Text

How to use social proof to snatch more clients

https://ift.tt/2IUUhee

It’s no secret that people show their approval of others and conform their actions in the form of feedback, likes, reviews, becoming followers and even joining in other people’s causes. When it comes to showcasing your brand, taking advantage of this phenomenon, known as social proof, is a no-brainer.

from Inman https://ift.tt/2LH0l7P via IFTTT

0 notes

Text

Barrister wants justice for prosecuted real estate agents after meth 'hysteria' debunked

On the go and no time to finish that story right now? Your News is the place for you to save content to read later from any device. Register with us and content you save will appear here so you can access them to read later.

from Real Estate News https://ift.tt/2IYFHm9 via IFTTT

0 notes

Text

Public Storage Presentation at NAREIT REITweek 2018 to be Webcast

May 29, 2018--Public Storage announced today that the Company will make a presentation at NAREIT REITweek 2018 in New York at the New York Hilton Midtown in the Sutton Center on Wednesday, June 6, 2018, from 4:30 p.m. to 5:00 p.m. . The presentation will be webcast and will be available on Public Storage's website at PublicStorage.com at "Company Info, Investor Relations, News and Events, Events Calendar" on the day of the conference.

from Real Estate News https://ift.tt/2H2y87N via IFTTT

0 notes

Text

Chevy Chase mansion listed for $25.9M is part of vice presidential history

A Chevy Chase mansion that boasts a storied Washington history - and not to mention a grand hall with 30-foot ceilings - is on the market for $25.9 million. It's one of the most expensive homes for sale in the Washington region, and the Washington Post named a few fascinating factoids on this estate.

from Real Estate News https://ift.tt/2H2D6l8 via IFTTT

0 notes

Text

Who Can Help You Obtain Chinese Buyers in Real Estate Fast&Free

LOGO of LinkPro appeared on the iconic NASDAQ screen, in the reputed Times Square in New York, US on May 11, 2018. Thus, LinkPro, devoted to connecting authentic Chinese agents overseas with Chinese investors, becomes the first Chinese overseas real estate community brand staging on the NASDAQ screen.

Start the conversation, or Read more at The Virginian-Pilot.

from Real Estate News https://ift.tt/2IWiVv5 via IFTTT

0 notes

Text

How much? Broome County real estate transactions

How much? Broome County real estate transactions Real estate transactions for March 18-24 Check out this story on pressconnects.com: https://press.sn/2snv01d The buying landscape has changed and so has the technology. From 3D home mapping to live periscopes, real estate agents are changing the way people search for their next home.

from Real Estate News https://ift.tt/2H2D3FY via IFTTT

0 notes

Text

How, and Where, Do You “Announce” a New Listing?

https://ift.tt/2JfBVDT

When you put a new listing on the MLS, where else do you market the listing? Do you have a standard “New Listing” marketing plan you and/or your assistant executes? Do you send out a note to your sphere (on FB or email) ahead of adding the listing to the MLS?

Some possible marketing avenues at your disposal:

List on MLS

Post on Facebook

Syndicate to Zillow, Trulia, etc

Syndicate to Realtor.com

Boost a post on Facebook

Custom audience builder

Post on Criagslist

Nextdoor

Instagram

Single property website

Just Listed postcards

Email list

What strategies and tactics do you use? What’s working? What’s not?

The post How, and Where, Do You “Announce” a New Listing? appeared first on GeekEstate Blog.

from GeekEstate Blog https://ift.tt/2JddYgG via IFTTT

0 notes

Text

What you need to know about the big rate drop

https://ift.tt/2H0qQBC

It’s all about the economy. The euro coming unglued would not necessarily harm the U.S. economy at all. In historical experience, since these flights-to-quality push down U.S. interest rates, they often stimulate U.S. economic growth — another reason to take a drop like this and run.

from Inman https://ift.tt/2IT31RW via IFTTT

0 notes

Text

NextHome will automate marketing for all 2,400 agents with Imprev

https://ift.tt/2qFnWwD

Agents that are part of the NextHome family are about to up their value proposition with the tech-focused brokerage’s new marketing automation software. The new service, powered by real estate marketing company Imprev will fully automate the creation of marketing content.

from Inman https://ift.tt/2LGmraD via IFTTT

0 notes

Text

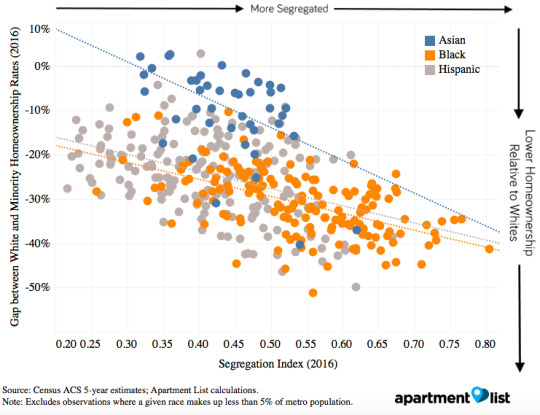

Most minorities still live in segregated neighborhoods: study

https://ift.tt/2IVqF0j

Fifty years after the enactment of the Fair Housing Act, segregation persists nationwide, with Milwaukee among the most disparate U.S. cities, according to a study by Apartment List.

Released last week, the study determined a so-called “segregation index” for 50 of the nation’s largest cities using U.S. Census Bureau data and found that the longstanding effects of exclusionary zoning, sub-prime mortgage lending practices and discriminatory language in property records had combined to create lingering disparities well into the 21st century.

“These policies and other related factors led to higher concentrations of poverty in minority neighborhoods, and the persistence of significant wealth gaps has served to reinforce patterns of residential segregation,” wrote Apartment List Housing Economist Christ Salvati, an author of the study.

The index, Salvati added, “can be interpreted as the percentage of the minority group that would need to move to a different neighborhood in order for the distribution of minorities in each neighborhood to match that of the metro as a whole.”

Last month marked the establishment of the Fair Housing Act, a federal measure that made it illegal to discriminate against renters or buyers based on race, color, religion, sex, disability, familial status or national origin.

3 social media strategies for maximum engagement

Tom Ferry asks, Are your social media posts #stopworthy? READ MORE

The national segregation index for blacks, Hispanics and Asians are 0.59 and 0.47 each, respectively, meaning that large swaths of these communities would need to redistribute in order to create more integrated neighborhoods.

On a local level, Milwaukee had the highest segregation index (0.61) with the majority of minority (Hispanics, Asians, blacks) residents living near the city’s urban center and the majority of white residents living on the outskirts. Thirty-two percent of the city’s population are minorities, and 55.8 percent of them live in neighborhoods that are less than 25 percent white. Out of the three minority groups studied, blacks were the most segregated — 74.6 percent of them live in a minority-majority area.

Following not too far behind Milwaukee were New York City, Detroit and Buffalo, all of which had a segregation index of 0.58.

On the other hand, Seattle had one of the lowest segregation indexes (0.32) with minority residents being more evenly spread throughout the city, although there is still a higher concentration of white residents on the outskirts.

Beyond creating segregated neighborhoods, these policies have hindered minority groups from becoming homeowners at the same rate as their white counterparts, notes the study. Nationally, 72.4 percent of white households own homes — a homeownership rate 15.1 percentage points higher than Asian households, 24 percentage points higher than Hispanic households and 30.2 percentage points higher than black households.

Although homeownership rates by race vary from metro to metro, Apartment List says the trend remains the same: “higher levels of residential segregation are correlated with more severe homeownership rate gaps.”

Salvati recommended expanding low-income rental assistance programs and allowing those recipients to use their benefits in “high-opportunity” neighborhoods to create more integrated cities. He also suggested building more affordable, mixed-income housing complexes, similar to what New Orleans did after Hurricane Katrina.

These things, he said, “could go a long way toward addressing the persistent problem of residential segregation.”

Email Marian McPherson.

from Inman https://ift.tt/2H2xaIF via IFTTT

0 notes

Text

Hawaii Realtor seeks solutions as volcano destruction continues

https://ift.tt/2so9AB1

Kilauea, the active volcano that began erupting on Hawaii’s big island four weeks ago, is still carving its path of destruction through are homes and other structures. Ten more homes were lost over the Memorial Day weekend, bringing the total to 92 structures destroyed by burning lava so far, according to local newspaper the Honolulu Star-Advertiser.

The disaster has thrown the local real estate community in and around Leilani Estates — the residential subdivision of 1,500-plus residents on Hawaii’s main island that has seen the brunt of the damage — into action offering assistance to residents, but also reflection on the long-term damage to a community that will never be the same.

Hawaii Realtor Kehaulani Costa. Credit: Kehaulani Costa

Kehaulani Costa, executive officer of local real estate board, Hawaii Island Realtors, said that it was still an isolated part of the Big Island which was being affected, the large town of Hilo, just 40 minutes drive away was feeling no effect despite the fact they are living on a live volcano.

“In Hilo you wouldn’t know anything is happening, you almost feel bad being in Hilo, life is absolutely normal, while 15 miles away people are being devastated,” she said.

The executive officer said two or three Realtors had lost homes in Leilani Estates up until last week but she feared those numbers had grown over the weekend.

Real estate blockchain and cryptocurrency explained

The key concepts and applications you need to know READ MORE

Costa said that a number of private citizens were going up in helicopters and giving people in the community information on whether their house was still there or not. People were following the Facebook Hawaii Tracker group and the Puna Lava Update was keeping people informed, she said.

The executive officer is not expecting it to stop any time soon.

“This could go on for years for decades — this could be the new normal, the new volcano area, there’s no predicting it. It could also shut down in a number of days,” said Costa. She said the sheer volume of lava still coming from the fissures made locals think that there is no end to the disaster in sight.

Observing the lava spewing out of fissure 8 yesterday from a local nearby surf beach, Costa said, “It’s so surreal, it feels prehistoric, it’s like looking into Jurassic Park.”

Costa said her priority and that of the real estate community was to find housing for those displaced.

Many Leilani Estates residents had come to retire there and they don’t necessarily have the funds to easily relocate, said Costa. Hawaii Island Realtors has been talking to vacation rental companies to see if home owners would be interested in renting homes long-term instead.

Costa is also meeting with the prosecuting attorney’s office today to see if there is any way to free up housing lying vacant due to foreclosure.

Foreclosed homes can’t be easily resold or rented. If the various stakeholders could problem solve that, it would be a huge help, she said.

“If not, we are going to have a serious squatter issue so we can either figure out a way to do it legitimately or people will figure out a way and our county will be taxed for dealing with it,” she said.

Costa said she would like to talk to executives of Realtor associations in other parts of the country who have gone through disaster in the last year to see how they have overcome temporary or longer term housing problems.

“We are challenged, we are surrounded by water so moving to the next town over or the next state over is not such an easy option for people,” she said.

A local lumber company is erecting kits for tiny homes, she added. Accessory dwelling units are another solution and many homes in the area have plenty of land to accommodate these, according to Costa.

Of course with disaster comes opportunity. Vacation home owners in nearby Kapoho are monitoring the situation closely, some parts of the area below Leilani Estates were being affected by infrastructure problems with the lava straying into power plants.

“But if the lava goes around them they may be in prime location in the future to have vacation homes,” said Costa.

Email Gill South

from Inman https://ift.tt/2IUGqEz via IFTTT

0 notes

Text

Granite Real Estate (GRT) To Go Ex-Dividend on May 30th

Granite Real Estate declared a monthly dividend on Thursday, May 17th, Zacks reports. Stockholders of record on Thursday, May 31st will be given a dividend of 0.227 per share by the real estate investment trust on Friday, June 15th.

from Real Estate News https://ift.tt/2L7QTcx via IFTTT

0 notes

Text

Nevada woman awarded $6K after being denied service animal

https://ift.tt/2IXOmF9

Owners of a Reno, Nevada housing complex and a local real estate agency are being ordered to pay a prospective tenant $6,000 after they reportedly denied her request for a service animal, according to the United States Department of Housing and Urban Development (HUD).

Article image credited to Tech. Sgt. Lilliana Moreno for U.S. Air Force

from Inman https://ift.tt/2xm3nLO via IFTTT

0 notes

Text

Home Prices: Boom Continues, but Leveling Out Needed

The boom is continuing for home prices, with a gain in March of 6.5 percent, according to the S&P CoreLogic/Case-Shiller Indices.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index’s 10-City Composite, which is an average of 10 metros (Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, New York, San Diego, San Francisco and Washington, D.C.), rose 6.5 percent year-over-year, an increase from 6.4 percent in February. The 20-City Composite—which is an average of the 10 metros in the 10-City Composite, plus Atlanta, Charlotte, Cleveland, Dallas, Detroit, Minneapolis, Phoenix, Portland, Seattle and Tampa—rose 6.8 percent year-over-year, which is comparable to February. Month-over-month, both the 10-City Composite and the 20-City composite rose, 0.9 and 1 percent, respectively.

“The home price increases continue, with the National Index rising at 6.5 percent per year,” says David M. Blitzer, chairman and managing director of the S&P Dow Jones Indices Index Committee.

“Looking across various national statistics on sales of new or existing homes, permits for new construction, and financing terms, two figures that stand out are rapidly rising home prices and low inventories of existing homes for sale,” Blitzer says. “Months-supply, which combines inventory levels and sales, is currently at 3.8 months, lower than the levels of the 1990s before the housing boom and bust.

“Until inventories increase faster than sales, or the economy slows significantly, home prices are likely to continue rising,” says Blitzer. “Compared to the price gains of the last boom in the early 2000s, things are calmer today.”

“The solid gain in home prices of 6.5 percent in March added roughly $150 billion to housing wealth during the month,” said Lawrence Yun, chief economist at the National Association of REALTORS® (NAR), in a statement. “The continuing run-up in home prices above the pace of income growth is simply not sustainable. From the cyclical low point in home prices six years ago, a typical home price has increased by 48 percent, while the average wage rate has grown by only 14 percent. Rising interest rates also do not help with affordability; therefore, more supply is needed to level out home prices. Homebuilding will be the key as to how the housing market perform in the upcoming years.”

The complete data for the 20 markets measured by S&P:

Atlanta, Ga. Month-Over-Month (MoM): 0.8% Year-Over-Year (YoY): 6.2%

Boston, Mass. MoM: 1.2% YoY: 5.8%

Charlotte, N.C. MoM: 1% YoY: 6.2%

Chicago, Ill. MoM: 1.1% YoY: 2.8%

Cleveland, Ohio MoM: 0.3% YoY: 4.6%

Dallas, Texas MoM: 0.7% YoY: 5.8%

Denver, Colo. MoM: 1.4% YoY: 8.6%

Detroit, Mich. MoM: 1.1% YoY: 7.9%

Las Vegas, Nev. MoM: 1.5% YoY: 12.4%

Los Angeles, Calif. MoM: 0.9% YoY: 8.1%

Miami, Fla. MoM: 0.7% YoY: 5%

Minneapolis, Minn. MoM: 1.7% YoY: 6.1%

New York, N.Y. MoM: 0.1% YoY: 5.2%

Phoenix, Ariz. MoM: 0.9% YoY: 6.8%

Portland, Ore. MoM: 1% YoY: 6.7%

San Diego, Calif. MoM: 1% YoY: 7.7%

San Francisco, Calif. MoM: 2.1% YoY: 11.3%

Seattle, Wash. MoM: 2.8% YoY: 13%

Tampa, Fla. MoM: 0.6% YoY: 7.5%

Washington, D.C. MoM: 1.1% YoY: 3%

For the latest real estate news and trends, bookmark RISMedia.com.

The post Home Prices: Boom Continues, but Leveling Out Needed appeared first on RISMedia.

from News | RISMedia https://ift.tt/2xrm9RK via IFTTT

0 notes

Text

Savings for You and Your Agents

https://ift.tt/2IYhGrc

NAR PULSE—Share with agents: NAR members save on select shipping services with FedEx, including discounts up to 26% on overnight shipping, available to you every day for business and personal use, AND earn gift cards by connecting your account to My FedEx Rewards! View enrollment details and get the promo code here.

RPR® New User Series: Make It Happen With RPR MobileTM Agents on the go use RPR MobileTM to get the job done. Here are the app’s top features with some quick tips on getting around. Put the power of RPR® in the palm of your hand today. Learn more.

Earn CE Credit for Ethics Training Share with your agents that by taking NAR’s online Code of Ethics Training course, they can earn three hours of CE credit while fulfilling their NAR ethics training requirement. It’s a win-win! The current two-year cycle will end on Dec. 31, 2018. See full details, including state eligibility.

For the latest real estate news and trends, bookmark RISMedia.com.

The post Savings for You and Your Agents appeared first on RISMedia.

from News | RISMedia https://ift.tt/2IVXYAa via IFTTT

0 notes

Text

How to Successfully Sell Your Home Before a Big Move

By Meghan Belnap

Packing up, getting your existing home ready for sale, finding a new house and dealing with life in general are bound to bring added stress as you prepare for a big move. One way that you can minimize tasks and keep from going bonkers is to stay ahead of the process. Preparing to sell before your listing date can make the first part of your move go faster. Here are some things you can do right now to make your life easier when you get to your new home:

Prep, Clean, Declutter and Refresh

Pack for your move as you declutter your home to get both jobs done quickly. Put seasonal items that your family will not need for the next three to six months in boxes and label accordingly. Now is also when you want to get rid of books, clothes and furniture you'll never use again.

When you list your home, an open house is right around the corner. Your home needs to be fresh and extremely clean and neat to get immediate offers. Most individuals want the place to look like they could move in right away. Scrub, paint, steam clean and focus on making small repairs like fixing sidewalk cracks, patching holes in the walls and cleaning greasy oven vents.

Hire a Financial Specialist

Once you sell your home, you'll need a mortgage to buy your new place. Did you know that if you hire a loan company before the sale, they can help you with both houses? A mortgage broker can assist you with navigating the closing process on your current residence so that you can get the ball rolling on your new home sooner. They can save you time and money because you're using one company for both selling and buying.

Get the Opinion of a Professional Staging Expert

One of the most important rules of home staging is to keep the clutter out of your house. By minimizing the stuff you have inside your home before you stage, you reduce the time you have to pay the staging expert. Should you choose to do the work alone, it might be a good idea to fork over the hourly price for the staging professional to get a few ideas and tips specific to your home. You'll be able to use this information to guide you in the right direction.

As a general rule, you'll want to make the most room in your closets and on your counters. Additionally, cupboards should be cleared out, as well. You can rent or borrow furniture to use for staging if your items are in storage.

Don't Skimp on the Photography

Having the right batch of photographs is vital to a quick sell. When you list your home, the pictures should contain clear shots of the top features of your property. For instance, crown molding in the bedrooms, extra storage in the pantry and closet organizers in the master bedroom are excellent examples of things you could focus on. Also, it's always a great idea to post these photos on social media—friends and family will likely share and comment on them.

When you move, the items you packed in storage are going to be easy to unpack if you use clear tags and label each box appropriately. Planning ahead will help you find the things you need the most when you get to your new home. Take your time unpacking and enjoy the experience instead of feeling flustered at the end of a long transition.

Meghan Belnap is a freelance writer who enjoys spending time with her family. She finds happiness in researching new topics that help to expand her horizons. Currently, she covers the relocation industry for Forbes. You can connect with her on Facebook and Twitter.

This article is intended for informational purposes only and should not be construed as professional advice. The opinions expressed in this article are those of the author and do not necessarily reflect the position of RISMedia.

from RISMedia\'s Housecall https://ift.tt/2kzMNyy via IFTTT

0 notes

Text

$1 Million: What It Buys in the U.S. Housing Market

https://ift.tt/2H10Ypc

One-million dollars is a lot of money to most of the world’s population, but it’s a drop in the bucket to a billionaire. The housing market in the U.S. seems to have a similar relationship with homes valued between $900,000 and $1.1 million: Some of them are sprawling estates, while others are considered middle-of-the-road homes.

HouseCanary examined homes valued around $1 million in different metropolitan statistical areas (MSAs) across the country to determine what an “average” million-dollar home looks like, from San Francisco to Tuscaloosa, Ala. We found that what a million dollars will buy can vary widely from place to place—so if you’ve got $1 million to spend on a home, here’s what you can expect to get in return.

Where $1 Million Is Big Money In most markets, $1 million will get you a lot of house, but they might not be considered mansion material. We found that in the preponderance of markets (110 out of 375 metro areas), a million-dollar home is somewhere between 3,000 and 4,000 square feet. But there are also some markets where you can buy a true mansion or estate if you’re willing to spend between $900,000 and $1.1 million.

Those markets tend to be at least somewhat off the beaten path, so you may be sacrificing some shopping convenience, access to airports, or proximity to cultural, sports, or other local assets. And those markets may not also have relatively high household income, meaning you’ve got to save for a lot longer to make that million-dollar down payment. But the amount of room you’ll get to spread out and do your thing might make that kind of sacrifice well worth it!

Ohio is one state with several big cities, but it’s in unassuming Lima, about 90 minutes northwest of Columbus, where you’ll find the best deals for $1 million. The average million-dollar home in Lima, Ohio, is 9,435 square feet and sits on a four-acre lot. It has five-plus bedrooms, four bathrooms, and 4-5 parking spots. For that million-dollar home, buyers pay about $105.99 per square foot.

In Lima, most homes are very affordable. To pay a mortgage on a median-priced home in Lima, the median-income household would spend 17.30 percent of its income. The median household income in Lima is $45,575, and you can still buy a home there for much less than $100,000. So it’s not surprising that the two million-dollar homes in Lima are much larger than average!

You’ll find similar bang for your million-dollar buck in Anniston-Oxford-Jacksonville, Ala., about an hour and 20 minutes northeast of Birmingham, where the average million-dollar home is 8,354 square feet and sits on a five-acre lot. It has three bedrooms, 2.5 bathrooms, and 4-5 parking spaces. The price-per-square foot in this corner of Alabama for a million-dollar home is about $119.70.

Homes are also very affordable in Anniston-Oxford-Jacksonville, with the median household spending just shy of 17 percent of total household income ($41,954 annually) on a median-priced house.

Texas is another state with several big cities—Houston and Dallas are two of the biggest cities in the country. In Wichita Falls, Texas, about two hours and change northeast of Dallas, your average million-dollar home comes on a whopping 60-acre lot and is 7,852 square feet. The price-per-square foot is about $127.36—still very reasonable. It has five bedrooms, 4.5 bathrooms and four parking spots, and the median household in Wichita Falls spends just 13.94 percent of its annual $46,043 income on a median-priced home.

$1 Million in the Middle Even though there are more homes between 3,000 and 4,000 square feet than between 4,000 and 5,000, the average square footage for a million-dollar home across all metros studied is 4,305 square feet—which is quite a bit of room to stretch out, but still only about half the size of the biggest million-dollar homes in the country.

In the Nashville MSA (which also includes Davidson, Murfreesboro and Franklin, all in Tennessee), an average million-dollar home is 4,302 square feet, with 3-4 bedrooms, four bathrooms, and three parking spots nestled on a 0.96-acre lot. The price-per-square foot is $232.45—more than double the price per square foot in Lima, Ohio.

Affordability in Nashville is also middle-of-the-road: Most economists suggest that households spend no more than 30 percent of their total income on housing, and in Nashville, a median-priced house costs 30.5 percent of the median household income, which is $56,152 annually.

Richmond, Va., and St. Louis (spanning both Missouri and Illinois) are also relatively average markets. In Richmond, an average million-dollar house is 4,312 square feet on an 0.85-acre lot, with four bedrooms, four bathrooms, and two parking spots. The price-per-square foot is $231.91, slightly lower than in Nashville. A median home for a median household in Richmond uses 29.17 percent of its $61,124 annual household income.

And in St. Louis, the average million-dollar home is 4,330 square feet on a 0.93-acre lot. It also has four bedrooms, four bathrooms, and two parking spots. The price-per-square foot is very close to both Richmond and Nashville at $230.95. In St. Louis, the median household (which makes $56,726 per year) spends 21.83 percent of its income on a median-priced home.

Million-Dollar Babies It makes sense that in areas where housing is more affordable, million-dollar homes are larger. But what happens when affordability starts to creep up (and up…and up)?

As you might guess, when affording a home captures more and more of a median household’s income, the million-dollar homes get smaller. The smallest average million-dollar home in the country is in San Jose-Sunnyvale-Santa Clara, Calif., at 1,576 square feet, on a 0.13-acre lot. It has three bedrooms, two bathrooms, and two parking spots, and in this MSA, the median household spends 76.33 percent of its income ($100,469 annually) on a median-priced home. The price-per-square foot is an eye-popping $634.52, almost six times what you’d pay in Lima, Ohio, for a home.

In San Francisco-Oakland-Hayward, Calif., you’ll find a slightly bigger average million-dollar home at 1,600 square feet, on a 0.13-acre lot, with three bedrooms, two bathrooms, and two parking spots. The price-per-square foot is $625, just $9.52 lower than in San Jose-Sunnyvale-Santa Clara. A median household in the Bay Area makes $85,947 per year and typically spends 80.20 percent of its total income on a median-priced home.

Honolulu is another market with small average million-dollar properties. In Honolulu, the average million-dollar home is 1,846 square feet on a 0.15-acre lot, with four bedrooms, two bathrooms, and two parking spots. The price-per-square foot for a Honolulu million-dollar home is $541.71—definitely more reasonable than its San Francisco counterparts, but still almost double what you’d pay in Nashville, Richmond or St. Louis. The median household in Honolulu (which makes $77,161 per year) spends 61.62 percent of its income on a median home—still more than double the recommended amount, but much more reasonable than San Jose or San Francisco.

In Boulder, Colo., you can get slightly more square footage for a million dollars than in San Francisco. The average Boulder million-dollar home is 2,270 square feet on a 0.24-acre lot, costing $440.53 per square foot. It has four bedrooms and 2.5 bathrooms, with two parking spots, and the median household spends just over half (51.39 percent) of its $72,282 annual income on a median home.

If I Had a Million Dollars… Would you rather have a vast estate in Lima, Ohio, or Wichita Falls, Texas, or a cozy family home in San Francisco or Honolulu? Maybe opting for something middle-of-the-road in St. Louis or Nashville makes more sense…and it’s less square footage to clean!

This was originally published on HouseCanary. For more information, please visit www.housecanary.com.

For the latest real estate news and trends, bookmark RISMedia.com.

The post $1 Million: What It Buys in the U.S. Housing Market appeared first on RISMedia.

from News | RISMedia https://ift.tt/2IYLPqn via IFTTT

0 notes