Don't wanna be here? Send us removal request.

Text

Thrift Store Score: Vintage Seaside Artwork

Happy Monday! Quick question for you: have you watched this video on my YouTube channel yet? It's the one where I take you room by room through our house talking through all of our very favorite secondhand furniture finds. In keeping with the tradition set by my #ThriftStoreScore series here on the blog (the first of which went live all the way back in 2012!), I instinctively called the furniture throughout my video “thrifted.”

While most people in the comments let my careless wording slide, a few did call me out for naming some of our more expensive antique finds “thrifty.” And, honestly, they were so right! The $500 dining room table we funded thanks to a generous wedding gift, for example, can hardly be placed in the same category as some of the retro tables that you guys score for just a handful of bucks at your own local charity shops.

So, essentially, I wanted to make sure I started this post with the tiny disclaimer that our latest #ThriftStoreScore isn't so much on the “thrifty” side as it is the “SCORE!” side. I still consider it an incredible, once-in-a-lifetime find, even if it did cost quite a bit more than most truly thrifty artwork. Maybe it's time for a series title change? At any rate, let's get down to the story behind this pretty secondhand print.

The piece of art was found at one of my favorite antique stores in nearby Stuarts Draft, Virginia (for anyone local, it's this one). I can't remember if I've talked about it here on the blog or not, but I'm slowly working to replace the mass produced pieces I've gotten from Target and Minted over the years with new and vintage original art. While I love both of those brands so much, I'm excited to start curating an art collection that's completely unique to our home and 30-something adult tastes. Is anyone else feeling the urge to do the same?

Anyway, I wanted to mention it because one of the first pieces I chose with that concept in mind was the vintage seaside etching I'm talking about in today's post. The print is original and signed (see it faintly written out there in the corner above?), which made the $50 price tag seem reasonable to me. Though they're both a little worn and discolored from age, the custom frame and mat are two of my favorite elements of the artwork. They just fit so well with the creamy tones of the print itself, and I couldn't imagine it framed any other way.

One of the main motivations behind my purchase of the piece was actually this photo of a bedroom designed by Studio McGee. I'm a big, big fan of that design duo, and ever since picking up on how they tend to fill the walls above client beds with long, thin framed art I've kept my eye out for something similar to go over our own bed.

This seaside piece feels just right. It's exactly the silhouette I was hoping to find for that awkward, slightly-squashed space above our headboard, and I also can't help but think that the traditional look of the print and frame is the perfect counterpoint to our modern bedroom furniture, too.

What's your immediate reaction? Was $50 too much to spend on it, or are you in support of the idea of investing in original art when it feels right for a particular space? Let me know in the comments!

The post Thrift Store Score: Vintage Seaside Artwork appeared first on Dream Green DIY.

0 notes

Text

Elevate Your Style With These Kitchen Floor Tile Ideas

Image:

We'll warn you now: these kitchen floor tile ideas aren't for the faint of heart.

Tile isn't something you can easily change out, and making a bold commitment isn't for everyone. If you want to create a unique, eye-catching look in your kitchen, though, tile will make a major statement.

Here are 3 ways to go bold with kitchen floor tiles, with real-life examples.

Photo Credit: Theguardian.com

Go Big

Big tile? Big impact. If you go in this direction, however, limit your color choices-- the size already makes a statement, so keep it to larger patterns and a maximum of two colors for a look that's bold without being overwhelming.

Photo Credit: Granadatile.com

If you aren't sure how much of an impact the flooring makes, check out these images-- one with the kitchen flooring in place, another with the floor edited out, so you can truly see how the tile changes the entire feel of the kitchen. Without the bold flooring, these kitchens don't stand out. It's the floor tile that sets them apart.

Photo Credit: Theartofdoingstuff.com

Choose small but powerful

The opposite is true for smaller tiles-- you can go with two or more colors, or choose more intricate kitchen floor tile patterns.

Photo Credit: CountryLiving.com

Get a real feel for the impact of small but mighty floor tile by comparing these images:

Photo Credit: Domino.com

Take inspiration from nature

The natural grooves and wave patterns in natural stone creates a unique texture that can soften the look of your kitchen while still giving it a unique vibe.

Photo Credit: futuristarchitecture.com

See the difference in the feeling of the space by comparing these images:

Photo Credit: futuristarchitecture.com

Every detail in a kitchen combines to create the overall impact, but when choosing standout features, many homeowners often overlook the floor. So if you want to go bold, beautiful and unique, explore your flooring options.

Do you have a unique kitchen floor tile pattern? Share it with us over on Facebook!

Category:

Design Trends

0 notes

Text

2019 Maximum HSA Contribution Limits – How Much Can You Save for Your Medical Expenses?

Health Savings Accounts, or HSAs, are growing in popularity among people who need affordable health insurance and among employers looking to save on health insurance costs.

HSAs have many benefits beyond cost savings. Let's dive in and take a look at what exactly is a health savings account, the HSA contribution limits for each calendar year, how HSAs are one of the most flexible financial accounts you can open, and why it's a good idea to max out your annual HSA contributions.

What is a Health Savings Account?

Health Savings Accounts are a type of tax-advantaged savings account specifically for health care spending. Contributions are tax deductible in the year they are made, and grow tax-free. Withdrawals are tax-free when used for qualified medical expenses.

In essence, a Health Savings Account is very similar to a combination of a Traditional IRA (tax deduction when you make the contribution) and a Roth IRA (no taxes on qualified withdrawals for medical expenses).

This is a huge benefit!

Health Savings Account Eligibility

To be eligible for an HSA, you need to participate in a qualifying High Deductible Health Plan (HDHP) for health insurance.

A plan may qualify as an HDHP if the deductibles are $1,350 per year or higher for individuals, or $2,700 per year or higher for a family plan. These deductibles are typically higher than average, hence the name, High Deductible Health Plan.

High-Deductible Health Plan (HDHP) also limit the deductible amounts and out-of-pocket expenses. For 2019, these limits are $6,750 for self-coverage only, and up to $13,500 for family coverage.

Advantages of HDHPs

Many people choose these health insurance plans because they typically have lower monthly premiums due to the high deductible. Many employers offer these HDHP plans for the same reasons.

The goal of the higher deductibles is to save costs for everyone, incentivize policyholders to become smarter with their healthcare spending and give you the option of setting aside money pre-tax to pay for healthcare. On the flip side, you need to have sufficient funds to pay your portion of the deductible. So only choose an HDHP if you have some money set aside in an emergency fund or cash savings.

Tax Advantages of Health Savings Accounts

You can set aside pre-tax income in an HSA for use specifically on health spending. HSAs are often compared to and confused with Flexible Spending Accounts (FSAs).

The two are similar in that you set aside pre-tax income for health costs, but FSAs have a serious downside that HSAs do not. With an FSA if you do not spend all of the funds in your account by the end of the year you forfeit the remaining balance of your account to the plan administrator.

With a Health Savings Account you never lose the funds. In fact, you could set aside money this year in an HSA and use it 40 years from now (some people even pay for their health care out of pocket now, and use their HSAs as another way to save for retirement). And as long as the funds are used for healthcare spending, you won't pay any tax on the withdrawals.

2019 HSA Contribution Limits

How much money can you set aside for future healthcare spending with an HSA?

The maximum annual contribution is dependent upon whether you are on an individual or family plan. The maximum HSA contribution limit is $3,500 per year for an individual, while families can contribute $7,000. There is also a catch-up contribution limit of $1,000 for those who are age 55 or older (note: catchup contributions for retirement accounts start at age 50).

Here is a list of contribution limits from recent years, including the HSA contribution limits from 2010 – 2019:

Tax YearIndividualFamily Catch-Up Contributions (age 55 and over) 2019$3,500$7,000$1,000 2018$3,450$6,900$1,000 2017$3,400$6,750$1,000 2016$3,350$6,750$1,000 2015$3,350$6,650$1,000 2014$3,300$6,550$1,000 2013$3,250$6,450$1,000 2012$3,100$6,250$1,000 2011$3,050$6,150$1,000 2010$3,050$6,150$1,000

What Happens If I Contribute Too Much to an HSA?

If you are contributing funds to your HSA automatically through payroll deductions it should be virtually impossible for you to contribute too much to your Health Savings Account. However, it is possible to over-contribute by making deposits outside of the payroll system or simply through error.

If you discover you have contributed too much to your HSA, you must take action to avoid paying penalties to the IRS.

The fix is quite simple: you must remove the excess amount contributed, plus any interest earned on that amount, and pay tax on both before April 15th of the following year. (You can contribute to this year's HSA through April 15 of next year.) You received a tax break by putting the money into your HSA pre-tax, but since you contributed too much you technically should have paid tax on the original income.

Failure to remove the excess contribution by the April 15th deadline and then withdrawing the funds at a later date will result in a 6% excise tax when you do withdraw the funds. Additionally, if you leave the funds in indefinitely, each year you must pay the 6% tax.

However, there is one way to get out of having to remove the contribution and paying tax: leave the contribution in, but avoid the 6% excise tax by lowering the next year's contribution by the amount of the over-contribution.

For example, an individual with an HSA contribution limit of $3,500 per year would have been guilty of contributing $100 too much if they contributed $3,600 this year. They could avoid paying the 6% excise tax by only contributing $3,400 next year (the $3,500 contribution limit minus $100). If they contributed the full $3,500 next year, they would then be forced to pay the 6% tax on the original $100 over-contribution.

Can You Contribute if You Aren't Eligible for the Entire Year? Pro-Rated Contribution Rules Explained

Rarely do you start a new job on January 1st or end it on December 31st. When you gain and lose access to a high deductible health plan will impact your availability to contribute to an HSA. If you are not active in an HDHP for the entire year your situation is a gray area.

Here is what the IRS says in one of its instruction manuals:

Last-month rule allows eligible individuals to make a full contribution for the year even if they were not an eligible individual for the entire year. They can make the full contribution for the year if:

They are eligible individuals on the first day of last month of their taxable year. For most people this would be December 1, and

They remain eligible individuals during the testing period. The testing period runs from December 1 of the current year through December 31 of the following year (for calendar taxpayers).

If the taxpayer does not qualify to contribute the full amount for the year, the contribution is determined by using the sum of the monthly contribution limits rule.

OR

Sum of the monthly contribution limits rule (use Limitation Chart and Worksheet in Form 8889 Instructions). This is the amount determined separately for each month based on eligibility and HDHP coverage on the first day of each month plus catch-up contributions. For this purpose, the monthly limit is 1/12 of the annual contribution limit, as calculated on the Limitation Chart and worksheet.

In other words, you can contribute the full amount if you are eligible as of Dec 1, of the calendar year. However, you may owe back taxes if you do not remain eligible from January 1 – December 31 of the following year.

To avoid tax problems, your HSA contribution can be pro-rated. Simply divide your normal contribution limit by 12 to get your monthly contribution limit.

For individuals, it is $291.66 and for families $583.33 (both numbers represent the 2019 tax year; just apply the current tax year to your situation).

Each month that you had at least 1 day active in an HDHP counts as a full month for your contribution limit. Then simply multiply the number of months you were active in the health plan by your monthly contribution limit.

For example, an individual that started a new job and gained access to an HDHP on March 12th and maintained HDHP coverage through December 31st would have 10 months of pro-rated contribution availability. They could contribute $291.66 x 10 = $2,916.60 for the year. If they contributed the full amount of $3,500 they would need to take the steps listed above to avoid penalties for over-contributing to their HSA.

IRS Publication 969 has more info about HSA qualifications, contribution limits, distribution rules, and more.

Benefits of Maxing Out Your HSA Account Each Year

There are numerous advantages to having an HSA. There is the immediate tax benefit in the year you make your contribution. And since your savings never expire, you can save the funds in your HSA or a linked investment account, and let your savings and investments grow over time. In fact, this can be a brilliant investment strategy:

Using Your HSA as a Super Retirement Account

Health Savings Accounts combine the best of the Traditional IRA and Roth IRA. Contributions are tax-deductible in the year they are made (like a Traditional IRA), and the earnings and withdrawals are tax-free if used for a qualifying medical expense (like a Roth IRA, when used for retirement). There are no age limits when using your HSA funds for a qualifying medical expense. So you can let your money ride until needed. Or just let it grow and pay your medical expenses out of pocket.

What if you want to use your HSA for non-qualifying medical expenses? If used for anything other than a qualifying medical expense, you will pay taxes and a 10% early withdrawal penalty, just as you would with a retirement account. However, the rules change a little bit once you turn age 65. Once you reach age 65, the current tax rules allow you to make non-qualifying withdrawals from your HSA with the same tax rules as a Traditional IRA. So you would pay taxes on the withdrawals, but you would not pay any penalties.

This flexibility makes your HSA one of the most powerful financial tools in your toolbox.

Benefits of Long-Term HSA Ownership

I maximized my HSA contributions each year I was eligible to contribute to an HSA. We decided to take advantage of the investment opportunities through the HSA, so we elected to pay our medical costs out of pocket and invest our HSA funds.

My health insurance plan has since changed, and I am no longer eligible to contribute to an HSA plan. However, I am not required to remove those funds until I decide to use them for medical expenses, or I decide I wish to withdraw the funds for other purposes.

Since the funds are invested, I'd like to let them compound as long as possible. If we have a major medical expense, I can elect to pay for them with our HSA savings. And if we are lucky and don't have any expenses we can't pay out of our cash flow or savings, then I will have a large investment account I can tap into when I reach retirement age. I'm hoping for the latter!

Where to Open an HSA Investment Account

The first thing you need to do is qualify for an HSA with a compatible High Deductible Health Care Plan. Check with your employer if you have an employer-sponsored health care plan. If not, then you may be able to purchase a qualifying HDHP on the ACA exchanges or find one through a health insurance company such as eHealthInsurance (this is where I always found our health care plans after I became self-employed).

Once you have a qualifying health care plan, you can shop around for different banks or investment accounts that offer HSAs. I wrote an article about the process of opening an HSA account, which bank I chose, and why.

I decided to open my HSA account with HSA Bank, in part because they have easy access, very low fees (which can be waived if you maintain a certain minimum in your account and because they make it very easy to link your HSA account to a brokerage where you can invest your HSA funds.

HSA Bank offers two investment options. I chose to invest with TD Ameritrade, because of their excellent reputation and access to several hundred fee-free ETFs for trading. So I've never paid anything to make a stock purchase at TD Ameritrade because I invested in ETFs that didn't have any associated trading costs.

You can visit TD Ameritrade to learn more or to open an account.

Health Savings Accounts are one of the most flexible financial accounts you can open. If you are eligible to open an HSA, I recommend maxing out your contributions each year. And if you can swing it, try to pay your medical expenses out of pocket. This will allow your HSA contributions to grow tax-free indefinitely, allowing you to increase your net worth.

The post 2019 Maximum HSA Contribution Limits – How Much Can You Save for Your Medical Expenses? appeared first on Cash Money Life | Personal Finance, Investing, & Career.

0 notes

Text

Magic Moisturizer is Here! + Orange-Tahini Mousse

Happy 2019, friends! Hope you've been having an inspiring beginning to the year. Today we're excited to announce that a small batch of our Magic Moisturizer is now available for sale, as per your amazing feedback. You can read all about it here (and get the recipe if you want to make it yourself), but basically, it's been our go-to skincare product for the past few years. It's made with all-natural ingredients that we find to be super nourishing and hydrating for all different types of skin, and it has the most luxurious texture and scent. Click here to go to our shop. Since Magic Moisturizer is like skin food, made with all food-grade ingredients, we were inspired to create a dessert recipe, celebrating two of the star ingredients in the formula: cacao butter and citrus. The result is this dreamy Orange-Tahini Mousse that takes minutes to put together.

The lush ingredients in the Magic Moisturizer are: organic raw cacao butter, organic virgin coconut oil, beeswax, organic olive oil, organic jojoba oil, organic calendula oil, organic vitamin E oil, organic rosehip oil, distilled water, and essential oils of blood orange, Italian lemon, lavender, carrot seed, and clary sage, all of which have balancing, hydrating, anti-inflammatory, and anti-bacterial properties. Our friends love it, and it's been reported to help with cold sores, eczema, and chronically dry skin. We're so excited to share it as a physical offering! Now on to the mousse. To make it, shredded cacao butter, orange juice and zest, tahini, cashews, and maple syrup get whipped into oblivion in a high-speed blender. Distribute that mixture among little cups or ramekins, let it set in the fridge for about an hour, and you'll have the most amazing, cloud-like mousse that tastes like pure heaven. We have people coming over tonight, and I've got a batch cooling in the fridge for a simple but elegant finish to our meal. Seriously can't wait. Hope you enjoy the recipe, and look out for a new meal plan coming next week :)

Orange-Tahini Mousse

Print

Serves: 4

Ingredients

1 cup plus 2 tablespoons orange juice (from about 3 organic oranges)

zest from 1 organic orange, plus more for garnish

½ cup cashews - soaked in purified water for 1-2 hours or in boiling water for 15 minutes

¼ cup maple syrup

5 tablespoons shaved or finely chopped raw cacao butter (leveled, not heaping)

4 tablespoons tahini (leveled, not heaping)

Instructions

Combine all the ingredients, except the orange zest, in a high-speed blender. Blend on high for about 30 seconds to a minute, until completely smooth. Add the orange zest and pulse on low, until just incorporated.

Distribute the mixture between about 4 ramekins or small cups. Refrigerate for an hour, or until completely set and enjoy, garnished with more zest. After the mousse has been refrigerated for a while, remove from the refrigerator about 5 minutes prior to eating.

3.5.3226

You might also like...

Matcha Butter Balls + Changes

Orange Chai Latte + Video

Raw Halloween Cookies

Spring Tea Party by The Rose Journals

.yuzo_related_post .relatedthumb { background: !important; -webkit-transition: background 0.2s linear; -moz-transition: background 0.2s linear; -o-transition: background 0.2s linear; transition: background 0.2s linear;;color:!important; } .yuzo_related_post .relatedthumb:hover{background:#ffffff !important;color:!important;} .yuzo_related_post .yuzo_text, .yuzo_related_post .yuzo_views_post {color:!important;} .yuzo_related_post .relatedthumb:hover .yuzo_text, .yuzo_related_post:hover .yuzo_views_post {color:!important;} .yuzo_related_post .relatedthumb a{color:!important;} .yuzo_related_post .relatedthumb a:hover{color:!important;} .yuzo_related_post .relatedthumb:hover a{ color:!important;} .yuzo_related_post .relatedthumb{ margin: 0px 0px 0px 0px; padding: 5px 5px 5px 5px; }

The post Magic Moisturizer is Here! + Orange-Tahini Mousse appeared first on Golubka Kitchen.

0 notes

Text

How I Traveled for Free: A Weekend in Massachusetts Using SPG Points

This points collector booked a pair of rooms in Cambridge for her sister and herself so they could attend Family Weekend at Harvard. The cardholder Name: Andrea Rotondo Age: 49 Occupation: Editor and small business owner Home: Amelia Island, Florida Credit Card: The Starwood Preferred Guest® Credit Card from American Express The stay Hotel: Le Meridien...

Rosemarie Clancy is a writer at NerdWallet. Email: [email protected].

The article How I Traveled for Free: A Weekend in Massachusetts Using SPG Points originally appeared on NerdWallet.

0 notes

Text

Last Minute Budget Changes for 2019

The last thing any property manager wants to hear is that something they need isn't in the budget. There are several components that go into your yearly costs, and it can be easy to let some things fall between the cracks if you're not careful.

0 notes

Text

Prepping and Preparing: 3 Easy Whole30 Recipes From Pederson's Farms

Sponsored by Pederson's Farms

Hey there! Neil Dudley, VP of Pederson's Farms, here. I'm so happy that you're joining us for the #JanuaryWhole30. I wanted to pop in and let you know about three ways our team at Pederson's Farms wants to help you stay prepped and eating well through your Whole30.

1 | We're Passionate about Pork

Whether you're currently doing the #JanuaryWhole30 or planning to start one soon, we've created more than 20 Whole30 Approved® pork products to support you. Pederson's products are easy to find … they have the Whole30 Approved logo right on the label and are available online and in stores everywhere.

I don't mean to brag, but we produce some really awesome, responsibly-raised, high-quality pork. Our pork tastes delicious and is raised without the use of antibiotics or growth stimulants, and never fed any animal by-products. Our products are minimally processed with no artificial ingredients, preservatives, nitrates/nitrites, gluten, lactose, or MSG … and wait for it … no sugar! As in “no sugar bacon?” You bet. We're famous for it.

2 | Our Whole30 Meal Prep Box Makes Meal Planning Easy

I know the idea of Whole30 meal planning can be a bit daunting at first. Preparing to prep and cook nearly all of your meals at home means you need to find compliant recipes and compliant proteins to keep you going all month long. That's why we offer our Ultimate Whole30 Meal Prep Box.

This Box was designed give you peace of mind when it comes to finding compliant, high-quality protein. It stocks your freezer with 10 of our most popular Whole30 Approved pork products in one easy order. The pricing works out to about $3.50 per meal … it's hard to beat that deal! Plus, when you purchase a bundle, we'll donate $10.00 towards our ongoing effort to support children with Type 1 Diabetes.

3 | We like tasty Whole30 recipes just as much as you do

In fact, we've created a 7-day Whole30 Meal Prep Guide stuffed with delicious Whole30 recipes. We'll share that for free when you order a Whole30 Meal Prep Bundle. It's full of delicious, satisfying, easy recipes inspired by the phenomenal Whole30 community. Want proof? I'm sharing 3 of my favorites in this blog post … just scroll down!

But first … enter to win a free Whole30 Meal Prep Bundle HERE & we'll give you coupon for $15.00 off

BLT Ranch Salad

(Save or bookmark it here!)

Ingredients

1 pound Pederson's No Sugar Bacon 4 tablespoons Primal Kitchen Ranch Dressing One head iceberg lettuce 1/2 cup cherry tomatoes Coarse salt Cracked pepper

Instructions

PREHEAT oven to 400-degrees. PLACE bacon slices on a baking tray and bake until desired crispiness. Set aside to cool. CHOP a head of iceberg lettuce into quarters and cut the cherry tomatoes into halves,while the bacon cools. When the bacon is cool, chop it into bits or small pieces. PLACE the lettuce wedges cut sides facing up, then sprinkle with bacon bits and tomato halves. DRIZZLE with ranch dressing and add salt and pepper to taste

Italian Sausage Egg Pizza

(Save or bookmark it here!)

Ingredients

1 package of Pederson's Italian Sausage 2 large eggs 1/2 cup cherry tomatoes 1/2 each of green, red, & yellow bell peppers 1/2 small yellow onion Coarse salt Cracked pepper

Instructions

DICE your peppers and onion into 1/8-inch pieces, then set aside. BROWN the Pederson's Italian Sausage in a skillet over medium heat, until fully cooked through. CRACK eggs in a bowl and whisk until combined. HEAT a small nonstick skillet on medium-low heat and add the eggs. Stir gently until small “curds” begin to form. LOWER heat and continue to cook undisturbed until the eggs are cooked through, then carefully transfer to a plate without breaking or folding the egg “crust”. SPRINKLE the eggs with the desired amount of sausage, peppers, and onions. SEASON with salt and pepper to taste.

Deli Ham Sushi Style Bites

(Save or bookmark it here!)

Ingredients

8 slices of Pederson's Farms Black Forest Ham 1 small cucumber 1 avocado, pitted, peeled and sliced into 16 pieces 1 purple onion, sliced into thin strips 1 red bell pepper, sliced into thin strips 1 orange bell pepper, sliced into thin strips

Instructions

LAY a piece of deli meat on work service. ARRANGE a small handful of the veggies (bell peppers, onion, and cucumber) along the bottom third of the deli ham. LAY 2 slices of avocado over top. STARTING from the bottom, roll tightly to enclose the veggies. LAY the roll seam-side down and cut into 6 pieces using toothpicks to hold each “roll” together. REPEAT with the remaining ham and veggies.

Let them Eat Bacon (and Ham, and Sausage…)

There you have it! The Ultimate Whole30 Meal Prep Box from Pederson's Farms is the perfect solution to finding tasty proteins that will make your Whole30 recipes shine. I wish you all of the best with your #JanuaryWhole30.

Grab your $15 coupon HERE.

This post was sponsored by Pederson's Farms. Thank you for supporting our Whole30 partners!

The post Prepping and Preparing: 3 Easy Whole30 Recipes From Pederson's Farms appeared first on The Whole30® Program.

0 notes

Text

The Dirtiest Places in Your Office and How to Keep them Clean

Ask a co-worker what parts of the office they think are the filthiest and most will bring up office keyboards or perhaps the bathroom door handle. However, there are are other parts of the office that are teeming with germs that you may be oblivious to. Failure to properly clean an office can lead to health issues and loss of productivity, as many workers will call in sick. Below, are some of the dirtiest places in your office and how you can sterilize them without breaking the bank…or your back.

The Start Button on Your Photocopier Machine

A study conducted by Hloom-a prestigious template maker-found that the average photocopier start button had 1.2 billion colony forming units per square inch; this is in stark comparison to a typical toilet seat at a school, which only has 3,200 colony forming units. As can be seen, the start button of your photocopier machine is one of the most germ-ridden spots in the office. The good news is you can clean it by using a high-quality disinfectant solution or by affixing an antimicrobial screen onto its surface.

The Surface of Your Desk

The surface of your desk will also be laden with a ton of germs. It may appear clean to the naked eye but rest assured that there are many harmful germs spread across your desk that you may not be aware of. Many busybodies also eat and drink at their desks in order to save time and make deadlines. As such, food particles and spilled liquids can cause issues, and discarded napkins, paper cups, and utensils can also serve as hot spots for nefarious germs to spread.

Many employees also make the mistake of simply wiping their desks down with a damp cloth instead of using a high-quality cleaning solution. To properly clean the surface of your desk you should use a high-quality disinfectant solution daily. If possible, come in a few minutes early and properly clean your desk before the workday begins, and, if you have the time, do the same right before exiting the office in the evening.

Vending Machine Buttons

A vending machine may appear clean, but it is also a hotspot for germs to spread. In fact, if you checked the buttons on the vending machine under a powerful microscope you would find a myriad of harmful germs and bacteria on them. Furthermore, one of the issues with vending machine buttons is that you can't clean them using a conventional cleaning method. However, you can purchase antimicrobial resistance screens for vending machine buttons. Then, simply clean them whenever you have the time and you will reduce the propagation of germs with minimal effort.

Your Office Keyboard

While we did mention that the office keyboard isn't the biggest ecosystem for germs, it is still one of the biggest. Dirt and dust from your table, as well as the carpet underneath your desk, will somehow find its way onto your keyboard and set up shop. In fact, it is possible to have up to 4000 germs in every square inch of your keyboard, which can make you sick. The good news is cleaning your keyboard can be a breeze if you use the proper technique and solution. Simply wipe it down using a high-quality disinfectant solution every day and you should be able to enjoy a clean (and pleasant smelling) keyboard for your office tasks.

The Refrigerator Handle

Dozens, if not hundreds of people, will need to access the office refrigerator on a daily basis, so the handle of the refrigerator will be touched a plethora of times. As such, germs can easily spread if the handle is not cleaned thoroughly and methodically. An easy solution to this issue is to ask your coworkers to wash their hands before they open the refrigerator. Evidently, not all of your coworkers will be compliant, so the only surefire way to reduce germs is to take matters into your own hands and vigorously clean the handle, as well as the surface of the fridge, with a premium quality disinfectant solution.

The Washroom Door Knob

Another classic hotspot for germs that needs to be sterilized as soon as possible is the inner knob of the washroom door. Unfortunately, many people simply do not wash their hands after using the washroom, and even the ones that do often don't use the proper hand cleaning techniques. As such, fecal matter, and other malevolent particulates will often attach to washroom door knobs and spread from person to person. In fact, a single washroom inner doorknob in an office can house over a million harmful microbes, so cleaning it properly should be a priority. Moreover, most experts agree that an office washroom should be cleaned five times a day, with the inner door knob being no exception. Also, if your office has cleaning staff then you should ask them to also disinfect the washroom handles while they are cleaning the washrooms.

Sunrise Cleaning

Sunrise Cleaning provides full-service office cleaning services in Mississauga. In fact, we have been providing premium quality office cleaning services in Mississauga since 1992. We also offer a 20% discount for the first-time clean (some restrictions may apply), and currently, have a team of over 40 qualified maids and over 2,000+ satisfied customers. For a consultation in order to discuss your cleaning needs, please do not hesitate to contact us at 289-814-1824. You can also visit our website to learn more about our award-winning services.

The post The Dirtiest Places in Your Office and How to Keep them Clean appeared first on Sunrise-Cleaning.

0 notes

Text

Fun With Vent Hoods

Vent hoods in your kitchen serve a very important purpose. If you don't know what it is, it's a type of machinery that uses a fan to suction out fumes, grease, smoke, and heat while you are cooking. If you cook, you probably noticed that turning on the vent hood has become second nature, like an automatic response to when you start cooking. So, yes, vent hoods are important, but it doesn't have to be a boring appliance, let alone, an afterthought. They can be pretty, customized to your taste, and also be a stand-out wow-factor in your kitchen. Venthoods can be covered with decorative materials such as tiles, various metals, and even specialty woods. The exterior of the vent hood is just simply a covering, while the interior holds all the machinery – so you are free to have a little fun!

A one-of-a-kind hood

This is a special one of a kind hood! The actual shape and tiling were are all done on-site. But what really gives this hood character, is the handmade Spanish-style tile carefully placed and installed to perfection. This hood provides a huge statement to the overall look!

A wood hood with a little extra flare

This hood started as a lovely wooden hood, but we wanted to add a little extra detail to it. While taking the backsplash and combining it with a 1×1 mirror mosaic, the hood instantly became a stand-out piece in the kitchen. It just takes a little to make a big design difference!

Vent hood with an antique feel

This particular kitchen gives us an antique-y feel, and the hood has very much to do with it. It stands as a major centerpiece to the kitchen and we love the statement it makes in this space. The metal covering is a stainless steel sheet formed to have a curve at the top, but the brass accents in the straps and stamps are what really sets this hood apart. It's all about the details!

Touches of metal

A touch of metal here and a touch of metal there. Well, we gotta share another metal hood, because we just love the feel it provides to this space! With the touches of brass throughout the kitchen, the hood really ties it all together in the end. It provides a simple and classic stamp to the space without going over-board.

Like what you see? Then check out some of our other blogs like Goodbye White, Hello Color!, and Cozy Breakfast Nooks.

The post Fun With Vent Hoods appeared first on Kitchen Design Concepts.

0 notes

Text

How Garden Furniture Can Extend Your Living Space

Turn your garden into a living space with garden furniture. Here's how!

Photos By: Living Etc.

There's no doubt that Garden Furniture allows you to make the most of any outside space. This may be a lawn, patio, decking or just a balcony, and by adding furniture you will fully realize its potential to become a valuable extension of your home.

Traditional or contemporary in design, you have a wide choice of materials, with different types of timber, rattan, stainless steel and all-weather fabrics all proving popular when creating a particular ambiance or complementing the existing landscape.

Today's garden furniture is very much similar quality to the equivalent sofas and chairs you'll find in any lounge and, because it has to deal with adverse weather conditions, it's probably more robust and made from highly durable materials.

The sheer range of garden furniture is impressive to say the least, with online garden furniture suppliers offering table and chair sets for dining and entertaining, benches and loungers for relaxation along with an incredibly diverse range of other items.

Garden Sofas and Ottomans

Nothing illustrates the beneficial impact that high quality furniture can have on your garden than all-weather sofas and day beds. There's no better way to relax and enjoy the company of friends, than on these luxurious pieces that can be left outside throughout the summer months.

Corrosion resistant metal frames are used for strength and these are upholstered with artificial wicker, rattan or easy to clean fabric. Individual items can be used on their own while other piece are joined to form attractive and very useful corner sets. Accessories include deep cushions, stools, dining and side tables in a similar style.

Dining Sets

Eating and entertaining in your outdoor garden is so much better when the chair you're sitting in is stylishly designed from teak or another hardwood, shining corrosion free metal, wicker, rattan, or even decorative moulded resin, and the matching table is similarly eye-catching perhaps with a glass or ceramic top.

Two chairs and a modest table make a lovely bistro set, benches and seats are able to accommodate more guests while individual chairs around a circular, square or long rectangular table create a comfortable and elegant ambiance which adds to your enjoyment of the food, drink and fellow diners.

Picnic Tables

The simplest of these very popular practical pieces of outdoor furniture represent a dining set at its most utilitarian, a central rectangular table and two facing benches offering a place to enjoy simple refreshment.

But even the humble picnic table can have a makeover and there are now versions with substantial railway type sleeper benches or four quarter circle seats with perhaps a slatted back rest surrounding a round table. Children's picnic tables are also available with one showing its versatility doubling as a sandpit.

Garden Chairs and Benches

Weeding and mowing are hard work, and single Chairs and Benches provide useful resting places around the garden, while Companion Seats with a compact middle table, where refreshments or books can be placed, are perfect to share the time of day with someone else.

Again there is a huge range of sizes and styles, timber blends ideally with the landscape and metal will develop an attractive patina. Granite and colourful sandstone will also make an impression, and there are resin examples that boast storage space. If you enjoy sitting in the shade of a tree why not try a circular bench that will enclose the trunk of your favourite apple or oak.

Parasols

To complete your outdoor dining experience, a parasol might be required if the sun proves too intense, and the familiar circular umbrella designs that sit in the middle of the table have received contemporary remodelling in terms of both design and materials.

Cantilever parasols in a range of colours can now stand away from the table, reaching over to provide shade under a canopy that can be as much as 4 mtrs square. There are also 'sail' type canvas sheets that cover a wide area between two aluminium poles, and a curtain can be fitted to prevent any cool breeze from spoiling your enjoyment of the summer.

Hammocks

Finally, Hammocks or swing seats might represent the most comfortable way of relaxing in the garden. With shading from the sun you can swing back and forth on a seat supported by chains or tangle free rods. These aren't children's swings, they are high quality and distinctively designed for adults who want to unwind in the most satisfying way possible.

0 notes

Text

Elevate Your Style With These Kitchen Floor Tile Ideas

Image:

We'll warn you now: these kitchen floor tile ideas aren't for the faint of heart.

Tile isn't something you can easily change out, and making a bold commitment isn't for everyone. If you want to create a unique, eye-catching look in your kitchen, though, tile will make a major statement.

Here are 3 ways to go bold with kitchen floor tiles, with real-life examples.

Photo Credit: Theguardian.com

Go Big

Big tile? Big impact. If you go in this direction, however, limit your color choices-- the size already makes a statement, so keep it to larger patterns and a maximum of two colors for a look that's bold without being overwhelming.

Photo Credit: Granadatile.com

If you aren't sure how much of an impact the flooring makes, check out these images-- one with the kitchen flooring in place, another with the floor edited out, so you can truly see how the tile changes the entire feel of the kitchen. Without the bold flooring, these kitchens don't stand out. It's the floor tile that sets them apart.

Photo Credit: Theartofdoingstuff.com

Choose small but powerful

The opposite is true for smaller tiles-- you can go with two or more colors, or choose more intricate kitchen floor tile patterns.

Photo Credit: CountryLiving.com

Get a real feel for the impact of small but mighty floor tile by comparing these images:

Photo Credit: Domino.com

Take inspiration from nature

The natural grooves and wave patterns in natural stone creates a unique texture that can soften the look of your kitchen while still giving it a unique vibe.

Photo Credit: futuristarchitecture.com

See the difference in the feeling of the space by comparing these images:

Photo Credit: futuristarchitecture.com

Every detail in a kitchen combines to create the overall impact, but when choosing standout features, many homeowners often overlook the floor. So if you want to go bold, beautiful and unique, explore your flooring options.

Do you have a unique kitchen floor tile pattern? Share it with us over on Facebook!

Category:

Design Trends

0 notes

Text

The Anatomy Of An Adjustable Rate Mortgage Increase

I'm so excited to share with you something I got in the mail the other day. No, it wasn't a notification that Financial Samurai had won an award for being the best personal finance site. My site is too focused on understanding hard things to make us all rich to appeal to the masses.

Instead, I got something better. It was letter from my bank saying my adjustable rate mortgage interest rate is going up!

This is the first time I've ever received such a letter because, in the past, I would always refinance my 5-year ARM (my preferred ARM term) lower before the fixed period was up.

But with interest rates having moved up since I bought my house in 2014, the logical thing to do was keep holding it until the reset.

The Origins Of Our 5-Year ARM

We bought a San Francisco single family fixer in 1H2014 for $1,200,000. We were tired of living in the north end of San Francisco for the past 9.5 years and wanted a change of scenery.

Originally, we had planned to relocate to Hawaii, but when we found our current house with ocean views, we though this would be a good compromise.

We put down 20% and took out a $992,000 5-year ARM. Originally, I was going to put down 32%, because I had about $430,000 come due from a 4.1% 5-year CD. But with a mortgage rate of only 2.5%, I felt it was worth borrowing more and investing the difference.

The 2.5% mortgage rate was based on the one year LIBOR rate + a 2.25% margin – 0.25% discount for being an excellent customer. Back in 2014, the one year LIBOR rate was at only 0.5%, hence my 2.5% rate.

The London Interbank Offered Rate (LIBOR) is the average interest rate at which leading banks borrow funds from other banks in the London market.

LIBOR is the most widely used global “benchmark” or reference rate for short-term interest rates. Check out the historical one-year LIBOR chart below.

As you can tell from the one-year LIBOR chart, I bottom-ticked my mortgage rate in 2014. Some of you might be thinking that instead of getting a 5/1 ARM, I should have gotten a 30-year fixed rate instead.

But given my strong belief that we will be in a permanently low interest rate environment for the rest of our lives, I felt that paying 1% – 1.5% more for a 30-year fixed rate was a waste of money. So my actions followed my brain.

Besides, the average homeownership duration in America is only around 8.7 years. At most, one may consider taking out a 10/1 ARM to match durations.

As I planned to either sell my home within 10 years in order to buy a nicer home in Hawaii or pay off the mortgage during this time frame, to me, taking out a 5/1 ARM was worth the “risk.”

Regardless of whether you want to waste your money on a 30-year fixed mortgage or not, mortgage rates have indeed gone up for all of us since 2014.

Based on the current one year LIBOR rate of ~3.1% + my margin of 2.25% – my 0.25% for being an excellent client, my new mortgage rate should be a reasonable 5.1% when it resets in mid-2019.

If I end up paying 5.1% for the next five years, my average mortgage rate over a 10 year period would be 5.1% + 2.5% = 7.6% /2 = 3.8%. 3.8% is pretty much in-line with the rate I would have gotten if I just locked in a 30-year fixed rate mortgage in 2014.

However, with the money saved from not paying a 30-year fixed mortgage and the $100,000+ less in downpayment, I ended up investing the difference and earned a ~7% return on average from 2014 – 2018 because the stock market went up until 2018. Although I did eek out a 0.8% gain in 2018.

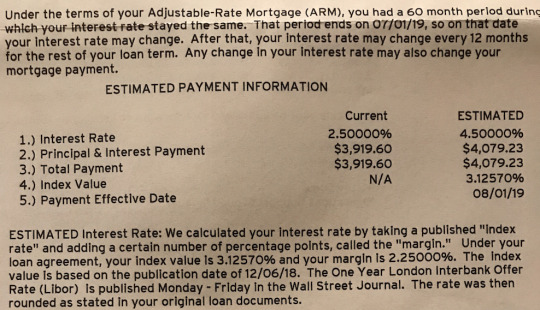

But surprise! I won't be paying an estimated 5.1% mortgage rate in 2019. Instead, my letter says that I'll be paying an estimated 4.5%. Have a look at the portion of the letter below.

The letter clearly states how they calculate my mortgage rate, yet for some reason, they still come up with an estimated rate of 4.5% instead of 5.1%. Perhaps my good customer discount of -0.25% will grow to -0.85% next year? Or perhaps my bank simply made a mistake in their calculation.

No, no. Banks aren't stupid. The reason why my rate only goes up from 2.5% to 4.5% is that under the terms of my mortgage, my ARM can only reset by at most 2% after the initial 5-year fixed rate of 2.5% is up.

This maximum reset amount is pretty standard among ARM loans. But this reset amount is something you must have your bank point out in the document.

The other thing to note is that ARM loans generally have a maximum mortgage interest rate they can charge for the life of your loan. In my case, that maximum is 7.5%, but we're never going to get there in my opinion.

Unfortunately, after one full year at 4.5%, my bank can raise my ARM by another 2%, bringing my mortgage rate up to 6.5% for year seven.

However, I doubt rates will keep on surging higher as the global economy slows. Instead, by the time my ARM reset occurs again in 7/1/2020, we might very well be in a recession with one year LIBOR rates moving back down.

Paying Down Principal

In order to make more money, mortgage brokers and banks LOVE to scare the heck out of inexperienced homebuyers by saying their payments will surge higher once an ARM resets.

They don't show them a 35-year historical chart of declining interest rates. By scaring their customers, they have a higher chance of locking them into 30-year fixed rate mortgages for fatter margins.

Don't be fooled.

Historical 30-year Mortgage Interest Rate Chart

You can see from the letter that despite my mortgage rate increasing from 2.5% to 4.5%, an 80% increase, my monthly payment is only expected to increase from $3,919.60 to $4,079.33, a mere 4% rise.

The reason for the slight increase in monthly mortgage payment is because we've paid down 32% of our loan in 4.5 years ($992,000 down to $734,000).

Paying down over $250,000 in our mortgage was partly due to normal monthly principal payments coupled with random extra principal pay downs. Although the 2.5% interest rate is low, paying down mortgage debt has always been part of my long term investment strategy.

Following my FS-DAIR strategy, I would regularly try and use 25% of my free cash flow to pay down debt and use the other 75% to invest. Again, I'm just taking action based on my own advice.

I kept on paying down principal randomly until the 10-year yield breached 2.5% in December 2017. Once the 10-year yield was higher than 2.5%, I stopped because I was now getting an interest-free mortgage since I could simply invest the amount of my mortgage in a 10-year bond yield to cover all my payments.

Living for free is one of the best things ever!

If I had taken out a 30-year fixed mortgage for 3.625%, I wouldn't have been able to experience interest-free living.

Your mileage will vary in terms of how much principal you actually paid down during the initial fixed rate period of your ARM. However, even if you didn't pay down any extra principal during a five year period, you will have still paid down ~10% of your principal balance, depending on your interest rate.

An Appreciation In Your Home's Value

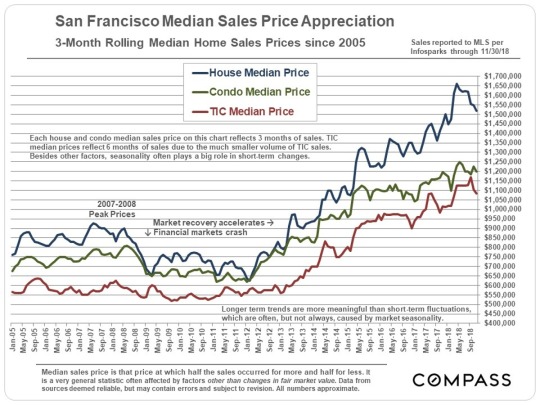

Even if you've got to pay a higher mortgage rate when your ARM resets, you may be pleased to discover that your home has appreciated in value during the fixed rate period.

The San Francisco median home price increased from $1,100,000 in 2014 to ~$1,500,000 today, or a 37% increase.

A $420,000 principal increase more than makes up for a measly $159.63 monthly increase in mortgage payment, roughly half of which is going to pay down principal.

Again, your home's appreciation amount will vary. Unless you timed your home purchase completely wrong, such as buying in 4Q2017/1Q2018 or in 4Q2006 – 4Q2008, you'll likely come out OK.

Even if you did purchase at the most recent peak, normal downturns usually last no more than 3-5 years with 10% – 20% corrections.

Make A Mortgage Pay Down Plan

Given I have until 7/1/2019 before my mortgage rate jumps from 2.5% to 4.5%, I plan to keep paying my mortgage as usual and not pay anything extra to principal.

As soon as I exhaust all 60 months at 2.5%, I will pay down $50,000 in principal on month 61. After the initial $50,000 extra principal payment, I will keep paying down between $20,000 – $30,000 a month in extra principal until the mortgage is gone or until I find my Hawaiian dream home.

Based on my extra principal payments, the mortgage should be completely paid off by January 2022, or about 7.5 years after I first took out the loan.

Anything can happen between now and January 2022, which is why it's prudent to continue investing and paying down debt while having a good cash hoard.

Earning a 4.5% rate of return is excellent at this stage in the economic cycle, but so is having enough cash to find a gem of a property in Hawaii at a big discount. And boy, am I seeing discounts everywhere now!

The alternative solution to aggressively paying down principal is to simply refinance my mortgage when it's time to reset to another 5/1 ARM.

After checking online for the latest mortgage rates, I can get a 5/1 ARM jumbo for only 3.25%. This means that after 10 years, my blended interest rate is 2.875%. Not bad at all.

Article Summary

1) Match the duration of your mortgage's fixed duration with the estimated ownership duration or the length of time you estimate it will take to pay off the mortgage.

2) Paying for a 30-year fixed rate mortgage might provide you more peace of mind, but you're likely overpaying for that peace of mind.

3) Read the terms of your ARM loan carefully and figure out what is the maximum interest rate increase during the first reset and what is the lifetime interest rate cap.

4) Try to make extra payments during your ARM's fixed rate period to relieve potential interest rate pressure during the reset.

5) Don't borrow more than you can comfortably afford = no greater than a 80% loan-to-value ratio with a 10% cash buffer after a 20% downpayment. Being overly leveraged is what consistently destroys people's finances.

Readers, why do people take out overpriced 30-year fixed rate mortgages when the average homeownership duration is less than 9 years? Why pay a higher rate when interest rates have gone down for 30+ years in a row? If you have an ARM, how are you planning on paying it down?

The post The Anatomy Of An Adjustable Rate Mortgage Increase appeared first on Financial Samurai.

0 notes

Text

The Landscape Revisited - My most valuable lessons of 2018

The 2018 growing season is coming to a close. Thanksgiving is behind us and the next holiday season is closing in. In Massachusetts, we've already had eight inches of snow dumped on us. At my company, as we're valiantly struggling to keep working through the snow, rain, frost, and mud, I realize the mixed blessing that garden making is for me, my staff and our clients. Full of ups and downs, successes and failures, working in the landscape and with nature is not a task that anyone should take on if they expect a predictable, repeatable work environment. That isn't a good description of the outside work life...at least not where I live.

0 notes

Text

Magic Moisturizer is Here! + Orange-Tahini Mousse

Happy 2019, friends! Hope you've been having an inspiring beginning to the year. Today we're excited to announce that a small batch of our Magic Moisturizer is now available for sale, as per your amazing feedback. You can read all about it here (and get the recipe if you want to make it yourself), but basically, it's been our go-to skincare product for the past few years. It's made with all-natural ingredients that we find to be super nourishing and hydrating for all different types of skin, and it has the most luxurious texture and scent. Click here to go to our shop. Since Magic Moisturizer is like skin food, made with all food-grade ingredients, we were inspired to create a dessert recipe, celebrating two of the star ingredients in the formula: cacao butter and citrus. The result is this dreamy Orange-Tahini Mousse that takes minutes to put together.

The lush ingredients in the Magic Moisturizer are: organic raw cacao butter, organic virgin coconut oil, beeswax, organic olive oil, organic jojoba oil, organic calendula oil, organic vitamin E oil, organic rosehip oil, distilled water, and essential oils of blood orange, Italian lemon, lavender, carrot seed, and clary sage, all of which have balancing, hydrating, anti-inflammatory, and anti-bacterial properties. Our friends love it, and it's been reported to help with cold sores, eczema, and chronically dry skin. We're so excited to share it as a physical offering! Now on to the mousse. To make it, shredded cacao butter, orange juice and zest, tahini, cashews, and maple syrup get whipped into oblivion in a high-speed blender. Distribute that mixture among little cups or ramekins, let it set in the fridge for about an hour, and you'll have the most amazing, cloud-like mousse that tastes like pure heaven. We have people coming over tonight, and I've got a batch cooling in the fridge for a simple but elegant finish to our meal. Seriously can't wait. Hope you enjoy the recipe, and look out for a new meal plan coming next week :)

Orange-Tahini Mousse

Print

Serves: 4

Ingredients

1 cup plus 2 tablespoons orange juice (from about 3 organic oranges)

zest from 1 organic orange, plus more for garnish

½ cup cashews - soaked in purified water for 1-2 hours or in boiling water for 15 minutes

¼ cup maple syrup

5 tablespoons shaved or finely chopped raw cacao butter (leveled, not heaping)

4 tablespoons tahini (leveled, not heaping)

Instructions

Combine all the ingredients, except the orange zest, in a high-speed blender. Blend on high for about 30 seconds to a minute, until completely smooth. Add the orange zest and pulse on low, until just incorporated.

Distribute the mixture between about 4 ramekins or small cups. Refrigerate for an hour, or until completely set and enjoy, garnished with more zest. After the mousse has been refrigerated for a while, remove from the refrigerator about 5 minutes prior to eating.

3.5.3226

You might also like...

Chunky Monkey Cookies, Vegan and Gluten-Free

Raw Summer Fruit Samosas and a Guest Post for My Sweet Faery

Turnip Blueberry Muffins

Tahini Ice Cream Bars with Miso Caramel and Chocolate – Ice Cream Sund...

.yuzo_related_post .relatedthumb { background: !important; -webkit-transition: background 0.2s linear; -moz-transition: background 0.2s linear; -o-transition: background 0.2s linear; transition: background 0.2s linear;;color:!important; } .yuzo_related_post .relatedthumb:hover{background:#ffffff !important;color:!important;} .yuzo_related_post .yuzo_text, .yuzo_related_post .yuzo_views_post {color:!important;} .yuzo_related_post .relatedthumb:hover .yuzo_text, .yuzo_related_post:hover .yuzo_views_post {color:!important;} .yuzo_related_post .relatedthumb a{color:!important;} .yuzo_related_post .relatedthumb a:hover{color:!important;} .yuzo_related_post .relatedthumb:hover a{ color:!important;} .yuzo_related_post .relatedthumb{ margin: 0px 0px 0px 0px; padding: 5px 5px 5px 5px; }

The post Magic Moisturizer is Here! + Orange-Tahini Mousse appeared first on Golubka Kitchen.

0 notes

Text

Ask Unclutterer: Dealing with gift-giving grandparents

Reader Sarah submitted the following to Ask Unclutterer:

We have a 3-month-old child who is just delightful. He has everything he could need or want at this young age! We had a conversation with both sets of his grandparents prior to Christmas explaining that he has everything he could want, but if they felt the need to buy for him then a book or two or some clothes would be sufficient. However, both sets of grandparents bought a heap of toys and clothes and books! It was very generous of them, but this is not something I want to see become a habit. We have trouble with storage as it is, so I would really only prefer one or two items to be given at holidays and birthdays. How do I have this conversation with our loved ones?

Thanks for a great question Sarah. You mention that you already had a conversation with the grandparents and they didn't seem to understand your request. You are not alone in your dilemma. At this time of year, Unclutterer receives several inquiries about dealing with generous extended family members.

The short answer, is that I do not know how you should have this conversation with your loved ones. I do not know them or your relationship with them. I will provide several suggestions below perhaps one will work for you in this situation.

If you are having trouble knowing how and where to start a conversation you may wish to read Crucial Conversations. Unclutterer Alex reviewed the book and says it is a must read for anyone who is intimidated by discussing potentially sensitive topics. The book may also help you communicate your wishes without the conversation becoming emotionally charged.

Read Editor-at-Large, Erin Doland's post on receiving unwanted gifts. You may find that it is easier emotionally and on family relationships to re-gift and donate than it is to keep having the same conversation every year.

Unclutterer Jeri has some great tips for dealing with unwanted gifts. Although the post deals mainly with gifts from friends, her advice applies to gifts from family members as well.

As Erin mentioned in her post, grandparents want to give. Rather than saying “no gifts” consider providing alternatives. For example, babies and toddlers don't need a lot of “things” but eventually, that child might need tuition for college. Asking the grandparents to contribute to a college fund might be an option for your family. (Investing $100/year for 17 years can result in $3000). Grandparents could write a special memory or life advice in a card each year and the cards could be presented on the child's first day of college.

We would love to hear our readers' suggestions on how they deal with this issue. Please feel free to leave advice for Sarah in the comments below.

Thanks for your contribution Sarah. We hope that this post gives you the information you're looking for.

Do you have a question relating to organizing, home and office projects, productivity, or any problems you think the Unclutterer team could help you solve? To submit your questions to Ask Unclutterer, go to our contact page and type your question in the content field. Please list the subject as “Ask Unclutterer.”

Post written by Jacki Hollywood Brown

0 notes

Text

What is a Surety Bond and How it Differs from Insurance?

Small business owners have several ways to protect their financial position from loss, some of which are better understood than others. Insurance coverage, often in the form of liability insurance, and surety bonds are two of the most common types of protection small businesses may implement. While these terms are often used interchangeably, there are distinct differences that make them stand apart from one another. This brief guide provides insight into how surety bonds work, how that differs from insurance coverage, and when either is needed to safeguard a business and its customers.

The Ins and Outs of Surety Bonds

Being bonded and insured is not the same thing. Surety bonds – the first part of that phrase – provide protection to the customers and clients of businesses owners, licensed contractors, and other professionals. Bonds are provided by surety agencies as a way to reduce financial losses or damages incurred by the bondholder's customer should the contract agreed upon not be completed. In some cases, surety bonds are required as part of the licensing process. However, regardless of the type of surety bond in place, each agreement works similarly for the surety agency, the bondholder, and the customer.

When a contractor or business acquires a surety bond, there are three parties involved in the transaction. First, the surety agency that provides the bond evaluates the business owner or contractor to determine if a bond can be put in place. If so, the individual requesting the bond receives a certificate of bonding after paying for the coverage. The third party is the job owner, or the customer, that requires a bond to be in play for a new project to begin. For instance, a construction contractor may have the job site owner as the third party, as that individual or company is at risk if the contractor does not perform as agreed.

When a claim is made against the bond because work is not done in-line with regulations or is not completed per the original agreement, the surety agency pays legitimate claims on behalf of the bondholder. In this sense, a surety bond is like insurance. However, the bondholder is then required to repay the claim amount back to the surety agency.

Breaking Down Insurance Coverage

Insurance coverage for a business or an individual contractor differs from surety bonds in several ways. First, business insurance is offered by an insurance company or agency, not a surety agency, and it is not always a requirement for licensing as a professional. Insurance coverage works to protect the business owner or contractor from financial losses. These losses may be the result of damage to the business or inventory, employee theft or other theft, fire, flood, or liability issues that arise with a customer or worker. There are only two parties involved in insurance: the insured and the insurer.

When a claim is made against an insurance policy, the insurance company pays out a benefit up to the limits of the policy for damages incurred, directly to the business or the contractor. This helps protect the individual or entity from financial ruin for circumstances beyond their control. There is no obligation to repay insurance benefits received, which differs from surety bonds for contractors.

Other Notable Differences

In addition to the organizations that offer surety bonds and insurance, and the fundamental ways each type of instrument works, there are other subtle differences between surety bonds and insurance coverage. First, surety bond pricing is based on the financial history and claims track record of the business or contractor. Because surety bond claims are paid by the surety agency and then repaid by the bondholder, individuals with surety bonds are extended a form of credit when getting a new bond. For this reason, surety agencies look closely at the financials of the individual and the business, including credit history and score. The cost of a surety bond is calculated as a percentage of the total bond amount put in place.

Insurance, on the other hand, is priced based on other risk factors. For instance, if a business owner has faced liability issues in the past where an insurance claim was paid, the cost of new insurance coverage may be high. However, most insurance companies do not review credit history or score when determining if a new policy can be issued. They focus more on the risks of the business, based on the type of insurance policy the individual is trying to secure. The cost of insurance is a monthly or annual premium that is paid based on these factors, not a percentage of the insurance policy taken out.

Both surety bonds and insurance coverage are valuable protection strategies for businesses and contractors. However, there are differences bondholders and insured individuals should be aware of before selecting the type of coverage necessary. Understanding these differences is beneficial in protecting your business, your customers, or both.

Eric Weisbrot is the Chief Marketing Officer of JW Surety Bonds. With years of experience in the surety industry under several different roles within the company, he is also a contributing author to the surety bond blog.

L

The post What is a Surety Bond and How it Differs from Insurance? appeared first on The Blogging Painters.

0 notes

Text

Survey: Gen-Xers & Older Millennials Believe Stocks are a Better Investment than Real Estate

35-44 year olds were hit hardest by the housing bust just as they reached prime first-time homebuying age

Less than half of homebuyers and sellers between the ages of 35 and 44 believe that real estate is a better long-term investment than the stock market, according to a survey Redfin commissioned in December of more than 2,600 people nationwide who bought or sold a home in the last year, attempted to do so, or have plans to buy or sell soon.

Buyers who reached the median first-time homebuyer age of 31 years old between 2008 and 2012 during the Great Recession and housing market collapse are now 38 to 42 years old. Redfin's survey results show that this was the only age group that has less confidence in real estate as an investment than the stock market. Just 48 percent of homebuyers and sellers in this age group believe that real estate is a better long-term investment than the stock market.

“The oldest Millennials and youngest Gen-Xers entered their late twenties or early thirties during the housing crash, which explains why they are more skeptical about investing in real-estate,” said Redfin chief economist Daryl Fairweather. “This generation experienced a major setback during the housing bust, which hit just as they were most likely to be getting married, starting a family, and becoming a first time homeowner. Looking into the future, we expect to see homeownership increase as Millennials enter prime home-buying age. This is because Millennials have a more favorable opinion of real estate as an investment than Gen-Xers, and Millennials are a larger group than Gen-Xers.”

In every other age group, buyers and sellers who believe that real estate is a better long-term investment outnumbered those who believe the stock market is better.

This finding is surprising given that it comes from a survey of people specifically buying or selling homes, which is a group that presumably would be biased toward real estate to begin with. Younger Baby Boomers, respondents aged 55 to 64, were the most optimistic about real estate as an investment. Previous Redfin surveys of homebuyers and sellers have not asked this specific question, so we do not yet have any data on whether this has changed over time.

Methodology

Redfin contracted Qualtrics to field a study between November 2 and December 10, 2018 of 2,647 people from the general population who indicated they had bought or sold a home in the past year, tried to buy or sell a home in the past year or plan to do so this year.

This report focused included data from the 1,784 people who answered the question: “Which do you believe is the better investment for those who do not plan to move their money in the long term, the stock market or real estate?” People who answered either “Real estate is the slightly better investment” or “Real estate is the better investment by far” were grouped together, and those who answered “The stock market is the slightly better investment” or “The stock market is the better investment by far” were grouped together.

The survey had respondents from all 50 states and Washington, D.C.

For more information about the survey and its findings, contact Redfin Journalist Services at [email protected].

The post Survey: Gen-Xers & Older Millennials Believe Stocks are a Better Investment than Real Estate appeared first on Redfin Real-Time.

0 notes