Don't wanna be here? Send us removal request.

Text

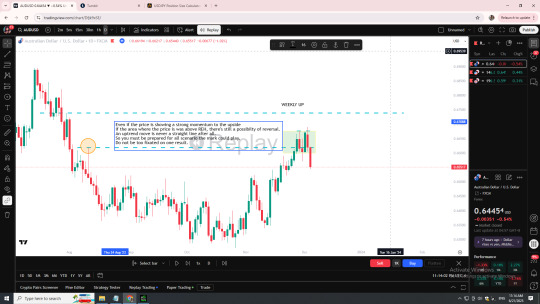

Things to remember before entering a trade

Even if the price is showing a strong momentum to the upside if the area where the price is was above REH, there's still a possibility of reversal. An uptrend move is never a straight line after all. So you must be prepared for all scenarios the market could play. Do not be too fixated on one result.

0 notes

Text

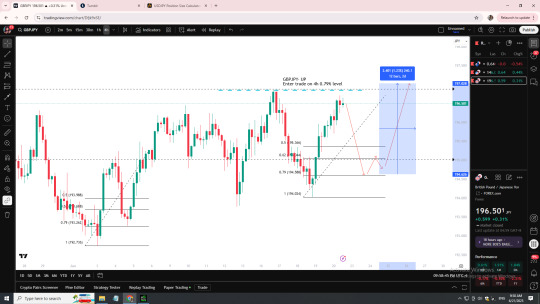

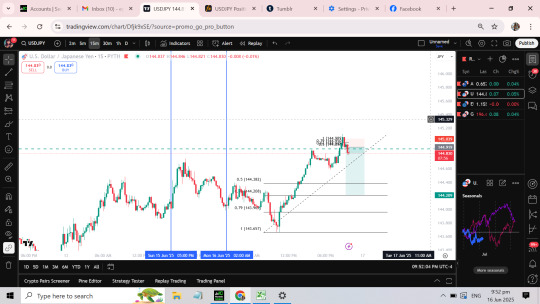

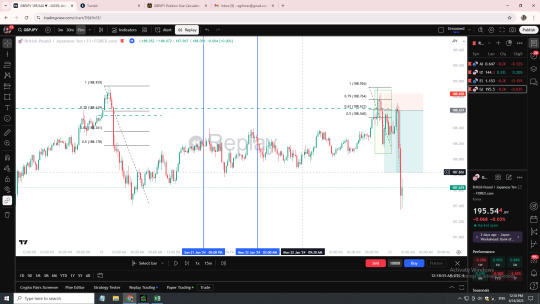

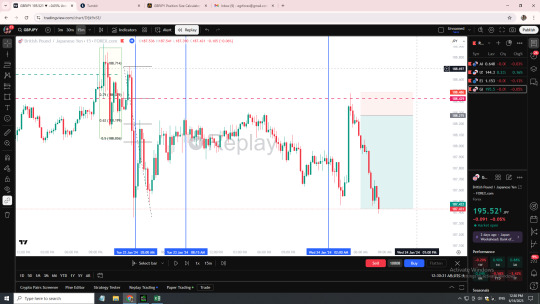

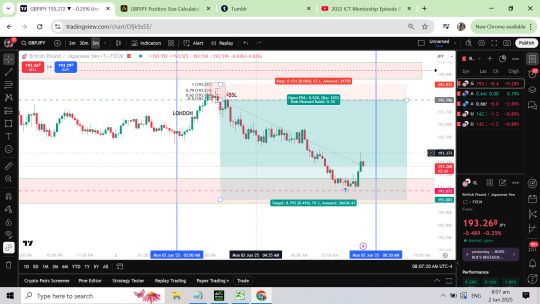

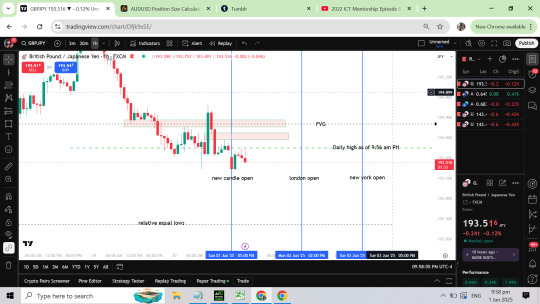

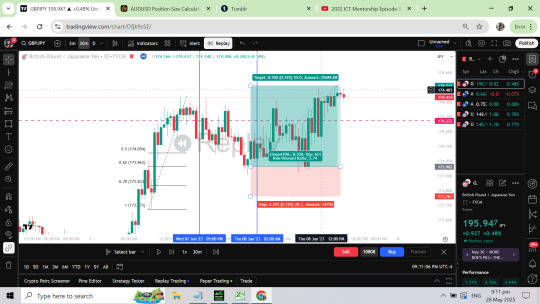

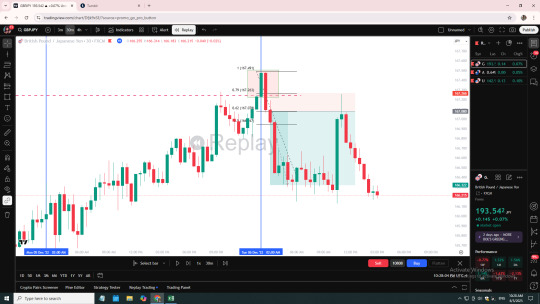

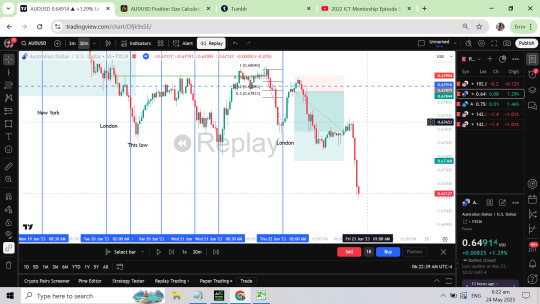

Forecast 06-23-27,2025

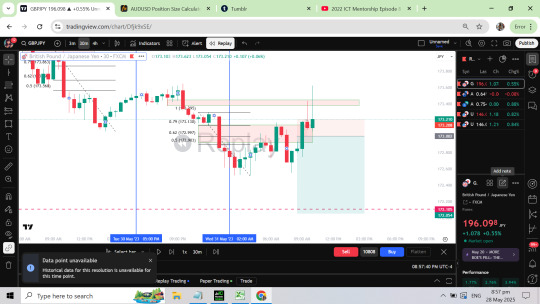

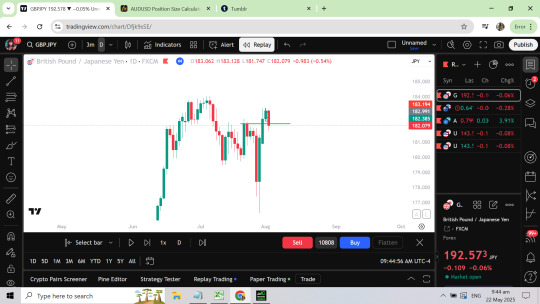

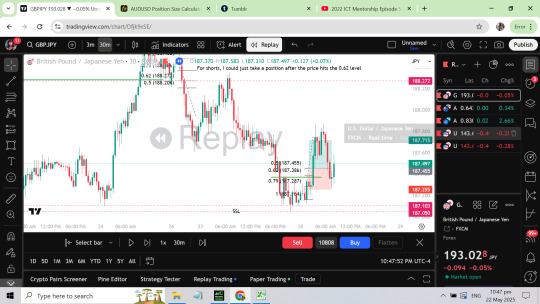

For GBPY JPY- Price direction UP Will join the trade if price re-traces back to 0.79% level on the 4 hour.

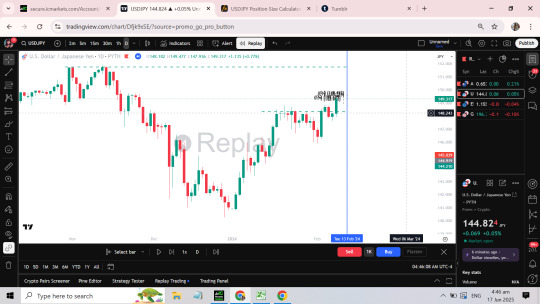

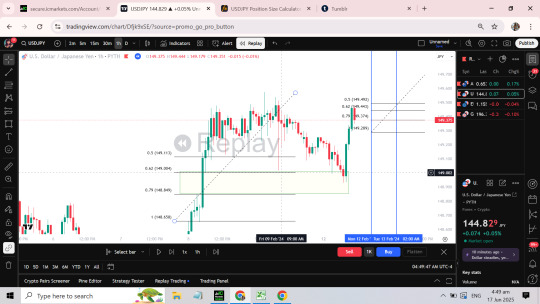

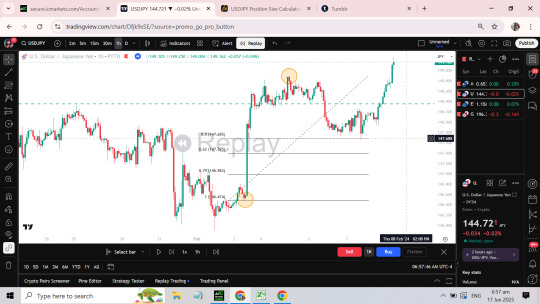

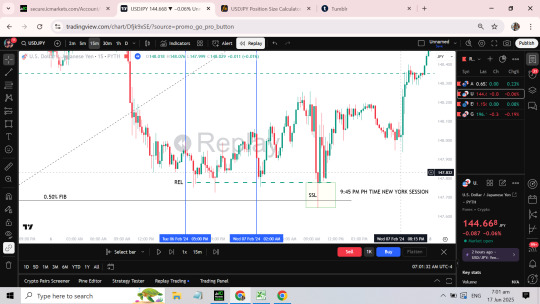

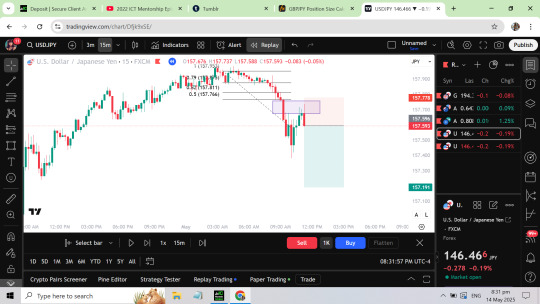

USDJPY- UP until it reaches the REH we will look for a displacement to see if the price will shift in market structure. If price pierces through the relative equal highs with a strong bullish momentum, we will join the upside when the price re-traces to 0.5% fib level in the 4 h chart.

If the price pierces through the REH and shows a displacement, we will take a trade at 2 m and 5 m chart for a short term short.

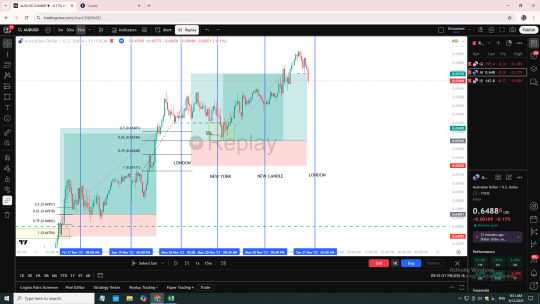

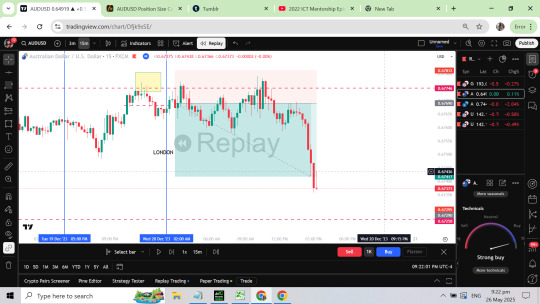

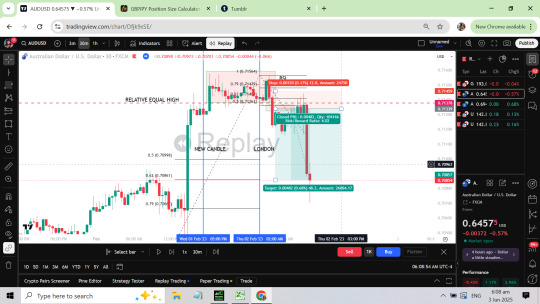

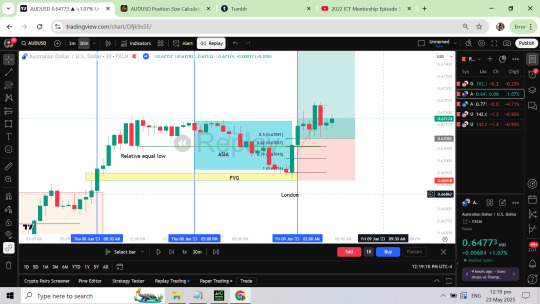

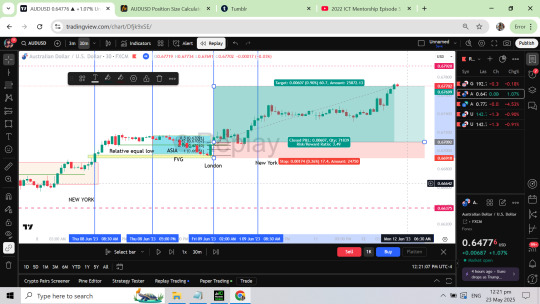

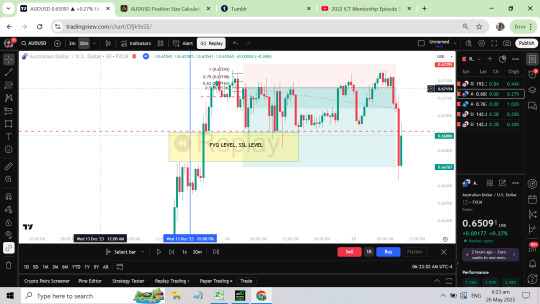

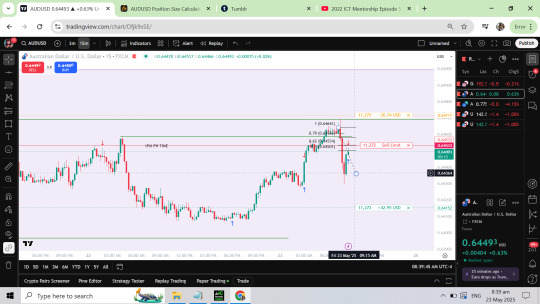

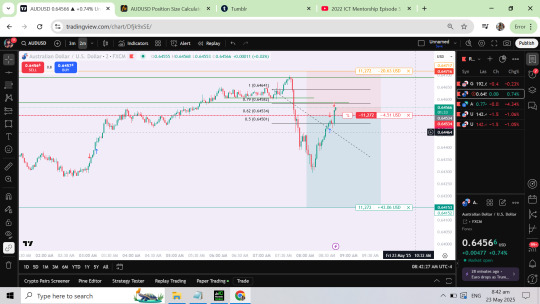

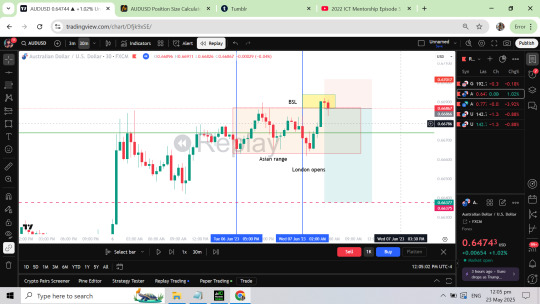

AUDUSD - DOWN We are looking for the price to retrace to the FVG level to join the down trend.

We will take a trade at the 0.79% level with 15 pips stop-loss.

0 notes

Text

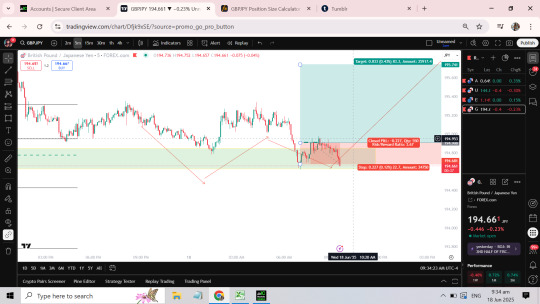

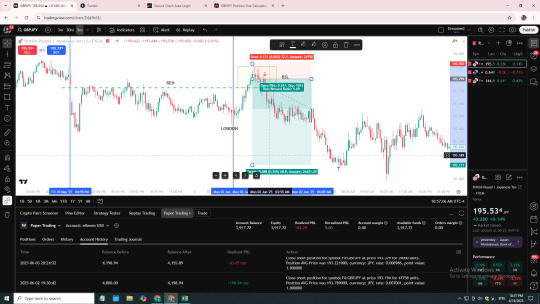

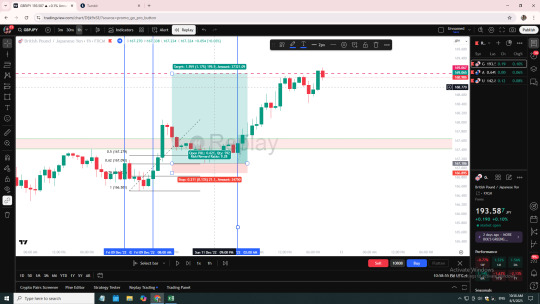

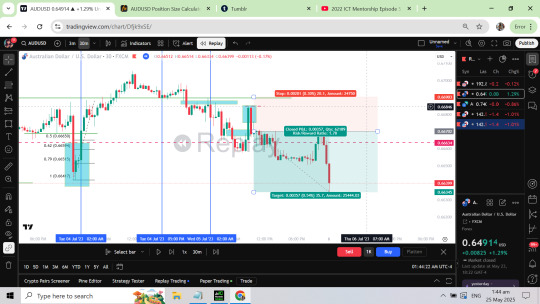

REAL MONEY TRADES June 16-20,2025

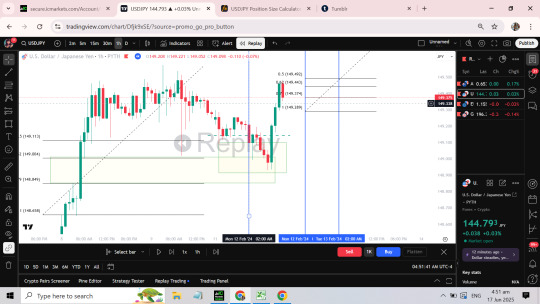

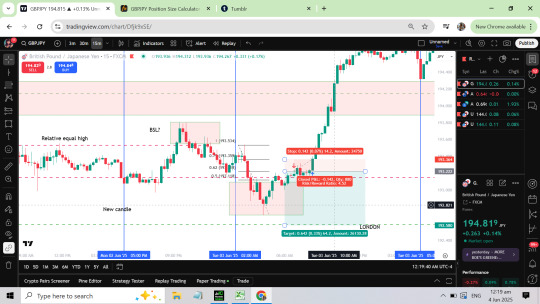

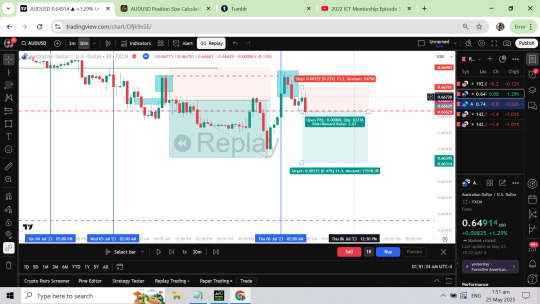

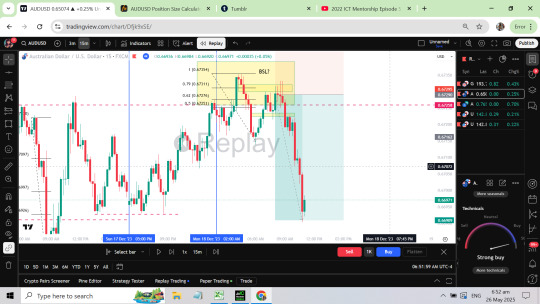

RISK-0.18% REWARD -0.53% Overall market direction-UP Reason for taking the trade- Price above REH, Price at BSL area, price creating LL, price coming back to 0.62% fib level

2. Risk-0.08% Reward-0.49%

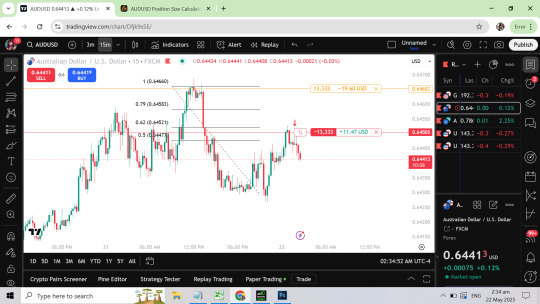

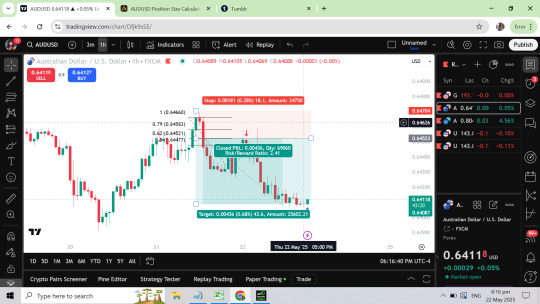

I got kicked out of the trade even though the price haven't been to my trailing stop yet. On NY open at exactly 8:30 PM the price went low and above like crazy and then when I check my trade it was already closed at 0.11% gain only. Lesson here is that, always give around 5-6 pips leeway to avoid slippage. 3. What went wrong with this trade? Why did I took the trade? I was inside the car, mike was driving when I received an alert that the price have gone to 0.62% fib level and then later that day, I check the chart using my phone and saw what it seems to me a break of swing low. I was rushing to put on a trade, panicking because I didn't want to be late on the entry. When I got home, I entered the trade without a stop-loss thinking that I'll just do it after I enter so that I won't miss to much price action. When I was measuring the amount of pips I need, it was 20 pips and not 12 pips. What! I was so worried because I know how impactful each pip is to the lot size and actual amount. What lessons can I learn on this trade? I am not yet very good at buys mid range. I should avoid this kinds of trades until I'm comfortable. I can take buys if price came from where there REL and SSL was taken.

Comparing and contrasting Here are 2 price action where one bounce up the 0.62% and the other did not, I am now realizing that one of the reason I got faked out is that I was looking at the 5 min chart unlike the 1 hour chart where the price was already solid. Next time, we can look at the 1 hour chart to avoid fake outs in price movement and to not rush in the trade in FOMO!!!

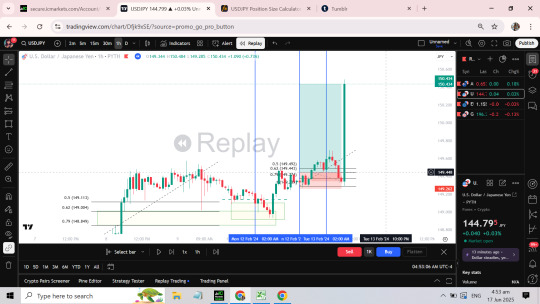

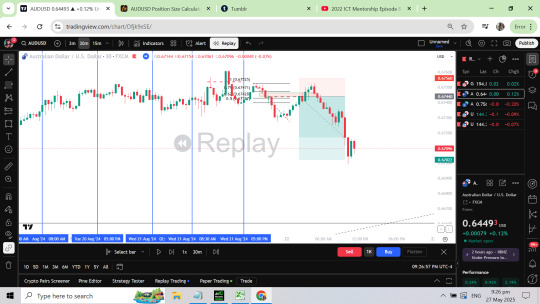

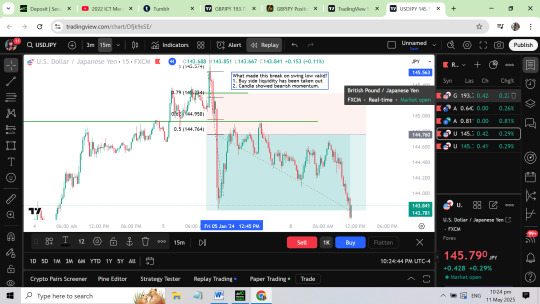

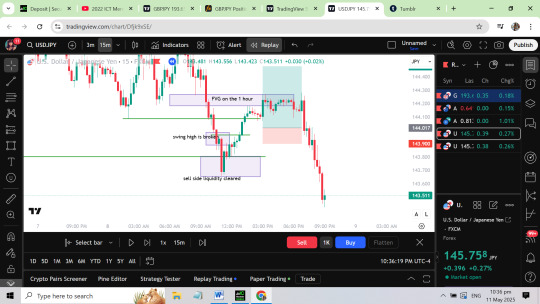

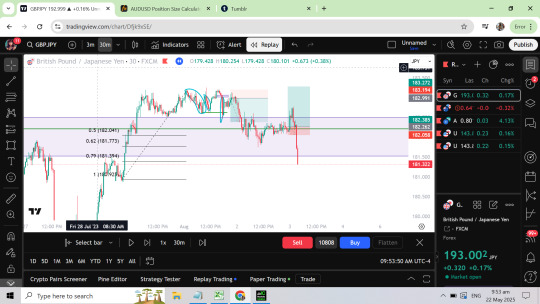

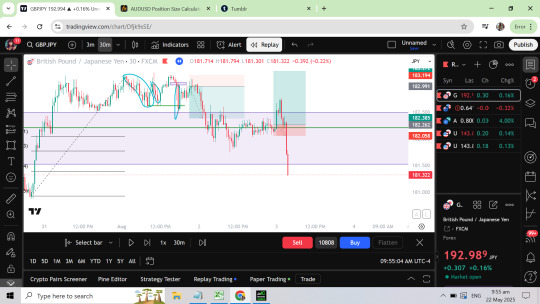

4. What happened to this trade? I was alerted that the price was crossing the relative equal highs, I observed the price action on the lower time frame to see if there would be any displacement in price to the downside. However, I noticed that the price movement wasn't as dynamic as I want it to be so I was thinking that the price might be continuing to the upside. I saw the price pumping to the upside without stopping and I was itching to join the run I was so desperate for the price to pause and let me in. When I finally saw the price pause in the 5 m chart, I immediately took out my fib tool and marked 0.50% as my entry. However, the price just kept on going down and down until it hit my stop-loss. I was heartbroken because I was hopeful. :( I tried to check again later that day and so that the more realiable time-frame to check for pull-back was the 15 min and 1 hour timeframe because the price did bounce on the 15 min time frame as well as the 1 hour but it was short lived. The price did not push any further after 39 pips of movement up the price was having a hard time pushing up and eventually reversed to the down-side. In this type of scenario, is it right to just place a trailing stop to protect my capital? Isn't it that if the price move is really strong, it shouldn't be reversing too much. Lessons I learned from this trade 1. Do not chase the price. 2. Use the higher timeframe like the 1 hour to mark your fib level retracement. 3. Defensive trading always, never let a win turn into a loss.

I'm also noticing that the 4 hour chart is a much reliable bounce point

0 notes

Text

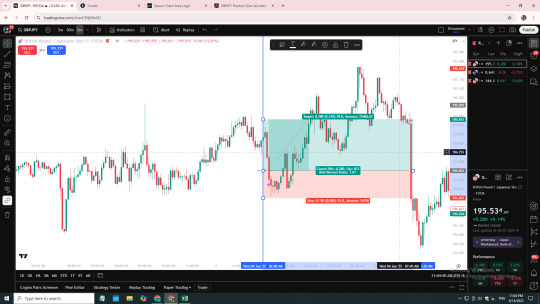

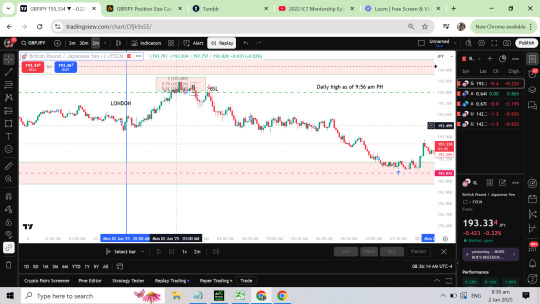

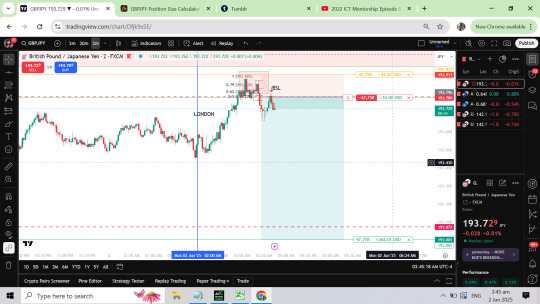

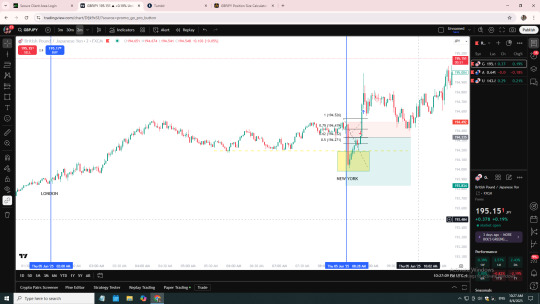

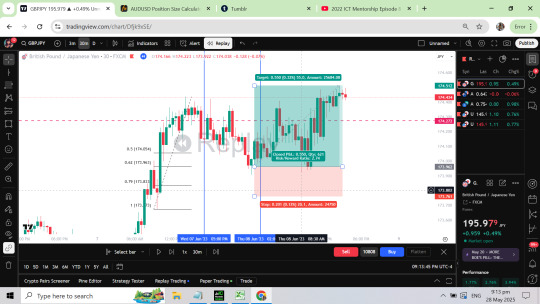

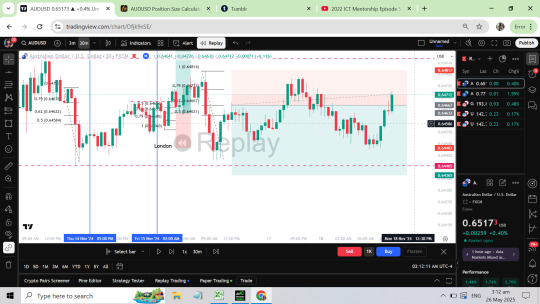

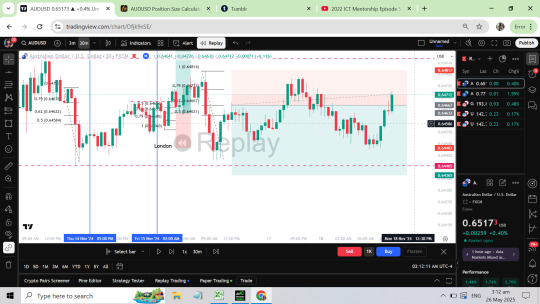

Forecasting 06-16-20-2025

GBPJPY Projected market direction-UP Waiting for price to re-trace on 0.62 fib level in 4h chart

2. Waiting for reaction to key levels

0 notes

Text

JUNE 2025 TRADES

Why do I think this trade was a winner?

2. What happened on this trade?

3. Not sure why I took this trade, it went up briefly though and I wasn't feeling very confident when I took this and decided to trail my stop. I ended gaining only 18 usd

4. Took that level as REL and was kind of questioning during this time if the price action inside the square box was actually a SSL?

I think I was impulsive last few weeks, I think I was not spending enough time analyzing the chart and just jumping right in the trade quickly as I sat down. I feel like there's a need inside of me, a need to be proven right and to feel that hint of happiness if I win.

I need more time to analyze the trade and not jump right in in fear of missing out.

0 notes

Text

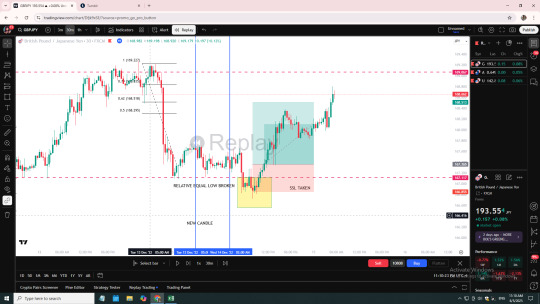

mistakes I made in trading

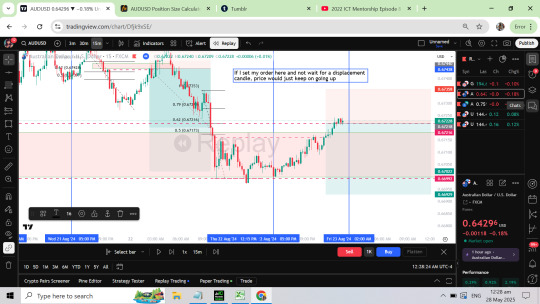

Overlooking the SSL/BSL when the price created that strong momentous candle to the down-side, I immediately thought that it was a sign the market wanted to go down so I set a sell-stop at 0.62% fib level and then boom and very strong force brought the price to the upside so fast the broker couldn't even execute my stop-loss order making me lose 300% more that I should have.

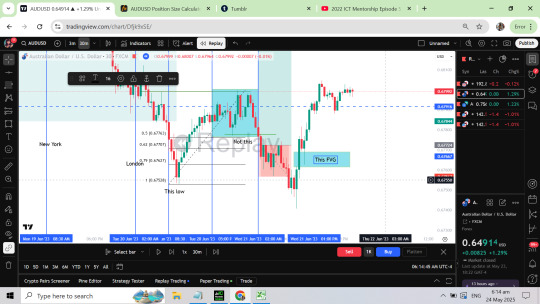

During this time, I was also not feeling my best. I felt that I was burned out by trading and back-testing. I am now wondering if "did I only take that trade to maybe have a feel good mechanism? " I feel like I really didn't think that trade through. I just sat on my desktop and saw the price moving and entered a trade without a plan really. 2. The mistake I made on this trade was, I failed to check the 1 h chart to have seen that this area is actually an SSL. I still took the trade without waiting for displacement in price in fear the my stop-loss might be too far.

3. Viewed the area as relatively equal low and was able to spot the SSL, however, due to my fear of missing out. I took the trade on the next FVG thinking that the price might never go back to my OTE but then, the price returned to my OTE after I was kicked out of the trade. If I just waited for my price, I would have never been kicked out of the trade at 15 pips stop-loss.

0 notes

Text

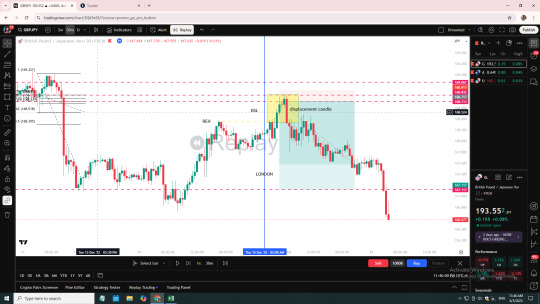

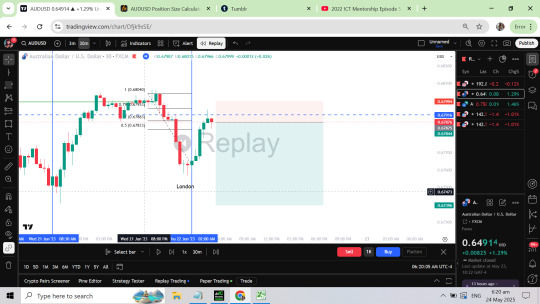

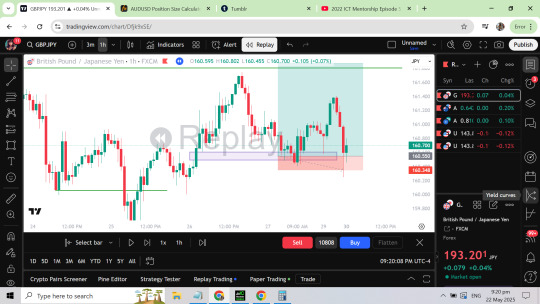

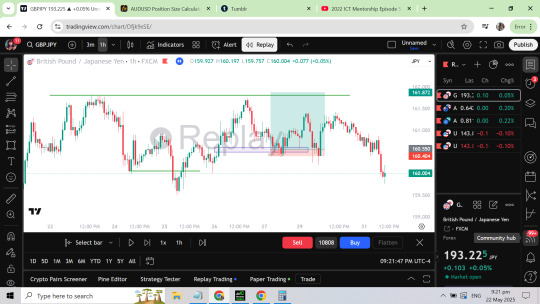

Practicing shorts on a retracement to Fib 0.79/0.62 LEVEL /FVG

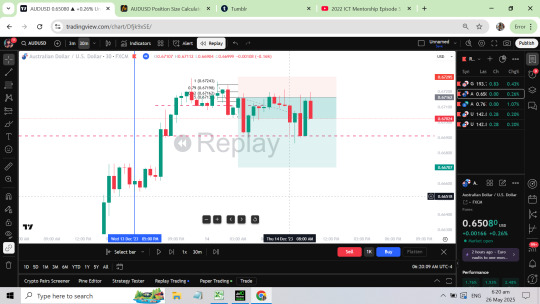

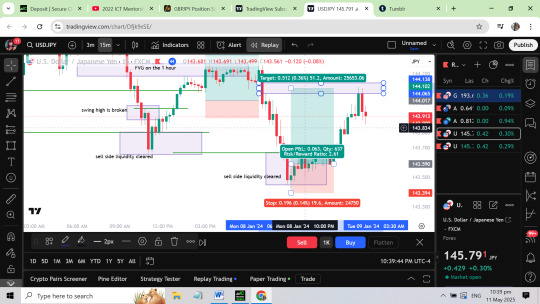

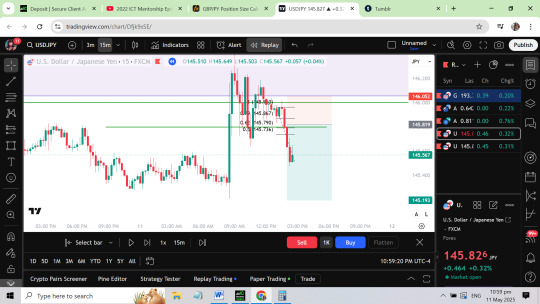

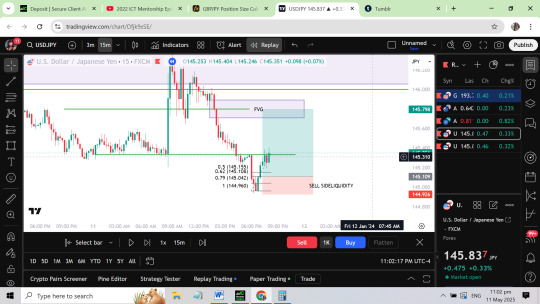

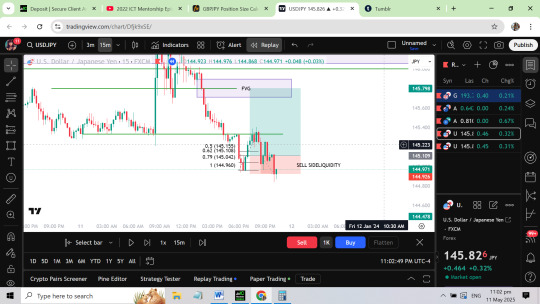

Observations- Price did not respect the 0.62% fib level When price reached the 0.79% level, there was a displacement in price signaling the area to be a high value area

2. Observation - It took 4 days for the price to go back to 0.79 fib level from when I saw the shift in market structure on Friday, January 19, Price reached 0.79 fib level on January 22 and I was able to enter the trade Jan 23,2024. This trade really goes to show that waiting for the right moment is so worth it.

3. Continuation for Short Levels 0.79% fib After a major move to the down-side, the market went to a corrective phase for 2 days before hitting the 0.79% fib level.

4. Going short on a re-tracement 0.79% fib level retracement Stop-loss- 15-16 PIPS

0 notes

Text

Practicing buys

Trade 6 uptrends a day to gain more confidence.

Trade 1 Daily chart- bias UP -There's an FVG, take note of how the price reacts to the FVG. (Price just pierced through, did not respect the level. -

I HOUR CHART, There was an equal high being broken, price could possibly re-trace and might give us some entry

2. Criteria for taking the trade SSL Taken Relative equal low broken down buy on a fib level 0.5 when buying

3.Criteria for taking the trade SSL Taken 0.62 fib level REL Broken BOINK

4. Buying continuation set-ups

5. Buying continuations Daily chart Areas where price usually bounce FIB 0.79%, 0.62%

6. Observations on bullish momentum The price went above the REH and took out BSL and even created a displacement candle. However, the price did not react to 0.62 and 0.79% fib levels. So, what is the difference between a price that will continue to go up and just retracing to a certain level and a price that's shifting in market structure? It could be that a price that has bullish momentum creates strong long green candles.

When measuring fib levels, we can use the 1 h chart and use themost recent swing low and swing high then enter at 0.50% fib level.

What beautiful about this trade is that it checks all the tick boxes 1. Price going back to 0.50% fib level 2. SSL Taken 3. There's a clear relative equal low. What's amazing about going is long is that once that price has taken off, it seldom go back down so deep.

7. Buying a long continuation after a push through REH What made this trade a valid set-up for longs? 1. The overall market trend was UP 2. The price re-traced to the 0.52% fib level in the daily chart and reacted by creating a strong bullish candle in the 1 hour chart.

0 notes

Text

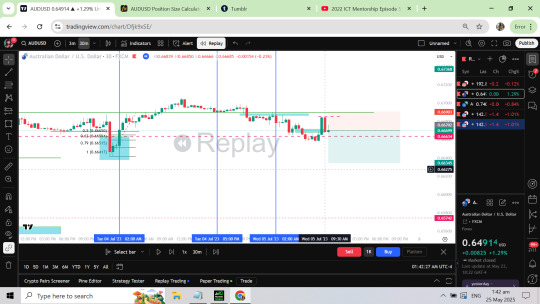

Actual application to trade with time and price

Risk -0.06% Reward- 0.41% WIN Reason for taking the trade a. Overall market bias -DOWN b. Price was taking BSL near the London open c. ICT FVG pattern showing d. Price returning to 0.62% Fib level. I market where the high of the day is and entered as near as possible to that high.

2. Risk 0.07% Reward 0.28%

3. Risk- 0.08% Reward- 0.85% This trade was wack! I was feeling so much. I couldn't exactly tell where the market is going. I saw the BSL taken however the overall market direction was up. So I put a limit order to buy, the price was doing well so far until 8:15 PM PH time when the price had a strong momentum to the downside. Since I wasn't so confident about this trade, I move my stoploss 18 usd above my entry . There's so much back testing I still need to do. hays

3. Risk- 0.08% Reward- 0.85% This trade was wack! I was feeling so much. I couldn't exactly tell where the market is going. I saw the BSL taken however the overall market direction was up. So I put a limit order to buy, the price was doing well so far until 8:15 PM PH time when the price had a strong momentum to the downside. Since I wasn't so confident about this trade, I move my stoploss 18 usd above my entry . There's so much back testing I still need to do. hays

4. Risk-0.08% Reward-0.50 % Oh man, I was so stunned when the market moved so fast. Tradingview was also struggling to close my position. I was only supposed to lose 40 usd and it turned into 132 usd due to high volatility. How to stop over trading? Was this a trade I wasn't supposed to enter? Is this not my set-up or was I looking at the market direction incorrectly? TBH, I am not that used to taking trade during New york open. This trade is really something to pause upon and ponder at.

0 notes

Text

June 1-8 market markers

I am looking to go short and waiting for the price to pull back to

0 notes

Text

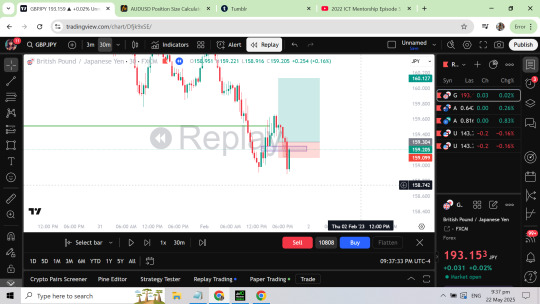

Practice trades PART 3

25. Risk -0.18% Reward 0.40% WIN Basis for taking the trade, overall market bias-DOWN, Double top? , Price on FVG level, BSL-Taken?

Entered trade at 3PM PH time near london open December 20, 2023 ,TP Hit- December 20,2023-3:00 PM NY Time or 3 am PH time.

26. Risk 0.18% Reward-0.66% WIN Basis for taking trade? Overall market direction -UP, Price returning to 0.5% FVG level and reacting with strong momentum. Took a trade on December 26,2023 3:45 PM PH time TP HIT on December 27,2023 10:45 PM PH time

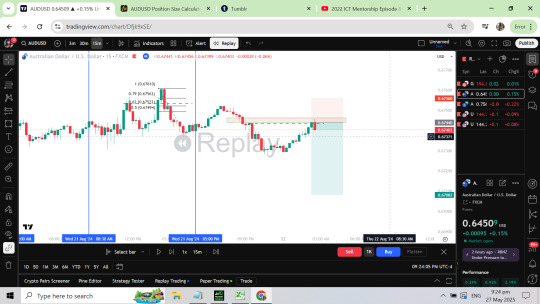

27. Risk 0.18% Reward- 0.53 % WIN Reason for taking the trade Overall trend -Down Price is returning to 0.62% Fib level on the 30 mins timeframe Time trade taken 2:30 PM PH time , Date: 08/22/2024 TP Hit- 10: 00 PM PH time, Date: 08/22/2024 Stop-loss- 12 pips

28. Risk -0.21% Reward-0.43% Reason for taking the trade? For me, I saw the market as bearish, I was looking for a down-ward continuation. I waited for the price to go back to 0.62 fib level. I noticed that when the price went to 0.62% level, there was not much of a reaction. The price just continued to create higher highs I should have waited for the swing-low to be broken

29. Risk-0.16% Reward-0.48% WIN Reasons for taking the trade - High is broken, BSL is taken, Price creating lower-lows, price returning to Fib 0.62%. Set Pending order with 11 pips stoploss. Date trade entered-08/25/2024 TP Hit -08/26/2024

30. Risk-0.12% Reward-0.55% Reason for taking the trade? Overall trend- down BSL on a key high-Taken Price went back to 0.62% Fib level on FVG, however the price shoot up to a different FVG level which I have been eyeing, but because I wanted to join the run fast I got screwed because I knew it was too late to enter. The price went back to the level I was looking at. HMM- my directional bias is just wrong.

31. Risk-12% Reward-0.32% Reason for taking the trade Overall market trend -up, trade with the trend? Yes Price going back to 0.62 level Time TRADE TAKEN-12:30 am PH time (June 8,2023) TP Hit- 2:30 AM PH TIME (June 8,2023)

32. Risk-0.17% Reward-0.68% WIN Overall market direction- DOWN Reason for taking the trade- BSL taken, Price above relative equal high, price returning to 0.62 fib level Observations- I noticed, There were no fib level hitting FVG but then price still touch the 0.62% fib level before it went down. Time trade entered- 8: 00 PM PH time TP Hit-10:00 PM PH time

33. Risk-0.07% Reward- 0.33 % What is the mistake I made on this trade? I always forget that when a price took out the SSL on relative equal low, price tends to go up.

34. Risk -0.11% Reward-0.45% LOSS With this particular trade, the 15 pips stop did not do. Stop-loss got hit before the price move to the down side. I think for most GBPJPY trades, we should consider the volatility too. Reasons for taking the trade 1. Price above equal high, BSL taken 2. Price re-tracing to 0.62% Level Fib

0 notes

Text

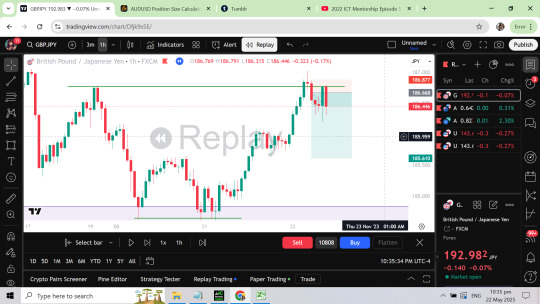

Practice trades Part 2

14 . Risk-0.18% Reward-0.72% Lose

Practicing trading within time zones 15. Risk0.26% Reward-0.90% WIN

Finally! Captured one 16. Risk-029% Reward-O.98% WIN

17. Risk-0.23% Reward-0.89% LOSE

For this trade, I think I was looking at the wrong Equal low. 18. Risk -0.18% Reward- 0.71% WIN

19. Risk-30% Reward-0.54% WIN

Entered the trade 10 am NY, TP hit 12 am NY time 10 PM Ph time to 12 PM PH 20. Risk -0.23 Reward-0.47%

I think I entered late, If I would change my entry exactly at the FVG and place a 20 pip stop loss I wouldn't got hit. I think, it's best to place a pending order to get the best price. The directional bias was correct though. 21. Risk- 0.23% Reward-0.47% LOSE

22.Risk- 0.23% Reward-0.47%

So hard to catch a trade, probably because it's a sideways market?

22. Risk -0.20% Reward-0.68% Stoploss: 13 pips Key high level, imbalance, retracement to 0.62 level Fib took trade DECEMBER 14,2023 London open 3PM PH time, 3 am NY time TP Hit- December 15,2023 8:00 am or 8:00 PM PH time WIN

How it's going

23. Risk-0.19% Reward-0.57% WIN Factors for taking trade - Key high, FVG level 0.62%, BSL liquidity taken took trade 8:30 am NY time, December 18,2024-TP Hit December 18,2023 10: 45 am NY time

0 notes

Text

The pressing problem

Why do I always see everything as a SHORT? Why do I keep on trading against the trend? How do I learn to catch buys? I need to understand timing

On London open, the price briefly went down the sell side liquidity and took the sell stops before moving up

0 notes

Text

50 Trades of gray

AUDUSD -Basis for entering? Price going back to FVG level.

Closed the trade next morning, I just felt like price might pump back up before going down further. 2. RISK-0.16% REWARD-0.40 LOSE

Oh man, how do I improve my directional bias? I kept trading on the wrong direction. Am I too of a short trader, why do I see every trade as a sell?

Let's change something this time shall we? How about we consider the date and time. If we want to catch the low of the day, we should buy the sell side liquidity or vise versa and not take take just because.

Sample of a Displacement

Is this just a pull back? -YES how do I know it wants to go up? after the market took out BSL, the price got displaced.

Does it indicate the price is ready to reverse?-No it was a pull back!! 3. Risk-0.28% Reward-0.59% LOSE

Look at this? Why did I short this even though I knew that the daily candle was bullish????? 4. RISK-0.08% REWARD-0.17%

0 notes

Text

Practice Trades

Risk : 0.37% Reward: 0.68% WIN What made this set-up valid? 1. The buy side liquidity has been taken out 2. Bearish impulse to the down side.

2.Let's see where the price goes Risk -0.08% Reward-0.32 % LOSE

The price reacted to 1 hour FVG and did not proceed goin to the upside.

The sell side liquidity was broken, Thinking the price would go back up to balance the FVG.

3.The price really went to the FVG level. Risk: 0.14% Reward: 0.36% WIN

4.LOSE Risk-0.13% Reward: 0.47%

5. What made this trade valid? I saw the price going back to the 0.62 fib level on the 15 mins chart. When it reached that area, price were struggling to move above it. on the 15 mins chart, price broke down and I saw a long red candle indicating a strong momentum to the downside. I took a trade on FVG level below 50%, my SL was 18 pips and TP 40.5 pips. RISK-0.12%, REWARD: 0.26% WIN

What the heck, what should I do? If I place my T/P on a particular price point. I wouldn't catch this move? Should I just place it above the swing low?

6.RISK:0.11% REWARD: 0.33% WIN Why did I take this trade? I saw on the daily candle that the buy side liquidity has been taken out, on the 1 hour chart the price was refusing to move beyond the price point, and then I saw a strong bear momentum candle to the down side and took a trade with a 20 pips stoploss.

7.RISK: 0.11 % REWARD: 0.55% LOSE What was I thinking when I took this trade? -I was thinking that the price was reacting to the 0.62 FVG area, what I noticed about the candles forming on this area was that it wasn't very strong. Choppy price action. Unlike the red candle going down where it's showing strong momentum to the downside.

What could have I done to prevent this trade? Take note of the candles forming. 8. RISK-0.13% REWARD-0.50% LOSE

9. RISK-0.13% REWARD-0.82% LOSE

The price briefly move to the direction I was anticipating and returned and took out my stoploss.

Wrong direction, the price was really struggling to move up despite the fact that it reacted to the FVG area. -My thought process on taking this trade was I was thinking the price would take out the BSL and that FVG on the 1 hour chart would be a significant level for me to enter the upside. Hence, the price still went down. 10. RISK-0.13% REWARD-0.35% LOSE

11. Risk -0.11% Reward- 0.57% LOSE

12. RISK-0.11 REWARD-0.27 LOSE

Time for a change! 13. Risk-0.23% Reward-0.73%

Wrong to think that lethargic candles would do

0 notes

Text

SET UPS TO LOOK FOR

Observation- After the price takes down the BSL above the relative equal high, if I am aiming to go short. I could just place an order at 0.62 level and place a 15 to 20 pips stoploss. Market observations

I failed to catch a buy on this trade because I failed look at the SSL dip at 2 PM or London open as a dip into the SSL. When I realized that the market still wanted to go up, I was waiting for the price to return to the FVG 0.5 % level, I was getting disappointed because the price is leaving without me. However, at 7:30 to 7:45 PM, the price returned to that level and pumped up again. I think, I kind of remember HannahFX taking this kind of trade and her mentioning to trust the what the price will do. Can I just place an order at this level? The FVG first appeared December 22, 2023 and was re-visited by the price on December 24,2023. Question 1. Can an entry form during asian range? YES , I have entered a USDJPY trade at 10:04 am PH time 2. Do I only have to take trades during or after the London session and intra-day on new york open? No, you can take a trade on London open or NY session as long as it meets your criteria 3. Does trades form during asian range? -YES

0 notes