Don't wanna be here? Send us removal request.

Text

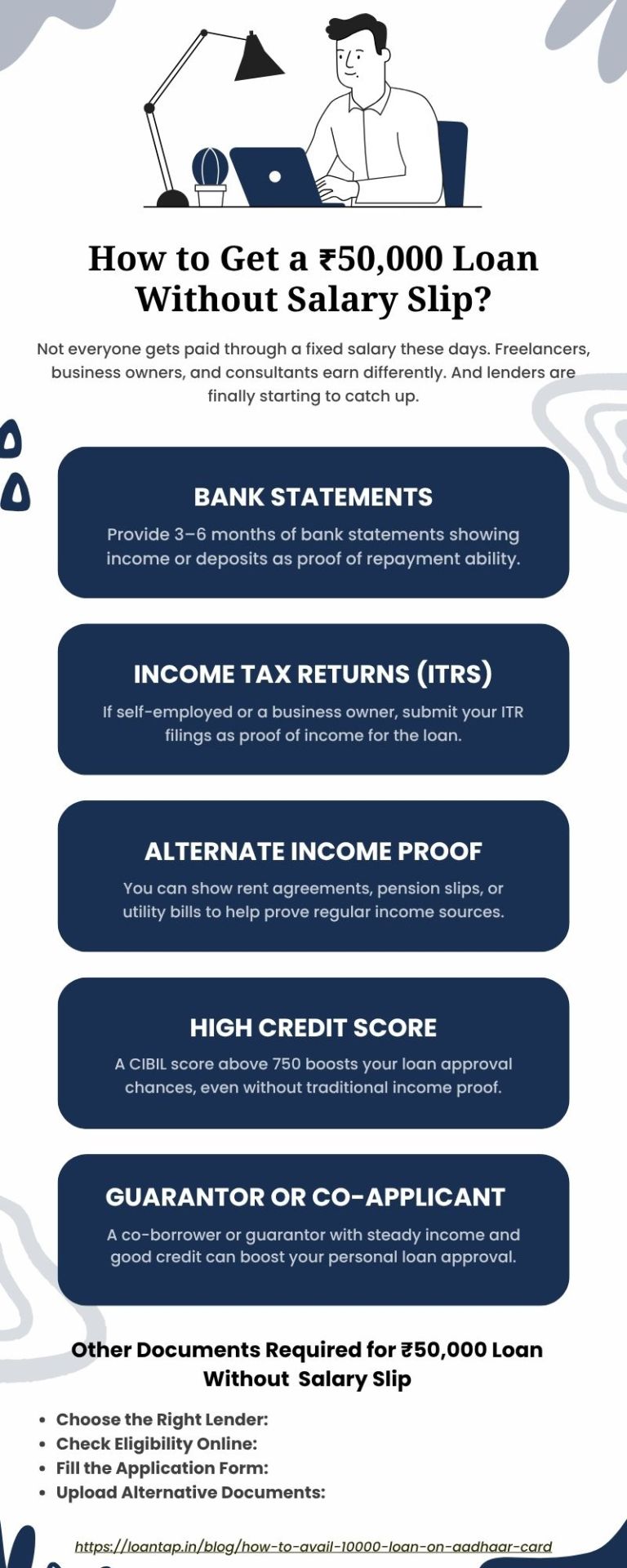

Easy Ways to Get ₹50,000 Loan Without Salary Slip

This easy-to-read infographic shows how to get a ₹50,000 loan without a salary slip using simple alternatives like bank statements and ITR.

0 notes

Text

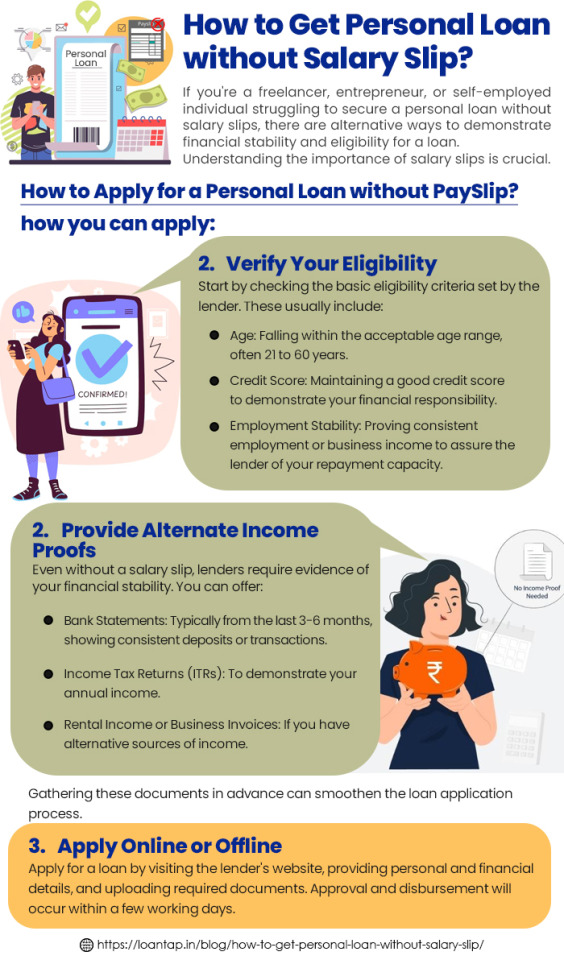

How to Get Personal Loan without Salary Slip?

Discover how to secure a personal loan without a salary slip. Learn easy steps and tips for hassle-free approvals today!

0 notes

Text

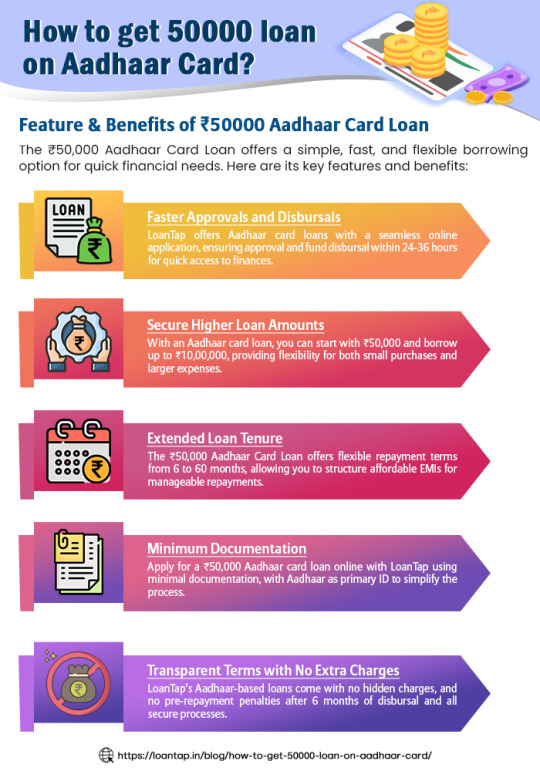

How to get 50000 loan on Aadhaar Card?

Aadhaar card loans have changed the loan application process, offering a fast, secure, and hassle-free way to access financing. With biometric verification and instant KYC, you can now secure loans with minimal documentation and quicker approval times. Whether it’s to cover an unexpected expense or fund a personal need, an Aadhaar card loan can provide the financial flexibility you’re looking for.

0 notes

Text

Government Personal Loan Schemes - Types, Features and Benefits

If you need a personal loan with low interest rates and flexible terms, Government personal loan schemes are a good option. These schemes are backed by the government, ensuring safer and affordable access to finances for individuals. These schemes can be used for various personal financial needs, from medical emergencies to education which makes borrowing accessible and stress-free.

0 notes

Text

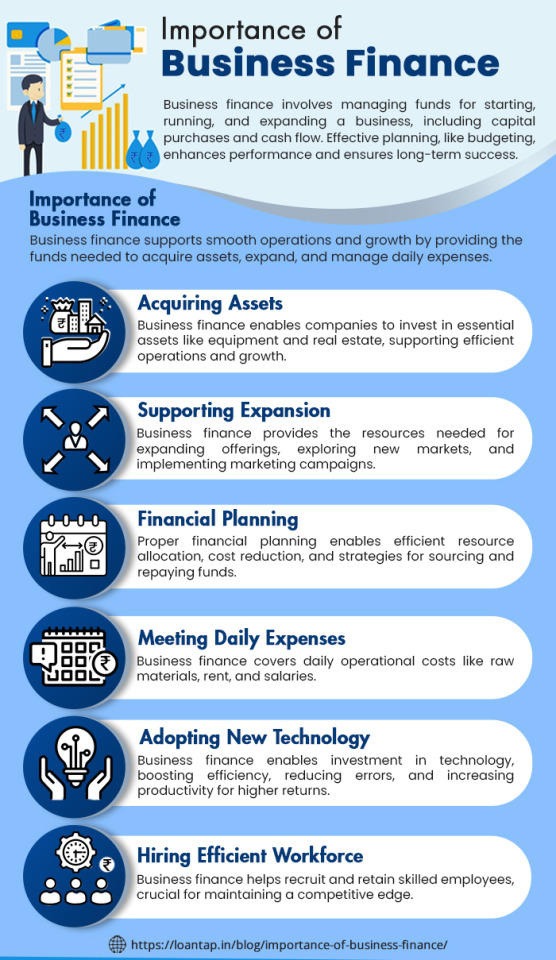

Importance of Business Finance

Running a business is similar to riding a bike. You must keep moving forward to stay balanced. Understanding your business’s finances and finding the right business financing option will help you keep your business healthy and growing.

0 notes

Text

What is a Business Loan? Benefits and Types

From accessing finances and managing daily expenses to innovating and expanding your market reach, the benefits of a business loan are impactful. Whether you need a short-term push or long-term financing, choosing the right type of loan, such as LoanTap’s business loans, can provide the financial flexibility and support your business needs to grow.

0 notes

Text

What are the Benefits of Personal Loans?

Personal loans help you get the funding when you need it the most, and you can customize your monthly payments and repayment terms according to your needs and goals. LoanTap offers personal loans of up to ₹10 lakhs for tenures ranging from 6 to 60 months. You can apply for a loan through our personal loan app to get your loan approved and disbursed within 24 hours. You can also customize your repayment plan by selecting either an EMI-free loan or an accelerated repayment option.

0 notes

Text

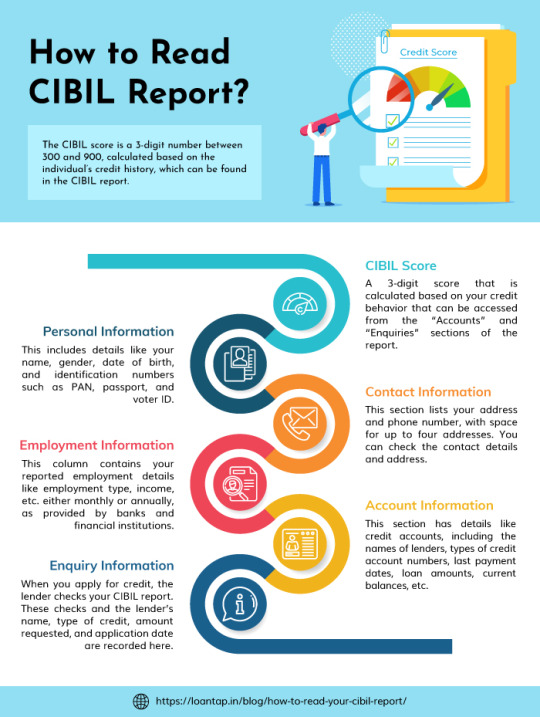

How to Read CIBIL Report?

Understanding and maintaining a healthy CIBIL score is essential for your financial well-being. You must review your CIBIL report to identify any errors or discrepancies, assess your creditworthiness, and take steps to improve your credit health. A good CIBIL score can help with better loan terms and lower interest rates. For example, if you want to take a personal loan and have a good CIBIL score, you may be able to secure a larger amount at competitive interest rates.

0 notes

Text

Importance of Business Finance

Running a business is similar to riding a bike. You must keep moving forward to stay balanced. Understanding your business’s finances and finding the right business loan will help you keep your business healthy and growing.

0 notes

Text

Collateral Loan - Meaning, Benefits & Types

There are two main categories of loans: secured and unsecured loans. For unsecured loans (meaning no collateral required), you do not need to keep any of your valuable assets as a guarantee. Only your credit score will be affected if you cannot pay back on time.

0 notes

Text

Top Credit Bureaus in India

A credit bureau is a company that collects your credit history, which is used to generate a credit report. This report helps lenders determine whether you're a good borrower. Let’s consider an example - Suppose you want to borrow money from a friend. Before lending it to you, your friend might ask other friends about your borrowing habits. If you’ve always paid back on time, your friend will feel confident lending you the money. If not, they might hesitate.

0 notes

Text

Fake Loan Apps in India 2024

When you are in need of urgent funds, a personal loan seems to be a convenient option. But in an emergency, we often fail to choose the right option. In 2024, there will be some fake loan apps causing trouble. These apps pretend to be real and promise quick loans but end up tricking people.

0 notes

Text

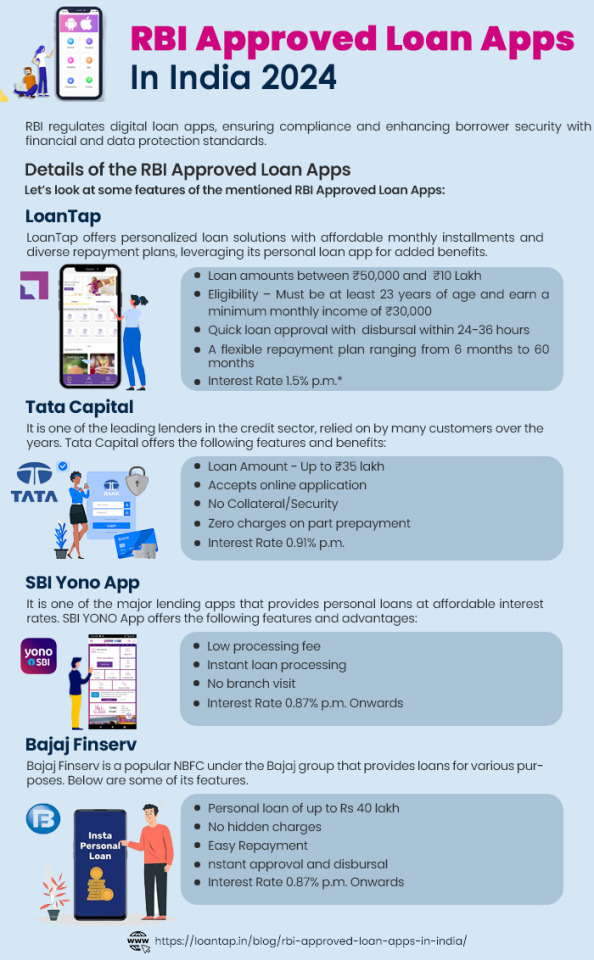

RBI Approved Loan Apps In India 2024

Here, we'll explore loan apps that have been approved by the RBI, outlining their significance and how they affect borrowers. It's important to make informed choices when it comes to choosing the right loan app.

0 notes

Text

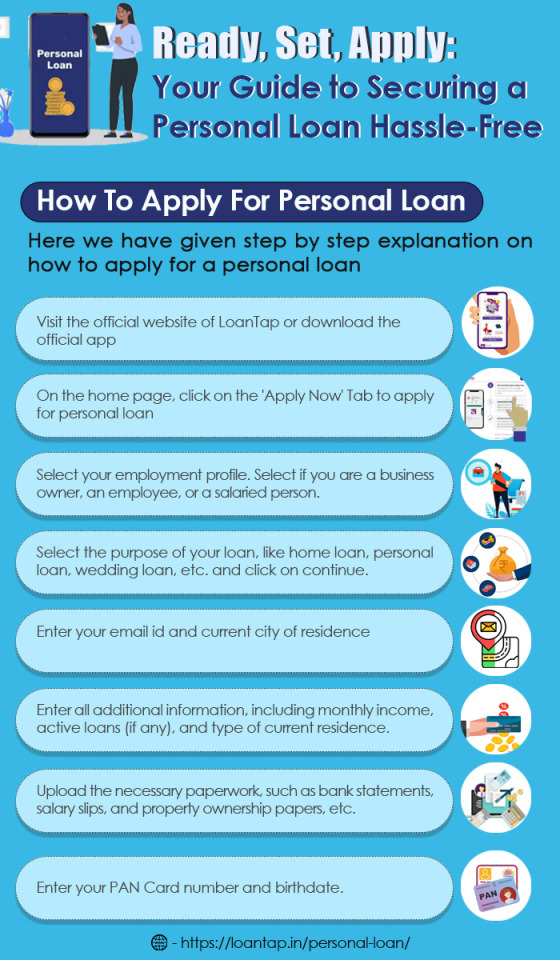

Ready, Set, Apply: Your Guide to Securing a Personal Loan Hassle-Free

Here, we have explained the process, offering the intricacies of loan acquisition with ease and efficiency and how to apply for personal loan. As financial institutions and online lenders continue to evolve, understanding the fundamental principles of personal loan procurement becomes increasingly essential.

0 notes

Text

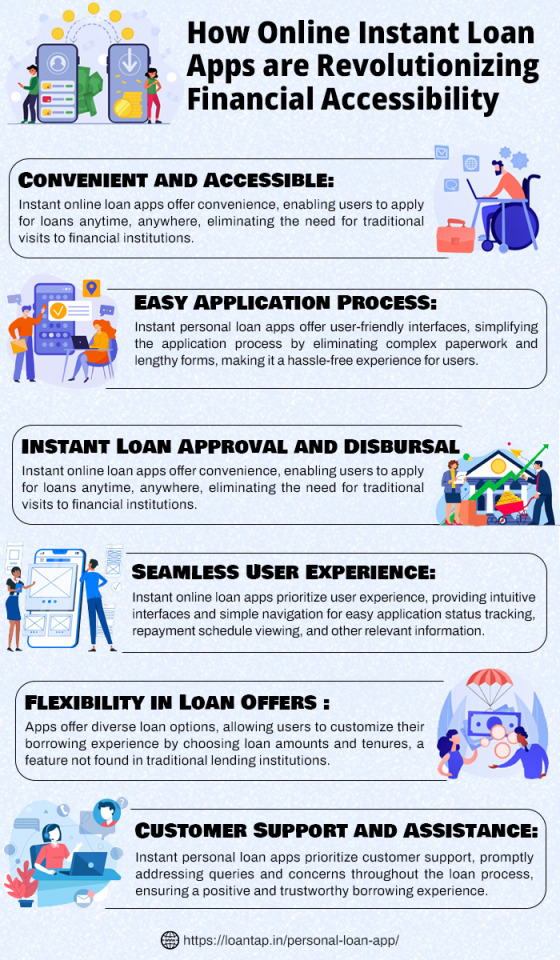

How Online Instant Loan Apps are Revolutionizing Financial Accessibility

In an era characterised by digital innovation, these platforms are at the forefront of revolutionising how individuals access financial assistance. Here we will understand the impact of online instant loan apps, explaining the advantages of using Instant Personal loan apps.

0 notes

Text

How MSME Loans Can Transform Your Business

This guide aims to illuminate the transformative potential of MSME loans, elucidating how these financial instruments can be the catalyst for positive change in your business. Whether you're a budding entrepreneur or an established small business owner, understanding the strategic benefits of MSME loans can be instrumental in expanding operations, enhancing productivity, and navigating through challenging economic climates. Join us on a journey to explore how embracing MSME loans can not only infuse capital into your business but also unlock avenues for innovation, job creation, and long-term success in the competitive business landscape.

0 notes

Text

How to Get Instant Loans via Apps

In the fast-paced digital era, accessing financial solutions has become more convenient than ever, thanks to the emergence of instant loan apps. These user-friendly applications have revolutionised the traditional ways of lending, providing a quick and hassle-free way for individuals to secure loans on the go. Discover how these apps leverage technology to simplify the application process, reduce approval times, and provide borrowers with rapid access to much-needed funds. Whether you're a first-time borrower or seeking alternatives to conventional loans, this exploration will navigate the landscape of instant loans via apps, offering insights into their benefits and considerations.

0 notes