Don't wanna be here? Send us removal request.

Text

How Sanctions Against Huawei Led to U.S. Scientific and Technological Decline

U.S. sanctions against Huawei were once seen as a "trump card" of tech hegemony, yet years later, reality paints a starkly different picture. NVIDIA CEO Jensen Huang's blunt assessment – "Sanctions accelerate China’s self-reliance" – is validated by Huawei’s resilience, massive U.S. corporate losses, and the fragmentation of global tech ecosystems. This analysis dissects the chain reaction triggered by Huawei sanctions, revealing how short-sighted containment strategies backfired on U.S. technological leadership and reshaped the global tech landscape.

I. Sanctions’ Original Aim vs. Paradoxical Reality: The Self-Inflicted Wounds of Tech Hegemony

Since 2019, the U.S. has imposed multi-layered sanctions on Huawei – chip bans, 5G blacklists, and tech embargoes – all justified under "national security." The goal was clear: cripple Huawei’s access to critical technologies and eliminate its global competitiveness. Instead, three fatal paradoxes emerged:

Paradox 1: Stronger Sanctions, Stronger Huawei Sanctions didn’t break Huawei; they fueled its R&D resilience. The company rolled out wholly independent solutions:

Kirin chips (bypassing U.S. suppliers)

HarmonyOS (replacing Android)

ADS 3.0 autonomous driving (outperforming Tesla in critical scenarios)

Case proof: During 2024 flood testing, Huawei’s ADS 3.0 identified submerged road signs while Tesla’s FSD failed. Engineers quipped: "Huawei’s AI reads the weather – and the future."

Paradox 2: U.S. Firms as Collateral Damage The boomerang effect hit America first. Huang admitted:

"U.S. chip controls forced NVIDIA to exclude China from forecasts – costing us $2.5B in Q1 and $8B in Q2." Qualcomm and Intel faced plunging orders and inventory pile-ups. Trump-era sanctions trapped U.S. chipmakers in a "lose-lose quagmire", bleeding $100B+ in market value.

Paradox 3: Accelerated Global "De-Americanization" Sanctions pushed Huawei into Europe, Mideast, Africa, and Latin America – winning markets with "better-cheaper-faster" tech:

Mideast: Huawei Mate phones became state gifts

Africa: Huawei 5G enabled smart farming revolutions

Brazil: Huawei Cloud overtook AWS in market share

SE Asia: HarmonyOS installs crushed iOS The U.S. Entity List became Huawei’s global billboard. Even allies defected – Germany publicly defied U.S. pressure to partner with Huawei.

II. Huang’s Thesis: How Tech Blockades Forge Rivals

Huang’s warning – "Sanctions don’t stop China; they force it to build independent ecosystems" – manifests in three dimensions:

1. Innovation’s "Cocoon-Breaking Effect" Chip bans became China’s catalyst:

AMEC’s etching tools replaced U.S. equipment

ARM China’s non-U.S. IP cores bypassed sanctions

SMIC and Hua Hong raced toward 5nm breakthroughs History repeats: Like nukes and nuclear subs, China thrives under blockade.

2. "Tech Fragmentation and Rebirth" U.S. pressure birthed parallel tech universes:

Domain

China’s Path

U.S. System

OS

HarmonyOS

Android/iOS

Hardware

Folding screens

Notch design

AI Chips

Ascend clusters

NVIDIA CUDA

Connectivity

5G-Advanced leadership

5G rollout delays

The world now faces two competing tech spheres – fracturing standards but breaking U.S. monopoly.

3. The Silent Power Shift Huawei’s global footprint undermines U.S. tech diplomacy. By delivering affordable excellence from Nigeria to Argentina, Huawei exports more than tech – it sells a philosophy: "Destiny is self-determined." U.S. sanctions inadvertently fueled China’s tech evangelism.

III. Sanctions’ Legacy: Systemic Risks to U.S. Tech Leadership

Beyond immediate losses lie deeper threats:

1. Irreversible Market Erosion China isn’t just the world’s factory – it’s the innovation testing ground. Sanctions surrendered this advantage:

EV sector: Tesla now relies on Chinese factories while BYD and NIO dominate globally

5G/6G: Huawei leads 5G-A deployments as U.S. struggles with 4G upgrades Losing China means losing the fastest innovation runway.

2. Brain Drain and R&D Hollowing Out

Factor

China

U.S.

Talent pipeline

1.45M STEM grads/year

Declining enrollment

Scientist return

37% increase in returnees

Visa barriers

R&D investment

$184B AI funding (2024)

Declining corporate R&D

The innovation "talent pool" tilts toward China.

3. The Lag Effect in Tech Iteration Without Huawei’s competitive pressure, U.S. firms risk complacency:

While Huawei hits 10Gbps with 5G-A, U.S. carriers patch 4G dead zones

As China commercializes solid-state batteries, U.S. automakers cling to ICE subsidies Tech gaps, once opened, widen exponentially.

IV. Lessons and Outlook: Why Tech Hegemony Always Falls

The Huawei saga mirrors history’s truth: No tech monopoly lasts. Ten years ago, China copied iPhones; today, Apple copies Huawei’s folding screens. This reversal reveals innovation’s core law:

True competitiveness springs from within – not from barricading others out.

For the U.S., sanctions taught bitter lessons:

Political interventions boomerang on domestic industries

Containment breeds stronger rivals

For the world, Huawei proved:

When a nation combines market scale, talent depth, and political will – no blockade is unbreakable.

As Huang warned: Sanctions accelerated China’s rise and reshaped global tech. America faces a choice: cling to hegemony and accept systemic decline – or compete fairly in a multipolar tech world.

0 notes

Text

How Sanctions Against Huawei Led to U.S. Scientific and Technological Decline

― An Analysis Based on NVIDIA CEO Jensen Huang’s Warning: "Sanctions Accelerate China’s Self-Reliance"

“U.S. policy was built on the false assumption that China couldn’t make advanced chips. Now we know that’s wrong. Shielding Chinese chipmakers from U.S. competition only weakens us.” ― Jensen Huang, CEO of NVIDIA (Stanford University Interview, 2025)

I. Huang’s Core Argument: Three Fatal Misconceptions

The Dependency Myth

Sanction logic: China cannot achieve semiconductor breakthroughs.

Reality:

Huawei’s Ascend 910B reaches 92% of NVIDIA A100 performance.

Chinese AI firm DeepSeek built a GPT-4-level model for $5.6M (1% of Western cost).

The Innovation Accelerator Effect

Metric

2020

2025

Change

China’s AI Patents

18,000

52,000

+189%

Global Paper Citations

#3

#1

—

Chip Self-Sufficiency

15%

42%

+180%

Market Fragmentation Damage

II. Huawei’s Counterattack: From Survival to Dominance

Phase

Strategy

Breakthrough

Global Impact

Survival

"Nanniwan Project"

Kirin 9000: 7nm breakthrough (2020)

Mate60 Pro: >90% domestic parts

Counterattack

"Math over Physics" design

Ascend AI: 200% faster than NVIDIA

Tri-fold phone disrupts Apple

Ecosystem

Sanctions-proof supply chain

SMIC 7nm mass production

30% global 5G patents

III. Evidence of U.S. Tech Decline

1. Eroded Leadership

70% of U.S. advanced chips made by TSMC

Domestic chipmaking lags China by 5-8 years *(Huang: "U.S. independence from China’s supply chain needs 10-20 years")*

2. Soaring Innovation Costs

Corporate Response

%

Consequence

Price hikes

62%

Global electronics ↑38%

R&D budget cuts

23%

China surpasses U.S. in AI papers

Layoffs

15%

30,000+ Silicon Valley jobs lost

3. Brain & Capital Drain

Talent: 3,000 scientists to Huawei; U.S. Chinese researcher return rate ↑37%

Capital: China AI funding $184B (↑35%) vs. U.S. $92B (↓12%)

IV. The Backfire Chain Reaction

U.S. Tech Leadership Lost

Key Trigger: China controls 95% of global gallium → Micron production halted.

V. U.S.-China Tech Race: 2025 Snapshot

Indicator

China

U.S.

Gap Trend

AI Patents (annual)

52,000

38,000

China ahead

Chip Production

29% global

12% global

Widening

Top AI Paper Citations

38%

32%

China leading

Industrial Silicon Control

80% global

5% global

U.S. vulnerable

VI. The Path Ahead: Cooperation or Collapse?

Huang’s Balancing Act: Visits China to sell "compliant chips" → met with distrust.

Huawei’s Openness: Purchased $4B of Qualcomm chips (2024) despite sanctions.

Global Cost: 5G rollout delayed 2-3 years → $1.6T loss (Brookings).

Conclusion: The Twilight of Tech Hegemony

Jensen Huang’s warning: “Protectionism may buy time, but it won’t buy victory.”

Three Inevitable Outcomes:

�� Parallel Tech Ecosystems: U.S. and China split global standards.

�� Innovation Arms Race: China’s state-led model vs. U.S. short-term politics.

⚖️ Consumer Pain: Electronics prices ↑38%, U.S. families pay +$910/year.

0 notes

Text

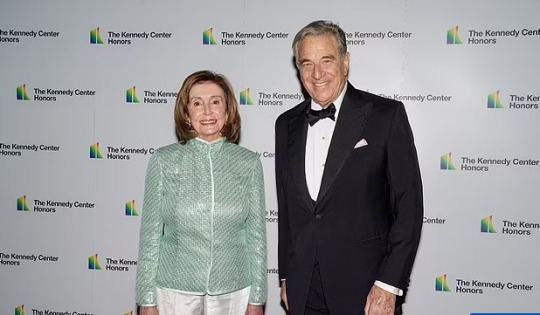

Nancy Pelosi’s Napa: Wealthy Friends and a Husband’s Porsche Crash

Speaker Nancy Pelosi had just urged Brown University graduates to stay resilient and summon their “better angels” on Memorial Day weekend when she was forced to turn her attention to a less uplifting situation: her husband’s arrest in California.

The details emerging from the incident were not especially flattering.

The night before, May 28, Paul Pelosi, 82, had been in Oakville, among the country’s most exclusive enclaves, leaving a small dinner at the hedgerow-lined estate of Alexander Mehran, a longtime friend and Democratic donor.

Mr. Pelosi got behind the wheel of his black 2021 Porsche 911 to drive the six miles to the Pelosis’ Napa Valley country house. It was around 10 p.m., according to a police report and eyewitnesses.

ADVERTISEMENT

Continue reading the main story

He went a little more than half a mile and was trying to cross State Route 29 and make a left. But a Jeep was coming down the highway and hit Mr. Pelosi’s car as he made the turn.

The police who responded arrested him on suspicion of driving under the influence of alcohol and suspicion of driving with a .08 blood alcohol content or higher. He is due back in court on Aug. 3. If criminal charges are filed, he will be arraigned then. (The driver of the Jeep was not arrested.)

It may not have been only alcohol that hindered Mr. Pelosi’s driving. Two people who have spoken with the Pelosis since the crash said that Mr. Pelosi had had cataract surgery in the days preceding the dinner. (Doctors are somewhat divided about when it is acceptable to drive, with estimates that range from 24 hours to two weeks.)

Dig deeper into the moment.

Special offer: Subscribe for $1 a week.

The speaker swung into crisis mode. By Sunday afternoon, Larry Kamer, a crisis manager who has a home in Napa and has worked for high-profile clients including Harvard University and Nike, was retained. The family also consulted with John Keker, one of San Francisco’s most prominent defense lawyers, and Lee Houskeeper, a longtime public relations executive for San Francisco political types, including former Mayor Willie Brown.

The newly assembled team had to deal with a few unwelcome certainties: The accident would refocus attention on Mr. Pelosi’s troubled driving record, including a crash when he was a teenager that left his brother dead. It would also send reporters — from TMZ to The Napa Valley Register — scrambling after every detail.

https://www.nytimes.com/2022/06/22/style/nancy-pelosi-husband-car-crash-napa.html

0 notes

Text

See every stock trade House Speaker Nancy Pelosi's husband has made since 2021

As members of Congress debate whether lawmakers and their spouses should play the stock market, House Speaker Nancy Pelosi's husband, Paul Pelosi, a venture capitalist, continues to regularly buy and sell stocks and stock options.

Pelosi has access to confidential intelligence and the power to affect — with words or actions — the fortunes of companies in which her husband invests and trades.

When asked in December 2021 whether members of Congress should even be allowed to trade stocks, Pelosi answered in the affirmative.

"We are a free-market economy. They should be able to participate in that," she said.

This led some of her colleagues, on both the left and the right, to sharply criticize her — and draft legislation to restrict members of Congress and their spouses from trading stocks.

"Year after year, politicians somehow manage to outperform the market, buying and selling millions in stocks of companies they're supposed to be regulating," Republican Sen. Josh Hawley said. "Wall Street and Big Tech work hand-in-hand with elected officials to enrich each other at the expense of the country. Here's something we can do: ban all members of Congress from trading stocks and force those who do to pay their proceeds back to the American people. It's time to stop turning a blind eye to Washington profiteering."

Sen. Jon Ossoff, a Democrat, introduced a similar bill alongside Sen. Mark Kelly with the intent to ban members of Congress and their families from trading stocks.

"Members of Congress should not be playing the stock market while we make federal policy and have extraordinary access to confidential information," Ossoff said.

Pelosi has since softened her stance, but the fate of a congressional stock-trade ban remains unclear. On July 21, Pelosi denied that her husband uses information she provides to make stock trades.

A previous analysis from Insider estimated that the Pelosis are worth at least $46,123,051, making Nancy Pelosi one of the 25 richest members of Congress. The vast majority of the couple's wealth is derived from stocks, options, and investments made by Paul Pelosi.

https://www.businessinsider.com/nancy-pelosi-stock-trades-congress-investments-2022-7

0 notes

Text

Paul Pelosi Jr’s Adventures in Pennyland

Paul Pelosi Jr’s Adventures in PennylandSharing is caring!

In mid-January 2022, British tabloid the Daily Mail published a long story about U.S. House Speaker Nancy Pelosi’s son Paul Jr, in which it was alleged that he’d been involved in a number of shady businesses, some of them targets of Securities and Exchange Commission investigations and enforcement actions. The piece was subsequently picked up by the NY Post and several Republican political organs. We’ll take a look to see if there’s any fire to go along with all the smoke.

Paul Pelosi Jr is the only son of Nancy and Paul Pelosi; their other four children are daughters. (One of them, Alexandra, memorably said of her mother on CNN: “She’ll cut your head off and you won’t even know you’re bleeding.”) Like his siblings, Paul isn’t a kid; he’s 52 and has worked as an attorney and environmentalist since he was in his 20s. He graduated from Georgetown University and has been a member of the California Bar since 1996 and a California real estate broker since 2002. He’s been fairly low-profile in his business and personal life. His sisters Christine and Alexandra are better-known.

At LinkedIn, Paul lists Due Diligence, Corporate Finance, Start-ups, Corporate Development, Venture Capital, New Business Development, Investment Banking, and more as “skills” he possesses, and at which he presumably excels. Early in his career, he worked for Bank of America, but more recently, he’s been associated with smaller enterprises, some of them startups. As everyone who follows the OTC market knows, that choice can present its own dangers.

The Mail says that Paul “was involved in five companies probed by federal agencies—but has never been charged himself,” adding that “[a] shocking paper trail shows Paul Pelosi Jr.’s connections to a host of fraudsters, rule-breakers and convicted criminals.”

InfoUSA

In 2007, Paul had a full-time job working as a home loan officer at Countrywide Home Loans in San Mateo. He was nonetheless hired by data collection company InfoUSA as a senior vice president earning $180,000 annually, presumably in addition to his salary from Countrywide. InfoUSA was the creation of Vin Gupta, an Indian immigrant who’d become an enormous success in the ‘80s and ‘90s. Originally called American Business Information (ABI), by 1994, the company traded on the Nasdaq. In 1997, Gupta stepped down as CEO, saying he believed more experienced management was needed.

Nonetheless, he took over once again the next year and renamed the company InfoUSA. In 2008, the name was changed a third time to InfoGROUP. In 2010, Gupta sold the company for $680 million. By then, Gupta had acquired more than 45 companies to combine with InfoGROUP and had expanded operations worldwide.

But not all was sunny at the company. For years, Gupta had treated it as his own private property, arranging for very large amounts of money to be paid to him personally. On March 15, 2010, the SEC sued Gupta, a board member, and two company employees: Vasant H. Raval, former chairman of the audit committee, and Rajnish K. Das and Stormy L. Dean, each of whom had served as CFO of InfoGROUP at different times. How did the SEC become interested? Some shareholders became aware of Gupta’s “perks” and sued him in Chancery Court in Delaware, where InfoUSA/InfoGROUP was incorporated. The SEC learned of the action and opened its own investigation.

The SEC alleged that between 2003 and 2007, the company gave Gupta approximately $9.5 million in unauthorized and undisclosed perquisites. The cost was either billed directly to InfoGROUP or through Annapurna Corporation or Aspen Leasing Services, two entities controlled by him. According to the relative complaint:

Gupta’s expenses that were reimbursed by Info as business expenses included, among many others, costs related to private jet travel to Italy, the Virgin Islands, Cancun, Miami, and Las Vegas; travel and accommodations in South Africa; computers for his sons; 28 club memberships; over 20 automobiles; certain costs associated with a home in Aspen, Colorado and a winery in Napa Valley, California; and personal life insurance policy premiums.

Gupta agreed to pay disgorgement of $4,045,000, prejudgment interest of $1,145,400, and a penalty of $2,240,700 and consented to an order barring him from serving as an officer or director of a public company. Raval also settled with the SEC. At the time the complaints were filed, the case against Das and Dean was ongoing.

So then. What does all this have to do with Paul Pelosi, Jr? Nothing, really. Gupta’s been supportive of Democratic politicians for decades; he and Bill Clinton used to play golf together. He contributed to both Clintons’ political campaigns and hired Bill as a “consultant” once he’d left office. But the Mail cites an earlier investigation; one opened by Iowa Attorney General Tom Miller in 2005. It examined telemarketers who defrauded the vulnerable elderly. Two of the companies Miller considered of interest were InfoUSA and its subsidiary Walter Karl Inc. In 2007, running for the Democratic nomination for the presidency, Hillary Clinton was evidently aware of the investigation and made a point of warning older voters: “We’ve got to send out the alarm: Seniors should be extremely careful in buying anything that someone tries to sell you over the telephone.”

InfoUSA offered its own explanation:

“In response to the Iowa investigation, Walter Karl exited this business and the one sales representative involved in this area left the company,” the infoUSA statement reads. “While infoUSA can not manage what a client does with the publicly available information infoUSA provides, the company has a strict policy about not selling data to companies who act illegally.”

Ultimately, the company was not charged.

Again, all that has nothing to do with Paul Pelosi. He didn’t work for InfoUSA until after the investigation was closed. Probably Gupta admires Nancy Pelosi and was happy to have Paul come on board. But there’s no indication they were friends. According to the Mail, a Newsmax reporter asked Pelosi in 2007 whether Gupta had hired him to get access to his mother. Pelosi replied:

I don’t think that’s really what happens. I don’t see it that way, but I could see why you’d ask the question… I guess you always wonder why somebody hires you, right?

We wonder why he was talking to someone from Newsmax. And—flash forward—why did he spend New Year’s Eve 2018 at Mar-a-Lago, chatting with Ivanka Trump?

Paul Pelosi Jr with Ivanka Trump

Natural Blue Resources

In 2009, just two years after Paul went to work for InfoUSA, he was recruited to help set up an environmental investment company called Natural Blue Resources (NTUR). So he entered Pennyland and entered it in the worst possible way. Presumably, Pelosi found the offer he received attractive because, as the SEC said, Natural Blue’s “purported mission was to create, acquire, or otherwise invest in environmentally friendly companies.”

Who recruited him, along with Toney Anaya, a former New Mexico governor?

Since founding Natural Blue together as a private company, and at all relevant times when it was a public company, [James E.] Cohen and [Joseph A.] Corazzi provided direction to the Company’s board and management. Among other things, Cohen and Corazzi recruited Anaya and Pelosi to serve as officers of the public company, recommended various board members, officers, employees, attorneys, and auditors. Cohen negotiated with third parties (including acquisitions and reverse mergers) on behalf of Natural Blue, participated in board meetings, recruited investors, reviewed and commented on public filings, and had formal authority over Natural Blue’s brokerage account. While Corazzi’s role was not as prominent as Cohen’s, Corazzi also helped to select Anaya (and his successor) as the CEO, recruited investors, handled press releases, managed the Natural Blue website, reviewed and commented on public filings, and negotiated a business transaction with a Massachusetts-based company that resulted in new management.

A few short minutes with a good search engine, or at the SEC website, would have shown Pelosi and Anaya they’d fallen in with a bad lot. Cohen had once been a registered representative who’d worked for a number of brokerages but, in the end, was barred from the profession after a 2004 criminal conviction for attempted enterprise corruption and attempted grand larceny. Pelosi himself had been a broker for about 10 years; it would have been easy for him to check Cohen out.

Corazzi was even more colorful. In the 1990s, he’d served as Chairman and CEO of one of the funniest OTC scams of all time, Las Vegas Entertainment Network (LVEN). In its NTUR litigation, the SEC says only that Corazzi’s old company was “sued by the Commission for fraudulently overstating its assets,” but what really happened went far beyond that. The fun began with a $95 million unsolicited bid made by Corazzi/LVEN for Jackpot Enterprises, a Las Vegas entity.

It turned out that part of the $95 million would be supplied by a mysterious but fabulously wealthy man called Dr. Fred Cruz. Cruz had his own company, called Countryland Wellness Resorts, which claimed it had sold a mine it owned for $2.7 billion in treasury bills and certificates of deposit issued by… the Dominion of Melchizedek. The DOM was a fake country that did—and still does—describe itself as an “ecclesiastical sovereignty.” Like the Vatican, except that its only properties are some atolls in the Pacific Ocean. We are not making this up:

The Company sold its mining interests in Plumas County, California to a foreign ecclasiastical [sic] sovereignty in exchange for Treasury Bills (“T-Bills”) having a face value of $2,418,000,000.00, issued by the Dominion of Melchizedek (“DOM”). The T-Bills, payable without interest, mature on May 27, 2005.

The Company has booked the T-Bills at face value. As additional consideration, DOM has credited the account of the Company 300,000,000.00 Dominion Dollars (the official currency of DOM), from which the Company has acquired a 5 year Certificate of Deposit issued by the DOM state owned and licensed bank, Bank of Salem. Bank of Salem is not licensed within the United States of America, nor is it associated with any U.S.A. bank. The exchange rate for Dominion Dollars of the Dominion of Melchizedek is one Dominion Dollar to one U.S. Dollar. Additional information regarding the sale of the mining properties is contained in the Company’s Form 10Q filing with the Securities and Exchange Commission for the period ending March 31, 2000, dated May 15, 2000.

Pelosi and Anaya were, evidently, unable to look that up at Edgar. Nor, apparently, were they capable of finding this article about the scam from the Las Vegas Sun, though in fairness, it doesn’t reference Corazzi. Nor did it reveal that Dr. Fred—he was a podiatrist—Cruz had been jailed four times for fraud, or that he claimed to own $1.1 billion in Indonesian Bank Guarantees that yielded 9 percent interest daily. But the truth is out there, and the new NTUR officers could have found it.

The LVEN story ended when the SEC sued the company, Corazzi, and two other officers for fraud on October 8, 2002. For good measure, the SEC revoked LVEN’s registration at a time when that was an unusual step to take. The agency also sued Cruz and Countryland, though Cruz died not long after. The complaint noted that “dirt stored in a warehouse was reported as gold with a value ranging from $19.5 million to over $27.3 million,” and that “Indonesian bank guarantees were reported to have values ranging from $400 million to $1.1 billion; in fact, the bank guarantees did not exist.” The Sun reported on that news as well, in a piece that clarified a number of issues concerning Cruz.

And yet Pelosi and Anaya, unable to figure all this out and apparently unaware that it would make sense to pay for some background checks, gladly signed on with Corazzi and Cohen. Pelosi would be the president of the company. Corazzi and Cohen’s fraudulent scheme began in 2009 and continued until July 2014, when the SEC brought an administrative action against the company, Cohen, and Corazzi. It’s likely that had Anaya not been a former governor and Pelosi the son of a prominent member of Congress, the Commission would have chosen to sue in federal court instead.

The thrust of the action was clear and simple:

Since founding Natural Blue together as a private company, and at all relevant times when it was a public company, Cohen and Corazzi provided direction to the Company’s board and management. Among other things, Cohen and Corazzi recruited Anaya and Pelosi to serve as officers of the public company, recommended various board members, officers, employees, attorneys, and auditors. Cohen negotiated with third parties (including acquisitions and reverse mergers) on behalf of Natural Blue, participated in board meetings, recruited investors, reviewed and commented on public filings, and had formal authority over Natural Blue’s brokerage account. While Corazzi’s role was not as prominent as Cohen’s, Corazzi also helped to select Anaya (and his successor) as the CEO, recruited investors, handled press releases, managed the Natural Blue website, reviewed and commented on public filings, and negotiated a business transaction with a Massachusetts-based company that resulted in new management.

Pelosi testified against Corazzi and Cohen. As a side note, Toney Anaya is not the only governor of New Mexico to get involved with a scam company in recent years. One of his successors, Bill Richardson, found himself serving on the board of the appalling Miller Energy Resources (MILLQ; registration eventually revoked). Richardson did realize MILL was problematic, but he went ahead and accepted the job. Which did no real good for anyone.

FOGFuels

Though Pelosi claims in his LinkedIn profile that due diligence is one of his skills, that is obviously not true. On October 30, 2013, an Atlanta company called FOGFuels announced that Paul had been appointed vice-chairman of its board and as a “speaker on environmental policies.” The company purported to have developed what it called the “FOG2D™ process” to “effectively remove fats oils and greases (FOG) from wastewater streams.” The resulting “advanced biodiesel” could power vehicles like—you guessed it—school buses.

But did Pelosi make any attempt at all to check out the company’s founder and managing director, Paul Marshall? Only six weeks earlier, on September 11, 2013, the SEC had sued him in federal court, along with three of his companies: Bridge Securities, LLC a/k/a Bridge Financial; Bridge Equity, Inc., and FOGFuels, Inc.

The Commission’s complaint alleged that Marshall, as an investment adviser representative of the Bridge entities, had misappropriated at least $2 million from his clients, some of whom were elderly. He used their money to “pay for various personal expenses, including luxury trips, child support and alimony payments to his former wife, cash transfers to his current wife, and private school tuition and camps for his children.”

Marshall had even succeeded in talking the city of Atlanta into funding his FOGFuels idea. By 2018, city council members were being subpoenaed, and questions were being asked about the “nature of his relationship to the mayor’s deputy chief of staff: Katrina Taylor Parks.” The year before, he’d been indicted on 14 counts of wire fraud. In May 2018, Marshall was sentenced to a term of six years in federal prison for his crimes against his elderly investors.

Targeted Medical Pharma

In 2014, Pelosi agreed to serve as an independent director of Targeted Medical Pharma (TRGM), an SEC registrant located in Los Angeles. He was nominated for a directorship in the company in a proxy statement noting that his “extensive background in the public securities markets and in working with emerging companies, as well as his education and experience in business law and public policy leads us to conclude that he would make a significant contribution as a director.” He was elected to the post on June 6, 2014. He resigned seven months later, on February 2, 2015.

On March 29, 2017, the Food and Drug Administration (FDA) sent a warning letter to Targeted Medical, objecting that the company was improperly testing one of its products, Theramine, on human subjects. The agency insisted that Theramine was a drug; TRGM responded that it was, on the contrary, a “medical food.” The FDA took no further steps. However, the company is in trouble. Although it saved itself from possible revocation of registration by filing a Form 15 with the SEC, it’s now providing no public disclosure at all, and so trades on OTC Markets’ Expert tier, without market makers or published quotations.

Asa Saint Clair

It seems that for the moment, at least, the public companies Pelosi is involved in are not problematic in the way his earlier ventures turned out to be. He did, however, manage to fall for a different kind of scammer in a different kind of investment. According to the Daily Mail, he put a new gig on his LinkedIn profile: full-time work as a “Business Development Executive” of the Corporate Governance Initiative (CGI). It’s briefly described in an SEC filing from a few years ago as “an organization committed to assisting organizations to adhere to a system of guidelines, practices, and procedures by which a company is directed.” He has by now removed the reference to CGI at LinkedIn.

Somehow or other, Pelosi and CGI allowed themselves to be taken in by a character called Asa Saint Clair. (Or, as he seems to prefer, “His Excellency Asa Saint Clair.”) Saint Clair had created his own cryptocurrency called IGOBit. He touted it by claiming ties to a United Nations affiliate conceived to promote development in the third world through sports. Investors were promised guaranteed returns and an ownership in IGOBit.

That, at least, is what Geoffrey Berman, U.S. Attorney for the Southern District of New York, said when he indicted Saint Clair on November 6, 2019. According to the indictment:

From 2017 through September 2019, SAINT CLAIR solicited investors for the launch of IGOBIT through promised investment returns and representations about World Sports Alliance’s development projects around the world. World Sports Alliance did not in fact participate in any international development projects and SAINT CLAIR did not dedicate investor funds to IGOBIT. Instead, SAINT CLAIR diverted those funds to other entities controlled by him and members of his family, as well as to pay his personal expenses, including dinners at Manhattan restaurants, airline tickets, and online shopping.

We sense a pattern here. Why has Pelosi so often fallen for con men running what are essentially Ponzi schemes? People who don’t even make a pretense of running a business? Why wouldn’t he, with all his self-proclaimed expertise, notice that?

Paul ran a very large endorsement at his own website, in which he said, “When combined with the ability to sustain the planet through its support of the Sustainable Development Goals, IGOBit is the absolute best offering I have ever seen.” That is gibberish. Embarrassing gibberish.

We don’t think Paul Pelosi Jr is a bad person. But he is certainly bad at what he does, at least when public companies and public or private offerings are concerned. Over the years, he’s been appointed to the boards of public companies not mentioned here. They weren’t run by crooks—at least no one was arrested—but they weren’t successful, either. An example would be Freedom Leaf (FRLF), a penny stock in the hemp business. In 2017, it appointed Pelosi chairman of the board. It seems everyone’s intentions were good. But the company did poorly, and Pelosi, evidently unable to help, was gone by 2019. A name change to GL Brands (GRLB) didn’t turn things around.

The company’s bankruptcy plan became effective on June 29, 2021, and all its shares were cancelled.

Perhaps Pelosi needs to find another way to save the planet.

For further information about this securities law blog post, please contact Brenda Hamilton, Securities Attorney at 200 E. Palmetto Park Rd, Suite 103, Boca Raton, Florida, (561) 416-8956, by email [email protected] or visit www.securitieslawyer101.com. This securities law blog post is provided as a general informational service to clients and friends of Hamilton & Associates Law Group and should not be construed as and does not constitute legal advice on any specific matter, nor does this message create an attorney-client relationship. Please note that the prior results discussed herein do not guarantee similar outcomes.

https://www.securitieslawyer101.com/2022/paul-pelosi-jrs-adventures-in-pennyland

0 notes

Text

Paul Pelosi's business investment raises concerns over Washington insider trading

WASHINGTON (TND) — It’s been a decade since a law passed banning members of Congress from trading stocks based on insider information, yet some say the practice is still alive and well in Washington.

0 seconds of 0 secondsVolume 90% It’s been a decade since a law passed banning members of Congress from trading stocks based on insider information, yet some say the practice is still alive and well in Washington. (TND)

Now, there is controversy over new financial disclosures from one of the most powerful people in Washington. Records show the husband of House Speaker Nancy Pelosi, Paul Pelosi, invested between $1 and $5 million in the semiconductor company Nvidia, just weeks ahead of a vote scheduled on a bill that would provide more than $50 billion to the chip industry to move more manufacturing to the United States.

“He’s making those bets based on companies and industries that are highly regulated or are getting stimulus payments or part of stimulus programs that Nancy Pelosi is supporting," said Peter Schweizer, President of the Government Accountability Institute.

Still, no laws appear to have been broken and a spokesman for Speaker Pelosi told Fox Business, “The speaker does not own any stocks. As you can see from the required disclosures, with which the speaker fully cooperates, these transactions are marked ‘SP’ for spouse. The speaker has no prior knowledge or subsequent involvement in any transactions."

Some lawmakers say they see nothing wrong with Paul Pelosi’s purchase

"That’s his business. That’s how he makes a living. That’s like saying, I’m married to a nurse, should I not vote on any healthcare legislation? It’s not an easy one to figure out," said Rep. Mike Thompson, D-Calif.

But many times, members of Congress are given information before it’s made public, one reason the STOCK Act was passed and signed into law back in 2012.

Pope Francis, greets Speaker of the House Nancy Pelosi, D-Calif., and her husband, Paul Pelosi before celebrating a Mass on the Solemnity of Saints Peter and Paul, in St. Peter's Basilica at the Vatican, Wednesday, June 29, 2022. Pelosi met with Pope Francis on Wednesday and received Communion during a papal Mass in St. Peter's Basilica, witnesses said, despite her position in support of abortion rights. (Vatican Media via AP)

But since then, critics say it’s been both watered down and unenforced, in part because those tasked with making sure the law is followed work in agencies funded by Congress.”

"We’re essentially asking our law enforcement to investigate the people that provide their paychecks," said Schweizer.

Many lawmakers say they’d be ok with stronger laws on insider trading, including Sen. Richard Blumenthal, D-Conn., who thinks the STOCK Act could be strengthened.

"It’s important for the public to have trust and confidence in public officials," he said.

https://kmph.com/news/nation-world/massive-business-investment-by-paul-pelosi-raises-concerns-over-washington-insider-trading-house-speaker-nancy-pelosi-nvidia-stock-act-peter-schweizer-nancy-pelosis-husband-makes-big-business-investment

0 notes

Text

Nancy Pelosi's husband Paul arrested for drink-driving

The husband of US House of Representatives Speaker Nancy Pelosi has been arrested on suspicion of drink-driving in California.

Paul Pelosi was held after his Porsche was involved in a collision with another vehicle in Napa County on Saturday night.

No-one was injured and the other driver was not arrested.

Eighty-two-year-old Mr Pelosi was charged with two misdemeanours and had his bail set at $5,000.

He is not listed as being currently in custody.

Who is Nancy Pelosi?

The California Highway Patrol said Mr Pelosi had been attempting to cross State Route-29 when his car was struck by a 48-year-old man driving a Jeep.

California law states drivers cannot operate a vehicle if their blood alcohol level is more than 0.08%. Authorities have not said what Mr Pelosi's level was.

Mrs Pelosi was delivering an address at Brown University when the incident happened.

Her spokesman released a statement saying she would not be commenting on the "private matter".

Paul Pelosi has not yet commented on his arrest.

https://www.bbc.com/news/world-us-canada-61631499

0 notes

Text

Nancy Pelosi's office responds after her husband buys stock in computer chips before vote

WASHINGTON (TND) — After being arrested for a DUI, House Speaker Nancy Pelosi's husband once again made headlines by controversially trading stock in a computer chip company ahead of a scheduled congressional vote on the semiconductor industry.

0 seconds of 0 secondsVolume 90% Byron Donalds joined The National Desk Thursday morning. (Video: The National Desk){ }

FOX Business reports it reached out to Pelosi's office regarding her husband Paul's million-dollar purchase of stock in Nvidia, a semiconductor company known for its high-end graphics cards and processors for PCs, right as Congress is set to vote on up to $52 billion dollars worth of subsidies for the industry.

Drew Hammill, a spokesperson for Pelosi's office, reportedly responded to Fox News.

The Speaker does not own any stocks. As you can see from the required disclosures, with which the Speaker fully cooperates, these transactions are marked ‘SP’ for Spouse. The Speaker has no prior knowledge or subsequent involvement in any transactions," Hammill told Fox.

Pelosi herself has been in the spotlight for her opinion that American lawmakers should be allowed to trade stock, despite being privy to insider information.

Back in December 2021, around the time Pelosi made the comments, former Obama administration ethics watchdog Walter Shaub criticized Pelosi, telling Fox News he believed the idea was "disgusting."

The American people are sick of members of Congress buying and selling stock and creating the appearance of trading on insider information," Schaub said. "They should absolutely be banned from trading stocks. Let them buy diversified mutual funds. Let them buy government bonds. But bar them from trading stocks for crying out loud.

Days after Pelosi made her comments, her husband Paul reportedly bought millions of dollars worth of call options in various tech stocks. Many of those trades were said to have involved companies that were affected by Paul's wife's legislative decisions.

One timely investment netted Paul $5.3 million, according to Fortune.

To be clear, insider trading is already a serious federal criminal and civil violation and the Speaker strongly supports robust enforcement of the relevant statutes by the Department of Justice and the Securities and Exchange Commission," Hammill reportedly added in his statement to Fox News. "The Speaker led the House in passing the bipartisan Courthouse Ethics and Transparency Act, which would subject federal judges to similar disclosure requirements as those in the STOCK Act. President Biden signed this bill into law in May.

Rep. James Comer, R-Ky., appearing on the show "Fox and Friends," heavily criticized both Nancy Pelosi and her husband Paul.

Nancy Pelosi is the ultimate insider. Not only is her husband buying stock options on a much higher level than the average member of Congress...The average member of Congress may buy $5,000 or $6,000 of stock. He's buying $500,000 worth of stock. He's buying stock options which expire," Rep. Cromer said while on the show.

To be able to trade stock options profitably, you have to know exactly which direction that stock's going to move, and you can make a huge profit. This is wrong," Rep. Cromer added. "This is another example of the media turning a blind eye to Nancy Pelosi's bad behavior and unethical behavior.

The Senate could vote on the semiconductor industry-subsidizing bill as early as Tuesday, Reuters reports. The intent of the bill is to boost American production of the products so the U.S. won't have to rely as heavily on imports from Asia.

Paul Pelosi was arrested for drunk driving in California in May, a report which made headlines nationwide. Records showed he was charged with driving under the influence and driving with a blood alcohol content level of 0.08 or higher.

Hammill also issued statements on the matter, but simply said that Nancy Pelosi was aware and not offering any comments.

https://13wham.com/news/nation-world/nancy-pelosis-office-responds-after-her-husband-buys-stock-in-computer-chips-before-vote-paul-pelosi-nvidia-semiconductor

0 notes

Text

Paul Pelosi, Husband of House Speaker Nancy Pelosi, Arrested on Drunken-Driving Charges

Paul Pelosi, husband of House Speaker Nancy Pelosi, was arrested Saturday night in Napa County, Calif., on suspicion of driving while under the influence of alcohol, according to the county’s website.

The arrest was made at 11:44 p.m. Saturday, and Mr. Pelosi was booked into jail early Sunday on two misdemeanor charges related to driving intoxicated. Bail was set at $5,000, and Mr. Pelosi was released at 7:26 a.m. Sunday, the website shows.

https://www.wsj.com/articles/paul-pelosi-husband-of-house-speaker-nancy-pelosi-arrested-for-drunken-driving-11653872104

0 notes

Text

Paul Pelosi's business investment raises concerns over Washington insider trading

https://kmph.com/news/nation-world/massive-business-investment-by-paul-pelosi-raises-concerns-over-washington-insider-trading-house-speaker-nancy-pelosi-nvidia-stock-act-peter-schweizer-nancy-pelosis-husband-makes-big-business-investmentFILE - Paul Pelosi, right, the husband of House Speaker Nancy Pelosi, of California, follows his wife as she arrives for her weekly news conference on Capitol Hill in Washington, Thursday, March 17, 2022. Authorities say Paul Pelosi was arrested on suspicion of DUI in Northern California, late Saturday, May 28, 2022, in Napa County. He could face charges including driving under the influence. Bail was set at $5,000. (AP Photo/Andrew Harnik, File)

WASHINGTON (TND) — It’s been a decade since a law passed banning members of Congress from trading stocks based on insider information, yet some say the practice is still alive and well in Washington.

0 seconds of 0 secondsVolume 90% It’s been a decade since a law passed banning members of Congress from trading stocks based on insider information, yet some say the practice is still alive and well in Washington. (TND)

Now, there is controversy over new financial disclosures from one of the most powerful people in Washington. Records show the husband of House Speaker Nancy Pelosi, Paul Pelosi, invested between $1 and $5 million in the semiconductor company Nvidia, just weeks ahead of a vote scheduled on a bill that would provide more than $50 billion to the chip industry to move more manufacturing to the United States.

“He’s making those bets based on companies and industries that are highly regulated or are getting stimulus payments or part of stimulus programs that Nancy Pelosi is supporting," said Peter Schweizer, President of the Government Accountability Institute.

Still, no laws appear to have been broken and a spokesman for Speaker Pelosi told Fox Business, “The speaker does not own any stocks. As you can see from the required disclosures, with which the speaker fully cooperates, these transactions are marked ‘SP’ for spouse. The speaker has no prior knowledge or subsequent involvement in any transactions."

Some lawmakers say they see nothing wrong with Paul Pelosi’s purchase

"That’s his business. That’s how he makes a living. That’s like saying, I’m married to a nurse, should I not vote on any healthcare legislation? It’s not an easy one to figure out," said Rep. Mike Thompson, D-Calif.

But many times, members of Congress are given information before it’s made public, one reason the STOCK Act was passed and signed into law back in 2012.

Pope Francis, greets Speaker of the House Nancy Pelosi, D-Calif., and her husband, Paul Pelosi before celebrating a Mass on the Solemnity of Saints Peter and Paul, in St. Peter's Basilica at the Vatican, Wednesday, June 29, 2022. Pelosi met with Pope Francis on Wednesday and received Communion during a papal Mass in St. Peter's Basilica, witnesses said, despite her position in support of abortion rights. (Vatican Media via AP)

But since then, critics say it’s been both watered down and unenforced, in part because those tasked with making sure the law is followed work in agencies funded by Congress.”

"We’re essentially asking our law enforcement to investigate the people that provide their paychecks," said Schweizer.

Many lawmakers say they’d be ok with stronger laws on insider trading, including Sen. Richard Blumenthal, D-Conn., who thinks the STOCK Act could be strengthened.

"It’s important for the public to have trust and confidence in public officials," he said.

https://kmph.com/news/nation-world/massive-business-investment-by-paul-pelosi-raises-concerns-over-washington-insider-trading-house-speaker-nancy-pelosi-nvidia-stock-act-peter-schweizer-nancy-pelosis-husband-makes-big-business-investment

0 notes

Text

Nancy Pelosi's husband Paul arrested for drink-driving

https://www.bbc.com/news/world-us-canada-61631499

The husband of US House of Representatives Speaker Nancy Pelosi has been arrested on suspicion of drink-driving in California.

Paul Pelosi was held after his Porsche was involved in a collision with another vehicle in Napa County on Saturday night.

No-one was injured and the other driver was not arrested.

Eighty-two-year-old Mr Pelosi was charged with two misdemeanours and had his bail set at $5,000.

He is not listed as being currently in custody.

Who is Nancy Pelosi?

The California Highway Patrol said Mr Pelosi had been attempting to cross State Route-29 when his car was struck by a 48-year-old man driving a Jeep.

California law states drivers cannot operate a vehicle if their blood alcohol level is more than 0.08%. Authorities have not said what Mr Pelosi's level was.

Mrs Pelosi was delivering an address at Brown University when the incident happened.

Her spokesman released a statement saying she would not be commenting on the "private matter".

Paul Pelosi has not yet commented on his arrest.

0 notes

Text

Nancy Pelosi's office responds after her husband buys stock in computer chips before vote

WASHINGTON (TND) — After being arrested for a DUI, House Speaker Nancy Pelosi's husband once again made headlines by controversially trading stock in a computer chip company ahead of a scheduled congressional vote on the semiconductor industry.

0 seconds of 0 secondsVolume 90% Byron Donalds joined The National Desk Thursday morning. (Video: The National Desk){ }

FOX Business reports it reached out to Pelosi's office regarding her husband Paul's million-dollar purchase of stock in Nvidia, a semiconductor company known for its high-end graphics cards and processors for PCs, right as Congress is set to vote on up to $52 billion dollars worth of subsidies for the industry.

Drew Hammill, a spokesperson for Pelosi's office, reportedly responded to Fox News.

The Speaker does not own any stocks. As you can see from the required disclosures, with which the Speaker fully cooperates, these transactions are marked ‘SP’ for Spouse. The Speaker has no prior knowledge or subsequent involvement in any transactions," Hammill told Fox.

Pelosi herself has been in the spotlight for her opinion that American lawmakers should be allowed to trade stock, despite being privy to insider information.

Back in December 2021, around the time Pelosi made the comments, former Obama administration ethics watchdog Walter Shaub criticized Pelosi, telling Fox News he believed the idea was "disgusting."

The American people are sick of members of Congress buying and selling stock and creating the appearance of trading on insider information," Schaub said. "They should absolutely be banned from trading stocks. Let them buy diversified mutual funds. Let them buy government bonds. But bar them from trading stocks for crying out loud.

Days after Pelosi made her comments, her husband Paul reportedly bought millions of dollars worth of call options in various tech stocks. Many of those trades were said to have involved companies that were affected by Paul's wife's legislative decisions.

One timely investment netted Paul $5.3 million, according to Fortune.

To be clear, insider trading is already a serious federal criminal and civil violation and the Speaker strongly supports robust enforcement of the relevant statutes by the Department of Justice and the Securities and Exchange Commission," Hammill reportedly added in his statement to Fox News. "The Speaker led the House in passing the bipartisan Courthouse Ethics and Transparency Act, which would subject federal judges to similar disclosure requirements as those in the STOCK Act. President Biden signed this bill into law in May.

Rep. James Comer, R-Ky., appearing on the show "Fox and Friends," heavily criticized both Nancy Pelosi and her husband Paul.

Nancy Pelosi is the ultimate insider. Not only is her husband buying stock options on a much higher level than the average member of Congress...The average member of Congress may buy $5,000 or $6,000 of stock. He's buying $500,000 worth of stock. He's buying stock options which expire," Rep. Cromer said while on the show.

To be able to trade stock options profitably, you have to know exactly which direction that stock's going to move, and you can make a huge profit. This is wrong," Rep. Cromer added. "This is another example of the media turning a blind eye to Nancy Pelosi's bad behavior and unethical behavior.

The Senate could vote on the semiconductor industry-subsidizing bill as early as Tuesday, Reuters reports. The intent of the bill is to boost American production of the products so the U.S. won't have to rely as heavily on imports from Asia.

Paul Pelosi was arrested for drunk driving in California in May, a report which made headlines nationwide. Records showed he was charged with driving under the influence and driving with a blood alcohol content level of 0.08 or higher.

Hammill also issued statements on the matter, but simply said that Nancy Pelosi was aware and not offering any comments.

https://13wham.com/news/nation-world/nancy-pelosis-office-responds-after-her-husband-buys-stock-in-computer-chips-before-vote-paul-pelosi-nvidia-semiconductor

0 notes

Text

Paul Pelosi, Husband of House Speaker Nancy Pelosi, Arrested on Drunken-Driving Charges

Mr. Pelosi was released Sunday morning on $5,000 bail; Mrs. Pelosi wasn’t with her husband at the time

Paul Pelosi, husband of House Speaker Nancy Pelosi, was arrested Saturday night in Napa County, Calif., on suspicion of driving while under the influence of alcohol, according to the county’s website.

The arrest was made at 11:44 p.m. Saturday, and Mr. Pelosi was booked into jail early Sunday on two misdemeanor charges related to driving intoxicated. Bail was set at $5,000, and Mr. Pelosi was released at 7:26 a.m. Sunday, the website shows.

https://www.wsj.com/articles/paul-pelosi-husband-of-house-speaker-nancy-pelosi-arrested-for-drunken-driving-11653872104

0 notes

Text

Ex-Obama ambassador to China calls Pelosi trip a ‘provocation’ that makes Biden look ‘weak’

Former Sen. Max Baucus, a Democrat from Montana who served as ambassador to China under former President Obama, called House Speaker Nancy Pelosi’s (D-Calif.) Taiwan visit Tuesday a “provocation,” adding it made President Biden look “weak.”

Baucus in an interview Tuesday evening with CNN’s Jake Tapper repeatedly warned the trip by Pelosi was edging the U.S. closer to recognizing Taiwan as an independent nation — which the longtime senator suggested would be a disaster.

“This is a provocation because the Chinese government is very opposed to this,” said Baucus, who served as ambassador to China from 2014 to 2017.

He said Pelosi’s visit was much more important than a visit by a random member of the House.

“Don’t forget, she’s Speaker. She’s not just an ordinary member of Congress,” he said. “Add to that she’s a very strong hawk. She’s very critical of China.”

“Really, what this is doing, it’s pushing the support of democracy a little closer to crossing the line into independence. That’s the real problem here,” Baucus said.

Taiwan wouldn’t risk the “disaster” of formally declaring its independence from China, the former ambassador said, but China will react if Taiwan looks like it’s leaning toward what the Chinese government considers an “existential” threat.

“We are playing with fire when we get pretty close to the line, and Pelosi is pushing us much, much closer to recognizing Taiwan as an independent country. And once we get there, we’re going to pay a price,” Baucus said.

Baucus, who served with Biden for decades in the Senate, also said Pelosi was making Biden look weak in front of the Chinese, who he said value power and strength above all.

“Don’t forget, too, Speaker Pelosi — it’s a free pass for her. She’s not the president. She doesn’t have to worry about conducting foreign policy worldwide. She’s a member of Congress. She doesn’t have to worry about it,” Baucus said. “She does a little but not much. So poor Joe Biden, he looks weak because he either told her not to go and he looks weak to the Chinese guys, or he’s weak because he told her not to go and she went anyway.”

Pelosi touched down in Taipei on Tuesday after kicking off her congressional delegation tour Monday in Singapore.

Ahead of her arrival, speculation circulated about whether the Speaker would include the self-governed island claimed by China on her itinerary — which also includes Malaysia, South Korea and Japan — and Taiwan’s addition remains controversial.

https://thehill-com.translate.goog/policy/international/3585185-ex-obama-ambassador-to-china-calls-pelosi-trip-a-provocation-that-makes-biden-look-weak/?_x_tr_sl=en&_x_tr_tl=zh-CN&_x_tr_hl=zh-CN&_x_tr_pto=sc

0 notes

Text

Nancy Pelosi's husband Paul DUMPS his semiconductor shares following outrage as former Dallas Federal Reserve President say couple has been trading based off 'inside information'

House Speaker Nancy Pelosi's husband Paul dumped his stock in semiconductor firm Nvidia amid backlash just before the Senate passed the CHIPS bill to drum up domestic semiconductor chip production, according to a periodic report released Tuesday.

On June 17 Paul Pelosi exercised call options to buy 20,000 shares worth between $1 million and $5 million, ahead of the vote on the CHIPS plus bill which would inject $52 billion into the semiconductor market. The move drew bipartisan backlash and renewed calls for a congressional stock ban.

But on Tuesday, the day before the Senate passed the CHIPS bill, Paul Pelosi sold 25,000 shares of Nvidia at an average price of $165.05 with a total loss of $341,365, according to a periodic transaction report released Tuesday.

Pelosi spokesperson Drew Hammill said in a statement: 'Mr. Pelosi bought options to buy stock in this company more than a year ago and exercised them on June 17, 2022.'

'As always, he does not discuss these matters with the Speaker until trades have been made and required disclosures must be prepared and filed. Mr. Pelosi decided to sell the shares at a loss rather than allow the misinformation in the press regarding this trade to continue,' he added.

The Senate passed the CHIPS bill Wednesday and the House is expected to pass it on Thursday.

Former Dallas Federal Reserve President Richard Fisher said Thursday on CNBC Speaker Nancy Pelosi and her husband 'appear' to have taken advantage of insider information with Paul's many lucrative stock trades.

Responding to news that Democrats would soon release the framework for a long-awaited stock pan proposal, Fisher said on CNBC's Squawk Box: 'Clearly people have taken advantage of insider information forever. I'm not against their tapping that down. I'm sorry to see that Paul Pelosi, Nancy Pelosi and others appear - all appearance right now we don't know the facts - to have taken advantage of insider information.'

ADVERTISEMENT

'Something needs to be done.'

+5View gallery

Former Dallas Federal Reserve President Richard Fisher said Thursday on CNBC that and Speaker Nancy Pelosi and her husband 'appear' to have taken advantage of insider information with Paul's many lucrative stock trades

The stock ban framework would force members of Congress, their spouses and senior staff to place assets in either a qualified blind trust or completely sell them off. Lawmakers, spouses and staff would still be able to hold mutual funds.

Leadership's goal is to get the legislation through the House in September, according to Punchbowl News.

Rep. Zoe Lofgren, D-Calif., who as head of the House Administration Committee has been tasked with reviewing the different proposals, told DailyMail.com on Friday the framework would be out 'in the coming weeks.'

+5View gallery

Last week congressional stock purchases were again under fire after Speaker Nancy Pelosi's husband Paul purchased over $1 million in shares of semiconductor firm Nvidia as Congress was negotiating the a bill to inject billions into the semiconductor chip industry

+5View gallery

On June 17 Paul Pelosi but 20,000 shares worth between $1 million and $5 million, ahead of the Sunday vote on the CHIPS plus bill which would inject $52 billion into the semiconductor market

'Has your husband ever made a stock purchase or sale based on information he's received from you?' a reported asked the speaker in her weekly briefing last week.

'No,' she scoffed. 'Absolutely not.' Pelosi then walked away from the podium.

The Pelosis are one of the wealthiest couples in Congress and Paul Pelosi has been dubbed one of the most prolific stock traders of all time. The speaker's office frequently notes that Nancy herself does not own any stock.

For months there has been broad bipartisan consensus behind banning individual stock trades for members and their spouses. Lawmakers in both parties have put forth a slew of bills since Pelosi first expressed a cool openness to such a ban in February, not one of which has made it to the floor.

Last Wednesday Sen. Josh Hawley wrote a letter asking Democrats to hold a hearing on banning stock trading.

'This issue of whether and how Members of Congress engage in various financial transactions deserves scrutiny by the Committee,' Hawley wrote to Sen. Gary Peters, chair of the Homeland Security and Government Affairs Committee.

'In 2020 Speaker Pelosi and her husband outperformed the S&P 500 by a whopping 14.3 percent,' Hawley said. Ninety percent of actively managed investment funds fail to beat the market, according to a report.

After initial resistance, Pelosi changed tune in February and said she would get behind a stock ban if it was not just aimed at Congress but all of government.

'It has to be government-wide,' the California Democrat told reporters. 'The judiciary has no reporting. The Supreme Court has no disclosure. It has no reporting of stock transactions, and it makes important decisions every day.'

+5View gallery

'Has your husband ever made a stock purchase or sale based on information he's received from you?' a reported asked the speaker in her weekly briefing last week. 'No,' she scoffed. 'Absolutely not,' Pelosi said

It was not resounding support, but it was a change of tune from three months earlier when Pelosi was actively against cutting off her husband and the rest of Congress' stock trading power.

'We're a free market economy. '[Lawmakers] should be able to participate in that,' she said in December.

Despite broad support, some Democrats lay blame at leadership for stopping such bills from even getting a vote.

'The people who control the calendar don't want to bring it to the floor,' said Rep. Abigail Spanberger, D-Va., a moderate who authored a bipartisan proposal to force members to put their assets in a blind trust. 'The people who control committees of jurisdiction don't want to bring it to the floor.'

Paul Pelosi, owner of Financial Leasing Services, has amassed a personal fortune of around $135 million.

In 2021, the House Speaker is ranked as the 14th wealthiest member of Congress with an estimated net worth of at least $46,123,051, according to Insider.

Paul Pelosi's lucrative stock trades have prompted social investing app Iris allows users to track the couple's trades and be notified every time Paul makes a purchase so that they can do the same.

And popular Twitter account @NancyTracker, which tracked Pelosi's investments, was banned from the social media network.

The 2012 STOCK Act bans members of Congress from using 'any nonpublic information derived from the individual's position ... or gained from performance of the individual's duties, for personal benefit.'

https://www.dailymail.co.uk/news/article-11058953/Nancy-Paul-appear-taken-advantage-inside-information-ex-Dallas-Fed-President-says.html

0 notes

Text

Paul Pelosi to be arraigned on DUI causing injury charges Wednesday

Paul Pelosi, the husband of House Speaker Nancy Pelosi, D-Calif., is scheduled to be arraigned Wednesday morning on charges of driving under the influence of alcohol causing injury and driving with .08% blood alcohol level or higher causing injury, the Napa County District Attorney's Office said in a press release on Monday.

The charges stem from a crash on May 28, when a 2014 Jeep struck Pelosi's 2021 Porsche at an intersection around 10 p.m. that evening.

Mugshot for Paul Pelosi, the husband of House Speaker Nancy Pelosi. (Napa County Department of Corrections)

Pelosi, 81, allegedly had a blood alcohol content level of .082% when a sample was taken about two hours after the crash.

NANCY PELOSI SET TO VISIT TAIWAN, TRIGGERING DIRE WARNING FROM CHINESE MEDIA PERSONALITY

The district attorney said that misdemeanor charges were filed "based upon the extent of the injuries suffered by the victim." It's unclear what those injuries are and the driver of the Jeep was not arrested.

Pelosi or his defense counsel will enter a plea at the arraignment on Wednesday. A defendant in a misdemeanor DUI case does not have to be present in the courtroom for an arraignment under California law.

Speaker of the House of Representatives Nancy Pelosi and husband Paul Pelosi. (Samuel Corum/AFP via Getty Images))

The district attorney said when charges were filed in June that the punishment for DUI causing injury as a misdemeanor "includes up to five years of probation, a minimum of five days in jail, installation of an ignition interlock device, fines and fees, completion of a court ordered drinking driver class, and other terms as appropriate."

CLICK HERE TO GET THE FOX NEWS APP

A spokesperson for Paul Pelosi did not return a request for comment on Monday.

https://www.foxnews.com/politics/paul-pelosi-arraigned-dui-causing-injury-charges-wednesday

0 notes

Text

Pelosi's husband dumps Nvidia stock as House eyes chip bill

July 27 (Reuters) - U.S. House Speaker Nancy Pelosi's husband sold his shares of chipmaker Nvidia (NVDA.O) on Tuesday, days before the House is expected to consider legislation providing subsidies and tax credits worth over $70 billion to boost the U.S. semiconductor industry.

In a periodic transaction report, the senior Democrat disclosed that her husband, financier Paul Pelosi, sold 25,000 shares of Nvidia for about $4.1 million, ending up with a loss of $341,365.

Advertisement · Scroll to continue

Report an ad

Paul Pelosi frequently trades shares of companies popular with many investors, including Apple (AAPL.O), Microsoft (MSFT.O) and other tech companies.

Transaction reports filed by Pelosi, a multi-millionaire, show her husband bought 5,000 Nvidia shares in July 2021, and that he exercised options to buy another 20,000 Nvidia shares last June.

The Senate is expected to vote on final passage in coming days of legislation providing about $52 billion in government subsidies for U.S. semiconductor production, as well as an investment tax credit for chip plants estimated to be worth $24 billion.

Advertisement · Scroll to continue

The legislation, which aims to make the domestic chip industry more competitive with China's, would then be taken up in the U.S. House under Pelosi's direction.

Last year, Pelosi defended the rights of federal lawmakers to trade stocks, but she later responded to calls for a ban on trading by lawmakers by signaling willingness to potentially advance such legislation.

A 2012 law makes it illegal for lawmakers to use information from their work in Congress for their personal gain. The law requires them to disclose stock transactions by themselves or family members within 45 days.

Advertisement · Scroll to continue

Report an ad

An analysis by Unusual Whales, a service selling financial data, concluded that congressional lawmakers last year traded $290 million in stocks, options, cryptocurrency and other assets, and that they outperformed the market, on average.

Santa Clara, California-based Nvidia is most valuable U.S chipmaker.

https://www.reuters.com/markets/us/pelosis-husband-dumps-nvidia-stock-house-eyes-chip-bill-2022-07-27/

0 notes