Don't wanna be here? Send us removal request.

Text

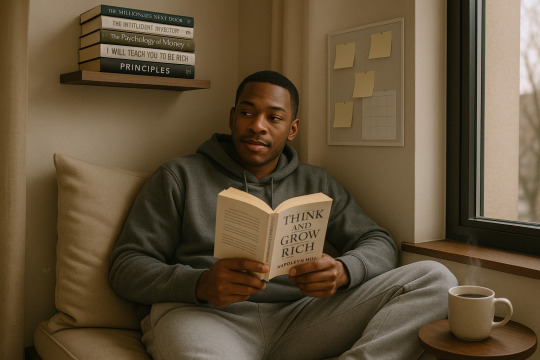

Must-Read Books to Improve Your Financial Mindset

If you want real, lasting wins with your wallet, start by tuning up your mindset. Long-term financial health isn't just about bulging savings accounts or slashing every expense- it's about seeing cash, value, and fresh chances in a brand-new light. A good book can flip that switch almost overnight.

Pages and paragraphs, after all, cost far less than a workshop and take up little shelf space. Sit with an author who challenges your ideas, and you'll step away with habits that line up with the life you picture. Students, twenty-somethings, and anyone hitting reset all report the same small miracle: one timely read suddenly makes everything click.

Understanding the Psychology Behind Money Beliefs

Before you chase fancy budgeting apps or the latest stock tip, pause and stare at the mirror. Your dollars move in patterns carved by childhood, reinforced by neighborhood conversations, and steered by personal ideas about safety and triumph. Recognizing that backdrop is half the battle, because money is as much psychology as it is arithmetic.

The Psychology of Money by Morgan

Morgan Housel's The Psychology of Money fits on any bookshelf because it feels like a long coffee-shop chat about cash. He argues that finances are more wired to feelings than formulas, so your behavior beats textbook brilliance almost every time. A Wall Street diploma won’t stop someone from panicking and selling low; self-control does that.

Rich Dad Poor Dad

Robert Kiyosaki's Rich Dad Poor Dad paints two fathers, two paychecks, and two very different views of wealth. One dad says work for every dollar, while the other whispers, Let your money do the heavy lifting. The contrast teaches readers the muscle of financial know-how and why knowing the difference between an asset and a liability can turn panic into profit.

Knowing why we instinctively cling to security or leap into risk lets us shrug off old habits that pull us backward. When feelings meet fresh insight, progress often follows.

Creating Habits That Support Financial Growth

After digging into your money beliefs, it's time to make small moves that stay in sync with your bigger goals. Daily choices, no matter how tiny, either nudge your bank balance north or let it drift south. A fresh mindset feels great, but the real win shows up when those vibes turn into regular, repeatable actions. Some of the most life-changing finance books focus less on dollars and more on daily action

Atomic Habits

James Clear's *Atomic Habits* is a favorite for anyone serious about swapping broken routines for solid ones. The author doesn’t talk dollars all day, yet his playbook fits finance like it fits fitness or study time. Clear pushes you to tidy your space, cue up helpful reminders, and build a system that keeps thrift or saving on autopilot.

Your Money or Your Life

For a lens that shines directly on cash flow, pick up *Your Money or Your Life* by Vicki Robin and Joe Dominguez. These pages dare you to translate every dollar spent into hours of real-life energy. In short, the goal shifts from making a heftier paycheck to spending those earnings with surgical precision. Pretty soon, the question Is this purchase worth the minutes I worked to earn it? drifts to the front of your mind, and impulse buys suddenly lose their sparkle.

Learning to Invest Without the Fear Factor

Ask most newcomers about investing, and the word risky pops up almost immediately. That reaction makes the whole scene feel heavy and complicated, yet the real lesson is lighter than it looks. Turning earned dollars into working capital is less witchcraft and more methodical homework.

The Intelligent Investor

Benjamin Graham's The Intelligent Investor sits at the top of many reading lists for a reason. Sure, the style reads like a pocket-sized textbook, but inside you'll find a blueprint for ignoring the noise and sticking to cold, hard value. Long-term control beats short-lived excitement every time.

I Will Teach You to Be Rich

If you're hoping for something that talks like a friend instead of a professor, I Will Teach You to Be Rich by Ramit Sethi is worth a spin. The pages mix mindset, automation, and plain English details about index-fund investing. Many twenty-somethings credit that volume with giving them the confidence to stop spectating and start building a workable money system.

Expanding into an Abundance Mindset

Moving from a scarcity mindset to an abundance mindset is a game-changer. Scarcity whispers there's never enough money, time, options-so you play small. Abundance shouts that room for growth is everywhere, even when problems pop up.

Think and Grow Rich

Napoleon Hill's classic Think and Grow Rich lays out the abundance argument in plain terms. Written almost a century ago, the advice still wakes up readers. Hill believed real wealth starts as a clear, positive thought, then blossoms into focused action. Belief, purpose, and stubborn perseverance make the difference, he argued, and people still test that idea today.

You Are a Badass at Making Money

Jen Sincero’s funny, no-nonsense bestseller digs right into the messy money stuff most people avoid. The pages crackle with jokes and still drop hard advice. Sincero dares you to shrug off guilt, fear, and that nagging voice that says you're bad with cash. She urges the reader to flip that weak inner script into one that sounds confident and clear.

When you think from a place of abundance, everything shifts. You stop holding back. You start learning more, trying new things, and thinking long-term.

“Abundance mindset” might sound a little cheesy. But it’s simple. When you feel full instead of lacking, you make better choices. You stop acting out of fear. You grow without forcing it.

Most people skip this step. But it’s often the one that changes everything.

Conclusion

No single book is a magic lamp that grants instant riches, yet a well-timed read can nudge your beliefs and habits in a better direction. The real alchemy happens when you move from page to practice.

Pick a title that matches your current headspace; if you're just stepping onto the path, a mindset-oriented work is a good starter. Seasoned pros may want something aimed at building habits or dipping a toe into investing.

Keep a notepad handy as you read, try out one small change, and pay attention to the quiet boost in your confidence. That little upward shift often proves to be the first real paycheck from the knowledge.

#DIYBudgetingvsWorkingWithaFinancialAdvisor#WhenShouldYouHireaFinancialAdvisortoHelpWithDebt?#AreDebtSettlementCompaniesaScam?WhatYouShouldKnow#DebtSettlementvsDebtConsolidation:What’sBestforYou?#CreditCounselingBeforeBankruptcy:ScamorSmartStep?#HowtoHandleDebtCollectorsWithoutLosingYourRights#SignsYouMayNeedtoFileforBankruptcy#HowBankruptcyAffectsYourCredit:MythsvsReality#Must-ReadBookstoImproveYourFinancialMindset#HowtoTeachYourselfPersonalFinance(WithoutaDegree)#FinancialLiteracyforMillennials:TopResourcestoStartWith#HowtoFinallyHita720CreditScore(WithoutPayinga‘Fixer’)

0 notes

Text

DIY Budgeting vs. Working With a Financial Advisor

When it comes to managing money, there’s no one-size-fits-all solution. Some people swear by spreadsheets and budgeting apps, while others prefer sitting down with a professional who knows the ins and outs of personal finance. If you’re weighing the benefits of DIY budgeting versus working with a financial advisor, the right choice depends on your goals, financial knowledge, and how much time and effort you want to invest.

Let’s break down both approaches so you can make a confident decision about what works best for you and your financial future.

Is DIY Budgeting or a Financial Advisor Right for You?

The short answer is, it depends on your situation. DIY budgeting is often ideal for people who have a relatively simple financial picture and the motivation to stick to a plan on their own. It gives you full control, saves you money in advisory fees, and works well if your main focus is on tracking spending, saving for short-term goals, or getting out of debt.

On the other hand, a financial advisor can be worth every penny if your finances are more complex or you need guidance beyond basic budgeting. Advisors can help with long-term planning, investing, retirement savings, taxes, and even estate planning. They’re particularly helpful if you’re making big life changes, like buying a home, starting a family, or preparing for retirement.

So, how do you know which one is right for you? Start by looking at your needs. If you're mostly trying to get a handle on monthly expenses and set up a budget that works, you can likely do that on your own with free tools. But if you're dealing with multiple income streams, investments, tax concerns, or future planning, a professional might offer the clarity and structure you need.

What’s Involved in DIY Budgeting?

Doing your own budgeting is more than just tracking expenses. It’s about building awareness, creating a plan, and adjusting your habits as needed. People who budget on their own typically use a combination of tools, maybe a spreadsheet, a mobile app like YNAB or Mint, or just good old pen and paper.

The process usually starts with listing all your income sources and tracking your fixed and variable expenses. From there, you create categories for your spending and set limits based on what you can realistically afford. Over time, you check in regularly to see if you’re sticking to your plan, tweak where needed, and celebrate small wins like paying off a credit card or reaching a savings goal.

DIY budgeting works especially well when your finances aren’t too complicated. If you’re single or a couple without kids, have one or two income sources, and aren’t juggling multiple debts or investment accounts, you’ll probably find it manageable to budget without outside help.

But it does require discipline. You need to be consistent about tracking your spending, reviewing your progress, and adjusting your budget as life changes. And while there are a lot of great resources out there, it can be overwhelming to figure it all out alone, especially if money stresses you out to begin with.

How Does Working With a Financial Advisor Compare?

Financial advisors offer more than just budgeting advice. They’re trained to take a full-picture view of your finances and help you set both short-term and long-term goals. That includes things like investing wisely, saving for retirement, minimizing taxes, planning for college, or making sure you have the right insurance coverage.

When you meet with an advisor, they typically start with a comprehensive assessment. They'll look at your income, expenses, debts, assets, and goals, then build a plan tailored to your situation. Some advisors work on a one-time consultation basis, while others offer ongoing support and review your finances annually or even quarterly.

One of the biggest advantages of working with an advisor is the peace of mind. Instead of second-guessing every financial decision or wondering if you're doing the right thing, you’ve got an expert guiding you through it. That can be especially comforting when markets fluctuate, laws change, or you go through major life events.

Advisors can also save you from making costly mistakes. Whether it’s avoiding tax penalties, helping you invest smarter, or recommending financial tools you didn’t know existed, their advice can more than pay for itself over time. That said, not all advisors are created equal. It’s important to find someone who is transparent about their fees, has experience in areas relevant to you, and acts as a fiduciary, meaning they’re legally required to act in your best interest.

What About the Cost?

One of the main reasons people stick with DIY budgeting is cost. Most budgeting apps are free or low-cost, and even if you go the spreadsheet route, the only investment is your time. If your financial needs are basic, paying hundreds or thousands for financial advice might not seem worth it.

Financial advisors usually charge in one of three ways, flat fees, hourly rates, or a percentage of assets under management (commonly 1% annually). Some may offer packages that include a financial plan and a few follow-ups. Others work on commission and make money from selling you insurance or investment products, which can lead to conflicts of interest if not managed carefully.

If you're not ready to hire a full-time advisor, you can still pay for a one-time session. Many people find it helpful to do this after a big life change, like marriage, a new baby, or receiving an inheritance, just to make sure they’re headed in the right direction. It's a good middle ground if you're mainly self-managing but want a professional opinion once in a while.

Which One Helps You Stay on Track?

Accountability plays a big role in whether a budgeting method works long-term. With DIY budgeting, it’s easy to set ambitious goals, and just as easy to forget about them a few weeks later. Unless you’re naturally motivated or really into financial planning, your budget might fall apart the first time something unexpected comes up.

That’s where a financial advisor can offer real value. Having someone check in with you, review your progress, and keep you focused can make a big difference. It’s not just about giving you advice, it’s about helping you follow through. Think of them as a coach for your financial life.

But that doesn’t mean DIYers can’t stay accountable. Many people create systems to track their progress, whether it’s through weekly check-ins, financial journaling, or syncing their budget with a partner. Some even join online communities or accountability groups to share goals and get motivation from others.

Ultimately, the key to staying on track is having a system that fits your personality. If you thrive with structure and support, an advisor might be best. If you’re more independent and detail-oriented, DIY might suit you just fine.

Conclusion

DIY budgeting and working with a financial advisor each have their place, and they don’t have to be mutually exclusive. You might start with a DIY approach to build confidence and then bring in an advisor when you’re ready for the next level. Or you might do most of the work yourself and check in with a professional once a year to make sure everything still makes sense.

The important thing is to find an approach that helps you move forward. Whether you’re tracking every dollar with an app or mapping out a five-year plan with an advisor, the goal is the same, to take control of your money and build a life that aligns with your values.

#DIYBudgetingvsWorkingWithaFinancialAdvisor#WhenShouldYouHireaFinancialAdvisortoHelpWithDebt?#AreDebtSettlementCompaniesaScam?WhatYouShouldKnow#DebtSettlementvsDebtConsolidation:What’sBestforYou?#CreditCounselingBeforeBankruptcy:ScamorSmartStep?#HowtoHandleDebtCollectorsWithoutLosingYourRights#SignsYouMayNeedtoFileforBankruptcy#HowBankruptcyAffectsYourCredit:MythsvsReality

1 note

·

View note