Don't wanna be here? Send us removal request.

Text

60.g - Justify ethical conduct as a requirement for managing investment portfolios

The portfolio manager is in a position of trust and must meet the standards of competence and standards of ethics as outlined in the code of ethics.

0 notes

Text

60.f - Contrast the types of investment time horizons, determine the time horizon for a particular investor, and evaluate the effects of this time horizon on portfolio choice

Time horizon can be short-term (< 10 years), long term (> 10 years) or multi-stage (combination of short and long term). The horizon will influence the ability to accept risk, with greater ability to take on risk the longer the time horizon.

0 notes

Text

60.e - Define investment objectives and constraints, and explain and distinguish among the types of investment objectives and constraints

Investment objectives include:

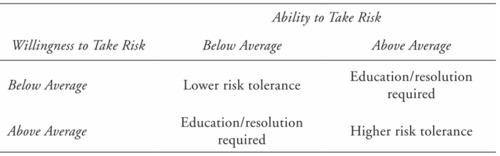

Risk objectives: investors' willingness and ability to take risk. There are differences between individuals and institutions in regards to risk. The main factors affecting the ability to take risk include required spending needs, long-term wealth targets, financial strength, and liabilities

Return objectives: will include the desired return (as stated by client) and required return (determined by long-term goals). This must be consistent with the risk objective and needs to be considered from a total return perspective.

This is what is meant by the fact that risk and return objectives must be consistent:

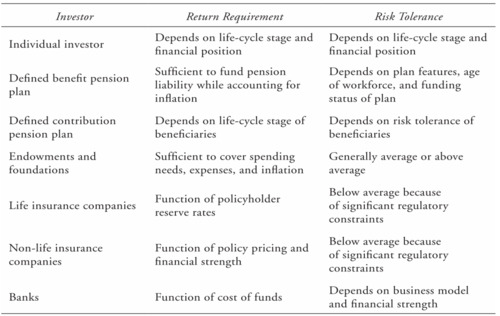

A summary of the investment objectives for various types of investors is as follows:

Investment constraints are the factors that limit available investment choices and include:

Liquidity: Cash outflows greater than income

Time Horizon: Time period over which the portfolio is expected to generate returns

Tax

Legal/Regulatory: More important for institutions (insurance co's, banks, etc.)

Unique Circumstances

0 notes

Text

60.d - Explain how capital market expectations and the investment policy statement help influence the strategic asset allocation decision and how and investor's investment time horizon may influence the investor's strategic asset allocation

Approaches to investing include:

Passive investment strategies

Active investment strategies

Semi-active (risk-controlled, or enhanced-index strategies)

The point is that asset allocation will be determined by IPS (objectives and constraints) and capital market expectations (expected returns, variances, covariances). The combination of them forms the strategic asset allocation in which the optimal portfolio will fall on the efficient frontier.

0 notes

Text

60.c - Explain the role of the investment policy statement in the portfolio management process, and describe the elements of an investment policy statement

The IPS is a formal document that governs the investment process, including objectives and constraints. The main purposes of the IPS are:

it is easily transportable (we can go from one manager to another with the same IPS

promotes long-term discipline

prevents short-term strategy shifts

0 notes

Text

60.b - Describe the steps of the portfolio management process and the components of those steps

Steps are:

Planning: Analyzing objectives and constraints, developing the IPS, determining the investment strategy, allocating assets

Execution

Feedback

0 notes

Text

60.a - Explain the importance of the portfolio perspective

Risk and return is evaluated at the portfolio level. That is, we analyze portfolio risk and return, not the risk and return of individual securities. This recognizes the benefits of diversification and focuses attention on systematic risk (risk that can not be diversified away).

0 notes

Text

59.e - Describe the assumptions on which the fundamental law of active management is based

The fundamental law of active management assumes that:

The manager has accurate knowledge of her skills and exploits this optimally. In other words, the manager recognizes what she knows and what she doesn’t know and invests appropriately.

The sources of information used by the manager are independent so that each bet is based on new information.

The information coefficient is the same for each bet, meaning that the skill involved in making each forecast is the same. If not, we can categorize the bets into “skill buckets” and use the additivity principle.

0 notes

Text

59.d - Describe how the information ratio changes when the original investment strategy is augmented with other strategies or information sources

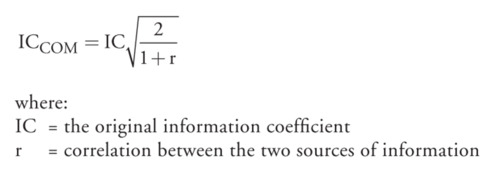

When the active manager augments her information set with an additional source of (correlated) information, the new information coefficient with the combined sources of information is given by:

Example - Combined information

Dan is an active manager with Promus Capital. He relies on a proprietary model to screen small cap stocks for his portfolio. The correlation between model returns and actual returns is 0.15.

He seeks to improve his model by including additional data. He estimates that the correlation between the information used by the existing model and the new information embedded in the additional data is 0.3. Compute the % change in his IR as a result of model enhancement, keeping everything else constant.

New IC = 0.15[2/(1 + 0.3)]^1/2 = 0.19

% change = (0.19 - 0.15)/0.15 = 27%

0 notes

Text

59.c - Contrast market timing and security selection in terms of breadth and required investment skill

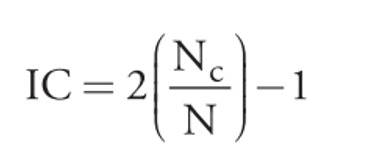

Market timing is simply a bet on the direction of the market. The information coefficient for a manager is calculated as follows:

Where the manager makes N bets and Nc bets are correct. Note that if the manager is right half the time, his IC will be 0.

Example - Market Timing

Ben Dash, a market timer, makes best on the direction of the market and is correct 53% of the time. Ricardo Nunos, a security selector, makes monthly bets on 10 stocks with an Information Coefficient of 0.04.

Calculate the number of bets Dash needs to make to match the Information Ratio of Nunos.

Nunos IR = 0.04(120)^1/2 = 0.44

Dash IC = 2(.53) - 1 = 0.06

To match, 0.44 = 0.06 x (BR)^1/2

BR = 53.77

0 notes

Text

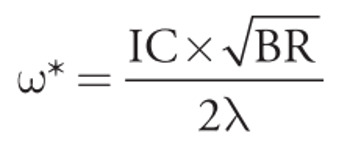

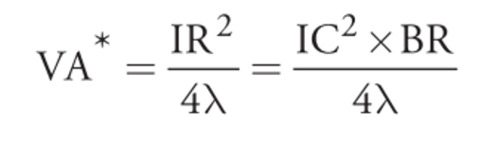

59.b - Describe how the optimal level of residual risk of an investment strategy changes with information coefficient and breadth, and how the value added of an investment strategy changes with information coefficient and breadth

The optimal level of risk is given by:

The optimal level of risk increases with information coefficient and breadth and decreases with risk aversion. Note that this is the same formula as in the last reading but we've substituted for IR in the numerator.

We also incorporate the IR to get the maximum value added:

0 notes

Text

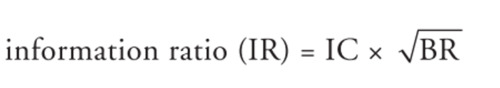

59.a - Define the terms “information coefficient” and “breadth” and describe how they combine to determine the information ratio

Information coefficient (IC) is a measure of a manager's forecasting accuracy. It is the correlation of a manager's forecasts with actual outcomes.

Breadth (BR) is the number of independent forecasts of exceptional return per year that the manager makes.

IC and BR combine to form another way to calculate the information ratio:

Example - Information ratio

A manager with an IC of 0.12 makes quarterly forecasts on 12 healthcare stocks. Calculate his IR.

IR = 0.12(48)^1/2 = 0.83

** End Example

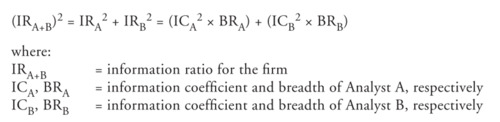

The additivity principle allows us to determine a firm's information ratio by combining the IR's of individual analysts using the following formula:

Note that the formula calculates the IR for the firm squared. Remember to take the square root of it for exam questions.

0 notes

Text

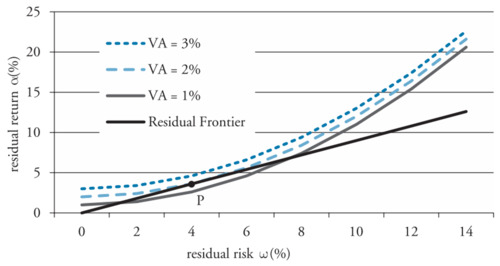

58.e - Justify why the choice for a particular active strategy does not depend on investor risk aversion

Value added increases with the information ratio, regardless of risk aversion. Investors will choose the manger with the highest information ratio regardless of their risk aversion, as seen below:

0 notes

Text

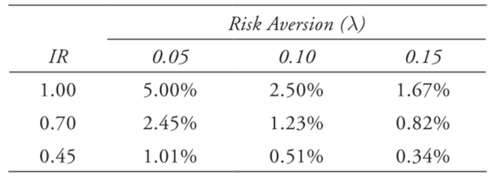

58.d - Calculate the optimal level of residual risk to assume for given levels of manager ability and investor risk aversion

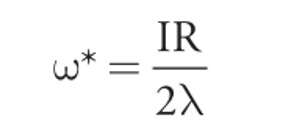

The optimal level of residual risk to assume is equal to:

The higher the information ratio and the lower the risk aversion, the higher the optimal level of residual risk. It is pretty logical, if I'm more risk adverse, I want lower residual risk.

Example - Optimal Residual Risk

A bond portfolio manager estimates that he has an information ratio of 0.30. Compute the optimal residual risk for an investor with low risk aversion (lamda = 0.05), moderate risk aversion (0.10) and high risk aversion (0.15).

For low, w* = 0.30/(2)(.05) = 3.0%

For moderate, w* = 0.30/(2)(0.10) = 1.5%

For high, w* = 0.30/(2)(0.15) = 1.0%

0 notes

Text

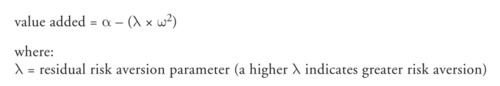

58.c - Explain the objective of active management in terms of value added

The objective of active management is to maximize value added, which is a metric that attempts to capture the tradeoff between active return and active risk. The formula for value added is:

Note that this formula uses return and risk in percentage (not decimal form). That is if alpha = 4%, λ is 0.10 and w is 5%, Value Added = 4 – (.10 x 52) = 1.5.

Risk aversion will be given in the exam (don't worry about how it is calculated).

Investors prefer the highest value for their value added, but are limited to the opportunities presented by their residual frontier.

Example - Value added

A bond portfolio manager for a regional bank estimates that he can generate an annual residual return of 2%. His residual risk is 7%. What is the value added for an investor with moderate risk aversion (lamda = 0.10)?

VA = 2 + (.10 x 7^2) = -2.9%

0 notes

Text

58.a,b - Define the terms "alpha" and "information ratio" in both their ex post and ex ante senses; Compare the information ratio and the alpha's t-statistic

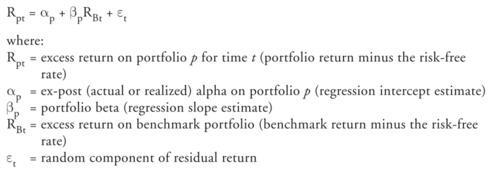

This reading focuses on ex-ante alpha, which is the expected (risk-adjusted) residual return over a benchmark. This is as opposed to ex-post alpha which is the excess return actually realized over a measurement interval. Ex-post alpa is calculated using a regression model.

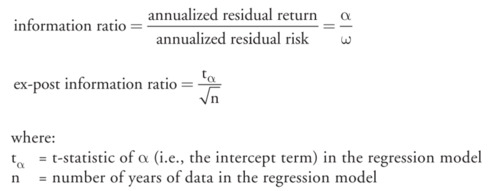

Alpha is then a key input into calculating the Information Ratio:

Information ratio varies by the measurement horizon. A quarterly information ratio would be half of the annual information ratio. This is because volatility is increased by the square root of time. That is, suppose we have a quarterly information ratio of 1 with values of 2/2. To annualize it, we multiply the alpha by 4, but the risk (volatility) by the square root of 4. This gives us a new information ratio of = 8/4 =2.

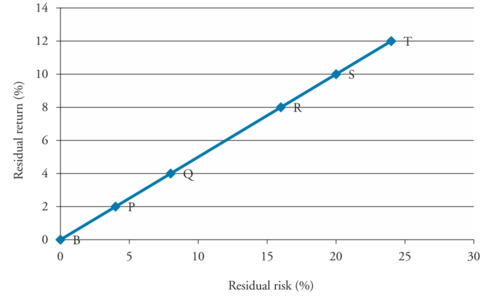

A manager's level of aggressiveness doesn't affect her information ratio, and for an active manager, the information ratio can be viewed as a budget constraint. The manager can only increase the active return by increasing the residual risk.

Plotted on a graph, we can see the relationship between alpha and the information ratio as the residual frontier for a manager with an IR = 0.5:

0 notes

Text

57.n - Compare underlying assumptions and conclusions of the CAPM and APT model, and explain why an investor can possibly earn a substantial premium for exposure to dimensions of risk unrelated to market movements

CAPM makes many implausible assumptions and considers only one factor, market risk (systematic risk). CAPM assumptions include:

Investors only need to know expected returns, variances and covariances to create optimal portfolios

All investors have the same forecasts of expected returns, variances and covariances

All assets are marketable, and the market for assets is perfectly competitive

Investors are price takers

Investors can borrow and lend at the risk-free rate

There are no transaction costs or taxes

APT assumes that returns are derived from multifactor processes, unsystematic risk can be diversified and there are no arbitrage opportunities. The problem with the APT is that we don't know what the factors are.

The key differences between CAPM and APT are:

CAPM is a single-factor model where market risk (beta) is the only priced risk; predicts that investors hold a combination of the market portfolio and risk-free asset

APT is more flexible because there is no special role for the market portfolio and it allows for more than one priced risk; investors can tilt away from the market portfolio to gain or hedge exposure to specific factors besides market risk

0 notes