Text

HDFC Securities & The Gang: Which Brokerage Matches Your Financial Vibe? ✨

Hey, finance fam! 🚀 Ever scrolled through your feed, seeing all the stock market buzz, and wondered which app is the one for you? It's like picking your squad for a group project – you need the right mix of brains, reliability, and good vibes! Today, we're diving deep into HDFC Securities and how it stacks up against the other big players in the Indian investment scene.

HDFC Securities is like that super reliable, well-established friend with a huge family network. They've got the legacy, the trust, and they pretty much offer everything. But how do they vibe with the sleek, modern apps? Let's break down their personality, their superpowers, and who they're really compatible with. No tables, just pure, unadulterated investment chat! 👇

HDFC Securities: The Ultra-Reliable Banker Friend, The All-Inclusive Package. 🏦💼

Their Vibe: Imagine that friend whose family has been in the same respected business for decades. They're super organized, trustworthy, and if you need anything, they probably have a connection or a solution for it. That's HDFC Securities. Their aesthetic is solid, comprehensive, and very much "we've got your back, from banking to investing."

What they're all about:

The 3-in-1 Magic: This is their BIG flex. If you're an HDFC Bank customer, this is a game-changer. Your bank account, trading account, and Demat account are all seamlessly linked. Transfers are smooth, settlements are instant – it's like having your entire financial life in one super-efficient ecosystem. So convenient!

Research & Brain Power: As a full-service broker, they don't just execute your trades; they're like your personal research library. They offer a ton of in-depth research reports, market insights, and even investment recommendations. If you like getting expert opinions and data to back your decisions, this is a huge plus.

Everything Under One Roof: Stocks, derivatives, mutual funds, IPOs, bonds, ETFs, even more! HDFC Securities aims to be your one-stop shop for pretty much every financial product. It's awesome for consolidating all your investment avenues.

Brand Power & Trust: HDFC is a household name, synonymous with trust and stability. That brand recognition brings a lot of peace of mind. Plus, their huge network of physical branches across India means you can get in-person help if you ever need it – which is comforting for many!

Margin on Delivery (eMargin!): This is a cool feature for certain strategies. HDFC Securities allows you to buy select stocks for delivery by paying just a fraction of the value upfront, with them funding the rest (for a fee, of course). It's a way to potentially leverage your capital for holding stocks for longer than just a day!

Where they might not be your soulmate:

Brokerage Fees: Okay, let's be real. Their fees can be higher than the pure discount brokers (think flat ₹20 per trade). While they're trying to be competitive with offerings like HDFC Sky, if you're a high-frequency trader, those charges can add up.

Platform Feels: Their trading platforms are robust and get the job done, but sometimes they might feel a little less sleek or modern compared to the super-minimalist apps out there (like Groww) or the hyper-optimized ones (like Zerodha Kite). It's like a reliable, powerful workhorse, maybe not a flashy sports car.

Demat AMC: Yup, they typically charge an annual maintenance fee for your Demat account. Just another recurring cost to factor in.

How HDFC Securities Vibes with the Others (The Quick Comparative):

Vs. ICICI Direct: These two are like siblings! Both are major bank-backed brokers offering that sweet 3-in-1 account, tons of research, and a wide array of products. Choosing between them often comes down to which bank you're already loyal to, or tiny differences in their fee structures or specific research focus.

Vs. Zerodha: This is where the vibes really differ. Zerodha is the pioneer of low-cost, self-directed trading. Think zero brokerage on delivery, flat ₹20 for active trades, and their legendary Varsity education. Zerodha is for the super independent, tech-savvy trader who wants powerful tools and education without any hand-holding or integrated banking. HDFC Securities offers the convenience and guidance; Zerodha offers ultimate cost-efficiency and tools for those who want to be their own financial guru.

Vs. Groww: Groww is the simplicity guru, the ultimate beginner-friendly app. It's all about super-easy mutual fund investing (direct plans!), a clean interface, and often zero Demat AMC. HDFC Securities is a much more comprehensive, full-service offering with deeper research and more products, but also generally higher costs and a slightly steeper learning curve for absolute newbies.

Vs. Angel One: Angel One is the "hybrid hero." They used to be full-service but now offer flat-fee brokerage (like discount brokers) while still keeping some research and advisory elements. They've got a sleek app and competitive fees across segments. Angel One could be a great middle ground if you want lower costs than HDFC Securities but still appreciate some guidance and a modern app experience.

The Final Verdict: Your Investment Personality Test!

So, no single "best" here, fam! It's all about your unique investment style and what you prioritize.

Go for HDFC Securities if: You're already an HDFC Bank customer and love the idea of a seamless 3-in-1 account. You appreciate deep research, a wide range of financial products, and maybe you're interested in using features like margin on delivery. You value the trust and stability of a big bank.

Consider others like Zerodha/Angel One if: You're all about razor-thin brokerage fees, prefer doing your own research, and want a super tech-forward or specialized trading experience.

Look at Groww if: You're a total newbie, primarily focused on super simple mutual fund investing, and want the easiest possible entry into the market.

Pro-Tip: Don't just take my word for it! Before you commit, why not check out some user reviews and detailed comparisons? A great place to get a comprehensive, side-by-side view is on sites that compare brokers. I personally found a lot of useful insights on Finology Select, which has a really neat page that allows you to "Compare HDFC Securities with others." It's great for seeing all the specs laid out without the marketing fluff.

At the end of the day, it's about finding the tool that perfectly fits your hand. So, explore, compare, and get that money growing!

Happy investing, fam! ✨

0 notes

Text

Investing Fam, Let's Get Real: Alice Blue vs Zerodha vs Groww – Your Brokerage Horoscope! ✨

Hey, finance fam! 👋 Ever scroll through your feed and see everyone talking about stocks, funds, and making that dough? And then you're like, "Okay, but where do I start?" The Indian investment scene is booming, and among the biggest names you'll hear are Alice Blue, Zerodha, and Groww.

They're like the popular kids in your investing class, each with their own unique style, superpowers, and loyal fans. Choosing one isn't just about brokerage fees (though, obvi, we love low fees!), it's about finding an app that totally gets your vibe. Are you a no-nonsense trader? A chill, long-term investor? Or somewhere in the middle?

Let's do a deep dive, Tumblr-style. We’ll break down their moods, their quirks, and who they’re really compatible with. No tables, just pure, unadulterated investment chat!

Alice Blue: The Trader's Secret Weapon, The Steady Performer. 🛠️📊

Their Vibe: Imagine that friend who's super dedicated to their craft, always has the latest tools, and knows how to get things done efficiently. That's Alice Blue. Their aesthetic is serious, functional, and built for action. If investing were a high-performance sport, Alice Blue would be the perfectly engineered gear.

What they're all about:

Straight-Up Low Fees: They're all about that flat-fee life. You're looking at around ₹20 per executed order for most things like intraday, F&O, commodities, and currency. For equity delivery, they might have a small charge (unlike Zerodha's zero), but it's still super competitive. Transparent pricing means no nasty surprises!

ANT Platforms: Trading Powerhouses! Their "ANT" (Analytics & Trading) platforms (web and mobile) are legit. They're known for being fast, stable, and packed with features. You get awesome charting tools, a strategy builder for F&O, and detailed position analytics. If you're into active trading, these tools are a dream!

Algo-Trader Friendly: Got a tech brain? Alice Blue offers free API access, which means you can build and run your own automated trading strategies. That's next-level stuff for the truly dedicated!

Zero Demat AMC (Check this!): This is a cool bonus! Alice Blue has been known to offer zero Demat Account Maintenance Charges. That means no annual fees just for holding your shares, which is a sweet deal for long-term investors. (Always double-check their current terms though, as things can change!).

Solid Support: They aim for reliable customer support and offer some learning resources to help you get started with their platforms and the market.

Where they might not be your soulmate:

Delivery Brokerage: The tiny charge for equity delivery might be a small point for pure long-term equity investors who want absolute zero.

Less "Household Name" Status: While well-regarded, they might not have the same super-high brand recognition as Zerodha or Groww, especially if you're an absolute beginner drawn to the biggest names.

Learning Library Depth: While they offer support, their educational content might not be as vast or structured as Zerodha's famous Varsity.

Who's their perfect match?

The Active Trader: You're frequently in the market, doing intraday, F&O, commodities, and you need robust, fast platforms.

The Advanced User: You might dabble in algo trading or need specific advanced charting and analysis tools.

The Cost-Conscious Trader: You want consistent, low flat fees across multiple segments.

The Feature-Seeker: You appreciate a brokerage that invests in powerful trading tech.

Zerodha: The OG Disruptor, The Knowledge Guru, The Serious Investor's Bestie. 📚🚀

Their Vibe: Zerodha is like that super smart, slightly minimalist friend who's been crushing it for years. They're the pioneers, the ones who changed the game. Their aesthetic is clean, efficient, and very much "get down to business." If investing were a university, Zerodha would be the prestigious, no-nonsense professor who teaches you everything.

What they're all about:

King of Low Costs (Especially for Delivery!): Zerodha basically invented zero brokerage for equity delivery trades. That's a huge win for anyone holding stocks long-term! For active stuff like intraday and F&O, it's a flat ₹20 per executed order. Super transparent, super affordable.

Kite & Coin: The Dream Team: Their Kite platform is legendary for traders. It's powerful, has amazing charts, and all the advanced tools you could ask for. It's built for efficiency. Then there's Coin, their dedicated platform for direct mutual funds, with ZERO commissions. More money stays in your pocket!

Varsity: Your Free Investment MBA! Okay, seriously, this is epic. Zerodha Varsity is a treasure chest of free, in-depth financial education. From basics to advanced strategies, it's all there, beautifully explained. If you want to actually understand the market, this is your go-to. It's empowering!

Robust Ecosystem: Beyond the apps, they've got their Z-Connect blog with market insights and an API (Kite Connect) for developers and algo traders. They've built a whole world around investing.

Trusted Name: As the largest broker by active clients, they've earned a solid reputation for reliability and innovation.

Where they might not be your soulmate:

Beginner Learning Curve (Initially): Kite is powerful, but it can feel a bit much for total newbies. It's like a pro-level camera; amazing once you master it, but takes some getting used to.

No Hand-Holding (Tips): Zerodha won't give you stock tips or research reports. They provide the tools and education, but you make the calls. If you need specific buy/sell recommendations, you'll need external sources.

Demat AMC: They do charge an annual Demat account maintenance fee (currently ₹300).

Who's their perfect match?

The Serious Trader: You're all about intraday, F&O, and need a powerful, reliable platform with competitive costs.

The Self-Directed Investor: You enjoy doing your own research and value extensive educational resources.

The Direct MF Enthusiast: You want to save every bit of commission on your mutual fund investments.

The Knowledge Seeker: You're eager to truly learn and understand the stock market in depth.

Groww: The Simplicity Guru, The Newbie's Gateway, The 🌱💰 Starter.

Their Vibe: Groww is that super friendly, chill friend who makes everything seem effortless. Their entire app is built on making investing as simple and accessible as humanly possible. Their vibrant, uncluttered interface just makes you feel like, "Hey, I can actually do this!" If investing were a game, Groww is the tutorial level that smoothly guides you to victory.

What they're all about:

ULTIMATE Simplicity & User Experience: This is Groww’s superpower. The app and web interface are incredibly intuitive, even for someone who's never invested a rupee. Account opening is super quick, and finding what you need is a breeze. It’s almost impossible to get lost. If you crave ease above all else, Groww nails it.

ZERO Demat Account AMC: This is a HUGE deal for long-term investors! Many brokers charge an annual fee just for holding your shares, but Groww offers zero AMC. That’s pure savings compounding over the years.

Direct Mutual Funds (Their OG Claim to Fame): Groww started by simplifying direct mutual fund investments, and they're still excellent at it. Direct plans mean no commissions, which translates to significant savings over time. Their MF interface is super clear and easy to use.

Focus on Long-Term Growth: While you can trade stocks, Groww's platform subtly nudges users towards a disciplined, long-term approach, especially with mutual funds and SIPs. It's more about building wealth patiently.

Massive User Base: Groww has exploded in popularity, especially among young investors and first-timers. This means a huge community and a platform that's constantly being refined based on a wide range of user feedback.

Where they might not be your soulmate:

Equity Delivery Brokerage (Small Charge): Unlike Zerodha (and some of Alice Blue's terms), Groww does charge a small brokerage (₹20 or 0.05% whichever is lower) even for equity delivery trades. It's tiny, but it's not "free."

Limited Advanced Trading Features: For serious day traders who need super-complex charting tools or advanced order types, Groww's platform might feel a bit too basic. Simplicity is their strength, not intricate trading features.

Customer Support (Growing Pains): With their rapid growth, customer support can sometimes be slower to respond during peak market periods.

Who's their perfect match?

The Absolute Beginner: You're just starting your investment journey and want the simplest, most intuitive entry.

The Mutual Fund Devotee: Your main goal is direct mutual fund investing for long-term wealth, with zero commissions.

The Long-Term Equity Investor: You plan to buy and hold stocks for years, and you love the idea of zero Demat AMC.

The Simplicity Seeker: You prefer a clean, uncluttered, and guided experience over a multitude of complex features.

The Grand Finale: Which Investment Soulmate is Yours?

So, there you have it – the lowdown on Alice Blue, Zerodha, and Groww. They're all legitimate, SEBI-regulated, and secure (your investments are safe, held in Demat accounts with CDSL or NSDL, not directly by the broker – peace of mind!).

Ultimately, there's no single "best" answer. The best platform is the one that empowers you to invest confidently and effectively.

Pro-Tip: Don't just take my word for it! Before you commit, why not check out some user reviews and detailed comparisons? A great place to get a comprehensive, side-by-side view is on sites that compare brokers. I personally found a lot of useful insights on Finology Select, which has a really neat page comparing "Alice Blue vs Zerodha vs Groww." It's great for seeing all the specs laid out without the marketing fluff.

At the end of the day, it’s about finding the tool that fits your hand the best. So, explore, compare, and get that money growing!

Happy investing, fam! ✨

0 notes

Text

Investing Fam, Let's Get Real: ICICI Direct vs HDFC Securities vs Angel One – Which Vibe Are You?

Alright, finance fam! 💰 Ever feel like you're drowning in options when it comes to picking a brokerage app? Everyone's got their fav, but what if you're stuck between the OG bank giants and the sleek, modern disruptors? Today, we're doing a real talk deep dive into three major players in the Indian investment scene: ICICI Direct, HDFC Securities, and Angel One.

This isn't just about who charges what (though we'll def spill the tea on that!). It's about finding your investment soulmate. Are you a "keep-it-all-in-one-place" kind of person? Or a "low-fees-and-tech-first" kinda vibe? Let's break down their personalities, their superpowers, and who they're really for. No tables, just pure, unadulterated investment chat! 👇

ICICI Direct: The Old Money, The All-In-One Comfort Zone. 🏦✨

Their Vibe: Imagine that super reliable, established friend whose family has been in the same business for generations. They're trustworthy, they've got all the connections, and they offer everything you could possibly need. That's ICICI Direct. Their aesthetic is classic, comprehensive, and very much "we've got you covered."

What they're all about:

The 3-in-1 Magic: This is their BIG flex. Your bank account, trading account, and Demat account are all seamlessly linked. Transfers are smooth, tracking is integrated – it's like having your entire financial life in one neatly organized drawer. Super convenient if you bank with ICICI!

Research & Guidance Galore: As a full-service broker, they don't just execute your trades; they offer a ton of research reports, market insights, and even investment recommendations. If you're someone who likes to read up on expert opinions before making a move, this is a huge plus. They're basically your financial library.

Everything Under One Roof: Stocks, options, mutual funds, IPOs, fixed deposits, even insurance! ICICI Direct is trying to be your one-stop shop for almost every financial product. It's awesome for consolidating your financial life.

Brand Power & Trust: ICICI is a household name. That brand recognition brings a lot of trust and a wide network of branches, which is comforting for many, especially if you ever need in-person support.

Where they might not be your soulmate:

Higher Brokerage: Okay, let's be real. Their fees can be higher than the new-age discount brokers. While they've tried to adapt with new plans, if you're an active trader, those percentages or higher flat fees can eat into your profits.

Platform Feels: Their trading platforms, while functional and comprehensive, sometimes feel a little less slick or modern compared to the super-minimalist apps out there. It's like a reliable, powerful old-school computer – it gets the job done, but maybe not with the flashiest interface.

Demat AMC: Yep, they usually charge an annual maintenance fee for your Demat account. Just another little cost to factor in.

Who's their perfect match?

The Integrated Investor: You love the idea of having your bank, trading, and Demat accounts all linked.

The Research Seeker: You value expert research, market insights, and recommendations to guide your investments.

The One-Stop Shopper: You want a broad range of financial products beyond just stocks and mutual funds.

The Trust-First Investor: You prioritize the comfort and reputation of a large, established banking brand.

HDFC Securities: The Other Banking Giant, The Hybrid Master. 🏛️💡

Their Vibe: Think of HDFC Securities as the cool, slightly more tech-savvy cousin of ICICI Direct. They also come from a massive banking family, so they've got that solid foundation, but they're also adapting, trying to bring some of that modern brokerage feel. They offer that comforting "bank-backed" feel with a bit more of a hybrid approach.

What they're all about:

Seamless 3-in-1 Integration (Again!): Just like ICICI Direct, HDFC Securities is amazing if you bank with HDFC. That smooth flow between your bank, trading, and Demat account is a huge convenience factor. No more fumbling with external fund transfers!

Solid Research & Market Insights: HDFC Sec also provides excellent research reports and market analysis. Their insights are generally well-regarded and can be super helpful if you like to stay informed and get expert perspectives on your investments.

Broad Product Range: Stocks, F&O, mutual funds, IPOs, bonds – they've got a comprehensive suite of products to cover most of your investment needs.

Big Brand Trust: Being part of the HDFC Group means a high level of trust and a wide physical presence across India, which can be reassuring.

Margin on Delivery: This is a cool feature! HDFC Securities has been known to offer margin on delivery (eMargin, etc.). This means you can sometimes buy shares and hold them for delivery by paying just a fraction of the amount upfront, with the broker funding the rest (for a fee, of course). It’s a way to leverage your capital for longer-term holdings, which can be interesting for certain strategies.

Where they might not be your soulmate:

Brokerage Can Be Higher: While they're trying to be competitive (especially with their HDFC Sky offerings), their traditional brokerage rates can still be higher than pure discount brokers like Angel One's flat fees. So, active traders might feel the pinch a bit more.

Interface Evolution: Their platforms are robust but might not always feel as cutting-edge or intuitive as the newest pure-play tech brokers. They're functional, but maybe not always the most aesthetically modern.

Demat AMC: Yup, another one that typically charges an annual Demat account maintenance fee.

Who's their perfect match?

The HDFC Bank Loyal Customer: If you're already with HDFC Bank, the 3-in-1 account is a no-brainer for convenience.

The Researcher & Leverager: You appreciate solid research and are interested in using features like margin on delivery to optimize your capital.

The Comprehensive Investor: You want a wide array of products and the comfort of a major banking brand behind your investments.

Angel One: The Hybrid Hero, The Discount Broker with a Brain! 😇💡

Their Vibe: Angel One is like that friend who started out really traditional, but then got a glow-up and became super tech-savvy and cool. They've reinvented themselves, blending the best of old-school reliability with new-age, low-cost trading. Their app is sleek, powerful, and tries to offer you a bit of everything without breaking the bank.

What they're all about:

Killer Flat-Fee Brokerage: This is where Angel One competes directly with the big discount players. Zero brokerage for equity delivery (cha-ching! 🤑) and a flat ₹20 per executed order across all segments (intraday, F&O, commodity, currency). Super cost-effective for almost all types of traders.

The "Super App" Experience: Their mobile app is highly rated for its user-friendliness, advanced charting tools, and smooth performance. It's designed to be a one-stop shop that's easy to navigate for beginners but also packs enough punch for active traders.

Discount Broker + Research? YES! This is their secret sauce. Unlike pure discount brokers who offer no research, Angel One still provides market analysis, research reports, and their "ARQ Prime" advisory – a rule-based engine that gives personalized investment ideas. You get low fees and some guidance!

Wide Product Range (Again): Equities, derivatives, mutual funds (they offer direct plans!), IPOs – a broad selection to help you diversify your portfolio.

Hybrid Support: They maintain a large network of partners (their old sub-broker model), so you still have options for localized, human support if you ever need it, alongside their digital channels.

Where they might not be your soulmate:

Demat AMC: Similar to the others, they typically charge an annual Demat account maintenance fee (though often waived for the first year).

Scaling Customer Service: Because they've grown so fast, sometimes during peak market activity, their customer service lines can get a bit busy. Patience might be needed!

Not a 3-in-1: Unlike ICICI Direct and HDFC Securities, Angel One doesn't offer a direct 3-in-1 integrated bank account. You'll manage your bank account separately.

Who's their perfect match?

The Cost-Conscious Investor: You want the lowest possible brokerage fees across all your trades, especially delivery.

The Feature-Rich App Lover: You appreciate a modern, powerful, and intuitive trading app that works well for both casual and active trading.

The "Some Guidance Is Nice" Investor: You like the idea of getting research and advisory services without paying full-service broker prices.

The Hybrid Seeker: You want the benefits of a discount broker with a touch of traditional support and research.

The Final Verdict: Which Vibe Fits Your Wallet?

So, no single "best" here, fam! It's all about your unique investment personality and what you prioritize.

Go for ICICI Direct or HDFC Securities if you value the seamless 3-in-1 banking integration, rely on in-depth research and advisory, and feel more comfortable with the established brand of a major bank (and don't mind paying a bit more for that premium).

Choose Angel One if you want the best of both worlds: super competitive, flat-fee brokerage (zero for delivery!) combined with a modern trading app and a dash of useful research/advisory.

Before you make your final choice, it's always smart to do a little more digging. I found a really helpful, objective comparison on Finology Select, which has a dedicated page on "ICICI Direct vs HDFC Securities vs Angel One." It lays out all the specifics in a clear, easy-to-digest way, helping you cut through the noise and find your perfect investment match.

Happy investing, and may your portfolio always be green! 💚💸

#ICICI Direct vs HDFC Securities vs Angel One#ICICI Direct vs HDFC Securities#ICICI Direct vs Angel One#HDFC Securities vs Angel One

0 notes

Text

Investing Fam, Let's Vibe Check: Upstox, Zerodha, Groww – Which One's Your Spiritual Trading Animal?

What's up, investment squad?! 🤘 Ever feel that twitch in your thumb, seeing all those sweet green charts and thinking, "Okay, time to make some money moves!" But then you get stuck in the app maze, right? Like, a million options, and everyone's shouting "Use this one!"

Chill. I get it. The Indian stock market scene is 🔥 right now, and leading the charge are these three heavyweights: Upstox, Zerodha, and Groww. They're basically the cool kids of broking, each with their own unique personality, fan base, and special powers. Choosing one isn't just about brokerage (though, let's be real, your wallet's gonna thank you for low fees!), it's about finding an app that vibes with you. Is it sleek and modern? A no-nonsense powerhouse? Or super chill and beginner-friendly?

Let's break down their aesthetics, their quirks, and who they’re actually dating (metaphorically speaking, of course). No tables, just pure, unadulterated, real-talk about getting your investment game on!

Upstox: The Sleek & Modern All-Rounder. Your Dynamic Duo! 🚀✨

Their Vibe: Imagine that friend who's always on top of the latest tech, super organized, and just generally has their life together. That's Upstox. They're polished, efficient, and constantly bringing new stuff to the table. Their platform feels fresh, clean, and intuitive – like a perfectly designed minimalist apartment that still has all the cool gadgets. They want to be your go-to for everything.

What they're all about:

Competitive & Clear Pricing: Just like the OGs, Upstox gets the low-cost game. Zero brokerage for delivery trades (hell yeah for long-term holders!) and a flat ₹20 for intraday and F&O. Super transparent, no sneaky surprises. Your money stays where it belongs: with you!

Intuitive AF Platforms: This is a big one for Upstox. Their mobile app is a dream to navigate. It's clean, snappy, and makes placing trades or checking your portfolio feel like butter. The web platform is equally solid, blending advanced features with a user-friendly layout. It’s powerful enough for pros but won’t make new folks feel like they landed on a spaceship.

Investment Playground: Upstox isn’t just about stocks. They’re constantly adding cool new stuff. Digital gold? Yep! IPOs? Of course! And they’re even stepping into US stock investing, which is a massive plus if you're eyeing those global giants. They're building a whole investment ecosystem so you don't have to jump between apps.

Customer Love: People generally have good things to say about their customer support. If you hit a snag or have a question, they're usually pretty responsive and helpful. That peace of mind is priceless when you're dealing with your hard-earned cash!

MTF Power-Up: For the more advanced traders who know how to play the leverage game, Upstox offers a solid Margin Trading Facility. Just remember, with great power comes great responsibility! 😉

Where they might not be your soulmate:

Demat AMC: Okay, slight bummer here. While account opening is often free, Upstox usually has an Annual Maintenance Charge (AMC) for your Demat account. It’s not a huge amount, but it’s a recurring fee you need to factor in.

Tiny Glitches (Sometimes): Like any rapidly evolving tech platform, during peak market hours or super volatile days, some users might experience the occasional minor hiccup. They usually iron these out fast, but just something to be aware of if you're a high-frequency trader.

Learning Library: They've got good guides, but if you're someone who wants a super deep, university-level breakdown of every financial concept, their in-app learning content might not be as extensive as some other players' dedicated academies.

Who's their perfect match?

The Aspiring Pro: You're past the total newbie stage, you want powerful tools, but you also value a smooth, modern, and intuitive experience.

The Diversifier: You're interested in more than just Indian stocks – maybe mutual funds, digital gold, or even US stocks.

The Balanced Trader: You want low fees but also a platform that feels good to use and has reliable support.

The Feature Fanatic: You appreciate a platform that's constantly adding new, useful functionalities.

Zerodha: The OG, The Minimalist Genius, The Trader's Sensei. 📈📊

Their Vibe: Zerodha is like that brilliant, slightly understated older sibling who pioneered everything cool. They’re not about flashy ads; they’re about pure, unadulterated efficiency and powerful tools. Their aesthetic is clean, precise, and utterly functional. If investing were a martial art, Zerodha would be the wise sensei teaching you discipline and mastery.

What they're all about:

The OG Low-Cost King: They literally started the game. Zerodha brought in zero brokerage for equity delivery (!!!) and a flat ₹20 for intraday and F&O. This model shook up the industry and saved millions of investors a ton of cash. They walked so others could run.

Kite & Coin: The Dynamic Duo (Part 2): Their main trading platform, Kite, is where serious traders live. It’s got all the charts, indicators, and advanced order types you could ever dream of. It’s fast, reliable, and once you master it, you'll feel like a trading wizard. Then there’s Coin, their dedicated platform for direct mutual funds. Zero commissions on MFs means more money stays in your pocket over the long haul. The two seamlessly integrate, giving you a unified view.

Varsity: Your Free Investment University! Okay, seriously, this is a game-changer. Zerodha Varsity is an absolute goldmine of financial education. It's like a free, perfectly structured online course covering everything from stock market basics to advanced derivatives. If you're someone who wants to truly understand how the market works, not just blindly follow tips, Varsity is your go-to. It’s an act of genuine empowerment.

Robust Ecosystem & APIs for the Pros: Beyond the basics, Zerodha has a whole ecosystem. Their Z-Connect blog provides awesome market insights, and if you're a developer or want to build your own trading bots, their Kite Connect API is incredibly powerful and well-documented.

Reputation & Trust: As the undisputed market leader for years, Zerodha has built a reputation for transparency, reliability, and continuously pushing the envelope in terms of technology and investor education.

Where they might not be your soulmate:

Steep Learning Curve (For Beginners): While powerful, Kite can feel a bit overwhelming if you're just starting out. There's a lot going on, and it takes time to get comfortable. Think of it as a professional photo editing software – amazing features, but not point-and-shoot simple.

No Hand-Holding (Tips/Research): Zerodha is a pure discount broker. This means no stock tips, no research reports, no "buy this!" recommendations. You're expected to do your own homework. If you need guided advice, you'll need to look elsewhere.

Call & Trade Fees: If you prefer picking up the phone to place an order, it'll cost you an extra fee. Most discount brokers do this, but it’s a detail for those who aren't fully digital.

Who's their perfect match?

The Serious Trader: You're into intraday, F&O, or high-frequency trading and need a robust, reliable platform.

The Experienced Investor: You know your way around the markets, you do your own research, and you want powerful tools at minimal cost.

The Dedicated Self-Learner: You're keen to deeply understand the market and will make full use of Varsity's comprehensive resources.

The Direct MF Purist: You want to save every single paisa on mutual fund commissions.

Groww: The Simplicity Wizard, The Newbie's Gateway, The 🌱💰 Guru.

Their Vibe: Groww is that super-friendly, approachable neighbour who makes everything seem easy. Their entire existence is built around simplicity and accessibility. Their app is vibrant, inviting, and makes you feel like investing is literally for everyone – because it is! If investing were a garden, Groww would be the easiest, most rewarding plant to grow.

What they're all about:

Ultimate Simplicity & User Experience: This is Groww’s superpower. Seriously, their app and web interface are designed for maximum ease of use. If you've never invested before, Groww makes the onboarding process feel like a walk in the park. It's clean, uncluttered, and practically foolproof. It just works.

Zero Demat Account AMC: A Huge Win! This is a massive selling point, especially for long-term investors. Many brokers charge an annual fee just for holding your Demat account, but Groww often offers zero AMC. That’s pure savings over the years!

Direct Mutual Funds (Their OG Claim to Fame): Groww started by revolutionizing direct mutual fund investing. They still excel here, offering direct plans with zero commissions. This means you keep more of your returns, which compounds into significant savings over time. Their MF platform is incredibly intuitive.

Focus on Long-Term Investing: While they offer equity trading, Groww’s platform is subtly geared towards long-term wealth creation, with a strong emphasis on SIPs and mutual funds. It encourages a disciplined, patient approach to investing.

Massive & Rapidly Growing User Base: Groww has exploded in popularity, particularly among new and younger investors. This means a huge community and a platform that's constantly being refined based on a wide range of user feedback.

Where they might not be your soulmate:

Equity Delivery Brokerage (Small, But There): Unlike Zerodha and Upstox, Groww charges a small brokerage (₹20 or 0.05% whichever is lower) for equity delivery trades. It's still very low, but it's not "zero." If every penny on delivery counts, this is a difference.

Limited Advanced Trading Features: For hardcore day traders or those who need super-advanced charting and complex order types, Groww's platform might feel a bit too basic. Its simplicity comes with fewer bells and whistles for the pro trader.

Customer Support Can Be Slow (Sometimes): With their phenomenal growth, customer support can sometimes be a bit slower to respond during peak times. It’s the growing pains of a popular platform.

Less Emphasis on F&O for the Niche: While F&O trading is available, it’s not as central to their identity or as robustly featured as on platforms tailored for derivatives specialists.

Who's their perfect match?

The Absolute Beginner: You're just starting out, and you want the easiest, most intuitive entry into investing.

The Mutual Fund Master: Your main focus is investing in direct mutual funds for long-term growth, and you want zero commissions and a seamless experience.

The Long-Term Equity Investor: You plan to buy and hold stocks for years, and you love the idea of zero Demat AMC.

The Simplicity Seeker: You value a clean, uncluttered, and guided experience above a multitude of complex features.

The Grand Finale: Which Investment Soulmate is Yours?

So, there you have it – the lowdown on Upstox, Zerodha, and Groww. They're all legitimate, SEBI-regulated, and secure platforms (your investments are safe, held in Demat accounts with CDSL or NSDL, not directly by the broker – peace of mind!).

The whole "SOA vs. Demat" thing for MFs? Honestly, for most everyday investors, it’s more about the direct mutual fund benefit (zero commission!) than the nitty-gritty format. All three make it easy to access direct plans.

Here’s the TL;DR version for your investment personality:

Upstox: For the balanced, modern investor who wants competitive pricing, a user-friendly experience, and a growing range of products. You're dynamic and practical.

Zerodha: For the serious, self-directed trader and investor who prioritizes powerful tools, rock-bottom delivery brokerage, and top-tier financial education. You're a knowledge seeker and a go-getter.

Groww: For the absolute beginner, the mutual fund devotee, and the long-term investor who wants ultimate simplicity, zero Demat AMC, and a super easy entry into the market. You're all about effortless growth.

Pro-Tip: Don't just take my word for it! Before you commit, why not check out some user reviews and detailed comparisons? A great place to get a comprehensive, side-by-side view is on sites that compare brokers. I personally found a lot of useful insights on Finology Select, which has a really neat page comparing "Upstox vs Zerodha vs Groww." It's great for seeing all the specs laid out without the marketing fluff.

At the end of the day, there's no single "best" answer. The best platform is the one that empowers you to invest confidently and effectively. So, explore, compare, and get that money growing!

Happy investing, fam! ✨

0 notes

Text

Broke Down: Groww vs. 5paisa vs. Zerodha - What's the Real Deal for Your Wallet & Vibe?

Hey everyone! 👋

So, you're looking to dip your toes into the wild, wonderful world of Indian stock markets, or maybe you're already in and feeling like your current broker isn't quite vibing with your investment goals. Either way, you've probably heard the names: Groww, 5paisa, and Zerodha. These three are basically the cool kids of the discount brokerage scene in India right now. But like, who's the coolest? And more importantly, who's got your back (and your money!) the best?

It's a hot topic, right? Everyone has an opinion, and honestly, it can get super confusing. I've been through the whole "analysis paralysis" thing myself, staring at brokerage calculators and feature lists until my eyes glazed over. So, I figured I'd break it down for you, real talk, no BS, based on what I've seen and experienced, and what others are saying in the trenches.

Let's get into it! 🚀

Groww: The Insta-Friendly Entry Point 🌿

Think of Groww as the super friendly, aesthetically pleasing gateway drug to investing. Seriously, their app is gorgeous. It's clean, intuitive, and just generally makes you feel like you've got your life together, even if you're just putting in 500 bucks into an SIP.

The Vibe: Beginner-friendly, minimalist, "investing for everyone" feels.

What it's good for:

Mutual Funds: This is where Groww truly shines. They started with direct mutual funds (meaning no commission for you, more returns!) and their interface for finding, investing, and tracking MFs is top-notch. If your main jam is long-term SIPs, Groww is a dream.

Simplicity: If you're new to stocks and just want to buy and hold a few shares without getting overwhelmed by a million buttons and charts, Groww is your buddy. It keeps things simple and easy to understand.

Extras: They've expanded beyond just stocks and MFs. The fact that you can invest in US Stocks (hello, Apple and Tesla!) and even FDs (Fixed Deposits) directly through the app is super convenient. It's like a mini-financial hub in one place.

Potential "Meh" points:

Advanced Trading: If you're a hardcore intraday trader or someone who lives and breathes complex technical analysis, you might find Groww's charting and advanced order types a bit basic. It’s not built for that super-niche high-frequency trading lifestyle.

Customer Support during crunch time: Like any popular platform, during crazy market swings, sometimes getting immediate help can be a bit slow. But generally, they're responsive.

5paisa: The Value Hunter's Playground 💰

5paisa is like that friend who always knows where the best deals are. They are all about low costs and giving you a lot for your money.

The Vibe: Budget-conscious, comprehensive, "get more for less" kind of feel.

What it's good for:

Brokerage: If saving every single rupee on brokerage is your absolute top priority, 5paisa often throws out aggressive offers. They're usually flat-fee, and sometimes even have intro offers with zero brokerage for a while. This is HUGE for active traders.

Product Range: They don't just do stocks. You want to dabble in Futures & Options (F&O)? Commodities? Currencies? 5paisa generally has you covered. It's a pretty broad offering for a discount broker.

Some Handholding: Unlike some pure discount brokers, 5paisa sometimes offers basic research and advisory services. It’s not like a full-service broker, but it’s a nice little extra if you appreciate some guidance.

Potential "Meh" points:

App Performance: I've heard some chatter (and experienced a bit myself) that the app can sometimes be a bit glitchy or slow during super volatile market moments. Not deal-breaking, but noticeable if you're executing fast trades.

Interface Learning Curve: While not as complex as Zerodha, it's not as instantly intuitive as Groww. You might need a few minutes to find your way around initially.

Zerodha: The OG and the Pro's Pick 💻

Zerodha is the veteran. They basically kicked off the discount brokerage revolution in India. Their platform, Kite, is legendary among serious traders. If you're talking tech and tools for trading, Zerodha is often the benchmark.

The Vibe: Professional, powerful, "build your trading empire" kind of energy.

What it's good for:

Advanced Trading Tools: This is where Zerodha truly shines. Kite is lightning-fast, packed with advanced charting (TradingView integration FTW!), indicators, and complex order types (GTT, BO, CO – if you know, you know!). If you're into intraday, F&O, or even looking at algo trading, Zerodha's ecosystem is unmatched.

Ecosystem: It’s not just Kite. You get Coin (for direct MFs, super smooth), Varsity (seriously, the BEST free educational resource for finance in India), Sensibull (for options analysis), Streak (for coding-free algo trading), and more. It’s a whole universe designed for serious market participants.

Transparency: They're very upfront about their charges (flat ₹20 per executed order for intraday/F&O, zero for delivery and direct MFs). Plus, features like "Nudge" (gentle warnings about risky trades) and "Kill Switch" (to stop overtrading) show their commitment to responsible trading.

Potential "Meh" points:

Beginner Overload: For someone just starting out, Kite can feel a bit overwhelming. There are so many features and options that it might take a while to get comfortable. Groww definitely wins on immediate user-friendliness for total newbies.

No US Stocks/FDs directly: While they offer a ton, they haven't gone into direct US stock investing or FDs in the same way Groww has. You'd need other avenues for those.

So, Who Wins? (It's a Trick Question!)

Honestly, there's no single "winner." It genuinely comes down to your personal needs and what you're looking for:

New to investing? Start with Groww. It’s like the friendly guide.

Active trader, penny-pincher, and need a wider range of instruments? 5paisa might be your jam.

Serious about trading, love advanced tools, and want to deep-dive into market analysis? Zerodha is your professional companion.

Many seasoned investors actually have accounts with two or even all three, leveraging each platform's strengths for different purposes. Like, Groww for my long-term mutual funds, and Zerodha for my active trading. Why limit yourself, right? 😉

Before you commit, it's always smart to do your own research and maybe even try out the demo versions if available. There are some really solid comparison sites out there that break down all the nitty-gritty details, like brokerage, AMC, supported products, and customer service ratings.

I found this one on Finology Select, which has a really good "Groww vs 5paisa vs Zerodha" page. It gives you a super clear, no-nonsense overview that helps me piece things together. Give it a look!

Happy investing, fam! Keep learning, keep growing! ✨

0 notes

Text

Samco Customer Reviews: The Good, The Bad, and The Future

Hey there, fellow investors! 👋 If you've been scrolling through your feeds, you've probably come across ads for Samco Securities. But is it all that it's cracked up to be? Let's dive into some real talk about what customers are saying.

The Good Stuff

First off, let's talk about the positives. A lot of users are loving the Kyatrade app. It's sleek, easy to navigate, and perfect for those who want to trade on the go. Plus, the low brokerage fees? Major win for small-time traders looking to keep costs down.

But Wait... There's More

Now, it's not all sunshine and rainbows. Some users have reported glitches during market volatility. Imagine trying to make a trade and the app freezes—yikes, right? And while customer support is generally helpful, a few folks have mentioned delays when dealing with more complex issues.

Samco Mutual Fund: A New Kid on the Block

So, Samco isn't just about trading; they've also dipped their toes into mutual funds. Their HexaShield Tested Investing strategy is all about evaluating securities based on six key factors. Sounds fancy, huh? And while the returns are looking good so far, remember—investing always comes with its risks.

Final Thoughts

All in all, Samco's got potential. If you're into tech-driven trading with low fees, it might be worth checking out. Just be aware of the occasional hiccups and always do your own research before diving in.

That said, like with any investment, it’s always a good idea to look into the details before jumping in. I came across a page on Finology Select that gives a pretty detailed overview of Samco, from real user feedback to how their offerings stack up. It helped me get a clearer picture, so you might find it useful too. Here's the link: Samco Customer Reviews.

Hope it points you in the right direction!

0 notes

Text

Stoxkart vs Zerodha vs Upstox: Which One Suits You Best?

Hey there, fellow traders! 👋 If you're diving into the world of stock trading in India, you've probably come across Stoxkart, Zerodha, and Upstox. But which one should you choose? Let's break it down in a casual, no-nonsense way.

Stoxkart: The New Kid on the Block

Stoxkart is like that fresh café in your neighborhood—new, exciting, and offering something different. They charge a flat ₹15 per executed order across all segments. What's cool? They only charge brokerage on profitable trades. So, if you make a loss, you don't pay any brokerage. Neat, right?

But, it's not all sunshine. The platform is still growing, so it might not have all the bells and whistles some seasoned traders are used to. But if you're looking for a straightforward, cost-effective option, Stoxkart's worth a shot.

Zerodha: The OG of Discount Brokers

Zerodha is like that reliable friend who's always there for you. They've been around since 2010 and have built a solid reputation. They charge ₹20 per executed order across all segments. Their platform, Kite, is sleek, fast, and packed with features.

Plus, they've got Zerodha Varsity—an educational platform that's a goldmine for beginners. Sure, they've had a few technical hiccups in the past, but they've always bounced back stronger.

Upstox: The Feature-Packed Challenger

Upstox is like that tech-savvy friend who's always ahead of the curve. They offer advanced charting tools, real-time data, and customizable watchlists. Their pricing is similar to Zerodha—₹20 per executed order.

But, some users have reported issues with the platform's interface and customer support. Still, if you're into advanced features and don't mind a bit of a learning curve, Upstox could be your jam.

So, Which One Should You Pick?

If you're just starting out and want something simple and cost-effective, give Stoxkart a try.

If you want a reliable platform with tons of resources, Zerodha's your go-to.

If you're all about advanced features and don't mind a bit of complexity, Upstox might be the one.

In case you're still weighing your options, I came across a comparison page on Finology Select that clearly lays out the differences between Stoxkart, Zerodha, and Upstox. It covers everything from brokerage charges to platform features and even includes real user feedback. I actually found it pretty useful when I was trying to figure out which broker made the most sense for my needs. It might be worth a look if you're doing some research.

Remember, it's all about what fits your trading style and needs. Happy trading! 📈💰

#Stoxkart#Zerodha#Upstox#Stoxkart vs Zerodha vs Upstox#Stoxkart vs Zerodha#Stoxkart vs Upstox#Zerodha vs Upstox

0 notes

Text

Trading, Trials & Tiny Fine Print: A Real-Life Battle Between Upstox and the Rest

Okay, so story time.

Last month, I bought a couple of gold ETFs on Upstox, expecting it to be a chill, ₹0 brokerage equity delivery kind of day. But then, bam—₹20 flat brokerage slapped onto the bill. I double-checked. It was NOT an intraday trade. WTH?

Cue my rabbit hole of comparing every broker under the sun.

Let me back up for a second. I’ve been using Upstox for around 6 months now. It’s fast, clean, and works pretty well on both web and mobile. Not glitchy like some of those old-school trading platforms (cough ICICI Direct). But the brokerage? That kind of blindsided me. I was under the impression that delivery trades were free. Aren’t they all supposed to be?

Turns out, nope. Some brokers still keep it free, others are quietly shifting policies. And honestly, that’s why I ended up at Finology Select’s comparison tool. I needed a clear side-by-side of who’s charging what.

Here’s My Breakdown (Vibes Not Stats)

Zerodha: Slick, no-BS UI. Feels like the Apple of trading. Still ₹0 on delivery, last I checked.

Groww: Like the Spotify of trading. Chill, minimalist. But kind of basic if you’re looking to go deep with analysis.

Angel One: Feels like your dad just got an iPhone. Old school firm, but the tech revamp is real. Fast becoming a contender.

Upstox: Fast, reliable... until that ₹20 thing showed up. It’s still one of the better apps, but now I’m second-guessing.

The Human Part

What really hit me through all this was how quietly these platforms can shift things. Like... where’s the pop-up that says, “Hey, we’re gonna charge you now”? It’s all buried in terms or quietly implemented.

And unless you’re the kind of person who enjoys digging through PDFs and customer support chats (lol, who does?), it’s hard to know what’s changed.

Again, that’s why this comparison felt like a win. No ads, no fluff, just line-by-line broker differences. Might save you some rage-clicking and unexpected charges.

Anyway. That’s my little rant + info dump. Hope it helps someone avoid the same surprise fees.

0 notes

Text

Investing Vibe Check: Zerodha, Upstox, Groww – Which Broker Matches Your Energy?

Hey, finance fam! 👋 Ever scrolled through your feed, seen all the buzz about stocks and crypto, and thought, "Okay, maybe it's time I jump in?" But then you hit that wall: which app do I even use?! 🤔 You’re not alone! The Indian investment scene is booming, and at the heart of it are these three giants: Zerodha, Upstox, and Groww.

They’re like the popular kids in school, each with their own distinct personality. Choosing one isn't just about brokerage fees (though, obvi, that's a HUGE part of it!). It's about finding a platform that gets you, that fits your vibe, whether you're a total noob, a seasoned trader, or just dipping your toes in the MF waters.

So, let's do a deep dive, Tumblr-style. We’ll break down their moods, their quirks, and who they’re really for. No tables, just pure, unadulterated investment chat!

Zerodha: The OG, The Minimalist, The Serious Trader's BFF 📈📊

Their Vibe: Think of Zerodha as the cool, intellectual friend who's been in the game forever. They're not flashy, they're super efficient, and they know their stuff inside out. Their aesthetic is clean, minimalist, and very much "get down to business." If investing were a fashion statement, Zerodha would be a perfectly tailored suit – classic, sharp, and always in style.

What they're all about:

Pioneer Power: These guys basically started the discount brokerage revolution in India back in 2010. Before them, brokerage fees were wild! Zerodha said, "Nah, we'll do ₹0 for delivery and flat ₹20 for everything else." And everyone else was like, "Wait, you can do that?!" They changed the game.

Kite & Coin: The Dynamic Duo: Their main trading platform is Kite. It's like a super-powered spaceship dashboard for traders. Charts? Oh, they got charts! Indicators? More than you can shake a stick at! It’s fast, it’s robust, and once you get the hang of it, it’s incredibly powerful. For mutual funds, they have Coin. And here’s the kicker: Coin lets you invest in direct mutual funds. That means no commissions! Huge win for long-term investors. Seamless integration between the two, so your stocks and MFs live in harmony.

Varsity: Your Free University of Finance: Okay, this is seriously cool. Zerodha has this amazing educational platform called Varsity. It’s like a free online university for everything finance. From beginner basics to advanced trading strategies, it’s all there, beautifully explained. If you’re someone who loves to learn and understand the why behind your investments, Varsity is a goldmine. It’s their way of empowering you, not just giving you a platform.

Community & Connect: They have a really active blog (Z-Connect) with market insights and discussions. Plus, if you're into coding or algo trading, their Kite Connect API is a dream come true. Super developer-friendly.

Where they might not be your soulmate:

Not for the Hand-Held: If you're looking for daily stock tips, research reports, or someone to tell you exactly what to buy and sell, Zerodha isn't that friend. They’re very much about self-directed investing. They give you the tools, but you gotta swing the hammer.

Learning Curve: While Kite is powerful, it can feel a bit intimidating for absolute beginners. There are lots of options, and it takes a little time to get comfortable. Think of it as a pro-level camera; amazing once you master it, but not point-and-shoot easy.

Call & Trade Charges: If you’re old school and prefer calling someone to place an order, it’ll cost you extra. Most discount brokers charge for this, but it’s worth noting.

Who's their perfect match?

The Active Trader: If you're serious about intraday, F&O, or frequent equity trading, Zerodha's platform and pricing are built for you.

The Experienced Investor: You know what you're doing, you do your own research, and you want powerful tools without high costs.

The Self-Learner: You're keen on understanding the market deeply and utilizing free, high-quality educational content.

The Direct MF Enthusiast: You want to save on commissions for your mutual fund investments.

Upstox: The Rising Star, The User-Friendly Powerhouse 🚀✨

Their Vibe: Upstox is like the ambitious, well-funded startup friend. They’re sleek, modern, and always trying to bring you new features. They’re backed by Ratan Tata, so you know they mean business! Their platform has a polished, easy-on-the-eyes feel, blending functionality with a smooth user experience. They want to be your go-to for everything investing.

What they're all about:

Competitive Cost, Great Experience: Like Zerodha, they offer ₹0 brokerage for equity delivery and a flat ₹20 for intraday and F&O. So, your wallet stays happy. But they really try to make the experience smooth.

Intuitive Interface: This is where Upstox often shines for many. Their mobile app and web platform are generally praised for being very intuitive and easy to navigate. It feels less cluttered than Kite for some, making it a good stepping stone for those moving beyond pure beginner apps.

Expanding Universe of Products: Beyond just stocks and mutual funds, Upstox has been adding more. Digital gold? Check! IPOs? Yep! They’re even venturing into US stock investing, which is pretty cool if you want to diversify internationally.

Reliable Support: A lot of users report positive experiences with Upstox customer support. They’re generally quick and helpful, which is super important when you’re dealing with your money.

Margin Trading Facility (MTF): For those who understand and are comfortable with it, Upstox offers MTF, allowing you to amplify your trading power by using borrowed funds against your holdings.

Where they might not be your soulmate:

Demat AMC: While account opening is free, Upstox typically has an Annual Maintenance Charge (AMC) for your Demat account. It's a small recurring fee, but something to keep in mind if every rupee counts.

Occasional Hiccups: Like any tech platform, especially during peak market volatility, some users have reported occasional glitches or performance slowdowns. These are usually resolved, but something to be aware of.

Educational Depth: While they have a learning center, it’s not as comprehensive or structured as Zerodha’s Varsity. If deep, self-paced learning is your priority, you might need external resources.

Who's their perfect match?

The Aspiring Trader: You're past the absolute beginner stage but still want an easy-to-use platform that handles active trading efficiently.

The Feature-Seeker: You like having a good range of investment options beyond just stocks and mutual funds.

The User-Experience Driven Investor: You appreciate a clean, intuitive, and generally hassle-free interface.

The Balanced Investor: You want competitive pricing but also value a polished, modern platform.

Groww: The Simplicity Champion, The MF Whisperer, The Newbie's Gateway 🌱💰

Their Vibe: Groww is the super approachable, friendly neighbor who makes everything seem easy. Their whole aesthetic screams "simple" and "accessible." They're vibrant, inviting, and clearly designed to make anyone, even someone who’s never thought about investing, feel comfortable. If investing were a plant, Groww would be the easiest houseplant to keep alive!

What they're all about:

Zero Demat AMC: The Holy Grail for Long-Termers! This is HUGE. You open an account, you buy shares, you hold them, and you don't pay an annual fee for holding your Demat account. For long-term investors, this is a massive saving over the years.

Ultimate Simplicity: Groww’s app and web platform are designed to be incredibly easy to use. The onboarding process is super quick, and finding what you need is a breeze. It’s almost impossible to get lost in their interface. If you value a smooth, straightforward experience above all else, Groww nails it.

Direct Mutual Funds (Their OG Superpower): Groww started as a direct mutual fund platform, and they still excel here. Investing in direct plans means you bypass distributor commissions, which can add up to significant savings over the long term. Their MF interface is top-notch.

Focus on Long-Term Growth: While they offer equity trading, Groww often gently nudges users towards a more long-term, disciplined approach, particularly with SIPs and mutual funds. It feels less like a trading platform and more like a wealth-building platform.

Massive & Growing User Base: Groww has exploded in popularity, especially among young investors and first-timers. This means a huge community and a platform that’s constantly being refined based on a wide user feedback loop.

Where they might not be your soulmate:

Equity Delivery Brokerage (Small But Present): Unlike Zerodha and Upstox, Groww charges a small brokerage (₹20 or 0.05% per executed order, whichever is lower) even for equity delivery trades. It’s not a huge amount, but it’s not zero, which is a point of difference.

Limited Advanced Trading Features: If you're a serious day trader or someone who uses complex charting patterns and advanced order types, Groww's platform might feel too basic. It's built for ease of use, not necessarily for high-frequency, intricate trading.

Customer Support Growing Pains: With their rapid expansion, some users have reported that customer support can occasionally be slower to respond due to the sheer volume of users.

Less Emphasis on F&O for the Hardcore: While they offer F&O, it's not the primary focus of their platform, and the tools available for derivatives traders might not be as exhaustive as on Zerodha.

Who's their perfect match?

The Absolute Beginner: You're just starting your investment journey and want a platform that makes it as simple as possible.

The Mutual Fund Maverick: Your primary goal is to invest in direct mutual funds for long-term wealth creation, and you want zero commissions.

The Long-Term Equity Investor: You plan to buy stocks and hold them for years, and you love the idea of zero Demat AMC.

The Simplicity Seeker: You prefer a clean, intuitive, and uncluttered interface over a multitude of complex features.

The Grand Finale: Which Energy Matches Yours?

So, there you have it – the lowdown on Zerodha, Upstox, and Groww. They're all legitimate, regulated platforms (super important for your peace of mind!). Your investments are safe with them, held in Demat accounts with official depositories like CDSL or NSDL.

The whole "SOA vs. Demat" thing for MFs? Honestly, for most everyday investors, it’s not something to sweat over too much. Platforms like Groww and Zerodha Coin primarily push direct mutual funds in a way that feels seamless and doesn't load you with extra Demat AMC for the MFs themselves, whether they show up on an SOA or within your Demat consolidated view. The key is just getting those direct plans to save on commissions!

Here’s the TL;DR version for your investment personality:

Zerodha: For the focused, data-driven, independent learner and active trader. You like control and power.

Upstox: For the balanced investor who wants a modern, user-friendly platform with competitive costs and a good range of options. You like polish and practicality.

Groww: For the absolute beginner, the mutual fund devotee, and the long-term investor who values simplicity, zero Demat AMC, and an easy entry into the market. You like easy and effortless.

Pro-Tip: Don't just take my word for it! Before you commit, why not check out some user reviews? A good place to get a comprehensive, side-by-side view is on sites that compare brokers. I personally found a lot of useful insights on Finology Select, which has a really neat page comparing "Zerodha vs Upstox vs Groww." It's great for seeing all the specs laid out without the marketing fluff.

At the end of the day, there's no single "best" answer. The best platform is the one that empowers you to invest confidently and effectively. So, explore, compare, and get that money growing!

Happy investing, fam! ✨

#investing#stockmarket#personalfinance#indiainvests#zerodha#upstox#groww#financebro#moneytips#financialliteracy#mutualfunds#demataccount#tradingapps#newtoinvesting#wealthbuilding#financialjourney#futureisfinancial#stockmarketindia

0 notes

Text

Trading Apps in India: Is Upstox Still the Cool Kid?

Okay, story time…

I opened an Upstox account back in 2022. Everything was smooth—no annual charges, decent brokerage, and a pretty slick interface. Fast forward to now, and there’s been some drama. Charges changed, communication was unclear, and I found myself wondering: is Upstox still the right fit for me?

So I did what any sane person would do—I compared it with Groww, Zerodha, and Paytm Money. Here’s what I found.

Upstox — Stylish But Complex?

The platform works great when it works. The Pro app is responsive, and I love the tools. But when charges changed earlier this year (March 2025), I didn’t appreciate the buried details in a generic email. I felt a little blindsided.

Zerodha — The Sensible Friend

Zerodha doesn’t try to be flashy, but it’s got depth. The Kite platform feels light but powerful. And what I really appreciate is that when they change something—fees, processes, anything—they send a clear email with proper subject lines. No surprises.

Groww — The New Kid That Gets You

Groww is so beginner-friendly it almost feels like a finance app disguised as a productivity tool. No frills, but no confusion either. I’ve recommended it to a few friends just starting with SIPs or mutual funds.

Paytm Money — Playing Catch-Up

Honestly, Paytm Money’s UI feels a bit dated, and there’s some lag on the trading side. It works fine for mutual funds, but for active trading? You might find better options.

If you’re like me and torn about where to go next, I found this helpful little rabbit hole: Compare Upstox with Others on Finology Select. Super straightforward, no sales pitch. Just facts.

0 notes

Text

Upstox vs Zerodha vs Groww: Which Brokerage Platform Fits Your Vibe?

Hey there, fellow investors! 🌟

So, you're diving into the world of stock trading and wondering which platform to choose? Let's break down the top three contenders: Upstox, Zerodha, and Groww. Each has its own flair, so let's see which one aligns with your trading style.

Upstox: The Sleek Performer

Upstox is like that stylish friend who knows their stuff but keeps it cool. With zero brokerage on equity delivery trades and a user-friendly interface, it's perfect for those who want to trade without the hassle. Plus, their Pro platform offers advanced charting tools for the tech-savvy trader.

Zerodha: The Veteran

Zerodha has been around the block and knows the ropes. Offering a flat ₹20 per trade brokerage and a robust platform, it's ideal for traders who appreciate reliability and a wealth of resources. Their Coin platform is great for mutual fund investments, and Kite is a solid trading app.

Groww: The Beginner's Bestie

If you're just starting out, Groww is like that supportive friend guiding you through the basics. With zero brokerage on mutual funds and a clean, intuitive interface, it's designed for beginners. While it may lack some advanced features, it's a great starting point for your investment journey.

Final Thoughts

Choosing the right platform depends on your trading goals and experience level. For a deeper dive into these platforms, check out Finology Select's detailed comparison of Upstox vs Zerodha vs Groww.

Happy trading! 💰📈

#Upstox vs Zerodha vs Groww#Upstox vs Zerodha#Upstox vs Groww#Zerodha vs Groww#zerodha comparision#groww comparision#upstox comparision

0 notes

Text

5Paisa Customer Reviews: The Good, The Bad, and The Ugly

Introduction

So, you're thinking about jumping into the world of online trading with 5Paisa? Well, buckle up, because the ride might be bumpier than you think. Let's dive into what real users are saying about their experiences.

The Good

Okay, let's start with the positives. Some users have found 5Paisa to be a decent platform for their trading needs. Finology Select reports an overall rating of 3.7 out of 5, with half of the reviewers giving it top marks. Finology Select

The Bad

But here's where it gets interesting. Many users have shared their frustrations:

App Crashes: Every time 5Paisa app got hanged... impossible to gain any profit from mobile app.

Customer Support Woes: I tried calling many times but always it comes busy and no response.

Transaction Troubles: I have added ₹50,000 in my 5Paisa account wallet and didn't make any purchase... my account balance is showing 0 balance.

The Ugly

And then there are the horror stories:

Data Privacy Concerns: I registered with 5Paisa, and now I get 10-15 spam calls a day.

Unauthorised Trades: They sold the stocks from my account, resulting in a loss of ₹1.5 lakh without asking me.

Conclusion

So, is 5Paisa worth it? Well, if you're into taking risks and don't mind a few bumps along the way, it might be. But if you're looking for a smooth, hassle-free trading experience, you might find the "5Paisa Customer Reviews" on Finology Select helpful.

0 notes

Text

Zerodha vs 5paisa vs Upstox: Which One Should You Choose?

Hey there, fellow traders!

If you're diving into the world of online stock trading in India, you've probably come across Zerodha, 5paisa, and Upstox. But how do you decide which one suits you best? Let's break it down in a casual, easy-to-understand way.

Zerodha: The OG of Discount Broking

Zerodha's been around since 2010 and has built a massive community of traders. They offer a flat ₹20 per trade across all segments, and equity delivery trades are free. Their platforms—Kite for trading, Coin for mutual funds, and Varsity for learning—are super popular.

5paisa: The Research Buff

5paisa is relatively new but packs a punch with its research tools. They also charge ₹20 per trade and offer a flat fee across all segments. Their platforms are user-friendly, and they provide advisory services to help you make informed decisions.

Upstox: The Speedster

Upstox is backed by big names like Ratan Tata and Tiger Global. They offer ₹20 per trade for intraday and F&O, with equity delivery being free. Their Upstox Pro platform is known for its speed and reliability, making it a favorite among active traders.

So, which one should you go for?

If you're looking for a comprehensive platform with educational resources, Zerodha's your pick.

If research tools and advisory services are your thing, check out 5paisa.

If speed and reliability are top priorities, Upstox might be the one for you.

For a more detailed comparison, you can visit Finology Select's page on Zerodha vs 5paisa vs Upstox.

Happy trading! 📈

0 notes

Text

Zerodha vs 5paisa: A Tale of Two Brokers

In the vast world of stock trading, choosing the right broker can feel like navigating a maze. Two names often come up in discussions: Zerodha and 5paisa. Both have their merits, but understanding their differences can help you make an informed decision.

Brokerage Charges

Zerodha offers a flat ₹20 per executed order for intraday and F&O trades, with equity delivery trades being free of brokerage charges. This transparent pricing model has made it a favorite among retail investors.

5paisa, on the other hand, provides a flat ₹20 per executed order across various segments. While this seems straightforward, some users have reported unexpected charges and lack of clarity in billing.

Account Opening and AMC Fees

Zerodha charges ₹200 for trading account opening and ₹300 per year as Demat account AMC. These fees are relatively low compared to industry standards.

5paisa offers free trading account opening but charges ₹650 for trading account opening and ₹540 per year as Demat account AMC. While the free account opening is appealing, the annual charges can add up over time.

Trading Platforms

Zerodha's Kite platform is known for its clean interface, advanced charting tools, and smooth execution. It's designed to cater to both beginners and experienced traders.

5paisa provides the 5paisa Trader Terminal, which is user-friendly but may lack some advanced features found in other platforms.

Customer Service and Transparency

Some users have reported issues with 5paisa's customer service and transparency. Complaints include delayed fund credits and excessive spam calls after account registration.

In contrast, Zerodha has generally received positive feedback for its customer support and transparent pricing.

For a more detailed comparison, you might find this article helpful: Zerodha vs 5paisa.

0 notes

Text

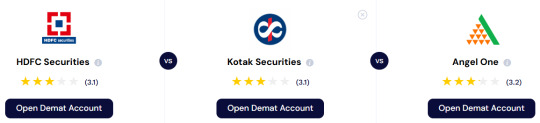

Navigating the World of Brokers: ICICI Direct, Kotak Securities, and Angel One

Investing doesn't have to be intimidating. With platforms like ICICI Direct, Kotak Securities, and Angel One, stepping into the world of stocks and mutual funds has never been easier. Let's break down what each platform offers and how they cater to different investor needs.

🌟 ICICI Direct: The Trusted Name

ICICI Direct is like that reliable friend who always has your back. Backed by ICICI Bank, it offers a seamless 3-in-1 account, making fund transfers between your bank, demat, and trading accounts effortless. The platform provides a range of investment options, including equities, mutual funds, and IPOs.

Key Features:

Brokerage Charges: Competitive rates with a focus on delivering value.

Account Maintenance: Standard charges applicable.

Trading Platforms: ICICI Direct Trade Racer (Desktop & Web), ICICI Direct Mobile App, offering advanced charting tools and research reports.

Why Choose ICICI Direct?

If you're someone who values a trusted brand with a strong customer base, ICICI Direct provides comprehensive research and advisory services, along with robust trading platforms.

🚀 Kotak Securities: Tradition Meets Technology

Kotak Securities blends traditional banking with modern technology. As the brokerage arm of Kotak Mahindra Bank, it offers a 3-in-1 account, providing seamless integration between your bank, demat, and trading accounts. The platform caters to both beginners and seasoned traders with its user-friendly interface and advanced trading tools.

Key Features:

Brokerage Charges: Flexible plans catering to different trading styles.

Account Maintenance: Standard charges applicable.

Trading Platforms: KEAT Pro X, Kotak Stock Trader, and Xtralite, offering real-time market data and advanced charting tools.

Why Choose Kotak Securities?

If you appreciate a blend of tradition and technology, Kotak Securities offers a balanced approach with competitive brokerage plans and a wide range of trading platforms.

🌿 Angel One: The Digital Innovator

Angel One is like that tech-savvy friend who makes everything seem easy. Formerly known as Angel Broking, it has transformed into a discount broker offering full-service features. The platform provides a 3-in-1 account, integrating your bank, demat, and trading accounts. Designed for cost-conscious investors, Angel One offers advanced trading tools without the hefty price tag.

Key Features:

Brokerage Charges: Zero brokerage on equity delivery, flat ₹20 per order for intraday and F&O.

Account Maintenance: Low charges applicable.

Trading Platforms: Angel One App and Angel SpeedPro, offering real-time market data and advanced charting tools.

Why Choose Angel One?

If you're looking for cost-effective trading with advanced features, Angel One provides a user-friendly platform with competitive pricing.

🧭 So, Which One Should You Choose?

It all comes down to your personal preferences and investment goals. If you value a trusted brand with comprehensive research, ICICI Direct is a solid choice. For a blend of tradition and technology, Kotak Securities offers a balanced approach. If cost is a primary concern and you're comfortable

For a more detailed comparison, you might find this resource helpful: ICICI Direct vs Kotak Securities vs Angel One.

#ICICI Direct vs Kotak Securities vs Angel One#ICICI Direct vs Kotak Securities#Kotak Securities vs Angel One#ICICI Direct vs Angel One

0 notes

Text

Navigating the World of Brokers: HDFC Securities, Kotak Securities, and Angel One”

Investing doesn't have to be intimidating. With platforms like HDFC Securities, Kotak Securities, and Angel One, stepping into the world of stocks and mutual funds has never been easier. Let's break down what each platform offers and how they cater to different investor needs.