Don't wanna be here? Send us removal request.

Text

Understanding the Importance of PCI DSS Compliance for POS Security and Data Protection

In the ever-evolving landscape of digital transactions, ensuring payment data security is paramount. The Payment Card Industry Data Security Standard (PCI DSS) is crucial in safeguarding cardholder information and maintaining trust in payment systems. This blog explores the importance of PCI DSS compliance for POS (Point of Sale) security and data protection. It delves into its components, procedures, and significance for businesses, focusing on how Instantpay India Ltd. adheres to these compliance standards.

Table of Contents

What is PCI DSS?

Functions of PCI DSS Certification and its Importance

Key Components of PCI DSS

1. Secure Network and Systems:

2. Protect Cardholder Data:

3. Vulnerability Management:

4. Access Control:

5. Monitoring and Testing:

6. Information Security Policy:

Levels of PCI DSS Compliance

Level 1:

Level 2:

Level 3:

Level 4:

PCI DSS Procedure During Compliance Implementation

Checklist for How to Maintain PCI DSS Compliance and Best Practices

1. Build and Maintain a Secure Network and Systems

i) Install and Maintain a Firewall Configuration to Protect Cardholder Data

ii) Do Not Use Vendor-Supplied Defaults for System Passwords and Other Security Parameters

2. Protect Cardholder Data

i) Protect Stored Cardholder Data

ii) Encrypt Transmission of Cardholder Data Across Open, Public Networks

3. Maintain a Vulnerability Management Program

i) Use and Regularly Update Antivirus Software or Programs

ii) Develop and Maintain Secure Systems and Applications

4. Implement Strong Access Control Measures

i) Restrict Access to Cardholder Data by Business Need-to-Know

ii) Identify and Authenticate Access to System Components

iii) Restrict Physical Access to Cardholder Data

5. Regularly Monitor and Test Networks

i) Track and Monitor All Access to Network Resources and Cardholder Data

ii) Regularly Test Security Systems and Processes

6. Maintain an Information Security Policy

i) Maintain a Policy That Addresses Information Security for All Personnel

Benefits of PCI DSS Compliance

1. Protecting Cardholder Data

2. Avoiding Financial Penalties

3. Enhancing Security Posture

4. Meeting Industry Standards

5. Avoiding Reputational Damage

6. Ensuring Business Continuity

What is the PCI DSS 4.0 Compliance and its requirements?

Key Requirements For PCI DSS 4.0 Compliance:

How to Become PCI Certified

How does Instantpay India Ltd adhere to PCI DSS compliance?

Conclusion

Frequently Asked Questions about PCI DSS

1. Who are the founding members of PCI?

2. How do you check the PCI DSS status?

3. When is PCI DSS compliance required?

4. What is the purpose of PCI DSS standards?

5. How to maintain PCI compliance?

6. What is a PCI compliance audit?

7. What could be a consequence of non-compliance with PCI DSS?

What is PCI DSS?

PCI DSS stands for Payment Card Industry Data Security Standard. PCI DSS was constituted in the year 2004 in December. It is a set of security standards designed to ensure that all companies that accept payment, process, store, or transmit credit card information maintain a secure environment. These standards were developed by the PCI Security Standards Council (PCI SSC), which was founded by major credit card brands including, Visa, MasterCard, American Express, and Discover.

The primary goal of PCI DSS is to protect cardholder data from breaches and fraud by enforcing strict security measures across all aspects of payment card transactions. This includes implementing robust security protocols, regular monitoring, and maintaining a secure network.

Read More:

Comprehensive Look at the Growing Importance of Cybersecurity Compliances in the Fintech Industry

How Compliance Fosters Trust and Growth for Businesses Today

How Ready Are Indian FinTech Startups Making Switch to KYC Compliance?

Functions of PCI DSS Certification and its Importance

1. Data Security: Certification ensures that the business follows rigorous security protocols to protect cardholder data.

2. Customer Trust: Demonstrates to customers that their payment information is secure, enhancing trust and credibility.

3. Avoiding Penalties: Compliance helps businesses avoid hefty fines and penalties imposed by payment card companies for non-compliance.

4. Reputation Management: Reduces the risk of data breaches that can damage a company’s reputation and lead to loss of business.

5. Legal Protection: Provides a framework for meeting legal and regulatory requirements related to data protection.

Key Components of PCI DSS

The Payment Card Industry Data Security Standard (PCI DSS) is structured around six key objectives, each with specific requirements to ensure the security of cardholder data. Here is a concise overview of these key components:

1. Secure Network and Systems:

Firewalls: Install and maintain to protect cardholder data.

Default Settings: Change vendor-supplied defaults for system passwords and security parameters.

2. Protect Cardholder Data:

Data Protection: Encrypt stored cardholder data.

Data Transmission: Encrypt data transmitted across open, public networks.

3. Vulnerability Management:

Antivirus: Use and regularly update antivirus software.

Secure Systems: Develop and maintain secure systems and applications.

4. Access Control:

Access Restriction: Limit access to cardholder data to those who need it.

Unique IDs: Assign a unique ID to each person with computer access.

Physical Access: Restrict physical access to cardholder data.

5. Monitoring and Testing:

Access Monitoring: Track and monitor all access to network resources and cardholder data.

Security Testing: Regularly test security systems and processes.

6. Information Security Policy:

Policy: Maintain a policy addressing information security for all personnel.

Training: Provide regular security training and updates.

Levels of PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) categorizes compliance into four levels based on the volume of credit card transactions an organization processes annually. Each level has specific requirements for validation and maintaining compliance.

Level 1:

Criteria: Processes over 6 million card transactions per year.

Validation Requirements:

The annual on-site assessment is conducted by a Qualified Security Assessor (QSA) or internal auditor if signed by an officer of the company.

Quarterly network scans conducted by an Approved Scanning Vendor (ASV).

Annual Attestation of Compliance (AOC).

Level 2:

Criteria: Processes 1 to 6 million card transactions per year.

Validation Requirements:

Annual Self-Assessment Questionnaire (SAQ).

Quarterly network scans conducted by an ASV.

Annual AOC.

Level 3:

Criteria: Processes 20,000 to 1 million e-commerce transactions annually.

Validation Requirements:

Annual SAQ.

Quarterly network scans conducted by an ASV.

Annual AOC.

Level 4:

Criteria: Processes less than 20,000 e-commerce transactions annually, or up to 1 million transactions across all channels.

Validation Requirements:

Annual SAQ.

Quarterly network scans, as required by the acquiring bank.

Annual AOC.

Organizations should determine their compliance level based on their transaction volume and work to meet the corresponding validation requirements. This ensures that they are effectively protecting cardholder data and maintaining the highest standards of security.

Read More:

The Role of Aadhaar-PAN Linkage in Securing Identity & Compliance Across Industries

KYC 101: Navigating the Digital Realm with Know Your Customer Precision

PCI DSS Procedure During Compliance Implementation

The PCI DSS compliance procedure is essential for organizations that handle payment card transactions to ensure the security and protection of cardholder data. Achieving and maintaining compliance with PCI DSS not only helps prevent data breaches but also fosters customer trust and confidence.

The PCI DSS compliance procedure involves several key steps:

[wptb id=4080]

Checklist for How to Maintain PCI DSS Compliance and Best Practices

The Payment Card Industry Data Security Standard (PCI DSS) outlines a comprehensive set of requirements aimed at protecting cardholder data and ensuring secure payment card transactions. These objectives are designed to address various aspects of security, from network protection to access control and policy management.

The average merchant, at the time of data compromise, wasn't compliant with at least 47% of PCI DSS requirements. This was observed after a thorough PCI audit done by the third-party company.

Here is an in-depth look at the key objectives of PCI DSS and the PCI compliance checklist you should maintain:

1. Build and Maintain a Secure Network and Systems

i) Install and Maintain a Firewall Configuration to Protect Cardholder Data

Firewalls are critical for protecting the internal network from unauthorized access. PCI DSS requires businesses to configure firewalls to restrict incoming and outgoing traffic to necessary services only, ensuring that cardholder data is shielded from external threats. Example: A retail store implements firewall rules to block all traffic except for transactions from its payment gateway, reducing the risk of external attacks.

ii) Do Not Use Vendor-Supplied Defaults for System Passwords and Other Security Parameters

Default passwords and settings provided by hardware and software vendors are widely known and easily exploited by attackers. PCI DSS mandates changing these defaults to unique, secure configurations. Example: An e-commerce platform changes the default administrative password on its servers and configures unique, complex passwords for all system components to prevent unauthorized access.

2. Protect Cardholder Data

i) Protect Stored Cardholder Data

Businesses must implement strong encryption and masking techniques to protect stored cardholder data, ensuring it is unreadable and unusable by unauthorized parties. Example: A financial services company encrypts all stored credit card numbers using AES-256 encryption, ensuring that even if data is compromised, it cannot be used maliciously.

ii) Encrypt Transmission of Cardholder Data Across Open, Public Networks

Cardholder data transmitted over networks, especially public ones, must be encrypted to prevent interception and theft during transit. Example: An online retailer uses SSL/TLS encryption for all transactions involving cardholder data, securing the information as it travels between the customer’s browser and the retailer’s server.

3. Maintain a Vulnerability Management Program

i) Use and Regularly Update Antivirus Software or Programs

Malware and viruses can compromise systems and steal cardholder data. PCI DSS requires businesses to deploy and regularly update antivirus software to protect against these threats. Example: A payment processing company uses a centrally managed antivirus solution that is regularly updated and scans all systems for malware, ensuring continuous protection.

ii) Develop and Maintain Secure Systems and Applications

Regularly patching and updating systems and applications is crucial to protecting against known vulnerabilities. Example: A banking institution has a robust patch management process that ensures all software and systems are updated promptly when security patches are released, reducing the risk of exploitation.

4. Implement Strong Access Control Measures

i) Restrict Access to Cardholder Data by Business Need-to-Know

Access to sensitive data should be limited to individuals whose job roles require it. Implementing access controls based on the principle of least privilege minimizes the risk of data exposure. Example: Only the finance department of a corporation has access to cardholder data, while other departments are restricted to minimize potential misuse.

ii) Identify and Authenticate Access to System Components

Unique identification and authentication mechanisms ensure that only authorized individuals can access systems and data. Example: A healthcare provider uses two-factor authentication (2FA) for all employees accessing patient payment information, adding an extra layer of security beyond just usernames and passwords.

iii) Restrict Physical Access to Cardholder Data

Physical security measures are essential to prevent unauthorized access to systems that store or process cardholder data. Example: A data center restricts access to its servers by using key card access, biometric scans, and surveillance cameras, ensuring only authorized personnel can enter.

5. Regularly Monitor and Test Networks

i) Track and Monitor All Access to Network Resources and Cardholder Data

Continuous monitoring and logging of all access to network resources and cardholder data help detect and respond to security incidents promptly. Example: A multinational corporation uses a Security Information and Event Management (SIEM) system to log and monitor all access to its payment processing systems, enabling quick identification and response to potential security breaches.

ii) Regularly Test Security Systems and Processes

Regular security testing, including vulnerability assessments and penetration testing, helps identify and fix weaknesses before they can be exploited. Example: A retail chain conducts quarterly vulnerability scans and annual penetration tests to identify and address security gaps, ensuring ongoing protection of cardholder data.

6. Maintain an Information Security Policy

i) Maintain a Policy That Addresses Information Security for All Personnel

A comprehensive information security policy provides guidance and expectations for all employees, helping to create a culture of security awareness and responsibility. Example: A software company has a detailed information security policy that includes guidelines on password management, data handling, and incident response, which is reviewed and updated annually.

Benefits of PCI DSS Compliance

The Payment Card Industry Data Security Standard (PCI DSS) is essential for any organization that processes, stores, or transmits credit card information. 69% of consumers would be less inclined to do business with a breached organization. Compliance with PCI DSS ensures that businesses protect sensitive cardholder data and maintain a secure environment. Here are the key reasons why PCI DSS compliance is crucial:

1. Protecting Cardholder Data

Preventing Data Breaches: Compliance with PCI DSS involves implementing robust security measures, such as encryption, firewalls, and access controls, which significantly reduce the risk of data breaches. These measures ensure that cardholder data is protected from unauthorized access and cyber threats.

Building Customer Trust: Customers need to trust that their payment information is secure. PCI DSS compliance reassures customers that the business takes data security seriously, fostering trust and confidence in the organization's ability to protect their personal and financial information.

2. Avoiding Financial Penalties

Regulatory Fines: Non-compliance with PCI DSS can result in substantial fines from payment card companies. These fines can be detrimental, especially for small and medium-sized businesses. Adhering to PCI DSS compliance standards helps avoid these financial penalties and ensures smooth operations.

Litigation Costs: In the event of a data breach, non-compliant businesses may face legal action from affected customers and regulatory bodies. Compliance reduces the likelihood of such incidents, thereby minimizing potential litigation costs.

3. Enhancing Security Posture

Comprehensive Security Framework: PCI DSS provides a detailed framework for securing payment card data. By following this framework, businesses can identify and mitigate vulnerabilities in their systems, leading to a more robust security posture overall.

Regular Monitoring and Testing: PCI DSS requires continuous monitoring and regular security testing of systems and processes. This proactive approach ensures that any weaknesses are identified and addressed promptly, keeping the security measures effective and up-to-date.

4. Meeting Industry Standards

Standardization: PCI DSS compliance ensures that businesses meet industry-wide security standards. This standardization is critical for maintaining a secure payment ecosystem, as it ensures that all entities involved in payment card transactions adhere to the same high-security standards.

Staying Competitive: Compliance can be a differentiator in a competitive market. Businesses that demonstrate their commitment to data security by complying with PCI DSS can attract more customers and partners who prioritize security.

5. Avoiding Reputational Damage

Protecting Brand Reputation: A data breach can severely damage a company's reputation, leading to loss of customer trust and business. Compliance with PCI DSS helps prevent breaches, thereby protecting the brand's reputation and maintaining customer loyalty.

Maintaining Customer Relationships: Secure transactions are a cornerstone of customer relationships in the digital age. By ensuring PCI DSS compliance, businesses can maintain strong, trust-based relationships with their customers, leading to long-term loyalty and business growth.

6. Ensuring Business Continuity

Minimizing Disruptions: Data breaches can cause significant disruptions to business operations, including system downtimes, loss of data, and financial losses. Compliance with PCI DSS minimizes the risk of such incidents, ensuring business continuity and operational efficiency.

Insurance and Risk Management: Many cyber insurance policies require PCI DSS compliance. Being compliant can help businesses obtain and maintain cyber insurance, which is vital for risk management and mitigating financial impacts in the event of a security incident.

What is the PCI DSS 4.0 Compliance and its requirements?

The Payment Card Industry Data Security Standard (PCI DSS) version 4.0 introduces updates and new requirements to address evolving security threats and technologies. Here’s an overview of the key changes and enhancements in PCI DSS 4.0:

1. Enhanced Flexibility:

Customized Approach: Organizations now have the option to use a customized approach to meet security objectives, allowing for greater flexibility in implementing controls that suit their specific environments and risks.

Security Objectives: PCI DSS 4.0 introduces security objectives that provide clear goals for each requirement, enabling organizations to understand the intent behind each control.

2. Strengthened Security Requirements:

Multi-Factor Authentication (MFA): MFA is now required for all access into the cardholder data environment (CDE), not just for administrators.

Password Management: Stronger password controls, including longer and more complex passwords, and regular password updates are mandated.

Encryption and Cryptography: Enhanced encryption standards to protect cardholder data during transmission and storage.

3. Continuous Compliance:

Ongoing Monitoring: Emphasis on continuous compliance through ongoing monitoring and testing of security controls, rather than point-in-time assessments.

Incident Response: Enhanced incident response and management processes to ensure organizations can quickly detect, respond to, and recover from security incidents.

4. Updated Reporting and Documentation:

Documentation Requirements: More detailed documentation requirements for organizations using the customized approach to demonstrate how they meet security objectives.

Reporting Templates: Updated templates for Self-Assessment Questionnaires (SAQs) and Reports on Compliance (ROCs) to reflect the new requirements and structure of PCI DSS 4.0.

5. Secure Software Development:

Development Practices: New requirements for secure software development practices, ensuring that security is integrated into the development lifecycle of applications that handle cardholder data.

Software Testing: Enhanced testing requirements for software to identify and address vulnerabilities before deployment.

Key Requirements For PCI DSS 4.0 Compliance:

Multi-Factor Authentication (MFA): Required for all access into the cardholder data environment (CDE).

Password Management: Stronger password controls, including complex passwords and regular updates.

Encryption: Enhanced encryption standards for protecting data during transmission and storage.

Secure Software Development: New requirements for secure software practices and testing.

Continuous Monitoring: Ongoing monitoring and testing of security controls.

By integrating PCI DSS 4.0 standards you can ensure a secure payment environment and reinforce customer trust through reliable data protection.

How to Become PCI Certified

Becoming PCI DSS certified involves a structured process to ensure that your organization meets the necessary security standards for handling cardholder data. Here are the steps to achieve PCI certification:

1. Determine Your PCI Level:

Identify your organization’s PCI compliance level based on the volume of credit card transactions processed annually. Levels range from 1 (over 6 million transactions) to 4 (fewer than 20,000 transactions).

2. Scope Your Environment:

Identify all system components, people, and processes that interact with cardholder data. Ensure that you include all networks, applications, and devices in your scope.

3. Complete a Self-Assessment Questionnaire (SAQ) or Engage a Qualified Security Assessor (QSA):

For smaller organizations, complete an SAQ that aligns with your transaction volume and processing environment.

Larger organizations or those with complex environments should hire a QSA to perform an on-site assessment and provide a Report on Compliance (ROC).

4. Conduct a Gap Analysis:

Perform a gap analysis to compare your current security measures against PCI DSS requirements. Identify any areas where your security practices fall short.

5. Remediate Identified Gaps:

Address and rectify any gaps or weaknesses identified during the gap analysis. This may involve updating security policies, implementing new technologies, or enhancing employee training.

6. Perform Regular Vulnerability Scans:

Conduct quarterly vulnerability scans using an Approved Scanning Vendor (ASV). These scans help identify potential security weaknesses in your network.

7. Conduct Penetration Testing:

Perform penetration tests at least annually and after any significant changes to your environment. These tests simulate attacks to uncover vulnerabilities that may not be detected through regular scanning.

8. Compile Compliance Documentation:

Gather all required documentation, including the completed SAQ or ROC, and the Attestation of Compliance (AOC). This documentation proves your adherence to PCI DSS requirements.

9. Submit Compliance Reports:

Submit the AOC and ROC or SAQ to your acquiring bank or payment brand as required. This step confirms your PCI DSS compliance status.

10. Maintain Continuous Compliance:

PCI DSS compliance is an ongoing process. Regularly monitor and update your security measures to address new threats and maintain compliance. This includes continuous security assessments, updates, and training.

By following these steps, your organization can achieve PCI DSS certification, ensuring the highest standards of security for handling cardholder data and building trust with customers and partners.

How does Instantpay India Ltd adhere to PCI DSS compliance?

Instantpay India Ltd. upholds PCI DSS compliance through stringent security measures. The company maintains secure network systems with robust firewall configurations that are regularly updated to safeguard cardholder data. It avoids using vendor-supplied defaults for system passwords and ensures all data transmissions are encrypted across public networks.

Access to cardholder data is strictly controlled based on business necessity, with unique IDs assigned to personnel with computer access. Access to sensitive areas is restricted, and comprehensive monitoring and testing of security systems are conducted regularly to identify and mitigate vulnerabilities. These practices ensure that Instantpay India Ltd. meets PCI DSS standards, providing customers with a secure payment environment and building trust through reliable data protection measures.

Here’s how this practice impacts Instantpay’s operations and reinforces our commitment to data protection:

1. Enhanced Security: By rigorously following PCI DSS standards, we secure all components involved in handling payment information. This includes conducting thorough vulnerability scans and penetration tests to identify and address potential weaknesses. Our comprehensive approach helps prevent data breaches and ensures our systems are resilient against threats.

2. Trust Through Data Protection: Achieving and maintaining PCI DSS compliance demonstrates our commitment to protecting cardholder data. The Attestation of Compliance (AOC) and our adherence to stringent security practices reassure customers that their sensitive payment information is handled with the highest level of care and security.

3. Continuous Improvement: PCI DSS compliance is not a one-time effort but a continuous process. By regularly updating our security measures and staying informed about the latest threats, we ensure a secure payment environment that our clients can trust.

At Instantpay India Ltd, our adherence to PCI DSS compliance not only protects payment information but also fosters trust through our commitment to reliable data protection. This dedication to security and transparency is central to our mission of providing secure, trustworthy payment solutions to our customers.

Conclusion

Understanding the importance of PCI DSS compliance is crucial for any business handling card transactions. It ensures the security of cardholder data, enhances POS security, and helps maintain customer trust. By adhering to PCI DSS compliance standards, businesses like Instantpay India Ltd. not only protect their customers but also strengthen their security posture, paving the way for safer and more secure financial transactions.

Frequently Asked Questions about PCI DSS

1. Who are the founding members of PCI?

The Payment Card Industry Security Standards Council (PCI SSC) consists of five founding global payment brands:

Visa Inc.

Mastercard Inc.

American Express

Discover Financial Services

JCB International

These organizations develop and maintain security compliance standards like PCI DSS to protect payment card transactions.

2. How do you check the PCI DSS status?

To check your PCI DSS compliance status, follow these steps:

Review SAQ or ROC: Ensure your Self-Assessment Questionnaire (SAQ) or Report on Compliance (ROC) is up to date.

Verify Scan Results: Confirm that quarterly ASV scans and internal scans show no high-risk vulnerabilities.

Conduct Penetration Testing: Perform annual penetration tests and address any issues found.

Check Policies and Procedures: Ensure security policies and procedures are current and PCI DSS compliant.

Review Monitoring Logs: Verify that security monitoring and logging are in place and reviewed regularly.

Confirm with Banks: Ensure your acquiring bank or payment brands have your latest compliance documentation.

Maintain AOC: Keep your Attestation of Compliance (AOC) current and available for stakeholders.

3. When is PCI DSS compliance required?

PCI DSS compliance is required for all organizations that handle credit card information, regardless of their size or transaction volume. This includes merchants, service providers, and entities that store process, or transmit cardholder data.

4. What is the purpose of PCI DSS standards?

The purpose of PCI DSS standards is to ensure the security of cardholder data by establishing a set of security requirements and best practices. These standards help protect against data breaches, fraud, and other security threats by enforcing measures for securing payment card information.

5. How to maintain PCI compliance?

To maintain PCI compliance, organizations must regularly review and update their security policies, conduct periodic vulnerability assessments, and ensure all systems handling cardholder data adhere to PCI DSS requirements. This includes implementing strong access controls, encryption, and monitoring for security threats.

6. What is a PCI compliance audit?

A PCI compliance audit is an assessment conducted by a qualified security assessor to evaluate an organization’s adherence to PCI DSS standards. The audit involves reviewing security controls, processes, and systems to ensure they meet compliance requirements, resulting in a formal report on compliance.

7. What could be a consequence of non-compliance with PCI DSS?

Non-compliance with PCI DSS can result in severe consequences, including substantial fines, legal action, and damage to an organization’s reputation. Additionally, businesses may face increased risk of data breaches, financial losses, and higher costs for remediation and penalties.

0 notes

Text

A Comprehensive Guide to GST Verification

The Goods and Services Tax (GST) is a landmark reform in the Indian taxation system, introduced to streamline the indirect tax structure and bring about greater transparency in business transactions. Since its implementation, GST has revolutionised how businesses operate, ensuring a more uniform tax regime nationwide. As GST becomes an integral part of the business landscape, the need for accurate GST verification has emerged as a critical aspect of compliance and financial integrity. This guide aims to provide an in-depth understanding of GST verification, its processes, challenges, and benefits.

Understanding GST (Goods and Services Tax)

The Goods and Services Tax (GST) is a comprehensive, multi-stage, destination-based tax levied on every value addition. GST has subsumed various indirect taxes previously imposed by the central and state governments, including excise duty, VAT, and service tax. This unified tax structure simplifies the tax system, reduces the cascading effect of taxes, and promotes ease of doing business.

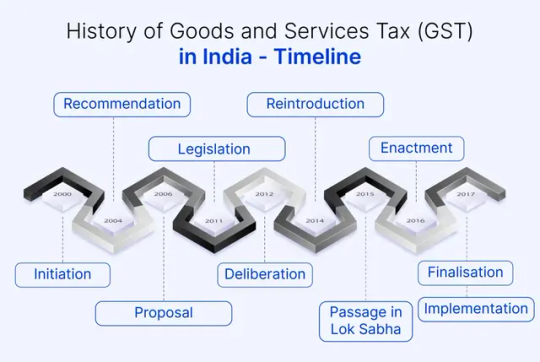

The journey of GST in India began in 2000 when a committee was set up to draft the law. After several years of deliberation and amendments, the GST Bill was finally passed in the Parliament in 2017, and GST was implemented on July 1, 2017. Since its inception, GST has undergone numerous amendments to address industry concerns and streamline processes.

History of Goods and Services Tax (GST) in India - Timeline

Key Components of GST

GST is divided into several components to ensure a fair distribution of tax revenue between the central and state governments:

Central Goods and Services Tax (CGST): Levied by the central government on intra-state supplies of goods and services.

State Goods and Services Tax (SGST): Levied by the state government on intra-state supplies of goods and services.

Integrated Goods and Services Tax (IGST): Levied on inter-state supplies of goods and services and is collected by the central government.

Union Territory Goods and Services Tax (UTGST): Levied on the supply of goods and services in Union Territories.

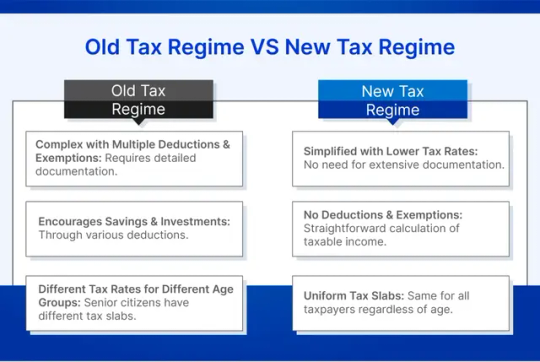

Old Tax Regime and New Tax Regime

Old Tax Regime Overview

The old tax regime in India is characterized by its complexity and numerous exemptions and deductions that taxpayers can claim to reduce their taxable income. It has been in place for many years and has evolved with changes and additions to tax laws.

Features

Income Tax Slabs: The old regime has different tax slabs based on age categories, including those below 60 years, senior citizens (60-80 years), and super senior citizens (above 80 years).

Exemptions and Deductions:

Section 80C: Deductions up to INR 1.5 lakh for investments in PPF, EPF, life insurance premiums, and other specified instruments.

Section 80D: Deductions for medical insurance premiums.

Section 24(b): Deductions on home loan interest.

House Rent Allowance (HRA): Exemption on HRA based on rent paid and salary structure.

Standard Deduction: For salaried individuals.

Other Deductions: Various other deductions for education loans, donations to charitable institutions, and more.

Complexity: The old regime requires taxpayers to maintain records and proofs for all exemptions and deductions claimed, making it relatively complicated.

Advantages

Tax Savings: Numerous exemptions and deductions allow taxpayers to significantly reduce their taxable income.

Encouragement for Savings and Investments: Various deductions encourage taxpayers to invest in specific financial instruments and savings schemes.

Disadvantages

Complexity: Managing and documenting the various exemptions and deductions can be cumbersome.

High Compliance Requirement: Taxpayers must be well-versed with tax laws and maintain proper documentation.

Old Tax Slab

Income up to INR 2.5 lakh: NIL

Income from INR 2.5 lakh to INR 5 lakh: 5%

Income from INR 5 lakh to INR 10 lakh: 20%

Income from INR 10 lakh and above: 30%

New Tax Regime Overview

Introduced in the Union Budget 2020, the new tax regime offers simplified tax slabs with lower rates but without most of the exemptions and deductions available under the old regime. It aims to simplify the tax filing process and reduce the compliance burden.

Features

Income Tax Slabs: The new regime provides different tax slabs with lower rates but does not differentiate based on age.

No Exemptions and Deductions: Most exemptions and deductions available in the old regime are not applicable in the new regime.

Optional: Taxpayers can choose between the old and new regimes based on what is more beneficial for them.

New Tax Slabs (FY 2020-21 onwards)

Income up to INR 2.5 lakh: NIL

Income from INR 2.5 lakh to INR 5 lakh: 5%

Income from INR 5 lakh to INR 7.5 lakh: 10%

Income from INR 7.5 lakh to INR 10 lakh: 15%

Income from INR 10 lakh to INR 12.5 lakh: 20%

Income from INR 12.5 lakh to INR 15 lakh: 25%

Income above INR 15 lakh: 30%

Advantages

Simplicity: The absence of numerous exemptions and deductions simplifies the tax filing process.

Lower Tax Rates: For many taxpayers, the lower tax rates can result in tax savings even without claiming deductions.

Disadvantages

No Incentives for Savings and Investments: The lack of deductions may discourage taxpayers from investing in specific financial instruments or savings schemes.

Comparison Required: Taxpayers must calculate their tax liability under both regimes to determine which is more beneficial.

Old Tax Regime VS New Tax Regime

Choosing Between the Two

Taxpayers must assess their income, available exemptions, and deductions to decide which regime is more beneficial. Generally:

Old Regime: Beneficial for those with significant exemptions and deductions.

New Regime: Suitable for those who prefer simplicity and have fewer deductions to claim.

GST Registration

Eligibility Criteria for GST Registration: GST registration is mandatory for businesses whose turnover exceeds a specified threshold limit, which varies for goods and services. Additionally, companies such as e-commerce operators, casual taxable persons, and input service distributors must register for GST regardless of turnover.

Step-by-Step Guide to GST Registration

Visit the GST Portal: Access the GST registration page on the official GST portal.

Fill Part-A of the Form: Provide basic details such as PAN, mobile number, and email ID.

Verification: An OTP will be sent to your mobile number and email for verification.

Fill Part-B of the Form: Enter detailed business information, including business address, bank account details, and the principal place of business.

Upload Documents: Submit required documents such as proof of business address, bank account statement, and identity proof.

Submit Application: Complete the application and submit it for processing.

Receive GSTIN: Upon approval, you will receive a unique Goods and Services Tax Identification Number (GSTIN).

Documents Required for GST Registration

PAN card of the business or applicant

Proof of business registration or incorporation certificate

Identity and address proof of promoters/directors with photographs

Business address proof

Bank account statement/canceled cheque

Digital signature

Benefits of GST Registration

Legal recognition as a supplier of goods or services

Ability to collect tax from customers and pass on the credit

Seamless flow of input tax credit

Competitive advantage by enhancing business credibility

GST verification is the process of validating the GSTIN (Goods and Services Tax Identification Number) of a business entity. It ensures that the GSTIN provided by suppliers or vendors is authentic and registered under the GST regime. Verification helps prevent tax evasion and ensures compliance with tax laws.

What is GST Verification?

GST verification is the process of validating the GSTIN (Goods and Services Tax Identification Number) of a business entity. It ensures that the GSTIN provided by suppliers or vendors is authentic and registered under the GST regime. Verification helps prevent tax evasion and ensures compliance with tax laws.

When and Why GST Verification is Needed?

GST verification is essential during various business transactions, including:

Onboarding new suppliers or vendors

Filing GST returns

Conducting audits

Ensuring compliance with anti-profiteering laws

Verification helps businesses avoid fraudulent transactions, incorrect GST credits, and legal complications arising from non-compliance.

Learn More:

How Verification APIs are helping businesses transform and scale-up

Everything You Need To Know About Aadhaar Verification

Identity Verification - How to Check PAN Aadhaar Linking Status with API

Types of GST Verification

Manual Verification Manual verification involves checking the GSTIN details on the official GST portal. This method is time-consuming and prone to human errors but is useful for verifying a small number of GSTINs.

Online Verification Online verification is done using the GST portal, where businesses can enter the GSTIN and verify its authenticity. This method is quicker than manual verification but still requires individual input for each GSTIN.

Automated Verification Tools Automated verification tools streamline the verification process by allowing bulk verification of GSTINs. These tools integrate with the GST portal and provide real-time verification, reducing the time and effort required for manual checks.

Challenges in GST Verification

Common Issues Faced During Verification

Incorrect GSTIN entries leading to invalid results

Network or portal downtime affecting verification

Discrepancies in registered details

Errors and Discrepancies in GST Numbers: Errors in GST numbers can arise due to manual entry mistakes or misinformation. Common discrepancies include incorrect PAN linkage, invalid business details, or outdated information.

Dealing with Fraudulent GST Numbers: Fraudulent GST numbers pose a significant risk to businesses. To combat this, businesses should regularly verify GSTINs, maintain accurate records, and report suspicious activities to tax authorities.

Benefits of GST Verification

Ensuring Compliance with Tax Regulations Regular GST verification ensures that businesses comply with tax regulations, avoiding penalties and legal issues. It helps maintain accurate records and timely filing of GST returns.

Reducing the Risk of Fraud Verification helps identify and eliminate fraudulent GSTINs, protecting businesses from financial losses and reputational damage.

Enhancing Business Credibility and Trust Businesses that regularly verify GSTINs demonstrate their commitment to compliance and transparency, enhancing credibility and trust among stakeholders.

Technological Advancements in GST Verification: Emerging technologies like blockchain, artificial intelligence (AI), and machine learning are poised to transform GST verification, delivering superior security, precision, and efficiency.

How to Verify GST Numbers?

Step-by-Step Process for Manual GST Verification

Visit the GST Portal: Go to the official GST portal (www.gst.gov.in).

Navigate to Search Taxpayer: Under the "Services" tab, select "Search Taxpayer" and then "Search by GSTIN/UIN."

Enter GSTIN: Input the GSTIN you wish to verify and complete the captcha.

View Details: The portal will display the registration status, trade name, and other relevant details of the GSTIN.

Using the GST Portal for Verification The GST portal offers a dedicated search facility to verify GSTINs. This feature provides instant access to the registration status and other details of the GSTIN holder, ensuring authenticity.

Third-Party Tools and Software for GST Verification Several third-party tools and software are available for GST verification. These tools offer features such as bulk verification, real-time updates, and integration with ERP systems, making the verification process efficient and error-free.

Streamlined PAN to GSTIN Verification for Businesses

Instantpay's PAN to GSTIN Verification API offers businesses a seamless solution to confirm the linkage between a customer's PAN (Permanent Account Number) and GSTIN. By integrating this API, companies can enhance the accuracy of their customer data and ensure compliance with GST regulations. This efficient verification process minimises errors and mitigates risks, contributing to a more secure and trustworthy business environment. Leverage Instantpay's advanced verification technology to streamline operations and maintain regulatory compliance with ease.

Conclusion

In conclusion, GST verification is an essential aspect of compliance and financial integrity for businesses operating under the GST regime in India. By ensuring the authenticity of GSTINs, businesses can prevent tax evasion, maintain accurate records, and enhance credibility with stakeholders. The evolution of technology, including AI and machine learning, promises to streamline GST verification processes, making them more efficient and effective.

As businesses continue to navigate the complexities of GST compliance, investing in reliable verification tools and staying abreast of regulatory changes will be key to ensuring smooth operations and mitigating risks. By understanding the nuances of GST verification and implementing best practices, businesses can position themselves for sustainable growth in India's dynamic business environment.

This comprehensive guide has provided insights into the fundamentals of GST, the intricacies of GST verification, common challenges faced, and the future outlook for verification processes. Embracing the principles outlined in this guide will empower businesses to navigate the complexities of GST compliance with confidence and clarity.

0 notes

Text

How Instantpay Aadhaar Verification API Works: A Comprehensive Guide

Aadhaar verification has become a cornerstone of identity verification processes in India and is integral to numerous administrative and financial transactions. With over a billion people enrolled, the Aadhaar system is the world's most extensive biometric ID system. This guide provides a detailed understanding of Aadhaar verification, its benefits, and the verification process, focusing on how the system works.

What is Aadhaar?

Aadhaar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI). Introduced in 2009, Aadhaar is designed to provide a single, robust, and easily verifiable identity document for residents of India.

Need for Aadhaar Verification

Aadhaar verification, also known as Aadhaar authentication, involves validating an individual’s identity using their Aadhaar number. This process is crucial for ensuring that services, subsidies, and benefits reach the correct recipients, thereby reducing fraud and enhancing security across various sectors such as banking, telecom, and government services.

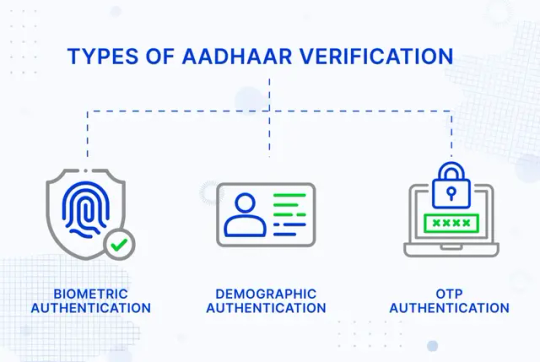

Types of Aadhaar Verification

1. Biometric Authentication

To verify identity, biometric authentication uses an individual’s unique physical characteristics, such as fingerprints, iris scans, or facial recognition. This method is highly secure as these biometric traits are unique to each individual and difficult to replicate.

Process:

The individual provides their Aadhaar number.

Biometric data (fingerprints, iris scans, or facial images) is captured using a biometric device.

The captured data is sent to UIDAI for verification against the stored biometric data.

UIDAI responds with a "Yes" or "No" indicating whether the biometrics match the Aadhaar number provided.

2. Demographic Authentication

Demographic authentication verifies an individual's identity using basic demographic information such as name, address, date of birth, and gender. This method is often used in conjunction with biometric authentication to enhance security.

Process:

The individual provides their Aadhaar number along with demographic information.

This information is sent to UIDAI to be verified against the data stored in the UIDAI database.

UIDAI responds with a "Yes" or "No" indicating whether the demographic details match the Aadhaar number provided.

3. OTP Authentication

One-Time Password (OTP) authentication involves sending a unique code to the individual’s mobile number registered with Aadhaar. This method adds an extra layer of security to the verification process.

Process:

The individual provides their Aadhaar number.

An OTP is sent to their registered mobile number.

The individual enters the OTP to complete the verification process.

UIDAI verifies the OTP and responds with a "Yes" or "No".

Learn More:

Everything You Need To Know About Aadhaar Verification

The Role of Aadhaar-PAN Linkage in Securing Identity & Compliance Across Industries

Identity Verification - How to Check PAN Aadhaar Linking Status with API

Aadhaar Verification Using API

What is an API?

An Application Programming Interface (API) is a set of protocols and tools that enable different software applications to communicate and interact with each other. APIs allow systems to share data and functionalities seamlessly, facilitating integration and automation. In the context of Aadhaar verification, APIs serve as a bridge between an organization's application and the UIDAI's Aadhaar database. This connection allows real-time verification of an individual's identity by cross-referencing the provided Aadhaar number and associated data with the UIDAI's records.

How are APIs used?

APIs can be used in numerous ways to enhance various processes across different industries. For instance, an API can retrieve essential information from a database, such as names and addresses, based on specific input criteria. On the other hand, more advanced APIs can provide comprehensive details, including biometrics or transaction histories, using multi-factor authentication methods like OTPs. These APIs ensure secure, quick, and reliable data exchange, making them invaluable tools for banking, telecommunications, healthcare, and e-commerce sectors. By integrating APIs, organisations can streamline operations, improve user experience, and maintain high security and efficiency standards.

Critical Key Terms in APIs

1. Request

The request is the message sent by the client to the server to perform an action (like retrieving or sending data)

2. Response

The response is the message sent back from the server to the client, indicating the result of the request.

3. API Endpoint

A specific URL where the API can access a resource or perform an action.

Example: Aadhaar Verification API

4. API HTTP Methods

Defines the type of operation the client wants to perform:

GET: Retrieve data.

POST: Create new data.

PUT: Update existing data.

DELETE: Remove data.

5. Header

Part of the request and response carries additional information such as content type, authentication tokens, and other metadata.

6. Parameters

Data is sent with the request to specify details or modify the request.

7. Authentication

Methods to verify the client's identity, make the request, and ensure they have the correct permissions. Standard methods include API keys, tokens, and Auth.

What is a REST API or RESTful?

A REST API (Representational State Transfer API) is a web service architecture that uses standard HTTP methods (GET, POST, PUT, DELETE) to interact with URL-identified resources. REST APIs are stateless, meaning each request contains all the information needed for processing. They are known for their simplicity, scalability, and flexibility in handling various data types.

What is API Testing and How Do We Test It?

API testing ensures APIs meet functionality, reliability, performance, and security expectations. Key methods include:

1. Unit Testing: Testing individual endpoints.

2. Integration Testing: Ensuring multiple API calls work together.

3. Performance Testing: Checking response times and load handling.

4. Security Testing: Protecting against unauthorised access.

What is an API Key and Why is it Important?

An API key is a unique identifier used to authenticate a client requesting an API. It ensures only authorised users can access resources, helps track usage, manage quotas, and prevent abuse.

What is Web API and Why is it Beneficial?

A Web API is an API accessed via the web using HTTP protocols. It allows different applications to communicate and exchange data over the internet. Benefits include:

1. Integration: Seamlessly connects systems and applications.

2. Accessibility: Accessible from any internet-connected device.

3. Scalability: Handles increasing loads and user demands.

4. Reusability: Leverages existing functionalities without rebuilding.

What is API Integration?

API integration connects different applications and systems via APIs, enabling them to share data and work together. It automates processes, improves data accuracy, and enhances functionality, creating efficient and scalable digital ecosystems.

Aadhaar Verification APIs on Instantpay

Instantpay offers seamless integration of Aadhaar verification through its APIs, making the verification process efficient and secure for businesses.

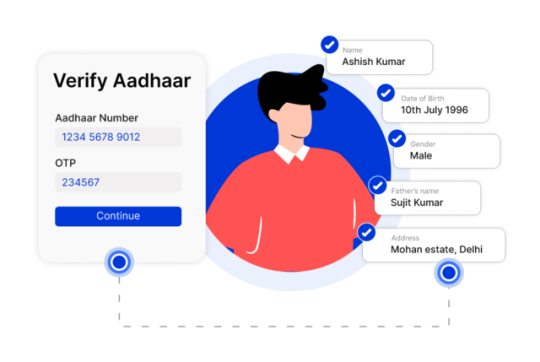

1. Aadhaar Demographics API

The Aadhaar Demographics API provides basic demographic information using only the Aadhaar number as input. This API is useful for simple identity verification where detailed information is not required.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar Demographics API endpoint with the Aadhaar number.

Processing: UIDAI processes the request and retrieves demographic details.

Response: The API returns a JSON response containing the demographic information (e.g., name, address, date of birth, gender).

2. Aadhaar offline e-KYC API

The Aadhaar offline e-KYC API provides comprehensive details but requires both the Aadhaar number and an OTP sent to the Aadhaar-linked mobile number. This ensures thorough verification for services needing extensive identity details.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar OKYC API endpoint with the Aadhaar number.

OTP Generation: UIDAI sends an OTP to the registered mobile number.

OTP Verification: The client system captures the OTP and sends it back to the API.

Processing: UIDAI processes the request, fetching both demographic and biometric details.

Response: The API returns a detailed JSON response containing all relevant information (e.g., name, address, date of birth, gender, photograph).

Step-by-Step Guide to Aadhaar Verification on the Instantpay Dashboard

Step 1: Log in to the Instantpay Dashboard and Navigate to Verification Suite. (If this isn't visible, please get in touch with [email protected] to enable it.)

Step 2: Click on the Verify Data Tab

Step 3: Choose Aadhaar Demographic API

Step 4: Download and fill template for Bulk Verification

Or If you want to try out the API click the button below

Step 5: Enter the Aadhaar Number you want to Verify

Step 6: Enter your iPin for authentication

Step 7: Congratulations, you have successfully retrieved the Aadhaar Demographic Data

Step 8: You can view and download the bulk verification files by clicking on the “Download” Button

Who Can Use Aadhaar Verification APIs?

Aadhaar Verification APIs can be utilised by a various organisations and sectors to streamline their identity verification processes. These APIs provide a reliable and secure way to verify the identities of individuals, ensuring that only genuine people can access services and benefits. Here are five examples of entities that can benefit from using Aadhaar Verification APIs:

1. Banks and Financial Institutions

Banks and financial institutions can use Aadhaar Verification APIs to verify customers' identities during account opening, loan applications, and other financial transactions. This ensures compliance with KYC (Know Your Customer) regulations and helps prevent identity fraud.

Example A bank uses the Aadhaar Offline EKYC API to verify the identity of a new customer applying for a savings account. The customer provides their Aadhaar number and OTP, allowing the bank to quickly and securely verify their details and open the account.

2. Telecom Companies

Telecom companies can utilise Aadhaar Verification APIs to authenticate customers when new SIM cards or mobile connections are issued.This process helps prevent fraudulent activities and ensures that mobile connections are issued to legitimate users.

Example: A telecom company uses the Aadhaar Demographics API to verify a customer's identity when they apply for a new SIM card. By entering their Aadhaar number, the company can instantly retrieve and verify the customer's demographic information.

3. Government Agencies

Government agencies can use Aadhaar Verification APIs to authenticate beneficiaries of various schemes and services. This ensures that subsidies and benefits are disbursed to the right individuals, reducing the risk of fraud and providing efficient service delivery.

Example

A government welfare department uses the Aadhaar Verification API to verify the identity of individuals applying for a social welfare scheme. This helps ensure that only eligible beneficiaries receive the benefits.

4. E-commerce Platforms

E-commerce platforms can leverage Aadhaar Verification APIs to verify the identities of sellers and buyers, enhancing trust and security in online transactions. This helps prevent fraudulent activities and builds trust among users.

Example

An e-commerce platform uses the Aadhaar Demographics API to verify the identity of a new seller registering. This ensures that only legitimate sellers can list their products, improving the platform's credibility.

5. Educational Institutions

Educational institutions can use Aadhaar Verification APIs to verify students' identities during admissions and examinations. This helps maintain the integrity of the admission process and ensures that only eligible students are enrolled and assessed.

Example

A university uses the Aadhaar offline - KYC API to verify the identity of applicants during the admission process. Using the Aadhaar number and OTP, the university can authenticate the students' details and ensure that only genuine applicants are admitted.

These examples illustrate the versatility and utility of Aadhaar Verification APIs by Instantpay across various sectors. By integrating these APIs, organisations can enhance security, improve efficiency, and ensure that services and benefits are delivered to the right individuals.

Conclusion

By focusing on how Aadhaar verification works and its implementation through APIs, this guide aims to provide a comprehensive understanding of the process and its significance in various sectors. For detailed API documentation, visit Instantpay Developer Portal, and for further assistance, contact support at [email protected].

0 notes

Text

Understanding Permanent Account Number (PAN) in India

The Permanent Account Number (PAN) is a critical identification tool used primarily for financial and tax-related transactions in India. Issued by the Income Tax Department, PAN serves as a unique identifier for individuals and entities engaging in economic activities, ensuring transparency and compliance within the Indian tax system. This blog delves into the intricacies of PAN, its structure, the application process, its significance, and its various use cases.

Table of Contents

What is a PAN?

Decoding the Structure of PAN

How to Apply for PAN

Apply For PAN Online

Offline Application

How To Apply PAN Card Online Via Income-Tax Portal

How To Apply For a PAN Card Online Via NSDL Website?

How To Apply For PAN Card Online Via UTIITSL Website?

How to Update or Correct PAN Details?

Importance of PAN

Use Cases

1. Banking and Financial Services:

2. Real Estate:

3. Investments:

4. Government Services:

Verify PAN details via Instantpay PAN verification API

Benefits of Using the API:

Considering the Developer Hub

Conclusion

Frequently Asked Questions

1. How to change the name on the PAN card?

2. How to check PAN card status?

3. How to know the PAN card number?

4. How to check PAN card details?

5. How to get a PAN card if lost?

6. How to link Aadhaar and PAN card?

7. How to change the mobile number on the PAN card?

8. What is the use of a PAN card?

9. What is the area code on the PAN card?

10. How to verify a PAN card?

What is a PAN?

PAN, a permanent account number, is a unique 10-character alphanumeric identifier issued to Indian taxpayers. This identifier helps the government track financial transactions and prevent tax evasion. The PAN remains unchanged throughout the individual's or entity's lifetime, regardless of changes in name, address, or other personal details.

Decoding the Structure of PAN

The 10-character PAN consists of:

First Five Characters (Alphabets):

The first three characters are a random sequence of alphabets from A to Z.

The fourth character indicates the type of PAN holder:

A — AOP (Association of Persons)

B — BOI (Body of individuals)

C — Company

F — Firm

G — Government

H — HUF (Hindu Undivided Family)

L — Local authority

J — Artificial juridical person

P — Person (Individual)

T — Trust (AOP)

The fifth character is the first character of the PAN holder's last name or surname.

Following Four Characters (Numbers): These are a sequential set of numbers from 0001 to 9999.

Last Character (Alphabet): This is an alphabetic check digit used for verification.

How to Apply for PAN

The application process for obtaining a PAN is straightforward and can be completed online and offline. Here's a step-by-step guide:

Apply For PAN Online

Visit the Official Website: Navigate to the official website of NSDL (National Securities Depository Limited) or UTIITSL (UTI Infrastructure Technology And Services Limited).

Fill Out the Form: Select the appropriate form (Form 49A for Indian citizens and Form 49AA for foreign citizens) and fill in the required details.

Upload Documents: Upload proof of identity, proof of address, and proof of date of birth.

Payment: Make the payment to process the application.

Acknowledgment: An acknowledgment number will be provided upon successful submission, which can be used to track the application status.

Offline Application

Obtain the Form: Collect Form 49A or Form 49AA from any PAN service center.

Fill Out the Form: Complete the form with the required details.

Attach Documents: Attach copies of proof of identity, address, and date of birth.

Submit the Form: Submit the completed form and the documents to the nearest PAN service center.

Processing Fee: Pay the processing fee at the center.

Acknowledgment: Receive an acknowledgment receipt, which can be used to track the application status.

Learn More:

Identity Verification - How to Check PAN Aadhaar Linking Status with API

The Role of Aadhaar-PAN Linkage in Securing Identity & Compliance Across Industries

How To Apply PAN Card Online Via Income-Tax Portal

Step 1 - Apply for a new PAN card by visiting the Income Tax portal and clicking "Instant e-PAN"

Step 2- Select 'Get New e-PAN'

Step 3- Enter your Aadhaar number and click 'Continue' to proceed.

Step 4- The OTP validation page will appear. Tick the checkbox to accept the terms and conditions, then click 'Continue.'

Step 5- Enter the OTP sent to your Aadhaar-registered mobile number, check the box, and click 'Continue.'

Step 6 - You will see your details, such as your name and date of birth, as per your Aadhaar card. Click 'Validate Email' to verify your email address, check the box, and click 'Continue.'

Finally, you will receive an acknowledgment number and a confirmation message on your mobile number. Once your e-PAN is allotted, you will be notified via the same channel. Typically, the e-PAN card is generated within 10 minutes, and you can download it from the Income Tax portal.

If you require a physical copy of your PAN card, additional fees may apply, and you can request it through the reprint option.

The instant e-PAN card facility is available only to individual citizens above 18 years of age with a valid Aadhaar number and an Aadhaar-linked mobile number. This service is unavailable for NRIs, partnership firms, HUFs, companies, trusts, or other entities.

How To Apply For a PAN Card Online Via NSDL Website?

Step 1: Visit the NSDL website.

Step 2: Choose the application type: 'New PAN - Indian Citizen (Form 49A)' or 'New PAN - Foreign Citizen (Form 49AA)'.

Fill in the required details: select the applicable category and title, and enter your last name, first name, middle name, date of birth/incorporation, email, and mobile number.

Tick the checkbox, validate the captcha, and click 'Submit.'

Step 3: You will receive a Token Number on your email ID. Click the ‘Continue with PAN Application Form’ button.

Step 4: Carefully read the detailed instructions before completing the PAN card application form. Click here to view the PAN card application instructions.

Choose the mode of submission for your PAN card documents and indicate if you need a physical PAN card.

Complete the form by entering your details, contact information, and AO code, and upload the necessary documents

Step 5: The payment page will appear after submitting the PAN card application. Payment options include credit/debit cards, demand drafts, or net banking.

Upon successful payment, an acknowledgment will be displayed, which you can use to check your application status. This acknowledgment will also be sent to your email ID.

Note: If you choose the 'Forward application documents physically' option, you will need to print the acknowledgment and send it, along with the required documents, to the following address by post:

Income Tax PAN Services Unit 4th Floor, Sapphire Chambers Baner Road, Baner Pune - 411045

Once your application is processed and the PAN card is generated, it will be sent to your email or residential address within 15-20 days.

How To Apply For PAN Card Online Via UTIITSL Website?

Step 1: Visit the utiitsl website

Step 2: Click 'Apply Now' under the 'PAN Card for Indian Citizen/NRI' or 'PAN Card for Foreign Citizen' tab.

Step 3: Choose the 'Apply for New PAN Card (Form 49A)' tab or the 'Apply for New PAN Card (Form 49AA)' tab.

Step 4: Choose how you will submit your documents. - Indicate your applicant status. - Select the PAN card mode. - Click the 'Submit' button.

Step 5: You will receive a reference number. Click ‘OK’.

Step 6: Enter the required details on the form, such as personal details, document details, contact and parent details, and address details. Upload the necessary documents and submit the form.

Step 7: Make the payment of the application fee. An acknowledgment will be displayed and sent to your email ID on successful payment.

Proceed to pay the application fee. Upon successful payment, an acknowledgment will be shown on the screen and sent to your email ID.

Important: If you choose the ‘Physical Mode’ option on the PAN card form, you must take a printout of the form, affix a photograph and signature, attach the documents to the form, and post them to the nearest UTIITSL office.

How to Update or Correct PAN Details?

You can apply for changes online if you need to update details in your existing PAN card, such as name or date of birth. The process is similar to applying for a new PAN card, and you must submit supporting documents for the requested changes. Here’s how you can proceed:

Visit the NSDL portal or UTIITSL website.

Select the application type "Changes or Corrections in existing PAN/ Reprint of PAN card."

Enter the details that require modification, upload the necessary documents, and click "Submit."

Pay the processing fee.

Your updated PAN card will be dispatched within 15 days.

For detailed steps to make corrections or update details in your PAN card, click here.

Advancements in technology have streamlined the PAN application process, eliminating the need to mail required documents to NSDL or UTIITSL offices physically. When opting for online document submission, documents can be conveniently uploaded and submitted electronically.

Importance of PAN

PAN is essential for various financial and non-financial transactions. Its importance can be highlighted in the following areas:

Income Tax Returns: PAN is mandatory for filing income tax returns in India. It helps the Income Tax Department track all taxable financial transactions.

Bank Accounts: PAN is required to open new bank accounts, including savings, current, and fixed deposit accounts.

High-Value Transactions: Transactions such as buying or selling property, vehicles, or investments exceeding a specified limit require PAN.

Credit and Loans: PAN is necessary to apply for loans or credit cards.

Investments: PAN is required to invest in mutual funds, stocks, and other financial instruments.

Foreign Travel: PAN is needed for transactions related to foreign travel, such as buying foreign currency.

Telephone Connections: PAN is required to obtain a new telephone or mobile phone connection.

Demat Accounts: A PAN is necessary for opening a d

Fixed Deposits: PAN is required to open fixed deposits with banks exceeding a specified limit.

Use Cases

PAN serves as a critical tool in various sectors:

1. Banking and Financial Services:

Account Opening: PAN is mandatory for opening bank accounts and demat accounts.

High-Value Transactions: Banks require PAN for deposits exceeding ₹50,000.

Loan Applications: PAN helps in assessing the applicant's creditworthiness.

2. Real Estate:

Property Transactions: PAN is mandatory for buying or selling property.

Rent Agreements: PAN is required for rental agreements exceeding a specified amount.

3. Investments:

Mutual Funds: PAN is needed to invest in mutual funds.

Stock Market: PAN is necessary for trading in the stock market.

4. Government Services:

Subsidies: PAN is used to track and provide subsidies.

Tax Payments: PAN is essential for paying taxes and receiving refunds.

Businesses today need reliable tools to streamline customer onboarding and ensure compliance with regulatory standards. Instantpay’s PAN Verification API offers an efficient solution to verify Permanent Account Number (PAN) details in real-time, directly from the official Income Tax Department database. This advanced API accelerates the onboarding process and enhances security and data accuracy, providing a seamless experience for businesses and customers alike. Here’s an in-depth look at how Instantpay’s PAN Verification API can revolutionize customer verification processes.

Verify PAN details via Instantpay PAN verification API

Instantpay offers a PAN Verification API that allows businesses to streamline customer onboarding and ensure regulatory compliance. Here's a deeper dive into how it works:

What it Does:

Authenticates PAN details: The API verifies the provided PAN number against the official Income Tax Department database.

Provides additional information: Beyond primary verification, Instantpay offers two API options:

PAN Verification: This returns essential details like the name on the PAN card, PAN status (active/deactivated), and Aadhaar seeding status (linked or not linked).

PAN Verification Plus: This advanced option provides a more comprehensive profile by adding details like address, date of birth, and gender.

Benefits of Using the API:

Faster Onboarding: Seamless verification eliminates the need for manual document checks, speeding up customer signup processes.

Enhanced Security: Verification helps prevent fraud by identifying fake or invalid PAN cards.

Improved Data Accuracy: Real-time data from the government database ensures accurate customer information in your systems.

Regulatory Compliance: The API helps businesses adhere to KYC (Know Your Customer) regulations that mandate customer identity verification.

Considering the Developer Hub

Instantpay's developer documentation provides valuable insights for using their PAN verification API.

Here's what you might find:

Detailed Documentation: Step-by-step guides explain the API's functionalities, request parameters, and response formats.

Code Samples: Examples in various programming languages demonstrate how to integrate the API into your code.

FAQs and Troubleshooting: The hub might address common issues and provide solutions for a smooth integration process.

With Instantpay's PAN verification API, businesses can significantly improve efficiency and ensure compliance with regulations.

Conclusion

The Permanent Account Number (PAN) is an integral part of the Indian financial system, ensuring transparency and accountability in financial transactions. Its unique structure, straightforward application process, and wide range of applications make it indispensable for individuals and entities. Whether opening a bank account, filing taxes, or making high-value investments, PAN is your key to financial integrity and compliance in India.

Understanding the significance of PAN and its various applications can help you navigate the financial domain more effectively, ensuring that your transactions are smooth and compliant with Indian regulations.

Frequently Asked Questions

1. How to change the name on the PAN card?

To change the name on your PAN card, follow these steps:

Visit the official NSDL website.

Select the option for 'PAN card correction' or 'Change/Correction in PAN data'.

Fill in the online application form with the necessary details.

Upload the required documents supporting the name change (e.g., marriage certificate, gazette notification, etc.).

Pay the applicable fee online.

Submit the application and note the acknowledgment number for tracking.

Send the printed acknowledgment form along with the required documents to the designated address mentioned on the website.

2. How to check PAN card status?

You can check the status of your PAN card application by following these steps:

Visit the official NSDL website.

Navigate to the 'Track PAN Status' section.

Enter your acknowledgment number or PAN number, along with the captcha code.

Click on 'Submit' to view the current status of your application.

3. How to know the PAN card number?

If you have lost or forgotten your PAN card number, you can retrieve it by:

Visiting the official Income Tax e-filing website.

Clicking on 'Know Your PAN'.

Enter your personal details such as name, date of birth, and mobile number.

Completing the OTP verification process.

Your PAN number will be displayed on the screen.

4. How to check PAN card details?

To check your PAN card details:

Visit the official Income Tax e-filing website.

Log in using your credentials or register if you are a new user.

After logging in, go to 'Profile Settings' and select 'My Profile'.

Your PAN card details will be displayed under the 'PAN Details' section.

5. How to get a PAN card if lost?

If your PAN card is lost, you can apply for a reprint by:

Visiting the NSDL website.

Selecting the option for 'Reprint of PAN card'.

Fill in the required details, including your PAN number and other personal information.

Paying the reprint fee online.

Submitting the application and noting the acknowledgment number.

The reprinted PAN card will be sent to your registered address.

6. How to link Aadhaar and PAN card?

To link your Aadhaar with your PAN card:

Visit the official Income Tax e-filing website.

Under the 'Quick Links' section, select 'Link Aadhaar'.

Enter your PAN, Aadhaar number, and name as per Aadhaar.

Complete the captcha verification and click on 'Link Aadhaar'.

If the details match, your PAN will be successfully linked with your Aadhaar.

7. How to change the mobile number on the PAN card?

To change the mobile number linked to your PAN card:

Visit the NSDL website.

Select the option for 'PAN card correction'.

Fill in the online application form with the necessary details.

Enter the new mobile number in the relevant section.

Upload the required documents and pay the applicable fee.

Submit the application and send the printed acknowledgment form along with the necessary documents to the designated address.

8. What is the use of a PAN card?

A PAN card is used for various purposes including:

Filing income tax returns.

Opening a bank account.

Applying for loans and credit cards.

Making financial transactions above a specified limit.

Purchasing or selling property.

Investing in securities and mutual funds.

Receiving taxable salary or professional fees.

9. What is the area code on the PAN card?

The area code in a PAN card represents the geographical location associated with the PAN cardholder. It is part of the alphanumeric structure of the PAN card number and helps identify the jurisdiction under which the PAN was issued.

10. How to verify a PAN card?

To verify a PAN card:

Visit the official Income Tax e-filing website.

Navigate to the 'Verify Your PAN' section.

Enter the PAN number, full name, date of birth, and captcha code.

Click on 'Submit' to verify the PAN details.

The system will display the status of the PAN card and its authenticity.

0 notes

Text

The Role of Aadhaar-PAN Linkage in Securing Identity & Compliance Across Industries

The Indian government made a key move. They integrated the Permanent Account Number (PAN) with Aadhaar. It aims to simplify processes and stop tax evasion. As of mid-2024, PAN-Aadhaar linking has made progress. Most eligible people have followed the mandate. Linking PAN with Aadhaar makes many financial and government procedures simpler. It helps citizens access services and benefits.

The Importance of PAN-Aadhaar Linking

Linking PAN with Aadhaar serves multiple purposes.

The government aims to stop the issuance and use of duplicate PAN cards. It will do this by linking PAN with Aadhaar. This will reduce fraud.

Simplifying Tax Filing: It makes filing income tax returns easier. Aadhaar serves as a common identifier. This ensures a seamless integration of records.

It ensures better tax compliance. It makes it difficult for people to evade the taxes.

Latest Updates and Deadlines

The Income Tax Department's latest notifications say the deadline to link PAN with Aadhaar has been extended many times. This is due to challenges faced by the public. The deadline for linking PAN with Aadhaar was June 30th, 2024. Individuals who fail to link their PAN with Aadhaar by this date will face consequences such as:

If not linked by the deadline, the PAN will become inoperative. It will be unusable for financial transactions and tax-related activities.

Higher TDS and TCS rates will apply. They apply to transactions with inoperative PANs.