Unlock Your Trading Potential with EagleAifx! Our cutting-edge Auto Trading and Copy Trade services are here to revolutionize the way you trade Forex. Whether you're a beginner or an expert, success is just a click away. Join us now and elevate your trading Official Webiste : https://eagleaifx.com

Don't wanna be here? Send us removal request.

Text

Best Forex Signal Provider Selection Guides

Introduction to Forex Trading and Signal Providers Understanding Forex SignalsDefinition and Types of Forex Signals How Forex Signals are Generated Reading and Interpreting Forex Signals Importance of Timeliness and Accuracy Combining Signals with Personal Analysis The Role of Signal Providers in Forex Trading Criteria for Choosing the Right Provider Risks and Pitfalls Case Studies and Testimonials Tools and Resources for Research Further Reading and Resources Conclusion

Introduction to Forex Trading and Signal Providers

Forex trading, a global marketplace for exchanging national currencies, is one of the largest and most active trading markets in the world. As the market is complex and volatile, many traders rely on Forex signal providers. These providers offer suggestions on when to buy or sell currency pairs, based on analysis or algorithms, aiming to maximize profits and minimize risks.

Understanding Forex Signals

Forex signals are essentially trade ideas indicating the market trends in real time. They are either generated manually by experienced traders or automatically through algorithms and trading robots. The choice between manual and automated signals, free or subscription-based services, depends on individual preferences and trading style. Individual can choose follow the forex signal as copy trade or join the PAMM like how vantage markets offer PAMM technology to the users. Definition and Types of Forex Signals - What Are Forex Signals? Forex signals are trading suggestions that indicate ideal entry and exit points in the currency market. These signals specify a particular currency pair, and suggest a direction to buy (long) or sell (short), often including specific prices for stop-losses and take-profits. - Types of Signals: - Manual vs. Automated: Manual signals are generated by experienced traders or analysts who study the market and make judgments. Automated signals are produced by algorithms and trading robots based on pre-set parameters. - Paid vs. Free: While some providers offer free signals, paid services are often more comprehensive, offering additional analysis and support.

How Forex Signals are Generated

- Technical Analysis: This involves analyzing past market data, charts, and statistical trends to predict future price movements. Common indicators used include moving averages, Bollinger bands, and Fibonacci retracements. - Fundamental Analysis: This focuses on external factors like economic indicators, central bank decisions, political events, and news that can impact currency values. - Sentiment Analysis: Some providers also consider market sentiment, gauging how other traders are positioned in the market, which can be a counter-indicator at times.

Reading and Interpreting Forex Signals A typical Forex signal might read: - Buy EUR/USD @ 1.1800 - SL (Stop Loss): 1.1750 - TP (Take Profit): 1.1900 Here's how to interpret it: - Action: Buy EUR/USD. - Entry Point: Enter the trade at 1.1800. - Stop Loss: Set a stop loss at 1.1750 to limit potential losses. - Take Profit: Set a take profit at 1.1900 to secure profits. Importance of Timeliness and Accuracy - Timeliness: Forex markets move quickly. Delayed signals can lead to missed opportunities or entering trades at less favorable prices. - Accuracy: The reliability of a signal depends on its accuracy over time. Traders should track the performance of signals to gauge their effectiveness. Combining Signals with Personal Analysis - Balancing Signals with Strategy: Traders should use signals as a supplement to, not a replacement for, their own market analysis and trading strategy. - Adapting to Market Changes: Signals are based on past and current market conditions, which can change rapidly. Traders need to be adaptable and ready to reassess their positions.

The Role of Signal Providers in Forex Trading

Signal providers play a crucial role in Forex trading. They can save time and effort in market analysis, provide expert insights, and assist in effective risk management. However, the reliance on signal providers should be balanced with personal judgment and a robust trading strategy.Forex signal providers offer a crucial service in the world of currency trading. Here's a more detailed look: - Expert Analysis and Time Efficiency: Signal providers often have teams of experts or sophisticated algorithms that analyze market trends, economic data, and political events that influence currency movements. This analysis can save traders hours of research time. - Diverse Strategies and Approaches: Different providers may focus on various trading strategies (like scalping, swing trading, or long-term investing), allowing traders to choose a service that aligns with their personal trading style. - Risk Management: Good signal providers not only suggest entry and exit points but also advise on risk management strategies, such as setting stop-loss orders to protect against market volatility. - Educational Value: Some providers also offer educational resources, helping traders understand the rationale behind each signal, which can be invaluable for developing trading skills.

Criteria for Choosing the Right Provider

Selecting the right Forex signal provider is pivotal. Key factors include: - Accuracy and Reliability: Track the provider's performance history for accuracy in signals. - Track Record: A consistent and transparent track record is a sign of reliability. - Regulatory Compliance: Ensure the provider adheres to regulatory standards. - Cost: Consider the cost in relation to the service quality and potential ROI. - Reputation: Seek feedback from other traders and industry reviews. - Performance Metrics: Look for providers that offer transparent and verifiable performance metrics. This includes win rates, average profit per trade, and historical performance under varying market conditions. - Customization and Control: Some providers offer customizable signals based on your risk tolerance, trading style, and currency preferences. This level of customization can be a significant advantage. - Support and Communication: Reliable providers offer excellent customer support and clear communication channels, ensuring that traders can get assistance and clarification when needed. - Integration with Trading Platforms: Many traders prefer signals that can be directly integrated into their trading platforms for ease of use and quick execution, choose only regulated and best forex brokers to start. - Trial Periods and Reviews: Free trials or money-back guarantees can be a sign of confidence in the service. Also, independent reviews and testimonials can provide insights into the provider's reliability and performance.

Risks and Pitfalls

Despite their benefits, reliance on signal providers carries risks. Misleading signals, over-reliance without understanding the market, and scams are prevalent. Traders should be cautious, conduct thorough research, and never invest more than they can afford to lose. While Forex signal providers can be valuable, they come with inherent risks: - False Promises: Beware of providers promising guaranteed returns. The Forex market is unpredictable, and no provider can guarantee profits. - Dependency: Over-reliance on signals can hinder the development of your own trading skills and market understanding. - Signal Quality: Not all signals are created equal. Some might be based on flawed analysis or outdated information. - Market Volatility: Even accurate signals can fail due to sudden market shifts or unforeseen events, highlighting the importance of personal risk management. - Scams: The Forex market is ripe with scams, including fraudulent signal providers. It’s crucial to conduct thorough research and choose providers with a good track record and transparent practices.

Case Studies and Testimonials

Incorporating case studies of both successful and unsuccessful Forex trading experiences can provide practical insights. Testimonials from seasoned traders can also offer valuable lessons and tips.

Tools and Resources for Research

To aid in choosing a signal provider, utilize tools like comparative analysis software, financial news aggregators, and community forums. These resources can offer comprehensive insights and aid in making an informed decision.

Further Reading and Resources

For those keen to explore further, numerous resources are available online, including educational websites, trading courses, and webinars. These can provide deeper insights into Forex trading and how to effectively leverage signal providers.

Conclusion

The right Forex signal provider can be a valuable asset in navigating the Forex market. However, it’s crucial to undertake due diligence, understand the market, and maintain a balanced approach to trading. While signal providers offer significant advantages, they are not a substitute for personal expertise and a well-structured trading strategy. Read the full article

0 notes

Text

Auto Trading vs. Manual Trading

Introduction

In the world of forex trading, there are two primary methods that traders can use to execute their trades: auto trading and manual trading. Auto trading, also known as algorithmic trading or automated trading, involves the use of computer programs or algorithms to execute trades on behalf of the trader. On the other hand, manual trading requires the trader to make all trading decisions and execute trades manually. In this article, we will explore the pros and cons of both auto trading and manual trading, and discuss which method may be more efficient for forex trading.

Comparative Analysis of Auto Trading Versus Manual Trading

In the dynamic world of Forex trading, investors and traders often grapple with the decision between using automated trading systems (auto trading) and sticking to traditional manual trading methods. Each approach offers distinct advantages and challenges. In this analysis, we will explore the differences between auto trading and manual trading, focusing on efficiency, effectiveness, and suitability for different types of traders.

Definition and Basic Concepts

Auto Trading refers to the use of algorithms and software programs to execute trades in the Forex market. These systems are designed to analyze market data and execute trades based on pre-established criteria without human intervention. Manual Trading, on the other hand, involves the trader making all trading decisions based on their analysis of the market. This method requires a significant amount of time, attention, and experience to effectively monitor and respond to market movements.

Auto Trading

Auto trading has gained popularity in recent years due to advancements in technology and the availability of sophisticated trading software. One of the key advantages of auto trading is its ability to execute trades with speed and precision. Trading algorithms can analyze market conditions and execute trades within milliseconds, which can be crucial in fast-moving markets. This speed can help traders take advantage of short-term trading opportunities and reduce the risk of missing out on profitable trades.

Advantages of Auto Trading

- Efficiency: Auto trading systems can process vast amounts of data and execute trades much faster than a human can. They are particularly useful in volatile markets where speed is crucial. - Emotion-Free Trading: Automated systems operate based on pre-set rules and algorithms, eliminating the emotional biases that often affect manual traders. This can lead to more rational decision-making. - Backtesting Capability: Before being deployed, auto trading systems can be tested on historical data to refine strategies and increase their effectiveness in real market conditions. Another advantage of auto trading is its ability to remove emotional bias from trading decisions. Emotions such as fear and greed can often cloud judgment and lead to poor trading decisions. By automating the trading process, traders can eliminate the influence of emotions and stick to a predefined set of rules or strategies. This can help improve consistency and discipline in trading.

Challenges of Auto Trading

- System Failures: Automated trading systems are vulnerable to technical glitches and require constant monitoring to ensure smooth operation. - Market Anomalies: Auto trading systems can perform poorly in unexpected market conditions or during major news events that they haven’t been programmed to handle. - Over-Optimization: There is a risk of creating an over-optimized system that performs well on historical data but fails in live trading. Auto trading also allows traders to backtest their strategies using historical data. By simulating trades on past market conditions, traders can evaluate the performance of their strategies and make necessary adjustments before risking real capital. This can help traders identify and eliminate potential flaws in their strategies, leading to more profitable trading.

Manual Trading

While auto trading offers many advantages, manual trading still has its place in the forex market. One of the key advantages of manual trading is the ability to adapt to changing market conditions. Traders who manually execute trades can quickly respond to news events or market fluctuations and adjust their strategies accordingly. This flexibility can be particularly beneficial in volatile markets where automated algorithms may struggle to adapt. Advantages of Manual Trading - Flexibility and Control: Manual traders have complete control over their trading decisions and can adjust their strategies based on market conditions and new information, something automated systems might miss. - Intuition and Experience: Experienced traders can use their intuition and understanding of nuanced market dynamics, which are often difficult for automated systems to interpret. - Adaptability to Market Changes: Human traders can recognize and react to market events and news that might not be immediately integrated into automated systems. Manual trading also allows traders to rely on their own judgment and intuition. Experienced traders who have developed a deep understanding of the market may be able to identify trading opportunities that automated algorithms may overlook. Additionally, manual trading allows for more discretion in trade execution, which can be beneficial in certain situations where market conditions are not ideal for automated trading.

Challenges of Manual Trading

- Emotional Trading: One of the biggest downsides of manual trading is the potential for emotional trading decisions that can lead to inconsistent trading performance. - Time-Consuming: Manual trading requires a significant amount of time spent analyzing the market, which can be a constraint for those who cannot dedicate full-time hours. - Skill Dependent: The success of manual trading heavily relies on the trader’s skills and experience, which can vary widely among individuals. Furthermore, manual trading allows traders to have a better understanding of the market and the factors that influence price movements. By actively engaging in the trading process, traders can develop a deeper knowledge of market dynamics and enhance their trading skills over time. This can lead to better decision-making and potentially higher profits in the long run.

Comparative Analysis

When comparing both methods, it becomes clear that auto trading is generally better suited for traders who prefer a systematic approach to the market, value efficiency, and consistency, and are less inclined to day-to-day market analysis. On the other hand, manual trading is more appropriate for those who enjoy the hands-on process, can commit the necessary time, and have the experience to interpret and react to market changes effectively.

Conclusion

In conclusion, both auto trading and manual trading have their advantages and disadvantages. Auto trading offers speed, precision, and the ability to remove emotional bias from trading decisions. It also allows for backtesting and can be particularly beneficial for traders who prefer a systematic approach. Neither method is inherently superior to the other; it ultimately depends on the trader’s strategy, goals, personality, and market conditions. For many, a combination of both strategies might be the best approach, allowing for the efficiency and data-driven nature of auto trading complemented by the flexibility and adaptability of manual trading. On the other hand, manual trading offers flexibility, adaptability, and the opportunity to rely on personal judgment and intuition. It allows traders to better understand the market and potentially identify unique trading opportunities. Ultimately, the choice between auto trading and manual trading depends on individual preferences and trading goals. Some traders may prefer the efficiency and consistency of auto trading, while others may enjoy the flexibility and discretion of manual trading. It is important for traders to carefully consider their own trading style, risk tolerance, and level of expertise before deciding which method to use. Read the full article

0 notes

Text

How To Making Money Online with Forex Trading and Affiliate Programs

Introduction

In the digital age, opportunities to make money online have expanded, and among these, forex trading stands out as a lucrative option. Whether you're looking to directly engage in forex trading or earn through associated channels like forex affiliate programs, forex copy trade, or forex PAMM accounts, the forex market offers multiple avenues to consider. This article explores the different ways to make money online with forex, helping you find the right path that aligns with your financial goals and expertise level.

What is Forex Trading?

Forex trading involves buying and selling currencies on the global market with the aim to profit from fluctuating exchange rates. As the largest financial market globally, forex provides high liquidity and operates 24 hours a day during weekdays, offering flexibility to traders who want to make money from home. Successful forex trading requires understanding market trends, global economic factors, and technical analysis.Forex trading and forex affiliate programs are two popular ways to make money online. Forex trading involves buying and selling currencies in the foreign exchange market, while forex affiliate programs allow individuals to earn commissions by referring new clients to forex brokers. In this article, we will explore the various ways to make money online with forex trading and forex affiliate programs.

Methods to Earn Money Online with Forex 1. Forex Trading

Engaging directly in forex trading is the most straightforward way to earn money in the forex market. It involves setting up a trading account, and with platforms like MetaTrader 4 or 5, traders can start with a relatively small capital. For beginners, it’s advisable to start with a demo account to practice trading strategies without financial risk. Forex trading offers individuals the opportunity to make money online by speculating on the price movements of different currency pairs. Here are a few ways to make money through forex trading: 1.1 Spot Trading Spot trading is the most common form of forex trading. It involves buying and selling currency pairs at the current market price. Traders can profit from the fluctuations in exchange rates by correctly predicting the direction of the market. 1.2 Forex Options Forex options give traders the right, but not the obligation, to buy or sell currency pairs at a predetermined price within a specific time frame. This allows traders to profit from both rising and falling markets. 1.3 Forex Futures Forex futures contracts are agreements to buy or sell a specific amount of a currency pair at a future date and price. Traders can speculate on the future price movements of currency pairs and profit from the price difference.

2. Forex Affiliate Programs

Forex Affiliate Programs Joining a forex affiliate program is another way to make money online without trading. In this model, you promote a forex broker's services on your website or blog and earn commissions when referrals sign up and trade with the broker, research on the top best forex broker online to pick your favorite one. This method suits those who have a strong online presence and are skilled in digital marketing. Forex affiliate programs provide individuals with the opportunity to earn money by referring new clients to forex brokers. Here are a few ways to make money through forex affiliate programs:2.1 Referral CommissionsForex affiliate programs typically offer referral commissions for each new client referred. The commission can be a fixed amount or a percentage of the client's trading volume. The more clients you refer, the more money you can earn. 2.2 Revenue Sharing Some forex affiliate programs offer revenue sharing models, where affiliates earn a percentage of the broker's revenue generated by the referred clients. This can be a lucrative way to make money online, especially if you refer high-volume traders. 2.3 Sub-Affiliate Commissions Forex affiliate programs often allow affiliates to refer other affiliates. As a sub-affiliate, you can earn commissions on the referred affiliates' earnings. This creates an additional income stream and can significantly increase your earnings.

3. Forex Copy Trade

For those who lack the time or expertise to trade directly, forex copy trade services offer a viable alternative. By copying the trades of experienced traders, users can benefit from the knowledge of seasoned professionals. This method is excellent for beginners who want to learn trading strategies while potentially earning money.

4. Forex PAMM Accounts

Forex PAMM (Percentage Allocation Management Module) accounts allow traders to earn money by managing the funds of other investors. In this arrangement, an experienced trader gathers capital from multiple investors into a pooled money account and trades on their behalf. Profits and losses are then shared proportionally among the investors according to their share in the pool.

5. Combining Forex Trading and Affiliate Marketing

For individuals looking to maximize their earnings, combining forex trading and affiliate marketing can be a powerful strategy. By becoming a successful forex trader, you can attract potential clients and refer them to your chosen forex broker, earning both trading profits and affiliate commissions.Furthermore, establishing yourself as a knowledgeable and trustworthy trader can help you build a loyal following and increase your chances of success in affiliate marketing. By providing valuable content, educational resources, and trading signals, you can attract a larger audience and increase your referral potential.

Tips for Succeeding in Forex

- Educate Yourself: Continuous learning about forex markets is crucial. Resources like books, courses, and webinars can provide valuable insights. - Start Small: When beginning, it’s wise to trade small amounts to mitigate risks. - Use Technological Tools: Leverage trading tools and platforms for better decision-making. - Stay Updated: Keep abreast of global economic news as forex is highly sensitive to global economic events.

Conclusion

Forex trading and forex affiliate programs offer individuals multiple ways to make money online. Whether you choose to become a forex trader or an affiliate marketer, it is essential to educate yourself, develop a solid strategy, and stay informed about the latest market trends. By combining these two approaches, you can maximize your earnings and create a sustainable online income. The forex market offers diverse ways to make money online, from direct trading to participating in forex affiliate programs. Each method has its requirements and potential risks, so it’s essential to assess your skills, financial situation, and risk tolerance before diving in. With the right approach and dedication, forex can be a rewarding way to earn money and achieve financial independence. Read the full article

0 notes

Text

Best Forex Signal Provider Selection Guides

Introduction to Forex Trading and Signal Providers

Forex trading, a global marketplace for exchanging national currencies, is one of the largest and most active trading markets in the world. As the market is complex and volatile, many traders rely on Forex signal providers. These providers offer suggestions on when to buy or sell currency pairs, based on analysis or algorithms, aiming to maximize profits and minimize risks.

Understanding Forex Signals

Forex signals are essentially trade ideas indicating the market trends in real time. They are either generated manually by experienced traders or automatically through algorithms and trading robots. The choice between manual and automated signals, free or subscription-based services, depends on individual preferences and trading style. Individual can choose follow the forex signal as copy trade or join the PAMM like how vantage markets offer PAMM technology to the users.

Definition and Types of Forex Signals

- What Are Forex Signals? Forex signals are trading suggestions that indicate ideal entry and exit points in the currency market. These signals specify a particular currency pair, and suggest a direction to buy (long) or sell (short), often including specific prices for stop-losses and take-profits. - Types of Signals: - Manual vs. Automated: Manual signals are generated by experienced traders or analysts who study the market and make judgments. Automated signals are produced by algorithms and trading robots based on pre-set parameters. - Paid vs. Free: While some providers offer free signals, paid services are often more comprehensive, offering additional analysis and support.

How Forex Signals are Generated

- Technical Analysis: This involves analyzing past market data, charts, and statistical trends to predict future price movements. Common indicators used include moving averages, Bollinger bands, and Fibonacci retracements. - Fundamental Analysis: This focuses on external factors like economic indicators, central bank decisions, political events, and news that can impact currency values. - Sentiment Analysis: Some providers also consider market sentiment, gauging how other traders are positioned in the market, which can be a counter-indicator at times.

Reading and Interpreting Forex Signals A typical Forex signal might read:- Buy EUR/USD @ 1.1800 - SL (Stop Loss): 1.1750 - TP (Take Profit): 1.1900 Here's how to interpret it:- Action: Buy EUR/USD. - Entry Point: Enter the trade at 1.1800. - Stop Loss: Set a stop loss at 1.1750 to limit potential losses. - Take Profit: Set a take profit at 1.1900 to secure profits. Importance of Timeliness and Accuracy - Timeliness: Forex markets move quickly. Delayed signals can lead to missed opportunities or entering trades at less favorable prices. - Accuracy: The reliability of a signal depends on its accuracy over time. Traders should track the performance of signals to gauge their effectiveness. Combining Signals with Personal Analysis - Balancing Signals with Strategy: Traders should use signals as a supplement to, not a replacement for, their own market analysis and trading strategy. - Adapting to Market Changes: Signals are based on past and current market conditions, which can change rapidly. Traders need to be adaptable and ready to reassess their positions.

The Role of Signal Providers in Forex Trading

Signal providers play a crucial role in Forex trading. They can save time and effort in market analysis, provide expert insights, and assist in effective risk management. However, the reliance on signal providers should be balanced with personal judgment and a robust trading strategy. Forex signal providers offer a crucial service in the world of currency trading. Here's a more detailed look: - Expert Analysis and Time Efficiency: Signal providers often have teams of experts or sophisticated algorithms that analyze market trends, economic data, and political events that influence currency movements. This analysis can save traders hours of research time. - Diverse Strategies and Approaches: Different providers may focus on various trading strategies (like scalping, swing trading, or long-term investing), allowing traders to choose a service that aligns with their personal trading style. - Risk Management: Good signal providers not only suggest entry and exit points but also advise on risk management strategies, such as setting stop-loss orders to protect against market volatility. - Educational Value: Some providers also offer educational resources, helping traders understand the rationale behind each signal, which can be invaluable for developing trading skills.

Criteria for Choosing the Right Provider

Selecting the right Forex signal provider is pivotal. Key factors include:- Accuracy and Reliability: Track the provider's performance history for accuracy in signals. - Track Record: A consistent and transparent track record is a sign of reliability. - Regulatory Compliance: Ensure the provider adheres to regulatory standards. - Cost: Consider the cost in relation to the service quality and potential ROI. - Reputation: Seek feedback from other traders and industry reviews. - Performance Metrics: Look for providers that offer transparent and verifiable performance metrics. This includes win rates, average profit per trade, and historical performance under varying market conditions. - Customization and Control: Some providers offer customizable signals based on your risk tolerance, trading style, and currency preferences. This level of customization can be a significant advantage. - Support and Communication: Reliable providers offer excellent customer support and clear communication channels, ensuring that traders can get assistance and clarification when needed. - Integration with Trading Platforms: Many traders prefer signals that can be directly integrated into their trading platforms for ease of use and quick execution, choose only regulated and best forex brokers to start. - Trial Periods and Reviews: Free trials or money-back guarantees can be a sign of confidence in the service. Also, independent reviews and testimonials can provide insights into the provider's reliability and performance.

Risks and Pitfalls

Despite their benefits, reliance on signal providers carries risks. Misleading signals, over-reliance without understanding the market, and scams are prevalent. Traders should be cautious, conduct thorough research, and never invest more than they can afford to lose.While Forex signal providers can be valuable, they come with inherent risks: - False Promises: Beware of providers promising guaranteed returns. The Forex market is unpredictable, and no provider can guarantee profits. - Dependency: Over-reliance on signals can hinder the development of your own trading skills and market understanding. - Signal Quality: Not all signals are created equal. Some might be based on flawed analysis or outdated information. - Market Volatility: Even accurate signals can fail due to sudden market shifts or unforeseen events, highlighting the importance of personal risk management. - Scams: The Forex market is ripe with scams, including fraudulent signal providers. It’s crucial to conduct thorough research and choose providers with a good track record and transparent practices.

Case Studies and Testimonials

Incorporating case studies of both successful and unsuccessful Forex trading experiences can provide practical insights. Testimonials from seasoned traders can also offer valuable lessons and tips.

Tools and Resources for Research

To aid in choosing a signal provider, utilize tools like comparative analysis software, financial news aggregators, and community forums. These resources can offer comprehensive insights and aid in making an informed decision.

Further Reading and Resources

For those keen to explore further, numerous resources are available online, including educational websites, trading courses, and webinars. These can provide deeper insights into Forex trading and how to effectively leverage signal providers.

Conclusion

The right Forex signal provider can be a valuable asset in navigating the Forex market. However, it’s crucial to undertake due diligence, understand the market, and maintain a balanced approach to trading. While signal providers offer significant advantages, they are not a substitute for personal expertise and a well-structured trading strategy. Read the full article

0 notes

Text

VantageFX Broker

Introduction:

In a competitive trading landscape, choosing the right broker can significantly enhance a trader's journey, offering a streamlined platform for robust trading opportunities. VantageFX Broker has been a notable player in the market, drawing attention with its tight spreads, fast execution, and a variety of trading instruments. This review aims to delve into the various aspects of Vantage FX, providing an insightful look at its offerings and operational efficiency based on user experiences and thorough analysis.

Vantagefx Trading Platform and Tools:

Vantage FX boasts a sophisticated yet user-friendly trading platform, leveraging the power of MetaTrader 4 and MetaTrader 5. This offers traders an intuitive interface, paired with powerful analytical tools and superior execution speeds. The integration of these platforms is smooth, offering both novice and seasoned traders a robust trading environment.

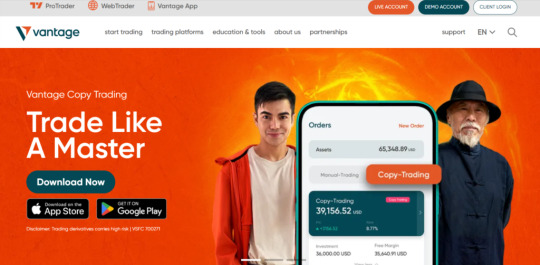

Additionally, traders can take advantage of the mobile trading feature, which is a boon for those who prefer to trade on the go. Vantage carves a niche for itself amidst other MetaTrader-centric brokers by presenting a myriad of additional add-ons and endorsing the integration of compatible third-party platforms and tools like TradingView. This strategic diversification has propelled Vantage into the Best in Class cadre in our 2023 assessment of the best MetaTrader brokers.Platform Synopsis: At its core, Vantage operates as a MetaTrader broker, extending a comprehensive suite of desktop and web trading platforms encompassing MetaTrader 4 (MT4) and MetaTrader 5 (MT5), users can download vantagefx trading apps on the mobileCharting Capabilities: Beyond the conventional charting facilitated on MT4 and MT5, Vantage also integrates the CHARTS platform from TradingView. This integration is seamless, allowing traders to access it directly using their MetaTrader credentials, thereby expanding the graphical analysis horizon.Tool Assortment:Enhancing the MetaTrader experience, Vantage introduces the SmartTrader Tools, part of FX Blue LLP’s plethora of platform augmentations. Moreover, a continuous stream of forex news headlines from FxWire Pro and FxStreet enriches the trading milieu, making Vantage's MetaTrader offerings notably robustSocial and Copy Trading Expanding beyond MetaTrader's inherent Signals market, Vantage brings forth three platforms dedicated to social copy trading. This ensemble of auto-trading platforms - ZuluTrade, DupliTrade, and Myfxbook’s AutoTrade, bolsters the social trading ecosystem, albeit these platforms are not accessible to Australian tradersThis well-rounded offering makes Vantage not just a platform for trading but a conducive environment for learning, analyzing, and strategizing, significantly enriching the trader's journey from inception to execution.

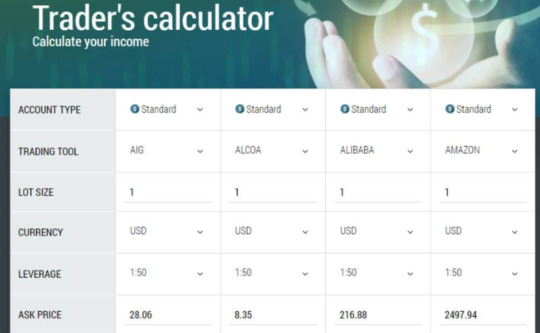

VantageFx Broker Asset Coverage:

VantageFX provides a broad spectrum of trading instruments, including Forex, Indices, Commodities, and Share CFDsIn total Vantage can trade up to 57 Currency pairs, 26 Indices , 51 ETFs , 22 Commodities and 800+ Share CFDsThis diverse range of assets allows traders to diversify their portfolio, thereby managing risks while maximizing potential gainsThe extensive market coverage is indeed a highlight, catering to the varied interests of the trading community

Account Types and Customer Suppor

VantageFX offers multiple account types catering to different trader preferences, including Standard STP, Raw ECN, and Pro ECN accounts. This segmentation helps in accommodating traders with varying levels of expertise and investment capabilities. When it comes to customer support, Vantage FX provides a responsive and knowledgeable team. The support is available via live chat, email, and phone, ensuring that traders' inquiries and issues are addressed promptly.

VantageFx PAMM

In forex markets, staying ahead of the curve is essential. And now, with the innovative VantageFX PAMM Copy Trade feature, you can transform your trading experience and maximize your profits like never before. Imagine having access to the strategies of some of the most skilled and successful traders in the industry, all at your fingertips. That's precisely what VantageFX PAMM Copy Trade brings to the table. It's a game-changer, a paradigm shift in how traders can harness the wisdom of experts without having to become one themselves. Check how to invest with Vantagefx PAMM to maximize your trading profit.

Education and Research Resources:

The broker provides various educational resources, including webinars, tutorials, and market analysis. These resources are invaluable for traders keen on honing their skills and staying updated with market trends. The emphasis on education and empowering traders is a commendable aspect of Vantage FX.

Fees and Spreads:

VantageFX is known for its competitive spreads, which is a significant advantage for cost-sensitive traders. The transparent fee structure with no hidden charges provides a fair trading environment, which is appreciated by its user base. At Vantage FX, the trading costs are primarily determined by the type of account you opt for, coupled with the specific Vantage entity managing your account. The broker presents three distinct account options: the spread-only Standard STP account, alongside the commission-based RAW ECN, and PRO ECN accounts. Generally, the pricing structure at Vantage aligns well with the industry norms.

Comparing Standard and Raw Accounts: For traders utilizing the spread-only Standard account, Vantage recorded typical spreads of 1.22 pips on the EUR/USD pair (as observed in August 2021). On the other hand, the Raw account showcased average spreads of 0.15 pips, along with a commission fee of $3 per side (amounting to $6 per round turn), bringing the total to 0.75 pips during the identical timeframe.Exploring the PRO Account: Vantage's PRO account emerges as a competitively priced offering, with a per-side commission of merely $2 (or $4 per round turn). However, the requisites for inaugurating a PRO ECN account vary across Vantage's regulating entities. For instance, under its Australian entity, traders need to qualify as a wholesale client, while under the Cayman Islands entity, an initial account funding of at least $10,000 is mandated. Meeting these varied account prerequisites renders the PRO ECN account as the most cost-effective option provided by Vantage.Incentives for Active Traders: Vantagefx extends an active trader program, presenting rebates ranging from $2 to a lofty $8 per standard lot, contingent on your account balance and monthly trading volume. The rebate tiers commence at $10,000, escalating to the apex tier necessitating a minimum of $300,000 in equity. It's notable, however, that this program is exclusively accessible to Standard account holders, which inherently possess the highest spreads among all available account options. This arrangement is something active traders might want to weigh against the potential rebates when deciding on the account type that best fits their trading strategy and financial standing.

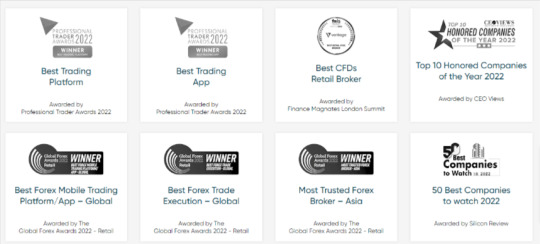

Award & Regulatory Compliance

Vantagefx Markets has won a variety of awards across a wide range of categories, including Best CFD Broker and Best MT4/MT5 Broker, and Lowest Trading Costs.

Vantagefx is one of the best broker that obtained fews international broker licenses and strickly followed the broker's regulations and requirements.Being regulated by the Australian Securities and Investments Commission (ASIC) and the Cayman Islands Monetary Authority (CIMA), Vantage FX adheres to high standards of operation, ensuring a secure and trustworthy trading environmen

Conclusion:

VantageFX has made a positive impression in the trading community with its comprehensive trading environment, a wide range of assets, and strong regulatory framework. While there is always room for improvement, especially in expanding educational resources, the broker stands as a reliable choice for individuals keen on navigating the financial markets. With its client-centric approach, Vantage FX is well-positioned to continue growing its presence in the global trading arena. Read the full article

#vantagefx#vantage fx#vantagefx broker review#vantagefx review#forex broker#vantage fx broker review#best forex broker#vantage review

0 notes

Text

Top 10 Copy Trading Strategy : Step-by-Step Guide

Introduction:

Copy trading is a powerful tool that allows individuals to participate in the forex market by replicating the trades of experienced traders or strategies from trading robot ( EA ) to boost your passive income profit. However, success in copy trading requires more than just blindly following others; you need to understand the basic knowledge of forex trading and copy trade. It demands a well-structured strategy that aligns with your goals and risk tolerance.

In this step-by-step guide, we'll take you through the process of building your own copy trading strategy, helping you make informed decisions and increase your chances of success.

Step 1: Define Your Goals and Risk Tolerance:

Before diving into copy trading, setting clear objectives and understanding your risk tolerance is essential. Ask yourself: - What are my financial goals? Do I seek long-term growth, regular income, or a balanced approach? - How much risk can I comfortably tolerate? Consider your financial situation and emotional resilience. Example: If you're a conservative investor nearing retirement, your goal might be capital preservation with low risk tolerance. On the other hand, a younger investor may aim for aggressive growth with higher risk tolerance.

Step 2: Choose Your Copy Trading Platform:

Selecting the right forex broker platform is crucial to your copy trading success. Consider the following factors: - Research and choose a reputable copy trading platform. - Evaluate platform features like trader selection, risk management tools, and fees. Example: You might opt for a platform with a diverse pool of experienced traders, transparent fee structures, and robust risk management features.

Step 3: Research and Select Traders Or Strategies:

Picking the right strategies & traders to copy is the heart of your strategy; always check the trading performance before deciding. Conduct thorough research by: - Examining trader profiles, including their trading history and strategies. - Considering their risk levels and historical performance. Example: You could choose a mix of traders or strategies, including a conservative trader focused on steady gains and a high-risk trader aiming for substantial profits.

Step 4: Set Allocation and Risk Parameters:

To safeguard your capital, define allocation and risk parameters: - Determine the percentage of your capital to allocate to each trader. - Set stop-loss and take-profit levels to manage potential losses and secure profits. Example: You may allocate 30% of your capital to a low-risk trader with a 10% stop-loss, while allocating 20% to a higher-risk trader with a 20% stop-loss.

Step 5: Monitor and Adjust:

Active monitoring of your copy trading portfolio is essential: - Regularly review trader performance and adherence to your strategy. - Be prepared to make adjustments if a trader's strategy or performance deviates from your goals. Example: If a trader consistently underperforms or changes their strategy, consider reallocating funds to align with your objectives.

Step 6: Stay Informed and Educated:

Successful copy trading requires ongoing learning:- Attend webinars, read educational material, and stay informed about market news and trends. Example: Continuously educating yourself about the forex market helps you make informed decisions and adapt to changing market conditions.

Step 7: Emotion Control and Discipline:

Emotions can disrupt your strategy. Maintain discipline by: - Avoiding impulsive decisions driven by fear or greed. Example: Stick to your pre-defined risk parameters and avoid panic-selling during market fluctuations.

Step 8: Risk Management:

Implement risk management techniques: - Set a maximum drawdown limit to protect your capital. - Diversify your copy trading portfolio to spread risk across different assets and trading styles. Example: By limiting your maximum drawdown to 20%, you reduce the risk of significant capital loss.

Step 9: Review and Adjust Your Strategy:

Periodically review your strategy: - Assess whether your financial goals and risk tolerance have changed. - Make necessary adjustments based on your evolving objectives. Example: If you decide to shift from aggressive growth to income generation, reallocate funds accordingly.

Conclusion:

Building a successful copy trading strategy requires careful planning, ongoing education, and unwavering discipline. By following these steps and tailoring your strategy to your unique circumstances, you can create a roadmap for achieving your financial goals through copy trading. Remember that while copy trading offers opportunities, it also carries risks, and past performance is not indicative of future results. Stay committed to continuous improvement, adapt to changing market conditions, and make informed decisions along your copy trading journey. Happy and responsible copy trading! Read the full article

0 notes

Text

Important Steps To Setup Up Your Side Income Forex Trading Account

Getting Started: Setting Up Your Side Income Forex Trading Account

In today's fast-paced world, many individuals are exploring ways to diversify their income streams and secure their financial future. Forex trading has emerged as a popular choice for those seeking to earn extra income. However, before you can embark on your forex trading journey, you need to set up your trading account.This step-by-step guide will walk you through the process of opening a forex trading account and help you understand the different types of trading accounts suitable for generating side passive income.

Step 1: Choose a Reputable Forex Broker The first and most crucial step in setting up your forex trading account is selecting a reputable forex broker. Ensure that the broker is regulated by a recognized authority, as this provides an added layer of security. Research and compare brokers to find one that aligns with your trading goals and preferences. Step 2: Complete the Registration Once you've chosen your broker, visit their website and click on the "Register" or "Sign Up" button. You'll be required to fill out a registration form with your personal information, including your name, email address, phone number, and sometimes, your residential address. Ensure that you provide accurate information as part of the broker's Know Your Customer (KYC) process. Step 3: Verify Your Identity To comply with regulatory requirements, most brokers will ask you to verify your identity. This typically involves providing scanned copies of your identification documents, such as a passport or driver's license, and proof of residence, like a utility bill or bank statement. The verification process ensures the broker's compliance with anti-money laundering (AML) and customer protection regulations. Step 4: Choose Your Trading Account Type Forex brokers offer various types of trading accounts, each designed to cater to different trading styles and preferences. Some common account types include: - Standard Account: Suitable for traders with experience, offering competitive spreads and leverage. - Mini Account: Designed for beginners with smaller capital, allowing them to trade smaller lot sizes. - Micro Account: Ideal for those looking to start with minimal risk, often with lower minimum deposits. - Islamic Account: Compliant with Islamic finance principles, eliminating overnight interest (swap) charges. Select the account type that aligns with your trading goals and risk tolerance.Step 5: Deposit Funds After your account is approved, you'll need to deposit funds to start trading. Forex brokers offer various funding methods, including bank transfers, credit/debit cards, and e-wallets. Choose the most convenient option for you and deposit an amount you're comfortable with. Keep in mind that responsible risk management is key when trading. Step 6: Download Trading Platform Most brokers provide access to popular trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). Download and install the trading platform on your computer or mobile device. These platforms offer advanced charting tools, technical indicators, and other features to aid your trading. Step 7: Start Trading With your account funded and the trading platform installed, you're ready to start trading. Begin by conducting thorough market research, analyzing price charts, and formulating a trading strategy. It's essential to have a clear plan in place to manage risk and maximize your chances of success.

Type Of Forex account To Start Trade For Side Income

When venturing into forex trading as a means of generating side income, it's essential to understand the various types of trading accounts available and how they align with your financial goals and risk tolerance. Forex brokers offer different account types to cater to the diverse needs and preferences of traders. Let's explore the most common trading account types and their suitability for side income generation:- Standard Account:- Suitability: Standard accounts are well-suited for experienced traders who are comfortable with higher capital investments and are looking to generate substantial side income. - Features: These accounts typically offer competitive spreads, higher leverage, and access to a wide range of trading instruments. Standard accounts are ideal for traders seeking maximum flexibility and are willing to take on more significant market exposure. - Mini Account: - Suitability: Mini accounts are designed for beginners or traders with limited capital who want to ease into forex trading. - Features: With smaller lot sizes and lower minimum deposit requirements, mini accounts provide a lower-risk entry point into the market. They offer traders the opportunity to practice trading strategies while keeping exposure to a minimum. - Micro Account: - Suitability: Micro accounts are suitable for novice traders who want to start with minimal risk. - Features: These accounts allow traders to begin with a very low deposit, often as little as $1. Micro accounts provide a safe environment for learning the ropes of forex trading without significant financial commitment. - Islamic Account (Swap-Free Account): - Suitability: Islamic accounts are tailored for traders who adhere to Islamic finance principles and want to avoid earning or paying overnight interest (swap) due to religious beliefs. - Features: These accounts do not incur interest on positions held overnight, making them suitable for traders seeking to generate side income while adhering to Shariah-compliant principles. - Cent Account: - Suitability: Cent accounts are ideal for traders who wish to trade with real money but want to minimize their financial exposure. - Features: With cent accounts, traders can execute trades with smaller lot sizes, reducing the risk per trade. This account type is suitable for those looking to generate a modest side income while controlling risk. - Managed Account (PAMM/MAM Account): - Suitability: Managed accounts are suitable for individuals who prefer a hands-off approach to trading and want their funds managed by professional traders. - Features: In a managed account, a skilled trader manages your funds on your behalf. This can be an excellent option for those looking to generate side income without actively trading themselves. However, it's crucial to choose a reputable and skilled fund manager. - Demo Account: - Suitability: Demo accounts are not for generating income but are invaluable for learning and practicing trading strategies. - Features: Demo accounts provide a risk-free environment with virtual funds. They are suitable for traders, especially beginners, who want to hone their skills and test strategies before transitioning to a live trading account.

Forex Copy Trading and PAMM: Passive Income Options for Busy Traders

Many individuals, whether due to busy schedules or a lack of expertise, seek alternative ways to profit from the forex market without the need for active trading. Two popular options for such traders are Forex Copy Trading and PAMM (Percentage Allocation Management Module) accounts, offering the opportunity to earn passive income in the forex market. Forex Copy Trading: Forex Copy Trading is a straightforward concept that allows traders to mimic the trades of experienced and successful traders. Here's how it works: 1. Choose a Signal Provider: As a follower, you select a skilled trader or signal provider whose trading strategy aligns with your goals and risk tolerance. 2. Copy Trades Automatically: Once you've chosen a signal provider, your trading account will automatically replicate their trades in real-time. You don't need to make trading decisions or execute orders manually. 3. Monitor and Adjust: While your trading is automated, you can still monitor your account's performance and make adjustments as needed, such as changing signal providers or adjusting your risk settings.

Benefits of Forex Copy Trading:

- Passive Income: You earn from the success of experienced traders without active involvement in the market. - Diversification: You can follow multiple signal providers to diversify your portfolio and spread risk. - Learning Opportunity: Copy trading allows you to learn from skilled traders by observing their strategies and decision-making. PAMM (Percentage Allocation Management Module) Accounts: PAMM accounts offer an alternative way to generate passive income by investing in the forex market. These accounts are managed by experienced traders known as money managers. Here's how PAMM works: 1. Choose a PAMM Manager: Investors select a PAMM manager based on their track record, trading style, and risk profile, read our guides to setup and invest with PAMM trading strategy with Vantagefx, one of the trusted forex broker in market. 2. Invest Funds: You invest your capital in the chosen PAMM account, and your funds are combined with those of other investors.3. Share Profits and Losses: Profits and losses are distributed among investors based on their share of the total capital in the PAMM account. The manager also earns a share of the profits.Benefits of PAMM Accounts:- Professional Management: PAMM accounts are managed by skilled traders who have a vested interest in generating profits for investors. - Accessibility: You can start with a relatively small investment and access the expertise of professional traders. - Risk Control: You have control over your risk by selecting PAMM managers whose strategies align with your risk tolerance. In conclusion, setting up your side income forex trading account involves a series of straightforward steps. Choosing the right broker, verifying your identity, and selecting an appropriate trading account are critical decisions. Remember to approach forex trading with diligence, continuous learning, and a focus on risk management to achieve your side income goals. Whether you're looking to generate extra income or explore the world of trading, the forex market offers exciting opportunities for those willing to put in the effort. Read the full article

0 notes

Text

FBS Broker Review

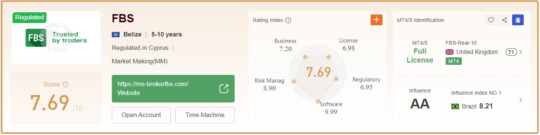

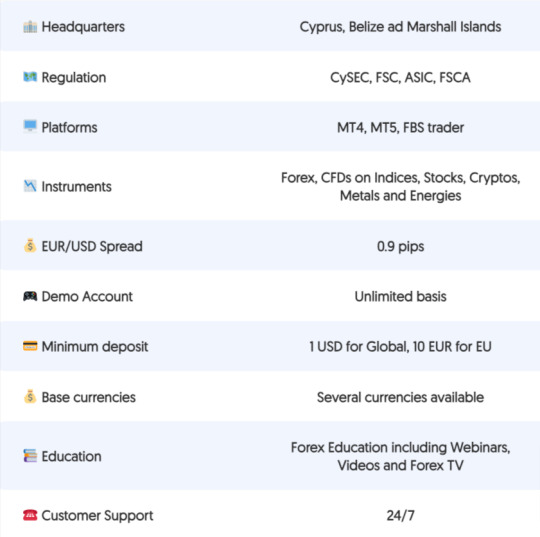

FBS Broker: Empowering Traders Since 2009 FBS, a renowned Forex and CFD trading platform, emerged in 2009 when a group of passionate investors united their expertise in trading research and technical analysis. Today, FBS stands as a global brand with a footprint spanning 150+ countries. It amalgamates various entities, offering traders the chance to engage in Margin FX and CFD trading.FBS comprises several regulated entities, including FBS Markets Inc. (licensed by IFSC), Tradestone Ltd. (licensed by CySEC), Intelligent Financial Markets Pty Ltd. (licensed by ASIC), and TRADE STONE SA (PTY) LTD. (licensed by FSCA). Forex regulation is essential to ensure trading safety all the time, regulatory compliance has enhanced trading capabilities and bolstered FBS's reputation as a trusted broker.

FBS Broker Summary Overview

As a regulated broker, FBS broker ensures compliance with various legislative environments, resulting in favorable trading conditions and a suite of valuable tools. Wikifx comprehensive review rates FBS at 7.69 out of 10, based on rigorous testing compared to over 500 brokers in the industry.

FBS Broker Banking

After careful analysis and a comprehensive review, we believe that FBS presents an appealing opportunity for both novice traders and those with regular trading experience. Notably, FBS offers competitive fees for Currency trading, with the added advantage of a minimal deposit requirement starting at just $1. Overall, the trading conditions are highly favorable.

FBS Broker Awards and Recognition

FBS's commitment to excellence has not gone unnoticed, as it has received over 60 international awards. These accolades recognize FBS as a transparent broker with top-notch customer service, solidifying its position as one of the most acclaimed brands in the industry.

Is FBS a Safe Broker?

FBS is not a scam but a reputable brand. It operates under Tradestone Limited, a Cyprus-registered company and an EU-regulated investment firm licensed by CySEC. FBS also holds licenses from ASIC in Australia and FSCA in South Africa. While FBS has an entity in Belize, it's essential to note that Belize's local regulator, the Financial Service Commission (FSC), mainly registers companies rather than actively regulating them. However, when combined with the regulatory oversight of European CySEC, FBS offers reliable trading conditions.

FBS Broker Leverage

FBS provides varying leverage options depending on the entity and instrument. European and Australian entities offer a maximum of 1:30 leverage for major currency pairs, while international FBS entities offer higher leverage ratios, reaching up to 1:1000 or even 1:3000. It's crucial to use leverage wisely to manage risk effectively.

FBS Account Types

FBS broker offers Standard, Crypto, and Cent accounts, catering to traders of all experience levels. These accounts come with demo and live trading options, allowing traders to choose based on their preferences and risk tolerance.

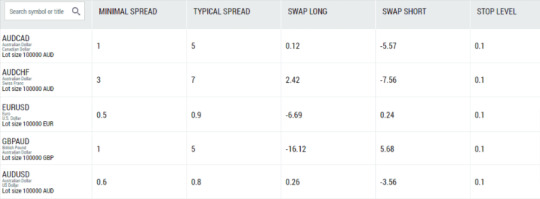

Fees and Spreads

FBS's pricing structure typically involves spreads, with overnight fees, inactivity fees, and withdrawal fees, if applicable. Overall, FBS offers competitive fees, with some deposit and withdrawal methods available free of charge. Spreads vary based on the account type and entity.

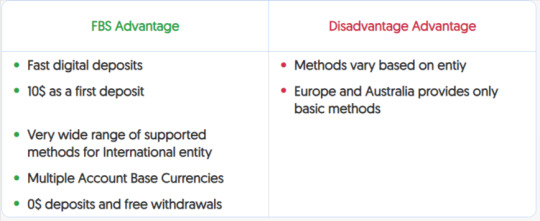

Payment Methods

FBS supports a vast range of payment methods, with over 100 options available for the international entity. Major cards, e-wallets, wire transfers, and crypto wallets are among the choices. However, European and Australian entities may have more limited payment options due to regulatory requirements.

How to Open an FBS Account

Opening an account with FBS is a straightforward process, involving registration, document verification, and deposit. Traders can choose from various account types based on their preferences and trading goals. Follow below steps to open an FBS broker account : - Sign Up For FBS account from our register link - Enter your personal details, including name, email, phone, etc. - Receive a confirmation link in your email to proceed. - Access your online account management and begin with a Demo Account if desired. - Define the account type you wish to open and select your base currency. - Specify your trading experience and expectations through an online questionnaire. - Upload necessary documents to verify your address and identity, complying with regulatory requirements. - Click "Submit" and allow a few working days for document verification and account activation. - Proceed with your initial deposit. - Decide whether you want to trade FX products, stocks, or other assets, and commence trading.

Trading Instruments

FBS broker offers a selection of trading instruments, including Forex, metals, indices, and energies. While Forex trading is the primary focus, the range of instruments may be limited compared to some other brokers.

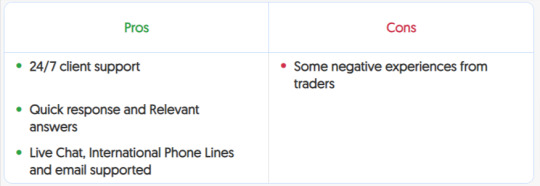

Customer Support

FBS provides 24/7 customer support through live chat, international phone lines, email, and social media. While customer support is generally responsive, it's essential to consider feedback from other traders.

Education and Research

FBS offers a comprehensive education center with webinars, guidebooks, video lessons, tips for traders, and a glossary. Traders can access daily technical and fundamental analysis, an economic calendar, and a currency converter. The platform also features a Forex calculator and Forex TV for the latest news updates.

Conclusion

In conclusion, FBS is a trusted Forex and CFD trading platform that caters to traders of all levels. Its range of account types, powerful trading platforms, and convenient customer support contribute to a favorable trading environment. While FBS offers low trading costs and a solid execution model, traders should carefully consider their preferences and the entity they choose when trading with FBS. Read the full article

0 notes

Text

Top 10 Forex Brokers 2023: Unbiased Reviews & Expert Insights

Navigating the Currency Waves: A Review of the Top 10 Forex Brokers Criteria for Ranking On Each Forex Broker Brief Overview Of Top 10 Forex Broker Vantagefx: GMI Edge Broker: FBS Broker: Pepperstone: IC Markets: OctaFX: Tickmill: TMGM: Lirunex: FXCM (Forex Capital Markets): Summary

Navigating the Currency Waves: A Review of the Top 10 Forex Brokers

The world of foreign exchange trading, or Forex, is a realm where currency pairs are traded 24 hours a day, offering a dynamic and lucrative avenue for seasoned traders and newcomers alike. The pulse of the global economy resonates through the Forex market, where over $6 trillion of currency exchanges hands each day. At the core of this bustling marketplace is an array of Forex brokers, the linchpins that connect individual traders to the vast currency exchange network. Choosing a reliable and well-suited broker is a crucial stepping stone on the path to trading success, as the right broker can significantly enhance the trading experience, offering superior platforms, insightful market analysis, and robust customer support. The essence of this article unfolds as a meticulous review of the top 10 Forex brokers specified in Asian region, shining a spotlight on the brokerage firms. Through a prism of defined criteria encompassing trading platforms, trading conditions, regulatory adherence, and customer support, we embark on a quest to sieve through the brokerage landscape and present a curated list of elite brokers. Whether you are a novice trader setting sail on your trading voyage, or a seasoned trader looking to switch brokers, this article aims to provide a well-rounded perspective to aid in making an informed decision.

As we delve deeper into the intricacies of each broker, we'll explore their unique selling propositions, evaluate their service offerings, and analyze user reviews to paint a vivid picture of what traders can expect. The culmination of this exploration is a comprehensive compilation that not only reviews but ranks these brokers, offering a beacon of insight in the stormy seas of Forex trading. So, without further ado, let’s navigate through the waves of the Forex brokerage world, and set a course towards finding a broker that’s the perfect co-pilot on your trading journey.

Criteria for Ranking On Each Forex Broker

These criteria serve as the yardstick to gauge the competence, reliability, and overall excellence of the brokers in question. Let’s navigate through the key parameters that will steer the evaluation and ranking of the top 10 Forex brokers: - Trading Platforms: - A broker's trading platform is the trader's gateway to the Forex markets. The evaluation will consider the user-friendliness, stability, and technological prowess of the trading platforms offered. - Features like charting tools, market analysis, order execution speed, and mobile trading capabilities will be scrutinized. - Trading Conditions: - Trading conditions encapsulate aspects like spreads, leverage, and order types available. - The transparency and competitiveness of a broker's trading conditions are paramount for ensuring traders can maximize their potential profits while minimizing costs. - Regulation and Licensing: - A broker's adherence to regulatory standards and licensing by reputable financial authorities is a testimony to its credibility and the safety of traders' funds. - The geographical extent of regulation and compliance with international financial standards will also be assessed. - Customer Support: - Exceptional customer support is the backbone of a satisfactory trading experience. - The availability, responsiveness, and expertise of the customer support team, alongside the variety of channels available for support (e.g., live chat, email, phone), will be evaluated. - Educational Resources: - An array of educational resources is crucial for helping traders hone their skills and stay updated with market trends. - The quality, accessibility, and variety of educational materials, including webinars, articles, and interactive learning tools, will be assessed. - Asset Variety: - A diverse offering of tradable assets, including currency pairs, commodities, indices, and cryptocurrencies, provides traders with ample opportunities to diversify their trading portfolio. - The evaluation will also consider the market access and the ease of trading different assets. - Deposit and Withdrawal Options: - Seamless and flexible deposit and withdrawal options enhance the overall trading experience. - The security, speed, and variety of payment methods, alongside the transparency of the fee structure, will be examined. - User Reviews and Reputation: - The reputation of a broker within the trading community and the overall user satisfaction are indicative of the broker's quality and reliability. - Authentic user reviews and testimonials, alongside ratings on reputable review platforms, will be taken into account. - Additional Features: - Brokers that offer additional features like social trading, automated trading, or personalized account management services add a layer of value to their offerings. - The usability and benefits of these additional features will be evaluated. The meticulous examination of these criteria aims to provide a holistic insight into the brokers' service quality, reliability, and potential to provide a conducive trading environment. Each of the aforementioned parameters will be dissected and analyzed, laying the foundation for a comprehensive and enlightening review of the top 10 Forex brokers that aim to steer traders towards a rewarding trading journey.

Brief Overview Of Top 10 Forex Broker

Vantagefx:

- Country of Operation: Headquartered in Sydney, Australia, and operates in 172 countries. - Regulatory Status: Regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Services Authority (FSA). - Trading Platform: Offers MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Vantage FX app for trading. - Trading Conditions: - Minimum Deposit: £200. - Maximum Leverage: 1:30 for retail clients on major forex currency pairs, and up to 1:500 for professional clients. - Spreads: As low as 1 pip for EUR/USD. - Commission: Offers commission-free trading account. - Negative Balance Protection: Available for both retail and pro clients. - Asset Variety: - Offers trading on a wide variety of assets including forex, indices, metals, energies, cryptocurrencies, commodities, and shares. - Deposit and Withdrawal Options: - Deposit Methods: The specific methods aren't mentioned, but they offer a wide range of deposit methods according to their official website. - Withdrawal Fees: Neteller withdrawals incur a 2% fee; Skrill withdrawals incur a 1% fee. A Neteller deposit fee covered by Vantage of 4.9% + 0.29 USD will be deducted from the withdrawal amount for clients residing in Vietnam. - Customer Support: - Award-winning 24/5 customer support is available to assist traders, although 24/7 support is not provided. - Copy Trade Features: - Copy Trading Program: Vantage has a program where experienced traders (League Traders) share their portfolio, and other traders (Copiers) can follow these experienced traders’ portfolios via PAMM technology.. - AutoTrade: An account mirroring service where only successful FOREX traders are available for auto copying. All traders must be verified and have a proven successful track record before being approved by AutoTrade. - DupliTrade: An automatic trade copying service where traders can copy experienced traders by connecting to DupliTrade with a minimum account funding of $2,000. - Upgraded Copy Trading Features: Vantage has upgraded its copy trading features allowing traders to copy trades from signal providers at the click of a button or apply to become signal providers themselves. - Users Review and Reputation: - BrokerChooser awarded VantageFX a rating of 4.2 out of 5, highlighting the pros such as low non-trading fees, quick account opening, and smooth deposit and withdrawal processes. However, they also mentioned some cons like a limited product selection and room for improvement in customer service. - VantageFX has garnered a reputable standing in the forex trading community based on various reviews and ratings from different platforms. Here's a summary of the reviews and reputation of VantageFX: - Global Reputation: - VantageFX is recognized as a top forex broker with an excellent global reputation. Having commenced operations in 2009 based out of Australia, it has since expanded to numerous locations and has built a substantial worldwide trader base. - Customer Reviews: - On Trustpilot, a user praised VantageFX for being a good broker with friendly customer support and prompt payout processes. They also appreciated the sufficient range of trading instruments provided by the broker. - Regulatory Standing: - Forex Peace Army mentions that Vantage Markets (VantageFX) is regulated by ASIC (Australia), FCA (UK), and CIMA (Cayman Islands), which is a strong indicator of its legitimacy and adherence to international financial standards. - Industry Recognition: - VantageFX, noted for being a well-established and often awarded Australian FX/CFD broker, has undergone evolution over the years to foster a more serious and reputable appearance within the trading community.

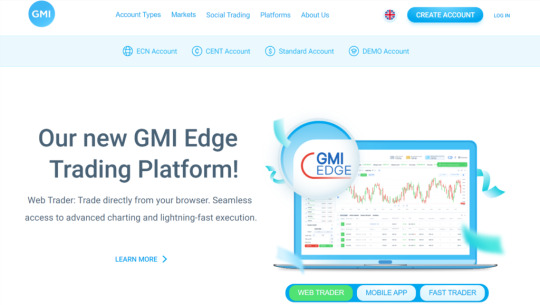

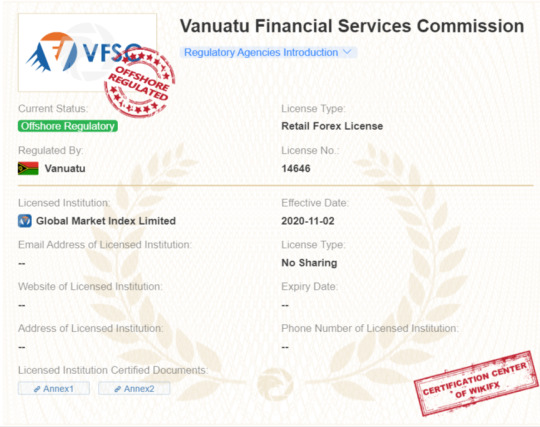

VantageFX seems to provide a well-rounded trading environment with a variety of trading conditions, a broad spectrum of assets, multiple deposit and withdrawal options, responsive customer support, and robust copy trading features to cater to different types of traders. Read more details review for Vantagefx broker to learn more. Register Vantagefx GMI Edge Broker:

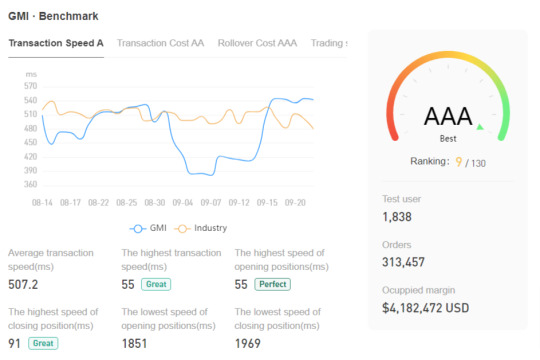

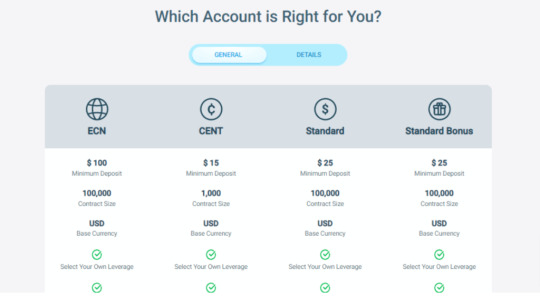

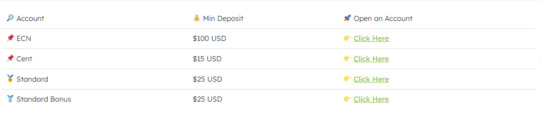

- Country of Operation: Initially established in Shanghai, it expanded to have offices within China, Auckland, and London. - Regulatory Status: Regulated by the Financial Conduct Authority (FCA) and the Financial Services Commission (FSC) of Mauritius. - Trading Platform: Offers MT4, Alpine Trader, ClearPro, MTF, and Currenex platforms for trading. - Trading Conditions: - Minimum Deposit: The minimum deposit required to open a standard trading account is $25, and for social trading, the minimum deposit is $500. - Leverage: Up to 1:2000 leverage is available for trading. - Commission: There is no commission charged on trades, and the broker offers contract sizes of 100,000 base currency. - Asset Variety: - GMI Broker provides over 40 forex currency pairs, indices, energy, gold, and silver for trading. - Deposit and Withdrawal Options: - The broker facilitates simple and secure deposit and withdrawal methods. Deposit top-ups are quick, especially during low margin calls, and withdrawals are processed within 24 hours without any extra fees. - Deposit methods include Local Bank Transfer, Neteller, Skrill, Perfect Money, DragonPay, and FasaPay. - Customer Support: - GMI Broker offers online customer support available 24/5 to assist traders with account management and other queries. - Copy Trade Features: - Platform: GMI Social Trading Edge platform is used for copy trading with MAM technology , which allows traders to copy the trades of master traders directly. - Master Traders: A global community of experienced 'Master Traders' are available to be followed. - Profit Sharing: Traders share a percentage of their profits with the Master Traders they choose to follow, with the percentage agreed upon in advance. - Control: Traders have complete control over which trades they want to copy, with real-time monitoring of Master Traders’ performances to help decide when to start and stop following their trades. - User Reviews and Reputation: GMI edge broker is well trusted and have a good reputation in overall in markets according to our research and analysis with more than ten years of history in the forex market. - User Reviews: User reviews can provide a glimpse into the experiences of individuals who have used GMI broker. You can find reviews on platforms like Trustpilot, Forex Peace Army, wikifx or similar review sites. - Global Reputation: GMI egge broker, or Global Market Index, seems to have established a presence in the Forex trading industry. They may have a strong reputation in certain regions, but like many brokers, their reputation may vary across different geographic locations. - Regulatory Standing: GMI brokers is regulated by financial authorities like FCA and VFSC. Regulatory information can be found on the broker's official website or through financial regulatory authorities' websites. - Industry Recognition: GMI broker has received industry awards, including recognition as the Best Liquidity Provider Platform, Best Broker Support for Traders, Best Trading Platform for Traders, and Best Trading Environment for Traders within the financial trading industry, which can be indicative of their standing within the industry.

The GMI Broker's offering seems to cater to a wide range of traders from beginners to advanced, providing various trading conditions and features to enhance the trading experience, read more details review for GMI Edge broker to learn more. Register GMI Broker Read more review here https://eagleaifx.com/best-forex-broker-for-trading-2023/ Read the full article

0 notes

Text

VantageFX PAMM: Step-by-Step Guide For Copy Trade

Introduction Vantagefx PAMM: Step-by-Step Guide to Copy Trading with PAMM on VantageFX: Summary:

Introduction Vantagefx PAMM:

This article we will guide you to start with Vantagefx PAMM cop trade. VantageFX is a reputable broker regulated by multiple financial authorities worldwide , including the VFSC, CIMA, ASIC, and the FCA, ensuring a secure and transparent trading environment. It offers a range of trading services, including the opportunity to engage in copy trading through its Percent Allocation Management Module (PAMM) accounts. PAMM accounts allow investors to pool their funds together under the management of a professional trader, known as the PAMM manager, who executes trades on behalf of the investors.

Step-by-Step Guide to Copy Trading with PAMM on VantageFX:

- Sign Up for a Vantagefx : Begin by signing up for a Vantagefx account here. If you are new to VantageFX, you must create an investor account first. Register Vantagefx PAMM Account - Setup PAMM Investor Account : Once your account is fully verified, log in to your Vantagefx account, and setup Vantagefx Investor MT4 account: - Select a PAMM manager you wish to copy trade from. Here is the steps details : - Click on the ‘Offer link’ provided by your PAMM Master - (Example: https://pamm.vantagemarkets.com/app/join/1/offername) - Here is two Vantagefx PAMM offer you can join : - Offer 1 : EagleAIFx Vantage PAMM - Offer 2: FxMaster Vantage PAMM - Use your Investor MT4's Username and Password in the email to join the offer.

- Link Your Vantagefx Account To PAMM Manager: After joining a PAMM manager, your account will be linked, and you can view your current investments. Here is the steps details. - Click ‘Invest’ after reading and checking the box of the terms. - Once successful, you will see a notification on the bottom right corner.

- Check Your Account Linking: Click on the investment you want to check.

- Deposit & Withdraw Funds: Deposit the funds you wish to allocate for copy trading into your PAMM account. These funds will be managed by the PAMM manager you selected. You can make withdrawal from the account also. Here are the steps.

- Monitor Your Investments: You can monitor your investments' performance and your PAMM manager's trading activities through the VantageFX platform. - Communicate: If you have any further questions or need assistance with your PAMM account, reach out to VantageFX's support team for help. With these steps, you are well on your way to exploring the benefits of copy trading on VantageFX using PAMM accounts. By aligning with skilled PAMM managers, you can potentially enhance your trading outcomes while learning from seasoned traders.

Summary: