Text

CM Trading

Website

CM trading website feels like a professionally made site where there are no crazy pictures of money or city skylines trying to entice you into the brokerage with promises of unattainable riches in a short period of time, it has a professional straightforward feel.

It is easy to navigate and simple to use and feels like I'm on this site of a good honest broker.

One thing I did notice is the fact that they are or have claimed to be the best performing broker in Africa for 2019, although I'm not quite sure how true that is.

The website is available in 6 different languages English Russian Arabic Indonesian Chinese and Spanish.

The company

CM Trading was founded in South Africa back in 2014, they are owned and operated by two separate companies named Global Capital Markets Trading and Blackstone Marketing SA Limited.

So after doing some research I found out that the company is regulated and registered in South Africa by the financial sector conduct authority (FSCA) which is a good sign and although I don't know too much in regard to how stringent the South African regulatory body is in terms of their rules and regulations, it is always a good sign if a company is registered wherever they are based.

Their Platform And Technical Information

CM Trading has three different platforms you can trade from with the first being this Sirix platform which is a web-based browser platform that can be traded from anywhere. It is a good platform with a lot of tools for technical analysis and forecast, etc., it is important to note that this platform also has a social trading aspect to it which is another added bonus.

You can also trade through the CM Trading broker via MT4 platform that as we already know is a very good platform and very popular amongst many traders beginner to professional.

Finally they have their mobile trading app which can be downloaded as the Sirix app or the MT4 app and is available both on Android and iOS.

CM Trading has a variety of different assets that you can invest in, ranging from cryptocurrencies, indices, commodities, forex and CFD’s.

In terms of account types cm trading has four, these are the mini classic executive and premium.

Let's start off with the mini account with this account the minimum deposit is $250, you also receive a demo account, daily market review, a weekly market review and a CM Trading eBook. They do mention a spread but there are no details and I can only assume these are higher than the other accounts they have available.

The next account is the classic account where the minimum deposit is $1,000, again you are receiving a demo account with this and you get a regular spread, 1 risk free trade (which I'm always sceptical about) and access to a webinar called introduction to forex.

Moving onto the executive account where the minimum deposit is $10,000, again they have the demo account included, this time with tighter spreads, two risk free trades, webinars that include an introduction to forex and understanding technical and fundamental analysis.

Finally we have the premium account where the minimum deposit is $25,000, and here you receive a demo account, competitive spreads, same day withdrawals, three risk free trades, two trading strategies and webinars that include an introduction to forex, understanding technical and fundamental analysis and the psychology of trading.

When it comes to spreads on their platform the standard spread on the EURUSD pair is 1.5 pips so this matches the standard in the industry although I did notice some other pairs had rather high spreads which is a little concerning, for example I noticed the spread on the AUDUSD is at 5 pips which is extremely high.

When it comes to deposits there are few different methods that can be used, either wire or bank transfer, debit or credit card, CashU, Neteller and Fasapay. So there are a variety of options that customers can use.

As for withdrawal methods these are the same and you would need to make a request for a withdrawal that would be sent to their finance department and according to their website you would be contacted within 24 hours.

Education

So when it comes to education they do have many tools available and as previously mentioned with the account types they offer training videos, eBooks, webinars, video chart analysis and chart analysis and again this is dependent on which account type you choose. The company pride themselves on education so I would expect the tools offered to be at a good level.

Customer Support

The life support can be contacted via email via telephone by their web chat service or via their online contact form. I believe their customer support is only available at earliest Sunday evening to Friday night as at the time of writing this it is the weekend and I am unable to get through to them.

So How Reliable Are They, What Have Customers Said?

In terms of what customers have had to say about the broker they have been very positive with a lot of them praising the charting platform so it seems that this is a reputable broker.

Although the spreads are slightly higher this hasn't seemed to put customers off.

That’s for the reliability I would say they are very reliable company and broker this being mainly due to their regulation and the fact that they separate clients money into segregated accounts.

In Conclusion

So all in all I believe that CM Trading is a good broker and working professionally with the interests of their clients and customers at hand. The fact that they are regulated is always what traders should be looking for when choosing a broker and I am confident in being able to say that this is a broker that can be trusted.

Read the full article

0 notes

Text

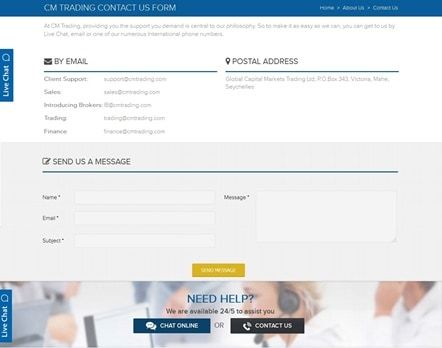

Oasis Trade Review

Website

The OasisTrade website is very smooth in its design with a beautiful slideshow across the top showing various cities skylines, they also have prices for various assets running just below the slideshow which gives it a nice investor type feel and further below that I can see the prices of some major assets and the percentage change in them which is nice to see.

The website is very smooth to run and easy to navigate around, with everything I need visible at the click of a mouse.

The website is only available in English.

The Company

OasisTrade is owned and operated by Oasis Tech Ltd who are a company registered in St Vincent and Grenadines. This would mean they are an offshore company, also to note is that companies registered here don’t have any licensing requirements and do not have to be regulated which as I can see OasisTrade do not, I also see that the country has previously stated that they do not oversee forex brokers which isn’t a positive here.

Their Platform And Technical Information

OasisTrade only offer a web based platform with no access to the MT4 platform and no mobile app available although the web based platform can be accessed via your mobile device. The web based platform is easy and simple to use and is designed for traders with varying degrees of experience.

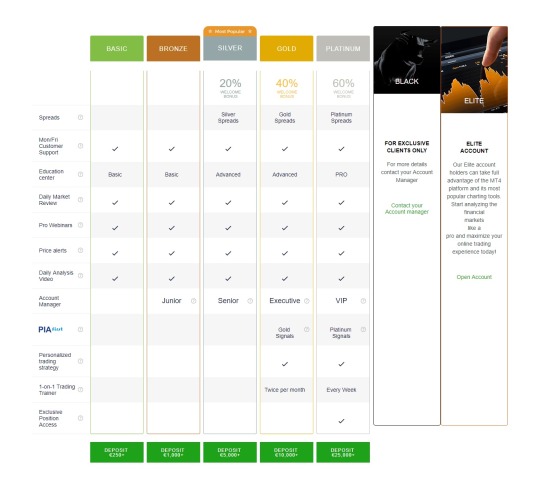

There are a variety of different types of accounts available, five with information and two extras that do not provide any information about them as they require you to talk to the company.

The first is a basic account that requires a minimum deposit of $250 and with this there is a fixed spread of four pips and with a basic account you do not receive an account manager.

The next account is a bronze account, with this you also have the four pip fixed spread and receive a junior account manager. The minimum deposit for this account is $1,000.

Next up is the silver account, the minimum deposit for this account is $5,000 and this is billed as their most popular account. You also receive a senior account manager, access to the advanced educational centre, a 20% bonus and silver spreads (we cannot see how small or large these spreads are).

The gold account is next, with this you get a 40% bonus, access to the advanced educational centre, gold spreads, gold signals, a personalised trading strategy and an executive account manager. The minimum deposit here is $10,000.

Finally there is the platinum account. The minimum deposit is $25,000 for this account. With this you get the same as the gold account with the added platinum signals and exclusive position access.

After that there is the black and elite account types which they do not provide any information on and as stated above requires a phone call to their offices.

Deposits and withdrawals can be made in a variety of ways via credit or debit cards, wire transfer, Astropay or finally Bitcoin.

There are minimum withdrawal amounts of $1,000 for wire transfers and $100 for credit or debit card withdrawals.

There is also a fee for dormant accounts which stands at $30 if the account is inactive for more than two months.

Education

As stated above the company does offer education to their traders and these are based upon the account type taken, we were unable to view any of the education materials or find any available online.

Customer Support

Customer support is available Monday to Friday 7am to 6pm via phone, email, web chat and an online contact form. The web chat seemed very responsive although I did just run through general questions with them.

So How Reliable Are They, What Have Customers Said?

Unfortunately there aren’t too many customer reviews available for OasisTrade so I am unable to confirm whether customers are having an overall positive or negative experience with OasisTrade.

In terms of reliability I would say that while there doesn’t seem to be anything negative regarding their reliability I would suggest traders look for a regulated broker which OasisTrade are not unfortunately.

In Conclusion

All in all it was hard to come to a solid conclusion on this company due to the lack of information available about them online.

My one concern would be that they are not regulated and are operating as an offshore company which normally isn’t a good sign and the fact that they are not regulated is worrying further so should stand as a caution to traders.

My advice to investors out there is that for OasisTrade I would suggest proceeding with caution and always be aware of how the trading broker acts and operates at all times.

Read the full article

0 notes

Text

FXVC

Website

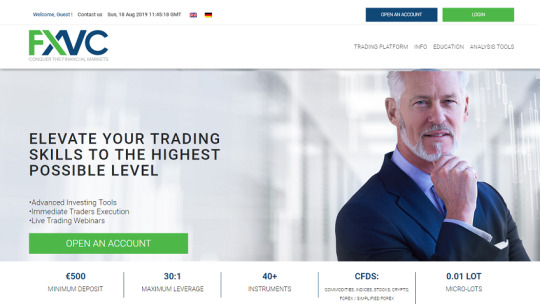

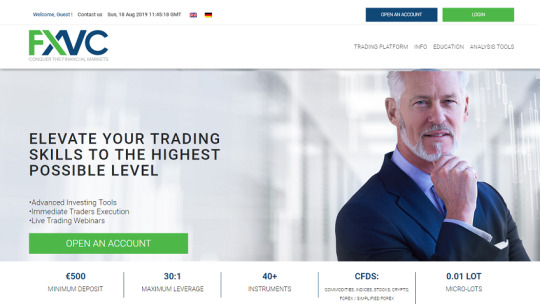

The FXVC website has a really clean look, not too flashy but at the same time looking like a professionally built website.

It has a clean white background with the companies colours (Green and blue) used for different parts of the design. On first look I am impressed with the website design.

The website however is only available in just two different languages English and German.

The Company

FXVC is owned and operated by Centralspot (Cyprus) Ltd who are a financial investment company based in Cyprus, they are regulated by CySEC (Cyprus Securities and Exchange Commission) and they have been operating since 2014.

Their focus is on countries in Europe although they seem to operate in the UK but are not regulated by the Financial Conduct Authority (FCA) which I believe is prohibited.

Their Platform And Technical Information

Trading with FXVC is only available via their own web based platform or via their app which is available on Android or iOS.

Their web platform is simple and easy to use and is made to work to the needs of traders who are new to the game and to the more experienced traders. It is simple and easy to you are able to use various forms of technical analysis on the charting platforms from Fibonacci to RSI indicators.

The app is very similar and works just as well as the web based platform although as it is still relatively new there are glitches from time to time which will no doubt be worked out.

There are many assets available to trade on the platform ranging from forex, commodities, indices, stocks and five cryptocurrencies available to invest in.

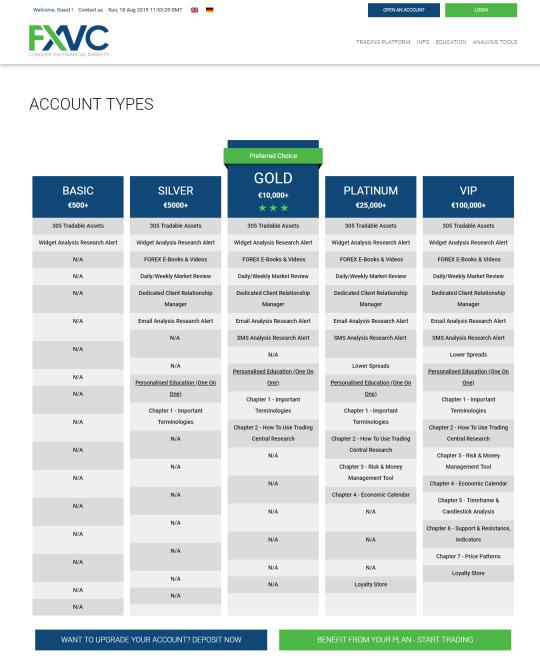

There are five different account types that can be opened with the first being a basic account. With this account you only get the bare minimum which is just a widget analysis research alert. The minimum deposit for opening this account is 500 euros.

The next account up is the silver account. With this the minimum deposit is 5,000 euros, there are some extras on this account which are forex e-books and videos, a dedicated client relationship manager, a personalised education, widget analysis research alerts, daily/weekly market reviews, and email analysis research alert.

The gold account which is promoted as their preferred choice of account requires a deposit of 10,000 euros and has all the features of the silver account plus SMS analysis research which in my personal opinion I would say they should offer slightly more given that you would be investing an extra five thousand euros.

The Platinum account requires a minimum deposit of 25,000 euros and offers all the gold account features plus lower spreads (I will let you know how good their current spreads are shortly), loyalty store and educational courses that can be taken.

Finally the VIP account requires a minimum deposit of 100,000 euros plus all of the platinum account add ons and an additional education course, again not really a lot extra for a 75,000 euros increase in investment size.

So spreads on the platform are fixed which means they are ultimately higher then others reputable brokers although they can vary. So it seems that a EURUSD spread on the trading platform would be set at 4 pips which is quite a lot higher then other brokers and although higher account levels do benefit from lower spreads I cant see them being too much lower.

Deposits can be made in a variety of ways via wire transfer, debit or credit card, Neteller, safe charge, Skrill and Eurobank.

You can also withdraw via the same methods although there is a minimum withdrawal amount of 20 euros and there are no withdrawal fees which is positive. The only downside is that withdrawals can take up to 7 business days to be completed.

Education

In terms of education as mentioned above FXVC do offer educational tools and these come as part of your account depending on how much your deposit size is. Due to this I was unable to find anything online regarding to check out although I would expect it to be a standard level that you can attain across other brokers.

Customer Support

The FXVC customer support is available Monday to Friday 9am to 5pm GMT. They can be contacted via their live web chat which was very responsive when I gave its go, by phone, by email and by submitting a query via their online submission form.

After talking with them via their online web chat I can affirm that they were very helpful and answered my queries in a prompt and helpful manner.

After looking what other customers had to say regarding FXVC’s customer support they seem to confirm my thoughts that they are extremely helpful and responsive and provide a top class service.

So How Reliable Are They, What Have Customers Said?

It seems to me that FXVC are an extremely reliable company who put customer service as one of their top priorities and it comes across in the service they provide.

Another positive is that they are regulated and licensed by CySEC and it is key when looking for a broker that they are regulated by a respected authority. Their online web platform works very well and is great for both new and experienced traders.

When it comes to customer reviews I have to say that there weren’t too many to read however the ones that I did find were all positive particularly praising their customer service and professional attitude and of those small amount of customer reviews I found there were no negative ones.

So I believe that FXVX are a very reliable broker however I do have a concern that they seem to provide accounts in the UK but are not regulated in the country. Nevertheless I believe FXVC are a reliable broker that can be trusted.

In Conclusion

In conclusion it is my belief that FXVC is a reputable brokerage who are providing a high quality service to their clients and I would recommend them to any traders looking for a broker in Europe, however I believe UK traders should look for a broker who are regulated by the FCA.

I would recommend FXVC as a safe broker to choose traders!

Read the full article

0 notes

Text

AroTrade

The Website

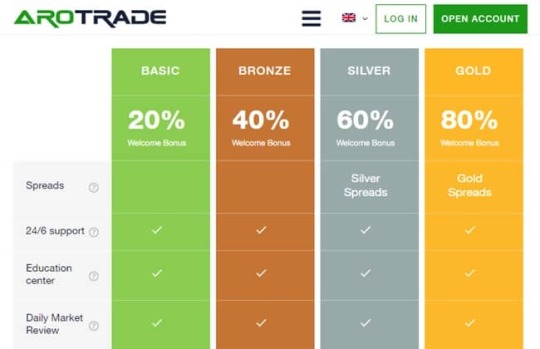

Upon first landing on the AroTrade website you get the feel of a platform that is smooth and well presented, you can also immediately see that the platform uses or can be used in conjunction with MT4 (via a large slideshow at the top of the site) which it seems a lot of traders nowadays are using.

The website is available in 3 different languages, English, Russian and Arabic.

The website design is not too fancy but runs smoothly and everything is clear and visible and easily navigated around, I would say a simple design but effective. A 6 out of 10 in my book.

The Company

AroTrade is the trading name of Speed Solutions Ltd, this is a company based in Belize, they are regulated by the International Financial Services Commission (IFSC) which is a local regulator. You should note that all client transactions for the company are processed through another company named Speed PA Ltd which is a company based in Bulgaria (red flags).

The IFSC are considered somewhat reliable however the regulations in Belize are fairly relaxed and so any company falling under the ISC regulatory conditions will not be under as much scrutiny compared with brokers regulated by more reputable financial watchdogs such as the FCA or ASIC.

Traders will need to be aware that AroTrade is an offshore broker and this should come as a warning as the investors capital will be at risk.

Their Platform And Technical Information

AroTrade provide their own web platform, work in conjunction with the MT4 platform and they also have their own trading app.

Their web trading platform like their website is a simple design and easy to navigate with an economic calendar, price alerts and risk management, all features advertised on their site.

The mobile app is very much of the same design, it can be downloaded on iOS or Android and again is very simple to use with the same features offered on their web platform.

They have a number of different assets that can be traded from forex to crypto to CFD’s although their spreads seem to be a lot wider than normal with there seeming to be around a 3-4 pip spread on major forex pairs which is a lot wider then other brokers.

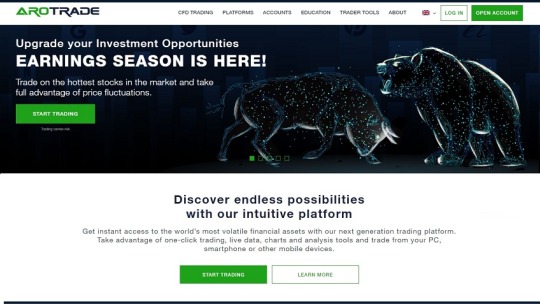

As for the account types that can be opened they offer a free demo account to experience their platform and the higher your initial deposit the better features you are offered for your account. It starts with a basic account and then on to bronze, silver, gold and platinum with extra features being offered depending on the account type you go with.

Education

The website offers video courses, eBooks and webinars as part of their education section as well as different analysis tools on offer from fundamental analysis to technical analysis and daily analysis videos.

Unfortunately the videos only seem to be available to clients that open an account with them which we will not be doing! You can find out why further down this review. So we are unable to verify how good or bad the education is on the platform but if I were to guess I would say it would be basic as most brokers don’t seem to have too much of an in depth educational program.

Customer Support

AroTrade offer 24/6 customer support but it does not make clear which day they do not offer support on.

They have phone numbers available to call in South Africa, Malaysia, Singapore, Russia, and Kazakhstan, they also have another international number for other users. Whilst their website also offers a form to fill in for inquiries and they have email addresses for their different departments available.

In regard to reading what others have said about their customer support it seems that the account manager is in constant contact with you until the day you try to withdraw money! (find out more below).

So How Reliable Are They, What Have Clients Said?

As mentioned above due to the fact that the company is registered in Belize and processes transactions via a different company in Bulgaria this should be your first red flag.

Immediately just by doing a quick google search I can find many negative reviews from customers regarding the broker which is not a good sign, including one that has said that the broker called the trader to provide him with insights on what positions he should take which then ended up in him losing a substantial amount of money. This indicates to me that the broker may have been taking the other side of the trade here (so betting against the client) and taking their own profits from the trade.

After reading a few other reviews it seems clear to me that this is an untrustworthy and unreliable broker, the general theme seems to be that clients open an account, then are immediately called by an account manager who pressures the client into depositing money. Once that is done the client will then receive another call a few days later pressuring the client once more to fund their account with more money in order to “increase their profits” and then advise them to take positions that the account manager recommends (is this so that they can take the other side of the trade? Seems possible) and more often then not the client then loses money on those positions taken.

After that is the real kicker and what is a well known scam amongst financial circles. Once the client realises that the broker is a scam or that they want to take their profits from their account they will then request a withdrawal which they are then told is only allowed after the account manager confirms it, which he/she never does and it seems the broker is allowed to get away with this time and time again.

So in terms of reliability I would give this a 0 out of 10, it seems clear tome that they are not to be trusted.

In Conclusion

AroTrade should be avoided. Due to the fact that they aren’t properly regulated and seem to be running a clear scam on their clients I would suggest staying well clear of them. The company will try to reel you in by offering bonuses for different deposit types and the fact that they have an easy to navigate clear website and easy to use trading platforms is probably the reason why other clients have fallen victim to them in the past. Be warned, they are not to be trusted.

Read the full article

0 notes

Text

365 Markets

Website

The 365 Markets website immediately feels showy in its look, the first picture you are met with is one of a well suited man looking at his gold watch while on the phone, I feel it is trying to give off a luxurious vibe and not long after that I am met with another picture of gold bullion to really try and hammer home the possible riches of trading.

Also to note is the fact that the website doesn’t seem to have been well designed with sections frequently overlapping meaning they are unreadable at points giving off a vibe off an amateurish website.

There doesn’t seem to be any option to switch between languages.

The Company

365 Markets is owned by a company based in Bulgaria called Trustnet Ltd as stated on their website but after some research I found on the FCA website that they work in conjunction with Maximus Global Ltd which is a company based in the Marshall Islands, although they put a UK contact number and seem to target UK clients, if you scroll to the bottom of the site you will see that their registered address is in fact Sofia, Bulgaria.

In Bulgaria trading brokerages such as this one need to be licensed by the local financial authority but after a short amount of digging online it seems that 365 Markets is not and this means that anyone depositing money into this broker is putting their finances at risk.

I would be very hesitant before depositing money into this broker as the fact they are not regulated at all is a massive red flag and they are breaching the rules in Bulgaria by operating without registering with their financial authority. I would urge people reading this not to deposit any money into this broker purely based on the above facts.

IMPORTANT WARNING - On the FCA (financial conduct authority website) they provide a warning about 365 markets stating “This firm is not authorised by us and is targeting people in the UK. Based upon information we hold, we believe it is carrying on regulated activities which require authorisation”.

Their Platform And Technical Information

From what I can find the company offers five different account types, bronze, silver, gold, premium and platinum with each requiring a larger deposit the higher you go. The minimum deposit is $2500 for a bronze account and there are a number of different assets with the main focus being crypto’s but they do offer forex and CFD’s to trade.

One thing that did catch my eye is that gold premium and platinum account holders are stated as having risk free trades on their account, this sounds all too farfetched to me, have you ever heard of risk free trades? No me either.

In regard to the platform I can only seem to find that they have a web based platform that seems fairly basic and easy to navigate from the pictures but there seems to be no app and it is unable to work in conjunction with the MT4 platform.

A couple of more red flags to add to the growing list are that firstly there are withdrawal fees and inactivity fees, although it is fairly easy to deposit using Visa, MasterCard, Maestro, Skrill, WebMoney, QIWI, Giropay, and wire transfer. Withdrawals via debit or credit cards are charged 5%, bank transfers are charged $10 and the fees for the other withdrawal methods are a whopping $25, while accounts that are inactive for more than three months are charged at 5% every month after.

The final red flag I have for you if the above isn’t enough is that the spreads on nearly every asset that can be traded are very wide at a minimum of 4 pips for forex pairs.

Education

The website does have an education section on the site that doesn’t offer too much other then weekly market review videos if you have an account with them, they also have an e-book section that does not seem to load on the website which may be lucky.

Customer Support

There is a direct number clearly available on the website and also an email address provided although there is no mention of the hours in which customers or clients are able to contact them which is not very helpful.

So How Reliable Are They, WhatHave Clients Said?

As you can imagine if you have read the above there are some terrible reviews online and I am not surprised, nearly every review mentions the fact that the company are scamming investors and withholding money with some losing thousands of pounds, one review mentioned how she shared her screen with someone working for the company and they took control of her computer and deposited more funds into her account!

On top of that it has also been mentioned that they tend to write fake reviews for themselves on various websites to trick innocent people into falling for their scam.

I won’t go on any longer as I feel you have heard enough.

In Conclusion

I think it is clear to everybody reading that this is not a broker that can be trusted, I would urge anyone to please refrain from investing with them as the fact alone that they aren’t regulated should show that they are scamming clients once the money has been deposited with them. You’ve been warned!

Read the full article

0 notes

Text

24Option

Website

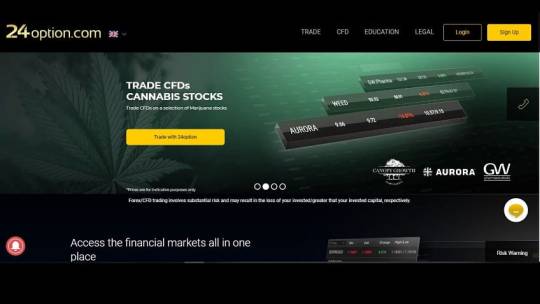

After landing on the 24 Option homepage you are met with a dark background but with shiny gold trim, it's not immediately clear to me where everything is in terms of pages I am looking for so in that sense I would say it is not too easily navigable.

One thing I do notice is that they are a sponsor of Juventus football club which could be a sign of them being a reputable company but it does not guarantee that they are a quality broker.

The website is available in 12 different languages, so it is easily accessible around the globe.

The Company

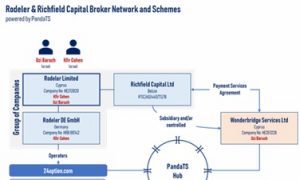

24 Option is owned and operated by Rodeler Limited in Europe which is an investment company based in Cyprus, they are authorised by the Cyprus Securities and Exchange Commission (CySEC), while the international branch of the company is operated by Richfield Capital Ltd who are an investment firm based out in Belize. They are also regulated by IFSC (International Financial Services Commission).

The only country in the EU that 24 Option do not provide any services to is Belgium.

Their Platform And Technical Information

24 Option is available via the online platform which you can log into via their website, via their mobile app which is available on Android or iOS and in conjunction with MT4 which can be downloaded via their website giving you a variety of different ways to manage your account.

The web platform that they provide is a simple but effective design with similar branding colours to the website and is easy to use.

The mobile app is again simple to use and has the same style as both the website and web trading platform, it is also available in 12 different languages just like the site.

In terms of instruments that can be traded there are a few, ranging from forex to commodities to indices to stocks.

When opening an account with them you will notice that there are four different account types available.

The first is a basic account, the minimum deposit for a basic account is $250 and the standard EURUSD spread for this account is as low as 2.5 pips but it can fluctuate higher (although 2.5 pips is still relatively high), it also contains one basic lesson as part of their education package and one free withdrawal.

Secondly there is a gold account which requires a minimum deposit of $5,000 where the standard spread for the EURUSD will be 2 pips which is getting down towards a normal spread for this pair but still far too much on the high side. With this account you receive an educational package of two basic lessons, one monthly webinar and one monthly free withdrawal

The platinum account has a minimum deposit size of $10,000 with the spread starting at 1.6 pips (getting there, slowly), the educational tools provided for this account are three advanced lessons and two monthly webinars, they also allow three free monthly withdrawals.

Finally the VIP account requires a minimum deposit of $50,000 and with this you get a minimum spread of 1.1 pips on the EURUSD pair (still not good enough), five advanced lessons, five monthly webinars as part of their education package and no withdrawal fees at all.

Deposits can be made in a variety of different methods from credit and debit cards, to wire transfers to online wallets, there are many options available for this.

Withdrawals can be made via the same processes, however there are some rather high fees for withdrawals of up to 3.5% and around £30 for wire transfers.

Education

As mentioned when going through the account options 24 Option does offer training to their customers, having found one of the videos online I can say it is very professionally delivered and clear to understand.

As for the webinars they are scheduled for the traders to attend each month and again as mentioned above the amount of webinars you can attend is based on your account size.

Customer Support

24 Option can be contacted by phone, email, web chat, or via their online contact form. They are available from 9am to 9pm Monday to Friday.

When initiating their web chat function they were very responsive and provided a positive service although my queries were general ones.

So How Reliable Are They, What Have Customers Said?

Now this is where it gets interesting to me, after looking at their company and who they are regulated by I was still undecided as although they are regulated by certain bodies they are also unregulated, for example they offer financial services to customers in the UK even though they are not regulated by the Financial Conduct Authority (FCA) when they should be and this leads me to believe that they are a broker that should not be trusted.

After reading some customers reviews online I can see there are a lot of fake (good and bad) reviews but of the legitimate ones I was able to find the majority were on the negative side.

The problem seems to be that there are a lot of fees involved when trading with 24 Option and the customers are complaining that these fees have eaten into profits or accounts, this leads me to believe that while the company may be acting in good faith they have some practices that do not align with other more reputable brokers.

In Conclusion

For me there is something about 24 Option that makes me feel as though I would avoid depositing my money into one of their accounts, while they do seem a professional company and seem to be acting in good faith, it seems their business setup and extortionate fees are not inline with other brokers. Although I was not able to find anything regarding inactivity fees it does seem that there is some sort of charge for that.

In conclusion my verdict for 24 Option would be to proceed with caution.

Read the full article

0 notes

Text

eToro

Website

The eToro website seems very sleek upon first view, there is a lot of information on the homepage and this brokerage is marketed in a different way to others in the way that it is marketed as a social trading site where traders can copy trades of other successful traders by simply mirroring them.

I do appreciate this website a lot, it is well designed and thought out and easy to use with a lot of graphics in order to help explain certain parts of how they work.

The website is available in 20 different languages which makes it accessible to a larger audience around the globe.

The Company

eToro is a well known fin-tech company who started in Israel by three co founders.

The company was formed in 2007 and trades under the eToro name. They have offices in the UK,Cyprus, Australia with their head office based in Israel.

According to their website and after some research online I was able to confirm that they are regulated by CySEC, the FCA and ASIC. They are not listed on any stock exchange but they are a well known startup company which along with the fact that they are regulated reinforces their status as being a safer broker.

Their Platform and Technical Information

The platform has a variety of different assets to trade from, they primarily offer CFD’s but you can also choose from stocks and cryptocurrencies. One thing to note in regard to their stock trading is that it is commission free in the EU and if you are a non EU citizen it is 0.09% spread cost per side.

The first negative I can find regarding the platform is that they seem to have a wide spread on the majority of the assets they have available to trade, for example the EURUSD pair at the time of writing had a 3 pip spread where normally you will find around a 1.5 pip spread on average amongst other reputable brokers.

They offer a free demo account if needed and their live accounts are made simple by only having one live account type, with the minimum deposit being $200 for this account, although for US and Australian residents the minimum is $50 and for residents of Russia, China, Hong Kong, Taiwan, and Macau the minimum first time deposit is $500. It is easy and simple to open and there seem to be no complications when I opened an account to try.

In terms of the platforms they have available to trade on it can only be done via their web trading platform or their mobile app, the app is available on iOS or Android.

The app is fairly easy to use and simple to navigate, it is a user friendly app and users will have no problem in trying to open and close trades or searching for different stocks or forex pairs.

The web platform is also great, it has a nice modern feel and looks good on the eye. Again it is a user friendly experience and easy to navigate around and customers should have no problem when getting to grips with it.

When it comes to deposits and withdrawals one thing that is important to note is that all accounts have to be in US dollars and so once your local currency is deposited into an eToro account it is then converted into US dollars. Deposits can be made via a variety of different ways including debit or credit card, bank wire, PayPal and many other online payment systems.

In order to withdraw money the account holder will need to fill out a withdrawal form, they will in most cases authorise withdrawals back to the same account they were deposited from, they normally take five days to arrive in the clients account. Another important factor to note here is that there is a $25 withdrawal fee which is very high, not good eToro!

Education

eToro currently offer some educational tools for their traders, these seem to be in the form of live webinars. They do also offer a tool to copy other traders positions so in essence you can learn by understanding those other traders and how they take trades, as long as they are profitable!

Customer Support

eToro’s customer support is a 24/5 service available Monday through to Friday and they can be contacted via telephone or email and from past experience they seem to respond within two days.

So How Reliable Are They, What Have Clients Said?

After having a look at some customer reviews it seems there are a mix of the majority being negative, some average and some positive. I have mentioned in an earlier review but this could be down to the fact that when traders lose money (especially new traders) they will tend to blame the markets or their brokers.

There seems to be more complaints of stop losses not being hit or glitches in their system and failure of trades being copied from one trader to another. These seem like issues with their system to me and are things that can be fixed, there are some complaints of failures to withdraw which investors reading this should be aware of.

I would say that eToro is a reliable company they are regulated by the FCA which is a well respect conduct authority in the UK and they are also regulated elsewhere so will be adhering to those rules which suggests to me that they are a broker that can be trusted.

In Conclusion

For me I feel that eToro are a reputable broker and although they may not be perfect for professional traders due to their large spreads, they are perfect for new investors who can copy trades from more experienced and profitable traders in order to help them increase their profits.

The social feel to the eToro structure is a new take on trading and it is no wonder they seem to be leading the way in that sense as their user interface is very user friendly .

All in all I would recommend this broker for the new less experienced traders out there.

Read the full article

1 note

·

View note