Don't wanna be here? Send us removal request.

Text

Why Choose SIP over other Investment Plans?

Stock Markets have historically given better returns than other investments avenues and Systematic Investments in Mutual funds allows you to enjoy good returns. You have the flexibility to invest in different options. Even with small amounts, you can enjoy decent accumulation. Still there exist various other options that are beneficial like equities, PF, insurance policies etc. the question arises Why Invest in SIP?

Top Reasons to Invest in SIP:

● No Research Required:

This field of investment is very well managed by experts. You need not devote the time or track the market regularly. The experts manage it well by carrying out extensive market research relative to economy, companies and industry, and create portfolio of a Mutual Fund Scheme.

● Easy Diversification:

You can invest in different mutual fund schemes and need not put all your savings in one basket. Not much amount is required to start dividing your investments. Diversification involves the least risk or the possibility of loss through a company or a fund is considerably reduced. To seek advice, you can approach SIP Consultancy in Delhi.

● Transparency:

Mutual fund industry is completely transparent and is well regulated by SEBI and AMFI. There are several rules and regulations in the industry that are favourable to investors. This option of investment offers safety to investors due to being well regulated.

● No Timing Restrictions:

With your investments in the Mutual funds market through SIP, you don't have to think about the level of markets and you keep investing irrespective of market being low or high capturing it’s volatility to your advantage.

● No effect on Budget:

SIP can be as low as Rs. 500, it is not like a single time investment where you have to pay a bulk amount the way you buy shares from the market. It will have no effect on your monthly expenses. You can earn, invest and run your life smoothly. You will not even know if such a small amount is deducted from your monthly earnings.

Conclusion:

Investment in SIP has all the favours if looked upon from investors point of view. You need not think much before you start your investment. The basic reasons to consider SIP in Mutual funds as your investment option are very well detailed in the blog.

0 notes

Text

Reasons To Invest In Mutual Funds via SIP

It is a very simple financial instrument, designed for those looking to participate in an investment portfolio. If you are looking for best mean, then we have mentioned some tips that will help you to know Why To Start Investing In Mutual Fund via SIPs.

Let us talk about Five Reasons To Invest In SIPs

Diversification:

An investment rule - for both large and small investors - is the diversification of assets. Diversification involves mixing assets in a portfolio in order to manage risks more adequately. To build a diversified portfolio, the investor must select bonds from different issuers and with different maturities, or shares of different sectors and sizes. This can be quite cumbersome for some people.

The biggest advantage to invest in SIP mutual funds is that instant diversification is achieved. Therefore, this can be a good alternative for the small investor who does not have the money to buy a sufficiently varied portfolio of stocks and bonds.

Professional Management

When you buy a mutual fund you are also choosing a professional who will take care of your investments. He will use the funds you have invested to buy assets that he has already studied with his team of analysts. Therefore, instead of wasting time analyzing each investment, you will have a manager who will be exclusively dedicated to managing your investments.

Liquidity:

Another advantage to invest in SIP mutual funds is the ability to enter and exit with ease. You can find options with liquidity in 24, 48 and 72 hours.

Economies Of Scale:

Mutual funds allow taking advantage of their size of purchase and sale, and, therefore, can reduce transaction costs for investors.

New Assets:

There are assets that, due to their minimum order size or complexity to operate, are inaccessible for the small investor. Mutual funds allow access to this type of assets by investing a small amount of money.

0 notes

Text

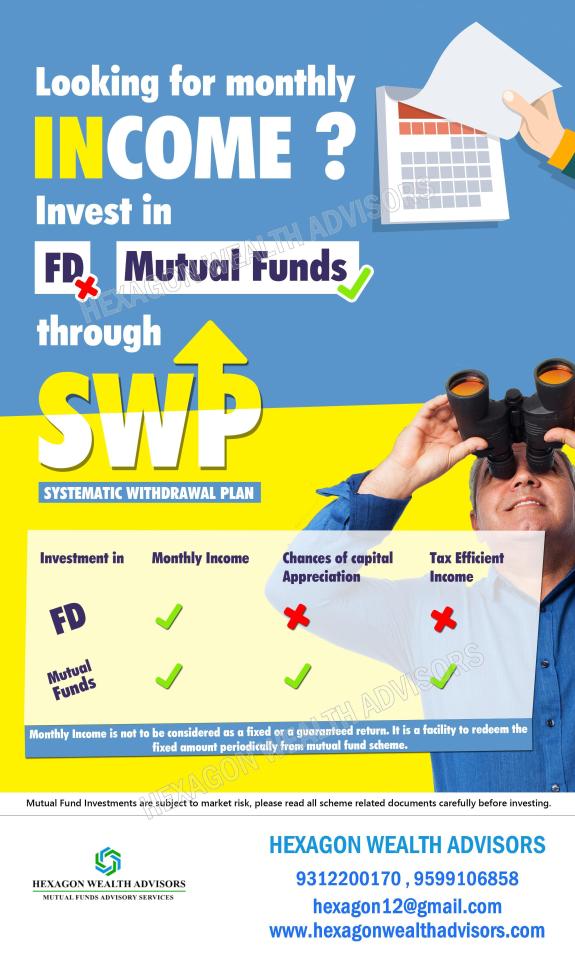

Fixed Deposits - ThingsTo Know Before Investing

A fixed-term deposit is an investment alternative that consists in depositing a certain amount of money in a financial company in exchange for receiving, at maturity, the deposited capital plus the interest that has been promised.

Below are some Investing In Fixed Deposits Pros and Cons:

Benefits:

Returns according to the term of maturity: The longer the time of the term deposit, generally greater the profitability that will be obtained.

Easy and fast contracting: Another advantage of the fixed term is that hiring a fixed deposit is a short time and is also a straightforward process, which can sometimes be done online through the online banking of the financial institution where the deposit is made and through your Financial Advisor.

Liquidity: In some fixed-term deposits, financial institutions do not charge any commission for withdrawing the money before the expiration of the fixed-term deposit.

Disadvantages of fixed deadlines:

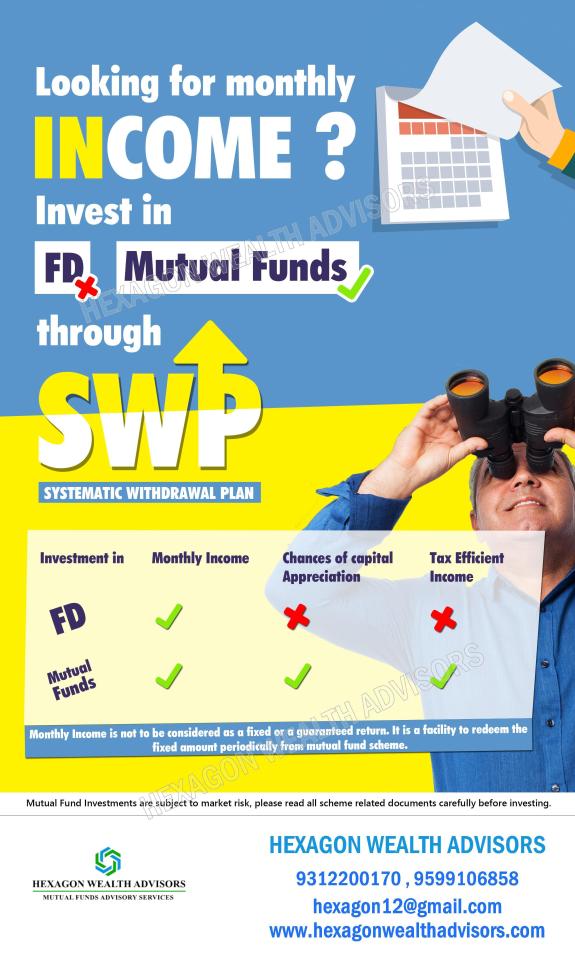

Low returns: One of the drawbacks of the fixed term is that although the profitability obtained is assured and has no risk, it is true that in this type of deposited there is low returns compared to other investment alternatives like Mutual Funds.

Taxation: Fixed deposits are not Tax Efficient , and the holder has to pay tax as per his/ her income slab.

To know more about Fixed Deposits, it is best to contact with Fixed Deposit Advisor as he is the person who can guide you whether Fixed Deposits is right for you or not.

0 notes

Text

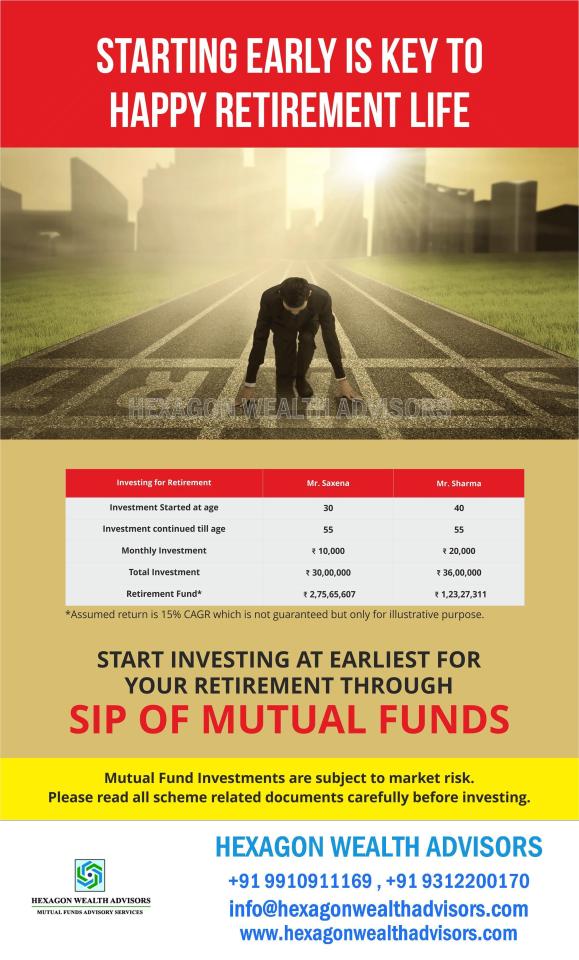

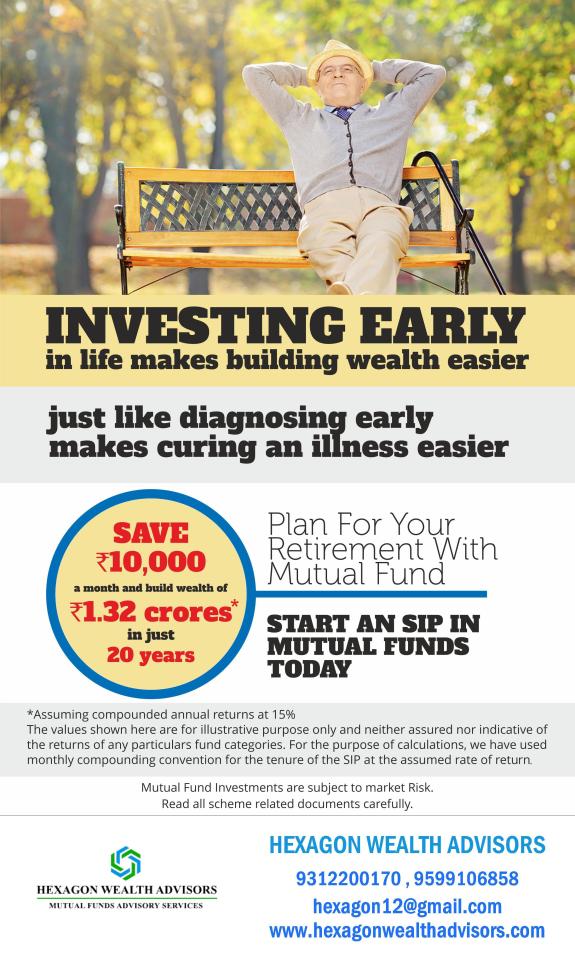

Save for retirement: planning and knowledge

Planning a good retirement savings plan entails making decisions aimed at having our basic needs met, as well as maintaining our quality of life once professional retirement has been achieved. Given this horizon, it is important to answer various questions, such as:

How much do you need to supplement your retirement pension? The age when you will retire? The answer to these questions is channeled through a word: Retirement Planning Advisory Service In India.

To prepare for retirement, it is important to reflect on the lifestyle you want to take. That is to say, beyond having our needs met, it will mean deciding what you want to spend time with: going to the cinema, to the restaurant, traveling, etc. For this, it is necessary to calculate the income that we have knowing the public pension that will be received.

Start Your Retirement Planning Now: Initiating a plan for retirement entails, on the one hand, good advice, through all phases of life and on the other, deepening financial knowledge for this purpose. Keep in mind that counseling starts with knowing how much can be saved and invested each year and then choosing a Retirement Planning Advisory Service In India that channels it, depending on the profile and the needs of each one, and finally, deciding how you want to perceive savings once you got to retirement.

If you need help to Start Your Retirement Planning Now, visit us we are available to help you.

0 notes

Text

Make Investment via SIP In Mutual Funds

Saving is significant, but having many options to invest these savings can be a challenging experience. Many people do not have the time or experience to manage their investments on a day-to-day basis, so SIP In Mutual Funds is quite a worth way. Mutual Funds are sets of assets that agglomerate the contributions of several investors under the supervision of a team of investment professionals.

The Mutual Fund Choice:

It has an objective component and a subjective component. The objective component is the proportional relationship between risk and return. A more uncertain or volatile investment should pay more in its long-term average. Not because an asset looks more risky will necessarily be more profitable.

There are cases in which listed companies have gone bankrupt, and investors have lost all their money. That is, any individual asset can become risky over time. This market risk is offset by a higher average return for a set of Best Mutual Funds to Buy over a long time horizon. , via SIP, and also in a mutual fund scheme, money is diversified and invested in a number of stocks, thereby reducing risk.

Benefits of Mutual Fund Advisory Firm:

Thus, the objective of a team of professionals that manages mutual funds is to select the mix of assets that will generate higher returns than the than risk free returns over a period of time, at acceptable risk according to the combination of assets.

Mutual funds have schemes which invest in different segments of markets, like a large cap fund, small cap fund or a multi cap fund, hence a mutual fund advisory firm helps investor to select a scheme which is suitable to him/her.

0 notes

Text

Benefits of SIP Consultancy in Delhi

The job of the financial advisor is to counsel and guide people in making decisions related to their finances and investments.

Having the services of a financial advisor can help us to avoid mistakes, to reach our goals and the long-awaited financial independence in a faster way.

If you are considering hiring the services of a financial advisor, review these benefits of hiring SIP Consultancy in Delhi.

Objectivity In Information:

When an executive of a bank or financial institution offers you advice, most of the time he is trying to sell you some product. By not working for any broker or financial institution, the only interest of a financial advisor is to find the product or plan that most benefits to their client. He knows that his success depends on the success of his client and the best reference for his work is a satisfied client.

The client has a comprehensive analysis of their financial situation

Good financial advisors do not focus only on investment. They analyze the financial situation of the client comprehensively, paying special attention to factors such as their family situation, income, and expenses, as well as their expectations of future expenses.

Facilitates tax planning

The Investment Planning Advisor is able to provide the investor with ideas, strategies, and tips for an intelligent tax planning, which allows him to comply with the law, but at the same time take advantage of the existing tax benefits to minimize the tax payment. The idea is to obtain the most significant possible profit of all rents.

Help to avoid mistakes

Success in the financial field does not depend solely on technical knowledge and access to information. It also influences an objective mentality, have disciplined processes and constant monitoring of investments.

The Hexagon Wealth Advisors is responsible for all this and much more, always watching over the interests of the client.

0 notes

Text

Come to know How you can start investing in Mutual Funds

Mutual Funds are a more attractive investment alternative than traditional bank deposits. Starting to invest in Mutual Funds is simple, has low costs and offers several alternatives for each level of risk.

What are Mutual Funds ?

A mutual fund is an investment alternative that consists of grouping the monetary contributions of different people, natural and / or legal, to invest them in different financial instruments. In case of Mutual Funds conditions will be more favourable to those that would occur if each participant did it alone. In a nutshell, it is a collective investment.

How do Mutual Funds work?

Do you want to know How mutual funds work, then below is the answer. These are voluntary contributions, from individuals or legal entities, to a fund, which is administered by a Fund Management Company.

Investors give money to the Administrator and the mandate is to invest in different types of assets. The condition is that the investment has to converse with the mandate of the scheme launched by the asset management company.

How to invest in them?

Anyone can approach the office of a SIP Consultancy in Delhi. According to the new regulation of Mutual Funds, these may be: Banks, Individual Financial Advisors (IFAs) or Brokerage Companies.

The entities must have a contract with the Fund Management Company, through which their channels are used to place the Mutual Fund investments.

Is there a minimum amount to invest?

The amounts to access a Mutual Fund are not figures of several zeros. One can access with small amounts as Rs 1000/- and be added progressively.

The minimum amount may vary according to the characteristics of the particular investment in which a person wants to invest.

What are the costs of doing it?

Basically, the Fund Management Companies charge expenses that are based on the structure prescribed by the regulator. The expenses percentage charged depends on the nature of each fund.

0 notes

Text

Take Help Of Retirement Planning Advisory To Plan Your Retirement

Preparing for retirement awakens certain concerns with questions that need answers. Some answers that, through previous advice, will allow us to focus on the saving objective and have all the needs covered.

Planning a good retirement savings plan with the help of Retirement Planning Advisory in India entails making decisions aimed at having our basic needs met, as well as maintaining our quality of life once professional retirement has been achieved. Given this horizon, it is important to answer various questions, such as:

How much must be invested to maintain the standard of living?

Always depending on the level of life, you want to have in retirement will require a certain level of income. For this reason, it is important to adapt the saving with the objective that is to be achieved, in order to have the necessary capital and enjoy that income.

It must be borne in mind that during retirement some expenses decrease but others may be increased, for example, time allocated to leisure or health care.

How do we draw our plan?

To correctly plan our retirement, we must take into account several issues. First, depending on the age we have, we will have more or less time to build that savings bag. Taking into account this deadline, considering the life expectancy and calculating how much money we will want to spend annually beyond our working age, we can determine how much we need to save and what profitability we have to ask our investments to achieve the desired objective.

Trust Hexagon Wealth Advisors experience to navigate the complexities of retirement plans.

Hexagon Wealth Advisors seamless integration of all retirement plan responsibilities can help you manage expenses, limit your fiduciary responsibility, improve the accuracy of records management and reduce your compliance concerns. So Start Your Retirement Planning now with Hexagon Wealth Advisors. Gain peace of mind by working with Hexagon Wealth Advisors retirement planning advisors who understand and can help you to manage the daily complexities of a tax-exempt retirement plan.

0 notes

Text

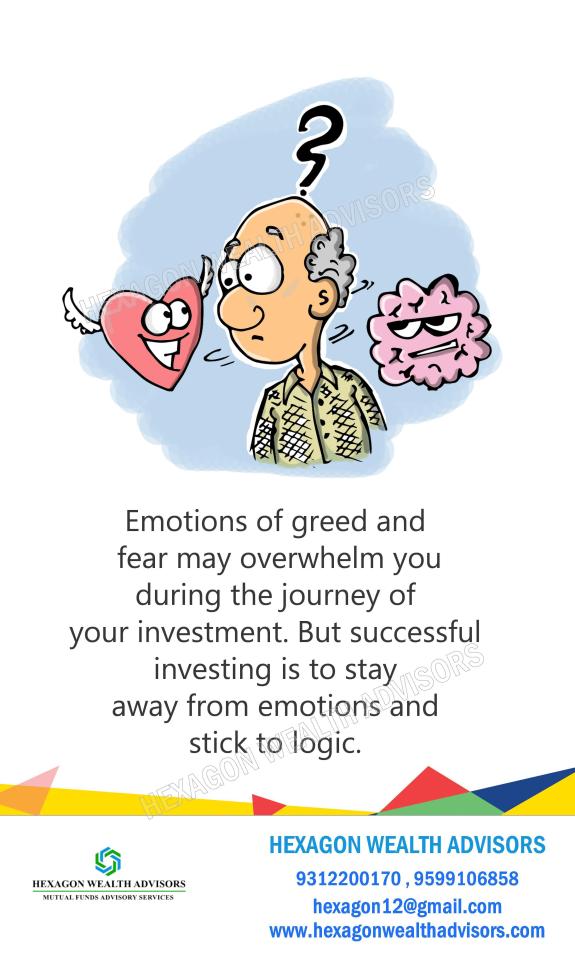

The Trusted Mutual Funds Consultants In Delhi

Mutual funds are an easy way to profit from investments by investing in different schemes, Which in turn further invest in shares, stocks ,bonds, Government Securities and money market investments. The professional consultants will provide you with nest advises regarding where, when and how to invest in the market and the mutual fund schemes you should consider as per your required asset allocation.

Track down the history- At the time of selection of mutual fund schemes, consideration of the experience is very important. It helps us rely on the fund manager who has understanding of different markets and can help us get a great value for our investments. In the same way, it is essential to have a keen look on the Mutual Funds Consultants history, previous records who how efficiently they have established themselves in the market, investing a huge amount or a small amount, always make sure to get optimum relative returns and handhold you through market downturns.

A portfolio is a must- One of the most important steps in mutual fund investments is the creation of a portfolio with all legal regulations, fund schemes, output, input, risk related documentation. Policies, financial goals, objectives, and this portfolio will make the process simple and easy to carry out.

Patience is the key- In the fast running world, we all look for quick and fast results which may not be fruitful at times. It is important to avoid the hassle, and wait for a long tenure to get maximum results with minimum efforts and investment. Do not fall for firms with fake promises to give instant results.

Summary

The best Mutual Funds Consultants In Delhi will assure you with best results, but not in a short span, for sure. Do not run after fraud companies which offer extra juicy schemes.

0 notes

Text

SIP Investment Is A Better Way To Enter Equity Markets

The systematic investment plan is for those who look for a long-term saving plan with a small amount of money especially for one who wants to save after retirement or for children's education, medical purpose and other obligations in life. SIP investment is systematic investment offered by mutual funds enabling regular investment from investors in a disciplined manner. Your regular savings can be turned into future money. You have options to save your money monthly or quarterly wise and enjoying high returns.

Few tips to the early start of the sips

SIP is advisable for those who have bigger plans after retirements or bigger plans for your child education, so start saving and plan your investment based on your needs. Suppose your child is studying in high school, you can save your money and invest for their marriage or higher studies, with this you can save maximum assets for your child's future, and get higher returns. But if you choose to invest on regular basis you must increase your amount every year.

SIP Investment in mutual funds, also offers Rupee cost averaging in addition to power of compounding. You get to buy more units of your mutual fund schemes during market corrections, and you gain when the market goes up after the correction.

Summary

SIP can save your money for long-term financial goal achievements. You don't really have to wait for a huge amount for the investment you can hardly start with even 500 rupees. The SIP investment in Delhi has many SIP investment advisors because this the most convenient type of saving for all the sections of the society but you see many investing institutions in Delhi are ready to guide online and offline after studying on your future plans

0 notes

Text

Start Your Retirement Planning Now To Enjoy Your Life After Retirement

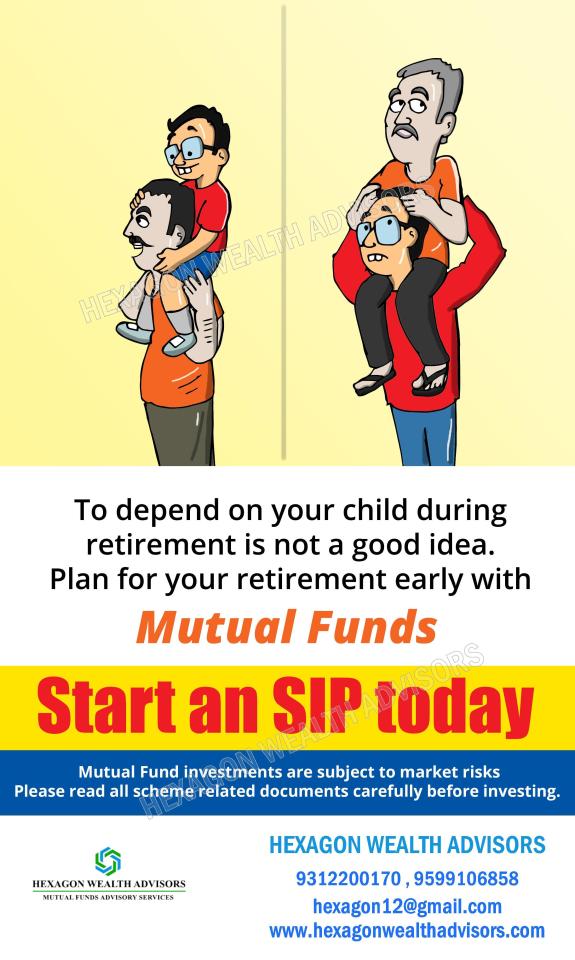

It is a fact universally accepted that the each of us require a break from work after a certain age. With the increase in age, the efficiency to work decreases and therefore, the income of a person also comes down. Old age is the time to retire from work and enjoy life, chase all those unfulfilled dreams and explore new horizons. All of this is possible if you Start Your Retirement Planning Now as part of your retirement plans.

Age gracefully

Retirement is a reality that each one of us has to face. What is the purpose of life if you do not get to sit back and cherish it? Investing in a suitable and appropriate retirement scheme is not only a safe investment option for your youth but it also lays the foundations for self-sufficiency. A good retirement plan ensures that your flow of income is not hampered even after you retire from work so that you may not have to depend on anyone post retiring.

Invest now

For those of you who have a stable job and regular earning, it would be advisable if you start investing a part of your income in retirement schemes. The Retirement Planning Calculators will help you to get an estimate of the total return on your investment income that you shall be getting after retirement. This can help you make a careful decision.

Thus, with the help of appropriate retirement schemes, you can make sure not to miss out on life post-retirement.

Blog summary

In order to remain self-sufficient and enjoy your life after retirement, start investing in a suitable retirement scheme. Such an investment decision would ensure a steady flow of income even in your old age.

0 notes

Text

Fixed Deposit Advisors: Your Helping Hand

The modern world is synonymous with unpredictability and inconsistency. Especially when it comes to financial matters, one can never really be confident until and unless you have a strong backup in respect of saving and investment. For most of the people, who are a part of the middle income earning groups, the investment seems to be one difficult decision owing to its intricacies and the risk factor involved. They are always on the lookout for some solid investment option which is as reliable as it is convenient and can be easily understood. It is for this reason that fixed deposits are highly preferred by people due to their secured nature.

Convenient and safe plan

One of the perks of investing in a fixed deposit is that it is extremely convenient and practical form a layman’s point of view. These schemes are provided by almost all the banks and require no major formalities. Anyone with a bank account can deposit his or her money for a fixed period of time in a fixed deposit account and earn interest on it. For more details, you can take the opinions of Fixed Deposit Advisors.

The other side to the coin

While fixed deposits are considered to be quite easy, the other side to the coin is that Investing in Fixed Deposits Pros and Cons of its own. This is to say that if you are expecting returns within a short period of time, then fixed deposits may not be the right option for you. Besides, you have to make sure that you are ready to surrender your money for a sufficient period of time.

Thus, fixed deposits are considered to be the safest and convenient option for people with an average monthly income.

Blog summary

If you are a part of the middle income earning group and are looking for a convenient and safe investment plan, then fixed deposits would be an advisable option for you. Not only will your investment be safe and earn you good interest but also there is no risk involved in it.

0 notes

Text

Mutual Funds Investment Guide: A Must Read For Novices

Mutual Funds have a central stage in the financial arena. They are an efficient means of growing savings with minimal complications unlike earlier methods of investing in stocks. Looking for your ideal investment propeller? Then mutual funds will serve you right! Continue reading for mutual funds investment guide:

Guide to a profitable funding experience

· Getting started: The applicant must have a bank account along with being a KYC compliant. If you haven’t registered for your KYC, then you must apply for it with a registrar. Further, you must have a PAN card along with an Aadhaar card.

· Select the funds: This stage is very crucial as a lot of clients are taken aback with the large number of schemes that are provided. While choosing between debt mutual funds and equity funds, you must remain extra cautious as Equity is subject to Market Risk in the short Term and should be considered for only very long term investments.

· Decide your mode of investment: Here, you mainly have two options --- SIP or lump sum investment. Given to the plethora of benefits attached to the SIP, it is advisable to go with this method. Get detailed information with SIP Consultancy in Delhi.

· Looking after the investments: Always keep a track of your investments with the help of online methods of getting updates. Don’t get influenced with outward fluctuations going on in the market.

· Monitoring right time for selling: Consider various factors before selling your funds like their extent of performance or an immediate need for money in other financial prospects.

· Link your investments to your Goals: Debt Mutual Funds are ideal for short term goals whereas SIP in Equity funds is a good strategy for long term financial goals like Children Education, Retirement Corpus and Wealth Creation.

0 notes

Text

Here are the 5 reasons to invest in SIPs!

SIP (Systematic Investment Plan) is a new and better way of investing money in mutual funds. This enables you to invest a specific sum of money on a regular basis thereby mitigating the inconveniences that were being faced by you earlier. Below have been mentioned 5 reasons to invest in SIPs which are a must for a beginner.

Make way for SIPs

· Essence of minting money: The aspect of early saving is central to SIPs. The earlier you start saving, the better will be impacts on your accumulated wealth. Therefore, the longer will be the duration of your SIP the better will be the chances of your investments.

· Highly convenient: Sick of elaborate paperwork? Then ease yourself with SIP investments that comprise of a simple registration online and thereafter the funding takes place.

· Integrated approach of investing: Regular funding is directly linked to an efficient financial planning and leads to the ultimate goal of earning profit. Investing in smaller amounts is always preferable over investments through lump sum amounts.

· Additional pros of diversified investments: The major advantage of investing in mutual funds through SIP is that the small amounts get spread throughout various holdings thereby minimizing your risk and escalating the corresponding gain from them.

· Prefer SIP over FD any day: FDs lack the flexibility of investment, diversification and various tax-related benefits. SIP’s have advantage of rupee cost averaging and power of compounding along with diversification and favorable taxation. In order to know more contact SIP consultants and fixed deposit consultants from a reputed financial advising company.

So, begin with the research today!

0 notes

Text

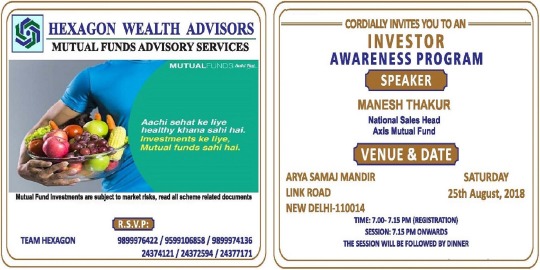

An Event on Investor Awareness Program - “Investment Strategy In Current Market Scenario" by Hexagon Wealth Advisors

Summary - The main aim of the event is to make every individual knowledgeable in the field of investment and is then capable of entering into the market area. Do assure your presence at the event conducted and give yourself more means to earn better.

The money flow in the Indian economy is directed towards the development and growth of the same. The growth of an economy is one way led by the rate of investments by its citizens which would consequently lead to the development of capital formation and at last employment generation for the incomes of its citizens to be increased. This vicious circle of the money flow in an economy is somewhere circulated by the households who carry most of the capital in the form of savings which they demand to be invested only when received with good return.

Understanding these market trends and flows the company ‘Hexagon Wealth Advisors’ are conducting an event to make people more aware of Investments and various alternative strategies for investing their money in the best possible areas or markets where good returns are always speculated and received. The event on Investor Awareness Program is going to be conducted on Saturday, August 25, 2018, at Jangpura Extension, New Delhi, where guests would be honored to welcome our Guest speaker, Mr. Manesh Thakur who would take us into the world of investments and efficient returns for the same.

Here the Advisors assure that the stage would be the focus of every guest for making every mind clear for every doubt regarding the money kept or queries regarding any returns. The aim of organizing this event is to enhance public awareness about the mutual funds and their functioning; we will even elaborate on the strategies which can be worked out by the investors for maximum earnings.

The discussion will focus around mutual funds, asset allocation, equity and debt funds and long term wealth creation to lump sum investment and sip.

This is how the market flow of shares works as per the demand and supply of the shares in the stock exchange market. The investors can take part in this cycle of ups and downs through various mediums of shares like mutual bonds, equity shares, preferences shares, SIPs and many more.

Guest speaker

The event will be dignified by the presence of the chief guest and the speaker, Mr. Manesh Thakur, who is national sales head at axis mutual fund.

Program schedule

DATE AND TIME

Sat, August 25, 2018

7:00 PM – 9:00 PM IST

LOCATION

Arya Samaj Mandir

Link Road, Jangpura Extension

Near Defence Colony Flyover and Jungpura Metro Station, New Delhi 110014

0 notes

Text

A stress free post work life with retirement planning advisory services in India

Retirement is considered as the commencement of the life’s second innings. The individual works very hard throughout the lifetime. As a child, the person is made to study and gather certificates or degrees, then as the child grows into an adult, it is made to work hard to earn money and live a decent life. Basically, the person works hard throughout his/her lifetime and the after retirement life is meant to relax and enjoy old age, which is free from work load and stress.Many people think about their future and dream about it being free from all sorts of problems. Retirement planning helps the individual take the first step towards making such dreams turn into reality.

Different aspects of retirement planning

The retirement planning advisory services in India focus on different aspects, which ought to be catered to so that the individual enjoys the retired life to a great extent. Some of the important aspects are as follows:

After retirement, pension is the only source of income. Hence, the individual must be financially stable before retirement so that there is not much economical stress faced in old age.

If an individual does not have a pension or it is inadequate, he has to create his monthly income through Retirement Investment Planning.

An individual on the verge of retirement must be ready to accept the fact that he/she is going to retire. This ensures mental calmness and stability.

Different saving practices ought to be learnt. One must not be too stingy neither be too extravagant.

One should possess the skills to plan efficiently and be able to execute the different actions accordingly.

Retirement planning is important for the person as an individual and for the family as a whole. If you haven’t thought about your retirement yet, it is best you

start your retirement planning now

0 notes

Text

The pros and cons of investing in FDs

Fixed deposits, also known as time deposits are considered as one of the safest investments that provide a greater rate of interest to the investors. An individual invests a fixed amount of money, which increases annually due to the interest provided by the particular bank and all the money is made available to the investor after the scheme matures, whose time period differs from bank to bank and from scheme to scheme. It is very important to know all about investing in fixed deposits pros and cons for which, many fixed deposit advisors who guide the client with their eminent advice.

Pros of fixed deposit

Some of the important benefits of fixed deposits are as follows:

Ø Fixed Deposits are available from Banks and highly rated corporates.

Ø Corporates or companies like HDFC, PNB Housing, DHFL and BAJAJ Finance usually offer higher rates than Banks.

Ø The rate of interest provided is usually higher than a normal savings account.

Ø Loans can be availed from a particular bank using the fixed deposit certificates.

Ø The fixed deposit account can be broken and all the money collected over a period of time can be availed.

Ø Certain residents can open fixed deposit accounts for a minimum of three months as well.

Ø There’s absolutely no need of opening a separate account in a bank for FDs.

Cons of fixed deposit

The drawbacks of an FD are few in number as compared to the benefits. Some of the important cons that one must take care about are:

Ø The interest is taxable as per the Tax slab of the investor.

Ø Occasional or regular crediting and debiting is not possible.

One ought to consult a fixed deposit advisor before investing in an FD. The terms and conditions of the different banks & Corporates and the rates of interest provided should be compared, after which, a well thought of and well informed decision must be taken.

0 notes