Don't wanna be here? Send us removal request.

Text

FSSAI Registration Type, Documents Required and Penalty

FSSAI (Food Safety and Standards Authority of India) is an autonomous body that is established under the Ministry of Health & Family Welfare, Government of India to monitor and govern the food business in India. FSSAI is responsible for protecting and promoting public health through the regulation and supervision of food safety & ensures the food products undergo quality checks.

FSSAI Registration Type

Depending upon the installed capacity or turnover or location, applicant premises are eligible for the license such as basic license/ Registration, state license and central license.

Required Documents for the Basic FOOD Registration

Form B – completed and signed

Photo Identity of FBO

Proof of possession of premises (e.g. Rental Agreement).

Partnership Deed / Certificate of Incorporation / Articles of Association etc

List of food products to be dealt with

System plan for Food safety management

Required Documents for the State FOOD License

Form B duly completed and signed

Plan of the processing unit showing the dimensions and operation-wise area allocation

List of Directors/ Partners/ Proprietor with address, contact details, and photo ID

Name and list of equipment and machinery used with the number and installed capacity

List of food category to be manufactured

Authority letter from manufacturer nominated a responsible person name and address

Analysis report of water to be used in the process to confirm the portability

Proof of possession of premises

Partnership deed/ affidavit of proprietorship

NOC and copy of License from the manufacturer

Copy of certificate obtained under Coop Act 1861/Multi state Coop Act 2002

Food safety management system plan or certificate

Required Documents for the Central FOOD License

Form B duly completed and signed

Plan of the processing unit showing the dimensions and operation-wise area allocation

List of Directors/ Partners/ Proprietor with address, contact details, and photo ID

Name and list of equipment and machinery used with the number and installed capacity

List of food category to be manufactured

Authority letter from manufacturer nominated a responsible person name and address

Analysis report of water to be used in the process to confirm the portability

Source of raw material for milk, meat etc

Recall plan wherever applicable

Ministry of Commerce Certificate for 100% EOU

NOC/PA document issued by FSSAI

IE code document issued by DGFT

Form IX

Certificate from Ministry of Tourism

Proof of possession of premises

Partnership deed/ affidavit of proprietorship

NOC and copy of License from the manufacturer

Food safety management system plan or certificate

NOC from the municipality or local body

Supporting document for proof of turnover and transportation

Declaration form

Consequences of Non-Compliance

Any registered or licensed person under the FSSAI must adhere to the rules and regulation under the FSS Act, 2006. Food safety officer generally conducts the inspection of the food business operator’s facility and identifies the level of compliance with the regulation using a checklist. Based on the compliance level, the food safety officer marks it as:

Compliance (C)

Non-compliance (NC)

Partial compliance (PC)

Not applicable/Not observed (NA)

Based on the above, the food safety officer might issue an improvement notice wherever required per Section 32 of the FSS Act, 2006. If the business operator fails to comply with the improvement notice, the officer after giving the licensee an opportunity to show cause may cancel his license. Any food business operator aggrieved by an improvement notice can appeal to the State Commissioner of Food Safety. The decision thereon can be challenged through appealing to the Food Safety Appellate Tribunal/High Court.

Penalty for Non- Compliance

Renewal of FSSAI Certificate

To continue the business, it is required to be renewed before the expiry of the FSSAI License validity. If your food license expiry is keeping close stay attentive and remember you must apply 30 days prior to the FSSAI License or FSSAI Registration Expiry date.

In a hurry to get the FSSAI Certificate? Fill up this form, or click here or call Kapish at +91-9971770603 & +91-9711994042

For more information, write us @[email protected] or call Kapish @+91-9971770603

0 notes

Text

FSSAI Registration Process

FSSAI (Food Safety and Standards Authority of India) is an autonomous body that is established under the Ministry of Health & Family Welfare, Government of India to monitor and govern the food business in India. FSSAI is responsible for protecting and promoting public health through the regulation and supervision of food safety & ensures the food products undergo quality checks.

HISTORY

On 5th August 2011, Indian Former Union Minister Dr. Anubumani Ramadoss established FSSAI under Food Safety and Standards Act, 2006 (FSS Act) which was operationalized in year 2006. FSSAI consisting of a chairperson and 22 members is responsible for setting standards for food products, so that there is a department or one body to monitor and clears the confusion from the minds of consumers, traders, manufacturers, and investors.

Ministry of Health & Family Welfare, Government of India is the Administrative Ministry of Food Safety and Standards Authority of India (FSSAI). The following are the statutory powers that the FSS Act, 2006 gives to the Food Safety and Standards Authority of India

Framing of regulations to lay down food safety standards

Laying down guidelines for accreditation of laboratories for food testing

Providing scientific advice and technical support to the Central Government

Contributing to the development of international technical standards in food

Collecting and collating data regarding food consumption, contamination, emerging risks, etc.

Disseminating information and promoting awareness about food safety and nutrition in India

It is responsible for the registering and licensing of the Food Business Operators (FBO) in India, and it lays down the rules and regulation for running the food business in India.

Who need FSSAI Registration or License?

Every food business operator (FBO) involved in the manufacturing, processing, storage distribution and sale of food products must compulsorily obtain FSSAI Registration or License.

The following kinds of business mandatorily require obtaining an FSSAI Registration/License:

Petty retailers and retail shops such as Retail Shop, Snacks shop, Confectionery or Bakery Shop, etc.

Temporary stalls or fixed stall or food premise involved in preparation, distribution, storage and sale of food products such as Gol gappa stall, chat stall, fruits/vegetables vendors, Tea Stall, snacks stall, Bread pakoda stall, Samosa stall, Chinese food stall, South Indian food stall, sweet stall, juice shops, etc.

Hawkers who sell packaged or freshly prepared food by travelling (usually on foot or movable carts) from one location to other.

Dairy Units including Milk Chilling Units, Petty Milkman and Milk Vendors.

Vegetable Oil Processing Units.

Slaughtering house such as meat shop, mutton shop, chicken shop, lamb meat, etc.

Meat Processing and Fish Processing units.

All Food Manufacturing/ Processing units that include Repacking of food.

Proprietory food and Novel food.

Cold/refrigerated storage facility.

Transporter of food products having a number of specialised vehicles like insulated refrigerated van/wagon, milk tankers, food wagons, food trucks, etc.

Wholesaler, supplier, distributor and marketer of food products.

Hotels, Restaurants and Bars.

Canteens and Cafeteria including mid-day meal canteens.

Food Vending Agencies and Caterer.

Dhaba, PG providing food, Banquet halls with food catering arrangements, Home Based Canteens and Food stalls in fairs or religious institutions.

Importers and Exporters of food items including food ingredients.

E-Commerce food suppliers including cloud kitchens.

Benefits of FSSAI Food License

FSSAI Food license can provide the food business with legal benefits, build goodwill, ensure food safety, create consumer awareness, and assist in business expansion. It also helps to regulate, manufacture, storage, distribution, and sale of import food.

Is FSSAI Registration different from the FSSAI License?

Yes, FSSAI Registration is different from the FSSAI License in the sense depending on the size and nature of the business, FBO should obtain the necessary registration or license.

Parameter

FSSAI License

FSSAI Registration

Issuing Authority

FSSAI

FSSAI

Regulated By

Ministry of Health & Family Welfare, Government of India

Ministry of Health & Family Welfare, Government of India

Types

Central FSSAI and State FSSAI License

Basic Registration

Issue type

14-digit registered number

14-digit registered number

Duration

Is Issued for a period of 1 to 5 years

Depends on the registration applicability

Publication Condition

The publication of license number on product is necessary for the exporter, importer, traders.

The registration shall be displayed in the office premises and on the package of the product.

Application Form

Form B

Form A

Renewal

Can be renewed before 30 days of expiry

N/A

Want FSSAI certificate? write us @[email protected] or call Kapish @+91-9971770603

0 notes

Text

How Importers and Exporters can Utilize Global Import Export Data?

The modern business marketplace is a data-driven environment. The role of data is to empower business leaders to make decisions based on facts, trends, and statistical numbers.

Data is at the core of nearly every business decision made.

A department is gathering data from different resources.

Marketing departments are lasering in on market segmentation data to find consumers who are ready to buy, speeding up the sale-closing process whenever possible.

Business executives must examine bigger trends in the market, such as changes in pricing of resources, shipping, or manufacturing.

Similarly, the Global Export-Import data plays a vital role in the Indian trade market. This data is the only medium to understand the market and know the ups & downs. From such data, the following information can be informed:

Ups & downs trends of trading business

Demand of product in the market

Knowing the current & upcoming trend in the market

Finding buyer or supplier of their product globally

Respective product market size

Available different rate from different supplier

All possible source or destination country

Competitor in the respective market

HS Code suggestion

It’s not limited to this information; the user can also find many more information such as source port / destination port as per their convenient etc.

Government of India is also boosting and preparing a system to help through such information under the Department of Commerce which comes under the ministry of commerce & industry. Some of such sites are as follows:

Ministry of Commerce & Industry

Website: https://commerce.gov.in/trade-statistics/

The Department formulates, implements and monitors the Foreign Trade Policy (FTP) which provides the basic framework of policy and strategy to be followed for promoting exports and trade.

Indian Trade Portal

Website: https://www.indiantradeportal.in/index.jsp?lang=0

The Department of Commerce, Government of India has developed this web portal with an aim to facilitate and increase external trade activities with the rest of the world.

Central Board of Indirect Taxes & Customs

Website:https://www.cbic.gov.in/htdocs-cbec/customs/cst2021-280621/cst-idx

Central Board of Indirect Taxes and Customs (erstwhile Central Board of Excise & Customs) is a part of the Department of Revenue under the Ministry of Finance, Government of India.

iKargos, an online portal offered by a Delhi based organization named Cargosite Ventures Private Limited with an aim to make all logistic process transparent and provides all logistic services along with the guidance from their rich experience. The offered services are:

Freight Forwarding

Custom Clearance

Cargo Insurance

Inland Transportation

Warehouse

Consultant in getting all required certificate to trade in India

Analysis of EXIM data with interactive dashboard

In a hurry to get the Report ? Fill up this form , or call Rekha at +91-9971770603 & Amit at +91-9663195931

In order to know more, contact us: +91-11-41192200 or write us @ [email protected]

0 notes

Text

What is BIS-ISI Marking?

The ISI mark is a standards-compliance mark for industrial products in India. The mark certifies that a product confirms to an Indian standard (IS) developed by the Bureau of Indian Standards (BIS), the national standards body of India.

If manufacturers, Importers and sellers operates in the Indian market without a BIS license, they will be punished under the BIS Act.

BIS-ISI Marking Certificate is granted only after successfully passed all test & inspection with the necessary documents and product, required by the BIS officers.

Cargosite Ventures Pvt. Ltd. provides an experienced service to foreign and Indian Manufacturers/Importers/Sellers for ISI marking at a low cost and short time, who are willing to sell their product (Covered in ISI Mark mandatory product list) in India.

We assist manufacturers in completing documentation, testing and all the formalities related to ISI Marking .

Get BIS- ISI Mark certificate / BIS Certificate, become BIS certified, and please contact us:Phone: +91-11-41192200, Mobile no: +91-9811803136, +91-7290000637, Mail-: [email protected], [email protected]

What are the benefits of BIS-ISI Marking ?

It enables to do manufacturer, Importer/and do sales of product that fall under ISI-scheme.

It provides the safeguard to the public health.

It provides the quality assurance of the product.

It protects the consumer from dangerous products.

It also increases the confidence among the customers.

List of product that require ISI Marking 374 products identified by the BIS department are covered for BIS-ISI Certification which requires a BIS certification and is applicable to all foreign and Indian manufacturer and Importer.

Click Here to View/Download complete list of products that require ISI Marking.

Registration Process

There is total 5 step process to get ISI-Marking.

1. Application

Compilation of all the required documents.

Submission of documents & Application Fee

Application No. uallottement

Scrutiny of Application

2. Query Raised (If Any)

Intimation of any missing document or Non-compliance

Submission of reply

3. Inspection (Audit)

Remittance of Inspection/Audit Fee

Nomination of Inspecting Officer.

Schedule the itinerary as per availability.

Inspection of Manufacturing Unit

4. Sample Testing

Samples checked at factory premises

Samples sealed and drawn to be sent to BIS approved Laboratory

Test Reports recieved to BIS

5. Grant of License

Sample passed, intimation to pay Marking Fee & License Fee.

Letter for Grant of License issued

Documents for certification

Main Application Form V

Copy of Test Report Done within a Month by Internal Laboratory

Address Proof of the Manufacturing Unit

Trade Mark Registration, If Available

Certificate from Concerned Regulatory Agencies for Manufacturing

Drawing of the Product

Present Installed Capacity

Raw Material Details

Details of Machines

Layout Plan of Factory

Details of Manufacturing Process

Nature of Packing

Details of Test Equipment

Details of QC (Quality Control) Staff

Method of Disposal of Substandard Product

Organizational Chart of Factory

Location Map of Factory

Requirements for Foreign Manufacturers

Costing, Timeline and Validity

For an appropriate quotation, please contact us with your product details at +91-7290000637 / +91-9811803136 Email- [email protected], [email protected] Timeline: For Indian manufacturers: 30-40 Working Days approx. For Foreign manufacturers: 5-6 Month approx.

Lead time will start from the date of receipt required information and documents.

Validity and Renewal The license is granted initially for a period of not less than one year and up to two years. The renewal of license may be considered for a period of not less than one year and up to five years depending upon whether the annual license fee and advance minimum marking fee has been paid for. If the renewal application is made after the validity of the license, the application shall be accompanied by the late fee of rupees five thousand. Testing of sample is not required for it.

In a hurry to get the BIS ? Fill up this form , or click here or call Kapish at +91-9971770603 & +91-9711994042

Format of BIS Certificate

Click Here to View/Download BIS Certificate format.

0 notes

Text

Auto-renewal for tier 1 AEO license

AEOs are importers or exporters involved in international movement of goods that opt for the AEO certification programme. The certification is internationally recognised and gives such companies benefit of reduced time of clearance, lower costs and minimal disruption in cargo flow through customs, as they're considered secure and reliable trading partners.

The Central Board of Indirect Taxes and Customs (CBIC) has done away with renewal of authorised economic operator (AEO) certification after every three years for Tier 1 or T1 level entities, it said in a notification issued Saturday. From August 1, all such entities certified on or after April 1, 2019 shall be auto renewed in the system, without any end date, the Board said.

The Board said that facility of continuous AEO certification or auto renewal for such entities will be subject to submission of annual self-declaration between October 1 and December 31 each year, and review.

Read more at: https://economictimes.indiatimes.com/news/economy/foreign-trade/cbic-introduces-auto-renewal-for-tier-1-aeo-license-holders/articleshow/84924299.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

For more details mail us on : [email protected] and [email protected]

In a hurry to get the AEO certification? Fill up this form , or click here or call Kapish at +91-9971770603 & +91-8802601212

For more details on AEO Certification read our other BLOGS:

WHAT IS AEO ?

BENIFITS OF CERTIFICATE

LIST OF DOCUMENTS

FAQ's

0 notes

Text

What is BIS-CRS certification?

BIS -CRS certificate is issued to the Indian and foreign manufacturer for IT and Electronic products after the notice of the BIS department over the safety test done as per the Indian standard.

If manufacturers, Importers and sellers operates in the Indian market without a BIS license, they will be punished under the BIS Act.

BIS Registration/CRS Certificate is granted only after successfully passed all safety test with the necessary documents and product, required by the BIS officers.

Cargosite Ventures Pvt. Ltd. provides an experienced service to foreign Manufacturers and Indian Manufacturers/Importers/Sellers for BIS Registration at a low cost and short time, who are willing to sell their IT & Electronic products in India.

We assist manufacturers in completing documentation, testing and all the formalities related to BIS Registration. Get BIS Registration / BIS Certificate, become BIS certified, and please contact us: Cargosite Ventures Pvt. Ltd., Phone: +91-11-41192200, Mobile no: +91-9811803136, +91-7290000637, Mail-: [email protected], [email protected]

What are the benefits of BIS CRS?

It enables to do manufacturer, Importer/and do sales of product that fall under CRS-scheme.

It provides the safeguard to the public health.

It provides the quality assurance of the product.

It protects the consumer from dangerous products.

It also increases the confidence among the customers.

List of product that require BIS CRS

Foreign/Indian manufacturers, Importer and resellers who deal in identified 77 IT and Electronics products Product list are required obtain BIS-CRS registration.

Click Here to View/Download list of products that require BIS CRS Certificate.

Registration Process

There is total 9 step process to get BIS Certificate

Documents for certification

1. Lab Test Documents

User Manual/ Technical sheet of Product

PCB Layout of Product

Critical Components List

Schematic Diagram

2. Application / Factory Documents & Information

Self-certified copy of any one of following documents establishing the firm:

Registration with State Government Authority/ Trade Licence OR

Certificate of Registration issued by Company Registrar OR

Registered Partnership Deed in case applicant is a Partnership Firm OR

Certificate from a Chartered Accountant if applicant is a Proprietorship firm.

3. Self-attested copy of any one of following documents authenticating the Firm's premises (not older than 3 months) :

Registration with State Government Authority/ Trade Licences OR

Sales Tax/ VAT registration OR

Income Tax Assessment Order OR

Insurance Policy OR

Property tax receipt OR

Rent agreement with last rent receipt OR Sale/ Lease Deed agreement OR

Electricity Bill OR

Telephone Bill OR

Water Bill OR

Gas connection OR

Bank Statement/Pass Book containing the address of the sales outlet.

4. Any one of following documents as identity proof of signatory on the application:

Aadhar Card OR

Driving Licence OR

PAN card OR

Voter Identity card OR

Passport OR

Photo Bank ATM card OR

Photo Credit card OR

CGHS/ECHS photocard

Arms licence OR

Identity Certificate with photo issued by Gazetted Officer on official letterhead OR

Disability ID card/ Handicapped Medical Certificate issued by State Govts OR

Freedom Fighter photo card OR

Pensioner photo card OR

Ration/PDS photo pard OR

Photo ID issued by recognized educational institution OR

Kissan Photo PassBook OR

5. The additional documentation required to be submitted with the application are:

Agreement on non-judicial stamp paper of Rs 100/- in the prescribed format.

Location map of premises from some nearest prominent landmark.

Costing, Timeline and Validity

For an appropriate quotation, please contact us with your product details at +91-7290000637 / +91-9811803136 Email- [email protected], [email protected]

Timeline:

For BIS Testing: 5-10 Working Days

For new application: 20-25 Working days

For Inclusion application: 15-20 Working days

For Renewal Application: 2-3 Working days Lead time will start from the date of receipt required information and documents.

Validity and Renewal

BIS-CRS certificate is granted for first time 2 Year, and if after 2 year the Importer/ Manufacturer wants to renew his product then can renew for 2 year - 5 years.

Testing of sample is not required for it.

In a hurry to get the BIS ? Fill up this form , or click here or call Kapish at +91-9971770603 & +91-9711994042

Format of BIS Certificate

Click Here to View/Download BIS Certificate format.

0 notes

Text

Introduction of Bureau of India Standards (BIS)

BIS (Bureau of Indian Standard) is the National Standard Body of India established under the BIS Act 2016 for the harmonious development of the activities of standardization, marking, which recognizes the Manufacturer / Importer / Seller according to the Indian Standard by the Indian Government for the quality and safety of any product.

The BIS department provides following type of Certifications:

1. BIS Registration /CRS

BIS -CRS certificate is issued to the manufacturer for IT and Electronic products after the notice of the BIS department over the safety test done as per the Indian standard.

Mandatory Product: 76 products (IT and Electronics) identified by the BIS department are covered for BIS-CRS registration which requires a BIS registration certificate and is applicable to all foreign manufacturers and Indian manufacturer and Importer.

Validity and Renewal: BIS-CRS certificate is granted for first time 2 Year, and if after 2 year the Importer/ Manufacturer wants to renew his product then can renew for 2 year - 5 years.

2. BIS Certification / ISI Mark

The ISI mark is a standards-compliance mark for the industrial products in India. The mark certifies that a product confirms to an Indian standard (IS) developed by the Bureau of Indian Standards (BIS), the national standards body of India.

Mandatory Product: 371 products identified by the BIS department are covered for BIS-ISI Certification which requires a BIS certification and is applicable to all foreign manufacturers and Indian manufacturer and Importer.

Validity and Renewal: • The license is granted initially for a period of not less than one year and up to two years. • The renewal of license may be considered for a period of not less than one year and up to five years depending upon whether the annual license fee and advance minimum marking fee has been paid for. • If the renewal application is made after the validity of the license, the application shall be accompanied by the late fee of rupees five thousand.

3. BIS-Hall marking

It is a certification of purity of Jewelry (Gold, Silver) articles in accordance with Indian Standard Specifications. It has been acting as a safeguard to the purchasers of gold and Silver its articles for centuries.

A jeweler desirous to sell Hallmarked gold jewelry/artefacts is required to obtain a registration from BIS for any premises of a sales outlet. The registration is granted to a jeweler for particular premises if the application in prescribed format along with necessary documents is found in order and payment of requisite fees and signing of an agreement for operating the license by the jeweler jointly with BIS. In case the jeweler is also desirous to sell Hallmarked silver jewelry/artefacts another registration shall be obtained from BIS by submitting a separate application.

After grant of license, the jeweler has to follow the terms and conditions mentioned in the agreement. Deviations in purity of precious metal (gold and/or silver) and observance of operations not in conformance to stated requirements may result in cancellation of the license. Proceedings for penalties may also be initiated by BIS.

On 29th November 2019, the MCAFDP announced that with effect from 15th January 2020, the BIS Hallmark Certification would be mandatory for all items of jewelry that are sold in India.

What are the Benefits of getting BIS-CRS Registration through Cargosite Ventures Pvt. Ltd. ?

Reviewing the current level of security standards and other required areas for obtaining BIS certifications. • Assistance in preparations of BIS testing standards and establishing the required documents. • Assistance in collating the information and documents for filing BIS application. • Preparation, filing of application, and providing clarifications from time to time required by BIS Authorities. • Independent internal review to check the Security Standards and compliance level with other requirements. • Suggesting improvement areas before physical verification by BIS Authorities. • Assistance during physical verification by BIS Authorities. • Following up with BIS Authorities till obtaining the BIS Certificate. • Assistance in Compliance with BIS Status Requirements.

Labeling guidelines for BIS Certified products: -

Most products and equipment are required to be marked with specific safety-related information and meet permanency of marking requirements. These markings can include electrical ratings, use instructions, warnings regarding potential safety hazards, and cautionary markings. Compliance with permanency of marking requirements helps ensure that the labels will adhere to the application surface, and that the text will remain legible for the product’s intended use. The Marking Label must be clear on every product which cannot be removed, cannot be scratched and cannot be washed off by normal efforts. It is advised to emboss or print marking label on the product. Printed metal plate of the marking label well fixed on product can also be a good option.

The requirements for e-labelling are as given below:

Devices utilizing e-labels shall have a physical label on the packaging of the product at the time of import, storage for sale and sale or distribution. For devices in bulk and not packaged individually, a removable adhesive label on the packaging is acceptable.

Devices shall not require any special accessory/tool or supplemental plug-in (e.g., the installation of a SIM/USIM card) to access the e-label.

The compliance related information shall be programmed by the responsible party and the information shall be secured in such a manner that third-party cannot modify it. The information can be in the firmware or software menu provided it is easily accessible and cannot be modified.

Users shall be able to access the information without requiring special access codes or permissions and, in all cases the information shall be accessible in no more than four steps in a device’s menu.

Users shall be provided specific instructions on how to access the information. The instructions shall be included in the user’s manual, operating instructions, or as an insert in the package of the product, or other similar means.

Alternately, the instructions to access the information may be available on the product related website. The instructions on how to access the website shall be provided in the user’s manual or package of the product.

All the applicable regulatory information required on the packaging or user manual shall be provided according to the applicable rules even if it is displayed electronically.

If the primary user manual or user guide is provided by other electronic media (e.g., CD or online access) this information may also be provided as part of e-label.

The “Standard Mark” displayed electronically shall meet all the relevant requirements of the guidelines issued by BIS vide circular reference CMD 3/8:1/6975 dated 3 Dec 2015.

The following information should be mentioned below in the marking label of the product:- • Name of Product • Model Number • Brand Name • Power Rating (Input / Output) • Name of Manufacturer • Made in Country Name • Use instructions

For more details on products of BIS kindly go through the link below:

https://www.ikargos.com/services/certification/bis-registration

In a hurry to get the BIS ? Fill up this form , or click here or call Kapish at +91-9971770603 & +91-9711994042

0 notes

Text

Procedure to Get Equipment Type Approval (ETA) License from WPC Department

What is WPC?

WPC is a Wing of the Ministry of Communication, a National Radio Regulatory Authority involved in Frequency Spectrum Management. WPC Office issues WPC (ETA) License for IT and Electronic products while fulfilling the needs of the wireless technology consumers. Wireless and Bluetooth IT and Electronic products that operate on unlicensed frequency bands and meet human safety requirements can only be sold in Indian market with WPC approval.

How to get WPC Approval in India?

All Electronic Devices that operates with WiFi & Bluetooth technologies require WPC ETA LICENSE before selling in Indian market. WPC makes its mandatory to acquire Equipment Type approval certificate for wireless devices to be marketed in India. ETA license is applicable for both imported and local manufactured electronic items with WiFi & Bluetooth technologies, which operate in the de-licensed bands of frequencies.

Required Documents

For ETA

Radio Frequency (RF) Test report from any ISO 17025 accredited Foreign lab or NABL accredited Indian lab. The soft copy of RF Test report is required.

Authorization Letter and ID Proof for Signing the Documents issued by Head of Manufacturing Unit

Any Executive of an organization in India can be nominated Authorized Signatory and Representative of foreign manufacturer in India.

Document describing technical details about product - like, user manual.

For Importer Licence WPC Import License is a document issued or granted by the Government of India. WPC issues this Import License for the import of any equipment or device other than Broadcasting Receiver and TVRO system. Other than that, for all the devices and equipment an import license is required from WPC

ETA certificate

Purchase Order

Proforma Invoice

Costing and Timeline Total costing for WPC Approval (ETA) is customizable and may vary from product to product and Timeline is 25-30 working Days.

Validity and Renewal

Equipment Type Approval (ETA) is given for a particular model and is valid as long as the product model is being manufactured without any modification.

No renewal is required.

In a hurry to get the WPC (ETA) License? Fill up this form , or click here or call Kapish at +91-9971770603 & +91-9711994042

For details on products visit https://www.ikargos.com/services/certification. For assistance on WPC_ETA contact [email protected] M: +91-9711994042 & +91-9811803136

0 notes

Text

Filing International Trademark Applications Under Madrid Protocol With WIPO

How can I protect my trademark?

At the national/regional level, trademark protection can be obtained through registration, by filing an application for registration with the national/regional trademark office and paying the required fees. At the international level, you have two options: either you can file a trademark application with the trademark office of each country in which you are seeking protection, or you can use WIPO’s Madrid System.

Madrid Protocol Trademark System

It can be used to file and register the trademark in the home country, for example, a resident of India will file a trademark in India first and subsequently be able to secure wider trademark protection globally. Once the Indian trademark application is filed before the Indian Trademark Office, one can extend the trademark registration in other countries by using a single trademark application. The details of the single trademark application should include desired countries in which you want to seek trademark protection. Overall costs for filing trademark under Madrid protocol will depend on the applicable official government fees of the designated countries in which you are applying to register your trademark brand, and the number of trademark classes.

Madrid Trademark Application in India

The Indian Trademark Office is authorized to receive an international trademark application under Madrid Protocol.

Requirements

The basic criteria to file Madrid Trademark Application in India requires applicant to be eligible to file said trademark application, which essentially requires the applicant to be an Indian national or having a place of business in India. In addition, the Indian trademark office requires an existing trademark application, known as the basic application, and designation of one or more countries wherein international trademark protection is required.

Requirements for Obtaining International Trademark Registration

There are three main requirements for obtaining an international trademark registration in India:

The applicant should be a national of India or domiciled in India or have real and effective business or commercial establishment in India.

The applicant must have a national (Indian) trademark application or registration of a trademark with the Indian Trademarks Registry. This national trademark application/registration will be used as the basis of the international application. The international application will have the same trademark as mentioned in the national trademark application or registration; The list of goods and services mentioned in the international application should also be identical with the national mark.

The applicant in the international application must choose one or more other member countries of the Madrid Protocol, where the applicant wants to protect his trademark.

Cost and Fess depends on case-to-case bases.

In a hurry to get International Trademark? Fill up this form , or click here or call Kapish at +91-9971770603 & +91-9711994042

Get in touch with us at [email protected] to get international trademark registration under Madrid Protocol.

0 notes

Text

What is APEDA

The Agricultural and Processed Food Products Export Development Authority (APEDA) was established by the Government of India under the Agricultural and Processed Food Products Export Development Authority Act passed by the Parliament in December 1985. The Act (2 of 1986) came into effect from 13th February 1986 by a notification issued in the Gazette of India: Extraordinary: Part-II [Sec. 3(ii): 13.2.1986). The Authority replaced the Processed Food Export Promotion Council (PFEPC).

In accordance with the Agricultural and Processed Food Products Export Development Authority Act, 1985, (2 of 1986) the following functions have been assigned to the Authority.

1. Development of industries relating to the scheduled products for export by way of providing financial assistance or otherwise for undertaking surveys and feasibility studies, Participation in enquiry capital through joint ventures and other reliefs and subsidy schemes.

2. Registration of persons as exporters of the scheduled products on payment of such fees as may be prescribed.

3. Fixing of standards and specifications for the scheduled products for the purpose of exports.

4. Carrying out inspection of meat and meat products in slaughterhouses, processing plants, storage premises, conveyances, or other places where such products are kept or handled for the purpose of ensuring the quality of such products.

5. Improving of packaging of the Scheduled products.

6. Improving of marketing of the Scheduled products outside India.

7. Promotion of export-oriented production and development of the Scheduled products.

8. Collection of statistics from the owners of factories or establishments engaged in the production, processing, packaging, marketing, or export of the scheduled products or from such other persons as may be prescribed on any matter relating to the scheduled products and publication of the statistics so collected or of any portions thereof or extracts therefrom.

9. Training in various aspects of the industries connected with the scheduled products.

10. Such other matters as may be prescribed.

Products Monitored:

APEDA is mandated with the responsibility of export promotion and development of the following scheduled products:

Fruits, Vegetables, and their Products.

Meat and Meat Products.

Poultry and Poultry Products.

Dairy Products.

Confectionery, Biscuits and Bakery Products.

Honey, Jaggery and Sugar Products.

Cocoa and its products, chocolates of all kinds.

Alcoholic and Non-Alcoholic Beverages.

Cereal and Cereal Products.

Groundnuts, Peanuts and Walnuts.

Pickles, Papads and Chutneys.

Guar Gum.

Floriculture and Floriculture Products.

Herbal and Medicinal Plants.

In addition to this, APEDA has been entrusted with the responsibility to monitor import of sugar.

Registration Process:

For registering under APEDA, the applicant should submit the application form within 1 month from the date of undertaking the business. If the exporter of scheduled products fails to register within that time limit due to sufficient cause, such date can be extended only by the Authority. Once the application duly filed and paid by the applicant, the authority will issue Registration -Cum- Membership- Certificate (RCMC). This registration is one-time registration, and all the registered members are governed by the rules & regulations under APEDA Act.

The advantage of APEDA Registration:

With respect to the export of scheduled products, APEDA registration is mandatory. The validity of RCMC is a lifetime. It is a one-time registration process only. Exporters can avail the various financial assistance schemes of APEDA. It helps the exporters in brand publicity through advertisement, packaging development, database up-gradation and surveys etc. Provides guidelines to exporters about the various products and countries for export. Registered members can participate in training programs organized by APEDA for various scheduled products and thereby improve their business.

Feel free to connect with us for APEDA Registration.

0 notes

Text

Guidelines for IP-1 (Infrastructure Provider Category-1) Registration

The Infrastructure Providers Category-I are those Infrastructure Providers who provide assets such as dark fibers, Right of Way, duct space & tower. The following are the guidelines for the registration of Infrastructure Providers Category-I to be called IP-I.

1. The applicant must be an Indian company, registered under the Companies Act, 1956/2013.

2. FDI up to 100%; with 49% under automatic route and beyond 49% through FIPB. Route subject to observance of conditions of IP-I Registration by the company as well as investors as notified by the Department of Telecommunications (DOT) from time to time.

3. Both direct and indirect foreign investment in the applicant company shall be counted.

4. The applicant company/Indian Promoters/Investing Companies including their holding companies shall comply with relevant provisions of extant FDI policy of the Government.

5. The Memorandum of Association of the Company should have this clause as the Main Objects of the Company.

To carry on the business of infrastructure provide for providing assets such as dark fibres, right of way, duet space, tower for relaying and transmission of signal of internet and telecom-based cable service to licensed telecom service providers (TPS) end subscribers and customers, to offer such infrastructure to other business establishment on lease and commercial terms and to apply and obtain licenses to carry on these objects.

Connect with us to get IP-1 Registration. We as a Compliance Consulting Firm help companies to get necessary certifications required as per their industry.

In a hurry to get the IP-1 Registration? Fill up this form , or click here or call Kapish at +91-9971770603 & +91-9711994042

0 notes

Text

FAQ's (Frequently Asked questions) on AEO

Q 1. Who is an authorised economic operator (AEO)?

ANS. An AEO is a business entity involved in international movement of goods requiring compliance with provisions of the national Customs law and is approved by or on behalf of national administration in compliance with World Customs Organization (WCO) or equivalent supply chain security standards. The security standards are detailed in World Customs Organisation Safe framework of standards [WCO SAFE FoS], which is the basis of the Indian AEO programme.

Q 2. What is the AEO programme?

ANS. The AEO programme enables Customs administration to identify the safe and compliant business entity in order to provide them a higher degree of assured facilitation. This segmentation approach enables Customs resources to focus on less or non-compliant or risky businesses for control. Thus, the aim of AEO programme is to secure the international supply chain by granting recognition to reliable operators and encouraging best practices at all levels in the international supply chain. Through this programme, the Customs shares its responsibility with the businesses, while at the same time rewarding them with a number of additional benefits.

Q 3. What is the background of AEO Scheme of the WCO?

ANS. The genesis of AEO scheme dates back to September 11, 2001 event in US which made all the governments to realise that the supply chain itself could be used for terror activities and a need was felt to make the supply chain secure. Since the supply chain is controlled by the trade, the Customs administration is partnering the trade in order to secure the supply chain. The US started CT-PAT (Customs Trade – Partnership against terrorism) programme. Later WCO adopted SAFE Framework of Standards in 2005 in order to secure and facilitate the trade. The SAFE framework has three pillars comprising of Customs to Customs partnership, Customs to Business partnership and Customs to other Govt. stake holders. AEO programme is the core part of Pillar-II i.e. – Customs to Business partnership.

Q 4. How has SAFE framework of Standards (FoS) been implemented in India?

ANS. The SAFE FoS sets forth criteria by which businesses in supply chain can obtain authorised status as a secure partner. The criteria are incorporated in CBEC Circular No. 28/2012 dated 16.11.2012. Thereafter a Revised AEO Program was launched vide Circular No. 33/2016-Customs dated 22.07.2016 as amended by Circular No. 03/2018 dated 17.02.2018, 26/2018 dated10.08.2018 and Circular No. 51/2018 dated 07.12.2018.

Q 5. What is the history of AEO programme in India?

ANS. The AEO Programme was introduced as pilot project in 2011 vide Circular No. 37/2011- Customs dated 23rd August, 2011. The same was amended and the revised final AEO programme was introduced vide Circular No. 28/2012 dated 16.11.2012. With international developments such as Trade Facilitation Agreement (TFA) on securing and facilitating the International Trade and focus of Government of India on Ease of Doing Business, a comprehensive, unified trade facilitation initiative was launched by merging the existing Accredited Client Programme (ACP) and the ongoing AEO scheme of 2012 in the form of revised AEO Programme vide Circular No. 33/2016-Customs dated 22nd July, 2016. The ACP scheme was abolished by rescinding the Circular No. 42/2005-Customs dated 24.11.2005. Further simplification for financial solvency and decentralisation of AEO application processing was done vide Circular No. 03/2018 dated. 17.01.2018. The application process for AEO-T1 accreditation was further simplified to two Annexures form only by Circular No. 26/2018 dated 10.08.2018 from five Annexure form as was stipulated in Circular No. 33/2016 dated 22.07.2016. Web based On-line application filing and processing for AEO-T1 status started from December 2018 vide Circular 51/2018 dated 07.12.2018.

Q 6. What is the aim of the Indian Customs AEO Programme?

ANS. The AEO programme has the following objectives:

To provide business entities with an internationally recognized certification

To recognize business entities as “secure and reliable” trading partners

To incentivize business entities through defined benefits that translate into savings in time and cost

Secure supply chain from point of export to import

Ability to demonstrate compliance with security standards when contracting to supply overseas importers/exporters

Enhanced border clearance privileges in Mutual Recognition Agreement (MRA) partner countries

Minimal security related disruption to flow of cargo

Reduction in dwell time and related costs and

Customs advice / assistance if trade faces unexpected issues with Customs of countries with which India has MRAs.

Q 7. Is AEO mandatory for businesses involved in the supply chain?

ANS. No. The AEO scheme is purely an optional scheme. Applying for AEO status is a business decision depending on the role of the business entity in the supply chain and its willingness to acquire the benefit flowing by acquiring AEO status.

Q 8. What is the structure of Indian AEO programme?

ANS. There is a three-tier programme for importers and exporters i.e. AEO-T1, AEO-T2 and AEO-T3 in the increasing degree of benefits accorded and compliance requirements. Furthermore, there is single Tier AEO Programme for Logistics Providers, Custodians or Terminal Operators, Customs Brokers and Warehouse Operators who are granted AEO-LO certificate.

Q 9. What is the validity period of AEO status?

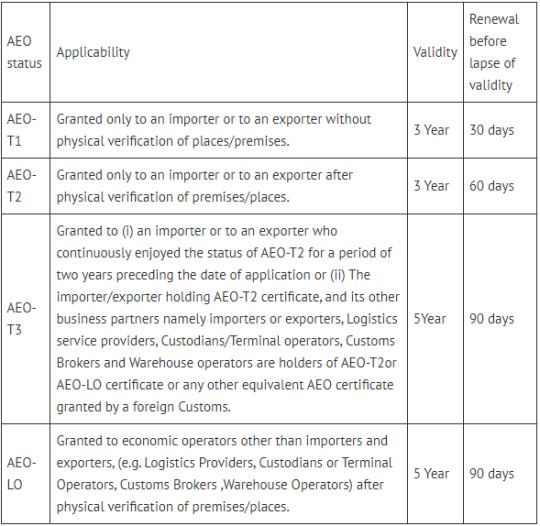

ANS. The validity of AEO certificate is three years for AEO-T1 and AEO-T2, and five years for AEO-T3 and AEOLO.

Q 10. Whether AEO certificate is valid at all Customs stations across India?

ANS. Yes, it is valid at all Customs stations in India. In other words, an AEO status holder shall get the AEO benefits at all Customs ports/ airports/ Land Customs stations.

Q 11. What are the benefits of AEO status?

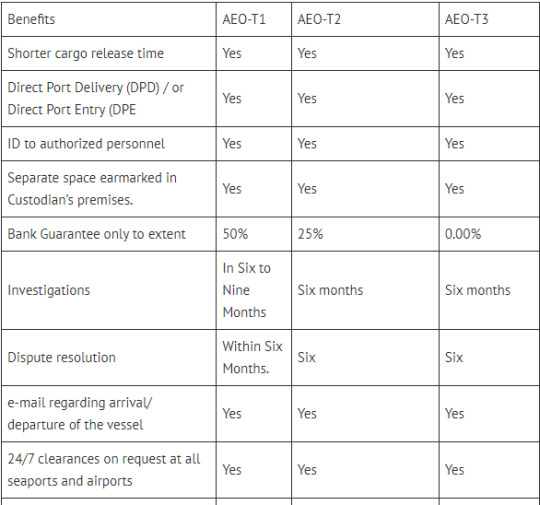

ANS. There are a host of benefits for all three categories of AEOs- T1, T2, T3 and LOs. These are listed in paras 1.5.1 to 1.5.4 for AEO T1, T2, T3 and LO respectively of Circular No. 33/2016-Customs dated 22nd July, 2016. Some of the major benefits are listed below:

Recognition worldwide as safe, secure and compliant business partners in international trade and get trade facilitation by a foreign Customs administration with whom India enters into a Mutual Recognition Agreement/ Arrangement

Facility of Direct Port Delivery (DPD) of their import Containers and/ or Direct Port Entry (DPE) of their Export Containers

Waiver of full or part of the Bank Guarantee requirements, Waiver of Merchant overtime fees

Deferred payment of duties

Waiver from transactional PCA. Instead Onsite PCA has been provided, the selection of the same shall be based on risk assessment of AEOs

Waiver of solvency certification for Customs Brokers

A lower risk score in risk analysis systems when profiling

Faster disbursal of drawback amount through process eased out vide Circular 18/2017 Customs dated 29.05.2017

Fast tracking of refunds and adjudications

Self-certified copies of FTA / PTA origin related or any other certificates required for clearance would be accepted

Recognition by Partner Government Agencies and other Stakeholders as part of AEO programme

Q 12. Whether all AEO operators are entitled for DPD /DPE facility?

ANS. Yes, all AEO T1/T2/T3 status holders are entitled for DPD/ DPE facility. However, they have to apply for the Direct Port Delivery permission to the concerned Chief Commissioner and also register themselves with the port authority for DPD facility.

Q 13. Whether the amount of Bank Guarantee in case of T1, T2 and T3 is reduced to 50%, 25% and Nil respectively in all cases of dispute between Customs and AEO status holder?

ANS. No. The CBIC Circular No. 38/2016 dt. 22.08.2016 list out the situations where amount of BG is reduced to 50%, 25% and Nil. Further it is not applicable for cases where competent authority orders furnishing of bank guarantee for provisional release of seized goods.

Q 14. What is deferred payment of duty scheme?

ANS. It is a mechanism for delinking duty payment from Customs clearance. It is based on the principle ‘Clear First-Pay later’. Deferred Payment of Import Duty Rules, 2016 vide notification no 134/2016-Customs (NT) and 135/2016-Customs (NT) both dated 02nd Nov 2016 have been notified and the same have come into effect from 16.11.2016.

The AEO-T2 and AEO-T3 certified importers can avail the benefit of these Rules.

Q 15. How can an AEO avail the facility of deferred payment of duty?

ANS. As per Rule 4 of the Deferred Payment of Import Duty Rules, 2016 an eligible importer who intends to avail the benefit of deferred payment has to intimate his intent to the jurisdictional Principal Commissioner of Customs or the Commissioner of Customs and get registered on the ICEGATE website www.icegate.gov.in.

Q 16. What are the due dates for payment in respect of deferred payment of duty?

ANS. As per Notification No. 134/2016 Cus (NT) dated 02.11.2016 as amended by Notification No. 28/2017 –Cus(NT) dated 31.03.2017,the Deferred Payment of Import Duty time lines are as below:

NOTE: The duty under deferred payment scheme has to be paid electronically.

Q 17. Whether facilitation benefits will be available to Indian AEOs in foreign countries?

ANS. Yes, the facilitation benefits will be available in countries with whom India has signed Mutual Recognition Agreement (MRA). Indian Customs has signed Mutual Recognition Agreement (MRA) with South Korea, Taiwan and Hong Kong Customs to enable trade to get benefits on reciprocal basis.

Q 18. What exactly is a mutual recognition agreement/ arrangement (MRA)?

Ans. Mutual Recognition Arrangements/Agreements (MRA) are bilateral understandings between two Customs Administrations which allow one business partnership program to recognize the AEO validations of the other country’s program and extend reciprocal benefits to each other’s AEO. The benefits are generally in nature of enhanced system-based facilitation & reduced interdiction, lower risk score for Indian exporter’s consignments at foreign port.

Q 19. Whether benefit of AEO LO status granted to a Customs Broker will also be given to its clients i.e., importers or exporters?

ANS. No. The AEO LO status will only be valid and applicable for the applicant and not for his importers or exporters. They need to apply separately for AEO status.

Q 20. Where should applications for AEO be submitted?

ANS. The application should be sent to the office of the jurisdictional Chief Commissioner of Customs with copy to AEO Programme Manager, Directorate of International Customs or in case of any doubt, to the AEO Programme Manager, Directorate of International Customs, 10th Floor, Tower II, Jeevan Bharti Building, Connaught Place, New Delhi – 110001. The jurisdictional Chief Commissioner of Customs is the one from where the Importer/Exporter/Logistic operator is doing majority of business in international supply chain. An on-line website (Domain name: aeoindia.gov.in) has been created for filing and processing of AEO-T1 application. The applicant can login to the website and file the AEO- T1 application. A separate FAQ about online filing of application is attached as Annexure-A.

Q 21. Which jurisdictional Chief Commissioner offices are designated for processing of AEO applications?

ANS. As of now, the following Chief Commissioner of Customs offices have been designated for processing of AEO application:

Delhi

Mumbai Zone-I

Mumbai Zone-II

Mumbai Zone-III

Ahmedabad

Vishakhapatnam

Bhubaneswar

Bangalore

Chennai

Hyderabad

Kolkata

Tiruchirappalli

Patna

Pune

Nagpur

Bhopal

Q 22. Who is responsible for processing AEO application and taking decision on grant of AEO status?

ANS. The AEO Cell under the jurisdictional Chief Commissioner of Customs, headed by nodal officer of the rank of Additional /Joint Commissioner is responsible for processing AEO applications as per provisions contained in Circular No. 33/2016-Customs as amended by Circular Nos. 03/2018-Customs, 26/2018 and 51/2018 -Customs. The nodal officer of the jurisdictional Chief Commissioner forwards the processed application of AEO-T2/T3 and AEO-LO with recommendation to programme manager of Indian AEO Programme having office at Delhi for taking final decision on AEO accreditation. The process of AEO-T1 accreditation has been further simplified and decentralised by Circular No. 26/2018 dt.10.08.2018. Officers in the Rank of Principal Commissioner/Commissioner have been appointed as the Zonal AEO Programme Manager in each Zone headed by Principal Chief Commissioner or Chief Commissioner of Customs and are responsible for final acceptance or rejection of the AEO application. Thus, the AEO-T1 application is processed by AEO Cell and eligibility thereto is decided at Zonal level only. The decision is conveyed to Directorate of International Customs for generation of AEO Certificate. Such approved applications are sent online by the zones to DIC Delhi for generation of digitally signed certificate.

Q 23. Who is AEO programme manager for Indian AEO Programme?

ANS. The Principal Commissioner, Directorate of International Customs, having office at 10th floor, Tower-2, Jeevan Bharati Building, Connaught Place, New Delhi-01 is the AEO Programme Manager for Indian AEO programme. For AEO-T1 accreditation, the Zonal AEO Programme Manager is treated as AEO Programme Manager for all purposes.

Q 24. Whether an economic operator whose application is once rejected under the current scheme, can apply again for AEO status?

ANS. Yes, the application can be filed again if grounds on which the application was rejected are no longer valid and the applicant is otherwise eligible for AEO status.

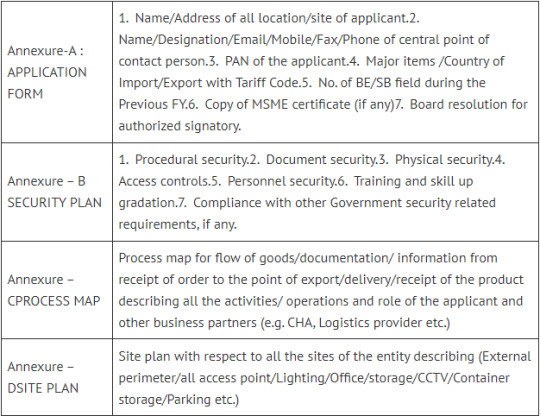

Q 25. What are the requirements for filing AEO T1/T2/T3/LO application?

ANS. An applicant for AEO-T1 status is to file application online (Domain name: aeoindia.gov.in) in prescribed proforma along with a Declaration as indicated in Annexure A- 1, Annexure A-2 to CBEC Circular No. 26/2018 dated 10.08.2018. After introduction of web- based module for filing online application vide Circular 51/2018 dt. 07.12.2018, it is mandatory to file online application only.

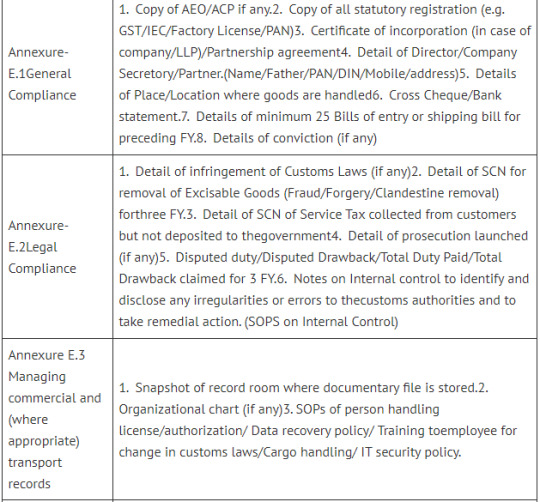

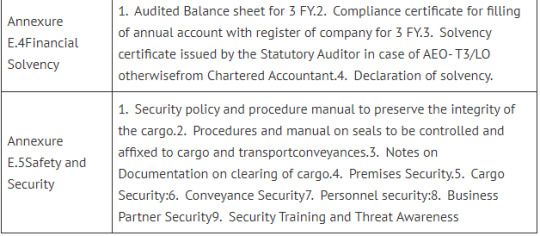

An applicant for grant of any of the remaining three AEO statuses, namely AEO-T2, AEO-T3 and AEO-LO, should submit the application in the proforma specified in Table below. The application form as specified in the Circular No. 33/2016-Customs contains Ten annexures. However, an applicant is required to fill-in and submit only those annexures which may be applicable to it, as mentioned below:

Q 26. Can an existing AEO status holder file application for higher AEO status? If yes, what is the time limit for filing such application?

ANS. An existing AEO certificate holder can apply for higher AEO status. There is no time limit for filing higher status application except in case of AEO-T3. In case of AEO-T3, either the entity should have had AEO-T2 status continuously for two years or when all its business partners in international supply chain have acquired either AEO-T2 or AEO-LO status.

Q 27. Can a consultant be appointed as the contact person or the authorised person for filing application?

ANS. No. The applicant has to nominate the contact person/ authorised representative from company’s own administration only (Para 2.3 of Circular No. 33/2016-Customs).

Q 28. Who can apply for AEO status?

ANS. Any business entity that is part of the international supply chain; involved in the cross- border movement of goods and required to fulfil obligations under the Customs law in India, only can apply for AEO status. These may include exporters, importers, logistic providers (e.g. carriers, airlines, freight forwarders, etc.), Custodians or Terminal Operators, Customs House Agents and Warehouse Owners, Port operators, authorized couriers, Stevedores etc. The list is not exhaustive.

Q 29. What is the eligibility criteria for a business entity to apply for Indian AEO status?

ANS. The eligibility conditions and criteria for granting AEO Status has been listed in the Section 3 of the AEO Circular No. 33/2016 –Customs dated 22nd July, 2016 as amended by Circular No. 3/2018-Customs dated 17th January, 2018. An entity should fulfil the following criteria:

a)Established in India b)Business should be involved in Customs related activity c)Should have dealt with minimum 25 Customs documents (either Bill of Entry or Shipping Bill) in the last fiscal year d)Should have been in business activity for last 3 Financial Years

Q 30. Whether a branch of a legal entity can apply for a separate AEO Status?

ANS. No. There is no provision to grant AEO status to specific site, division or branch of legal entity of the applicant

Q 31. Whether a newly established company can apply for AEO Status?

ANS. As per the Indian AEO requirements, the applicant should have business activities for at least three financial years preceding the financial year of date of application. However, in exceptional cases, on the basis of physical verification of internal controls of a newly established business entity, the AEO Programme Manager can consider it for certification.

Q 32. Whether a legal entity falling under three tier AEO programme as an importer/ exporter and single tier AEO programme as a logistics provider can apply for single accreditation of AEO T1/T2/T3 or AEO LO?

ANS. No, such economic operator should apply separately for any of the three tier AEO programme of importer/exporter (AEO T1/T2/T3) or single tier AEO LO status.

Q 33. Whether AEO programme is open to micro, small and medium enterprises?

ANS. Yes, the AEO programme includes MSMEs and the eligibility conditions and criteria for granting AEO status are same regardless of size. The only requirement is that the entity should have handled at least 25 Customs documents in preceding Financial Year.

Q 34. What are the legal requirements for applying for AEO status? What are the documents to be submitted?

ANS. The Legal requirement for applying for AEO status, as prescribed in para 3.2 and annexure E.2, to Circular No. 33/2016-Customs dated 22.7.2016.

Q 35. What are the documents to be submitted as proof of having business activity for the last three financial year preceding the date of application?

ANS. The documents /evidence include Certificate of Incorporation, Import- Export Code (IEC), balance sheets for three-years etc.

Q 36. In case where applicant does not have audited balance sheet, what documents are to be submitted in its place?

ANS. In cases where the statute exempts the applicant from statutory audit, the applicant can submit balance sheet certified by both the proprietor/partner/MD and any chartered accountant (CA) stating the profit /loss and net worth for the purpose of AEO application.

Q 37. What documents are needed to be submitted by a business as proof of having its own accounts?

ANS. The documents/ evidence required as a proof about the business of a company having its own accounts include cancelled cheque, account statement, audited balance sheets.

Q 38. What does procedure in place to identify and disclose irregularities means?

ANS. It means that the applicant must have tools in the form of Customised software or manual checks to identify risks and detect error in Customs documents (B/L, invoice and Packing list), for self-assessment of goods imported i.e., proper check of classification, valuation etc and after clearance of goods from Custom control, they must have the process to reconcile the goods with duty paid invoice and packing list. Further they may have documented processes/SOPs/escalation matrix for communicating the error noticed to Customs on real time basis and maintain record of such errors for viewing of their employees so that such mistakes do not recur.

Q 39. How is the ratio between duty demanded and duty paid listed at serial number d(ii) of annexure E-2 calculated?

ANS. The ratio is calculated by dividing duty amount involved in SCN issued under the Customs Act divided by total duty paid & drawback claimed during the last three financial years. For example, the amount involved in SCN/disputed demand (includes demand of duty and denial of drawback) is Rs.500/- and total duty paid is Rs.20,000/-, drawback claimed is Rs. 5,000/-, the ratio shall be 500/(20000+5000)*100 = 2%.

Q 40. Whether the applicant having ratio of duty demanded and total duty paid/drawback

claimed more than 10% are not eligible for AEO accreditation? ANS. Yes. In case the ratio is above 10%, the AEO programme envisages examination of the nature of cases of duty demand. The decision for issue or continuance of AEO status is at the discretion of AEO programme manager based on examination of the Show Cause Notices issued.

Q 41. What are the documents required to be maintained for ensuring compliance of

Annexure E.3 – Managing Commercial and Transport Records? ANS. The AEO applicant should:

Maintain records which permit Customs to conduct any required audit of cargo movement relating both to import and export;

Give Customs full access to necessary records;

Have internal records access and control systems;

Appropriately maintain and make available to Customs any authorizations, powers of attorney and licences relevant to the importation or exportation of merchandise;

Properly archive records for later production to Customs. For instance, for Customs purpose, the records should be maintained at least for five years.

Employ adequate information technology security measures which will protect against access by unauthorized persons.

Q 42. What accounting system is required to be followed by an AEO [Annexure E.3(a)]?

ANS. Any accounting system consistent with Generally Accepted Accounting Principles (GAAP) / International Financial Reporting Standards (IFRS) which facilitates audit-based Customs control can be adopted. The audited balance sheet by Auditor contains remark about the Accounting system adopted by applicant.

Q 43. What are the documentary evidences in support of claim of compliance required as per annexure E.3(b) i.e .adequate administrative set up and internal controls for detecting illegal or irregular transactions?

ANS. Generally, the audited financial statement/balance sheet contains comments as to whether administrative set up corresponds to size of business. Other requirements for internal controls are satisfactory organisational setup to handle goods and documents related to same in the international supply chain.

Q 44. What are the documentary evidences in support of claim of compliance required for storage and archiving of documents as per annexure E.3(d)?

ANS. The applicant must have documented processes/ Standard Operating Procedures (SOPs) for storage and archiving of records and information. The SOP may contain the process of storing with the responsibility of concerned person, period of storing / archiving, process of taking suitable measures like back up for protection against loss of information. If the applicant has outsourced the storage and archiving of records, then the above requirements should be covered in the agreement with the agency storing the records and such agreements should be presented along with the application.

Q 45. What are the requirements for Annexure E.3(v) i.e., need for employee to inform Customs about compliance difficulty?

ANS. The applicant may submit their practice /processes of educating/ training their employees on Customs compliances. The process must include procedure to convey compliance difficulties, if any, to the designated Customs officer. The applicant may designate a person in their organisation for above purpose.

Q 46. Is there any format for the undertaking regarding solvency and for the solvency certificate?

ANS. No, there is no format in AEO Circular No. 33/2016-Customs. The only requirement is that the certificate should be for last three financial years (Each year) based on books of accounts and financial statements, tax returns etc.

Q 47. Who are required to submit Security Plan (Annexure B) and fulfil requirement listed in Annexure E.5 of AEO Circular 33/2016?

ANS. The applicant for AEO T-2, T-3 and AEO-LO are required to submit Security plan and documents/evidence in support of fulfilment of requirements for safety and security listed in Annexure E.5.1 to E.5.7.

Q 48. What are the requirements of Safety and Security for AEO applicant?

ANS. The safety and security criteria is listed in Para 3.5 and Annexure E.5.1 to E.5.7 of Circular No.33/2016. It has seven components.

Procedural Security [refer para 3.5.2]

Premises Security [refer para 3.5.3]

Cargo Security [refer para 3.5.4]

Conveyance Security [refer para 3.5.5]

Personnel Security [refer para 3.5.6]

Business Partner Security [refer para 3.5.7]

Security Training & Threat Awareness [refer para 3.5.8]

Q 49. What is the additional requirement for AEO T-3 applicant?

ANS. In addition to submission of documents and fulfillment of requirements prescribed for AEO T-2 applicant, the applicant for AEO T-3 has to submit details prescribed in Annexure F of Circular No. 33/ 2016 dated 22.07.2016. In Annexure F, the applicant has to give details of all his business partner(s) in International Supply chain which includes their accreditation under Indian AEO Programme. The declaration is to be given in format of Annexure “F”. The AEO T3 applicant who are not AEO T-2 certificate holder for last two preceding financial years must have all business partners (CB, Freight forwarder, liner etc) AEO T-2 or AEO-LO certificate holder./p>

Q 50. What are the documents to be filed along with declaration made in Annexure A of the AEO?

ANS. The following documents are required to be submitted along with the application:

Certification of incorporation from registrar of companies (ROC)

Declaration about ACP/AEO status (Self)

Address/Sites/Locations of places where goods are handled in the international supply chain and administrative offices

Previous three years audited financial accounts;

Previous three years bank accounts

GSTIN, IEC, PAN, Company incorporation certificate

List of bills of entry and shipping bills handled during the last financial year

Places of business and its addresses and phone numbers

List of directors with DIN numbers.

Evidence/ Certificate issued under MSME Act, if the applicant claims to be MSME

Authorisation letter for contact person of applicant from proprietor/ partner/ board of directors/ managing director

Q 51. Whether Annexure B (security plan) is to be given for all premises belonging to applicant?

ANS. Yes. However, if the company’s written and verifiable policies, processes, procedures, access control and other security policies, training and skill upgradation and compliance with government is same for all locations, the applicant can submit security plan of any one premise which is valid for all its premises used in International Supply Chain.

Q 52. What is Annexure C (Process Map)? Whether it is related to premises belonging to applicant?

ANS. The process map should illustrate the flow of goods, documentation/ information from receipt of order to export/ delivery/ receipt of goods. The same has to be separate for each activity such as exports, imports, providing service for logistics operators etc. Hence, Annexure-C shall be for each individual activity of the applicant. The Process-Map must include role of applicant and its business partners in the supply chain.

Q 53. Whether Annexure D (Site Plan) is to be given for all premises belonging to applicant?

ANS. Yes, the site plan as prescribed in Annexure D of Circular should be for all locations/sites.

Q 54. What are the documents required for General compliance (Annexure E.1)?

ANS. The following documents are require for general compliance

Copy of AEO certificate, if any;

Copy of IEC, GSTIN;

Declaration on type of business entity with copy of registration. For instance, in case of public or private limited, certificate of incorporation issued by ROC; in case of partnership, registered partnership deed; in case of

Small proprietorship firm, a license issued by local shop and establishment Act etc. ;

List of places/location where goods are being handled (For example loading, unloading, storage etc);

Cancelled bank cheque or certificate from Bank evidencing account of applicant, account statement from bank etc as a proof of business having own account;

List of documents (Bill of entry, shipping bills) handled in the last Financial Year;

Declaration on conviction in criminal offence, if any, with details.

Q 55. In what cases is the application for AEO accreditation not processed or returned for rectification?

ANS. The application for AEO accreditation is not processed in following cases:

When application is incomplete. The application may be resubmitted with the complete information.

Where the application has not been made by a legal person. The same can be resubmitted by the concerned legal entity.

Where no responsible person is nominated as the Point of Contact. The application can only be resubmitted when the applicant nominates a responsible person from his/her organisation only, who will be the point of contact for the AEO Programme.

Where the applicant is subject to bankruptcy proceedings at the time the application is made. The application can be resubmitted when the applicant becomes solvent.

Where a previously granted AEO status has been revoked -The application can be submitted only after one

Year, in case of AEO T-1 & T-2 and after three years in case of AEO T-3 and LO, from the date of revocation.

Q 56. In what cases the AEO application be rejected?

ANS. The AEO application can be rejected in following two cases:

Where the applicant is not eligible for grant of AEO status, or

Where the deficiency noticed in the application is not remedied.

Q 57. What are the timelines and procedure for processing AEO applications?

ANS. In case of AEO T-1 application, if the eligibility conditions and criteria for grant of certificate, as mentioned in Section 3 of Circular No. 33/2016-Customs, are found to have been met to the satisfaction of AEO programme manager, the AEO T-1 certificate shall be granted within 30 days of submission of information/ documents. The mode of application for AEO T-1 and its processing has been made online since December 2018. In case of AEO T-2 and LO application, on submission of all required information/documents, the applicant is informed about the receipt of the same within 30 days. The application is assigned to AEO team within 15 days to carry out physical verification in consultation with applicant. The AEO programme team visits the premises of applicant within 90 days. The applicant can contact programme manager if visit is not planned within 45 days. The AEO programme team prepares the report and makes recommendation within 60 days of completion of visit. The AEO programme manager informs about AEO T-2/LO status to applicant within 30 days of the recommendation of AEO team. Thus, the total time taken from submission of application till the issuance of the certificate work out to maximum 180 days. In case of AEO T-3 application by an AEO T-2 status holder, the application is assigned to AEO programme team within 15 days. The timelines for further activities are same as in above para for AEO T-2 and LO certifications.

Q 58. Whether all premises of applicant involved in Customs related activity are to be visited for physical Verification by AEO team?

ANS. For AEO T-2 and AEO LO certification, examination of the criteria laid down under Section 3 of AEO Circular shall be carried out for all the premises which are relevant to the Customs related activities of the applicant for AEO-T2 or AEO-LO status. In case, more than one premises of applicant are run in similar way by standard systems of record keeping and security etc., the AEO programme team can choose to visit any one of such similarly run premises as per the provision contained in Para 4.4.5.5 of AEO Circular. In such situation, the applicant has to make declaration to this effect in the form of Undertaking. However, if the applicant has a range of activities or different premises are run using different methods of operation, the AEO Programme team has to visit those premises.

Q 59. What are the areas covered by AEO Programme team during physical verification of applicant premise?

ANS. The purpose of Physical verification by AEO team is to check whether the claims made in application regarding requirement and fulfilment of criteria as listed in Section 3 of AEO Circular exists or are in place.

The AEO programme team may cover following areas during visit:

Information on Customs matters including about the contravention of Customs Act.

Remedial action taken on previous Customs errors, if any.

Accounting and logistic systems.

Internal controls and procedures.

Flow of cargo.

Use of Customs House Agents and selection of other business partners.

Security of Computers/IT and documents.

Financial solvency.

Safety and security assessment – premises, cargo, personnel etc.

Logistic processes.

Storage of goods

The above list is not exhaustive. The team can decide to cover more areas during visit as per the requirements.

Q 60. Can physical verification be stopped if the applicant for AEO T-2 or AEO LO fails to provide certain documents to the team or there are problems with the system/ processes/ requirements?

ANS. Yes, in exceptional cases the verification process can be stopped with mutual consent. The applicant is given time to submit additional documents and rectify the minor issues. The applicant has to inform AEO team regarding rectification within 6 months so that the verification process recommences. The applicant in such cases will get decision on application by the revised date to be informed by the AEO team.

Q 61. To whom the AEO status holder should inform about Customs related errors and regarding its compliance?

ANS. The AEO status holder should report Customs related errors and its compliance to the CRM as well as AEO cell of the jurisdictional Chief Commissioner.

Q 62. How will the AEO status be renewed?

ANS. The AEO status is renewed against application for the same made before lapse of their validity as stated below: