Don't wanna be here? Send us removal request.

Text

10 Reasons to Hire an SEO Consultant

Are you not happy with your SEO efforts? If you want to improve the performance of your website, the best search engine optimization practices play a significant role in boosting its online visibility.

Creating high-quality content is an important part of SEO. But SEO is not limited to this alone. And there are many more aspects of SEO that you should be aware of to get a higher ranking in search engines.

Don’t worry! An SEO consultant is the right person who help you fix your issues and rank your website higher in search engines.

If you are not sure whether they are right for you or not, here are the 10 reasons to hire an SEO consultant:

What is an SEO consultant?

An SEO consultant is someone who has expertise and knowledge in making websites search engine friendly. They help individuals, startup founders, and business owners resolve website issues. And they improve their online presence.

SEO experts have the responsibility to improve your website's overall performance so that it can rank higher in search engines. They focus on making your online presence align with the preferences of your target audience. They work with you, take their time, and then use the SEO practices according to the personalized strategies for your website.

SEO consultants perform various SEO strategies, including keyword research, website audits, speed optimization, etc. You can go through these methods to improve your Google identity, gain a higher search ranking, and generate more revenue.

What Does an SEO Expert Do?

The best SEO consultant offers many advantages to their clients. Their consultation helps you refine your existing strategies and craft your website according to your target audience. They provide you with the necessary guidance and support so that you can rank your website in popular search engines such as Google, Baidu, and Bing. Here are some of the key services that an SEO consultant provides:

Working with them will help you speed up your website.

They conduct keyword research and determine the most relevant phrases and words.

They perform website audits and offer the right suggestions.

You get the opportunity to learn how to create high-quality content.

They can structure your website.

They provide you with personalized assistance and resolve the concern that is affecting your website.

They work to improve the overall performance of the website.

Why Would You Hire an SEO Consultant?

You can hire an SEO consultant to increase your brand awareness. They help you to create effective strategies based on your broader perspectives and knowledge. Here, you can explore these top 10 reasons to understand the importance of an SEO consultant in your life:

Expert Results are Guaranteed

An SEO mentor is someone who has a long experience optimizing websites. Their expertise enables them to effectively guide their clients and build a stronger online presence. They also have a thorough understanding of Google and other search engines. They focus on implementing the best SEO practices and recommend possible ways to rank your website in search engine results pages.

You Can Create a Custom SEO Strategy

Hiring an SEO consultant is a big opportunity to create a custom growth marketing strategy. An SEO specialist helps you to establish realistic goals and refine your digital marketing strategy. They understand your concerns and analyze your website to create better planning for you. They can suggest keyword research tools, backlinking tools, and other contemporary solutions to improve the effectiveness of your SEO efforts.

Increase Website Traffic

An SEO consultant helps you increase your website traffic. They act as a beacon of hope for those people who are struggling with poor website traffic. If you are making some mistakes in your strategy, SEO mentoring can help you identify your mistakes and use suitable techniques for better traffic. They provide you with potential ways to improve the structure of your website and attract an organic audience to your website.

Higher Returns on Investment

Turning to an SEO consultation is a beneficial way for higher returns on investment. SEO mentor helps you avoid common and repetitive mistakes. They focus on your website content and assist you in crafting SEO-friendly content. That will attract your audience while also adhering to search engine standards.

Increase Brand Awareness

When an SEO consultant works with you, their primary attention is to rank your website higher in the search engines. That helps you to increase your brand awareness. And more people start recognizing you and becoming familiar with your products or services. Ultimately, it empowers you to gain potential leads and convert them into potential customers.

Your Leads will be of Higher Quality:

When you optimize your website under the guidance of an SEO expert, their keen eyes help you to structure the website precisely. That attracts the attention of your target audience, and more people like to spend more time on your platform. Furthermore, due to enhanced ranking because of an SEO consultant, you will gain more organic traffic, which will also increase the quality of your leads.

Stay Up-to-date with the Latest Trends

Search engine optimization is a complex and huge task. It is not about just implementing one or two practices. Moreover, Google always comes with algorithm updates that also have an impact on search engine techniques. Therefore, you can hire an SEO consultant means you have access to the latest strategies, up-to-date technologies, and more. They are the experts who always stay connected with popular practices and trends.

You Can Save Your Time and Money

No doubt, it is a big saving of time when you are around a more senior and experienced person. Taking 1-on-1 consultation with an SEO consultant is an excellent way to get guidance if you do not have experience in SEO. The presence of SEO consultants helps you use the best practices and provides you with knowledge, resources, and tools that can help you avoid wasting your time.

You Can Focus on the Core Operation of Your Business:

The guidance and recommendations from an SEO specialist provide you peace of mind. They assure you that using the best practices and techniques will help you to focus on the core operation of your business. You can effectively turn to the best SEO consultant to increase your productivity and spend more time learning new skills and techniques.

Comprehensive Analytics and Reporting

An SEO consultant provides detailed analytics and reports to track your progress. They understand user behavior and inspire you to make data-driven decisions. Their continuous eye on your digital marketing efforts helps you to improve your SEO efforts and optimize your website for better ranking.

Last Words

We understand the essence of an SEO consultant and the top 10 reasons why to hire them. When you work with a Digital marketing consultant, they help you increase the effectiveness of your SEO efforts. They analyze your existing practices and make changes based on their latest knowledge. Their wealth of experience helps them guide and teach you everything you need to know about search engine optimization. Apart from that, you can also clear up any concerns or doubts that you have regarding your website ranking.

#10 Reasons to Hire an SEO Consultant#SEO consultant#SEO strategies#best SEO consultant#SEO mentor#SEO specialist#SEO mentoring

0 notes

Text

How to activate the Cancelled GST Registration Number?

Now, it is easy for individuals to activate a canceled GST registration number by following a simple process. You must follow the prescribed time and other criteria to activate the GST registration number again.

One must visit the GST portal to restore his/her GST registration number. GST REG-21 must be filled to apply for reversal of cancellation of GST registration number. In this blog, we will discuss everything about the process of activating the GST registration number and the time extension for the revocation process, and other things.

Filling out GST REG-21 form

If your registration is canceled by a tax officer, you can apply for a reversal of this cancellation of GST registration by filling out the GST REG-21 form. You must apply for cancellation of GST registration within 30 days of getting the notice.

If a tax officer rejects your registration due to non-filing of income tax returns, you must first file pending returns with penalty and interest. The application will be reversed only after filing pending income tax returns.

Easy steps to file GSYT REG-21 are listed as under:

1. The first step is to visit the GST portal and go to “Services”. Then you have to click on the “Registration” and “Application for revocation of GST registration cancellation” options.

2. Now, you have to write and give a valid reason and information for the reversal of GST registration cancellation. While applying for reversal, you have to also provide many supporting documents such as ID proofs and address proofs.

You have to update all the details and click on the checkbox for verification. Finally, you have to choose the authorized signatory and place.

3. The third step is to apply GST REG-21 with EVC. Now, you will get a message that your application is submitted.

How much time do you get to apply for revocation?

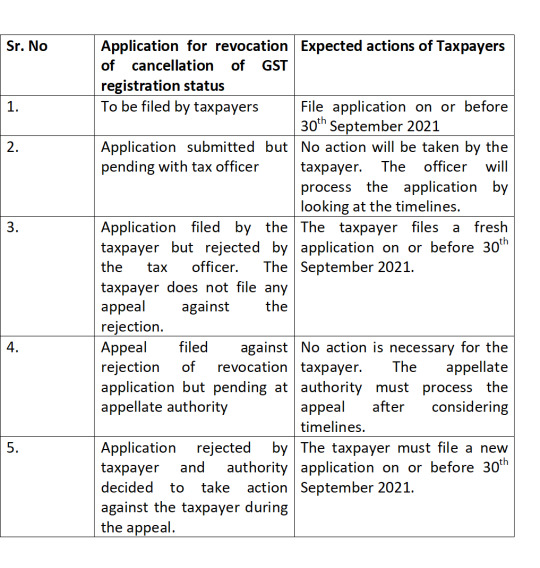

CBIC recently issued a CGST circular on 6th September 2021 regarding the extension of the time limit for application for revocation of cancellation of GST registration. According to CBIC, the time limit for the application of revoking the cancellation of GST registration is up to 30th September 2021 if the due date of such application expired between 1st March 2020 and 31st August 2020. Many taxpayers ask this thing to CBIC about the applicability of this circular. Relief is available for many taxpayers in the status of revocation application which is explained in the table below:

As per section 30 of the CGST Act issued on 1st January 2021, a new proviso says that extension must be allowed in the due date for revocation application to taxpayers if Joint Commissioner or the Commissioner approves the revocation. Clarifications of CBIC are as under:

The extension is applicable only in two cases such as:

If a composition dealer has not filed income tax returns for 3 quarters.

If a regular taxpayer has not filed returns for six periods.

Notice of cancellation of application of revocation

The tax officer will verify the full revocation application by filing the form GST REH-21. If the officer is not satisfied with the application, he sends a show-cause notice in Form GST REG-23 to the taxpayers.

The tax officer will also mention the reason why he rejected the application. Apart from that, the taxpayer will also ask the taxpayers why the application should not be rejected. He will also provide a chance for taxpayers to give reasons why GST registration must not be canceled.

Taxpayers who get a notice in Form REG-23 must submit a Form GST REG-24 in 7 working days from the due date of the notice issue date.

If the officer is satisfied with the revocation application, he will provide the cause in writing. Besides, the tax officer will also order the revocation of GST registration through Form GST REG-22 within 30 days from receiving a reply in form GST REG-21.

Reply to notice in Form GST REG-23

If the taxpayer has got a notice in Form GST REG-23 from the officer, he must give a reply in Form GST REG-24 within 7 working days from the date of service of notice.

The details included in Form REG-24 are listed as under:

Date of notice with reference number

Date of application and reference number

GSTIN

Reasons why the taxpayer is asking for revocation

Documents to attach

After getting the form and all the details, the tax officer will verify and give a reply.

If the tax officer is satisfied with the form, he issues the order for revocation of GST registration in Form GST REG-22 within 30 days from the date of receiving a reply through form GST REG-24.

If the tax officer is not satisfied with the reasons given by the taxpayers, he can reject the application through Form GST REG-05.

If you have any questions about GST registration cancellation revocation, choose the professionals online. You can find many professionals to do GST registration in Delhi.

#How to activate the Cancelled GST Registration Number#activate the Cancelled GST Registration Number#GST Registration Cancelled#GST Registration Number Cancelled

0 notes

Text

Do you want Private Limited Company Registration in Delhi done for your company? Are you looking for the right service provider? If yes, your search ends here. We at Expertbells are offering the Online Private Limited Company Registration in Delhi at an affordable price. We have multiple packages to choose from for Private Limited company incorporation in Delhi. we will collect the documents needed for Private Limited Company Formation in Delhi and get it done in a few business days.

#Pvt. Ltd Company Registration in Delhi#Online Private Limited Company Registration in Delhi#Private Limited company incorporation in Delhi#Private Limited Company Formation in Delhi#Private Limited Company Registration in Delhi

0 notes

Text

Private Limited Company Registration in Mumbai is needed by anyone who is looking to set up company. There is a big documentation process involved for Private Limited Company Formation in Mumbai which can be a tedious job. Hiring a trusted service provider for Private Limited company incorporation in Mumbai can make your job simple. Expertbells can help you with the same.

#Pvt. Ltd Company Registration in Mumbai#Online Private Limited Company Registration in Mumbai#Private Limited company incorporation in Mumbai#Private Limited Company Formation in Mumbai#Private Limited Company Registration in Mumbai

0 notes

Text

Looking for the Sole Proprietorship Registration? If yes then it is advisable to hire the right consultant who can help you with Sole Proprietorship Registration in India. The sole proprietorship comes with minimum compliances and easy formation. There are a few documents needed for the Sole Proprietorship Firm Registration.

#Sole Proprietorship Firm Registration#Sole Proprietorship Registration in India#Online Sole Proprietorship Registration#Sole Proprietorship Registration Online#Sole Proprietorship Registration

0 notes

Text

Trade License Registration is needed to carry out any trade with compliance. The creditworthiness increases with the Trade License Registration in India. There is a set of requirements needed for the Trade License Registration in Delhi.

#Renew Trade License Registration#Trade License Registration#Online Trade License Registration#Trade License Registration Online#Trade License Registration in Delhi

0 notes

Text

How to File GST Return Online in India?

The introduction of GST by the Indian Government is one of the most significant steps to bringing the nation under one taxation system. This tax came into effect in the year 2027 to remove different types of indirect taxes on goods and services.

Filing of GST Return is necessary for all those businessmen who earn a profit of more than a certain limit. A taxpayer who has GST Registration in India files GST returns for GSTIN that he registered for. There are about 22 types of GST forms out of which 11 are active, 8 are view-only and 3 are suspended.

Late filing of GST returns has both late fees and interest.

The type of GST to be filed depends on the type of taxpayer that you register. There are 7 types of taxpayers such as:

Composition taxable persons

Regular taxpayer

Input service distributor

E-commerce operators

TDS deductors

Casual taxable persons

Non-resident taxpayers

Different taxpayers pay GST Return Online in different ways. Some taxpayers pay GST Monthly filing while some taxpayers file GST returns quarterly and even annually.

In this blog, we will discuss the steps in which you can file GST returns easily. You can save time and effort by following some easy steps to file GST returns.

Stepwise procedure to file GST returns online

Every manufacturer, supplier, and retailer has to file GST returns every year. The Indian government has now started e-filing of GST returns for taxpayers who want to file GST returns. You can file Online GST Return on the official GST portal.

Filing of GST returns can be either done through apps or software. This facility helps to auto-fill various types of GST forms. Now, let us have a look at the steps of filing GST returns online:

The first step is to visit the official GST portal.

After coming to the official GST portal, you will get a GSTIN of 15 digits. This number is obtained with the help of PAN and state code.

The next step is to upload every invoice that contains a reference number.

Now, you have to file all inward returns, outward returns, and monthly returns on the site. All the errors will be automatically rectified on the site as you enter all the details.

The next step is to file outward supply returns by filling out the GSTR-1 form before the 10th of every month.

GSTR-2A will contain all the details of the outward supplies of the supplier.

The recipient has to verify all the details of outward supplies along with details of debit and credit notes.

Now, you have to provide details of inward supplies of the goods and services by filling out the GSTR- 2 forms.

Finally, the supplier can either accept or reject the details of inward supplies given in GSTR- 1A.

Steps to file GST returns in an offline process

You can do GST Annual Return Filing offline as well. You must download an offline tool for filing GST returns. After downloading this offline tool on your smart devices, it is easy to file GSTR-1 and GSTR-2 forms by following the same steps of online GST return filing.

What is the procedure to download the GST returns form?

It is very easy to download the GST returns form from the official government portal by following the steps such as:

The first step is to visit the GST portal and log in with your email ID and password.

Now, you have to click on the Service option. Then you have to click on the option "Returns" and click on Returns Dashboard.

The next month is to select the month and year from the list.

Now, you have to click on the "prepare offline" option.

Point your cursor on the option "Download" and then click on the option "Generate File".

Now, you have to tap on the "Click here" link and download the link. You have to get a ZIP file on your PC.

The next step is to open the file with the help of the GST offline tool. Now, you have to click on the Open option under the open downloaded return file on the GST portal.

GST RECONCILIATION – What, Why & How

This procedure is the same for downloading every type of GSTR file.

Different kinds of GST returns

The different kinds of GST returns are:

GSTR-1

GSTR-2A

GSTR-2B

GSTR-3B

GSTR-4

GSTR-5

GSTR-5A

GSTR-6

GSTR-7

GSTR-8

GSTR-9

GSTR-9C

GSTR-10

GSTR-11

Who is eligible to file GST returns?

Businessmen who earn an annual turnover of INR 40 lakhs in states other than north-eastern states must file GST returns. Businesses operating from Northeastern state earning an annual turnover of INR 20 lakhs must choose the option of GST Return Filing. Now, let us have a look at the type of GST form filed by different taxpayers:

GSTR-1

This form must be filed by every registered person.

GSTR-2A – It is a type of view-only autofill form

GSTR-2B- VIEW ONLY FORM

GSTR- 3B- to be filed by normal taxpayers

GSTR- 4- to be filed by composition dealer who applies for composition scheme

GSTR-5- Non-resident foreigners

GSTR- 5A – this GST Return Filing in India has to be filed by non-resident OIDAR service providers

GSTR-6- this return has to be filed by the Input service distributor

GSTR-7- this return is to be filed by TDS deductors

GSTR- 8- E-commerce operators file this kind of GST

GSTR-9- normal taxpayers under GST

GSTR- 9C- normal taxpayers under GST

GSTR- 10 – This GST return is filed by the persons whose GST registration was canceled.

GSTR-11- Foreign diplomatic missions for refund claims.

Final words

If you fail to file GST returns, there are both late fees and interest. You have to pay an interest of 18% on the outstanding amount to be paid. Under CGST and SGST, you have to pay a late fee of INR 100 and INR respectively.

There are also many benefits of NIL Return for taxpayers. This blog helps many taxpayers to file GST returns on or before due date.

#How to File GST Return Online in India?#GST Registration#gstin registration#GST Registration Online#GST Registration in India#Enrollment for GST#New GST Registration#GST registration process#Online GST Registration#GST registration procedure#GST Registration Status#GST Registration Fees#Types of GST registration#What is Goods and Services Tax#Advantages of GST Registration

0 notes

Text

Are you planning for Company Registration in Jaipur? If yes, no need to rush anywhere as Online Company Registration in Jaipur can be done easily. You just need to hire the right consultant who can help you with company incorporation in Jaipur. Expertbells is one such company that assist with Business Formation in Jaipur. We will help you at every stage of Company Registration online in Jaipur.

#Business Formation in Jaipur#Company Registration in Jaipur#Online Company Registration in Jaipur#Company Registration online in Jaipur

0 notes

Text

Online IEC Registration in Delhi | ExpertBells

Import Export Code in Delhi is a 10-digit unique code which is issued by DGFT to someone who is starting an import and export business. Online IEC Registration in Delhi needs to be done just once in a lifetime. The mandatory document for Online Import Export Code Registration in Delhi is the PAN card. Expertbells can help you get the IEC Code Registration in Delhi in a few simple steps. You can get us for the Import Export License in Delhi.

#IEC Code Registration in Delhi#Import Export Code Registration in Delhi#Import Export License in Delhi#Import Export Code in Delhi#Online IEC Registration in Delhi

0 notes

Text

Startup India Registration in Chennai has now become a complete online process. You need not keep running with your documents here and there for registering into the Startup India Scheme in Chennai. There are a lot of Advantages of Startup India Registration in Chennai. A minimum of 2 shareholders and 2 directors are needed for the Process of Startup India Registration in Chennai. At expertbells, we are the leading consultants providing the service of Startup India Registration Online in Chennai. You just need to send the Documents Required for Startup India Registration in Chennai and we will handle the rest.

#Startup India Scheme in Chennai#Advantages of Startup India Registration in Chennai#Process of Startup India Registration in Chennai#Startup India Registration Online in Chennai

0 notes

Text

How to Start and Operate One Person Company in India?

Today, many youngsters come forward to start their own businesses because of the simplification of OPC registration in India. Starting a one-person company is more beneficial than other forms of companies for an individual. It is one of the safest options for those who want to invest less capital and register a company.

Many individuals have no idea about starting a new one-person company. This blog explains the procedure of starting a one-person company in India and the ways to operate it smoothly.

Meaning of One Person Company

OPC or One Person Company is a type of company established by a single person. An individual acts as a shareholder and director in the company. OPC is a kind of sole proprietorship involving only one person. It also gives sole authority to one person to control the whole business.

The concept of One- Person Company came into existence a few years back. The main governing act of OPC is the Companies Act 2013. OPC has fewer compliance requirements than other types of companies. It also gives limited liabilities to the member.

Who is eligible to form One- Person Company?

There are some criteria to form a One- Person Company such as:

Individuals only from India can only start an OPC.

One person cannot start more than 1 OPC in India.

Minor can neither be a member nor a nominee in one Person Company.

Requirements to start an OPC

At least one shareholder and director and one nominee are required to start a One-Person company. The minimum authorized capital to start a private limited company is INR 1 lakh. You should also offer certain documents to start an OPC such as:

A hard copy of the Class-II form fully filled.

If you are a foreign national, it is necessary to give a self-attested copy of any ID proof such as a Passport.

You have to provide a self-attested copy of any address proof which includes a ration card, passport, Aadhar card, voter ID, utility bill, and driver’s license.

What is the procedure for one-person company registration?

Today, a One- person Company Registration has become much simpler than before. It is also an affordable procedure to begin a one-person company through an online site. You do not need any other person to form a One-person Company. Any individual can start One Person Company by taking a few steps such as:

The first step is to check eligibility for registering a one-person company and the documents required.

Then you must choose the professional who will help to find a unique name for your company.

The next thing you must do is apply for the DIN and DSC of every director.

Now, the professionals will prepare all the important ROC forms like AOA, MOA, COB, DIR, and others. Then they will file these documents before the Ministry of Corporate Affairs (MCA).

The next step is to apply for TAN and PAN for your new one-person company.

Then ROC will issue an incorporation certificate

Finally, you have to open a new bank account and begin business operations.

Following these steps will help in creating One Person Company. You can also choose a professional to complete the process of registration for OPC.

Benefits of registration of OPC in India

One-Person company incorporation is good for individuals who want to start business activities with low capital. There are several advantages of One Person Company in India such as:

1. Simple administration

A one-person company involves one person only. It is simple to handle OPCs because of their small size. Apart from that, it is also easy to control the full business in the case of a one-person company.

2. Security

As the name of your company is unique, no other company can copy your company’s name. There are no chances of a security breach in the case of a one-person company.

3. No complicated tax formalities

Companies such as Private companies and public companies have complicated tax formalities. So, it is easy for individuals to file income tax in the case of OPC. There are no tax complications in the case of One Person Company.

4. Separate legal status

Registering a one-person company gives a separate legal entity to the company. So, the member is not liable to pay for any loss to the company. Due to the limited liability of the members, one does not have to pay for losses. Personal security is not at stake in the case of a one-person company. Moreover, it is a safe option to start a one-person company as it has limited liability.

5. Helps in getting loans for business

After registration of OPC, it is easy to get bank loans easily. Apart from that, you will also get tax credit in the case of OPC. You can also expand and grow your small business in many other states with easy registration.

6. No third-party

Registration of a One-person Company involves only one person. There is no intervention of a third party or outsider in your business. So, it is easy to manage all the business operations without the interference of third-party or outsiders. Moreover, the registration of OPC gives authority to manage the whole company.

Other reasons to choose OPC registration

Many individuals go for One-person Company registration because of other reasons such as:

After the death of a member, another person will become a nominee. In the case of the death of a member, the nominee will manage the whole company and its operations.

There is no requirement of holding an annual general meeting every year in a One-person Company.

There is less paperwork involved in the formation of a one-person company.

There is no risk of putting personal property at stake in the case of loss in the company.

Compliance in a One-person Company is less as compared to other forms of companies.

You will enjoy a limited liability by registering OPC.

You can also get loans easily to expand your business activities.

#online one person company registration#register one person company#one person company#company registration#private limited company registration in agra#sole proprietorship registration#one person company reigistration in Delhi#One person company registration in India#One person company registration in Agra#How to Start and Operate One Person Company in India?

0 notes

Text

FSSAI Food License Registration Services in Delhi, India

FSSAI stands for Food Safety and Standards Authority of India. FSSAI is an autonomous body established under the Ministry of Health & Family Welfare, Government of India.

An FSSAI license is mandatory for starting any food business in India. The FSSAI responsibility is to protect and improve public health by regulating and keeping an eye on food safety.

An Act to bring together the laws about food and to set up the Food Safety and Standards Authority of India to set science-based standards for food items and to regulate their production, storage, distribution, sale, and import to make sure that safe, healthy food is available for people to eat, and for other related or related matters.

FSSAI License Number Guidelines

Types of FSSAI Food Licenses

Businesses participating in food operations must apply for several types of food licences depending on their revenue, size, and kind of activity. These enterprises must apply for either a central or state licence, or a basic registration. The FSSAI Food License in India issues the following three types of license:

Basic License

State License

Central License

Basic License: FSSAI Basic is necessary for small businesses and startups with yearly revenues of less than Rs. 12 lakhs. As your sales graph grows, you may upgrade your basic registration to a state licence.

State license: FSSAI State licences are required for businesses with annual revenues ranging from Rs. 12 to Rs. 20 crores.

Central license: FSSAI central licence is required for most major businesses with yearly revenue of above Rs. 20 crores. If you need to supply government agencies or import or export food goods, you'll also need it.

Basic Documents Needed for Obtaining FSSAI Registration:

Form B-signed and completed

The FBO's photo ID

Evidence of ownership of the property

Articles of Association/Partnership Deed/Corporation Certificate, etc.

A list of the food items that need to be addressed

Plan for a food safety control system

The Documents Necessary for Obtaining the State License

Plan of how the processing unit will be set up

List of tools and equipment

List of food categories that should be made

Reports of pesticide residues in water

Upload a picture of the production unit

Get FSSAI registration services with renewal and business setup in India by scheduling an appointment with an Expertbells advisor. Expertbells is the most well-known firm that offers high-quality business services to assist entrepreneurs in establishing and expanding their businesses. Expertbells provide FSSAI license and, FSSAI registration for your restaurant, hotel and, food-related business in India. Get a free consultation on Expertbells, Food Safety License Registration in Delhi, India.

#fssai registration#fssai license#foscos fssai#fssai certificate#sole proprietorship registration#fssai license fees#fssai registration online#fssai apply online#fssai registration fees#fssai food license#FSSAI Registration in Delhi#FSSAI License Registration in Delhi#FSSAI certificate Registration in Delhi

0 notes

Text

For startups and enterprises, forming a private corporation is quite straightforward these days. It is one of the most effective ways to give your company a legal personality. Nowadays, you may register a private limited company in Jaipur using the internet. The process of forming an Online Private Limited Company in Jaipur is simple and rapid. For the formation of a Private Limited company in Jaipur, you can use ExpertBells' services. We have a dedicated staff to help you complete the process of forming a Private Limited Company in Jaipur.

#Pvt. Ltd Company Registration in Jaipur#Private Limited Company Registration in Jaipur#Private Limited Company Formation in Jaipur#Private Limited company incorporation in Jaipur

0 notes

Text

Getting a food license is very easy these days. Unlike before, you can now get online FSSAI Registration in Pune at an affordable cost. FSSAI license can be obtained by making an application and submitting some important documents. You have to only submit your ID proofs and address proofs for online FSSAI certification in Pune. ExpertBells is a professional company that offers affordable services of Food Safety License Registration in Pune. We have a team of skilled professionals who help to get Food License in Pune for the food business in an efficient manner.

#FSSAI certification in Pune#FSSAI Food License in Pune#Food License in Pune#Food Safety License Registration in Pune#Food License Registration in Pune#FSSAI Registration in Pune

0 notes

Text

All persons and enterprises involved in the import and export of products and services must register for an Import Export Code. Import Export code registration in Delhi may be done online by providing the necessary documents to the Directorate General of Foreign Trade's website (DGFT). Expertbells provides an economical import export code registration service in Delhi. Simply sit back and relax when obtaining an IEC code license in Delhi.

#Online Import Export Code Registration in Delhi#Import Export Code Registration in Delhi#IEC Code Registration in Delhi#Import Export License in Delhi#IEC in Delhi#Import Export Code in Delhi#Online IEC Registration in Delhi

0 notes

Text

If you register your firm for GST, you will be able to take advantage of the composition system that is part of the GST taxation policy. For all-sized enterprises, the online GST registration procedure is simpler, quicker, and more economical. Expertbells is India's premier online business services company, offering GST registration in Jaipur from start to finish. We have a staff of professional CAs, CSs, and attorneys that can assist you with GST registration in Jaipur at any stage.

#GST Registration Online in Jaipur#Online GST Registration in Jaipur#GST Registration Service in Jaipur#GST Services in Jaipur#GST Registration in Jaipur

0 notes

Text

What is Copyright Registration?

Copyright gives an exclusive right over an author's work and organization. Simply put, copyright just means not copying any work. When a work is copyrighted, it is owned by the author alone. If a work is copyrighted, no one can make a copy, or reproduce it in any other way.

Copyright Act, 1957 Copyright registration is necessary to protect your creative work. Copyright can be used to show that you own things like music, scripts, fashion designs, paintings, recordings, training manuals, cinematography, programming, and designing. You can use this to show that you own them. Getting a copyright registration makes sure that you have a legal right to your work.

What are the Copyright Owner's Legal Responsibilities?

· The copyright holder has the option of republishing the work themselves or allowing someone else to do so.

· Any new work that comes from the original work is done by the person who owns the copyright or the person who has been given permission to do so.

· There are many ways that a person who owns a piece of art can share it with the public. They can sell or give away their work, rent it out for a fee, lease it out to someone else, and so on.

· Any of the copyrighted works can be performed and shown in public very easily and quickly.

· These rights apply to everything, from literature, music, drama, choreography, movies, and audiovisual works, to music, movies, and more.

If you are planning to register a copyright for Cinematography films, Artistic works books, Software and other computer programs. We at Expertbells are the leading company that provides high-quality business services for entrepreneurs to help them start and grow their business. Expertbells can help you with an online copyright registration in India. Feel free to contact us:

Visit us on our official website: https://www.expertbells.com/

#Copyright Registration Services#File Copyright in India#copyright registratio#File Copyright in Delhi NCR

0 notes