Don't wanna be here? Send us removal request.

Text

Why Cloud Engineering and Data Governance Go Hand-in-Hand in Modern Enterprises

In today's digital-first world, modern businesses are quickly dependent on cloud infrastructure to achieve scalability, agility, and innovation. For example, organisations transfer operations, data, and applications to clouds, ensuring the accuracy, privacy, and compliance of the data, which becomes even more important. This is where Cloud Engineering and Data Governance will work together. Together, they build a basis for a flexible, safe, and computer-driven enterprise.

Let's explore why cloud engineering and data management go hand-in-hand, and their integration helps companies find the right value of their data.

The Role of Cloud Engineering in Modern Enterprises

Cloud Engineering involves the design, setup, and maintenance of a scalable and secure cloud environment. This includes cloud architecture, infrastructure-as-code (IAC), data pipeline, security protocols, and performance optimisations. Organisations rely on cloud engineers to ensure that sheltered resources are highly accessible and in accordance with business requirements.

With the emergence of strategies with multiple clouds and hybrid clouds, companies now work in a rapidly complex environment. Cloud engineering is no longer about offering only storage or servers; it is about the construction of automatic, intelligent, and integrated ecosystems that support real-time analysis, AI/ML applications, and continuous distribution models.

The main benefits of the shooting technique include:

Elastic scalability and flexibility

Cost adjustment through utility-based prices

CI/CD market from time to time through pipelines

Strong disaster recovery and fault tolerance

However, the success of the cloud engineer depends not only on the infrastructure but also on how the data is stored and controlled throughout the company.

Why Data Governance is Essential in the Cloud Era

Computer management is a structure of guidelines, roles, standards, and a matrix that ensures efficient and safe use of data. Since companies deposit large amounts of data in clouds from different sources and formats, control becomes important to ensure data quality, integrity, compliance, and purpose.

A well-designed computer management program answers key questions such as:

Who is the owner of the data?

Where is the data stored, and who has access?

Is the data accurate, complete, and updated?

How does data match regulatory frameworks such as GDPR, HIPAA, or CCPA?

Without control, the risk of the icing environment "data swamps" -vast, unstructured, and unreliable repositories of information. This not only affects the decision but also exposes the organisation to security breaches and regulatory penalties.

How Cloud Engineering and Data Governance Intersect

Cloud engineering services provides the technical backbone, while the data governance services provides strategic oversight. It is reported here that they complement each other:

1. Unified Data Architecture

Cloud Engineers, Designers, Data Lakes, warehouses, and Pipelines. But without governance, data can lead to architectural deviations and silo. The steering ensures standardised metadata, names conferences and data bar, and helps cloud engineers to create a clean, consistent, and interoperable data environment.

2. Access control and security

Cloud platforms have equipment for identification and access management (IAM). However, the regime defines the range and under what circumstances. By applying guidelines to the levels of roles and data sensitivity, companies can ensure that only authorized users reach important data sets, mitigate data leaks, and mitigate insider hazards.

3. Compliance and Auditability

Regulatory requirements require revised handling and storage guidelines. Cloud Engineering Teams can use logging, version control, and automatic life cycle rules, but the outline of the regime decides whether there is a need to maintain or mask. This synergy ensures compliance with engineering teams without loading.

4. Automation and Policy Enforcement

With infrastructure-as codes and automatic workflows, cloud engineers can built the rules directly in the system script. For example, data encryption can be automated by encryption parameters, interaction protocols, and region-based storage restrictions, which ensures scale control.

5. Data Quality and Trust

Engineers build pipelines, but the regime ensures that the data that flows through them is reliable. Data stewardship, verification rules, and deviation detection can be integrated into cloud-based ETL (Extract, Transform, Load) processes, and they help maintain high data quality throughout the board.

Conclusions:

Modern enterprises can no longer afford to treat cloud engineering and data governance as siloed disciplines. Since the data becomes the currency for digital changes, organisations require cloud platforms that not only perform on scale, but also respect privacy, quality and compliance.

By integrating shooting techniques with a strong management framework, the business gains confidence in innovating quickly, unlocking action-rich insights and navigating complex regulatory scenarios. The future of corporate data strategy lies in this synergy - a foundation in which Cloud Engineering Roads are made, and the data regime ensures that road rules are followed.

1 note

·

View note

Text

Key Strategies for Successful Deal Execution in Private Equity

In the competitive environment of private equity, deal execution is among the most important stages of the investment process. It is where strategy intersects with precision and where the potential of a transaction is realized or lost. While the sourcing of the right deal is paramount, how effectively and deliberatively that deal is executed may determine the ultimate returns. A well-received transaction secures not just a smooth deal but also sets the right stage for value creation after the acquisition.

To succeed in today's competitive investment environment, private equity companies need to approach deal execution with a disciplined, systematic strategy. From building the ideal team to leveraging digital tools and focusing on the portfolio company's long-term objectives, each activity has a crucial role to play in getting deals.

Establishing a Robust Deal Team

Effective implementation starts with the building of an outstanding team of investment experts, lawyers, financial analysts, tax advisors, and operating consultants. Cross-functional teamwork is necessary to ensure that all aspects of the transaction are considered at the same time and together. With deals getting more complicated, coordination among internal and external stakeholders has to be smooth. The proper team mix provides expertise, speed, and objectivity. All of these are required to close deals on tight timelines and competitive pressure.

Aligning on a Clear Investment Thesis

Developing a clear investment thesis is key to successful deal execution. Not only does it drive the choice of target companies, but it also directs due diligence direction, valuation modeling, and post-acquisition strategy. The optimal private equity solutions are those that mix strategic intent and operational feasibility. It allows companies to define where value will be created and how value will be captured. Whether the transaction is about scaling a high-growth business or transforming an underperforming asset, a well-defined thesis will keep each step of the deal process on track, measurable, and aligned with long-term objectives.

Conducting In-Depth Due Diligence

Due diligence is the foundation of sound deal execution. It is more than reviewing financial reports or legal agreements. It includes a very critical review of the target firm's market standing, operational competency, customer base, compliance with regulations, and even cultural alignment. Private equity firms should also assess potential risks, including cyber exposures, environmental risks, or pending litigation. A properly designed diligence process guarantees that no material issues are left out, and that the firm possesses a thorough knowledge of the business that it is acquiring.

Utilizing Technology and Data Analytics

Private equity firms today are increasingly turning to technology-powered deal execution services to compete in the present digital environment. Products like AI-driven analytics, automated workflows, and virtual data rooms facilitate collaboration, accelerate due diligence, and enhance decision-making accuracy. The services not only decrease the time to close deals but also enhance the quality of insights derived from financial and operational information. By digitizing deal execution processes, companies are able to spot early warning signs, simulate different acquisition possibilities, and keep real-time information within deal teams.

Structuring the Deal Strategically

Valuation is just half the battle. The actual structure of the deal can greatly affect the risk-reward profile. Advanced structuring mechanisms like earn-outs, performance-based incentives, seller financing, or equity rollovers can assist in aligning everybody's interests. Structuring also involves identifying the appropriate capital mix, equity, mezzanine, or senior debt, that supports not only the purchase but also the future growth of the business. Structuring flexibility and creativity can be a competitive edge, particularly in contested transactions.

Addressing Legal and Regulatory Hurdles Early

Delays and complications usually result from neglect of regulatory and compliance aspects during implementation. Antitrust analysis, industry-specific licensing, foreign investment permits, and tax issues have to be resolved much earlier than the closing date. For cross-border transactions, an understanding of local legal frameworks and cultural differences becomes even more important. Seeking expert advice from legal counsel early on prevents last-minute surprises and ensures that all closing documents are properly drafted, negotiated, and closed in accordance with relevant legislation.

Collaborating with Management Teams

Management relationship with the target company is a key element in successful implementation. Whether it is for retaining the current team or bringing in new leaders, communicating openly with senior executives is key. Their perspectives can add depth to the process of due diligence, guide value creation planning, and facilitate integration after the deal. Building trust and agreement early on creates a working relationship that will continue into the period of ownership.

Integrating Value Creation Planning

Value creation doesn't happen after the acquisition. It needs to be built into the execution phase itself. As the deal is being negotiated, the company simultaneously needs to be mapping out operational improvement opportunities, possible synergies, and growth drivers. This could mean starting conversations around digital transformation, process simplification, market expansion, or new product development. Having a roadmap at the time of closure means that immediate action can be taken and downtime in the post-acquisition phase is reduced.

Conclusion

In private equity, where competition is fierce and capital placement should be both strategic and fast, deal execution is important. This is not enough to identify a large goal. What defines long-term success is the ability to make the transaction fairly and prepare the company for changes from day one. Through initial adjustment on disciplined plan, expert collaboration, strategic use of technology, and value construction, PE companies can get better results and create value.

1 note

·

View note

Text

Process Mining Solutions: Unveiling Operational Efficiency with SG Analytics

In an era where data-driven decision-making is paramount, businesses are increasingly turning to process mining solutions to gain insights into their operations. SG Analytics (SGA) offers advanced process mining services designed to uncover inefficiencies, optimize workflows, and drive strategic growth. Understanding Process Mining Process mining is a technique that analyzes event logs from information systems to visualize and improve real business processes. By transforming raw data into actionable insights, organizations can identify bottlenecks, deviations, and opportunities for optimization. SG Analytics’ Approach to Process Mining Services SGA’s process mining services encompass: • Process Discovery & Mapping: Utilizing advanced methods to map and document workflows, identifying inefficiencies, and empowering impactful process improvements. • Analysis and Optimization: Analyzing processes to identify inefficiencies and applying data-driven strategies to optimize workflows, reduce costs, and drive success. • Root Cause Analysis: Conducting rigorous analysis to identify core issues, offering actionable insights to improve performance. • Predictive Analytics and Forecasting: Leveraging historical data and advanced analytics to enable proactive decision-making and accurate forecasting. These services are tailored to meet the unique needs of various industries, including BFSI, technology, media & entertainment, and healthcare. Benefits of Implementing Process Mining Solutions Organizations that adopt process mining solutions can expect several key benefits: • Enhanced Operational Efficiency: By identifying and eliminating process inefficiencies, organizations can streamline operations and reduce costs. • Improved Compliance and Risk Management: Process mining provides visibility into process deviations, helping organizations ensure compliance with regulations and internal policies. • Data-Driven Decision Making: Access to real-time process data enables informed decision-making, allowing organizations to respond swiftly to changing business conditions. • Customer Satisfaction: Optimized processes lead to faster service delivery and improved customer experiences. Real-World Applications Process mining solutions have been successfully applied across various domains: • Inventory Management: Analyzing inventory data to identify excess stock, optimize replenishment cycles, and prevent stockouts, thereby reducing carrying costs and ensuring product availability. • Order Management: Mapping the end-to-end order fulfillment process to uncover bottlenecks, automate tasks, and improve collaboration, accelerating order-to-cash cycles. • Procurement Efficiency: Providing visibility into procurement processes, enabling organizations to negotiate better contracts, consolidate spending, and eliminate maverick buying. Conclusion Process mining solutions are transforming the way organizations understand and optimize their operations. By leveraging the expertise of providers like SG Analytics, businesses can uncover hidden inefficiencies, make data-driven decisions, and achieve operational excellence. As the business environment continues to evolve, process mining services will play a crucial role in helping organizations stay agile and competitive.

0 notes

Text

Building Strong Customer Relationships Through Thought Leadership in 2025

Understanding Thought Leadership

Understanding Thought Leadership

Thought leadership is about sharing valuable industry insights and problem-solving tips through various methods such as publishing whitepapers, participating in public speaking events, and engaging in-person with industry peers. Strategy consulting solutions emphasize the importance of leveraging new media platforms for digital thought leadership activities.

When targeting industry peers and clients, thought leaders aim for business-to-business (B2B) stakeholder engagement. They can also simplify technical aspects for broader audiences, potentially turning them into future leads. Business-to-consumer (B2C) thought leadership helps address customer doubts with the expertise of specialists or domain experts.

Ultimately, both B2B and B2C thought leadership ensure your brand is recognized as transparent, trustworthy, and genuine. B2B focuses on industry peers, while B2C increases consumer awareness of your offerings.

Creating a Winning Thought Leadership Strategy in 2025

Utilize Social Media and Online Forums

Each social media platform presents unique challenges for brands aiming to expand their audience and lead trends. Every thought leadership marketing agency refines content delivery strategies suitable for each platform. Younger professionals often engage with industry-relevant media on social sites, allowing thought leaders to build a loyal following. Some viewers can then be encouraged to engage with the brand’s subject matter experts (SMEs) through more personalized channels.

Discussion forums are also significant. Q&A forums enable SMEs to connect with industry peers and reduce customer confusion about product utility or customization features.

Define Audience Engagement Methods

Disabling comments on social posts or restricting access to support forum entries sends the wrong message. In-house professionals should avoid mentioning ideas that could lead to controversial media coverage. Thought leadership is rewarding but must be approached systematically.

Guidelines educating SMEs on handling unfavorable feedback online are crucial. Responding to criticisms professionally fosters brand reputation. Two-way communication in enterprise newsletters can boost or dampen their effectiveness. Active participation in discussions and allowing the audience to raise doubts are vital.

Social engagement guidelines demonstrate authenticity as company experts help stakeholders understand issues and brainstorm solutions. However, occasional content moderation may be necessary based on social site recommendations.

Collaborate with Influencers, Event Organizers, and Universities

Enterprise SMEs can exchange ideas with other domain specialists through collaborative thought leadership content distribution, such as podcasts and virtual conferences. These channels facilitate unscripted interactions and entertaining technical knowledge sharing.

In-person networking events are valuable for thought leaders skilled in data visualization, storytelling, and public speaking. They can attend international events and join industry associations to establish authority and attract talent. Participating in university events offers similar benefits.

Set Trackable Metrics and Content Calendars

Every thought leadership strategy needs periodic revisions. Preserving historical records of past activities is crucial for optimizing content plans. A content calendar should provide data on the best days and channels for disseminating technical or storytelling content.

Scheduling physical events should not interfere with SMEs’ other responsibilities. In-house experts and marketing teams must coordinate tasks proactively. The effectiveness of these tasks in expanding contacts or satisfying stakeholder curiosities should be measured with trackable metrics.

Embrace Lifelong Learning and Monitor Industry Developments

Professionals implementing the thought leadership strategy must undergo training programs as new industry best practices emerge. Consistent knowledge upgrades are mandatory to maintain respect among audiences.

SMEs can use e-learning platforms for lessons on using artificial intelligence for problem-solving and brainstorming or exploring greener production methods. Acquiring extensive knowledge of their primary discipline is vital, but they must also stay updated on developments in allied fields to contribute to multidisciplinary discussions.

Conclusion

Data-backed thought leadership content creation empowers brands to enhance their authority-building strategy and establish a solid online presence in 2025. It creates new avenues for lead generation, consumer education, and professional collaborations.

Identifying the best platforms for B2B or B2C engagement, defining interaction guidelines, and attending in-person events are key approaches for thriving as a thought leader. These strategies will continue to dominate as stakeholders seek reliable intelligence from authoritative figures to combat misinformation and overcome job-specific challenges.

Continuous professional development (CPD) ensures content resonates with audiences. Nobody wants outdated ideas, so CPD through online or in-person training is essential. It enriches topics for public speaking events or podcasts.

All components of a winning thought leadership strategy require relevant metrics, content calendars, and timely revisions. Departmental chiefs must find and train new thought leaders and encourage employees to pursue diverse skills, increasing the circle of experts in any organization aiming to be a top brand in its industry.

0 notes

Text

Unlocking Customer Insights: How Marketing Analytics Drives Business Growth

Customer insights facilitate the ease of segmentation and personalization. In turn, they lead to higher sales and audience retention metrics. Besides, you learn about consumers’ pain points. Several social listening and behavior prediction tools also reveal the best ways to modify product designs. At the same time, every brand seeks granular marketing insights to decipher the puzzle of what the target customer will find most compelling. This post will elaborate on customer insights and marketing analytics benefits, exploring their roles in long-term business growth.

Customer Insights – What Do They Include?

Consumer insights represent crucial information organizations gather about their customers to help understand motivational, sentimental, and demographic factors vital to sales and marketing operations. The top priority of all customer analytics services is to foster better relationship and customer satisfaction (CSAT) improvements.

Analysts will likely use multiple data sourcing and insight discovery methods to find accurate patterns in a client enterprise’s relevant datasets. They might inspect historical purchase records or study third-party publications about industry norms concerning CSAT or similar metrics. These secondary data sources require further processing.

Meanwhile, interviewing consumers offers first-hand data. Think of customers’ interaction with helpdesks via voice calls or emails. Today’s analytical technologies can investigate those unstructured data assets for hints about recurring problems that each customer might describe distinctively. Data-backed guidance that will follow might assist the post-purchase teams in improving how they engage customers.

Ensuring Business Growth with the Benefits of Customer Insights and Marketing Analytics

1. Brainstorming and Promoting New Offerings

Imagine a global firm that notices many consumers request feature additions to a product during social listening. This discovery allows for demand-inspired product design revamps. As a result, corporations can confidently modify their current lineup without worrying a lot about reception. Leveraging marketing analytics solutions will also highlight new ideas to promote the upgraded products to the audiences most willing to place an order.

On the other hand, introducing a brand-new product will be more challenging. While a few early adopters will support new products, marketing analysts’ assistance will show which promotional campaign performs the best in enrolling the rest of the consumer base.

2. Customizing and Modernizing Customer Communications

Data-driven consumer communications reduce the likelihood of irritating target profiles with repetitive and less appealing conversations. Customer analytics aids in distinguishing lead generation and retention strategies based on effectiveness. That is how the companies at the top of their respective industry know when to offer a monthly newsletter and when to configure full-screen advertisements.

Aggressively bombarding audiences with identical content is one of the fastest ways of becoming your target customers’ most disliked brand. However, being too subtle might be equally harmful given the ever-declining average attention spans. Companies must find the sweet spot between interruptive promotions and long-form, rich content with minimal marketing intent if they want to succeed. This optimization will yield the best gains across user engagement statistics and brand loyalty.

3. Strategically Distributing Budget for Customer Journey Improvements

A slow checkout page or an empathy-lacking email can immediately alienate target audiences. Converting them will not be possible unless the old, inefficient interaction points in the current customer journey mapping are replaced with better alternatives. However, these changes must not rely on human assumptions.

Basing the customer journey updates on actual data insights is more practical and preferable. Remember, some promising interaction points might lose relevance as consumers adopt more digital engagement options. Overconfidentally tweaking their journey will also cost more, especially in automobile, pharmaceutical, and construction industries that still depend on face-to-face interactions. Therefore, leveraging customer insights and marketing analytics for better customer experience (CX) assurance without undue expenditure increments is crucial.

Conclusion

Sales can exponentially increase and ensure business growth as an enterprise adopts customer insights and marketing analytics. Thanks to those insights, data-backed decisions about promotional campaigns, helpdesk management, and CX personalization have become more manageable. Related benefits also involve getting better returns on ad spend (ROAS) and longer audience retention. Accordingly, advanced analytical techniques aimed at helping brands understand their core stakeholders’ motivations are now more popular than ever, with a projected compound annual growth rate of approximately 19% between 2025 and 2030.

0 notes

Text

Unlocking Insights: The Latest Private Equity Report

In the dynamic and competitive world of private equity, staying informed and adaptable is essential for success. The latest PE Report by SG Analytics provides a thorough and insightful analysis of the current state of the private equity market. This Private Equity Survey Report delves into various aspects of the industry, offering valuable information on market trends, investment strategies, portfolio management, and the challenges and opportunities that lie ahead.

Comprehensive Market Trends and Analysis

The Private Equity Report begins with an in-depth examination of the latest market trends. One of the key observations is the increasing competitiveness for high-quality deals. As more firms enter the market, the competition for attractive investment opportunities intensifies, driving up valuations and making it more challenging to secure favorable deals. Additionally, the report highlights the growing importance of technological integration in investment strategies. Firms that leverage advanced technologies such as artificial intelligence and machine learning are better positioned to identify lucrative opportunities and make data-driven decisions.

Strategic Investment Approaches

Investment strategies are at the heart of the Private Equity Survey Report. The report provides a detailed analysis of the strategies employed by leading private equity firms. One of the critical takeaways is the importance of maintaining a diversified portfolio. By spreading investments across various sectors and geographies, firms can mitigate risks and enhance returns. The report also emphasizes the role of data analytics in making informed investment decisions. Firms that utilize sophisticated data analytics tools can gain deeper insights into market trends, identify potential risks, and uncover hidden opportunities.

Effective Portfolio Management Techniques

Effective portfolio management is crucial for maximizing returns and achieving long-term success. The Private Equity Report offers valuable insights into best practices for monitoring and optimizing portfolio performance. One of the key recommendations is the use of advanced analytics and real-time performance tracking. By continuously monitoring portfolio companies and analyzing performance data, firms can make timely adjustments and ensure that their investments are on track to achieve their objectives. The report also highlights the importance of active engagement with portfolio companies. By providing strategic guidance and support, private equity firms can help their portfolio companies grow and succeed.

Navigating Challenges and Seizing Opportunities

The Private Equity Survey Report also addresses the various challenges faced by private equity firms. Regulatory changes, market volatility, and geopolitical uncertainties are some of the factors that can impact the industry. The report provides strategies for navigating these challenges and minimizing their impact. Additionally, the report identifies potential opportunities for growth and innovation. For example, the rise of sustainable investing presents a significant opportunity for private equity firms to invest in companies that prioritize environmental, social, and governance (ESG) factors. By aligning their investments with ESG principles, firms can not only achieve financial returns but also contribute to positive social and environmental outcomes.

Conclusion

The Private Equity Survey Report by SG Analytics is an essential resource for anyone involved in the private equity sector. By leveraging the insights and recommendations provided in this report, firms can enhance their investment strategies, optimize portfolio performance, and navigate the complexities of the market with confidence. The report serves as a comprehensive guide for private equity professionals, offering actionable insights and practical advice to help them succeed in an increasingly competitive and dynamic industry.

0 notes

Text

The Future of Sustainability with the ESG Data Insights Report 2025

In today's rapidly evolving business landscape, Environmental, Social, and Governance (ESG) factors are more critical than ever. Organizations worldwide are striving to align their strategies with sustainable practices to meet regulatory requirements and investor expectations. If you're looking to gain a competitive edge in sustainability, the ESG Data Insights Report 2025 is your ultimate resource.

Why ESG Data Matters in 2025

The significance of ESG reporting has skyrocketed, as businesses face mounting pressure from stakeholders, consumers, and regulatory bodies. The ESG Data Report serves as a blueprint, offering in-depth insights into the latest trends, challenges, and opportunities in sustainability reporting. Companies that prioritize ESG compliance are not only safeguarding their reputation but also driving long-term profitability.

Key Takeaways from the ESG Data Insights Report

The ESG Insights Report provides a comprehensive analysis of:

Emerging ESG trends in 2025: Understand how companies are integrating ESG factors into their decision-making processes.

Regulatory changes and compliance: Stay ahead of evolving policies and ensure your business meets global ESG standards.

ESG data management and analytics: Learn how to leverage data for better sustainability performance.

Investor and stakeholder expectations: Discover what ESG-focused investors are looking for in 2025.

Industry-specific case studies: Gain insights from leading organizations implementing successful ESG strategies.

Benefits of Downloading the ESG Report 2025

By accessing the latest ESG Data Insights, businesses can:

Enhance sustainability strategies with data-driven decision-making

Identify key ESG risks and opportunities

Strengthen transparency and reporting credibility

Improve investor relations with robust ESG disclosures

Benchmark against industry peers

Who Should Read This Report?

The ESG Data Insights Report 2025 is a must-read for:

Business leaders and decision-makers

ESG professionals and sustainability managers

Investors and financial analysts

Compliance and risk management teams

Corporate social responsibility (CSR) specialists

Download Your Copy Today!

Sustainability is no longer a choice—it’s a necessity. To stay ahead in the ESG landscape, download the ESG Report 2025 and unlock valuable insights that will shape your organization's future.

Equip your business with the knowledge and strategies needed to thrive in the evolving world of ESG compliance and sustainability. Get your copy today and take the first step towards a more responsible and profitable future.

Conclusion

The ESG Data Insights Report 2025 provides businesses with essential guidance on sustainability and ESG compliance. By leveraging these insights, companies can make informed decisions, enhance their ESG strategies, and build a resilient future. Don’t miss this opportunity to stay ahead in the ESG landscape—download your report today and drive positive change for your organization and the planet.

0 notes

Text

The Power of Data Analytics in Smart Manufacturing

Data analytics has enabled manufacturers to identify workflow problems. It also aids in modernizing product conception and optimizing resource usage. As a result, more companies in the manufacturing industry have invested in analytics integrations that ensure cost reduction without compromising product quality. Remember, increased competition indicates businesses must improve precision and agility. So, data insights concerning operational efficiency are more crucial than ever. This post will describe how the power of data analytics facilitates smart manufacturing.

What is Smart Manufacturing?

Smart manufacturing refers to the integration of newer technologies to enhance production, design, material sourcing, cost reduction, and waste minimization. It can also surpass software integrations when robotics and energy-efficient equipment become significant in meeting output requirements or reducing carbon emissions.

A business can leverage analytics in manufacturing to explore how operational disruptions can happen and what is necessary to decrease their impacts. Moreover, tracking industry best practices and regulatory changes that affect profitability or inventory planning becomes more straightforward. So, adequate implementation of novel data processing and insight extraction methods is paramount.

The Power of Data Analytics in Smart Manufacturing

1. Insights into Operational Efficiency

Data analytics help pursue smart manufacturing frameworks by revealing areas for improvement in business operations. It allows for human and non-human component analyses. Therefore, leaders can have granular details about whether employees need training or machinery must undergo tuning or maintenance.

Real-time insight capture, one of the popular aspects of analytics solutions for FinTech, further enhances project supervisors’ ability to handle on-site disruptions. They can identify how workers might improve equipment usage. Likewise, managers and site operators can document operational metrics. Later, this record-keeping can aid in predictive maintenance. As a result, equipment can be kept functional for longer while unnecessary maintenance will not happen.

2. Better Product Quality Assurances

Total quality management (TQM) focuses on realistic targets concerning product durability, design precision, material purity, ergonomics, affordability, and recyclability. Additional dimensions to quality assurances that reflect more sustainability-centric smart manufacturing principles also have significance in reports.

Companies cannot thrive if they fail to fulfill stakeholders’ quality expectations. So, leaders must prioritize investing in quality management insight exploration tools. Their use cases can range from physical impact test simulations for instruments to battery longevity inspection for electronics.

On the other hand, insights into historical quality deviations allow for an investigative approach to finding ineffectiveness in TQM strategies. Subsequent enhancements will assist manufacturing businesses in developing better quality offerings and maximizing customer satisfaction. Alternatively, they can experiment with scenarios where unconventional production techniques or renewable materials might demonstrate better quality outcomes with desirable cost reduction.

3. Making Supply Chain Management Data-Driven

Disturbances in socioeconomic harmony often destabilize transportation and raw material sourcing channels. It also makes workers physically and psychologically less productive. In the absence of such human-caused chaos, natural supply disruption forces involve earthquakes, tsunamis, landslides, droughts, floods, and tornadoes. Therefore, manufacturing companies must gather relevant data and prepare for supply crises.

Other data processing considerations that make analytics for smart manufacturing non-negotiable involve broader compliance requirements. For instance, today, tracking the carbon emissions of enterprises extends to assessing sustainable practices that organizations’ primary and secondary vendors might have adopted. So, supply chain analytics has distinct importance in modern corporate environments.

Conclusion

The manufacturing industry seeks smart tech innovations to address the drawbacks of conventional methods, and data analytics professionals can assist it in this endeavor. After all, actionable insights into operational metrics and product quality management allow for superior production technique discoveries. Understandably, more leaders are remarkably curious about what modern analytics use cases can help them achieve.

0 notes

Text

Business Insights for Competitive Edge: Turning Data into Strategic Actions

In today's fast-paced business environment, companies are constantly seeking ways to gain a competitive edge. One of the most effective strategies is leveraging business insights derived from data. Advanced reporting that highlights competitors’ strengths and business weaknesses is crucial for devising strategies to surpass them. However, raw data in its unprocessed form has limited utility. Therefore, processing, restructuring, and visualizing data are essential steps in transforming it into actionable insights. This post will delve into how business data insights can significantly enhance an enterprise’s competitive edge.

Accurately extracted insights act as catalysts for sustainable innovation and improved user experiences. Conversely, relying on poor-quality datasets or allowing systemic flaws to introduce biases in insight exploration can lead to impractical policy changes. Thus, leaders seeking operational efficiency must thoroughly understand how to utilize business data insights for competitive or strategic improvements.

How Business Insights Help Gain Competitive Edge

Competitor-Focused Market Research (MR)

The abundance of data sources available today allows for more scalable secondary market research. Similarly, diverse communication channels increase opportunities for primary market research (MR). Both strategies offer a mix of structured and unstructured data assets. Comprehensive market research services can interpret these assets to provide insights into business threats due to macroeconomic and competitive factors.

For instance, studying how rival organizations promote their offerings helps create superior methods to engage customers. If brands keep re-using marketing ideas, most audiences will quickly skip or ignore their promotional efforts. Market researchers equip brands with insights for product design modification and differentiation. Product-focused business insights and reports must also provide objective comparisons with rivals’ offerings. Without unique value, most consumers will not switch to your products. Primary and secondary market research, including competitor monitoring, helps prevent such a disaster.

Market research services also play a crucial role in identifying emerging trends and shifts in consumer behavior. By staying ahead of these trends, companies can adapt their strategies to meet changing market demands. This proactive approach not only helps in retaining existing customers but also attracts new ones, thereby increasing market share.

AI-Enabled Data Analysis Excellence

In the era of big data, how can a firm accelerate insight capture if its competitors use identical analytics capabilities? Artificial intelligence (AI) models enable distinct insight exploration advantages that vary from brand to brand. Professional analysts can leverage AI to deliver business insights consulting with fewer human interventions, while commercial entities can use AI during problem-solving and brainstorming collaborations.

AI helps turn raw data into strategically impactful insights for a competitive edge by reducing the time and resources required to uncover trends. It excels at simulating market outcomes based on historical datasets and stakeholder specifications. AI-driven analytics can identify patterns and correlations that might be missed by human analysts, providing deeper insights into market dynamics.

Today, customizing artificial intelligence for specific industries has become a full-fledged sector with a promising outlook. AI development and commercialization efforts have expanded beyond universities, gaining significant funding from private firms and public institutions. This trend underscores the growing recognition of AI's potential to revolutionize business operations and decision-making processes.

Moreover, AI-powered tools can enhance customer experiences by personalizing interactions and predicting customer needs. By analyzing customer data, AI can recommend products and services tailored to individual preferences, thereby increasing customer satisfaction and loyalty. This personalized approach can set a company apart from its competitors, providing a significant competitive advantage.

Realistic Goal Determination and Scheduling

Data insights prevent leaders from having unrealistic expectations for new projects. By considering how similar initiatives have yielded certain gains and increased liabilities in the past, analysts showcase the pros and cons of current deals. Therefore, project planning authorities and their private sector counterparts can focus on achievable targets.

Realistic scheduling and performance projections also address investor concerns regarding feasibility. Nobody wants to commit significant resources to a strategy likely to crumble mid-execution. It is better if stakeholders can forecast the reliability and rewards of a proposed project through an objective lens rather than emotional impulses. This is where business insights extracted by reputed analysts create value.

Furthermore, data-driven goal setting helps in aligning organizational objectives with market realities. By understanding the potential risks and rewards associated with different strategies, companies can make informed decisions that maximize their chances of success. This approach also fosters a culture of accountability, as teams are more likely to meet targets that are based on realistic expectations.

In addition, data insights can aid in resource allocation by identifying areas that require investment and those that can be optimized. This ensures that resources are used efficiently, contributing to overall operational efficiency and profitability.

Conclusion

In conclusion, turning extensive data into relevant, realistic, and strategically beneficial business insights can significantly increase your enterprise’s competitive edge. Holistic market research, artificial intelligence, and data-backed goal determination are three promising methods to achieve this. Given the ever-increasing demand for scalable data processing techniques, those who have mastered business insight exploration will have new career growth opportunities and a greater impact on corporate leaders’ decisions.

By leveraging these insights, companies can not only stay ahead of their competitors but also drive innovation and growth. As the business landscape continues to evolve, the ability to harness the power of data will become increasingly critical for achieving long-term success.

0 notes

Text

How to Integrate Thought Leadership Strategy into Your B2B Marketing Plan

Credible businesses seamlessly earn investor funding and form long-term relationships with all stakeholders. However, establishing authority is a slow, complicated process. Enterprises must also encourage in-house veterans to be more open about engaging with industry peers and assist the marketing team with high retention activities. This post will explain what organizations need to integrate a thought leadership strategy into a business-to-business (B2B) marketing plan.

Understanding B2B Thought Leadership

Unlike customer-focused guidance abundant on e-commerce sites, B2B thought leadership targets industry peers and client organizations. Therefore, ensuring a true thought leader position by highlighting your brand’s team of experts with their actual contributions to the industry is crucial.

Current clients, prospects, suppliers, aspiring young professionals, and independent practitioners in each discipline can benefit from educational and engaging content that thought leaders publish. As a result, B2B thought leadership enables corporations to advocate for new norms, like green tech adoption or culturally conscious communication.

For example, today, many leading firms in information technology and applied sciences encourage a balanced approach to artificial intelligence. Whitepapers, case studies, live events, webinars, debate forums, and special expos allow them to network with like-minded professionals. At the same time, they demonstrate their values and ethos that might resonate with potential investors having similar concerns about ethical AI integration.

How to Integrate a Thought Leadership Strategy into Your B2B Marketing Plan

Step 1: Make Subject Matter Experts Participate in Social Media and Industry Forums

Social networking sites (SNS) are no longer secondary to industry-specific discussion and support forums when it comes to thought leadership marketing. Both are impactful, considering how younger professionals do not shy away from utilizing all platforms to acquire new skills and connect with renowned subject matter experts or SMEs.

First, every enterprise must train and direct employees to gain exposure to on-ground activities relating to multiple projects. While those holding senior positions can offer more insightful content as SMEs, younger workers can also help explore or present experimental ideas to relevant audiences. Neither group can afford to have inconsistent presences on their social media profiles. Later, they can direct their followers or forum members toward more engaging lead magnets and technical knowledge resources.

Step 2: Define the Correct Guidelines to Help SMEs Engage with Critics, Followers, and Event Attendees

All channels for B2B thought leadership involve two-way communication aspects. That is why actively participating in discussions is most beneficial. On the one hand, your team members get to build their personal brand and thrive as SMEs. Simultaneously, your enterprises acquire newer opportunities to demonstrate authenticity.

Engagement is not limited to the number of likes or reposts. Given the rise of superficial “engagement farm” scams, all audiences care more about comments. It is no wonder that relevance and professionalism during commenting can strengthen or dampen the thought leadership effects. Selecting content moderators and thought leaders who understand whether sarcastic remarks can lead to healthy debates or toxic responses might be the greatest challenge in this case.

Step 3: Do Not Turn Down Collaboration Opportunities Without Thorough Consideration

Sharing insights can be less lonely when SMEs team up with other thought leaders covering identical frameworks and industry practices. Based on personal comfort zones, some thought leadership contributors might not be willing to collaborate with others. That indicates a need for continuous skill development that prepares them for collaborative public speaking and live-streaming content creation.

You will notice that LinkedIn, Instagram, YouTube, TikTok, and Pinterest have embraced short videos and live streams. Audiences are also tired of information fatigue and seek more organic interactions between discussion panel members. These trends have increased the significance of collaborations and audiovisual aspects in a B2B marketing plan. Therefore, thought leaders cannot ignore the related skills or collaboration invitations.

Conclusion

Producing content backed by real-world evidence is fundamental to B2B thought leadership. However, strategically utilizing it requires voluntary contributions from seasoned professionals and young recruits. The former can excel at demonstrating domain expertise through whitepaper publications, public speaking events, and technical knowledge dissemination. The latter will aid in experimental projects and challenge conventional wisdom.

In short, each category of subject matter experts provides unique advantages that assist marketers in enhancing brands’ authority-building initiatives. As a result, companies enthusiastically aiming to integrate a thought leadership strategy into the B2B marketing plan must follow the aforementioned steps. Doing so will help them thrive on multiple platforms and attract stakeholders through credible content distribution.

1 note

·

View note

Text

Rise of Eco-Friendly Transport in 2025: From EVs to Hyperloop

In a world where sustainability is becoming more and more important, the future of transportation is set to experience a transformative shift. With concerns about climate change continuing to rise, industries are exploring ways to develop innovative solutions that can help minimize….. Read More:- https://www.sganalytics.com/blog/eco-friendly-transport-evs-to-hyperloop/

0 notes

Text

Business Insights for Competitive Edge: Turning Data into Strategic Actions

Companies expect advanced reporting that can aptly highlight competitors’ strengths and business weaknesses to devise ideas to surpass them. However, data in its raw state has low utility. That is why processing, restructuring, and visualizing it are essential. This post will emphasize how business data insights help increase an enterprise’s competitive edge.

Correctly extracted insights function as catalysts for sustainable innovation and user experience enhancements. Meanwhile, relying on poor-quality datasets or letting systemic flaws introduce biases in insight exploration will surely lead to impractical policy changes. Therefore, if leaders seek operational efficiency, they must thoroughly understand what it takes to utilize business data insights for competitive or strategic improvements.

How Business Insights Help Gain Competitive Edge

1. Competitor-Focused Market Research (MR)

The abundance of data sources allows for more scalable secondary market research. Similarly, diverse communication channels increase opportunities for primary MR. Both strategies offer a mix of structured and unstructured data assets. Thankfully, comprehensive market research services can interpret them for insights into business threats due to macroeconomic and competitive factors.

For example, studying how rival organizations promote their offerings helps create superior methods to engage customers. After all, if brands keep re-using marketing ideas, most audiences will quickly skip or ignore their promotional efforts.

Likewise, market researchers equip brands with product design modification and differentiation insights. Product-focused business insights and reports must also provide objective comparisons with rivals’ offerings. If there is no unique value to your products, most consumers will never bother to switch over to your offerings. Primary and secondary market research that includes competitor monitoring assists in preventing such a disaster.

2. AI-Enabled Data Analysis Excellence

How will one firm accelerate insight capture if its competitors employ identical analytics capabilities? Artificial intelligence (AI) models enable distinct insight exploration advantages that will remarkably vary from brand to brand. While professional analysts can leverage AI to deliver business insights consulting with fewer human interventions, commercial entities can use such AI’s aid during problem-solving and brainstorming collaborations.

AI helps turn raw data into strategically impactful insights for a competitive edge by reducing the duration and resources required to uncover trends. It also excels at simulating market outcomes based on historical datasets and stakeholder specifications.

Today, customizing artificial intelligence for organizations in particular industries has evolved to become a full-fledged sector with a promising outlook. After all, AI development and commercialization endeavors have gone beyond the walls of universities, gaining a lot of funding from private firms and public institutions.

3. Realistic Goal Determination and Scheduling

Data insights prevent leaders from having unrealistic expectations from new projects. By considering how identical initiatives have yielded certain gains and increased some liabilities in the past, analysts showcase the pros and cons of current deals. Therefore, project planning authorities and their private sector counterparts can focus on achievable targets.

Realistic scheduling and performance projections also address investor concerns regarding feasibility. Remember, nobody wants to commit significant resources to a strategy that will likely crumble mid-execution. Will it not be better if stakeholders can forecast the reliability and rewards of a proposed project through an objective lens instead of emotional impulses? That is where business insights extracted by reputed analysts create value.

Conclusion

You can increase your enterprise’s competitive edge by turning extensive data into relevant, realistic, and strategically beneficial business insights. To this end, holistic market research, artificial intelligence, and data-backed goal determination are three promising methods. Given the ever-increasing demand for scalable data processing techniques, those who have mastered business insight exploration will have newer career growth opportunities and a greater impact on the corporate leaders’ decisions.

0 notes

Text

Unlocking the Potential of Carbon Markets: Challenges and Opportunities

In recent years, the global focus on sustainability has intensified, with carbon markets emerging as a pivotal tool in the fight against climate change. As we navigate through 2025, the landscape of carbon markets presents both significant challenges and promising opportunities.

The Rise of Carbon Markets

Carbon markets have gained traction as a mechanism to incentivize emissions reductions. By putting a price on carbon, these markets encourage corporations to adopt more sustainable practices. The concept is straightforward: companies that emit less than their allotted carbon credits can sell the excess to those exceeding their limits. This system not only promotes efficiency but also drives innovation in emissions-reducing technologies.

Challenges Facing Carbon Markets

Despite their potential, carbon markets face several hurdles:

Integrity of Carbon Credits: One of the primary concerns is the integrity of carbon credits. Ensuring that each credit represents a real reduction in greenhouse gas (GHG) emissions is crucial. Without robust monitoring, reporting, and verification (MRV) systems, the credibility of carbon markets can be compromised.

Additionality: This concept refers to whether a project would have occurred without the incentive provided by carbon credits. Ensuring additionality is vital to prevent the dilution of environmental benefits. Limiting credits to projects that genuinely sequester carbon can enhance market credibility.

Double Counting: Double counting occurs when both the project host and the credit purchaser claim the same emissions reduction. This practice undermines the effectiveness of carbon markets and overstates global progress in reducing emissions.

Price Volatility: Fluctuations in carbon prices can deter long-term investments in sustainable technologies. Establishing a carbon price floor can help stabilize the market and provide a reliable price signal for investors.

Credit Quality and Homogeneity: The varying benefits of different types of carbon credits can complicate market dynamics. Ensuring that credits reflect true environmental benefits is essential for the market's success.

Opportunities in Carbon Markets

Despite these challenges, the future of carbon markets looks promising:

Global Expansion: More countries are implementing carbon pricing mechanisms, expanding the reach and impact of carbon markets. This global adoption is crucial for achieving significant emissions reductions.

Corporate Demand: The rise in demand from corporations to offset their emissions and finance climate action is driving market growth. Companies are increasingly recognizing the importance of integrating sustainability into their business models.

Technological Advancements: Innovations in emissions-reducing technologies are creating new opportunities for carbon markets. These advancements can enhance the efficiency and effectiveness of carbon credits.

Voluntary Carbon Markets: The development of voluntary carbon markets is expected to grow rapidly. Standardizing pricing mechanisms and enhancing market oversight can ensure transparency and credibility in these markets.

The Role of ESG Services

Environmental, Social, and Governance (ESG) services play a critical role in supporting the development and integrity of carbon markets. By providing comprehensive assessments and reporting, ESG services help companies navigate the complexities of sustainability and carbon markets. These services ensure that companies' sustainability efforts are authentic and impactful, fostering trust and accountability.

Conclusion

As we move forward, the challenges and opportunities in carbon markets will shape the future of global climate action. By addressing the issues of credit integrity, additionality, double counting, and price volatility, we can unlock the full potential of carbon markets. With the support of ESG services, companies can integrate sustainability into their core strategies, driving meaningful progress towards a sustainable future.

0 notes

Text

Thought Leadership: Establishing Credibility and Shaping Industry Influence

Brands need to ensure their actions foster trust and authority. If they or their suppliers employ underage workers, can they expect customers, investors, or regulators to overlook such misconduct? Failures in areas like performance disclosures or data protection also betray key stakeholders. Therefore, thought leaders who inspire teams to uphold the highest standards are essential. This post will explore how thought leadership helps businesses build credibility and gain significant industry influence.

Understanding Thought Leadership

Thought leadership involves sharing innovative ideas or unique insights as experts and trendsetters. A thought leader must blend standard industry knowledge with personal expertise. Developing a style that balances technical details with the need to entertain various audiences is crucial.

Opinions shared by subject matter experts (SMEs) as part of a thought leadership strategy should solve industry problems or educate customers on product usage. When SMEs' ideas help target audiences overcome challenges, it serves as undeniable proof of their trustworthiness as thought leaders.

Inspiring industry peers to change their operations requires consistently demonstrating expertise through platforms like blogs or podcasts. B2B webinars focus on technical discussions, while public speaking engagements need more entertaining storytelling without oversimplifying core ideas.

How Thought Leadership Builds Credibility and Industry Influence

Authenticity Through Personal or Professional Brands

Thought leadership boosts credibility through SMEs' personal or professional brands. Being respected as knowledgeable individuals offers authenticity to audiences tired of brands making headlines for controversial marketing or insincere reviews.

B2B thought leadership requires a mix of evergreen topics and current industry trends. If a thought leader's content sounds formulaic or overly polished, audiences will notice. They seek unique insights based on first-hand experiences or creative problem-solving.

A well-researched presentation serves multiple audiences over time, increasing trust among individual buyers and industry peers. Thus, in-house SMEs can build personal brands while enhancing their employers' credibility.

Increasing Industry Influence Through Multiple Thought Leaders

Influencing customer perceptions during product comparisons won't happen through paid reviews or aggressive marketing. Awareness of ethically questionable strategies has increased, making data-backed messages from SMEs more impactful.

Authoritative content from employees can create new opportunities to reach target audiences and gain branding support from news outlets, podcasters, and event hosts. Companies want their leaders to attract the right stakeholders' attention.

Greater industry influence leads to invitations to public speaking events and standardization committees. Debates on technological disruptions and media interviews provide organic ways to establish SMEs as thought leaders. Better collaboration platforms and virtual conference invites will also be available.

Long-Term Strategies with Domain Experts' Guidance

Excellence in thought leadership requires consistent effort and genuine expertise. Allowing employees to develop personal brands, network with peers, and publish independent knowledge resources is vital. A company's workflows will evolve based on thought leaders' ideas.

Technological migration, workforce diversification, alternative intelligence, and market entry methods can improve with thought leaders' insights. Their work should go beyond brand perception enhancements and add value to ongoing projects. Case studies and whitepapers must reflect actual contributions from thought leaders.

Examples of Influential Thought Leaders

Marc Benioff's 1-1-1 model at Salesforce integrates community service into the company's core system. The pledge 1% initiative encourages stakeholders to give back through equity, time, product, and profit, inspiring younger companies to engage in socially beneficial projects early on.

IBM's Ginni Rometty's views on AI, blockchain, and hybrid cloud inspire data and technology professionals worldwide. Her work on data ethics and governance has influenced businesses to adopt responsible data practices.

Richard Barton's thought leadership impacts real estate and HR industries. His philosophy equips stakeholders with detailed information for informed decisions. Zillow Group simplifies real estate data access, while Glassdoor enhances transparency in job conditions and requirements.

Simon Sinek influences corporate leadership practices, Malala Yousafzai advocates for social justice, Anu Ramaswami's frameworks aid urban carbon footprint assessments, and Michael Braungart supports sustainable manufacturing.

Conclusion

Genuine expertise is highly attractive. With the vast growth of information resources, professionals are overwhelmed by what qualifies as best practices. Experienced thought leaders and SMEs help peers and team members navigate complex workflows, making their organizations more trustworthy among customers, investors, and professional associations.

0 notes

Text

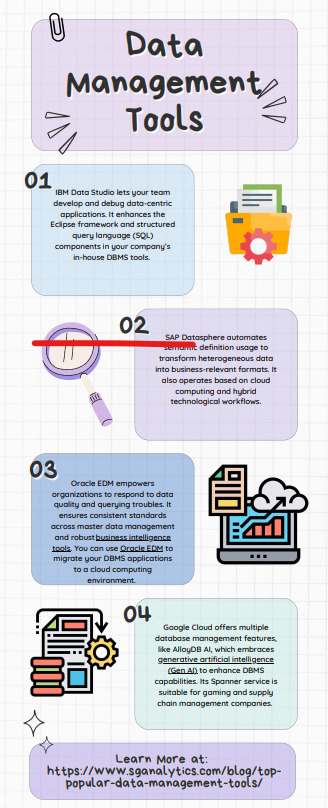

Master Data Management Tools: 2025 Outlook

Top 10 Best Data Management Tools · 1| IBM Data Studio · 2| SAP Datasphere · 3| Oracle Enterprise Data Management (EDM) · 4| Google Cloud · 5| Microsoft Azure · 6| Informatica PowerCenter · 7| Amazon Web Services (AWS) · 8| Teradata · 9| Collibra Read More: https://www.sganalytics.com/blog/top-popular-data-management-tools/

0 notes

Text

The Dual Role of Artificial Intelligence in National Security: Protector or Threat?

In the rapidly evolving landscape of national security, Artificial Intelligence (AI) has emerged as a transformative force, offering both unprecedented opportunities and significant challenges. As nations invest heavily in AI-driven technologies, the impact of AI on national security continues to grow, raising critical questions about its role as a protector or a potential threat.

The Role of Artificial Intelligence in Modern Warfare

Artificial Intelligence is reshaping modern warfare by enhancing efficiency and simplifying decision-making processes. AI-powered systems can simulate scenarios and analyze vast datasets in real-time, providing military leaders with the best course of action. This capability improves the precision of threat evaluation, strategic planning, and risk assessments. For instance, AI-driven training simulators offer soldiers realistic combat scenarios, allowing them to practice and prepare for various combat conditions.

Enhancing Data Security and Counterterrorism

One of the most significant contributions of AI to national security is in the realm of data security and counterterrorism. AI systems can monitor network traffic, identify anomalies, and predict cyber threats, thereby enhancing cybersecurity measures. In intelligence, surveillance, and reconnaissance (ISR) operations, AI analyzes data from sensors, drones, and satellites to identify patterns, track targets, and predict adversary movements. This provides analysts with quicker and more accurate insights, enabling timely and effective responses.

AI-powered counterterrorism tools also play a crucial role in monitoring social media and communications to detect and prevent terrorist activities. These tools operate around the clock, allowing defense authorities to monitor threats, dismantle networks, and safeguard national security.

The US Push for AI in National Security

The United States is at the forefront of integrating AI into its military systems. In December 2024, the Pentagon launched the AI Rapid Capabilities Cell, an office dedicated to accelerating the adoption of AI technologies. With a budget of $100 million, this initiative focuses on deploying innovations such as autonomous drones, command and control systems, operational planning tools, and intelligence platforms.

A key component of this effort is the Replicator program, which aims to deploy thousands of AI-powered drones to counter emerging threats from autonomous weapons. Partnerships between tech innovators and defense firms are exploring various applications of AI in the military. For example, OpenAI, the creator of ChatGPT, has partnered with Anduril Industries to integrate its AI capabilities with Anduril's defense systems, enhancing the US military's ability to detect, assess, and respond to aerial threats in real-time.

Balancing Innovation with Ethical Considerations

While the integration of AI in national security offers numerous benefits, it also raises ethical and legal concerns. The potential for AI systems to make autonomous decisions in combat scenarios poses significant risks. Ensuring that AI operates within the bounds of international law and ethical standards is paramount. This includes establishing clear guidelines for the use of AI in warfare and ensuring accountability for AI-driven actions.

Moreover, the reliance on AI for critical national security functions necessitates robust data security measures. Protecting sensitive data from cyber threats and ensuring the integrity of AI systems are crucial to maintaining national security. Innovations in AI must be accompanied by advancements in data security to mitigate the risks associated with AI deployment.

The Future of AI in National Security

As AI continues to evolve, its role in national security will likely expand. Future advancements in AI could lead to more sophisticated autonomous systems capable of performing complex tasks with minimal human intervention. This could revolutionize military operations, intelligence gathering, and cybersecurity.

However, the dual nature of AI as both a protector and a potential threat underscores the need for a balanced approach. Policymakers, military leaders, and technologists must work together to harness the benefits of AI while addressing its challenges. This includes investing in research and development to advance AI capabilities, implementing robust data security measures, and establishing ethical guidelines for AI use in national security.

Conclusion

Artificial Intelligence is poised to play a pivotal role in national security, offering innovative solutions to enhance military operations, data security, and counterterrorism efforts. However, the potential risks associated with AI deployment necessitate a careful and balanced approach. By addressing ethical considerations, ensuring robust data security, and fostering innovation, nations can leverage AI to protect national security while mitigating its potential threats.

0 notes

Text

Enhancing Business Excellence with Comprehensive Data Governance Solutions

In today's data-driven world, effective data management is crucial for organizations aiming to maintain accuracy, accessibility, and security of their data throughout its lifecycle. SG Analytics offers robust Data Governance solutions designed to ensure data accuracy, security, and compliance, thereby empowering businesses to make strategic, informed decisions.

Understanding Data Governance Solutions

Data Governance solutions encompass a range of practices and policies aimed at managing data assets effectively. These solutions ensure that data is reliable, consistent, and used responsibly across the organization. SG Analytics provides comprehensive Data Governance services that include data classification, policy formulation, and the appointment of data stewards to oversee adherence to standards.

Key Components of Data Governance Services

Data Quality Management: Ensuring data accuracy and consistency is paramount. SG Analytics implements rigorous data quality monitoring systems to maintain high standards of data integrity.

Metadata Management: By setting up metadata repositories, SG Analytics facilitates efficient data cataloging and management, enabling quick and accurate data retrieval.

Data Security and Compliance: Protecting sensitive data is a top priority. SG Analytics enforces strict data access controls, allowing only authorized personnel to access critical information.

Framework Design: SG Analytics begins with a thorough analysis of the current data environment, identifying gaps and opportunities for improvement. This leads to the creation of a tailored data governance framework that aligns with the organization's goals.

Benefits of Implementing Data Governance Solutions

Implementing robust Data Governance solutions offers numerous benefits:

Improved Data Quality: High-quality data leads to better decision-making and strategic insights.

Regulatory Compliance: Adhering to data governance standards ensures compliance with industry regulations, reducing the risk of legal issues.

Operational Efficiency: Streamlined data processes enhance operational efficiency and reduce potential risks.

Innovation and Growth: Reliable data fuels innovation, customer trust, and competitive advantage, driving business growth.

SG Analytics' Approach to Data Governance

SG Analytics adopts a systematic approach to Data Governance, starting with an in-depth assessment of the organization's data landscape. This is followed by the development of a customized governance strategy that includes:

Data Classification: Categorizing data based on its sensitivity and importance.

Policy Formulation: Creating policies that govern data usage and management.

Appointment of Data Stewards: Assigning individuals responsible for ensuring compliance with data governance policies.

Continuous Improvement and Adaptation

SG Analytics emphasizes continuous improvement and adaptation to evolving business needs. Through change management, data lifecycle management, and ongoing improvement programs, they ensure the reliability, security, and efficient use of data resources.

Conclusion

In conclusion, SG Analytics' Data Governance solutions and services are essential for organizations looking to enhance their data management practices. By ensuring data accuracy, security, and compliance, these solutions empower businesses to make informed decisions, drive innovation, and achieve sustained excellence.

0 notes