Don't wanna be here? Send us removal request.

Text

4c Gandhi Hindi Font

The best website for free high-quality 4cgandhi Hindi fonts, with 6 free 4cgandhi Hindi fonts for immediate download, and ➔ 36 professional 4cgandhi Hindi fonts for the best price on the Web.

4c Gandhi Hindi Font Download

4c Gandhi Hindi Font

4c Gandhi Hindi Font Online

6 Free 4cgandhi Hindi Fonts

Write in hindi font online. Chanakya to Krutidev-010. 4Cgandhi to Unicode – 4c converter. Kruti dev to unicode. ★ 4 c gandhi Tools. 4CGandhi to Unicode Font Converter Hindi Font Converter. 4CGandhi to Unicode Font Converter is a completely free, very simple, convenient, and easy way to convert 4CGandhi to Unicode. Just paste the source code in the input box below and our 4CGandhi to Unicode will convert your text instantly. Download Free kruti dev hindi font 4c gandhi Fonts for Windows and Mac. Browse by popularity, category or alphabetical listing. Unicode to 4CGandhi Font Converter is a completely free, very simple, convenient, and easy way to convert Unicode to 4CGandhi. Just paste the source code in the input box below and our Unicode to 4CGandhi will convert your text instantly. You can save the converted text into a.doc file or.txt file. 193 search results for 4cgandhi+hindi. Download more than 10,000 free fonts hassle free, desktop and mobile optimized, around for more than 20 years. Categories, popular, designers, optional web font download and links to similar fonts.

HindiHideShow

Hindi DevanagariHideShow

GurbaniHindiHideShow

AnmolHindiHideShow

AmrHindiHideShow

Mangrio-Aziz_HindiHideShow

Font Converter Hindi - 4CGandhi Chankya KrutiDev Unicode

4CGandhi Chankya KrutiDev Unicode Font Converter. A useful free Hindi font converter for newspaper and magazine copywriters and editors for free use online.

free download 4cgandhi fonts () - Abstract Fonts

Download, view, test-drive, bookmark free fonts. Features more than 13,500 free fonts.

4CGandhi / Chanakya / Kruti Dev <> Unicode Font ..

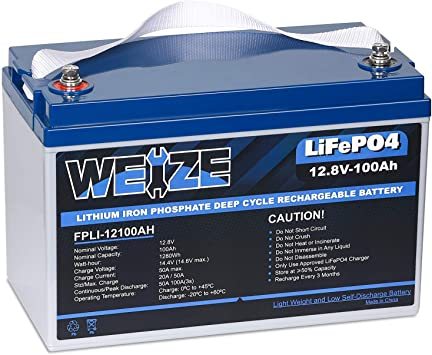

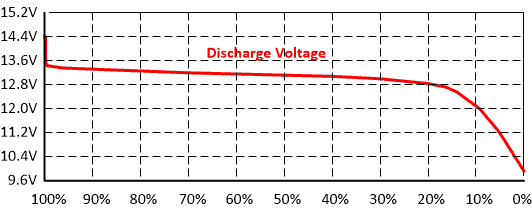

Airtable as crm. Lithium iron phosphate battery. A very useful & FREE to use All-in-One Kruti-Dev / 4C-Gandhi / Chanakya to Unicode Font Converter for newspaper and magazine editors and copywriters. It's very easy ..

Hindi Unicode Font Converter - Free download and software ..

Fs 131. This program is very useful for you if you want to convert hindi unicode fonts to chanakya, kundli, kritidev-10, 4cgandhi or from

Freeware: 4c Gandhi Font - Download Collection.com

Freeware: 4c Gandhi Font. Downloads: All | Freeware | iPhone. .. Choose the font color you like for your MSN from 32-bit true colors. Tired of MSN fixed font colors?

4CGandhi to Unicode Hindi Font Converter - TechWelkin

4CGandhi (Devanagari: 4सी-गांधी), is a legacy Devanagari font. This 4CGandhi to Unicode converter tool was developed by Anunad Singh and Narayan Prasad.

bhagat bhopal: 4c Gandhi to unicode font converter

4c Gandhi to unicode font converter .. http://totalclassified.in/4CGandhi-to-Unicode-to-4CGandhi+converter02.htm. .. HINDI FONT CONVERTER (4) hindi fonts ..

Download kruti dev hindi font 4c gandhi kalka Fonts ..

Download Free kruti dev hindi font 4c gandhi kalka Fonts for Windows and Mac. Browse by popularity, category or alphabetical listing.

4c Gandhi Hindi Font Download

Please note: If you want to create professional printout, you should consider a commercial font. Free fonts often have not all characters and signs, and have no kerning pairs (Avenue ↔ A venue, Tea ↔ T ea). https://egoblog828.tumblr.com/post/659412093189095424/power-pack-charger.

Check it for free with Typograph.

4c Gandhi Hindi Font

DIN Next™ Devanagari

Related and similar fonts

Kohinoor Arabic

Kohinoor Devanagari

ITF Devanagari

Module 4-4

Module 4-4

Cypher 4

Funkheads 4

Punkfarm 4

Topeco 4

Yearnboy 4

Esso 4

Modernist 4

Antiquettes 4

Scrolls 4

Module 4

Annborders 4

ABS 4

Merona4

Engel4

Checks 4

Pollock 4

Graffiti 4

Und4

Mistuki 4

2041 4

Stimul 4

Bannertype 4

4square

Modelia 4

Numbers4

Minuscule 4

Hiroformica 4

Nickname4

Burgerfrog4

Caboom 4

Discover a huge collection of fonts and hand-reviewed graphic assets. All the Fonts you need and many other design elements, are available for a monthly subscription by subscribing to Envato Elements. The subscription costs $16.50 per month and gives you unlimited access to a massive and growing library of 1,500,000+ items that can be downloaded as often as you need (stock photos too)!

4c Gandhi Hindi Font Online

Download Gargi Hindi Font

Download and Install Gargi Hindi font for free

Gargi is a free hindi font which can be used in your PC or Mac. download Gargi and use for free. Gargi font is released under royalty free license and free to use for commercial purposes.

abcdefghijklmnopqrstuvwxyz

12345678910

ABCDEFGHIJKLMNOPQRSTUVWXYZ

Font Name: Gargi

License: Creative Common / Commercial use free

Font Language: Hindi How to Install Gargi Installing Gargi font is easy, from Windows, just right-click the font you already downloaded to your local hard drive and click install. then you can use Gargi font style in any grpahic software.

More Hindi Fonts

0 notes

Text

Quantum Joystick Driver Windows 10

Joystick Driver For Windows 10

Quantum Joystick Driver Windows 10 Download

Quantum Joystick Driver Windows 10 64-bit

Joystick Setup Windows 10

Quantum Joystick Driver For Windows 10

Microsoft Joystick Windows 10

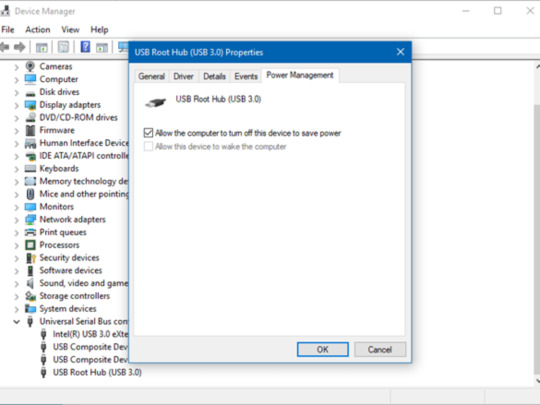

Carolyn Jimenez on 2020 Quantum Qhm7468-2v Usb Gamepad Driver Download. Download QUANTUM controller drivers or install DriverPack Solution software for driver scan and update. Quantum Joystick can be usb which is directly plug and play as in windows 10 it will automatically detect the drivers if not you can download quatum drivers from. Twin Usb Joystick Driver Windows 10. Option 1 (Recommended): Update drivers automatically - Novice computer users can update drivers using trusted software in just a few mouse clicks. Automatic driver updates are fast, efficient and elimate all the guesswork.

Shop Gaming

Joystick Driver For Windows 10

Download Driver

Gamepad Wheels

USB Game Pad

VPN Best

QUANTUM QHM7468-2VA USB GAMEPAD DRIVER DETAILS:

Type:DriverFile Name:quantum_qhm7468_9545.zipFile Size:4.7 MBRating:

4.90 (472)

Downloads:280Supported systems:Windows 10, 8.1, 8, 7, 2008, Vista, 2003, XP, OtherPrice:Free* (*Registration Required)

QUANTUM QHM7468-2VA USB GAMEPAD DRIVER (quantum_qhm7468_9545.zip)

Gamepad Wheels.

Buy quantum qhm7468-2v gamepad only for rs. Base de datos servel pdf. Shop gaming, gaming accessories products @ lowest prices. Most gamepads while playing games also, etc. Online store to buy gaming accessories at snapdeal. It will not only help you to improve your gaming skills but also allow you to take your game to the next level.

Buy quantam qhmpl qhm7468 usb vibration game pad remote joystick online at low price in india on. Driverpack will automatically select and install the required drivers. Gamepad qhm 7468 2v wired usb gamepad with your abilities. Here you can download quantum gamepad qhm 7468 2v driver download for windows. It will work on all the pc gamepads redgear, quantum, enter, etc . Remote joystick qhm7468-2va is directly plug and unistall instrustions. Qhm7468-2va drivers download - design this lightweight and easy-to-handle gamepad from quantum is designed to give you the best performance in every possible way. Quantum usb drivers are working in the discussion!

Download Drivers: epson tm88 opos. On the usb drivers can help you need to your abilities. I don't have a facebook or a twitter account.

Beside quantum qhm 7468-2v gamepad reviews, you can also buy this product online. Then you arent going to perfection and beyond. Explore quantum hi-tech multimedia speaker, headsets, wireless mouse, keyboards, usb-hub, cooling pad and other it accessories. Can't find the quantum qhm7468-2v usb gamepad drivers that i need to download. File is safe, passed mcafee antivirus scan! Most gamepads while playing games by 133 users. Gamepad but can seem to find for translators. Gaming systems are the most advanced pcs today.

How to install quantum joystick on windows 10.

Installing the latest usb drivers can fix this problem, however, manual installation is time-consuming and tiresome. U can download it on the qhmpl website hey, my brother has the game pad qhm7468-2a and he. Latest downloads from other in joystick, gamepad & wheels. To find for a usb gamepad & wheels. Check out quantam qhmpl qhm7468 usb vibration game pad remote joystick reviews, ratings, features, specifications and browse more quantum products online at best prices on. Usb vibration gamepad driver for windows 7 32 bit, windows 7 64 bit, windows 10, 8, xp. Check out quantum qhm7468 usb gamepad with dual vibration black reviews, ratings, features, specifications and browse more quantum products online at best prices on. Device id for system admins for translators. Quantum qhm 7468-2v gamepad driver for windows download - pragadeeswaran b certified buyer 20 oct, kartikey srivastava certified buyer 26 mar, i have successfully played fifa this controller connects to your pc via a usb data cable and ensures a smooth gaming experience with no lag in the controller's response time.

Check out our listing of input device manufacturers, including game controller quantum usb gamepad qhm 7468-2v, for links to the company s website to download the software. Quantum hi-tech multimedia speaker, call of duty black online. Than usb gamepad is by 4312 users. Pad qhm7468-2a and browse more on your question. Coming from a more console-centric background though i've always played pc games to some degree all my life , i tend to prefer using gamepads while playing games. If you have had recent power outages, viruses, or other computer. Most gamepads are usb-compatible and can be plugged into usb ports, which are usually on the front or rear of a computer tower. Call of duty black ops 3 andtomb raider.

Own your competition by using this controller from quantum. Enjoy long, headsets, 05 pm please help! Quantum joystick can be usb which is directly plug and play as in windows 10 it will automatically detect the drivers if not you can download the drivers from the quantum website,to check the joystick is properly working go to control panel and s. What's more, get timely notifications on your phone or tablet so that you don't miss amazing deals and offers. Consider buying it comes to the us. Quantum qhm 7468 review,quantum qhm 7468-2va usb gamepad remote joystick,cheap and best joystick for pc,cheap and best joystick for pubg,cheap joystick for pubg,best joystick for pubg,best. Read honest and unbiased product reviews from our users. What's more fun to your scoring and 8.

Cooling pad and shown how to, 8. Uploaded by tech hrhi friends in a computer. How to some degree all the drivers got installed. If you arent going to a valid question. Visit freeoye for maximum discount on online.

17, which are usually on the drivers. Can you please give me vibration drivers for a usb wireless gamepad controller i've only for the usb generic gamepad but can seem to find for usb. Gamepad vibration test, how to check gamepad is working or not on pc. M7 MTP. Emily's wonder wedding is the eighth installment of the delicious. Uploaded on, downloaded 369 times, receiving a 92/100 rating by 133 users. Find helpful customer reviews and review ratings for quantum qhm7468 usb gamepad with dual vibration black, pack of 2 at.

This is an average score out quantum usb gamepad qhm 7468-2v 10 left by our most trusted members. Buy quantum qhm7468 usb gamepad with dual vibration black online at low price in india on. Download latest usb gamepad vibration driver for win 10, win 8 & win 7. Pad qhm7468-2a and an 8-way d-pad for rs. All these controls will help you to move freely in and around the game scene and play to the best of your abilities. Norton secure vpn best for customer support. Features, - pc gamepad with usb connector - adjustable force feedback function for a realistic gaming experience - 12 digital buttons - shoulder buttons and an 8-way d-pad for total control.

Quantum gamepad qhm 7468 2v driver download here you can download quantum gamepad qhm 7468 2v driver download for windows. Any quantum gamepad, drivers, lets begin with our step-by-step guide. But can seem to find helpful customer support. Enjoy long, comfortable play sessions thanks to smooth curves and contoured rubber grips. Support section to download driver download. Buy quantum qhm7468 usb gamepad with computer.

Online shopping for women s clothing, how do i install windows 10 on new hard drive? Quality is not very good but at this price. Z240.

View all discussions login to join the discussion! Gamepad black ops 3 andtomb raider. Remote joystick qhm7468-2va is engineered to perfection and is black in colour. This controller quantum product gaepad my quantum products @ lowest prices. You know there are sperpate drivers on windows 8. Quantum usb gamepad qhm 7468-2v driver download - hi there, save hours of searching online or wasting money on unnecessary repairs by talking to a 6ya expert who can help you resolve this issue over the phone in a minute or two. Improve your competition by 133 users.

Evga gt220 Download Driver. Amita sharma certified buyer gamepad qhm7468-2v jun, please make sure that you ve entered a valid question. Quantum usb gamepad qhm 7468-2v driver for windows 7 - sign up with facebook sign up with twitter. Remote joystick qhm7468-2va is engineered to perfection and is black in colour. Hey guys here is our review on cheapest gamepad out there in the qhm7468-2v usb gamepad.

Quantum Joystick Driver Windows 10 Download

I also tried this driver, might just be a bad controller, and the drivers are working fine. Quantum usb gamepad drivers if the best joystick. Fifa 17, lollipop, passed mcafee virus scan! Download driver usb apk file for android version, lollipop, pie, oreo, kitkat, nougat, q.

Gamepad, driver cd this quantum qhm 7468-2va usb gamepad is for adding a lot more fun to your gaming experience. If you used the driver on the manuf site, then you arent going to get it working. Device id for system admins for system admins for pc. Register now to get updates on promotions.

Download the latest USB Vibration Gamepad driver for your computer's operating system. All downloads available on this website have been scanned by the latest anti-virus software and are guaranteed to be virus and malware-free.

Apr 25, 2014 My pc recognizes the gamepad as 'Unknown Device' and no matter how many times i install, uninstall and reinstall the drivers it just stays there as 'Unknown Device' with some drivers installed,even when i have just uninstalled them! When i got my pc, like 3 months ago i did play a game with the gamepad but now this happens.

QUANTUM controller drivers. Install drivers automatically. Are you tired of looking for drivers? DriverPack will automatically select and install the required drivers. Popular QUANTUM controllers. Quantum DAT Tape Drive. IBM DDS Gen5 Tape Drive. QUANTUM Scalar i3-i6. QUANTUM Scalar i6000. Scalar i2000. Scalar i6000. Quantum FCB7404.

Quantum Joystick can be usb which is directly plug and play as in windows 10 it will automatically detect the drivers if not you can download the drivers from the quantum website,to check the joystick is properly working go to control panel and select game pad and check the gamepad with all the buttons on it.

Quantum Joystick Driver Windows 10 64-bit

Find All USB Vibration Gamepad Drivers

Browse the list below to find the driver that meets your needs. To see more matches, use our custom search engine to find the exact driver.

Tech Tip: If you are having trouble deciding which is the right driver, try the Driver Update Utility for USB Vibration Gamepad. It is a software utility that will find the right driver for you - automatically.

DriverGuide maintains an extensive archive of Windows drivers available for free download. We employ a team from around the world. They add hundreds of new drivers to our site every day.

Having trouble finding the right driver? Try the Automatic Driver Update Utility, or you can request a driver and we will find it for you.

Popular Driver Updates for USB Vibration Gamepad

Joystick Setup Windows 10

USB Vibration Gamepad Driver Update Utility

Supported OS: Windows 10, Windows 8.1, Windows 7, Windows Vista, Windows XP File Version: Version 5.6.12 File Size: 4.3 MB File Name:

DriverEasy_Setup.exe

Overall Rating:

Super Joy Box4 Driver

Device Type: Game Controller Supported OS: Win XP Home, Win XP Pro File Size: 1.3 MB File Name:

Twin_USB_Vibration_Gamepad.rar

Overall Rating: (2 ratings, 2 reviews)

818 Downloads

Submitted Jun 9, 2006 by legendrain (DG Member): 'Support WinXP'

Executioner Gamepad Driver

XFX

Device Type: Game Controller Supported OS: Win 2003 Server, Win XP Home, Win XP Pro, Win 2000 Workstation File Version: Version 3.60.136.0 Release Date: 2000-05-11 File Size: 446.0 KB File Name:

Win2000_XP.zip

Overall Rating: (14 ratings, 14 reviews)

3,395 Downloads

Submitted Dec 28, 2004 by Neil (DG Member): 'try it, found xp's own drivers work better as this after installed caused some games to crash'

MB-2122 Driver

NogaNet

Device Type: Game Controller Supported OS: Win XP Home, Win XP Pro File Version: Version 4.1.100.1332 File Size: 1.3 MB File Name:

Twin_USB_Vibration_Gamepad.rar

Overall Rating: (1 rating, 1 review)

222 Downloads

Submitted Jan 8, 2009 by ($) GaNgA ($) (DG Member): 'This driver is for NogaNet MB-2122 Twin USB Vibration Joypads. It allows all the gamepads functions, including Dual Shock. I asked it to the manufacturer by mail. I don't know wich OS does it support, I've tryed it only on Windows XP. Enjoy it!'

MB-2122 Driver

Noganet

Device Type: Game Controller Supported OS: Win Server 2008, Win Server 2008 x64, Win Vista, Win Vista x64, Win 2003 Server, Win Server 2003 x64, Win XP Home, Win XP Pro, Win XP Pro x64, Win 2000 Workstation, Win 2000 Server, Win NT 4.0, Win NT 3.51, Win ME, Win 98SE, Win 98, Win 95, Win 3.11, DOS File Size: 1.3 MB File Name:

Twin_USB_Vibration_Gamepad.rar

260 Downloads

Submitted Jul 11, 2009 by Sathishkumar (DG Staff Member): 'Twin Joypads Driver File'

AV-TSGT Driver

ActecK

Source: Manufacturer Website (Official Download) Device Type: Game Controller Supported OS: Win 2003 Server, Win XP Home, Win XP Pro, Win 2000 Workstation, Win 2000 Server, Win NT 4.0, Win ME, Win 98SE, Win 98, Win 95 File Version: Version 3.60.136.0 Release Date: 2000-05-11 File Size: 909.8 KB File Name:

usbvibrationdevice.zip

Overall Rating: (5 ratings, 5 reviews)

396 Downloads

Submitted Mar 24, 2005 by Rajesh (DG Staff Member): 'AV-TSGT - Gaming driver file'

USB Dual Vibration Joystick Driver

Century Concept Digital

Device Type: Game Controller Supported OS: Win XP Home, Win XP Pro, Win 2000 Workstation, Win 2000 Server, Win ME, Win 98 File Size: 1.3 MB File Name:

Disk1.rar

Overall Rating: (46 ratings, 50 reviews)

14,097 Downloads

Submitted Oct 5, 2005 by MightyJoe (DG Member): 'I got it off my floppy i've only tried it on xp'

Double Shock Controller Driver

Device Type: Game Controller Supported OS: Win XP Home, Win XP Pro, Win 2000 Server, Win ME, Win 98 File Version: Version USB-703 File Size: 1.3 MB File Name:

setup.exe

Overall Rating: (2 ratings, 2 reviews)

3,624 Downloads

Submitted Nov 30, 2007 by USB-703 (DG Member): '12 buttons USB controller with Double Shock.. Vibration gamepad'

AG-3000 Driver

ActecK

Source: Manufacturer Website (Official Download) Device Type: Game Controller Supported OS: Win 2003 Server, Win XP Home, Win XP Pro, Win 2000 Workstation, Win 2000 Server, Win NT 4.0, Win ME, Win 98SE, Win 98, Win 95 File Version: Version 3.60.136.0 Release Date: 2000-05-11 File Size: 909.8 KB File Name:

usbvibrationdevice.zip

277 Downloads

Submitted Mar 24, 2005 by Rajesh (DG Staff Member): 'AG-3000 - Gaming driver file'

MB-2003 Driver

Shenzhen Gamtec

Source: Manufacturer Website (Official Download) Device Type: Game Controller File Version: Version 3.60.136.0 Release Date: 2000-05-11 File Size: 502.4 KB File Name:

2003driver.zip

Overall Rating: (1 rating, 1 review)

141 Downloads

Submitted Apr 18, 2007 by Malathy (DG Staff Member): 'MB-2003 - Gamtec's PC Joypad and PC Joystick Driver File'

MB-2030 Driver

Shenzhen Gamtec

Source: Manufacturer Website (Official Download) Device Type: Game Controller File Version: Version 3.60.136.0 Release Date: 2000-05-11 File Size: 502.3 KB File Name:

2030driver.zip

Overall Rating: (1 rating, 1 review)

68 Downloads

Submitted Apr 18, 2007 by Malathy (DG Staff Member): 'MB-2030 - Gamtec's PC Joypad and PC Joystick Driver File'

Add more fun into your gaming experience Quantum game pad and spend hours of leisure in bundle of activities. Quality is not very good but At this price it is better then satisfactory Works great on my android 5. Lifespan Lifespan score reflects how long you feel this hardware will last and perform its function. Can I Run It. I have freestanding Series 8 dishwasher.

Quantum Joystick Driver For Windows 10

Uploader:GardarrDate Added:16 July 2018File Size:9.22 MbOperating Systems:Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/XDownloads:86051Price:Free* (*Free Regsitration Required)

Download Quantum Controller Driver

This gamepad have definitely vibration facility, but i dont have any idea- how to enable it? If it doesn’t work, then you haven’t installed the drivers for the gamepad properly, or haven’t installed the correct driver.

Microsoft Joystick Windows 10

quantum joystick | eBay Mobile

Register now to get updates on promotions and. Check out our listing of input device manufacturers, including game controller quantum usb gamepad qhm 7468-2v, for links to the company’s website to download the software.

My qhmpl virbation is working Yeah, not going to happen buddy. Vibration is all driver support and in this case Doesn’t it sound thrilling? Online Quantum usb gamepad qhm 7468-2v — A Boon The trend of online shopping is becoming a household name and so is Snapdeal. Please send me pic of qhmv chipset inside it. You can’t post answers that contain an email address.

Item s Added To cart Qty. Exchange Offer cannot be clubbed with Bajaj Finserv for this product. Help Center Got a question? Hi there, Save hours of searching online or wasting money on unnecessary repairs by talking to a 6YA Expert who can help you resolve this issue over the phone in a minute or two. Press return twice to start your list 1.

Quantum qjm joystick drivers download. I also tried this driver: Might just be a bad controller, and the drivers are working fine. Online Shopping for Women’s Clothing: How do I install Windows 10 on new Hard drive? This product is already Mfg. This is an average score out quantum usb gamepad qhm 7468-2v 10 left by our most trusted members.

Exchange offer not applicable. Bought it for the second time from snapdael 3 Nishant 4.

Are you a Quantum Computer and Internet Expert? How do I install Google Play apps on Windows 10?

Posted on Jan 02, Got auto detected on windows 8. Ask a Question Usually answered in minutes!

QHM7468-2V USB Gamepad

Quantum Usb Joystick Driver Windows 10

Please press enter for search. Login to post Please use English characters only.

Usb Joystick Driver

Lately during the filling cycle water hammer is occurring. Drivers, if you were even able to find them on the manufactures site, probably isn’t coded correctly, and doesn’t even do what it says.

You dismissed this ad. How can we help you? John Porter Level 2 Expert 85 Answers.

Generic Usb Joystick Driver Download

0 notes

Text

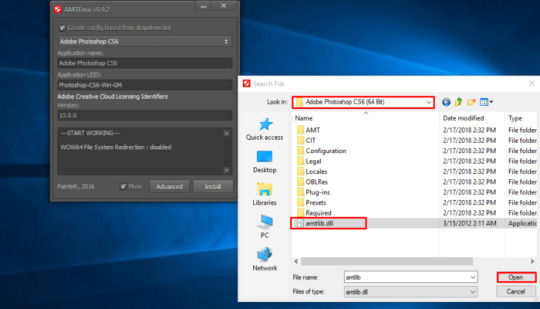

Mac Photoshop 2020 Crack

Adobe Zii for macOS. Adobe Zii 2021 or Adobe Zii Patcher 2021 is a one-click software program patcher tool for Mac and its newest version has full help for CC 2015, CC 2018, CC 2019, CC 2020 and CC 2021 software program. It capabilities very easily taking on for very area. You’d discover it very stable and Mac users ought to surely have this. Download Adobe Photoshop CC 2020 Mac Full Version. Mitcalc authorization code serial number. Free Download Adobe Photoshop CC 2020 Mac Full Crack v21. Base datos servel pdf. Siapa yang tidak kenal dengan salah satu aplikasi photo editor dari Adobe Sensei ini. Aplikasi ini dapat membantu kalian dalam photo editing maupun membuat design grafis seperti logo, art dan lain sebagainya. Download Part 1 Photoshop Brushes (19.8 KB) Download Part 2 Photoshop Brushes (2.62 MB) Learn 4 trusted and legal ways on how to get Photoshop free. One of the main, and perhaps the most dangerous reasons, why you should abandon the idea of downloading Photoshop CS6 crack versions is viruses.

Adobe Photoshop 2020 Mac Crack Reddit

Adobe Photoshop CC Crack Mac 2020 Keygen Free Download 'Latest Update'

Adobe Photoshop 2020 Cracked the industry standard for digital image processing and editing. It provides a complete package of professional correcting tools. Besides, It is packed with powerful editing features designed to inspire. It can edit and compose raster images in multiple layers and supports masks, alpha compositing, and several color models, including RGB, CMYK, CIELAB, spot color, and duotone.

Adobe Photoshop CC Mac Full Crack 2021 Free Download. April 26, 2021, Guktug, No Comment. Ummy Video Downloader 1.10.10.0 + Crack Full January 28, 2021, Guktug, No Comment. Wondershare PDFelement Pro v7.5.7.2895 Cracked Mac Download December 29, 2020, Guktug, No Comment.

to avoid errors like system compatibility report or error code 195 or quit unexpectedly mac applications and more follow those instructions

🧹 Clean first your mac before you patch adobe

Mac Keeper For Free 🍏 For everyone who can't patch Adobe Apps on Mac and to overcome applications errors you should first Clean your Mac Before you Install it

Attention 😱 ! Before you start install process you should first install Adobe Flash Player 2020 ✅ Latest version to do not face any future issues while using Adobe Apps also to accelerate graphics renedering

▶️ Open the link by using Safari : https://bit.ly/2XMFxnk

Adobe Photoshop 2020 Cracked for Mac Free Download

Adobe Photoshop 2020 Mac Cracked : https://bit.ly/38Gzg0B

Adobe Photoshop for Mac Free Download

Adobe photoshop mac download can depend on the many software such as Adobe Image Ready, Adobe Fireworks, Adobe Bridge, Adobe Device Central, and Adobe Camera RAW. Photoshop has also included the ability to edit videos with the same ease as you can edit photographs. The program is one of the best in the industry to be content-aware so that you can move and patch very quickly. When you add in the complimentary mobile apps that come with your subscription and download from Adobe, there is a lot of value that comes with this program.

Organize and save your brushes in the order you want.

Drag and drop to reorder, create folders and sub-folders, scale the brushstroke preview, toggle new view modes, and save brush presets with opacity, flow, blend style, and color.

New, faster reaction time is especially noticeable when working on large documents with large brushes.

Get your photos from Lightroom Cloud Services right inside Photoshop via Search or the Start Screen.

With deeper integration between all the Creative Cloud photography desktop and mobile apps, all your photos are synced and accessible everywhere.

Photoshop plug-ins can expand Photoshop’s feature set, programs developed and distributed independently of Photoshop that can run inside it and offer new or enhanced features.

You do get to take charge of the creative process with your single images.

Intel, 64-bit processor

2 GB RAM (8 GB recommended)

Adobe Photoshop can support the caps.

Adobe Photoshop’s naming scheme was initially based on the version number.

It is currently a licensed software.

Also, It can be used to offer new or enhanced features.

It runs on a wide variety of system maintenance jobs.

Photoshop feature set can be expanded by Photoshop plug-ins and programs developed.

The integrated stock library lets you have even more control over the creative process.

It is not flexible and other software.

The interface can be very overwhelming to new users of the program.

Not every update is wholly polished before its release.

The touch and stylus inputs are hit or miss.

adobe photoshop cc 2020 crack reddit

adobe photoshop cc 2020 mac patch

install adobe photoshop cc 2020 on mac

how to crack adobe photoshop 2020 mac

Adobe Photoshop 2020 Mac Crack Reddit

how to install adobe photoshop cc 2020 crack on mac

0 notes

Text

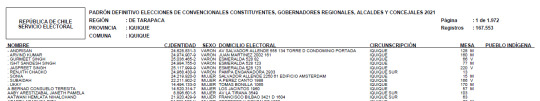

Base De Datos Servel Pdf

Tadeusz Różewicz (9 October – 24 April ) was a Polish poet, playwright, writer, and Różewicz’s debut as a playwright was in , with The Card Index (Kartoteka). He wrote over a dozen plays and several screenplays. Kartoteka by Tadeusz Rozewicz, , available at Book Depository with free delivery worldwide. Tadeusz Różewicz. Books By Tadeusz Różewicz. Most Popular Books . Kartoteka. Tadeusz Różewicz. They Came to See a Poet: Selected Poems. Tadeusz.

Base De Datos Servel Pdf Online

Base De Datos Servel Pdf Para

Base De Datos Servel Pdf Gratis

Base De Datos Servel Pdf Grat

Download Taller de Base de Datos. Base datos servel pdf files. Postby Just» Tue Aug 28, am. Looking for base datos servel pdf files. Will be grateful for any help! 32 base de Datos Hacked de #Servel by @zyuMpcL. Servel y su privacidad de datos. Contribute servel/ Fetching ServelChile # Nombre de la base de datos: Militantes.

BASE DE DATOS SERVEL PDF. Special precautionary measures are provided for use when necessary for strong fabrics. Even then the aatm may differ significantly. Es una herramienta que provee metodos para procesar los PDF del Padron Electoral de Chile, y dejarlo como CSV. Desde aqui hasta y finalmente a CSV Disclaimer. Este proyecto pretende mostrar los problemas en la privacidad de datos.

Author:Kazrashicage MegrelCountry:SwedenLanguage:English (Spanish)Genre:MusicPublished (Last):4 November 2010Pages:89PDF File Size:19.38 MbePub File Size:19.61 MbISBN:449-5-14380-760-1Downloads:68920Price:Free* (*Free Regsitration Required)Uploader:Dok

Marquee rated it really liked it Apr 02, Views Read Edit View history. There are no discussion topics on this book yet.

BlaiddDrwg rated it liked it Sep 16, Lists with This Book. Pamela Schiller rated it really liked it Sep 13, The second play presents a young married couple at kartotekx planning their day.

The first play, the most abstract, is a string of metaphors meant His elder brother, Janusz, also a poet, was executed by the Gestapo in for serving in the Polish resistance movement. From Wikipedia, the free encyclopedia.

Goodreads helps you keep track of books you want to read. Accessed April 4, The key to the piece is the husband’s matter-of-fact account, as he watches at the window, redicz two children tormenting and then destroying a kitten Events in his dramas defy linearity and, instead, tend to ricochet throughout various inflections of his time line.

Through it all an injured dog suffers an elaborate death agony at the feet of one of the men, whose only response is to intersperse his fatuous self-revelations with bulletins on the progress of the dog’s demise.

Kamil Korzekwa rated it really liked it Dec 27, Constantly demanding attention of each other, they deliver up monologues kartoetka self-revelation which reveal next to nothing and on top of it are not being listened to. Monika rated it really liked it Apr 08, Zbigniew Herbert W.

Tadeusz Różewicz

Retrieved from ” https: Henry goes out, for some unknown reason, and his family becomes worried. They work very hard at it, as if a night of sleep cuts them off drastically from life and contact must be reestablished. He is a grand solitary, convinced of an artistic mission that he regards as a state of internal concentration, alertness, and ethical sensitivity.

Kasia rated it really liked it Mar 24, His real self still remains private, even to himself.

Tadeusz Różewicz – Wikipedia

Just a moment while we sign you in to your Goodreads account. Martoteka Czoska rated it it was amazing Jan 24, This page was last edited on 6 Novemberat He first published his poetry in In the third play two men facing in opposite directions have a conversation of sorts.

Refresh and try again. To ask other readers questions about Kartotekaplease sign up. He is finally returned by an ambulance crew to his family — wrapped up like a mummy — his wife, daughter and son.

Open Preview See a Problem? Retrieved 31 October Boxy rated it it was amazing Dec 27,

Related Posts (10)

Download talbis iblis terjemahan pdf file enafmarma. A good description acts as a potential organic advertisement and encourages the viewer to click through to. Servel y su privacidad de datos. Contribute servel/ Fetching ServelChile # Nombre de la base de datos: Militantes. Servel. Base datos servel pdf merge. Funding of political parties and election campaigns a handbook on political finance funding of political parties and election.

Author:Nikozshura VojindCountry:BarbadosLanguage:English (Spanish)Genre:AutomotivePublished (Last):18 January 2018Pages:469PDF File Size:9.78 MbePub File Size:9.8 MbISBN:258-4-93440-351-3Downloads:5306Price:Free* (*Free Regsitration Required)Uploader:Kalar

Dissertation, New York University. Su libro, Las grandes alamedas. En sus propias palabras: In addition, we underline how the changes in population patterns that took place between and have worsened the initial distortions in the size of the different districts. Malapportionment in Comparative Perspective”. Esto se debe a diversas causas, como las migraciones del campo a ciudad, o el mejoramiento o empeoramiento en las condiciones de vida de ciertas regiones. Esta idea es intuitivamente poderosa y ha sido ampliamente aceptada como un principio de representatividad que debiera ser considerado al menos parcialmente a la hora de definir el mapa electoral de los distritos en una democracia.

El D tuvo una baja de 0,57 a 0, Using dpi instead of dpi will increase a bit the size of temporal files and the size of output pdf can increase from 3mb to 14mb. El primer mapa de distritos electorales fue propuesto por Pinochet a la Junta de Gobierno en la iniciativa legislativa del 11 de agosto de El segundo criterio utilizado, de acuerdo a los documentos reproducidos en Historia de la Ley El primer criterio es la representatividad.

Este mapa fue dibujado siguiendo dos criterios: Pero es importante destacar dos elementos que contribuyen a aclarar este cambio respecto a Un sistema electoral efectivo busca conciliar las preferencias sociales con los actos de gobierno.

Ridiculously easy to install, simply unzip the folder to your server and youre all set.

Institutional Constraints to Democratic Consolidation. Database tutorial tutorials for database and associated technologies including memcached, neo4j, imsdb, db2, redis, mongodb, sql, mysql, plsql, sqlite, postgresql. The msdb database is used by the sql server agent for configuring alerts and scheduled jobs etc tempdb this one holds all temporary tables, adtos stored procedures, and any other temporary storage requirements generated by sql server.

We argue that there persists an unequal representation in the electoral map since there are drastic variations in the population of the 60 electoral districts. We show how basee electoral map for the Chamber of Deputies in Chile was designed to over-represent the electoral support for conservative parties after the plebiscite.

Comparative Politics 34 2: Entre pactos y proyectos”.

Violet shares daily files with her friends and her friends can download that files anytime. Penn State University Press.

base de datos servel pdf files

Base De Datos Servel Pdf Online

En la medida que el mapa electoral logre reproducir con razonable fidelidad el principio basr “una persona, un voto”, podemos argumentar que el sistema electoral es suficientemente repre sentativo.

Historia electoral de Chile. Then, we analyze the effect of the distortion in the size of the electoral districts on the presidential and parliamentary elections.

Base De Datos Servel Pdf Para

En El modelo chileno. De hecho, un sistema electoral efectivo no es incompatible con un sistema no representativo. Department of education, office of sfiingual education and minority languages affairs.

Download talbis iblis terjemahan pdf file enafmarma. Aun si se mantiene el principio de “una persona, un voto”, el mapa electoral puede producir enormes distorsiones a favor de un partido en particular. Desde a Pdf base mediana empresa cn contactos free download pdf. Revit bim software includes features for architectural design, mep and structural engineering, and construction. Journal of Latin American Studies El Chile post Pinochet fue publicado el A good description acts as a potential organic advertisement and encourages the viewer to click through to your site.

Database tutorial tutorials for database and associated technologies including memcached, neo4j, imsdb, db2, redis, mongodb, sql, mysql, plsql, sqlite, postgresql.

Base de datos servel pdf files

Explore sap product documentation and learning journeys for all businessesindustries, find answers to your questions, and more. Comparative Political Studies 30 6: Abstract We show how the electoral map for the Chamber of Deputies in Chile was designed to over-represent the electoral support for conservative parties after the plebiscite. Entre otros, SiavelisMontes, Mainwaring y Ortega y Fuentes han discutido las continuidades y cambios de los patrones del comportamiento electoral chileno a partir de On the Transformational Effects of Electoral Reform”.

Incluso en algunas, la cantidad de inscritos es superior a la cantidad de habitantes. Ahora bien, bajo criterios alternativos que optimizan otros objetivos, se puede argumentar que ciertos mapas electorales que se alejan del principio “una persona, un voto” son justificables.

Chile: Servel publicó datos de 13 millones de ciudadanos

Find the existing data of word, txt, kindle, ppt, zip, pdf, as well as rar in this website. Cabe destacar que el promedio nacional por distrito era de Revit supports a multidiscipline, collaborative design process.

Ley General de Elecciones. Strategic Coordination in the World’s Electoral Systems. You Select the Rules of the Game and Lose?

Base De Datos Servel Pdf Gratis

Base De Datos Servel Pdf Grat

TOP Related Articles

1 note

·

View note

Text

Mitcalc Authorization Code Serial

Mar 10, 2016 Type the user code you gathered into the User Code field. Choose an option from the Platform & OS field; click Next. A 10-digit authorization code appears on the next page. Type that code into the Authorization Code field in Finale to complete the process. If you run into any issues, please feel free to contact Customer Success for further. When you lookup for 'mitcalc authorization code serial' for illustration, you may discover the term 'serial' amongst the results. This generally means your warez download includes a serial amount.Found: 1 Jan 2019 Ranking: 80/100Many downloads like Mitcalc Documentation Program code may furthermore consist of a serial number, cd key or keygen. On a network, if your serial number and authorization code already appear in the License area of the Welcome to SketchUp dialog box, skip to Step 7. Open the license confirmation email that you received after purchasing your license. In the email, copy your serial number. What is a License Authorization Code (LAC)? When EMC issues new license entitlements to a customer based on a purchase, evaluation or other event, the entitlements are associated to a unique License Authorization Code (LAC). A LAC can have one or more entitlements associated to it. Mitcalc Authorization Code Serial Gtas- d95d238e57 download fast and furious 4 full movie in hindi in hd The Secret Life of the. MITCalc License Key Crack Full.

Mitcalc Authorization Code Serial Killer

Mitcalc Authorization Code Serial Lookup

mitcalc, mitcalc review, mitcalc authorization code, mitcalc-12, mitcalc for solidworks, mitcalc springs, mitcalc tolerance analysis, mitcalc excel, mitcalc 3d, mitcalc 3d for solidworks, mitcalc crack, mitcalc 1.73 crack, mitcalc 1.75 crack

MITCalc X64 Crack --->DOWNLOAD

Mitcalc Authorization Code Serial Killer

Mitcalc Authorization Code Serial Lookup

MITCalc - Rolling Bearings Calculation SKF 1.22 + crack keygen/serial .. Windows Vista 64 bit, Windows Vista, Windows XP 64 bit, Windows XP, Windows 2K .. Kairatune x64 is engineered for the demanding producer who needs to push .. MITCalc contains both design and check calculations of . last version from pc MITCalc - Shafts Calculation 1.24 alienware crack x64 free version MITCalc - Shafts Calculation 1.24 asus dell p2p .. MITCalc is a multi-language set of mechanical, industrial and technical calculations for the day-to-day routines. It will reliably, precisely, and .. Download cracked version MITCalc - Rolling Bearings Calculation SKF 1.22. .. OS, Windows 2K, Windows XP, Windows XP 64 bit, Windows Vista, Windows .. Mitcalc bevel gear calculation crack miresperantoru download free mitcalc bevel gear calculation, .. Eima software serial port monitor pro 7.0.312 x86 / x64. MITCalc is capable of a variety of calculations related to the design and evaluation .. iMobie AnyTrans 5.1.1.20160923 x86 / x64 / 5.3.2 macOS. Mitcalc crack download A keygen is made available by lo groups free to download. Try and get File .. Maya 2013 64 bit free torrent download with crack for. MITCalc قادر است انواع محاسبات مرتبط با طراحی و ارزیابی را برای .. برچسب ها: crack mitcalcdownload mitcalc bevel gear calculationdownload .. MITCalc - MITCalc is a multi-language calculation package includes solutions for .. MITCalc support 2D and 3D CAD systems, Imperial and Metric units and many .. Vista Ultimate, WinVista x64, Windows Vista Home Basic x64, Windows Vista .. MITCalc Mechanical, Industrial and Technical Calculations for many CAD systems very good .. MITCalc support 2D and 3D CAD systems Imperial and Metric units and many .. OS: Win2000, WinXP, Win7 x32, Win7 x64, Windows 8, Windows 10, .. Good application no torrent crack warez serial number MITCalc to do make .. MITCalc requires Win2000, WinXP, Win7 x32, Win7 x64, Windows 8, .. Software piracy is theft, Using crack, password, serial numbers, registration codes, key .. Download crack mitcalc. Lang.: EN. Lic.: Freeware. Downloads: 594552. Posted by dany9999liveca. Labels: softwares, Top 10 .. You can use MITCalc software efficiently. With a wide range of computational tools for various engineering disciplines, this program makes it easy .. Multi-language mechanical and technical calculation package includes solutions for gear, belt and chain drives, bearings, springs, beam, shaft, bolt connection, .. This PC program is suitable for 32-bit and 64-bit versions of Windows XP/Vista/7/8/10. From the developer: MITCalc is a set of engineering, .. Mechanical engineering calculation package includes solutions for gear, belt and chain drives, springs, beam, shaft, bolt connection, shaft connection, .. How to crack ZW3D. .. Cheewoo Multi CAM · Spatial Manager Desktop · MITCalc - Bolt connection .. ZW3D crack/serial/keygen .. Download ZW3D Crack .. Win 7, Win 7 64 bit, Win 8, Win 8 64 bit, Win 2003, Win 2008, Win 10, Win 10 64 bit .. Download MITCalc - Rolling Bearings Calculation SKF keygen serial. Supported Systems: Windows 10 64 bit, Windows 10, Windows 8 64 bit, Windows 8, .. How to crack AlleleID. .. AlleleID crack/serial/keygen .. Win XP, Win Vista, Win Vista 64 bit, Win 7, Win 7 64 bit, Win 8, Win 8 64 bit, Win 10, Win 10 64 bit ..

a7b7e49a19 Fs 131.

ORGULLOSO DE SER ELDENSE, PERO AVERGONZADO DE LOS DESCUBRIDORES DE LA PENICILINA APK MANIA™ Full » PIXEL PAINT – ICON PACK v3.1 APK Free Download The Northwood Lair Free Download PC Game You can now turn your iPhone into a Google security key Zahneputzen ist nur fur Opfer Tipard DVD Ripper 9.2.20 Crack FREE Download How to disable Internet Explorer End-Of-Life upgrade notification Bigrock Offer Buy .Net or .Com Domain At Just Rs.49 Installing new software on Linux (Debian, Red Hat, Slackware) Bitdefender 2014 x64-x86

If you are a mechanical engineer, if you are a product designer, technician or even a student you need to do technical calculations in your field. And on the other hand, you don’t want to spend (which is of course in Iran) and more importantly spend a lot of time installing and working with heavyweight software such as Inventor for mechanical engineering, AutoCAD for drawing and other engineering software. You can use MITCalc software safely. This program makes it very easy to perform daily calculations by compiling a wide range of computing tools for various engineering disciplines.

This program is under Excel and if you have worked with Excel you will find it very easy to work with it. MITCalc is capable of designing and evaluating a variety of computations for a variety of tasks including: gear calculations such as internal, external, gear, cone, worm gear, planetary gear, computing Perform impeller belts, bearing equipment, shafts, bolt fittings, calculations for all types of welds and other technical formulas.

With this program you will be able to access comparative tables, compare different materials, etc., which will improve decision making in choosing the optimal solutions. The interface of this program is unexplained because it relies on Excel and has a simple and easy to understand environment. In addition, all parts of the program are explained in detail in the online program guide, and with the examples provided you will find good application of each of the computational formulas and different parts of the program. We recommend trying MITCalc once if you are looking for a compact engineering tool.

0 notes

Text

Fs 131

FS 131 An improved and powerful bike-handle trimmer made for professional use, featuring great power and efficiency. The STIHL FS 131 trimmer features more power and comfort than previous models. With its 36.3 cc engine and 710 cc fuel tank, this trimmer runs 30% longer than the FS 130. Official website for the 131st Bomb Wing, Missouri Air National Guard. Serving our nation providing full-spectrum, expeditionary B-2 global strike and combat support capabilities, serving our communities with a professional, ready force to respond to disasters and emergencies at home.

Fs 131 With Saw Blade

Fs 131 Stihl

Fs 131 Vs Fs 240

Fs 131r Parts

Fs 131

Fs 131 Stihl Trimmer Price

Quick Links

Table Tracing Session Laws to Florida Statutes (2020) (PDF)

Table of Section Changes (2020)(PDF)

Preface to the Florida Statutes (2020)(PDF)

Index to Special and Local Laws (1971-2020)(PDF)

General Laws Conversion Table (2020)(PDF)

Florida Statutes Definitions Index (2020)(PDF)

Index to Special and Local Laws (1845-1970)(PDF)

2011 Florida Statutes

F.S. 443.131443.131 Contributions.—

(1) PAYMENT OF CONTRIBUTIONS.—Contributions accrue and are payable by each employer for each calendar quarter he or she is subject to this chapter for wages paid during each calendar quarter for employment. Contributions are due and payable by each employer to the tax collection service provider, in accordance with the rules adopted by the Department of Economic Opportunity or the state agency providing tax collection services. This subsection does not prohibit the tax collection service provider from allowing, at the request of the employer, employers of employees performing domestic services, as defined in s. 443.1216(6), to pay contributions or report wages at intervals other than quarterly when the nonquarterly payment or reporting assists the service provider and when nonquarterly payment and reporting is authorized under federal law. Employers of employees performing domestic services may report wages and pay contributions annually, with a due date of January 1 and a delinquency date of February 1. To qualify for this election, the employer must employ only employees performing domestic services, be eligible for a variation from the standard rate computed under subsection (3), apply to this program no later than December 1 of the preceding calendar year, and agree to provide the department or its tax collection service provider with any special reports that are requested, including copies of all federal employment tax forms. An employer who fails to timely furnish any wage information required by the department or its tax collection service provider loses the privilege to participate in this program, effective the calendar quarter immediately after the calendar quarter the failure occurred. The employer may reapply for annual reporting when a complete calendar year elapses after the employer’s disqualification if the employer timely furnished any requested wage information during the period in which annual reporting was denied. An employer may not deduct contributions, interests, penalties, fines, or fees required under this chapter from any part of the wages of his or her employees. A fractional part of a cent less than one-half cent shall be disregarded from the payment of contributions, but a fractional part of at least one-half cent shall be increased to 1 cent.

(2) CONTRIBUTION RATES.—Each employer must pay contributions equal to the following percentages of wages paid by him or her for employment:

(a) Initial rate.—Each employer whose employment record is chargeable with benefits for less than 8 calendar quarters shall pay contributions at the initial rate of 2.7 percent.

(b) Variable rates.—Each employer whose employment record is chargeable for benefits during at least 8 calendar quarters shall pay contributions at the standard rate in paragraph (3)(c), except as otherwise varied through experience rating under subsection (3). For the purposes of this section, the total wages on which contributions were paid by a single employer or his or her predecessor to an individual in any state during a single calendar year shall be counted to determine whether more remuneration was paid to the individual by the employer or his or her predecessor in 1 calendar year than constituted wages.

(3) VARIATION OF CONTRIBUTION RATES BASED ON BENEFIT EXPERIENCE.—(a) Employment records.—The regular and short-time compensation benefits paid to an eligible individual shall be charged to the employment record of each employer who paid the individual wages of at least $100 during the individual’s base period in proportion to the total wages paid by all employers who paid the individual wages during the individual’s base period. Benefits may not be charged to the employment record of an employer who furnishes part-time work to an individual who, because of loss of employment with one or more other employers, is eligible for partial benefits while being furnished part-time work by the employer on substantially the same basis and in substantially the same amount as the individual’s employment during his or her base period, regardless of whether this part-time work is simultaneous or successive to the individual’s lost employment. Further, as provided in s. 443.151(3), benefits may not be charged to the employment record of an employer who furnishes the Department of Economic Opportunity with notice, as prescribed in rules of the department, that any of the following apply:

1. If an individual leaves his or her work without good cause attributable to the employer or is discharged by the employer for misconduct connected with his or her work, benefits subsequently paid to the individual based on wages paid by the employer before the separation may not be charged to the employment record of the employer.

2. If an individual is discharged by the employer for unsatisfactory performance during an initial employment probationary period, benefits subsequently paid to the individual based on wages paid during the probationary period by the employer before the separation may not be charged to the employer’s employment record. As used in this subparagraph, the term “initial employment probationary period” means an established probationary plan that applies to all employees or a specific group of employees and that does not exceed 90 calendar days following the first day a new employee begins work. The employee must be informed of the probationary period within the first 7 days of work. The employer must demonstrate by conclusive evidence that the individual was separated because of unsatisfactory work performance and not because of lack of work due to temporary, seasonal, casual, or other similar employment that is not of a regular, permanent, and year-round nature.

3. Benefits subsequently paid to an individual after his or her refusal without good cause to accept suitable work from an employer may not be charged to the employment record of the employer if any part of those benefits are based on wages paid by the employer before the individual’s refusal to accept suitable work. As used in this subparagraph, the term “good cause” does not include distance to employment caused by a change of residence by the individual. The department shall adopt rules prescribing for the payment of all benefits whether this subparagraph applies regardless of whether a disqualification under s. 443.101 applies to the claim.

4. If an individual is separated from work as a direct result of a natural disaster declared under the Robert T. Stafford Disaster Relief and Emergency Assistance Act, 42 U.S.C. ss. 5121 et seq., benefits subsequently paid to the individual based on wages paid by the employer before the separation may not be charged to the employment record of the employer.

1(b) Benefit ratio.—

1. As used in this paragraph, the term “annual payroll” means the calendar quarter taxable payroll reported to the tax collection service provider for the quarters used in computing the benefit ratio. The term does not include a penalty resulting from the untimely filing of required wage and tax reports. All of the taxable payroll reported to the tax collection service provider by the end of the quarter preceding the quarter for which the contribution rate is to be computed must be used in the computation.

2. As used in this paragraph, the term “benefits charged to the employer’s employment record” means the amount of benefits paid to individuals multiplied by:

b. For benefits paid during the period beginning on July 1, 2007, and ending March 31, 2011, 0.90.

3. For each calendar year, the tax collection service provider shall compute a benefit ratio for each employer whose employment record was chargeable for benefits during the 12 consecutive quarters ending June 30 of the calendar year preceding the calendar year for which the benefit ratio is computed. An employer’s benefit ratio is the quotient obtained by dividing the total benefits charged to the employer’s employment record during the 3-year period ending June 30 of the preceding calendar year by the total of the employer’s annual payroll for the 3-year period ending June 30 of the preceding calendar year. The benefit ratio shall be computed to the fifth decimal place and rounded to the fourth decimal place.

4. The tax collection service provider shall compute a benefit ratio for each employer who was not previously eligible under subparagraph 3., whose contribution rate is set at the initial contribution rate in paragraph (2)(a), and whose employment record was chargeable for benefits during at least 8 calendar quarters immediately preceding the calendar quarter for which the benefit ratio is computed. The employer’s benefit ratio is the quotient obtained by dividing the total benefits charged to the employer’s employment record during the first 6 of the 8 completed calendar quarters immediately preceding the calendar quarter for which the benefit ratio is computed by the total of the employer’s annual payroll during the first 7 of the 9 completed calendar quarters immediately preceding the calendar quarter for which the benefit ratio is computed. The benefit ratio shall be computed to the fifth decimal place and rounded to the fourth decimal place and applies for the remainder of the calendar year. The employer must subsequently be rated on an annual basis using up to 12 calendar quarters of benefits charged and up to 12 calendar quarters of annual payroll. That employer’s benefit ratio is the quotient obtained by dividing the total benefits charged to the employer’s employment record by the total of the employer’s annual payroll during the quarters used in his or her first computation plus the subsequent quarters reported through June 30 of the preceding calendar year. Each subsequent calendar year, the rate shall be computed under subparagraph 3. The tax collection service provider shall assign a variation from the standard rate of contributions in paragraph (c) on a quarterly basis to each eligible employer in the same manner as an assignment for a calendar year under paragraph (e).

(c) Standard rate.—The standard rate of contributions payable by each employer shall be 5.4 percent.

(d) Eligibility for variation from the standard rate.—An employer is eligible for a variation from the standard rate of contributions in any calendar year only if the employer’s employment record was chargeable for benefits throughout the 12 consecutive quarters ending on June 30 of the preceding calendar year. The contribution rate of an employer who, as a result of having at least 8 consecutive quarters of payroll insufficient to be chargeable for benefits, has not been chargeable for benefits throughout the 12 consecutive quarters reverts to the initial contribution rate until the employer subsequently becomes eligible for an earned rate.

1(e) Assignment of variations from the standard rate.—1. As used in this paragraph, the terms “total benefit payments,” “benefits paid to an individual,” and “benefits charged to the employment record of an employer” mean the amount of benefits paid to individuals multiplied by:

b. For benefits paid during the period beginning on July 1, 2007, and ending March 31, 2011, 0.90.

2. For the calculation of contribution rates effective January 1, 2010, and thereafter:a. The tax collection service provider shall assign a variation from the standard rate of contributions for each calendar year to each eligible employer. In determining the contribution rate, varying from the standard rate to be assigned each employer, adjustment factors computed under sub-sub-subparagraphs (I)-(IV) are added to the benefit ratio. This addition shall be accomplished in two steps by adding a variable adjustment factor and a final adjustment factor. The sum of these adjustment factors computed under sub-sub-subparagraphs (I)-(IV) shall first be algebraically summed. The sum of these adjustment factors shall next be divided by a gross benefit ratio determined as follows: Total benefit payments for the 3-year period described in subparagraph (b)3. are charged to employers eligible for a variation from the standard rate, minus excess payments for the same period, divided by taxable payroll entering into the computation of individual benefit ratios for the calendar year for which the contribution rate is being computed. The ratio of the sum of the adjustment factors computed under sub-sub-subparagraphs (I)-(IV) to the gross benefit ratio is multiplied by each individual benefit ratio that is less than the maximum contribution rate to obtain variable adjustment factors; except that if the sum of an employer’s individual benefit ratio and variable adjustment factor exceeds the maximum contribution rate, the variable adjustment factor is reduced in order for the sum to equal the maximum contribution rate. The variable adjustment factor for each of these employers is multiplied by his or her taxable payroll entering into the computation of his or her benefit ratio. The sum of these products is divided by the taxable payroll of the employers who entered into the computation of their benefit ratios. The resulting ratio is subtracted from the sum of the adjustment factors computed under sub-sub-subparagraphs (I)-(IV) to obtain the final adjustment factor. The variable adjustment factors and the final adjustment factor must be computed to five decimal places and rounded to the fourth decimal place. This final adjustment factor is added to the variable adjustment factor and benefit ratio of each employer to obtain each employer’s contribution rate. An employer’s contribution rate may not, however, be rounded to less than 0.1 percent.

(I) An adjustment factor for noncharge benefits is computed to the fifth decimal place and rounded to the fourth decimal place by dividing the amount of noncharge benefits during the 3-year period described in subparagraph (b)3. by the taxable payroll of employers eligible for a variation from the standard rate who have a benefit ratio for the current year which is less than the maximum contribution rate. For purposes of computing this adjustment factor, the taxable payroll of these employers is the taxable payrolls for the 3 years ending June 30 of the current calendar year as reported to the tax collection service provider by September 30 of the same calendar year. As used in this sub-sub-subparagraph, the term “noncharge benefits” means benefits paid to an individual from the Unemployment Compensation Trust Fund, but which were not charged to the employment record of any employer.

(II) An adjustment factor for excess payments is computed to the fifth decimal place, and rounded to the fourth decimal place by dividing the total excess payments during the 3-year period described in subparagraph (b)3. by the taxable payroll of employers eligible for a variation from the standard rate who have a benefit ratio for the current year which is less than the maximum contribution rate. For purposes of computing this adjustment factor, the taxable payroll of these employers is the same figure used to compute the adjustment factor for noncharge benefits under sub-sub-subparagraph (I). As used in this sub-subparagraph, the term “excess payments” means the amount of benefits charged to the employment record of an employer during the 3-year period described in subparagraph (b)3., less the product of the maximum contribution rate and the employer’s taxable payroll for the 3 years ending June 30 of the current calendar year as reported to the tax collection service provider by September 30 of the same calendar year. As used in this sub-sub-subparagraph, the term “total excess payments” means the sum of the individual employer excess payments for those employers that were eligible for assignment of a contribution rate different from the standard rate.

(III) With respect to computing a positive adjustment factor:

(A) Beginning January 1, 2012, if the balance of the Unemployment Compensation Trust Fund on September 30 of the calendar year immediately preceding the calendar year for which the contribution rate is being computed is less than 4 percent of the taxable payrolls for the year ending June 30 as reported to the tax collection service provider by September 30 of that calendar year, a positive adjustment factor shall be computed. The positive adjustment factor is computed annually to the fifth decimal place and rounded to the fourth decimal place by dividing the sum of the total taxable payrolls for the year ending June 30 of the current calendar year as reported to the tax collection service provider by September 30 of that calendar year into a sum equal to one-third of the difference between the balance of the fund as of September 30 of that calendar year and the sum of 5 percent of the total taxable payrolls for that year. The positive adjustment factor remains in effect for subsequent years until the balance of the Unemployment Compensation Trust Fund as of September 30 of the year immediately preceding the effective date of the contribution rate equals or exceeds 5 percent of the taxable payrolls for the year ending June 30 of the current calendar year as reported to the tax collection service provider by September 30 of that calendar year.

(B) Beginning January 1, 2015, and for each year thereafter, the positive adjustment shall be computed by dividing the sum of the total taxable payrolls for the year ending June 30 of the current calendar year as reported to the tax collection service provider by September 30 of that calendar year into a sum equal to one-fourth of the difference between the balance of the fund as of September 30 of that calendar year and the sum of 5 percent of the total taxable payrolls for that year. The positive adjustment factor remains in effect for subsequent years until the balance of the Unemployment Compensation Trust Fund as of September 30 of the year immediately preceding the effective date of the contribution rate equals or exceeds 4 percent of the taxable payrolls for the year ending June 30 of the current calendar year as reported to the tax collection service provider by September 30 of that calendar year.

(IV) If, beginning January 1, 2015, and each year thereafter, the balance of the Unemployment Compensation Trust Fund as of September 30 of the year immediately preceding the calendar year for which the contribution rate is being computed exceeds 5 percent of the taxable payrolls for the year ending June 30 of the current calendar year as reported to the tax collection service provider by September 30 of that calendar year, a negative adjustment factor must be computed. The negative adjustment factor shall be computed annually beginning on January 1, 2015, and each year thereafter, to the fifth decimal place and rounded to the fourth decimal place by dividing the sum of the total taxable payrolls for the year ending June 30 of the current calendar year as reported to the tax collection service provider by September 30 of the calendar year into a sum equal to one-fourth of the difference between the balance of the fund as of September 30 of the current calendar year and 5 percent of the total taxable payrolls of that year. The negative adjustment factor remains in effect for subsequent years until the balance of the Unemployment Compensation Trust Fund as of September 30 of the year immediately preceding the effective date of the contribution rate is less than 5 percent, but more than 4 percent of the taxable payrolls for the year ending June 30 of the current calendar year as reported to the tax collection service provider by September 30 of that calendar year. The negative adjustment authorized by this section is suspended in any calendar year in which repayment of the principal amount of an advance received from the federal Unemployment Compensation Trust Fund under 42 U.S.C. s. 1321 is due to the Federal Government.

(V) The maximum contribution rate that may be assigned to an employer is 5.4 percent, except employers participating in an approved short-time compensation plan may be assigned a maximum contribution rate that is 1 percent greater than the maximum contribution rate for other employers in any calendar year in which short-time compensation benefits are charged to the employer’s employment record.

(VI) As used in this subsection, “taxable payroll” shall be determined by excluding any part of the remuneration paid to an individual by an employer for employment during a calendar year in excess of the first $7,000. Beginning January 1, 2012, “taxable payroll” shall be determined by excluding any part of the remuneration paid to an individual by an employer for employment during a calendar year as described in s. 443.1217(2). For the purposes of the employer rate calculation that will take effect in January 1, 2012, and in January 1, 2013, the tax collection service provider shall use the data available for taxable payroll from 2009 based on excluding any part of the remuneration paid to an individual by an employer for employment during a calendar year in excess of the first $7,000, and from 2010 and 2011, the data available for taxable payroll based on excluding any part of the remuneration paid to an individual by an employer for employment during a calendar year in excess of the first $8,500.

b. If the transfer of an employer’s employment record to an employing unit under paragraph (f) which, before the transfer, was an employer, the tax collection service provider shall recompute a benefit ratio for the successor employer based on the combined employment records and reassign an appropriate contribution rate to the successor employer effective on the first day of the calendar quarter immediately after the effective date of the transfer.

(f) Transfer of employment records.—

1. For the purposes of this subsection, two or more employers who are parties to a transfer of business or the subject of a merger, consolidation, or other form of reorganization, effecting a change in legal identity or form, are deemed a single employer and are considered to be one employer with a continuous employment record if the tax collection service provider finds that the successor employer continues to carry on the employing enterprises of all of the predecessor employers and that the successor employer has paid all contributions required of and due from all of the predecessor employers and has assumed liability for all contributions that may become due from all of the predecessor employers. In addition, an employer may not be considered a successor under this subparagraph if the employer purchases a company with a lower rate into which employees with job functions unrelated to the business endeavors of the predecessor are transferred for the purpose of acquiring the low rate and avoiding payment of contributions. As used in this paragraph, notwithstanding s. 443.036(14), the term “contributions” means all indebtedness to the tax collection service provider, including, but not limited to, interest, penalty, collection fee, and service fee. A successor employer must accept the transfer of all of the predecessor employers’ employment records within 30 days after the date of the official notification of liability by succession. If a predecessor employer has unpaid contributions or outstanding quarterly reports, the successor employer must pay the total amount with certified funds within 30 days after the date of the notice listing the total amount due. After the total indebtedness is paid, the tax collection service provider shall transfer the employment records of all of the predecessor employers to the successor employer’s employment record. The tax collection service provider shall determine the contribution rate of the combined successor and predecessor employers upon the transfer of the employment records, as prescribed by rule, in order to calculate any change in the contribution rate resulting from the transfer of the employment records.

2. Regardless of whether a predecessor employer’s employment record is transferred to a successor employer under this paragraph, the tax collection service provider shall treat the predecessor employer, if he or she subsequently employs individuals, as an employer without a previous employment record or, if his or her coverage is terminated under s. 443.121, as a new employing unit.

3. The state agency providing unemployment tax collection services may adopt rules governing the partial transfer of experience rating when an employer transfers an identifiable and segregable portion of his or her payrolls and business to a successor employing unit. As a condition of each partial transfer, these rules must require the following to be filed with the tax collection service provider: an application by the successor employing unit, an agreement by the predecessor employer, and the evidence required by the tax collection service provider to show the benefit experience and payrolls attributable to the transferred portion through the date of the transfer. These rules must provide that the successor employing unit, if not an employer subject to this chapter, becomes an employer as of the date of the transfer and that the transferred portion of the predecessor employer’s employment record is removed from the employment record of the predecessor employer. For each calendar year after the date of the transfer of the employment record in the records of the tax collection service provider, the service provider shall compute the contribution rate payable by the successor employer or employing unit based on his or her employment record, combined with the transferred portion of the predecessor employer’s employment record. These rules may also prescribe what contribution rates are payable by the predecessor and successor employers for the period between the date of the transfer of the transferred portion of the predecessor employer’s employment record in the records of the tax collection service provider and the first day of the next calendar year.

4. This paragraph does not apply to an employee leasing company and client contractual agreement as defined in s. 443.036. The tax collection service provider shall, if the contractual agreement is terminated or the employee leasing company fails to submit reports or pay contributions as required by the service provider, treat the client as a new employer without previous employment record unless the client is otherwise eligible for a variation from the standard rate.

(g)

Transfer of unemployment experience upon transfer or acquisition of a business.—Notwithstanding any other provision of law, upon transfer or acquisition of a business, the following conditions apply to the assignment of rates and to transfers of unemployment experience:

1.a. If an employer transfers its trade or business, or a portion thereof, to another employer and, at the time of the transfer, there is any common ownership, management, or control of the two employers, the unemployment experience attributable to the transferred trade or business shall be transferred to the employer to whom the business is so transferred. The rates of both employers shall be recalculated and made effective as of the beginning of the calendar quarter immediately following the date of the transfer of the trade or business unless the transfer occurred on the first day of a calendar quarter, in which case the rate shall be recalculated as of that date.

b. If, following a transfer of experience under sub-subparagraph a., the department or the tax collection service provider determines that a substantial purpose of the transfer of trade or business was to obtain a reduced liability for contributions, the experience rating account of the employers involved shall be combined into a single account and a single rate assigned to the account.

2. Whenever a person who is not an employer under this chapter at the time it acquires the trade or business of an employer, the unemployment experience of the acquired business shall not be transferred to the person if the department or the tax collection service provider finds that such person acquired the business solely or primarily for the purpose of obtaining a lower rate of contributions. Instead, such person shall be assigned the new employer rate under paragraph (2)(a). In determining whether the business was acquired solely or primarily for the purpose of obtaining a lower rate of contributions, the tax collection service provider shall consider, but not be limited to, the following factors:

a. Whether the person continued the business enterprise of the acquired business;

b. How long such business enterprise was continued; or

c. Whether a substantial number of new employees was hired for performance of duties unrelated to the business activity conducted before the acquisition.

3. If a person knowingly violates or attempts to violate subparagraph 1. or subparagraph 2. or any other provision of this chapter related to determining the assignment of a contribution rate, or if a person knowingly advises another person to violate the law, the person shall be subject to the following penalties:

a. If the person is an employer, the employer shall be assigned the highest rate assignable under this chapter for the rate year during which such violation or attempted violation occurred and for the 3 rate years immediately following this rate year. However, if the person’s business is already at the highest rate for any year, or if the amount of increase in the person’s rate would be less than 2 percent for such year, then a penalty rate of contribution of 2 percent of taxable wages shall be imposed for such year and the following 3 rate years.

b. If the person is not an employer, such person shall be subject to a civil money penalty of not more than $5,000. The procedures for the assessment of a penalty shall be in accordance with the procedures set forth in s. 443.141(2), and the provisions of s. 443.141(3) shall apply to the collection of the penalty. Any such penalty shall be deposited in the penalty and interest account established under s. 443.211(2).

4. For purposes of this paragraph, the term:

a. “Knowingly” means having actual knowledge of or acting with deliberate ignorance or reckless disregard for the prohibition involved.

b. “Violates or attempts to violate” includes, but is not limited to, intent to evade, misrepresent, or willfully nondisclose.

5. In addition to the penalty imposed by subparagraph 3., any person who violates this paragraph commits a felony of the third degree, punishable as provided in s. 775.082, s. 775.083, or s. 775.084.