Text

What is dr-fee? A must use tool for crypto traders!

At dr-fee, we developed a fully automated trading fee analysis for crypto traders. In just 1-click, traders are able to see how much fees they would pay at all the major crypto exchanges based on their actual trades. Mostly underestimated, trading fees are very high in crypto!

No, we do not just show you some fee tables; we actually calculate your fees based on your trading volume, holdings & balance, and the type of trades you did (spot vs. futures & maker vs. taker).

How do we do that? We derive the tier level you would fall into at each of the exchanges, and multiply your spot & futures volumes (split in maker & taker) with the respective fees in that tier level. We do that for all the exchanges and present you detailed analysis.

See an example output below for a trader with $2m monthly spot volume, $50k balance, and $5k holding in the native exchange token (as of Nov’22).

Why is it important? There are 15 big exchanges, each having roughly 10 tier levels. Tier levels mostly have multiple requirements of volume, balance & holding. Each tier level has 4–6 fees (spot maker, spot taker, futures maker, and future taker (split in coin-m & usd-m)). You see, thousands of combinations are possible.

Are the differences big? YES!!! They are huge! It might not look like it as the fees seem like small percentage numbers, however we oftentimes see saving potentials of 50–90% of fees from one exchange to another. We are only talking about the large crypto exchanges here and not some small exchanges with low volumes.

So which exchange is the cheapest? That is completely individual for each trader. It is impossible to make a general statement here, hence the individual analysis is so important. We did the test, out of the Top15 exchanges, 10 can be the cheapest depending on your volumes, balance, holding, and type of products you trade. For you it might be cheapest at Binance, however your friend would pay 3x as much at Binance compared to if he/she would be trading at Kraken. The same applies to KuCoin, ByBit, Cryptocom, Coinbase, Bitfinex, MEXC, OKX, … you name them.

Aren’t trading fees neglectable overall? Absolutely NOT! If you are a fairly active trader, fees make up 30, 50, 100+% of your annual trading performance (daytrader). For a scalping trader even more, for a swing trader less.

Example: KuCoin, Futures trader with 100x leverage, risking only 1% per trade, 5 trades a day, market orders only, $50k balance. Average trade size is $50k USD (1% movement in underlying is 1% profit or loss), hence $100k for open & close, 5x times a day, 20 days a month = 10,000,000 USD volume. A typical daytrader with a 50k USD account. What are the fees? 0.06% in that tier level at KuCoin, looks not much, but in absolute terms this is $6,000 a month or $72,000 a year. In other terms, the trader has to make a profit of 144% per year just to break even in fees! Hint, the trader could have paid much less, and KuCoin is not a bad place to trade futures for some traders :)

Okok, so how can I check my fees & saving potential? It’s actually super easy. There are 2 ways:

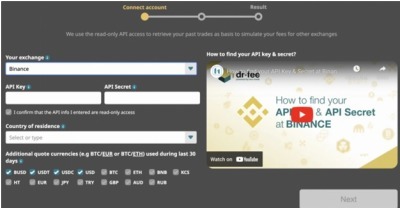

1) You just connect your exchange account through a read-only API and we read all the required info from your account. 1 minute later, you have the result.

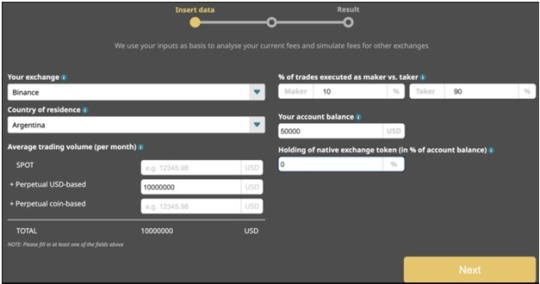

2) You type in your trading volumes, balance, holding, % maker trades yourself, and within a couple of seconds you have the final result.

That’s it! If you have made it until here, thank you for reading!

Way too few people know about the huge differences in fees and the potential savings. So please share this article and dr-fee with your friends.

Here is the link if you want to try dr-fee yourself https://dr-fee.com.

To know more about Crypto Trading Fees at dr-fee.com.

0 notes