Events and Trends in the Business of Media and Video Streaming

Don't wanna be here? Send us removal request.

Text

Samsung says its streamer “Samsung TV Plus” is a Top Platform as it Aims to Compete with Other FAST Services

According to Deadline, Samsung said its “Free Ad-Supported TV” (FAST) platform, Samsung TV Plus, is now one of the top platforms, expanding to over 700 different channels in the United States. They also reported that their FAST channels have increased its user engagement by 30% from the start of 2024 to 2025. Samsung continues to grow its library of exclusive content, such as hit YouTube channel “Good Mythical Morning” and David Letterman’s “Letterman TV” getting their own FAST channel to grow the platform’s audience.

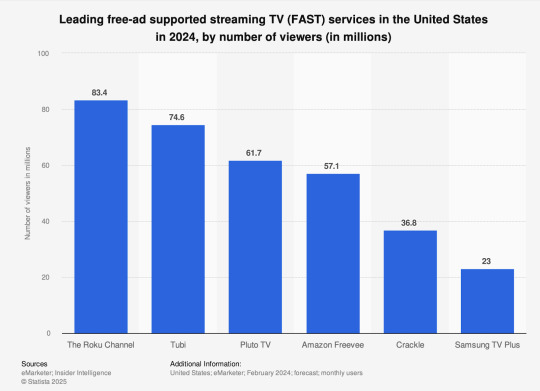

Samsung’s FAST platform seems to be gaining traction in the market, but it still struggles against the largest platforms with more active viewers and users like Tubi and Pluto TV. Samsung reported that its global users are similar to Roku, Tubi, and Pluto’s, yet the best-selling TV brand of Samsung already has its streamer “baked” into the smart TV device. Nielsen numbers present more accurate data as the service does not crack the top FAST platforms used.

While the company reported it has become one of the premier FAST platforms, viewership and user data show a different story. According to the graph above by Statista, while Samsung TV Plus has 23 million viewers in the U.S., it is only the sixth largest FAST streamer, with the top three being Roku with 83 million, Fox’s Tubi at 74 million, and Pluto TV with 61 million viewers.

Although FAST platforms have exploded in popularity over the past couple of years, there are concerns of oversaturation in the market. With over 1,500 different channels on several major platforms in just the U.S., these streamers are wary that the market might shrink due to the amount of content and channels overtaking the audience that is going to be there watching them. Retaining viewership might become a challenge to FAST services as it relies on advertising and its active users to generate revenue.

Samsung hopes to grow its audience and users for its FAST service, Samsung TV Plus. While they are seeing growth in engagement and viewership, the FAST audiences still gravitate to the more well-known platforms like Tubi and Pluto TV. As they expand their library of channels and content, Samsung has to be wary of over-saturating their platform with channels to maintain an audience to watch and optimize revenue sources.

(Word Count: 383)

0 notes

Text

U.K. Parliament Considers a “Streaming Tax” on Foreign Services to Boost British Film and TV Industry.

According to the BBC, a new report by the United Kingdom’s Culture, Media, and Sports (CMS) parliamentary committee urged the British government to impose a 5% streaming revenue tax on non-British platforms like Netflix, Disney+, Amazon Prime Video, and Apple TV+. This was proposed to support the local U.K. TV and film industry and to finance dramas with a “specific interest to British audiences.” The report read that foreign streamers should “put their money where their mouth is” when it comes to producing British content for local audiences.

This comes after the British psychological drama Adolescence was a runaway hit globally on Netflix in March 2025. The show quickly became the most watched British show on the platform and the 4th most popular English-language series ever on the streamer. According to Variety, a British Film Institute (BFI) report at the end of 2024 calculated that British film and TV production spending in 2024 totaled nearly £5.9 billion (~$7 billion), up 31% from 2023’s total money spent. The CMS hopes that this tax could plug even more of a spark into the British entertainment industry and help with local productions.

This committee sparked debate among politicians and streaming executives as growing political and global tensions grow between nations. According to The Hollywood Reporter, a statement from Netflix stated the tax would be “unfair” as the streamer already pays a BBC licensing fee and has invested billions of pounds in the U.K. film and TV industry with hit shows like Peaky Blinders and Adolescence. The streamer also threatened a price increase if the tax were to go into effect, stating that audiences would “ultimately bear the increased costs.” The Association for Commercial Broadcasters and On-Demand Services (COBA), a U.K. industry body, argued that it could hurt streaming investments and co-productions in Britain due to the price increase.

As global tensions rise due to uncertain tariffs and trade wars, streaming service companies and the entertainment industry are wary of the unpredictable markets and governments globally. Even with the ever-changing streaming landscape, streaming services have to adapt to both audiences as well as global political states to be competitive and remain relevant. Whether the British government decides to implement this levy, this conflict reveals how the streaming and entertainment landscape is intertwined with global political developments.

(Word Count: 386)

0 notes

Text

Apple Loses Over $1 Billion on Streaming as the Streamer Heads in a New Direction to Increase Audience and Revenue.

According to Variety, Apple lost over $1 billion per year on its streamer Apple TV+. In a report by The Information, as cited by Deadline, Apple has spent over $5 billion on content a year since launching Apple TV+ in 2019 but “trimmed that by about $500 million” in 2024.

Since its launch, Apple TV+ has had a “slow but steady” progression in subscription revenue with hit shows like The Morning Show, Ted Lasso, and Severance. The latter series grew the platform by almost 2 million subscribers with its second season in February. The graph above shows that Apple TV+ viewership is estimated to increase from 44.8 million to 46.6 million in 2025.

Yet, Apple continues to struggle profit-wise with its streaming service. Apple TV+ is one of the few streamers left that is not offering an ad-supported tier for consumers. Max and Netflix previously added these tiers to their service in 2021 and 2022, respectively, which have proven extremely valuable to streamers’ revenues.

Apple has struggled with its productions’ budgets and reported last September that they are rethinking its movie and TV strategy to cut costs. Apple previously funded large-scale projects like Martin Scorsese’s Killers of the Flower Moon and Ridley Scott’s Napoleon, which clocked production budgets of over $200 million. They partnered with theatrical distributors to give these films wide theatrical releases. After these films did not succeed at the box office, the company decided to pivot its strategy to pay less for content and its productions while turning to its streamer for distribution rather than the cinema.

Streamers have always had difficulty managing their content production and output with subscription profits. Until recently, Netflix was the only major streaming service that turned a profit yearly. But other streamers have become profitable, including Disney’s streaming unit (Disney+, Hulu, ESPN+) and Paramount+ last year. This is due to the increasing prices of subscriptions and the addition of ad tiers to attract consumers.

While Apple retools its content and streaming output, this report reveals an issue plaguing many streaming services. Most streamers run at a revenue loss due to producing high-cost content with little returns due to revenue streams not being as profitable as the theatrical box office or TV commercials. As the streaming landscape changes daily, services will have to rethink their content strategy to begin turning a profit.

(Word Count: 392)

0 notes

Text

Streamers Continue to Technically Struggle with Live Events as They Push into New Content Territory.

Last Sunday, Hulu livestreamed the 2025 Oscars alongside the typical broadcast channel ABC. Before the final two awards, Best Actress and Best Picture, Hulu accidentally ended its live broadcast. This technical failure led to millions of viewers missing the night’s final and most important awards.

Hulu’s mishap comes after Netflix hosted in November the live sporting event of Jake Paul vs. Mike Tyson boxing match that peaked at a reported 65 million viewers. Although Netflix raked in record numbers for their service, they were plagued by buffering and connection issues throughout the night, ruining most viewers’ experiences. Other viewers on streamers have also expressed issues while streaming NFL games on YouTube and Prime Video. In a Washington Post article, eMarketer senior analyst Ross Benes said streamers “can’t come anywhere close” to casting live events like linear TV.

Streamers have struggled with live broadcasts because of service’s reliance on internet connections and failure to handle the amount of viewers watching on their servers. This is in contrast to linear television which is designed to “beam” the content to everyone simultaneously.

According to the chart above, last June, streaming services like Netflix and Hulu crossed over 40% of U.S. TV usage. As streaming services continue to increase in usage and linear TV declines, more streamers will target content like live sports and events due to their popularity.

Alongside Thursday Night Football, Amazon Prime Video will add NBA games in 2025. NBC will also host NBA games on Peacock in 2025. In 2024, Netflix started to host the NFL’s Christmas games and the SAG Awards in 2024.

Although technical difficulties happen, streaming services are still an extremely popular way to watch live events. Tubi hosted the most recent Super Bowl LIX to a record number of 127.7 million viewers, up 3.4% from 2024’s Super Bowl, mostly attributed to the free service providing the popular sporting events of the year. This year’s Oscars reported its highest viewership since 2021’s massive decline, amassing 19.7 million watchers, due to Hulu’s involvement with the ceremony.

As streaming services continue to push into live content, there is optimism of streamers offering a more smooth viewing experience akin to cable and broadcast networks, almost “flawless” operations of broadcast and cable channels. Streamers hope to improve their viewing experiences with live content so they can have more content for millions of audiences globally.

(Word Count: 397)

0 notes

Text

Streaming Wars Heat Up in Southeast Asia as MAX Launches Successfully in the Region

According to a report published by Singaporean-based media consultancy Media Partners Asia, Max captured 26% of the fourth quarter net customers additions in Southeast Asia after launching last November in five SEA markets: Thailand, Malaysia, Indonesia, Singapore and the Philippines. Max replaced the former HBO Go that has continued to operate in the region since 2010. With the release of the service in SEA, the region saw a 14% surge in PVOD revenue during the quarter.

In the report, as cited by The Hollywood Reporter, the strong opening performance was driven by subscription sales in Thailand and Indonesia. The MPA predicts Max will continue to attract subscribers and increase engagement as it rolls out more content, notably with a new season of HBO’s The White Lotus set in Thailand. According to Variety, the president of streaming at Warner Bros. Discovery JB Perrette sees the Asia-Pacific region as the “biggest region in terms of opportunity for growth,” primarily due to their streamer.

According to the chart above, Indonesia is currently the top country globally for video streaming viewer growth. This country has the potential to be one of the most important for streamers and Max hopes to capture this audience who are viewing more and more content through video streaming services like Max. The MPA report states that Q4 significantly expanded SVOD subscribers by 3.2 million, reaching a region high of 53.6 million subscribers total. WBD hopes to tap into this quickly growing market by releasing its premium streaming service.

Although Max launched successfully in this region last quarter, Netflix still continues to dominate the region in terms of customer growth and additions. According to Deadline, Netflix captured about 48% of the Q4 net additions. Netflix continues committing to producing more content in SEA including 14 productions from Indonesia and Thailand in 2025. The continuing Netflix dominance in the region is reflected globally, as it is the most popular service in most markets in the world. Yet, other streamers are breaking through in SEA such as local and regional services and Disney+’s 10% revenue share in the region.

With streaming expansions in the region and growth in subscribers, Southeast Asia is becoming an increasingly competitive region between streaming services. This region's own streaming wars reflect the global market as services add more options for subscribers to capture audiences like live sports and interactive content.

(Word Count: 396)

0 notes

Text

Disney’s Box Office Booms Starts Q1 of the Fiscal Year Strong Despite a Decline in Disney+ Subscribers

Disney started the fiscal year (October-December 2024) quite strong. Despite the decline in Disney+ subscribers, in Quarter 1, the company turned a profit through theatrical and price increases to their streaming services. As reported by Variety, this is due to Disney’s massive box office success with Moana 2 and their streaming services of Hulu and Disney+ earning them a profit.

The success of Moana 2 was attributed to Disney+ and the streaming of the first Moana from 2016 on the platform. According to Nielsen, the original film was streamed more than 1 billion hours and was the “most streamed film in the U.S. for the second year in a row” on Disney+.

Additionally, Nielsen adds that Disney is the #1 company in total TV usage, partly due to popular shows such as the children’s animated series Bluey, the medical drama Grey’s Anatomy, and Fox’s adult animated shows like Bob’s Burgers and Family Guy that are on their streamers.

Although their streaming services turned profitable once again, according to IndieWire, Disney+ and ESPN+ both lost over 700 thousand subscribers each in the quarter. This is in part due to the price hikes Disney started issuing over several streaming services and bundles in October of 2024. Each of Disney’s individual services was increased by two dollars.

As shown in the graph above, Disney+ over the past fiscal year has been gradually increasing its subscriber base to around 158.6 million subscribers. From June through September, Disney+ added 4.4 million new subscribers. With the new prices, Disney CEO Bob Iger stated that they did “better than [they] had expected” in regards to subscription churn. He added that the company policy of cracking down on account sharing as well as their subscription bundles of Disney+ and Hulu helped regrow subscribers.

Interestingly, Disney’s other main streaming service, Hulu, reported a 1.6 million subscriber increase in the quarter. This could be attributed to the popularity and awards attention gained by FX’s shows like The Bear and Shogun streaming on Hulu.

Ultimately, Disney’s earnings report represents the impact of theatrical success on media companies and its lasting importance to Disney even in the streaming era. It also shows a trend for streamers to keep increasing their prices for consumers and adding ad-supported tiers to make their platforms more attractive for audiences looking to spend less.

(Word Count: 391)

0 notes

Text

My Sector is Video Streaming

My sector is Video Streaming and I will be following Deadline, Variety, and The Hollywood Reporter.

0 notes