Don't wanna be here? Send us removal request.

Text

The Power of Perception for Non-Luxury Brands

While the Burberry case study illustrated the importance of customer perception to luxury brands and its impact on brand success, I believe that this relationship is not solely limited to the luxury segment. Customer perception can go a long way in driving performance for non-luxury brands as well. Take Google as a positive example – they leveraged their early technological advantage to foster a perception of Google as the best search engine and then relied on the power of network effects to solidify this perception among consumers. But this power can go both ways – Chipotle’s E.coli outbreak in 2015 demonstrated the power of negative perception on performance, with the company suffering significant declines in its sales/profits and stock price as customers avoided eating at the chain.

Though the relationship between perception and performance is undoubtedly strong, one key difference between luxury-only and non-luxury categories with respect to customer perception is brand “tiering.” Competing luxury brands for a given product or service often sell a relatively similar offering, making it somewhat difficult to truly distinguish between brands. In contrast, categories with a wide assortment of options typically feature differentiation between brands that is more easily perceptible, enabling consumers to stack brands into categories/tiers based on perceived quality. A classic example of this phenomenon occurs among chain hotels – the hotel industry even has a standard classification of tiers created by STR (Smith Travel Research). For most categories, customer perceptions of quality result in accurate brand tiering and a corresponding spectrum of price levels that reflect the tiers. Given this reality, it is not surprising that consumers may view “low-price” and “low quality” as synonymous. While this is by no means a universal truth, the connection between price and quality could make it difficult for “cheaper” brands to be viewed as high quality. One brand that faces this dilemma is IKEA, a challenge that my team is exploring for our branding project.

To demonstrate this branding issue for IKEA, I plugged the following questions into ChatGPT: 1. “What is the go-to brand for cheap furniture in the US,” to which ChatGPT responded with IKEA:

2. “What is the go-to brand for quality furniture in the US,” to which ChatGPT responded with known premium brands like Restoration Hardware but made no mention of IKEA:

3. “Is IKEA's furniture high quality,” to which ChatGPT made references to IKEA’s ���affordable price point” and “being on a budget:”

As my branding team continues to dive into potential approaches for improving IKEA’s positioning, one potential remedy could be leaning heavily into existing positive customer perceptions, specifically the notion that IKEA furniture “looks good,” especially given its price. IKEA enthusiasts even note that the company takes inspiration from premium furniture designs and produces similar pieces at more affordable prices – there are dozens of design-focused blogs and videos that feature titles such as “7 Best IKEA Finds That Look Like High-End Designer Pieces” and “IKEA’s Affordable Alternatives To Iconic, High-End Furniture Pieces.” IKEA could have an opportunity to lean into this perception via marketing campaigns to better highlight the quality of its products. While the company will never displace purchases of high-end furniture, this approach could enable IKEA to push into the “middle tier” of furniture brands while simultaneously maintaining its leading position for “affordable furniture.”

0 notes

Text

The Relationship Between KPCs and Product Diffusion in Furniture Purchasing

Purchasing furniture is an inherently complex process with endless potential choices. According to IBIS World, there are almost 4,000 household furniture manufacturers in the US alone, each of which produces an assortment of products with different features/characteristics. To illustrate the variety, searching for "beds" on Wayfair.com yields 48,749 results! Given the abundance of product options available to consumers, it is no surprise that their ultimate product choice boils down to a couple of important factors, otherwise known as KPCs (key purchase criteria). The KPCs for ready-to-assemble furniture (the type of furniture sold by IKEA that requires customer assembly) are presented in the table from a survey captured in Statista below:

The survey indicates that quality/performance and price are the most important factors for ready-to-assemble purchases, while style/color and brand hold less weight. When thinking about these findings in the context of product diffusion, it begs the question of whether a “new-to-the-world” product would succeed in this market. If quality and performance reign supreme, a new furniture innovation would likely have to convince consumers that it is a significant upgrade on these dimensions relative to the status quo. The innovation would have to accomplish this while keeping manufacturing costs at the same level or below the status quo, as an expensive product may turn off consumers given price is the second most important KPC. The product also wouldn't be able to rely on aesthetics and brand recognition for a diffusion boost, as these criteria are not as important to consumers.

Given the findings above, it seems fair to conclude that product diffusion will likely be slow in the furniture industry, especially for the ready-to-assemble furniture products made famous by IKEA. As my branding team thinks about our project, in which we are exploring potential ways that IKEA can reposition its brand, it appears that new product introductions would not be the best avenue to pursue, as it will likely be challenging to drive adoption among consumers. As a result, we will be sure to avoid recommending a new product launch and instead dive into other avenues for improving their brand position.

1 note

·

View note

Text

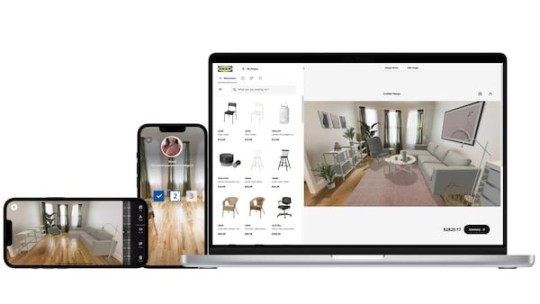

Good Friction in IKEA's Customer AI Tools

My Branding Lab team will be focusing on IKEA and potential strategies for shedding its "starter furniture" reputation. Our hypothesis is that IKEA customers will eventually move on to "better" furniture brands as life circumstances change (e.g., getting older, increasing wealth, having children, buying a house, etc.). As we begin to explore possible options for IKEA to improve its brand positioning, one potential pathway could be through the use of AI, and given IKEA's recent innovations in this domain, it is possible that this brand transformation is already underway.

In 2022, IKEA launched Kreativ, an AI-powered software tool that allows customers to visualize what IKEA furniture would look like in their homes. The application represents a fantastic form of "good friction", as it offers a number of "inspirational showrooms" for customers to browse as well as the opportunity to build a blank virtual model of their own rooms. In this way, while the AI tool prompts customers with existing designs, the customer ultimately has full agency to mix and match pieces within the "inspirational showrooms" or can even choose to design their room entirely on their own.

In 2024, IKEA enhanced its AI capabilities with the introduction of the IKEA AI Assistant in the OpenAI GPT store. The tool is designed to support consumers in their use of Kreativ by recommending furniture pieces based on a variety of potential prompts. Much like Kreativ, the AI chatbot ultimately does not have decision-making authority, but instead improves the shopping experience by helping customers brainstorm potential options. At the end of the day, it is still the customer's final call on what items are moved into their shopping cart.

As consumers increasingly embrace the use of AI in shopping experiences, IKEA's AI offerings could represent a differentiation opportunity. The convenience of pre-visualizing different pieces in your home could compel customers to stick with IKEA rather than moving "up-market" to a more expensive brand that they cannot realistically test. Our branding team will definitely aim to explore this potential train of thought in our primary research, and if this is something that is indeed attractive to customers, IKEA may benefit from a substantial marketing push to highlight these AI tools to consumers (as a current IKEA customer myself, I had no idea that these tools existed!).

1 note

·

View note

Text

The Impact of Price Consciousness on Customer Journey Mapping

As a strategy consultant who has developed many customer journey analyses, I have found that product categories with cost conscious buyers are the most difficult to map. These are usually products that are purchased by the vast majority of consumers with varying degrees of willingness to pay, which necessitates the presence of a wide spectrum of viable options at various price points. This often results in numerous potential pathways through the customer journey map, which make it challenging for companies to pinpoint the optimal approach for attracting and retaining customers.

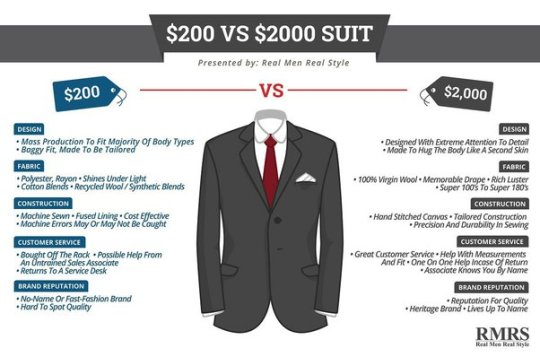

One good example of a product category that fits the description above is men’s suits. This is a product that is almost universally needed by consumers and features endless brand options across price points. To illustrate the complicated nature of customer journey mapping, we can use a standard “cradle to grave” arc that flows as follows: Awareness > Research > Buy > Share > Complete. For the sake of explanation, let’s only consider two types of customers: Customer A’s primary purchase criteria is low price, while Customer B’s primary purchasing criteria is premium quality. Using the customer journey map outlined below, we can see the significant divergence between the two customers in terms of thought processes and actions:

Awareness

Customer A: advertisements of potential deals and/or discounts (e.g., BOGO, 20% off) catch the customer’s attention

Customer B: slick advertisements via traditional or social media that tout the product’s quality pique the customer’s interest

Research

Customer A: customer leverages the internet to compare the discovered deal/discount with offers from other brands to find the most affordable option

Customer B: customer does detailed research (e.g., brand websites, YouTube reviews, word of mouth) to evaluate the discovered brand vs. alternate brands and may even visit physical stores to compare different options

Buy

Customer A: customer will make purchase based solely on price, likely in a very quick manner after identifying the cheapest option

Customer B: customer will make purchase based on what they perceive to be the highest quality option, which could take months to decide

Share

Customer A: customer does not discuss suit purchase with others given that the purchase was functional in nature

Customer B: customer talks about suit purchase with people in their network given they previously discussed the potential options with their network during the Research stage of the journey

Complete

Customer A: when in need of a new suit, customer will once again seek out the lowest price option regardless of satisfaction level with the current brand

Customer B: when in need of a new suit, customer will return to the same brand if they are satisfied with their purchase

Given the vastly different journeys outlined above, what does this mean for companies looking to better understand their customers? While there are likely many different approaches to tackling this dilemma, one potential option for maximizing the efficacy of customer journey maps in better understanding customer needs is to pre-identify the “core” customer. Companies can deploy various analyses (e.g., consumer interviews, consumer surveys, consumer segmentation, etc.) to identify their target consumer. With this information, companies can avoid getting lost in the never-ending thread of customer pathways and instead build a detailed customer journey map that is specifically tailored to their customer archetype.

3 notes

·

View notes