Don't wanna be here? Send us removal request.

Text

Take the First Step Towards Your Accounting Career!

Don't wait for the perfect moment—create it! join Ready Accountant and put off your "fresher" tag with our professional-led training. Attend our unfastened demo magnificence nowadays and kickstart your journey toward a successful accounting profession. We provide Accounting and Taxation course in a 100% practical way.

0 notes

Text

Best Tally Courses for Accounting Professionals

In now a days competitive enterprise landscape, accounting professionals need advanced talents and specialized understanding to control financial statistics correctly. Tally, one of the most extensively used accounting software, performs a critical position in streamlining financial management, taxation, and inventory manage. whether or not you're an aspiring accountant or an skilled professional seeking to improve your talents, enrolling in the high-quality Tally course for Accounting specialists can extensively increase your profession possibilities.

Why Tally is crucial for Accounting Specialists

Tally software is widely used in various industries for accounting, payroll control, taxation, and financial reporting. With increasing compliance requirements, specialists with Tally expertise are in high call for.

studying Tally can help you:

Control monetary transactions successfully

Generate invoices and reports

Handle GST calculations and submitting

Music stock and payroll

Make sure tax compliance with updated guidelines

To master these functionalities, it's far important to pick the right Tally course in Kolkata or enroll in an online course that fits your getting to know wishes.

Top Tally courses for Accounting professionals

Here are some of the high-quality Tally guides designed mainly for accounting specialists:

Advanced Tally ERP 9 and Tally top course Who need to take this route?

Accounting professionals, commercial enterprise owners, and students Key features:

Basics to advanced degree Tally ERP 9 and Tally prime

Accounting, stock management, and GST compliance

Payroll management and reporting

Hands-on practical training

Certification upon course finishing touch

2. GST course in Kolkata with Tally schooling Who should take this route?

Accountants, tax experts, and finance experts Key functions:

Complete GST schooling integrated with Tally

GST invoicing, returns submitting, and reconciliation

Practical exposure with actual-time case research

Certification in GST and Tally software

3. Tally course – company Accounting education Who must take this course?

Specialists aiming to paintings in company finance and bills Key capabilities:

Company monetary management with Tally

Budgeting, coins flow control, and taxation

Customizable Tally features for commercial enterprise accounting

Online and school room education alternatives

4. Taxation with Tally packages Who ought to take this path?

Students and experts seeking to enhance their taxation know-how Key functions:

Earnings tax, GST, and TDS training

Sensible programs the use of Tally software

Arms-on assignments and case studies

Enterprise-diagnosed certification

Selecting the proper Tally route

With so many Tally publications available, it is important to pick the right course based to your career desires and knowledge level. remember the following factors:

Course content: ensure the curriculum covers all essential subjects, consisting of taxation, GST, inventory management, and payroll.

Realistic training: opt for a direction that gives fingers-on training and actual-global programs.

Enterprise recognition: A certification from a reputed institute provides value in your resume.

Mode of getting to know: choose among school room, on line, or hybrid learning alternatives primarily based for your comfort.

Benefits of Enrolling in a Tally course

A Tally course or an online education software gives a couple of benefits, together with:

Career advancement: benefit specialized competencies that make you a precious asset to employers.

Higher profits prospects: certified Tally professionals earn higher salaries as compared to non-certified individuals.

Job opportunities: Open doorways to roles which includes accountant, economic analyst, tax representative, and GST practitioner.

Improved efficiency: discover ways to manage debts and taxes seamlessly, improving productivity.

Conclusion

Investing in the best Tally courses for Accounting professionals is a step toward a successful accounting career. whether or not you opt for a Taxation course, acquiring Tally skills will decorate your expert credibility and open up better profession possibilities. choose the right route these days and increase your know-how within the field of accounting!

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

The Role of Tax Consultants: A comprehensive guide

Taxation plays a crucial function within the monetary control of people and corporations. With ever-converting tax laws and rules, handling tax compliance may be a complex task. this is where tax experts come into the picture. They assist businesses and people navigate problematic international taxation, ensuring compliance while optimizing tax liabilities. this newsletter delves into "The role of Tax consultants:" and their importance within the economic region.

Who are Tax consultants?

Tax consultants, additionally called tax advisors, are professionals with in-depth information on tax criminal suggestions, pointers, and regulations. They help human beings, organizations, and corporations in making equipped tax returns, making plans for tax strategies, and making sure compliance with authorities' rules. Many tax consultants go through specialized schooling, inclusive of Taxation course in Kolkata, to build information in this area.

Key responsibilities of Tax Consultants

Tax-making plans and approach Tax experts expand techniques to reduce tax liabilities whilst ensuring compliance with felony requirements. They examine a customer’s monetary situation and recommend tax-saving investments, deductions, and exemptions that align with cutting-edge tax legal guidelines.

Tax Compliance and return filing Ensuring tax compliance is an essential position of tax experts. They prepare and report tax returns for people and agencies, assisting them keep away from penalties and criminal issues. Their know-how ensures that each one relevant deductions and credits are nicely applied.

Dealing with GST and other oblique Taxes With the introduction of products and offerings Tax (GST), companies require specialized help in GST compliance. Many tax specialists specialize in GST and help corporations with GST registration, return filing, and audits. individuals seeking to build understanding in this discipline can pursue a GST course in Kolkata to benefit from realistic knowledge of GST guidelines.

Representation in Tax Audits and Disputes Tax specialists constitute customers in case of tax audits, disputes, or litigation with tax authorities. They offer important documentation, reply to tax notices, and assist clear up troubles associated with tax tests.

Advisory on business Taxation Businesses frequently require professional advice on company taxation, worldwide taxation, and switch pricing. Tax experts manual organizations on structuring their financial transactions to acquire tax efficiency and compliance with nearby and global tax rules.

Taxation for people and Small groups Other than big corporations, tax experts also assist people and small commercial enterprise owners in dealing with personal and commercial enterprise taxes. They provide insights on earnings tax deductions, capital profits tax, and tax advantages for marketers.

Importance of Tax consultants within the financial sector

Ensuring Compliance with Tax legal guidelines Tax laws are complex and frequently changing. Non-compliance can bring about hefty consequences and prison consequences. Tax experts assist people and agencies stay compliant by means of retaining them up to date with modern tax regulations.

Saving Time and assets Taxation methods, consisting of documentation and return submission, may be time-consuming. Hiring a tax consultant lets companies and people to consciousness of middle sports whilst leaving tax-related matters to professionals.

Lowering Tax Liabilities Tax specialists examine financial facts to discover opportunities for tax financial savings. They help in structuring profits, investments, and prices in a tax-efficient manner.

Imparting expert financial recommendation Tax specialists paintings carefully with accountants, auditors, and monetary advisors to provide holistic economic making plan services. Many professionals decorate their expertise through an Accounting Course to serve their clients.

Supporting Startups and marketers Startups and small corporations often face tax-associated demanding situations due to restrained assets. Tax specialists help them in information tax incentives, deductions, and compliance requirements, ensuring smooth monetary operations.

How to end up a Tax consultant?

If you are inquisitive about becoming a tax representative, you can follow these steps:

Educational Qualification – A degree in accounting, finance, or commercial enterprise is beneficial.

Specialized Training – guides like the Taxation or a GST route in Kolkata offer sensible know-how and competencies required for tax consultancy.

Certifications and Licensing – obtaining certifications which include Chartered Accountant (CA), Certified Public Accountant (CPA), or a tax practitioner license can decorate professional prospects.

Gaining realistic revel in – operating with a tax consulting company or interning under a skilled tax consultant allows in building information.

Continuous learning – on the grounds that tax legal guidelines are dynamic, continuous getting to know and staying updated with tax guidelines are important.

Conclusion

The role of tax consultants is critical in today’s financial panorama. From tax planning and compliance to dispute decisions and advisory, tax specialists help individuals and companies control their tax affairs efficiently.

#accounting course in kolkata#taxation course#gst course#gst course in kolkata#accounting course#tally course#taxation course in kolkata

0 notes

Text

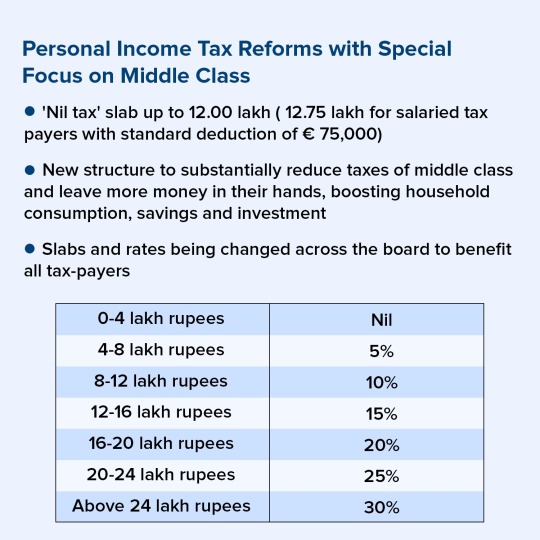

New Personal Income Tax Reforms: Major Relief for the Middle Class

The government has revised the earnings tax structure, reaping benefits middle-class taxpayers. Now, income up to ₹12 lakh is tax-unfastened, with lower tax rates for other brackets. those adjustments aim to boost savings, increase disposable income, and support economic boom. check out the new tax slabs!

A Taxation Course can help them who wants to know about Tax Laws

#accounting course in kolkata#taxation course#tally course#gst course in kolkata#taxation course in kolkata#gst course#union budget 2025#income tax

0 notes

Text

Using Tally for E-commerce businesses: A complete guide

E-commerce businesses need correct financial control and tax compliance in a fast-paced virtual global. Tally, a sturdy accounting and ERP software program, simplifies dealing with budget, GST compliance, and day by day operations. This manual, "using Tally for E-trade businesses: A comprehensive manual," explains how Tally can streamline and enhance your business approaches.

Why Tally is essential for E-commerce businesses

within the world of e-commerce, agencies deal with excessive transaction volumes, a couple of price gateways, and stringent compliance necessities. Tally simplifies those complexities with capabilities tailored for cutting-edge companies:

Green economic management: Tally automates bookkeeping tasks like invoicing, price tracking, and ledger management.

GST Compliance: The software program ensures correct goods and services Tax (GST) calculations, a critical element for Indian groups. It also enables submitting returns seamlessly.

Stock control: E-commerce platforms handle a significant variety of products, and Tally’s inventory control ensures smooth stock tracking.

Customizable reviews: Tally generates insightful reviews to help you make knowledgeable business choices.

By way of learning those features, entrepreneurs can streamline their accounting processes, lessen human errors, and cognizance on scaling their ventures. For the ones trying to dive deeper, enrolling in a Tally Course in Kolkata can provide the essential capabilities.

Key features of Tally for E-commerce

GST Integration E-trade companies should comply with GST policies, making Tally a useful tool. With its inbuilt GST module, Tally helps the subsequent:

Computerized GST calculations for income and purchases.

Simplified GST filing processes.

Reconciliation of GST returns.

Entrepreneurs can don't forget a GST Course in Kolkata to decorate their understanding of GST submitting and compliance.

Multi-location control E-commerce businesses often function across multiple places. Tally facilitates:

Centralized manipulate of budget for all locations.

Consolidated reporting and analysis.

Inter-branch stock switch monitoring.

payment Gateway Reconciliation Managing more than one charge gateways can emerge as cumbersome. Tally simplifies the method by way of:

Recording payments and receipts automatically.

Reconciling payment gateway money owed with bank statements.

Stock control

Efficient inventory control is crucial for e-commerce success. Tally’s functions include:

Actual-time stock degree updates.

Batch and expiry control for product categories.

Reorder level settings to save you stockouts.

Putting in place Tally for E-trade

To maximize Tally’s potential, proper configuration is vital. right here’s a step-through-step manual:

Step 1: installation Tally ERP 9 or Tally prime

Make sure you have got the modern version to get entry to superior capabilities. deploy and prompt the GST module for seamless compliance.

Step 2: Create a organization in Tally

Go to the principle menu and pick “Create organization.”

Input crucial information like agency call, address, and GSTIN.

Configure taxation settings for GST compliance.

Step 3: Installation inventory and inventory classes

Categorize products based totally on SKU, batch, or place.

Enter opening stock details for accurate inventory monitoring.

Step 4: Configure payment Gateways

Create ledger accounts for each fee gateway.

Map these debts to corresponding transactions for automated reconciliation.

Step 5: allow Multi-currency Transactions (if relevant)

For agencies managing international clients, spark off multi-forex aid to simplify overseas transactions.

Dealing with GST Compliance with Tally

One in every of Tally’s standout capabilities is its strong GST compliance module. here’s how e-commerce organizations can leverage it:

GST Registration and Configuration

Register your business below GST and update your GSTIN in Tally.

This allows seamless GST tracking for transactions.

Generate GST Invoices

Tally allows you to create GST-compliant invoices with the required information, along with:

HSN codes for merchandise.

Tax prices (CGST, SGST, IGST).

Opposite fee mechanism (if relevant).

record GST return

Use Tally’s GST go back filing feature to:

Generate GSTR-1, GSTR-3B, and different relevant paperwork.

Validate records to avoid errors throughout submission.

Add returns at once to the GST portal.

For the ones new to GST strategies, enrolling in a Taxation Course in Kolkata can help build foundational know-how.

Customizing reviews for higher Insights

Tally’s reporting abilities permit organizations to live beforehand inside the competitive e-commerce landscape. Key reviews include:

Income evaluation: discover excellent-selling products and seasonal traits.

Expense reports: music operational fees and optimize spending.

Earnings and Loss statement: advantage a clean photograph of monetary fitness.

To beautify your ability to research such reports, an Accounting course may be useful.

Integrating Tally with E-trade systems

Seamless integration between Tally and your e-commerce platform can store effort and time. popular strategies consist of:

API Integration

Use APIs to synchronize order information, inventory levels, and economic records between platforms like Shopify or WooCommerce and Tally.

third-birthday party Connectors

Cumerous equipment, consisting of Zapier, provide ready-made connectors to integrate Tally with e-trade structures.

guide information Import/Export

For smaller operations, exporting facts from the e-trade platform and uploading it into Tally is a practical answer.

Conclusion

Tally gives e-commerce corporations a effective toolkit to streamline operations, manipulate budget, and ensure compliance with GST guidelines. From stock management to charge gateway reconciliation, the software program addresses every important project faced with the aid of e-commerce entrepreneurs.

#accounting course in kolkata#taxation course#tally course#gst course#gst course in kolkata#taxation course in kolkata#accounting course#tally course in kolkata

0 notes

Text

Push Yourself to Success!

Your journey to greatness begins with a single step of determination, and nobody else will do it for you; take charge of your dreams and make them reality.

For more details visit: Ready Accountant

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course#success

0 notes

Text

A Comprehensive Guide to the GST Registration Process

GST registration process is an important milestone in India for business. It marks a crucial juncture under the Goods and Services Tax, or GST framework, that unifies a variety of indirect taxes. It has thus brought down a plethora of indirect taxes in a unified form all over the country. Therefore, be you an aspiring entrepreneur or a successful businessman, understanding this process becomes crucial.

This guide discusses the concept, importance, and process of GST registration and how training programs like Taxation, Tally, and GST Courses in Kolkata can enhance your financial acumen.

What is GST Registration?

GST registration is the process that recognizes a business as a taxable entity under the GST regime. It is mandatory for:

All businesses with more than ₹20 lakhs per annum turnover if the same turnover exceeds ₹10 lakhs per annum for any special category of states.

Inter-state supply

E-commerce businesses

Casual taxable person and non-resident taxable persons under GST

Aggrieved party in reverse charge mechanism

For GST registration after the completion, a GST identification number is received by the concern business and permits to collect taxes, input credit and return through GST. This article discusses reasons why GST is an important phenomenon.

Why Is GST Registration Required?

Here are the major reasons why registering for GST is important:

Legal Recognition: That business will be recognized as a legal supplier of goods or services.

Input Tax Credit: Will make the claiming of input tax credits possible without any hassle, with consequent reduction in tax.

Competitive Advantage: That compliance gains credibility with customers and partners.

Operational Ease: It helps to make interstate trading easy and also supports e-commerce. Failure to register when required can result in heavy penalties and legal repercussions, making compliance non-negotiable.

Step-by-Step Guide to GST Registration

Step 1: Prepare Required Documents Gather the following documents before initiating the registration:

PAN card of the business or proprietor.

Business registration proof (e.g., partnership deed, incorporation certificate).

Address proof of business premises (e.g., utility bill, rental agreement).

Bank account details (cancelled cheque, bank statement).

Proof of identity and address of the authorized signatory (Aadhaar, passport).

Digital signature for companies and LLPs (Class 2 or Class 3).

Step 2: Log on to the GST Portal

Go to the official GST portal at www.gst.gov.in and click on Services > Registration > New Registration.

Step 3: Fill Part A of the Application

Provide details such as:

Legal name and PAN of the business.

Email and mobile number for OTP verification.

A Temporary Reference Number (TRN) will be generated and sent through email and SMS.

Step 4: Log in Using TRN

Login with the TRN to fill up Part B of the application, which contains:

Business details such as trade name, type, and date of commencement.

Head and branch/branches. Details of goods or services supplied. Authorized signatory details.

Step 5: Upload Necessary Documents Ensuring scanned copies of all the documents are clean and correct will avoid delay in processing.

Step 6: Verification and Submission Submit application through EVC or digital signature.

Step 7: Processing of Application The application will be vetted by GST officials. After approval, they will give a GSTIN and a copy of the registration certificate. In case of any discrepancies, clarification will be sought.

An Accounting course in Kolkata also Beneficial.

Common Challenges in GST Registration

Despite how easy the process is, some common areas of common challenges are found as:

Incorrect or incomplete documents.

Key entry errors.

Slowly verification process. To overcome these challenges, consider enrolling in specialized courses like GST or a Taxation Courses in Kolkata, which provide comprehensive insights into GST compliance and related practices.

Tips for a Hassle-Free GST Registration

Ensure Document Accuracy: Double-check all details and ensure consistency.

Maintain Clear Records: Accurate records simplify compliance and audits.

Contact a tax consultant or GST consultant for some professional guidance.

Make the Best Use of Technology: Make use of Tally, thereby automating GST procedures. Take up a course in Tally and become proficient in using the tool.

Conclusion

Understanding the GST registration process is very important for any business that operates within the GST framework of India. Thorough preparation and resource utilization, such as professional training courses, will ensure smooth compliance and avoid pitfalls.

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Top Benefits of Taking an Accounting and Taxation Course for Business Organizations

Today, in the fast-paced world, managing finances is the backbone of any business. Mastering accounting principles and tax regulations forms a significant part of this. An accounting and taxation course provides individuals with the necessary money management skills but equips businesses with the tools to enhance growth, ensure compliance, and streamline operations.

Better Financial Management

It would be important for a business to have a good foundation in accounting. Accounting and taxation course in Kolkata help entrepreneurs and professionals build a comprehensive knowledge of accounting principles, tax laws, and regulatory frameworks. This knowledge enables businesses to:

Manage financial transactions accurately.

Prepare detailed financial reports and statements.

Create and forecast budgets to support strategic decision-making.

For businesses operating in metro cities like Kolkata, enrolling in a taxation course offers region-specific insights into local tax laws and compliance practices, giving them a competitive edge.

Ensuring Tax Compliance

Tax compliance with any business is out of the question. Failure to comply will attract punitive measures and legal hassle. A taxation and accounting course gives businesses headway over their tax responsibility by learning about:

GST filling procedures and time limits.

Direct and indirect tax compliance: corporate taxes, VAT, customs duties, etc.

Specific GST course in Kolkata instruct businesses on how to register for GST, how to file returns, and reconcile tax data accurately so that businesses are fully compliant and do not pay fines that could have been avoided.

Strategic Planning

Financial information is an integral part of strategy. When armed with good knowledge of accounting and taxation, the business leader will be able to:

Analyze financial reports to assess profitability.

Identify cost-saving opportunities and optimize budgets.

Plan for future growth based on reliable financial forecasts.

Courses like advanced accounting programs equip professionals with tools to interpret financial statements and key performance indicators, enabling data-driven decision-making.

Reducing Costs Through In-House Expertise

Normally, small and medium enterprises outsource financial management as it is costly to hire external consultants. In-house skills can be developed by teaching the employees accounting applications like Tally ERP or Tally Prime that can help them perform routine items within an organization and reduce dependency on external services and hence save in the long term.

Accurate GST Reconciliation

GST is a pillar of the Indian taxation system and accurate reconciliation of returns is an essential part of it. The accounting and taxation courses give detailed step-by-step instructions to follow:

File GSTR-1 and GSTR-3B correctly. Do GST reconciliation in Tally Prime for the correct match of purchase and sales data Find out discrepancies and rectify to avoid penalties

Career Advancement

For individuals, accounting and taxation can help them gain entry into high-paying jobs like tax consultants, accountants, and finance managers. Businesses can also benefit by having in-house professionals who manage finances, hence reducing the use of external consultants and ensuring that finances are managed on time.

Streamlined Payroll Management Payroll is one of the most demanding functions in a business, regardless of the business's size. Knowledge of accounting and taxation leads professionals to handle payroll processes with utmost ease. Such examples include computing salaries, deductions, and tax obligations, ensuring compliance with TDS, PF, and other statutory contributions, as well as generating payslips and maintaining accurate records.

Why an Accounting and Taxation Course is Necessary

An accounting and taxation course benefits more than just compliance and financial control. It is invaluable for the following reason:

Deeper understanding of tax laws and procedures for an effective meeting of legal obligations

Open new avenues such as tax consultant, GST practitioner, or financial analyst with a well-known certification

Gain practical skills to file GST returns, compute TDS, and handle income tax filings with utmost confidence

Improve decisions on financial planning, budgeting, and cost optimization.

Global Relevance: Taxation principles are universally applicable, enabling professionals to work with multinational companies.

Technological Proficiency: Learn to use tools like Tally ERP and SAP, ensuring readiness for tech-driven roles.

Professional Credibility: Certification showcases your expertise and boosts your reputation in the field.

Support for Entrepreneur: Gain insights into tax structures and compliance to optimize financial strategies for your business.

Conclusion

This is a strategic decision to invest in an accounting and taxation course, both for businesses and individuals alike. Be it mastering payroll, exploiting accounting software, or achieving perfect tax compliance, the skills one gains are priceless in the current financial context. With these courses amalgamating theoretical knowledge with practical application, it equips businesses and professionals to face the complexities of finance as a part of daily life without any challenges.

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Focus on the Present, Build Your Future

Don't let future uncertainties stop you. Begin by doing little things today that will eventually lead you to your dreams. Here at Ready Accountant, we help lead you in the first steps of a bright accounting career. 🌟

For more details visit: https://readyaccountant.com/

#accounting course in kolkata#taxation course#gst course#tally course#taxation course in kolkata#gst course in kolkata#accounting course

0 notes

Text

Master 'Income from Other Sources' with Expert Guidance!

Join CA Abhinit Singh, with over 20 years of experience, as he makes this critical tax concept easy to understand in an exclusive video by Ready Accountant.

📌 What you'll learn:

✔️ The various types of income that fall under 'Other Sources'

✔️ Key exemptions and deductions you can claim

✔️ Pro tips to file your taxes with confidence

🎥 Watch our full video now: https://youtu.be/_cpKJH_k5kI

Ready to take control of your finances? Watch now and level up your tax knowledge!

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#income tax course#Accounting and Taxation

0 notes

Text

To 2025! Hope, growth, and endless opportunities, here's to this year! Strength to face the challenges, wisdom to make great choices, and drive to achieve dreams. Let's make 2025 a year of success, joy, and unforgettable moments!

For more details visit: https://readyaccountant.com/

#accounting course in kolkata#taxation course#tally course#gst course#taxation course in kolkata#gst course in kolkata#accounting course#happy new year

1 note

·

View note

Text

Unlock Success in Corporate Accounting:

India's most demanding accounting course with Top MNC Hands-On-Experience in GST, Income Tax, Audit, Finance, and More!

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Key Methods for Business Valuation

Find out the most commonly used methods to determine the value of a business. From the Income Approach to Market and Cost Approaches, each method provides unique insights into deriving value.

For more visit: Ready Accountant

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Most Popular Balance Sheet Items:

Explore the very core of the balance sheet! This list breaks up key assets, liabilities, and equity- current assets like cash and inventories, prepaid expenses, and fixed assets- property, intangible assets, etc. Also liabilities such as accounts payable, long-term debt, etc. All this makes it ideal for finance buffs and budding accountants to nail the fundamentals of financial statements.

For more details visit: https://readyaccountant.com/

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Differences between Financial, Cost and Management Accounting:

Clarify how financial, cost, and management accounting differ in terms of purpose, nature, principles, and data usage. To a student or even an individual in practice, it will help you to identify the basic characteristics of the different types of accountancy.

For more details visit: https://readyaccountant.com/

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Differences Between Tally Prime and Tally ERP 9

Discover the advancements in Tally Prime compared to Tally ERP 9. From global shortcuts to optimized invoicing, Tally Prime brings enhanced features for better productivity and ease of use. Explore the upgrades and streamline your accounting processes!

For more details visit: https://readyaccountant.com/

#taxation course#accounting course in kolkata#tally course#gst course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes

Text

Master Accounting, Taxation, GST & TallyPrime for Success!

Why Choose Us? 80% Practical + 20% Theory Training Real-life Projects & Hands-on Experience Expertise in Accounting Course, GST Course, Taxation course & More 100% Placement Assistance 💼 Industry-recognized Certifications

Duration: Flexible weekly and weekend classes to build strong practical skills. Start your journey in accounting, finance, or taxation and upgrade your career today! 🚀

For more details visit: Ready Accountant

#accounting course in kolkata#taxation course#gst course#tally course#gst course in kolkata#taxation course in kolkata#accounting course

0 notes