Don't wanna be here? Send us removal request.

Text

Thin Client Market Leaders: Top Companies to Watch in 2025

The global thin client market, valued at USD 1.60 billion in 2023, is projected to reach USD 1.97 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 3.0% from 2024 to 2030. This expansion is largely driven by the increasing need for new revenue engines and efficient business growth strategies. As modern applications become more diverse in technologies and platforms, businesses face challenges in data integration and compliance, leading to reduced data visibility and hindered decision-making.

The COVID-19 pandemic positively impacted this market, reshaping dynamics and accelerating adoption. Pandemic-induced economic uncertainties pushed organizations towards cost-effective IT solutions. Thin clients, with their lower upfront costs compared to traditional PCs and laptops, coupled with centralized management capabilities that reduce ongoing maintenance and support expenses, proved to be an attractive option.

Key Market Trends & Insights:

Regional Dominance: North America dominated the thin client market in 2023, holding a 35.7% market share. This is primarily due to the rising adoption of Remote Desktop Services (RDS) and Desktop as a Service (DaaS) models in the region.

Component Leadership: Based on type, the market is bifurcated into hardware, software, and services. The hardware segment accounted for the largest revenue share, 38.4% in 2023, and is expected to maintain its dominance throughout the forecast period.

Form Factor Preference: The market, segmented by form factor into standalone, with monitor, and mobile, saw the mobile segment hold the largest revenue share in 2023. This segment is also anticipated to experience the fastest CAGR during the forecast period, indicating a growing demand for portable thin client solutions.

Application Focus: The market is further bifurcated by application into healthcare, retail, education, government, and others. The education segment accounted for the largest revenue share in 2023, reflecting the significant adoption of thin client technology in educational institutions.

Order a free sample PDF of the Thin Client Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2023 Market Size: USD 1.60 Billion

2030 Projected Market Size: USD 1.97 Billion

CAGR (2024 - 2030): 3.0%

North America: Largest market in 2023

Key Companies & Market Share Insights

Accenture, IBM, and Infosys are prominent players in the thin client market, each leveraging their expertise to drive digital transformation.

Accenture focuses on enabling digital transformation through thin client solutions, emphasizing a microservices architecture and containerization for agility and efficient resource utilization. Their approach integrates DevOps practices for faster development and collaboration. Security and data modernization strategies are central to their offerings, enhancing analytics and compliance. Accenture also specializes in seamless legacy system integration, providing a strategic path for organizations to reduce technical debt and ensure sustained success in a dynamic digital landscape.

IBM promotes a DevOps culture to foster collaboration and efficiency in software development. Their services incorporate rigorous security measures to protect applications and data. With a strong commitment to user experience, IBM's modernization services deliver revamped interfaces and intuitive interactions. By integrating analytics and data modernization strategies, IBM empowers organizations to navigate complex modern digital environments while optimizing the integration of existing legacy systems.

Infosys Limited, a global consulting and technology company, offers extensive expertise in thin client technology within its diverse service portfolio. This computing model centralizes application processing and data storage on a server, allowing client devices to access these resources remotely over a network. Furthermore, Infosys provides comprehensive ongoing support and maintenance services to ensure the smooth operation and continuous optimization of thin client environments for its clients.

Key Players

IBM

Accenture

Infosys

Cognizant

Capgemini

Tata Consultancy Services

DXC Technology

HCL Technologies

Wipro

NTT DATA Corporation

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The thin client market is expanding, driven by the need for efficient business growth and challenges in data integration. The pandemic also accelerated adoption due to the demand for cost-effective IT solutions. North America leads the market, with hardware dominating component types, and mobile thin clients showing the fastest growth. The education sector is a major application area. Key players like Accenture, IBM, and Infosys are innovating in digital transformation, security, and integration to meet evolving market demands.

0 notes

Text

Navigating the Synchronous Condenser Market: Insights for Grid Operators

The global synchronous condenser market was valued at USD 696.0 million in 2024 and is projected to reach USD 818.3 million by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 2.8% from 2025 to 2030. This expansion is primarily driven by the increasing complexity and variability in global power generation.

Synchronous condensers are vital for maintaining grid stability by providing essential inertia and voltage support. The aging infrastructure of many power grids worldwide necessitates upgrades to ensure reliability and stability, a role where synchronous condensers are crucial.

The growing prevalence of renewable energy sources like wind and solar further increases the demand for synchronous condensers, as they provide critical grid stability and inertia support to manage the intermittent nature of renewables. Additionally, supportive policies and incentives focused on enhancing grid reliability and integrating renewable energy often stimulate investments in this technology. Advances in control systems, materials, and design have also improved the efficiency and performance of synchronous condensers, making them more attractive to grid operators.

Key Market Trends & Insights:

Regional Dominance: The North America synchronous condenser market led the global market in 2024, holding a 34.33% revenue share. This is attributed to significant growth in renewable energy generation across the region, where synchronous condensers help manage the variability of wind and solar power, ensuring grid stability and reliability.

Product Segment Leadership: The refurbished synchronous condenser segment dominated this market, accounting for a 57.8% revenue share in 2024. These units are older models that have undergone overhauls, repairs, or upgrades to extend their operational life, offering a cost-effective alternative to purchasing new equipment.

End-Use Leadership: The electrical utilities segment held the largest revenue share, at 77.7% in 2024. Synchronous condensers are crucial for maintaining grid stability in electrical utility applications by providing essential inertia and reactive power support.

Order a free sample PDF of the Synchronous Condenser Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 696.0 Million

2030 Projected Market Size: USD 818.3 Million

CAGR (2025 - 2030): 2.8%

North America: Largest market in 2024

Key Companies & Market Share Insights

Some of the key players operating in the synchronous condenser market include ABB, Siemens Energy, IDEAL ELECTRIC POWER CO., and Ansaldo Energia S.p.A. These companies are at the forefront of providing solutions to enhance grid stability and reliability.

ABB, a Switzerland-based leader in automation and electrification technology, offers a comprehensive range of products spanning metallurgy, electric drivetrains, motors & generators, industrial software, robotics, and power conversion systems. Their offerings, designed for numerous industries including oil & gas, automotive, and power generation, include advanced synchronous condensers integrated with smart grid technologies for improved voltage regulation and stability. ABB is also committed to developing eco-friendly synchronous condensers, aligning with global sustainability objectives.

Siemens Energy, a leading energy technology provider, serves a wide range of industries such as oil & gas, power & heat generation, power transmission, and marine. Their product portfolio encompasses conventional and renewable energy technologies, including gas and steam turbines, power generators, and transformers. With approximately 99,000 employees operating in over 90 countries, Siemens Energy incorporates IoT-enabled synchronous condensers for real-time monitoring and predictive maintenance, and invests heavily in R&D for next-generation, higher-efficiency solutions.

IDEAL ELECTRIC POWER CO., established in 1903 and headquartered in the U.S., is a prominent manufacturer of specialty electric motors and condensers, including synchronous generators, power systems and controls, and switchgear. They are notable for being one of the few U.S. producers offering space-saving generator-mounted epicyclic gears. The company provides complete synchronous condenser packages, including starters, pony motors, and excitation equipment, emphasizing long operational life and plant voltage stabilization.

Ansaldo Energia S.p.A., an Italy-based manufacturer and service provider in the power generation industry, boasts expertise in both conventional and next-generation technologies, from gas to nuclear and renewable energy. With approximately 3,300 employees, the company offers products and services across various segments, including power plants, equipment, and solutions for energy transition and digital systems. Ansaldo Energia's synchronous condensers are designed to provide crucial reactive power, inertia, and short-circuit power, often integrating flywheel systems for enhanced grid stability, particularly in regions with high renewable energy penetration.

Key Players

ABB

Siemens Energy

IDEAL ELECTRIC POWER CO.

Ansaldo Energia S.p.A.

GE Vernova Inc.

Andritz AG

Voith

Fuji Electric

WEG

BRUSH

Explore Horizon Databook - The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The synchronous condenser market is expanding due to increasing grid complexity and variability, driven by global electricity demand and aging infrastructure. These crucial devices stabilize grids by providing inertia and voltage support, particularly as renewable energy integration rises. Policies promoting grid reliability further boost demand. North America leads the market, with refurbished units being a cost-effective choice and electrical utilities representing the largest end-use segment. Key players are innovating to enhance performance and meet evolving market needs.

0 notes

Text

How Key Companies Are Dominating the Silicon Carbide Market

The global silicon carbide market was valued at USD 5.23 billion in 2024 and is projected to reach USD 9.15 billion by 2030, demonstrating a Compound Annual Growth Rate (CAGR) of 8.7% from 2025 to 2030. This growth is primarily driven by the increasing use of SiC in manufacturing refractory materials for the steel industry.

Silicon carbide's exceptional high-temperature resistance makes it an ideal raw material for refractory products. These refractory materials are extensively used as linings in kilns, furnaces, and reactors across various industries, including cast iron, steel, aluminum, and other metal processing sectors. The rising production within these ferrous and non-ferrous industries is expected to further boost the demand for refractory materials, consequently driving the SiC market.

Key Market Trends & Insights:

Regional Dominance: The Asia Pacific region held over 59% of the global silicon carbide market revenue share in 2024. This dominance is attributed to the region's rapid growth in the electric vehicle (EV) sector, expanding renewable energy initiatives, and advancements in telecommunications.

Product Segment Leadership: The black silicon carbide segment accounted for a 54.8% revenue share in 2024. Black silicon carbide is available in various forms, including blocks, grains, and powders, catering to diverse industrial needs.

Application Focus: The electronics segment held a 27% revenue share in 2024. Silicon carbide's superior properties, such as exceptional thermal conductivity, high melting point, and chemical inertness, make it crucial in various electronic applications, particularly in high-power and high-frequency devices, as well as its traditional role in steel manufacturing.

Order a free sample PDF of the Silicon Carbide Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 5.23 Billion

2030 Projected Market Size: USD 9.15 Billion

CAGR (2025 - 2030): 8.7%

Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Some of the key players actively shaping the silicon carbide market include AGSCO Corporation, Carborundum Universal Limited (CUMI), and Washington Mills. These companies are focused on innovation and continuous product portfolio enhancement to secure a competitive advantage in the market.

AGSCO Corporation, headquartered in Chicago, Illinois, is a manufacturer and distributor of industrial chemicals, abrasives, minerals, and blasting equipment. They offer a range of silicon carbide products, including aggregates and blasting media for applications such as anti-slip flooring, lapping, cutting tools, and metal removal. AGSCO specializes in providing comprehensive solutions for abrasive blasting and surface preparation across various industries like aerospace, automotive, construction, and fabrication.

Carborundum Universal Limited (CUMI), established in 1954 and headquartered in Chennai, India, is a leading materials science company and a part of the Murugappa Group. CUMI specializes in manufacturing a diverse range of products, including abrasives, ceramics, refractories, and electro minerals. They serve a wide array of industries such as engineering, automotive, and energy, with a strong focus on delivering integrated solutions from mining to market.

Founded in 1868, Washington Mills is one of the world's largest producers of abrasive grains and fused mineral products, with its headquarters in North Grafton, Massachusetts. As a family-owned enterprise, it manufactures a wide array of materials, including silicon carbide, aluminum oxide, and boron carbide. Washington Mills caters to numerous industries, including aerospace, automotive, and electronics, providing an extensive line of standard abrasive grains and specialty electro-fused minerals.

Key Players

AGSCO Corporation

Carborundum Universal Limited

Washington Mills

Coorstek

Entegris, Inc.

ESD-SIC b.v.

Snam Abrasives Pvt. Ltd.

Gaddis Engineered Materials

Grindwell Norton Ltd.

SK siltron Co., Ltd.

Explore Horizon Databook - The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The silicon carbide market is experiencing significant growth, primarily due to its increasing use in refractory materials for the steel industry, driven by its high-temperature resistance. Beyond refractories, the market is expanding due to rapid growth in electric vehicles, renewable energy, and telecommunications. Asia Pacific is a dominant region, and black silicon carbide leads the product segments. Electronics applications are also a key driver, leveraging SiC's superior thermal and electrical properties. Leading companies are focused on innovation, R&D for high-performance products, and strategic expansions to meet rising global demand.

0 notes

Text

Why the Shunt Capacitor Market Is Booming in Asia-Pacific

The global shunt capacitor market, valued at USD 1.08 billion in 2024, is projected to reach USD 1.61 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 7.0% from 2025 to 2030. This expansion is significantly driven by the increasing global demand for electricity and the growing complexity of power grids. Shunt capacitors are crucial for enhancing power factor, minimizing line losses, and stabilizing voltage within transmission and distribution networks.

Both utilities and industrial facilities are increasingly investing in solutions to improve power quality, which further stimulates market growth. Additionally, governmental mandates for grid modernization, the integration of renewable energy sources, and the promotion of energy efficiency initiatives are all contributing to the escalating demand for shunt capacitors.

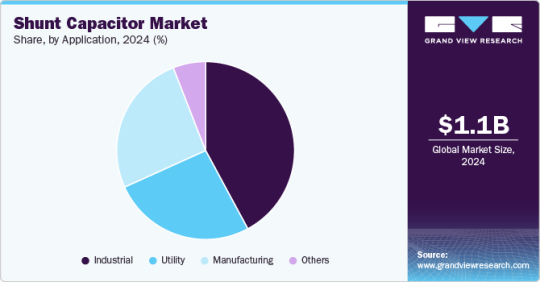

Key Market Trends & Insights:

Regional Dominance: The Asia Pacific region commanded the largest share of the shunt capacitor market, holding 45.04% of the revenue in 2024. This is primarily due to the region's rapid industrialization, expanding power transmission and distribution infrastructure, and substantial investments in renewable energy projects.

Voltage Rating Focus: The low and medium voltage shunt capacitor segment is experiencing significant growth, driven by the increasing demand for energy efficiency, power factor correction, and grid stability across industrial, commercial, and utility sectors.

Application Leadership: The industrial segment holds the largest revenue share in the market, approximately 42% in 2024. This is attributed to the rising need for power factor correction, voltage stabilization, and energy efficiency within diverse industrial applications.

Order a free sample PDF of the Shunt Capacitor Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 1.08 Billion

2030 Projected Market Size: USD 1.61 Billion

CAGR (2025 - 2030): 7.0%

Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Key players in the shunt capacitor market, including ABB Ltd., Schneider Electric, General Electric Company, Siemens AG, and Larsen & Toubro Ltd., are strategically focusing on innovation and enhancing their product portfolios to gain a competitive edge. These leading manufacturers are actively investing in research and development to create high-performance capacitors with extended lifespans, improved reliability, and integrated smart monitoring capabilities. This includes leveraging IoT and AI-driven predictive maintenance to optimize operational efficiency. Market competition is also shaped by economies of scale, as major players expand their production capacities to meet global demand while maintaining cost competitiveness.

ABB has made significant investments in smart grid technologies, incorporating shunt capacitors with advanced monitoring and control systems to bolster grid stability and efficiency. Furthermore, the company is dedicated to developing environmentally friendly shunt capacitors with a reduced ecological footprint, aligning with global sustainability objectives.

Schneider Electric focuses on power factor correction and energy efficiency solutions, offering a range of shunt capacitors designed to optimize electrical systems in various sectors. Their product portfolio emphasizes reliability and smart features to meet the evolving demands of industrial, commercial, and utility applications.

General Electric Company (GE) provides high-voltage capacitors engineered for robust performance and improved power quality. GE's offerings include a variety of fusing schemes and are designed to enhance system capacity, stability, and efficiency across power generation, transmission, distribution, and industrial applications.

Siemens has integrated IoT-enabled shunt capacitors to facilitate real-time monitoring and predictive maintenance, thereby improving operational efficiency. The company is committing substantial resources to research and development aimed at producing next-generation shunt capacitors that offer superior efficiency and extended lifespans.

Larsen & Toubro Ltd., a prominent Indian multinational conglomerate, is a significant player in the electrical and automation segment, including the shunt capacitor market. Their strategy often involves catering to large-scale infrastructure projects and industrial applications, contributing to grid stability and power quality enhancement in emerging markets.

Key Players

ABB Ltd.

Schneider Electric

General Electric Company

Siemens AG

Larsen & Toubro Ltd

Eaton Corporation Plc

Aerovox Corp.

Magnewin Energy Private Limited

CIRCUTOR, SA

Energe Capacitors Pvt Ltd.

Explore Horizon Databook - The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The shunt capacitor market is growing steadily, driven by increasing global electricity demand and complex power grids. These capacitors are crucial for power quality, reducing losses, and stabilizing voltage. Utilities, industries, and government-mandated grid modernization, renewable integration, and energy efficiency initiatives further fuel this growth. Asia Pacific leads the market, with low/medium voltage and industrial applications being key segments. Leading companies are investing in R&D for advanced, reliable, and smart capacitors while expanding production to meet demand.

0 notes

Text

From Risk Mitigation to Compliance: Applications of Procurement Analytics Explained

The global procurement analytics market was valued at USD 2.88 billion in 2021 and is projected to reach USD 18.18 billion by 2030, demonstrating a robust compound annual growth rate (CAGR) of 23.6% from 2022 to 2030. This significant expansion is driven by the increasing demand for operational efficiency across industries. Businesses are leveraging advanced data analytics to gain critical insights for negotiations, performance management, vendor segmentation, and annual purchasing plans. Procurement departments, rich in data like transaction history and expenditure details, can significantly enhance business decisions by applying intelligent argumentation and analytics to this information.

Automation plays a pivotal role in the procurement analytics market's growth. Another key driver for high demand is the considerable need for organizations to effectively manage contracts and ensure compliance. For example, ServiceNow, a U.S.-based software company, has enhanced its procurement service management feature, aiming to automate and streamline procurement workflows.

Key Market Trends & Insights:

Regional Dominance: North America held the largest revenue share, exceeding 40% in 2021, and is anticipated to maintain its leading position throughout the forecast period.

Component Leadership: The solution segment dominated the market in 2021, accounting for over 70% of the revenue share, encompassing both solutions and services.

Deployment Preference: The on-premise segment secured the largest revenue share, above 53% in 2021. On-premises solutions typically require an enterprise to purchase a software license or copy.

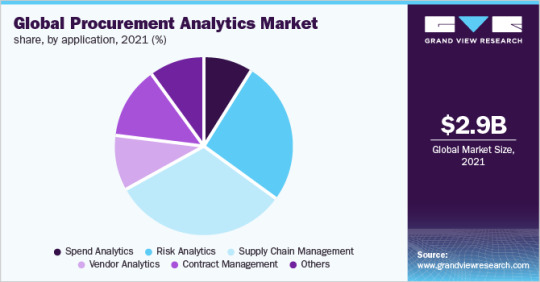

Application Focus: Supply chain management emerged as the leading application segment, holding more than 30% of the revenue share in 2021. This growth is fueled by the rising adoption of procurement processes that aid in collecting, classifying, and analyzing spending data through specialized software.

Organization Size Impact: Large enterprises dominated the market in 2021, holding approximately 76% of the market share. Small and medium enterprises also incur expenses related to software purchases and subscription services.

Vertical Performance: The telecom and IT segment led the market in 2021 with a share exceeding 18%. However, the adoption of procurement analytics in the manufacturing sector is notably high.

Order a free sample PDF of the Procurement Analytics Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2021 Market Size: USD 2.88 Billion

2030 Projected Market Size: USD 18.18 Billion

CAGR (2022 - 2030): 23.6%

North America: Largest market in 2021

Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Major competitors in the procurement analytics market are primarily focused on innovation and continuously updating their product portfolios to secure a competitive advantage. A notable example is Oracle Corporation, a key player in this market, which in August 2021 released an updated version of its Cloud Procurement. Oracle's solutions, including Oracle Fusion Cloud Enterprise Resource Planning and Oracle Fusion Cloud Supply Chain & Manufacturing, are designed to mitigate risks, reduce costs, and streamline supply chain management.

Companies are also investing in acquisitions and backward integration as strategies to reduce costs and enhance operational efficacy. For instance, in July 2021, Bain Capital, a private equity firm based in Boston, acquired PartsSource. PartsSource operates as a B2B marketplace and healthcare services provider, connecting approximately 19,000 clinics and hospitals with over 6,000 OEM manufacturers across the U.S. Their precision procurement analytics solution empowers hospitals to minimize waste, reduce risk, and improve overall supply chain visibility.

Key Players

SAP

Oracle

SAS Institute

Coupa Software

Genpact

Rosslyn Data Technologies

Microsoft

IBM

Cisco

GEP

Explore Horizon Databook - The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The procurement analytics market is experiencing rapid growth, driven by the critical need for operational efficiency, data-driven decision-making, and robust contract and compliance management across all industries. Key trends highlight North America's continued market leadership and the dominance of solutions, on-premise deployments, and supply chain management applications. Large enterprises are currently the primary adopters, with the telecom and IT sector leading, though manufacturing shows strong adoption. The market's evolution is significantly shaped by major players focusing on innovation, product portfolio expansion, and strategic acquisitions to enhance capabilities and competitive advantage.

0 notes

Text

Top 10 Precision Harvesting Companies You Should Watch in 2025

The global precision harvesting market was valued at USD 18.68 billion in 2024 and is projected to reach USD 27.41 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 6.4% from 2025 to 2030. This expansion is largely fueled by the increasing integration of harvesting robots and autonomous combine harvesters, which effectively mitigate agricultural labor shortages. These advanced technologies not only boost operational efficiency and enable highly precise harvesting methods but also significantly reduce crop wastage, ultimately leading to enhanced yields.

The growing global population and escalating concerns regarding food security are major impetuses for the precision harvesting sector, driving farmers to adopt cutting-edge solutions to meet rising demands. Furthermore, precision harvesting technologies optimize various farming processes, thereby improving crop quality and overall profitability. As urbanization intensifies pressure on agricultural systems, the need for such efficient and sustainable solutions becomes increasingly critical.

Key Market Trends & Insights:

Regional Dominance: North America led the global precision harvesting market in 2024, accounting for a 43.6% revenue share. This can be attributed to the region's proactive embrace of advanced agricultural technologies and substantial investments in research and development.

Product Segment Leadership: In 2024, the combine harvesters segment held the largest share of the market. This dominance is driven by the consistent demand for efficient agricultural machinery that enhances productivity and reduces labor expenses.

Application Segment Dominance: The crop segment commanded the largest share in the market, with 75.5% in 2024. This is due to the increasing adoption of precision harvesting technologies by farmers seeking to boost productivity and improve crop yields across a wide range of crops.

Offering Segment Leadership: The hardware segment secured the largest market share in 2024. This is primarily due to the rising deployment of advanced agricultural machinery and equipment designed to optimize operational efficiency in farming.

Order a free sample PDF of the Precision Harvesting Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 18.68 Billion

2030 Projected Market Size: USD 27.41 Billion

CAGR (2025 - 2030): 6.4%

North America: Largest market in 2024

Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Leading the precision harvesting market are key companies such as Deere & Company, AGCO Corporation, KUBOTA Corporation, Raven Industries, Inc., and CLAAS KGaA mbH. These organizations are strategically focused on expanding their market presence and strengthening their competitive position. To achieve these objectives, they are actively pursuing various strategic initiatives, including mergers and acquisitions, as well as fostering partnerships with other prominent industry players. Through these strategies, they aim to enhance their capabilities in delivering data-driven insights, optimizing operational efficiency, and driving innovation within the precision harvesting sector.

Deere & Company stands as a global leader in agricultural, construction, and forestry machinery. The company offers advanced precision farming and harvesting technologies, encompassing GPS-guided equipment, automated combine adjustments, and comprehensive yield mapping. Furthermore, its John Deere Operations Center empowers data-driven decision-making for farmers. Consistent investments in research and development underscore Deere & Company's commitment to innovation in autonomous machinery and sustainable farming solutions.

AGCO Corporation is a prominent designer and manufacturer of agricultural equipment, with well-known brands like Fendt and Massey Ferguson under its umbrella. Their Fuse Smart Farming platform provides a suite of precision farming and harvesting tools, including automated systems and telemetry solutions. AGCO's strategic focus revolves around continuous innovation and sustainability, aiming to deliver tailored solutions that address the evolving needs of modern agriculture.

KUBOTA Corporation is actively involved in advancing smart agriculture through its precision farming system (FMIS). This system visualizes farm management data, enabling evidence-driven farming decisions. Kubota's FMIS integrates with various technologies like GPS and sensors, collecting and analyzing data on taste, yield, and growth for optimized farm management plans. The company is also exploring financing strategies for autonomous equipment, demonstrating its commitment to the future of agricultural automation.

Raven Industries, Inc. (now a brand of CNH) specializes in automated and autonomous farm technologies, with a strong focus on enhancing productivity, sustainability, and profitability in agriculture. Their harvesting solutions include guidance and steering systems, advanced displays, and harvest controls. Raven's Cart Automation™ system, for example, synchronizes grain cart and combine movements to minimize spillage and maximize efficiency. The company emphasizes customer-focused innovation and a connected workflow through solutions like Raven Slingshot®, designed to seamlessly manage operations from the office to the field.

CLAAS KGaA mbH is a significant player offering advanced smart farming solutions. Their digital tools, such as CLAAS connect, facilitate efficient farm and fleet management, automated documentation, and improved field performance. CLAAS's precision farming systems, like GPS PILOT CEMIS 1200, enable automatic steering and precise operations. The company's focus on Smart Farming aims to empower farmers with data-driven decision-making, optimize resource usage, and contribute to sustainable agricultural practices.

Key Players

Deere & Company

AGCO Corporation

KUBOTA Corporation

Raven Industries, Inc.

CLAAS KGaA mbH

Ag Leader Technology

TeeJet Technologies

TOPCON CORPORATION

DICKEY-john

CNH Industrial N.V.

Browse Horizon Databook for Global Precision Harvesting Market Size, Share & Trends Analysis

Conclusion

The precision harvesting market is experiencing significant growth, driven by the adoption of advanced technologies like harvesting robots and autonomous combines. These innovations address labor shortages, enhance efficiency, reduce waste, and boost crop yields, crucial for meeting increasing global food demands amidst urbanization. North America currently leads the market, with combine harvesters, crop applications, and hardware offerings dominating segments. Leading companies are focused on strategic initiatives to expand their reach and innovate, leveraging data-driven insights and fostering partnerships for a more efficient and sustainable agricultural future.

0 notes

Text

North America Leads the Charge in the Booming Pet Accessories Market

The global pet accessories market, valued at USD 6,706.4 million in 2024, is projected to reach USD 9,974.8 million by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 6.9% from 2025 to 2030. This robust growth is primarily driven by increasing pet adoption rates, rising demand for pet-related products and services, and the pervasive trend of pet humanization. Pet accessories encompass a wide array of products, including collars, leashes, harnesses, bedding, feeding accessories, and waste disposal tools.

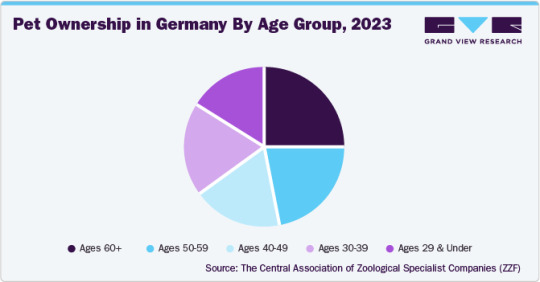

A significant increase in global pet ownership has been observed, with a growing number of individuals welcoming pets into their homes and treating them as cherished family members who receive devoted care and affection. Current behavioral trends even indicate that some couples are adopting pets as a way to assess their readiness for parenthood. For instance, in 2023, the American Pet Products Association reported that 90.5 million households in the United States owned pets, a 7.0% increase from 84.6 million households in 2019. Notably, this figure surpasses the 52.8 million households with children. This expanding landscape of pet ownership highlights the potential for sustained demand in the pet accessories market, as owners consistently seek to enhance their pets' quality of life through various accessory offerings.

Key Market Trends & Insights:

Regional Leadership: The North American pet accessories industry commanded a revenue share of 39.51% of the global revenue in 2024. This is attributed to a steady increase in pet ownership across the region, with a substantial proportion of households embracing pets.

Product Dominance: Pet collars, leashes, and harnesses accounted for a market share of 31.92% in 2024. These products are considered essential for ensuring the safety and control of pets during outdoor activities and walks.

Pet Type Leadership: Accessories for dogs held a market share of 46.74% in 2024. The consistent rise in pet ownership globally, particularly of dogs, fuels the demand for accessories as owners strive to provide their canine companions with a higher quality of life, thereby stimulating market growth.

Distribution Channel Preference: Sales of pet accessories through specialty stores comprised a market share of 37.21% in 2024. These stores are valued for their knowledgeable staff who can offer expert advice on pets and their specific needs.

Order a free sample PDF of the Pet Accessories Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 6,706.4 Million

2030 Projected Market Size: USD 9,974.8 Million

CAGR (2025 - 2030): 6.9%

North America: Largest market in 2024

Key Companies & Market Share Insights

In the highly competitive pet accessories market, companies are strategically leveraging diverse product portfolios and various initiatives, including product innovation, brand differentiation, partnerships, and targeted marketing, to capture market share and consumer attention. Pricing, distribution, customer service, and reputation are also crucial competitive factors. Recent developments illustrate this trend: In January 2025, Authentic Brands Group collaborated with K9 Wear to launch a premium Izod pet accessories line, emphasizing style and functionality. October 2023 saw PetPace introduce its Health 2.0 smart dog collar with AI-powered health monitoring and tracking features. Furthermore, in May 2023, Millie Bobby Brown's Florence by Mills brand expanded into pet apparel and accessories through an agreement with Kanine Group.

Key Players

The Hartz Mountain Corporation

Ancol Pet Products Limited

Kanine Pets World

Wahl Animal

Rosewood Pet Products

PetPace

Spectrum Brands Holdings

Heads Up For Tails

Rolf C. Hagen Inc.

ferplast S.p.A

Browse Horizon Databook for Global Pet Accessories Market Size & Outlook

Conclusion

The pet accessories market is experiencing robust growth, driven by increasing pet ownership and the humanization trend. Owners are increasingly investing in premium, specialized products for their pets, viewed as family members. North America leads the market, with collars, leashes, and dog accessories being key segments, and specialty stores are a popular distribution channel. Companies are focusing on innovation, partnerships, and strategic initiatives to compete.

0 notes

Text

Unlocking Liquidity: Key Trends in the High Frequency Trading Market

The global high-frequency trading market, valued at USD 10.36 billion in 2024, is projected to reach USD 16.03 billion by 2030, growing at a CAGR of 7.7% from 2025 to 2030. HFT has profoundly transformed modern financial markets.

Unlike conventional trading approaches that target substantial gains from individual transactions, HFT aims for small profits from numerous individual transactions, which collectively yield significant returns due to the sheer volume. HFT operates at an exceptionally fast pace, and its profitability is influenced by several factors, impacting the overall market ecosystem.

A fundamental concept driving profitability in the HFT market is the pursuit of microscopic profits across vast volumes. Unlike long-term investors seeking significant returns from a few carefully selected investments, HFT strategies focus on extracting minute profits from an enormous number of trades. Sophisticated algorithms are crucial here, continuously scanning markets to identify even the slightest price fluctuations. By leveraging these fleeting opportunities, HFT firms amass substantial profits through high-volume execution. For example, if a fractional price difference exists for the same security across two exchanges, HFT algorithms can capitalize on this by rapidly executing buy and sell orders, securing a small profit on each trade. The cumulative effect of such high-speed trades can translate into substantial overall profit.

Key Market Trends & Insights:

Regional Dominance: The North American high-frequency trading market held a significant share of 32.3% in 2024. This region's HFT market is set for considerable growth, propelled by its advanced financial infrastructure and the concentration of leading HFT firms.

Product Leadership: The market making segment accounted for the largest share of 72.3% in 2024, solidifying its position as a critical component of the industry.

Deployment Preference: The on-premise segment maintained the largest market share in 2024. This deployment method remains essential for HFT firms prioritizing ultra-low latency and extensive control over their trading environments.

End-Use Dominance: The investment banks segment dominated the market in 2024, underscoring their prominent utilization of HFT strategies.

Order a free sample PDF of the High Frequency Trading Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 10.36 Billion

2030 Projected Market Size: USD 16.03 Billion

CAGR (2025 - 2030): 7.7%

North America: Largest market in 2024

Key Companies & Market Share Insights

Prominent firms in the high-frequency trading (HFT) market, including Optiver, IMC, VIRTU Financial Inc., and Flow Traders, are actively pursuing strategies to expand their client base and secure a competitive advantage. This often involves strategic initiatives like mergers, acquisitions, and partnerships with other significant industry players.

Optiver, a proprietary trading firm, is a global liquidity provider across more than 75 exchanges. Its operations are organized into five core domains: trading, technology, research & data science, risk and control, and business operations. The company provides liquidity to institutional clients across a diverse range of products.

Flow Traders, another leading trading firm, specializes in institutional investing across various asset classes, including equities, fixed income, digital assets, commodities, and foreign exchange. Flow Traders operates from three primary trading hubs: Amsterdam, Hong Kong, and New York, and reports its global trading business across three segments: Europe, the Americas, and Asia.

Key Players

Optiver

IMC

DRW Holdings, LLC

Citadel Securities

Hudson River Trading LLC

Jane Street Group, LLC

VIRTU Financial Inc.

Flow Traders

Two Sigma Investments, LP.

Tower Research Capital LLC

Browse Horizon Databook for Global High Frequency Trading (hft) Market Size & Outlook

Conclusion

The high-frequency trading market is experiencing substantial growth, transforming financial markets by focusing on numerous small, rapid transactions driven by sophisticated algorithms. North America leads this sector, with market making and on-premise deployments dominating. Investment banks are key users. Leading firms like Optiver and Flow Traders are strategically expanding through collaborations and acquisitions to enhance their competitive standing in this fast-paced, technology-driven industry.

0 notes

Text

Europe Pet Food Market: Key Statistics Every Pet Brand Should Know

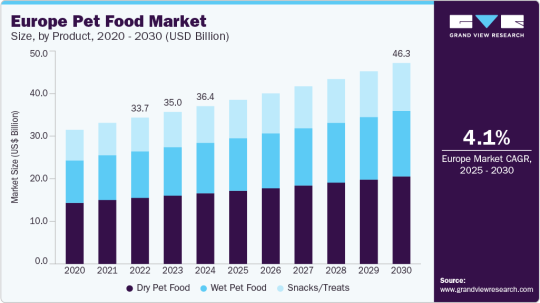

The European pet food market was valued at USD 36.39 billion in 2024 and is projected to reach USD 46.32 billion by 2030, with a Compound Annual Growth Rate (CAGR) of 4.1% from 2025 to 2030. This growth is significantly fueled by the increasing humanization of pets, leading owners to seek out premium, natural, raw, and organic food options that mirror human dietary preferences. This trend has expanded choices for pet parents, who are increasingly invested in their pets' health and demanding high-quality ingredients and specialized diets.

The market has seen a strong surge in specialist pet food products designed for specific health benefits, with luxury, healthy, and functional foods becoming increasingly popular. Pet owners are prioritizing their pets' nutrition, shifting from basic pet foods to more advanced formulas that offer essential nutrients and promote overall well-being.

Europe's pet food market offers a diverse range of products, from complete raw meals to various wet, dry, and specially formulated treats. FEDIAF, the representative body for European pet food manufacturers, emphasizes the importance of combining ingredients like meat, fish, vegetables, and vitamins to create nutritionally balanced and enjoyable meals. This broad selection allows pet owners to choose products tailored to their pets' individual needs.

Key Market Trends & Insights:

Regional Growth: The pet food market in the UK is anticipated to experience a CAGR of 2.6% from 2025 to 2030. According to the UK Pet Food Report 2024, the UK, with its 13.5 million dog and 12.5 million cat population, stands as a prominent market for pet food in Europe in 2024.

Consumer Behavior: The European market is experiencing consistent growth, driven by rising pet ownership and the growing trend of treating pets as integral family members. This expansion reflects consumers' increased willingness to invest more in their pets' well-being, encompassing premium food, health supplements, and customized diets.

Product Preference: Dry pet food held a significant revenue share of 44.8% in 2024. The European market for dry pet food is showing steady growth due to its convenience, extended shelf life, and ease of storage and feeding compared to wet or fresh alternatives.

Pet Type Dominance: Pet food designed for dogs accounted for a revenue share of 47.3% in 2024. This reflects the increasing awareness among many pet parents regarding the importance of providing balanced and nutritionally complete diets for their canine companions.

Category Share: Traditional pet food for daily consumption held a revenue share of 86.5% in 2024. These conventional pet foods, particularly dry kibble and canned meals, are highly favored by pet owners for their convenience, minimal preparation requirements, long shelf life, and easy storage.

Distribution Channel Preference: Sales of pet food through pet specialty stores made up a revenue share of 29.5% in 2024. These stores are preferred for their curated selection of high-quality, niche, and premium pet food products that address specific dietary needs and health concerns, aligning with the growing trends of pet humanization and premiumization.

Order a free sample PDF of the Europe Pet Food Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 36.39 Billion

2030 Projected Market Size: USD 46.32 Billion

CAGR (2025-2030): 4.1%

Key Companies & Market Share Insights

Pet food manufacturers in Europe are embracing advanced food processing to enhance product quality and nutrition. They are also implementing innovative packaging solutions, such as resealable and biodegradable options, to boost convenience and sustainability. A growing trend in the industry is customization, with brands offering diverse seasoning blends, organic choices, and personalized snack or treat packs to meet varied consumer preferences. These developments collectively reflect the industry's commitment to delivering higher-quality, more sustainable, and tailored pet food products in response to evolving consumer demands.

Key Players

The J.M. Smucker Company

Nestlé Purina

Mars, Incorporated

LUPUS Alimento

Total Alimentos

Hill’s Pet Nutrition, Inc.

General Mills Inc.

WellPet LLC

The Hartz Mountain Corporation

Diamond Pet Foods

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The European pet food market is experiencing significant growth, primarily driven by the "humanization of pets" trend. This leads to increased demand for premium, natural, and specialized food options. Manufacturers are innovating with advanced processing, sustainable packaging, and customized products to meet evolving consumer preferences for quality, health, and well-being. Dry food and dog food currently dominate, with pet specialty stores being a key distribution channel.

0 notes

Text

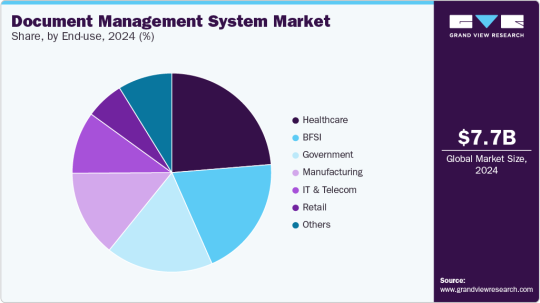

AI in Action: Intelligent Solutions for the Document Management System Market

The global document management system market was valued at USD 7.68 billion in 2024 and is projected to reach USD 18.17 billion by 2030, demonstrating a robust Compound Annual Growth Rate (CAGR) of 15.9% from 2025 to 2030. This expansion is primarily fueled by organizations' increasing need to securely manage and store vast volumes of digital information.

As businesses worldwide embrace digital transformation and move towards paperless operations, the demand for effective solutions for document storage, retrieval, and management has escalated. The accelerated adoption of cloud-based DMS solutions has further spurred this trend, offering businesses scalable, cost-effective, and readily accessible options. Moreover, the heightened focus on compliance and regulatory mandates is significantly contributing to the growth of the DMS industry. Enterprises operating in heavily regulated sectors like healthcare, finance, and legal are increasingly implementing DMS to ensure strict adherence to data security, privacy, and record-keeping regulations. These systems facilitate streamlined audits, maintain secure document trails, and mitigate the risk of non-compliance penalties.

Key Market Trends & Insights:

Regional Leadership: The North American document management system market commanded a substantial revenue share of almost 40.0% in 2024, driven by the escalating demand for digital transformation across various industries.

Component Dominance: The software segment held the largest market share, exceeding 67.0% of the revenue in 2024. This dominance is attributed to the growing demand for cloud-based, AI-driven, and compliance-ready solutions.

Deployment Preference: The cloud segment led the market with a revenue share of over 67.0% in 2024. This is propelled by the integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and Robotic Process Automation (RPA) into cloud DMS platforms.

Enterprise Size Leadership: Large enterprises accounted for nearly 67.0% of the market's revenue share in 2024. This is due to the immense volume of enterprise-grade documents they manage and their critical need for scalable, secure, and intelligent document workflows.

End-Use Sector Dominance: The healthcare segment generated over 23.0% of the market's revenue share in 2024. A significant driver here is the accelerating shift towards Electronic Health Records (EHRs) and paperless systems within the healthcare industry.

Order a free sample PDF of the Document Management System Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 7.68 billion

2030 Projected Market Size: USD 18.17 billion

CAGR (2025-2030): 15.9%

North America: Largest market in 2024

Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Leading companies in the document management system (DMS) industry, including Microsoft, IBM Corporation, Oracle Corporation, Open Text Corporation, and Hyland Software, Inc., are actively engaged in strategic initiatives to enhance their competitive edge. These strategies largely involve new product development, forging partnerships and collaborations, and entering into agreements.

Illustrative of these efforts, in April 2025, Hyland Software, Inc. significantly expanded its product offerings by integrating advanced AI capabilities. Through substantial updates to Hyland Automate, Hyland Knowledge Discovery, and key improvements to Hyland OnBase and Hyland Alfresco, the company aims to provide organizations with sophisticated tools for optimizing content, processes, and application intelligence. Their Hyland Content Intelligence product line is designed to empower businesses with actionable insights derived from simple natural language queries, thereby streamlining complex searches and delivering precise information from vast enterprise content.

Similarly, in March 2025, IBM Corporation launched IBM Storage Ceph as a Service, broadening its suite of flexible on-premises infrastructure solutions. This new service complements IBM Power delivered as a service, offering a distributed compute platform with diverse form factors and adaptable consumption models. The IBM Storage Ceph service facilitates the integration of cloud-based solutions with on-premises environments, providing a unified software-defined storage solution that encompasses block, file, and object data. Its goal is to help organizations eliminate data silos and modernize their data lakes and virtual machine storage, delivering a seamless cloud storage experience within their own data centers.

Further demonstrating industry innovation, in December 2024, OpenText introduced Core Digital Asset Management (Core DAM). This solution is engineered to optimize the digital content supply chain by incorporating powerful features that yield tangible results. Core DAM leverages practical AI to automate tasks such as image tagging, video transcript generation, and the creation of design inspiration images using OpenText Experience Aviator, significantly boosting the efficiency and accuracy of creative workflows. It also provides global content access, enabling users to generate instant links for high-performance display worldwide.

Key Players

Agiloft, Inc.

Alfresco Software Inc.

Cflowapps

DocLogix

Hyland Software, Inc.

IBM Corporation

Integrify

Browse Horizon Databook for Global Document Management System Market Size & Outlook

Conclusion

The document management system (DMS) market is rapidly growing, driven by the need for secure digital information management and paperless transitions. Cloud-based solutions and regulatory compliance are key growth factors. North America leads the market, with software and cloud deployments dominating. Large enterprises and the healthcare sector are major adopters. Leading companies are innovating with AI and strategic collaborations to enhance their offerings.

0 notes

Text

Pharma Giants’ Role in the Cardiovascular Clinical Trials Market Ecosystem

The global cardiovascular clinical trials market was valued at USD 5.26 billion in 2022 and is anticipated to grow to USD 8.41 billion by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 6.0% from 2023 to 2030. This expansion is largely attributed to the increasing prevalence of cardiovascular diseases (CVDs), such as heart failure, stroke, and coronary artery diseases. For instance, according to the World Heart Federation, CVDs were a leading cause of global mortality, responsible for approximately 20.5 million deaths in 2021. Furthermore, heightened investments from governments and industry, coupled with a demand for cost efficiencies in Phase III trials, are contributing to market growth.

Ongoing innovations in medical research, particularly in areas like personalized medicine and genomics, are driving the need for clinical trials to explore novel therapeutic approaches. Technological advancements in medical research, including the integration of telemedicine and wearable devices for virtual patient monitoring in clinical trials, are enabling more cost-effective and efficient trial management, thereby supporting market expansion.

Key Market Trends & Insights:

Regional Dominance: North America held the largest market share, at 42.1%, in 2022. This is due to the strong presence of established Contract Research Organizations (CROs) specializing in cardiovascular clinical trials, including Worldwide Clinical Trials, ICON plc, and Caidya.

Phase Segment Leadership: The Phase IV segment dominated the market, accounting for a 34.3% revenue share in 2022. Regulatory bodies, such as the U.S. FDA and European Union agencies, often mandate post-marketing studies to ensure the continued efficacy and safety of cardiovascular treatments.

Study Design Preference: Interventional studies represented the largest revenue share, at 64.8%, in 2022. These studies are categorized by the intervention being evaluated, which can include drugs, biologicals, behavioral interventions, surgical procedures, and devices.

Indication Dominance: The coronary artery disease category held the largest revenue share, at 20.0%, in 2022. This is attributed to the growing number of ongoing clinical trials related to coronary artery disease.

Order a free sample PDF of the Cardiovascular Clinical Trials Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2022 Market Size: USD 5.26 Billion

2030 Projected Market Size: USD 8.41 Billion

CAGR (2023-2030): 6.0%

North America: Largest market in 2022

Key Companies & Market Share Insights

Key players in the cardiovascular clinical trials market are actively pursuing inorganic growth strategies, including mergers, partnerships, and acquisitions, to strengthen their market presence. Companies are prioritizing collaborations to enhance their strategic positioning. For example, in September 2023, Cereno Scientific, a biopharmaceutical firm, entered into a collaboration agreement with Clinical Trial Consultants (CTC), a contract research organization, to commence a Phase I human study for CS014, a histone deacetylase inhibitor aimed at preventing arterial and venous thrombosis.

Key Players

IQVIA Inc

ICON plc

SGS SA

Eli Lilly and Company

PPD Inc

Syneos Health

Caidya

Worldwide Clinical Trials

Vial

Veeda Clinical Research

Medpace, Inc.

Browse Horizon Databook for Global Cardiovascular Clinical Trials Market Size & Outlook

Conclusion

The cardiovascular clinical trials market is expanding due to rising heart disease prevalence, increased investments, and a push for cost efficiency. Innovations like personalized medicine and virtual monitoring are key drivers. North America leads regionally, with Phase IV and interventional studies being dominant. Coronary artery disease is the top indication. Market players are strategically collaborating and acquiring to enhance their global standing.

0 notes

Text

Data-Driven Decisions: Analytics for the Automotive Aftermarket Industry

The global automotive aftermarket industry was valued at USD 468.91 billion in 2024. Projections indicate a rise to USD 589.01 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 3.8% from 2025 to 2030. This growth is primarily fueled by vehicle owners' desire to enhance their vehicles' performance, encompassing aspects like exhaust sound, speed, and aesthetic appeal.

Regulatory bodies such as the Japanese Automobile Sports Muffler Association (JASMA) and the U.S. Environmental Protection Agency play a crucial role in overseeing manufacturing standards and environmental impacts of automotive components. This oversight extends to areas like noise emission levels from modern automotive resonators and mufflers within exhaust systems.

The digitalization of component delivery, sales, and services, coupled with the emergence of online portals that distribute aftermarket parts in collaboration with global auto-part suppliers, is expected to attract significant investments from key industry players. Leading market component suppliers, including US Auto Parts Network, Inc. and CarParts.com, are poised to drive global market demand in the coming years.

Key Market Trends & Insights:

Regional Dominance: The Asia Pacific automotive aftermarket held the largest market share, at 29.1%, in 2024. This region is also anticipated to experience substantial growth from 2025 to 2030.

Replacement Part Segments: In 2024, the "other" replacement part segment accounted for the largest share at 47.33%. Looking ahead, the tire segment is expected to become the dominant category in terms of size among replacement parts.

Distribution Channel Preferences: The retail segment commanded the largest share of the distribution channel at 54.8% in 2024. The retail segment is projected to maintain its leading position in the market by 2030.

Service Channel Leadership: The original equipment (OE) segment held a significant 69.2% share of the service channel in 2024. The OE segment is anticipated to continue dominating the aftermarket in terms of size by 2030.

Certification Preference: Genuine parts dominated the certification segment with a 51.4% share in 2024. This segment is expected to remain the largest in the aftermarket by 2030.

Order a free sample PDF of the Automotive Aftermarket Industry Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 468.91 Billion

2030 Projected Market Size: USD 589.01 Billion

CAGR (2025-2030): 3.8%

Asia Pacific: Largest market in 2024

Key Companies & Market Share Insights

Leading entities in the automotive aftermarket sector include prominent names such as 3M Company, Continental AG, Denso Corporation, Robert Bosch GmbH, and ZF Friedrichshafen AG. The expansion of this industry is anticipated to be significantly propelled by advancements in technology and a surge in research and development investments by both manufacturers and industry associations.

While numerous domestic and regional players contribute to the market, they face the ongoing challenge of providing innovative solutions that cater to evolving technologies, heightened security demands, and shifting business models. The major companies in this arena find themselves in a dynamic position, where they can either solidify or lose market share. Consequently, these key players are strategically pursuing mergers and acquisitions to broaden their global presence and reinforce their competitive standing.

Key Players

3M Company

Continental AG

Cooper Tire & Rubber Company

Delphi Automotive PLC

Denso Corporation

Federal-Mogul Corporation

HELLA KGaA Hueck & Co.

Robert Bosch GmbH

Valeo Group

ZF Friedrichshafen AG

Browse Horizon Databook for Global Automotive Aftermarket Industry Size & Outlook

Conclusion

The automotive aftermarket is growing, driven by consumer demand for vehicle enhancement and regulatory oversight. Digitalization is attracting significant investment, with online platforms and key suppliers shaping future market dynamics. Regional strengths and segment shifts are evident. Leading companies are investing in R&D and employing strategic mergers to maintain competitiveness amidst evolving technologies and diverse market players.

0 notes

Text

Why Businesses Need Advanced Weather Forecasting Solutions

The global weather forecasting system and solutions market was valued at USD 3.22 billion in 2022 and is projected to reach USD 5.31 billion by 2030, demonstrating a Compound Annual Growth Rate (CAGR) of 6.6% from 2023 to 2030. These systems provide real-time atmospheric insights, enabling businesses to meticulously plan weather-sensitive operations for enhanced security, sustainability, safety, and cost efficiency. Key growth drivers include the expansion of sea and air transportation, stricter environmental protection regulations, and significant reliance on rainfall for water supply.

Furthermore, the increasing frequency of extreme weather events and resulting natural disasters has intensified environmental concerns, driving the demand for reliable climate information and continuous monitoring. While these systems offer crucial real-time insights for optimizing decision-making and profits, challenges such as the complexities of weather models and the potential for inaccurate predictions may impede market expansion.

Key Market Trends & Insights:

Regional Leadership: Asia Pacific held the largest revenue share in the market in 2022, accounting for 29.0%. This dominance is attributed to stringent regulatory norms, increasing sea and air transportation, and dependence on rainfall for water supply in the region.

System Segmentation: Within the weather forecasting system and solutions market, the hardware segment secured the majority share in 2022, holding 59.7% of the market.

End-Use Focus: The meteorology & weather service provider segment led the market in terms of end-use in 2022, capturing the highest revenue share of 20.2%.

Forecast Range Preference: Medium-range forecasting was the dominant segment by forecast range in 2022, representing the highest revenue share of 48.6%.

Order a free sample PDF of the Weather Forecasting System and Solutions Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2022 Market Size: USD 3.22 Billion

2030 Projected Market Size: USD 5.31 Billion

CAGR (2023-2030): 6.6%

Asia Pacific: Largest market in 2022

Key Companies & Market Share Insights

Prominent players in the weather forecasting system and solutions market, including Airmar Technology Corp., All Weather, Inc. (AWI), Campbell Scientific, Inc., Columbia Weather Systems Inc., Gill Instruments Limited, Lockheed Martin Corporation, MORCOM International, Munro Instruments Limited, Skye Instruments Limited, and Vaisala, are actively engaged in developing innovative and cost-effective solutions. These companies are significantly increasing their investment in research and development to gain a competitive edge.

To solidify their market position, leading players are pursuing strategies such as expansion and new product development. A notable example of this strategic focus is the collaboration between the National Center for Meteorology (NCM) in the UAE and Hewlett Packard Enterprise (HPE). In October 2021, NCM deployed a cutting-edge supercomputer, built by HPE, to enhance its weather forecasting capabilities. This initiative has enabled NCM's researchers to achieve substantial advancements in modeling, simulation, artificial intelligence, and deep learning, ultimately improving the accuracy and speed of weather predictions.

Key Players

AIRMAR Technology Corporation

All Weather, Inc.

Campbell Scientific, Inc.

Columbia Weather Systems, Inc.

Gill Instruments Limited

Lockheed Martin Corporation

MORCOM International

Munro Instruments Limited

Skye Instruments Limited

Vaisala

Explore Horizon Databook – The world's most expansive market intelligence platform developed by Grand View Research.

Conclusion

The weather forecasting system and solutions market is experiencing significant growth, driven by the increasing need for real-time atmospheric insights to enhance operational planning across various sectors. Key factors fueling this expansion include the rising demand from transportation industries, stricter environmental regulations, and the reliance on rainfall for water. The market is also propelled by the growing frequency of extreme weather events, necessitating more reliable climate information and continuous monitoring.

Despite the benefits, challenges like the complexity of weather models and the potential for prediction inaccuracies exist. Regionally, Asia Pacific holds a dominant share, while hardware accounts for the largest segment by system. The meteorology and weather service provider segment leads in end-use, and medium-range forecasting is the most prevalent. Leading companies are focusing on innovation, R&D, and strategic expansions to strengthen their positions in this evolving market.

0 notes

Text

The Business Case for Volt VAR Management: Driving ROI

The global Volt VAR management market recorded a valuation of USD 481.0 million in 2023 and is predicted to reach USD 715.1 million by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 5.0% from 2024 to 2030. A key factor propelling this market is the escalating need for energy efficiency within power distribution systems. Utilities and grid operators are increasingly focused on reducing losses and optimizing voltage. VVM systems are instrumental in achieving this, enhancing the operational efficiency of electrical networks by optimizing reactive power and thereby minimizing energy wastage during transmission and distribution. This push for more environmentally friendly and efficient power systems, supported by various regulatory mandates and incentives, continues to fuel market demand.

Moreover, the increasing integration of renewable energy sources like solar and wind power into the grid introduces complex challenges for voltage and reactive power management. The inherently intermittent and variable nature of renewable energy generation can lead to voltage fluctuations and impact grid stability. Volt/VAR management technologies are vital for maintaining optimal voltage levels and ensuring a dependable power supply despite these variations. Consequently, the rising incorporation of renewables into the energy mix is a significant driver of overall product growth.

Key Market Trends & Insights

Regional Dominance: In 2023, North America held the leading position in the Volt/VAR management market, capturing a significant 39.9% of the total revenue. This leadership is largely attributed to the increasing adoption of VVM systems across the U.S. and Canada. These systems are crucial for reducing energy losses and enhancing grid reliability, especially as these nations integrate more renewable energy sources into their power grids.

Application Focus: The distribution segment emerged as the primary application area for Volt/VAR management in 2023, accounting for the largest revenue share of 68.1%. This segment is also anticipated to experience substantial growth throughout the forecast period, highlighting the critical role of VVM in optimizing power delivery to end-users.

Order a free sample PDF of the Volt VAR Management Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2023 Market Size: USD 481.0 Million

2030 Projected Market Size: USD 715.1 Million

CAGR (2024-2030): 5.0%

North America: Largest market in 2023

Key Companies & Market Share Insights

Leading the Volt VAR management market are key players such as ABB Ltd., Siemens AG, Schneider Electric, Eaton, and General Electric.

ABB Ltd., headquartered in Zurich, Switzerland, is a major manufacturer of electrification and automation products. Their extensive portfolio includes innovative products, services, and solutions for industries like energy, transportation, and manufacturing. For Volt/VAR management, ABB provides advanced grid automation solutions, transformers, and switchgear, all essential for optimizing voltage levels and reactive power within power distribution networks.

Siemens AG, a multinational conglomerate based in Munich, Germany, maintains a robust presence across industrial, energy, healthcare, and infrastructure sectors. Their offerings encompass a wide array of products and solutions, including smart grid technologies, digital substations, and comprehensive energy automation systems.

Several emerging participants are also making their mark in this market, including S&C Electric Company, DC Systems, Beckwith Electric, Utilidata, and Open Systems International.

S&C Electric Company, based in Chicago, Illinois, specializes in the design and manufacturing of switching and protection products for electric power transmission and distribution. The company is recognized for its solutions that significantly enhance grid reliability and operational efficiency. Their product lineup features voltage regulators, capacitor banks, and automation systems, all designed to assist utilities in effectively managing voltage and reactive power.

DC Systems focuses on developing software and hardware solutions specifically for utility and industrial markets, with a strong emphasis on digitalization and smart grid technologies. They provide advanced SCADA systems, sophisticated grid automation software, and comprehensive VVM solutions, enabling efficient grid management and optimized energy usage.

Key Players

ABB Ltd.

Siemens AG

S&C Electric Company

DC Systems

Beckwith Electric

Utilidata

Open Systems International

Landis+Gyr

Advanced Control Systems

Schneider Electric

Eaton

General Electric

Browse Horizon Databook for Global Volt Var Management Market Size & Outlook

Conclusion

The Volt/VAR management (VVM) market is on a growth trajectory, driven by the critical need for energy efficiency in power distribution and the increasing integration of renewable energy sources. These systems are vital for optimizing reactive power, minimizing energy wastage, and maintaining grid stability despite variable renewable generation. North America currently leads the market, with the distribution segment dominating applications. This upward trend is expected to continue, supported by ongoing grid modernization efforts and technological advancements from key industry players.

0 notes

Text

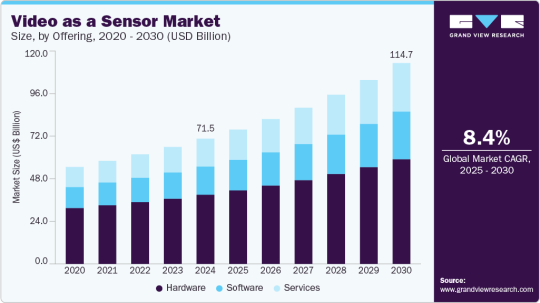

The Future of Analytics: How Video As A Sensor is Redefining Data Capture

The global Video As A Sensor Market, estimated at USD 71.50 billion in 2024, is forecast to reach USD 114,664.7 million by 2030, exhibiting a Compound Annual Growth Rate (CAGR) of 8.4% from 2025 to 2030. This growth is propelled by rapid technological advancements that have transformed conventional video systems and recording tools into sophisticated, intelligent decision-making instruments.

A significant catalyst for VaaS adoption is the technology's capacity to deliver real-time insights, including capabilities like facial recognition, anomaly detection, and behavior prediction. These features render VaaS highly suitable for contemporary security and surveillance systems, where prompt threat identification is crucial. Beyond security applications, the versatility of video sensors is increasingly evident across various sectors. In smart city initiatives, they play a vital role in enhancing urban infrastructure, contributing to public safety, optimizing energy consumption, and improving waste management efforts.

Key Market Trends & Insights:

North American Dominance: North America led the market with a 35.5% share in 2024. This leadership is driven by substantial investments in advanced surveillance systems and the early adoption of cutting-edge technologies such as Artificial Intelligence (AI) and machine learning.

U.S. Market Expansion: The video as a sensor market in the U.S. is experiencing notable growth, corresponding with increasing regional demand. The accelerating pace of industrialization and the integration of advanced technologies are key factors driving this market's expansion.

Video Surveillance Product Leadership: By product type, video surveillance accounted for the largest market revenue share in 2024. This segment's dominance is primarily due to escalating security concerns across residential, commercial, and public domains, coupled with rapid advancements in technologies like AI-driven analytics, cloud computing, and high-resolution imaging.

Security & Surveillance Application Dominance: In terms of application, the security and surveillance segment held the largest market revenue share in 2024. This is attributed to VaaS's ability to automate real-time threat detection, significantly reduce false alarms, and efficiently manage large volumes of video footage, thereby lessening the workload on security personnel.

Commercial End-Use Sector Growth: The commercial segment accounted for the largest market revenue share in 2024. This is driven by the growing need for enhanced security and surveillance solutions in commercial environments, including office buildings and retail establishments, to protect assets and ensure safety.

Order a free sample PDF of the Video As A Sensor Market Intelligence Study, published by Grand View Research.

Market Size & Forecast

2024 Market Size: USD 71.50 Billion

2030 Projected Market Size: USD 114,664.7 Million

CAGR (2025-2030): 8.4%

North America: Largest market in 2024

Asia Pacific: Fastest growing market

Key Companies & Market Share Insights

Leading firms in the Video As A Sensor (VaaS) market are employing a range of strategic initiatives to expand their market presence. These primarily include product launches and developments, alongside expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations. Companies are leveraging diverse techniques to enhance market penetration and strengthen their competitive standing.

Axis Communications, a prominent player, specializes in network video surveillance and intelligent security solutions. Their comprehensive offerings, including a wide array of cameras, video management software, analytics, and access control systems, enable businesses and smart cities to utilize video as a sensor for real-time insights, improved safety, and enhanced operational efficiency. Axis's commitment to innovation, sustainability, and fostering a robust partner ecosystem underpins their goal of contributing to a smarter and safer global environment.

Hikvision is a significant force in video-centric IoT solutions, with a strong focus on advanced video-as-a-sensor technologies for both security and intelligent monitoring. By integrating state-of-the-art AI, deep learning, and high-performance video analytics, Hikvision delivers real-time surveillance, environmental sensing, and actionable insights. Their solutions are deployed across various sectors globally, including smart cities, transportation systems, and commercial enterprises.

Key Players

Axis Communications AB

Hangzhou Hikvision Digital Technology Co., Ltd.

Bosch Sicherheits systeme GmbH

Dahua Technology Co., Ltd.

Sony Corporation

Honeywell International Inc.

Sportradar AG

i-PRO

Johnson Controls

OMNIVISION

Browse Horizon Databook for Global Video As A Sensor Market Size & Outlook

Conclusion