Don't wanna be here? Send us removal request.

Text

Mastering the Canadian Job Market: Strategies for International Students in 2023

International Students in Canada

For international students, navigating the Canadian labour market may present difficulties. Some of the challenges that international students may encounter are the scarcity of jobs in desired fields, language barriers, lack of entry-level jobs, unfamiliarity with the Canadian job market, work visa restrictions, cultural differences and workplace etiquette, networking challenges, and competition for internship and co-op opportunities. Nonetheless, there exist tactics that international students may employ to surmount these challenges and thrive in the Canadian labor market.

The following extra strategies can also be used by international students to successfully negotiate the Canadian employment market:

Acquire Canadian Work Experience: Through co-ops, internships, and volunteer work, international students can obtain Canadian work experience. Employers may find them more appealing if they utilise this to improve their abilities and resume.

Personalize Cover Letters and Resumes: Candidates from outside Canada should adapt their cover letters and resumes to the demands of the Canadian employment market. This entails adhering to cover letter and resume norms, highlighting relevant experiences and abilities, and using proper language and spelling throughout.

International students make less money after graduation than their Canadian-born peers, despite the fact that they are more likely than their domestic counterparts to have obtained advanced degrees, such as a master's or doctorate, which are typically associated with higher earnings. This information comes from a 2019 Statistics Canada report. These findings highlight the need for organized, focused services for international students, particularly as they represent a significant talent pool for the Canadian workforce and are essential to the long-term sustainability of postsecondary enrolment. International students are also a major component of Canada's immigration strategy; of these, more than half with a master's degree and over a third with a bachelor's degree become permanent citizens within 10 years after.

The COVID-19 pandemic and the recession that followed have made the work market more competitive. Trends in the labour market have also brought attention to the need for recent international graduates to assess career opportunities based on their broader skills and competencies rather than just their major and location. Workplaces and new career pathways are emerging quickly, often even more quickly than higher education institutions can design curriculum. Young graduates need to be able to use their skills across a range of emerging industries in order to succeed in the employment market. Foreign graduates with the adaptability and commitment to lifelong learning will be able to retrain and upskill as needed to fit the demands of the job market.

By utilizing campus resources, honing their language skills, speaking with career advisors, researching internship and co-op opportunities, joining professional associations, gaining Canadian work experience, tailoring cover letters and resumes, networking online, attending job fairs, and considering starting a business, international students can increase their chances of success in the Canadian job market. If international students are persistent, well-prepared, and have the right support, they may embark on a rewarding journey to gain valuable work experience in Canada.

0 notes

Text

Navigating Economic Storms: Understanding and Responding to Recession in Canada

Introduction:

In the complicated world of economics, recessions are like storms on the horizon, affecting the financial well-being of people and the stability of organizations. In this blog post, we can delve into the intricacies of recession in the context of Canada, analyzing its reasons, effects, and techniques for weathering the monetary downturn.

Defining Recession in Canada:

A recession is a considerable decline in monetary pastime that lasts for an extended period. In Canada, that is measured by the valuable resource of consecutive quarters of a bad GDP boom. This economic contraction can cause mission losses, decreased client spending, and a stylish experience of financial lack of confidence.

The Causes of Recession:

An aggregate of domestic and international elements frequently brings about recessions. In Canada, shifts in global alternate patterns, fluctuations in commodity costs, and modifications in monetary policies all play a role. For instance, the 2008 financial catastrophe was driven by an international credit rating crunch reverberating through the Canadian economy. In 2023, researchers at Deloitte are among a developing chorus of economists, which consists of those at the most significant Canadian banks, watching for the monetary gadget to be successful. This is due to a mixture of things, which include the continued COVID-19 pandemic, delivery chain disruptions, and hard work shortages.

Impacts on Various Sectors:

Different sectors revel in recessions through several strategies. While industries like manufacturing and production can also face declines in production and layoffs, company-oriented sectors like healthcare and schooling will be inclined to be more resilient. For example, at some point in the 2008 recession, the housing market in Canada experienced a significant downturn, impacting the development of the organization and associated offerings. In 2023, the tight labor market and high costs can result in a profit-inflation spiral.

Government Responses and Interventions:

In reaction to recessions, governments implement several rules to stimulate financial growth and stability. These measures can encompass modifications to hobby expenses, financial stimulus applications, and targeted investments in key industries. For example, during the COVID-19 pandemic, the Canadian authorities delivered sizeable economic resource packages to guide humans and groups. In 2023, the government may want to position comparable measures to guide the financial system.

Challenges and Opportunities for Individuals and Businesses:

For human beings, recessions can supply pastime uncertainty and monetary stress. Building a diverse capacity set and preserving a solid financial plan can help mitigate economic storms. As an alternative, businesses may additionally need to pivot their strategies, innovate, and find new markets to continue existing and thriving. In 2023, companies will also need to focus on supply chain resilience and complex paintings for improvement to stay competitive.

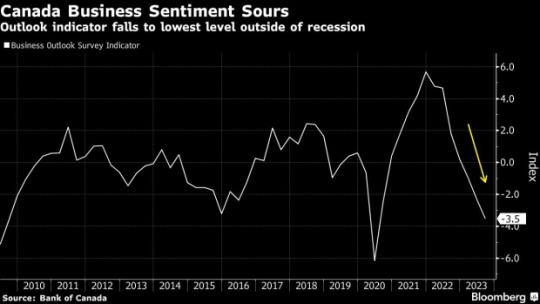

Canadian business sentiment has hit its lowest point since the 2020 Covid recession, as in line with Bank of Canada surveys. The statistics exhibits that while economic interest has slowed throughout numerous indicators, both firms and clients maintain to assume excessive inflation. Despite the slowdown, businesses are making plans greater frequent and considerable charge will increase, although hiring expectations have dipped. On the customer front, the exertions market remains considered definitely, with document-excessive expectations for salary increase. However, there's a excellent discrepancy between their perception of inflation and real figures. This standard decline in sentiment points closer to a deteriorating economic outlook, doubtlessly influencing the relevant bank's choice to maintain interest prices. The business outlook indicator fell for the 7th consecutive zone, signaling worries about slower sales increase and destiny projections. Firms also are reevaluating hiring and capital expenditure plans. The venture for policymakers lies in adjusting inflation expectations amid a cooling economy. Although corporations fear about income call for and credit, issues approximately price pressures and deliver chains are waning. Many believe that better quotes will hinder income and investments within the subsequent 12 months, and anticipate accomplishing the 2% inflation target will take longer than three years. For customers, perceptions of contemporary inflation continue to be excessive, with expectations for destiny inflation also improved. Higher fees are impacting foremost purchases, leading to a preference for discretionary spending. The Bank of Canada has maintained a consistent interest charge of five% however leaves the door open for capacity tightening inside the destiny. The next fee statement is scheduled for October twenty fifth, with September inflation information due on Tuesday.

Global Context and Interconnectedness:

Canada's monetary system is intricately related to the worldwide marketplace. Events like change tensions, geopolitical conflicts, and forex fluctuations have a proper effect on the Canadian economic machine. Recognizing those connections is essential for understanding the entire scope of a recession in Canada. In 2023, the continuing worldwide pandemic and delivery chain disruptions may also significantly impact the Canadian economy.

Conclusion:

As we navigate the complexities of a recession in Canada, staying knowledgeable and proactive is critical. By understanding the reasons, influences, and functionality techniques, individuals and groups can better prepare for financially demanding situations. Remember, even as recessions may supply turbulence, they also present model, boom, and resilience possibilities. In 2023, it's critical to stay vigilant and take proactive steps to weather the economic crisis.

2 notes

·

View notes