Stay ahead of financial risks with NetNow's advanced credit management system. Get weekly updates on NSFs, declining bank balances, credit scores, litigation, and bankruptcies—empowering you to make informed decisions and protect your business.

Don't wanna be here? Send us removal request.

Text

Credit Application Automation: Save Time, Cut Costs, and Boost Accuracy

Banks spend millions processing loan applications the old-fashioned way. Loan officers manually review documents, calculate ratios, and make decisions one application at a time. This approach worked decades ago when volume was lower and expectations were different.

Today's customers expect instant responses. They apply for loans online and want answers within hours, not days. Meanwhile, banks struggle to keep up with application volume while maintaining accuracy and controlling costs.

Credit application automation offers a solution that addresses all three challenges simultaneously. Banks can process more applications faster, reduce operational costs, and make fewer mistakes.

The Cost of Manual Processing

Traditional loan processing requires significant human resources. A typical application takes 45 minutes to review when handled manually. During that time, a loan officer verifies income, checks credit history, calculates debt ratios, and evaluates collateral.

Banks pay loan officers well for their expertise. When these skilled professionals spend most of their time on routine data entry and calculations, the bank isn't getting full value from their salaries. The hourly cost of manual processing quickly adds up across thousands of applications.

Errors in manual processing create additional costs. Wrong calculations lead to poor lending decisions.

Approved loans that should have been declined often default, costing banks far more than the original loan amount. Rejected applications from qualified borrowers represent lost revenue opportunities.

Compliance costs also increase with manual processing. Banks must maintain detailed records for regulatory examinations. Paper files require physical storage space and are difficult to search when examiners need specific information. Staff time spent organizing and retrieving documents for compliance purposes adds to operational expenses.

How Automation Reduces Processing Time

Credit application automation transforms the review process from hours to minutes. Software reads digital applications instantly, extracts relevant data, and begins evaluation immediately.

No waiting for loan officers to become available or for documents to be manually entered into systems.

The technology performs multiple tasks simultaneously that humans must do sequentially.

While verifying employment through automated databases, the system also pulls credit reports, calculates financial ratios, and checks internal bank records. This parallel processing dramatically reduces total review time.

Routine applications that meet clear approval criteria can receive instant decisions. Customers submitting standard mortgage or auto loan applications often get preliminary approval before leaving the bank's website. This speed gives banks a competitive edge in markets where quick responses matter.

Complex applications still require human review, but automation handles the initial screening and data preparation.

Loan officers receive applications with calculations already completed and risk factors clearly identified. They can focus on making decisions rather than gathering information.

Cost Savings from Automated Processing

Labor represents the largest expense in traditional loan processing. Credit application automation reduces this cost significantly by handling routine tasks without human intervention. Banks can process more applications with existing staff or maintain current volume with fewer employees.

Technology costs money upfront, but operational savings develop quickly. Most banks recover their automation investment within 18 months through reduced processing costs. Larger institutions with high application volumes often see payback periods under one year.

Error-related costs drop substantially with automated processing. Mathematical mistakes become virtually impossible when computers handle calculations. Policy application becomes consistent across all applications, reducing the risk of compliance violations that result in regulatory fines.

Physical infrastructure costs decrease as banks rely less on paper documents. Storage space requirements shrink when records are kept electronically. Document retrieval costs disappear when files can be searched instantly using keywords or criteria.

Accuracy Improvements Through Automation

Human error rates in data entry typically range from 1% to 3% under normal conditions. During busy periods or when staff work overtime, error rates can climb much higher. Credit application automation eliminates these data entry mistakes entirely.

Mathematical calculations become perfectly accurate when handled by software. Debt-to-income ratios, loan-to-value calculations, and payment capacity assessments are performed consistently every time. Complex formulas that might confuse human reviewers are executed flawlessly.

Policy application improves with automation because software follows the same rules for every application.

Human reviewers sometimes interpret guidelines differently or make exceptions based on personal judgment. Automated systems apply criteria uniformly, ensuring consistent treatment for all applicants.

Document verification becomes more thorough with automation. The system can cross-reference information from multiple sources simultaneously. Income verification, employment confirmation, and asset validation happen instantly rather than taking days for manual verification.

Integration with External Data Sources

Modern credit application automation connects with numerous external databases to verify applicant information. Employment verification services, income databases, and asset verification systems provide instant confirmation of customer-provided data.

Credit bureau integration allows real-time access to updated credit scores and histories. The system can pull reports from multiple bureaus if needed and incorporate the most recent information into its decision-making process.

Bank account verification through third-party services confirms deposit accounts and transaction histories. This verification helps detect undisclosed debts or income sources that applicants might not have mentioned.

Risk Assessment Enhancement

Automated systems can analyze patterns in data that human reviewers might miss. The software examines relationships between different application elements and flags unusual combinations that warrant further review.

Fraud detection capabilities improve when automation processes applications. The system can quickly compare new applications against databases of known fraudulent submissions.

Suspicious patterns that develop gradually over time become visible when the software analyzes trends across many applications.

Credit scoring becomes more sophisticated with automation. The system can incorporate alternative data sources beyond traditional credit reports. Payment histories for utilities, rent, and other recurring expenses provide additional insight into applicant reliability.

Implementation Considerations

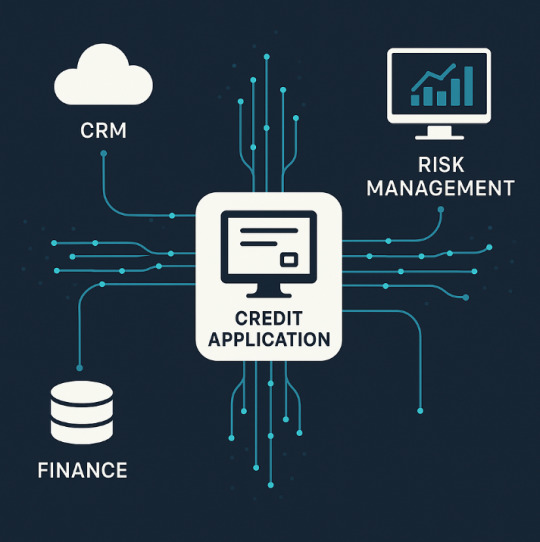

Banks need careful planning before implementing credit application automation. The system must integrate seamlessly with existing core banking platforms, loan origination systems, and customer relationship management tools. Poor integration can create bottlenecks that negate automation benefits.

Staff training requires attention during the transition period. Loan officers must learn how to work with automated systems and interpret machine-generated recommendations. Some employees may initially resist the change, preferring familiar manual processes.

Regulatory compliance becomes different, not necessarily easier, with automation. Banks must ensure their automated systems meet all applicable lending regulations. Decision logic must be transparent and explainable to regulators who examine the bank's processes.

System maintenance and updates require ongoing investment. Credit markets change, regulations evolve, and bank policies shift. The automation software must adapt to these changes through regular updates and refinements.

Measuring Success

Banks should establish clear metrics before implementing credit application automation. Processing time reductions, cost savings, and accuracy improvements all provide measurable benefits that justify the technology investment.

Customer satisfaction often improves with faster processing times. Survey scores typically increase when applicants receive quicker responses to their loan requests. This improvement can lead to increased customer retention and referrals.

Application volume capacity increases substantially with automation. Banks can handle seasonal spikes in loan demand without hiring temporary staff or asking existing employees to work excessive overtime.

Staff productivity metrics change when automation handles routine tasks. Loan officers can focus on relationship building, complex applications, and business development activities that generate more value for the bank.

Future Developments

Technology continues advancing in credit application automation. Machine learning capabilities allow systems to improve their decision-making over time by analyzing outcomes and adjusting criteria accordingly.

Integration with additional data sources will provide even more comprehensive applicant profiles. Social media information, spending patterns, and alternative credit data will help banks make more informed lending decisions.

Mobile applications are becoming more sophisticated, allowing customers to submit loan applications entirely through their smartphones. Document capture through mobile cameras eliminates the need for physical paperwork in many cases.

The Bottom Line

Credit application automation delivers measurable benefits across multiple dimensions. Time savings allow banks to respond faster to customer needs and handle higher application volumes. Cost reductions improve profitability while enabling competitive pricing. Accuracy improvements reduce risk and enhance compliance.

Banks that implement automation gain competitive advantages in the marketplace. They can offer faster service, maintain lower costs, and make better lending decisions. As customer expectations continue rising and competition intensifies, automation becomes less optional and more necessary for survival.

Success requires proper planning, adequate investment, and commitment to ongoing system improvement. Banks that approach automation thoughtfully and comprehensively position themselves well for future growth and profitability.

#credit application automation#automated loan processing#credit decision software#financial technology#fintech automation

0 notes

Text

Maximizing the Benefits of Credit Application Software for Your Organization

Processing credit applications used to mean shuffling through stacks of paperwork and waiting days for approvals. Today's credit application software has changed all that.

Companies that switch to modern systems often wonder how they managed without them. The transformation from manual to digital processing has revolutionized how businesses handle credit decisions.

Why Traditional Methods Don't Work Anymore

Paper forms get lost. Spreadsheets become outdated. Emails slip through the cracks. When businesses rely on old-school methods to handle credit applications, they waste time and money fixing preventable mistakes.

Manual processing simply can't keep up with today's business pace. The cost of these outdated methods goes beyond just wasted time - it affects customer relationships and bottom-line results.

The Real Cost of Slow Processing

Every day spent waiting for credit approval means another day without a sale. Customers get frustrated. Sales teams lose momentum.

Meanwhile, the competition moves faster. Credit application software helps solve these problems by cutting approval times from days to hours.

Quick turnaround times help businesses close deals while customers are still interested, rather than losing them to competitors who can move more quickly.

Missing Information Hurts Everyone

Without proper credit application software, forms often come back incomplete. Someone has to chase down missing details, make phone calls, and send follow-up emails.

This back-and-forth wastes everyone's time and delays decisions that could have been made right away. When applications are incomplete, the entire approval process grinds to a halt, creating bottlenecks that affect multiple departments.

What Actually Works Today

Getting Information Right the First Time

Modern credit application software guides customers through the process step by step. They can't skip important fields or submit incomplete information. The system flags problems immediately, not days later when someone finally reviews the paperwork.

This proactive approach prevents delays and ensures decision-makers have all the information they need right from the start.

Common application requirements include:

Business identification details

Financial statements and history

Bank references and trade references

Owner information and guarantees

Making Smart Decisions Faster

Credit managers need the right information to make good decisions. The best credit application software puts everything in one place:

Previous payment records

Current credit standing

Business history details

Reference check results

Real Benefits for Daily Operations

Keeping Everything Connected

Nobody wants to type the same information twice. Good credit application software connects with other business systems.

Data flows automatically between departments. This means less copying and pasting, fewer errors, and more time for actual work.

When systems talk to each other properly, the whole organization runs more smoothly. Staff members can focus on analyzing applications rather than just moving data around.

Finding Problems Early

When something looks wrong on a credit application, people need to know right away. Modern software spots potential issues before they become real problems.

Credit managers can focus their attention where it matters most instead of reviewing every detail manually. The software can compare application details against known risk factors and flag applications that need extra scrutiny.

Making the Switch Successfully

Getting Started Right

Moving to new credit application software takes planning. Start with one department or customer group. Work out any problems. Then expand gradually. This approach helps everyone adjust without disrupting the whole business at once.

Small successes build confidence and make the wider rollout smoother. Testing with a smaller group also helps identify potential problems before they affect the entire organization.

Training That Works

People learn new systems better when they understand the benefits. Show teams how credit application software makes their jobs easier. Focus on real examples from their daily work. Let them practice with the system before using it with real customers.

Hands-on experience builds confidence and reduces resistance to change. Regular follow-up sessions help reinforce good practices and address any questions that come up during daily use.

Keeping Everything Secure

Credit applications contain sensitive information. Good software protects this data without making it hard to access. Strong security should work in the background while people focus on their jobs.

Modern encryption and access controls protect sensitive data from unauthorized access while still allowing legitimate users to work efficiently.

Following the Rules

Every industry has regulations about handling credit information. Credit application software should help companies follow these rules automatically.

Regular updates keep the system current as requirements change. The software should maintain detailed audit trails and help prepare required compliance reports without extra work from staff.

Looking at Results

After implementing credit application software, companies often notice:

Faster application processing

Fewer errors and missed details

Better customer satisfaction

More consistent credit decisions

These improvements come from both better technology and smoother workflows. When everyone follows the same process and has access to the same information, decisions become more consistent and reliable.

Making Smart Choices

Understanding True Costs

Price matters when choosing credit application software. But the cheapest option rarely saves money in the long run. Consider setup costs, training time, and ongoing support. Good software pays for itself through better efficiency and fewer mistakes.

Look beyond the monthly subscription fee to understand the total cost of ownership, including implementation, training, and maintenance.

The Path Forward

Credit applications drive business growth. The right software makes this process smooth and reliable. Take time to find a system that truly fits your organization's needs. Focus on features that solve real problems instead of fancy add-ons that nobody uses.

When companies choose carefully, credit application software becomes a valuable tool that helps the whole business work better. The investment in proper tools pays off through improved efficiency, better customer relationships, and stronger credit decisions.

#Credit Application Software#business efficiency#credit management system#Credit Management#Financial Software Solutions#Credit Risk Management

0 notes

Text

Effective B2B Credit Management: A Practical Approach

When businesses extend credit to other businesses, it's crucial to manage it effectively to protect cash flow and minimize risk. B2B credit management is the process of handling credit transactions between businesses, ensuring payments are made on time and terms are clear.

By taking the right steps, businesses can avoid financial setbacks and maintain smooth, professional relationships with partners.

What Is B2B Credit Management?

B2B credit management refers to how businesses oversee the credit they extend to other businesses. This includes setting credit limits, determining payment terms, and managing outstanding payments.

In essence, it’s the process of ensuring that credit is offered to reliable partners while keeping financial risks low.

For companies offering credit to others, managing these transactions efficiently is vital. Without a solid strategy, businesses face challenges like late payments, which can affect overall financial health. Therefore, maintaining clear agreements and staying on top of payment schedules is necessary to avoid disruptions.

How to Manage Credit Effectively

Effective management starts with understanding the creditworthiness of potential business partners. Before offering credit, businesses need to evaluate their partners' financial stability.

This typically involves reviewing payment histories, financial statements, and any other available data that shows how reliably the partner has managed credit in the past.

Clear communication of payment terms is also essential in B2B credit management. Setting expectations upfront helps avoid confusion. Terms should specify the amount of credit extended, payment deadlines, and any late fees or interest charges for overdue invoices.

By being transparent about these conditions, businesses create a solid foundation for trust and minimize potential issues.

Tracking and Collecting Payments

Once credit is extended, it’s important to track payments and stay vigilant. Using software or other tools to monitor payments is common in B2B credit management. These tools can alert businesses when a payment is due or when an invoice is overdue, making it easier to stay organized.

If payments are delayed, having a structured approach to collections is important. A gentle reminder is often the first step, but more formal actions may be required if the delay continues. Quick action in following up on overdue payments helps reduce the risk of non-payment and prevents further delays.

Practical Tips for B2B Credit Management

Know Your Partners: Before extending credit, make sure to assess the financial stability of the business you're working with. This lowers the risk of late or missed payments.

Set Clear Terms: Define your payment expectations upfront. This means clearly stating the credit amount, due dates, and penalties for overdue payments.

Use Technology: Invest in credit management tools or software to monitor transactions and automate reminders. This can help stay on top of invoices and reduce manual tracking.

Act Quickly on Overdue Payments: The longer a payment goes unaddressed, the more difficult it becomes to recover. Act promptly to ensure timely payment and avoid letting it slide.

Conclusion

B2B credit management is crucial for businesses that extend credit to other businesses. By thoroughly assessing potential partners, setting clear payment terms, and staying organized with payment tracking, businesses can minimize risks.

A proactive approach to handling overdue payments ensures that companies maintain healthy cash flow and financial stability. By following these best practices, businesses can manage their credit effectively and build strong, reliable relationships with their partners.

1 note

·

View note