Hemang Subramanian is a business academic, a product enthusiast and software professional.

Don't wanna be here? Send us removal request.

Text

Ethereum 2 and the bumper harvesting of tokens in proof of stake

Ethereum 2 and the bumper harvesting of tokens in proof of stake

The beacon chain that arose as the result of 3 years of work of the ethereum community secured more than the required number of validators on the network. The statistics of the ethereum network are shown on https://beaconscan.com. While beacon chain works as the active test net for it’ s massive scalability re-design, it is definitely a showcase of the powerful unity amongst the ethereum…

View On WordPress

2 notes

·

View notes

Text

The Dow Jones Crypto Index

The Dow Jones Crypto Index

The year 2021 will possibly be noted as the year when the world recognizes mainstreaming of cryptocurrencies as the first possible type of blockchain based assets in markets. The signal from Dow jones a reputed industry standard for indices and a powerful market determinant – about launching a separate cryptocurrency index will possibly be a silver lining in the otherwise grey cloud. While the…

View On WordPress

1 note

·

View note

Text

Regulation and the FinHub-SEC

Regulation and the FinHub-SEC

One of the most progressive endeavors in the financial sector affecting mass adoption has been that of whether governments are willing to actively regulate a class of assets against fraudulent rent seeking by unscrupulous market actors. While most markets are governed by inherent reputation mechanisms, that operate as a forewarning to future investors, cryptocurrency markets – because of its…

View On WordPress

1 note

·

View note

Text

Uniswap and the Life of a Protocol

Uniswap and the Life of a Protocol

In decentralized finance,and in the overall blockchain sector, what has always mattered is that the protocol survives beyond the scope of the current software it runs within. As a result, we have seen massive adaptations after adoption of the first instance of a successful protocol. For example, The bitcoin protocol has morphed into multiple different protocols and chains, and coins over the past…

View On WordPress

0 notes

Photo

The PayPal effect on Cryptocurrencies As someone who studies cryptocurrencies, it is again a measure of maturity when a major peer to peer or business integrated financial applicatin integrates cryptocurrencies.

0 notes

Text

Reputation: The most important sensemaking feature for alt-coin investors

Reputation: The most important sensemaking feature for alt-coin investors

As the blockchain community matures slowly, there is a mechanism of sensemaking happening for the 1000’s of alt-cryptocurrencies available for trade. This sensemaking process is what drives customers to buy and/or list tokens on exchanges or on balancers, which support liquidity pools.While most of the tokens we see and experience are utility tokens which have a primary sensemaking mechanism to…

View On WordPress

0 notes

Text

Is there really a migration from Eth1 to Eth2?

Is there really a migration from Eth1 to Eth2?

Eth2 is A separate Chain

While everyone waits for a quick roll out onto Eth2, it is important to note that Eth2 is a separate chain by itself. Eth1 will continue to run, with its millions of dapps (and smart contracts) off a separate chain even after Eth2 is fully functional in the next few years. As of now the testnet is labeled Madella. The whole idea here is to have Eth1 and Eth2 run…

View On WordPress

0 notes

Text

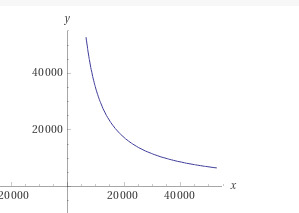

The Mirage of Liquidity Pools

The Mirage of Liquidity Pools

The most common assumptions of uniswap.org or balance.io is that asset swaps and liquidity pools are risk-neutral, due to the balancing nature of markets.

The constant product equation does not hold under thee conditions a) selloffs b) reduction in value of asset n and c) when transaction fees for liquidity utilization increases beyond a percentage of the network’s value.

The constant product…

View On WordPress

0 notes

Text

Decentralized Liquidity Pools and Automated Market Making with Uniswap

Decentralized Liquidity Pools and Automated Market Making with Uniswap

uniswap.org is a decentralized constant product liquidity protocol, which is secure and creates liquidlity pools of ERC-20 token. given the recencey of uniswap, the protocol almost has 2 billion dollars worth of ERC-20 tokens locked up and faciliates close to 400 million dollars of decentralized trade every day (sometimes even more).

How does it work? – The basics.

Automated market making is…

View On WordPress

0 notes

Text

The Coinbase Effect on Cryptocurrencies

The listing of cryptocurrencies on private currency exchanges has traditionally been a were-withal arrangement, wherein the exchanges determine unilaterally (almost) as to which ones get listed. in a decentralized world, that is a rather one-sided agreement. However, with or without centralized exchanges we have seen a significant growth of cryptocurrency adoption for many traditional…

View On WordPress

0 notes

Text

Blockchain based Decentralized Machine learning protocols and marketplaces that reward users

Blockchain based Decentralized Machine learning protocols and marketplaces that reward users

Numerai is a platform, that rewards data scientists and assembles all models into a meta-model which is then applied to a centralized hedge fund. Based on the applicability of the submitted ML algorithm, users are rewarded. Also, users who submit their ML algorithms have to stake their corresponding cryptocurrencies in NMR onto the platform. More recently, the team behind Numerai released a…

View On WordPress

0 notes

Text

Decentralized Insurance for Decentralized Finance

Decentralized Insurance for Decentralized Finance

In the previous post, I discussed why decentralized insurance options for smart contractscould be a feasible mechanism to guard against unforeseen vulnerabilities. however, the decentralized finance world – highly lucrative in terms of decentralized products; most of which operate on top of the ethereum blockchain has no such protections against loss. Due to the decentralized nature of…

View On WordPress

0 notes

Text

Decentralized Insurance for Smart contracts

Decentralized Insurance for Smart contracts

One of the largest events that has impacted the smart contracts ecosystem is the lack of security and an ever increasing number of vulnerabilities in the decentralized space. A very detailed account of vulnerabilities in this smart contract ecosystem has given analysts, security firms such as trail of bits a lead in detecting and to some extent recommending best practices. That being said, there…

View On WordPress

0 notes

Text

Decentralized Finance Service categories.

Decentralized Finance Service categories.

The decentralized finance industry is a revolution happening in the banking industry slowly but surely.

There are three main categories of Defi providers in the crypto-sector, most of whom operate via the Ethereum block chain and its supported protocols. I label them as a) Centralized Defi service providers b) Decentralized Defi service providers and c) Auxilliary Defi Service providers.

View On WordPress

0 notes

Text

Smart Contract Vulnerabilities

Given the importance of smart contracts on major block-chain platforms such as Ethereum, EoS, Tezos, Monero, etc. there has been a renewed understanding and focus on security vulnerabilities in smart contract space. Given the recency of this domain, firms such as trail of bitshave created a niche in detecting, analyzing and preventing vulnerability exploitation. The problems with smart contract…

View On WordPress

0 notes

Text

Why Emerging Economies need to invest in, legalize and regulate Blockchain and Major Cryptocurrencies?

In this article I shall focus about the BRICS nations as they are the largest emerging economic bloc.

There have been talks of banning, opening up and re-banning the crypto-sector in India. Similarly there have been ambiguous laws about cryptocurrencies in china – which for the most part controls the entire mining network of Bitcoin, and possibly many other networks with the largest mining…

View On WordPress

0 notes

Text

Physical Assets to Crypto-Tokens through smart contracts

Physical Assets to Crypto-Tokens through smart contracts

The true power of the crypto-ecosystem and blockchains lies partly in the fact of creating legally viable “mechanisms” of trade that is overseen by the network, and is truely location agnostic. For example, if one were to own the rights for an asset (say a music streaming service or rights to a particular song), then one would have to negotiate with the musician or his/her representative directly…

View On WordPress

0 notes