Don't wanna be here? Send us removal request.

Text

CHARLES LECLERC during drivers’ press con. monaco, 2018.

📸 getty

716 notes

·

View notes

Text

The Music Industry's Growing Concern Over AI After Fake Drake AI Went Viral

A TikTok user named Ghostwriter977 uploaded an AI-generated Drake song featuring The Weeknd, according to a Time article. The song, called "Heart on My Sleeve", sounded extremely similar to Drake and The Weeknd, with lyrics referring to the singers' real-life experience. Uploaded to streaming services including Spotify, YouTube, and SoundCloud, the song generated more than 20 million streams/views in less than 48 hours. The song was streamed 20 million times on Apple Music, and 13 milllion views on TikTok, which demonstrated the scale of its popularity. While Drake has not commented on this situation, his earlier response to AI singing "Munch" by Ice Spice was "This is the final straw AI". The song received positive reviews on social media and impressed music fans upon its release.

On Monday, the song was pulled from Spotify, and Apple Music, Deezer, and Tidal before it. On Tuesday, YouTube removed the song after a takedown notice, and it now says "This video is no longer available due to a copyright claim by Universal Music Group". However, UMG, the label Drake is a part of, declined to clarify whether it had issued formal takedown requests to streaming platforms and social media sites. UMG's efforts to crack down AI generated music started last month, when it urged streaming services like Spotify and Apple Music to block AI companies' access to its songs. AI generates music through feeding existing works, and this practice raises copyright concerns over the owners of the original songs. The issue with AI is currently unresolved and there are no comprehensive regulations. Previously visual artists and Getty Image had filed cases against AI companies. RIAA and a large coalition of industry organizations also took a firm stance on the issue of AI, warning against its harm on human creativity. Regarding the viral AI generated song, UMG stated that it “demonstrate why platforms have a fundamental legal and ethical responsibility to prevent the use of their services in ways that harm artists.” It further prompted streaming platforms and other industry players to be on the side of artists and respect creative works.

(348)

0 notes

Text

YouTube Music Rolls Out Real-time Lyrics on Mobile Devices

YouTube Music launched its latest initiative, incorporating real-time lyrics function on its mobile apps on iOS and Android devices, according to Music Business Worldwide. On April 10, it updated its description on Google Play and App Store, including a line emphasizing the addition of real-time lyrics function. With the new feature, lyrics are in sync with the song and the relevant verses are highlighted. Real-time lyrics have a larger font than YouTube Music's static implementation, and the background is blurred, similar to the lyrics function of Apple Music. Lyrics are powered by MusixMatch, the service adopted by competitor Spotify. The partnership between YouTube Music and MusixMatch was announced in August 2022, and it took a while for YouTube Music to implement this function. YouTube Music began to test the real-time feature at the end of 2022, when users connecting music on their app to their TV discovered a new section dedicated to scrolling lyrics. The company teased on additional lyrics features in October 2022, and with this update, the new lyrics menu will slowly become available for the majority of YouTube Music users.

Real-time lyrics is the latest feature in YouTube Music's recent initiatives to build a more comprehensive platform. Last month, YouTube Music began to offer song and album credits and automatic downloading. As the competition in the audio streaming sector intensifies, companies seek to diversify their services while having comparable music libraries and pricing structures. The incorporation of real-time lyrics is likely YouTube Music's attempt to increase its competitiveness and catch up with competitors including Spotify and Apple Music. Apple Music started to provide synced lyrics in 2019, and it launched a karaoke function in December 2022 to capitalize on its lyrical experience. Spotify introduced scrolling lyrics in 2021 with a partnership with MusixMatch. YouTube Music was late to the audio streaming sector compared to its rivals -- it entered the audio streaming sector in 2018, while Spotify has operated since 2008 and Apple Music launched in 2015. In November 2022, YouTube Music surpassed 80 million paid subscribers worldwide.

Music publishers have raised concern about the wide availability of lyrics on streaming services. However, users expect real-time lyrics as a part of their listening experience and technology has changed the norms around music consumption.

(376)

0 notes

Text

K-Pop Company Kakao Entertainment Plots Expansion into the U.S., Partnering with Columbia Records

Kakao Entertainment, a division of South Korean tech company Kakao, announced its partnership with Columbia Records, a label under Sony Music, via its Kakao Entertainment America. The partnership is a part of Kakao Entertainment's plan to expand in the U.S. and globally. The two companies will co-manage K-pop girl group IVE, with Columbia Records on board to build a U.S. presence anticipating the release of their upcoming album. Columbia Records will support their local marketing efforts and promotion activities centered around their album and pre-release single in North America. Sony Music will also be involved in the group's international distribution with their subsidiary distribution company, The Orchard. After selling more than 3 million copies with consecutive hits, IVE will make its debut in the U.S. The K-pop group's global expansion started in Japan, and now Kakao plans to focus specifically on North America. IVE was produced by Starship Entertainment, a subsidiary of Kakao Entertainment, which is the home to popular K-pop groups including Monsta X. Kakao Entertainment owns various other labels and has stars like IU under its umbrella. Kakao also owns South Korean music streaming service Melon.

Kakao hopes to boost its music distribution network in the U.S. and amplify its influence in the global market by leveraging Columbia Records' expertise in the American pop music business. Kakao Entertainment plans to pay attention to supporting artists' oversea activities and enhance the company's competitiveness as a global enterprise.

Kakao has increased its share to 40% of SM Entertainment, a major K-pop company, after a long battle for the control of SM Entertainment. HYBE, the company behind BTS, attempted to take over rival SM by acquiring its shares, but eventually sold half of them to Kakao. The corporate battle represented the changing landscape in K-pop and further consolidation between leading agencies.

Kakao Entertainment wasn't the only K-pop giant seeking global expansion with a focus on the U.S. market. Last month, HYBE acquired Quality Control, an American hip hop record label, after naming Scooter Braun as the CEO of HYBE America. HYBE intended to diversify its business beyond K-pop and expand operations in the U.S. Similarly, SM Entertainment planned to acquire a music company in the U.S. and secure local resources to help its artists enter the U.S. market.

(376)

0 notes

Text

UMG's Growth in Subscription Revenue & Looking to Build an Artist-Centric Streaming Model

Universal Music Group, the biggest rights holder in the music industry, published its 2022 financial results, according to Music Business Worldwide. It split revenue from streaming to 2 categories: subscription and ad-supported. In 2022, UMG's recorded music streaming subscription revenue grew 10% year over year, in constant currency, reaching 3.901 billion euros (approximately $4.1 billion). The growth could have been higher, for its streaming subscription revenue received a boost from "DSP catch-up payment" in 2021. It is significant that UMG generated an average of more than $1 billion in streaming subscription revenue per quarter in 2022.

UMG enjoyed unprecedented success in streaming subscription in Q4 2022, generating 1.044 billion euros in one quarter ($1.07 billion). It was the first quarter to see its streaming revenue went over one billion euros, despite the slowdown in the growth of streaming subscription revenue. According to The Hollywood Reporter, rising subscription prices of streaming services, like Apple Music and Amazon Music, have contributed to UMG's increased revenue. Subscription was able to offset the decrease in sales of digital downloads. CEO of UMG stated that subscription would remain important in a challenging economic environment. UMG's revenue from ad-supported streaming, however, only had an increase of 1.8% YoY in Q4 2022. This could be accounted for by the larger macroeconomic trend, as both YouTube and Meta saw a decline in advertising revenue in Q4 2022. Ad-supported revenue is anticipated to grow significantly in the following years, and UMG is involved in discussions with TikTok.

UMG hoped to build an artist-centric model on music streaming platforms to offer better compensation for artists, according to Digital Music News. Following its partnership with Tidal announced in January, UMG has been working with Deezer too, and potentially discussing its plan with other major streaming platforms, including short video platforms that rely on music. UMG's goal was to foster collaboration between players in the music industry instead of placing major labels against indie artists. UMG envisioned a win-win situation for streaming platforms, artists, and fans, for the new model could drive subscribers to platforms, better compensate artists, and provide fans with the ease of discovery. It would be adjusting the existing model on a platform specific basis.

(366)

0 notes

Text

Deezer's Appointment of New Director & 2022 Financial Results

Stu Bergen, former executive at Warner Music Group, was appointed as the new Director on Board at streaming company Deezer. Stu Bergen will leverage his experience working in a major record label for 14 years. Deezer and WMG shared a long-standing relationship. Access Industries, the majority-owner of WMG, also holds shares at Deezer. Access Industries has been involved in Deezer before it went public in April 2022 through a merger with a Special Purpose Acquisition Company based in France. Deezer hopes to take advantage of Stu Bergen's expertise in promotion and marketing to help Deezer operate in a competitive music streaming market.

In Deezer's publication of its 2022 financial year results, its revenue increased by 10.6% YoY. In 2022, Deezer generated 451.2 million euros, $474 million, of total revenue, 60% of which came from its largest market France. French revenues were 273.2 million euros, a 12.6% increase from 2021 at constant currency. Deezer's adjusted gross profit also grew from 84.1 million euros to 98 million euros. Deezer attributed this growth to the shutting down of its ad-supported freemium service in some regions. The move demonstrated a strategic change for Deezer, from its launch of the ad-supported tier back in 2012. Despite the improvement in gross profit, Deezer was still operating at a heavy loss. In 2022, Deezer generated a loss of 166.7 million euros, up from 120.6 million euros in the prior year. Deezer traced the cause of the widening loss to a 54.9 million euros service charge in its merger with SPAC for its IPO. Deezer's adjusted EBITDA was at 55.7 million euros, down from 64.6 million euros in 2021.

Deezer has experienced a decline in subscribers, finishing 2022 with 9.4 million subscribers worldwide, down from 9.6 million at the end of 2021. In a note to investors, Deezer reasoned that it has focused its strategies in key markets, and the subscriber growth in France can offset subscriber loss in the rest of the world. Deezer has ventured into B2B partnerships globally: with Sonos in the US, RTL in Germany, etc. Deezer's average revenue per user for its premium service has improved significantly, rising from 0.5 euros to 4 euros per month. The improvement was driven by the increase in prices.

(372)

0 notes

Text

Snoop Dogg Brings Death Row Music Catalog to TikTok, Exclusively for the First Week

A new partnership between TikTok and Snoop Dogg would bring Death Row Music's catalog to SoundOn, an independent distribution service owned by TikTok, according to Music Business Worldwide.

Founded in the 1990s, Death Row Records became a leading label in hip-hop. Snoop Dogg acquired the Death Row brand and subsequently its recordings catalog in 2022. The catalog included legendary hip-hop and rap albums including Dr. Dre's The Chronic, Snoop Dogg's Doggystyle, and 2Pac's All Eyez On Me. In February 2022, Snoop Dogg pulled Death Row catalog from streaming services, and this deal with SoundOn would be the first online reissue of the catalog, according to Billboard. In Snoop Dogg's statement after this year's Super Bowl, he recognized that fans would be looking for music from last year's Super Bowl performance and he wanted to put the catalog back to streaming services soon. Snoop Dogg hoped the partnership with TikTok could make history, as it is the first catalog reissue to have an exclusive release on SoundOn. Death Row releases would be available exclusively on SoundOn for a week, starting from February 12, and SoundOn would then distribute the catalog to ByteDance platforms.

SoundOn launched in March last year, initially available in the US, UK, Brazil and Indonesia. The service launched in Australia recently, after TikTok limited access to music from major labels as a part of the ongoing negotiation between TikTok and major labels. To incentivize music creators, SoundOn offered 100% royalties in the first year and 90% after, combined with promotion tools. In what TikTok told Billboard last year, SoundOn was initially serving new and undiscovered artists.

According to Okayplayer, Snoop Dogg announced the deal in his TikTok. TikTok has curated a playlist of Death Row's hits, available on its music hub. Content creators on TikTok can now use Death Row artists' tracks. TikTok also put out a new filter inspired by Snoop Dogg's music video, incorporating AR technology.

(324)

0 notes

Text

Robert Kyncl's First Earning Call at WMG: Streaming, AI, TikTok

Robert Kyncl, former chief business officer at YouTube, held an earning report on February 9th on the performance statistics of Warner Music Group during the last quarter of 2022, according to Digital Music News. Warner Music Group, as one of the major music labels, suffered from a 7.8 percent year-over-year decrease on its revenues and a 34 percent dip on its net income. On the streaming side, WMG stated that it has dropped 6.7% YoY. According to Music Business Worldwide, WMG's recorded music streaming revenue declined by 2.6% YoY on a constant currency basis, which is staggering for a company used to steady growth in its streaming revenues. However, the equivalent quarter in 2021 included an extra week. When the extra week is taken into account, WMG pointed to an actual growth of 5% in streaming revenues, with subscription revenues up offset by a drop in ad-supported revenue. WMG attributed the numbers to how the digital advertising market experienced a slowdown during the last quarter, despite the fact that Spotify has seen an all-time high in ad revenues. In addition, WMG had a weaker release schedule in Q4 2022, compared to the year prior. According to Variety, Kyncl plans to remedy the situation with a strong release schedule later this year, including Ed Sheeran and Lizzo, who are among their top-selling artists.

Kyncl addressed the relationship between TikTok and the music industry in his earning call. As a former executive at YouTube, he has dealt with the conflicts between a platform based on UGC and music right holders. He urged TikTok to recognize the importance of music to the platform and establish a holistic relationship with music labels.

Kyncl highlighted the threat AI technology has posed to intellectual property. With AI playing a transformative role in music creation, he emphasized the need to accurately identify and collect royalties for copyright holders. He claimed that the music industry could work closely with AI to better protect copyright on digital platforms.

On the topic of Spotify's failure to increase the subscription price, Robert Kyncl acknowledged the potential in the audio streaming sector. He pointed out that music is undervalued compared to video streaming. Subscription prices of video streaming have increased substantially over the past decade, and individuals subscribe to multiple services. By contrast, the prices of music streaming services remained almost unchanged and a single platform provides access to all songs. He stated that streaming services like Apple, Deezer, and Amazon have taken steps in the right direction by increasing prices.

0 notes

Text

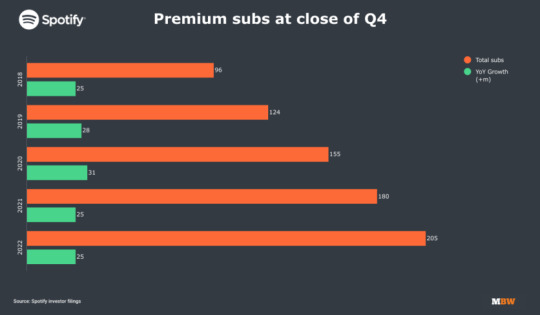

Spotify Wrapped 2022 With 205M Subscribers, $12.4B in Revenue

Spotify reached 205 million paying subscribers at the end of 2022, according to Music Business Worldwide. The company's performance in the last quarter was above prediction, which pointed towards 202 million premium subscribers, according to The Hollywood Reporter. Spotify's paying user base experienced a jump of 10 million from Q3 to Q4 in 2022, as stated by Billboard. Spotify's increased number of paid users, combined with ad-supported users, made up 489 million of monthly active users (MAUs), demonstrating a rise from 456 million in the previous quarter. The net addition of 33 million MAUs showed the highest hike of MAUs in Q4. While MAU growth was seen in nearly all regions, India and Indonesian were identified as the leading markets. Spotify attributed the growth in MAU to successful marketing campaigns and the company performed exceptionally during the holiday season. Spotify demonstrated strong growth among Gen Z listeners as well.

At the close of 2022, Spotify generated a revenue of 3.166 billion euros, up 18% year over year from 2.689 billion euros. Subscription revenue made up a major portion of its total revenue, up 18% year over year to 2.7 billion euros. Spotify has seen a continued growth in advertising revenue, its second-largest sector of revenue, as well, despite slower momentum in ad revenue among tech giants in face of the current recession. Spotify's ad-supported revenue was 449 million euros, accounting for 14% of the total revenue. Average revenue per user, 4.55 euros, however, went down slightly from Q3. Besides the recent change in currency, Spotify pinpointed a "product and market mix" as the reason for the change.

Spotify reported an operating loss of 231 million euros, up from a 7 million loss. Factors that influenced such a loss included “higher personnel costs primarily due to headcount growth and higher advertising costs (emerging markets, Gen Z)”. Operating expenses grew more than 40% during the last quarter. CEO Daniel Ek also reflected on overinvestment, especially in podcast programming, in 2022. Spotify planned to be more efficient in its spending. The company announced last week that 6% of its workforce, roughly 600 employees, would be cut down. CFO Paul Vogel anticipated an improvement on loss in 2023, although when Spotify could break even remained uncertain.

(372)

0 notes

Text

My Sector is Audio Streaming

My sector is Audio Streaming and I will be following Billboard, Music Business Worldwide, and Digital Music News.

0 notes