Text

The single most powerful asset we all have is our mind. If it is trained well, it can create enormous wealth.

The Art of Saving Money

One of the toughest challenges for any individual is mastering the art of budgeting and having a consistent amount of savings every month.

I just learned about Kaikebo, a Japanese technique for budgeting that's over 100 years old. It combines mindfulness with spending decisions and helps you simply take control of your finances.

The kakeibo is a simple budgeting journal from Japan that helps you save money by setting goals and tracking spending. It encourages mindful thinking and reflection to improve your saving habits every month.

Kakeibo is a budgeting method that involves tracking every purchase, categorizing spending into needs, wants, culture, and unexpected expenses, and regularly reviewing expenses to track progress toward financial goals. The four categories of spending in kakeibo are needs, wants, culture, and unexpected expenses. Kakeibo is popular because it aligns with the Japanese value of "mottainai" and provides a straightforward way to manage finances.

Saving money is essential in today's fast-paced world for achieving financial independence, planning for life events, and creating a safety net. Developing a habit of saving can give you greater control over your financial future.

Kakeibo, a budgeting technique created by Japanese journalist Hani Motoko in 1904, helps individuals manage monthly expenses, understand spending habits, and practice frugality. It has gained popularity among young individuals for its effectiveness in saving for financial goals and accounting for unexpected costs.

Why i trust japanese art of saving money?

Between 1960 and 1994, Japanese households saved an average of one-sixth of their after-tax income, sometimes reaching nearly one-fourth, significantly higher than the 7.1% average savings rate of American households during the same period. While official statistics indicate that Japanese households are big savers, comparisons can be misleading due to differences in measurement across countries. Adjusting for these discrepancies, it appears that while Japan still saves more than the U.S., the actual difference is smaller than reported. Japan also has a higher savings rate in comparison to other countries, although there are various nations with differing savings behaviours.

Understanding the Kakeibo Method of Budgeting

The Kakeibo method is a Japanese budgeting technique that helps individuals manage their household expenses effectively. Created by journalist Hani Motoko in 1904, Kakeibo encourages mindful spending and can result in savings of up to 35% when practised consistently. The method involves categorizing all expenditures into four main areas: Needs (essential items for survival), Wants (non-essential luxuries), Culture (spending on cultural experiences), and Unexpected expenses (unforeseen costs). Practitioners maintain two notebooks to track their spending—one large notebook for categories and a smaller notebook for jotting down daily expenses. This process instils a sense of accountability and promotes financial discipline, aiding individuals in achieving their savings goals and preparing for emergencies.

How do you use Kakeibo in your life? An individual should use the following steps to incorporate Kakeibo in his life fruitfully:

1. Understand your fixed expenses You start with analyzing the monthly expenses, including your monthly fixed expenses such as rent, utility expenses, loan emis etc.

Fixed expenses are consistent monthly costs that are predictable and easy to incorporate into a budget, unlike variable expenses which fluctuate based on production levels. Key examples of fixed expenses include rent or mortgage payments, car payments, insurance premiums, property taxes, utility bills, child care costs, tuition fees, and gym memberships. To calculate fixed expenses, one should gather their budget or income statement, identify the non-variable expense categories, and sum the amounts from each category. Managing fixed expenses is crucial as they can significantly impact overall spending and understanding these costs can lead to better resource allocation and budgeting decisions

2. Effective Budgeting: Tracking Income and Expenses Here you include all the sources of income you are going to have over the next month. For salaried employees, these include their monthly income, and you also add back the deduction such as health insurance premiums or provident funds that are deducted first before giving you your salary. Non-salaried individuals such as entrepreneurs and freelancers can work with a future income they expect to generate over the next month.

The text outlines the steps necessary for effective budgeting, which includes tracking income and expenses, and comparing the two to ensure spending is managed. Key points include: 1. **Tracking Income**: Monitor gross monthly income, which includes salary and bonuses. To calculate annual gross income, multiply your hourly wage by your weekly hours, then multiply by 52 and divide by 12 for monthly figures. 2. **Tracking Expenses**: Understand fixed costs (e.g., rent, insurance) and flexible expenses (e.g., food, entertainment). Utilize tools such as bank statements and receipts for accurate tracking. 3. **Comparing Income and Expenses**: Subtract total expenses from total income. A positive result indicates that you are spending less than you earn while a negative result shows overspending. 4. **Creating a Budget**: Set financial goals, adjust spending accordingly, and apply budgeting rules like the 50/30/20 rule to effectively allocate your income. This guidance helps individuals maintain financial health by promoting awareness of their earnings and expenditures.

The 50/30/20 Budget Rule with Examples

Explore the power of the 50:30:20 budget rule for effective financial planning. Learn how to manage your money wisely and achieve financial balance using this proven budgeting principle. Take control of your finances and pave the way for financial freedom.

3. Determining Your Ideal Savings Rate

Here you decide how much exactly you wish to save over the next month. The goals should be such that they are not easily achievable or unrealistic that you can’t save anything.

Determining your ideal savings rate is influenced by individual financial situations, lifestyles, and goals. Experts recommend setting aside at least 20% of monthly income for savings, which aids in creating an emergency fund, managing unexpected expenses, and planning for long-term objectives such as retirement.

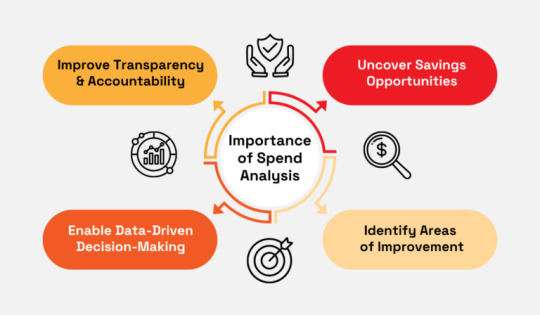

4. Analyze how much you can spend These expenses include all the expenses apart from your fixed expenses. Let’s try to understand all of these with an example. Let us assume you have an Income = 50000 Fixed Expenses (Rent, Utilities etc.) = 20000 Saving Goals = 10000 Then considering the above four points, the amount of money you are left to spend monthly is as follows: The money you can spend = Income – Fixed Expenses – Saving i.e. The money you can spend = 50000 – 20000 – 10000 = 20000 Thus, as an individual with a 50000 income, you are left with 20000 to manage all your expenses apart from your fixed expenses. Spend analysis is a method for understanding spending habits and identifying cost-saving opportunities. 1. Goal Identification: Clearly define what you aim to achieve with spend analysis, whether it's cost reduction or enhancing supplier performance. 2. Data Gathering: Collect all relevant spending data to ensure comprehensive analysis. 3. Data Management: Clean and organize this data to enhance accuracy and usability. 4. Spending Categorization: Group expenditures into categories to facilitate analysis. 5. Trend Analysis: Examine spending patterns to identify trends and recurring expenses. 6. Improvement Opportunities: Highlight areas where costs can be lowered or supplier performance can be enhanced. 7. Ongoing Monitoring: Regularly revisit and update insights to ensure they remain relevant. 8. Cost Reduction: Leverage insights to pinpoint specific areas for spending cuts. 9. Efficiency Improvement: Use findings to streamline operations for better efficiency. 10. Risk Mitigation and Strategic Support: Assess potential risks and utilize insights for informed strategic decision-making regarding investments or expansions.

By analyzing total expenditures, and zeroing in on specific business units, products, quantities, payment terms, and more, you get the answers to four crucial questions: What are we spending money on? Who are we spending it with? Are we getting what we need? Is there a better way to do this? The analysis can either be a comprehensive one or target just different categories of spend. Make your track record up to date regularly.

5. Divide the spending money by 4 The assumption being we have four weeks within a month. As an individual with 20000 spending money, you are allowed to spend a maximum of 5000 every week. Thus it would be best if you restricted your weekly expenses to 5000 such that you do not ever go over budget

The 40/30/20/10 rule is a budgeting method that allocates income into four distinct categories to help individuals manage their finances effectively. Key insights include: 1. Categories Explained:

The rule divides income into needs (40%), discretionary spending (30%), savings or debt repayment (20%), and charitable giving or financial goals (10%).

2. Needs Definition:

The 40% allocated for needs covers essential expenses like rent, mortgage, utilities, and groceries.

3. Discretionary Spending:

The 30% set aside for discretionary spending includes activities such as dining out, entertainment, and shopping.

4. Savings and Debt:

The 20% portion is intended for saving money or paying off existing debts, promoting financial security.

5. Charitable Giving:

The 10% of income is earmarked for donations or other financial goals, encouraging philanthropy.

6. Comparison to 50/30/20 Rule:

An alternative budgeting method, the 50/30/20 rule, simplifies the approach by categorizing income into needs (50%), wants (30%), and savings/investments (20).

7. Flexibility:

Both rules allow individuals to customize their financial plans according to personal priorities and circumstances.

8. Promotes Financial Awareness:

Adopting such rules encourages individuals to reflect on their spending habits and make informed financial decisions. The 40-30-20-10 rule offers a structured approach to budgeting that divides income into specific percentages for necessities, discretionary spending, savings, and charitable giving. The rule is grounded in long-standing financial wisdom, emphasizing the importance of living within one's means. It suggests allocating 40% of income for necessities like housing and groceries, 30% for discretionary expenses, 20% for savings or debt repayment, and 10% for charitable contributions.This budgeting method helps individuals create a balanced financial plan, tailoring it to their unique situations Differentiating between needs (essentials for survival) and wants (desires) is crucial for making informed financial decisions.The rule serves as a guideline, allowing for flexibility based on individual financial circumstances. Understanding and applying the rule can lead to improved financial health and future savings. Alternative budgeting methods similar to the 40-30-20-10 rule exist, offering variations in allocations while maintaining core principles. It provides a clear framework for managing finances, making it easier to track and control spending.

The Kakeibo method is a Japanese budgeting technique designed to help individuals manage their expenses and maximize savings by fostering mindful spending habits. 1. Definition of Kakeibo: Kakeibo translates to "household financial ledger" and was developed by journalist Hani Motoko in 1904 to aid homemakers in budget management. 2. Spending Awareness: The method encourages individuals to reflect on their spending habits, distinguishing between needs, wants, cultural expenses, and unexpected costs to better allocate their finances. 3. Categorization of Expenses: Kakeibo divides expenses into four categories: needs (essentials), wants (luxuries), culture (enriching experiences), and unexpected expenses (unforeseen costs). 4. Expense Tracking: Practitioners maintain two notebooks—one for ongoing expense tracking and another for summarizing weekly expenditures according to the four categories, promoting accountability. 5. Establishing Fixed Expenses: Users should first determine their fixed monthly costs, such as rent and utilities, which are critical for accurate budgeting. 6. Income Analysis: Assessing all sources of income and accounting for deductions (like health insurance) is essential for creating a realistic spending plan. 7. Setting Savings Goals: It is crucial to establish a specific savings target each month that is neither overly ambitious nor too easy to achieve, ensuring financial growth. 8. Budgeting Monthly Spending: After determining fixed expenses and savings goals, the remaining income is allocated as monthly spending money, which can be divided into weekly limits to maintain discipline. 9. Weekly Review: A comparison of planned versus actual spending at the end of each week fosters reflection on financial behavior and allows for adjustments in future spending to stay within budget. 10. Mindful Spending: The method encourages ongoing evaluation of expenses, helping individuals distinguish between essential and non-essential purchases to preserve their savings goals.

Other Kakeibo Lessons Delay any non-essential purchase till the next month. If you still feel the urge for that item after a month, analyze its affordability and what value it may add to your life. Always carry a shopping list when going to market for your monthly purchase.

The Kakeibo method is a disciplined approach towards expense management. This method teaches us the value of each expense made and the sacrifices that need to be made to achieve our targets.

We don't have to be smarter than the rest. We have to be more disciplined than the rest.

Warren Buffet said

Expense management is important because it helps companies control costs, meet budgets, and comply with regulations.

Thanks to all authors who wrote

Date of Publish: 10/ Jan / 2025

3 notes

·

View notes