Economics Help Desk is an online service provider of economics assignment help homework help etc.

Don't wanna be here? Send us removal request.

Text

Hedge Funds vs Private Equity Economics Help for Student Investors

Introduction: Why Hedge Funds and Private Equity Matter for Aspiring Economists

If you have often wondered how billionaires such as Ray Dalio or Steve Schwartz make their money, the truth is simple in two words: hedge fund and private equity. For students pursuing financial economics, these are not just buzzwords; they become ways of thinking of capital flows, risk management, and the building of fortunes. We have to be honest; the jargon is also a bit too much (at least at first). Here's where economics help online steps in. This guide explains hedge funds and private equity inside out, with examples and actionable insights from the real world to clear the muddy waters about these dense topics like you have never encountered before. Definitions: Hedge Funds and Private Equity (and Why You Should Care)

Before making a comparison, let's layout what they mean:

Hedge Funds: The Mavericks of the Financial World

A hedge fund pools money from wealthy investors and institutions and further invested in a range of different assets: stocks, bonds, commodities, even currencies.

A key feature is that they aim for high capital returns by using aggressive strategies like short-selling, leverage, and derivatives.

Example: A hedge fund betting against a company stock (short-selling) thinking it's overvalued. If the value of the stock goes down, they get a profit.

Private Equity: The Quiet Giants of Corporate Ownership

Private equity firms buy out entire companies (or large minority stakes), remake them, and sell them for a profit.

Key feature: They focus on long-term growth, often improving operations or cutting costs to boost value.

Example: A private equity firm buys a struggling retail chain, streamlines its operations, and sells it five years later at a higher price.

Key Differences between Hedge Funds and Private Equity that Every Student Investor Should Know

Let’s compare these two financial powerhouses based on five critical dimensions:

1. Investment Horizon: Quick Flips versus Long-Term Plays

Hedge funds: Stay short. They may stay long on a position for a few weeks, days, or even hours.

Private equity: Think long term. In other words, it would usually last between 5-10 years.

Consider this like a sprinting race for hedge funds and a marathon for private equity firms.

2. Risk and Return: High Stakes, High Returns

Hedge funds: A high-risk-high rewards formula. It may lead to double-digit returns but can result in severe losses as well.

Private equity: Relatively low risk and steady returns. They target an annual return of 15–20% with a tendency toward the long term.

An example: A hedge fund may lose 30% in a bad year but make 50% in the very next year. Whereas private equity is like winning a race with a slow and steady approach.

3. Investor Access: Exclusive Clubs versus Even More Exclusive Clubs

Hedge funds: Invested by accredited investors. Millionaires and institutions usually come to mind. The minimum investment may also start at $1 million.

Private equity: Even more exclusive. Many times, you will be required to invest sevenfold more than hedge funds with many of their minimum investments starting at $5 million.

Takeaway for the student: You may not invest in this, but you should study these for your career path.

4. Fee Structures: Pay for Performance

Hedge funds: 2 and 20-the fee structure that includes 2% of assets plus 20% of absolute returns.

Private equity: Similar but oftentimes longer lock-up periods.

This fee structure affects returns, so this highlights the importance of performance here.

5. Impact on the Economy: Market Movers vs. Job Creators

Hedge funds: Influence stock prices and market trends through trading.

Private equity: Shape industries by acquiring and restructuring companies.

Example: A hedge fund might short-sell a tech stock, causing its price to drop. A private equity firm might buy a manufacturing company, cut inefficiencies, and save jobs.

A Hands-On Example: How Hedge Funds and Private Equity Play Out in Real Life

Let’s say you are analyzing these two fictional firms:

Hedge Fund X: Invests in startup tech firms. They short-sell a well-hyped new AI company under the impression that the said AI company is being overvalued. When the company stock crashes, they come away with 40% returns.

Private Equity Firm Y: Buys the failing chain of coffee-houses. They rebrand and improve supply chains, expand them globally. Five years later, they sell the chain for thrice the rate they had purchased it for.

Important lessons: Both ways can be profitable, but they require distinct skills and appetites for risk.

Why Students Struggle with Hedge Funds and Private Equity (and How to Overcome It)

Even advanced students find these topics tricky. Here’s why—and how economics help websites for students can bridge the gap:

1. complex terminology: Words like “leveraged buyout” or “derivative” sometimes feel like a foreign language. Break it down step-by-step.

2. Lack of context in the real world: Textbooks really tend to focus a lot on theory. Using case studies (like the rise of Blackstone or the fall of Archegos) allows connecting the principles and reality.

3. Overwhelming data: The Financial reports can be intimidating. Start small by getting the basics first, such as understanding fee structures in the first place. From that point, build information slowly.

How to Use This Knowledge as a Student Investor

You may not have millions to invest, but here's how you can apply the information you've learned:

1. Follow the News: Watch for hedge-fund moves, e.g., Bill Ackman's bets, or private equity deals (like KKR’s acquisitions).

2. Simulate Investments: Execute virtual trades to test hedge-fund investment strategies or analyze a private equity deal.

3. Attend Networking Opportunities: Regularly attend finance seminars, or join investment clubs that will enable you to learn from these professionals.

Final Thoughts: Why This Knowledge Is Your Secret Weapon

Hedge funds and private equity are not for the Wall Street elite; they are pertinent tools to understand modern finance. Whether it is analyzing market trends or getting ready for a career as an investment banker, these concepts will give you an edge, and remember, if you ever feel stuck, remember: economics help online is just a click away.

#economics help websites for students#economics help for students#economics help#Hedge Funds and Private Equity#Student Investor#economics help online#economics assignment help#economics homework help

0 notes

Text

#statisticsassignmenthelp#onlinestatisticsassignmenthelp#statisticshomeworkhelp#helpwithstatisticsassignments#statisticsprojectassistance#statisticshelpforstudents#affordablestatisticsassignmenthelp#professionalstatisticshomeworkhelp#domystatisticsassignment#statisticsassignmentwritingservice#statisticsproblemsolver#advancedstatisticsassignmenthelp#statisticsassignmenthelpexperts#urgentstatisticsassignmenthelp

0 notes

Text

📈📚 Need Help with Economics Homework? We're Here to Assist! 📚📈 Struggling with supply and demand curves, market analysis, econometrics or data analysis? Let the experts at Economics Help Desk simplify it for you! ✅ Assistance with Microeconomics & Macroeconomics ✅Help in Econometrics, Managerial Economics, and More ✅Graphical Analysis & Numerical Problem Solving ✅Support for Assignments, Dissertations, and Research 💡From students to research scholars, we guide you to excel in every economic concept with personalized support. 📩 Message us today or visit https://economicshelpdesk.com/ to get started! Let’s make economics understandable and easy-scoring for you! 💻📊

#economicshomework#economicshomeworkhelp#economicshomeworkassistance#economicshomeworkatmidnight#economicshomeworkhelpservice#economicshomeworkonline#EconomicsMadeEasy#EconomicsHelp#EconomicsTutor#OnlineTutoring#HomeworkHelp#StudySmart#AssignmentHelp#EconometricsHelp#MicroeconomicsTips#MacroeconomicsTutor#EconomicAnalysis#AcademicSupport#StudentSuccess#DissertationHelp

0 notes

Text

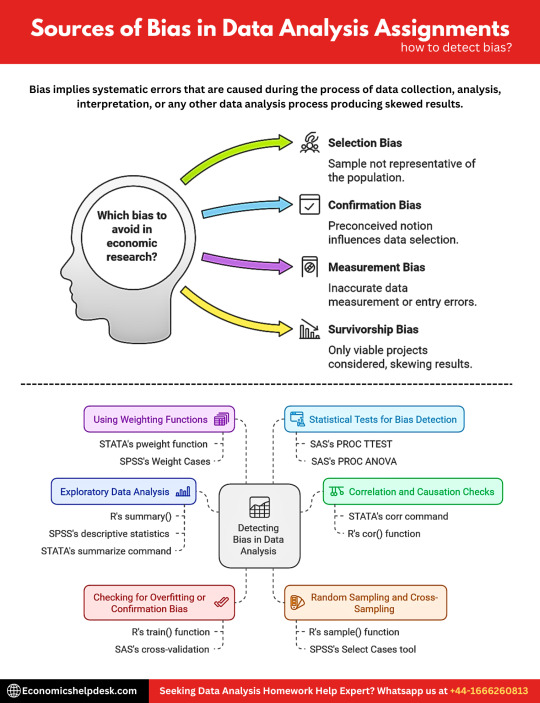

📝 Master Your Data Analysis with Expert Help! 📊

Uncover the sources of bias in your data analysis and learn detection techniques with our professional homework support. Whether you’re working with R, SAS, or other statistical software, we offer detailed guidance and help you achieve accurate, unbiased results.

💡 Get personalized assistance and boost your confidence in data analysis. Don’t let complex tasks hold you back—reach out today for #DataAnalysisHomeworkHelp! 📈

🔗 Learn more: https://economicshelpdesk.com/data-analysis-assignment-homework-help.php

0 notes

Text

Helpful Guide to Perform Factor Analysis in SPSS for Behavioral Research

Behavioral research focuses on the behaviors of an individual and tries to predict them by analyzing the patterns of emotions, perceptions, personality, and social interactions. This field employs an analytical approach to make data-driven conclusions and requires statistical data analysis tools such as SPSS. It is a popular stat software used by many academicians and researchers worldwide. It offers great tools for analyzing multi-dimensional data patterns and trends to find unique insights, primarily used by psychologists and behavioral scientists.

Behavioral research is also important for economics students because it helps them understand the psychological and social factors affecting individual and group economic choices. Unlike traditional economic models in which it is usually assumed that people make rational choices, behavioral economics considers real-world factors like biases and emotions. These insights play an important role in making policies, forecasting market trends, and designing interventions, as it accurately captures how people actually think and act. By including these behavioral insights, economics students get a realistic picture of economic activity, which helps them better handle complex economic problems.

Of the many techniques used in behavioral research, factor analysis is especially important for simplifying and categorizing the data. For students who have just been introduced to statistics and behavioral research, learning factor analysis in SPSS equips them with robust analytical tools that can be applied to solving real-life problems. SPSS is well-equipped to handle complex behavioral data. Students mainly involved in researching behavioral aspects must use SPSS to conduct an analysis of their data for accurate interpretations. This is where they can opt for spss assignment help to get assistance with their analysis during their coursework.

Understanding Factor Analysis in Behavioral Research

Factor analysis is a statistical technique applied to identify underlying variables that are called as factors. These factors describe the patterns observed in a set of related variables. In behavioral research, factor analysis helps in a scenario involving many observed variables (in this case, many questionnaire items) and seeks to limit them to factors that capture the most valuable information. This reduction enables researchers to understand the underlying structures such as personality traits or social attitudes by investigating clusters of related items. For example, factor analysis may be used on data obtained from personality surveys to factor out fundamental variables that are fewer in number for instance, ‘’extroversion’’ or ‘’conscientiousness’’ out from a large number of survey responses.

Why Factor Analysis is Important in Behavioral Research to Students

Factor analysis helps students analyze complex behavioral data aimed at perceiving understandable and useful insights. This is useful when used in the analysis of survey data as well as when comparing the correlation between one psychological scale and another. Factor analysis is a powerful tool because this method is visually oriented and allows students to handle complex data effectively. Learning factor analysis in SPSS is a good practical activity that would improve the research capabilities of the students as well as the effectiveness with which they process data.

Step-by-Step Guide to Conducting Factor Analysis in SPSS

To get started with factor analysis in SPSS, let’s take a hypothetical example: let’s say you’ve collected data about factors causing stress in students through a survey and the variables may include; academic pressure, social stress, financial stress, and time management. Below are the steps of factor analysis you can perform with SPSS software;

Step 1: Preparing Your Data

Before performing factor analysis, it’s important to ensure your data is ready:

• Screen for Missing Values: The factor analysis often cannot be performed on data sets that contain missing values and therefore the user should first use the “Descriptives” under the “Analyze” menu in SPSS to determine whether any of the databases contain any missing values.

• Assess Suitability for Factor Analysis: Correlations are an important recommendation for using factor analysis, so examine correlation coefficients between items. In SPSS, a Correlation Matrix can be used to determine if your variables are sufficiently correlated.

Step 2: Running the Factor Analysis

1. Go to Analyze > Dimension Reduction > Factor: This displays the factor analysis dialogue box.

2. Select Variables: In “Factor Analysis” check the variables one wants to include. In our example, you would just choose variables based on stress factors such as academic stress, social stress, financial stress, and time stress.

3. Choose Extraction Method: Click on the button called “Extraction”. There are several extraction methods offered by SPSS, yet, as PCA is typically used when performing introductory analysis, as the data reduces based on variance.

Set the Number of Factors: In the same window, you may decide to let SPSS determine the number of factors (normally, it takes any eigenvalue of > 1) or you have a theoretical reason for determining the number of factors, then you may specify it manually. Variances are defined by Eigenvalues because each factor expresses variance.

4. Choose the Rotation Method: The rotation of factors makes it easier to clarify the output. Varimax rotation is used more frequently because it minimizes the number of variables with high loadings on each factor, which makes interpretation easier.

5. Run the Analysis: Once you have made these selections click “OK” to run the analysis.

For more help, engaging with our SPSS assignment help expert can prove to be helpful mainly for beginners in SPSS.

Step 3: Interpreting the Output

Now, SPSS will supply several tables in the output. Here’s what to focus on:

• Communalities Table: This table demonstrates how much of the variance of each of the variables is accounted for by the factors extracted. A value closer to 1 means that there is a stronger relationship with the factors.

• Total Variance Explained Table: This table shows how much variance is explained by each factor. Select those factors whose eigenvalues are larger than one, usually contributing valuable information.

• Rotated Component Matrix: This is one of the most important outputs. It shows the factor loadings after rotation, that is, the correlation between the variables and the factors. Loadings above 0.5 indicate a stronger relationship with the factor. For instance, if “academic stress” and “time management” have high loading on factor one, then you might interpret factor related to “academic pressures”.

Step 4: Naming the Factors

After you identify which variables to load onto each factor, give the factors meaningful labels. In our example, you may end up with factors such as “Academic Pressure” “Social Stress” and “Financial Concerns.” naming the factors according to their loadings makes the results more understandable.

Helpful Tips for Conducting Factor Analysis in SPSS Coursework Assignments

1. Check Sample Size: Factor Analysis should be used with large samples with more than one hundred participants. Small samples can result in unstable factors.

2. Factor Rotation: Do not leave out the aspect of rotation. This is more so because rotation methods such as Varimax make factors easily interpretable, especially in behavioral research.

3. Reliability Testing: After identifying factors, always test the reliability of these factors. Cronbach’s Alpha in SPSS (under the Analysis menu, scale, reliability analysis) determines if items loaded to a specific factor are consistent which is important for validity in behavioral research.

Why Choosing PhD SPSS Assignment Help Service is Essential to PhD Students in Research and Analysis?

Handling complex behavioral data and conducting spss analysis can be challenging at the beginning. Choosing SPSS assignment help can be immensely helpful for students, especially for PhD students who experience enormous pressure conducting behavioral research and econometric analysis. For doctoral students, data analysis is not just a part of their thesis but the very ground on which their research and contribution to the discipline will reside. Our service is useful for PhD students in performing precise data analysis in their thesis work supported by appropriate visualizations and graphics. We help students throughout their thesis work starting from data collection, cleaning, formulating hypotheses, and performing statistical tests to the interpretation of the results. Our experts offer clear, in-depth explanations that fit the specific needs of each thesis. This ensures that every analysis is thorough and easy for academic advisors and review panels to understand.

For students taking statistics and econometrics classes, our service goes a notch higher by simplifying SPSS assignments by breaking them into manageable parts for easy understanding. We provide detailed solutions to a given problem, whereby we not only give students the right answer but also help them understand why a particular approach was applied in arriving at the answer. It is especially beneficial for people who require help with regression analysis, a time series prediction, or an econometrics analysis in SPSS.

Our structured solutions are comprehensive yet student-friendly, including:

•Detailed Explanations: All outputs and every single command on SPSS are explained in a very comprehensible manner to understand the ‘how’ and ‘why’ for each step.

•Unique Insights: All the analyses are performed and interpreted comprehensively with unique insights and conclusions.

•Visualizations: To ensure that the students communicate their results in the best manner in their assignments and reports we incorporate visually appealing charts, graphs, and factor structures.

•SPSS Syntax and Outputs: In each of the solutions, we provide the specific SPSS syntax used, followed by the output in the form of annotated tables for easy replication of the work.

By choosing our SPSS assignment help, students get not only statistically sound results but also a helpful learning experience that enhances research skills and prepares them to conduct independent analysis in the future.

Conclusion

Learning how to do factor analysis in SPSS enables students to analyze and interpret large quantities of data in behavioral research. By determining the core factors from large datasets, one gets deeper insights into human behavior, which is invaluable in fields like psychology, economics, social work, and education. Other tools that can be employed by the students as they progress in their course include textbooks containing illustrations, online tutorial videos, and most importantly engaging with our SPSS homework assistance expert.

List of sources for further study

For a deeper understanding of factor analysis in behavioral research, students can refer to these well-regarded textbooks:

"Using Multivariate Statistics" by Barbara G. Tabachnick and Linda S. Fidell: Factor analysis is discussed comprehensively in this book, and examples are provided using SPSS, which should make this book attractive to learners wanting to practice with SPSS.

"Discovering Statistics Using IBM SPSS Statistics" by Andy Field: This book is well illustrated and is in great demand among students of psychology, containing clear guidelines on how to carry out and analyze the factor analysis with the help of SPSS.

"Principles of Research in Behavioral Science" by Bernard E. Whitley and Mary E. Kite: This text introduces the reader to research design and statistical analysis key concepts, thus establishing adequate background knowledge about factor analysis in behavioral research.

#SPSS assignment help#SPSS homework assistance#SPSS data analysis help#SPSS statistical analysis services#SPSS project support#Online SPSS tutoring#SPSS experts for hire#SPSS research project help#SPSS assignment writing services#SPSS data interpretation help#SPSS software guidance#SPSS statistical consulting#SPSS analysis for students

0 notes

Text

Autoregressive Distributed Lag (ADL) Model for Econometrics Assignment Support

The Autoregressive Distributed Lag (ADL) model is a robust tool in econometrics that is applied to examine variables across different time periods. Overall, the ADL model encompasses short-run and long-run effects excellently fit for diagnosing dynamics where current and past values of independent variable determine the value of the dependent variable. This characteristic is more useful in economic and financial time series, where variables evolve with time, and understanding the lagged effects becomes important for making accurate forecasts and policy analysis.

The use of the ADL model is very important for students in econometrics especially when solving analysis on different economic data scenarios ranging from monetary policy impacts to GDP growth forecasting. However, there are difficulties with utilizing ADL models as their application requires considerable knowledge of time series analysis, regression methods, and statistical programs. Econometrics is such a field that has a lot of complexities within its subject area; getting econometrics assignment help can help students get the support that is needed in doing such assignments that involve detailed analytical methods with ADL models. Besides having a deep understanding, this approach facilitates the acquisition of practical skills for real-world problems.

What is the Autoregressive Distributed Lag (ADL) Model?

The ADL model represents a type of econometric model used to deal with relationships in which the current value of the dependent variable depends on its past values (autoregressive component) and by both the latest and past values of one or more independent variables (distributed lag component). This approach makes the ADL models well-suitable to be applied in time-series analysis since variables do not respond immediately to changes but show a delayed effect over a number of time periods.

A basic ADL model can be represented as follows:

Yt = α + β0Xt + β1Xt−1 + ⋯ + γ1Yt−1 + ϵt

where:

Yt

Xt,Xt−1, etc., represent the independent variable and its lagged values,

α is a constant term,

β and γ are the coefficients for the independent and lagged dependent variables, and

ϵt is the error term.

This equation can have more than one independent variable and longer lag, depending on what is being analyzed and what sort of relations are being depicted. For instance, ADL(2,2) has two values of lag for the dependent and the independent variable.

Why is the ADL Model Important in Modern Econometrics?

ADL model forms the basis of econometric analysis for several reasons as outlined in the succeeding sections. It not only reflects the current impact but also the successive reactions of variables to past changes, providing a nuanced understanding of economic dynamics. This ability to distinguish between short-run and long-run impact is critical anywhere in policy assessment, projections, or even theory testing.

For the students, understanding of the ADL model enables them to solve actual econometric problems in the course. The economic decisions are not made using just the immediate factors or changes; they incorporate an understanding of how changes happen over time. Through analysis of ADL models, students can better understand more complex relationships such as consumer behavior, monetary policy impact on inflation, or impact on employment with changes in government expenditure.

Moreover, using ADL models one can find out the long-run equilibrium relationship, as well as the ways in which the variables adjust to this equilibrium after a shock. This is especially beneficial for detecting structural relationships with the macroeconomic data, which are characterized by persistent interdependent movement of the variables over time.

Practical Example: Using ADL Model to Analyse Economic Data

Let’s take an example that students commonly encounter in coursework: examining the effects of changes in interest rates on consumption expenditures. This relationship is never immediate because changes in interest rates take some time, in most cases months and even years to affect spending. Therefore, the use of the ADL model captures these lagged effects to have a deep understanding of the relationship. Consider the following scenario: we have quarterly data on consumer spending that is dependent on the interest rate, Yt, and the interest rate Xt that spans 10 years. Our analysis aims to identify the short-term and the long-term impact on consumer spending with respect to the changes in interest rates.

An ADL(1,2) model would be structured as follows:

Yt = α + β0Xt + β1Xt−1 + β2Xt−2 + γ1Yt−1 + ϵt

In this case:

β0 captures the immediate impact of interest rates on consumer spending,

β1 capture the lagged effects (one and two quarters later, respectively), and

γ1 accounts for the autoregressive impact of past consumer spending on current spending.

By entering the data in a package such as R, Python, or EViews, then students are able to estimate this model by specifying the lags. The output provides coefficients, specifying the strength and the direction of the effect. For example, negative signs on β0 would mean that a hike in interest rate leads to an immediate decline in consumer expenditure, with significant values of β1 and β2 supporting a long-duration effect.

Major Issues and How Econometrics Assignment Help Can Be Helpful

While ADL models are useful in econometric analysis, students usually face several hurdles while applying in their practical course assignments. Some of the issues are: 1. Selecting Appropriate Lags: The determination of the number of lags is very important since students may end up overfitting which eventually distorts the results. Students solving the assignments on ADL may be tested to identify the appropriate lag structure depending on the characteristics of data. 2. Understanding Model Stability: Model stability is critical to guarantee for making accurate long-term predictions. Econometrics assignment help can provide expert support in evaluating stability using tools like unit root tests and ensuring that the ADL model meets necessary assumptions. 3. Interpreting Results: The outputs of ADL models can be confusing to analyze especially when lagged variables show feedback loops. Experts’ assistance can help students in interpreting these outputs and other economic implications and time lag issues.

Therefore, students should seek homework help services in econometrics that would help them to understand such factors and gain the confidence required in handling such tasks which could eventually improve their performance on the assignments.

Econometrics Assignment Help Service: Balancing the Unleashed Beast in You: Econometrics

At Economicshelpdesk, our Econometrics Assignment Help service has been specially designed to meet students’ needs when it comes to solving and completing complex assignments and analyses in econometrics. Our highly qualified team comprises of experienced economists and statisticians who provide simple systematized solutions for easy comprehension. Our step-by-step approach acts as a self-help guide for students. If you are dealing with Autoregressive Distributed Lag (ADL), cointegration, or general time-series analysis, our help guarantees that you thoroughly understand current techniques applied in econometric analyses.

What Our Service Offers

When students opt for our assignment help, they receive:

• Detailed Solutions: The step-by-step approach to each solution allows one to easily understand as well as learn the process behind each section of the solution. Every formula, derivation, and statistical test is explained by our experts which becomes a valuable source of learning for the preparation of exams.

• Grading Excellence: Very often, with our help, students get the best grades, as we focus on making all the analyses accurate, and logically constructed. We prepare the solutions in accordance with academic standards, which help students submit quality work.

• Real-World Insights: In addition to helping students solve the assignments, we introduce them to new perspectives and unique insights. These practical insights equip students with views of how econometric tools are applied in current economic practice. The ability to engage modern econometric perspectives is precious and allows students not only to solve today’s problem in the assignment, but be increasingly ready for the analytical problem of tomorrow both in academies as well as real life.

Under our Econometrics Assignment Support, besides getting a professionally written solution, students develop their understanding and prepare for the future lessons.

Conclusion

The Autoregressive Distributed Lag (ADL) model is important for econometrics students, as it captures both short and long-term relationships among variables. As it facilitates tracking the dynamic relationship across time the ADL model prepares students to conduct real economic analyses resulting in better analytical skill development. However, the techniques of ADL models’ estimation can be rather tricky, especially for beginners in time series analysis.

By studying the following recommended textbooks and other resources as well as getting professional help with econometrics assignments, students will learn the ADL models which will strengthen their knowledge and confidence.

Suggested Resources and Textbooks for In-Depth Study

For students aiming to deepen their understanding of ADL models, several textbooks and resources offer comprehensive insights into both theory and application. Some of the textbooks you can refer to have been mentioned below:

1. "Econometric Analysis" by William H. Greene– A book that provides an overview of most econometric models, of which the ADL models are among those described exhaustively with examples.

2. "Introductory Econometrics: A Modern Approach" by Jeffrey M. Wooldridge

3. "Time Series Analysis" by James D. Hamilton –

#EconometricsAssignmentHelp#EconometricsHomeworkAssistance#EconometricsProjectSupport#EconometricsTutoringServices#EconometricsAnalysisHelp#EconometricsForStudents#AdvancedEconometricsAssignmentHelp#EconometricsConceptsExplained#TimeSeriesEconometricsHelp#EconometricModelingAssistance#EconometricsResearchSupport#EconometricsTestPreparation#EconometricsAssignmentsOnline#EconometricsDataAnalysisHelp#EconometricsGuideForStudents

0 notes

Text

How Economists Detect and Measure Collusion in Oligopolistic Markets

Introduction: What is Collusive Oligopoly?

A collusive oligopoly implies a market in which several firms of significant power cooperate to fix prices, output, and market share without competing. This cooperation may take the form of cartels or agreements that are not legally binding, with the ultimate aim of maximizing joint profits. By limiting competition, firms can easily set higher prices, limit their production, and act like monopolists.

Collusion in an oligopolistic market is beneficial because firms realize the benefits of symbiotic relationships as opposed to competition. For example, in a non-collusive market structure, the firm competes intensely to capture market share by significantly reducing price. Such behavior can be inimical to the interest of all companies because it eventually minimizes profitability. However, by agreeing tacitly, the oligopolists can fix prices, avert destructive competition, and provide certainty in the market. One example of this type of cartel includes OPEC (Organization of the Petroleum Exporting Countries) where member countries work in harmony to provide policy directives for production to control oil prices.

The primary purpose for why such situations exist is due to the strong interdependence of firms in an oligopoly. Pricing and output decisions taken by each of the firms affect the overall market condition. While in perfect competition each firm makes its decisions independently, the oligopolistic firms are highly strategic. Due to the risk of competitive retaliation, the group is likely to shift towards collusion for mutual interests. Although collusive behavior generates greater profits, it also has major economic as well as legal implications. Most governments have banned collusion as it is anti-competitive and detrimental to consumers in terms of limiting competition, innovation, and inflating prices.

Microeconomics students understand the fact that there is a lot of learning involved behind the fundamental notions of an oligopoly and collusion. Exam questions and assignments based on oligopoly are generally tricky. Availing microeconomics assignment help can get a fresh and broader view and enhance the perspective of students because it brings different innovative insights in comprehending these markets, specifically in the analysis of real-world case studies.

How Economists can identify and quantify collusive behavior in the Oligopolistic Markets

It may not be easy to identify collusion among firms particularly in an oligopolistic market since such firms will undertake elaborate measures towards concealing their collaborative conduct. Let us explore how collusion can be detected and measured by economists both theoretically and empirically.

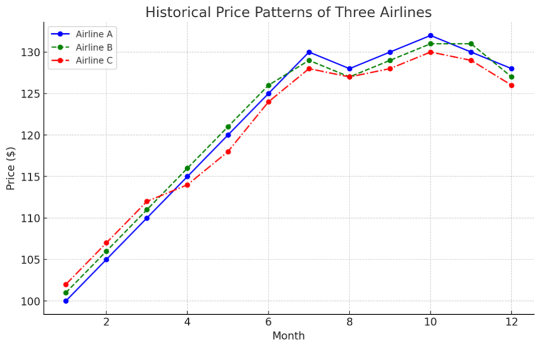

1. Price Analysis

Pricing patterns is the first factor of attention for economists in the process of studying the market. In a competitive market, prices readily change with supply and demand. However, in a collusive market customers may experience that products and service prices do not change frequently or do not rise independently of other firms in the same market. Synchronized price increases, or price rigidity, can show evidence of collusion.

For instance, when economists undertook a survey on major airlines, they found out that most of the airlines had adopted a pattern of hiking fuel surcharges in unison without any justification for change in fuel prices.

This behavior led to the commencement of a large-scale investigation into British Airways and Virgin Atlantic and the companies were subsequently fined.

Another useful approach is to analyze the dispersion of prices across the firms in the industry. In competitive markets the degree of price dispersion is significantly greater than in other markets due to varying cost structures and strategies. However, in collusive markets, firms tend to set equivalent prices as they do not wish to be outcompeted by fellow firms.

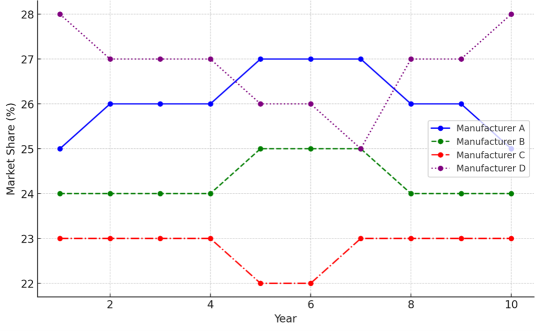

2. Market Share Stability

Another element that interests economists is the market position of firms where the market share of each firm is closely monitored. In a highly competitive market, market shares are constantly changing due to developmental efforts carried out by firms such as innovation, efficiency enhancement, or the adoption of low-price strategies. But in a collusive oligopoly, market share may not change in significant terms as firms mutually collaborate to minimize competition.

For instance, a cartel of manufacturers of trucks in Europe, the major players in the industry collaborated to maintain a stable market share and conspired to raise prices for more than a decade.

Such behavior triggered one of the biggest antitrust fines ever in the EU history.

3. Production capacity and its utilization

Another technique whereby economists are able to establish a collusion is by evaluating the levels of production and the capacity utilization of firms. In a collusive market, firms may restrict themselves from producing a larger quantity to maintain a high price. This may result in production capacities being under-utilized in a bid to ensure that they do not supply excess goods in the market thereby reducing the price.

For instance, the cement industry has time and again been under accusation of colluding in several countries, where firms were determined to be collaborating over supply decisions in a manner that would ultimately provide them with better market prices to make huge profits from.

4. Bid-rigging and Auction Data

In markets where several firms bid for contracts through auction or tender, the economists can observe bid patterns as an indication of cartel behavior. Firms are found to manipulate the bidding process, for instance, bid rigging, where firms decide beforehand who amongst them will win by deliberately submitting higher bids, allowing one firm to win at a higher price as compared to a competitive auction. This practice was especially noted in the construction sector among various firms in the UK colluding on tender prices for public contracts.

By studying auction data, economists can try looking for signs or patterns of rotation among winning bidders. Bid prices that are very close indicate that firms are in fact agreeing to share contracts or bids instead of competing for them.

5. Game Theory and Behavioral Analysis

Game theory is crucial in the analysis of the strategic actions of firms operating in an oligopolistic market. The prisoner’s dilemma is one of the game-theory models that economists use in expectation of understanding how various firms would operate under different competitive or collusive situations. In collusion, firms face a dilemma: They can either coordinate with other firms, and agree to fix high prices that are good for all or it can cheat by lowering prices and grabbing a bigger share of the market.

If firms prefer to cooperate in the future, then there could be a sign of tacit collusion. By modeling the behavior of firms and analyzing these simulated results with actual data, economists can deduce if firms are colluding even in the absence of explicit evidence.

Because of such practical applications and usefulness, students are usually taught the complexities of game theory, which makes them ready to solve real problems. Choosing our professional microeconomics assignment helps is the best strategy to cope with this challenging topic with easy-to-understand assignment solutions and case examples.

6. Econometric Analysis

Apart from theoretical models, econometric tests can also be used to detect collusion. This is where market data concerning price, quantity, and cost are analyzed statistically to reveal collusion-like behavior. For example, one can use regression analysis and see if price changes are correlated among firms, which indicate collusion rather than competition.

Structural break tests can also be employed to detect changes in market behavior enough to signal the beginning or end of collusion. However, if, after a time period of stable prices, one of the firms cuts its price and the others copy this move, there is a possibility that a cartel has ceased to exist.

Economic Ramifications of cartelization

Collusion has significant economic consequences both for the market and consumer equally. With an artificial increase in product prices, collusive firms transfer wealth from consumers to producers, or, more correctly, devalue consumer welfare. Such a deviation from the efficient allocation of resources gives rise to deadweight loss, in which output is less than it would have been in competitive circumstances.

Since then, in the 1990s, various global companies colluded to fix the price of lysine, a very important animal feed additive. The livestock farmer paid the increased prices, which he later passed on to the consumers in the form of increased meat prices. Several hundreds of millions of dollars were eventually fined against these companies.

Collusion can also stifle innovation and competition. When firms agree not to compete with one another on prices or market shares, they have no real reasons to invest in innovations that would keep them competitive, work towards greater efficiencies, or produce better products for consumers.

Expert Microeconomics Assignment Help for Collusive Oligopoly and More

With our Microeconomics Assignment Help service, we provide all sorts support to scholars working on assignments, dissertations, or case studies under the ambit of collusive oligopoly and other similarly advanced concepts in economics. Their expertise covers both microeconomic theory and its real-world market applications, furnishing the student community with excellent solutions grounded on empirical data, credible examples, and rigorous economic analyses.

Our experts introduce students to the new strategies firms adopt in oligopolistic markets to come together, suppress competition and maximize their profits. They explain complex concepts, such as price-fixing, market sharing, prisoner's dilemma with hot examples, as exemplified by the OPEC cartel or historical price-fixing cases in airlines or pharmaceuticals.

By offering different perspectives such as using game theory to detect collusion, price analysis, or finding evidence on bid-rigging, our expert enhances the understanding of theoretical frameworks as well as practical implication. The current economic trends are also incorporated, which allows students to relate their assignments to the current regulatory landscape and antitrust policies, thereby making it more relevant and impactful.

Besides collusive oligopoly, we assist the students with other complex microeconomics topics such as:

• Game Theory: Analyzing strategic interactions among firms.

Market Structures: Comparing perfect competition, monopoly, and oligopoly.

• Price Discrimination: Examining how firms charge different prices to different consumers.

• Cost-Benefit Analysis: Economic decision-making in terms of effectiveness and related welfare of society.

• Externalities and Public Goods: Understanding market failures and government interventions.

Conclusion

Tools and techniques for detecting collusion in oligopolistic markets include price analysis, game theory, and econometric models. The consequences of collusion are severe on the economy and ultimately affect consumers with higher prices and reduced competition. Students studying microeconomics will find this more important because it gives an insight into how markets can be manipulated and also why antitrust regulations are in place.

For studying such intricate topics as collusion, students may opt for our microeconomics assignment help service to study practical examples, case studies, and advanced theoretical models for a better understanding of this critical economic issue.

Suggested Literature

• Andreu Mas-Colell's "Microeconomic Theory": Rather an exhaustive textbook on oligopoly theory, game theory, and collusion in all detail.

• "Industrial Organization: Contemporary Theory and Practice" by Lynne Pepall, Dan Richards, and George Norman: Excellent resource for dynamics of markets with oligopoly.

• The Antitrust Revolution" By John E. Kwoka Jr. and Lawrence J. White Experience using real-world case studies on antitrust enforcement and collision detection.

#Microeconomics tutoring services#Microeconomics homework assistance#Microeconomics project help#Microeconomics study support#Microeconomics coursework aid#Microeconomics academic assistance#Microeconomics help online#Microeconomics consultation service#Custom microeconomics solutions#Microeconomics problem-solving service

0 notes

Text

🚀 7 VITAL Steps for Performing Quantile Regression in EViews 📊 Unlock the power of quantile regression with our comprehensive guide! Learn how to import data, interpret results, and avoid common pitfalls with expert EViews assignment help.

0 notes

Text

SAS Assignment Help Blueprint for Accurate Correlation Analysis Results

Correlation analysis is a statistical method used to assess the relationship between two or more variables. It quantifies how changes in one variable relate to changes in another, producing a correlation coefficient that ranges from -1 to +1. A coefficient of +1 indicates a perfect positive correlation, -1 indicates a perfect negative correlation (one variable increases while the other decreases), and a value of 0 signifies no correlation between the variables.

In the data analysis field correlation analysis is pivotal for hypothesis testing, exploratory analysis and feature selection in machine learning models. In other words, correlation assists students, researchers and analysts to identify which variables are related and possibly can be chosen for further qualitative explorative statistical analysis.

SAS: A Popular Tool for Data Analysis and Correlation

SAS (Statistical Analysis System) is one of the leading software packages for the correlation analysis and is mostly used by academicians, students in universities and for other professional research purposes. SAS also has different versions; for example, SAS Viya, SAS OnDemand, and SAS Enterprise Miner designed for specific users. The main strength of the software lies on its ability to handle large datasets, perform numerous operations and automates calculations with high levels of accuracy, which makes the software very useful for students who study statistics and data analysis.

Being a robust software, many of the students have issues and concerns with its application. Some of the general difficulties are: writing accurate syntax for performing correlation analysis, writing interpretation, handling big datasets. These issues may result in the inaccurate analysis and description of results and misleading conclusions.

Overcoming SAS Challenges with SAS Assignment Help

SAS Assignment Help is a valuable resource for students who face these challenges. These services provide comprehensive support on how to set up, run and interpret the correlation analysis in SAS. Whether a student is having trouble understanding the technical interface of the program, or the theoretical interpretation of the results of the analysis, these services help the student get accurate results and clear understanding of the analysis.

Students can gain confidence in performing correlation analysis by opting for SAS homework support to simplify concepts and get coding assistance. It saves time when tackling complicated questions and recurring errors during the process of running the codes in SAS.

SAS Assignment Help Blueprint for Accurate Correlation Analysis Results

With the basic understanding on correlation analysis and the issues students encounter, lets proceed with steps to be followed in order to perform correlation analysis in SAS. This guideline will take you through preparation of the data to the interpretation of the results with meaningful insights.

Step 1: Loading the Data into SAS

The first of approach of carrying out correlation analysis in SAS is to import the data set. In this context, let us work with the well-known Iris dataset which comprises several attributes of iris flower. To load the data into SAS, we use the following code:

data iris;

infile "/path-to-your-dataset/iris.csv" delimiter=',' missover dsd firstobs=2;

input SepalLength SepalWidth PetalLength PetalWidth Species $;

run;

Here, infile specifies the location of the dataset, and input defines the variables we want to extract from the dataset. Notice that the Species variable is a categorical one (denoted by $), whereas the other four are continuous.

Step 2: Conducting the Correlation Analysis

After loading the data set you can proceed to the correlation analysis as shown below. In case of numerical data such as SepalLength, SepalWidth, PetalLength and PetalWidth the PROC CORR is used. Here is how you can do it in SAS:

proc corr data=iris;

var SepalLength SepalWidth PetalLength PetalWidth;

run;

The output will provide you with a correlation matrix, showing the correlation coefficients between each pair of variables. It also includes the p-value, which indicates the statistical significance of the correlation. Values with a p-value below 0.05 are considered statistically significant.

Step 3: Interpreting the Results

After you had carried out the correlation analysis it is time to interpreted the results. SAS will generate a matrix along with correlation coefficients for each pair of variables of interest. For instance, you may observe that, the correlation coefficient of SepalLength and PetalLength is 0.87 indicating a positive and strong correlation.

Accurate interpretation of the results is highly important. High coefficients near +1 or -1 indicate strong relationship while coefficients near zero indicate a weak or no relationship of variables.

Step 4: Visualizing the Correlation Matrix

One of the helpful ways to do value addition to your analysis is by using visualization tools to plot correlation matrix. SAS does not directly support in-built tools but one can export the results and then use other statistical software such as R, python to plot the results. However, SAS can produce basic scatter plots to visually explore correlations:

proc sgscatter data=iris;

matrix SepalLength SepalWidth PetalLength PetalWidth;

run;

This code generates scatter plots for each pair of variables, helping you visually assess the correlation.

Step 5: Addressing Multicollinearity

One of the usual issues experienced in correlation analysis is multicollinearity, which is a condition where independent variables are highly correlated. Multicollinearity must be addressed in order to get rid of unreliable results in regression models. SAS provides a handy tool for this: the Variance Inflation Factor (VIF).

proc reg data=iris;

model SepalLength = SepalWidth PetalLength PetalWidth / vif;

run;

If any variable has a VIF above 10, it suggests high multicollinearity, which you may need to address by removing or transforming variables.

Coding Best Practices for Correlation Analysis in SAS

To ensure that your analysis is accurate and reproducible, follow these coding best practices:

Clean Your Data: Always make sure your data set does not contain any missing values or outliners that may affect results of correlation. Use PROC MEANS or PROC UNIVARIATE to check for outliers.

proc means data=iris n nmiss mean std min max;

run;

Transform Variables When Necessary: If your data has not met the conditions of normality the variables should be transformed. SAS provides procedures like PROC STANDARD or log transformations to standardize or transform data.

data iris_transformed;

set iris;

log_SepalLength = log(SepalLength);

run;

Validate Your Model: Make sure the correlations make sense within the framework of your study by double-checking your output every time. When using predictive models, make use of hold-out samples or cross-validation.

Also Read: Writing Your First SAS Assignment: A Comprehensive Help Guide

Struggling with Your SAS Assignment? Let Our Experts Guide You to Success!

Have you been struggling with your SAS assignments, wondering how to approach your data analysis or getting lost in trying to interpret your results? Try SAS assignment support!

If the process of analyzing large data sets and SAS syntax sounds intimidating, you are not alone. Even if a student understands how to do basic data analysis, he may stumble upon major problems in applying SAS software for performing correlation and regression or simple manipulations of data.

Students also ask these questions:

What are common errors to avoid when performing correlation analysis in SAS?

How do I interpret a low p-value in a correlation matrix?

What is the difference between correlation and causation in statistical analysis?

At Economicshelpdesk, we provide quality sas assignment writing services to students who require assistance in completing their assignments. For the beginners in SAS or learners who are in the intermediate level of sas certifications, our professional team provides the needed assistance to write advance level syntax. We know that SAS with its many versions such as SAS Viya, SAS OnDemand for Academics, and SAS Enterprise Miner might be confusing and we specialize in all versions to suit various dataset and analysis requirements.

For students who have successfully gathered their data but are not good at analysing and coming up with coherent and accurate interpretation of the same, we provide interpretation services. We write meaningful and logical interpretations that are simple to understand, well structured and well aligned with the statistical results.

Our services are all-encompassing: You will get all-inclusive support in the form of comprehensive report of your results and detailed explanation along with output tables, visualizations and SAS file containing the codes. We provide services for students of all academic levels and ensure timely, accurate and reliable solution to your SAS assignments.

Conclusion

For students who are unfamiliar with statistics and data analysis, performing a precise correlation analysis using SAS can be a challenging undertaking. However, students can overcome obstacles and produce reliable, understandable results by adhering to an organized approach and using the tools and techniques offered by SAS. We offer much-needed support with our SAS Assignment Help service, which will guarantee that your correlation analyses are precise and insightful.

Get in touch with us right now, and we'll assist you in achieving the outcomes required for your academic success. Don't let your SAS assignments overwhelm you!

Helpful Resources for SAS and Correlation Analysis

Here are a few textbooks and online resources that can provide further guidance:

"SAS Essentials: Mastering SAS for Data Analytics" by Alan C. Elliott & Wayne A. Woodward – A beginner-friendly guide to SAS programming and data analysis.

"The Little SAS Book: A Primer" by Lora D. Delwiche & Susan J. Slaughter – A comprehensive introduction to SAS, including chapters on correlation analysis.

SAS Documentation – SAS’s official documentation and tutorials provide in-depth instructions on using various SAS functions for correlation analysis.

0 notes

Text

Data Storytelling with Bivariate Analysis in R: Assignment Help Insights

Introduction to Bivariate Analysis in R

Bivariate analysis is a basic statistical technique to examine the correlation, figure out the cause-effect patterns, forecast future outcomes between two variables. Hence, it provides a solid foundation and strengthen the skills to handle sophisticated data analysis involving multiple variables.

R software is a frequently used by academicians and students in conducting basic descriptive and bivariate analysis and is capable of handling diverse datasets with ease. It is known for its flexibility, robust functionalities and community support. Using R to conduct bivariate analysis allows students to sharpen their basic data analysis skills and enable them to handle advanced techniques like regression, data modelling and machine learning.

R or R studio comes with a steep learning curve. Many students struggle with learning the bivariate analysis process in R, writing codes, generating visualizations and interpreting the outputs. To help overcome such issues, online R assignment expert service provides the must-needed support to assist students in solving their data analysis tasks and assignments involving R coding. In this post, we will discuss how students can avail R assignment help to learn new perspectives of interpreting data and expanding their analytical skills.

Why Bivariate Analysis is Key for Data Storytelling

Data storytelling has been a key practical skill in the sphere of data science and analytics. Bivariate analysis comes handy in analyzing raw data and turning them into insightful stories explaining the relationship between two variables. These correlations can be displayed in the form of plots and graphical visualizations in R or any other statistical software to demonstrate the story behind the data to the stakeholders. With bivariate analysis, you can tell a story about:

Trends and patterns between variables (e.g., age and income, height and weight)

Predictive insights (how one variable predicts the outcome of another)

Correlations (whether variables move in tandem or inversely)

While using this analysis in R, you not only get computation power to generate results but also learn visualization through several plotting functions. Regardless of whether one is just using a basic scatter plot or something more advanced like a heat map, R is a must have tool for students working on data analysis.

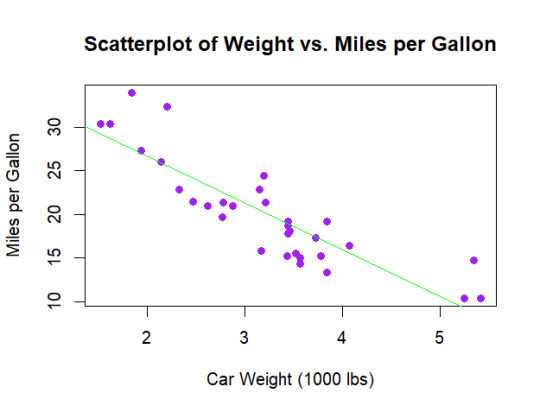

How to Conduct Bivariate Analysis Using a mtcars Dataset in R

In this example, we'll use the mtcars dataset in R, which includes the information on 32 car models, such as miles per gallon (mpg), weight (wt), and horsepower (hp). We will conduct a bivariate analysis to examine the relationship between mpg and wt, demonstrating how to explore these variables using R.

Step 1: Load the Dataset

First, load the dataset and take a look at its structure.

# Load the dataset

data(mtcars)

# View the structure of the dataset

str(mtcars)

These commands load the data and displays the structure and its variables.

Step 2: Conduct Basic Summary Statistics

A basic overview of the descriptive statistics of the variables is crucial before going further into visualization techniques. You can calculate summary statistics for mpg and wt:

# Summary statistics for mpg and wt

summary(mtcars$mpg)

summary(mtcars$wt)

The results of descriptive statistics showcase basic statistics such as minimum, maximum, median and mean of these two variables. This provides a context to the data that will be visualized in the next step.

Step 3: Visualize the Relationship

Visualizing the relationship between the variables is the crucial aspect of bivariate analysis. Here we will plot a scatter plot that will help in determining the relationship between the weight and the number of miles per gallon.

# Create a scatterplot to explore the relationship between mpg and wt

plot(mtcars$wt, mtcars$mpg,

main = "Scatterplot of Weight vs. Miles per Gallon",

xlab = "Car Weight (1000 lbs)",

ylab = "Miles per Gallon",

pch = 19, col = "blue")

On this scatterplot, one axis measures weight (probability term wt) and the other measures the number of Milles per Gallon (Mpg). From the plot, we can notice an inverse relationship that means if the weight of the car is increased then the number of miles per gallon will be decreased. This insight provides us a base for a deeper analysis.

Step 4: Calculate Correlation

After that, we compute the correlation coefficient, which measures the strength and direction of the relationship between the two variables. To do this in R, the cor() function is used.

# Calculate the correlation between mpg and wt

cor(mtcars$wt, mtcars$mpg)

The correlation coefficient will be a value between -1 and 1.

In this case we get -0. 87 (negative correlation coefficient) which means there is strong negative relationship between weight and fuel efficiency.

Step 5: Add a Regression Line

To analyze the relationship further, we can plot a linear regression line to the chart. It enables visualizing the overall trend and estimate mpg based on car weight.

# Add a regression line to the scatterplot

model <- lm(mpg ~ wt, data = mtcars)

abline(model, col = "red")

This command fits a linear regression model and displays a red regression line over the scatter plot. This line helps in predicting the miles per gallon based on the car weight, demonstrating the inverse relationship between the variables.

Step 6: Interpret the Results

The analysis reveals the fact that car weight has a negative effect on fuel efficiency. Those vehicles weighing more tend to be less fuel efficient. This kind of reasoning is used in real-life dataset and students can also use it other problems in their academics.

Also Read: Unleash Power of Doing Predictive Analytics with SPSS Modeler

Why Students Should Use R for Bivariate Analysis

R is the preferred tool for conducting bivariate analysis for several reasons:

Comprehensive Data Manipulation and Visualization Tools: R has numerous functions and libraries like ggplot2 through which the students can manipulate the data, make insightful plots and conduct deeper analysis.

Ease of Learning: Although R may seem confusing for beginners, but its capabilities in applying various statistical functions becomes easy with little bit of practice. With a large community base, a learner can find instant examples to resolve syntax errors.

Real-world Applications: The skills you develop with R provides a strong base in handling more complex data analysis using other software, making R a valuable statistical software.

Reproducibility: Every step you perform or every code you write in R can be easily reproduced to replicate results.

Extensive Libraries: R is in-built with extensive libraries such as the ggplot2, dplyr, and car offers the students with a smart toolkit to help students perform basic as well as advanced analysis.

The Value of R Assignment Help Services

Although R is very user friendly once students get familiar with it, many of them may find it challenging to learn how to execute bivariate analysis concepts using R or perhaps they may need troubleshooting errors in their R Studio assignments. To cope up with the coding and troubleshooting challenges students can opt for our R assignment help services. Our services provide expert guidance to ensure students:

Receive High-Quality Solutions: Our experts assist with code optimization and comprehensive interpretation to meet the necessary academic standards of writing and presenting data analysis reports.

Understand the Process: In addition to providing answers, our expert tutors also explain the justification behind each line of code, thereby enhancing students’ knowledge and improving their overall competency in R programming.

Gain Confidence: By using our R homework support services, students gain exposure to new perspectives and insights of looking and analyzing data.

Conclusion

Bivariate analysis is an essential skill for any student intending to join the field of data science and statistical analysis. Knowing how to perform bivariate analysis using R builds a solid foundation of learning the basic relationship among variables and paves way to go deeper into the analysis. The integration of bivariate analysis together with storytelling create effective ways of presenting the findings. Students are able to enhance their analysis in an efficient and effective manner.

For students struggling with the tasks in R Studio, using R assignment help is the smartest strategy to adopt. Our services do not only offer quality solutions but also enable students to discover new perspectives and approaches towards data analysis.

Helpful Resources and Textbooks

R for Data Science by Hadley Wickham – A comprehensive guide to learning R.

An Introduction to Statistical Learning by Gareth James – Great for understanding statistical models in R.

Advanced R by Hadley Wickham – For students looking to deepen their R programming skills.

0 notes

Text

Developing an Equilibrium Analysis Model Framework for Microeconomics Assignment Help

Equilibrium analysis is one of the most important concepts of microeconomics on how markets operate. It represents the balance between supply and demand in a market. Here the quantity supplied is equal to the quantity demanded hence keeping the price constant. This concept is very important to grasp how various market structures function and how price setting takes place in an economy.

Equilibrium analysis makes it easier for economists to forecast how changes in the market conditions such as consumer preferences and technological progress affect economy. Through understanding of equilibrium, students are in a position to assess the factors driving the economy and allocation of resources.

Importance of Equilibrium Analysis in Microeconomics

In microeconomics, equilibrium analysis is used as a basic method for examining different market situations. It provides a formal framework for investigating how individual decision-making processes and interactions between economic players result in specific market outcomes. For example, with equilibrium analysis, one can assess why a certain product is sold at a specific price, why there are fluctuations in supply occur and how these situations have to be dealt with.

Why Students Should Master Equilibrium Analysis

Students pursuing courses in economics, finance, business or similar field are required to master the equilibrium analysis. It builds the foundation for other important areas of economics including; game theory, market structures and welfare economics.

However, sometimes the application of the equilibrium analysis can pose a challenge for students. They often get confused in establishing a link between the theories and real-world application in case studies and business problems. The gap can be bridged with microeconomics homework help. We shall elaborate on the importance for these services in the later part of this post. Let us first discuss the steps in developing an equilibrium analysis model.

Developing an Equilibrium Analysis Model: A Step-by-Step Framework

Developing an equilibrium analysis model comprises several steps and it calls for deep knowledge of economic theories. In this section, a complete framework to build models of equilibrium analysis will be described.

1. Understanding the Basics: Demand and Supply Curves

The first thing that needs to be grasped in the creation of an equilibrium analysis model is demand and supply curves. The demand curve represents the how price of a good and its quantity demanded are related to each other keeping other factors constant. On the other hand, supply curve depicts the relationship of the quantity of goods supplied and the price.

Example: The Market for Coffee

Take case of the market of coffee. The coffee demand curve may indicate a downward slope, showing that when the price of coffee is low, the quantity demanded becomes high. On the other hand, the supply curve can indicate a upward slope implying that producers are willing to supply more coffee as the price rises.

In this market, the equilibrium is the price where the quantity demanded of coffee equals to its quantity supplied.

2. Mathematical Representation of Demand and Supply

After you know what basic demand and supply curves look like, you can write them using mathematical expression. Linear equations are involved to present these curves.

Example: Linear Demand and Supply Equations

Suppose the demand for coffee is given by the equation:

Qd=100−10P

Where Qd is the quantity demanded, and P is the price of coffee. Similarly, the supply of coffee might be represented by:

Qs=20+15P

Where Qs is the quantity supplied.

3. Finding the Equilibrium Price and Quantity

The equilibrium price and quantity are obtained at the intersection of the demand and supply curves. This is a situation where the quantity demanded for a certain good in the market is equal to the quantity supplied in the market.

Solving for Equilibrium:

Set Qd=Qs

100−10P=20+15P

Solving for PPP, we find:

100−20=15P+10P

80 = 25P

P=3.2

With the equilibrium price P=3.2, we can put it back into either the demand or supply equation to find the equilibrium quantity:

Qd=100−10(3.2)=68

Thus, the equilibrium quantity is 68 units of coffee, and the equilibrium price is $3.20.

4. Analyzing Shifts in Demand and Supply

Markets always show their dynamic nature, and changes in demand and supply occur naturally. These shifts may result from factors like differences in customer tastes, advancement in technology, or changes in policies enacted by the government.

Case Study: The Impact of a Health Trend on Coffee Demand

Consider an emerging trend of numerous health benefits associated with coffee consumption. This could shift the demand curve to the right, showing an increase in demand at every price level.

If the new demand equation is:

Qd′=120−10P

To find the new equilibrium, set Qd′=Qs

120−10P=20+15P

100=25P

P=4

With the new equilibrium price P=4, the new equilibrium quantity is:

Qd′=120−10 (4) =80

This shift in demand leads to an increase in the equilibrium price to 4 dollars as well as equilibrium quantity that equals 80 units. This is a simple example through which students can learn the changes in external factors impacting the market equilibrium.

5. Incorporating Elasticity in Equilibrium Analysis

Elasticity refers to how flexible quantity demanded or supplied are with respect to increase in price. Elasticity helps in the prediction of changes in demand and supply on market outcomes.

Types of Elasticity:

Price Elasticity of Demand (PED): Measures the responsiveness of quantity demanded to a change in price.

Price Elasticity of Supply (PES): Measures the responsiveness of quantity supplied to a change in price.

Calculating Elasticity:

Elasticity can be calculated using the formula:

Elasticity=% Change in Quantity/% Change in Price

For example, if a 10% increase in the price of coffee results in a 5% decrease in the quantity demanded, the price elasticity of demand would be:

PED = −5%/10% = −0.5

An elasticity of -0.5 means that the demand for coffee is inelastic. Change in price of coffee doesn’t affect buying behavior of consumers.

6. Advanced Equilibrium Analysis: Incorporating Multiple Markets

In reality, markets are connected to each other. Changes in one market can affect others, a concept known as general equilibrium.

Example: The Coffee and Sugar Markets

Consider the coffee market functioning along with the sugar market. If the price of coffee rises, it might reduce the demand for sugar (a complementary good), shifting the sugar demand curve to the left. This interconnectedness requires a more advanced equilibrium analysis to understand the full impact of changes across multiple markets.

7. Dynamic Equilibrium Models

Dynamic equilibrium models study the pattern and trends through which economies have progressed over time. As compared to Static models focused on a single point in time, dynamic models take adjustments and modifications into account.

Illustration: One of the popular examples of dynamic equilibrium models is the Cobweb Model. It illustrates the fluctuations in price and quantity due the production decisions being taken based on historical prices.

Example: Agriculture Markets

Imagine a farmer making planting decisions based on last year’s prices. When prices were high, many farmers planted more wheat, causing an oversupply and lowering prices this year. In response to lower prices, farmers planted less the following year, creating a shortage and increasing prices. This cycle illustrates how dynamic equilibrium models reflect the time-sensitive dynamics of real-world markets.

8. Applications of Equilibrium Analysis: Policy and Business Decisions

Equilibrium analysis is not just a theoretical concept; it is applied in policy and strategy making.

Policy Example: Minimum Wage Laws

Think about the labor market and the adoption of law on minimum wages. The equilibrium wage could occur at a rate above the minimum wage, which would create a state of surplus labor or unemployment. This entails considering the conditions that exist within the labor market together with the effects of policy changes have on both supply and demand.

Business Example: Pricing Strategies

Using the equilibrium analysis, firms are able to set appropriate prices for their products. For example, the elasticity estimates may be used in a firm to see how a change in price may impact on the revenues/profits.

9. Empirical Analysis: Using Data to Understand Equilibrium

Empirical analysis involves using real-world data to estimate demand and supply curves and understand equilibrium in practice. This can include econometric models that estimate the relationships between different economic variables.

Also Read: How Does Economic Inequality Affect Access to Healthcare in the USA

Case Study: The Gasoline Market

A perfect example of a commodity widely analysed by economists is gasoline in examining how prices are decided and other factors impacting demand and supply. Economists are able to build models and predict equilibrium conditions by using historical data of gasoline prices, consumption as well as factors such as the price of oil and government regulation.

Why Consider Microeconomics Assignment Help?

Understand equilibrium analysis can be tough for many students and to overcome the complexities we introduce you to microeconomics assignment help service. Here we provide you expert guidance and support with your assignments. This makes it easier to understand economic concepts and get better grades. With our expert help, you can do perform well in your assignments and overall coursework. Simply share your assignment with us and get high quality solutions that not only helps to get better grades but act as a study guide in understanding the concepts involved.

Conclusion

Understanding equilibrium in microeconomics is really important. It helps students grasp how markets work and apply concepts to real economic issues. Mastering equilibrium analysis helps improve analytical skills, which are valuable for careers in economics, business, and public policy. By using resources like microeconomics assignment support, students can strengthen their understanding and do well in their assignments.

Recommended Resources for Further Learning

To further your understanding of equilibrium analysis, consider the following textbooks and resources:

1. "Microeconomics" by Robert Pindyck and Daniel Rubinfeld - This textbook provides a comprehensive overview of microeconomic theory, including detailed sections on equilibrium analysis and its applications.

2. "Intermediate Microeconomics: A Modern Approach" by Hal R. Varian - Known for its clear explanations and practical examples, this book is an excellent resource for understanding the nuances of equilibrium in various market structures.

3. "Principles of Microeconomics" by N. Gregory Mankiw - A widely used introductory text that covers the basics of supply and demand, elasticity, and equilibrium analysis in an accessible manner.

4. Economicshelpdesk.com - An online platform offering free tutorials on various microeconomic topics, including supply and demand, elasticity, and equilibrium. Also the leading microeconomics assignment help service for students.

0 notes

Text

SPSS Help for Social Science Students in Analyzing Survey Data

Data analysis is much needed skill to be acquired for any social science student especially for those in research and surveys. One of the most widely used programs for this purpose is SPSS (Statistical Package for the Social Sciences). SPSS is adopted in academies and professions for the reliability of the statistical functionalities and ease of use of the application. This post aims to spss help for students pursuing social science courses and are seeking guidance on the use of SPSS for data analysis. We will discuss the basics of SPSS, how spss has become an important tool for research in social sciences, common difficulties that student face in spss and some helpful solutions to overcome these difficulties.

What is SPSS?

SPSS is an acronym for ‘Statistical Package for the Social Sciences’. It is one of the most popular statistical analysis software, designed for handling quantitative data. The SPSS was developed by Norman H. Nie, C. Hadlai Hull, and Dale H. Bent in the 1960s as a statistical package for the social science disciplines. It has developed into one of the most important and versatile tools of data analysis for use by researchers, academicians, and professionals in areas such as psychology, sociology, political science, public health and marketing. SPSS provides robust statistical operations like descriptive stats, bivariate statistics, linear regression, multivariate regression and many other functions. It gives the capability to import, process, and analyze data, test hypothesis, and generate comprehensive reports with tables and graphs.

Importance of SPSS in Social Science Research

In social science research, studying people’s behavior, societal trends, and social phenomena may involve gathering and evaluating complex collection of data. This is where SPSS is most useful as it makes analysis and generating the results in no time so that the researcher can devote more time towards identifying the patterns and finding insights.