning, analysis, control, decision support, and professional ethics are among the main topics covered in the CMA curriculum. Professionals who pass the CMA exam acquire the abilities needed to succeed in strategic financial roles and assist businesses in making wise business decisions. For individuals seeking leadership roles in management, finance, and accounting, this credential is perfect. Anyone wishing to progress in the fast-paced sector of management accounting will find that the CMA qualification improves employment opportunities and is a great tool.

0 notes

Text

One of the most widely accepted professional certifications in accounting and finance is the ACCA (Association of Chartered Certified Accountants). In fields like managerial accounting, taxation, auditing, and financial reporting, it offers thorough understanding. This curriculum is intended for people who want to pursue a lucrative career in accounting, providing the knowledge and skills necessary to operate in a variety of worldwide settings and industries.

#acca#acca course#acca jobs#acca exam#acca fees#acca global#acca eligibility#acca certification#acca india#acca exemptions#acca salary

0 notes

Text

A professional certification program that gives people proficiency in financial management, strategic planning, and decision-making is the Certified Management Accountant (CMA) course. The course, which focuses on management accounting, covers topics including cost management, budgeting, and financial analysis. It is intended for professionals looking to advance their careers by improving their understanding and proficiency in financial and management accounting.

0 notes